Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size, Share & Trends Analysis Report by Component (Sensors & Actuators, Flexible Circuits & Interconnects, Data Processing Units, Power Supply Systems, Communication Modules, Substrate Materials, Others), Material Type, Flexibility Type, Fabrication Technology, Power Source, Connectivity, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size, Share, and Growth

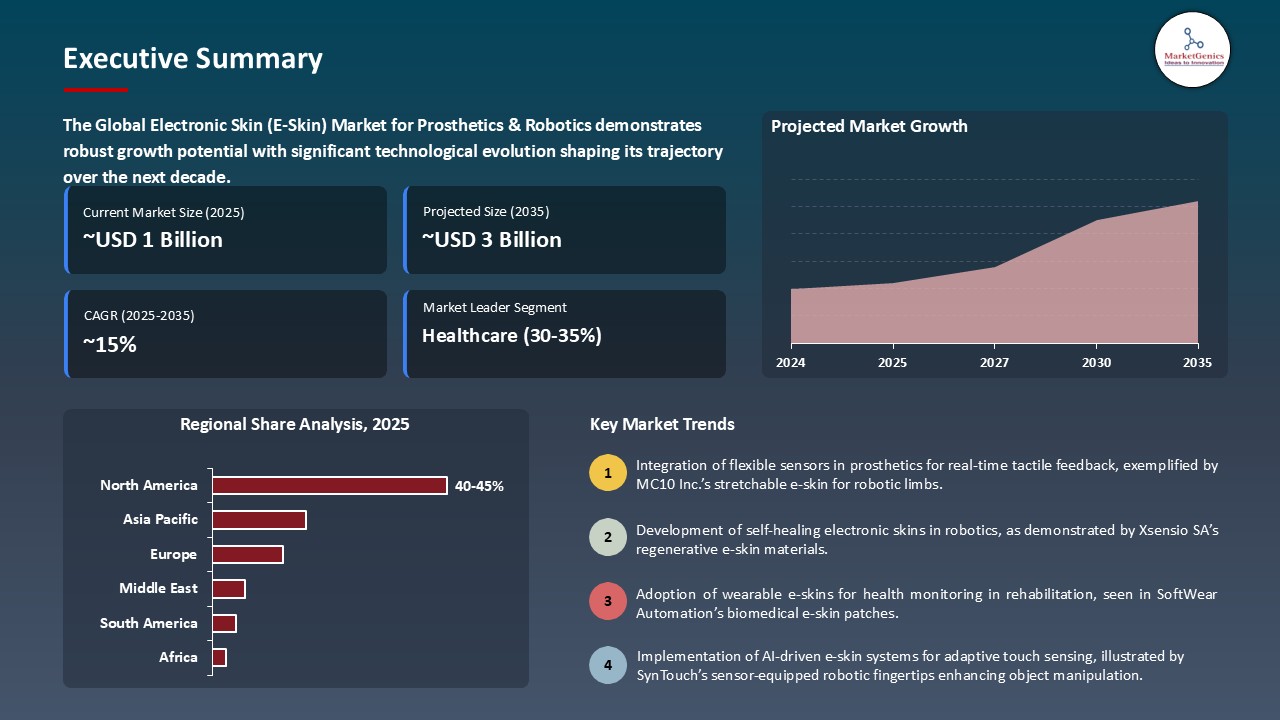

The global electronic skin (E‑Skin) market for prosthetics & robotics is experiencing robust growth, with its estimated value of USD 0.8 billion in the year 2025 and USD 3.1 billion by the period 2035, registering a CAGR of 14.6% during the forecast period.

Fengyuan Liu, a member of the BEST group and a co-author of the paper, added: “In the future, Printed Synaptic Transistors based Electronic Skin for Robots to Feel and Learn, research could be the basis for a more advanced electronic skin which enables robots capable of exploring and interacting with the world in new ways, or building prosthetic limbs which are capable of near-human levels of touch sensitivity.”

The advances in ultra-responsive tactile sensing, flexible materials and AI controllable feedback systems are driving the global market of electronic skin (E-skin) in prosthetics and robotics. Indicatively, scientists in China have developed a 3D e-skin that has 240 microsensors that can detect pressure, friction, and strain in real time that is capable of imitating various mechanical signals like human skin.

In Singapore, the National University of Singapore created the so-called ACES (Asynchronous Coded Electronic Skin) that sends both thermal and tactile data with very small latency and scales to thousands of individual sensors with great fidelity. Equally, the developments in dual-modal tactile e-skin adding magnetic sensors and haptic feedback enable the robots to recognize contact and provide feedback of the contact and tactile stimuli, enhancing the ability to manipulate objects in manufacturing.

These inventions are fulfilling increased requirements by producers of prosthetics and creators of robots of more realistic feel, shorter response times, and flexible and durable materials. With the growing attempt by the developers of the prosthetics to incorporate such e-skins to provide sensory feedback, the requirement of strong and powerful performance, cyclic performance, and biocompatibility is escalating investments.

The wearable health monitoring devices, artificial intelligence based sensory systems, bioelectronic medical interfaces and humanoid robotics are adjacent market opportunities to the global electronic skin (E-Skin) market in the field of prosthetics and robotics. These disciplines use the e-skin technology to improve human machine interaction, sensory intelligence, and adaptive biofeedback systems.

Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Dynamics and Trends

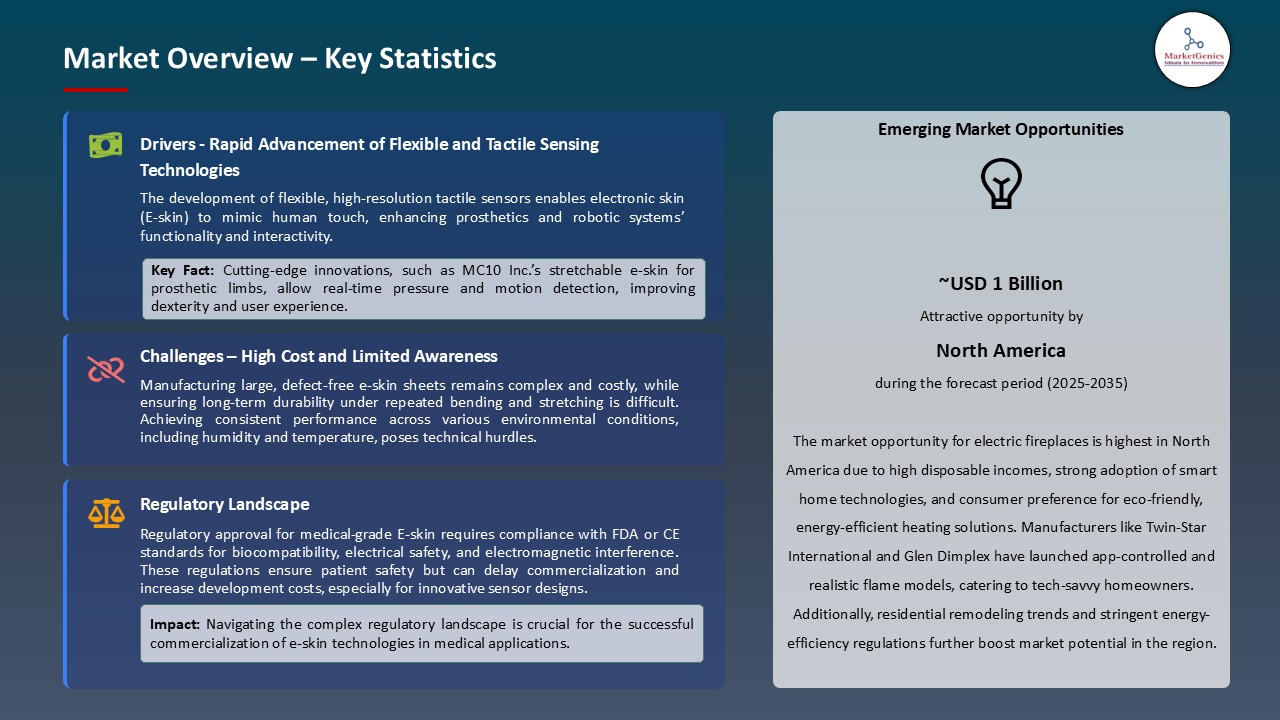

Driver: Advanced Haptic Feedback Systems Revolutionizing Prosthetic Sensory Restoration Capabilities Worldwide

- The adoption of advanced haptic feedback devices into electronic skin systems is a radical force that is driving market growth. The latest e-skin technologies introduce multimodal sensory arrays allowing an amputee to feel the texture and temperature changes along with the gradients of pressure level.

- In March 2024, the Applied Physics Laboratory of Johns Hopkins University was able to demonstrate their LUKE prosthetic arm with e-skin sensors that could transmit 20 dissimultaneously or 20 different tactile sensations to users using targeted neural stimulation. This invention allows prosthetic users to do such delicate jobs like using fragile objects, typing and even detecting small changes in temperature.

- Increased sensory ability is a major boost to the rates of adoption and high price payment of highly advanced prosthetic machines in the world market.

Restraint: Manufacturing Complexity and Scalability Challenges Limiting Commercial Production Expansion

- The complexity of fabrication in creating reliable and biocompatible electronic skin systems has great obstacles in market penetration and competitiveness in the cost. The e-skin fabrication process requires cleanroom facilities, nanofabrication processes, and multi-layered integration, involving organic semiconductors, flexible electronics and biocompatible encapsulations.

- In September 2024, Samsung Advanced Institute of Technology announced that scaled manufacturing tests of their stretchable sensor arrays had shown serious yield rate problems with only 62 percent of functional devices produced because of interconnect failures and delaminate problems during mechanical stress tests.

- High production costs and technicalities are a significant hindrance to accessing the market and competitive pricing approaches to market entry by new manufacturers.

Opportunity: Collaborative Robotics Applications Expanding Beyond Traditional Industrial Manufacturing Environments

- The emerging collaborative robotics market contains significant prospects of electronic skin implementation, especially in the human-robot interaction case where increased safety measures and tactile sense are compulsory. Robotics are increasingly required in industries that include the care of the elderly, surgical assistance, automation of logistics, and service robotics, which also require force application to be dynamically regulated in order to avoid inadvertent human contact.

- ABB Robotics launched their YuMi collaborative robot in June 2024, which has full body e-skin coverage (with more than 10,000 separate capacitive sensors) and, with response times of less than 15 milliseconds and force sensitivity of less than 3 Newtons, is able to detect a collision and react in real-time. This is a technology that ensures safe human-Robot cooperation in unstructured settings that do not require customary safety systems or enclosed areas of operation.

- Market potential is further heightened by the growing applications in rehabilitation therapy, where robots can offer physically assistive exercises in which prominent force modulation is necessary, and healthcare institutions demand technology-based therapeutic interventions to actors of advanced age.

Key Trend: Artificial Intelligence Integration Enabling Predictive Tactile Sensing and Autonomous Adaptation

- This intersection of artificial intelligence algorithms and electronic skin sensor network is a powerful trend that is transforming the developmental paths of products and functionalities. Modern e-skin systems are progressively using edge computing processors and machine learning models to process the pattern of the tactile data in real-time and provide a predictive grip control, material recognition, and autonomous sensory calibration.

- In November 2024, Meta Reality Labs presented their prototype of a neural interface with e-skin sensors and on-board AI processing which could accurately identify 47 types of fabric textures with 94% accuracy using a convolutional neural network trained on proprioceptive feedback data. This smart processing makes prosthetic devices automatically change the grip pressure depending on predictions about object fragility and also depending on surface friction coefficients without direct user control.

- Moreover, adaptive learning systems can be accomplished by continuous learning algorithms that customize sensory mappings based on the personal neural plasticity pattern, which optimize signal interpretation with longer periods of usage and enhance the user embodiment experiences significantly.

Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis and Segmental Data

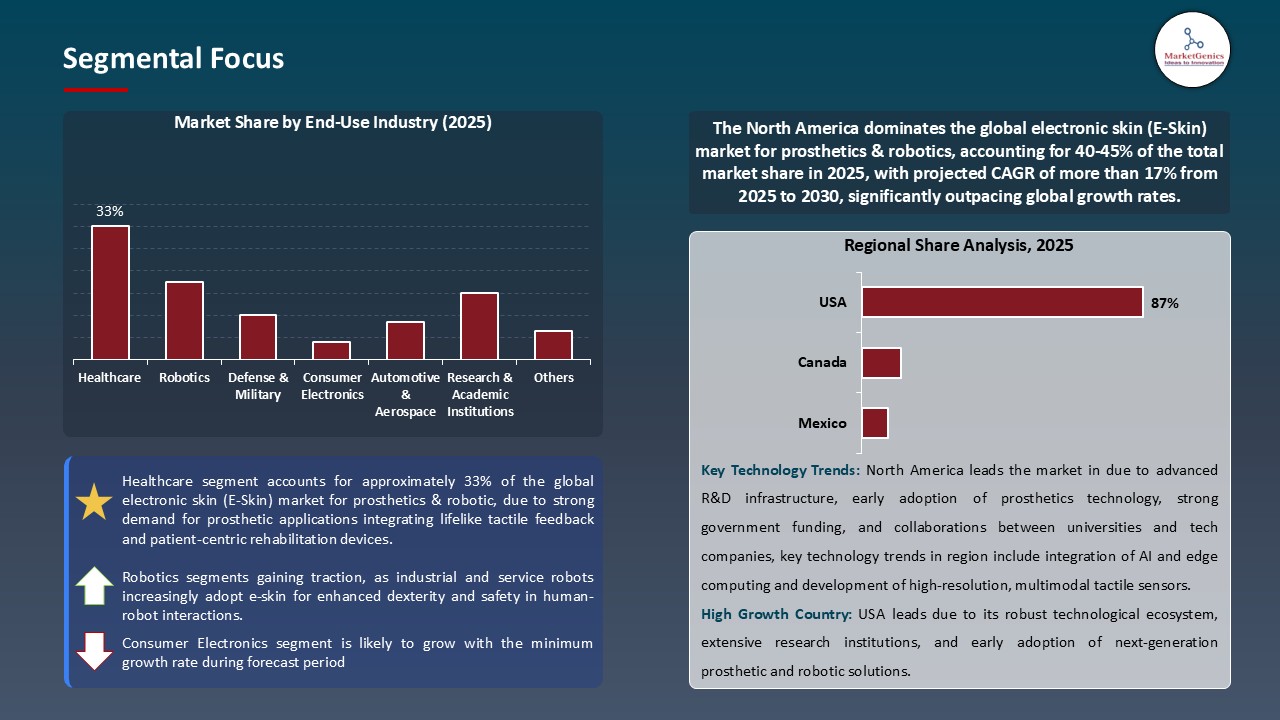

Healthcare Sector Dominates E-Skin Adoption Through Critical Medical Applications

- The healthcare facilities have unprecedented demand of e-skin technologies because of the urgent patient care needs and clinical rehabilitation needs. High-tech artificial limbs with electronic skin sensors directly respond to the restoration of quality of life to an amputation victim, which offers procedures of functional autonomy and mental health.

- Cleveland Clinic was also able to implant e-skin-enabled bionic hands in 12 patients in August 2024, after which it reported 89 percent improvements in metrics of daily activity performance. Medical facilities are focusing on investing in technologies that present quantifiable therapeutic benefits and improvement of patient satisfaction.

- The regulatory needs and reimbursement systems of healthcare provide the stability of procurement volumes in the market and sustainability of high prices.

North America Commands E-Skin Market Leadership Through Innovation Infrastructure

- North America upholds a dominant position in the market with respect to concentrated research infrastructures, availability of large amounts of venture capital and already established medical device ecosystems that can support expedite commercialization avenues. The area is home to the leading academic enterprises and corporate research labs that have been leading the breakthrough innovations in flexible electronics and biocompatible materials.

- Stanford University Bio-X lab collaborated with Tactile robotics to commercially license self-healing e-skin technology in February 2025, attracting Silicon Valley-based investors to the tune of $45 million, in the form of series B. Likewise, in January 2025, the United States Department of Veterans Affairs announced $180 million procurement contracts with the next-generation e-skin-enabled prosthetic systems of Atom Limbs, with a specific focus of 15,000 veteran amputees being attracted through VA medical facilities in the country.

- This government undertaking creates predictable levels of demand which motivates manufacturers to set up manufacturing facilities as well as distribution networks in North American territories and generates self-reinforcing effects of market concentration that increases regional hegemony.

Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Ecosystem

The global electronic skin (E‑Skin) market for prosthetics & robotics demonstrates moderate consolidation, with established players including HaptX Inc., Tekscan Inc., MC10 Inc., Syntouch LLC, Xenoma Inc., and Psyonic leveraging advanced flexible electronics, nanomaterial integration, and biomimetic sensor architectures to maintain competitive differentiation. These leading companies dominate through proprietary fabrication techniques, extensive patent portfolios, and strategic partnerships with prosthetic manufacturers and robotics integrators, enabling superior tactile resolution and durability standards.

Key market participants focus on specialized niche solutions, with HaptX Inc. developing microfluidic displacement actuators for high-fidelity haptic feedback, while Tekscan Inc. concentrates on piezoresistive sensor arrays optimized for pressure mapping in prosthetic socket interfaces. Syntouch LLC specializes in biomimetic tactile sensors replicating human fingertip mechanoreceptor distributions, and Xenoma Inc. produces stretchable circuit garments enabling full-body motion tracking for rehabilitation robotics applications.

Government bodies and research institutions actively invest in advancing e-skin technologies. In September 2024, the National Institute of Biomedical Imaging and Bioengineering allocated $12.3 million toward developing self-powered triboelectric e-skin sensors at Northwestern University, resulting in autonomous prosthetic systems requiring no external battery charging and demonstrating 72-hour continuous operational capacity.

Recent Development and Strategic Overview:

- In March 2025, Scientists at a German research lab have created an ultra-thin, flexible electronic skin (e-skin) that can detect and track magnetic fields using a single global sensor. This e-skin has the potential to give robots a sense of touch through magnetic fields, allow humans to interact with digital environments (virtual reality) without any physical controllers.

- In July 2024, HaptX Inc. commenced commercial shipments of their HaptX Gloves G1 product line featuring 133 pneumatic actuators per glove, delivering unprecedented tactile fidelity for prosthetic training and robotic teleoperation applications.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 0.8 Bn |

|

Market Forecast Value in 2035 |

USD 3.1 Bn |

|

Growth Rate (CAGR) |

14.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Component |

|

|

By Material Type |

|

|

By Flexibility Type |

|

|

By Fabrication Technology |

|

|

By Power Source |

|

|

By Connectivity |

|

|

By End-Use Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Outlook

- 2.1.1. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing demand for advanced materials across automotive, electronics, and construction industries.

- 4.1.1.2. Growing emphasis on sustainable and green chemicals to meet environmental regulations.

- 4.1.1.3. Rapid technological advancements in chemical synthesis and material engineering.

- 4.1.2. Restraints

- 4.1.2.1. High production and raw material costs limiting small and medium manufacturers.

- 4.1.2.2. Stringent environmental regulations and compliance requirements increasing operational challenges.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Demand

- 4.9.1. Historical Market Size – in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Sensors & Actuators

- 6.2.2. Flexible Circuits & Interconnects

- 6.2.3. Data Processing Units

- 6.2.4. Power Supply Systems

- 6.2.5. Communication Modules

- 6.2.6. Substrate Materials

- 6.2.7. Others

- 7. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Organic Materials

- 7.2.2. Inorganic Materials

- 7.2.3. Nanomaterial

- 7.2.4. Hydrogel-Based Materials

- 7.2.5. Textile-Integrated Materials

- 8. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Flexibility Type

- 8.1. Key Segment Analysis

- 8.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Flexibility Type, 2021-2035

- 8.2.1. Rigid E-Skin

- 8.2.2. Flexible E-Skin

- 8.2.3. Stretchable E-Skin

- 9. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Fabrication Technology

- 9.1. Key Segment Analysis

- 9.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Fabrication Technology, 2021-2035

- 9.2.1. Printing Technologies

- 9.2.2. Photolithography

- 9.2.3. Self-Assembly Techniques

- 9.2.4. Transfer Printing

- 9.2.5. Laser Processing

- 9.2.6. Roll-to-Roll Manufacturing

- 9.2.7. Others

- 10. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Power Source

- 10.1. Key Segment Analysis

- 10.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2021-2035

- 10.2.1. Battery-Powered

- 10.2.2. Energy Harvesting

- 10.2.3. Self-Powered Systems

- 10.2.4. Hybrid Power Systems

- 11. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Connectivity

- 11.1. Key Segment Analysis

- 11.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, by Connectivity, 2021-2035

- 11.2.1. Wired Systems

- 11.2.2. Wireless Systems

- 11.2.3. IoT-Enabled Systems

- 11.2.4. Standalone/Non-Connected

- 12. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by End-Use Industry

- 12.1. Key Findings

- 12.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Mn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 12.2.1. Healthcare

- 12.2.1.1. Limb Prosthetics

- 12.2.1.1.1. Upper Limb

- 12.2.1.1.2. Lower Limb

- 12.2.1.2. Facial Prosthetics

- 12.2.1.3. Rehabilitation Devices

- 12.2.1.4. Surgical Robotics with Tactile Feedback

- 12.2.1.5. Patient Monitoring Systems

- 12.2.1.6. Others

- 12.2.1.1. Limb Prosthetics

- 12.2.2. Robotics

- 12.2.2.1. Industrial Robots

- 12.2.2.2. Collaborative Robot

- 12.2.2.3. Service Robots

- 12.2.2.4. Robotic Surgery Systems

- 12.2.2.5. Humanoid Robots

- 12.2.2.6. Others

- 12.2.3. Defense & Military

- 12.2.3.1. Military-Grade Prosthetics for Veterans

- 12.2.3.2. Bomb Disposal Robots

- 12.2.3.3. Reconnaissance Robots

- 12.2.3.4. Exoskeleton Systems

- 12.2.3.5. Others

- 12.2.4. Consumer Electronics

- 12.2.4.1. Wearable Health Monitors

- 12.2.4.2. Smart Prosthetics for Consumers

- 12.2.4.3. Gaming & Virtual Reality Interfaces

- 12.2.4.4. Personal Care Robots

- 12.2.4.5. Others

- 12.2.5. Automotive & Aerospace

- 12.2.6. Research & Academic Institutions

- 12.2.7. Others

- 12.2.1. Healthcare

- 13. Global Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis, by Region

- 13.1. Key Findings

- 13.2. Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Volume - Thousand Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Material Type

- 14.3.3. Flexibility Type

- 14.3.4. Fabrication Technology

- 14.3.5. Power Source

- 14.3.6. Connectivity

- 14.3.7. End-Use Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Material Type

- 14.4.4. Flexibility Type

- 14.4.5. Fabrication Technology

- 14.4.6. Power Source

- 14.4.7. Connectivity

- 14.4.8. End-Use Industry

- 14.5. Canada Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Material Type

- 14.5.4. Flexibility Type

- 14.5.5. Fabrication Technology

- 14.5.6. Power Source

- 14.5.7. Connectivity

- 14.5.8. End-Use Industry

- 14.6. Mexico Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Material Type

- 14.6.4. Flexibility Type

- 14.6.5. Fabrication Technology

- 14.6.6. Power Source

- 14.6.7. Connectivity

- 14.6.8. End-Use Industry

- 15. Europe Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Material Type

- 15.3.3. Flexibility Type

- 15.3.4. Fabrication Technology

- 15.3.5. Power Source

- 15.3.6. Connectivity

- 15.3.7. End-Use Industry

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Material Type

- 15.4.4. Flexibility Type

- 15.4.5. Fabrication Technology

- 15.4.6. Power Source

- 15.4.7. Connectivity

- 15.4.8. End-Use Industry

- 15.5. United Kingdom Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Material Type

- 15.5.4. Flexibility Type

- 15.5.5. Fabrication Technology

- 15.5.6. Power Source

- 15.5.7. Connectivity

- 15.5.8. End-Use Industry

- 15.6. France Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Material Type

- 15.6.4. Flexibility Type

- 15.6.5. Fabrication Technology

- 15.6.6. Power Source

- 15.6.7. Connectivity

- 15.6.8. End-Use Industry

- 15.7. Italy Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Material Type

- 15.7.4. Flexibility Type

- 15.7.5. Fabrication Technology

- 15.7.6. Power Source

- 15.7.7. Connectivity

- 15.7.8. End-Use Industry

- 15.8. Spain Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Material Type

- 15.8.4. Flexibility Type

- 15.8.5. Fabrication Technology

- 15.8.6. Power Source

- 15.8.7. Connectivity

- 15.8.8. End-Use Industry

- 15.9. Netherlands Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Material Type

- 15.9.4. Flexibility Type

- 15.9.5. Fabrication Technology

- 15.9.6. Power Source

- 15.9.7. Connectivity

- 15.9.8. End-Use Industry

- 15.10. Nordic Countries Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Material Type

- 15.10.4. Flexibility Type

- 15.10.5. Fabrication Technology

- 15.10.6. Power Source

- 15.10.7. Connectivity

- 15.10.8. End-Use Industry

- 15.11. Poland Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Material Type

- 15.11.4. Flexibility Type

- 15.11.5. Fabrication Technology

- 15.11.6. Power Source

- 15.11.7. Connectivity

- 15.11.8. End-Use Industry

- 15.12. Russia & CIS Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Material Type

- 15.12.4. Flexibility Type

- 15.12.5. Fabrication Technology

- 15.12.6. Power Source

- 15.12.7. Connectivity

- 15.12.8. End-Use Industry

- 15.13. Rest of Europe Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Material Type

- 15.13.4. Flexibility Type

- 15.13.5. Fabrication Technology

- 15.13.6. Power Source

- 15.13.7. Connectivity

- 15.13.8. End-Use Industry

- 16. Asia Pacific Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Material Type

- 16.3.3. Flexibility Type

- 16.3.4. Fabrication Technology

- 16.3.5. Power Source

- 16.3.6. Connectivity

- 16.3.7. End-Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Material Type

- 16.4.4. Flexibility Type

- 16.4.5. Fabrication Technology

- 16.4.6. Power Source

- 16.4.7. Connectivity

- 16.4.8. End-Use Industry

- 16.5. India Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Material Type

- 16.5.4. Flexibility Type

- 16.5.5. Fabrication Technology

- 16.5.6. Power Source

- 16.5.7. Connectivity

- 16.5.8. End-Use Industry

- 16.6. Japan Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Material Type

- 16.6.4. Flexibility Type

- 16.6.5. Fabrication Technology

- 16.6.6. Power Source

- 16.6.7. Connectivity

- 16.6.8. End-Use Industry

- 16.7. South Korea Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Material Type

- 16.7.4. Flexibility Type

- 16.7.5. Fabrication Technology

- 16.7.6. Power Source

- 16.7.7. Connectivity

- 16.7.8. End-Use Industry

- 16.8. Australia and New Zealand Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Material Type

- 16.8.4. Flexibility Type

- 16.8.5. Fabrication Technology

- 16.8.6. Power Source

- 16.8.7. Connectivity

- 16.8.8. End-Use Industry

- 16.9. Indonesia Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Material Type

- 16.9.4. Flexibility Type

- 16.9.5. Fabrication Technology

- 16.9.6. Power Source

- 16.9.7. Connectivity

- 16.9.8. End-Use Industry

- 16.10. Malaysia Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Material Type

- 16.10.4. Flexibility Type

- 16.10.5. Fabrication Technology

- 16.10.6. Power Source

- 16.10.7. Connectivity

- 16.10.8. End-Use Industry

- 16.11. Thailand Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Material Type

- 16.11.4. Flexibility Type

- 16.11.5. Fabrication Technology

- 16.11.6. Power Source

- 16.11.7. Connectivity

- 16.11.8. End-Use Industry

- 16.12. Vietnam Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Material Type

- 16.12.4. Flexibility Type

- 16.12.5. Fabrication Technology

- 16.12.6. Power Source

- 16.12.7. Connectivity

- 16.12.8. End-Use Industry

- 16.13. Rest of Asia Pacific Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Material Type

- 16.13.4. Flexibility Type

- 16.13.5. Fabrication Technology

- 16.13.6. Power Source

- 16.13.7. Connectivity

- 16.13.8. End-Use Industry

- 17. Middle East Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Material Type

- 17.3.3. Flexibility Type

- 17.3.4. Fabrication Technology

- 17.3.5. Power Source

- 17.3.6. Connectivity

- 17.3.7. End-Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Material Type

- 17.4.4. Flexibility Type

- 17.4.5. Fabrication Technology

- 17.4.6. Power Source

- 17.4.7. Connectivity

- 17.4.8. End-Use Industry

- 17.5. UAE Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Material Type

- 17.5.4. Flexibility Type

- 17.5.5. Fabrication Technology

- 17.5.6. Power Source

- 17.5.7. Connectivity

- 17.5.8. End-Use Industry

- 17.6. Saudi Arabia Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Material Type

- 17.6.4. Flexibility Type

- 17.6.5. Fabrication Technology

- 17.6.6. Power Source

- 17.6.7. Connectivity

- 17.6.8. End-Use Industry

- 17.7. Israel Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Material Type

- 17.7.4. Flexibility Type

- 17.7.5. Fabrication Technology

- 17.7.6. Power Source

- 17.7.7. Connectivity

- 17.7.8. End-Use Industry

- 17.8. Rest of Middle East Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Material Type

- 17.8.4. Flexibility Type

- 17.8.5. Fabrication Technology

- 17.8.6. Power Source

- 17.8.7. Connectivity

- 17.8.8. End-Use Industry

- 18. Africa Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Material Type

- 18.3.3. Flexibility Type

- 18.3.4. Fabrication Technology

- 18.3.5. Power Source

- 18.3.6. Connectivity

- 18.3.7. End-Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Material Type

- 18.4.4. Flexibility Type

- 18.4.5. Fabrication Technology

- 18.4.6. Power Source

- 18.4.7. Connectivity

- 18.4.8. End-Use Industry

- 18.5. Egypt Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Material Type

- 18.5.4. Flexibility Type

- 18.5.5. Fabrication Technology

- 18.5.6. Power Source

- 18.5.7. Connectivity

- 18.5.8. End-Use Industry

- 18.6. Nigeria Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Material Type

- 18.6.4. Flexibility Type

- 18.6.5. Fabrication Technology

- 18.6.6. Power Source

- 18.6.7. Connectivity

- 18.6.8. End-Use Industry

- 18.7. Algeria Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Material Type

- 18.7.4. Flexibility Type

- 18.7.5. Fabrication Technology

- 18.7.6. Power Source

- 18.7.7. Connectivity

- 18.7.8. End-Use Industry

- 18.8. Rest of Africa Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Material Type

- 18.8.4. Flexibility Type

- 18.8.5. Fabrication Technology

- 18.8.6. Power Source

- 18.8.7. Connectivity

- 18.8.8. End-Use Industry

- 19. South America Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Electronic Skin (E‑Skin) Market for Prosthetics & Robotics Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Material Type

- 19.3.3. Flexibility Type

- 19.3.4. Fabrication Technology

- 19.3.5. Power Source

- 19.3.6. Connectivity

- 19.3.7. End-Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Material Type

- 19.4.4. Flexibility Type

- 19.4.5. Fabrication Technology

- 19.4.6. Power Source

- 19.4.7. Connectivity

- 19.4.8. End-Use Industry

- 19.5. Argentina Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Material Type

- 19.5.4. Flexibility Type

- 19.5.5. Fabrication Technology

- 19.5.6. Power Source

- 19.5.7. Connectivity

- 19.5.8. End-Use Industry

- 19.6. Rest of South America Electronic Skin (E‑Skin) Market for Prosthetics & Robotics

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Material Type

- 19.6.4. Flexibility Type

- 19.6.5. Fabrication Technology

- 19.6.6. Power Source

- 19.6.7. Connectivity

- 19.6.8. End-Use Industry

- 20. Key Players/ Company Profile

- 20.1. Bebop Sensors Inc.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Bloomlife

- 20.3. Canatu Oy

- 20.4. DIALOG Semiconductors

- 20.5. FlexEnable Limited

- 20.6. GENTAG, Inc

- 20.7. G-Ray Switzerland SA

- 20.8. HaptX Inc.

- 20.9. Infi-Tex Inc.

- 20.10. Interlink Electronics

- 20.11. MC10 Inc.

- 20.12. Next Sense Ltd

- 20.13. Peratech Holdco Limited

- 20.14. Plastic Electronic GmbH

- 20.15. PolyIC GmbH & Co. KG

- 20.16. PPS GmbH

- 20.17. Smart Skin Technologies

- 20.18. SynSense AG

- 20.19. Syntouch LLC

- 20.20. TactoTek Oy

- 20.21. Tekscan Inc.

- 20.22. Touchence Inc.

- 20.23. VivaLNK

- 20.24. Xenoma Inc.

- 20.25. Other Key Players

- 20.1. Bebop Sensors Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation