Engineered Exosomes Market Size, Share & Trends Analysis Report by Source/Origin (Plant-derived exosomes, Mammalian cell-derived exosomes, Bacterial exosomes, Yeast-derived exosomes Disorders, Stem cell-derived exosomes), Cargo Type, Engineering Method, Isolation/Production Method, Therapeutic Application, Diagnostic Application, Surface Modification, Product Type, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Engineered Exosomes Market Size, Share, and Growth

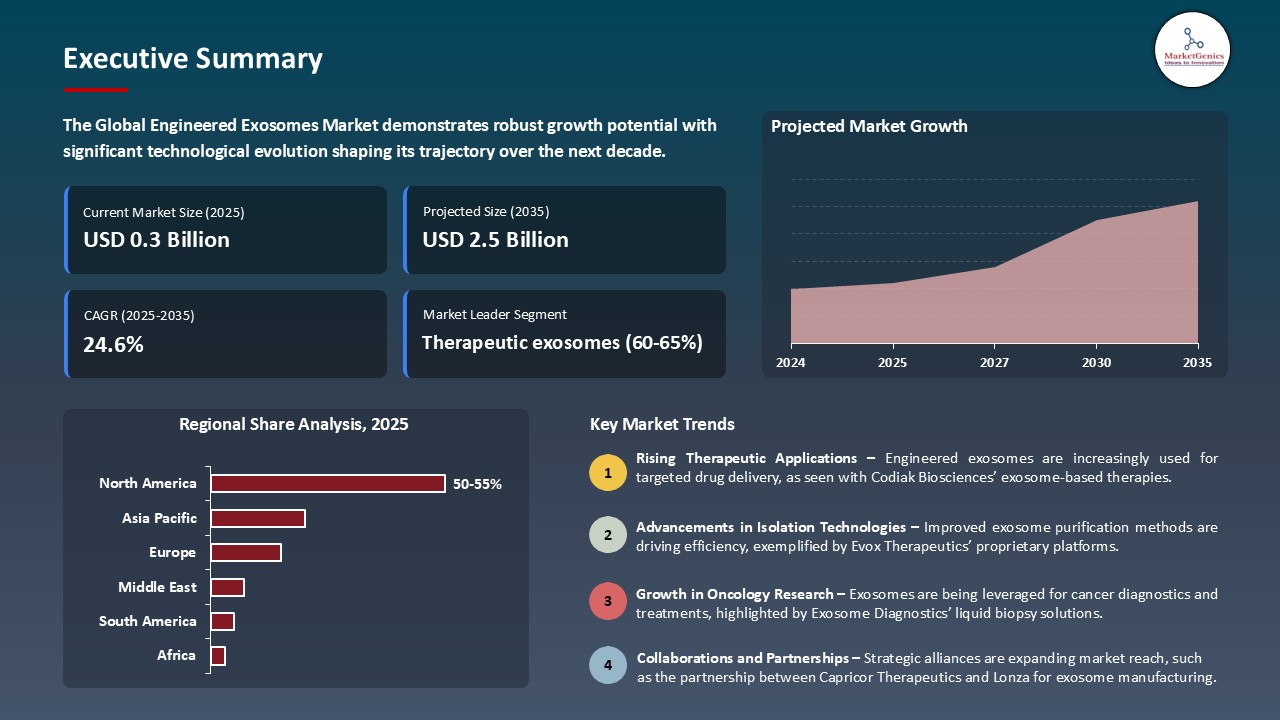

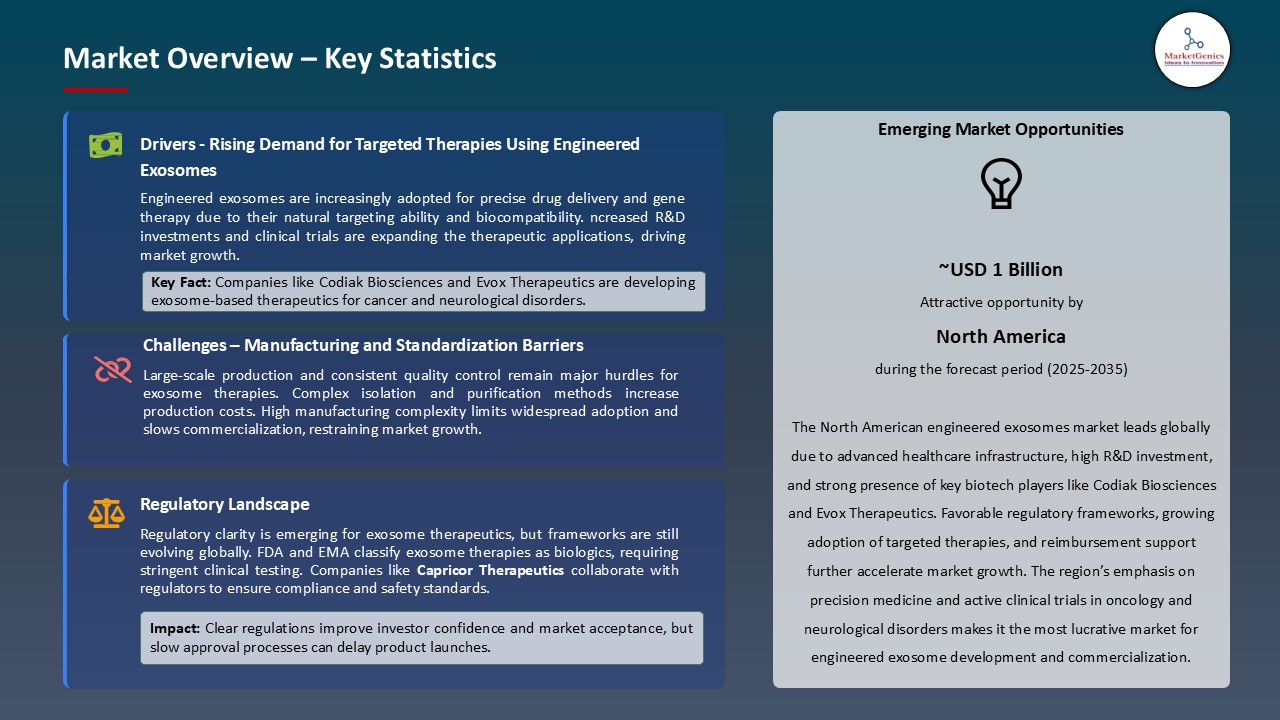

The global engineered exosomes market is witnessing strong growth, valued at USD 0.3 billion in 2025 and projected to reach USD 2.5 billion by 2035, expanding at a CAGR of 24.6% during the forecast period. North America leads the engineered exosomes market due to strong healthcare infrastructure, high adoption of digital health technologies, and supportive regulatory frameworks such as FDA approvals.

Atta Behfar, Co-Founder of RION said that, “Creation of INTENT Biologics marks a pivotal milestone in our mission to revolutionize standards of care through regenerative exosome science, By creating a company with dedicated focus on deploying our exosome platform in I&I, we can accelerate the clinical and commercial path for PEP Biologic and unlock its potential across multiple high impact indications.”.

The market of engineered exosomes worldwide is being stimulated by the increasing use of regenerative medicine because exosomes are a key element in tissue repair, immune modulation, and cell regeneration. As an example, NurExone Biologic Inc. had formulated ExoPTEN, an siRNA-impregnated exosome therapy, demonstrated to regenerate and rewire neurons.

Artificial intelligence (AI) integration into exosome studies is an emerging phenomenon that is changing the world of engineered exosomes market. Complex biological data, exosome-related predictions, and engineering optimization are being studied with the help of AI algorithms. As an example, scientists at Zhongshan Hospital, Fudan University invented ChatExosome, an artificial intelligence agent that uses the deep AI learning of exosome Raman spectroscopy to identify hepatocellular carcinoma (HCC).

Engineered exosomes have an opportunity to allow targeted delivery of gene editing and RNA therapeutics and offer better treatment of complex diseases and a broader market opportunity. By using such platforms, companies can create safer and more effective therapies and cure previously incurable conditions and broaden the therapeutic horizon. As an example, In 2025, Evox Therapeutics announced achievements across its ExoEdit platform, which includes exosome-mediated delivery of genetic medicines, such as gene editing tools and RNA therapeutics, and the opportunities of engineered exosomes in precision therapy.

Engineered Exosomes Market Dynamics and Trends

Driver: Surge in Chronic Disease Incidence Accelerates Engineered Exosome Development

- The increasing chronic disease rates in the world, such as cancer, cardiovascular and neurodegenerative disorders are driving the need in more complex therapeutic modalities, which further enhances the expansion of the market of engineered exosomes. An example is that a clinical trial (NCT07183384) was initiated in September 2025 to test the use of mesenchymal stem cell (MSC)-derived exosomes to improve endothelial dysfunction in post-preeclampsia women to minimize cardiovascular risks in the long term.

- Engineered exosomes, with their inherent capacity in targeted drug administration and cell-cell communication are becoming promising in solving these complicated health problems. As an example, in October 2025, RION introduced INTENT Biologics to create PEP exosome therapies to target Inflammation & Immunology, and post Phase 3 trials in tissue regeneration and immune-mediated dermatologic diseases.

- These strategic initiatives highlight the desire of the industry to use engineered exosomes to fight chronic illnesses.

Restraint: Regulatory Challenges Impede Widespread Clinical Application of Engineered Exosomes

- Engineered exosomes have great potential and can be useful in medical treatments but the regulatory challenges persist as a major obstacle to the broad clinical use that causes the hindrance of engineered exosomes market. It is also difficult to obtain regulatory approval due to the absence of standardized procedures in the production of exosomes, their characterization, and quality control.

- The difficulties are reflected in the high standards of regulatory authorities, which require extensive information on safety and efficacy, before authorization to use the product in clinical settings. Therefore, this results in longer development cycles and higher costs by companies, thus making it difficult to translate engineered exosome therapies quickly out of the laboratory and into clinical practice.

- Thus, the challenge of Regulation is decreasing the rate of clinical implementation of engineered exosome therapies, and market development.

Opportunity: Advancements in Exosome-Based Drug Delivery Systems Enhance Therapeutic Efficacy

- The importance of recent technological advances in exosome-based drug delivery systems lies in creating a promising opportunity to improve the efficacy of therapeutic applications of the engineered exosomes market. The inherent characteristics of exosomes, including their capacity to traverse biological barriers, including the blood-brain barrier, and low immunogenicity, make them the best exosomes to use in targeted drug delivery. As an example, In 2025, Indian biotech company, ExSURE, introduced the first patented exosome-based targeted anti-cancer drug delivery platform in the country. It is aimed at treating cancer and cancer stem cells and minimizing the toxicity levels of chemotherapy and likelihood of recurrence.

- The growing ability to develop engineered exosomes that can deliver small molecules, nucleic acids and proteins to predetermined locations provides an exciting prospective in treating previously inaccessible conditions. Organizations are also investing in research to exploit these abilities with a view to transforming the paradigm of treating different diseases. As an example, in July 2025, Capricor Therapeutics reported a development in its StealthX platform, a designed exosome system to carry therapeutic proteins and nucleic acids in a targeted delivery.

- The development of exosome-based drug delivery systems is creating new opportunities in therapy, which is driving the growth of the market.

Key Trend: Increasing Focus on Personalized Medicine Accelerates Engineered Exosome Development

- The exosomes market is moving towards customized and precision medicine which is increasingly becoming a global engineered exosomes market. Patient engineered exosomes can be programmed to specific therapies, allowing them to deliver drugs, nucleic acids, or proteins to the body based on genetic and molecular specifics.

- This personalization enhances efficacy, decreases adverse effects, and allows treating complicated diseases such as cancer, neurodegenerative, and immune diseases, with the help of the developments in bioinformatics and individual patient diagnostics. As an example, Ilias Biologics, which grows exosome-based precision treatment, indicated successful completion of the Phase 1 trial of ILB-202, precision anti-inflammatory exosome treatment.

- Ilias is proceeding with ILB-202 follow-up studies and developing additional immune and inflammatory disease pipelines on exosome platform. Thus, the increasing popularity of personalized medicine is prompting the development and implementation of engineered exosome therapeutics, which can greatly broaden the market size and opportunities in the market.

Engineered Exosomes Market Analysis and Segmental Data

Therapeutic exosomes Dominate Global Engineered Exosomes Market

- Therapeutic exosomes are quickly taking over the global engineered exosome market because they can better provide targeted therapies, with higher specificity and less immunogenicity. These naturally occurring extracellular vesicles can be modified to carry and deliver numerous therapeutic molecules, such as small molecules, proteins, and nucleic acids, to cells or tissues.

- The natural biocompatibility and ability to penetrate through biological barriers qualify therapeutic exosomes as the best drugs in the treatment of complex diseases like cancer, neurodegenerative and autoimmune diseases. To take an example, in June 2024, EXO Biologics finished with the first group of dosing in the EVENEW study. The study is the first mesenchymal stromal cell (MSC)-derived exosome-based trial to be approved by the European Medicines Agency (EMA), a landmark in exosomes therapeutics development.

- Therefore, therapeutic exosomes are under intense research and development with high investment rates and rapid clinical trials, to develop the new technologies into effective therapeutic applications.

North America Leads Global Engineered Exosomes Market Demand

- North America currently holds a leading position in the global engineered exosome market, driven by its well-established biotechnology infrastructure, high healthcare expenditure, and strong presence of key market players. The region benefits from advanced research and development capabilities, robust clinical trial networks, and supportive regulatory frameworks that facilitate rapid development and commercialization of exosome-based therapeutics.

- Moreover, personalized medicine and regenerative therapy is widely embraced in the U.S. and Canada, which further contributes to the need of engineered exosomes. An example is that on April 2025, the association of PlantForm Corporation, a Canadian biopharmaceutical company, declared a research partnership with Baiya Phytopharm Co. Ltd. of Thailand and The DABOM Inc. of South Korea. The collaboration will focus on creating artificial exosomes that are made of plants to use in countermeasures and vaccines.

- The emphasis on the state-of-the-art therapies and the large investment levels by both the government and the private sector are guarantees of the continued growth of the market and places the region at the center of the exosome-based treatments of the next generation.

Engineered-Exosomes-Market Ecosystem

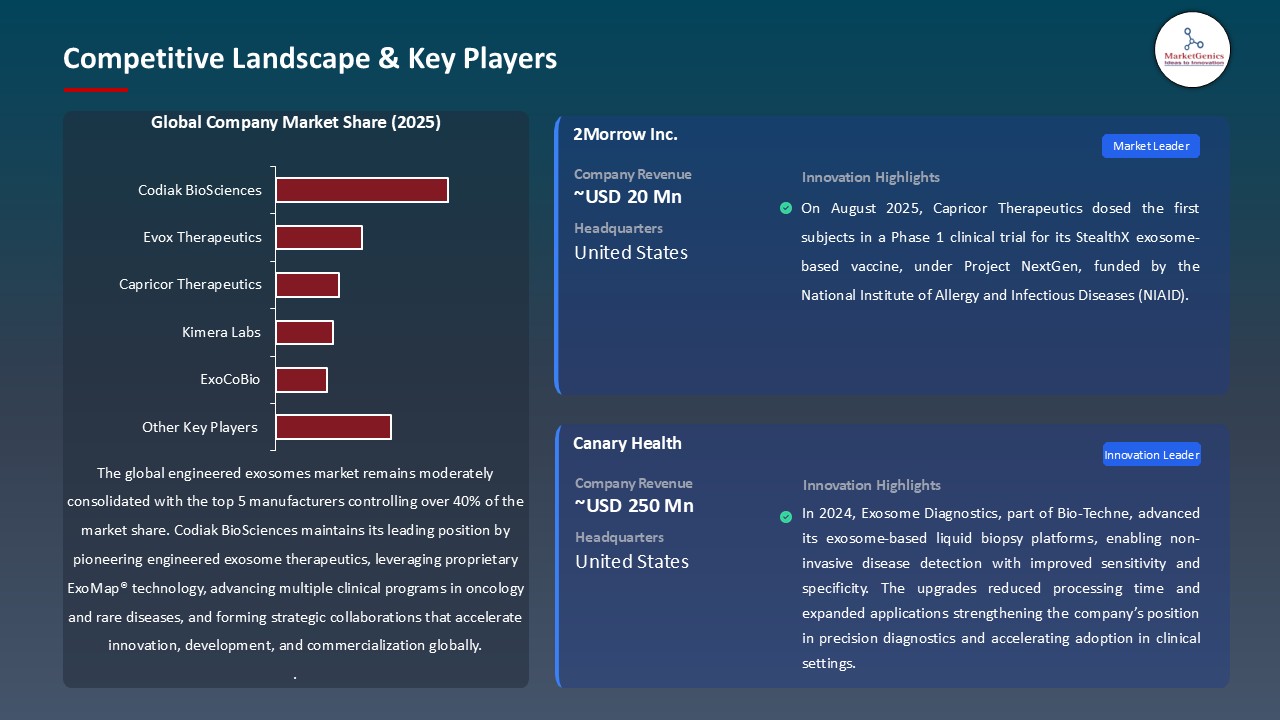

The global engineered exosome market is moderately consolidated, with key players such as Codiak BioSciences, Evox Therapeutics, Capricor Therapeutics, Kimera Labs, and ExoCoBio holding a combined market share of approximately 42%. These companies are pioneers in developing engineered exosome-based therapeutics, owning significant intellectual property, robust preclinical and clinical pipelines, strategic collaborations, and advanced manufacturing capabilities. Their technological expertise and regulatory achievements set industry benchmarks, creating entry barriers for new participants.

Service providers and contract development organizations (CDMOs) play a crucial role in the exosome ecosystem, enabling scalable manufacturing, regulatory compliance, and accelerated clinical translation. For example, Codiak BioSciences leverages its engEx platform and manufacturing partnerships to streamline production and facilitate rapid development of exosome-based therapies.

Recent Development and Strategic Overview:

- In October 2025, PranaX Corporation licensed its proprietary exosome technology to commercialize mesenchymal stem cell (MSC)-derived exosomes. The agreement enables PranaX to expand its therapeutic portfolio across multiple disease areas. The technology focuses on safe and targeted delivery of exosome-based therapies. This move accelerates the industrialization of stem cell exosomes for clinical applications. It highlights the growing commercial potential of engineered exosome market.

- In August 2024, Aruna Bio was granted a U.S. patent covering the use of neural-derived exosomes designed to reduce inflammation in the brain. This milestone advances the company’s neurological therapy programs and strengthens its intellectual property portfolio, highlighting its leadership in exosome-based therapeutics.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.3 Bn |

|

Market Forecast Value in 2035 |

USD 2.5 Bn |

|

Growth Rate (CAGR) |

24.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Engineered-Exosomes-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Engineered Exosomes Market, Source/Origin |

|

|

Engineered Exosomes Market, By Cargo Type |

|

|

Engineered Exosomes Market, Engineering Method |

|

|

Engineered Exosomes Market, By Isolation/Production Method |

|

|

Engineered Exosomes Market, Therapeutic Application |

|

|

Engineered Exosomes Market, By Diagnostic Application |

|

|

Engineered Exosomes Market, Surface Modification |

|

|

Engineered Exosomes Market, Product Type |

|

|

Engineered Exosomes Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Engineered Exosomes Market Outlook

- 2.1.1. Engineered Exosomes Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Engineered Exosomes Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for targeted drug delivery and regenerative therapies.

- 4.1.1.2. Advances in exosome engineering and isolation technologies.

- 4.1.1.3. Growing investment in research and clinical applications of exosome-based therapeutics.

- 4.1.2. Restraints

- 4.1.2.1. High production and purification costs.

- 4.1.2.2. Regulatory challenges and safety concerns for clinical use

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

-

- 4.2.1.1. Regulatory Framework

- 4.2.2. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.2.3. Tariffs and Standards

- 4.2.4. Impact Analysis of Regulations on the Market

-

- 4.3. Value Chain Analysis

- 4.3.1. Raw Material Supliers

- 4.3.2. Manufacturing & Scale-Up

- 4.3.3. Distributors

- 4.3.4. End-users

- 4.4. Porter’s Five Forces Analysis

- 4.5. PESTEL Analysis

- 4.6. Global Engineered Exosomes Market Demand

- 4.6.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.6.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.6.2.1. Y-o-Y Growth Trends

- 4.6.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Engineered Exosomes Market Analysis, By Source/Origin

- 6.1. Key Segment Analysis

- 6.2. Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, By Source/Origin, 2021-2035

- 6.2.1. Plant-derived exosomes

- 6.2.2. Mammalian cell-derived exosomes

- 6.2.2.1. Human cell-derived

- 6.2.2.2. Animal cell-derived

- 6.2.3. Bacterial exosomes

- 6.2.4. Yeast-derived exosomes

- 6.2.5. Stem cell-derived exosomes

- 6.2.5.1. Mesenchymal stem cells (MSCs)

- 6.2.5.2. Induced pluripotent stem cells (iPSCs)

- 6.2.5.3. Embryonic stem cells

- 6.2.5.4. Others

- 7. Global Engineered Exosomes Market Analysis, By Cargo Type

- 7.1. Key Segment Analysis

- 7.2. Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, By Cargo Type, 2021-2035

- 7.2.1. Protein-loaded exosomes

- 7.2.2. RNA-loaded exosomes

- 7.2.2.1. mRNA

- 7.2.2.2. miRNA

- 7.2.2.3. siRNA

- 7.2.2.4. lncRNA

- 7.2.2.5. Others

- 7.2.3. DNA-loaded exosomes

- 7.2.4. Drug-loaded exosomes

- 7.2.4.1. Small molecule drugs

- 7.2.4.2. Biologics

- 7.2.4.3. Others

- 7.2.5. Peptide-loaded exosomes

- 7.2.6. Others

- 8. Global Engineered Exosomes Market Analysis and Forecasts,By Engineering Method

- 8.1. Key Findings

- 8.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By Engineering Method, 2021-2035

- 8.2.1. Genetic engineering

- 8.2.1.1. Transfection

- 8.2.1.2. Transduction

- 8.2.2. Physical methods

- 8.2.2.1. Electroporation

- 8.2.2.2. Sonication

- 8.2.2.3. Extrusion

- 8.2.3. Chemical methods

- 8.2.3.1. Incubation

- 8.2.3.2. Saponin treatment

- 8.2.4. Hybrid approaches

- 8.2.1. Genetic engineering

- 9. Global Engineered Exosomes Market Analysis and Forecasts, By Isolation/Production Method

- 9.1. Key Findings

- 9.2. Engineered Exosomes Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Isolation/Production Method, 2021-2035

- 9.2.1. Ultracentrifugation-based

- 9.2.2. Size-exclusion chromatography

- 9.2.3. Immunoaffinity capture

- 9.2.4. Precipitation-based methods

- 9.2.5. Microfluidics-based isolation

- 9.2.6. Tangential flow filtration

- 9.2.7. Others

- 10. Global Engineered Exosomes Market Analysis and Forecasts, By Therapeutic Application

- 10.1. Key Findings

- 10.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By Therapeutic Application, 2021-2035

- 10.2.1. Oncology/Cancer therapy

- 10.2.1.1. Chemotherapy delivery

- 10.2.1.2. Immunotherapy

- 10.2.1.3. Gene therapy

- 10.2.1.4. Others

- 10.2.2. Cardiovascular diseases

- 10.2.3. Neurological disorders

- 10.2.3.1. Alzheimer's disease

- 10.2.3.2. Parkinson's disease

- 10.2.3.3. Stroke

- 10.2.3.4. Others

- 10.2.4. Infectious diseases

- 10.2.4.1. Regenerative medicine

- 10.2.4.2. Wound healing

- 10.2.4.3. Tissue regeneration

- 10.2.4.4. Others

- 10.2.5. Autoimmune diseases

- 10.2.6. Inflammatory diseases

- 10.2.1. Oncology/Cancer therapy

- 11. Global Engineered Exosomes Market Analysis and Forecasts, By Diagnostic Application

- 11.1. Key Findings

- 11.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By Diagnostic Application, 2021-2035

- 11.2.1. Cancer diagnostics

- 11.2.1.1. Liquid biopsy

- 11.2.1.2. Biomarker detection

- 11.2.2. Cardiovascular disease diagnostics

- 11.2.3. Neurological disease diagnostics

- 11.2.4. Infectious disease diagnostics

- 11.2.5. Prenatal diagnostics

- 11.2.1. Cancer diagnostics

- 12. Global Engineered Exosomes Market Analysis and Forecasts, By Surface Modification

- 12.1. Key Findings

- 12.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By Surface Modification, 2021-2035

- 12.2.1. Peptide-modified exosomes

- 12.2.2. Antibody-conjugated exosomes

- 12.2.3. Ligand-modified exosomes

- 12.2.4. Lipid-modified exosomes

- 12.2.5. Polymer-coated exosomes

- 12.2.6. Unmodified/native exosomes

- 13. Global Engineered Exosomes Market Analysis and Forecasts, By Product Type

- 13.1. Key Findings

- 13.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By Product Type, 2021-2035

- 13.2.1. Therapeutic exosomes

- 13.2.2. Diagnostic exosomes

- 13.2.3. Research-grade exosomes

- 13.2.4. Cosmetic exosomes

- 14. Global Engineered Exosomes Market Analysis and Forecasts, By End-users

- 14.1. Key Findings

- 14.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 14.2.1. Pharmaceutical & Biotechnology Companies

- 14.2.1.1. Drug delivery systems

- 14.2.1.2. Vaccine development

- 14.2.1.3. Targeted cancer therapy

- 14.2.1.4. Gene therapy applications

- 14.2.1.5. Protein therapeutics delivery

- 14.2.1.6. Others

- 14.2.2. Hospital & Clinics

- 14.2.2.1. Disease diagnosis

- 14.2.2.2. Therapeutic treatment

- 14.2.2.3. Personalized medicine

- 14.2.2.4. Point-of-care testing

- 14.2.2.5. Regenerative procedures

- 14.2.2.6. Others

- 14.2.3. Research & Academic Institutes

- 14.2.3.1. Basic research

- 14.2.3.2. Biomarker discovery

- 14.2.3.3. Mechanism studies

- 14.2.3.4. Clinical trials

- 14.2.3.5. Technology development

- 14.2.3.6. Others

- 14.2.4. Diagnostic Laboratories

- 14.2.4.1. Disease screening

- 14.2.4.2. Early detection

- 14.2.4.3. Patient monitoring

- 14.2.4.4. Companion diagnostics

- 14.2.4.5. Prognostic assessment

- 14.2.4.6. Others

- 14.2.5. Cosmetic & Personal Care Industry

- 14.2.5.1. Anti-aging products

- 14.2.5.2. Skin regeneration

- 14.2.5.3. Hair growth treatments

- 14.2.5.4. Wound healing applications

- 14.2.5.5. Dermatological treatments

- 14.2.5.6. Others

- 14.2.6. Contract Research Organizations (CROs)

- 14.2.6.1. Preclinical studies

- 14.2.6.2. Clinical trial services

- 14.2.6.3. Manufacturing services

- 14.2.6.4. Quality testing

- 14.2.6.5. Regulatory support

- 14.2.6.6. Others

- 14.2.7. Veterinary Medicine

- 14.2.7.1. Animal therapeutics

- 14.2.7.2. Veterinary diagnostics

- 14.2.7.3. Livestock health management

- 14.2.7.4. Companion animal care

- 14.2.7.5. Others

- 14.2.1. Pharmaceutical & Biotechnology Companies

- 15. Global Engineered Exosomes Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Engineered Exosomes Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Engineered Exosomes Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Source/Origin

- 16.3.2. Cargo Type

- 16.3.3. Engineering Method

- 16.3.4. Isolation/Production Method

- 16.3.5. Therapeutic Application

- 16.3.6. Diagnostic Application

- 16.3.7. Surface Modification

- 16.3.8. Product Type

- 16.3.9. End-Users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Engineered Exosomes Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Source/Origin

- 16.4.3. Cargo Type

- 16.4.4. Engineering Method

- 16.4.5. Isolation/Production Method

- 16.4.6. Therapeutic Application

- 16.4.7. Diagnostic Application

- 16.4.8. Surface Modification

- 16.4.9. Product Type

- 16.4.10. End-Users

- 16.5. Canada Engineered Exosomes Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Source/Origin

- 16.5.3. Cargo Type

- 16.5.4. Engineering Method

- 16.5.5. Isolation/Production Method

- 16.5.6. Therapeutic Application

- 16.5.7. Diagnostic Application

- 16.5.8. Surface Modification

- 16.5.9. Product Type

- 16.5.10. End-Users

- 16.6. Mexico Engineered Exosomes Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Source/Origin

- 16.6.3. Cargo Type

- 16.6.4. Engineering Method

- 16.6.5. Isolation/Production Method

- 16.6.6. Therapeutic Application

- 16.6.7. Diagnostic Application

- 16.6.8. Surface Modification

- 16.6.9. Product Type

- 16.6.10. End-Users

- 17. Europe Engineered Exosomes Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapeutic Application

- 17.3.2. Source/Origin

- 17.3.3. Cargo Type

- 17.3.4. Engineering Method

- 17.3.5. Isolation/Production Method

- 17.3.6. Therapeutic Application

- 17.3.7. Diagnostic Application

- 17.3.8. Surface Modification

- 17.3.9. Product Type

- 17.3.10. End-Users

- 17.3.11. Country

- 17.3.11.1. Germany

- 17.3.11.2. United Kingdom

- 17.3.11.3. France

- 17.3.11.4. Italy

- 17.3.11.5. Spain

- 17.3.11.6. Netherlands

- 17.3.11.7. Nordic Countries

- 17.3.11.8. Poland

- 17.3.11.9. Russia & CIS

- 17.3.11.10. Rest of Europe

- 17.4. Germany Engineered Exosomes Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Source/Origin

- 17.4.3. Cargo Type

- 17.4.4. Engineering Method

- 17.4.5. Isolation/Production Method

- 17.4.6. Therapeutic Application

- 17.4.7. Diagnostic Application

- 17.4.8. Surface Modification

- 17.4.9. Product Type

- 17.4.10. End-Users

- 17.5. United Kingdom Engineered Exosomes Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Source/Origin

- 17.5.3. Cargo Type

- 17.5.4. Engineering Method

- 17.5.5. Isolation/Production Method

- 17.5.6. Therapeutic Application

- 17.5.7. Diagnostic Application

- 17.5.8. Surface Modification

- 17.5.9. Product Type

- 17.5.10. End-Users

- 17.6. France Engineered Exosomes Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Source/Origin

- 17.6.3. Cargo Type

- 17.6.4. Engineering Method

- 17.6.5. Isolation/Production Method

- 17.6.6. Therapeutic Application

- 17.6.7. Diagnostic Application

- 17.6.8. Surface Modification

- 17.6.9. Product Type

- 17.6.10. End-Users

- 17.7. Italy Engineered Exosomes Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Source/Origin

- 17.7.3. Cargo Type

- 17.7.4. Engineering Method

- 17.7.5. Isolation/Production Method

- 17.7.6. Therapeutic Application

- 17.7.7. Diagnostic Application

- 17.7.8. Surface Modification

- 17.7.9. Product Type

- 17.7.10. End-Users

- 17.8. Spain Engineered Exosomes Market

- 17.8.1. Therapeutic Application

- 17.8.2. Source/Origin

- 17.8.3. Cargo Type

- 17.8.4. Engineering Method

- 17.8.5. Isolation/Production Method

- 17.8.6. Therapeutic Application

- 17.8.7. Diagnostic Application

- 17.8.8. Surface Modification

- 17.8.9. Product Type

- 17.8.10. End-Users

- 17.9. Netherlands Engineered Exosomes Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Source/Origin

- 17.9.3. Cargo Type

- 17.9.4. Engineering Method

- 17.9.5. Isolation/Production Method

- 17.9.6. Therapeutic Application

- 17.9.7. Diagnostic Application

- 17.9.8. Surface Modification

- 17.9.9. Product Type

- 17.9.10. End-Users

- 17.10. Nordic Countries Engineered Exosomes Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Source/Origin

- 17.10.3. Cargo Type

- 17.10.4. Engineering Method

- 17.10.5. Isolation/Production Method

- 17.10.6. Therapeutic Application

- 17.10.7. Diagnostic Application

- 17.10.8. Surface Modification

- 17.10.9. Product Type

- 17.10.10. End-Users

- 17.11. Poland Engineered Exosomes Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Source/Origin

- 17.11.3. Cargo Type

- 17.11.4. Engineering Method

- 17.11.5. Isolation/Production Method

- 17.11.6. Therapeutic Application

- 17.11.7. Diagnostic Application

- 17.11.8. Surface Modification

- 17.11.9. Product Type

- 17.11.10. End-Users

- 17.12. Russia & CIS Engineered Exosomes Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Source/Origin

- 17.12.3. Cargo Type

- 17.12.4. Engineering Method

- 17.12.5. Isolation/Production Method

- 17.12.6. Therapeutic Application

- 17.12.7. Diagnostic Application

- 17.12.8. Surface Modification

- 17.12.9. Product Type

- 17.12.10. End-Users

- 17.13. Rest of Europe Engineered Exosomes Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Source/Origin

- 17.13.3. Cargo Type

- 17.13.4. Engineering Method

- 17.13.5. Isolation/Production Method

- 17.13.6. Therapeutic Application

- 17.13.7. Diagnostic Application

- 17.13.8. Surface Modification

- 17.13.9. Product Type

- 17.13.10. End-Users

- 18. Asia Pacific Engineered Exosomes Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Therapeutic Application

- 18.3.2. Source/Origin

- 18.3.3. Cargo Type

- 18.3.4. Engineering Method

- 18.3.5. Isolation/Production Method

- 18.3.6. Therapeutic Application

- 18.3.7. Diagnostic Application

- 18.3.8. Surface Modification

- 18.3.9. Product Type

- 18.3.10. End-Users

- 18.3.11. Country

- 18.3.11.1. China

- 18.3.11.2. India

- 18.3.11.3. Japan

- 18.3.11.4. South Korea

- 18.3.11.5. Australia and New Zealand

- 18.3.11.6. Indonesia

- 18.3.11.7. Malaysia

- 18.3.11.8. Thailand

- 18.3.11.9. Vietnam

- 18.3.11.10. Rest of Asia Pacific

- 18.4. China Engineered Exosomes Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Source/Origin

- 18.4.3. Cargo Type

- 18.4.4. Engineering Method

- 18.4.5. Isolation/Production Method

- 18.4.6. Therapeutic Application

- 18.4.7. Diagnostic Application

- 18.4.8. Surface Modification

- 18.4.9. Product Type

- 18.4.10. End-Users

- 18.5. India Engineered Exosomes Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Source/Origin

- 18.5.3. Cargo Type

- 18.5.4. Engineering Method

- 18.5.5. Isolation/Production Method

- 18.5.6. Therapeutic Application

- 18.5.7. Diagnostic Application

- 18.5.8. Surface Modification

- 18.5.9. Product Type

- 18.5.10. End-Users

- 18.6. Japan Engineered Exosomes Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Source/Origin

- 18.6.3. Cargo Type

- 18.6.4. Engineering Method

- 18.6.5. Isolation/Production Method

- 18.6.6. Therapeutic Application

- 18.6.7. Diagnostic Application

- 18.6.8. Surface Modification

- 18.6.9. Product Type

- 18.6.10. End-Users

- 18.7. South Korea Engineered Exosomes Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Source/Origin

- 18.7.3. Cargo Type

- 18.7.4. Engineering Method

- 18.7.5. Isolation/Production Method

- 18.7.6. Therapeutic Application

- 18.7.7. Diagnostic Application

- 18.7.8. Surface Modification

- 18.7.9. Product Type

- 18.7.10. End-Users

- 18.8. Australia and New Zealand Engineered Exosomes Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Source/Origin

- 18.8.3. Cargo Type

- 18.8.4. Engineering Method

- 18.8.5. Isolation/Production Method

- 18.8.6. Therapeutic Application

- 18.8.7. Diagnostic Application

- 18.8.8. Surface Modification

- 18.8.9. Product Type

- 18.8.10. End-Users

- 18.9. Indonesia Engineered Exosomes Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Source/Origin

- 18.9.3. Cargo Type

- 18.9.4. Engineering Method

- 18.9.5. Isolation/Production Method

- 18.9.6. Therapeutic Application

- 18.9.7. Diagnostic Application

- 18.9.8. Surface Modification

- 18.9.9. Product Type

- 18.9.10. End-Users

- 18.10. Malaysia Engineered Exosomes Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Source/Origin

- 18.10.3. Cargo Type

- 18.10.4. Engineering Method

- 18.10.5. Isolation/Production Method

- 18.10.6. Therapeutic Application

- 18.10.7. Diagnostic Application

- 18.10.8. Surface Modification

- 18.10.9. Product Type

- 18.10.10. End-Users

- 18.11. Thailand Engineered Exosomes Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Source/Origin

- 18.11.3. Cargo Type

- 18.11.4. Engineering Method

- 18.11.5. Isolation/Production Method

- 18.11.6. Therapeutic Application

- 18.11.7. Diagnostic Application

- 18.11.8. Surface Modification

- 18.11.9. Product Type

- 18.11.10. End-Users

- 18.12. Vietnam Engineered Exosomes Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Source/Origin

- 18.12.3. Cargo Type

- 18.12.4. Engineering Method

- 18.12.5. Isolation/Production Method

- 18.12.6. Therapeutic Application

- 18.12.7. Diagnostic Application

- 18.12.8. Surface Modification

- 18.12.9. Product Type

- 18.12.10. End-Users

- 18.13. Rest of Asia Pacific Engineered Exosomes Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Source/Origin

- 18.13.3. Cargo Type

- 18.13.4. Engineering Method

- 18.13.5. Isolation/Production Method

- 18.13.6. Therapeutic Application

- 18.13.7. Diagnostic Application

- 18.13.8. Surface Modification

- 18.13.9. Product Type

- 18.13.10. End-Users

- 19. Middle East Engineered Exosomes Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Therapeutic Application

- 19.3.2. Source/Origin

- 19.3.3. Cargo Type

- 19.3.4. Engineering Method

- 19.3.5. Isolation/Production Method

- 19.3.6. Therapeutic Application

- 19.3.7. Diagnostic Application

- 19.3.8. Surface Modification

- 19.3.9. Product Type

- 19.3.10. End-Users

- 19.3.11. Country

- 19.3.11.1. Turkey

- 19.3.11.2. UAE

- 19.3.11.3. Saudi Arabia

- 19.3.11.4. Israel

- 19.3.11.5. Rest of Middle East

- 19.4. Turkey Engineered Exosomes Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Source/Origin

- 19.4.3. Cargo Type

- 19.4.4. Engineering Method

- 19.4.5. Isolation/Production Method

- 19.4.6. Therapeutic Application

- 19.4.7. Diagnostic Application

- 19.4.8. Surface Modification

- 19.4.9. Product Type

- 19.4.10. End-Users

- 19.5. UAE Engineered Exosomes Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Source/Origin

- 19.5.3. Cargo Type

- 19.5.4. Engineering Method

- 19.5.5. Isolation/Production Method

- 19.5.6. Therapeutic Application

- 19.5.7. Diagnostic Application

- 19.5.8. Surface Modification

- 19.5.9. Product Type

- 19.5.10. End-Users

- 19.6. Saudi Arabia Engineered Exosomes Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Source/Origin

- 19.6.3. Cargo Type

- 19.6.4. Engineering Method

- 19.6.5. Isolation/Production Method

- 19.6.6. Therapeutic Application

- 19.6.7. Diagnostic Application

- 19.6.8. Surface Modification

- 19.6.9. Product Type

- 19.6.10. End-Users

- 19.7. Israel Engineered Exosomes Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Source/Origin

- 19.7.3. Cargo Type

- 19.7.4. Engineering Method

- 19.7.5. Isolation/Production Method

- 19.7.6. Therapeutic Application

- 19.7.7. Diagnostic Application

- 19.7.8. Surface Modification

- 19.7.9. Product Type

- 19.7.10. End-Users

- 19.8. Rest of Middle East Engineered Exosomes Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Source/Origin

- 19.8.3. Cargo Type

- 19.8.4. Engineering Method

- 19.8.5. Isolation/Production Method

- 19.8.6. Therapeutic Application

- 19.8.7. Diagnostic Application

- 19.8.8. Surface Modification

- 19.8.9. Product Type

- 19.8.10. End-Users

- 20. Africa Engineered Exosomes Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Therapeutic Application

- 20.3.2. Source/Origin

- 20.3.3. Cargo Type

- 20.3.4. Engineering Method

- 20.3.5. Isolation/Production Method

- 20.3.6. Therapeutic Application

- 20.3.7. Diagnostic Application

- 20.3.8. Surface Modification

- 20.3.9. Product Type

- 20.3.10. End-Users

- 20.3.11. Country

- 20.3.11.1. South Africa

- 20.3.11.2. Egypt

- 20.3.11.3. Nigeria

- 20.3.11.4. Algeria

- 20.3.11.5. Rest of Africa

- 20.4. South Africa Engineered Exosomes Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Source/Origin

- 20.4.3. Cargo Type

- 20.4.4. Engineering Method

- 20.4.5. Isolation/Production Method

- 20.4.6. Therapeutic Application

- 20.4.7. Diagnostic Application

- 20.4.8. Surface Modification

- 20.4.9. Product Type

- 20.4.10. End-Users

- 20.5. Egypt Engineered Exosomes Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Source/Origin

- 20.5.3. Cargo Type

- 20.5.4. Engineering Method

- 20.5.5. Isolation/Production Method

- 20.5.6. Therapeutic Application

- 20.5.7. Diagnostic Application

- 20.5.8. Surface Modification

- 20.5.9. Product Type

- 20.5.10. End-Users

- 20.6. Nigeria Engineered Exosomes Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Source/Origin

- 20.6.3. Cargo Type

- 20.6.4. Engineering Method

- 20.6.5. Isolation/Production Method

- 20.6.6. Therapeutic Application

- 20.6.7. Diagnostic Application

- 20.6.8. Surface Modification

- 20.6.9. Product Type

- 20.6.10. End-Users

- 20.7. Algeria Engineered Exosomes Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Source/Origin

- 20.7.3. Cargo Type

- 20.7.4. Engineering Method

- 20.7.5. Isolation/Production Method

- 20.7.6. Therapeutic Application

- 20.7.7. Diagnostic Application

- 20.7.8. Surface Modification

- 20.7.9. Product Type

- 20.7.10. End-Users

- 20.8. Rest of Africa Engineered Exosomes Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Source/Origin

- 20.8.3. Cargo Type

- 20.8.4. Engineering Method

- 20.8.5. Isolation/Production Method

- 20.8.6. Therapeutic Application

- 20.8.7. Diagnostic Application

- 20.8.8. Surface Modification

- 20.8.9. Product Type

- 20.8.10. End-Users

- 21. South America Engineered Exosomes Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Engineered Exosomes Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Therapeutic Application

- 21.3.2. Source/Origin

- 21.3.3. Cargo Type

- 21.3.4. Engineering Method

- 21.3.5. Isolation/Production Method

- 21.3.6. Therapeutic Application

- 21.3.7. Diagnostic Application

- 21.3.8. Surface Modification

- 21.3.9. Product Type

- 21.3.10. End-Users

- 21.3.11. Country

- 21.3.11.1. Brazil

- 21.3.11.2. Argentina

- 21.3.11.3. Rest of South America

- 21.4. Brazil Engineered Exosomes Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Source/Origin

- 21.4.3. Cargo Type

- 21.4.4. Engineering Method

- 21.4.5. Isolation/Production Method

- 21.4.6. Therapeutic Application

- 21.4.7. Diagnostic Application

- 21.4.8. Surface Modification

- 21.4.9. Product Type

- 21.4.10. End-Users

- 21.5. Argentina Engineered Exosomes Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Source/Origin

- 21.5.3. Cargo Type

- 21.5.4. Engineering Method

- 21.5.5. Isolation/Production Method

- 21.5.6. Therapeutic Application

- 21.5.7. Diagnostic Application

- 21.5.8. Surface Modification

- 21.5.9. Product Type

- 21.5.10. End-Users

- 21.6. Rest of South America Engineered Exosomes Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Source/Origin

- 21.6.3. Cargo Type

- 21.6.4. Engineering Method

- 21.6.5. Isolation/Production Method

- 21.6.6. Therapeutic Application

- 21.6.7. Diagnostic Application

- 21.6.8. Surface Modification

- 21.6.9. Product Type

- 21.6.10. End-Users

- 22. Key Players/ Company Profile

- 22.1. Aegeria Soft Tissue

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Aegle Therapeutics

- 22.3. Anjarium Biosciences

- 22.4. Aruna Bio

- 22.5. Avalon GloboCare

- 22.6. Capricor Therapeutics

- 22.7. Carmine Therapeutics

- 22.8. Cellcolabs

- 22.9. Clara Biotech

- 22.10. Codiak BioSciences

- 22.11. Direct Biologics

- 22.12. EverZom

- 22.13. Evox Therapeutics

- 22.14. ExoCoBio

- 22.15. Exosome Diagnostics (Bio-Techne)

- 22.16. Kimera Labs

- 22.17. MDimune

- 22.18. Organicell Regenerative Medicine

- 22.19. PureTech Health

- 22.20. ReNeuron Group

- 22.21. United Therapeutics Corporation

- 22.22. Other Key Players

- 22.1. Aegeria Soft Tissue

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation