Level Sensors and Transmitters Market Size, Share & Trends Analysis Report by Technology Type (Ultrasonic Level Sensors, Radar Level Sensors, Capacitance Level Sensors, Hydrostatic/Pressure Level Sensors, Optical Level Sensors, Conductivity/Resistance Level Sensors, Vibrating/Tuning Fork Level Sensors, Magnetic Float Level Sensors, Others), Product Type, Monitoring Type, Output Signal, Measured Medium, Installation Type, Pressure Rating, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Level Sensors and Transmitters Market Size, Share, and Growth

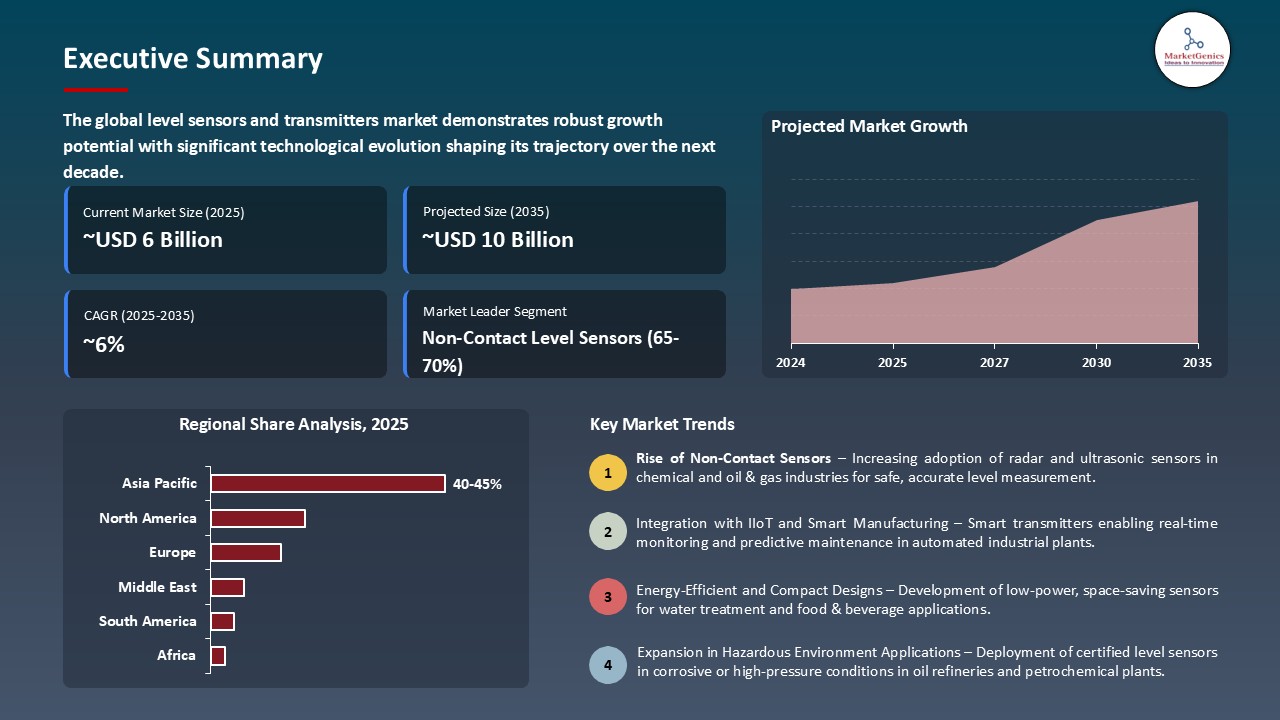

The global level sensors and transmitters market is witnessing strong growth, valued at USD 5.6 billion in 2025 and projected to reach USD 9.8 billion by 2035, expanding at a CAGR of 5.8% during the forecast period. North America is the fastest-growing region in the level sensors and transmitters market due to high adoption of advanced industrial automation, stringent safety regulations, and increasing demand for smart, connected measurement solutions.

Melissa Stiegler, hygienic business director for Emerson's Measurement Solutions business, said, “Emerson Introduces World's First Non-Contacting Radar Level Transmitter Designed Specifically for Food and Beverage Applications, By meeting the strict safety requirements of the food and beverage industry, this level transmitter minimizes contamination risk, while its accuracy and reliability ensures the production of consistent, high-quality products that consumers expect, providing a compact and cost-effective alternative to legacy technologies”.

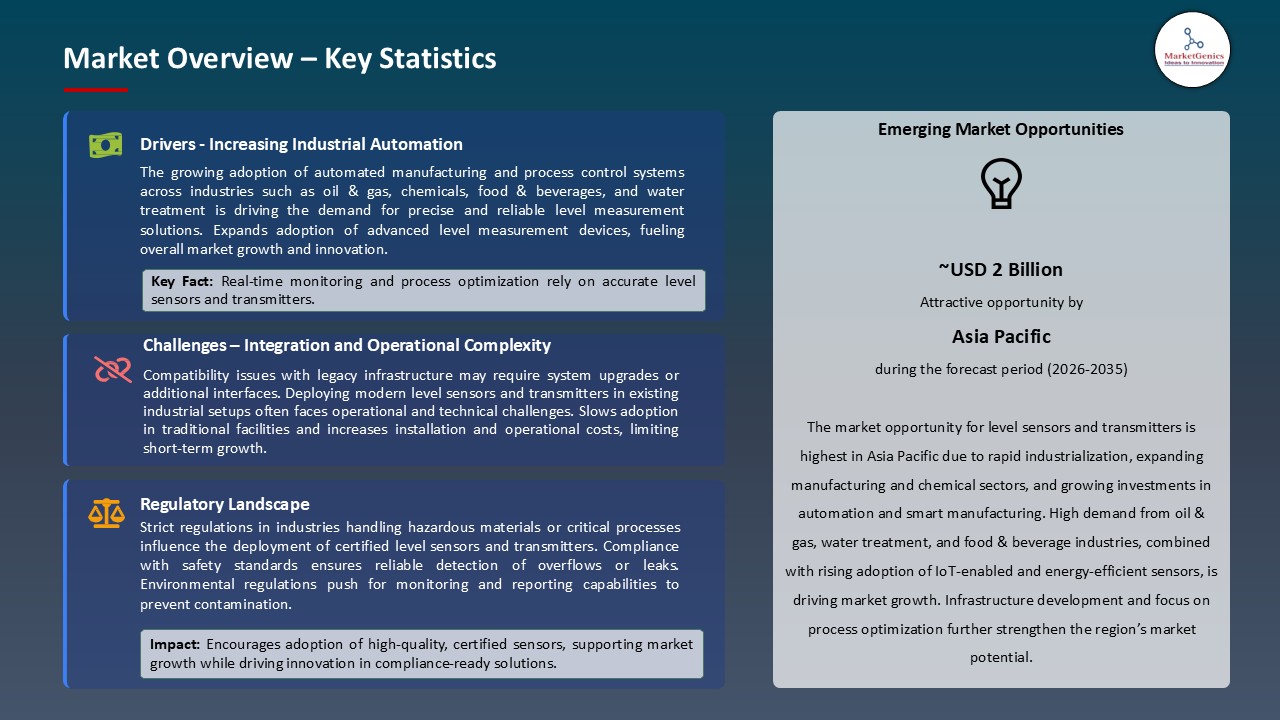

The growing adoption of digital and IoT technologies in the industrial process is driving the need of smart level sensors and transmitters market. The devices provide predictive maintenance, remote monitoring and direct connection with the Industry 4.0 systems, allowing real-time data analytics, downtime reduction and streamlined operations. These features are used in the chemicals, food and beverage, oil and gas and pharmaceutical industries to provide efficiency and reliability in the processes.

The increased goal of energy transition globally, such as the production of green hydrogen, biofuels, and renewable energy projects, has led to increased demand on advanced level and pressure monitoring solutions. The real-time measurements of storage tanks, electrolysis and biofuel reactors are highly essential in safety management. The emergence of this trend suggests that level sensors and transmitters have a big opportunity to assist in sustainable energy generation and optimization of processes in new fields of energy.

The major adjacent market opportunities are industrial IoT platforms to data analytics, cloud-based monitoring platforms, ECI, and artificial intelligence applications. These complementary technologies present both synergistic integration opportunities, which increase the scale of the overall addressable market, and allow manufacturers to provide full solutions to several customer pain points at once.

Level Sensors and Transmitters Market Dynamics and Trends

Driver: Increasing Automation in Bulk Material Handling

- The growing automation of bulk material handling is becoming a huge force behind the level sensors and transmitters market. Automated systems are becoming more popular among industries, including mining, cement, food processing, and chemicals, to handle large amounts of materials more precisely, efficiently, and safely.

- Automated bulk handling eliminates the need of human intervention, error reduction, and the ability to monitor material levels at all times which directly increases the demand on high level sensing technologies. Level sensors and transmitters are also important in offering real-time and accurate measurements of storage tanks, silos, and conveyors to allow a smooth and smooth integration with automated systems.

- VEGA achieved a milestone of 500,000 VEGAPULS BASIC radar sensor sales in Europe to a building materials company in the year 2025 where VEGAPULS 31 reliably measures bulk solids in silos with dust and noisy and coarse material conditions. Its 80gHz radar, tough housing, all-enclosed electronics, and smartphone set up app can assist in automated bulk material management, and reflects well in industry adoption.

- This trend highlights the fact that efficient, automation, and accuracy of level sensors are at the forefront of efficiency and automation in bulk material handling sectors.

Restraint: Performance Challenges in Extreme Process Conditions

- Performance issues in the extreme process conditions can be seen as a significant constraint to the level sensors and transmitters market. Firms that deal with chemicals, oil and gas, cement, mining and food processing have a very hostile environment where high temperatures, extreme pressures, corrosive liquids, abrasive solids and dust, foam and vibrations are normal phenomena which may severely impair sensor accuracy, reliability and durability.

- To manufacturers and suppliers, such issues lead to more warranty claims, greater cost of maintenance and even reputation risk when devices malfunction during critical applications. End-users are likely to be reluctant to use the advanced level of measurement technologies in harsh environments, instead using the traditional solutions that are less efficient but are viewed to be safer. Moreover, the existence of stringent safety and compliance measures in hazardous areas adds to the cost of installation, certification, and operation, which limits market penetration.

- The extreme limiting performance puts a strong barrier on such performance, which limits the growth of the market even in the face of increased automation, digitalization and real-time monitoring needs.

Opportunity: Growth in Food and Beverage Industry Automation

- The level of new automation and modernization of the food and beverage sector is a good opportunity to the Level Sensors and Transmitters market. Automated systems are becoming standard in the sector to improve production efficiency, ensure continuity of product quality and adherence to high standards of hygiene and safety.

- The increase in consumer demand of packaged and processed foods, along with the trend towards digitalization and the implementation of Industry 4.0, is creating the necessity of high-quality, real-time level measurements.

- The food and beverage industry are quickly adopting automation to enhance hygiene, quality and throughput. The adoption of hygienic, CIP/SIP-capable level sensors and transmitters to track liquids, powders, and bulk ingredients are becoming increasingly popular in companies on all production lines, storage lines, and filling lines. As an example, NivoRadar NR 8400 by UWT, with hygienic antenna and FDA/EHEDG-compliant connections, is being implemented to measure levels continuously in dairy and beverage processes.

- This trend is motivating manufacturers to invest in advanced, easy to clean and food grade compatible sensors that would open up large growth potential in the market.

Key Trend: Adoption of Non-Contact Measurement Technologies

- The increasing demand of non-contact measurement technologies in various industries has become one of the most important trends in Level Sensors and Transmitters market. Other industries like chemicals, food and beverage, pharmaceutical, and bulk material handling are also opting to use radar, ultrasonic and laser-based sensors to attain accurate and real time level control without necessarily being in direct contact with liquids or solids.

- Non-contact technologies lower the risk of contamination, decrease the maintenance need and preserve accuracy in adverse environments with dust, foam or corrosive and abrasive media. Adoption is being fueled by rising automation, new regulatory requirements and demand of hygienic, safe, and reliable measurement systems.

- Rosemount 5408 Non-Contacting Radar by Emerson provides precise and contact-free level measurement of liquids and solids. It has FMCW radar, Smart Echo Supervision, easy setup and SIL 2 safety certification to promote reliable readings, minimize risks, and automated industrial operations.

- The trend indicates that less invasive level sensors that are innovative, efficient, and automate are being used to achieve safer and efficient measurement in industries.

Flow-Meters-and-Controllers-Market Analysis and Segmental Data

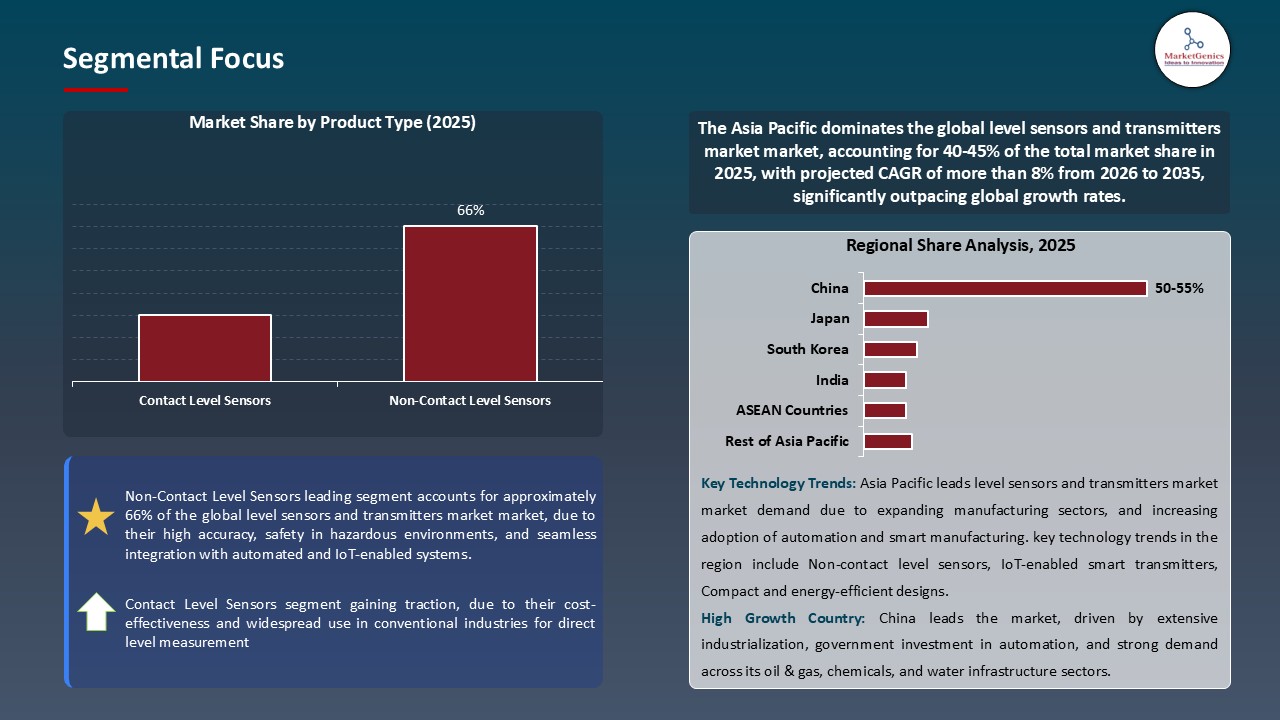

Non-Contact Level Sensors Dominate Global Level Sensors and Transmitters Market

- Non-contact level sensors is the most dominant segment in level sensors and transmitters market since it provides a precise, reliable and maintenance free measurement which has a large variety of industrial applications. These sensors such as radar, ultrasonic, and laser-based sensors do not come into contact with liquids or solids, thus lowering the chances of contamination and wear and tear, which is essential in the chemical, food and beverage, pharmaceutical and bulk material handling industries.

- • Non-contact sensors deliver real-time information that is precise even in harsh conditions with dust, foam, corrosive, and abrasive media and can be integrated without any difficulties with automated control systems. Their dominance continues to increase due to growing demand of hygienic processes, adoption of Industry 4.0, safety compliance, and minimization of operational downtime, which makes non-contact measurement technologies the solution of choice to the modern industrial level measurements.

- In 2025, the Siemens SITRANS LR120 is a small W-band FMCW three-level radar level transmitter with a PVDF enclosure that is chemically resistant offering continuous, non-contact level measurements to a distance of 30m in both liquid and solid fluoride. It facilitates Bluetooth connection through SITRANS mobile IQ application and provides an accuracy of 2mm which is a good option when high precision of 2mm is needed in an automated application.

- This proves that non-contact level sensors are establishing benchmarks in accurate, dependable and automatic level measurement in a wide range of industrial aspects.

Asia Pacific Leads Global Level Sensors and Transmitters Market Demand

- The Asia Pacific region leading the level sensors and transmitters market, due to rapid industrialization, expanding manufacturing infrastructure, and increased automation in industries such as chemicals, oil and gas, food and beverage, pharmaceutical, and power production. China, India, Japan, and South Korea are investing heavily in process sectors, creating a demand for precise, safe, and efficient measurement.

- Urbanization, infrastructure expansion, and demanding safety and environmental standards are prompting companies to adopt high-performance, low-maintenance monitoring systems. As a result, Asia Pacific is expected to maintain its dominance, accounting for a sizable proportion of the global market for level measurement solutions. Endress+Hauser's Micropilot FMR10B, FMR20B, and FMR30B radar level meters deliver fast and accurate liquid and solid measurements.

- Guided setup wizards, smartphone connectivity, Heartbeat Technology, which enables continuous diagnostics, and the use of ISO 9001 compliant verification increased sensor efficiency, reduced maintenance, and enabled automated and high precision operations in industries.

- This underscores the intensive high-precision, efficient, and automated level measurement technologies adoption in most Asian Pacific industrial sectors.

Flow-Meters-and-Controllers-Market Ecosystem

The global level sensors and transmitters market is moderately consolidated, with a high concentration among key players such as Endress+Hauser Group, Emerson Electric Co., VEGA Grieshaber KG, KROHNE Group, and Siemens AG. These companies maintain a leadership by having a vast global distribution channels, fine measurement and diagnostics which are integrated with undisrupted systems of industrial automation.

The market value chain includes sensor and transmitter manufacturing, signal processing technologies, system integration, calibration, certification, and after sales services including predictive maintenance, performance monitoring, and lifecycle analytics.

The barriers to entry are high because it requires certified, high-accuracy, and application-specific level measurement solutions, and a loyal customer base. The market is still being driven by technological advancement as major vendors have been developing technology in the fields of radar, ultrasonic, capacitive, and IoT-enabled smart level measurements of liquids and bulk solids in various industries.

Recent Development and Strategic Overview:

- In March 2025, Nordex Electrolyzers installed VEGA VEGAFLEX″81 and VEGABAR sensors on a 500-kW green hydrogen demonstrator, capable of automated monitoring in extreme conditions with SIL/ATEX certification, Bluetooth configuration, and self-monitoring, demonstrating the power of intelligent sensors in sustainable hydrogen production.

- In May 2025, KROHNE and WIKA strengthened their strategic relationship in temperature measurement, with WIKA becoming the sole provider of temperature products in KROHNE. The partnership also includes the incorporation of INOR Process AB which means that WIKA and INOR will work together on the development and supply of high-precision temperature sensors and transmitters, expand product lines, certifications, and application experience of industrial measurement solutions.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 5.6 Bn |

|

Market Forecast Value in 2035 |

USD 9.8 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Flow-Meters-and-Controllers-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Level Sensors and Transmitters Market, By Technology Type |

|

|

Level Sensors and Transmitters Market, By Product Type |

|

|

Level Sensors and Transmitters Market, By Monitoring Type |

|

|

Level Sensors and Transmitters Market, By Output Signal |

|

|

Level Sensors and Transmitters Market, By Measured Medium |

|

|

Level Sensors and Transmitters Market, By Installation Type |

|

|

Level Sensors and Transmitters Market, By Pressure Rating |

|

|

Level Sensors and Transmitters Market, By End-Use Industry |

|

Frequently Asked Questions

The global level sensors and transmitters market was valued at USD 5.6 Bn in 2025.

The global level sensors and transmitters market industry is expected to grow at a CAGR of 5.8% from 2026 to 2035.

Key factors driving demand include increasing automation in bulk material handling, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of product type, the non-contact level sensors segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for level sensors and transmitters market.

Prominent players operating in the global level sensors and transmitters market are ABB Ltd., AMETEK Inc., Baumer Group, Dwyer Instruments Inc., Emerson Electric Co., Endress+Hauser Group, Fortive Corporation (Fluke), Gems Sensors & Controls, Honeywell International Inc., Ifm Electronic GmbH, Keller America Inc., KROHNE Group, Magnetrol International, Matsushima Measure Tech Co. Ltd., Omega Engineering (Spectris plc), Pepperl+Fuchs SE, Schneider Electric SE, Sick AG, Siemens AG, Turck Inc., VEGA Grieshaber KG, WIKA Group, Yokogawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Level Sensors and Transmitters Market Outlook

- 2.1.1. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Level Sensors and Transmitters Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing industrial automation and need for precise process control.

- 4.1.1.2. Growing adoption of smart manufacturing and IIoT-enabled solutions.

- 4.1.1.3. Rising demand for real-time monitoring and predictive maintenance.

- 4.1.2. Restraints

- 4.1.2.1. High initial cost of advanced level sensors and transmitters.

- 4.1.2.2. Integration complexity with legacy infrastructure and control systems.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material & Component Suppliers

- 4.4.2. Manufacturing & Assembly

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End-User Industries

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Level Sensors and Transmitters Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Level Sensors and Transmitters Market Analysis, by Technology Type

- 6.1. Key Segment Analysis

- 6.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Technology Type, 2021-2035

- 6.2.1. Ultrasonic Level Sensors

- 6.2.2. Radar Level Sensors

- 6.2.2.1. Guided Wave Radar (GWR)

- 6.2.2.2. Non-Contact Radar (FMCW)

- 6.2.3. Capacitance Level Sensors

- 6.2.4. Hydrostatic/Pressure Level Sensors

- 6.2.5. Optical Level Sensors

- 6.2.6. Conductivity/Resistance Level Sensors

- 6.2.7. Vibrating/Tuning Fork Level Sensors

- 6.2.8. Magnetic Float Level Sensors

- 6.2.9. Others

- 7. Global Level Sensors and Transmitters Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Contact Level Sensors

- 7.2.1.1. Float Switches

- 7.2.1.2. Displacer Level Transmitters

- 7.2.1.3. Capacitance Probes

- 7.2.1.4. Others

- 7.2.2. Non-Contact Level Sensors

- 7.2.2.1. Ultrasonic Sensors

- 7.2.2.2. Radar Sensors

- 7.2.2.3. Laser Sensors

- 7.2.2.4. Others

- 7.2.1. Contact Level Sensors

- 8. Global Level Sensors and Transmitters Market Analysis, by Monitoring Type

- 8.1. Key Segment Analysis

- 8.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Monitoring Type, 2021-2035

- 8.2.1. Point Level Measurement

- 8.2.1.1. High-Level Detection

- 8.2.1.2. Low-Level Detection

- 8.2.1.3. Dual-Point Detection

- 8.2.2. Continuous Level Measurement

- 8.2.2.1. Full Range Measurement

- 8.2.2.2. Interface Level Measurement

- 8.2.1. Point Level Measurement

- 9. Global Level Sensors and Transmitters Market Analysis, by Output Signal

- 9.1. Key Segment Analysis

- 9.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Output Signal, 2021-2035

- 9.2.1. Analog Output (4-20 mA)

- 9.2.2. Digital Output

- 9.2.2.1. HART Protocol

- 9.2.2.2. Profibus

- 9.2.2.3. Modbus

- 9.2.2.4. Foundation Fieldbus

- 9.2.2.5. Others

- 9.2.3. Relay/Switch Output

- 9.2.4. Wireless Output

- 9.2.4.1. WirelessHART

- 9.2.4.2. ISA100.11a

- 9.2.4.3. Bluetooth/Wi-Fi

- 9.2.4.4. Others

- 10. Global Level Sensors and Transmitters Market Analysis, by Measured Medium

- 10.1. Key Segment Analysis

- 10.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Measured Medium, 2021-2035

- 10.2.1. Liquids

- 10.2.1.1. Conductive Liquids

- 10.2.1.2. Non-Conductive Liquids

- 10.2.1.3. Corrosive Liquids

- 10.2.1.4. Others

- 10.2.2. Solids/Bulk Materials

- 10.2.2.1. Powders

- 10.2.2.2. Granules

- 10.2.2.3. Slurries

- 10.2.2.4. Others

- 10.2.3. Multi-Phase/Interface Measurement

- 10.2.1. Liquids

- 11. Global Level Sensors and Transmitters Market Analysis, by Installation Type

- 11.1. Key Segment Analysis

- 11.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 11.2.1. Top-Mounted

- 11.2.2. Side-Mounted

- 11.2.3. Bottom-Mounted

- 11.2.4. In-Line/Insertion Type

- 11.2.5. External/Non-Invasive

- 11.2.6. Others

- 12. Global Level Sensors and Transmitters Market Analysis, by Pressure Rating

- 12.1. Key Segment Analysis

- 12.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Pressure Rating, 2021-2035

- 12.2.1. Up to 50 bar

- 12.2.2. 50-200 bar

- 12.2.3. Above 200 bar

- 13. Global Level Sensors and Transmitters Market Analysis, by End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 13.2.1. Chemical & Petrochemical

- 13.2.2. Oil & Gas

- 13.2.3. Water & Wastewater Treatment

- 13.2.4. Food & Beverage

- 13.2.5. Pharmaceutical

- 13.2.6. Power Generation

- 13.2.7. Mining & Metals

- 13.2.8. Pulp & Paper

- 13.2.9. Marine & Shipbuilding

- 13.2.10. Agriculture & Irrigation

- 13.2.11. Automotive

- 13.2.12. Building & Construction

- 13.2.13. Others

- 14. Global Level Sensors and Transmitters Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Level Sensors and Transmitters Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology Type

- 15.3.2. Product Type

- 15.3.3. Monitoring Type

- 15.3.4. Output Signal

- 15.3.5. Measured Medium

- 15.3.6. Installation Type

- 15.3.7. Pressure Rating

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Level Sensors and Transmitters Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Product Type

- 15.4.4. Monitoring Type

- 15.4.5. Output Signal

- 15.4.6. Measured Medium

- 15.4.7. Installation Type

- 15.4.8. Pressure Rating

- 15.4.9. End-Use Industry

- 15.5. Canada Level Sensors and Transmitters Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Product Type

- 15.5.4. Monitoring Type

- 15.5.5. Output Signal

- 15.5.6. Measured Medium

- 15.5.7. Installation Type

- 15.5.8. Pressure Rating

- 15.5.9. End-Use Industry

- 15.6. Mexico Level Sensors and Transmitters Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Product Type

- 15.6.4. Monitoring Type

- 15.6.5. Output Signal

- 15.6.6. Measured Medium

- 15.6.7. Installation Type

- 15.6.8. Pressure Rating

- 15.6.9. End-Use Industry

- 16. Europe Level Sensors and Transmitters Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology Type

- 16.3.2. Product Type

- 16.3.3. Monitoring Type

- 16.3.4. Output Signal

- 16.3.5. Measured Medium

- 16.3.6. Installation Type

- 16.3.7. Pressure Rating

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Level Sensors and Transmitters Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Product Type

- 16.4.4. Monitoring Type

- 16.4.5. Output Signal

- 16.4.6. Measured Medium

- 16.4.7. Installation Type

- 16.4.8. Pressure Rating

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Level Sensors and Transmitters Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology Type

- 16.5.3. Product Type

- 16.5.4. Monitoring Type

- 16.5.5. Output Signal

- 16.5.6. Measured Medium

- 16.5.7. Installation Type

- 16.5.8. Pressure Rating

- 16.5.9. End-Use Industry

- 16.6. France Level Sensors and Transmitters Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Product Type

- 16.6.4. Monitoring Type

- 16.6.5. Output Signal

- 16.6.6. Measured Medium

- 16.6.7. Installation Type

- 16.6.8. Pressure Rating

- 16.6.9. End-Use Industry

- 16.7. Italy Level Sensors and Transmitters Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Product Type

- 16.7.4. Monitoring Type

- 16.7.5. Output Signal

- 16.7.6. Measured Medium

- 16.7.7. Installation Type

- 16.7.8. Pressure Rating

- 16.7.9. End-Use Industry

- 16.8. Spain Level Sensors and Transmitters Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology Type

- 16.8.3. Product Type

- 16.8.4. Monitoring Type

- 16.8.5. Output Signal

- 16.8.6. Measured Medium

- 16.8.7. Installation Type

- 16.8.8. Pressure Rating

- 16.8.9. End-Use Industry

- 16.9. Netherlands Level Sensors and Transmitters Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology Type

- 16.9.3. Product Type

- 16.9.4. Monitoring Type

- 16.9.5. Output Signal

- 16.9.6. Measured Medium

- 16.9.7. Installation Type

- 16.9.8. Pressure Rating

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Level Sensors and Transmitters Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology Type

- 16.10.3. Product Type

- 16.10.4. Monitoring Type

- 16.10.5. Output Signal

- 16.10.6. Measured Medium

- 16.10.7. Installation Type

- 16.10.8. Pressure Rating

- 16.10.9. End-Use Industry

- 16.11. Poland Level Sensors and Transmitters Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology Type

- 16.11.3. Product Type

- 16.11.4. Monitoring Type

- 16.11.5. Output Signal

- 16.11.6. Measured Medium

- 16.11.7. Installation Type

- 16.11.8. Pressure Rating

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Level Sensors and Transmitters Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology Type

- 16.12.3. Product Type

- 16.12.4. Monitoring Type

- 16.12.5. Output Signal

- 16.12.6. Measured Medium

- 16.12.7. Installation Type

- 16.12.8. Pressure Rating

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Level Sensors and Transmitters Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology Type

- 16.13.3. Product Type

- 16.13.4. Monitoring Type

- 16.13.5. Output Signal

- 16.13.6. Measured Medium

- 16.13.7. Installation Type

- 16.13.8. Pressure Rating

- 16.13.9. End-Use Industry

- 17. Asia Pacific Level Sensors and Transmitters Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology Type

- 17.3.2. Product Type

- 17.3.3. Monitoring Type

- 17.3.4. Output Signal

- 17.3.5. Measured Medium

- 17.3.6. Installation Type

- 17.3.7. Pressure Rating

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Level Sensors and Transmitters Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Product Type

- 17.4.4. Monitoring Type

- 17.4.5. Output Signal

- 17.4.6. Measured Medium

- 17.4.7. Installation Type

- 17.4.8. Pressure Rating

- 17.4.9. End-Use Industry

- 17.5. India Level Sensors and Transmitters Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Product Type

- 17.5.4. Monitoring Type

- 17.5.5. Output Signal

- 17.5.6. Measured Medium

- 17.5.7. Installation Type

- 17.5.8. Pressure Rating

- 17.5.9. End-Use Industry

- 17.6. Japan Level Sensors and Transmitters Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Product Type

- 17.6.4. Monitoring Type

- 17.6.5. Output Signal

- 17.6.6. Measured Medium

- 17.6.7. Installation Type

- 17.6.8. Pressure Rating

- 17.6.9. End-Use Industry

- 17.7. South Korea Level Sensors and Transmitters Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Product Type

- 17.7.4. Monitoring Type

- 17.7.5. Output Signal

- 17.7.6. Measured Medium

- 17.7.7. Installation Type

- 17.7.8. Pressure Rating

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Level Sensors and Transmitters Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Product Type

- 17.8.4. Monitoring Type

- 17.8.5. Output Signal

- 17.8.6. Measured Medium

- 17.8.7. Installation Type

- 17.8.8. Pressure Rating

- 17.8.9. End-Use Industry

- 17.9. Indonesia Level Sensors and Transmitters Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Technology Type

- 17.9.3. Product Type

- 17.9.4. Monitoring Type

- 17.9.5. Output Signal

- 17.9.6. Measured Medium

- 17.9.7. Installation Type

- 17.9.8. Pressure Rating

- 17.9.9. End-Use Industry

- 17.10. Malaysia Level Sensors and Transmitters Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Technology Type

- 17.10.3. Product Type

- 17.10.4. Monitoring Type

- 17.10.5. Output Signal

- 17.10.6. Measured Medium

- 17.10.7. Installation Type

- 17.10.8. Pressure Rating

- 17.10.9. End-Use Industry

- 17.11. Thailand Level Sensors and Transmitters Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Technology Type

- 17.11.3. Product Type

- 17.11.4. Monitoring Type

- 17.11.5. Output Signal

- 17.11.6. Measured Medium

- 17.11.7. Installation Type

- 17.11.8. Pressure Rating

- 17.11.9. End-Use Industry

- 17.12. Vietnam Level Sensors and Transmitters Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Technology Type

- 17.12.3. Product Type

- 17.12.4. Monitoring Type

- 17.12.5. Output Signal

- 17.12.6. Measured Medium

- 17.12.7. Installation Type

- 17.12.8. Pressure Rating

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Level Sensors and Transmitters Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Technology Type

- 17.13.3. Product Type

- 17.13.4. Monitoring Type

- 17.13.5. Output Signal

- 17.13.6. Measured Medium

- 17.13.7. Installation Type

- 17.13.8. Pressure Rating

- 17.13.9. End-Use Industry

- 18. Middle East Level Sensors and Transmitters Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology Type

- 18.3.2. Product Type

- 18.3.3. Monitoring Type

- 18.3.4. Output Signal

- 18.3.5. Measured Medium

- 18.3.6. Installation Type

- 18.3.7. Pressure Rating

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Level Sensors and Transmitters Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Product Type

- 18.4.4. Monitoring Type

- 18.4.5. Output Signal

- 18.4.6. Measured Medium

- 18.4.7. Installation Type

- 18.4.8. Pressure Rating

- 18.4.9. End-Use Industry

- 18.5. UAE Level Sensors and Transmitters Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Product Type

- 18.5.4. Monitoring Type

- 18.5.5. Output Signal

- 18.5.6. Measured Medium

- 18.5.7. Installation Type

- 18.5.8. Pressure Rating

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Level Sensors and Transmitters Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Product Type

- 18.6.4. Monitoring Type

- 18.6.5. Output Signal

- 18.6.6. Measured Medium

- 18.6.7. Installation Type

- 18.6.8. Pressure Rating

- 18.6.9. End-Use Industry

- 18.7. Israel Level Sensors and Transmitters Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology Type

- 18.7.3. Product Type

- 18.7.4. Monitoring Type

- 18.7.5. Output Signal

- 18.7.6. Measured Medium

- 18.7.7. Installation Type

- 18.7.8. Pressure Rating

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Level Sensors and Transmitters Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology Type

- 18.8.3. Product Type

- 18.8.4. Monitoring Type

- 18.8.5. Output Signal

- 18.8.6. Measured Medium

- 18.8.7. Installation Type

- 18.8.8. Pressure Rating

- 18.8.9. End-Use Industry

- 19. Africa Level Sensors and Transmitters Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology Type

- 19.3.2. Product Type

- 19.3.3. Monitoring Type

- 19.3.4. Output Signal

- 19.3.5. Measured Medium

- 19.3.6. Installation Type

- 19.3.7. Pressure Rating

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Level Sensors and Transmitters Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology Type

- 19.4.3. Product Type

- 19.4.4. Monitoring Type

- 19.4.5. Output Signal

- 19.4.6. Measured Medium

- 19.4.7. Installation Type

- 19.4.8. Pressure Rating

- 19.4.9. End-Use Industry

- 19.5. Egypt Level Sensors and Transmitters Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology Type

- 19.5.3. Product Type

- 19.5.4. Monitoring Type

- 19.5.5. Output Signal

- 19.5.6. Measured Medium

- 19.5.7. Installation Type

- 19.5.8. Pressure Rating

- 19.5.9. End-Use Industry

- 19.6. Nigeria Level Sensors and Transmitters Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology Type

- 19.6.3. Product Type

- 19.6.4. Monitoring Type

- 19.6.5. Output Signal

- 19.6.6. Measured Medium

- 19.6.7. Installation Type

- 19.6.8. Pressure Rating

- 19.6.9. End-Use Industry

- 19.7. Algeria Level Sensors and Transmitters Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Technology Type

- 19.7.3. Product Type

- 19.7.4. Monitoring Type

- 19.7.5. Output Signal

- 19.7.6. Measured Medium

- 19.7.7. Installation Type

- 19.7.8. Pressure Rating

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Level Sensors and Transmitters Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Technology Type

- 19.8.3. Product Type

- 19.8.4. Monitoring Type

- 19.8.5. Output Signal

- 19.8.6. Measured Medium

- 19.8.7. Installation Type

- 19.8.8. Pressure Rating

- 19.8.9. End-Use Industry

- 20. South America Level Sensors and Transmitters Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Level Sensors and Transmitters Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Technology Type

- 20.3.2. Product Type

- 20.3.3. Monitoring Type

- 20.3.4. Output Signal

- 20.3.5. Measured Medium

- 20.3.6. Installation Type

- 20.3.7. Pressure Rating

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Level Sensors and Transmitters Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Technology Type

- 20.4.3. Product Type

- 20.4.4. Monitoring Type

- 20.4.5. Output Signal

- 20.4.6. Measured Medium

- 20.4.7. Installation Type

- 20.4.8. Pressure Rating

- 20.4.9. End-Use Industry

- 20.5. Argentina Level Sensors and Transmitters Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Technology Type

- 20.5.3. Product Type

- 20.5.4. Monitoring Type

- 20.5.5. Output Signal

- 20.5.6. Measured Medium

- 20.5.7. Installation Type

- 20.5.8. Pressure Rating

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Level Sensors and Transmitters Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Technology Type

- 20.6.3. Product Type

- 20.6.4. Monitoring Type

- 20.6.5. Output Signal

- 20.6.6. Measured Medium

- 20.6.7. Installation Type

- 20.6.8. Pressure Rating

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. AMETEK Inc.

- 21.3. Baumer Group

- 21.4. Dwyer Instruments Inc.

- 21.5. Emerson Electric Co.

- 21.6. Endress+Hauser Group

- 21.7. Fortive Corporation (Fluke)

- 21.8. Gems Sensors & Controls

- 21.9. Honeywell International Inc.

- 21.10. Ifm Electronic GmbH

- 21.11. Keller America Inc.

- 21.12. KROHNE Group

- 21.13. Magnetrol International

- 21.14. Matsushima Measure Tech Co. Ltd.

- 21.15. Omega Engineering (Spectris plc)

- 21.16. Pepperl+Fuchs SE

- 21.17. Schneider Electric SE

- 21.18. Sick AG

- 21.19. Siemens AG

- 21.20. Turck Inc.

- 21.21. VEGA Grieshaber KG

- 21.22. WIKA Group

- 21.23. Yokogawa Electric Corporation

- 21.24. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data