Enamel Technology Market Size, Share & Trends Analysis Report by Product Type (Porcelain Enamel Coatings, Glass-lined Enamel, Specialty Enamel Formulations, Hybrid Enamel Systems), Application, Technology Type, Functional Properties, Substrate Material, End-user Facility Type, Processing Temperature, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Enamel Technology Market Size, Share, and Growth

The global enamel technology market is witnessing strong growth, valued at USD 1.8 billion in 2025 and projected to reach USD 3.1 billion by 2035, expanding at a CAGR of 5.7% during the forecast period. North America leads the enamel technology in healthcare market due to its advanced dental care infrastructure, strong R&D investments in biomaterials, high patient awareness, and rapid integration of digital and minimally invasive restorative technologies.

Craig Rosenblum, President, Himed said that,“In a nutshell, hydroxyapatite is the primary inorganic constituent in the human body. The body likes a material that it already knows. So, the goal from using this blast media is to texturize and increase the surface area of a medical implant.”

The world is gradually moving towards preventive and patient-centered healthcare, and with this change, the trend is high uptake of advanced enamel technologies, which further support the expansion of the enamel technology market. With the focus of healthcare systems shifting towards early intervention, minimum intervention, and long-term patient outcomes, both dental and medical professionals are in search of materials that improve durability, biocompatibility and aesthetic value. As an example, the 3M Company introduced Filtek One Bulk Fill and Filtek Universal Restorative bioactive enamel composites, that is, strengthen natural enamel, reinforce minimally invasive practice, and improve long-term oral health.

The enamel technology market can take a major step forward to meet the increasing demand of minimal invasive and aesthetic dentistry by providing improved enamel-like materials that are durable, biocompatible, and which resemble a natural tooth-like structure. As an example, Scientists at the Kings College London have created a technique that utilizes keratin found in sheep wool to create a long-lasting coating on the teeth using a coating that is enamel- like. This ecological solution resembles natural tooth enamel and may have the potential to provide an alternative to regular dental resin, which is not toxic.

Enamel Technology Market Dynamics and Trends

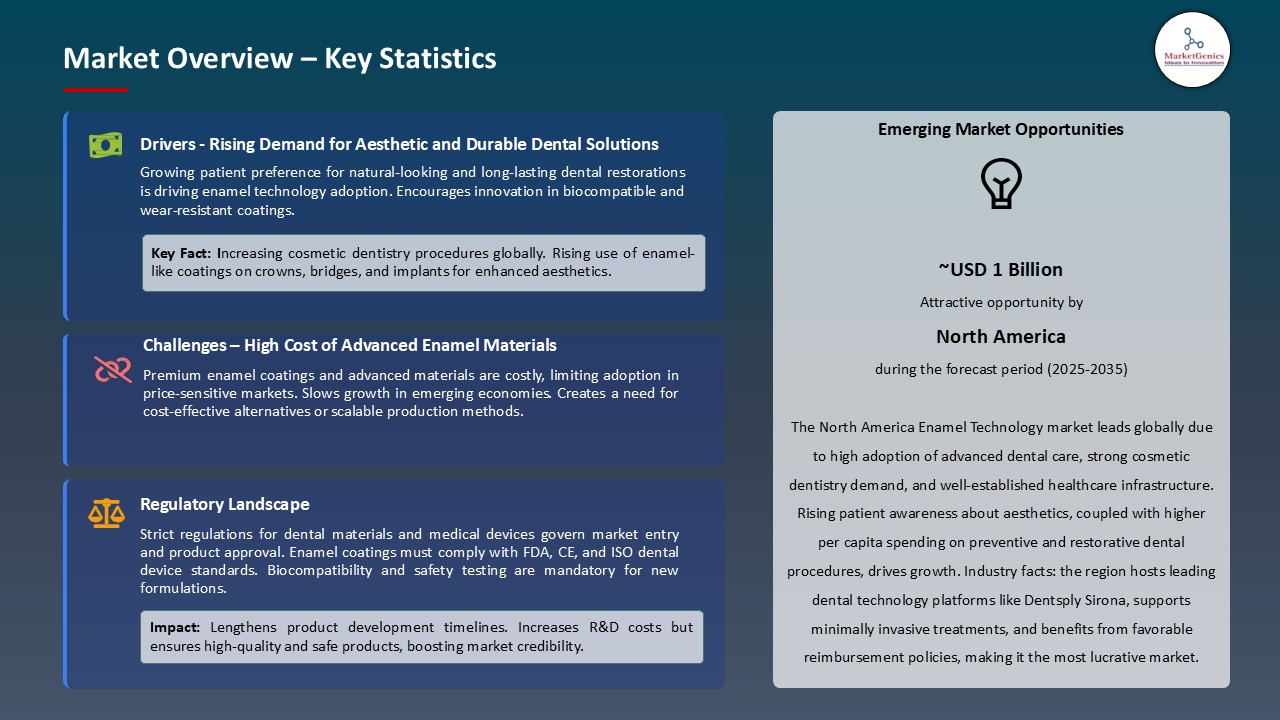

Driver: Rising Demand for High-Performance Coatings in Medical Devices Propels Enamel Technology Growth

- Enamel technology market is being driven by the increase in the need to have durable, biocompatible and corrosion-resistant in medical devices. Surgical tools, diagnostic devices, implants, and tools that are used in hospitals must have a coating that is resistant to sterilization, mechanical loads, chemical exposure, and body fluids and does not deteriorate in performance. An example is that Harland Medical systems have a complete package of high-performance hydrophilic coatings, equipment, and production services to the medical devices allowing the manufacturers to improve the patient outcomes without incurring high costs and efficiency.

- Enamel Coatings, especially porcelain and hybrid types, are uniquely placed to address these challenges, and they have superior chemical stability, wear resistance, biocompatibility. The implementation of the enamel technology will increase the level of reliability in the devices, reduce the maintenance and replacement expenses and assure the application of high regulatory standards in the healthcare system.

- Extensive introduction of enamel coatings into medical equipment stimulates the market development by enhancing the durability, efficiency, and safety of medical devices and guaranteeing regulatory adherence.

Restraint: Limited Accessibility, Regulatory Challenges and Standardization in Enamel Coating Technologies

- The enamel technology market facilitates promising advantages of new advanced enamel restoration materials, yet the cost factor and their unavailability are serious issues. The manufacturing process and costs of are complicated with high costs of raw materials, which increase the prices. WHO reveals that access to primary oral care is limited by the unequal distribution of dental professionals and the lack of oral health facilities. Financial barriers are created by high out of pocket expense particularly in highly effective treatments of enamel.

- Advanced enamel coating technologies are challenged by high regulatory barriers and absence of universal guidelines, which adds barriers to the adoption of the technologies. As an illustration, the implementation of implants with bioactive glasses requires thorough preclinical and clinical testing to satisfy the regulatory demands, and it may require a long and expensive process.

- Moreover, the fact that there are no standardized testing procedures of the enamel coating makes it difficult to compare the performance of the coating between the various uses. Such obstacles can slow down the process of commercialization of innovative enamel-coated medical devices, as well as restrict their use in healthcare facilities.

- High prices, lack of accessibility and regulatory barriers all limit the market expansion and dominant penetration of the global enamel technology.

Opportunity: Expansion of Enamel Coatings to Surgical Instruments, Implants and Dental Restorations in Dentistry

- An enamel technology market is finding new opportunities beyond the traditional applications and is entering in the high-growth medical and dental sectos. Enamel coatings are finding applications in minimally invasive medical equipment such as catheters, stents and surgical equipment because of their enhanced biocompatibility, corrosion resistance and sustainability in undergoing repeated sterilization. As an example, Medesy, an Italian manufacturer with a high-quality dental tool, has a special set of enamel instruments that are aimed at the specific finishing and preparation of the cavities before the full restoration.

- In dentistry, enamel coating is being used to provide crowns, braces, and implants with a more natural tooth enamel appearance to enhance appearance and durability. On the same note, enamel-like layers on brackets and wires in orthodontics increase wear resistance and minimal discoloration with time. As an example, Himed hydroxyapatite (HA) coating and enamel-like discs are used to improve dental implants by increasing the rate of osseointegration, biocompatibility, and surface morphology. They have developed their MCD Apatitic Abrasive that forms clean and micro-porous surfaces on implants, which maximize cell adhesion and implant survival.

- Dentistry Enamel and enamel-like coating enhance the life span, appearance and biocompatibility of restorations and implants, spurring the adoption of improved dental materials and growth of market.

Key Trend: Integration of Digital and CAD/CAM Coating Technologies for Precision Medical and Dental Applications

- Digital coating and CAD/CAM technologies are changing the application of enamel in the medical and dental fields. The use of automated spray systems, robotic deposition, and CAD/CAM activated dental enamel blocks are guaranteed to carry out consistent coating structure, better adhesion, and reduced material wasteage. As an example, the First LiSi Block that was introduced in 2024 by GC Corporation, LiSi disilicate ceramic CAD/CAM block, LiSi Enamel Coating provided a chance to create dental restorations with specific enamel thickness, evenly coated, and little waste material.

- Digitally optimized cleanroom coatings, panel coatings, and furniture also enter the hospitals to satisfy the standards of hygiene. The trend provides improved reproducibility, operational efficiency and regulatory compliance across all enamel applications. Indicatively, American Cleanroom Systems launched digitally optimized cleanroom wall panels with antimicrobial coating and easy to install in 2024. These panels are also designed to operate in high traffic areas of hospitals, which guarantees greater hygiene and longevity.

- The combination of digital and CAD/CAM technologies enhances the accuracy, effectiveness, and the increased acceptance of healthcare in the dental field.

Enamel Technology Market Analysis and Segmental Data

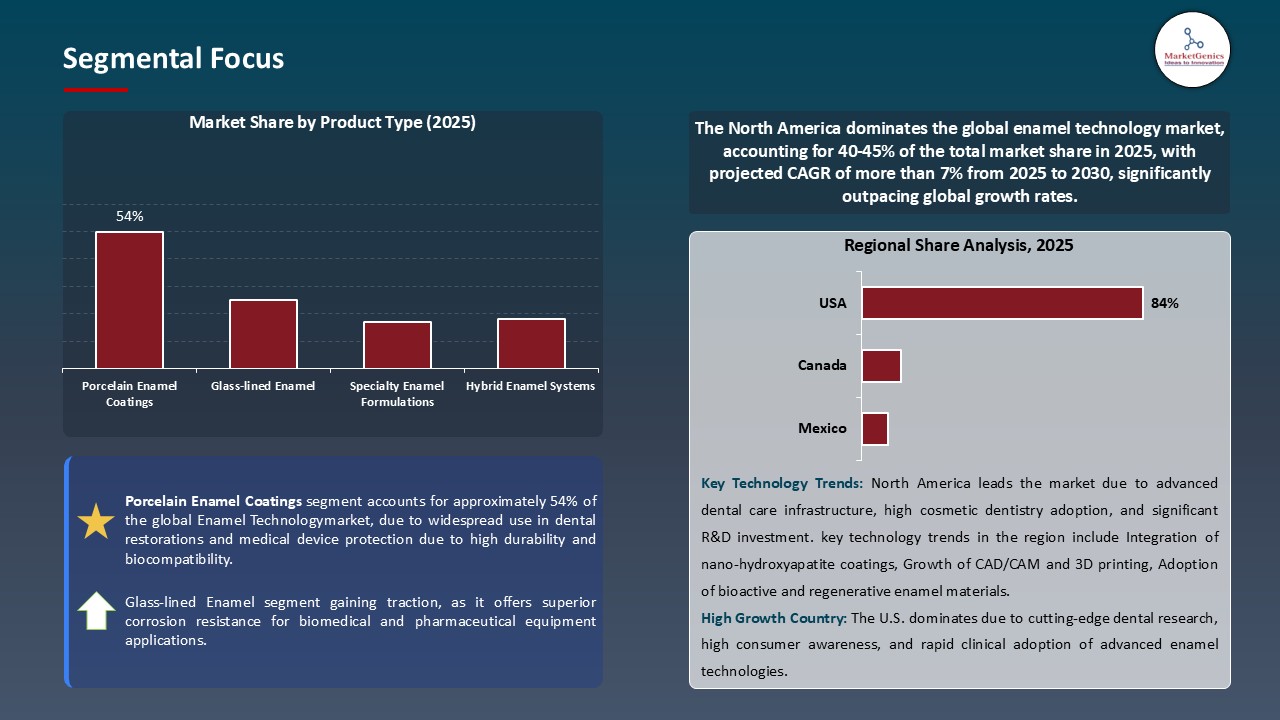

Porcelain Enamel Coatings Dominate Global Enamel Technology Market

- Porcelain enamel coatings dominate the market in the world enamel technology sector of healthcare industry because of their high biocompatibility, durability, and aesthetic qualities. As an example, the porcelain-based dental products offered by BAOT Biological Technology such as their Enamel Porcelain Powder, Zirconia Ceramic Powders, etc, provide realistic translucency and high-resistance against wear in dental restorations.

- Porcelain enamel coatings find their way into dental restorations including crowns, bridges and dental implants, medical devices including surgical equipment and diagnostic equipment where corrosion prevention and long-term surface integrity are paramount. As an example, Vibrantz Technologies offers engineered porcelain enamel frits in powder, paste, and ready-to-use applications to be used in medical equipment, and their PERC7 enamel powders are tailor-made to be used as electrostatic. These surfaces provide acid and alkali resistance, thermal stability and adjustable color and gloss, which guarantee long-lasting, corrosion-resistant and biocompatible surfaces.

- The broad usage highlights the importance of the porcelain enamel coatings in the development of patient-centered health care, a combination of functional reliability and high aesthetic results that have propelled enamel technology in the world market.

North America Leads Global Enamel Technology Market Demand

- North American region has the largest share in the market of global enamel technology in the healthcare sector through the rising use of porcelain enamel coatings in the dental and medical fields.

- The increased popularity of minimally invasive surgery and the availability of high-level dental facilities has increased the application of these coatings in crowns, bridges, implants, and orthodontic appliances, where long-lasting properties, bio-compatibility and aesthetic value are essential. As an example, there is an A Canadian company, OT Implant Lab, which produces Porcelain Fused to Zirconia (PFZ) restorations, which combine zirconia hardness with the looks of porcelain. PFZ restorations have been developed through CAD/CAM which makes them very strong, translucent and offer the most aesthetically pleasing results when used in dentistry.

- Other than dentistry, enamel coating can also be used on medical equipment and surgical blades to increase resistance to corrosion and long-term surface integrity. High expenditure on health care, high rates of insurance on restorative treatment, and focus on preventive care also encourage market growth.

- Thus, the combination of all these aspects makes North America a high-value market segment, pushing the revenue growth, and shaping the global trends in adopting healthcare enamel technologies.

Enamel-Technology-Market Ecosystem

The enamel technology market in healthcare industry around the world with leading companies like Ferro Corporation, Schott AG, Nihon Yamamura Glass Co., Ltd., Borosil Limited, and Vitro Minerals with a collective market share in the market of about 31%. These organisations are at the forefront in coming up with superior enamel compositions, porcelain and hybrid finishes as well as biocompatible surfaces of the medical equipment and dental practice. Their large patent books, strong R&D pipelines, strategic alliances and commercialization platforms establish technological and regulatory hoops that bring high barriers to new entrants. An example is Ferro Corporation who has been developing biocompatible enamel powders and frits to use in medical equipment, which strengthens its credibility and trust in the market.

The enamel technology ecosystem is further reinforced by service providers and contract manufacturers who help to accelerate product development, comply with regulations, and deploy enamel-coated medical and dental devices on scale. Their presence lowers development cycle, decreases new market entry capital needs and speeds up commercialization. As an example, specialized coating service vendors can guarantee that surface coating of surgical equipment, implants and diagnostic equipment against enamel coating is up to high performance and safety levels, allowing it to be more widely used in healthcare.

Recent Development and Strategic Overview:

- In September 2025, Dentsply Sirona has launched an expanded AI-powered CEREC workflow, introducing new milling solutions to enhance single-visit dentistry. The workflow integrates artificial intelligence via the cloud-based DS Core platform, enabling dental professionals to design restorations with greater precision and efficiency.

- In April 2025, HIMEDIA’s Hydroxyapatite blast media, developed over 30 years ago, is experiencing renewed interest in modern healthcare applications. It is being applied as a coating on 3D-printed implant surfaces to improve their biocompatibility. The coating enhances integration with surrounding tissue, promoting faster healing. It also improves surface roughness, increasing the stability and longevity of implants.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.8 Bn |

|

Market Forecast Value in 2035 |

USD 3.1 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Enamel-Technology-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Enamel Technology Market, By Product Type |

|

|

Enamel Technology Market, By Application |

|

|

Enamel Technology Market, By Technology Type |

|

|

Enamel Technology Market, By Functional Properties |

|

|

Enamel Technology Market, By Substrate Material |

|

|

Enamel Technology Market, By End-user Facility Type |

|

|

Enamel Technology Market, By Processing Temperature |

|

|

Enamel Technology Market, Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Enamel Technology Market Outlook

- 2.1.1. Enamel Technology Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Enamel Technology Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for durable and aesthetic coatings in construction and consumer goods

- 4.1.1.2. Growth in automotive and appliance industries using advanced enamel coatings

- 4.1.1.3. Technological innovations enhancing enamel adhesion and heat resistance

- 4.1.2. Restraints

- 4.1.2.1. High energy consumption and production costs

- 4.1.2.2. Limited recyclability and environmental concerns during manufacturing

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Materials & Suppliers

- 4.4.2. Product Development & Manufacturing

- 4.4.3. Distributors/ Dealers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Enamel Technology Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Enamel Technology Market Analysis, By Product Type

- 6.1. Key Segment Analysis

- 6.2. Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product Type, 2021-2035

- 6.2.1. Porcelain Enamel Coatings

- 6.2.1.1. Traditional Porcelain Enamel

- 6.2.1.2. Advanced Ceramic Enamel

- 6.2.1.3. Nano-enhanced Enamel

- 6.2.2. Glass-lined Enamel

- 6.2.2.1. Borosilicate Glass Enamel

- 6.2.2.2. Soda-lime Glass Enamel

- 6.2.3. Specialty Enamel Formulations

- 6.2.3.1. Antimicrobial Enamel

- 6.2.3.2. Radio-opaque Enamel

- 6.2.3.3. Biocompatible Enamel

- 6.2.4. Hybrid Enamel Systems

- 6.2.4.1. Polymer-enamel Composites

- 6.2.4.2. Ceramic-metal Enamel

- 6.2.1. Porcelain Enamel Coatings

- 7. Global Enamel Technology Market Analysis, By Application

- 7.1. Key Segment Analysis

- 7.2. Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, By Application, 2021-2035

- 7.2.1. Medical Equipment Coatings

- 7.2.1.1. Surgical Instrument Coating

- 7.2.1.2. Diagnostic Equipment Coating

- 7.2.1.3. Laboratory Equipment Coating

- 7.2.1.4. Others

- 7.2.2. Hospital Infrastructure

- 7.2.2.1. Wall Panel Coatings

- 7.2.2.2. Cleanroom Surface Coatings

- 7.2.2.3. Furniture Coatings

- 7.2.2.4. Others

- 7.2.3. Medical Implants & Devices

- 7.2.3.1. Dental Enamel Applications

- 7.2.3.2. Orthopedic Implant Coatings

- 7.2.3.3. Cardiovascular Device Coatings

- 7.2.3.4. Others

- 7.2.4. Sterilization Equipment

- 7.2.4.1. Autoclave Interior Coatings

- 7.2.4.2. Sterilization Container Coatings

- 7.2.4.3. Others

- 7.2.5. Pharmaceutical Manufacturing

- 7.2.5.1. Reactor Vessel Coatings

- 7.2.5.2. Storage Tank Coatings

- 7.2.5.3. Processing Equipment Coatings

- 7.2.5.4. Others

- 7.2.1. Medical Equipment Coatings

- 8. Global Enamel Technology Market Analysis and Forecasts,By Technology

- 8.1. Key Findings

- 8.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, By Technology, 2021-2035

- 8.2.1. Wet Enamel Technology

- 8.2.1.1. Slurry-based Application

- 8.2.1.2. Electrophoretic Deposition

- 8.2.2. Dry Enamel Technology

- 8.2.2.1. Powder Coating Technology

- 8.2.2.2. Electrostatic Application

- 8.2.3. Sol-Gel Technology

- 8.2.3.1. Low-temperature Sol-gel

- 8.2.3.2. High-temperature Sol-gel

- 8.2.4. Plasma Spray Technology

- 8.2.5. Physical Vapor Deposition (PVD)

- 8.2.6. Chemical Vapor Deposition (CVD)

- 8.2.7. Others

- 8.2.1. Wet Enamel Technology

- 9. Global Enamel Technology Market Analysis and Forecasts, By Functional Properties

- 9.1. Key Findings

- 9.2. Enamel Technology Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Functional Properties, 2021-2035

- 9.2.1. Antimicrobial Enamel

- 9.2.1.1. Silver-ion Embedded

- 9.2.1.2. Copper-ion Embedded

- 9.2.1.3. Zinc-oxide Based

- 9.2.1.4. Others

- 9.2.2. Chemical Resistant Enamel

- 9.2.2.1. Acid Resistant

- 9.2.2.2. Alkali Resistant

- 9.2.2.3. Solvent Resistant

- 9.2.2.4. Others

- 9.2.3. Thermal Resistant Enamel

- 9.2.4. High-temperature Resistant

- 9.2.5. Thermal Shock Resistant

- 9.2.6. Wear & Abrasion Resistant Enamel

- 9.2.7. Corrosion Resistant Enamel

- 9.2.8. Sterilization Compatible Enamel

- 9.2.1. Antimicrobial Enamel

- 10. Global Enamel Technology Market Analysis and Forecasts, By Substrate Material

- 10.1. Key Findings

- 10.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, By Substrate Material, 2021-2035

- 10.2.1. Steel-based Substrates

- 10.2.1.1. Stainless Steel

- 10.2.1.2. Carbon Steel

- 10.2.1.3. Galvanized Steel

- 10.2.1.4. Others

- 10.2.2. Aluminum-based Substrates

- 10.2.3. Titanium-based Substrates

- 10.2.4. Ceramic Substrates

- 10.2.5. Glass Substrates

- 10.2.6. Composite Material Substrates

- 10.2.1. Steel-based Substrates

- 11. Global Enamel Technology Market Analysis and Forecasts, By End-user Facility Type

- 11.1. Key Findings

- 11.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-user Facility Type, 2021-2035

- 11.2.1. Hospitals

- 11.2.1.1. General Hospitals

- 11.2.1.2. Specialty Hospitals

- 11.2.1.3. Teaching Hospitals

- 11.2.1.4. Others

- 11.2.2. Clinics & Ambulatory Care Centers

- 11.2.2.1. Outpatient Clinics

- 11.2.2.2. Surgical Centers

- 11.2.2.3. Diagnostic Centers

- 11.2.2.4. Others

- 11.2.3. Dental Facilities

- 11.2.3.1. Dental Hospitals

- 11.2.3.2. Dental Clinics

- 11.2.3.3. Dental Laboratories

- 11.2.3.4. Others

- 11.2.4. Pharmaceutical Manufacturing Facilities

- 11.2.5. Medical Device Manufacturing Units

- 11.2.6. Research & Academic Institutions

- 11.2.7. Veterinary Healthcare Facilities

- 11.2.1. Hospitals

- 12. Global Enamel Technology Market Analysis and Forecasts, By Processing Temperature

- 12.1. Key Findings

- 12.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, By Processing Temperature, 2021-2035

- 12.2.1. Below 450°C

- 12.2.2. 450-650°C

- 12.2.3. Above 650°C

- 13. Global Enamel Technology Market Analysis and Forecasts, By Distribution Channel

- 13.1. Key Findings

- 13.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, By Distribution Channel, 2021-2035

- 13.2.1. Direct Sales

- 13.2.2. OEM Direct Supply

- 13.2.3. Contract Manufacturing

- 13.2.4. Distributors & Wholesalers

- 13.2.5. Online Platforms

- 14. Global Enamel Technology Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Enamel Technology Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Enamel Technology Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Application

- 15.3.3. Technology Type

- 15.3.4. Functional Properties

- 15.3.5. Substrate Material

- 15.3.6. End-user Facility Type

- 15.3.7. Processing Temperature

- 15.3.8. Distribution Channel

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Enamel Technology Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Application

- 15.4.4. Technology Type

- 15.4.5. Functional Properties

- 15.4.6. Substrate Material

- 15.4.7. End-user Facility Type

- 15.4.8. Processing Temperature

- 15.4.9. Distribution Channel

- 15.5. Canada Enamel Technology Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Application

- 15.5.4. Technology Type

- 15.5.5. Functional Properties

- 15.5.6. Substrate Material

- 15.5.7. End-user Facility Type

- 15.5.8. Processing Temperature

- 15.5.9. Distribution Channel

- 15.6. Mexico Enamel Technology Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Application

- 15.6.4. Technology Type

- 15.6.5. Functional Properties

- 15.6.6. Substrate Material

- 15.6.7. End-user Facility Type

- 15.6.8. Processing Temperature

- 15.6.9. Distribution Channel

- 16. Europe Enamel Technology Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Therapeutic Application

- 16.3.2. Product Type

- 16.3.3. Application

- 16.3.4. Technology Type

- 16.3.5. Functional Properties

- 16.3.6. Substrate Material

- 16.3.7. End-user Facility Type

- 16.3.8. Processing Temperature

- 16.3.9. Distribution Channel

- 16.3.10. Country

- 16.3.10.1. Germany

- 16.3.10.2. United Kingdom

- 16.3.10.3. France

- 16.3.10.4. Italy

- 16.3.10.5. Spain

- 16.3.10.6. Netherlands

- 16.3.10.7. Nordic Countries

- 16.3.10.8. Poland

- 16.3.10.9. Russia & CIS

- 16.3.10.10. Rest of Europe

- 16.4. Germany Enamel Technology Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Application

- 16.4.4. Technology Type

- 16.4.5. Functional Properties

- 16.4.6. Substrate Material

- 16.4.7. End-user Facility Type

- 16.4.8. Processing Temperature

- 16.4.9. Distribution Channel

- 16.5. United Kingdom Enamel Technology Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Application

- 16.5.4. Technology Type

- 16.5.5. Functional Properties

- 16.5.6. Substrate Material

- 16.5.7. End-user Facility Type

- 16.5.8. Processing Temperature

- 16.5.9. Distribution Channel

- 16.6. France Enamel Technology Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Application

- 16.6.4. Technology Type

- 16.6.5. Functional Properties

- 16.6.6. Substrate Material

- 16.6.7. End-user Facility Type

- 16.6.8. Processing Temperature

- 16.6.9. Distribution Channel

- 16.7. Italy Enamel Technology Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Application

- 16.7.4. Technology Type

- 16.7.5. Functional Properties

- 16.7.6. Substrate Material

- 16.7.7. End-user Facility Type

- 16.7.8. Processing Temperature

- 16.7.9. Distribution Channel

- 16.8. Spain Enamel Technology Market

- 16.8.1. Therapeutic Application

- 16.8.2. Product Type

- 16.8.3. Application

- 16.8.4. Technology Type

- 16.8.5. Functional Properties

- 16.8.6. Substrate Material

- 16.8.7. End-user Facility Type

- 16.8.8. Processing Temperature

- 16.8.9. Distribution Channel

- 16.9. Netherlands Enamel Technology Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Application

- 16.9.4. Technology Type

- 16.9.5. Functional Properties

- 16.9.6. Substrate Material

- 16.9.7. End-user Facility Type

- 16.9.8. Processing Temperature

- 16.9.9. Distribution Channel

- 16.10. Nordic Countries Enamel Technology Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Application

- 16.10.4. Technology Type

- 16.10.5. Functional Properties

- 16.10.6. Substrate Material

- 16.10.7. End-user Facility Type

- 16.10.8. Processing Temperature

- 16.10.9. Distribution Channel

- 16.11. Poland Enamel Technology Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Application

- 16.11.4. Technology Type

- 16.11.5. Functional Properties

- 16.11.6. Substrate Material

- 16.11.7. End-user Facility Type

- 16.11.8. Processing Temperature

- 16.11.9. Distribution Channel

- 16.12. Russia & CIS Enamel Technology Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Application

- 16.12.4. Technology Type

- 16.12.5. Functional Properties

- 16.12.6. Substrate Material

- 16.12.7. End-user Facility Type

- 16.12.8. Processing Temperature

- 16.12.9. Distribution Channel

- 16.13. Rest of Europe Enamel Technology Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Application

- 16.13.4. Technology Type

- 16.13.5. Functional Properties

- 16.13.6. Substrate Material

- 16.13.7. End-user Facility Type

- 16.13.8. Processing Temperature

- 16.13.9. Distribution Channel

- 17. Asia Pacific Enamel Technology Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Application

- 17.3.3. Technology Type

- 17.3.4. Functional Properties

- 17.3.5. Substrate Material

- 17.3.6. End-user Facility Type

- 17.3.7. Processing Temperature

- 17.3.8. Distribution Channel

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Enamel Technology Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Application

- 17.4.4. Technology Type

- 17.4.5. Functional Properties

- 17.4.6. Substrate Material

- 17.4.7. End-user Facility Type

- 17.4.8. Processing Temperature

- 17.4.9. Distribution Channel

- 17.5. India Enamel Technology Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Application

- 17.5.4. Technology Type

- 17.5.5. Functional Properties

- 17.5.6. Substrate Material

- 17.5.7. End-user Facility Type

- 17.5.8. Processing Temperature

- 17.5.9. Distribution Channel

- 17.6. Japan Enamel Technology Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Application

- 17.6.4. Technology Type

- 17.6.5. Functional Properties

- 17.6.6. Substrate Material

- 17.6.7. End-user Facility Type

- 17.6.8. Processing Temperature

- 17.6.9. Distribution Channel

- 17.7. South Korea Enamel Technology Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Application

- 17.7.4. Technology Type

- 17.7.5. Functional Properties

- 17.7.6. Substrate Material

- 17.7.7. End-user Facility Type

- 17.7.8. Processing Temperature

- 17.7.9. Distribution Channel

- 17.8. Australia and New Zealand Enamel Technology Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Application

- 17.8.4. Technology Type

- 17.8.5. Functional Properties

- 17.8.6. Substrate Material

- 17.8.7. End-user Facility Type

- 17.8.8. Processing Temperature

- 17.8.9. Distribution Channel

- 17.9. Indonesia Enamel Technology Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Application

- 17.9.4. Technology Type

- 17.9.5. Functional Properties

- 17.9.6. Substrate Material

- 17.9.7. End-user Facility Type

- 17.9.8. Processing Temperature

- 17.9.9. Distribution Channel

- 17.10. Malaysia Enamel Technology Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Application

- 17.10.4. Technology Type

- 17.10.5. Functional Properties

- 17.10.6. Substrate Material

- 17.10.7. End-user Facility Type

- 17.10.8. Processing Temperature

- 17.10.9. Distribution Channel

- 17.11. Thailand Enamel Technology Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Application

- 17.11.4. Technology Type

- 17.11.5. Functional Properties

- 17.11.6. Substrate Material

- 17.11.7. End-user Facility Type

- 17.11.8. Processing Temperature

- 17.11.9. Distribution Channel

- 17.12. Vietnam Enamel Technology Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Application

- 17.12.4. Technology Type

- 17.12.5. Functional Properties

- 17.12.6. Substrate Material

- 17.12.7. End-user Facility Type

- 17.12.8. Processing Temperature

- 17.12.9. Distribution Channel

- 17.13. Rest of Asia Pacific Enamel Technology Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Application

- 17.13.4. Technology Type

- 17.13.5. Functional Properties

- 17.13.6. Substrate Material

- 17.13.7. End-user Facility Type

- 17.13.8. Processing Temperature

- 17.13.9. Distribution Channel

- 18. Middle East Enamel Technology Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Application

- 18.3.3. Technology Type

- 18.3.4. Functional Properties

- 18.3.5. Substrate Material

- 18.3.6. End-user Facility Type

- 18.3.7. Processing Temperature

- 18.3.8. Distribution Channel

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Enamel Technology Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Application

- 18.4.4. Technology Type

- 18.4.5. Functional Properties

- 18.4.6. Substrate Material

- 18.4.7. End-user Facility Type

- 18.4.8. Processing Temperature

- 18.4.9. Distribution Channel

- 18.5. UAE Enamel Technology Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Application

- 18.5.4. Technology Type

- 18.5.5. Functional Properties

- 18.5.6. Substrate Material

- 18.5.7. End-user Facility Type

- 18.5.8. Processing Temperature

- 18.5.9. Distribution Channel

- 18.6. Saudi Arabia Enamel Technology Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Application

- 18.6.4. Technology Type

- 18.6.5. Functional Properties

- 18.6.6. Substrate Material

- 18.6.7. End-user Facility Type

- 18.6.8. Processing Temperature

- 18.6.9. Distribution Channel

- 18.7. Israel Enamel Technology Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Application

- 18.7.4. Technology Type

- 18.7.5. Functional Properties

- 18.7.6. Substrate Material

- 18.7.7. End-user Facility Type

- 18.7.8. Processing Temperature

- 18.7.9. Distribution Channel

- 18.7.10. End-use Industry

- 18.8. Rest of Middle East Enamel Technology Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Application

- 18.8.4. Technology Type

- 18.8.5. Functional Properties

- 18.8.6. Substrate Material

- 18.8.7. End-user Facility Type

- 18.8.8. Processing Temperature

- 18.8.9. Distribution Channel

- 19. Africa Enamel Technology Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Application

- 19.3.3. Technology Type

- 19.3.4. Functional Properties

- 19.3.5. Substrate Material

- 19.3.6. End-user Facility Type

- 19.3.7. Processing Temperature

- 19.3.8. Distribution Channel

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Enamel Technology Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Application

- 19.4.4. Technology Type

- 19.4.5. Functional Properties

- 19.4.6. Substrate Material

- 19.4.7. End-user Facility Type

- 19.4.8. Processing Temperature

- 19.4.9. Distribution Channel

- 19.5. Egypt Enamel Technology Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Application

- 19.5.4. Technology Type

- 19.5.5. Functional Properties

- 19.5.6. Substrate Material

- 19.5.7. End-user Facility Type

- 19.5.8. Processing Temperature

- 19.5.9. Distribution Channel

- 19.6. Nigeria Enamel Technology Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Application

- 19.6.4. Technology Type

- 19.6.5. Functional Properties

- 19.6.6. Substrate Material

- 19.6.7. End-user Facility Type

- 19.6.8. Processing Temperature

- 19.6.9. Distribution Channel

- 19.7. Algeria Enamel Technology Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Application

- 19.7.4. Technology Type

- 19.7.5. Functional Properties

- 19.7.6. Substrate Material

- 19.7.7. End-user Facility Type

- 19.7.8. Processing Temperature

- 19.7.9. Distribution Channel

- 19.8. Rest of Africa Enamel Technology Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Application

- 19.8.4. Technology Type

- 19.8.5. Functional Properties

- 19.8.6. Substrate Material

- 19.8.7. End-user Facility Type

- 19.8.8. Processing Temperature

- 19.8.9. Distribution Channel

- 20. South America Enamel Technology Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Enamel Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Application

- 20.3.3. Technology Type

- 20.3.4. Functional Properties

- 20.3.5. Substrate Material

- 20.3.6. End-user Facility Type

- 20.3.7. Processing Temperature

- 20.3.8. Distribution Channel

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Enamel Technology Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Application

- 20.4.4. Technology Type

- 20.4.5. Functional Properties

- 20.4.6. Substrate Material

- 20.4.7. End-user Facility Type

- 20.4.8. Processing Temperature

- 20.4.9. Distribution Channel

- 20.5. Argentina Enamel Technology Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Application

- 20.5.4. Technology Type

- 20.5.5. Functional Properties

- 20.5.6. Substrate Material

- 20.5.7. End-user Facility Type

- 20.5.8. Processing Temperature

- 20.5.9. Distribution Channel

- 20.6. Rest of South America Enamel Technology Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Application

- 20.6.4. Technology Type

- 20.6.5. Functional Properties

- 20.6.6. Substrate Material

- 20.6.7. End-user Facility Type

- 20.6.8. Processing Temperature

- 20.6.9. Distribution Channel

- 21. Key Players/ Company Profile

- 21.1. 3M Company

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. A.O. Smith Corporation

- 21.3. Belco Enamel

- 21.4. Borosil Limited

- 21.5. DuPont de Nemours, Inc.

- 21.6. Enamel Industries Group

- 21.7. Enamel Products & Plating Company

- 21.8. Enamelco International

- 21.9. European Enamel

- 21.10. Ferro Corporation

- 21.11. Fusion Ceramics

- 21.12. Hunan Noli Enamel Co., Ltd.

- 21.13. Inortech Chimie

- 21.14. Kermetico Inc.

- 21.15. Nihon Yamamura Glass Co., Ltd.

- 21.16. O.C. White Company

- 21.17. Pfalzkeramik GmbH

- 21.18. Prince Minerals Inc.

- 21.19. Schott AG

- 21.20. Specialty Glass Inc.

- 21.21. Tomatec America Inc.

- 21.22. Vitro Minerals

- 21.23. Wendel Email GmbH

- 21.24. Zschimmer & Schwarz GmbH & Co KG

- 21.25. Other Key Players

- 21.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation