Hospital-at-Home Market Size, Share & Trends Analysis Report by Service Type (Acute Care Services, Chronic Disease Management, Rehabilitation Services, Palliative Care Services, Preventive Care Services), Technology/Platform, Patient Condition/Disease Type, Care Provider Type, Payment Model, Age Group, Monitoring Intensity, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Hospital-at-Home Market Size, Share, and Growth

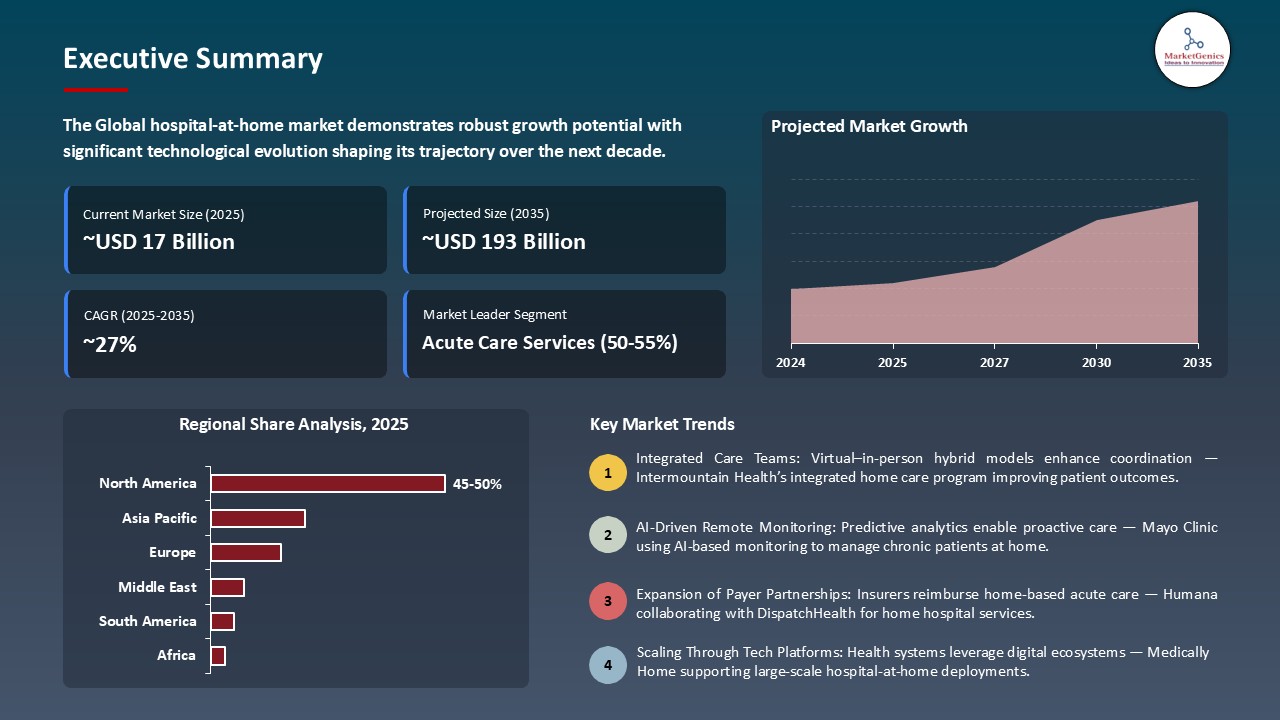

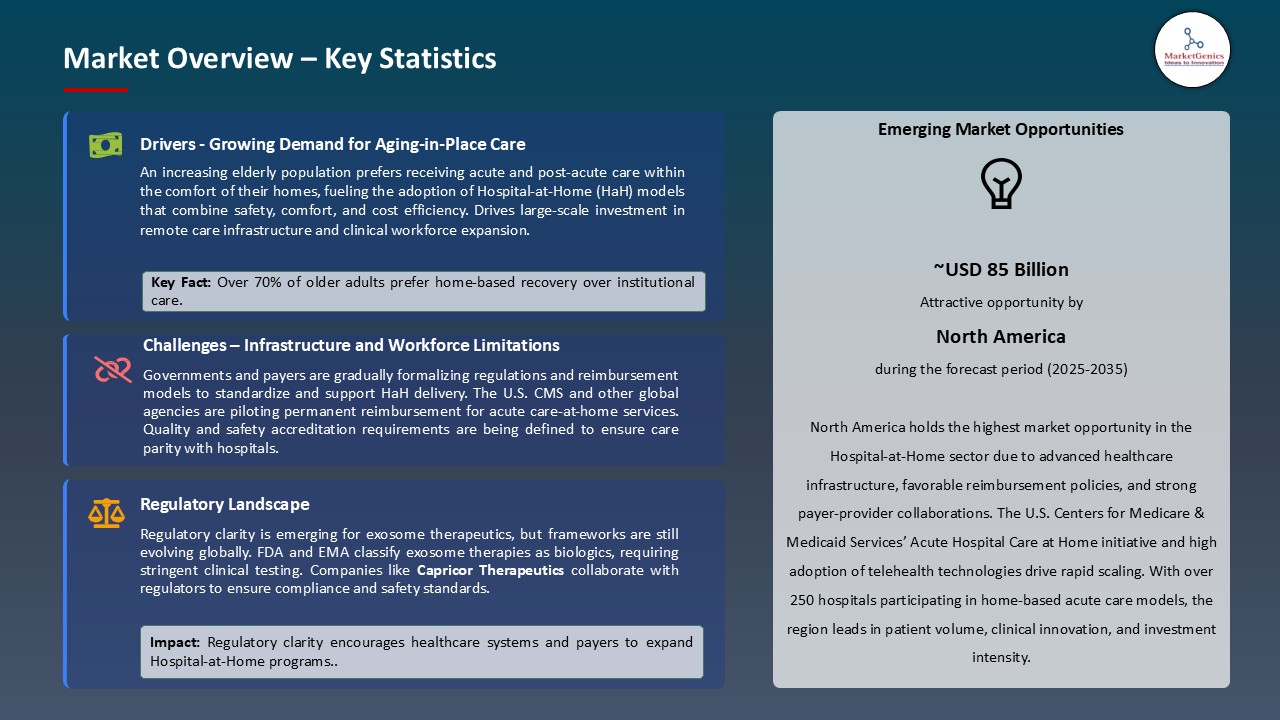

The global hospital-at-home market is witnessing strong growth, valued at USD 17.3 billion in 2025 and projected to reach USD 193.3 billion by 2035, expanding at a CAGR of 27.3% during the forecast period. North America leads the hospital-at-home market due to strong healthcare infrastructure, favorable reimbursement policies, high adoption of telehealth technologies, and growing demand for cost-efficient, patient-centered acute care services.

Nancy Lefebre, chief operating officer and senior vice-president at SE Health, said that, “This innovative and integrated model is reinventing how we deliver authentic patient and family-centered care and inspiring our commitment to home care modernization, through strong partnerships and an interdisciplinary, flexible care model, we facilitate a safe and seamless transition from hospital to home for our patients and their families. We continue to enhance and expand this approach every day”.

The growing occupancy rate in hospitals, workforce shortage, and the growing patient crowd are necessitating the use of alternative forms of acute care delivery models, including Spital-Home programs. In 2025, Cleveland Clinic has extended Hospital Care at Home program to Weston and Broward County where patients could now receive hospital level acute care at home. Since its 2023 introduction, the program has assisted more than 1,800 patients and helped to decrease readmission levels and alleviate pressure on the inpatient hospital capacity.

One of the primary catalysts of the Hospital-at-Home market is government support, with the policies, reimbursement reforms, and investments in digital health infrastructure allowing the expansion of the program, the removal of financial obstacles to providers, and the improvement of patient access to home-based acute care services. As an example, In 2025, the Taiwan National Health Insurance Administration (NHIA) introduced an IoT-based remote patient monitoring system to provide acute hospital care at home, which allows to track the health of patients in real-time and enhance the comfort of patients and their trust in home-based hospital care.

The growing adoption of digital health tools and related connected monitoring devices is allowing the real-time gathering of patient health data, and this creates opportunities of highly personalized Hospital-at-Home care. Through the use of analytics, artificial intelligence, and electronic health record (EHR) integration, the providers will be able to develop tailored care pathways through patient-specific factors, including the severity of the disease, comorbidities, and lifestyle. Indicatively, the Atrium Health introduced an innovative project to transform the post-heart surgery recovery in 2025, which is Spital-Home and digital health ecosystem.

Hospital-at-Home Market Dynamics and Trends

Driver: Patient Preference for Home Recovery Drives Program Adoption

- The increasing tendency of patients to access medical services and recuperate in the comfort of their homes is a major stimulus of the hospital-at-home market. The rationale behind this choice is the wish of having a familiar, stress-free setting that will improve emotional health and accelerate recovery.

- Mayo Clinic, its program, Advanced Care at Home, represents the increased trend in patient-based healthcare provision in the Spital-Home market. The program combines hospital-level remote monitoring, virtual doctor visits, and physical clinical services to treat acute diseases, including heart failure, pneumonia, and post-operative care in the homes of patients. Through the use of digital health platform and coordinated models of care the program has shown better patient outcomes, reduction of recovery times and cost efficiency.

- • The growing use of home-based recovery models is transforming the care delivery models, promoting greater market penetration, cost-efficiency, and satisfaction to patients throughout the Hospital-at-Home market.

Restraint: Regulatory and Payment Policy Uncertainty Limits Program Expansion

- Fragmentation of regulatory regimes and unequal reimbursement policies that make large-scale adoption impossible limit the growth of the hospital-at-home market. Home-based acute care has good clinical evidence, but lacks standardized payment pathways and can be associated with financial risks because of the need to cover most patients under Medicare, Medicaid, and private insurance providers.

- Besides, complicated licensing policies, interstate telehealth policies, and data compliance policies add to the administrative burden and cost of operation. Such uncertainties prevent hospital and technology vendors to invest, which slows down the commercialization and expansion of Hospital-at-Home models in major healthcare markets.

- Moreover, the temporary quality of pandemic-era policy waivers and pilot reimbursement programs has left providers with reluctance to invest long-term in resources due to uncertainty about the future of Spital-Home reimbursement and accreditation.

Opportunity: Technology Advancement Enables More Complex Care Delivery at Home

- Rapid growth of digital health technologies is presenting substantial opportunities to the hospital-at-home market, as it allows through safe and effective management of increasingly complex medical conditions out of the conventional hospital environment.

- Such innovations as AI-based clinical decision support, round-the-clock remote patient monitoring, wearable biosensors, connected medical devices give an opportunity to monitor vital parameters in real time and identify complications in their early stages. Clinical accuracy and coordination of care are also further improved by integrating telehealth platforms with electronic health records (EHRs).

- Texas Health Resources rolled out its Care at Home program in 202 at the Texas Health Harris Methodist Southlake which provided acute care to conditions such as heart failure and pneumonia using remote monitoring, virtual command centers, and in-home clinical teams, and advanced the field of technology-driven care in the Spital-Home market. This program enhances the access to care and minimizes the hospital workload and patient recovery outcomes.

- The innovations and the efforts are accelerating the process of digitalization of the Hospital-at-Home market, increasing its adoption, better patient results, and the provision of more complex acute care at home.

Key Trend: Integrated Care Teams Combine Virtual and In-Person Touchpoints

- The hospital-at-home market is being propelled by the combination of multidisciplinary care teams that organize the virtual and face-to-face interactions to provide coordinated, patient-centred care. This hybrid model helps to improve clinical results because it allows constant monitoring with the help of telehealth tools, and nurses, paramedics, or therapists should visit homes to provide hand-on testing and interventions.

- IHACPA Virtual Care Project in 2025, Australia demonstrated a scalable format of Hospital-at-Home which combines daily visits by clinicians at home with use of remote monitoring and tele-linked physicians/pharmacists. This consultant-led model provided optimal care coordination, enhanced patient outcomes, and alleviated hospital bed pressure, which evidenced the market movement to integrated virtual-physical care delivery in sophisticated home-based models of care.

- Integrated teams combine digital connectivity with face-to-face care that provides real-time oversight and rapid escalation with personalized care which replicates hospital standards at home. Multidisciplinary teams, comprising of physicians, nurses, and pharmacists, use common digital platforms, and thus coordinate smoothly to maximize the outcomes and continuity of care.

- The strategy promotes care continuity, fewer readmissions, and more efficient resource allocation, which makes it a fundamental part of next-generation home-based healthcare delivery.

Hospital-at-Home-Market Analysis and Segmental Data

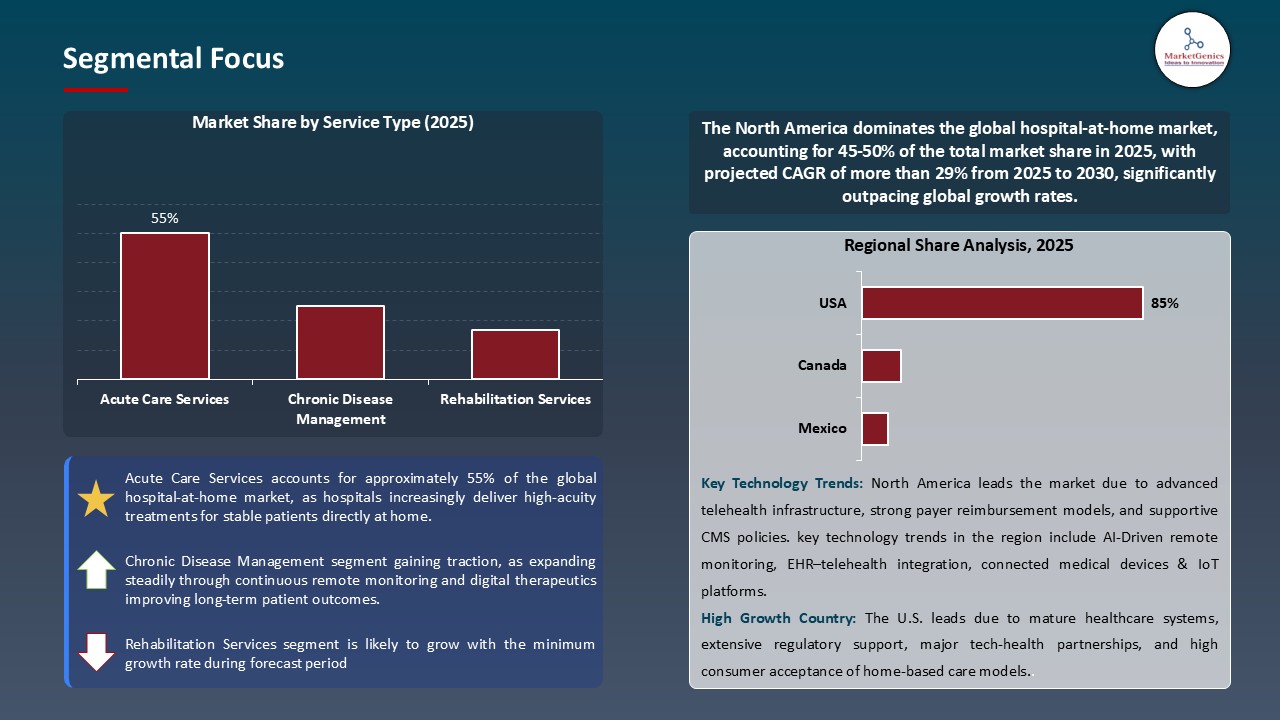

Acute Care Services Dominate Global Hospital-at-Home Market

- Acute care services that are offered by the hospitals constitute the largest part of the world hospital-at-home market, due to the increased adoption of offering hospital-level care to seriously-but-stable medical conditions directly to patients in hospitals These services are usually those related to acute conditions, including pneumonia, chronic obstructive pulmonary disease (COPD) exacerbations, heart failure, among others.

- Hospitals are also actively using virtual rounds and mobile diagnostics and in-home nursing assistance to provide continuity in acute care, ease hospital overcrowding and expenses. The Hospital-Level Care at Home program of Intermountain Health has also achieved a significant goal, including 1,000 Utah patients receiving acute care at home (pneumonia, COPD, and heart failure). The combination of remote monitoring, virtual physician visits, and home-based nursing helped the program to decrease hospital admission and expenses, which further supports the leading role of acute care in the world Spital Home market.

- The active implementation of telehealth and new technologies in monitoring processes is still enhancing the role of acute care as the general service that can support the global hospital-at-home concept.

North America Leads Global Hospital-at-Home Market Demand

- North America holds the position of the largest hospital-at-home market in the world because the region has a well-developed healthcare system, early access to telehealth and remote monitoring technologies, as well as favorable regulatory and reimbursement models. A robust network of medical professionals, insurance firms, and technology developers that work together to provide smooth and quality care at home also supports this leadership.

- Scientific evidence The U.S. and Canada have led in adopting home-based acute care models involving virtual consultation followed by in-person medical support that have resulted in better patient outcomes and fewer hospital readmissions. An example is in October 2025, The Ottawa Hospital opened the first Hospital-at-Home (HaH) program in Ontario, which is quite a significant step in changing the Canadian acute care orientation towards communities.

- The project combines remote monitoring, daily virtual rounds, and face-to-face visits of nurses, which will lead to a decrease in the readmission rate and improve patient satisfaction. Thus, to provide patients with safe, efficient, and patient-centered care at home, the North American health systems are relying on technology and multidisciplinary care models.

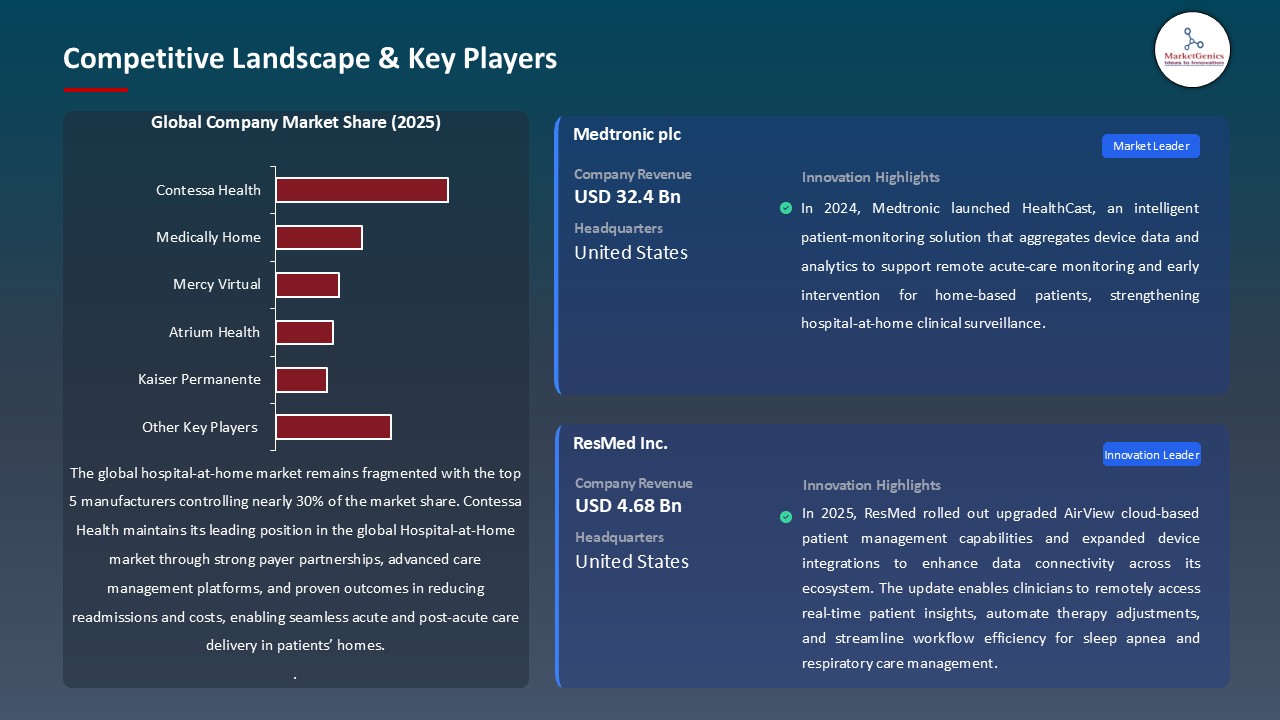

Hospital-at-Home-Market Ecosystem

The global hospital-at-home market is diverse, the major players in the market including Contessa Health, Medically Home, Mercy Virtual, Atrium Health and Kaiser Permanente absorb a market share of roughly 29%. These are organizations that are innovators in providing acute and post-acute hospital-level services at home, with a robust clinical platform, digital platform, and collaborations with health systems and payers. Their approach of combining remote monitoring, virtual consultations and face-to-face care coordination has established benchmarks in how operations and quality are conducted in the industry, providing high barriers to entry.

Moreover, the vendors of technology, telehealth system, and home care service providers are essential ecosystem enablers, which assist in scaled deployment, data interoperability, and adherence to care standards. An example is the case of Medically Home, which is also partnered with leading health systems and technology partners in an attempt to provide high-acuity care that is decentralized and incorporates logistics, analytics, and clinical expertise to evolve the Hospital-at-Home model throughout the world.

Recent Development and Strategic Overview:

- In July 2025, Hackensack Meridian Health expanded its “Hospital From Home” program to two more hospitals in partnership with Medically Home, enabling acute care delivery at patients’ homes through virtual physician oversight, remote monitoring, and in-home clinical support—enhancing patient outcomes, comfort, and operational efficiency in the Hospital-at-Home market.

- In March 2025, SE Health in 2025 expanded its “Acute Care Transitions” programs across Ontario to facilitate seamless patient movement from hospital to home, reflecting the growing momentum of the Hospital-at-Home market. The initiative delivers up to 16 weeks of bundled, multidisciplinary care supported by remote patient monitoring (RPM) technology, enabling real-time tracking of vital signs and virtual clinician oversight.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 17.3 Bn |

|

Market Forecast Value in 2035 |

USD 193.3 Bn |

|

Growth Rate (CAGR) |

27.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Hospital-at-Home-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Hospital-at-Home Market, By Service Type |

|

|

Hospital-at-Home Market, By Technology/Platform |

|

|

Hospital-at-Home Market, By Patient Condition/Disease Type |

|

|

Hospital-at-Home Market, By Care Provider Type |

|

|

Hospital-at-Home Market, By Payment Model |

|

|

Hospital-at-Home Market, By Age Group |

|

|

Hospital-at-Home Market, By Monitoring Intensity |

|

|

Hospital-at-Home Market, By End-users |

|

Frequently Asked Questions

The global hospital-at-home market was valued at USD 17.3 Bn in 2025

The global hospital-at-home market industry is expected to grow at a CAGR of 27.3% from 2025 to 2035

The key factors driving the demand for the hospital-at-home market include rising healthcare costs, increasing prevalence of chronic diseases, advancements in remote monitoring technologies, patient preference for home-based recovery, and growing focus on reducing hospital readmissions and capacity burdens

In terms of service type, the acute care services segment accounted for the major share in 2025

North America is the most attractive region for hospital-at-home market vendors

Adventist Health, Advocate Aurora Health, Atrium Health, Avera Health, Banner Health, Cleveland Clinic, CommonSpirit Health, Contessa Health, Geisinger Health System, Intermountain Healthcare, Johns Hopkins Medicine, Kaiser Permanente, Mayo Clinic, Medically Home, Mercy Virtual, Mount Sinai Health System, Ochsner Health, Presbyterian Healthcare Services, Sharp HealthCare, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Hospital-at-Home Market Outlook

- 2.1.1. Hospital-at-Home Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Hospital-at-Home Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Ageing population and rising chronic-disease burden

- 4.1.1.2. Payer and provider incentives for lower-cost, value-based care (reimbursement expansion)

- 4.1.1.3. Advances in remote monitoring, telehealth and home-based clinical technologies

- 4.1.2. Restraints

- 4.1.2.1. Fragmented regulation, licensure and inconsistent reimbursement across regions

- 4.1.2.2. Clinical safety/logistics challenges, limited acute-care capability, workforce and supply-chain constraints

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Technology Providers

- 4.4.2. Medical Equipment & Device Manufacturers

- 4.4.3. Connectivity & Infrastructure Providers

- 4.4.4. Healthcare Providers

- 4.4.5. Care Coordination & Logistics Partners

- 4.4.6. Payers & Insurers

- 4.4.7. Patients & Caregivers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Hospital-at-Home Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Hospital-at-Home Market Analysis, By Service Type

- 6.1. Key Segment Analysis

- 6.2. Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, Service Type, 2021-2035

- 6.2.1. Acute Care Services

- 6.2.1.1. Post-surgical care

- 6.2.1.2. Infection management

- 6.2.1.3. Respiratory care

- 6.2.1.4. Others

- 6.2.2. Chronic Disease Management

- 6.2.2.1. Diabetes management

- 6.2.2.2. Heart failure monitoring

- 6.2.2.3. COPD management

- 6.2.2.4. Others

- 6.2.3. Rehabilitation Services

- 6.2.3.1. Post-stroke rehabilitation

- 6.2.3.2. Orthopedic rehabilitation

- 6.2.3.3. Cardiac rehabilitation

- 6.2.3.4. Others

- 6.2.4. Palliative Care Services

- 6.2.5. Preventive Care Services

- 6.2.1. Acute Care Services

- 7. Global Hospital-at-Home Market Analysis, By Technology/Platform

- 7.1. Key Segment Analysis

- 7.2. Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology/Platform, 2021-2035

- 7.2.1. Remote Patient Monitoring (RPM) Systems

- 7.2.1.1. Wearable devices

- 7.2.1.2. Connected medical devices

- 7.2.1.3. Mobile health applications

- 7.2.1.4. Others

- 7.2.2. Telehealth Platforms

- 7.2.2.1. Video consultation systems

- 7.2.2.2. AI-powered diagnostic tools

- 7.2.2.3. Others

- 7.2.3. Electronic Health Records (EHR) Integration

- 7.2.4. Point-of-Care Testing Devices

- 7.2.5. Medication Management Systems

- 7.2.1. Remote Patient Monitoring (RPM) Systems

- 8. Global Hospital-at-Home Market Analysis and Forecasts,By Patient Condition/Disease Type

- 8.1. Key Findings

- 8.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, By Patient Condition/Disease Type, 2021-2035

- 8.2.1. Cardiovascular Diseases

- 8.2.2. Respiratory Diseases

- 8.2.3. Infectious Diseases

- 8.2.4. Neurological Disorders

- 8.2.5. Orthopedic Conditions

- 8.2.6. Post-operative Recovery

- 8.2.7. Cancer Care

- 8.2.8. Geriatric Care

- 8.2.9. Wound Care

- 9. Global Hospital-at-Home Market Analysis and Forecasts, By Care Provider Type

- 9.1. Key Findings

- 9.2. Hospital-at-Home Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Care Provider Type, 2021-2035

- 9.2.1. Hospital-Operated Programs

- 9.2.2. Independent Home Healthcare Agencies

- 9.2.3. Physician Group Practices

- 9.2.4. Health System Networks

- 9.2.5. Virtual Hospital Operators

- 9.2.6. Hybrid Models

- 10. Global Hospital-at-Home Market Analysis and Forecasts, By Payment Model

- 10.1. Key Findings

- 10.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, By Payment Model, 2021-2035

- 10.2.1. Fee-for-Service

- 10.2.2. Bundled Payment Models

- 10.2.3. Value-Based Care Contracts

- 10.2.4. Insurance-Based Reimbursement

- 10.2.5. Out-of-Pocket Payment

- 11. Global Hospital-at-Home Market Analysis and Forecasts, By Age Group

- 11.1. Key Findings

- 11.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, By Age Group, 2021-2035

- 11.2.1. Pediatric

- 11.2.2. Adults

- 11.2.3. Elderly

- 11.2.3.1. Young elderly (65-74)

- 11.2.3.2. Old elderly (75-84)

- 11.2.3.3. Oldest old (85+)

- 12. Global Hospital-at-Home Market Analysis and Forecasts, By Monitoring Intensity

- 12.1. Key Findings

- 12.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, By Monitoring Intensity, 2021-2035

- 12.2.1. 24/7 Surveillance

- 12.2.2. Multiple Daily Check-ins

- 12.2.3. Periodic Assessments

- 12.2.4. On-Demand Monitoring

- 13. Global Hospital-at-Home Market Analysis and Forecasts, By End-users

- 13.1. Key Findings

- 13.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 13.2.1. Healthcare Providers

- 13.2.2. Healthcare Payers/Insurance Companies

- 13.2.3. Patients/Caregivers

- 13.2.4. Government & Public Health Organizations

- 13.2.5. Others

- 14. Global Hospital-at-Home Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Hospital-at-Home Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Hospital-at-Home Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Service Type

- 15.3.2. Technology/Platform

- 15.3.3. Patient Condition/Disease Type

- 15.3.4. Care Provider Type

- 15.3.5. Payment Model

- 15.3.6. Age Group

- 15.3.7. Monitoring Intensity

- 15.3.8. End-Users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Hospital-at-Home Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Service Type

- 15.4.3. Technology/Platform

- 15.4.4. Patient Condition/Disease Type

- 15.4.5. Care Provider Type

- 15.4.6. Payment Model

- 15.4.7. Age Group

- 15.4.8. Monitoring Intensity

- 15.4.9. End-Users

- 15.5. Canada Hospital-at-Home Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Service Type

- 15.5.3. Technology/Platform

- 15.5.4. Patient Condition/Disease Type

- 15.5.5. Care Provider Type

- 15.5.6. Payment Model

- 15.5.7. Age Group

- 15.5.8. Monitoring Intensity

- 15.5.9. End-Users

- 15.6. Mexico Hospital-at-Home Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Service Type

- 15.6.3. Technology/Platform

- 15.6.4. Patient Condition/Disease Type

- 15.6.5. Care Provider Type

- 15.6.6. Payment Model

- 15.6.7. Age Group

- 15.6.8. Monitoring Intensity

- 15.6.9. End-Users

- 16. Europe Hospital-at-Home Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Service Type

- 16.3.2. Technology/Platform

- 16.3.3. Patient Condition/Disease Type

- 16.3.4. Care Provider Type

- 16.3.5. Payment Model

- 16.3.6. Age Group

- 16.3.7. Monitoring Intensity

- 16.3.8. End-Users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Hospital-at-Home Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Service Type

- 16.4.3. Technology/Platform

- 16.4.4. Patient Condition/Disease Type

- 16.4.5. Care Provider Type

- 16.4.6. Payment Model

- 16.4.7. Age Group

- 16.4.8. Monitoring Intensity

- 16.4.9. End-Users

- 16.5. United Kingdom Hospital-at-Home Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Service Type

- 16.5.3. Technology/Platform

- 16.5.4. Patient Condition/Disease Type

- 16.5.5. Care Provider Type

- 16.5.6. Payment Model

- 16.5.7. Age Group

- 16.5.8. Monitoring Intensity

- 16.5.9. End-Users

- 16.6. France Hospital-at-Home Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Service Type

- 16.6.3. Technology/Platform

- 16.6.4. Patient Condition/Disease Type

- 16.6.5. Care Provider Type

- 16.6.6. Payment Model

- 16.6.7. Age Group

- 16.6.8. Monitoring Intensity

- 16.6.9. End-Users

- 16.7. Italy Hospital-at-Home Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Service Type

- 16.7.3. Technology/Platform

- 16.7.4. Patient Condition/Disease Type

- 16.7.5. Care Provider Type

- 16.7.6. Payment Model

- 16.7.7. Age Group

- 16.7.8. Monitoring Intensity

- 16.7.9. End-Users

- 16.8. Spain Hospital-at-Home Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Service Type

- 16.8.3. Technology/Platform

- 16.8.4. Patient Condition/Disease Type

- 16.8.5. Care Provider Type

- 16.8.6. Payment Model

- 16.8.7. Age Group

- 16.8.8. Monitoring Intensity

- 16.8.9. End-Users

- 16.9. Netherlands Hospital-at-Home Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Service Type

- 16.9.3. Technology/Platform

- 16.9.4. Patient Condition/Disease Type

- 16.9.5. Care Provider Type

- 16.9.6. Payment Model

- 16.9.7. Age Group

- 16.9.8. Monitoring Intensity

- 16.9.9. End-Users

- 16.10. Nordic Countries Hospital-at-Home Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Service Type

- 16.10.3. Technology/Platform

- 16.10.4. Patient Condition/Disease Type

- 16.10.5. Care Provider Type

- 16.10.6. Payment Model

- 16.10.7. Age Group

- 16.10.8. Monitoring Intensity

- 16.10.9. End-Users

- 16.11. Poland Hospital-at-Home Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Service Type

- 16.11.3. Technology/Platform

- 16.11.4. Patient Condition/Disease Type

- 16.11.5. Care Provider Type

- 16.11.6. Payment Model

- 16.11.7. Age Group

- 16.11.8. Monitoring Intensity

- 16.11.9. End-Users

- 16.12. Russia & CIS Hospital-at-Home Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Service Type

- 16.12.3. Technology/Platform

- 16.12.4. Patient Condition/Disease Type

- 16.12.5. Care Provider Type

- 16.12.6. Payment Model

- 16.12.7. Age Group

- 16.12.8. Monitoring Intensity

- 16.12.9. End-Users

- 16.13. Rest of Europe Hospital-at-Home Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Service Type

- 16.13.3. Technology/Platform

- 16.13.4. Patient Condition/Disease Type

- 16.13.5. Care Provider Type

- 16.13.6. Payment Model

- 16.13.7. Age Group

- 16.13.8. Monitoring Intensity

- 16.13.9. End-Users

- 17. Asia Pacific Hospital-at-Home Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Service Type

- 17.3.2. Technology/Platform

- 17.3.3. Patient Condition/Disease Type

- 17.3.4. Care Provider Type

- 17.3.5. Payment Model

- 17.3.6. Age Group

- 17.3.7. Monitoring Intensity

- 17.3.8. End-Users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Hospital-at-Home Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Service Type

- 17.4.3. Technology/Platform

- 17.4.4. Patient Condition/Disease Type

- 17.4.5. Care Provider Type

- 17.4.6. Payment Model

- 17.4.7. Age Group

- 17.4.8. Monitoring Intensity

- 17.4.9. End-Users

- 17.5. India Hospital-at-Home Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Service Type

- 17.5.3. Technology/Platform

- 17.5.4. Patient Condition/Disease Type

- 17.5.5. Care Provider Type

- 17.5.6. Payment Model

- 17.5.7. Age Group

- 17.5.8. Monitoring Intensity

- 17.5.9. End-Users

- 17.6. Japan Hospital-at-Home Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Service Type

- 17.6.3. Technology/Platform

- 17.6.4. Patient Condition/Disease Type

- 17.6.5. Care Provider Type

- 17.6.6. Payment Model

- 17.6.7. Age Group

- 17.6.8. Monitoring Intensity

- 17.6.9. End-Users

- 17.7. South Korea Hospital-at-Home Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Service Type

- 17.7.3. Technology/Platform

- 17.7.4. Patient Condition/Disease Type

- 17.7.5. Care Provider Type

- 17.7.6. Payment Model

- 17.7.7. Age Group

- 17.7.8. Monitoring Intensity

- 17.7.9. End-Users

- 17.8. Australia and New Zealand Hospital-at-Home Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Service Type

- 17.8.3. Technology/Platform

- 17.8.4. Patient Condition/Disease Type

- 17.8.5. Care Provider Type

- 17.8.6. Payment Model

- 17.8.7. Age Group

- 17.8.8. Monitoring Intensity

- 17.8.9. End-Users

- 17.9. Indonesia Hospital-at-Home Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Service Type

- 17.9.3. Technology/Platform

- 17.9.4. Patient Condition/Disease Type

- 17.9.5. Care Provider Type

- 17.9.6. Payment Model

- 17.9.7. Age Group

- 17.9.8. Monitoring Intensity

- 17.9.9. End-Users

- 17.10. Malaysia Hospital-at-Home Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Service Type

- 17.10.3. Technology/Platform

- 17.10.4. Patient Condition/Disease Type

- 17.10.5. Care Provider Type

- 17.10.6. Payment Model

- 17.10.7. Age Group

- 17.10.8. Monitoring Intensity

- 17.10.9. End-Users

- 17.11. Thailand Hospital-at-Home Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Service Type

- 17.11.3. Technology/Platform

- 17.11.4. Patient Condition/Disease Type

- 17.11.5. Care Provider Type

- 17.11.6. Payment Model

- 17.11.7. Age Group

- 17.11.8. Monitoring Intensity

- 17.11.9. End-Users

- 17.12. Vietnam Hospital-at-Home Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Service Type

- 17.12.3. Technology/Platform

- 17.12.4. Patient Condition/Disease Type

- 17.12.5. Care Provider Type

- 17.12.6. Payment Model

- 17.12.7. Age Group

- 17.12.8. Monitoring Intensity

- 17.12.9. End-Users

- 17.13. Rest of Asia Pacific Hospital-at-Home Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Service Type

- 17.13.3. Technology/Platform

- 17.13.4. Patient Condition/Disease Type

- 17.13.5. Care Provider Type

- 17.13.6. Payment Model

- 17.13.7. Age Group

- 17.13.8. Monitoring Intensity

- 17.13.9. End-Users

- 18. Middle East Hospital-at-Home Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Service Type

- 18.3.2. Technology/Platform

- 18.3.3. Patient Condition/Disease Type

- 18.3.4. Care Provider Type

- 18.3.5. Payment Model

- 18.3.6. Age Group

- 18.3.7. Monitoring Intensity

- 18.3.8. End-Users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Hospital-at-Home Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Service Type

- 18.4.3. Technology/Platform

- 18.4.4. Patient Condition/Disease Type

- 18.4.5. Care Provider Type

- 18.4.6. Payment Model

- 18.4.7. Age Group

- 18.4.8. Monitoring Intensity

- 18.4.9. End-Users

- 18.5. UAE Hospital-at-Home Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Service Type

- 18.5.3. Technology/Platform

- 18.5.4. Patient Condition/Disease Type

- 18.5.5. Care Provider Type

- 18.5.6. Payment Model

- 18.5.7. Age Group

- 18.5.8. Monitoring Intensity

- 18.5.9. End-Users

- 18.6. Saudi Arabia Hospital-at-Home Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Service Type

- 18.6.3. Technology/Platform

- 18.6.4. Patient Condition/Disease Type

- 18.6.5. Care Provider Type

- 18.6.6. Payment Model

- 18.6.7. Age Group

- 18.6.8. Monitoring Intensity

- 18.6.9. End-Users

- 18.7. Israel Hospital-at-Home Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Service Type

- 18.7.3. Technology/Platform

- 18.7.4. Patient Condition/Disease Type

- 18.7.5. Care Provider Type

- 18.7.6. Payment Model

- 18.7.7. Age Group

- 18.7.8. Monitoring Intensity

- 18.7.9. End-Users

- 18.8. Rest of Middle East Hospital-at-Home Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Service Type

- 18.8.3. Technology/Platform

- 18.8.4. Patient Condition/Disease Type

- 18.8.5. Care Provider Type

- 18.8.6. Payment Model

- 18.8.7. Age Group

- 18.8.8. Monitoring Intensity

- 18.8.9. End-Users

- 19. Africa Hospital-at-Home Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Service Type

- 19.3.2. Technology/Platform

- 19.3.3. Patient Condition/Disease Type

- 19.3.4. Care Provider Type

- 19.3.5. Payment Model

- 19.3.6. Age Group

- 19.3.7. Monitoring Intensity

- 19.3.8. End-Users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Hospital-at-Home Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Service Type

- 19.4.3. Technology/Platform

- 19.4.4. Patient Condition/Disease Type

- 19.4.5. Care Provider Type

- 19.4.6. Payment Model

- 19.4.7. Age Group

- 19.4.8. Monitoring Intensity

- 19.4.9. End-Users

- 19.5. Egypt Hospital-at-Home Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Service Type

- 19.5.3. Technology/Platform

- 19.5.4. Patient Condition/Disease Type

- 19.5.5. Care Provider Type

- 19.5.6. Payment Model

- 19.5.7. Age Group

- 19.5.8. Monitoring Intensity

- 19.5.9. End-Users

- 19.6. Nigeria Hospital-at-Home Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Service Type

- 19.6.3. Technology/Platform

- 19.6.4. Patient Condition/Disease Type

- 19.6.5. Care Provider Type

- 19.6.6. Payment Model

- 19.6.7. Age Group

- 19.6.8. Monitoring Intensity

- 19.6.9. End-Users

- 19.7. Algeria Hospital-at-Home Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Service Type

- 19.7.3. Technology/Platform

- 19.7.4. Patient Condition/Disease Type

- 19.7.5. Care Provider Type

- 19.7.6. Payment Model

- 19.7.7. Age Group

- 19.7.8. Monitoring Intensity

- 19.7.9. End-Users

- 19.8. Rest of Africa Hospital-at-Home Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Service Type

- 19.8.3. Technology/Platform

- 19.8.4. Patient Condition/Disease Type

- 19.8.5. Care Provider Type

- 19.8.6. Payment Model

- 19.8.7. Age Group

- 19.8.8. Monitoring Intensity

- 19.8.9. End-Users

- 20. South America Hospital-at-Home Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Hospital-at-Home Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Service Type

- 20.3.2. Technology/Platform

- 20.3.3. Patient Condition/Disease Type

- 20.3.4. Care Provider Type

- 20.3.5. Payment Model

- 20.3.6. Age Group

- 20.3.7. Monitoring Intensity

- 20.3.8. End-Users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Hospital-at-Home Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Service Type

- 20.4.3. Technology/Platform

- 20.4.4. Patient Condition/Disease Type

- 20.4.5. Care Provider Type

- 20.4.6. Payment Model

- 20.4.7. Age Group

- 20.4.8. Monitoring Intensity

- 20.4.9. End-Users

- 20.5. Argentina Hospital-at-Home Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Service Type

- 20.5.3. Technology/Platform

- 20.5.4. Patient Condition/Disease Type

- 20.5.5. Care Provider Type

- 20.5.6. Payment Model

- 20.5.7. Age Group

- 20.5.8. Monitoring Intensity

- 20.5.9. End-Users

- 20.6. Rest of South America Hospital-at-Home Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Service Type

- 20.6.3. Technology/Platform

- 20.6.4. Patient Condition/Disease Type

- 20.6.5. Care Provider Type

- 20.6.6. Payment Model

- 20.6.7. Age Group

- 20.6.8. Monitoring Intensity

- 20.6.9. End-Users

- 21. Key Players/ Company Profile

- 21.1. Adventist Health

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Advocate Aurora Health

- 21.3. Atrium Health

- 21.4. Avera Health

- 21.5. Banner Health

- 21.6. Cleveland Clinic

- 21.7. CommonSpirit Health

- 21.8. Contessa Health

- 21.9. Geisinger Health System

- 21.10. Intermountain Healthcare

- 21.11. Johns Hopkins Medicine

- 21.12. Kaiser Permanente

- 21.13. Mayo Clinic

- 21.14. Medically Home

- 21.15. Mercy Virtual

- 21.16. Mount Sinai Health System

- 21.17. Ochsner Health

- 21.18. Presbyterian Healthcare Services

- 21.19. Sharp HealthCare

- 21.20. Other Key Players

- 21.1. Adventist Health

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data