Household Cleaning Products Market Size, Share & Trends Analysis Report by Product Type (Surface Cleaners, Dishwashing Products, Toilet Care Products, Specialty Cleaners), Form, Formulation, Packaging Type, Distribution Channel, Price Range, Fragrance Type, Pack Size, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Household Cleaning Products Market Size, Share, and Growth

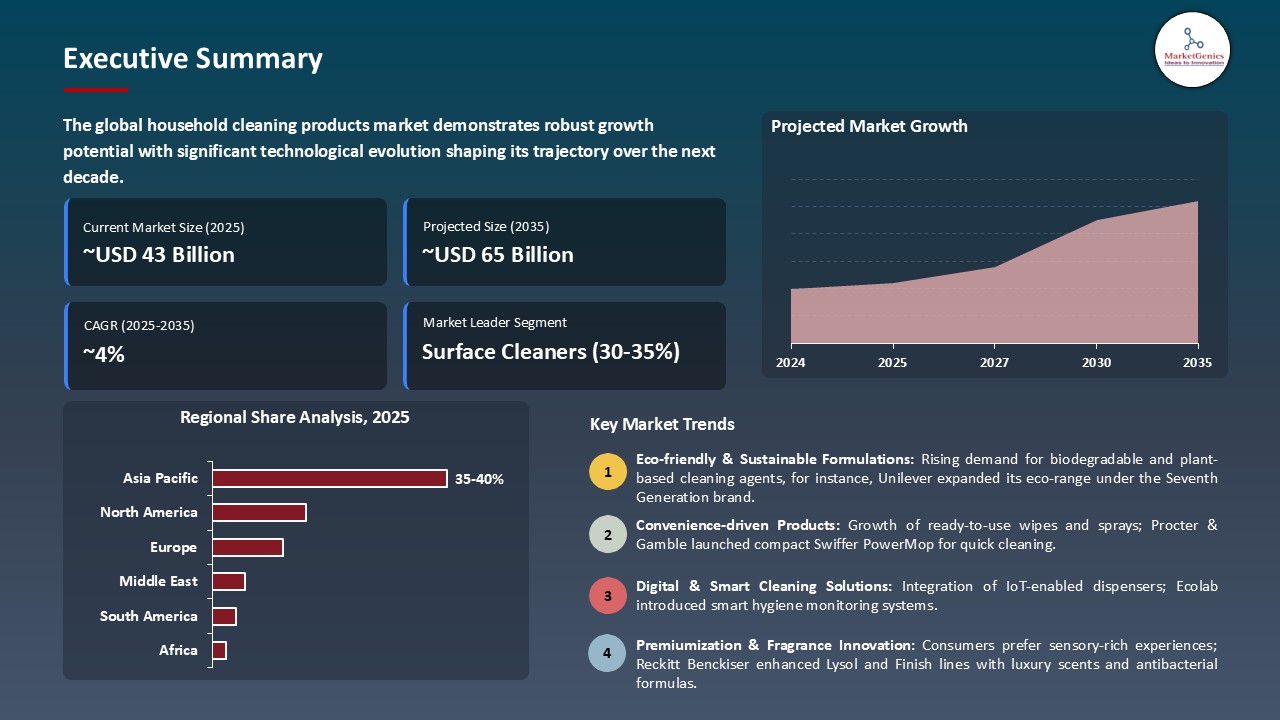

The global household cleaning products market is experiencing robust growth, with its estimated value of USD 42.8 billion in the year 2025 and USD 64.6 billion by 2035, registering a CAGR of 4.2%, during the forecast period. The household cleaning products market is boosted due to the need for convenience and efficiency boosts the popularity of multi-purpose and time-saving products like sprays and wipes.

Eduardo Campanella, Business Group President of Unilever Home Care said,

“We’re challenging traditional cleaning norms and how people think about cleaning their homes by creating a disruptive cleaning product that harnesses the potency of nature’s probiotics, to not just clean our homes but also to provide a longer-lasting clean.”

The global household cleaning products market has been on a growth path due to increases in post-pandemic hygiene awareness that continues to fuel market expansion in disinfecting and antibacterial formulations especially in residential areas and households as people focus on enhanced long-term health and sanitized surfaces in their daily cleaning routines, alongside complementary hygiene accessories such as soap dispenser used in everyday cleaning habits. As an example, in April 2025, Unilever introduced its Cif Infinite Clean probiotic cleaning spray that is a hard and soft surface, pet- and child-safe, and that has continuing cleaning action that lasts days after use. This rising emphasis on higher hygiene and health-sensitive cleaning agents is driving the product innovation and product premiumization in the entire household cleaning industry, enhancing brand differentiation and engaging the market to grow steadily through consumer loyalty and value-added products.

Also, the high environmental laws, combined with the increasing interest in environmentally friendly products by consumers, are driving the growth of the global household cleaning products sector as manufacturers are inventing to match product ranges with the trend in purchasing environmentally friendly products and the requirement of environmental compliance. An example in point is the launching in 2025 of a household cleaning brand, Blueland, which has tablet-to-water formulations, plant-based ingredients, compostable packaging, and 1,800 stores of Target in the U.S.

Air purification systems and HVAC solutions to supplement surface cleaning regimens are the leading market prospects of the global household cleaning products market. Cross-category bundling is made possible by laundry care products such as detergents and fabric softeners. Brand Equity is extended through personal hygiene products like hand sanitizers as well as antibacterial soaps. The storage products at home improve the ease of finding cleaning products. Professional cleaning services and business cleaning equipment are those B2B growth opportunities that can be used to play on the recognition of the residential brand, including adjacent segments such as contract cleaning services. This side-by-side opportunity generates a complete ecosystem of home hygiene, turbulent revenues and greater customer lifetime value through combined product lines and cross-selling economies.

Household Cleaning Products Market Dynamics and Trends

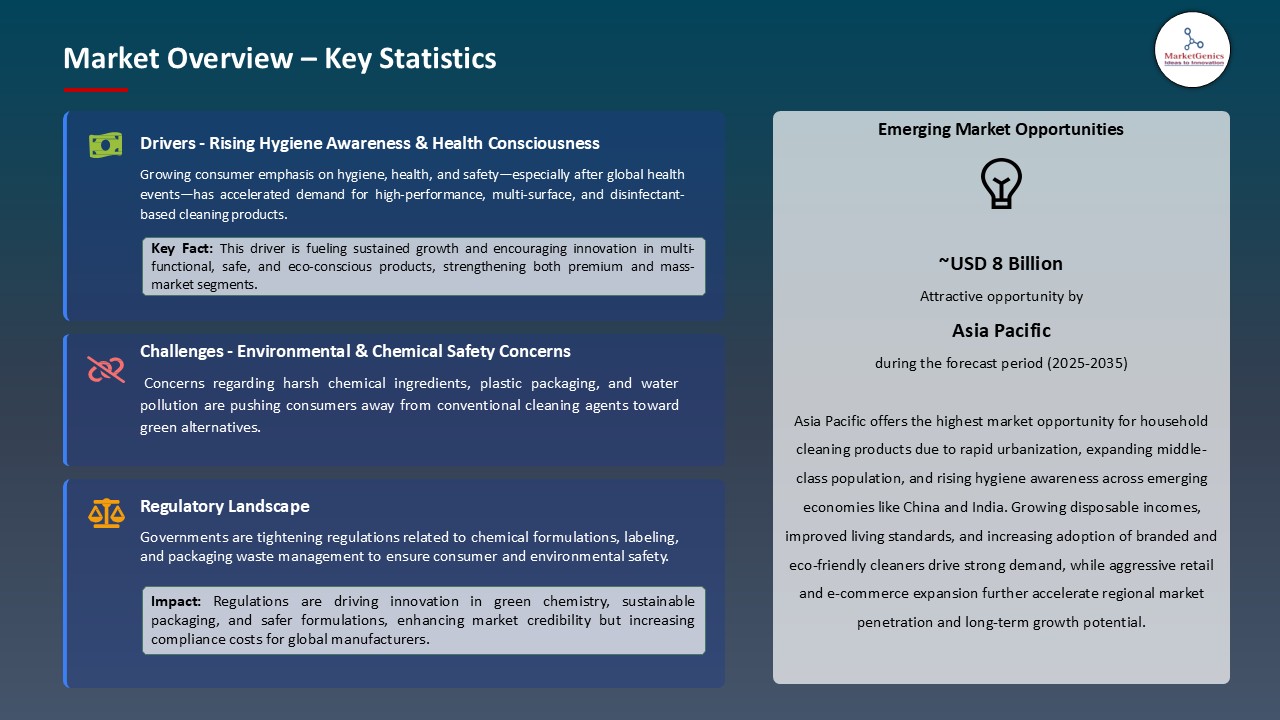

Driver: Escalating Consumer Focus on Health, Hygiene Standards and Pathogen Elimination

- The growth of the household cleaning products market is driven by the behavioral changes of the pandemic have irrevocably increased the world level of hygiene, which facilitates the permanent growth of the market of disinfectant and antimicrobial cleaning agents. Increased concern of consumers with surface hygiene leads to higher cleaning frequency and preference to more premium and high-efficacy formulations that guarantee better protection and long-term health protection. An example is that in August 2024, Clorox EcoClean (of The Clorox Company) released plant-based disinfecting wipes, which destroy 99.9% of germs, with a completely plant-based substrate and natural actives as a mirror of premium, hygiene-oriented, high-efficacy positioning.

- Moreover, medical-grade hygiene requirements are also expanding into residential markets to create demand of household cleaning products that provide hospital-level disinfection and efficacy, which contribute to the long-term growth of markets in high-quality and antimicrobial formulations. As an example, in May 2024, Diversey has also incorporated Oxivir Three 64 as an addition to its leading Oxivir product brand. The emergence of hospital grade disinfectant recipe is increasing the need of high quality and high efficiency cleaning agent, strengthening the consumer trust in high quality hygiene products and pushing the market to continue growing steadily both at household and business level.

Restraint: Environmental Concerns Regarding Chemical Compositions and Packaging Waste Generation

- The increased consciousness of chemical toxicity and environmental impact is dampening the growth of the household cleaning products market of conventional cleaning products because regulatory restrictions on VOCs, phosphates, and synthetic fragrances limit formulation flexibility and change demand to eco-certified, safer, and more environmentally responsible products.

- As an example, the European Chemicals Agency (ECHA) has tightened REACH restrictions on volatile organic compounds and phosphates used in household cleaning formulations in 2025, which will provoke manufacturers to repackage products with biodegradable, plant-based ingredients and catalyze the use of eco-certified and low-toxicity alternatives into major markets.

- Also, the complexity of production and cost premiums of biodegradable ingredients are high, and the price competitiveness is limited, which is limiting the market penetration of sustainable cleaning formulations in the market as compared to conventional products.

- Moreover, environmental limitations require major reformulation, investments and packaging innovations that may squeeze margins and divide conventional and sustainable product markets.

Opportunity: Strategic Development of Concentrated Formulas and Refill-Based Business Models

- The household cleaning products market is presenting as a massive potential in the world market because the trend of resource efficiency is providing the opportunity to focus on concentrated and refillable washing products and decreasing the packaging and shipping expenses and frequent revenues into the hands of consumers as subscriptions generate convenience and a brand that builds loyalty. As an example, in 2025, Clean Cult has introduced its cleaning products in paper-based cartons in 1,800 Paper-based cartons in Target stores with a $5 million extension in Series B. This will be a big milestone in the company development, as its mission is to deliver its refillable, low-waste program to millions of households and contribute to the further development of the country.

- Also, new market opportunities are being introduced through development of sustainable packaging technology, such as biodegradable pods, water-soluble film formats, that do not require the conventional plastic containers, create less waste, and make household cleaning products convenient and environmentally better in the industry. As an example, in 2025, Grove Co. introduced toilet cleaner pods with a film based on zero-waste which is a polyvinyl alcohol (PVA) reduced by approximately 38% and a home-compostable pouch.

Key Trend: Digital Integration and Smart Dispensing Technologies Enhancing User Experience

- The IoT-enabled dispensing systems, linked mobile applications, and automated reordering systems are transforming the household cleaning products market. These intelligent technologies help to make operations more efficient by optimizing product dosage, reducing waste, and allowing data-driven personalization, as well as facilitating predictive consumption analytics, which create consumer engagement and sustainable consumption patterns. An example would be a white paper published by Roborock in cooperation with IDC in January 2024, describing how the integration of AI and IoT in cleaning machines will be used to rationalize smart-home ecosystems, allowing analytics of usage, predictive maintenance and automated cleaning processes.

- Moreover, data-driven personalization is also fueling market expansion with the help of e-commerce solutions that incorporate purchase analytics to present personalized bundles and subscriptions, and through the use of augmented reality that will help a consumer select their products to fit particular surfaces and cleaning purposes. In April 2024, as an example, Bloomreach Discovery introduced built-in product-recommendation functionalities that are more powered by AI, such as Frequently Bought Together and visual-recommendation algorithms, allowing online sellers to better adjust bundles and subscriptions to the behavior of individual shoppers.

Household Cleaning Products Market Analysis and Segmental Data

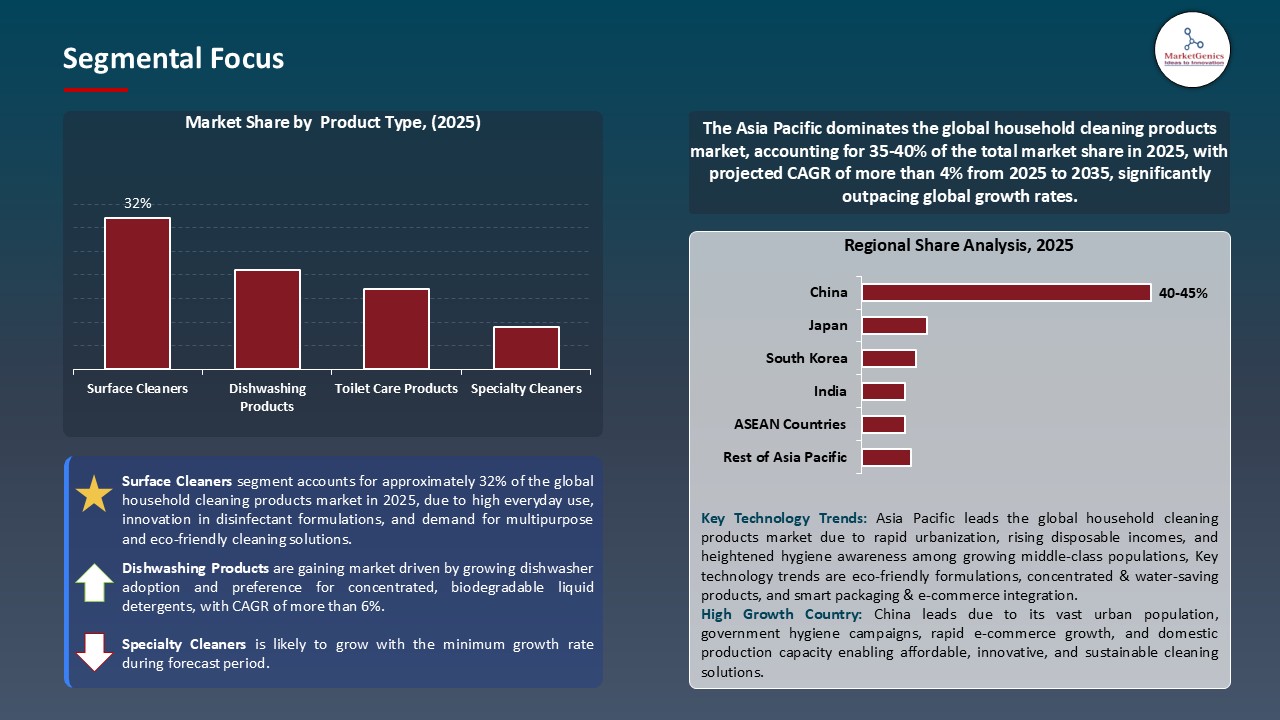

Surface Cleaners Dominate Global Household Cleaning Products Market

- Surface cleaners are leading in the household cleaning products market because of their wide usage in various surfaces including kitchen, bathrooms and living rooms as an essential high consumption category both at home and in commercial environment. Indicatively, Pine-Sol in April 2024 announced the release of its new and improved multi-surface cleansers line. The new version of all Scented Pine-Sol Multi-Surface Cleaners, such as Lemon Fresh, Lavender Clean and Refreshing Clean also contain twice the cleaning strength as previously and have twice the cleaning power per drop. The introduction of new concentrated surface cleaners helps boost the market growth, as it improves the performance of cleaning, minimizes the amount of products wasted, and fulfills the desire of the consumer towards high-performance multi-surface cleaners, which are more valuable and sustainable.

- Also, consumerism regarding hygiene after the pandemic has increased the level of consumer attention to the surface cleaning, which leads to a long-term demand of antibacterial and multi-purpose formulations to provide their efficient protection against germs and convenient usage. As an example, in the year 2025, Unilever introduced Cif Infinite Clean spray through the application of innovative bioscience and probiotics to transform their homes. The innovation enhances the growth of the market with hygiene conscious cleaning solutions, consumer confidence and creation of demand of high quality, science-based surface care products.

Asia Pacific Leads Global Household Cleaning Products Market Demand

- The demand of household cleaning products is growing in the Asia Pacific region due to a rapid urbanization process and the rise of disposable incomes among the growing number of middle-class consumers, due to the increase in the adoption of modern hygiene standards, high-end formulations, and brand-conscious buying habits. As an example, the latest innovations of KEENON Robotics such as new cleaning robots series were presented by the company at the Food & Hotel Asia-HoReCa Singapore 2024 exhibition in 2024. They collaborated with Truly Robotics and demonstrated how KEENON delivery robots could be used in the food and hospitality industries, which received significant attention among industry players and the general population.

- There is also an increase in the market, which is being boosted by the spread of organized retail and e-commerce distribution channels in the emerging economies as more people become health conscious following the pandemic and the implementation of modern cleaning routines. As an example, in 2025, Hindustan Unilever Ltd launched Surf Excel Matic Express-liquid, which targets short cycles (urban lifestyle), integrating the fast/efficient cleaning facility with high-end positioning. This trend is transforming consumer choice of high-end, convenient, and health-sensitive cleaning products, which are increasing sales using structured retail and online store channels and strengthening brand penetration in fast-evolving urban markets.

Household-Cleaning-Products-Market Ecosystem

The global household cleaning products market is highly fragmented, with high concentration among key players such as Procter & Gamble (P&G), Unilever, Henkel AG & Co. KGaA, SC Johnson & Son, and Amway Corporation, who dominate through extensive product portfolios, continuous innovation in eco-friendly formulations, robust global distribution networks, and aggressive marketing strategies that strengthen brand loyalty and market penetration across both developed and emerging economies.

Recent Development and Strategic Overview:

- In April 2025, Unilever has announced the launch of a new, science-backed, all-in-one cleaning solution that can be used anywhere in the home in response to evolving cleaning needs. Using the power of probiotics, or ‘friendly bacteria’, 60-year-old brand Cif is changing the way consumers think about cleaning their homes.

- In April 2025, Henkel introduced concentrated formulas and packaging across all, Persil and Snuggle liquid laundry products. This update offers laundry-doers effective detergent cleaning power and fabric conditioning softness and scent at a more concentrated level per load making every wash more environmentally conscious.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 42.8 Bn |

|

Market Forecast Value in 20255 |

USD 64.6 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2025 – 20255 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Household-Cleaning-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Household Cleaning Products Market, By Product Type |

|

|

Household Cleaning Products Market, By Form |

|

|

Household Cleaning Products Market, By Formulation |

|

|

Household Cleaning Products Market, By Packaging Type |

|

|

Household Cleaning Products Market, By Distribution Channel

|

|

|

Household Cleaning Products Market, By Price Range

|

|

|

Household Cleaning Products Market, By Fragrance Type |

|

|

Household Cleaning Products Market, By Pack Size |

|

|

Household Cleaning Products Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Household Cleaning Products Market Outlook

- 2.1.1. Household Cleaning Products Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Household Cleaning Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Household Cleaning Products Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Household Cleaning Products Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing consumer awareness about hygiene and sanitation

- 4.1.1.2. Rising urbanization and improved living standards globally

- 4.1.1.3. Product innovation with eco-friendly and multifunctional cleaning solutions

- 4.1.2. Restraints

- 4.1.2.1. Health and environmental concerns over chemical-based cleaning agents

- 4.1.2.2. Price sensitivity and availability of low-cost local alternatives

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Household Cleaning Products Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Household Cleaning Products Market Demand

- 4.7.1. Historical Market Size - (Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Household Cleaning Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Surface Cleaners

- 6.2.1.1. All-Purpose Cleaners

- 6.2.1.2. Glass & Window Cleaners

- 6.2.1.3. Floor Cleaners

- 6.2.1.4. Kitchen Cleaners

- 6.2.1.5. Others

- 6.2.2. Dishwashing Products

- 6.2.2.1. Laundry Care Products

- 6.2.2.2. Laundry Detergents

- 6.2.2.3. Fabric Softeners

- 6.2.2.4. Bleach

- 6.2.2.5. Stain Removers

- 6.2.2.6. Others

- 6.2.3. Toilet Care Products

- 6.2.3.1. Toilet Bowl Cleaners

- 6.2.3.2. Toilet Blocks

- 6.2.3.3. Toilet Rim Blocks

- 6.2.3.4. Others

- 6.2.4. Specialty Cleaners

- 6.2.4.1. Drain Cleaners

- 6.2.4.2. Oven Cleaners

- 6.2.4.3. Carpet Cleaners

- 6.2.4.4. Leather Cleaners

- 6.2.4.5. Metal Polish

- 6.2.4.6. Others

- 6.2.1. Surface Cleaners

- 7. Global Household Cleaning Products Market Analysis, by Form

- 7.1. Key Segment Analysis

- 7.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 7.2.1. Liquid

- 7.2.2. Powder

- 7.2.3. Gel

- 7.2.4. Spray

- 7.2.5. Foam

- 7.2.6. Aerosol

- 7.2.7. Others

- 8. Global Household Cleaning Products Market Analysis and Forecasts, by Formulation

- 8.1. Key Findings

- 8.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Formulation, 2021-2035

- 8.2.1. Chemical-based

- 8.2.2. Natural

- 8.2.3. Organic

- 8.2.4. Eco-friendly

- 8.2.5. Biodegradable

- 8.2.6. Others

- 9. Global Household Cleaning Products Market Analysis and Forecasts, by Packaging Type

- 9.1. Key Findings

- 9.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 9.2.1. Bottles

- 9.2.2. Spray Bottles

- 9.2.3. Refill Pouches

- 9.2.4. Cans

- 9.2.5. Cartons/Boxes

- 9.2.6. Sachets

- 9.2.7. Jars

- 9.2.8. Others

- 10. Global Household Cleaning Products Market Analysis and Forecasts, by Distribution Channel

- 10.1. Key Findings

- 10.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Offline/Traditional Retail

- 10.2.1.1. Supermarkets/Hypermarkets

- 10.2.1.2. Convenience Stores

- 10.2.1.3. Department Stores

- 10.2.1.4. Specialty Stores

- 10.2.1.5. Drug Stores/Pharmacies

- 10.2.1.6. Others

- 10.2.2. Online/E-commerce

- 10.2.2.1. Company Websites

- 10.2.2.2. E-commerce Platforms

- 10.2.2.3. Online Grocery Retailers

- 10.2.2.4. Others

- 10.2.1. Offline/Traditional Retail

- 11. Global Household Cleaning Products Market Analysis and Forecasts, by Price Range

- 11.1. Key Findings

- 11.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 11.2.1. Premium

- 11.2.2. Mid-range

- 11.2.3. Economy/Budget

- 12. Global Household Cleaning Products Market Analysis and Forecasts, by Fragrance Type

- 12.1. Key Findings

- 12.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Fragrance Type, 2021-2035

- 12.2.1. Scented

- 12.2.2. Floral

- 12.2.3. Citrus

- 12.2.4. Lavender

- 12.2.5. Others

- 12.2.6. Unscented/Fragrance-free

- 13. Global Household Cleaning Products Market Analysis and Forecasts, by Pack Size

- 13.1. Key Findings

- 13.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Pack Size, 2021-2035

- 13.2.1. Below 500ml/grams

- 13.2.2. 500ml-1L/grams

- 13.2.3. 1L-2L/grams

- 13.2.4. Above 2L/grams

- 14. Global Household Cleaning Products Market Analysis and Forecasts, by End-users

- 14.1. Key Findings

- 14.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Residential/Household Users

- 14.2.1.1. Kitchen Cleaning

- 14.2.1.2. Bathroom Cleaning

- 14.2.1.3. Living Areas Cleaning

- 14.2.1.4. Laundry Applications

- 14.2.1.5. General Household Maintenance

- 14.2.1.6. Others

- 14.2.2. Commercial/Institutional Users

- 14.2.2.1. Office Buildings

- 14.2.2.2. Hospitality Sector

- 14.2.2.3. Healthcare Facilities

- 14.2.2.4. Educational Institutions

- 14.2.2.5. Retail Establishments

- 14.2.2.6. Others

- 14.2.3. Small Business/Professional Users

- 14.2.3.1. Cleaning Service Providers

- 14.2.3.2. Property Management

- 14.2.3.3. Small Offices/Home Offices (SOHO)

- 14.2.3.4. Others

- 14.2.4. Other End-users

- 14.2.1. Residential/Household Users

- 15. Global Household Cleaning Products Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Household Cleaning Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Form

- 16.3.3. Formulation

- 16.3.4. Packaging Type

- 16.3.5. Distribution Channel

- 16.3.6. Price Range

- 16.3.7. Fragrance Type

- 16.3.8. Pack Size

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Household Cleaning Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Form

- 16.4.4. Formulation

- 16.4.5. Packaging Type

- 16.4.6. Distribution Channel

- 16.4.7. Price Range

- 16.4.8. Fragrance Type

- 16.4.9. Pack Size

- 16.4.10. End-users

- 16.5. Canada Household Cleaning Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Form

- 16.5.4. Formulation

- 16.5.5. Packaging Type

- 16.5.6. Distribution Channel

- 16.5.7. Price Range

- 16.5.8. Fragrance Type

- 16.5.9. Pack Size

- 16.5.10. End-users

- 16.6. Mexico Household Cleaning Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Form

- 16.6.4. Formulation

- 16.6.5. Packaging Type

- 16.6.6. Distribution Channel

- 16.6.7. Price Range

- 16.6.8. Fragrance Type

- 16.6.9. Pack Size

- 16.6.10. End-users

- 17. Europe Household Cleaning Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Form

- 17.3.3. Formulation

- 17.3.4. Packaging Type

- 17.3.5. Distribution Channel

- 17.3.6. Price Range

- 17.3.7. Fragrance Type

- 17.3.8. Pack Size

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Household Cleaning Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Form

- 17.4.4. Formulation

- 17.4.5. Packaging Type

- 17.4.6. Distribution Channel

- 17.4.7. Price Range

- 17.4.8. Fragrance Type

- 17.4.9. Pack Size

- 17.4.10. End-users

- 17.5. United Kingdom Household Cleaning Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Form

- 17.5.4. Formulation

- 17.5.5. Packaging Type

- 17.5.6. Distribution Channel

- 17.5.7. Price Range

- 17.5.8. Fragrance Type

- 17.5.9. Pack Size

- 17.5.10. End-users

- 17.6. France Household Cleaning Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Form

- 17.6.4. Formulation

- 17.6.5. Packaging Type

- 17.6.6. Distribution Channel

- 17.6.7. Price Range

- 17.6.8. Fragrance Type

- 17.6.9. Pack Size

- 17.6.10. End-users

- 17.7. Italy Household Cleaning Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Form

- 17.7.4. Formulation

- 17.7.5. Packaging Type

- 17.7.6. Distribution Channel

- 17.7.7. Price Range

- 17.7.8. Fragrance Type

- 17.7.9. Pack Size

- 17.7.10. End-users

- 17.8. Spain Household Cleaning Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Form

- 17.8.4. Formulation

- 17.8.5. Packaging Type

- 17.8.6. Distribution Channel

- 17.8.7. Price Range

- 17.8.8. Fragrance Type

- 17.8.9. Pack Size

- 17.8.10. End-users

- 17.9. Netherlands Household Cleaning Products Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Form

- 17.9.4. Formulation

- 17.9.5. Packaging Type

- 17.9.6. Distribution Channel

- 17.9.7. Price Range

- 17.9.8. Fragrance Type

- 17.9.9. Pack Size

- 17.9.10. End-users

- 17.10. Nordic Countries Household Cleaning Products Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Form

- 17.10.4. Formulation

- 17.10.5. Packaging Type

- 17.10.6. Distribution Channel

- 17.10.7. Price Range

- 17.10.8. Fragrance Type

- 17.10.9. Pack Size

- 17.10.10. End-users

- 17.11. Poland Household Cleaning Products Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Form

- 17.11.4. Formulation

- 17.11.5. Packaging Type

- 17.11.6. Distribution Channel

- 17.11.7. Price Range

- 17.11.8. Fragrance Type

- 17.11.9. Pack Size

- 17.11.10. End-users

- 17.12. Russia & CIS Household Cleaning Products Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Form

- 17.12.4. Formulation

- 17.12.5. Packaging Type

- 17.12.6. Distribution Channel

- 17.12.7. Price Range

- 17.12.8. Fragrance Type

- 17.12.9. Pack Size

- 17.12.10. End-users

- 17.13. Rest of Europe Household Cleaning Products Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Form

- 17.13.4. Formulation

- 17.13.5. Packaging Type

- 17.13.6. Distribution Channel

- 17.13.7. Price Range

- 17.13.8. Fragrance Type

- 17.13.9. Pack Size

- 17.13.10. End-users

- 18. Asia Pacific Household Cleaning Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Form

- 18.3.3. Formulation

- 18.3.4. Packaging Type

- 18.3.5. Distribution Channel

- 18.3.6. Price Range

- 18.3.7. Fragrance Type

- 18.3.8. Pack Size

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Household Cleaning Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Form

- 18.4.4. Formulation

- 18.4.5. Packaging Type

- 18.4.6. Distribution Channel

- 18.4.7. Price Range

- 18.4.8. Fragrance Type

- 18.4.9. Pack Size

- 18.4.10. End-users

- 18.5. India Household Cleaning Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Form

- 18.5.4. Formulation

- 18.5.5. Packaging Type

- 18.5.6. Distribution Channel

- 18.5.7. Price Range

- 18.5.8. Fragrance Type

- 18.5.9. Pack Size

- 18.5.10. End-users

- 18.6. Japan Household Cleaning Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Form

- 18.6.4. Formulation

- 18.6.5. Packaging Type

- 18.6.6. Distribution Channel

- 18.6.7. Price Range

- 18.6.8. Fragrance Type

- 18.6.9. Pack Size

- 18.6.10. End-users

- 18.7. South Korea Household Cleaning Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Form

- 18.7.4. Formulation

- 18.7.5. Packaging Type

- 18.7.6. Distribution Channel

- 18.7.7. Price Range

- 18.7.8. Fragrance Type

- 18.7.9. Pack Size

- 18.7.10. End-users

- 18.8. Australia and New Zealand Household Cleaning Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Form

- 18.8.4. Formulation

- 18.8.5. Packaging Type

- 18.8.6. Distribution Channel

- 18.8.7. Price Range

- 18.8.8. Fragrance Type

- 18.8.9. Pack Size

- 18.8.10. End-users

- 18.9. Indonesia Household Cleaning Products Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Form

- 18.9.4. Formulation

- 18.9.5. Packaging Type

- 18.9.6. Distribution Channel

- 18.9.7. Price Range

- 18.9.8. Fragrance Type

- 18.9.9. Pack Size

- 18.9.10. End-users

- 18.10. Malaysia Household Cleaning Products Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Form

- 18.10.4. Formulation

- 18.10.5. Packaging Type

- 18.10.6. Distribution Channel

- 18.10.7. Price Range

- 18.10.8. Fragrance Type

- 18.10.9. Pack Size

- 18.10.10. End-users

- 18.11. Thailand Household Cleaning Products Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Form

- 18.11.4. Formulation

- 18.11.5. Packaging Type

- 18.11.6. Distribution Channel

- 18.11.7. Price Range

- 18.11.8. Fragrance Type

- 18.11.9. Pack Size

- 18.11.10. End-users

- 18.12. Vietnam Household Cleaning Products Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Form

- 18.12.4. Formulation

- 18.12.5. Packaging Type

- 18.12.6. Distribution Channel

- 18.12.7. Price Range

- 18.12.8. Fragrance Type

- 18.12.9. Pack Size

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Household Cleaning Products Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Form

- 18.13.4. Formulation

- 18.13.5. Packaging Type

- 18.13.6. Distribution Channel

- 18.13.7. Price Range

- 18.13.8. Fragrance Type

- 18.13.9. Pack Size

- 18.13.10. End-users

- 19. Middle East Household Cleaning Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Form

- 19.3.3. Formulation

- 19.3.4. Packaging Type

- 19.3.5. Distribution Channel

- 19.3.6. Price Range

- 19.3.7. Fragrance Type

- 19.3.8. Pack Size

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Household Cleaning Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Form

- 19.4.4. Formulation

- 19.4.5. Packaging Type

- 19.4.6. Distribution Channel

- 19.4.7. Price Range

- 19.4.8. Fragrance Type

- 19.4.9. Pack Size

- 19.4.10. End-users

- 19.5. UAE Household Cleaning Products Market

- 19.5.1. Product Type

- 19.5.2. Form

- 19.5.3. Formulation

- 19.5.4. Packaging Type

- 19.5.5. Distribution Channel

- 19.5.6. Price Range

- 19.5.7. Fragrance Type

- 19.5.8. Pack Size

- 19.5.9. End-users

- 19.6. Saudi Arabia Household Cleaning Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Form

- 19.6.4. Formulation

- 19.6.5. Packaging Type

- 19.6.6. Distribution Channel

- 19.6.7. Price Range

- 19.6.8. Fragrance Type

- 19.6.9. Pack Size

- 19.6.10. End-users

- 19.7. Israel Household Cleaning Products Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Form

- 19.7.4. Formulation

- 19.7.5. Packaging Type

- 19.7.6. Distribution Channel

- 19.7.7. Price Range

- 19.7.8. Fragrance Type

- 19.7.9. Pack Size

- 19.7.10. End-users

- 19.8. Rest of Middle East Household Cleaning Products Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Form

- 19.8.4. Formulation

- 19.8.5. Packaging Type

- 19.8.6. Distribution Channel

- 19.8.7. Price Range

- 19.8.8. Fragrance Type

- 19.8.9. Pack Size

- 19.8.10. End-users

- 20. Africa Household Cleaning Products Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Form

- 20.3.3. Formulation

- 20.3.4. Packaging Type

- 20.3.5. Distribution Channel

- 20.3.6. Price Range

- 20.3.7. Fragrance Type

- 20.3.8. Pack Size

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Household Cleaning Products Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Form

- 20.4.4. Formulation

- 20.4.5. Packaging Type

- 20.4.6. Distribution Channel

- 20.4.7. Price Range

- 20.4.8. Fragrance Type

- 20.4.9. Pack Size

- 20.4.10. End-users

- 20.5. Egypt Household Cleaning Products Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Form

- 20.5.4. Formulation

- 20.5.5. Packaging Type

- 20.5.6. Distribution Channel

- 20.5.7. Price Range

- 20.5.8. Fragrance Type

- 20.5.9. Pack Size

- 20.5.10. End-users

- 20.6. Nigeria Household Cleaning Products Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Form

- 20.6.4. Formulation

- 20.6.5. Packaging Type

- 20.6.6. Distribution Channel

- 20.6.7. Price Range

- 20.6.8. Fragrance Type

- 20.6.9. Pack Size

- 20.6.10. End-users

- 20.7. Algeria Household Cleaning Products Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Form

- 20.7.4. Formulation

- 20.7.5. Packaging Type

- 20.7.6. Distribution Channel

- 20.7.7. Price Range

- 20.7.8. Fragrance Type

- 20.7.9. Pack Size

- 20.7.10. End-users

- 20.8. Rest of Africa Household Cleaning Products Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Form

- 20.8.4. Formulation

- 20.8.5. Packaging Type

- 20.8.6. Distribution Channel

- 20.8.7. Price Range

- 20.8.8. Fragrance Type

- 20.8.9. Pack Size

- 20.8.10. End-users

- 21. South America Household Cleaning Products Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Household Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Form

- 21.3.3. Formulation

- 21.3.4. Packaging Type

- 21.3.5. Distribution Channel

- 21.3.6. Price Range

- 21.3.7. Fragrance Type

- 21.3.8. Pack Size

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Household Cleaning Products Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Form

- 21.4.4. Formulation

- 21.4.5. Packaging Type

- 21.4.6. Distribution Channel

- 21.4.7. Price Range

- 21.4.8. Fragrance Type

- 21.4.9. Pack Size

- 21.4.10. End-users

- 21.5. Argentina Household Cleaning Products Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Form

- 21.5.4. Formulation

- 21.5.5. Packaging Type

- 21.5.6. Distribution Channel

- 21.5.7. Price Range

- 21.5.8. Fragrance Type

- 21.5.9. Pack Size

- 21.5.10. End-users

- 21.6. Rest of South America Household Cleaning Products Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Form

- 21.6.4. Formulation

- 21.6.5. Packaging Type

- 21.6.6. Distribution Channel

- 21.6.7. Price Range

- 21.6.8. Fragrance Type

- 21.6.9. Pack Size

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Amway Corporation

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Blue Moon Group

- 22.3. Church & Dwight Co., Inc.

- 22.4. Colgate-Palmolive Company

- 22.5. Dabur India Limited

- 22.6. Earth Friendly Products

- 22.7. Godrej Consumer Products Limited

- 22.8. Henkel AG & Co. KGaA

- 22.9. Kao Corporation

- 22.10. Liby Group

- 22.11. Lion Corporation

- 22.12. McBride plc

- 22.13. Nice Group

- 22.14. Procter & Gamble (P&G)

- 22.15. Reckitt Benckiser Group

- 22.16. SC Johnson & Son

- 22.17. The Caldrea Company

- 22.18. The Clorox Company

- 22.19. Unilever

- 22.20. Other Key Players

- 22.1. Amway Corporation

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation