Health Data Interoperability Market Size, Share & Trends Analysis Report by Component (Software, Services), Interoperability Level, Deployment Mode, Standard Type, Application, End-Use Industry, Data Type, Integration Type, Technology, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Health Data Interoperability Market Size, Share, and Growth

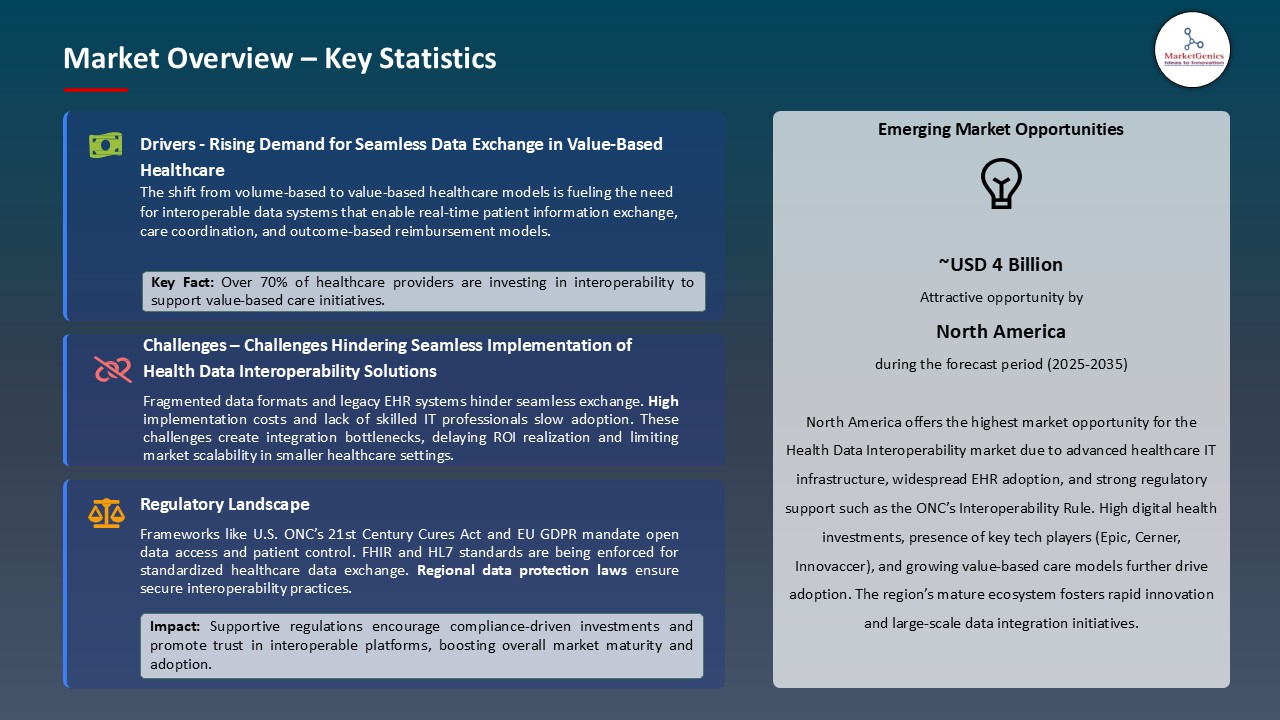

The global health data interoperability market is witnessing strong growth, valued at USD 3.6 billion in 2025 and projected to reach USD 13.5 billion by 2035, expanding at a CAGR of 14.1% during the forecast period. North America leads the health data interoperability market due to robust regulatory frameworks, advanced health IT infrastructure, high adoption of EHR systems, and strong collaboration between public initiatives and private technology providers driving seamless data exchange across healthcare networks.

Don Woodlock, head of Global Healthcare Solutions at InterSystems said that, “By integrating HealthShare into Google Cloud’s comprehensive health data and AI ecosystem, we are helping organizations ensure their data is interoperable and responsibly managed. This means providers can focus on improving workflows and delivering smarter care”.

The increase in the adoption of value-based care models improves the necessity of data integration promotes the development of health data interoperability market. Value-based reimbursement models are based on the sharing of comprehensive and real-time data involving providers, payers, and patients to quantify outcomes and enhance efficiency. Indicatively, Optum has expanded their Interoperability Hub that links payers and providers to unified data analytics that supports value-based care contracts.

The adoption of national framework of standardized and secure health information exchange is increasing the rate of data connectivity, compliance and interoperability adoption, which is driving the development of the Health Data Interoperability market. As an example, the ONC released TEFCA Version 1.1 as part of the 21st Century Cures Act, uniting a national structure of health data exchange through a secure and standardized national system. This project enhances interoperability throughout the country and improves the market of the U.S. Health Data Interoperability.

The increasing demand of cross-border collaboration in healthcare, clinical research, and disease surveillance is catalyzing huge prospects of cross-border health data interoperability. With medical travel, multi-national trials and world-wide health crises on the rise, interoperable frameworks that would facilitate the secure and standardized exchange of data across national borders have become a necessity. As an example, In April 2025, the European Commission progressed with its project European Health Data Space (EHDS), which will establish a single electronic health record exchange model between EU countries.

Health Data Interoperability Market Dynamics and Trends

Driver: Integration of wearable and home-monitoring data strengthens real-time clinical interoperability and patient engagement

- The increasing adoption of data collected by wearable gadgets and remote monitoring devices as a source of patient-generated data into clinical workflows is a potent source of health data interoperability. This development allows continuous, real-time health monitoring, closing the information gap that exists between the patients and the providers. As an example, In January 2025, Validic tackled health data interoperability by building real-time wearable data from and into Epic and Oracle Health EHR workflows for more than 350 device types (including Fitbit, Apple, Garmin and Oura).

- Progress shows that interoperability platforms and connected devices are revolutionizing preventive care and giving providers access to more detailed data to make personalized decisions. The growing pressure on healthcare institutions to adopt interoperable infrastructure to implement continuous care models is a result of the growing pressures to deploy the integrated patient data ecosystems.

- Interoperability increase and market expansion with real time digital health interaction is provided by integration of connected device data.

Restraint: Legacy System Integration Complexity Impedes Implementation Progress

- Healthcare organizations have hundreds of disparate clinical and administrative systems that have been built up over decades, posing significant technical challenges to enable full interoperability. Older platforms do not always have modern API interfaces or are based on legacy data formats that cannot be consumed by existing standards. An example is that NHS England encountered significant delays in incorporating old-fashioned hospital systems into its Federated Data Platform (FDP) because of non-compatible legacy architecture and non-standard data formats.

- The implementation plans postpone the realization of benefits, and they consume a vast amount of IT resources, which would otherwise support other organizational priorities. As an example, Guy and St Thomas NHS foundation trust and King College Hospital postponed their joint Epic EHR implementation because of the significant data migration and quality problems caused by the old legacy IT systems. The case also illustrates how the complexity of the legacy systems can hamper the seamless integration of EHR, which prolongs the timelines and increases the cost in the Health Data Interoperability Market.

- Data quality concerns desktop these problems make integration difficult because inconsistent formats, missing data, and duplicate records must be cleansed extensively before the exchange can be done reliably.

Opportunity: Artificial Intelligence Applications Require Comprehensive Data Access

- Clinical decision support, diagnostic assistance, and predictive analytics machine learning algorithms rely on having access to varied datasets in several organizations.

- The interoperability infrastructure has allowed AI applications to take advantage of the complete information to train models and produce insights. As an example, athenahealth is bringing to a reality the age of AI-powered, intelligent interoperability of physician practices in the U.S. in 2025. The platform of the firm combines machine learning and advanced analytics to amplify the level of sharing of data, clinical decision-making, and move operational efficiency across the nation.

- The partnership is a crucial move to deepen AI-based interoperability of healthcare infrastructure, which integrates secure cloud hosting with a powerful and efficient data integration facility to ensure the flow of information without any barriers, data quality, and the rapid deployment of smart health apps. As an example, Google Cloud and InterSystems published the collaboration of InterSystems HealthShare platform with Google Healthcare API that builds stronger foundations of interoperability of AI applications in healthcare.

- The developments are propelling the rapid data-based health care environment in which AI-based interoperability improves clinical accuracy, operational efficiency and patient outcomes.

Key Trend: FHIR Standard Adoption Accelerates Ecosystem Development

- Fast Healthcare Interoperability Resources emerges as the dominant standard for health data exchange, enabling developers to build applications accessing clinical information through standardized APIs.

- FHIR adoption accelerates as vendors implement compliant interfaces and healthcare organizations recognize benefits of standardized integration approaches. For instance, In 2025, InterSystems reduced connection times by up to 60% for CDA and 50% for HL7 v2 interfaces through its accelerator framework. This advancement underscores the industry’s shift toward FHIR-based, standardized integration models that enhance interoperability, reduce API development effort, and enable seamless health data exchange across systems.

- FHIR-based app ecosystems enable innovation in patient engagement, clinical decision support, and care coordination tools. Healthcare organizations benefit from vendor-neutral integration approaches reducing dependency on proprietary interfaces while enabling rapid deployment of innovative applications addressing specific clinical and operational needs.

- Advancements establish FHIR as the backbone of seamless, data-driven healthcare innovation and interoperability.

Health-Data-Interoperability-Market Analysis and Segmental Data

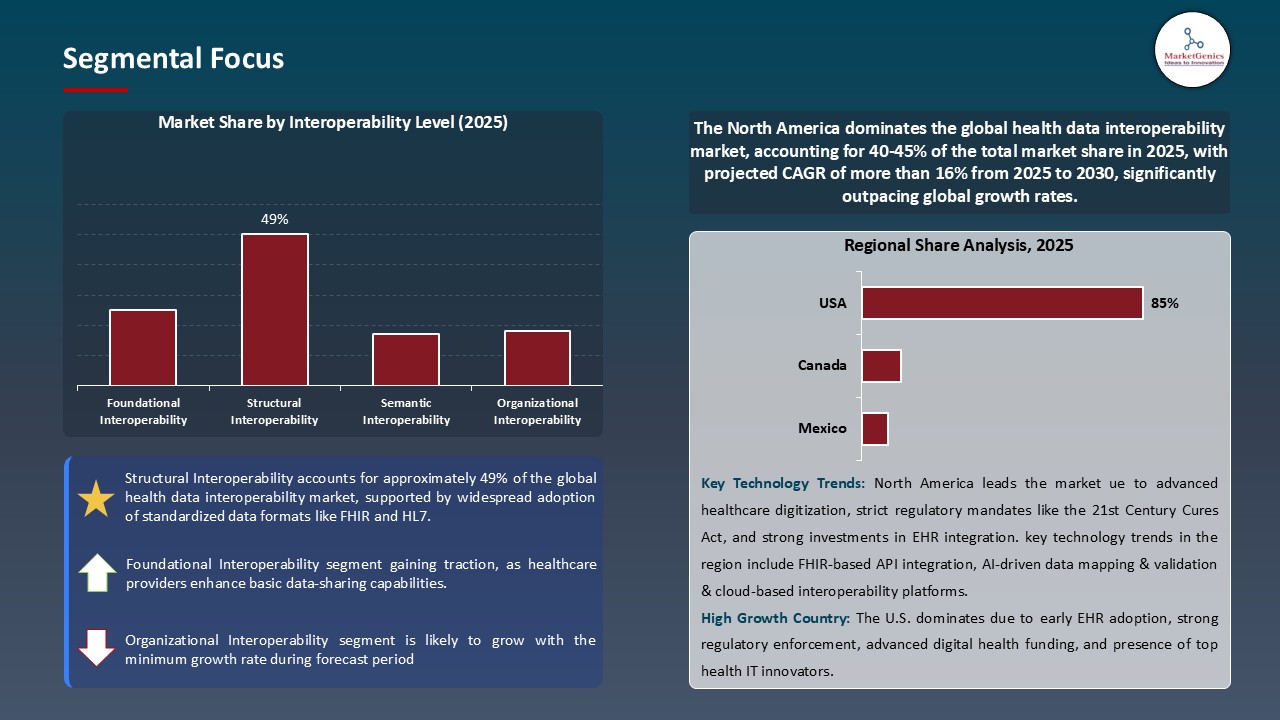

Structural Interoperability Dominate Global Health Data Interoperability Market

- Structural interoperability carries the greatest market share in the global health data interoperability market because it is the primary foundation of proper and consistent health information exchange among different systems. An example is EMR Direct rolled out its Interoperability Engine platform that has superior FHIR services and HL7 UDAP FAST. This enhances structural interoperability by making sure that there are standardized forms of data and that all the information is exchanged easily between the healthcare systems.

- Structural interoperability requires that data, including clinical summary, laboratories, and medical imaging, are presented in standard formats and syntax allowing systems to communicate with each other without loss of meaning or integrity. The popularity of this layer is supported by the common practice of standardized frameworks like HL7 v2, C-CDA, and FHIR that are used to allow transfer of data between electronic health records, laboratories, pharmacies, and payer systems.

- Healthcare organizations are focusing on structural interoperability as a requirement to other interoperability maturity levels, including semantic and organizational interoperability.

North America Leads Global Health Data Interoperability Market Demand

- In North America, the market of health data interoperability is mainly dominated by the region with extensive regulatory requirements, elaborate health IT infrastructure, and a substantial amount of government-funded exchange networks. To illustrate, in April 2025, the U.S. FDA initiated a project to research HL7 FHIR standards of integrating real-world data in regulatory submissions to promote standardized and interoperable data exchange among healthcare systems.

- The area enjoys countrywide interoperability programs such as CommonWell Health Alliance and Carequality framework linking thousands of healthcare organizations. Health information exchange regional leadership goes to commercial innovation, and many startup companies are creating focused interoperability solutions to telehealth, remote monitoring, and consumer health apps. As an example, Apple Health Records has increased its FHIR-based integration with large U.S. health systems allowing patients to obtain cohesive medical data in various providers.

- The initiatives make North America the world leader in health data interoperability; a powerful regulatory support, a well-developed digital environment, and a vigorous partnership between government agencies and commercial innovation is worthy.

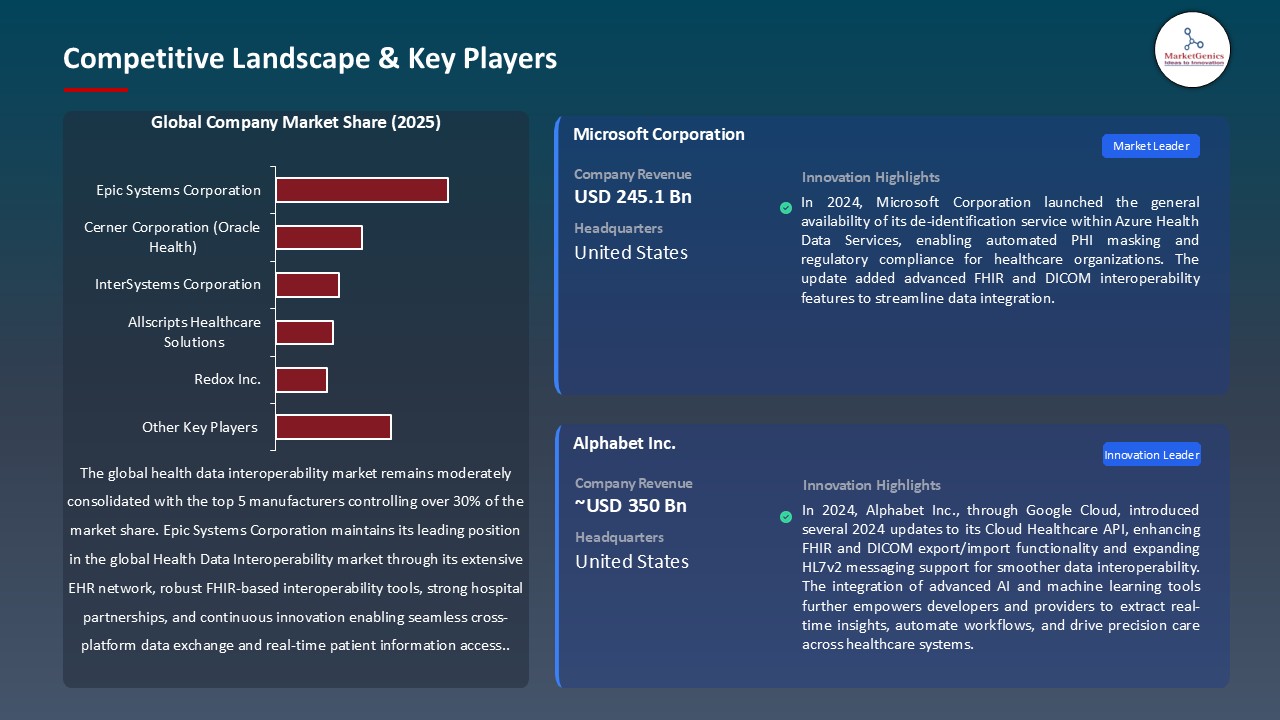

Health-Data-Interoperability-Market Ecosystem

The health data interoperability market globally is moderately fragmented with varying competitive dynamic and service platform models. Epic Systems Corporation, Oracle Health, and Cerner Corporation are Tier 1 providers who dominate with comprehensive electronic health record platforms with inbuilt interoperability features and expansive market penetration among large healthcare systems. There are also tier 2 category of companies including InterSystems Corporation, Redox Inc., and Rhapsody Health that concentrate on niche integration platforms and cloud-based services of exchange, frequently to middle-sized organizations or to add-on functionality to the existing health IT infrastructure. Tier 3 players usually respond to niche needs or regional markets as a solution to specific needs.

The concentration of buyers is average with large health systems that have significant bargaining power and small organizations that are not influential on the contract terms and price. The concentration of suppliers depends on the type of solution, and they are highly concentrated in the case of electronic health record vendors and more diversified in the case of specialized integration platform market. Switching costs in favor of established vendor relations are created due to complexity of implementation and the difficulty of moving data.

Recent Development and Strategic Overview:

- In July 2025, Oracle Health aligned with the White House’s interoperability vision, pledging to advance TEFCA-based, AI-enabled data exchange through its cloud platform. The initiative aims to eliminate data silos and enable unified, patient-centric records, reinforcing Oracle’s leadership in the Health Data Interoperability market.

- In February 2025, At HIMSS, MEDITECH announced collaborations with Google Cloud, Microsoft, Commure, DrFirst, Health Gorilla, and Suki to demonstrate seamless interoperability within its Expanse EHR ecosystem. The initiative highlighted integration of AI-driven tools, cloud connectivity, and standardized data exchange through FHIR-based APIs, reinforcing MEDITECH’s commitment to open platforms and connected healthcare delivery.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.6 Bn |

|

Market Forecast Value in 2035 |

USD 13.5 Bn |

|

Growth Rate (CAGR) |

14.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Health-Data-Interoperability-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Health Data Interoperability Market, By Component |

|

|

Health Data Interoperability Market, By Interoperability Level |

|

|

Health Data Interoperability Market, By Deployment Mode |

|

|

Health Data Interoperability Market, By Standard Type |

|

|

Health Data Interoperability Market, By Application |

|

|

Health Data Interoperability Market, By End-Use Industry |

|

|

Health Data Interoperability Market, By Data Type |

|

|

Health Data Interoperability Market, By Integration Type |

|

|

Health Data Interoperability Market, By Technology |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Health Data Interoperability Market Outlook

- 2.1.1. Health Data Interoperability Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Health Data Interoperability Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing need for real-time patient data exchange and coordinated care

- 4.1.1.2. Government mandates and standards supporting healthcare data interoperability

- 4.1.1.3. Growing adoption of cloud and AI-driven health information systems

- 4.1.2. Restraints

- 4.1.2.1. Data privacy, security, and compliance challenges

- 4.1.2.2. High implementation costs and system integration complexities

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

-

- 4.2.1.1. Regulatory Framework

- 4.2.2. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.2.3. Tariffs and Standards

- 4.2.4. Impact Analysis of Regulations on the Market

-

- 4.3. Value Chain Analysis

- 4.3.1. Data Sources & Generators

- 4.3.2. Integration & Data Exchange Platforms

- 4.3.3. System Integration & Deployment Services

- 4.3.4. End Users & Stakeholders

- 4.4. Porter’s Five Forces Analysis

- 4.5. PESTEL Analysis

- 4.6. Global Health Data Interoperability Market Demand

- 4.6.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.6.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.6.2.1. Y-o-Y Growth Trends

- 4.6.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Health Data Interoperability Market Analysis, By Component

- 6.1. Key Segment Analysis

- 6.2. Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, By Component, 2021-2035

- 6.2.1. Software

- 6.2.1.1. Electronic Health Records (EHR) Integration Software

- 6.2.1.2. Health Information Exchange (HIE) Software

- 6.2.1.3. Enterprise Application Integration Software

- 6.2.1.4. Data Analytics and Visualization Software

- 6.2.1.5. Middleware Solutions

- 6.2.1.6. Others

- 6.2.2. Services

- 6.2.2.1. Implementation Services

- 6.2.2.2. Consulting Services

- 6.2.2.3. Training and Education Services

- 6.2.2.4. Support and Maintenance Services

- 6.2.2.5. Managed Services

- 6.2.2.6. Others

- 6.2.1. Software

- 7. Global Health Data Interoperability Market Analysis, By Interoperability Level

- 7.1. Key Segment Analysis

- 7.2. Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, By Interoperability Level, 2021-2035

- 7.2.1. Foundational Interoperability

- 7.2.2. Structural Interoperability

- 7.2.3. Semantic Interoperability

- 7.2.4. Organizational Interoperability

- 8. Global Health Data Interoperability Market Analysis and Forecasts,By Deployment Mode

- 8.1. Key Findings

- 8.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By Deployment Mode, 2021-2035

- 8.2.1. On-Premises

- 8.2.2. Cloud-Based

- 9. Global Health Data Interoperability Market Analysis and Forecasts, By Standard Type

- 9.1. Key Findings

- 9.2. Health Data Interoperability Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Standard Type, 2021-2035

- 9.2.1. HL7 (Health Level Seven)

- 9.2.1.1. HL7 v2.x

- 9.2.1.2. HL7 v3

- 9.2.1.3. HL7 FHIR

- 9.2.2. DICOM

- 9.2.3. CDA

- 9.2.4. SNOMED CT

- 9.2.5. ICD

- 9.2.6. LOINC

- 9.2.7. EDI

- 9.2.8. X12

- 9.2.9. Others

- 9.2.1. HL7 (Health Level Seven)

- 10. Global Health Data Interoperability Market Analysis and Forecasts, By Application

- 10.1. Key Findings

- 10.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By Application, 2021-2035

- 10.2.1. Diagnostic Imaging

- 10.2.2. Laboratory Information Systems

- 10.2.3. Electronic Health Records (EHR) Management

- 10.2.4. Clinical Data Management

- 10.2.5. Patient Administration and Billing

- 10.2.6. Population Health Management

- 10.2.7. Public Health Surveillance

- 10.2.8. Clinical Decision Support

- 10.2.9. E-Prescribing

- 10.2.10. Remote Patient Monitoring

- 10.2.11. Healthcare Analytics

- 10.2.12. Claims and Denial Management

- 10.2.13. Others

- 11. Global Health Data Interoperability Market Analysis and Forecasts, By End-Use Industry

- 11.1. Key Findings

- 11.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-Use Industry, 2021-2035

- 11.2.1. Healthcare Providers

- 11.2.1.1. Hospitals

- 11.2.1.2. Ambulatory Care Centers

- 11.2.1.3. Diagnostic and Imaging Centers

- 11.2.1.4. Clinics

- 11.2.1.5. Long-Term Care Facilities

- 11.2.1.6. Home Healthcare

- 11.2.1.7. Others

- 11.2.2. Healthcare Payers

- 11.2.2.1. Private Insurance Companies

- 11.2.2.2. Public Insurance Programs

- 11.2.2.3. Managed Care Organizations

- 11.2.2.4. Others

- 11.2.3. Pharmaceutical Companies

- 11.2.4. Medical Device Companies

- 11.2.5. Clinical Laboratories

- 11.2.6. Research and Academic Institutions

- 11.2.7. Government and Public Health Agencies

- 11.2.8. Others

- 11.2.1. Healthcare Providers

- 12. Global Health Data Interoperability Market Analysis and Forecasts, By Data Type

- 12.1. Key Findings

- 12.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By Data Type, 2021-2035

- 12.2.1. Clinical Data

- 12.2.1.1. Patient Demographics

- 12.2.1.2. Medical History

- 12.2.1.3. Diagnosis and Treatment Records

- 12.2.1.4. Medication Records

- 12.2.1.5. Laboratory Results

- 12.2.1.6. Radiology Images

- 12.2.1.7. Vital Signs

- 12.2.1.8. Others

- 12.2.2. Administrative Data

- 12.2.2.1. Billing and Claims Data

- 12.2.2.2. Scheduling Information

- 12.2.2.3. Insurance Information

- 12.2.2.4. Others

- 12.2.3. Financial Data

- 12.2.4. Research Data

- 12.2.1. Clinical Data

- 13. Global Health Data Interoperability Market Analysis and Forecasts, By Integration Type

- 13.1. Key Findings

- 13.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By Integration Type, 2021-2035

- 13.2.1. Internal Integration

- 13.2.1.1. Intra-hospital Systems Integration

- 13.2.1.2. Departmental Integration

- 13.2.2. External Integration

- 13.2.2.1. Inter-hospital Systems Integration

- 13.2.2.2. Provider-to-Payer Integration

- 13.2.2.3. Provider-to-Pharmacy Integration

- 13.2.2.4. Provider-to-Laboratory Integration

- 13.2.1. Internal Integration

- 14. Global Health Data Interoperability Market Analysis and Forecasts, By Technology

- 14.1. Key Findings

- 14.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, By Technology, 2021-2035

- 14.2.1. Application Programming Interfaces (APIs)

- 14.2.1.1. RESTful APIs

- 14.2.1.2. SOAP APIs

- 14.2.2. Enterprise Service Bus (ESB)

- 14.2.3. Blockchain Technology

- 14.2.4. Artificial Intelligence and Machine Learning

- 14.2.5. Internet of Things (IoT)

- 14.2.6. Natural Language Processing (NLP)

- 14.2.1. Application Programming Interfaces (APIs)

- 15. Global Health Data Interoperability Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Health Data Interoperability Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Health Data Interoperability Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Interoperability Level

- 16.3.3. Deployment Mode

- 16.3.4. Standard Type

- 16.3.5. Application

- 16.3.6. End-Use Industry

- 16.3.7. Data Type

- 16.3.8. Integration Type

- 16.3.9. Technology

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Health Data Interoperability Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Interoperability Level

- 16.4.4. Deployment Mode

- 16.4.5. Standard Type

- 16.4.6. Application

- 16.4.7. End-Use Industry

- 16.4.8. Data Type

- 16.4.9. Integration Type

- 16.4.10. Technology

- 16.5. Canada Health Data Interoperability Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Interoperability Level

- 16.5.4. Deployment Mode

- 16.5.5. Standard Type

- 16.5.6. Application

- 16.5.7. End-Use Industry

- 16.5.8. Data Type

- 16.5.9. Integration Type

- 16.5.10. Technology

- 16.6. Mexico Health Data Interoperability Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Interoperability Level

- 16.6.4. Deployment Mode

- 16.6.5. Standard Type

- 16.6.6. Application

- 16.6.7. End-Use Industry

- 16.6.8. Data Type

- 16.6.9. Integration Type

- 16.6.10. Technology

- 17. Europe Health Data Interoperability Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Interoperability Level

- 17.3.3. Deployment Mode

- 17.3.4. Standard Type

- 17.3.5. Application

- 17.3.6. End-Use Industry

- 17.3.7. Data Type

- 17.3.8. Integration Type

- 17.3.9. Technology

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Health Data Interoperability Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Interoperability Level

- 17.4.4. Deployment Mode

- 17.4.5. Standard Type

- 17.4.6. Application

- 17.4.7. End-Use Industry

- 17.4.8. Data Type

- 17.4.9. Integration Type

- 17.4.10. Technology

- 17.5. United Kingdom Health Data Interoperability Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Interoperability Level

- 17.5.4. Deployment Mode

- 17.5.5. Standard Type

- 17.5.6. Application

- 17.5.7. End-Use Industry

- 17.5.8. Data Type

- 17.5.9. Integration Type

- 17.5.10. Technology

- 17.6. France Health Data Interoperability Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Interoperability Level

- 17.6.4. Deployment Mode

- 17.6.5. Standard Type

- 17.6.6. Application

- 17.6.7. End-Use Industry

- 17.6.8. Data Type

- 17.6.9. Integration Type

- 17.6.10. Technology

- 17.7. Italy Health Data Interoperability Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Interoperability Level

- 17.7.4. Deployment Mode

- 17.7.5. Standard Type

- 17.7.6. Application

- 17.7.7. End-Use Industry

- 17.7.8. Data Type

- 17.7.9. Integration Type

- 17.7.10. Technology

- 17.8. Spain Health Data Interoperability Market

- 17.8.1. Component

- 17.8.2. Interoperability Level

- 17.8.3. Deployment Mode

- 17.8.4. Standard Type

- 17.8.5. Application

- 17.8.6. End-Use Industry

- 17.8.7. Data Type

- 17.8.8. Integration Type

- 17.8.9. Technology

- 17.9. Netherlands Health Data Interoperability Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Interoperability Level

- 17.9.4. Deployment Mode

- 17.9.5. Standard Type

- 17.9.6. Application

- 17.9.7. End-Use Industry

- 17.9.8. Data Type

- 17.9.9. Integration Type

- 17.9.10. Technology

- 17.10. Nordic Countries Health Data Interoperability Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Interoperability Level

- 17.10.4. Deployment Mode

- 17.10.5. Standard Type

- 17.10.6. Application

- 17.10.7. End-Use Industry

- 17.10.8. Data Type

- 17.10.9. Integration Type

- 17.10.10. Technology

- 17.11. Poland Health Data Interoperability Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Interoperability Level

- 17.11.4. Deployment Mode

- 17.11.5. Standard Type

- 17.11.6. Application

- 17.11.7. End-Use Industry

- 17.11.8. Data Type

- 17.11.9. Integration Type

- 17.11.10. Technology

- 17.12. Russia & CIS Health Data Interoperability Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Interoperability Level

- 17.12.4. Deployment Mode

- 17.12.5. Standard Type

- 17.12.6. Application

- 17.12.7. End-Use Industry

- 17.12.8. Data Type

- 17.12.9. Integration Type

- 17.12.10. Technology

- 17.13. Rest of Europe Health Data Interoperability Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Interoperability Level

- 17.13.4. Deployment Mode

- 17.13.5. Standard Type

- 17.13.6. Application

- 17.13.7. End-Use Industry

- 17.13.8. Data Type

- 17.13.9. Integration Type

- 17.13.10. Technology

- 18. Asia Pacific Health Data Interoperability Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Interoperability Level

- 18.3.3. Deployment Mode

- 18.3.4. Standard Type

- 18.3.5. Application

- 18.3.6. End-Use Industry

- 18.3.7. Data Type

- 18.3.8. Integration Type

- 18.3.9. Technology

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Health Data Interoperability Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Interoperability Level

- 18.4.4. Deployment Mode

- 18.4.5. Standard Type

- 18.4.6. Application

- 18.4.7. End-Use Industry

- 18.4.8. Data Type

- 18.4.9. Integration Type

- 18.4.10. Technology

- 18.5. India Health Data Interoperability Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Interoperability Level

- 18.5.4. Deployment Mode

- 18.5.5. Standard Type

- 18.5.6. Application

- 18.5.7. End-Use Industry

- 18.5.8. Data Type

- 18.5.9. Integration Type

- 18.5.10. Technology

- 18.6. Japan Health Data Interoperability Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Interoperability Level

- 18.6.4. Deployment Mode

- 18.6.5. Standard Type

- 18.6.6. Application

- 18.6.7. End-Use Industry

- 18.6.8. Data Type

- 18.6.9. Integration Type

- 18.6.10. Technology

- 18.7. South Korea Health Data Interoperability Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Interoperability Level

- 18.7.4. Deployment Mode

- 18.7.5. Standard Type

- 18.7.6. Application

- 18.7.7. End-Use Industry

- 18.7.8. Data Type

- 18.7.9. Integration Type

- 18.7.10. Technology

- 18.8. Australia and New Zealand Health Data Interoperability Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Interoperability Level

- 18.8.4. Deployment Mode

- 18.8.5. Standard Type

- 18.8.6. Application

- 18.8.7. End-Use Industry

- 18.8.8. Data Type

- 18.8.9. Integration Type

- 18.8.10. Technology

- 18.9. Indonesia Health Data Interoperability Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Component

- 18.9.3. Interoperability Level

- 18.9.4. Deployment Mode

- 18.9.5. Standard Type

- 18.9.6. Application

- 18.9.7. End-Use Industry

- 18.9.8. Data Type

- 18.9.9. Integration Type

- 18.9.10. Technology

- 18.10. Malaysia Health Data Interoperability Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Component

- 18.10.3. Interoperability Level

- 18.10.4. Deployment Mode

- 18.10.5. Standard Type

- 18.10.6. Application

- 18.10.7. End-Use Industry

- 18.10.8. Data Type

- 18.10.9. Integration Type

- 18.10.10. Technology

- 18.11. Thailand Health Data Interoperability Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Component

- 18.11.3. Interoperability Level

- 18.11.4. Deployment Mode

- 18.11.5. Standard Type

- 18.11.6. Application

- 18.11.7. End-Use Industry

- 18.11.8. Data Type

- 18.11.9. Integration Type

- 18.11.10. Technology

- 18.12. Vietnam Health Data Interoperability Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Component

- 18.12.3. Interoperability Level

- 18.12.4. Deployment Mode

- 18.12.5. Standard Type

- 18.12.6. Application

- 18.12.7. End-Use Industry

- 18.12.8. Data Type

- 18.12.9. Integration Type

- 18.12.10. Technology

- 18.13. Rest of Asia Pacific Health Data Interoperability Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Component

- 18.13.3. Interoperability Level

- 18.13.4. Deployment Mode

- 18.13.5. Standard Type

- 18.13.6. Application

- 18.13.7. End-Use Industry

- 18.13.8. Data Type

- 18.13.9. Integration Type

- 18.13.10. Technology

- 19. Middle East Health Data Interoperability Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Interoperability Level

- 19.3.3. Deployment Mode

- 19.3.4. Standard Type

- 19.3.5. Application

- 19.3.6. End-Use Industry

- 19.3.7. Data Type

- 19.3.8. Integration Type

- 19.3.9. Technology

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Health Data Interoperability Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Interoperability Level

- 19.4.4. Deployment Mode

- 19.4.5. Standard Type

- 19.4.6. Application

- 19.4.7. End-Use Industry

- 19.4.8. Data Type

- 19.4.9. Integration Type

- 19.4.10. Technology

- 19.5. UAE Health Data Interoperability Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Interoperability Level

- 19.5.4. Deployment Mode

- 19.5.5. Standard Type

- 19.5.6. Application

- 19.5.7. End-Use Industry

- 19.5.8. Data Type

- 19.5.9. Integration Type

- 19.5.10. Technology

- 19.6. Saudi Arabia Health Data Interoperability Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Interoperability Level

- 19.6.4. Deployment Mode

- 19.6.5. Standard Type

- 19.6.6. Application

- 19.6.7. End-Use Industry

- 19.6.8. Data Type

- 19.6.9. Integration Type

- 19.6.10. Technology

- 19.7. Israel Health Data Interoperability Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Interoperability Level

- 19.7.4. Deployment Mode

- 19.7.5. Standard Type

- 19.7.6. Application

- 19.7.7. End-Use Industry

- 19.7.8. Data Type

- 19.7.9. Integration Type

- 19.7.10. Technology

- 19.8. Rest of Middle East Health Data Interoperability Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Interoperability Level

- 19.8.4. Deployment Mode

- 19.8.5. Standard Type

- 19.8.6. Application

- 19.8.7. End-Use Industry

- 19.8.8. Data Type

- 19.8.9. Integration Type

- 19.8.10. Technology

- 20. Africa Health Data Interoperability Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Interoperability Level

- 20.3.3. Deployment Mode

- 20.3.4. Standard Type

- 20.3.5. Application

- 20.3.6. End-Use Industry

- 20.3.7. Data Type

- 20.3.8. Integration Type

- 20.3.9. Technology

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Health Data Interoperability Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Interoperability Level

- 20.4.4. Deployment Mode

- 20.4.5. Standard Type

- 20.4.6. Application

- 20.4.7. End-Use Industry

- 20.4.8. Data Type

- 20.4.9. Integration Type

- 20.4.10. Technology

- 20.5. Egypt Health Data Interoperability Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Interoperability Level

- 20.5.4. Deployment Mode

- 20.5.5. Standard Type

- 20.5.6. Application

- 20.5.7. End-Use Industry

- 20.5.8. Data Type

- 20.5.9. Integration Type

- 20.5.10. Technology

- 20.6. Nigeria Health Data Interoperability Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Interoperability Level

- 20.6.4. Deployment Mode

- 20.6.5. Standard Type

- 20.6.6. Application

- 20.6.7. End-Use Industry

- 20.6.8. Data Type

- 20.6.9. Integration Type

- 20.6.10. Technology

- 20.7. Algeria Health Data Interoperability Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Component

- 20.7.3. Interoperability Level

- 20.7.4. Deployment Mode

- 20.7.5. Standard Type

- 20.7.6. Application

- 20.7.7. End-Use Industry

- 20.7.8. Data Type

- 20.7.9. Integration Type

- 20.7.10. Technology

- 20.8. Rest of Africa Health Data Interoperability Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Component

- 20.8.3. Interoperability Level

- 20.8.4. Deployment Mode

- 20.8.5. Standard Type

- 20.8.6. Application

- 20.8.7. End-Use Industry

- 20.8.8. Data Type

- 20.8.9. Integration Type

- 20.8.10. Technology

- 21. South America Health Data Interoperability Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Health Data Interoperability Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Component

- 21.3.2. Interoperability Level

- 21.3.3. Deployment Mode

- 21.3.4. Standard Type

- 21.3.5. Application

- 21.3.6. End-Use Industry

- 21.3.7. Data Type

- 21.3.8. Integration Type

- 21.3.9. Technology

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Health Data Interoperability Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Component

- 21.4.3. Interoperability Level

- 21.4.4. Deployment Mode

- 21.4.5. Standard Type

- 21.4.6. Application

- 21.4.7. End-Use Industry

- 21.4.8. Data Type

- 21.4.9. Integration Type

- 21.4.10. Technology

- 21.5. Argentina Health Data Interoperability Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Component

- 21.5.3. Interoperability Level

- 21.5.4. Deployment Mode

- 21.5.5. Standard Type

- 21.5.6. Application

- 21.5.7. End-Use Industry

- 21.5.8. Data Type

- 21.5.9. Integration Type

- 21.5.10. Technology

- 21.6. Rest of South America Health Data Interoperability Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Component

- 21.6.3. Interoperability Level

- 21.6.4. Deployment Mode

- 21.6.5. Standard Type

- 21.6.6. Application

- 21.6.7. End-Use Industry

- 21.6.8. Data Type

- 21.6.9. Integration Type

- 21.6.10. Technology

- 22. Key Players/ Company Profile

- 22.1. Allscripts Healthcare Solutions

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Amazon Web Services (AWS)

- 22.3. Cerner Corporation (Oracle Health)

- 22.4. Corepoint Health

- 22.5. Epic Systems Corporation

- 22.6. Google Cloud (Google Health)

- 22.7. Health Catalyst

- 22.8. IBM Corporation

- 22.9. Infor (Cloverleaf Integration Suite)

- 22.10. Inovalon Holdings Inc.

- 22.11. Interfaceware Inc.

- 22.12. InterSystems Corporation

- 22.13. Jvion Inc.

- 22.14. Kno2 LLC

- 22.15. Koninklijke Philips N.V.

- 22.16. Microsoft Corporation

- 22.17. Mulesoft (Salesforce)

- 22.18. Nextgen Healthcare

- 22.19. Oracle Corporation

- 22.20. Orion Health

- 22.21. OSP Labs

- 22.22. Redox Inc.

- 22.23. Smile Digital Health

- 22.24. VigiLanz Corporation

- 22.25. Other Key Players

- 22.1. Allscripts Healthcare Solutions

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation