Outdoor TV Market Size, Share & Trends Analysis Report by Screen Size (Below 32 inches, 32-55 inches, 55-75 inches, and Above 75 inches), Display Technology, Brightness Level, Weatherproofing Rating, Installation Type, Anti-Glare Technology, Smart Features, Power Source, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Outdoor TV Market Size, Share, and Growth

The global outdoor tv market is experiencing robust growth, with its estimated value of USD 0.5 billion in the year 2025 and USD 1.33 billion by the period 2035, registering a CAGR of 10.6%, during the forecast period. The outdoor tv market is boosted due to the growing popularity of outdoor entertainment spaces, rising disposable incomes, and increased consumer spending on premium lifestyle products. Technological advancements such as weatherproof designs, anti-glare displays, and 4K resolution enhance viewing quality in varying outdoor conditions.

Nick Belcore, Executive Vice President at Peerless-AV said, "We are thrilled to introduce this new line of Neptune Full Sun TVs, representing a meaningful advancement in our outdoor TV technology, developed specifically for direct sun usage, the Full Sun Series sets a new standard for durability and performance in outdoor entertainment. We are extremely proud of this new solution and the unparalleled viewing experience these TVs offer in even the brightest outdoor environments."

The global outdoor TV market growth is driven by the rise in both outdoor living, as well as outdoor commercial entertainment installations, as homeowners, hospitality sites, and sports venues continue to invest in weather-resistant display options for outdoor spaces such as patios, rooftops and lounges. An increase in requests for outdoor viewing experiences has prompted manufacturers to create and launch commercial-grade, high-brightness, and durable outdoor televisions for a variety of environmental applications. For instance, in April 2024, Peerless-AV announced its newest product launch of the Neptune Full Sun Outdoor Smart TVs.

Moreover, the global outdoor TV market is experiencing growth driven by rapid advancements in product brightness, weatherproofing ability, and smart connectivity to deliver a high-quality experience, improved durability, and an enhanced user experience in a variety of outdoor environments. For example, in April 2024, Samsung Electronics America introduced its´ upgraded 2024 range of The Terrace outdoor TVs at CEDIA Expo 2024, which included Full Sun and Partial Sun models. The 2024 models offer improved water and dust resistance, IP56 rating, as well as Neo QLED Mini LED displays to provide increased brightness and an AI-based processor that can upscale to 4K content to maximize the outdoor viewing experience.

The key market opportunities of the global outdoor tv market include smart lighting solutions, outdoor audio systems, weather-resistant furniture, outdoor projectors, and home automation systems that enhance connected outdoor living. These complementary markets drive integrated entertainment experiences. Their combined growth fosters ecosystem expansion, increasing consumer investment in premium, technology-driven outdoor environments.

Outdoor TV Market Dynamics and Trends

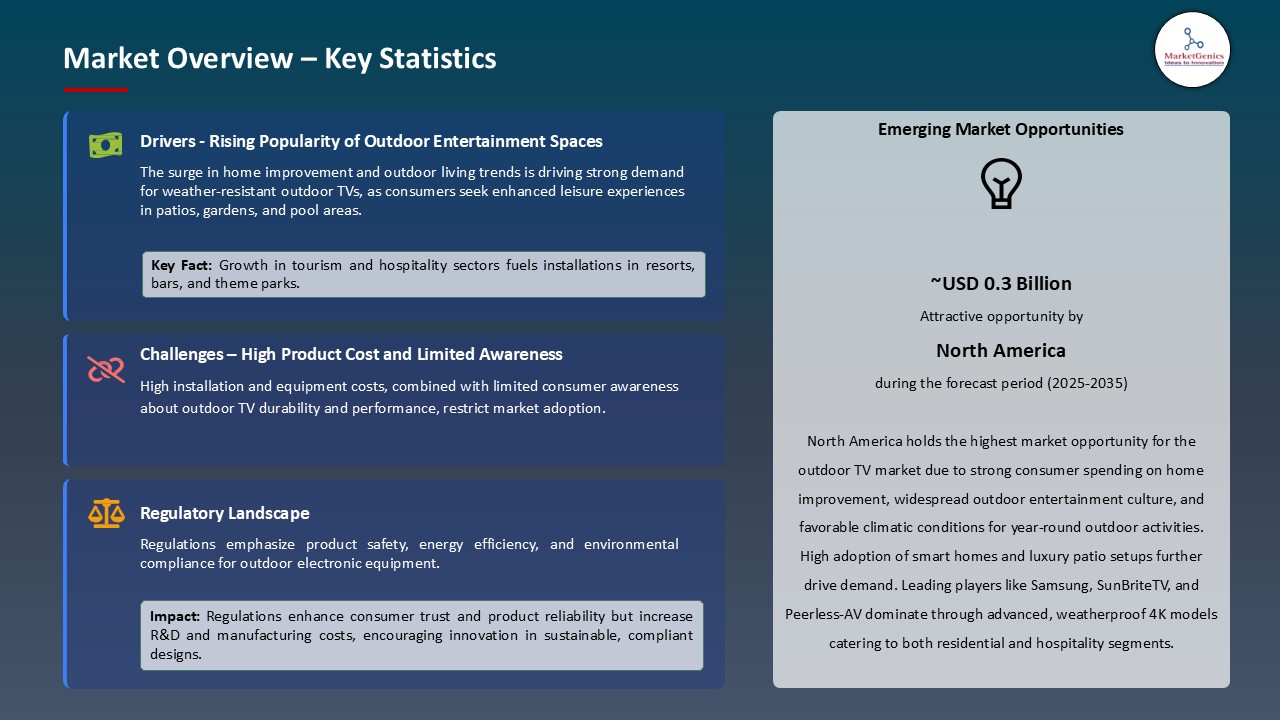

Driver: Rising Demand for Premium Outdoor Entertainment Solutions

- The rising consumer desire for high-quality outdoor entertainment experiences is a significant contributor to the development of the global Outdoor TV market. As residential and commercial properties continue to incorporate entertainment areas with patios, poolside lounges, and rooftops, consumers are becoming increasingly interested in heavy-duty technology that features high-quality screens. The same can be said for the increase in disposable income and demand for newly connected, smart devices. For example, in 2025, LG Electronics launched its LG MAGNIT outdoor LED series with ultra-bright and weather-resistant technology and considered its residential and luxury hospitality market, reflecting the growing segment. The addition of features like voice control and other smart features, which enables seamless streaming, is witnessing more engagement from the consumer.

- In addition, the continuing demand for technology-enhanced premium outdoor entertainment systems will eventually lead to revenue growth and the global high-end Outdoor TV user base expansion.

Restraint: High Cost and Maintenance Challenges

- Despite growing demand, the cost of Outdoor TVs and ongoing maintenance associated with them will remain one of the largest obstacles to broad market acceptance outdoor TVs offer. Advanced weatherproofing, anti-glare, and high brightness panels drive up base prices and will keep these products from entering the hands of the average mid-market consumer.

- Furthermore, continuous exposure to extreme weather can reduce lifespan and repair or replacement costs. For example, in 2024, SunBriteTV released their Veranda 3 Series, announcing improvements in corrosion resistance as well as energy saving for long term consumer costs. However, affordability still deters Outdoor TV consumers in developing regions.

- In addition, the continued cost of these products and maintenance requirements will limit larger scale adoption of these products, especially in developing regions.

Opportunity: Expansion of Smart Outdoor Living Ecosystems

- The global outdoor tv market is being driven by the proliferation of smart outdoor living ecosystems, with consumers wanting an all-in-one entertainment set-up with voice-controlled televisions, smart lighting, and audio systems creating hassle-free outdoor living experiences. In September 2024, Samsung launched updated models of its Terrace outdoor televisions that have an AI-enhanced upscaling processor as well as support for Samsung’s Gaming Hub streaming and integrated with smart home functionality. This has effectively turned the outdoor television into an all-in-one hub within the smart outdoor living ecosystem.

- By introducing smart features and connectivity to the smart living ecosystem, Outdoor televisions are becoming multifunctional entertainment hubs and therefore are driving the trend of more outdoor televisions and helping facilitate their popularity to the connected outdoor ecosystem.

- Additionally, as IoT and smart home tech continue to be widely adopted, Outdoor TVs will act as the central control device increasing convenience, interconnection and user engagement in contemporary outdoor spaces. For example, in January 2025, Sylvox revealed its next-generation outdoor TVs at CES 2025, revealing dramatic integration into outdoor entertainment ecosystems and even suggesting compatibility with home automation systems like Control4, allowing the outdoor TV to connect with lighting, audio, and climate devices.

Key Trend: Advancements in Display and Weatherproofing Technologies

- An increase in the use of advanced display technologies, including OLED, QLED, and Mini-LED, is one of the current market development trends as the products are characterized by high brightness and contrast with low energy consumption improving the outdoor visibility and user experience of all types of installations (residential or commercial). As an example, TCL Electronics featured its top portfolio of innovative technologies in several categories in a January 2024 appearance at the Consumer Electronics Show, such as the largest QD-Mini LED TV in the market and one of the first smart connected mobile device entertainment solutions in the industry. Introduction of innovated display technologies is raising the visual performance and energy efficiency and is fueling the necessity to preimmunize and broaden the appeal of the Outdoor TVs in both residential and commercial use.

- Also, the ongoing development of weatherproof materials and IP-rated enclosures is an opportunity of new growth since it adds product lifespan and reliability in harsh weather conditions to expand the use of Outdoor TVs in hospitality, sports stadiums, and coastal areas. An example is when Skyworth released its new Clarus Outdoor S1 and PS1 series of television sets in 2025, which were more weatherproofed to suit a wide range of outdoor use. The S1 models are provided with IP66 rating and the full-metal enclosures that are created to handle the extreme weather condition whereas PS1 has the IP55 rating which is considered to be under the partial-sun condition installations.

Outdoor-TV-Market Analysis and Segmental Data

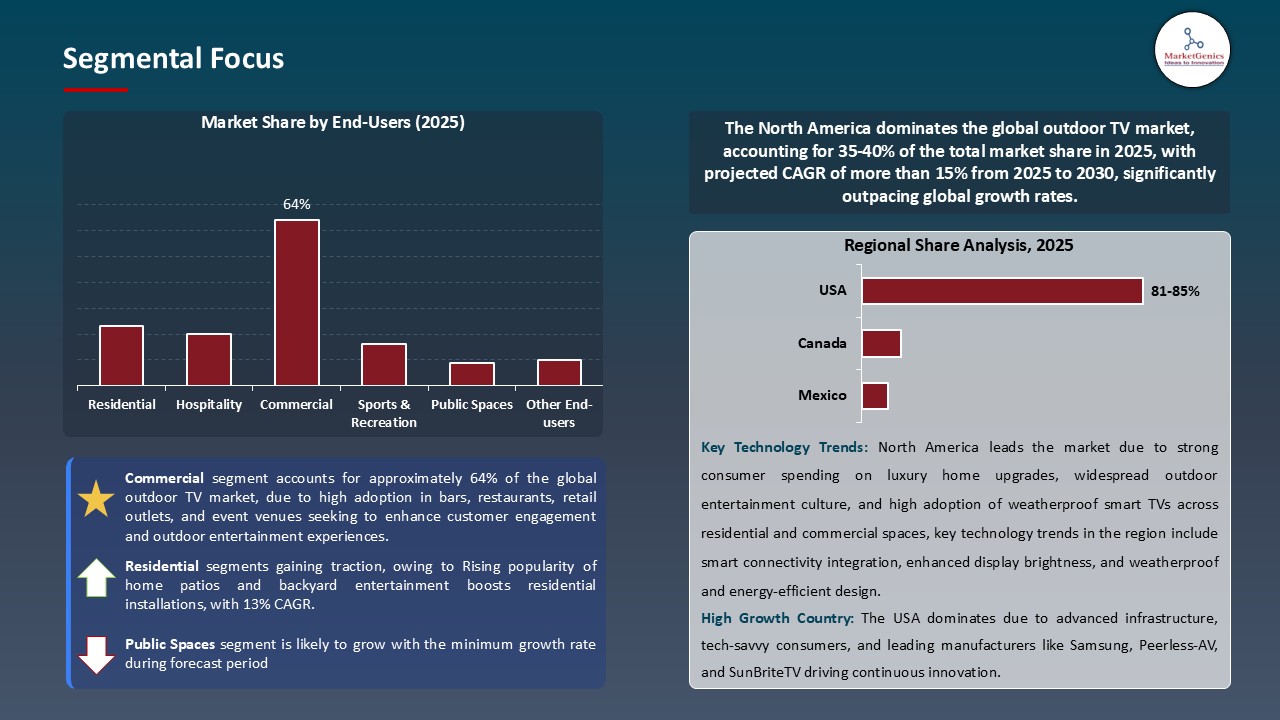

Commercial TVs Dominate Global Outdoor TV Market

- Due to the rise in the utilization of digital display systems in hospitals and entertainment and retail outlets, the commercial sector takes over the global outdoor TV market. TVs used in restaurants, resorts, stadiums and outdoor bars are getting higher-brighter and weatherproof to enhance the interaction with the consumers and give them immersive viewing experience in the open air.

- Additionally, the growing trend of outdoor food and sports screens, as well as the revival of tourist business and investment in high-end hospitality, is also leading to the mass use of the outdoor display systems across the globe. One can mention LG Business Solutions USA that has collaborated with Dallas Cowboys to become an official display provider of the AT&T stadium and training facility in 2025, signed as a multi-year contract. The installation includes a series of suites and concourses with large screen LG MAGNIT Micro LED (price pitch 0.9 mm-1.2 mm). Such novelty denotes the tendency toward active and professional-level outdoor exhibits in the crowded areas.

- These massive commercial uses of Outdoor TVs are creating mass implementations, increasing revenues and creating greater visibility of the manufacturers in the B2B scene throughout the globe.

North America Leads Global Outdoor TV Market Demand

- The North America region dominates the global outdoor TV market, owing to the fact that more homeowners continue to install high quality backyards with intelligent weatherproofing display systems. An example is in 2024, Samsung Electronics America increased its The Terrace outdoor television line within the retail outlets of the United States, with Neo QLED screens and IP56 weather resistance to fulfill the increasing demand of homes. The growth in the premium residential installations is enhancing the leadership position of North America in the Outdoor TV business, which generates greater share of revenue and motivates further development of smart, robust, and weatherproof display products.

- Also, the boom in commercial outdoor spaces like rooftop bars, sports lounges and hospitality patios are also driving growth in the market. In 2025, LG Business solutions USA collaborated with the Dallas Cowboys to install large format LG MAGNIT Micro LED Displays AT&T Stadium and training facilities, which reflects a high level of adoption of high-tech outdoor display technology in business settings. The increase in commercial installations is expanding large scale deployment and making North America the largest market of high-performance outdoor display solutions.

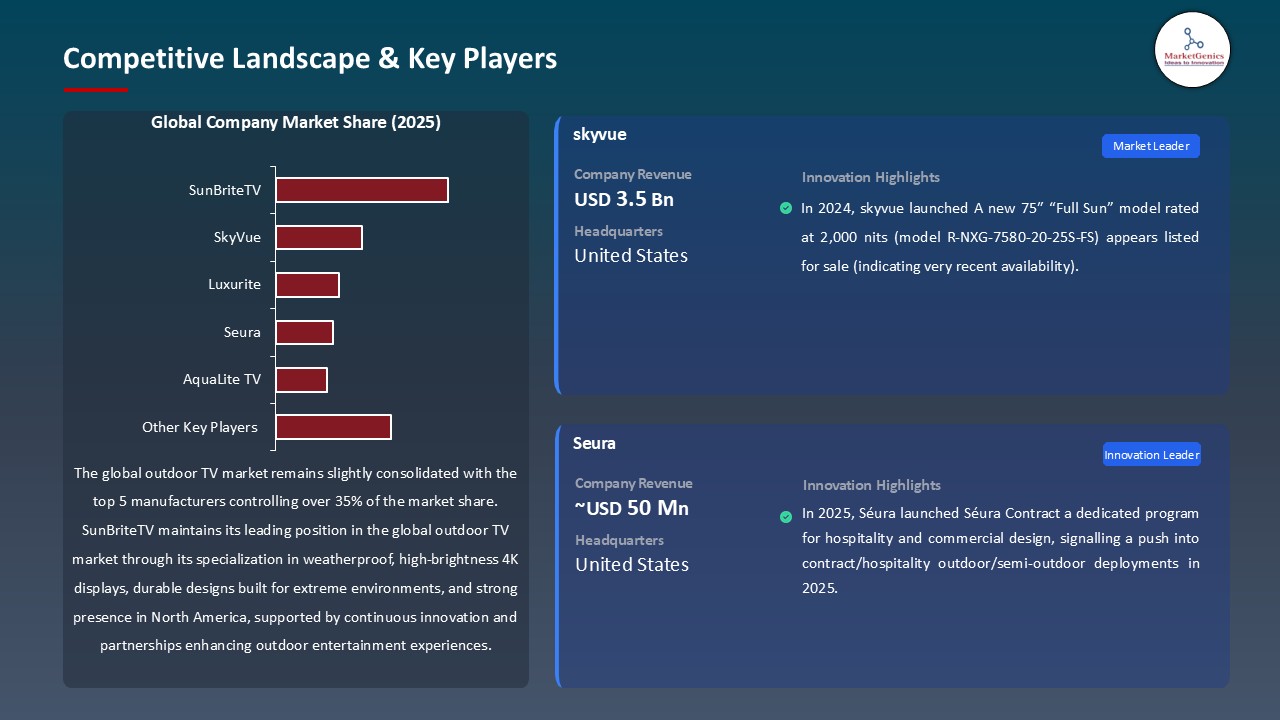

Outdoor-TV-Market Ecosystem

The global outdoor TV segment is mid-level fragmented with high concentration of major industry players who survive on relentless innovations in weatherproof technologies, high brightness display panels, and intelligent connection capabilities, including SunBriteTV, SkyVue, Luxurite, Seura, and AquaLite TV. The companies reinforce their market value by engaging in strategic alliances with hospitality and commercial entertainment venues, product diversification with full-sun and partial-sun models, together with the extension of their distribution channels in the strategic areas of demand to satisfy the increased demand in quality outdoor entertainment solutions. As an example, SunBriteTV 75-inch Veranda Series was included with the 2025 new outdoor 4K smart TV series by the Snap One division titled SunBriteTV called Solis. Solis line has an IP55 weatherproof rating, has a maximum of 1,500 nit of brightness with wide-daylight use in the sun, has built-in Wi-Fi/Bluetooth, voice controls and remote diagnostics through the OvrC Pro platform.

Recent Development and Strategic Overview:

- In September 2025, SKYWORTH showcased its Clarus Outdoor TV line at the CEDIA Expo 2025, featuring Full-Sun S1 models with up to 3,000-nit brightness and IP66-rated all-metal enclosures, and Partial-Sun PS1 models with 1,200-nits and IP55 durability targeted at commercial integrators.

- In February 2025, Séura announced the launch of Séura Contract, a dedicated experience for hospitality and commercial spaces. This new industry site introduces an extensive collection of designer mirrors, including entirely new product categories for Séura tailored to elevate the guest experience in hotels worldwide.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.5 Bn |

|

Market Forecast Value in 2035 |

USD 1.33 Bn |

|

Growth Rate (CAGR) |

10.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Outdoor-TV-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Outdoor TV Market, By Screen Size |

|

|

Outdoor TV Market, By Display Technology |

|

|

Outdoor TV Market, By Brightness Level |

|

|

Outdoor TV Market, By Weatherproofing Rating |

|

|

Outdoor TV Market, By Installation Type

|

|

|

Outdoor TV Market, By Anti-Glare Technology

|

|

|

Outdoor TV Market, By Smart Features |

|

|

Outdoor TV Market, By Power Source |

|

|

Outdoor TV Market, By End-Users |

|

Frequently Asked Questions

The global outdoor TV market was valued at USD 0.5 Bn in 2025.

The global outdoor tv market industry is expected to grow at a CAGR of 10.6% from 2025 to 2035.

The outdoor TV market is driving due to the rising trend of outdoor entertainment and luxury living spaces, particularly in residential and hospitality sectors.

In terms of end-users, commercial are the segment accounted for the major share in 2025

North America is a more attractive region for vendors.

Key players in the global outdoor TV market include Apollo Outdoor TV, Aqualite Outdoor Solutions, AquaLite TV, CinemaView, Cinios, Furrion, LG Electronics, Luxurite, MirageVision, Oolaa, Peerless-AV, ProofVision, Samsung Electronics, Seura, SkyVue, Storm Shell, SunBriteTV, Sunsetter Outdoor TVs, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Outdoor TV Market Outlook

- 2.1.1. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Outdoor TV Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Outdoor TV Industry Overview, 2025

- 3.1.1. Consumer Goods & Services Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Consumer Goods & Services Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Outdoor TV Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for outdoor entertainment and luxury home leisure spaces

- 4.1.1.2. Technological advancements in weatherproof and high-brightness display panels

- 4.1.1.3. Growing adoption in commercial venues such as hotels, bars, and sports arenas

- 4.1.2. Restraints

- 4.1.2.1. High product and installation costs

- 4.1.2.2. Limited awareness and penetration in developing regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Outdoor TV Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Outdoor TV Market Demand

- 4.7.1. Historical Market Size - (Volume - Thousand Units and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - (Volume - Thousand Units and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Outdoor TV Market Analysis, by Screen Size

- 6.1. Key Segment Analysis

- 6.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Screen Size, 2021-2035

- 6.2.1. Below 32 inches

- 6.2.2. 32-55 inches

- 6.2.3. 55-75 inches

- 6.2.4. Above 75 inches

- 7. Global Outdoor TV Market Analysis, by Display Technology

- 7.1. Key Segment Analysis

- 7.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Display Technology, 2021-2035

- 7.2.1. LED (Light Emitting Diode)

- 7.2.1.1. Edge-lit LED

- 7.2.1.2. Direct-lit LED

- 7.2.2. QLED (Quantum Dot LED)

- 7.2.3. OLED (Organic LED)

- 7.2.4. 4K UHD

- 7.2.5. 8K UHD

- 7.2.1. LED (Light Emitting Diode)

- 8. Global Outdoor TV Market Analysis and Forecasts, by Brightness Level

- 8.1. Key Findings

- 8.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Brightness Level, 2021-2035

- 8.2.1. 700-1000 Nits

- 8.2.2. 1000-1500 Nits

- 8.2.3. 1500-2000 Nits

- 8.2.4. Above 2000 Nits

- 9. Global Outdoor TV Market Analysis and Forecasts, by Weatherproofing Rating

- 9.1. Key Findings

- 9.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Weatherproofing Rating, 2021-2035

- 9.2.1. IP55

- 9.2.2. IP65

- 9.2.3. IP68

- 10. Global Outdoor TV Market Analysis and Forecasts, by Installation Type

- 10.1. Key Findings

- 10.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 10.2.1. Wall-mounted

- 10.2.2. Ceiling-mounted

- 10.2.3. Portable/Freestanding

- 10.2.4. Built-in/Recessed

- 11. Global Outdoor TV Market Analysis and Forecasts, by Anti-Glare Technology

- 11.1. Key Findings

- 11.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Anti-Glare Technology, 2021-2035

- 11.2.1. Standard Anti-Glare

- 11.2.2. Advanced Anti-Reflective Coating

- 11.2.3. Sunlight Readable Display

- 12. Global Outdoor TV Market Analysis and Forecasts, by Smart Features

- 12.1. Key Findings

- 12.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Smart Features, 2021-2035

- 12.2.1. Smart TV (with OS)

- 12.2.2. Non-Smart TV

- 12.2.3. IoT Enabled

- 13. Global Outdoor TV Market Analysis and Forecasts, by Power Source

- 13.1. Key Findings

- 13.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Power Source, 2021-2035

- 13.2.1. Electric Power

- 13.2.2. Solar Compatible

- 13.2.3. Hybrid Power System

- 14. Global Outdoor TV Market Analysis and Forecasts, by End-users

- 14.1. Key Findings

- 14.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Residential

- 14.2.1.1. Patio/Deck Entertainment

- 14.2.1.2. Poolside Viewing

- 14.2.1.3. Backyard Theatre

- 14.2.1.4. Outdoor Kitchen Integration

- 14.2.1.5. Garden/Landscape Entertainment

- 14.2.1.6. Balcony/Terrace Setup

- 14.2.1.7. Others

- 14.2.2. Hospitality

- 14.2.2.1. Hotels & Resorts

- 14.2.2.1.1. Pool Area Entertainment

- 14.2.2.1.2. Rooftop Bars/Lounges

- 14.2.2.1.3. Outdoor Dining Areas

- 14.2.2.1.4. Spa & Wellness Centers

- 14.2.2.1.5. Others

- 14.2.2.2. Restaurants & Cafés

- 14.2.2.2.1. Outdoor Seating Areas

- 14.2.2.2.2. Patio Dining

- 14.2.2.2.3. Sports Bar Outdoor Sections

- 14.2.2.2.4. Others

- 14.2.2.3. Event Venues

- 14.2.2.3.1. Wedding Venues

- 14.2.2.3.2. Banquet Halls

- 14.2.2.3.3. Beach Clubs

- 14.2.2.3.4. Others

- 14.2.2.4. Others

- 14.2.2.1. Hotels & Resorts

- 14.2.3. Commercial

- 14.2.3.1. Retail & Shopping Centers

- 14.2.3.1.1. Outdoor Advertising

- 14.2.3.1.2. Mall Entrance Displays

- 14.2.3.1.3. Shopping Plaza Entertainment

- 14.2.3.1.4. Others

- 14.2.3.2. Corporate Offices

- 14.2.3.2.1. Outdoor Break Areas

- 14.2.3.2.2. Rooftop Terraces

- 14.2.3.2.3. Courtyard Spaces

- 14.2.3.2.4. Others

- 14.2.3.3. Healthcare Facilities

- 14.2.3.3.1. Hospital Gardens

- 14.2.3.3.2. Rehabilitation Centers

- 14.2.3.3.3. Outdoor Waiting Areas

- 14.2.3.3.4. Others

- 14.2.3.4. Others

- 14.2.3.1. Retail & Shopping Centers

- 14.2.4. Sports & Recreation

- 14.2.4.1. Sports Stadiums

- 14.2.4.2. Golf Courses

- 14.2.4.3. Marina & Yacht Clubs

- 14.2.4.4. Fitness Centers

- 14.2.4.5. Others

- 14.2.5. Public Spaces

- 14.2.5.1. Parks & Recreation Centers

- 14.2.5.2. Transportation Hubs

- 14.2.5.3. Municipal Buildings

- 14.2.5.4. Educational Institutions

- 14.2.5.5. Others

- 14.2.6. Entertainment & Leisure

- 14.2.6.1. Theme Parks & Amusement Parks

- 14.2.6.2. Outdoor Cinemas

- 14.2.6.3. Concert Venues

- 14.2.6.4. Beach Clubs & Waterfront Areas

- 14.2.6.5. Camping & RV Parks

- 14.2.6.6. Others

- 14.2.7. Military & Defense

- 14.2.8. Automotive & Transportation

- 14.2.9. Other End-users

- 14.2.1. Residential

- 15. Global Outdoor TV Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Outdoor TV Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Screen Size

- 16.3.2. Display Technology

- 16.3.3. Brightness Level

- 16.3.4. Weatherproofing Rating

- 16.3.5. Installation Type

- 16.3.6. Anti-Glare Technology

- 16.3.7. Smart Features

- 16.3.8. Power Source

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Outdoor TV Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Screen Size

- 16.4.3. Display Technology

- 16.4.4. Brightness Level

- 16.4.5. Weatherproofing Rating

- 16.4.6. Installation Type

- 16.4.7. Anti-Glare Technology

- 16.4.8. Smart Features

- 16.4.9. Power Source

- 16.4.10. End-users

- 16.5. Canada Outdoor TV Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Screen Size

- 16.5.3. Display Technology

- 16.5.4. Brightness Level

- 16.5.5. Weatherproofing Rating

- 16.5.6. Installation Type

- 16.5.7. Anti-Glare Technology

- 16.5.8. Smart Features

- 16.5.9. Power Source

- 16.5.10. End-users

- 16.6. Mexico Outdoor TV Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Screen Size

- 16.6.3. Display Technology

- 16.6.4. Brightness Level

- 16.6.5. Weatherproofing Rating

- 16.6.6. Installation Type

- 16.6.7. Anti-Glare Technology

- 16.6.8. Smart Features

- 16.6.9. Power Source

- 16.6.10. End-users

- 17. Europe Outdoor TV Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Screen Size

- 17.3.2. Display Technology

- 17.3.3. Brightness Level

- 17.3.4. Weatherproofing Rating

- 17.3.5. Installation Type

- 17.3.6. Anti-Glare Technology

- 17.3.7. Smart Features

- 17.3.8. Power Source

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Outdoor TV Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Screen Size

- 17.4.3. Display Technology

- 17.4.4. Brightness Level

- 17.4.5. Weatherproofing Rating

- 17.4.6. Installation Type

- 17.4.7. Anti-Glare Technology

- 17.4.8. Smart Features

- 17.4.9. Power Source

- 17.4.10. End-users

- 17.5. United Kingdom Outdoor TV Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Screen Size

- 17.5.3. Display Technology

- 17.5.4. Brightness Level

- 17.5.5. Weatherproofing Rating

- 17.5.6. Installation Type

- 17.5.7. Anti-Glare Technology

- 17.5.8. Smart Features

- 17.5.9. Power Source

- 17.5.10. End-users

- 17.6. France Outdoor TV Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Screen Size

- 17.6.3. Display Technology

- 17.6.4. Brightness Level

- 17.6.5. Weatherproofing Rating

- 17.6.6. Installation Type

- 17.6.7. Anti-Glare Technology

- 17.6.8. Smart Features

- 17.6.9. Power Source

- 17.6.10. End-users

- 17.7. Italy Outdoor TV Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Screen Size

- 17.7.3. Display Technology

- 17.7.4. Brightness Level

- 17.7.5. Weatherproofing Rating

- 17.7.6. Installation Type

- 17.7.7. Anti-Glare Technology

- 17.7.8. Smart Features

- 17.7.9. Power Source

- 17.7.10. End-users

- 17.8. Spain Outdoor TV Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Screen Size

- 17.8.3. Display Technology

- 17.8.4. Brightness Level

- 17.8.5. Weatherproofing Rating

- 17.8.6. Installation Type

- 17.8.7. Anti-Glare Technology

- 17.8.8. Smart Features

- 17.8.9. Power Source

- 17.8.10. End-users

- 17.9. Netherlands Outdoor TV Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Screen Size

- 17.9.3. Display Technology

- 17.9.4. Brightness Level

- 17.9.5. Weatherproofing Rating

- 17.9.6. Installation Type

- 17.9.7. Anti-Glare Technology

- 17.9.8. Smart Features

- 17.9.9. Power Source

- 17.9.10. End-users

- 17.10. Nordic Countries Outdoor TV Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Screen Size

- 17.10.3. Display Technology

- 17.10.4. Brightness Level

- 17.10.5. Weatherproofing Rating

- 17.10.6. Installation Type

- 17.10.7. Anti-Glare Technology

- 17.10.8. Smart Features

- 17.10.9. Power Source

- 17.10.10. End-users

- 17.11. Poland Outdoor TV Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Screen Size

- 17.11.3. Display Technology

- 17.11.4. Brightness Level

- 17.11.5. Weatherproofing Rating

- 17.11.6. Installation Type

- 17.11.7. Anti-Glare Technology

- 17.11.8. Smart Features

- 17.11.9. Power Source

- 17.11.10. End-users

- 17.12. Russia & CIS Outdoor TV Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Screen Size

- 17.12.3. Display Technology

- 17.12.4. Brightness Level

- 17.12.5. Weatherproofing Rating

- 17.12.6. Installation Type

- 17.12.7. Anti-Glare Technology

- 17.12.8. Smart Features

- 17.12.9. Power Source

- 17.12.10. End-users

- 17.13. Rest of Europe Outdoor TV Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Screen Size

- 17.13.3. Display Technology

- 17.13.4. Brightness Level

- 17.13.5. Weatherproofing Rating

- 17.13.6. Installation Type

- 17.13.7. Anti-Glare Technology

- 17.13.8. Smart Features

- 17.13.9. Power Source

- 17.13.10. End-users

- 18. Asia Pacific Outdoor TV Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. East Asia Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Screen Size

- 18.3.2. Display Technology

- 18.3.3. Brightness Level

- 18.3.4. Weatherproofing Rating

- 18.3.5. Installation Type

- 18.3.6. Anti-Glare Technology

- 18.3.7. Smart Features

- 18.3.8. Power Source

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Outdoor TV Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Screen Size

- 18.4.3. Display Technology

- 18.4.4. Brightness Level

- 18.4.5. Weatherproofing Rating

- 18.4.6. Installation Type

- 18.4.7. Anti-Glare Technology

- 18.4.8. Smart Features

- 18.4.9. Power Source

- 18.4.10. End-users

- 18.5. India Outdoor TV Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Screen Size

- 18.5.3. Display Technology

- 18.5.4. Brightness Level

- 18.5.5. Weatherproofing Rating

- 18.5.6. Installation Type

- 18.5.7. Anti-Glare Technology

- 18.5.8. Smart Features

- 18.5.9. Power Source

- 18.5.10. End-users

- 18.6. Japan Outdoor TV Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Screen Size

- 18.6.3. Display Technology

- 18.6.4. Brightness Level

- 18.6.5. Weatherproofing Rating

- 18.6.6. Installation Type

- 18.6.7. Anti-Glare Technology

- 18.6.8. Smart Features

- 18.6.9. Power Source

- 18.6.10. End-users

- 18.7. South Korea Outdoor TV Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Screen Size

- 18.7.3. Display Technology

- 18.7.4. Brightness Level

- 18.7.5. Weatherproofing Rating

- 18.7.6. Installation Type

- 18.7.7. Anti-Glare Technology

- 18.7.8. Smart Features

- 18.7.9. Power Source

- 18.7.10. End-users

- 18.8. Australia and New Zealand Outdoor TV Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Screen Size

- 18.8.3. Display Technology

- 18.8.4. Brightness Level

- 18.8.5. Weatherproofing Rating

- 18.8.6. Installation Type

- 18.8.7. Anti-Glare Technology

- 18.8.8. Smart Features

- 18.8.9. Power Source

- 18.8.10. End-users

- 18.9. Indonesia Outdoor TV Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Screen Size

- 18.9.3. Display Technology

- 18.9.4. Brightness Level

- 18.9.5. Weatherproofing Rating

- 18.9.6. Installation Type

- 18.9.7. Anti-Glare Technology

- 18.9.8. Smart Features

- 18.9.9. Power Source

- 18.9.10. End-users

- 18.10. Malaysia Outdoor TV Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Screen Size

- 18.10.3. Display Technology

- 18.10.4. Brightness Level

- 18.10.5. Weatherproofing Rating

- 18.10.6. Installation Type

- 18.10.7. Anti-Glare Technology

- 18.10.8. Smart Features

- 18.10.9. Power Source

- 18.10.10. End-users

- 18.11. Thailand Outdoor TV Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Screen Size

- 18.11.3. Display Technology

- 18.11.4. Brightness Level

- 18.11.5. Weatherproofing Rating

- 18.11.6. Installation Type

- 18.11.7. Anti-Glare Technology

- 18.11.8. Smart Features

- 18.11.9. Power Source

- 18.11.10. End-users

- 18.12. Vietnam Outdoor TV Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Screen Size

- 18.12.3. Display Technology

- 18.12.4. Brightness Level

- 18.12.5. Weatherproofing Rating

- 18.12.6. Installation Type

- 18.12.7. Anti-Glare Technology

- 18.12.8. Smart Features

- 18.12.9. Power Source

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Outdoor TV Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Screen Size

- 18.13.3. Display Technology

- 18.13.4. Brightness Level

- 18.13.5. Weatherproofing Rating

- 18.13.6. Installation Type

- 18.13.7. Anti-Glare Technology

- 18.13.8. Smart Features

- 18.13.9. Power Source

- 18.13.10. End-users

- 19. Middle East Outdoor TV Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Screen Size

- 19.3.2. Display Technology

- 19.3.3. Brightness Level

- 19.3.4. Weatherproofing Rating

- 19.3.5. Installation Type

- 19.3.6. Anti-Glare Technology

- 19.3.7. Smart Features

- 19.3.8. Power Source

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Outdoor TV Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Screen Size

- 19.4.3. Display Technology

- 19.4.4. Brightness Level

- 19.4.5. Weatherproofing Rating

- 19.4.6. Installation Type

- 19.4.7. Anti-Glare Technology

- 19.4.8. Smart Features

- 19.4.9. Power Source

- 19.4.10. End-users

- 19.5. UAE Outdoor TV Market

- 19.5.1. Screen Size

- 19.5.2. Display Technology

- 19.5.3. Brightness Level

- 19.5.4. Weatherproofing Rating

- 19.5.5. Installation Type

- 19.5.6. Anti-Glare Technology

- 19.5.7. Smart Features

- 19.5.8. Power Source

- 19.5.9. End-users

- 19.6. Saudi Arabia Outdoor TV Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Screen Size

- 19.6.3. Display Technology

- 19.6.4. Brightness Level

- 19.6.5. Weatherproofing Rating

- 19.6.6. Installation Type

- 19.6.7. Anti-Glare Technology

- 19.6.8. Smart Features

- 19.6.9. Power Source

- 19.6.10. End-users

- 19.7. Israel Outdoor TV Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Screen Size

- 19.7.3. Display Technology

- 19.7.4. Brightness Level

- 19.7.5. Weatherproofing Rating

- 19.7.6. Installation Type

- 19.7.7. Anti-Glare Technology

- 19.7.8. Smart Features

- 19.7.9. Power Source

- 19.7.10. End-users

- 19.8. Rest of Middle East Outdoor TV Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Screen Size

- 19.8.3. Display Technology

- 19.8.4. Brightness Level

- 19.8.5. Weatherproofing Rating

- 19.8.6. Installation Type

- 19.8.7. Anti-Glare Technology

- 19.8.8. Smart Features

- 19.8.9. Power Source

- 19.8.10. End-users

- 20. Africa Outdoor TV Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Screen Size

- 20.3.2. Display Technology

- 20.3.3. Brightness Level

- 20.3.4. Weatherproofing Rating

- 20.3.5. Installation Type

- 20.3.6. Anti-Glare Technology

- 20.3.7. Smart Features

- 20.3.8. Power Source

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Outdoor TV Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Screen Size

- 20.4.3. Display Technology

- 20.4.4. Brightness Level

- 20.4.5. Weatherproofing Rating

- 20.4.6. Installation Type

- 20.4.7. Anti-Glare Technology

- 20.4.8. Smart Features

- 20.4.9. Power Source

- 20.4.10. End-users

- 20.5. Egypt Outdoor TV Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Screen Size

- 20.5.3. Display Technology

- 20.5.4. Brightness Level

- 20.5.5. Weatherproofing Rating

- 20.5.6. Installation Type

- 20.5.7. Anti-Glare Technology

- 20.5.8. Smart Features

- 20.5.9. Power Source

- 20.5.10. End-users

- 20.6. Nigeria Outdoor TV Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Screen Size

- 20.6.3. Display Technology

- 20.6.4. Brightness Level

- 20.6.5. Weatherproofing Rating

- 20.6.6. Installation Type

- 20.6.7. Anti-Glare Technology

- 20.6.8. Smart Features

- 20.6.9. Power Source

- 20.6.10. End-users

- 20.7. Algeria Outdoor TV Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Screen Size

- 20.7.3. Display Technology

- 20.7.4. Brightness Level

- 20.7.5. Weatherproofing Rating

- 20.7.6. Installation Type

- 20.7.7. Anti-Glare Technology

- 20.7.8. Smart Features

- 20.7.9. Power Source

- 20.7.10. End-users

- 20.8. Rest of Africa Outdoor TV Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Screen Size

- 20.8.3. Display Technology

- 20.8.4. Brightness Level

- 20.8.5. Weatherproofing Rating

- 20.8.6. Installation Type

- 20.8.7. Anti-Glare Technology

- 20.8.8. Smart Features

- 20.8.9. Power Source

- 20.8.10. End-users

- 21. South America Outdoor TV Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Central and South Africa Outdoor TV Market Size (Volume - Thousand Units and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Screen Size

- 21.3.2. Display Technology

- 21.3.3. Brightness Level

- 21.3.4. Weatherproofing Rating

- 21.3.5. Installation Type

- 21.3.6. Anti-Glare Technology

- 21.3.7. Smart Features

- 21.3.8. Power Source

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Outdoor TV Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Screen Size

- 21.4.3. Display Technology

- 21.4.4. Brightness Level

- 21.4.5. Weatherproofing Rating

- 21.4.6. Installation Type

- 21.4.7. Anti-Glare Technology

- 21.4.8. Smart Features

- 21.4.9. Power Source

- 21.4.10. End-users

- 21.5. Argentina Outdoor TV Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Screen Size

- 21.5.3. Display Technology

- 21.5.4. Brightness Level

- 21.5.5. Weatherproofing Rating

- 21.5.6. Installation Type

- 21.5.7. Anti-Glare Technology

- 21.5.8. Smart Features

- 21.5.9. Power Source

- 21.5.10. End-users

- 21.6. Rest of South America Outdoor TV Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Screen Size

- 21.6.3. Display Technology

- 21.6.4. Brightness Level

- 21.6.5. Weatherproofing Rating

- 21.6.6. Installation Type

- 21.6.7. Anti-Glare Technology

- 21.6.8. Smart Features

- 21.6.9. Power Source

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Apollo Outdoor TV

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Aqualite Outdoor Solutions

- 22.3. AquaLite TV

- 22.4. CinemaView

- 22.5. Cinios

- 22.6. Furrion

- 22.7. LG Electronics

- 22.8. Luxurite

- 22.9. MirageVision

- 22.10. Oolaa

- 22.11. Peerless-AV

- 22.12. ProofVision

- 22.13. Samsung Electronics

- 22.14. Seura

- 22.15. SkyVue

- 22.16. Storm Shell

- 22.17. SunBriteTV

- 22.18. Sunsetter Outdoor TVs

- 22.19. Other Key Players

- 22.1. Apollo Outdoor TV

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data