Neurovascular Devices Market Size, Share & Trends Analysis Report by Product Type (Neurovascular Stents, Embolic Coils, Neurothrombectomy Devices, Access Devices, Embolic Protection Devices, Neurovascular Balloon Catheters, Others), Procedure Type, Technology, Material Type, Indication/Disease Type, Patient Demographics, Deployment Method, Treatment Approach, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Neurovascular Devices Market Size, Share, and Growth

The global neurovascular devices market is experiencing robust growth, with its estimated value of USD 5.6 Billion in the year 2025 and USD 12.2 Billion by the period 2035, registering a CAGR of 8.1% during the forecast period.

Dr. James Carter, Chief Medical Officer, Global Neurovascular Devices, MedNova Health, says “We are moving towards a pathway of more precise, less invasive, and more personalized care in neurovascular health, with the launch of our next-generation device platform that includes real-time imaging, AI-enabled diagnostics, and better navigational technologies."

The neurovascular devices market have substantial growth around the globe due to many factors contributing to improved patient safety and improved treatment outcomes. Starting with September 2025, Medtronic has a new medical device called the neurovascular stent system, which includes AI-enabled deployment guidance so that patients get the precision they expect while reducing procedure time, thus making these procedures more efficient for hospitals.

Further, the increased prevalence of neurovascular associated conditions, such as stroke and cerebral aneurysm, and the growing elderly population increases demand for more innovative and effective devices (Stryker, August 2025, developed new use next generation embolic coils for concerned hospitals in Europe, in response to demand for less invasive options). Conversion of regulatory agency standards, like FDA and EMA, to advanced safety and efficacy levels, encourages advanced development in manufacturing sector to higher standards of safety and efficacy, and thus greater clinical care.

Additionally, advanced care through more advanced technology, patient safety, efficacy and more clinically necessary options management will continue to drive the neurovascular device market growth.

The global neurovascular devices market also provides nearby opportunity expansion into additional neurointerventional imaging systems, robotics-assisted surgical platforms, bioresorbable scaffolds, and real time monitoring systems. Taking advantage of nearby sectors in neurovascular medical devices allows manufacturers to enhance overall care and increase their presence in the greater medical device market.

Neurovascular Devices Market Dynamics and Trends

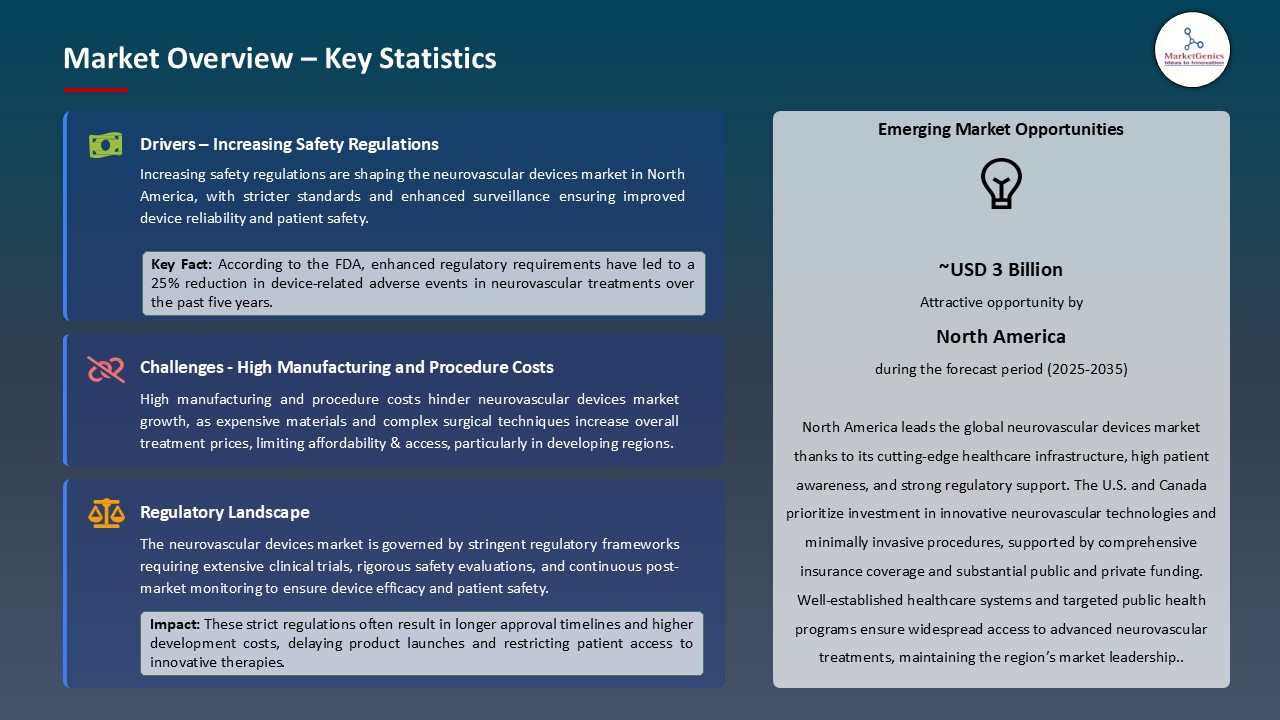

Driver: Increasing Safety Regulations Mandating Advanced Neurovascular Devices Globally

- The progress and acceptance of sophisticated neurovascular devices are being greatly expedited by the increased healthcare regulations and safety obligations imposed by worldwide health authorities, such as the FDA, EMA, and others. These regulations focus on increasing clinical effectiveness, lowering the procedure's risks, and being more favorable regarding long-term outcomes for cases of stroke, aneurysms, and other neurovascular indications.

- In 2025, companies such as Medtronic and Stryker launched next-generation stent retrievers and embolic coils to address more rigorous demand for clinical performance-related thresholds that now involve enhanced navigability, quicker clot retrieval, and diminished risk of vessel trauma. These devices offer improved recovery potential and complement hospital directives for safer, expeditious, and less costly methods.

- The regulatory requests for improvement on the timing of care for stroke patients (e.g., “door-to-treatment” time), as well as an inferred requirement for complication reduction in neurointerventional techniques, are furthering acceptance of new, advanced, annual changes in the neurovascular product portfolio.

Restraint: High Manufacturing and Procedure Costs Limiting Widespread Adoption of Advanced Neurovascular Devices

- The introduction of advanced neurovascular devices is limited by high manufacturing and procedural expenses. Devices such as bioresorbable coils, stent retrievers, and flow diverters represent complex engineering, expensive materials, and years of research and testing to meet the standards for regulatory approval. For example, the introduction of a dual-layered flow diverter in 2025 cost the company millions of dollars in research and clinical validation, and it introduced a higher manufacturing cost to the product.

- These costs limit the number of facilities (particularly small hospitals and hospitals in developing countries with limited budgets for neurovascular technologies) that can afford and make available advanced neurovascular devices to patients. Special equipment and specially trained personnel will incur further expenses, and this alone diminishes the likelihood of many first-line hospitals implementing the technology.

- Another reason adoption is not just targeted due to cost, but also tied to reimbursement limitations and the inability to justify the increased cost of a device over the standard of care in the existing healthcare system (mostly public).

Opportunity: Growing Demand for Neurovascular Devices in Regional and Emerging Markets

- Rising stroke incidents, increasing healthcare access, and awareness across the globe are driving demand for neurovascular devices in the Asia-Pacific, Latin America, and the Middle East region. Accordingly, as health systems in these regional areas evolve, the use of innovative devices, such as stent retrievers and embolic coils, will be the focus of continual advancement and innovation.

- In 2025 and onward, Stryker and MicroVention (Terumo) partnered with hospitals in India and Brazil to provide next-gen thrombectomy devices and clinical training to support the growing local demand for the next-gen technologies. Medtronic also intensified its distribution in Southeast Asia to respond to the growing local demand.

- Supporting regulations, tech transfer, and rapidly increasing investments into stroke care will encourage wider use of neurovascular devices in emerging markets-creating exciting growth opportunities for key players in the neurovascular market, such as Penumbra, Cerenovus (Johnson & Johnson), and Balt Extrusion.

Key Trend: Innovation in Smart Neurovascular Technologies and Digital Integration Boosting Market Expansion

- The neurovascular devices market is becoming increasingly influenced by pervading smart technology, real-time imaging, and precision-engineered devices that improve clinical outcomes and procedural efficiency. Notable advances include microcatheters with sensor technology, AI-assisted navigation, and next-generation embolic coils with enhanced delivery and control features.

- By 2025, companies such as Penumbra, Terumo Corporation (MicroVention), Cerenovus (Johnson & Johnson), MicroPort Scientific, Rapid Medical, and Pulsera Medical are growing their remote monitoring tools and robotic-assisted neurointerventional platforms intended to reduce variability and improved operator accuracy.

- Emerging innovators such as Concentric Medical, Phenox GmbH, Balt Extrusion, Silk Road Medical, and KRA Neuroscience are creating innovative devices to address the device's enhanced delivery mechanism, improved safety, and overall procedural efficiency.

Neurovascular Devices Market Analysis and Segmental Data

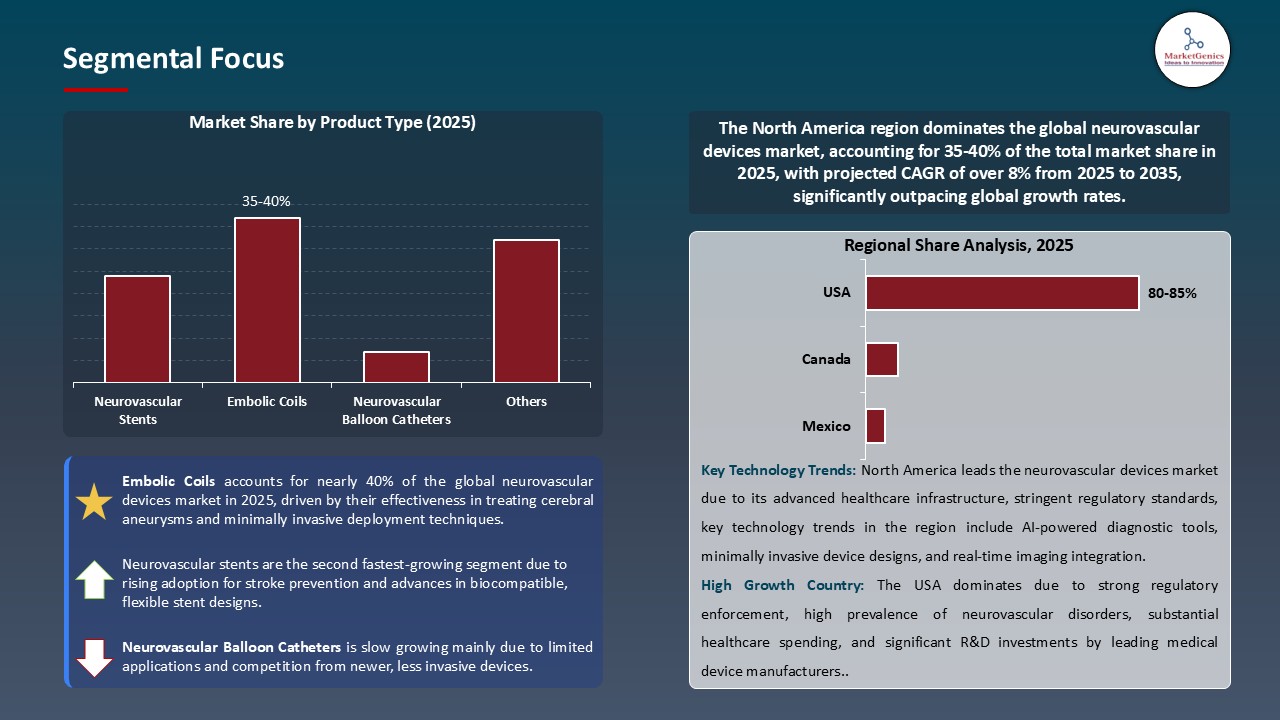

Embolic Coils Maintain Dominance in Global Market amid Rising Incidence of Cerebral Aneurysms and Advancements in Coil Technology

- Within the neurovascular devices product category, embolic coils account for the highest share due to their pivotal role in treating cerebral aneurysms and other vascular malformations. Furthermore, advancements in the materials and designs of coils have contributed to improvements in occlusion rates, flexibility, and precision delivery. For example, in March 2025, Medtronic launched a next-generation detachable coil, which features improved softness and shape memory to help ensure better navigation through these complex vascular anatomies.

- - In response to the rise in cerebral aneurysms, and stringent clinical guidelines for treatment, hospitals and intervention centers are investing in more sophisticated coil systems that facilitate reduced procedure time and complications. Manufacturers are also researching hybrid coils that incorporate coils with bioactive coatings aimed at faster healing and reduced recanalization risk.

- - The increased awareness of cerebral aneurysms and neurovascular devices market in general, regulatory support and continuous evolution of technology will help drive adoption of embolic coils into "the standard of care" treatment; maintaining the greatest product type share of the global neurovascular devices market.

North America Dominates the Neurovascular Devices Market, Driven by Advanced Healthcare Infrastructure and Strong R&D Investments

- North America will have a higher demand for neurovascular devices because of its developed healthcare structure, research institutes, and the investment of R&D, and the number of major medical devices companies and stroke centers. This will increase the speed of adoption of new technologies. For example, in 2025 Penumbra and Cerenovus (Johnson & Johnson) added new embolic coil and thrombectomy device products to their neurovascular portfolios for the unique case patients.

- Governments have also been helping to fund new clinical trials and keep our reimbursement policies favorable; both of these factors will keep the ceaseless efforts of clinical trials and appeal to the public market. This is compounded with the increasing burden of stroke and other neurovascular diseases to an older patient population requiring more treatment options.

- These explained factors along with the continued collaborations of an academic center with the biotech or medical device industry creates a more favorable market in North America, making it the largest potential market and fastest growing regional market in global neurovascular devices.

Neurovascular Devices Market Ecosystem

The neurovascular devices market shows moderate consolidation of market share among the key players of Medtronic plc, Johnson & Johnson (Cerenovus), Penumbra, Inc., Boston Scientific Corporation, MicroVention, Inc. (Terumo Corporation), and Stryker Corporation that have led the industry with their cutting-edge technology. Specialization remains inherent in neurovascular devices with industry innovations such as Penumbra's aspiration thrombectomy systems and Cerenovus's embolic coils that enhance care for patients and improve innovation.

Governmental funders and research institutions remain a primary driver of market demand. For instance, in March 2025, the U.S. National Institutes of Health (NIH) announced funding for an AI-based imaging project conducting initial studies to increase accurate stroke diagnoses which can provide faster treatment and increase recovery rates.

Key-industry players are also focused on continued product specialization and extensions of the portfolio, integrating AI and IoT enabled-digital monitoring as well as real-time monitoring for overall efficiencies and discipline reliability. For instance, Boston Scientific announced, in June 2025, an AI-enhanced neurovascular navigation system to improve catheter placement accuracy by 30% and reduce time in procedures.

This convergence of market consolidation, innovations, government support, and integration of new technology is contributing to the underlying growth and advance health care for patients in the neurovascular devices market internationally.

Recent Development and Strategic Overview:

- In March 2025, Penumbra, Inc. reported that their latest thrombectomy devices were used in 100,000+ neurovascular interventions across the globe in 2024, a major achievement. Additionally, to further improve patient outcomes, Penumbra expanded their digital platform to include AI-enabled imaging analysis and remote monitoring of procedures, supporting clinicians in developing better treatment strategies and reducing complications.

- In April 2025, Boston Scientific announced that the firm observed a 25% increase in the adoption of their AI-enabled neurovascular navigation systems in 2024. The company built on their ecosystem by introducing real-time data analytics and telemedicine support, which increased procedural accuracy and created personalized opportunities for patient care before, during, and after treatment.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 5.6 Bn |

|

Market Forecast Value in 2035 |

USD 12.2 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Neurovascular Devices Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Neurovascular Devices Market, By Product Type |

|

|

Neurovascular Devices Market, By Procedure Type |

|

|

Neurovascular Devices Market, By Technology |

|

|

Neurovascular Devices Market, By Material Type |

|

|

Neurovascular Devices Market, By Indication/Disease Type |

|

|

Neurovascular Devices Market, By Patient Demographics |

|

|

Neurovascular Devices Market, By Deployment Method |

|

|

Neurovascular Devices Market, By Treatment Approach |

|

|

Neurovascular Devices Market, By End-users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Neurovascular Devices Market Outlook

- 2.1.1. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Neurovascular Devices Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Neurovascular Devices Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Global Neurovascular Devices Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing Safety Regulations Mandating Advanced Neurovascular Devices Globally

- 4.1.2. Restraints

- 4.1.2.1. High Manufacturing and Procedure Costs Limiting Widespread Adoption of Advanced Neurovascular Devices

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturing and Processing

- 4.4.3. Wholesalers/ E-commerce Platform

- 4.4.4. End-use/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Neurovascular Devices Market Demand

- 4.9.1. Historical Market Size – (Value - USD Bn and Volume - Million Units), 2021-2024

- 4.9.2. Current and Future Market Size – (Value - USD Bn and Volume - Million Units), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Neurovascular Devices Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Neurovascular Stents

- 6.2.1.1. Flow Diverters

- 6.2.1.2. Self-Expanding Stents

- 6.2.1.3. Balloon-Expandable Stents

- 6.2.1.4. Others

- 6.2.2. Embolic Coils

- 6.2.2.1. Detachable Coils

- 6.2.2.2. Pushable Coils

- 6.2.2.3. Bare Platinum Coils

- 6.2.2.4. Others

- 6.2.3. Neurothrombectomy Devices

- 6.2.3.1. Stent Retrievers

- 6.2.3.2. Aspiration Devices

- 6.2.3.3. Others

- 6.2.4. Access Devices

- 6.2.5. Embolic Protection Devices

- 6.2.6. Neurovascular Balloon Catheters

- 6.2.7. Others

- 6.2.1. Neurovascular Stents

- 7. Global Neurovascular Devices Market Analysis, by Procedure Type

- 7.1. Key Segment Analysis

- 7.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Procedure Type, 2021-2035

- 7.2.1. Cerebral Aneurysm Treatment

- 7.2.2. Ischemic Stroke Intervention

- 7.2.3. Arteriovenous Malformation (AVM) Treatment

- 7.2.4. Carotid Artery Stenosis Treatment

- 7.2.5. Intracranial Atherosclerotic Disease Treatment

- 7.2.6. Hemorrhagic Stroke Management

- 7.2.7. Venous Sinus Thrombosis Treatment

- 7.2.8. Others

- 8. Global Neurovascular Devices Market Analysis, by Technology

- 8.1. Key Segment Analysis

- 8.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. Mechanical Thrombectomy

- 8.2.2. Endovascular Coiling

- 8.2.3. Flow Diversion Technology

- 8.2.4. Liquid Embolization

- 8.2.5. Angioplasty and Stenting

- 8.2.6. Balloon-Assisted Coiling

- 8.2.7. Others

- 9. Global Neurovascular Devices Market Analysis, by Material Type

- 9.1. Key Segment Analysis

- 9.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Material Type, 2021-2035

- 9.2.1. Nitinol-Based Devices

- 9.2.2. Platinum-Based Devices

- 9.2.3. Stainless Steel Devices

- 9.2.4. Polymer-Based Devices

- 9.2.5. Cobalt Chromium Devices

- 9.2.6. Hybrid Material Devices

- 10. Global Neurovascular Devices Market Analysis, by Indication/Disease Type

- 10.1. Key Segment Analysis

- 10.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Indication/Disease Type, 2021-2035

- 10.2.1. Cerebral Aneurysms

- 10.2.2. Acute Ischemic Stroke

- 10.2.3. Carotid Stenosis

- 10.2.4. Intracranial Stenosis

- 10.2.5. Arteriovenous Malformations

- 10.2.6. Dural Arteriovenous Fistulas

- 10.2.7. Vasospasm

- 10.2.8. Brain Tumors

- 10.2.9. Others

- 11. Global Neurovascular Devices Market Analysis, by Patient Demographics

- 11.1. Key Segment Analysis

- 11.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Patient Demographics, 2021-2035

- 11.2.1. Pediatric (<18 years)

- 11.2.2. Adults (18-64 years)

- 11.2.3. Geriatric (65+ years)

- 12. Global Neurovascular Devices Market Analysis, by Deployment Method

- 12.1. Key Segment Analysis

- 12.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Deployment Method, 2021-2035

- 12.2.1. Catheter-Based Delivery

- 12.2.2. Microcatheter Delivery

- 12.2.3. Guide Catheter Systems

- 12.2.4. Direct Puncture Systems

- 13. Global Neurovascular Devices Market Analysis, by Treatment Approach

- 13.1. Key Segment Analysis

- 13.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Treatment Approach, 2021-2035

- 13.2.1. Minimally Invasive Procedures

- 13.2.2. Hybrid Procedures

- 13.2.3. Emergency/Acute Treatment

- 13.2.4. Elective/Planned Procedures

- 14. Global Neurovascular Devices Market Analysis, by End-users

- 14.1. Key Segment Analysis

- 14.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Hospitals

- 14.2.1.1. Emergency Stroke Treatment

- 14.2.1.2. Aneurysm Repair Surgery

- 14.2.1.3. Elective Neurovascular Procedures

- 14.2.1.4. Intensive Care Management

- 14.2.1.5. Inpatient Rehabilitation

- 14.2.1.6. Others

- 14.2.2. Ambulatory Surgical Centers (ASCs)

- 14.2.2.1. Day-Case Neurovascular Procedures

- 14.2.2.2. Diagnostic Angiography

- 14.2.2.3. Minor Embolization Procedures

- 14.2.2.4. Follow-up Interventions

- 14.2.2.5. Others

- 14.2.3. Specialized Neurovascular Centers

- 14.2.3.1. Complex Aneurysm Treatment

- 14.2.3.2. Advanced Stroke Intervention

- 14.2.3.3. AVM Treatment

- 14.2.3.4. Clinical Trials & Research

- 14.2.3.5. High-Risk Patient Management

- 14.2.3.6. Others

- 14.2.4. Catheterization Laboratories

- 14.2.5. Research & Academic Institutions

- 14.2.6. Rehabilitation Centers

- 14.2.7. Others

- 14.2.1. Hospitals

- 15. Global Neurovascular Devices Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Global Neurovascular Devices Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Procedure Type

- 16.3.3. Technology

- 16.3.4. Material Type

- 16.3.5. Indication/Disease Type

- 16.3.6. Patient Demographics

- 16.3.7. Deployment Method

- 16.3.8. Treatment Approach

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Global Neurovascular Devices Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Procedure Type

- 16.4.4. Technology

- 16.4.5. Material Type

- 16.4.6. Indication/Disease Type

- 16.4.7. Patient Demographics

- 16.4.8. Deployment Method

- 16.4.9. Treatment Approach

- 16.4.10. End-users

- 16.5. Canada Global Neurovascular Devices Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Procedure Type

- 16.5.4. Technology

- 16.5.5. Material Type

- 16.5.6. Indication/Disease Type

- 16.5.7. Patient Demographics

- 16.5.8. Deployment Method

- 16.5.9. Treatment Approach

- 16.5.10. End-users

- 16.6. Mexico Global Neurovascular Devices Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Procedure Type

- 16.6.4. Technology

- 16.6.5. Material Type

- 16.6.6. Indication/Disease Type

- 16.6.7. Patient Demographics

- 16.6.8. Deployment Method

- 16.6.9. Treatment Approach

- 16.6.10. End-users

- 17. Europe Global Neurovascular Devices Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Procedure Type

- 17.3.3. Technology

- 17.3.4. Material Type

- 17.3.5. Indication/Disease Type

- 17.3.6. Patient Demographics

- 17.3.7. Deployment Method

- 17.3.8. Treatment Approach

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Global Neurovascular Devices Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Disease Indication/Therapeutic Area

- 17.4.5. Test Type

- 17.4.6. Sample Type

- 17.4.7. Mode of Purchase

- 17.4.8. Setting/Point of Care

- 17.4.9. Modality/Treatment Approach

- 17.4.10. End-users

- 17.5. United Kingdom Global Neurovascular Devices Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Procedure Type

- 17.5.4. Technology

- 17.5.5. Material Type

- 17.5.6. Indication/Disease Type

- 17.5.7. Patient Demographics

- 17.5.8. Deployment Method

- 17.5.9. Treatment Approach

- 17.5.10. End-users

- 17.6. France Global Neurovascular Devices Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Procedure Type

- 17.6.4. Technology

- 17.6.5. Material Type

- 17.6.6. Indication/Disease Type

- 17.6.7. Patient Demographics

- 17.6.8. Deployment Method

- 17.6.9. Treatment Approach

- 17.6.10. End-users

- 17.7. Italy Global Neurovascular Devices Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Procedure Type

- 17.7.4. Technology

- 17.7.5. Material Type

- 17.7.6. Indication/Disease Type

- 17.7.7. Patient Demographics

- 17.7.8. Deployment Method

- 17.7.9. Treatment Approach

- 17.7.10. End-users

- 17.8. Spain Global Neurovascular Devices Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Procedure Type

- 17.8.4. Technology

- 17.8.5. Material Type

- 17.8.6. Indication/Disease Type

- 17.8.7. Patient Demographics

- 17.8.8. Deployment Method

- 17.8.9. Treatment Approach

- 17.8.10. End-users

- 17.9. Netherlands Global Neurovascular Devices Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Procedure Type

- 17.9.4. Technology

- 17.9.5. Material Type

- 17.9.6. Indication/Disease Type

- 17.9.7. Patient Demographics

- 17.9.8. Deployment Method

- 17.9.9. Treatment Approach

- 17.9.10. End-users

- 17.10. Nordic Countries Global Neurovascular Devices Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Procedure Type

- 17.10.4. Technology

- 17.10.5. Material Type

- 17.10.6. Indication/Disease Type

- 17.10.7. Patient Demographics

- 17.10.8. Deployment Method

- 17.10.9. Treatment Approach

- 17.10.10. End-users

- 17.11. Poland Global Neurovascular Devices Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Procedure Type

- 17.11.4. Technology

- 17.11.5. Material Type

- 17.11.6. Indication/Disease Type

- 17.11.7. Patient Demographics

- 17.11.8. Deployment Method

- 17.11.9. Treatment Approach

- 17.11.10. End-users

- 17.12. Russia & CIS Global Neurovascular Devices Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Procedure Type

- 17.12.4. Technology

- 17.12.5. Material Type

- 17.12.6. Indication/Disease Type

- 17.12.7. Patient Demographics

- 17.12.8. Deployment Method

- 17.12.9. Treatment Approach

- 17.12.10. End-users

- 17.13. Rest of Europe Global Neurovascular Devices Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Procedure Type

- 17.13.4. Technology

- 17.13.5. Material Type

- 17.13.6. Indication/Disease Type

- 17.13.7. Patient Demographics

- 17.13.8. Deployment Method

- 17.13.9. Treatment Approach

- 17.13.10. End-users

- 18. Asia Pacific Global Neurovascular Devices Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Procedure Type

- 18.3.3. Technology

- 18.3.4. Material Type

- 18.3.5. Indication/Disease Type

- 18.3.6. Patient Demographics

- 18.3.7. Deployment Method

- 18.3.8. Treatment Approach

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia-Pacific

- 18.4. China Global Neurovascular Devices Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Procedure Type

- 18.4.4. Technology

- 18.4.5. Material Type

- 18.4.6. Indication/Disease Type

- 18.4.7. Patient Demographics

- 18.4.8. Deployment Method

- 18.4.9. Treatment Approach

- 18.4.10. End-users

- 18.5. India Global Neurovascular Devices Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Procedure Type

- 18.5.4. Technology

- 18.5.5. Material Type

- 18.5.6. Indication/Disease Type

- 18.5.7. Patient Demographics

- 18.5.8. Deployment Method

- 18.5.9. Treatment Approach

- 18.5.10. End-users

- 18.6. Japan Global Neurovascular Devices Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Procedure Type

- 18.6.4. Technology

- 18.6.5. Material Type

- 18.6.6. Indication/Disease Type

- 18.6.7. Patient Demographics

- 18.6.8. Deployment Method

- 18.6.9. Treatment Approach

- 18.6.10. End-users

- 18.7. South Korea Global Neurovascular Devices Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Procedure Type

- 18.7.4. Technology

- 18.7.5. Material Type

- 18.7.6. Indication/Disease Type

- 18.7.7. Patient Demographics

- 18.7.8. Deployment Method

- 18.7.9. Treatment Approach

- 18.7.10. End-users

- 18.8. Australia and New Zealand Global Neurovascular Devices Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Procedure Type

- 18.8.4. Technology

- 18.8.5. Material Type

- 18.8.6. Indication/Disease Type

- 18.8.7. Patient Demographics

- 18.8.8. Deployment Method

- 18.8.9. Treatment Approach

- 18.8.10. End-users

- 18.9. Indonesia Global Neurovascular Devices Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Procedure Type

- 18.9.4. Technology

- 18.9.5. Material Type

- 18.9.6. Indication/Disease Type

- 18.9.7. Patient Demographics

- 18.9.8. Deployment Method

- 18.9.9. Treatment Approach

- 18.9.10. End-users

- 18.10. Malaysia Global Neurovascular Devices Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Procedure Type

- 18.10.4. Technology

- 18.10.5. Material Type

- 18.10.6. Indication/Disease Type

- 18.10.7. Patient Demographics

- 18.10.8. Deployment Method

- 18.10.9. Treatment Approach

- 18.10.10. End-users

- 18.11. Thailand Global Neurovascular Devices Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Procedure Type

- 18.11.4. Technology

- 18.11.5. Material Type

- 18.11.6. Indication/Disease Type

- 18.11.7. Patient Demographics

- 18.11.8. Deployment Method

- 18.11.9. Treatment Approach

- 18.11.10. End-users

- 18.12. Vietnam Global Neurovascular Devices Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Procedure Type

- 18.12.4. Technology

- 18.12.5. Material Type

- 18.12.6. Indication/Disease Type

- 18.12.7. Patient Demographics

- 18.12.8. Deployment Method

- 18.12.9. Treatment Approach

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Global Neurovascular Devices Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Procedure Type

- 18.13.4. Technology

- 18.13.5. Material Type

- 18.13.6. Indication/Disease Type

- 18.13.7. Patient Demographics

- 18.13.8. Deployment Method

- 18.13.9. Treatment Approach

- 18.13.10. End-users

- 19. Middle East Global Neurovascular Devices Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Procedure Type

- 19.3.3. Technology

- 19.3.4. Material Type

- 19.3.5. Indication/Disease Type

- 19.3.6. Patient Demographics

- 19.3.7. Deployment Method

- 19.3.8. Treatment Approach

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Global Neurovascular Devices Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Procedure Type

- 19.4.4. Technology

- 19.4.5. Material Type

- 19.4.6. Indication/Disease Type

- 19.4.7. Patient Demographics

- 19.4.8. Deployment Method

- 19.4.9. Treatment Approach

- 19.4.10. End-users

- 19.5. UAE Global Neurovascular Devices Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Procedure Type

- 19.5.4. Technology

- 19.5.5. Material Type

- 19.5.6. Indication/Disease Type

- 19.5.7. Patient Demographics

- 19.5.8. Deployment Method

- 19.5.9. Treatment Approach

- 19.5.10. End-users

- 19.6. Saudi Arabia Global Neurovascular Devices Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Procedure Type

- 19.6.4. Technology

- 19.6.5. Material Type

- 19.6.6. Indication/Disease Type

- 19.6.7. Patient Demographics

- 19.6.8. Deployment Method

- 19.6.9. Treatment Approach

- 19.6.10. End-users

- 19.7. Israel Global Neurovascular Devices Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Procedure Type

- 19.7.4. Technology

- 19.7.5. Material Type

- 19.7.6. Indication/Disease Type

- 19.7.7. Patient Demographics

- 19.7.8. Deployment Method

- 19.7.9. Treatment Approach

- 19.7.10. End-users

- 19.8. Rest of Middle East Global Neurovascular Devices Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Procedure Type

- 19.8.4. Technology

- 19.8.5. Material Type

- 19.8.6. Indication/Disease Type

- 19.8.7. Patient Demographics

- 19.8.8. Deployment Method

- 19.8.9. Treatment Approach

- 19.8.10. End-users

- 20. Africa Global Neurovascular Devices Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Procedure Type

- 20.3.3. Technology

- 20.3.4. Material Type

- 20.3.5. Indication/Disease Type

- 20.3.6. Patient Demographics

- 20.3.7. Deployment Method

- 20.3.8. Treatment Approach

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Global Neurovascular Devices Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Procedure Type

- 20.4.4. Technology

- 20.4.5. Material Type

- 20.4.6. Indication/Disease Type

- 20.4.7. Patient Demographics

- 20.4.8. Deployment Method

- 20.4.9. Treatment Approach

- 20.4.10. End-users

- 20.5. Egypt Global Neurovascular Devices Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Procedure Type

- 20.5.4. Technology

- 20.5.5. Material Type

- 20.5.6. Indication/Disease Type

- 20.5.7. Patient Demographics

- 20.5.8. Deployment Method

- 20.5.9. Treatment Approach

- 20.5.10. End-users

- 20.6. Nigeria Global Neurovascular Devices Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Procedure Type

- 20.6.4. Technology

- 20.6.5. Material Type

- 20.6.6. Indication/Disease Type

- 20.6.7. Patient Demographics

- 20.6.8. Deployment Method

- 20.6.9. Treatment Approach

- 20.6.10. End-users

- 20.7. Algeria Global Neurovascular Devices Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Procedure Type

- 20.7.4. Technology

- 20.7.5. Material Type

- 20.7.6. Indication/Disease Type

- 20.7.7. Patient Demographics

- 20.7.8. Deployment Method

- 20.7.9. Treatment Approach

- 20.7.10. End-users

- 20.8. Rest of Africa Global Neurovascular Devices Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Procedure Type

- 20.8.4. Technology

- 20.8.5. Material Type

- 20.8.6. Indication/Disease Type

- 20.8.7. Patient Demographics

- 20.8.8. Deployment Method

- 20.8.9. Treatment Approach

- 20.8.10. End-users

- 21. South America Global Neurovascular Devices Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Global Neurovascular Devices Market Size (Value - USD Bn and Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Procedure Type

- 21.3.3. Technology

- 21.3.4. Material Type

- 21.3.5. Indication/Disease Type

- 21.3.6. Patient Demographics

- 21.3.7. Deployment Method

- 21.3.8. Treatment Approach

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Global Neurovascular Devices Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Procedure Type

- 21.4.4. Technology

- 21.4.5. Material Type

- 21.4.6. Indication/Disease Type

- 21.4.7. Patient Demographics

- 21.4.8. Deployment Method

- 21.4.9. Treatment Approach

- 21.4.10. End-users

- 21.5. Argentina Global Neurovascular Devices Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Procedure Type

- 21.5.4. Technology

- 21.5.5. Material Type

- 21.5.6. Indication/Disease Type

- 21.5.7. Patient Demographics

- 21.5.8. Deployment Method

- 21.5.9. Treatment Approach

- 21.5.10. End-users

- 21.6. Rest of South America Global Neurovascular Devices Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Procedure Type

- 21.6.4. Technology

- 21.6.5. Material Type

- 21.6.6. Indication/Disease Type

- 21.6.7. Patient Demographics

- 21.6.8. Deployment Method

- 21.6.9. Treatment Approach

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Abbott Laboratories (Abbott Vascular)

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Acandis GmbH

- 22.3. Asahi Intecc Co., Ltd.

- 22.4. Balt Extrusion (Balt Group)

- 22.5. Boston Scientific Corporation

- 22.6. Cerus Endovascular

- 22.7. Imperative Care, Inc.

- 22.8. InNeuroCo, Inc.

- 22.9. Integer Holdings Corporation

- 22.10. Johnson & Johnson (Cerenovus)

- 22.11. Medtronic plc

- 22.12. Merit Medical Systems, Inc.

- 22.13. MicroPort Scientific Corporation

- 22.14. MicroVention, Inc. (Terumo Corporation)

- 22.15. Penumbra, Inc.

- 22.16. Perflow Medical Ltd.

- 22.17. Phenox GmbH

- 22.18. Rapid Medical Ltd.

- 22.19. Stryker Corporation

- 22.20. Zylox-Tonbridge Medical Technology Co., Ltd.

- 22.21. Other Key Players

- 22.1. Abbott Laboratories (Abbott Vascular)

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation