Electric Rice Cooker Market Size, Share & Trends Analysis Report by Product Type (Standard Rice Cookers, Micom (Microcomputer) Rice Cookers, Multi-functional Rice Cookers, Others), Capacity, Material Type, Distribution Channel, Price Range, Power Rating, Technology, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Electric Rice Cooker Market Size, Share, and Growth

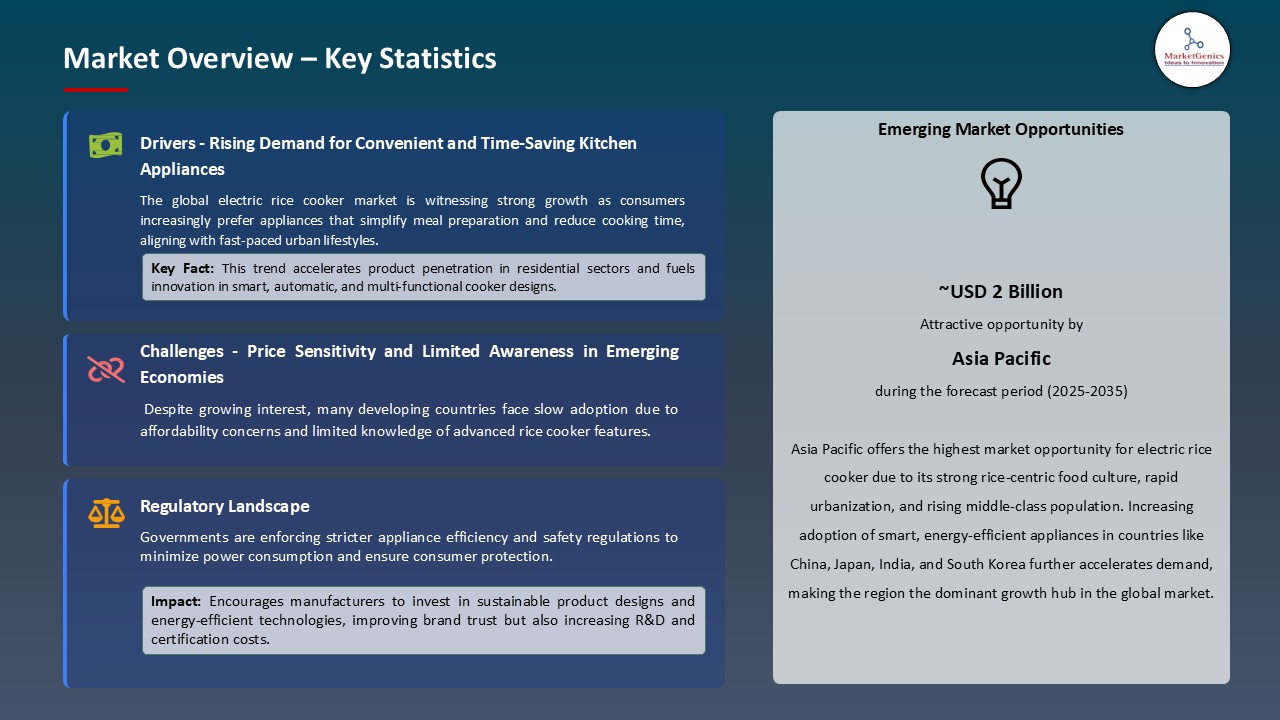

The global electric rice cooker market is experiencing robust growth, with its estimated value of USD 1.9 billion in the year 2025 and USD 5.8 billion by 2035, registering a CAGR of 11.8%, during the forecast period. The electric rice cooker market is boosted by increasing need for convenient, time-saving kitchen solutions due to busy lifestyles, growing interest in healthy and rice-based diets, and the rise of smart home appliances with features like multi-functionality and app connectivity.

Chad Ries, global brand director for KitchenAid small appliances at Whirlpool Corporation said,

"The innovation behind the KitchenAid Grain and Rice Cooker was driven by consumers, Consumers are craving simplicity in their routines and that's exactly what this new product delivers as it removes the guesswork in the kitchen with its automation features. KitchenAid brand is dedicated to meeting the demands of its consumer base and we're excited to unveil the Grain and Rice Cooker as the first of many innovations to come.”

The electric rice cooker market is one of the segments of small kitchen appliances that is growing gradually around the world because of the urbanization, changing cooking patterns and technological advancement. These appliances are used to automate the process of rice cooking by controlling the temperature and the moisture level so that the quality remains the same, providing the added convenience and efficiency in the modern kitchen. An example, in March 2024, KitchenAid released the first Grain and Rice Cooker of the brand that has an innovation that handles the measuring and monitoring for consumer. The KitchenAid Grain and Rice Cooker is able to identify the amount of grain that has been introduced into it, automatically dispensing the appropriate amount of water and simmers to perfection, all the time.

Moreover, the global electric rice cookers market is expanding because producers are also positioning the electric rice cookers as all-purpose devices that can cook various foods (quinoa, oatmeal, steamed vegetables, and other grains) and increase their areas of application to consumers with non-rice-centric diets who are finding versatile and convenient kitchen items. As an example, in November 2024, Xiaomi has released the Xiaomi Smart Multifunctional Rice Cooker in Nepal. The rice cooker is truly a convenience with its 8-in-1 capability and the ability to support smart apps. It is also capable of high-power cooking, customizable settings, and it is user-friendly to meet various culinary demands.

The regulatory framework of the major economies is encouraging the development of the international Electric Rice Cooker market due to these factors that support sustainability, energy saving and responsible production. Governments are progressively implementing policies aimed at decreasing carbon emission reduction, reduction in electronic waste, and improved product recyclability with the help of eco-labeling and extended producer responsibility (EPR) programs.

The key market opportunities of the global electric rice cooker market are smart kitchen appliances, induction cooktops, IoT-enabled home devices, multifunctional pressure cookers, and compact food steamers. These segments have a comparable consumer base focusing on convenience, automation, and energy efficiency.

Electric Rice Cooker Market Dynamics and Trends

Driver: Increasing Disposable Incomes Boost Demand for Modern, Multifunctional Kitchen Appliances

- The electric rice cookers market led by the rise in disposable incomes are allowing consumers, especially those in the emerging economies, to upgrade the simple cookware into the use of sophisticated electric rice cookers which are more convenient, precise and energy efficient. This financial flexibility is the driver of up taking high-end models with smart controls, induction heating, multi-purpose features that meet the requirements of various meal preparation. An example, in 2024, Tiger Corporation introduced foam fire cooking series. These rice cookers are the outcome of attempts to realize the perfect cooking methods. They are aimed to extract the rich sweetness and taste of the rice through high heat generated in the ceramic inner pot.

- Moreover, the global electric rice cooker market is also enhanced as the population of middle classes continues to rise worldwide with consumers becoming ready to spend more on durable and time-saving kitchen appliances that reflect the modern lifestyle and healthy cooking behaviors.

- The shift towards value-added functions and brand dependability prompts manufactures to improve design, technology, and functionality, which continues to support the development of the market of the high-performance electric rice cookers.

Restraint: High Product Saturation Limits Growth in Mature Regional Markets

- The electric rice cooker market is limited due to the existence of other markets that have not yet reached maturity like Japan, South Korea and certain regions of North America where market saturation limits further expansion of the electric rice cookers. A majority of the households already have efficient or premium models and thus will not have a high replacement demand. As an example, in 2024, integrated report, Zojirushi revealed that, although its own series of high-end induction-heating, pressure rice cookers sold well in Japan, sales of rice cookers/warmers in general decreased in the domestic market every year. This fall highlights the fact that in well-developed markets such as Japan where families already have premium models and replacement rates are long growth prospects in the device category are becoming more limited.

- Additionally, purchase frequency is further reduced by the longevity and reliability of the available appliances. Manufacturers are struggling with products differentiation in an extremely competitive world where innovation cycles are brief and consumer preference changes slowly. Consequently, firms are forced to work on design improvements, connectivity, or energy efficiency to arouse fresh appeal. This saturation ends up limiting the growth of revenues and increasing competition in the mature markets.

Opportunity: Product Premiumization Through Advanced Heating Technologies and Smart Connectivity Features

- The electric rice cooker market is presenting opportunities in the global market since the induction Heating (IH) and Pressure Induction Heating (PIH) technologies represent a major market opportunity as they have the potential of product premiumization by offering better precision and consistency in cooking. Their superior functionality justifies high prices and appeals to quality-sensitive customers and boosts profitability and differentiation in the competitive electric rice cooker market. As an example, Xiaomi introduced Mijia 3D Pressure IH Rice Cooker P1 3 in April 2025. The Mijia P1 has a 1.2x pressure cooking, which adds to the pressure cooking the texture and sweetness of the rice in up to 48 percent more. It employs IH (Induction Heating) 3D surround technology to achieve even heating with no clumping and a glossy finish on the rice similar to that found in a restaurant.

- Moreover, smart connectivity is a major driver of premiumization with rice cookers, which have IoT-based features, feature app-based control, cooking notifications, recipe integration, and smart home compatibility. Despite the fact that adoption is still in its infancy, connectivity improves product differentiation, user interaction and long-term value generation via digital ecosystems and possible subscription based culinary content. In 2024 the manufacturer Midea International Group introduced its second-generation IoT low-carb rice cooker, which enables upgrading software to the cloud, and adjustment of the cooking curve along with data integration with its larger AIoT system (including health data and partner devices).

Key Trend: Multifunctionality Expansion Beyond Rice Cooking to Slow Cooking, Steaming, and Baking

- The growing focus on multifunctionality is a major market trend in the electric rice cooker industry, with new models adding such features as slow cooking, pressure cooking, steaming, preparing porridge, baking cakes, and making yogurts into one device, aligning with adjacent compact kitchen appliances such as portable blender that appeal to urban consumers with space constraints and demand for versatility. This improved flexibility appeals greatly to urban consumers with space constraints and cost-conscious consumers who need to see more possibility and utility through a multifunctional kitchen solution. As an example, in September 2025, Xiaomi has released its first smart variable-pressure IH (Induction Heating) rice cooker under the Mijia brand. The appliance has the capacity of 4 liters and costs 1999 yuan (280 dollars). It is intended to serve the family of four to five members and accommodates the high-tech pressure modulation and intelligent cooking features.

- Additionally, the introduction of recipe collections, automatic programs and use guided cooking applications contributes to the market advancement providing easiness of use and multifunction adoption. These characteristics enhance consumer focus, appliance efficiency, and satisfaction, making the electric rice cooker market a leading force of demand based on connected, rich content models. For instance, in September 2025, a smart CUCKOO Electronics (such as Smart IH Rice Cooker and Twin Pressure) was launched with smart features, silent steam type and Smart-Home integration highlighting continuing high-end smart appliances releases.

Electric-Rice-Cooker-Market Analysis and Segmental Data

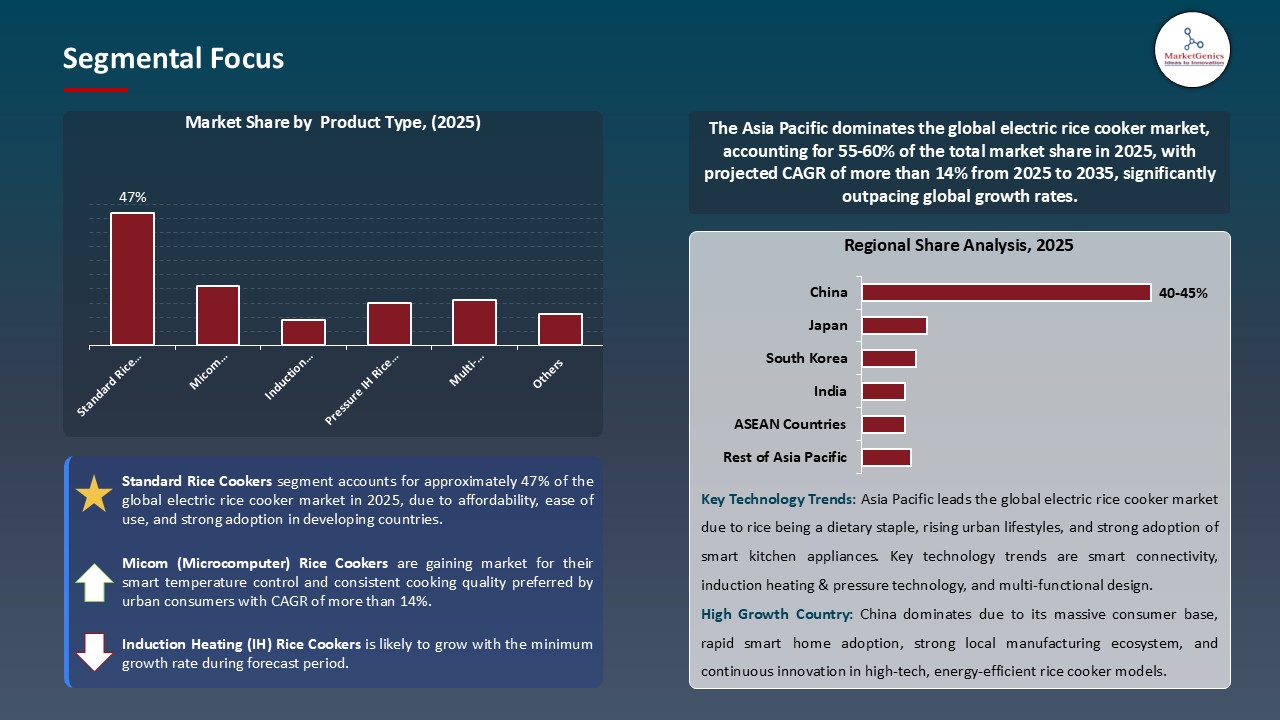

Standard Rice Cookers Dominate Global Electric Rice Cooker Market

- The standard rice cookers lead in the global electric rice cooker market because of their low cost, ease of use, and dependability, and are thus so readily available in both the developing and the developed markets, where consumers do not value the sophisticated functions of these devices as much as the straightforward functionality. As an example, in February 2025, super-market chain Ambiano introduced a 6-cup standard ceramic-pot rice cooker at USD 16.99 in the U.S. market, which demonstrated that it is committed to no-frills as well as low-priced appliances. The model focuses on essential cooking dependability, which is attractive to cost-conscious consumers and strengthens the presence of economical standard rice cookers. These advancements are indicative of the ongoing momentum of the standard segment in the emerging and developed markets whereby consumers focus on the basic performance and affordability rather than the premium features.

- Moreover, their performance and convenience of use and low-maintenance needs guarantee consistent demand among households, restaurants and catering services, which further supports their role as the choice in the international electric rice cooker market. For instance, in 2025, Tiger Corporation published, a commercial-use IH rice cooker, “JIK-P180, which provides rapid-cook settings, to food-service settings, and reliability and consistency is a factor in promoting institutional acceptance of standard equipment.

Asia Pacific Leads Global Electric Rice Cooker Market Demand

- The Asia Pacific region leads global electric rice cooker because of rice is a staple food in most of the developed economies such as China, India, Japan and Indonesia, which leads to a steady household and institutional usage. In early 2025, the Government stimulus in China increased trade-in subsidies on home appliances such as rice cookers with an allocation USD 11.1 billion to promote replacement of old appliances. This cultural staple consumption, government stimulus and localized product innovation combination ensures that Asia Pacific continues to lead the global electric rice cooker segment.

- Additionally, the increasing disposable incomes, urbanization in Asia Pacific markets and busy lifestyles are driving the consumers towards automated and convenient cooking devices, enhancing the domination of the region in the electric rice cooker market across the world. As an example, in October 2024, in India, local player Agaro announced the Regal series in early 2025 with more steaming and keep-warm capabilities and at a lower price, with volume and simplified functionality being a key feature of emerging-market brands competing on price, not advanced technical features.

Electric-Rice-Cooker-Market Ecosystem

The global electric rice cooker market is slightly fragmented, with high concentration among key players such as Midea Group, Panasonic Corporation, Zojirushi Corporation, Breville Group, and Tiger Corporation, who dominate through technological innovation, extensive distribution networks, and strong brand equity. Their market presence is also enhanced through strategic partnerships with e-commerce platforms, regional distributors and component suppliers. The sustained leadership and competitive edge in various geographic markets is possible through continuous investment in the research and development, especially in energy efficiency, multifunctionality, and digital integration.

Recent Development and Strategic Overview:

- In April 2025, Xiaomi announced the Mijia 3D Pressure IH Rice Cooker P1 3L, a high-tech cooker with an upgrade to make your daily bowl of rice taste like it was made by a professional chef, which is, nevertheless, compact and is covered with titanium.

- In March 2024, Toshiba launched smart cooking solutions that can make the cooking process easier and contribute to the best cooking experience as well. The advanced technology in smart kitchen appliances offers intuitive control and automation to users and makes the cooking process more convenient and quicker.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.9 Bn |

|

Market Forecast Value in 2035 |

USD 5.8 Bn |

|

Growth Rate (CAGR) |

11.8% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Electric-Rice-Cooker-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Electric Rice Cooker Market, By Product Type |

|

|

Electric Rice Cooker Market, By Capacity |

|

|

Electric Rice Cooker Market, By Material Type

|

|

|

Electric Rice Cooker Market, By Distribution Channel |

|

|

Electric Rice Cooker Market, By Price Range

|

|

|

Electric Rice Cooker Market, By Power Rating

|

|

|

Electric Rice Cooker Market, By Technology |

|

|

Electric Rice Cooker Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Electric Rice Cooker Market Outlook

- 2.1.1. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Electric Rice Cooker Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Electric Rice Cooker Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Electric Rice Cooker Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising consumer preference for convenient and time-saving cooking appliances

- 4.1.1.2. Growing urbanization and increasing disposable incomes, especially in Asia-Pacific

- 4.1.1.3. Technological advancements such as smart, multifunctional, and energy-efficient rice cookers

- 4.1.2. Restraints

- 4.1.2.1. High competition from traditional cooking methods and low-cost substitutes

- 4.1.2.2. Limited product penetration in rural and price-sensitive regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Electric Rice Cooker Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Electric Rice Cooker Market Demand

- 4.7.1. Historical Market Size - (Volume - Million Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Million Units and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Electric Rice Cooker Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Standard Rice Cookers

- 6.2.2. Micom (Microcomputer) Rice Cookers

- 6.2.3. Induction Heating (IH) Rice Cookers

- 6.2.4. Pressure IH Rice Cookers

- 6.2.5. Multi-functional Rice Cookers

- 6.2.6. Others

- 7. Global Electric Rice Cooker Market Analysis, by Capacity

- 7.1. Key Segment Analysis

- 7.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Capacity, 2021-2035

- 7.2.1. Small (Less than 3 cups)

- 7.2.2. Medium (3-5 cups)

- 7.2.3. Large (6-10 cups)

- 7.2.4. Commercial Grade (Above 20 cups)

- 8. Global Electric Rice Cooker Market Analysis and Forecasts, by Material Type

- 8.1. Key Findings

- 8.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 8.2.1. Stainless Steel Inner Pot

- 8.2.2. Non-stick Aluminum Inner Pot

- 8.2.3. Ceramic Coated Inner Pot

- 8.2.4. Carbon/Copper Coated Inner Pot

- 8.2.5. Cast Iron Inner Pot

- 8.2.6. Others

- 9. Global Electric Rice Cooker Market Analysis and Forecasts, by Distribution Channel

- 9.1. Key Findings

- 9.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online

- 9.2.1.1. E-commerce Platforms

- 9.2.1.2. Company Websites

- 9.2.1.3. Online Retail Chains

- 9.2.1.4. Others

- 9.2.2. Offline

- 9.2.2.1. Hypermarkets/Supermarkets

- 9.2.2.2. Specialty Stores

- 9.2.2.3. Departmental Stores

- 9.2.2.4. Direct Sales

- 9.2.2.5. Others

- 9.2.1. Online

- 10. Global Electric Rice Cooker Market Analysis and Forecasts, by Price Range

- 10.1. Key Findings

- 10.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 10.2.1. Economy (Below $50)

- 10.2.2. Mid-Range ($50-$150)

- 10.2.3. Premium ($150-$300)

- 10.2.4. Luxury (Above $300)

- 11. Global Electric Rice Cooker Market Analysis and Forecasts, by Power Rating

- 11.1. Key Findings

- 11.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Power Rating, 2021-2035

- 11.2.1. Below 400W

- 11.2.2. 400-700W

- 11.2.3. 700-1000W

- 11.2.4. Above 1000W

- 12. Global Electric Rice Cooker Market Analysis and Forecasts, by Technology

- 12.1. Key Findings

- 12.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 12.2.1. Conventional Heating

- 12.2.2. Fuzzy Logic Technology

- 12.2.3. Induction Heating Technology

- 12.2.4. Pressure Cooking Technology

- 12.2.5. Combination Technology (IH + Pressure)

- 12.2.6. Others

- 13. Global Electric Rice Cooker Market Analysis and Forecasts, by End-Users

- 13.1. Key Findings

- 13.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 13.2.1. Residential/Household

- 13.2.2. Commercial - Food Service

- 13.2.2.1. Restaurant Rice Preparation

- 13.2.2.2. Catering Services

- 13.2.2.3. Cloud Kitchen Operations

- 13.2.2.4. Fast Food Chains

- 13.2.2.5. Hotel Kitchen Operations

- 13.2.2.6. Buffet Services

- 13.2.2.7. Others

- 13.2.3. Institutional

- 13.2.3.1. School/College Cafeterias

- 13.2.3.2. Hospital Kitchens

- 13.2.3.3. Corporate Canteens

- 13.2.3.4. Military Mess Halls

- 13.2.3.5. Others

- 13.2.4. Hospitality

- 13.2.5. Retail & Demonstration

- 13.2.6. Other End-users

- 14. Global Electric Rice Cooker Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Electric Rice Cooker Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Capacity

- 15.3.3. Material Type

- 15.3.4. Distribution Channel

- 15.3.5. Price Range

- 15.3.6. Power Rating

- 15.3.7. Technology

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Electric Rice Cooker Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Capacity

- 15.4.4. Material Type

- 15.4.5. Distribution Channel

- 15.4.6. Price Range

- 15.4.7. Power Rating

- 15.4.8. Technology

- 15.4.9. End-users

- 15.5. Canada Electric Rice Cooker Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Capacity

- 15.5.4. Material Type

- 15.5.5. Distribution Channel

- 15.5.6. Price Range

- 15.5.7. Power Rating

- 15.5.8. Technology

- 15.5.9. End-users

- 15.6. Mexico Electric Rice Cooker Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Capacity

- 15.6.4. Material Type

- 15.6.5. Distribution Channel

- 15.6.6. Price Range

- 15.6.7. Power Rating

- 15.6.8. Technology

- 15.6.9. End-users

- 16. Europe Electric Rice Cooker Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Capacity

- 16.3.3. Material Type

- 16.3.4. Distribution Channel

- 16.3.5. Price Range

- 16.3.6. Power Rating

- 16.3.7. Technology

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Electric Rice Cooker Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Capacity

- 16.4.4. Material Type

- 16.4.5. Distribution Channel

- 16.4.6. Price Range

- 16.4.7. Power Rating

- 16.4.8. Technology

- 16.4.9. End-users

- 16.5. United Kingdom Electric Rice Cooker Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Capacity

- 16.5.4. Material Type

- 16.5.5. Distribution Channel

- 16.5.6. Price Range

- 16.5.7. Power Rating

- 16.5.8. Technology

- 16.5.9. End-users

- 16.6. France Electric Rice Cooker Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Capacity

- 16.6.4. Material Type

- 16.6.5. Distribution Channel

- 16.6.6. Price Range

- 16.6.7. Power Rating

- 16.6.8. Technology

- 16.6.9. End-users

- 16.7. Italy Electric Rice Cooker Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Capacity

- 16.7.4. Material Type

- 16.7.5. Distribution Channel

- 16.7.6. Price Range

- 16.7.7. Power Rating

- 16.7.8. Technology

- 16.7.9. End-users

- 16.8. Spain Electric Rice Cooker Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Capacity

- 16.8.4. Material Type

- 16.8.5. Distribution Channel

- 16.8.6. Price Range

- 16.8.7. Power Rating

- 16.8.8. Technology

- 16.8.9. End-users

- 16.9. Netherlands Electric Rice Cooker Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Capacity

- 16.9.4. Material Type

- 16.9.5. Distribution Channel

- 16.9.6. Price Range

- 16.9.7. Power Rating

- 16.9.8. Technology

- 16.9.9. End-users

- 16.10. Nordic Countries Electric Rice Cooker Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Capacity

- 16.10.4. Material Type

- 16.10.5. Distribution Channel

- 16.10.6. Price Range

- 16.10.7. Power Rating

- 16.10.8. Technology

- 16.10.9. End-users

- 16.11. Poland Electric Rice Cooker Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Capacity

- 16.11.4. Material Type

- 16.11.5. Distribution Channel

- 16.11.6. Price Range

- 16.11.7. Power Rating

- 16.11.8. Technology

- 16.11.9. End-users

- 16.12. Russia & CIS Electric Rice Cooker Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Capacity

- 16.12.4. Material Type

- 16.12.5. Distribution Channel

- 16.12.6. Price Range

- 16.12.7. Power Rating

- 16.12.8. Technology

- 16.12.9. End-users

- 16.13. Rest of Europe Electric Rice Cooker Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Capacity

- 16.13.4. Material Type

- 16.13.5. Distribution Channel

- 16.13.6. Price Range

- 16.13.7. Power Rating

- 16.13.8. Technology

- 16.13.9. End-users

- 17. Asia Pacific Electric Rice Cooker Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Capacity

- 17.3.3. Material Type

- 17.3.4. Distribution Channel

- 17.3.5. Price Range

- 17.3.6. Power Rating

- 17.3.7. Technology

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Electric Rice Cooker Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Capacity

- 17.4.4. Material Type

- 17.4.5. Distribution Channel

- 17.4.6. Price Range

- 17.4.7. Power Rating

- 17.4.8. Technology

- 17.4.9. End-users

- 17.5. India Electric Rice Cooker Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Capacity

- 17.5.4. Material Type

- 17.5.5. Distribution Channel

- 17.5.6. Price Range

- 17.5.7. Power Rating

- 17.5.8. Technology

- 17.5.9. End-users

- 17.6. Japan Electric Rice Cooker Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Capacity

- 17.6.4. Material Type

- 17.6.5. Distribution Channel

- 17.6.6. Price Range

- 17.6.7. Power Rating

- 17.6.8. Technology

- 17.6.9. End-users

- 17.7. South Korea Electric Rice Cooker Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Capacity

- 17.7.4. Material Type

- 17.7.5. Distribution Channel

- 17.7.6. Price Range

- 17.7.7. Power Rating

- 17.7.8. Technology

- 17.7.9. End-users

- 17.8. Australia and New Zealand Electric Rice Cooker Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Capacity

- 17.8.4. Material Type

- 17.8.5. Distribution Channel

- 17.8.6. Price Range

- 17.8.7. Power Rating

- 17.8.8. Technology

- 17.8.9. End-users

- 17.9. Indonesia Electric Rice Cooker Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Capacity

- 17.9.4. Material Type

- 17.9.5. Distribution Channel

- 17.9.6. Price Range

- 17.9.7. Power Rating

- 17.9.8. Technology

- 17.9.9. End-users

- 17.10. Malaysia Electric Rice Cooker Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Capacity

- 17.10.4. Material Type

- 17.10.5. Distribution Channel

- 17.10.6. Price Range

- 17.10.7. Power Rating

- 17.10.8. Technology

- 17.10.9. End-users

- 17.11. Thailand Electric Rice Cooker Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Capacity

- 17.11.4. Material Type

- 17.11.5. Distribution Channel

- 17.11.6. Price Range

- 17.11.7. Power Rating

- 17.11.8. Technology

- 17.11.9. End-users

- 17.12. Vietnam Electric Rice Cooker Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Capacity

- 17.12.4. Material Type

- 17.12.5. Distribution Channel

- 17.12.6. Price Range

- 17.12.7. Power Rating

- 17.12.8. Technology

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Electric Rice Cooker Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Capacity

- 17.13.4. Material Type

- 17.13.5. Distribution Channel

- 17.13.6. Price Range

- 17.13.7. Power Rating

- 17.13.8. Technology

- 17.13.9. End-users

- 18. Middle East Electric Rice Cooker Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Capacity

- 18.3.3. Material Type

- 18.3.4. Distribution Channel

- 18.3.5. Price Range

- 18.3.6. Power Rating

- 18.3.7. Technology

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Electric Rice Cooker Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Capacity

- 18.4.4. Material Type

- 18.4.5. Distribution Channel

- 18.4.6. Price Range

- 18.4.7. Power Rating

- 18.4.8. Technology

- 18.4.9. End-users

- 18.5. UAE Electric Rice Cooker Market

- 18.5.1. Product Type

- 18.5.2. Capacity

- 18.5.3. Material Type

- 18.5.4. Distribution Channel

- 18.5.5. Price Range

- 18.5.6. Power Rating

- 18.5.7. Technology

- 18.5.8. End-users

- 18.6. Saudi Arabia Electric Rice Cooker Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Capacity

- 18.6.4. Material Type

- 18.6.5. Distribution Channel

- 18.6.6. Price Range

- 18.6.7. Power Rating

- 18.6.8. Technology

- 18.6.9. End-users

- 18.7. Israel Electric Rice Cooker Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Capacity

- 18.7.4. Material Type

- 18.7.5. Distribution Channel

- 18.7.6. Price Range

- 18.7.7. Power Rating

- 18.7.8. Technology

- 18.7.9. End-users

- 18.8. Rest of Middle East Electric Rice Cooker Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Capacity

- 18.8.4. Material Type

- 18.8.5. Distribution Channel

- 18.8.6. Price Range

- 18.8.7. Power Rating

- 18.8.8. Technology

- 18.8.9. End-users

- 19. Africa Electric Rice Cooker Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Capacity

- 19.3.3. Material Type

- 19.3.4. Distribution Channel

- 19.3.5. Price Range

- 19.3.6. Power Rating

- 19.3.7. Technology

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Electric Rice Cooker Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Capacity

- 19.4.4. Material Type

- 19.4.5. Distribution Channel

- 19.4.6. Price Range

- 19.4.7. Power Rating

- 19.4.8. Technology

- 19.4.9. End-users

- 19.5. Egypt Electric Rice Cooker Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Capacity

- 19.5.4. Material Type

- 19.5.5. Distribution Channel

- 19.5.6. Price Range

- 19.5.7. Power Rating

- 19.5.8. Technology

- 19.5.9. End-users

- 19.6. Nigeria Electric Rice Cooker Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Capacity

- 19.6.4. Material Type

- 19.6.5. Distribution Channel

- 19.6.6. Price Range

- 19.6.7. Power Rating

- 19.6.8. Technology

- 19.6.9. End-users

- 19.7. Algeria Electric Rice Cooker Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Capacity

- 19.7.4. Material Type

- 19.7.5. Distribution Channel

- 19.7.6. Price Range

- 19.7.7. Power Rating

- 19.7.8. Technology

- 19.7.9. End-users

- 19.8. Rest of Africa Electric Rice Cooker Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Capacity

- 19.8.4. Material Type

- 19.8.5. Distribution Channel

- 19.8.6. Price Range

- 19.8.7. Power Rating

- 19.8.8. Technology

- 19.8.9. End-users

- 20. South America Electric Rice Cooker Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Electric Rice Cooker Market Size (Volume - Million Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Capacity

- 20.3.3. Material Type

- 20.3.4. Distribution Channel

- 20.3.5. Price Range

- 20.3.6. Power Rating

- 20.3.7. Technology

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Electric Rice Cooker Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Capacity

- 20.4.4. Material Type

- 20.4.5. Distribution Channel

- 20.4.6. Price Range

- 20.4.7. Power Rating

- 20.4.8. Technology

- 20.4.9. End-users

- 20.5. Argentina Electric Rice Cooker Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Capacity

- 20.5.4. Material Type

- 20.5.5. Distribution Channel

- 20.5.6. Price Range

- 20.5.7. Power Rating

- 20.5.8. Technology

- 20.5.9. End-users

- 20.6. Rest of South America Electric Rice Cooker Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Capacity

- 20.6.4. Material Type

- 20.6.5. Distribution Channel

- 20.6.6. Price Range

- 20.6.7. Power Rating

- 20.6.8. Technology

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Aroma Housewares Company

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Bajaj Electricals

- 21.3. BLACK+DECKER

- 21.4. Breville Group

- 21.5. Cuckoo Electronics

- 21.6. Cuisinart (Conair Corporation)

- 21.7. Galanz Enterprise Group

- 21.8. Hamilton Beach Brands

- 21.9. Havells India

- 21.10. Hitachi Ltd.

- 21.11. Instant Brands (Instant Pot)

- 21.12. Joyoung Company

- 21.13. Midea Group

- 21.14. Panasonic Corporation

- 21.15. Philips Electronics

- 21.16. Prestige Group

- 21.17. Sharp Corporation

- 21.18. Supor Group

- 21.19. Tatung Company

- 21.20. Tiger Corporation

- 21.21. Toshiba Corporation

- 21.22. Xiaomi Corporation

- 21.23. Zojirushi Corporation

- 21.24. Other Key Players

- 21.1. Aroma Housewares Company

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation