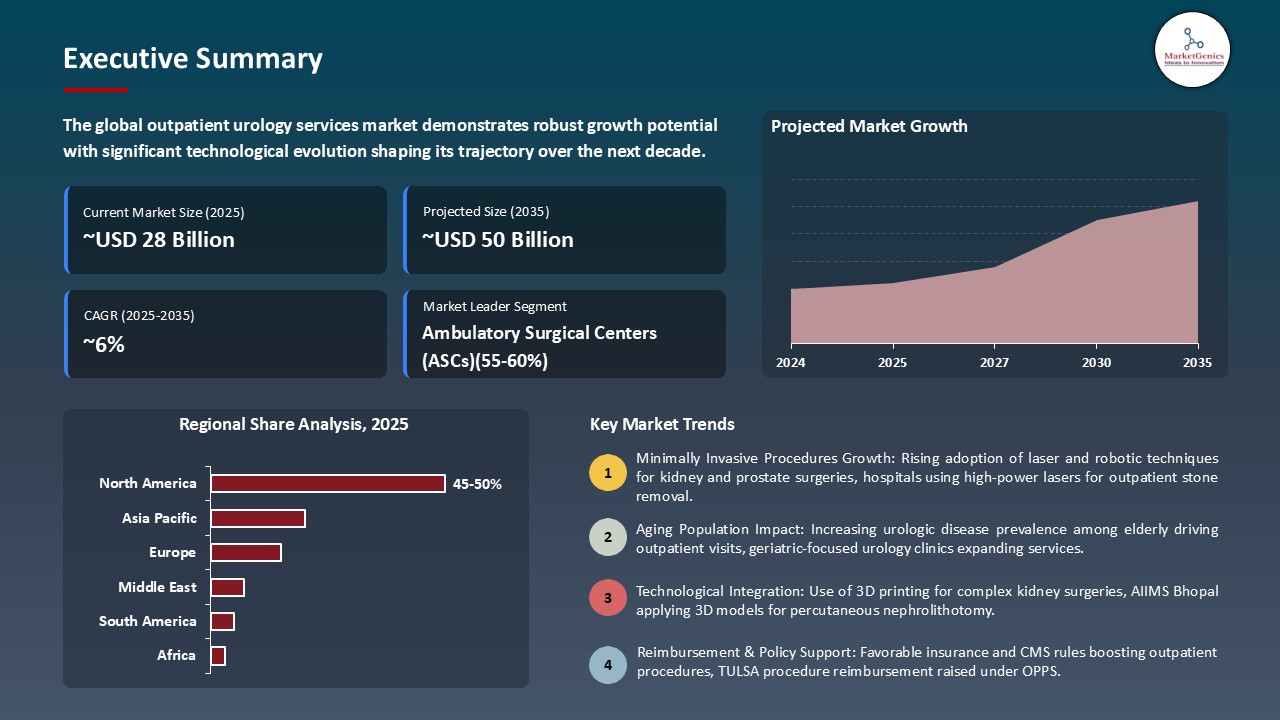

- The global outpatient urology services market is valued at USD 28.2 billion in 2025.

- The market is projected to grow at a CAGR of 5.8% during the forecast period of 2026 to 2035.

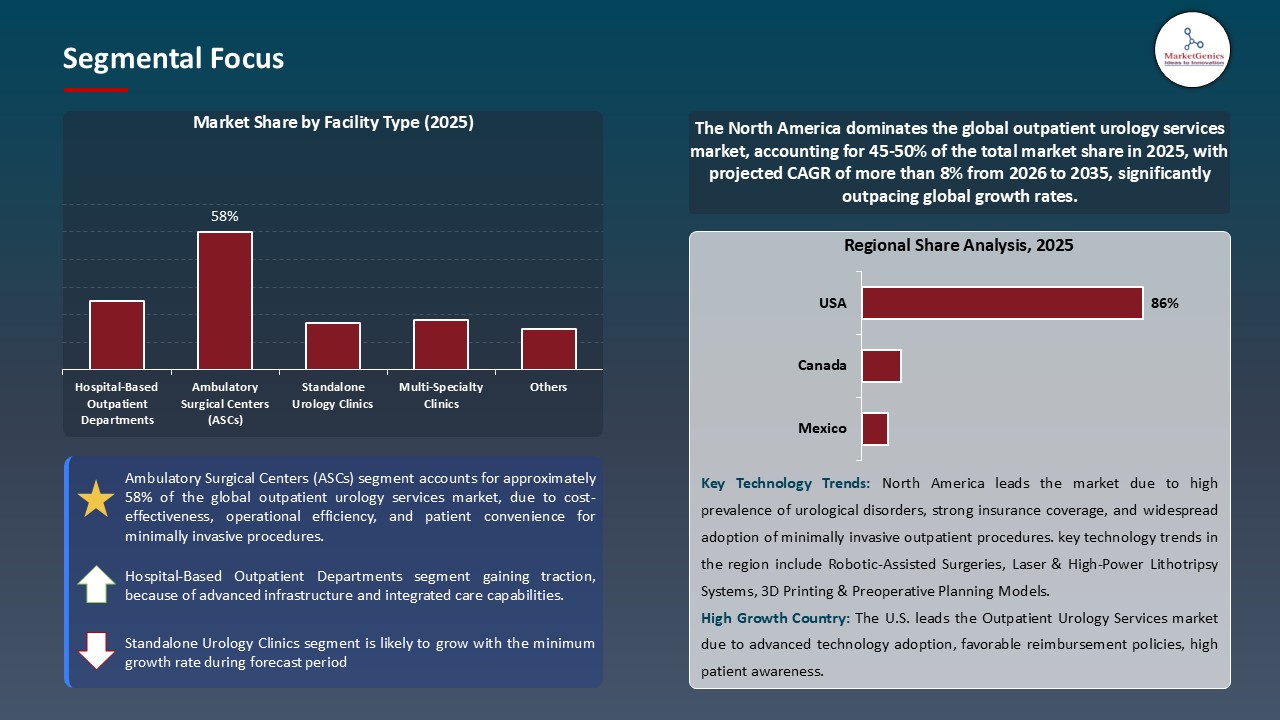

- The ambulatory surgical centers (ASCs) segment dominates the global outpatient urology services market with a 58% share due to their cost-effectiveness, operational efficiency, and ability to provide minimally invasive procedures with faster patient recovery

- Rising demand for minimally invasive and robotic-assisted urological procedures is driving growth in the outpatient urology services market

- Increasing prevalence of kidney stones, urinary incontinence, and other urological disorders is boosting the need for outpatient urology services

- The top five players account for nearly 25% of the global outpatient urology services market in 2025

- In July 2025, Safdarjung Hospital, New Delhi upgraded its urology department with advanced equipment urodynamic machines, lithotripters, lasers, and endoscopy systems

- In December 2024, University of Rochester Medical Center (URMC) expanded outpatient urology care in the Finger Lakes and Southern Tier region by opening a new clinic in Canandaigua

- Global Outpatient Urology Services Market is likely to create the total forecasting opportunity of ~USD 21 Bn till 2035.

- North America’s outpatient urology services market offers strong opportunities in expanding minimally invasive procedures, adoption of advanced laser and robotic technologies, and growing investment in ambulatory surgical centers to meet rising patient demand.

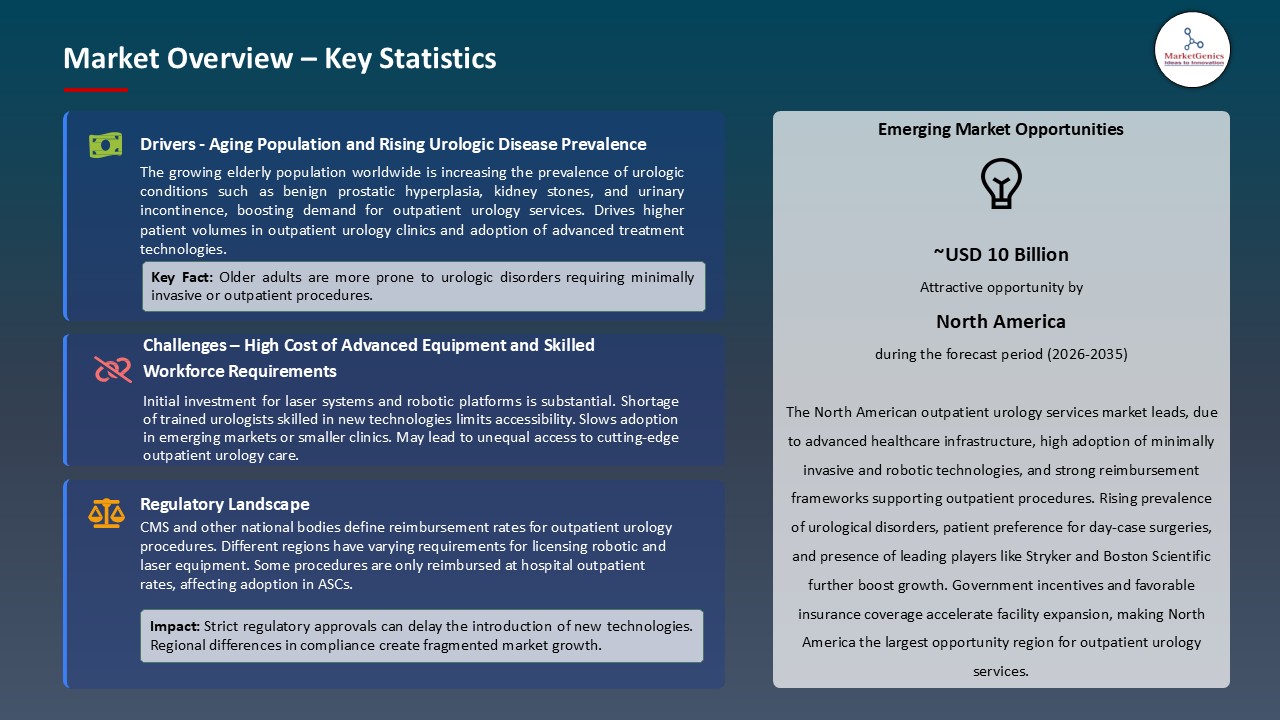

- The rising number of elderly patients has been one of the significant stimuli to the outpatient urology services market, as benign prostatic hyperplasia (BPH), kidney stones, urinary incontinence, and prostate cancer are more common in the elderly. The rising life expectancy in most countries has meant that more of the population is at higher risks of these conditions and this has ensured that there is a continuous need in urology related care.

- Outpatient urology services are less invasive, have shorter recovery duration and less expensive treatment methods and are therefore highly appropriate to elderly patients who might be comorbid and would want treatment that is less disruptive. Moreover, the elderly population also needs continuous follow up and control procedures further increasing the use of outpatient urology services.

- The first hospital in the region to provide the HYDROS Robotic System to treat enlarged prostates (BPH) in 2025, a condition prevalent in older adults, was the Mount Sinai Hospital in New York City. The less invasive, same-day surgery permits earlier recovery and hospitalization, which is an example of the increasing elderly population witnessed to lead to the necessity of the enhanced outpatient urology services.

- The developments highlight the importance of aging population as a critical factor in the demand of outpatient urology services in terms of sustaining and expanding demand.

- The key limitation influencing the development of the outpatient urology services market is the unwillingness of physicians to alter the existing modes of practice. Most urologists are well acclimated to hospital care, with all of the known clinical workflows, built referral networks, and predictable reimbursement arrangements.

- Transitioning to outpatient or ambulatory surgical center (ASC) models can typically demand significant organizational changes, such as the adoption of new technology, redesigning of patient management, and the organization of care across staff and ancillary services. These changes can be viewed as a disruption to clinical efficiency and continuity of care by the physicians, which will cause reluctance to adopt new service delivery models.

- Financial factors also add weight to this opposition. Outpatient models can involve capital expenditure on facilities, specialized treatment equipment, employee training, and unknown reimbursement rates and insurances. The physicians might also feel threatened by the possible effect on the revenue lines or the number of patients, especially in the long-established hospital affiliations.

- As a barrier, this may inhibit the adoption of new outpatient urology services in ways that would slow down facility expansion and restrict patient access to cost-effective and minimally invasive care. Although there is increased need in urologic procedures, technological solutions, and favorable policy framework, which promote outpatient treatment, the reluctance of physicians is still a major problem.

- The introduction of minimally invasive technologies is a considerable opportunity offering a chance to increase the range of urology treatments in offices. The treatment of complex urologic diseases can be safely done outside the hospital through advanced procedures like laser lithotripsy, robotic-assisted surgeries, and the high-precision endoscopic procedures. These technologies shorten the duration of procedures, decrease the pain of patients, and decrease the recovery time, which makes outpatient and office-based treatment more viable and appealing to patients and providers.

- Expanding the scope of what can be done in the outpatient or ambulatory space, the minimally invasive technologies can enhance patient throughput, efficiency, and the general cost of healthcare. Also, the increasing inclination of patients towards outpatient care, which demands convenience and lower cost, is another factor that promotes the use of the technologies.

- Teleflex Incorporated released the UroLift 2 System in 2024, a minimally invasive system enabling outpatient management of all prostate types, enhancing the accuracy of the procedure, shortening the time to recovery, and promoting urology practice in the office.

- In conclusion, the adoption of minimally invasive technologies will continue to expand and optimize outpatient urology care and improve patients experience.

- The evolution of integrated diagnostic and treatment facilities can be considered a significant trend that affects the outpatient urology services market and facilitates the coordination of care and improves patient outcomes. By integrating the diagnostic imaging, laboratory tests, and treatment in one outpatient or ambulatory center, it is possible to reduce the time between a diagnosis and intervention, reduce patient travel, and enhance clinical efficiency in general.

- The interconnected configurations also provide the possibility of multidisciplinary cooperation, allowing urologists, radiologists, as well as support personnel to exchange information immediately, which results in more precise diagnostics and individual treatment strategies.

- The IR Center of Greater Cincinnati was established in 2025 by the Urology Group as an outpatient center that provides BPH with minimally invasive prostate artery embolization. The facility combines interventional radiology and urology to provide a combination of office and treatment as well as reduced recovery time and more convenient patient care.

- The increasing demands of patients who need convenient, one-stop, care and the emphasis on efficiency by the healthcare systems are driving providers towards investing in integrated diagnostic-treatment centers, which improves continuity of care, patient satisfaction and competitiveness in the outpatient urology services market.

- Ambulatory Surgical Centers (ASCs) dominate the global outpatient urology services market because of cost-effectiveness, operational efficacy, and easily accessible patients. They allow minimal invasive and endoscopic surgeries within an outpatient environment, which is less expensive, less time-consuming, and flexible and is why they are increasingly becoming favored by providers and patients.

- Other factors driving ASC expansion include favorable payment policies, advancements in minimally invasive technology, and a surge in urological problems requiring immediate treatment. Furthermore, ASCs allow enhancing resource use, boosting patient throughput, and specialization, improving clinical outcomes and operational efficiency.

- The USPI network of Tenet Healthcare increased higher acuity urology procedures in the 544 ambulatory surgery centers of the company, which resulted in revenue growth and emphasized the growing popularity of outpatient settings with affordable and efficient care as compared to hospital services.

- The proliferation of ASCs highlights their strategic importance in delivering high quality, minimally invasive urology services that lie beyond the hospital.

- The North American outpatient urology services market is the largest in the world because of the combination of the high healthcare spending, the high degree of healthcare infrastructure and the tendency of more patients to choose outpatient and less invasive surgical operations. The area has a strong system of hospitals, ambulatory surgical centers (ASCs) and office-based urology practices that support rapid implementation of innovative technologies, such as laser lithotripsy, robotic-assisted surgeries, and high-precision endoscopic procedures.

- The urologic disorders, including benign prostatic hyperplasia (BPH), kidney stones, and prostate cancer, will be increasing the need of efficient and cost-effective outpatient care. The positive reimbursement policies, favorable regulatory environments, and high awareness levels of patients and physicians only serve to make the transition to outpatient environments faster.

- Also, North American providers are spending more on combined diagnostic and treatment centers, ambulatory surgery centers, and minimally invasive technologies, which enhance the coordination of care, patient convenience, and clinical outcomes.

- MetroEast Surgery Center in St. Louis, which offered outpatient surgery services, came in with a proposal to expand outpatient surgery services to include urology in 2025, which would raise outpatient surgery hours by 88 and usage of its operating rooms by 34.2% to 36.6% illustrating an increase in outpatient urology capacity.

- Thus, such factors strengthen the leadership and further expansion of the North America outpatient urology services market.

- In July 2025, Safdarjung Hospital, New Delhi modernized its urology department with modern equipment urodynamic machines, lithotripters, lasers and endoscopy machines that better its outpatient capacity and care delivery. It is supported by POWERGRID and will enhance patient throughput, waiting times and will demonstrate strategic investments and public-private collaborations proliferating high-quality outpatient urology in the emerging markets.

- In December 2024, University of Rochester Medical Center (URMC) increased outpatient urology services in the Finger Lakes and Southern Tier area with a new clinic in Canandaigua and an expansion of the Hornell facility, including new advanced diagnostics, procedure rooms and offering specialized care, including MRI-guided prostate biopsy, Mini-PCNL, and HoLEP. This growth has raised the number of outpatient services accessing a wide range of urology services in underserved areas.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Advanced Urology Institute

- Boston Scientific Corporation

- Community Health Systems

- DaVita Inc.

- Fresenius Medical Care

- HCA Healthcare

- SCA Health

- Solaris Health Holdings

- Sonic Healthcare

- Surgery Partners

- Tenet Healthcare

- United Urology Group

- Universal Health Services

- AMSURG

- US Urology Partners

- Other Key Players

- Diagnostic Services

- Urodynamic Testing

- Cystoscopy

- Ultrasound Imaging

- CT/MRI Urography

- Uroflowmetry

- Prostate Biopsy

- Others

- Therapeutic Services

- Lithotripsy (Stone Management)

- Catheterization Services

- Minimally Invasive Procedures

- Intravesical Therapy

- Urethral Dilation

- Others

- Consultative Services

- Initial Consultation

- Follow-up Care

- Second Opinion Services

- Others

- Surgical Procedures (Outpatient)

- Vasectomy

- Circumcision

- Minor Endoscopic Procedures

- Office-Based Procedures

- Others

- Urinary Tract Infections (UTI)

- Kidney Stones

- Urinary Incontinence

- Erectile Dysfunction

- Overactive Bladder

- Prostate Cancer Screening/Management

- Bladder Cancer Screening/Management

- Others

- Pediatric Urology

- Adult Urology

- Geriatric Urology

- Traditional/Conventional Methods

- Advanced Imaging Systems

- 3D Ultrasound

- Fluoroscopy

- Others

- Robotic-Assisted Systems

- Laser Technology

- Holmium Laser

- Thulium Laser

- Others

- Endoscopic Equipment

- Flexible Cystoscopes

- Rigid Cystoscopes

- Others

- Urodynamic Systems

- Telemedicine/Virtual Consultation Platforms

- Medical Management

- Minimally Invasive Procedures

- Conservative Management

- Interventional Procedures

- Preventive/Screening Services

- Hospital-Based Outpatient Departments

- Ambulatory Surgical Centers (ASCs)

- Standalone Urology Clinics

- Multi-Specialty Clinics

- Physician Office-Based Labs (POBLs)

- Mobile Urology Units

- Academic Medical Centers

- Others

- Private Insurance

- Public/Government Insurance

- Self-Pay

- Bundled Payment Models

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Outpatient Urology Services Market Outlook

- 2.1.1. Outpatient Urology Services Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Outpatient Urology Services Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of urological disorders

- 4.1.1.2. Technological advancements in minimally invasive procedures

- 4.1.1.3. Growing preference for outpatient and day-care treatments

- 4.1.2. Restraints

- 4.1.2.1. High cost of advanced urology equipment.

- 4.1.2.2. Regulatory and compliance challenges across regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Manufacturing & Suppliers

- 4.4.2. Service Providers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Outpatient Urology Services Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Outpatient Urology Services Market Analysis, By Service Type

- 6.1. Key Segment Analysis

- 6.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Service Type, 2021-2035

- 6.2.1. Diagnostic Services

- 6.2.1.1. Urodynamic Testing

- 6.2.1.2. Cystoscopy

- 6.2.1.3. Ultrasound Imaging

- 6.2.1.4. CT/MRI Urography

- 6.2.1.5. Uroflowmetry

- 6.2.1.6. Prostate Biopsy

- 6.2.1.7. Others

- 6.2.2. Therapeutic Services

- 6.2.2.1. Lithotripsy (Stone Management)

- 6.2.2.2. Catheterization Services

- 6.2.2.3. Minimally Invasive Procedures

- 6.2.2.4. Intravesical Therapy

- 6.2.2.5. Urethral Dilation

- 6.2.2.6. Others

- 6.2.3. Consultative Services

- 6.2.3.1. Initial Consultation

- 6.2.3.2. Follow-up Care

- 6.2.3.3. Second Opinion Services

- 6.2.3.4. Others

- 6.2.4. Surgical Procedures (Outpatient)

- 6.2.4.1. Vasectomy

- 6.2.4.2. Circumcision

- 6.2.4.3. Minor Endoscopic Procedures

- 6.2.4.4. Office-Based Procedures

- 6.2.4.5. Others

- 6.2.1. Diagnostic Services

- 7. Global Outpatient Urology Services Market Analysis, By Condition/Disease Type

- 7.1. Key Segment Analysis

- 7.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Condition/Disease Type, 2021-2035

- 7.2.1. Urinary Tract Infections (UTI)

- 7.2.2. Kidney Stones

- 7.2.3. Urinary Incontinence

- 7.2.4. Erectile Dysfunction

- 7.2.5. Overactive Bladder

- 7.2.6. Prostate Cancer Screening/Management

- 7.2.7. Bladder Cancer Screening/Management

- 7.2.8. Others

- 8. Global Outpatient Urology Services Market Analysis,By Patient Demographics

- 8.1. Key Segment Analysis

- 8.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Patient Demographics, 2021-2035

- 8.2.1. Pediatric Urology

- 8.2.2. Adult Urology

- 8.2.3. Geriatric Urology

- 9. Global Outpatient Urology Services Market Analysis, By Technology/Equipment Used

- 9.1. Key Segment Analysis

- 9.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology/Equipment Used, 2021-2035

- 9.2.1. Traditional/Conventional Methods

- 9.2.2. Advanced Imaging Systems

- 9.2.2.1. 3D Ultrasound

- 9.2.2.2. Fluoroscopy

- 9.2.2.3. Others

- 9.2.3. Robotic-Assisted Systems

- 9.2.4. Laser Technology

- 9.2.4.1. Holmium Laser

- 9.2.4.2. Thulium Laser

- 9.2.4.3. Others

- 9.2.5. Endoscopic Equipment

- 9.2.5.1. Flexible Cystoscopes

- 9.2.5.2. Rigid Cystoscopes

- 9.2.5.3. Others

- 9.2.6. Urodynamic Systems

- 9.2.7. Telemedicine/Virtual Consultation Platforms

- 10. Global Outpatient Urology Services Market Analysis, By Treatment Approach

- 10.1. Key Segment Analysis

- 10.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, by Treatment Approach, 2021-2035

- 10.2.1. Medical Management

- 10.2.2. Minimally Invasive Procedures

- 10.2.3. Conservative Management

- 10.2.4. Interventional Procedures

- 10.2.5. Preventive/Screening Services

- 11. Global Outpatient Urology Services Market Analysis, By Facility Type

- 11.1. Key Segment Analysis

- 11.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Facility Type, 2021-2035

- 11.2.1. Hospital-Based Outpatient Departments

- 11.2.2. Ambulatory Surgical Centers (ASCs)

- 11.2.3. Standalone Urology Clinics

- 11.2.4. Multi-Specialty Clinics

- 11.2.5. Physician Office-Based Labs (POBLs)

- 11.2.6. Mobile Urology Units

- 11.2.7. Academic Medical Centers

- 11.2.8. Others

- 12. Global Outpatient Urology Services Market Analysis, By Payment Mode

- 12.1. Key Segment Analysis

- 12.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, By Payment Mode, 2021-2035

- 12.2.1. Private Insurance

- 12.2.2. Public/Government Insurance

- 12.2.3. Self-Pay

- 12.2.4. Bundled Payment Models

- 13. Global Outpatient Urology Services Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Outpatient Urology Services Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Service Type

- 14.3.2. Condition/Disease Type

- 14.3.3. Patient Demographics

- 14.3.4. Technology/Equipment Used

- 14.3.5. Treatment Approach

- 14.3.6. Facility Type

- 14.3.7. Payment Mode

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Outpatient Urology Services Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Service Type

- 14.4.3. Condition/Disease Type

- 14.4.4. Patient Demographics

- 14.4.5. Technology/Equipment Used

- 14.4.6. Treatment Approach

- 14.4.7. Facility Type

- 14.4.8. Payment Mode

- 14.5. Canada Outpatient Urology Services Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Service Type

- 14.5.3. Condition/Disease Type

- 14.5.4. Patient Demographics

- 14.5.5. Technology/Equipment Used

- 14.5.6. Treatment Approach

- 14.5.7. Facility Type

- 14.5.8. Payment Mode

- 14.6. Mexico Outpatient Urology Services Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Service Type

- 14.6.3. Condition/Disease Type

- 14.6.4. Patient Demographics

- 14.6.5. Technology/Equipment Used

- 14.6.6. Treatment Approach

- 14.6.7. Facility Type

- 14.6.8. Payment Mode

- 15. Europe Outpatient Urology Services Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Service Type

- 15.3.2. Condition/Disease Type

- 15.3.3. Patient Demographics

- 15.3.4. Technology/Equipment Used

- 15.3.5. Treatment Approach

- 15.3.6. Facility Type

- 15.3.7. Payment Mode

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Outpatient Urology Services Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Service Type

- 15.4.3. Condition/Disease Type

- 15.4.4. Patient Demographics

- 15.4.5. Technology/Equipment Used

- 15.4.6. Treatment Approach

- 15.4.7. Facility Type

- 15.4.8. Payment Mode

- 15.5. United Kingdom Outpatient Urology Services Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Service Type

- 15.5.3. Condition/Disease Type

- 15.5.4. Patient Demographics

- 15.5.5. Technology/Equipment Used

- 15.5.6. Treatment Approach

- 15.5.7. Facility Type

- 15.5.8. Payment Mode

- 15.6. France Outpatient Urology Services Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Service Type

- 15.6.3. Condition/Disease Type

- 15.6.4. Patient Demographics

- 15.6.5. Technology/Equipment Used

- 15.6.6. Treatment Approach

- 15.6.7. Facility Type

- 15.6.8. Payment Mode

- 15.7. Italy Outpatient Urology Services Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Service Type

- 15.7.3. Condition/Disease Type

- 15.7.4. Patient Demographics

- 15.7.5. Technology/Equipment Used

- 15.7.6. Treatment Approach

- 15.7.7. Facility Type

- 15.7.8. Payment Mode

- 15.8. Spain Outpatient Urology Services Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Service Type

- 15.8.3. Condition/Disease Type

- 15.8.4. Patient Demographics

- 15.8.5. Technology/Equipment Used

- 15.8.6. Treatment Approach

- 15.8.7. Facility Type

- 15.8.8. Payment Mode

- 15.9. Netherlands Outpatient Urology Services Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Service Type

- 15.9.3. Condition/Disease Type

- 15.9.4. Patient Demographics

- 15.9.5. Technology/Equipment Used

- 15.9.6. Treatment Approach

- 15.9.7. Facility Type

- 15.9.8. Payment Mode

- 15.10. Nordic Countries Outpatient Urology Services Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Service Type

- 15.10.3. Condition/Disease Type

- 15.10.4. Patient Demographics

- 15.10.5. Technology/Equipment Used

- 15.10.6. Treatment Approach

- 15.10.7. Facility Type

- 15.10.8. Payment Mode

- 15.11. Poland Outpatient Urology Services Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Service Type

- 15.11.3. Condition/Disease Type

- 15.11.4. Patient Demographics

- 15.11.5. Technology/Equipment Used

- 15.11.6. Treatment Approach

- 15.11.7. Facility Type

- 15.11.8. Payment Mode

- 15.12. Russia & CIS Outpatient Urology Services Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Service Type

- 15.12.3. Condition/Disease Type

- 15.12.4. Patient Demographics

- 15.12.5. Technology/Equipment Used

- 15.12.6. Treatment Approach

- 15.12.7. Facility Type

- 15.12.8. Payment Mode

- 15.13. Rest of Europe Outpatient Urology Services Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Service Type

- 15.13.3. Condition/Disease Type

- 15.13.4. Patient Demographics

- 15.13.5. Technology/Equipment Used

- 15.13.6. Treatment Approach

- 15.13.7. Facility Type

- 15.13.8. Payment Mode

- 16. Asia Pacific Outpatient Urology Services Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Service Type

- 16.3.2. Condition/Disease Type

- 16.3.3. Patient Demographics

- 16.3.4. Technology/Equipment Used

- 16.3.5. Treatment Approach

- 16.3.6. Facility Type

- 16.3.7. Payment Mode

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Outpatient Urology Services Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Service Type

- 16.4.3. Condition/Disease Type

- 16.4.4. Patient Demographics

- 16.4.5. Technology/Equipment Used

- 16.4.6. Treatment Approach

- 16.4.7. Facility Type

- 16.4.8. Payment Mode

- 16.5. India Outpatient Urology Services Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Service Type

- 16.5.3. Condition/Disease Type

- 16.5.4. Patient Demographics

- 16.5.5. Technology/Equipment Used

- 16.5.6. Treatment Approach

- 16.5.7. Facility Type

- 16.5.8. Payment Mode

- 16.6. Japan Outpatient Urology Services Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Service Type

- 16.6.3. Condition/Disease Type

- 16.6.4. Patient Demographics

- 16.6.5. Technology/Equipment Used

- 16.6.6. Treatment Approach

- 16.6.7. Facility Type

- 16.6.8. Payment Mode

- 16.7. South Korea Outpatient Urology Services Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Service Type

- 16.7.3. Condition/Disease Type

- 16.7.4. Patient Demographics

- 16.7.5. Technology/Equipment Used

- 16.7.6. Treatment Approach

- 16.7.7. Facility Type

- 16.7.8. Payment Mode

- 16.8. Australia and New Zealand Outpatient Urology Services Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Service Type

- 16.8.3. Condition/Disease Type

- 16.8.4. Patient Demographics

- 16.8.5. Technology/Equipment Used

- 16.8.6. Treatment Approach

- 16.8.7. Facility Type

- 16.8.8. Payment Mode

- 16.9. Indonesia Outpatient Urology Services Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Service Type

- 16.9.3. Condition/Disease Type

- 16.9.4. Patient Demographics

- 16.9.5. Technology/Equipment Used

- 16.9.6. Treatment Approach

- 16.9.7. Facility Type

- 16.9.8. Payment Mode

- 16.10. Malaysia Outpatient Urology Services Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Service Type

- 16.10.3. Condition/Disease Type

- 16.10.4. Patient Demographics

- 16.10.5. Technology/Equipment Used

- 16.10.6. Treatment Approach

- 16.10.7. Facility Type

- 16.10.8. Payment Mode

- 16.11. Thailand Outpatient Urology Services Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Service Type

- 16.11.3. Condition/Disease Type

- 16.11.4. Patient Demographics

- 16.11.5. Technology/Equipment Used

- 16.11.6. Treatment Approach

- 16.11.7. Facility Type

- 16.11.8. Payment Mode

- 16.12. Vietnam Outpatient Urology Services Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Service Type

- 16.12.3. Condition/Disease Type

- 16.12.4. Patient Demographics

- 16.12.5. Technology/Equipment Used

- 16.12.6. Treatment Approach

- 16.12.7. Facility Type

- 16.12.8. Payment Mode

- 16.13. Rest of Asia Pacific Outpatient Urology Services Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Service Type

- 16.13.3. Condition/Disease Type

- 16.13.4. Patient Demographics

- 16.13.5. Technology/Equipment Used

- 16.13.6. Treatment Approach

- 16.13.7. Facility Type

- 16.13.8. Payment Mode

- 17. Middle East Outpatient Urology Services Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Service Type

- 17.3.2. Condition/Disease Type

- 17.3.3. Patient Demographics

- 17.3.4. Technology/Equipment Used

- 17.3.5. Treatment Approach

- 17.3.6. Facility Type

- 17.3.7. Payment Mode

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Outpatient Urology Services Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Service Type

- 17.4.3. Condition/Disease Type

- 17.4.4. Patient Demographics

- 17.4.5. Technology/Equipment Used

- 17.4.6. Treatment Approach

- 17.4.7. Facility Type

- 17.4.8. Payment Mode

- 17.5. UAE Outpatient Urology Services Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Service Type

- 17.5.3. Condition/Disease Type

- 17.5.4. Patient Demographics

- 17.5.5. Technology/Equipment Used

- 17.5.6. Treatment Approach

- 17.5.7. Facility Type

- 17.5.8. Payment Mode

- 17.6. Saudi Arabia Outpatient Urology Services Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Service Type

- 17.6.3. Condition/Disease Type

- 17.6.4. Patient Demographics

- 17.6.5. Technology/Equipment Used

- 17.6.6. Treatment Approach

- 17.6.7. Facility Type

- 17.6.8. Payment Mode

- 17.7. Israel Outpatient Urology Services Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Service Type

- 17.7.3. Condition/Disease Type

- 17.7.4. Patient Demographics

- 17.7.5. Technology/Equipment Used

- 17.7.6. Treatment Approach

- 17.7.7. Facility Type

- 17.7.8. Payment Mode

- 17.8. Rest of Middle East Outpatient Urology Services Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Service Type

- 17.8.3. Condition/Disease Type

- 17.8.4. Patient Demographics

- 17.8.5. Technology/Equipment Used

- 17.8.6. Treatment Approach

- 17.8.7. Facility Type

- 17.8.8. Payment Mode

- 18. Africa Outpatient Urology Services Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Service Type

- 18.3.2. Condition/Disease Type

- 18.3.3. Patient Demographics

- 18.3.4. Technology/Equipment Used

- 18.3.5. Treatment Approach

- 18.3.6. Facility Type

- 18.3.7. Payment Mode

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Outpatient Urology Services Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Service Type

- 18.4.3. Condition/Disease Type

- 18.4.4. Patient Demographics

- 18.4.5. Technology/Equipment Used

- 18.4.6. Treatment Approach

- 18.4.7. Facility Type

- 18.4.8. Payment Mode

- 18.5. Egypt Outpatient Urology Services Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Service Type

- 18.5.3. Condition/Disease Type

- 18.5.4. Patient Demographics

- 18.5.5. Technology/Equipment Used

- 18.5.6. Treatment Approach

- 18.5.7. Facility Type

- 18.5.8. Payment Mode

- 18.6. Nigeria Outpatient Urology Services Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Service Type

- 18.6.3. Condition/Disease Type

- 18.6.4. Patient Demographics

- 18.6.5. Technology/Equipment Used

- 18.6.6. Treatment Approach

- 18.6.7. Facility Type

- 18.6.8. Payment Mode

- 18.7. Algeria Outpatient Urology Services Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Service Type

- 18.7.3. Condition/Disease Type

- 18.7.4. Patient Demographics

- 18.7.5. Technology/Equipment Used

- 18.7.6. Treatment Approach

- 18.7.7. Facility Type

- 18.7.8. Payment Mode

- 18.8. Rest of Africa Outpatient Urology Services Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Service Type

- 18.8.3. Condition/Disease Type

- 18.8.4. Patient Demographics

- 18.8.5. Technology/Equipment Used

- 18.8.6. Treatment Approach

- 18.8.7. Facility Type

- 18.8.8. Payment Mode

- 19. South America Outpatient Urology Services Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Outpatient Urology Services Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Service Type

- 19.3.2. Condition/Disease Type

- 19.3.3. Patient Demographics

- 19.3.4. Technology/Equipment Used

- 19.3.5. Treatment Approach

- 19.3.6. Facility Type

- 19.3.7. Payment Mode

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Outpatient Urology Services Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Service Type

- 19.4.3. Condition/Disease Type

- 19.4.4. Patient Demographics

- 19.4.5. Technology/Equipment Used

- 19.4.6. Treatment Approach

- 19.4.7. Facility Type

- 19.4.8. Payment Mode

- 19.5. Argentina Outpatient Urology Services Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Service Type

- 19.5.3. Condition/Disease Type

- 19.5.4. Patient Demographics

- 19.5.5. Technology/Equipment Used

- 19.5.6. Treatment Approach

- 19.5.7. Facility Type

- 19.5.8. Payment Mode

- 19.6. Rest of South America Outpatient Urology Services Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Service Type

- 19.6.3. Condition/Disease Type

- 19.6.4. Patient Demographics

- 19.6.5. Technology/Equipment Used

- 19.6.6. Treatment Approach

- 19.6.7. Facility Type

- 19.6.8. Payment Mode

- 20. Key Players/ Company Profile

- 20.1. Advanced Urology Institute

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. AMSURG

- 20.3. Boston Scientific Corporation

- 20.4. Community Health Systems

- 20.5. DaVita Inc.

- 20.6. Fresenius Medical Care

- 20.7. HCA Healthcare

- 20.8. SCA Health

- 20.9. Solaris Health Holdings

- 20.10. Sonic Healthcare

- 20.11. Surgery Partners

- 20.12. Tenet Healthcare

- 20.13. United Urology Group

- 20.14. Universal Health Services

- 20.15. US Urology Partners

- 20.16. Other Key Players

- 20.1. Advanced Urology Institute

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Outpatient Urology Services Market by Service Type, Condition/Disease Type, Patient Demographics, Technology/Equipment Used, Treatment Approach, Facility Type, Payment Mode, and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Outpatient Urology Services Market Size, Share & Trends Analysis Report by Service Type (Diagnostic Services, Therapeutic Services, Consultative Services, Surgical Procedures (Outpatient)), Condition/Disease Type, Patient Demographics, Technology/Equipment Used, Treatment Approach, Facility Type, Payment Mode, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Outpatient Urology Services Market Size, Share, and Growth

The global outpatient urology services market is witnessing strong growth, valued at USD 28.2 billion in 2025 and projected to reach USD 49.6 billion by 2035, expanding at a CAGR of 5.8% during the forecast period. The Asia Pacific region is the fastest-growing for the outpatient urology services market due to rising geriatric populations, increasing prevalence of urological disorders, and expanding healthcare infrastructure.

Jake Newman, President, The Americas, Teleflex said that, “UroLift 2 ATC optimizes enlarged prostate treatment by providing urologists with unparalleled confidence and customization capabilities, The UroLift 2 System with ATC offers a comprehensive solution for BPH care, combining cutting-edge technology with proven clinical outcomes.1 Our innovative platform streamlines procedures and eliminates the need to transition between platforms during a procedure. Enhanced features, including greater and more consistent implant compression and reduced waste, will help drive outcomes and efficiency in healthcare delivery”.

The outpatient urology services market is developed due to the supportive policies regarding reimbursement and regulation that encourage the shift of urology procedures to outpatient care settings, reducing costs and increasing patient access. As an example, Profound Medical declared that the reimbursement of TULSA procedure had been increased to Urology APC Level 7 in the CMS Outpatient Prospective Payment System (OPPS) final rule, which is more financially feasible to provide in an outpatient setting and helps to expand outpatient urology services in the United States.

Strategic alliances between urology providers and ASCs increase access to services, resources, facilitate the use of advanced technology, and improve patient convenience in outpatient care of the urethra. As an example, United Urology Group collaborated with oneOncology to increase outpatient urology service access via integrated urology-oncology care, advanced treatments, and ASC innovations, increasing patient access and clinical efficiency throughout the nation in 2025.

Tele-urology and remote patient monitoring is an opportunity that can improve follow-up, chronic care, and increase patient access, which will stimulate the growth of the outpatient urology services market. An example is the digital health firm Emano Flow that launched a remote uroflowmetry initiative on a smartphone that enables patients with enlarged prostates (BPH) or those with urinary difficulties to complete voiding assessments at home and urologists to make remote care decisions based on the quality data collected by the app.

Outpatient Urology Services Market Dynamics and Trends

Driver: Aging Population Growth Expands Urologic Disease Prevalence

Restraint: Physician Resistance to Practice Model Changes Slows Adoption

Opportunity: Minimally Invasive Technology Expands Office-Based Treatment Scope

Key Trend: Integrated Diagnostic and Treatment Facilities Improve Care Coordination

Outpatient-Urology-Services-Market Analysis and Segmental Data

Ambulatory Surgical Centers (ASCs) Dominate Global Outpatient Urology Services Market

North America Leads Global Outpatient Urology Services Market Demand

Outpatient-Urology-Services-Market Ecosystem

The global outpatient urology services market structure is extremely fragmented, with HCA Healthcare, Tenet Healthcare, United Urology Partners, US Urology Partners, and Advanced Urology Institute having a market share of about 24% of the whole market. These strategic actors have influenced the industry through the delivery of innovative outpatient urology services, minimally invasive surgery services, and integrated care pathways, which are facilitated by powerful research and development, solid clinical skills, and developed working networks. Their technological solutions, clinical guidelines, and strategic alliances are of high standards in the industry and they pose entry barriers to new entrants.

The ambulatory surgical centers (ASCs) and service providers are also essential components of the ecosystem and support the outpatient operations at a cost-effective rate, compliance with regulations, and scalability. Major urology service providers working in collaboration with ASCs stream surgical operations, improve patient recovery rates, improve the efficiency of the processes, and increase their availability at a regional level. It is through these partnerships that the operations of the organization not only enhance the effectiveness of operations but it also encourages implementation of state-of-the-art outpatient urology, customized care plans, and minimally invasive interventions which in the long-term achieve expansions in the market of the global outpatient urology services.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 28.2 Bn |

|

Market Forecast Value in 2035 |

USD 49.6 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Outpatient-Urology-Services-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Outpatient Urology Services Market, By Service Type |

|

|

Outpatient Urology Services Market, By Condition/Disease Type |

|

|

Outpatient Urology Services Market, By Patient Demographics |

|

|

Outpatient Urology Services Market, By Technology/Equipment Used |

|

|

Outpatient Urology Services Market, By Treatment Approach |

|

|

Outpatient Urology Services Market, By Facility Type |

|

|

Outpatient Urology Services Market, By Payment Mode |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation