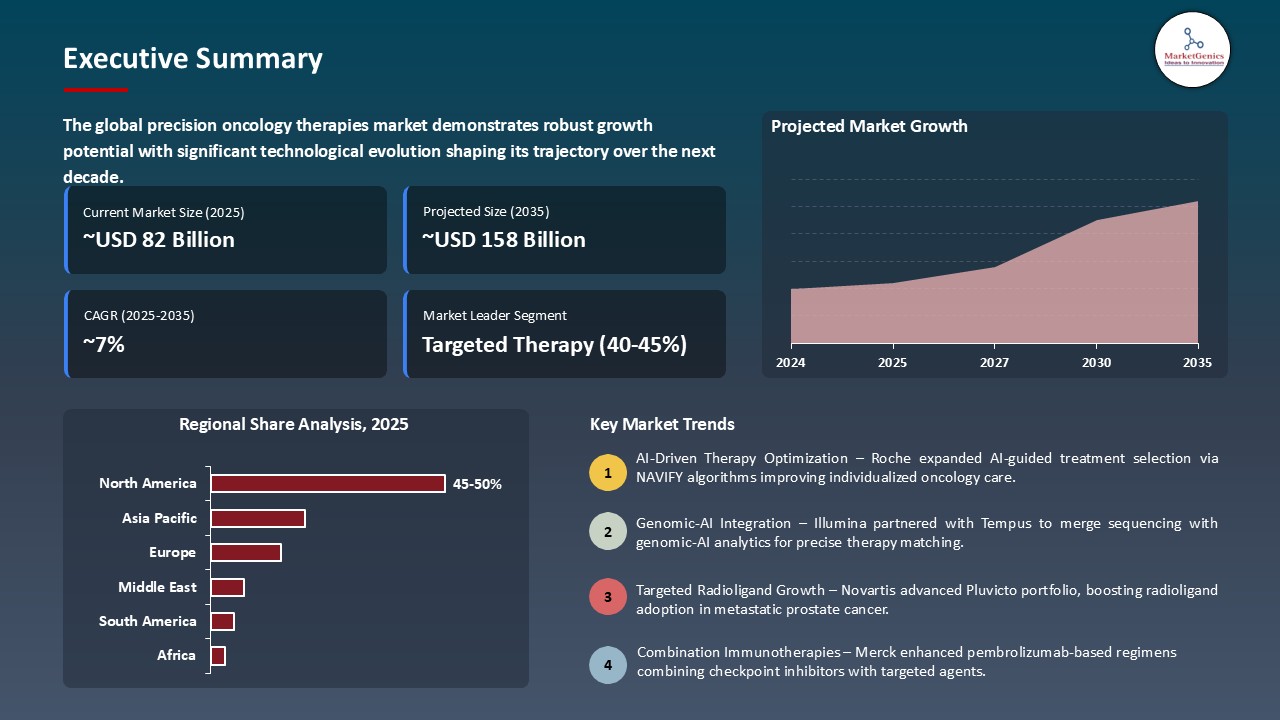

- The global precision oncology therapies market is valued at USD 82.4 billion in 2025.

- The market is projected to grow at a CAGR of 6.7% during the forecast period of 2026 to 2035.

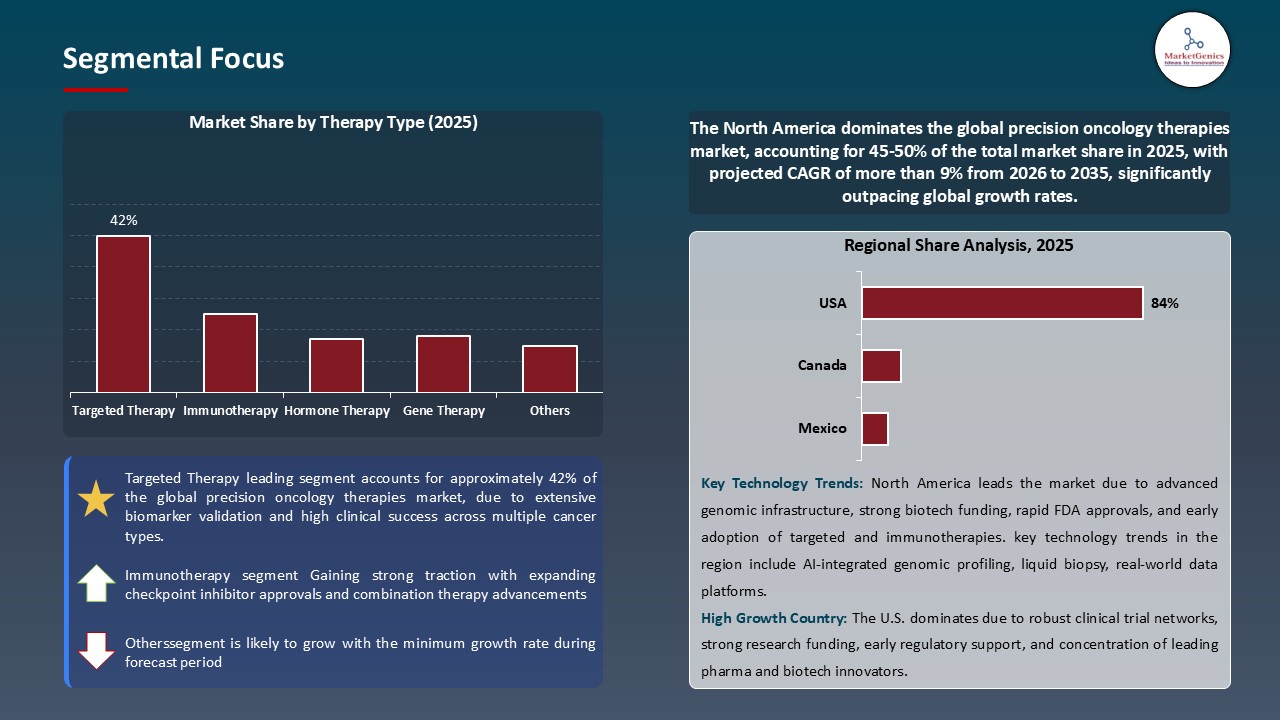

- The targeted therapy segment dominates the global precision oncology therapies market, accounting for around 42% share, due to its high efficacy in addressing specific genetic mutations and delivering personalized cancer treatments

- Rising demand for precision oncology therapies is driven by the increasing prevalence of cancer and the need for personalized treatment approaches

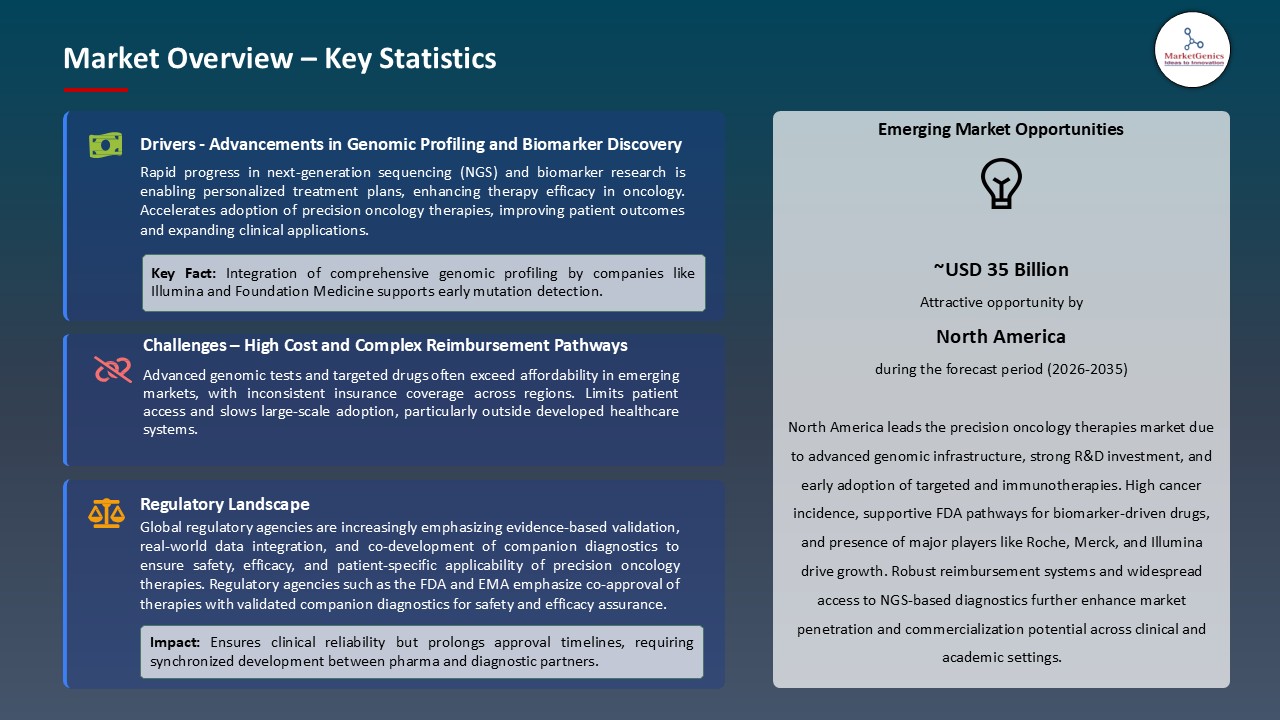

- Growing adoption of genomic profiling and biomarker-based drug development is fueling demand for precision oncology therapies

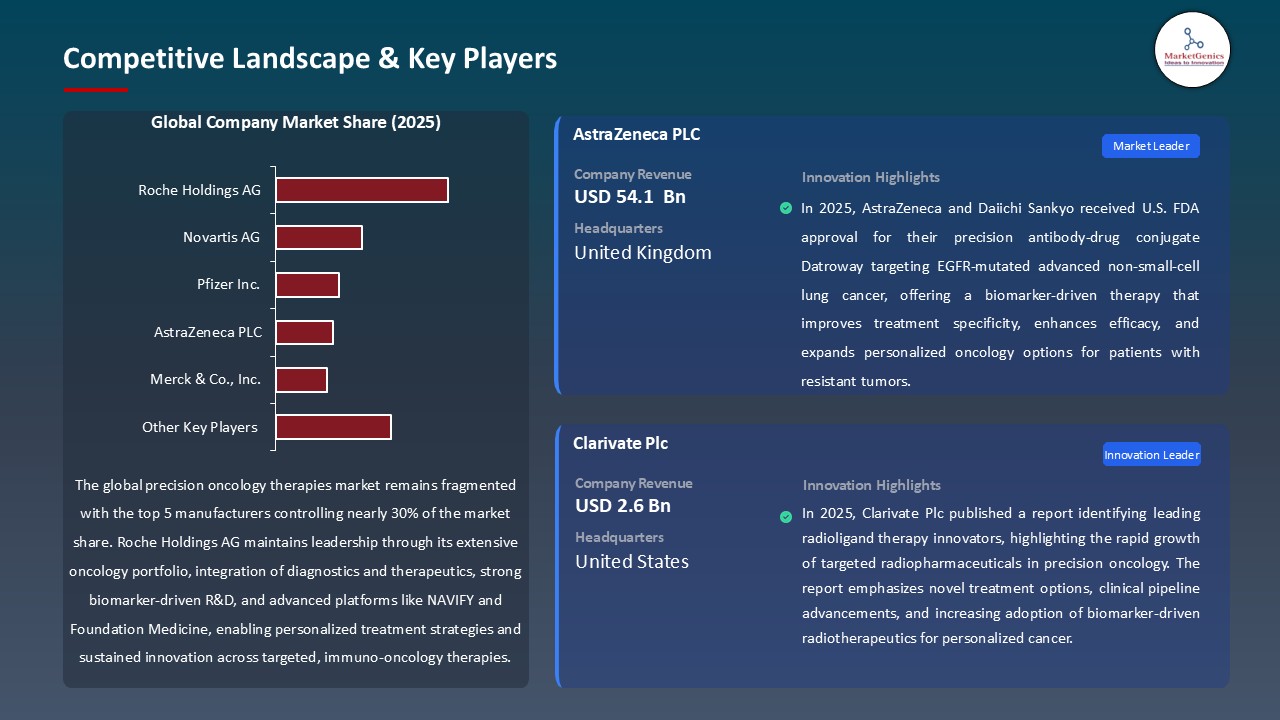

- The top five players account for nearly 30% of the global precision oncology therapies market in 2025

- In September 2025, the FDA approved Guardant Health’s Guardant360 CDx as a companion diagnostic to identify ESR1 mutations in advanced breast cancer patients

- In September 2025, the U.S. FDA approved Eli Lilly’s Inluriyo (imlunestrant), an oral selective estrogen receptor degrader (SERD), for treating ER-positive, HER2-negative, ESR1-mutated advanced or metastatic breast cancer in adults

- Global Precision Oncology Therapies Market is likely to create the total forecasting opportunity of ~USD 75 Bn till 2035.

- North America’s precision oncology therapies market offers strong opportunities in advanced genomic testing, biomarker-driven drug development, and AI-enabled clinical decision support solutions.

- The increasing popularity of comprehensive genomic profiling (CGP) is one of the main driving forces in the precision oncology therapies market since it allows identifying genetic adjustments, biomarkers, and molecular changes that promote tumors precisely. Giving a comprehensive molecular map of a cancer patient, CGP allows choosing individualized targeted therapies and immunotherapies depending on the patient-specific genetic patterns that enhances the efficacy and outcome of therapy significantly.

- Research institutions and healthcare workers are actively incorporating CGP in their everyday clinical activities to identify actionable mutations and inform evidence-based decision-making. Furthermore, the use of companion diagnostics and next-generation sequencing (NGS) technologies increases the usefulness of CGP in the discovery of uncommon or complicated genetic variants.

- Illumina was granted a MHLW approval of its TruSight Oncology Comprehensive test in 2025, which is a Class III/IV medical device analyzing 500+ genes in both DNA and RNA. Being the first distributable CGP IVD kit that can be used in clinical trials under FDA approval, it complements the recognition of actionable biomarkers in specific therapeutic applications and in clinical trials.

- The breakthroughs highlight the central role of CGP in faster personalized cancer treatment and advancing the universalization of precision oncology treatment.

- Resistance development is one of the significant issues of the precision oncology therapies market since cancer cells tend to develop resistance to targeted treatment, weakening its effectiveness over time. Although this may have an initial positive effect, secondary mutations or effects caused by the activation of compensatory pathways or modification of their molecular signalling can revert a tumor to be able to bypass therapeutic inhibition. Such flexibility leads to a failure in treatment, recurrence of the disease, and subsequent alternative or combination therapy.

- Genomic monitoring and therapy adjustments must be continuous, and predictions, and resistance management in tumors are complicated by the dynamic and heterogeneous nature of tumors, which need continuous monitoring and adjustment of therapies. Also, studies on resistance mechanisms overcome increase the cost of development and increase time-to-market of new drugs.

- Takeda voluntarily discontinued EXKIVITY (mobocertinib) to EGFR Exon20 insertion+ NSCLC following its failure to achieve its primary endpoint in the Phase 3 EXCLAIM-2 test, even after initial approval under the FDA Accelerated Approval pathway. This is due to the absence of long-term effectiveness highlighting the resistance to targeted therapies by cancer cells, which restricts the sustainability of the treatment.

- Hence, the resistance development does not only reduce the quality of the long-term treatment results but also restricts the long-term clinical and commercial developmental potential of precision oncology therapies.

- The adoption of liquid biopsy technology offers a great opportunity to the precision oncology therapies market because it will allow monitoring tumor dynamics in real-time and in a noninvasive way. In comparison to conventional tissue biopsies, liquid biopsies examine the aspect of circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) in blood samples so that clinicians can monitor the genetic mutations, treatment response, and emerging resistance on a near-real time scale.

- The capability provides the ability to make prompt modifications to treatment, including switching or combining therapeutic options as tumor profiles change, enhancing patient outcomes and extending the effect of therapy. Liquid biopsies also support the detection of minimal residual disease (MRD) and relapse at an early stage, which makes it possible to apply more active and personalized management.

- Labcorp added two liquid biopsy solutions to its precision oncology portfolio in 2025. PDX elio plasma focus Plasma detect. Plasma Detect is a completely solid-phase blood test with the ability to detect circulating tumor DNA (ctDNA) to measure molecular residual disease (MRD) and risk of recurrence in patients with stage III colon cancer. The PGDx elio plasma focus Dx, which is FDA-approved, was the first pan-solid tumor liquid biopsy kit.

- Liquid biopsy will become a vital ally in precision oncology and create pressure on adaptive treatment plans and opportunities in developing targeted therapies and clinical decision support systems.

- One of the key trends that have influenced the current state of the precision oncology therapies market is the growing pace of tumor-agnostic drug development, where drugs are developed by targeting particular genetic or molecular modifications instead of focusing on the tissue of origin of the tumor. Such a paradigm shift enables one treatment to treat multiple forms of cancer with the same biomarker, including NTRK, RET, or MSI-H mutations.

- Pharmaceutical companies are also seeking pan-cancer indications, which is facilitated by the developments in next-generation sequencing (NGS) and companion diagnostics, which allows the detection of these actionable mutations in various cancers. The success of tumor-agnostic therapies pembrolizumab and larotrectinib was approved by the FDA, increasing the pace of investments in the respective pipeline.

- Caris Life Sciences in March 2025, a real-world study of over 295,000 patients found out that over 20% of that group could be treated using a tumor-agnostic possibly pan-cancer therapy due to shared molecular biomarkers and not based on tumor origin. This underscores the increasing trend of biomarker-based, pan-cancer precision oncology and the growing opportunities of molecularly targeted therapy in a variety of cancer types.

- The growth highlights the growing embrace of the use of tumor-agnostic, biomarker-based therapies as a primary approach of precision oncology.

- The most compelling segment within the global precision oncology therapies market is targeted therapy which is capable of inhibiting cancer-specific molecular pathways selectively with little to no harm to the healthy cells. This segment entails small molecule inhibitors, monoclonal antibodies, and immune-modulating agents against major oncogenic modifications which include EGFR, HER2, BRAF and ALK.

- The growing use of next-generation sequencing (NGS) and full-scale genomic profiling allows clinicians to detect actionable mutations and customize therapies to the individual patient profile, further cementing the supremacy of targeted therapies. Powerful clinical pipelines, increased regulatory approvals and strategic partnerships between pharmaceutical and diagnostic firms are also contributing to growth.

- In 2025, the next-generation oral therapy IBTROZI (taletrectinib) was approved by the U.S. FDA, an oral therapy that targets ROS1-positive non-small cell lung cancer (NSCLC), as another precision treatment that targets a particular molecular change and enhances the supremacy of precision oncology in the market.

- Advances highlight the continued leadership of targeted therapies as the foundation of precision oncology, led by biomarker-sensitive, molecularly precise therapy.

- North America has been the leading region in the world precision oncology therapies market which has been as a result of a combination of well-developed healthcare facilities, high rates of innovative diagnostic and therapeutic technologies, and high levels of research and development.

- Motivated by the availability of the major pharmaceutical and biotechnology firms, high government support, and an appropriate regulatory environment, has hastened the creation and commercialization of targeted therapies, immunotherapies, and next-generation sequencing (NGS) technologies. In June 2025, the U.S. FDA licensed Datroway (datopotamab deruxtecan) in patients with non-small cell lung cancer that have previous history of treatment with EGFR-mutated non-small cell lung cancer, which underscores the leadership of North America in terms of precision oncology by adopting biomarker-driven and targeted therapies at a rapid rate.

- Moreover, the spread of knowledge among the clinicians and patients regarding personalized medicine, and broad availability of comprehensive genomic profiling, have elevated the need of precision oncology treatments. The U.S. in particular is the most active in clinical trials, the use of companion diagnostics, and reimbursement assistance, which further consolidates dominance in the region.

- Thus, these elements strengthen the role of the North American ecosystem as the most promising to the precision oncology therapies market, which is technologically well-developed and broadly uses biomarker-guided therapy.

- In September 2025, the FDA granted Guardant Health Guardant360 CDx a companion diagnostic that was used to detect ESR1 mutations in patients who had advanced breast cancer. This authorization contributes to the strength of Guardant Health in the field of liquid biopsy and precision oncology, and its contribution to making targeted cancer treatments gene-guided in their choice of treatment.

- In September 2025, the U.S. FDA approved Eli Lilly’s Inluriyo (imlunestrant), an oral selective estrogen receptor degrader (SERD), for treating ER-positive, HER2-negative, ESR1-mutated advanced or metastatic breast cancer in adults. This approval marks a major advancement in targeted endocrine therapy, offering a new precision treatment option for patients with hormone receptor driven tumors.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- AbbVie Inc.

- Amgen Inc.

- Astellas Pharma Inc.

- AstraZeneca PLC

- GlaxoSmithKline plc

- Bayer AG

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Sanofi S.A.

- Eli Lilly and Company

- Exact Sciences Corporation

- Eisai Co., Ltd.

- Incyte Corporation

- Gilead Sciences, Inc.

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals, Inc.

- Roche Holdings AG

- Seagen Inc.

- Takeda Pharmaceutical Company Limited

- Other Key Players

- Targeted Therapy

- Small Molecule Inhibitors

- Monoclonal Antibodies

- Antibody-Drug Conjugates

- Others

- Immunotherapy

- Checkpoint Inhibitors

- CAR-T Cell Therapy

- Cancer Vaccines

- Cytokine Therapy

- Others

- Hormone Therapy

- Gene Therapy

- Epigenetic Therapy

- Others

- Lung Cancer

- Non-Small Cell Lung Cancer (NSCLC)

- Small Cell Lung Cancer (SCLC)

- Breast Cancer

- HER2-Positive

- Triple-Negative

- Hormone Receptor-Positive

- Colorectal Cancer

- Melanoma

- Leukemia

- Acute Myeloid Leukemia (AML)

- Chronic Lymphocytic Leukemia (CLL)

- Lymphoma

- Prostate Cancer

- Ovarian Cancer

- Gastric Cancer

- Pancreatic Cancer

- Others

- Genetic Biomarkers

- EGFR Mutations

- PD-L1 Expression

- HER2 Overexpression

- Others

- Protein Biomarkers

- Epigenetic Biomarkers

- Next-Generation Sequencing (NGS)

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Gene Panels

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)

- FISH (Fluorescence In Situ Hybridization)

- CISH (Chromogenic In Situ Hybridization)

- Liquid Biopsy

- Microarray Technology

- Kinase Inhibitors

- Tyrosine Kinase Inhibitors

- Serine/Threonine Kinase Inhibitors

- PARP Inhibitors

- mTOR Inhibitors

- CDK Inhibitors

- Proteasome Inhibitors

- Angiogenesis Inhibitors

- Immune Checkpoint Inhibitors

- Others

- Oral

- Intravenous

- Subcutaneous

- Intramuscular

- Biologics

- Monoclonal Antibodies

- Biosimilars

- Small Molecules

- Cell & Gene Therapies

- Pediatric Population

- Adult Population

- Geriatric Population

- Hospitals & Cancer Centers

- Diagnostic Laboratories

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Ambulatory Surgical Centers

- Home Healthcare Providers

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Precision Oncology Therapies Market Outlook

- 2.1.1. Precision Oncology Therapies Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Precision Oncology Therapies Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising cancer incidence and demand for personalized, targeted treatments

- 4.1.1.2. Advances in genomic profiling, biomarker discovery and companion diagnostics

- 4.1.1.3. Growth in targeted drug development and immuno-oncology with strong industry investment and collaborations

- 4.1.2. Restraints

- 4.1.2.1. High cost of therapies and associated diagnostics limiting patient access

- 4.1.2.2. Complex regulatory pathways, reimbursement challenges and small biomarker-defined patient populations

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Precision Oncology Therapies Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Precision Oncology Therapies Market Analysis, By Therapy Type

- 6.1. Key Segment Analysis

- 6.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Therapy Type, 2021-2035

- 6.2.1. Targeted Therapy

- 6.2.1.1. Small Molecule Inhibitors

- 6.2.1.2. Monoclonal Antibodies

- 6.2.1.3. Antibody-Drug Conjugates

- 6.2.1.4. Others

- 6.2.2. Immunotherapy

- 6.2.2.1. Checkpoint Inhibitors

- 6.2.2.2. CAR-T Cell Therapy

- 6.2.2.3. Cancer Vaccines

- 6.2.2.4. Cytokine Therapy

- 6.2.2.5. Others

- 6.2.3. Hormone Therapy

- 6.2.4. Gene Therapy

- 6.2.5. Epigenetic Therapy

- 6.2.6. Others

- 6.2.1. Targeted Therapy

- 7. Global Precision Oncology Therapies Market Analysis, By Cancer Type

- 7.1. Key Segment Analysis

- 7.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Cancer Type, 2021-2035

- 7.2.1. Lung Cancer

- 7.2.1.1. Non-Small Cell Lung Cancer (NSCLC)

- 7.2.1.2. Small Cell Lung Cancer (SCLC)

- 7.2.2. Breast Cancer

- 7.2.2.1. HER2-Positive

- 7.2.2.2. Triple-Negative

- 7.2.2.3. Hormone Receptor-Positive

- 7.2.3. Colorectal Cancer

- 7.2.4. Melanoma

- 7.2.5. Leukemia

- 7.2.5.1. Acute Myeloid Leukemia (AML)

- 7.2.5.2. Chronic Lymphocytic Leukemia (CLL)

- 7.2.6. Lymphoma

- 7.2.7. Prostate Cancer

- 7.2.8. Ovarian Cancer

- 7.2.9. Gastric Cancer

- 7.2.10. Pancreatic Cancer

- 7.2.11. Others

- 7.2.1. Lung Cancer

- 8. Global Precision Oncology Therapies Market Analysis,By Biomarker Type

- 8.1. Key Segment Analysis

- 8.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Biomarker Type, 2021-2035

- 8.2.1. Genetic Biomarkers

- 8.2.1.1. EGFR Mutations

- 8.2.1.2. PD-L1 Expression

- 8.2.1.3. HER2 Overexpression

- 8.2.1.4. Others

- 8.2.2. Protein Biomarkers

- 8.2.3. Epigenetic Biomarkers

- 8.2.1. Genetic Biomarkers

- 9. Global Precision Oncology Therapies Market Analysis, By Technology Platform

- 9.1. Key Segment Analysis

- 9.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology Platform, 2021-2035

- 9.2.1. Next-Generation Sequencing (NGS)

- 9.2.1.1. Whole Genome Sequencing

- 9.2.1.2. Whole Exome Sequencing

- 9.2.1.3. Targeted Gene Panels

- 9.2.2. Polymerase Chain Reaction (PCR)

- 9.2.3. Immunohistochemistry (IHC)

- 9.2.4. In Situ Hybridization (ISH)

- 9.2.4.1. FISH (Fluorescence In Situ Hybridization)

- 9.2.4.2. CISH (Chromogenic In Situ Hybridization)

- 9.2.5. Liquid Biopsy

- 9.2.6. Microarray Technology

- 9.2.1. Next-Generation Sequencing (NGS)

- 10. Global Precision Oncology Therapies Market Analysis, By Drug Class

- 10.1. Key Segment Analysis

- 10.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Drug Class, 2021-2035

- 10.2.1. Kinase Inhibitors

- 10.2.1.1. Tyrosine Kinase Inhibitors

- 10.2.1.2. Serine/Threonine Kinase Inhibitors

- 10.2.2. PARP Inhibitors

- 10.2.3. mTOR Inhibitors

- 10.2.4. CDK Inhibitors

- 10.2.5. Proteasome Inhibitors

- 10.2.6. Angiogenesis Inhibitors

- 10.2.7. Immune Checkpoint Inhibitors

- 10.2.8. Others

- 10.2.1. Kinase Inhibitors

- 11. Global Precision Oncology Therapies Market Analysis, By Route of Administration

- 11.1. Key Segment Analysis

- 11.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Route of Administration, 2021-2035

- 11.2.1. Oral

- 11.2.2. Intravenous

- 11.2.3. Subcutaneous

- 11.2.4. Intramuscular

- 12. Global Precision Oncology Therapies Market Analysis, By Molecule Type

- 12.1. Key Segment Analysis

- 12.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Molecule Type, 2021-2035

- 12.2.1. Biologics

- 12.2.2. Monoclonal Antibodies

- 12.2.3. Biosimilars

- 12.2.4. Small Molecules

- 12.2.5. Cell & Gene Therapies

- 13. Global Precision Oncology Therapies Market Analysis, By Patient Demographics

- 13.1. Key Segment Analysis

- 13.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, By Patient Demographics, 2021-2035

- 13.2.1. Pediatric Population

- 13.2.2. Adult Population

- 13.2.3. Geriatric Population

- 14. Global Precision Oncology Therapies Market Analysis and Forecasts, by End-Users

- 14.1. Key Findings

- 14.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 14.2.1. Hospitals & Cancer Centers

- 14.2.2. Diagnostic Laboratories

- 14.2.3. Research & Academic Institutes

- 14.2.4. Pharmaceutical & Biotechnology Companies

- 14.2.5. Ambulatory Surgical Centers

- 14.2.6. Home Healthcare Providers

- 14.2.7. Others

- 15. Global Precision Oncology Therapies Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Precision Oncology Therapies Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Therapy Type

- 16.3.2. Cancer Type

- 16.3.3. Biomarker Type

- 16.3.4. Technology Platform

- 16.3.5. Drug Class

- 16.3.6. Route of Administration

- 16.3.7. Molecule Type

- 16.3.8. Patient Demographics

- 16.3.9. End-Users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Precision Oncology Therapies Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Therapy Type

- 16.4.3. Cancer Type

- 16.4.4. Biomarker Type

- 16.4.5. Technology Platform

- 16.4.6. Drug Class

- 16.4.7. Route of Administration

- 16.4.8. Molecule Type

- 16.4.9. Patient Demographics

- 16.4.10. End-Users

- 16.5. Canada Precision Oncology Therapies Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Therapy Type

- 16.5.3. Cancer Type

- 16.5.4. Biomarker Type

- 16.5.5. Technology Platform

- 16.5.6. Drug Class

- 16.5.7. Route of Administration

- 16.5.8. Molecule Type

- 16.5.9. Patient Demographics

- 16.5.10. End-Users

- 16.6. Mexico Precision Oncology Therapies Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Therapy Type

- 16.6.3. Cancer Type

- 16.6.4. Biomarker Type

- 16.6.5. Technology Platform

- 16.6.6. Drug Class

- 16.6.7. Route of Administration

- 16.6.8. Molecule Type

- 16.6.9. Patient Demographics

- 16.6.10. End-Users

- 17. Europe Precision Oncology Therapies Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Therapy Type

- 17.3.2. Cancer Type

- 17.3.3. Biomarker Type

- 17.3.4. Technology Platform

- 17.3.5. Drug Class

- 17.3.6. Route of Administration

- 17.3.7. Molecule Type

- 17.3.8. Patient Demographics

- 17.3.9. End-Users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Precision Oncology Therapies Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Therapy Type

- 17.4.3. Cancer Type

- 17.4.4. Biomarker Type

- 17.4.5. Technology Platform

- 17.4.6. Drug Class

- 17.4.7. Route of Administration

- 17.4.8. Molecule Type

- 17.4.9. Patient Demographics

- 17.4.10. End-Users

- 17.5. United Kingdom Precision Oncology Therapies Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Therapy Type

- 17.5.3. Cancer Type

- 17.5.4. Biomarker Type

- 17.5.5. Technology Platform

- 17.5.6. Drug Class

- 17.5.7. Route of Administration

- 17.5.8. Molecule Type

- 17.5.9. Patient Demographics

- 17.5.10. End-Users

- 17.6. France Precision Oncology Therapies Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Therapy Type

- 17.6.3. Cancer Type

- 17.6.4. Biomarker Type

- 17.6.5. Technology Platform

- 17.6.6. Drug Class

- 17.6.7. Route of Administration

- 17.6.8. Molecule Type

- 17.6.9. Patient Demographics

- 17.6.10. End-Users

- 17.7. Italy Precision Oncology Therapies Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Therapy Type

- 17.7.3. Cancer Type

- 17.7.4. Biomarker Type

- 17.7.5. Technology Platform

- 17.7.6. Drug Class

- 17.7.7. Route of Administration

- 17.7.8. Molecule Type

- 17.7.9. Patient Demographics

- 17.7.10. End-Users

- 17.8. Spain Precision Oncology Therapies Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Therapy Type

- 17.8.3. Cancer Type

- 17.8.4. Biomarker Type

- 17.8.5. Technology Platform

- 17.8.6. Drug Class

- 17.8.7. Route of Administration

- 17.8.8. Molecule Type

- 17.8.9. Patient Demographics

- 17.8.10. End-Users

- 17.9. Netherlands Precision Oncology Therapies Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Therapy Type

- 17.9.3. Cancer Type

- 17.9.4. Biomarker Type

- 17.9.5. Technology Platform

- 17.9.6. Drug Class

- 17.9.7. Route of Administration

- 17.9.8. Molecule Type

- 17.9.9. Patient Demographics

- 17.9.10. End-Users

- 17.10. Nordic Countries Precision Oncology Therapies Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Therapy Type

- 17.10.3. Cancer Type

- 17.10.4. Biomarker Type

- 17.10.5. Technology Platform

- 17.10.6. Drug Class

- 17.10.7. Route of Administration

- 17.10.8. Molecule Type

- 17.10.9. Patient Demographics

- 17.10.10. End-Users

- 17.11. Poland Precision Oncology Therapies Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Therapy Type

- 17.11.3. Cancer Type

- 17.11.4. Biomarker Type

- 17.11.5. Technology Platform

- 17.11.6. Drug Class

- 17.11.7. Route of Administration

- 17.11.8. Molecule Type

- 17.11.9. Patient Demographics

- 17.11.10. End-Users

- 17.12. Russia & CIS Precision Oncology Therapies Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Therapy Type

- 17.12.3. Cancer Type

- 17.12.4. Biomarker Type

- 17.12.5. Technology Platform

- 17.12.6. Drug Class

- 17.12.7. Route of Administration

- 17.12.8. Molecule Type

- 17.12.9. Patient Demographics

- 17.12.10. End-Users

- 17.13. Rest of Europe Precision Oncology Therapies Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Therapy Type

- 17.13.3. Cancer Type

- 17.13.4. Biomarker Type

- 17.13.5. Technology Platform

- 17.13.6. Drug Class

- 17.13.7. Route of Administration

- 17.13.8. Molecule Type

- 17.13.9. Patient Demographics

- 17.13.10. End-Users

- 18. Asia Pacific Precision Oncology Therapies Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Therapy Type

- 18.3.2. Cancer Type

- 18.3.3. Biomarker Type

- 18.3.4. Technology Platform

- 18.3.5. Drug Class

- 18.3.6. Route of Administration

- 18.3.7. Molecule Type

- 18.3.8. Patient Demographics

- 18.3.9. End-Users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Precision Oncology Therapies Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Therapy Type

- 18.4.3. Cancer Type

- 18.4.4. Biomarker Type

- 18.4.5. Technology Platform

- 18.4.6. Drug Class

- 18.4.7. Route of Administration

- 18.4.8. Molecule Type

- 18.4.9. Patient Demographics

- 18.4.10. End-Users

- 18.5. India Precision Oncology Therapies Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Therapy Type

- 18.5.3. Cancer Type

- 18.5.4. Biomarker Type

- 18.5.5. Technology Platform

- 18.5.6. Drug Class

- 18.5.7. Route of Administration

- 18.5.8. Molecule Type

- 18.5.9. Patient Demographics

- 18.5.10. End-Users

- 18.6. Japan Precision Oncology Therapies Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Therapy Type

- 18.6.3. Cancer Type

- 18.6.4. Biomarker Type

- 18.6.5. Technology Platform

- 18.6.6. Drug Class

- 18.6.7. Route of Administration

- 18.6.8. Molecule Type

- 18.6.9. Patient Demographics

- 18.6.10. End-Users

- 18.7. South Korea Precision Oncology Therapies Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Therapy Type

- 18.7.3. Cancer Type

- 18.7.4. Biomarker Type

- 18.7.5. Technology Platform

- 18.7.6. Drug Class

- 18.7.7. Route of Administration

- 18.7.8. Molecule Type

- 18.7.9. Patient Demographics

- 18.7.10. End-Users

- 18.8. Australia and New Zealand Precision Oncology Therapies Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Therapy Type

- 18.8.3. Cancer Type

- 18.8.4. Biomarker Type

- 18.8.5. Technology Platform

- 18.8.6. Drug Class

- 18.8.7. Route of Administration

- 18.8.8. Molecule Type

- 18.8.9. Patient Demographics

- 18.8.10. End-Users

- 18.9. Indonesia Precision Oncology Therapies Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Therapy Type

- 18.9.3. Cancer Type

- 18.9.4. Biomarker Type

- 18.9.5. Technology Platform

- 18.9.6. Drug Class

- 18.9.7. Route of Administration

- 18.9.8. Molecule Type

- 18.9.9. Patient Demographics

- 18.9.10. End-Users

- 18.10. Malaysia Precision Oncology Therapies Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Therapy Type

- 18.10.3. Cancer Type

- 18.10.4. Biomarker Type

- 18.10.5. Technology Platform

- 18.10.6. Drug Class

- 18.10.7. Route of Administration

- 18.10.8. Molecule Type

- 18.10.9. Patient Demographics

- 18.10.10. End-Users

- 18.11. Thailand Precision Oncology Therapies Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Therapy Type

- 18.11.3. Cancer Type

- 18.11.4. Biomarker Type

- 18.11.5. Technology Platform

- 18.11.6. Drug Class

- 18.11.7. Route of Administration

- 18.11.8. Molecule Type

- 18.11.9. Patient Demographics

- 18.11.10. End-Users

- 18.12. Vietnam Precision Oncology Therapies Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Therapy Type

- 18.12.3. Cancer Type

- 18.12.4. Biomarker Type

- 18.12.5. Technology Platform

- 18.12.6. Drug Class

- 18.12.7. Route of Administration

- 18.12.8. Molecule Type

- 18.12.9. Patient Demographics

- 18.12.10. End-Users

- 18.13. Rest of Asia Pacific Precision Oncology Therapies Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Therapy Type

- 18.13.3. Cancer Type

- 18.13.4. Biomarker Type

- 18.13.5. Technology Platform

- 18.13.6. Drug Class

- 18.13.7. Route of Administration

- 18.13.8. Molecule Type

- 18.13.9. Patient Demographics

- 18.13.10. End-Users

- 19. Middle East Precision Oncology Therapies Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Therapy Type

- 19.3.2. Cancer Type

- 19.3.3. Biomarker Type

- 19.3.4. Technology Platform

- 19.3.5. Drug Class

- 19.3.6. Route of Administration

- 19.3.7. Molecule Type

- 19.3.8. Patient Demographics

- 19.3.9. End-Users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Precision Oncology Therapies Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Therapy Type

- 19.4.3. Cancer Type

- 19.4.4. Biomarker Type

- 19.4.5. Technology Platform

- 19.4.6. Drug Class

- 19.4.7. Route of Administration

- 19.4.8. Molecule Type

- 19.4.9. Patient Demographics

- 19.4.10. End-Users

- 19.5. UAE Precision Oncology Therapies Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Therapy Type

- 19.5.3. Cancer Type

- 19.5.4. Biomarker Type

- 19.5.5. Technology Platform

- 19.5.6. Drug Class

- 19.5.7. Route of Administration

- 19.5.8. Molecule Type

- 19.5.9. Patient Demographics

- 19.5.10. End-Users

- 19.6. Saudi Arabia Precision Oncology Therapies Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Therapy Type

- 19.6.3. Cancer Type

- 19.6.4. Biomarker Type

- 19.6.5. Technology Platform

- 19.6.6. Drug Class

- 19.6.7. Route of Administration

- 19.6.8. Molecule Type

- 19.6.9. Patient Demographics

- 19.6.10. End-Users

- 19.7. Israel Precision Oncology Therapies Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Therapy Type

- 19.7.3. Cancer Type

- 19.7.4. Biomarker Type

- 19.7.5. Technology Platform

- 19.7.6. Drug Class

- 19.7.7. Route of Administration

- 19.7.8. Molecule Type

- 19.7.9. Patient Demographics

- 19.7.10. End-Users

- 19.8. Rest of Middle East Precision Oncology Therapies Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Therapy Type

- 19.8.3. Cancer Type

- 19.8.4. Biomarker Type

- 19.8.5. Technology Platform

- 19.8.6. Drug Class

- 19.8.7. Route of Administration

- 19.8.8. Molecule Type

- 19.8.9. Patient Demographics

- 19.8.10. End-Users

- 20. Africa Precision Oncology Therapies Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Therapy Type

- 20.3.2. Cancer Type

- 20.3.3. Biomarker Type

- 20.3.4. Technology Platform

- 20.3.5. Drug Class

- 20.3.6. Route of Administration

- 20.3.7. Molecule Type

- 20.3.8. Patient Demographics

- 20.3.9. End-Users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Precision Oncology Therapies Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Therapy Type

- 20.4.3. Cancer Type

- 20.4.4. Biomarker Type

- 20.4.5. Technology Platform

- 20.4.6. Drug Class

- 20.4.7. Route of Administration

- 20.4.8. Molecule Type

- 20.4.9. Patient Demographics

- 20.4.10. End-Users

- 20.5. Egypt Precision Oncology Therapies Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Therapy Type

- 20.5.3. Cancer Type

- 20.5.4. Biomarker Type

- 20.5.5. Technology Platform

- 20.5.6. Drug Class

- 20.5.7. Route of Administration

- 20.5.8. Molecule Type

- 20.5.9. Patient Demographics

- 20.5.10. End-Users

- 20.6. Nigeria Precision Oncology Therapies Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Therapy Type

- 20.6.3. Cancer Type

- 20.6.4. Biomarker Type

- 20.6.5. Technology Platform

- 20.6.6. Drug Class

- 20.6.7. Route of Administration

- 20.6.8. Molecule Type

- 20.6.9. Patient Demographics

- 20.6.10. End-Users

- 20.7. Algeria Precision Oncology Therapies Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Therapy Type

- 20.7.3. Cancer Type

- 20.7.4. Biomarker Type

- 20.7.5. Technology Platform

- 20.7.6. Drug Class

- 20.7.7. Route of Administration

- 20.7.8. Molecule Type

- 20.7.9. Patient Demographics

- 20.7.10. End-Users

- 20.8. Rest of Africa Precision Oncology Therapies Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Therapy Type

- 20.8.3. Cancer Type

- 20.8.4. Biomarker Type

- 20.8.5. Technology Platform

- 20.8.6. Drug Class

- 20.8.7. Route of Administration

- 20.8.8. Molecule Type

- 20.8.9. Patient Demographics

- 20.8.10. End-Users

- 21. South America Precision Oncology Therapies Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Precision Oncology Therapies Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Therapy Type

- 21.3.2. Cancer Type

- 21.3.3. Biomarker Type

- 21.3.4. Technology Platform

- 21.3.5. Drug Class

- 21.3.6. Route of Administration

- 21.3.7. Molecule Type

- 21.3.8. Patient Demographics

- 21.3.9. End-Users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Precision Oncology Therapies Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Therapy Type

- 21.4.3. Cancer Type

- 21.4.4. Biomarker Type

- 21.4.5. Technology Platform

- 21.4.6. Drug Class

- 21.4.7. Route of Administration

- 21.4.8. Molecule Type

- 21.4.9. Patient Demographics

- 21.4.10. End-Users

- 21.5. Argentina Precision Oncology Therapies Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Therapy Type

- 21.5.3. Cancer Type

- 21.5.4. Biomarker Type

- 21.5.5. Technology Platform

- 21.5.6. Drug Class

- 21.5.7. Route of Administration

- 21.5.8. Molecule Type

- 21.5.9. Patient Demographics

- 21.5.10. End-Users

- 21.6. Rest of South America Precision Oncology Therapies Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Therapy Type

- 21.6.3. Cancer Type

- 21.6.4. Biomarker Type

- 21.6.5. Technology Platform

- 21.6.6. Drug Class

- 21.6.7. Route of Administration

- 21.6.8. Molecule Type

- 21.6.9. Patient Demographics

- 21.6.10. End-Users

- 22. Key Players/ Company Profile

- 22.1. AbbVie Inc.

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Amgen Inc.

- 22.3. Astellas Pharma Inc.

- 22.4. AstraZeneca PLC

- 22.5. Bayer AG

- 22.6. Bristol-Myers Squibb Company

- 22.7. Daiichi Sankyo Company, Limited

- 22.8. Eisai Co., Ltd.

- 22.9. Eli Lilly and Company

- 22.10. Exact Sciences Corporation

- 22.11. Gilead Sciences, Inc.

- 22.12. GlaxoSmithKline plc

- 22.13. Incyte Corporation

- 22.14. Johnson & Johnson

- 22.15. Merck & Co., Inc.

- 22.16. Novartis AG

- 22.17. Pfizer Inc.

- 22.18. Regeneron Pharmaceuticals, Inc.

- 22.19. Roche Holdings AG

- 22.20. Sanofi S.A.

- 22.21. Seagen Inc.

- 22.22. Takeda Pharmaceutical Company Limited

- 22.23. Other Key Players

- 22.1. AbbVie Inc.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Precision Oncology Therapies Market by Therapy Type, Cancer Type, Biomarker Type, Technology Platform, Drug Class, Route of Administration, Molecule Type, Patient Demographics, End-Users and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Precision Oncology Therapies Market Size, Share & Trends Analysis Report by Therapy Type (Targeted Therapy, Immunotherapy, Hormone Therapy, Gene Therapy, Epigenetic Therapy, Others), Cancer Type, Biomarker Type, Technology Platform, Drug Class, Route of Administration, Molecule Type, Patient Demographics, End-Users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Precision Oncology Therapies Market Size, Share, and Growth

The global precision oncology therapies market is witnessing strong growth, valued at USD 82.4 billion in 2025 and projected to reach USD 157.6 billion by 2035, expanding at a CAGR of 6.7% during the forecast period. The Asia Pacific region is the fastest-growing for the precision oncology therapies market because of expanding cancer genomics research, increasing healthcare investments, and rising adoption of personalized medicine.

Shakti Ramkissoon, vice president, medical lead for oncology at Labcorp, said that,

“Labcorp is dedicated to providing oncologists with a comprehensive portfolio of innovative solutions that enable precise, timely and personalized treatment decisions, With the expansion of our portfolio to include Labcorp Plasma Detect for clinical use and the availability of PGDx elio plasma focus Dx to support patient treatment selection, we're advancing care across the oncology spectrum, solidifying our commitment to transforming cancer diagnostics and improving patient outcomes”.

The increasing occurrences of cancer in the global population are driving the demand of precision oncology therapies whereby clinicians are progressively using personalized, biomarker-based treatments in order to improve patient outcomes, and global challenges of increasing numbers of complex and hard-to-treat malignancies. For instance, the International Agency of Research on Cancer (IARC) released in February 2025, discovered that, on average, 1 out of every 20 women in the world would develop breast cancer at some point in their life. The study estimates 3.2 million new breast cancer per year by 2050 which highlights the rising occurrence of certain cancers.

The precise oncology therapies market is becoming increasingly innovative due to the development of strategic partnerships between pharmaceutical firms and biotech companies and diagnostic development, which combine the genomic knowledge with advanced therapy. For instance, an agreement between Bayer and Kumquat Biosciences in August 2025 to co-develop a precision KRAS G12D inhibitor in the treatment of pancreatic, colorectal and lung cancers. The US 1.3 billion acquisition hastens precision oncology and increases biomarker-driven based therapy.

The availability of precision therapies of ultra-rare and aggressive brain tumors will be a major opportunity of the precision oncology therapies market where with the growth of molecular profiling and the development of biomarkers to lead drug development, hard-to-treat cancers with few therapeutic options will be offered precise treatment. As an example, Jazz Pharmaceuticals was the first to achieve accelerated approval worldwide in August 2025 of Modeyso (dordaviprone), the first and only cure of recurrent H3 K27M-mutant diffuse midline glioma, an ultra-rare, highly aggressive brain tumor that typically afflicts children and young adults.

Precision Oncology Therapies Market Dynamics and Trends

Driver: Comprehensive Genomic Profiling Adoption Identifies Treatment Opportunities

Restraint: Resistance Development Limits Treatment Durability

Opportunity: Liquid Biopsy Monitoring Enables Dynamic Treatment Adjustment

Key Trend: Tumor-Agnostic Drug Development Expands Across Molecular Targets

Precision-Oncology-Therapies-Market Analysis and Segmental Data

Targeted Therapy Dominate Global Precision Oncology Therapies Market

North America Leads Global Precision Oncology Therapies Market Demand

Precision-Oncology-Therapies-Market Ecosystem

The global precision oncology therapies market is fragmented market, where Roche Holdings AG, Novartis AG, Pfizer Inc., AstraZeneca PLC, and Merck & Co., Inc. control nearly 30% of the market share. These top firms have undergone a lot in influencing the industry through advanced targeted therapies, immuno-oncology and biomarker-driven treatment options. They have high expectations of therapeutic efficacy, patient stratification and precision-based care due to their high levels of R&D capacity, extensive clinical trial pipelines, and wide intellectual property portfolios, which restrict entry by new competitors.

There is also the collaboration with diagnostic developers, research institutions, and healthcare providers that make the ecosystem stronger owing to the ability to integrate companion diagnostics and real-world data analytics with personalized treatment protocols. These strategic alliances hasten the innovation process, increase access to the highest-level therapy to the patient and strengthen the market leadership and growth momentum of these leading players.

Hospital systems, oncology practices and specialty pharmacies have an influence on access and insurance payers dictate reimbursement, indicating moderate buyer concentration. The level of concentration in companion diagnostics suppliers is moderate, with the leading companies in the field of full-scale genomic profiling being Foundation Medicine, Guardant Health, and Caris Life Sciences. The barriers to entry are substantial due to long development cycles and lengthy requirements to do clinical validation to defend against established players.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 82.4 Bn |

|

Market Forecast Value in 2035 |

USD 157.6 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Precision-Oncology-Therapies-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Precision Oncology Therapies Market, By Therapy Type |

|

|

Precision Oncology Therapies Market, By Cancer Type |

|

|

Precision Oncology Therapies Market, By Biomarker Type |

|

|

Precision Oncology Therapies Market, By Technology Platform |

|

|

Precision Oncology Therapies Market, By Drug Class |

|

|

Precision Oncology Therapies Market, By Route of Administration |

|

|

Precision Oncology Therapies Market, By Molecule Type |

|

|

Precision Oncology Therapies Market, By Patient Demographics |

|

|

Precision Oncology Therapies Market, By End-Users |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation