Food Safety Testing Market Size, Share & Trends Analysis Report by Technology/Testing Method (Traditional Methods, Rapid Methods, Convenience-based Methods, Advanced Technologies), Contaminant Type, Food Type Tested, Sample Type, Testing Service Type, Testing Location, Mode of Operation, Verticals, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Food Safety Testing Market Size, Share, and Growth

The global food safety testing market is experiencing robust growth, with its estimated value of USD 23.3 billion in the year 2025 and USD 49.8 billion by the period 2035, registering a CAGR of 7.9%, during the forecast period. The global food safety testing market is experiencing tremendous growth, driven by the growing concerns about food-related risks, the heightening of regulatory requirements, and the growing need to find clear and safe food supply chains. The investments made by food manufacturers, the strategic alliances between testing service providers and technology companies, and the development of AI-based analytics, quick molecular assays, and IoT-based monitoring systems are helpful to reach the desired growth. Digital traceability platforms and automated testing processes, as well as predictive hazard detection add extra value to the operation efficiency, compliance, and real-time decision-making, which strengthens market growth on a global scale.

Pavar Sai Kumar, Senior Research Associate, BITS Pilani, Hyderabad, said, “Our device is portable and user-friendly. It can be taken to markets or used at home to check whether produce contains pesticides. This is a critical step toward safer food, especially in areas with limited access to laboratories.

The global food safety testing industry is witnessing a tremendous development owing to the widespread use of sophisticated testing methods, artificial intelligence based analysis systems, and high-speed molecular testing. For instance, In April 2025, BRCGS joined forces with the Food Authenticity Network as a gold partner, further enhancing the global standards of food safety with a special emphasis on the testing of authenticity and supply-chain transparency. Such cooperation allows businesses to adopt more successful and effective testing procedures, improve adherence to global standards, and increase consumer confidence in all food chains on the international market.

Accuracy, efficiency and transparency of supplies in the supply-chain is being enhanced by technological innovations, such as high-throughput molecular diagnostics, AI-based predictive analytics, and next-generation sequencing. For instance, in September 2025 LuminUltra collaborated with Kikkoman Biochemifa to market Kikkomen food-safety and hygiene monitoring equipment (such as the A3 Hygiene Monitoring System and Easy⁻ Plate assay) in North America via the LuminUltra distribution channel. This collaboration improves the real-time testing of the presence of pathogens and assists the food manufacturers to keep the safety and compliance levels higher.

Startups and international testing services providers are presenting other new solutions, including digital traceability platforms, IoT sensors, AI-based monitoring systems, and similar solutions. Implementation of these solutions enables food businesses to improve testing processes, decrease turnaround time and ensure regulatory compliance throughout the supply chain, which facilitates the broader commercialisation of advanced food safety solutions.

Food Safety Testing Market Dynamics and Trends

Driver: Regulatory Compliance Requirements Drive Mandatory Testing Programs

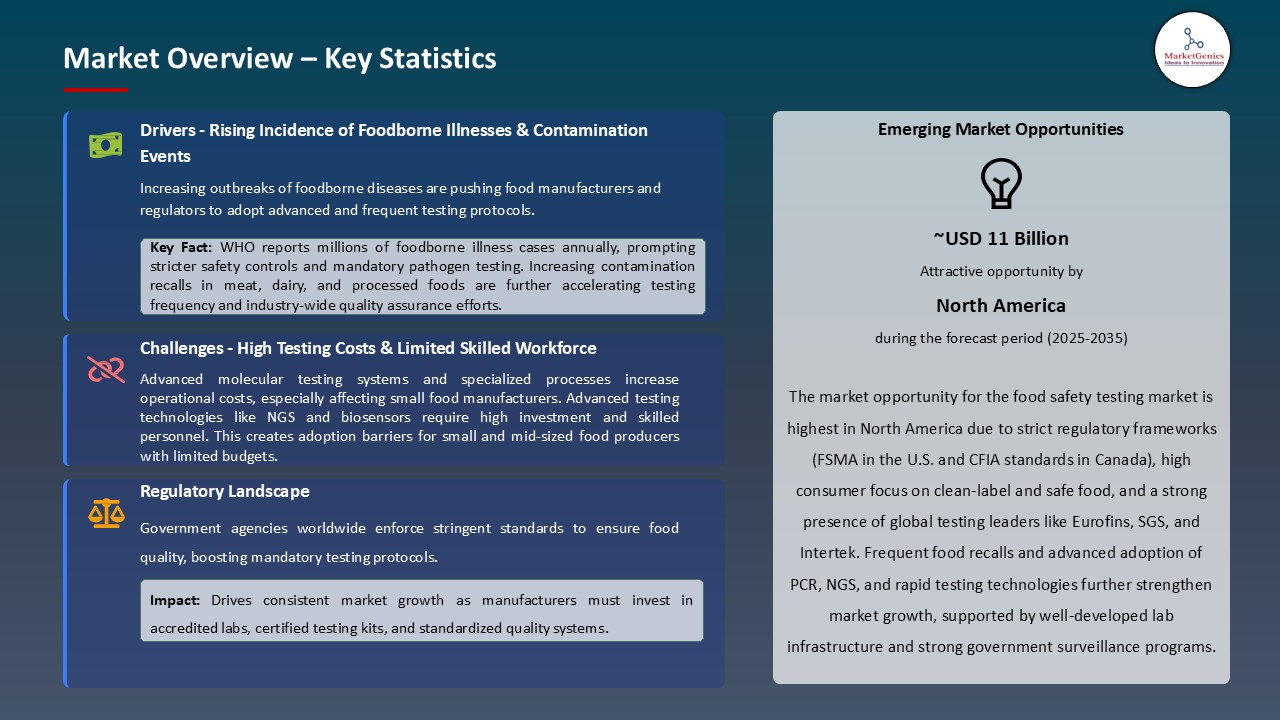

- Rising concerns about foodborne diseases, food contamination and consumer protection have become one of the driving forces of the food safety testing market. The increase in the awareness of the food safety standards, stringent government regulations, and the necessity to comply with the international quality certifications have facilitated the rapid implementation of advanced testing solutions.

- Modern food safety technologies enable the manufacturers to trace pathogens, allergens as well as chemical contaminants with high precision and speed. For instance, in March 2024, Intertek introduced a new traceability and sustainability platform with Trace for Good, which can be used to map the product-level supply-chain, verify documents, assess supplier risk, and a digital product passport. The programme empowers compliance and improves transparency and expediences regulatory compliance in the food supply chain.

- Adoption of these innovations assists food producers to proactively manage risks, take corrective measures promptly and ensure product safety throughout the supply chain. On the whole, the pattern reinforces compliance with regulations, promotes consumer trust, and spurred the general acceptance of the current food safety testing methods.

Restraint: High Testing Costs Burden Small Food Producers

- The food safety testing market is challenged with high cost of testing equipment, reagents and molecular diagnostic tools which are very expensive. Small and middle-sized food producers are unable to conduct regular tests due to the financial hardship of these tests, which reduces their chances to ensure compliance and product safety.

- Smaller manufacturers can find it hard to access certified laboratories, hire trained staff, and introduce quick test procedures. These financial and operational limitations hinder the use of sophisticated food safety technologies by the small-scale producers.

- Moreover, different regulations, lack of uniform accreditation standards and disjointed testing infrastructure among regions also make the implementation more difficult. The high operational costs and the complex nature of regulatory requirements present a challenge to smaller players to compete and implement the latest food safety testing solutions.

Opportunity: Rapid Molecular Testing Enables Real-Time Quality Decisions

- New opportunities in food safety management are being introduced by the advances in fast molecular tests, biosensors, and AI-powered diagnostic devices. These technologies enable the manufacturers and the laboratories to identify pathogens, allergens, and contaminants promptly and make quality decisions faster than before, reducing risks of foodborne epidemic. It also improve efficiency in operations and timely interventions throughout the supply chain.

- Continuous cooperation of food producers, technology startups, and regulatory agencies is driving the rapid testing solutions to development and implementation faster. These alliances fill the gaps between scientific innovation, regulatory compliance, and commercial scalability, and more advanced food safety testing becomes more accessible, less expensive, and more integrated into operations.

- These technologies are assisting food-safety personnel to respond to outcomes more quickly than ever. For instance, in July 2025, Neogen Corporation released Listeria -Right-Now, an enrichment-free molecular assay with results in about two hours. This allows same day cleaning and corrective actions. The growth of rapid molecular testing systems can enable prompt hazard identification, minimize recalls, and enhance visibility in the supply chain, which constitute considerable business prospects of food manufacturers, labs, and technology vendors globally.

Key Trend: Artificial Intelligence Enhances Risk Prediction and Resource Optimization

- The food safety testing market is showing a mode of adopting AI-powered predictive analytics and supply chain automation in laboratories and supply chains. This enables quicker identification of risks of contamination, management of resources, and interventions in food safety management.

- The food safety service providers are decentralising the testing activities by setting up sophisticated labs and mobile test units in strategic places other than the traditional urban centres. For instance, in September 2024, SGS announced the introduction of food safety testing services with high-throughput molecular diagnostic tools that are based on AI and next-generation sequencing to detect allergens and GMOs in foods faster, demonstrating the use of advanced analytics in food safety solutions.

- Implementing AI-based sensors, real-time monitoring, and digital traceability systems enhances efficiency in operations, predictive hazard management, and performance reporting on compliance. The trend contributes to increased accessibility, provides food businesses with a real-time availability of safety information, and contributes to the practical implementation of improved food safety testing.

Food-Safety-Testing-Market Analysis and Segmental Data

Rapid Methods Dominate Global Food Safety Testing Market

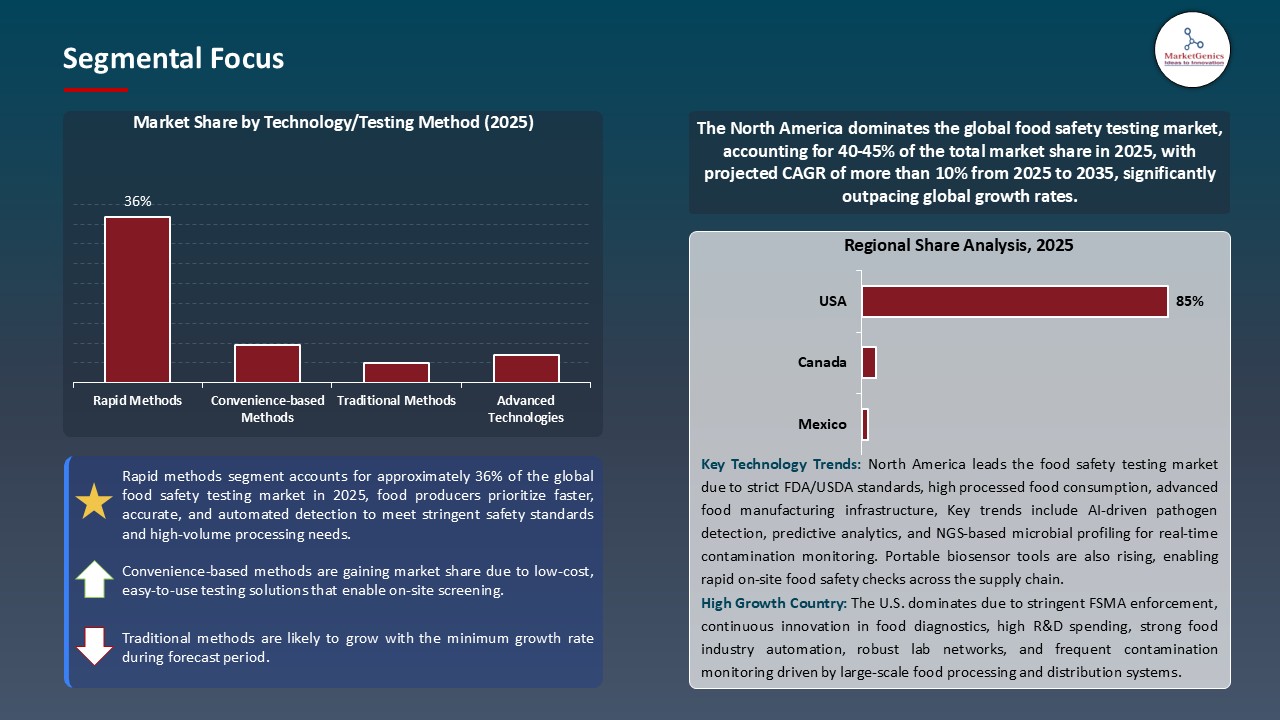

- The rapid methods segment leads the global food safety testing industry because of the increasing cases of foodborne diseases, escalating regulatory demands, and the necessity to detect pathogens and allergens, as well as chemical contaminants, faster. Quick microbiological, immunoassays and molecular testing is essential in facilitating prompt food quality and safety decisions along processing, retail and distribution lines.

- Technological improvements are increasing speed, precision, and efficiency of operations. Advances including PCR-based assays, lateral flow immunoassays, biosensor-based systems enable real-time detection of contaminants, automated and portable test systems can assist in on-site measurements, shortening turnaround times, and preventing recalls.

- Strategic deployments and facility expansions are enhancing market adoption. For instance, in March 2025, Eurofins Scientific opened a new rapid-testing facility in Chicago, Illinois, which will allow detecting the presence of pathogens and ensuring the quality of food more quickly to local and regional food manufacturers. This trend shows the expanding usage of fast techniques, greater testing capacity, and consolidation of rapid testing as a major niche in the international food safety testing market.

North America Leads Global Food Safety Testing Market Demand

- Food safety testing North America is the leading market in the food safety testing industry because of the introduction of new and sophisticated testing technologies, AI-based food safety monitoring, and integrated food safety traceability systems. Strict regulatory standards, high consumer awareness, and the need by food manufacturers to have fast and dependable safety testing solutions all contribute to the market dominance of the region.

- An effectively developed ecosystem of laboratories, research centers, and food-tech innovators enables the area to adopt the latest testing solutions on the fast basis. For instance, in March 2025, Food Safety Net Services (FSNS) opened a new ISO-17025-accredited laboratory in St. Louis, Missouri, which expands its network of 30+ laboratories in North America and offers prompt microbiological and pathogen identification services, proving that industry leadership in the field of food safety solutions in North America is led by companies with global presence.

- Market growth is further enhanced by strong government regulations, standards of quality and investment in R&D. Along with the recent manufacturing science, analytical methods, and online capabilities of traceability and monitoring, the North American states possess the greatest market share and are very appealing to international investors in the food safety testing industry.

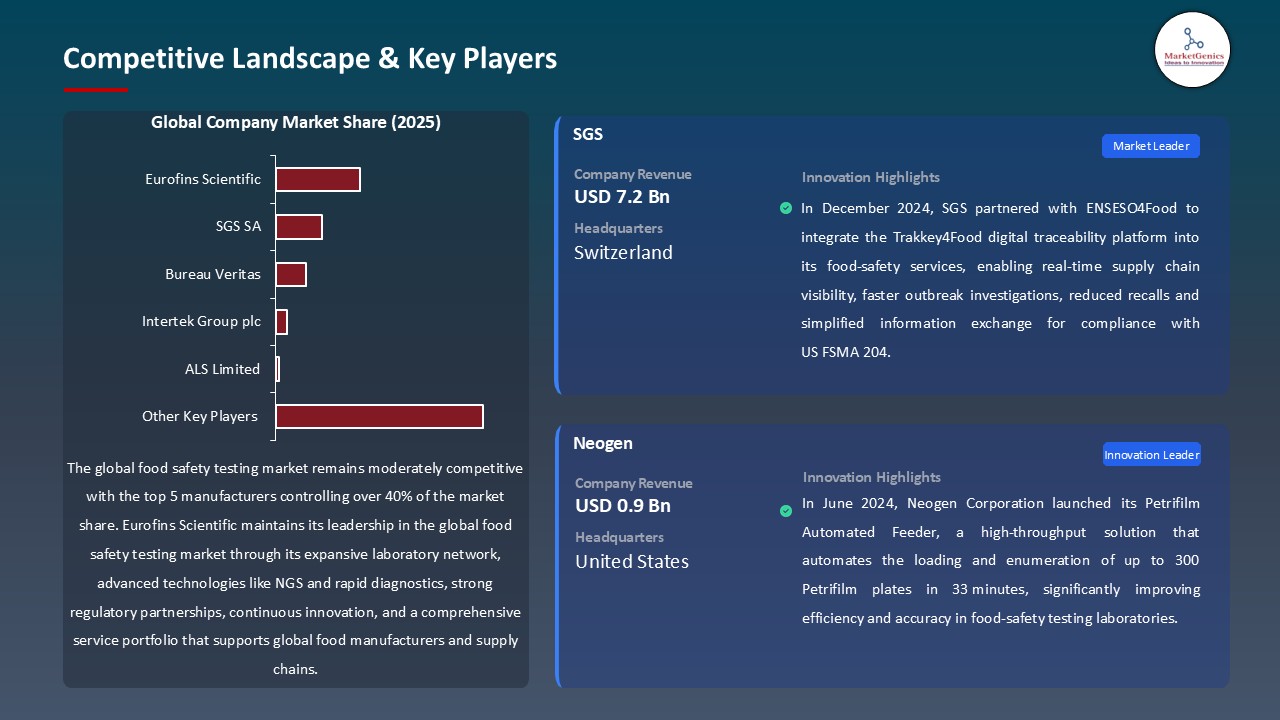

Food-Safety-Testing-Market Ecosystem

The world food testing food safety market possesses a moderate fragmentation with a variety of competitive frameworks in testing services, diagnostic products as well as geographic markets. Tier 1 companies such as Eurofins Scientific, SGS S.A. and Bureau Veritas have a large market presence due to their large networks of labs, wide test menu and established customer relationships in segments of the food industry. Tier 2 companies like Intertek Group plc and ALS Limited can target specific testing types, regions or food niches. Tier 3 companies are usually used in local markets or niche applications.

The concentration of buyers is moderate with big food producers accounting significant volumes of testing and smaller producers establishing a range of customers. The concentration in suppliers of specialized testing equipment and reagents is relatively high that establishes dependencies with technology providers. The switch costs exist through certification requirements and quality standards because customers will not switch laboratories that may lead to regulatory audit problems.

Recent Development and Strategic Overview:

- In October 2025, Thermo Fisher Scientific introduced the industry-first high-resolution mass detector, namely, the Orbitrap Exploris EFOX Mass Detector, a device to conduct environmental and food-safety analyses. The device provides the full scan capability of analyzing the actual mass of the material accurately, which makes the laboratories to identify the contaminant like PFAS and other chemical dangers more effectively. This introduction will fill the current needs of advanced instrumentation in food-safety laboratories due to regulatory pressure and consumer awareness.

- June 4, 2025, Hygiena introduced a new Australian e-commerce outlet to sell its entire repertoire of food safety and hygiene testing kits. The platform will enable companies within the food and beverage sector to buy their products directly to enhance their accessibility and delivery in Australia. This program makes Hygiena a stronger entity in the region and promotes increased food safety practices.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 23.3 Bn |

|

Market Forecast Value in 2035 |

USD 49.8 Bn |

|

Growth Rate (CAGR) |

7.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Food-Safety-Testing-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Food Safety Testing Market, By Technology/Testing Method |

|

|

Food Safety Testing Market, By Contaminant Type |

|

|

Food Safety Testing Market, By Food Type Tested |

|

|

Food Safety Testing Market, By Sample Type |

|

|

Food Safety Testing Market, By Testing Service Type |

|

|

Food Safety Testing Market, By Testing Location |

|

|

Food Safety Testing Market, By Mode of Operation |

|

|

Food Safety Testing Market, By Verticals |

|

Frequently Asked Questions

The global food safety testing market was valued at USD 23.3 Bn in 2025.

The global food safety testing market industry is expected to grow at a CAGR of 7.9% from 2025 to 2035.

The demand for the food safety testing market is driven by stringent regulations, rising foodborne illnesses, and the globalization of the food supply chain requiring standardized testing. Additionally, increasing consumer awareness of food safety, adoption of advanced technologies like PCR and immunoassays, and the emergence of rapid on-site testing kits are fueling market growth.

In terms of technology/testing method, the rapid methods segment accounted for the major share in 2025.

Key players in the global food safety testing market include prominent companies such as SGS SA, Agilent Technologies, ALS Limited, AsureQuality, Bio-Rad Laboratories, Bruker Corporation, Bureau Veritas, Eurofins Scientific, Intertek Group plc, Mérieux NutriSciences, Microbac Laboratories, Neogen Corporation, PerkinElmer Inc., Romer Labs, Shimadzu Corporation, Symbio Laboratories, Thermo Fisher Scientific, TÜV Nord Group, TÜV SÜD, Waters Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Food Safety Testing Market Outlook

- 2.1.1. Food Safety Testing Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Food Safety Testing Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Food & Beverages Industry Overview, 2025

- 3.1.1. Food & Beverages Industry Ecosystem Analysis

- 3.1.2. Key Trends for Food & Beverages Industry

- 3.1.3. Regional Distribution for Food & Beverages Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Food & Beverages Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising incidences of foodborne illnesses and contamination outbreaks.

- 4.1.1.2. Stringent government regulations and compliance requirements across regions.

- 4.1.1.3. Growing consumer awareness about food quality, safety, and transparency.

- 4.1.2. Restraints

- 4.1.2.1. High cost of advanced testing equipment and reagents.

- 4.1.2.2. Limited technical expertise and trained personnel for sophisticated testing methods.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Food Safety Testing Market Demand

- 4.7.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Food Safety Testing Market Analysis, by Technology/Testing Method

- 6.1. Key Segment Analysis

- 6.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology/Testing Method, 2021-2035

- 6.2.1. Traditional Methods

- 6.2.1.1. Culture-based Testing

- 6.2.1.2. Immunoassay-based Testing

- 6.2.2. Rapid Methods

- 6.2.2.1. PCR-based Testing

- 6.2.2.2. Immunoassay Rapid Tests

- 6.2.2.3. Biosensor-based Testing

- 6.2.3. Convenience-based Methods

- 6.2.3.1. ATP Bioluminescence

- 6.2.3.2. Indicator Tests

- 6.2.4. Advanced Technologies

- 6.2.4.1. Next-Generation Sequencing (NGS)

- 6.2.4.2. Spectroscopy-based Testing

- 6.2.4.3. Mass Spectrometry

- 6.2.1. Traditional Methods

- 7. Global Food Safety Testing Market Analysis, by Contaminant Type

- 7.1. Key Segment Analysis

- 7.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Contaminant Type, 2021-2035

- 7.2.1. Pathogens

- 7.2.1.1. Salmonella

- 7.2.1.2. E. coli

- 7.2.1.3. Listeria

- 7.2.1.4. Campylobacter

- 7.2.1.5. Other Bacteria

- 7.2.1.6. Viruses

- 7.2.1.7. Parasites

- 7.2.2. Chemical Contaminants

- 7.2.2.1. Pesticides

- 7.2.2.2. Heavy Metals

- 7.2.2.3. Toxins (Mycotoxins, Marine Toxins)

- 7.2.2.4. Allergens

- 7.2.3. GMO Testing

- 7.2.4. Others (Antibiotics, Hormones)

- 7.2.1. Pathogens

- 8. Global Food Safety Testing Market Analysis, by Food Type Tested

- 8.1. Key Segment Analysis

- 8.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Food Type Tested, 2021-2035

- 8.2.1. Meat & Poultry Products

- 8.2.2. Dairy Products

- 8.2.3. Processed Foods

- 8.2.4. Fruits & Vegetables

- 8.2.5. Cereals & Grains

- 8.2.6. Seafood

- 8.2.7. Beverages

- 8.2.8. Infant Food & Formula

- 9. Global Food Safety Testing Market Analysis, by Sample Type

- 9.1. Key Segment Analysis

- 9.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Sample Type, 2021-2035

- 9.2.1. Solid Samples

- 9.2.2. Liquid Samples

- 9.2.3. Surface Swabs

- 9.2.4. Environmental Samples

- 10. Global Food Safety Testing Market Analysis, by Testing Service Type

- 10.1. Key Segment Analysis

- 10.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Testing Service Type, 2021-2035

- 10.2.1. Laboratory Testing Services

- 10.2.1.1. Microbiological Testing

- 10.2.1.2. Chemical & Nutritional Testing

- 10.2.1.3. Allergen Testing

- 10.2.1.4. Shelf-Life Testing

- 10.2.1.5. Others

- 10.2.2. In-House Testing

- 10.2.3. Third-Party Testing Services

- 10.2.4. Certification Services

- 10.2.5. Other Services

- 10.2.1. Laboratory Testing Services

- 11. Global Food Safety Testing Market Analysis, by Testing Location

- 11.1. Key Segment Analysis

- 11.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Testing Location, 2021-2035

- 11.2.1. On-site Testing

- 11.2.2. Laboratory Testing

- 11.2.3. Field Testing

- 12. Global Food Safety Testing Market Analysis, by Mode of Operation

- 12.1. Key Segment Analysis

- 12.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Mode of Operation, 2021-2035

- 12.2.1. Automated Testing Systems

- 12.2.2. Semi-Automated Testing Systems

- 12.2.3. Manual Testing Systems

- 13. Global Food Safety Testing Market Analysis, by Verticals

- 13.1. Key Segment Analysis

- 13.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Verticals, 2021-2035

- 13.2.1. Food & Beverage Manufacturers

- 13.2.2. Food Service Industry

- 13.2.3. Retail & Grocery Chains

- 13.2.4. Agriculture & Primary Production

- 13.2.5. Meat & Poultry Processing Plants

- 13.2.6. Dairy Processing Facilities

- 13.2.7. Seafood Processing Industry

- 13.2.8. Beverage Industry

- 13.2.9. Bakery & Confectionery

- 13.2.10. Infant Food & Baby Formula Manufacturers

- 13.2.11. Government & Regulatory Bodies

- 13.2.12. Contract Testing Laboratories

- 13.2.13. Export-Import Organizations

- 13.2.14. Other Verticals

- 14. Global Food Safety Testing Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Food Safety Testing Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Food Safety Testing Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology/Testing Method

- 15.3.2. Contaminant Type

- 15.3.3. Food Type Tested

- 15.3.4. Sample Type

- 15.3.5. Testing Service Type

- 15.3.6. Testing Location

- 15.3.7. Mode of Operation

- 15.3.8. Verticals

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Food Safety Testing Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology/Testing Method

- 15.4.3. Contaminant Type

- 15.4.4. Food Type Tested

- 15.4.5. Sample Type

- 15.4.6. Testing Service Type

- 15.4.7. Testing Location

- 15.4.8. Mode of Operation

- 15.4.9. Verticals

- 15.5. Canada Food Safety Testing Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology/Testing Method

- 15.5.3. Contaminant Type

- 15.5.4. Food Type Tested

- 15.5.5. Sample Type

- 15.5.6. Testing Service Type

- 15.5.7. Testing Location

- 15.5.8. Mode of Operation

- 15.5.9. Verticals

- 15.6. Mexico Food Safety Testing Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology/Testing Method

- 15.6.3. Contaminant Type

- 15.6.4. Food Type Tested

- 15.6.5. Sample Type

- 15.6.6. Testing Service Type

- 15.6.7. Testing Location

- 15.6.8. Mode of Operation

- 15.6.9. Verticals

- 16. Europe Food Safety Testing Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology/Testing Method

- 16.3.2. Contaminant Type

- 16.3.3. Food Type Tested

- 16.3.4. Sample Type

- 16.3.5. Testing Service Type

- 16.3.6. Testing Location

- 16.3.7. Mode of Operation

- 16.3.8. Verticals

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Food Safety Testing Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology/Testing Method

- 16.4.3. Contaminant Type

- 16.4.4. Food Type Tested

- 16.4.5. Sample Type

- 16.4.6. Testing Service Type

- 16.4.7. Testing Location

- 16.4.8. Mode of Operation

- 16.4.9. Verticals

- 16.5. United Kingdom Food Safety Testing Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology/Testing Method

- 16.5.3. Contaminant Type

- 16.5.4. Food Type Tested

- 16.5.5. Sample Type

- 16.5.6. Testing Service Type

- 16.5.7. Testing Location

- 16.5.8. Mode of Operation

- 16.5.9. Verticals

- 16.6. France Food Safety Testing Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology/Testing Method

- 16.6.3. Contaminant Type

- 16.6.4. Food Type Tested

- 16.6.5. Sample Type

- 16.6.6. Testing Service Type

- 16.6.7. Testing Location

- 16.6.8. Mode of Operation

- 16.6.9. Verticals

- 16.7. Italy Food Safety Testing Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology/Testing Method

- 16.7.3. Contaminant Type

- 16.7.4. Food Type Tested

- 16.7.5. Sample Type

- 16.7.6. Testing Service Type

- 16.7.7. Testing Location

- 16.7.8. Mode of Operation

- 16.7.9. Verticals

- 16.8. Spain Food Safety Testing Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology/Testing Method

- 16.8.3. Contaminant Type

- 16.8.4. Food Type Tested

- 16.8.5. Sample Type

- 16.8.6. Testing Service Type

- 16.8.7. Testing Location

- 16.8.8. Mode of Operation

- 16.8.9. Verticals

- 16.9. Netherlands Food Safety Testing Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology/Testing Method

- 16.9.3. Contaminant Type

- 16.9.4. Food Type Tested

- 16.9.5. Sample Type

- 16.9.6. Testing Service Type

- 16.9.7. Testing Location

- 16.9.8. Mode of Operation

- 16.9.9. Verticals

- 16.10. Nordic Countries Food Safety Testing Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology/Testing Method

- 16.10.3. Contaminant Type

- 16.10.4. Food Type Tested

- 16.10.5. Sample Type

- 16.10.6. Testing Service Type

- 16.10.7. Testing Location

- 16.10.8. Mode of Operation

- 16.10.9. Verticals

- 16.11. Poland Food Safety Testing Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology/Testing Method

- 16.11.3. Contaminant Type

- 16.11.4. Food Type Tested

- 16.11.5. Sample Type

- 16.11.6. Testing Service Type

- 16.11.7. Testing Location

- 16.11.8. Mode of Operation

- 16.11.9. Verticals

- 16.12. Russia & CIS Food Safety Testing Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology/Testing Method

- 16.12.3. Contaminant Type

- 16.12.4. Food Type Tested

- 16.12.5. Sample Type

- 16.12.6. Testing Service Type

- 16.12.7. Testing Location

- 16.12.8. Mode of Operation

- 16.12.9. Verticals

- 16.13. Rest of Europe Food Safety Testing Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology/Testing Method

- 16.13.3. Contaminant Type

- 16.13.4. Food Type Tested

- 16.13.5. Sample Type

- 16.13.6. Testing Service Type

- 16.13.7. Testing Location

- 16.13.8. Mode of Operation

- 16.13.9. Verticals

- 17. Asia Pacific Food Safety Testing Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology/Testing Method

- 17.3.2. Contaminant Type

- 17.3.3. Food Type Tested

- 17.3.4. Sample Type

- 17.3.5. Testing Service Type

- 17.3.6. Testing Location

- 17.3.7. Mode of Operation

- 17.3.8. Verticals

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Food Safety Testing Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology/Testing Method

- 17.4.3. Contaminant Type

- 17.4.4. Food Type Tested

- 17.4.5. Sample Type

- 17.4.6. Testing Service Type

- 17.4.7. Testing Location

- 17.4.8. Mode of Operation

- 17.4.9. Verticals

- 17.5. India Food Safety Testing Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology/Testing Method

- 17.5.3. Contaminant Type

- 17.5.4. Food Type Tested

- 17.5.5. Sample Type

- 17.5.6. Testing Service Type

- 17.5.7. Testing Location

- 17.5.8. Mode of Operation

- 17.5.9. Verticals

- 17.6. Japan Food Safety Testing Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology/Testing Method

- 17.6.3. Contaminant Type

- 17.6.4. Food Type Tested

- 17.6.5. Sample Type

- 17.6.6. Testing Service Type

- 17.6.7. Testing Location

- 17.6.8. Mode of Operation

- 17.6.9. Verticals

- 17.7. South Korea Food Safety Testing Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology/Testing Method

- 17.7.3. Contaminant Type

- 17.7.4. Food Type Tested

- 17.7.5. Sample Type

- 17.7.6. Testing Service Type

- 17.7.7. Testing Location

- 17.7.8. Mode of Operation

- 17.7.9. Verticals

- 17.8. Australia and New Zealand Food Safety Testing Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology/Testing Method

- 17.8.3. Contaminant Type

- 17.8.4. Food Type Tested

- 17.8.5. Sample Type

- 17.8.6. Testing Service Type

- 17.8.7. Testing Location

- 17.8.8. Mode of Operation

- 17.8.9. Verticals

- 17.9. Indonesia Food Safety Testing Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Technology/Testing Method

- 17.9.3. Contaminant Type

- 17.9.4. Food Type Tested

- 17.9.5. Sample Type

- 17.9.6. Testing Service Type

- 17.9.7. Testing Location

- 17.9.8. Mode of Operation

- 17.9.9. Verticals

- 17.10. Malaysia Food Safety Testing Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Technology/Testing Method

- 17.10.3. Contaminant Type

- 17.10.4. Food Type Tested

- 17.10.5. Sample Type

- 17.10.6. Testing Service Type

- 17.10.7. Testing Location

- 17.10.8. Mode of Operation

- 17.10.9. Verticals

- 17.11. Thailand Food Safety Testing Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Technology/Testing Method

- 17.11.3. Contaminant Type

- 17.11.4. Food Type Tested

- 17.11.5. Sample Type

- 17.11.6. Testing Service Type

- 17.11.7. Testing Location

- 17.11.8. Mode of Operation

- 17.11.9. Verticals

- 17.12. Vietnam Food Safety Testing Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Technology/Testing Method

- 17.12.3. Contaminant Type

- 17.12.4. Food Type Tested

- 17.12.5. Sample Type

- 17.12.6. Testing Service Type

- 17.12.7. Testing Location

- 17.12.8. Mode of Operation

- 17.12.9. Verticals

- 17.13. Rest of Asia Pacific Food Safety Testing Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Technology/Testing Method

- 17.13.3. Contaminant Type

- 17.13.4. Food Type Tested

- 17.13.5. Sample Type

- 17.13.6. Testing Service Type

- 17.13.7. Testing Location

- 17.13.8. Mode of Operation

- 17.13.9. Verticals

- 18. Middle East Food Safety Testing Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology/Testing Method

- 18.3.2. Contaminant Type

- 18.3.3. Food Type Tested

- 18.3.4. Sample Type

- 18.3.5. Testing Service Type

- 18.3.6. Testing Location

- 18.3.7. Mode of Operation

- 18.3.8. Verticals

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Food Safety Testing Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology/Testing Method

- 18.4.3. Contaminant Type

- 18.4.4. Food Type Tested

- 18.4.5. Sample Type

- 18.4.6. Testing Service Type

- 18.4.7. Testing Location

- 18.4.8. Mode of Operation

- 18.4.9. Verticals

- 18.5. UAE Food Safety Testing Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology/Testing Method

- 18.5.3. Contaminant Type

- 18.5.4. Food Type Tested

- 18.5.5. Sample Type

- 18.5.6. Testing Service Type

- 18.5.7. Testing Location

- 18.5.8. Mode of Operation

- 18.5.9. Verticals

- 18.6. Saudi Arabia Food Safety Testing Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology/Testing Method

- 18.6.3. Contaminant Type

- 18.6.4. Food Type Tested

- 18.6.5. Sample Type

- 18.6.6. Testing Service Type

- 18.6.7. Testing Location

- 18.6.8. Mode of Operation

- 18.6.9. Verticals

- 18.7. Israel Food Safety Testing Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology/Testing Method

- 18.7.3. Contaminant Type

- 18.7.4. Food Type Tested

- 18.7.5. Sample Type

- 18.7.6. Testing Service Type

- 18.7.7. Testing Location

- 18.7.8. Mode of Operation

- 18.7.9. Verticals

- 18.8. Rest of Middle East Food Safety Testing Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology/Testing Method

- 18.8.3. Contaminant Type

- 18.8.4. Food Type Tested

- 18.8.5. Sample Type

- 18.8.6. Testing Service Type

- 18.8.7. Testing Location

- 18.8.8. Mode of Operation

- 18.8.9. Verticals

- 19. Africa Food Safety Testing Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology/Testing Method

- 19.3.2. Contaminant Type

- 19.3.3. Food Type Tested

- 19.3.4. Sample Type

- 19.3.5. Testing Service Type

- 19.3.6. Testing Location

- 19.3.7. Mode of Operation

- 19.3.8. Verticals

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Food Safety Testing Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology/Testing Method

- 19.4.3. Contaminant Type

- 19.4.4. Food Type Tested

- 19.4.5. Sample Type

- 19.4.6. Testing Service Type

- 19.4.7. Testing Location

- 19.4.8. Mode of Operation

- 19.4.9. Verticals

- 19.5. Egypt Food Safety Testing Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology/Testing Method

- 19.5.3. Contaminant Type

- 19.5.4. Food Type Tested

- 19.5.5. Sample Type

- 19.5.6. Testing Service Type

- 19.5.7. Testing Location

- 19.5.8. Mode of Operation

- 19.5.9. Verticals

- 19.6. Nigeria Food Safety Testing Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology/Testing Method

- 19.6.3. Contaminant Type

- 19.6.4. Food Type Tested

- 19.6.5. Sample Type

- 19.6.6. Testing Service Type

- 19.6.7. Testing Location

- 19.6.8. Mode of Operation

- 19.6.9. Verticals

- 19.7. Algeria Food Safety Testing Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Technology/Testing Method

- 19.7.3. Contaminant Type

- 19.7.4. Food Type Tested

- 19.7.5. Sample Type

- 19.7.6. Testing Service Type

- 19.7.7. Testing Location

- 19.7.8. Mode of Operation

- 19.7.9. Verticals

- 19.8. Rest of Africa Food Safety Testing Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Technology/Testing Method

- 19.8.3. Contaminant Type

- 19.8.4. Food Type Tested

- 19.8.5. Sample Type

- 19.8.6. Testing Service Type

- 19.8.7. Testing Location

- 19.8.8. Mode of Operation

- 19.8.9. Verticals

- 20. South America Food Safety Testing Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Food Safety Testing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Technology/Testing Method

- 20.3.2. Contaminant Type

- 20.3.3. Food Type Tested

- 20.3.4. Sample Type

- 20.3.5. Testing Service Type

- 20.3.6. Testing Location

- 20.3.7. Mode of Operation

- 20.3.8. Verticals

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Food Safety Testing Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Technology/Testing Method

- 20.4.3. Contaminant Type

- 20.4.4. Food Type Tested

- 20.4.5. Sample Type

- 20.4.6. Testing Service Type

- 20.4.7. Testing Location

- 20.4.8. Mode of Operation

- 20.4.9. Verticals

- 20.5. Argentina Food Safety Testing Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Technology/Testing Method

- 20.5.3. Contaminant Type

- 20.5.4. Food Type Tested

- 20.5.5. Sample Type

- 20.5.6. Testing Service Type

- 20.5.7. Testing Location

- 20.5.8. Mode of Operation

- 20.5.9. Verticals

- 20.6. Rest of South America Food Safety Testing Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Technology/Testing Method

- 20.6.3. Contaminant Type

- 20.6.4. Food Type Tested

- 20.6.5. Sample Type

- 20.6.6. Testing Service Type

- 20.6.7. Testing Location

- 20.6.8. Mode of Operation

- 20.6.9. Verticals

- 21. Key Players/ Company Profile

- 21.1. SGS SA

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Agilent Technologies

- 21.3. ALS Limited

- 21.4. AsureQuality

- 21.5. Bio-Rad Laboratories

- 21.6. Bruker Corporation

- 21.7. Bureau Veritas

- 21.8. Eurofins Scientific

- 21.9. Intertek Group plc

- 21.10. Mérieux NutriSciences

- 21.11. Microbac Laboratories

- 21.12. Neogen Corporation

- 21.13. PerkinElmer Inc.

- 21.14. Romer Labs

- 21.15. Shimadzu Corporation

- 21.16. Symbio Laboratories

- 21.17. Thermo Fisher Scientific

- 21.18. TÜV Nord Group

- 21.19. TÜV SÜD

- 21.20. Waters Corporation

- 21.21. Other Key Players

- 21.1. SGS SA

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data