Genomics & CRISPR Market Size, Share & Trends Analysis Report by Technology Type (CRISPR-Cas9, CRISPR-Cas12, CRISPR-Cas13, Y CRISPR-Cas14, Base Editing, Prime Editing, TALENs, ZFNs, Next-Generation Sequencing, Others), Product & Service, Application, Therapeutic Area, Delivery Method, End-User, Mode, Design Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Genomics & CRISPR Market Size, Share, and Growth

The global genomics & CRISPR market is witnessing strong growth, valued at USD 27.4 billion in 2025 and projected to reach ~USD 134 billion by 2035, expanding at a CAGR of 17.2% during the forecast period. North America leads the Genomics & CRISPR market due to robust research infrastructure, high R&D investments, strong presence of key biotechnology companies, and supportive regulatory and funding frameworks for gene editing and genomic innovation.

“VERVE-102 has the potential to be the first in vivo gene editing therapy for broad patient populations and could shift the treatment paradigm for cardiovascular disease from chronic care to one-and-done treatment, Lilly is eager to welcome our Verve colleagues to Lilly and continue the development of these promising potential new medicines aimed at improving outcomes for patients with cardiovascular disease and addressing the significant unmet medical need in this space”, said Ruth Gimeno, Lilly group vice president.

The growing prevalence of cancer, rare genetic diseases and inherited disorders are increasing the demand to scale up diagnostic platforms and targeted therapeutic interventions with genomics and CRISPR-based applications, further leading to the growth of genomics and CRISPR market. This expanding disease burden is the direct cause of the expansion and commercialization prospect of the universe genomics and CRISPR economy. As an instance, in early 2025, the company reported that its Phase 1 trial of CTX310 (targeting ANGPTL3) had achieved significant improvements of up to 82% reduction in triglycerides and 81% reduction in LDL-cholesterol and has generated clinical momentum and indicated expansion into cardiovascular indicators.

The speed of innovation, broader therapeutic pipelines, and the accelerated overall development of the global genomics and CRISPR market are driven by strategic partnerships between biotechnology companies, research centers, and pharmaceutical companies that can leverage their expertise, technological combination, and clinical translation in a much faster manner. In January 2024, as an example, Danaher and IGI created the Beacon for CRISPR Cures to create CRISPR therapies in response to inborn immune disorders.

Functional genomics and target discovery single-cell CRISPR screening technologies are emerging with major opportunity. This method will offer more than ever before a complete understanding of the complex cellular mechanisms and pathways of disease by facilitating the same-cell analysis of gene modifications and transcriptomic alterations. As an example, In February 2025, Illumina announced its Single Cell 3′ RNA Prep.3 workflow, allowing scalable single-cell transcriptomics of pooled CRISPR screening, further improving the accuracy of functional genomics studies.

Genomics & CRISPR Market Dynamics and Trends

Driver: Technological Advancements in Gene-Editing Tools and Delivery Platforms Drive Market Expansion

- The genomics and CRISPR market are driven by ongoing innovation where CRISPR-Cas12, base editing, and prime editing are increasing the precision, efficiency and safety of the genome being manipulated allowing more controlled and predictable results. An example is In March 2025, Prime Medicine claimed a preclinical gene editing program of Alpha-1 Antitrypsin Deficiency (AATD) under its Prime Editing system based on its liver-targeted LNP delivery system. The treatment recorded a 72% accurate correction in the SERPINA1 gene with complete correction of normal AAT protein with no off-target effects.

- The development of sophisticated delivery technologies like viral vectors, lipid nanoparticles and non-viral carriers has greatly enhanced targeted gene delivery and off-target effects have been minimized. As an example, In June 2025, Editas Medicine reported up to 58% HBG1/2 in vivo promoter editing with its own targeted lipid nanoparticle (tLNP) delivery system in non-human primates to advance sickle cell disease and beta thalassemia treatment.

- Hence, the ongoing advancement of gene-editing applications and delivery systems is directly driving the expansion of the worldwide genomics and CRISPR market through the ability to offer therapeutic options in a scalable, safe, and commercial manner.

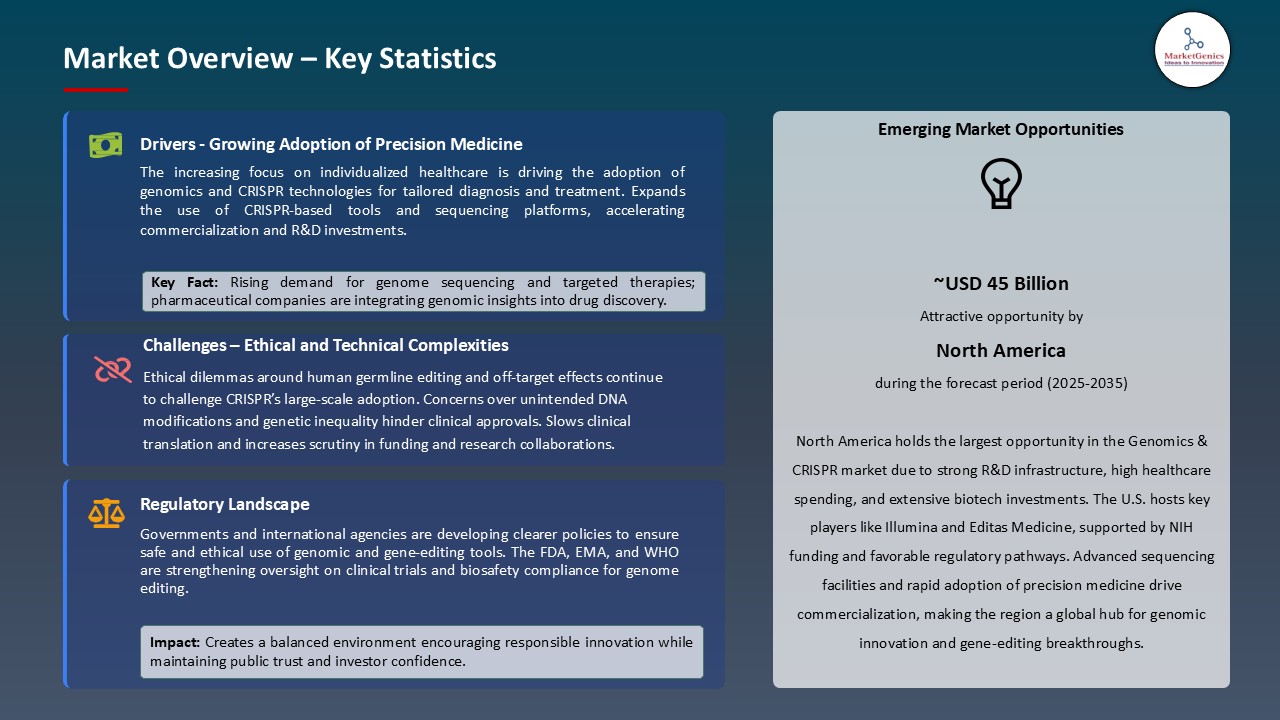

Restraint: Ethical, Regulatory, and Safety Barriers Limit Clinical Expansion

- Intricate ethical and regulatory issues are a major hold-up to the clinical progress of the gene and cell-based therapies. The unethical issues of germline editing, off-target genetic outcomes and even the safety of patient survival over the long term in genome-modified individuals have resulted in increased scrutiny by regulatory authorities.

- The multiplicity of international regulations and changing approval processes poses discrepancies on the development of clinical trials, patient consent and follow-up. Also, the expensive nature and difficulty of meeting the strict biosafety and ethical regulations slows down the commercialization schedules and limits the access of patients.

- With promising initial outcomes, the safety and effectiveness of genomic and gene-editing therapies in the long run are unclear. Increased risks including immune response, insertional mutagenesis and off target effect coupled with the lack of post-market data undermine stakeholder confidence. These safety considerations influence conservative regulatory approvals and limited adoption, delaying more extensive clinical integration.

Opportunity: Expanding Application of Genomics and CRISPR in Precision Medicine Creates High-Growth Opportunity

- The increasing use of Genomics and CRISPR in precision and personalized medicine presents a key opportunity to the global market of Genomics and CRISPR. With the transition towards personalized treatment methods in the healthcare sector, CRISPR allows individual correction of disease-causing mutations with a precision that has never been seen before. As an example, in April 2025, Verve Therapeutics announced positive Phase 1b results on VERVE-102, an in vivo base-editing therapy against PCSK9 gene to treat heterozygous familial hypercholesterolemia (HeFH) and premature coronary artery disease (CAD). One dose entailed a maximum of 69% drop in low-density lipoprotein cholesterol (LDL-C) with absolutely no severe adverse effects, which is a breakthrough in the specificity of cardiovascular medicine.

- The innovations increase the therapeutic scope of CRISPR in the cardiovascular, neurological, and rare disease clinical indications, and an increase in regulatory support heightens investor trust and precision medicine. As an example, In September 2025, Intellia Therapeutics announced long term Phase 1 results of Nexiguran Ziclumeran (Nex-Z), a single dose in vivo CRISPR/Cas9 therapy of hereditary transthyretin (ATTR) amyloidosis and polyneuropathy. One dose resulted in lasting 90 percent or higher TTR, and the results of CRISPR use in treating genetic diseases in a personalized and lasting way have transformed.

- The emergence of genomics and CRISPR-based precision medicine opens up enormous business and clinical opportunities, leading to long-term market growth.

Key Trend: Rising Focus on CRISPR-Based Agricultural Biotechnology Enhances Market Diversification

- The growing development of CRISPR technology in agricultural biotechnology is a defining trend that is changing the international market of Genomics and CRISPR. An example is that under the May 2025, India was the first to develop genome-edited rice, with the release of DRR Rice 100 (Kamala) and Pusa DST Rice 1 designed by ICAR using CRISPR-Cas technology. These varieties can be characterized by better yield, resistance to climatic conditions, and the use of less water, which was unveiled by the Union Agriculture Minister, Shri Shivraj Singh Chouhan.

- With climate change, food insecurity and pathogen resistance escalating, gene-editing technology such as CRISPR is being used to produce more robust, high-profitable, and nutritionally enriched foods. An example of this is In February 2025, Corteva Agriscience collaborated with the International Maize and Wheat Improvement Center (CIMMYT) to create CRISPR-edited maize resistant to maize lethal necrosis disease which has reduced yields in sub-Saharan Africa by up to 90%. The project is expected to develop climate and disease resistant corn hybrids in order to enhance the food security in the region.

- Application of CRISPR in agriculture is accelerating innovation in crops, improving food security in the world, and diversifying the Genomics & CRISPR market to sustainable agricultural biotechnology rather than just in healthcare.

Genomics-and-CRISPR-Market Analysis and Segmental Data

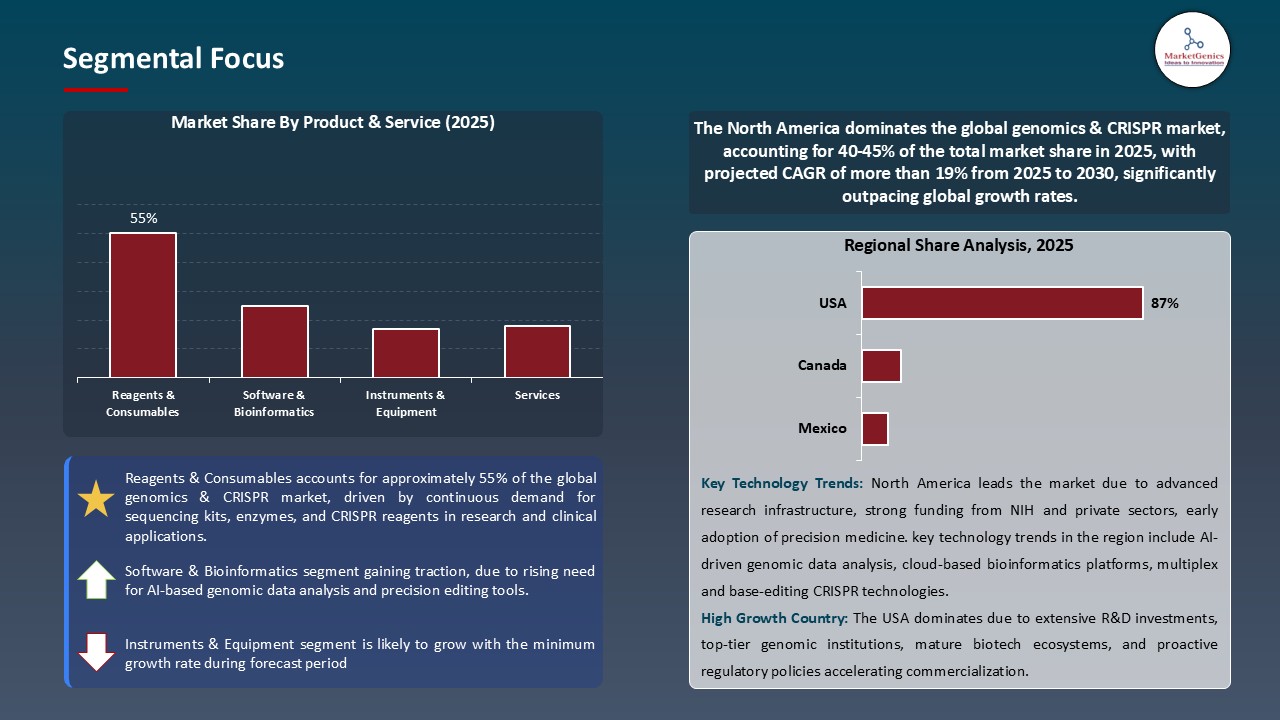

Reagents & Consumables Dominate Global Genomics & CRISPR Market

- Reagents and consumables account for over 55% of the global genomics and CRISPR market revenue, driven by their recurrent use across gene editing workflows and diagnostic assays. Consumables like Cas enzymes, guide RNAs and library preparation kits are required in each experiment cycle and they create a continuous demand therefore generating consistent and high-margin revenue streams. As an example, Agilent Technologies released its SureGuide CRISPR Library Kits, which is created to simplify high-throughput functional genomics and precision medicine studies.

- The growing number of studies in the fields of genomics, cell and gene therapy, and precision medicine is an additional driver of reagent demand, and technological developments in CRISPR formats and pre-prepared genome editing systems make these more widely used. As an example, Thermo Fisher Scientific has extended its Gibco CTS TrueCut Cas9 Protein range to provide high-fidelity CRISPR reagents to aid in large cell therapy production and genome studies.

- Thus, the innovations enhance the reagent market dominance through acceleration of scalability, efficiency, and recurring revenue in genomics and gene editing.

North America Leads Global Genomics & CRISPR Market Demand

- The global genomics and CRISPR market is dominated by North America, because of its superior research infrastructure, high level of R&D spending and good representation of large biotechnology and pharmaceutical firms. The area enjoys a strong ecosystem which combines scholarly research, clinical practices, and business invention in gene editing.

- Additionally, Favourable regulatory environment, substantial support by both the government and the non-government funds, and the rapidness of next-generation sequencing and CRISPR technologies also contribute to its dominance. As an example, The National Institutes of Health (NIH) granted more funding to the Somatic Cell Genome Editing (SCGE) Program that funds more than 45 projects involving next-generation genome editing tools and delivery systems. The initiative also establishes the U.S as an international leader in genomics and CRISPR technology.

- Moreover, with the current accelerating development of precision medicine, cell and gene therapy, and many leading institutions, including the Broad Institute, and large biotech hubs in the U.S. and Canada, market growth and innovation in genomics and CRISPR-based solutions remain sustainable.

Genomics-and-CRISPR-Market Ecosystem

The global Genomics and CRISPR market are rather concentrated with the leaders including Illumina, Inc., Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, and Synthego, having an approximate market share of 42%. These firms lead the genomic sequencing platform development, gene-editing, and CRISPR-based study solution development, backed by comprehensive intellectual property portfolios, substantial R&D investments and worldwide distribution systems. Their technological advances both in high-throughput sequencing overhauls and automated CRISPR design and synthesis systems establish standards in the industry and present substantial barriers to entry by new entrants.

Service providers and contract research organizations (CROs/CDMOs) are also essential to the genomics and CRISPR ecosystem, as they facilitate the development of assays at scale, genomics, regulatory compliance, and clinical translation. An example is that Synthego uses its automated genome engineering technology and key strategic collaborations to hasten CRISPR-based therapeutic and research uses across the globe.

Recent Development and Strategic Overview:

- In June 2025, Eli Lilly and Company said it was buying in the USD 1.3 billion Verve Therapeutics, a Boston-based developer of gene-editing medicines to treat cardiovascular disease. Verve Lead program, VERVE-102 is an in vivo therapy against the PCSK9 gene to achieve a lifelong reduction of cardiovascular risk with a single dose, which is a strategic growth of Lilly in the field of genomics and therapeutic gene-based therapy.

- In May 2025, Regeneron Pharmaceuticals announced it acquired 23andMe with a USD 256 million bid, having access to one of the largest human genomic databases in the world of more than 14 million people. The acquisition proposes to combine consumer genetics information with the findings by Regeneron to hasten gene discovery and genomics-based therapeutic development and enhance its presence in precision medicine.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 27.4 Bn |

|

Market Forecast Value in 2035 |

~USD 134 Bn |

|

Growth Rate (CAGR) |

17.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Genomics-and-CRISPR-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Genomics & CRISPR Market, By Technology Type |

|

|

Genomics & CRISPR Market, By Product & Service |

|

|

Genomics & CRISPR Market, By Application |

|

|

Genomics & CRISPR Market, By Therapeutic Area |

|

|

Genomics & CRISPR Market, By Delivery Method |

|

|

Genomics & CRISPR Market, By End-User |

|

|

Genomics & CRISPR Market, By Mode |

|

|

Genomics & CRISPR Market, By Design Type |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Genomics & CRISPR Market Outlook

- 2.1.1. Genomics & CRISPR Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Genomics & CRISPR Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for precision and personalized medicine

- 4.1.1.2. Advancements in next-generation sequencing and CRISPR technologies

- 4.1.1.3. Increasing investments in genomics-based drug discovery and diagnostics

- 4.1.2. Restraints

- 4.1.2.1. Ethical and regulatory concerns surrounding human gene editing

- 4.1.2.2. High cost of genomic research and CRISPR implementation

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Genomics & CRISPR Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Genomics & CRISPR Market Analysis, By Technology Type

- 6.1. Key Segment Analysis

- 6.2. Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology Type, 2021-2035

- 6.2.1. CRISPR-Cas9

- 6.2.2. CRISPR-Cas12

- 6.2.3. CRISPR-Cas13

- 6.2.4. CRISPR-Cas14

- 6.2.5. Base Editing

- 6.2.6. Prime Editing

- 6.2.7. TALENs (Transcription Activator-Like Effector Nucleases)

- 6.2.8. ZFNs (Zinc Finger Nucleases)

- 6.2.9. Next-Generation Sequencing (NGS)

- 6.2.10. Others

- 7. Global Genomics & CRISPR Market Analysis, By Product & Service

- 7.1. Key Segment Analysis

- 7.2. Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product & Service, 2021-2035

- 7.2.1. Reagents & Consumables

- 7.2.1.1. gRNA

- 7.2.1.2. Cas Enzymes

- 7.2.1.3. Vectors & Plasmids

- 7.2.1.4. Delivery Systems

- 7.2.1.5. Others

- 7.2.2. Software & Bioinformatics

- 7.2.2.1. Design Tools

- 7.2.2.2. Analysis Software

- 7.2.2.3. Data Management Platforms

- 7.2.2.4. Others

- 7.2.3. Instruments & Equipment

- 7.2.3.1. Sequencers

- 7.2.3.2. PCR Machines

- 7.2.3.3. Electroporation Systems

- 7.2.3.4. Others

- 7.2.4. Services

- 7.2.4.1. Cell Line Engineering

- 7.2.4.2. Genotyping Services

- 7.2.4.3. Gene Synthesis

- 7.2.4.4. Library Preparation

- 7.2.4.5. Others

- 7.2.1. Reagents & Consumables

- 8. Global Genomics & CRISPR Market Analysis and Forecasts,By Application

- 8.1. Key Findings

- 8.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, By Application, 2021-2035

- 8.2.1. Biomedical Research

- 8.2.2. Drug Discovery & Development

- 8.2.3. Agricultural Biotechnology

- 8.2.4. Diagnostic Applications

- 8.2.5. Therapeutic Applications

- 8.2.6. Industrial Biotechnology

- 8.2.7. Others

- 9. Global Genomics & CRISPR Market Analysis and Forecasts, By Therapeutic Area

- 9.1. Key Findings

- 9.2. Genomics & CRISPR Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, Therapeutic Area, 2021-2035

- 9.2.1. Oncology

- 9.2.2. Genetic Disorders

- 9.2.3. Cardiovascular Diseases

- 9.2.4. Infectious Diseases

- 9.2.5. Neurological Disorders

- 9.2.6. Hematological Disorders

- 9.2.7. Immunological Disorders

- 9.2.8. Rare Diseases

- 9.2.9. Others

- 10. Global Genomics & CRISPR Market Analysis and Forecasts, By Delivery Method

- 10.1. Key Findings

- 10.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, By Delivery Method, 2021-2035

- 10.2.1. Viral Delivery

- 10.2.1.1. Adeno-Associated Virus (AAV)

- 10.2.1.2. Lentivirus

- 10.2.1.3. Adenovirus

- 10.2.1.4. Others

- 10.2.2. Non-Viral Delivery

- 10.2.2.1. Electroporation

- 10.2.2.2. Microinjection

- 10.2.2.3. Lipofection

- 10.2.2.4. Nanoparticles

- 10.2.2.5. Others

- 10.2.1. Viral Delivery

- 11. Global Genomics & CRISPR Market Analysis and Forecasts, By End-User

- 11.1. Key Findings

- 11.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-User, 2021-2035

- 11.2.1. Pharmaceutical & Biotechnology Companies

- 11.2.2. Academic & Research Institutes

- 11.2.3. Contract Research Organizations (CROs)

- 11.2.4. Hospitals & Diagnostic Centers

- 11.2.5. Agricultural Companies

- 11.2.6. Industrial Biotechnology Firms

- 12. Global Genomics & CRISPR Market Analysis and Forecasts, By Mode

- 12.1. Key Findings

- 12.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, By Mode, 2021-2035

- 12.2.1. Ex Vivo

- 12.2.2. In Vivo

- 12.2.3. In Vitro

- 13. Global Genomics & CRISPR Market Analysis and Forecasts, By Design Type

- 13.1. Key Findings

- 13.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, By Design Type, 2021-2035

- 13.2.1. gRNA Design & Vector Construction

- 13.2.2. Cell Line Development

- 13.2.3. Animal Model Engineering

- 13.2.4. Plant Genome Engineering

- 14. Global Genomics & CRISPR Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Genomics & CRISPR Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Genomics & CRISPR Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology Type

- 15.3.2. Product & Service

- 15.3.3. Application

- 15.3.4. Therapeutic Area

- 15.3.5. Delivery Method

- 15.3.6. End-User

- 15.3.7. Mode

- 15.3.8. Design Type

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Genomics & CRISPR Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Product & Service

- 15.4.4. Application

- 15.4.5. Therapeutic Area

- 15.4.6. Delivery Method

- 15.4.7. End-User

- 15.4.8. Mode

- 15.4.9. Design Type

- 15.5. Canada Genomics & CRISPR Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Product & Service

- 15.5.4. Application

- 15.5.5. Therapeutic Area

- 15.5.6. Delivery Method

- 15.5.7. End-User

- 15.5.8. Mode

- 15.5.9. Design Type

- 15.6. Mexico Genomics & CRISPR Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Product & Service

- 15.6.4. Application

- 15.6.5. Therapeutic Area

- 15.6.6. Delivery Method

- 15.6.7. End-User

- 15.6.8. Mode

- 15.6.9. Design Type

- 16. Europe Genomics & CRISPR Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Therapeutic Application

- 16.3.2. Technology Type

- 16.3.3. Product & Service

- 16.3.4. Application

- 16.3.5. Therapeutic Area

- 16.3.6. Delivery Method

- 16.3.7. End-User

- 16.3.8. Mode

- 16.3.9. Design Type

- 16.3.10. Country

- 16.3.10.1. Germany

- 16.3.10.2. United Kingdom

- 16.3.10.3. France

- 16.3.10.4. Italy

- 16.3.10.5. Spain

- 16.3.10.6. Netherlands

- 16.3.10.7. Nordic Countries

- 16.3.10.8. Poland

- 16.3.10.9. Russia & CIS

- 16.3.10.10. Rest of Europe

- 16.4. Germany Genomics & CRISPR Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Product & Service

- 16.4.4. Application

- 16.4.5. Therapeutic Area

- 16.4.6. Delivery Method

- 16.4.7. End-User

- 16.4.8. Mode

- 16.4.9. Design Type

- 16.5. United Kingdom Genomics & CRISPR Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology Type

- 16.5.3. Product & Service

- 16.5.4. Application

- 16.5.5. Therapeutic Area

- 16.5.6. Delivery Method

- 16.5.7. End-User

- 16.5.8. Mode

- 16.5.9. Design Type

- 16.6. France Genomics & CRISPR Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Product & Service

- 16.6.4. Application

- 16.6.5. Therapeutic Area

- 16.6.6. Delivery Method

- 16.6.7. End-User

- 16.6.8. Mode

- 16.6.9. Design Type

- 16.7. Italy Genomics & CRISPR Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Product & Service

- 16.7.4. Application

- 16.7.5. Therapeutic Area

- 16.7.6. Delivery Method

- 16.7.7. End-User

- 16.7.8. Mode

- 16.7.9. Design Type

- 16.8. Spain Genomics & CRISPR Market

- 16.8.1. Technology Type

- 16.8.2. Product & Service

- 16.8.3. Application

- 16.8.4. Therapeutic Area

- 16.8.5. Delivery Method

- 16.8.6. End-User

- 16.8.7. Mode

- 16.8.8. Design Type

- 16.9. Netherlands Genomics & CRISPR Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology Type

- 16.9.3. Product & Service

- 16.9.4. Application

- 16.9.5. Therapeutic Area

- 16.9.6. Delivery Method

- 16.9.7. End-User

- 16.9.8. Mode

- 16.9.9. Design Type

- 16.10. Nordic Countries Genomics & CRISPR Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology Type

- 16.10.3. Product & Service

- 16.10.4. Application

- 16.10.5. Therapeutic Area

- 16.10.6. Delivery Method

- 16.10.7. End-User

- 16.10.8. Mode

- 16.10.9. Design Type

- 16.11. Poland Genomics & CRISPR Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology Type

- 16.11.3. Product & Service

- 16.11.4. Application

- 16.11.5. Therapeutic Area

- 16.11.6. Delivery Method

- 16.11.7. End-User

- 16.11.8. Mode

- 16.11.9. Design Type

- 16.12. Russia & CIS Genomics & CRISPR Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology Type

- 16.12.3. Product & Service

- 16.12.4. Application

- 16.12.5. Therapeutic Area

- 16.12.6. Delivery Method

- 16.12.7. End-User

- 16.12.8. Mode

- 16.12.9. Design Type

- 16.13. Rest of Europe Genomics & CRISPR Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology Type

- 16.13.3. Product & Service

- 16.13.4. Application

- 16.13.5. Therapeutic Area

- 16.13.6. Delivery Method

- 16.13.7. End-User

- 16.13.8. Mode

- 16.13.9. Design Type

- 17. Asia Pacific Genomics & CRISPR Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapeutic Application

- 17.3.2. Technology Type

- 17.3.3. Product & Service

- 17.3.4. Application

- 17.3.5. Therapeutic Area

- 17.3.6. Delivery Method

- 17.3.7. End-User

- 17.3.8. Mode

- 17.3.9. Design Type

- 17.3.10. Country

- 17.3.10.1. China

- 17.3.10.2. India

- 17.3.10.3. Japan

- 17.3.10.4. South Korea

- 17.3.10.5. Australia and New Zealand

- 17.3.10.6. Indonesia

- 17.3.10.7. Malaysia

- 17.3.10.8. Thailand

- 17.3.10.9. Vietnam

- 17.3.10.10. Rest of Asia Pacific

- 17.4. China Genomics & CRISPR Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Product & Service

- 17.4.4. Application

- 17.4.5. Therapeutic Area

- 17.4.6. Delivery Method

- 17.4.7. End-User

- 17.4.8. Mode

- 17.4.9. Design Type

- 17.5. India Genomics & CRISPR Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Product & Service

- 17.5.4. Application

- 17.5.5. Therapeutic Area

- 17.5.6. Delivery Method

- 17.5.7. End-User

- 17.5.8. Mode

- 17.5.9. Design Type

- 17.6. Japan Genomics & CRISPR Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Product & Service

- 17.6.4. Application

- 17.6.5. Therapeutic Area

- 17.6.6. Delivery Method

- 17.6.7. End-User

- 17.6.8. Mode

- 17.6.9. Design Type

- 17.7. South Korea Genomics & CRISPR Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Product & Service

- 17.7.4. Application

- 17.7.5. Therapeutic Area

- 17.7.6. Delivery Method

- 17.7.7. End-User

- 17.7.8. Mode

- 17.7.9. Design Type

- 17.8. Australia and New Zealand Genomics & CRISPR Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Product & Service

- 17.8.4. Application

- 17.8.5. Therapeutic Area

- 17.8.6. Delivery Method

- 17.8.7. End-User

- 17.8.8. Mode

- 17.8.9. Design Type

- 17.9. Indonesia Genomics & CRISPR Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Technology Type

- 17.9.3. Product & Service

- 17.9.4. Application

- 17.9.5. Therapeutic Area

- 17.9.6. Delivery Method

- 17.9.7. End-User

- 17.9.8. Mode

- 17.9.9. Design Type

- 17.10. Malaysia Genomics & CRISPR Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Technology Type

- 17.10.3. Product & Service

- 17.10.4. Application

- 17.10.5. Therapeutic Area

- 17.10.6. Delivery Method

- 17.10.7. End-User

- 17.10.8. Mode

- 17.10.9. Design Type

- 17.11. Thailand Genomics & CRISPR Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Technology Type

- 17.11.3. Product & Service

- 17.11.4. Application

- 17.11.5. Therapeutic Area

- 17.11.6. Delivery Method

- 17.11.7. End-User

- 17.11.8. Mode

- 17.11.9. Design Type

- 17.12. Vietnam Genomics & CRISPR Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Source/Origin

- 17.12.3. Technology Type

- 17.12.4. Product & Service

- 17.12.5. Application

- 17.12.6. Therapeutic Area

- 17.12.7. Delivery Method

- 17.12.8. End-User

- 17.12.9. Mode

- 17.12.10. Design Type

- 17.13. Rest of Asia Pacific Genomics & CRISPR Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Technology Type

- 17.13.3. Product & Service

- 17.13.4. Application

- 17.13.5. Therapeutic Area

- 17.13.6. Delivery Method

- 17.13.7. End-User

- 17.13.8. Mode

- 17.13.9. Design Type

- 18. Middle East Genomics & CRISPR Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Therapeutic Application

- 18.3.2. Technology Type

- 18.3.3. Product & Service

- 18.3.4. Application

- 18.3.5. Therapeutic Area

- 18.3.6. Delivery Method

- 18.3.7. End-User

- 18.3.8. Mode

- 18.3.9. Design Type

- 18.3.10. Country

- 18.3.10.1. Turkey

- 18.3.10.2. UAE

- 18.3.10.3. Saudi Arabia

- 18.3.10.4. Israel

- 18.3.10.5. Rest of Middle East

- 18.4. Turkey Genomics & CRISPR Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Product & Service

- 18.4.4. Application

- 18.4.5. Therapeutic Area

- 18.4.6. Delivery Method

- 18.4.7. End-User

- 18.4.8. Mode

- 18.4.9. Design Type

- 18.5. UAE Genomics & CRISPR Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Product & Service

- 18.5.4. Application

- 18.5.5. Therapeutic Area

- 18.5.6. Delivery Method

- 18.5.7. End-User

- 18.5.8. Mode

- 18.5.9. Design Type

- 18.6. Saudi Arabia Genomics & CRISPR Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Product & Service

- 18.6.4. Application

- 18.6.5. Therapeutic Area

- 18.6.6. Delivery Method

- 18.6.7. End-User

- 18.6.8. Mode

- 18.6.9. Design Type

- 18.7. Israel Genomics & CRISPR Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology Type

- 18.7.3. Product & Service

- 18.7.4. Application

- 18.7.5. Therapeutic Area

- 18.7.6. Delivery Method

- 18.7.7. End-User

- 18.7.8. Mode

- 18.7.9. Design Type

- 18.8. Rest of Middle East Genomics & CRISPR Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology Type

- 18.8.3. Product & Service

- 18.8.4. Application

- 18.8.5. Therapeutic Area

- 18.8.6. Delivery Method

- 18.8.7. End-User

- 18.8.8. Mode

- 18.8.9. Design Type

- 19. Africa Genomics & CRISPR Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology Type

- 19.3.2. Product & Service

- 19.3.3. Application

- 19.3.4. Therapeutic Area

- 19.3.5. Delivery Method

- 19.3.6. End-User

- 19.3.7. Mode

- 19.3.8. Design Type

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Genomics & CRISPR Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology Type

- 19.4.3. Product & Service

- 19.4.4. Application

- 19.4.5. Therapeutic Area

- 19.4.6. Delivery Method

- 19.4.7. End-User

- 19.4.8. Mode

- 19.4.9. Design Type

- 19.5. Egypt Genomics & CRISPR Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology Type

- 19.5.3. Product & Service

- 19.5.4. Application

- 19.5.5. Therapeutic Area

- 19.5.6. Delivery Method

- 19.5.7. End-User

- 19.5.8. Mode

- 19.5.9. Design Type

- 19.6. Nigeria Genomics & CRISPR Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology Type

- 19.6.3. Product & Service

- 19.6.4. Application

- 19.6.5. Therapeutic Area

- 19.6.6. Delivery Method

- 19.6.7. End-User

- 19.6.8. Mode

- 19.6.9. Design Type

- 19.7. Algeria Genomics & CRISPR Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Technology Type

- 19.7.3. Product & Service

- 19.7.4. Application

- 19.7.5. Therapeutic Area

- 19.7.6. Delivery Method

- 19.7.7. End-User

- 19.7.8. Mode

- 19.7.9. Design Type

- 19.8. Rest of Africa Genomics & CRISPR Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Technology Type

- 19.8.3. Product & Service

- 19.8.4. Application

- 19.8.5. Therapeutic Area

- 19.8.6. Delivery Method

- 19.8.7. End-User

- 19.8.8. Mode

- 19.8.9. Design Type

- 20. South America Genomics & CRISPR Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Genomics & CRISPR Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Technology Type

- 20.3.2. Product & Service

- 20.3.3. Application

- 20.3.4. Therapeutic Area

- 20.3.5. Delivery Method

- 20.3.6. End-User

- 20.3.7. Mode

- 20.3.8. Design Type

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Genomics & CRISPR Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Technology Type

- 20.4.3. Product & Service

- 20.4.4. Application

- 20.4.5. Therapeutic Area

- 20.4.6. Delivery Method

- 20.4.7. End-User

- 20.4.8. Mode

- 20.4.9. Design Type

- 20.5. Argentina Genomics & CRISPR Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Technology Type

- 20.5.3. Product & Service

- 20.5.4. Application

- 20.5.5. Therapeutic Area

- 20.5.6. Delivery Method

- 20.5.7. End-User

- 20.5.8. Mode

- 20.5.9. Design Type

- 20.6. Rest of South America Genomics & CRISPR Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Technology Type

- 20.6.3. Product & Service

- 20.6.4. Application

- 20.6.5. Therapeutic Area

- 20.6.6. Delivery Method

- 20.6.7. End-User

- 20.6.8. Mode

- 20.6.9. Design Type

- 21. Key Players/ Company Profile

- 21.1. Agilent Technologies

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Beam Therapeutics

- 21.3. Caribou Biosciences

- 21.4. Cellecta

- 21.5. CRISPR Therapeutics

- 21.6. Danaher Corporation

- 21.7. Editas Medicine

- 21.8. GenScript Biotech

- 21.9. Horizon Discovery (Revvity)

- 21.10. Illumina

- 21.11. Integrated DNA Technologies (IDT)

- 21.12. Intellia Therapeutics

- 21.13. Lonza Group

- 21.14. Merck KGaA

- 21.15. New England Biolabs

- 21.16. OriGene Technologies

- 21.17. PerkinElmer

- 21.18. Qiagen

- 21.19. Synthego

- 21.20. Takara Bio

- 21.21. Thermo Fisher Scientific

- 21.22. Other Key Players

- 21.1. Agilent Technologies

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation