Epitranscriptomics Market Size, Share & Trends Analysis Report by Modification Type (m6A, m5C, Pseudouridine (Ψ), m1A, m7G, A-to-I Editing, Other Modifications), Technology/Method, Product Type, Application, Disease Area, End-Use Industry, Workflow Stage, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Epitranscriptomics Market Size, Share, and Growth

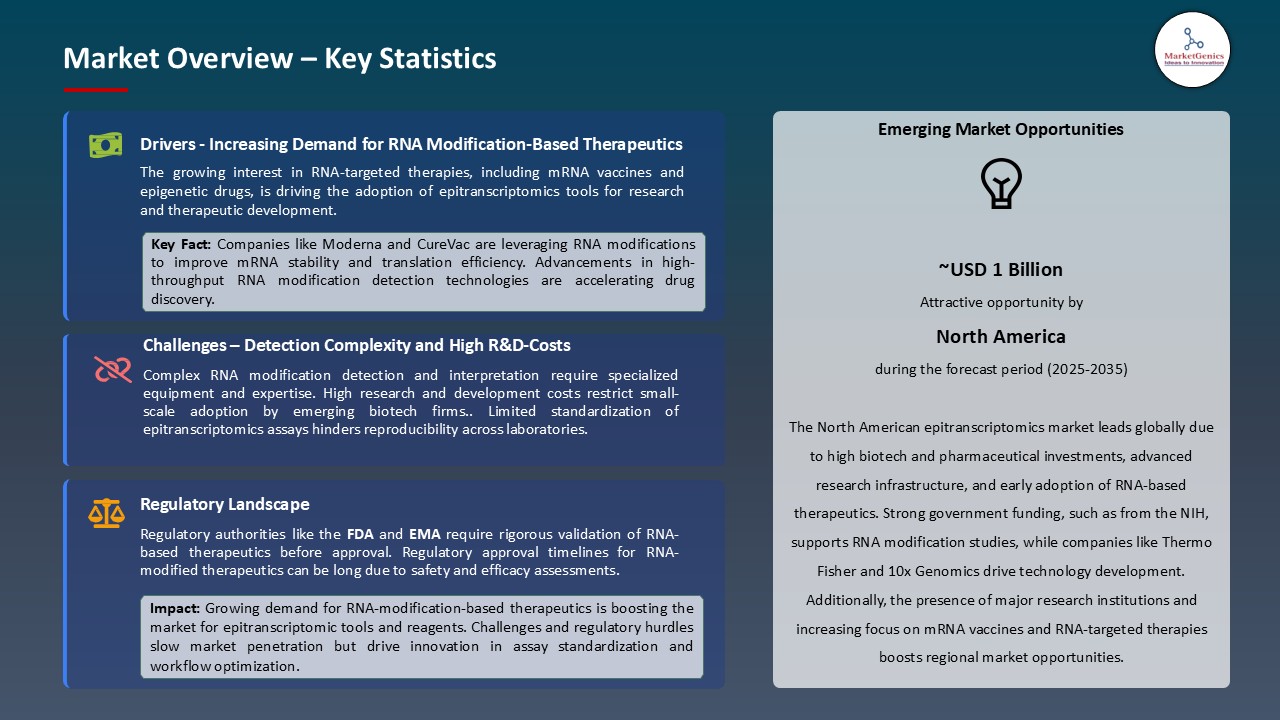

The global epitranscriptomics market is witnessing strong growth, valued at USD 0.8 billion in 2025 and projected to reach USD 3.0 billion by 2035, expanding at a CAGR of 14.3% during the forecast period. North America leads the epitranscriptomics market due to its robust research infrastructure, high adoption of advanced RNA analysis technologies, strong government and private funding, and active collaborations between academic institutions and biotech companies driving RNA-based diagnostics and therapeutics.

Betsy Young, Senior Product Marketing Manager for the NEBNext portfolio, said that “Small RNA species – including rare and non-coding RNAs – have historically been relegated to a black box. Now, researchers are opening that box and realizing these tiny RNAs have an outsized influence on health and disease. However, sequencing bias in preexisting library preparation methods has made it hard for researchers to understand the true diversity and abundance of small RNAs in their samples. This kit was designed to generate RNA libraries with a more accurate representation of small RNA species.”

The growing focus on RNA-targeted therapeutics is another key driver of the epitranscriptomics market. RNA modifications are a novel field of therapeutic target that pharmaceutical and biotech firms are investigating to cure cancer, neurodegenerative diseases, and meta-metabolic diseases. An example would be the Silence Therapeutics, which has been developing the RNAi therapeutics based on their mRNA GOLD platform to silence disease-related genes.

The epitranscriptomics market is expanding through strategic collaborations and partnerships, which have enabled the combination of complementary expertise, technologies, and resources by various stakeholders. The collaboration of pharmaceutical companies, biotech firms, and research institutions will facilitate the RNA modification studies, help faster the development of RNA-targeted therapeutics, and increase the discovery of novel biomarkers. An example is that Synfini Inc. collaborated with O2nix Bio to co-discover new cancer therapeutics in FTSJ1, a tRNA-modifying enzyme that leads to survival in metastatic cancer cells.

The use of AI with epitranscriptomics is one of the main opportunities since epitranscriptomics research is focused on RNA modifications that can regulate gene expression and cellular behavior. With AI and machine learning in place, the discovery of disease-specific epitranscriptomic signatures and predictions of patient responses to treatment will be possible by analyzing large volumes of RNA modifications. Indicatively, in 2025, Alida Biosciences has collaborated with DNAnexus to improve the research capacities of epitranscriptomics. Their joint effort combines EpiScout Analysis Suite of AlidaBio and the cloud application of DNAnexus to help researchers design RNA modification markers of individualized medicine strategies.

Epitranscriptomics Market Dynamics and Trends

Driver: Rapid improvements in direct RNA sequencing technologies enabling modification detection

- New technological advances in single-molecule and direct RNA sequencing are simplifying and accelerating the process of examining chemical modifications in RNA, resulting in the development of the epitranscriptomics market. An example is the case of Oxford Nanopore Technologies which has brought an enhancement in its direct RNA sequencing technology which can detect multiple RNA modification.

- New DNA sequencing companies are also improving their platforms to enable them to analyze RNA directly as well as identify the subtle chemical modifications, such as m 6A, without the use of complicated laboratory methods. An example is the NEBNext Low-bias Small RNA Library Prep Kit was introduced by In 2025, New England Biolabs. This kit represents a new technology of precise representation of all the diversity of RNA samples. It allows researchers to profile small RNA and investigate RNA modifications in more detail, which help in epitranscriptomics research.

- • Progress is an indication of an increasing interest on the part of major life sciences organizations in funding and developing epitranscriptomics research. They are making it easier to understand and explore RNA modifications, which play a major role in regulating gene expression and which are important in many diseases, by having innovative tools and resources available.

Restraint: Clinical Validation Gaps and Reimbursement Challenges in the Epitranscriptomics Market Limit Accessibility

- The field of technological progress is moving quite fast, but no standard is yet established concerning the detection and quantification of RNA modifications across platforms and laboratories. The inconsistent outcomes are due to differences in library preparation, sequencing chemistry, antibody specificity, and bioinformatics pipelines.

- Various methods, such as antibody-based immunoprecipitation (MeRIP-seq), chemical labeling, and mass spectrometry, are applied in different laboratories and companies, and they have respective sensitivity, specificity, and biases. An example is that the m 6A detection can differ with the use of either the LC-MS or antibody-based enrichment protocols, introducing problems of reproducibility.

- The inconsistency also complicates the use of epitranscriptomic data by pharmaceutical companies and clinical researchers in decision-making processes and slows the use of much of this data in drug development, diagnostics, and biomarker discovery. The absence of standardisation slows down mass adoption, which limits market expansion and business prospects.

Opportunity: Development of diagnostic biomarkers based on RNA modifications

- The market of epitranscriptomics is to be offering substantial prospects with a creation of diagnostic and prognostic biomarkers utilizing the changes of RNA. The chemical modification of RNA is now deemed as an important regulator of gene expression and cellular activity, and has been implicated in a variety of disease conditions such as cancer, neurodegenerative disorders, cardiovascular diseases, and viral infections. As an example, scientists at the Singapore-MIT Alliance for Research and Technology (SMART) have created a device that is able to scan thousands of biological samples to identify transfer RNA (tRNA) modification.

- The ways in which RNA is modified in the patients can be analyzed to create biomarkers that can be used to detect disease early, to stratify patients and to monitor therapeutic response to support precision medicine initiatives. As an example, in 2025, Genialis renewed its partnership with Debiopharm to create WEE1-targeted cancer therapy predictive biomarkers based on RNA. Clinical data stratification and response mechanism discovery on RNA-seq data are used with the Genialis Supermodel, which is an AI-driven tool that orchestrates DDR-oriented treatment.

- RNA modification-based biomarkers broaden the market base between simple research instruments, clinical diagnostic & personized medicine, generating new revenue streams and speeding up the adoption of epitranscriptomic technologies.

Key Trend: Growing Integration of Single-Cell Epitranscriptomics for Disease Mapping

- Combination of single-cell RNA sequencing with RNA modification profiling is also a significant trend defining epitranscriptomics market as the disease mapping shifts. As an example, In 2025, 10x Genomics improved single-cell epitranscriptomics using the Chromium platform and GEM-X 3' Reagent Kits v4 to provide the possibility to do a high-throughput RNA sequencing of single cells. With Cell Ranger multi pipeline, researchers are able to map cell-type-specific modifications of the RNA and gene expression up to study disease mechanisms.

- The trend allows the researchers to discover versatile regulation processes inaccessible to bulk tests, including m 6A in single immune or cancer cells. Recent developments in single-cell transcriptomics offer high throughput and low input profiling. An example is the production of a high-throughput single-cell multi-omics platform by Singleron Biotechnologies that integrates transcriptomics and epigenomics and can be used to conduct advanced work on RNA modifications and gene expression in single cells.

- Single-cell RNA modification profiling is changing the disease investigations by uncovering the cell-regulatory processes and making it possible to discover biomarkers in specific cells.

Epitranscriptomics Market Analysis and Segmental Data

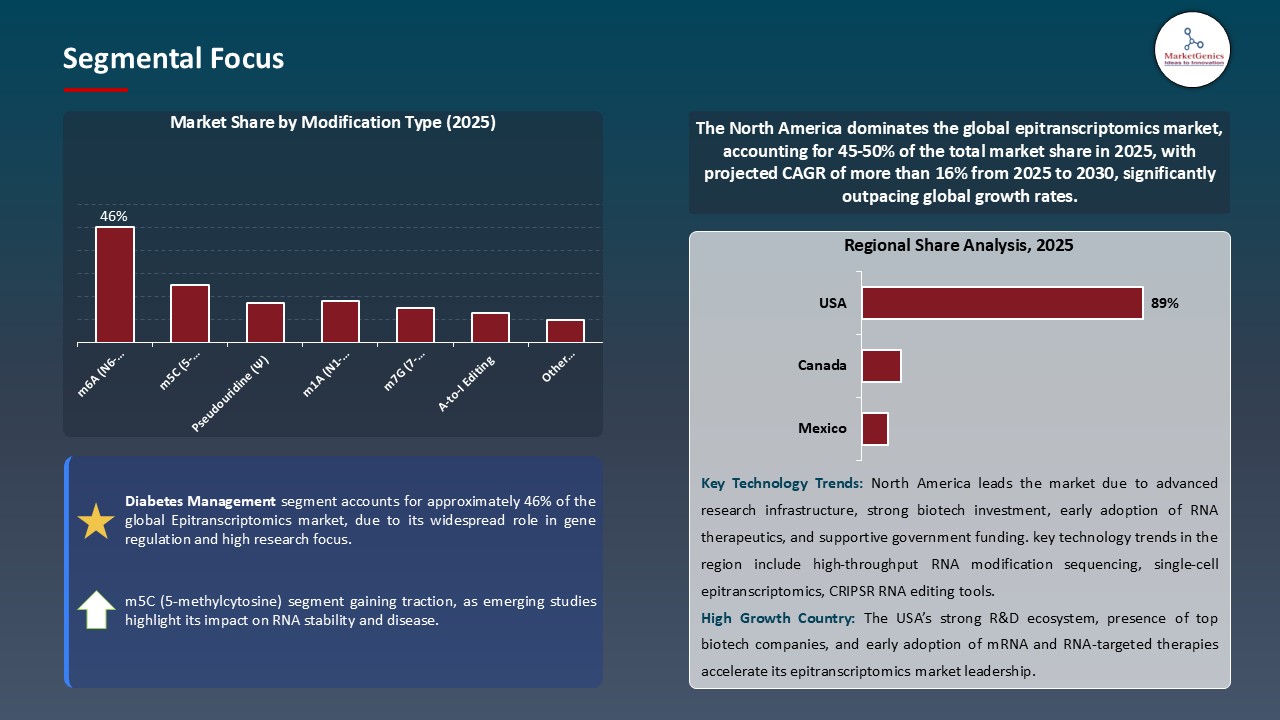

m6A (N6-methyladenosine) Dominate Global Epitranscriptomics Market

- The m6A (N6-methyladenosine) modification is the most prevalent in the worldwide epitranscriptomics market since it is essential in the regulation of RNA stability, splicing, translation, and gene expression of various biological activities. Being the most common internal alteration of eukaryotic mRNA, m6A is a natural target of both fundamental research and therapeutic applications in cancer, neurodegenerative and metabolic diseases.

- Combinations of sophisticated detection methods, such as high-throughput sequencing and AI-based epitranscriptomic analysis, have made it possible to map m6A locations at high precision, which has stimulated the creation of targeted RNA therapies and diagnostic biomarkers.

- The prevalence of m6A in a market is supported by the rising investment and collaboration of pharmaceutical and biotech companies, strategic partnerships, and the rising awareness of its potential in personalized medicine.

- The m6A-centricity facilitates the identification of novel RNA-based therapeutics, improving precision medicine and broadening the business scope of the epitranscriptomics industry.

North America Leads Global Epitranscriptomics Market Demand

- The North America dominates the epitranscriptomics market, with its developed biotechnology framework, robust research environment, and considerable investments in RNA biology. Companies that are pioneering are re-inventing innovation through the creation of state-of-the-art RNA sequencing technology and epitranscriptomic reagents, allowing the specific analysis of RNA modifications like m6A.

- Prestigious research institutions, such as the National Institutes of Health (NIH) and the Broad Institute, contribute to the field of translational research and new therapeutic approaches, especially in cancer, neurodegenerative disorders, and rare genetic diseases. To illustrate, The NIH National Institute of Neurological Disorders and Stroke (NINDS) has launched the Ultra-rare Gene-based Therapy (URGenT) Network to develop gene-based therapies of ultra-rare neurological disorders.

- Thus, the emphasis on precision medicine, personalized therapeutics, and incorporation of AI-driven bioinformatics in RNA research makes the region a leader, making the U.S. a global leader in breakthroughs in RNA-based diagnostics and therapies, which will eventually influence the future of epitranscriptomics market worldwide.

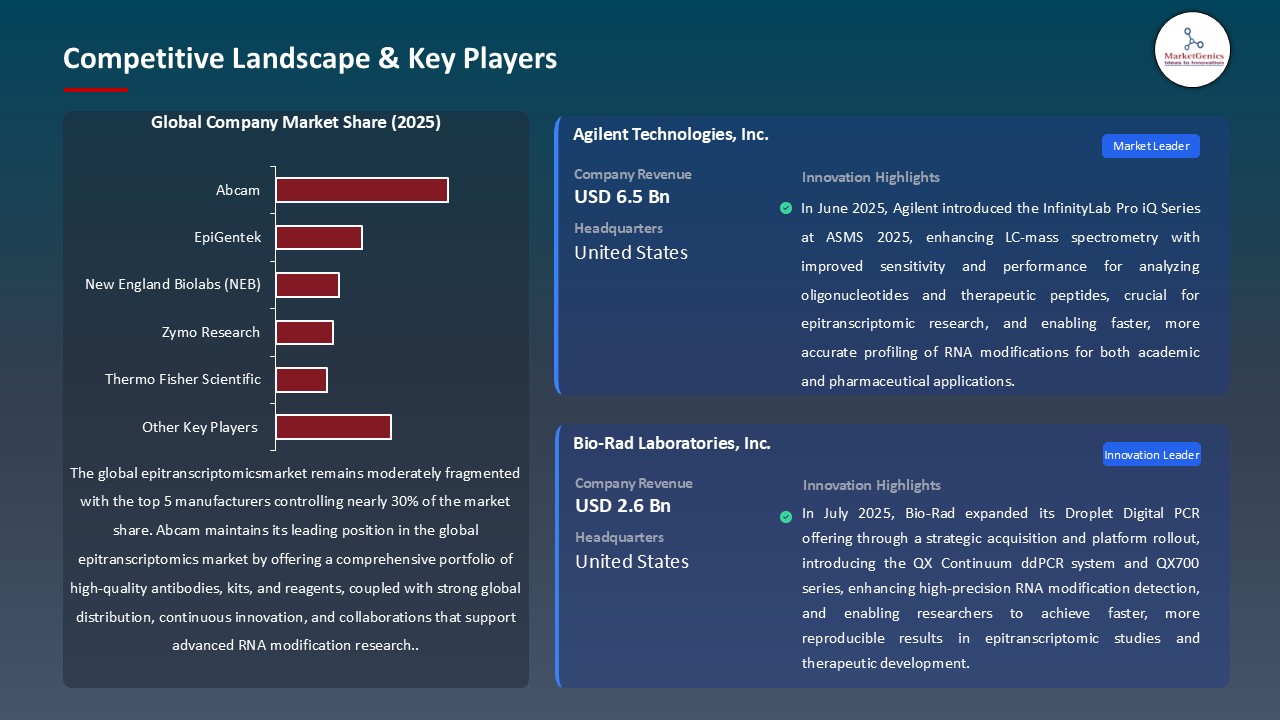

Epitranscriptomics Market Ecosystem

The size of the global epitranscriptomics market is moderately concentrated with the major competitors in the market including Abcam, EpiGentek, New England Biolabs (NEB), Zymo Research and Thermo Fisher Scientific controlling a total market share of an estimated 35. Such companies are pioneers in the supply of tools, reagents, and platforms of RNA modification analysis with substantial intellectual property, extensive product portfolios, strong research pipelines, and have strategic alliances. Their technology, regulation standards are on top of the industry, and posing a barrier to new entrants. As an example, the epitranscriptomics product line of Abcam now has advanced m6A and RNA modification detection kits, which further supports its credibility and market trust.

The ecosystem of epitranscriptomics requires service providers and integrators of the platform to facilitate quicker research, assay development, and scalable implementation of the RNA modification analysis. Their help minimizes the time spent on experiments, lowers the capital cost of new entrants, and hastens their uptake both in academic and clinical research. An example is Thermo Fisher Scientific that provides integrated platforms and bioinformatics solutions that enable other researchers and biotech companies to easily conduct RNA modification profiling at scale.

Recent Development and Strategic Overview:

- In March 2025, Aqemia, a Paris-based biotech company specializing in drug discovery through generative AI, announced a significant advancement in its epitranscriptomics programs. The company secured a €7.4 million grant as part of France's "France 2030" initiative, aimed at accelerating innovation in the pharmaceutical sector.

- In April 2025, Zymo Research has introduced the RNome Disruptive Research Grant, designed to empower scientists mapping the RNome and advance the overall understanding of RNA. This initiative fosters collaboration and innovation, accelerating scientific breakthroughs with diagnostic and therapeutic potential.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.8 Bn |

|

Market Forecast Value in 2035 |

USD 3.0 Bn |

|

Growth Rate (CAGR) |

14.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Epitranscriptomics Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Epitranscriptomics Market, By Modification Type |

|

|

Epitranscriptomics Market, By Technology/Method |

|

|

Epitranscriptomics Market, By Product Type |

|

|

Epitranscriptomics Market, By RNA Type |

|

|

Epitranscriptomics Market, By Application |

|

|

Epitranscriptomics Market, By Disease Area |

|

|

Epitranscriptomics Market, By End-Use Industry |

|

|

Epitranscriptomics Market, By Workflow Stage |

|

|

Epitranscriptomics Market, By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Epitranscriptomics Market Outlook

- 2.1.1. Epitranscriptomics Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Epitranscriptomics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for RNA modification-based biomarkers in precision medicine

- 4.1.1.2. Advancements in sequencing technologies enabling single-cell epitranscriptomic profiling

- 4.1.1.3. Expanding academic–industry collaborations for RNA-targeted drug discovery

- 4.1.2. Restraints

- 4.1.2.1. High cost and complexity of epitranscriptomic data analysis

- 4.1.2.2. Limited standardization and reproducibility across detection platforms

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Materials & Reagents Suppliers

- 4.4.2. Product Development & Manufacturing

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Epitranscriptomics Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Epitranscriptomics Market Analysis, By Modification Type

- 6.1. Key Segment Analysis

- 6.2. Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, By Modification Type, 2021-2035

- 6.2.1. m6A (N6-methyladenosine)

- 6.2.1.1. Writers (METTL3, METTL14)

- 6.2.1.2. Erasers (FTO, ALKBH5)

- 6.2.1.3. Readers (YTHDF proteins)

- 6.2.1.4. Others

- 6.2.2. m5C (5-methylcytosine)

- 6.2.3. Pseudouridine (Ψ)

- 6.2.4. m1A (N1-methyladenosine)

- 6.2.5. m7G (7-methylguanosine)

- 6.2.6. A-to-I Editing

- 6.2.7. Other Modifications

- 6.2.1. m6A (N6-methyladenosine)

- 7. Global Epitranscriptomics Market Analysis, By Technology/Method

- 7.1. Key Segment Analysis

- 7.2. Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology/Method, 2021-2035

- 7.2.1. Sequencing-Based Methods

- 7.2.1.1. MeRIP-seq/m6A-seq

- 7.2.1.2. miCLIP

- 7.2.1.3. PA-m6A-seq

- 7.2.1.4. DART-seq

- 7.2.1.5. Others

- 7.2.2. Mass Spectrometry

- 7.2.2.1. LC-MS/MS

- 7.2.2.2. UHPLC-MS/MS

- 7.2.2.3. Others

- 7.2.3. Antibody-Based Detection

- 7.2.4. Chemical Labeling Methods

- 7.2.5. Nanopore Sequencing

- 7.2.6. Enzymatic Methods

- 7.2.7. Others

- 7.2.1. Sequencing-Based Methods

- 8. Global Epitranscriptomics Market Analysis and Forecasts,By Product Type

- 8.1. Key Findings

- 8.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Product Type, 2021-2035

- 8.2.1. Kits & Reagents

- 8.2.1.1. RNA modification detection kits

- 8.2.1.2. Enrichment kits

- 8.2.1.3. Sequencing library preparation kits

- 8.2.1.4. Others

- 8.2.2. Instruments & Equipment

- 8.2.3. Software & Bioinformatics Tools

- 8.2.4. Services

- 8.2.1. Kits & Reagents

- 9. Global Epitranscriptomics Market Analysis and Forecasts, By RNA Type

- 9.1. Key Findings

- 9.2. Epitranscriptomics Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By RNA Type, 2021-2035

- 9.2.1. mRNA (Messenger RNA)

- 9.2.2. tRNA (Transfer RNA)

- 9.2.3. rRNA (Ribosomal RNA)

- 9.2.4. lncRNA (Long Non-coding RNA)

- 9.2.5. miRNA (MicroRNA)

- 9.2.6. circRNA (Circular RNA)

- 9.2.7. snRNA (Small Nuclear RNA)

- 9.2.8. Others

- 10. Global Epitranscriptomics Market Analysis and Forecasts, By Application

- 10.1. Key Findings

- 10.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Application, 2021-2035

- 10.2.1. Disease Biomarker Discovery

- 10.2.2. Drug Target Identification

- 10.2.3. Therapeutics Development

- 10.2.3.1. mRNA therapeutics

- 10.2.3.2. Antisense oligonucleotides

- 10.2.3.3. Small molecule modulators

- 10.2.3.4. Others

- 10.2.4. Basic Research

- 10.2.5. Diagnostic Development

- 10.2.6. Personalized Medicine

- 10.2.7. Vaccine Development

- 10.2.8. Others

- 11. Global Epitranscriptomics Market Analysis and Forecasts, By Disease Area

- 11.1. Key Findings

- 11.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Disease Area, 2021-2035

- 11.2.1. Cancer/Oncology

- 11.2.1.1. Leukemia

- 11.2.1.2. Breast cancer

- 11.2.1.3. Lung cancer

- 11.2.1.4. Liver cancer

- 11.2.1.5. Others

- 11.2.2. Neurological Disorders

- 11.2.2.1. Alzheimer's disease

- 11.2.2.2. Parkinson's disease

- 11.2.2.3. Glioblastoma

- 11.2.2.4. Others

- 11.2.3. Metabolic Disorders

- 11.2.3.1. Obesity

- 11.2.3.2. Diabetes

- 11.2.3.3. Others

- 11.2.4. Cardiovascular Diseases

- 11.2.5. Infectious Diseases

- 11.2.6. Immunological Disorders

- 11.2.7. Others

- 11.2.1. Cancer/Oncology

- 12. Global Epitranscriptomics Market Analysis and Forecasts, By End-Use Industry

- 12.1. Key Findings

- 12.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Delivery Mode, 2021-2035

- 12.2.1. Pharmaceutical & Biotechnology Companies

- 12.2.2. Academic & Research Institutes

- 12.2.3. Contract Research Organizations (CROs)

- 12.2.4. Diagnostic Laboratories

- 12.2.5. Hospital & Clinical Laboratories

- 12.2.6. Others

- 13. Global Epitranscriptomics Market Analysis and Forecasts, By Workflow Stage

- 13.1. Key Findings

- 13.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Workflow Stage, 2021-2035

- 13.2.1. Sample Preparation

- 13.2.2. RNA Extraction & Purification

- 13.2.3. Modification Detection

- 13.2.4. Enrichment & Immunoprecipitation

- 13.2.5. Sequencing & Analysis

- 13.2.6. Data Interpretation

- 14. Global Epitranscriptomics Market Analysis and Forecasts, By Distribution Channel

- 14.1. Key Findings

- 14.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, By Distribution Channel, 2021-2035

- 14.2.1. Direct Sales

- 14.2.2. Distributors & Resellers

- 14.2.3. Online Channels

- 15. Global Epitranscriptomics Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Epitranscriptomics Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Epitranscriptomics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Modification Type

- 16.3.2. Technology/Method

- 16.3.3. Product Type

- 16.3.4. RNA Type

- 16.3.5. Application

- 16.3.6. Disease Area

- 16.3.7. End-Use Industry

- 16.3.8. Workflow Stage

- 16.3.9. Distribution Channel

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Epitranscriptomics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Modification Type

- 16.4.3. Technology/Method

- 16.4.4. Product Type

- 16.4.5. RNA Type

- 16.4.6. Application

- 16.4.7. Disease Area

- 16.4.8. End-Use Industry

- 16.4.9. Workflow Stage

- 16.4.10. Distribution Channel

- 16.5. Canada Epitranscriptomics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Modification Type

- 16.5.3. Technology/Method

- 16.5.4. Product Type

- 16.5.5. RNA Type

- 16.5.6. Application

- 16.5.7. Disease Area

- 16.5.8. End-Use Industry

- 16.5.9. Workflow Stage

- 16.5.10. Distribution Channel

- 16.6. Mexico Epitranscriptomics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Modification Type

- 16.6.3. Technology/Method

- 16.6.4. Product Type

- 16.6.5. RNA Type

- 16.6.6. Application

- 16.6.7. Disease Area

- 16.6.8. End-Use Industry

- 16.6.9. Workflow Stage

- 16.6.10. Distribution Channel

- 17. Europe Epitranscriptomics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapeutic Application

- 17.3.2. Modification Type

- 17.3.3. Technology/Method

- 17.3.4. Product Type

- 17.3.5. RNA Type

- 17.3.6. Application

- 17.3.7. Disease Area

- 17.3.8. End-Use Industry

- 17.3.9. Workflow Stage

- 17.3.10. Distribution Channel

- 17.3.11. Country

- 17.3.11.1. Germany

- 17.3.11.2. United Kingdom

- 17.3.11.3. France

- 17.3.11.4. Italy

- 17.3.11.5. Spain

- 17.3.11.6. Netherlands

- 17.3.11.7. Nordic Countries

- 17.3.11.8. Poland

- 17.3.11.9. Russia & CIS

- 17.3.11.10. Rest of Europe

- 17.4. Germany Epitranscriptomics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Modification Type

- 17.4.3. Technology/Method

- 17.4.4. Product Type

- 17.4.5. RNA Type

- 17.4.6. Application

- 17.4.7. Disease Area

- 17.4.8. End-Use Industry

- 17.4.9. Workflow Stage

- 17.4.10. Distribution Channel

- 17.5. United Kingdom Epitranscriptomics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Modification Type

- 17.5.3. Technology/Method

- 17.5.4. Product Type

- 17.5.5. RNA Type

- 17.5.6. Application

- 17.5.7. Disease Area

- 17.5.8. End-Use Industry

- 17.5.9. Workflow Stage

- 17.5.10. Distribution Channel

- 17.6. France Epitranscriptomics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Modification Type

- 17.6.3. Technology/Method

- 17.6.4. Product Type

- 17.6.5. RNA Type

- 17.6.6. Application

- 17.6.7. Disease Area

- 17.6.8. End-Use Industry

- 17.6.9. Workflow Stage

- 17.6.10. Distribution Channel

- 17.7. Italy Epitranscriptomics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Modification Type

- 17.7.3. Technology/Method

- 17.7.4. Product Type

- 17.7.5. RNA Type

- 17.7.6. Application

- 17.7.7. Disease Area

- 17.7.8. End-Use Industry

- 17.7.9. Workflow Stage

- 17.7.10. Distribution Channel

- 17.8. Spain Epitranscriptomics Market

- 17.8.1. Therapeutic Application

- 17.8.2. Modification Type

- 17.8.3. Technology/Method

- 17.8.4. Product Type

- 17.8.5. RNA Type

- 17.8.6. Application

- 17.8.7. Disease Area

- 17.8.8. End-Use Industry

- 17.8.9. Workflow Stage

- 17.8.10. Distribution Channel

- 17.9. Netherlands Epitranscriptomics Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Modification Type

- 17.9.3. Technology/Method

- 17.9.4. Product Type

- 17.9.5. RNA Type

- 17.9.6. Application

- 17.9.7. Disease Area

- 17.9.8. End-Use Industry

- 17.9.9. Workflow Stage

- 17.9.10. Distribution Channel

- 17.10. Nordic Countries Epitranscriptomics Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Modification Type

- 17.10.3. Technology/Method

- 17.10.4. Product Type

- 17.10.5. RNA Type

- 17.10.6. Application

- 17.10.7. Disease Area

- 17.10.8. End-Use Industry

- 17.10.9. Workflow Stage

- 17.10.10. Distribution Channel

- 17.11. Poland Epitranscriptomics Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Modification Type

- 17.11.3. Technology/Method

- 17.11.4. Product Type

- 17.11.5. RNA Type

- 17.11.6. Application

- 17.11.7. Disease Area

- 17.11.8. End-Use Industry

- 17.11.9. Workflow Stage

- 17.11.10. Distribution Channel

- 17.12. Russia & CIS Epitranscriptomics Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Modification Type

- 17.12.3. Technology/Method

- 17.12.4. Product Type

- 17.12.5. RNA Type

- 17.12.6. Application

- 17.12.7. Disease Area

- 17.12.8. End-Use Industry

- 17.12.9. Workflow Stage

- 17.12.10. Distribution Channel

- 17.13. Rest of Europe Epitranscriptomics Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Modification Type

- 17.13.3. Technology/Method

- 17.13.4. Product Type

- 17.13.5. RNA Type

- 17.13.6. Application

- 17.13.7. Disease Area

- 17.13.8. End-Use Industry

- 17.13.9. Workflow Stage

- 17.13.10. Distribution Channel

- 18. Asia Pacific Epitranscriptomics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Modification Type

- 18.3.2. Technology/Method

- 18.3.3. Product Type

- 18.3.4. RNA Type

- 18.3.5. Application

- 18.3.6. Disease Area

- 18.3.7. End-Use Industry

- 18.3.8. Workflow Stage

- 18.3.9. Distribution Channel

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Epitranscriptomics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Modification Type

- 18.4.3. Technology/Method

- 18.4.4. Product Type

- 18.4.5. RNA Type

- 18.4.6. Application

- 18.4.7. Disease Area

- 18.4.8. End-Use Industry

- 18.4.9. Workflow Stage

- 18.4.10. Distribution Channel

- 18.5. India Epitranscriptomics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Modification Type

- 18.5.3. Technology/Method

- 18.5.4. Product Type

- 18.5.5. RNA Type

- 18.5.6. Application

- 18.5.7. Disease Area

- 18.5.8. End-Use Industry

- 18.5.9. Workflow Stage

- 18.5.10. Distribution Channel

- 18.6. Japan Epitranscriptomics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Modification Type

- 18.6.3. Technology/Method

- 18.6.4. Product Type

- 18.6.5. RNA Type

- 18.6.6. Application

- 18.6.7. Disease Area

- 18.6.8. End-Use Industry

- 18.6.9. Workflow Stage

- 18.6.10. Distribution Channel

- 18.7. South Korea Epitranscriptomics Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Modification Type

- 18.7.3. Technology/Method

- 18.7.4. Product Type

- 18.7.5. RNA Type

- 18.7.6. Application

- 18.7.7. Disease Area

- 18.7.8. End-Use Industry

- 18.7.9. Workflow Stage

- 18.7.10. Distribution Channel

- 18.8. Australia and New Zealand Epitranscriptomics Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Modification Type

- 18.8.3. Technology/Method

- 18.8.4. Product Type

- 18.8.5. RNA Type

- 18.8.6. Application

- 18.8.7. Disease Area

- 18.8.8. End-Use Industry

- 18.8.9. Workflow Stage

- 18.8.10. Distribution Channel

- 18.9. Indonesia Epitranscriptomics Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Modification Type

- 18.9.3. Technology/Method

- 18.9.4. Product Type

- 18.9.5. RNA Type

- 18.9.6. Application

- 18.9.7. Disease Area

- 18.9.8. End-Use Industry

- 18.9.9. Workflow Stage

- 18.9.10. Distribution Channel

- 18.10. Malaysia Epitranscriptomics Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Modification Type

- 18.10.3. Technology/Method

- 18.10.4. Product Type

- 18.10.5. RNA Type

- 18.10.6. Application

- 18.10.7. Disease Area

- 18.10.8. End-Use Industry

- 18.10.9. Workflow Stage

- 18.10.10. Distribution Channel

- 18.11. Thailand Epitranscriptomics Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Modification Type

- 18.11.3. Technology/Method

- 18.11.4. Product Type

- 18.11.5. RNA Type

- 18.11.6. Application

- 18.11.7. Disease Area

- 18.11.8. End-Use Industry

- 18.11.9. Workflow Stage

- 18.11.10. Distribution Channel

- 18.12. Vietnam Epitranscriptomics Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Modification Type

- 18.12.3. Technology/Method

- 18.12.4. Product Type

- 18.12.5. RNA Type

- 18.12.6. Application

- 18.12.7. Disease Area

- 18.12.8. End-Use Industry

- 18.12.9. Workflow Stage

- 18.12.10. Distribution Channel

- 18.13. Rest of Asia Pacific Epitranscriptomics Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Modification Type

- 18.13.3. Technology/Method

- 18.13.4. Product Type

- 18.13.5. RNA Type

- 18.13.6. Application

- 18.13.7. Disease Area

- 18.13.8. End-Use Industry

- 18.13.9. Workflow Stage

- 18.13.10. Distribution Channel

- 19. Middle East Epitranscriptomics Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Therapeutic Application

- 19.3.2. Modification Type

- 19.3.3. Technology/Method

- 19.3.4. Product Type

- 19.3.5. RNA Type

- 19.3.6. Application

- 19.3.7. Disease Area

- 19.3.8. End-Use Industry

- 19.3.9. Workflow Stage

- 19.3.10. Distribution Channel

- 19.3.11. Country

- 19.3.11.1. Turkey

- 19.3.11.2. UAE

- 19.3.11.3. Saudi Arabia

- 19.3.11.4. Israel

- 19.3.11.5. Rest of Middle East

- 19.4. Turkey Epitranscriptomics Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Modification Type

- 19.4.3. Technology/Method

- 19.4.4. Product Type

- 19.4.5. RNA Type

- 19.4.6. Application

- 19.4.7. Disease Area

- 19.4.8. End-Use Industry

- 19.4.9. Workflow Stage

- 19.4.10. Distribution Channel

- 19.5. UAE Epitranscriptomics Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Modification Type

- 19.5.3. Technology/Method

- 19.5.4. Product Type

- 19.5.5. RNA Type

- 19.5.6. Application

- 19.5.7. Disease Area

- 19.5.8. End-Use Industry

- 19.5.9. Workflow Stage

- 19.5.10. Distribution Channel

- 19.6. Saudi Arabia Epitranscriptomics Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Modification Type

- 19.6.3. Technology/Method

- 19.6.4. Product Type

- 19.6.5. RNA Type

- 19.6.6. Application

- 19.6.7. Disease Area

- 19.6.8. End-Use Industry

- 19.6.9. Workflow Stage

- 19.6.10. Distribution Channel

- 19.7. Israel Epitranscriptomics Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Modification Type

- 19.7.3. Technology/Method

- 19.7.4. Product Type

- 19.7.5. RNA Type

- 19.7.6. Application

- 19.7.7. Disease Area

- 19.7.8. End-Use Industry

- 19.7.9. Workflow Stage

- 19.7.10. Distribution Channel

- 19.8. Rest of Middle East Epitranscriptomics Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Modification Type

- 19.8.3. Technology/Method

- 19.8.4. Product Type

- 19.8.5. RNA Type

- 19.8.6. Application

- 19.8.7. Disease Area

- 19.8.8. End-Use Industry

- 19.8.9. Workflow Stage

- 19.8.10. Distribution Channel

- 20. Africa Epitranscriptomics Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Therapeutic Application

- 20.3.2. Modification Type

- 20.3.3. Technology/Method

- 20.3.4. Product Type

- 20.3.5. RNA Type

- 20.3.6. Application

- 20.3.7. Disease Area

- 20.3.8. End-Use Industry

- 20.3.9. Workflow Stage

- 20.3.10. Distribution Channel

- 20.3.11. Country

- 20.3.11.1. South Africa

- 20.3.11.2. Egypt

- 20.3.11.3. Nigeria

- 20.3.11.4. Algeria

- 20.3.11.5. Rest of Africa

- 20.4. South Africa Epitranscriptomics Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Modification Type

- 20.4.3. Technology/Method

- 20.4.4. Product Type

- 20.4.5. RNA Type

- 20.4.6. Application

- 20.4.7. Disease Area

- 20.4.8. End-Use Industry

- 20.4.9. Workflow Stage

- 20.4.10. Distribution Channel

- 20.5. Egypt Epitranscriptomics Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Modification Type

- 20.5.3. Technology/Method

- 20.5.4. Product Type

- 20.5.5. RNA Type

- 20.5.6. Application

- 20.5.7. Disease Area

- 20.5.8. End-Use Industry

- 20.5.9. Workflow Stage

- 20.5.10. Distribution Channel

- 20.6. Nigeria Epitranscriptomics Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Modification Type

- 20.6.3. Technology/Method

- 20.6.4. Product Type

- 20.6.5. RNA Type

- 20.6.6. Application

- 20.6.7. Disease Area

- 20.6.8. End-Use Industry

- 20.6.9. Workflow Stage

- 20.6.10. Distribution Channel

- 20.7. Algeria Epitranscriptomics Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Modification Type

- 20.7.3. Technology/Method

- 20.7.4. Product Type

- 20.7.5. RNA Type

- 20.7.6. Application

- 20.7.7. Disease Area

- 20.7.8. End-Use Industry

- 20.7.9. Workflow Stage

- 20.7.10. Distribution Channel

- 20.8. Rest of Africa Epitranscriptomics Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Modification Type

- 20.8.3. Technology/Method

- 20.8.4. Product Type

- 20.8.5. RNA Type

- 20.8.6. Application

- 20.8.7. Disease Area

- 20.8.8. End-Use Industry

- 20.8.9. Workflow Stage

- 20.8.10. Distribution Channel

- 21. South America Epitranscriptomics Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Epitranscriptomics Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Therapeutic Application

- 21.3.2. Modification Type

- 21.3.3. Technology/Method

- 21.3.4. Product Type

- 21.3.5. RNA Type

- 21.3.6. Application

- 21.3.7. Disease Area

- 21.3.8. End-Use Industry

- 21.3.9. Workflow Stage

- 21.3.10. Distribution Channel

- 21.3.11. Country

- 21.3.11.1. Brazil

- 21.3.11.2. Argentina

- 21.3.11.3. Rest of South America

- 21.4. Brazil Epitranscriptomics Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Modification Type

- 21.4.3. Technology/Method

- 21.4.4. Product Type

- 21.4.5. RNA Type

- 21.4.6. Application

- 21.4.7. Disease Area

- 21.4.8. End-Use Industry

- 21.4.9. Workflow Stage

- 21.4.10. Distribution Channel

- 21.5. Argentina Epitranscriptomics Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Modification Type

- 21.5.3. Technology/Method

- 21.5.4. Product Type

- 21.5.5. RNA Type

- 21.5.6. Application

- 21.5.7. Disease Area

- 21.5.8. End-Use Industry

- 21.5.9. Workflow Stage

- 21.5.10. Distribution Channel

- 21.6. Rest of South America Epitranscriptomics Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Modification Type

- 21.6.3. Technology/Method

- 21.6.4. Product Type

- 21.6.5. RNA Type

- 21.6.6. Application

- 21.6.7. Disease Area

- 21.6.8. End-Use Industry

- 21.6.9. Workflow Stage

- 21.6.10. Distribution Channel

- 22. Key Players/ Company Profile

- 22.1. Abcam

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Active Motif

- 22.3. Agilent Technologies

- 22.4. Arraystar

- 22.5. Bio-Rad Laboratories

- 22.6. CD Genomics

- 22.7. Cell Signaling Technology

- 22.8. Creative Biolabs

- 22.9. EpiGentek

- 22.10. Epigentek Group

- 22.11. Genecopoeia

- 22.12. Illumina

- 22.13. LC Sciences

- 22.14. Merck KGaA

- 22.15. Moderna, Inc.

- 22.16. New England Biolabs (NEB)

- 22.17. Oxford Nanopore Technologies

- 22.18. Pacific Biosciences (PacBio)

- 22.19. PerkinElmer

- 22.20. QIAGEN

- 22.21. Takara Bio

- 22.22. Thermo Fisher Scientific

- 22.23. Zymo Research

- 22.24. Other Key Players

- 22.1. Abcam

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation