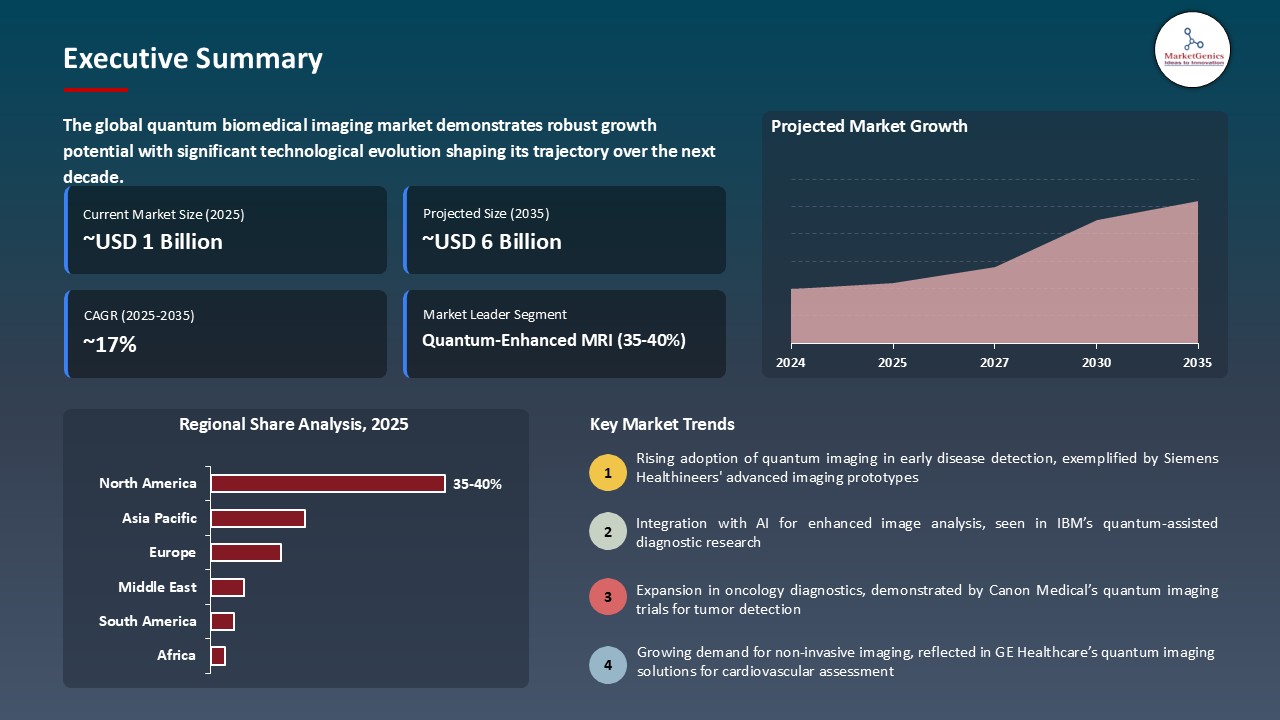

- The global quantum biomedical imaging market is valued at USD 1.3 billion in 2025.

- The market is projected to grow at a CAGR of 17.3% during the forecast period of 2026 to 2035.

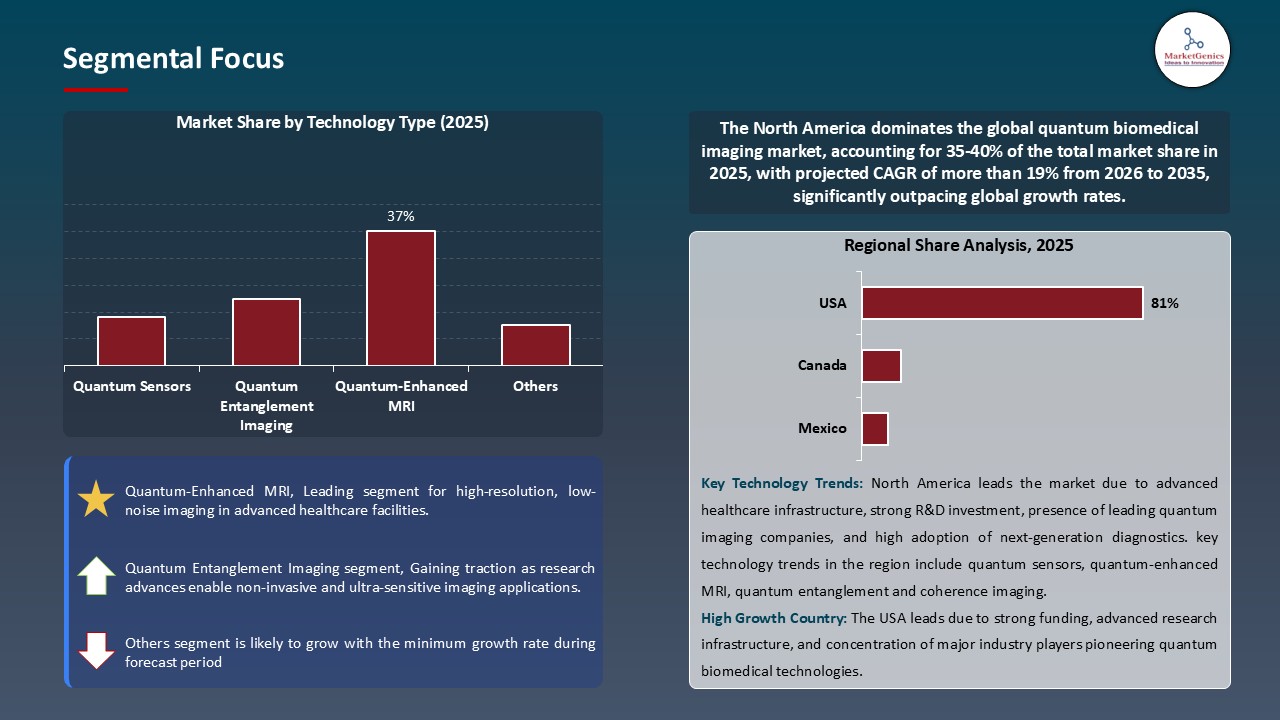

- The quantum-enhanced MRI segment dominates the global quantum biomedical imaging market, holding around 37% share, due to its superior imaging resolution and faster, non-invasive diagnostics

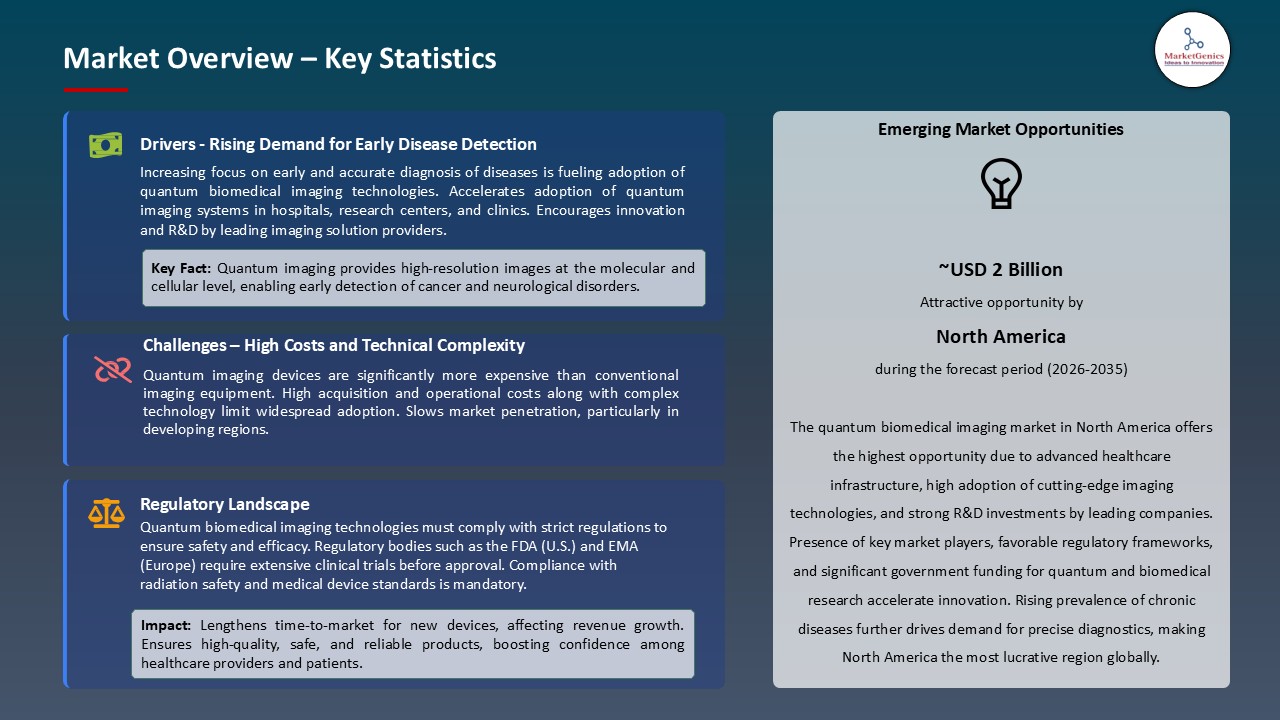

- Rising demand for quantum biomedical imaging is driven by the increasing need for early and precise diagnosis of complex diseases like cancer and neurological disorders

- Growing adoption of advanced imaging technologies in research and clinical settings is boosting the demand for quantum biomedical imaging solutions globally

- The top five players account for nearly 30% of the global quantum biomedical imaging market in 2025

- In March 2025, Canon received regulatory clearance for its Aquilion ONE / INSIGHT Edition CT scanner, featuring AI-driven image reconstruction

- In May 2025, Researchers at Quanta Image Sensors developed a high-sensitivity imaging system that enhances bioluminescent signal detection in living cells.

- Global Quantum Biomedical Imaging Market is likely to create the total forecasting opportunity of ~USD 5 Bn till 2035.

- North America’s Quantum Biomedical Imaging market offers strong opportunities due to high healthcare expenditure and rapid adoption of advanced medical imaging technologies.

- The quantum biomedical imaging market is driven by the increasing focus on early disease diagnosis and individual treatment plans. Detection of disease at the initial stages is a growing concern among healthcare systems around the globe with the view of enhancing patient outcomes, lowering treatment expenses, and quality of life.

- Quantum biomedical imaging technologies, including quantum-enhanced MRI and quantum sensing devices, are highly sensitive and high-resolution technologies that provide clinicians with the opportunity to detect subtle pathological changes that traditional imaging can overlook. Also, the emergence of precision medicine, the method of customizing the treatment process depending on the genetic, molecular, and physiological characteristics of the individual, contributes to the increased necessity of non-invasive and highly accurate imaging solutions.

- In 2025, Quantum Biosciences collaborated with Netherlands-based QT Sense to combine its in-silico predictive modelling with Quantum Nuova quantum relaxometry hardware by QT Sense. This partnership will speed the creation of predictive diagnostic tests of radiation-induced toxicity to advance the use of quantum sensing in personalized medicine.

- The increased convergence between quantum imaging and sensing technology and precision medicine is destined to transform the early detection of disease and personalized medicine.

- The development of quantum biomedical imaging market can be considerably impeded by the fact that advanced imaging systems need a lot of capital investment to be developed, deployed, or maintained. Quantum technologies, such as quantum-enhanced MRI, quantum sensing devices, etc., use advanced hardware, materials and accurate cryogenic systems which add significant additional costs to upfront costs.

- The technical nature requires extremely qualified individuals to operate, calibrate and read data and this contributes to operation costs. The complexity of adoption is also increased by the need to integrate with current clinical workflows, the reliability in a wide range of conditions, and the need to be standardized in healthcare facilities. The small health care providers and research centers find it difficult to install quantum imaging solutions because of these financial and technical obstacles, restricting their uptake and reducing the growth of the market in general.

- The fact that quantum imaging systems require constant studies and technological advancements to ensure the accuracy and high efficiency only increases expenditure and complexity of the operation. The quick development of the quantum technology means that a regular update of the systems, the improvement of software, and the refinement of the hardware tend to require more money, as well as the specialized technical expertise, and long-term adoption is not available to most healthcare providers.

- The combination of quantum biomedical imaging and artificial intelligence (AI) is an important opportunity to increase the accuracy of diagnoses, efficiency, and clinical decision-making. The huge and intricate datasets produced by quantum imaging systems can be processed and analyzed by AI algorithms and each detail of the patterns and abnormalities that could also escape the traditional ways of imaging can be identified. This combination allows to detect diseases earlier, accurately track the development of the disease, and develop more personalized treatment plans.

- In addition, AI-based automation will be able to automatize image reconstruction, interpretations, and human error reduction, hence making healthcare facilities more efficient in terms of workflow overall. The combination of the high sensitivity of quantum imaging and the predictive analytics of AI also provides the possibility of new research, drug development opportunities, and the application of precision medicine.

- Quantum Biosciences - Quantum Sentinel is an implementation of quantum sensing and Artificial Intelligence to deliver early and personalized diagnostics. AI uses NV-diamond sensors to measure cellular stress, and interprets the signal to create a Radiosensitivity Index (RTS) to use in planning radiation personally. Moreover, on the platform, nephrotoxicity and drugs safety can be monitored, which reveals the prospects of quantum imaging and AI to improve predictive diagnostics and patient outcomes.

- Quantum imaging combined with AI is another disruptive example of the future of healthcare that will provide more timely, accurate, and personalized solutions.

- The trend of miniaturization and creation of portable quantum sensors is immensely changing the quantum biomedical imaging market as the high-precision diagnostics become more accessible and versatile. Recent developments in nanofabrication, materials science, and quantum engineering have made it possible to develop small NV-diamond and other quantum sensors that do not lose the sensitivity and performance of larger laboratory systems.

- Portable devices enable clinicians to practice point-of-care diagnostics, bedside monitoring, and real-time imaging within a range of clinical settings, such as distant or resource-constrained settings. Small-scale sensors are also used to integrate with wearable systems and mobile health systems to provide an ongoing track of physiological variables at a molecular or cellular scale.

- In addition, quantum sensors are portable, which promotes the development of drugs, personalized medicine, and early detection of diseases since researchers can gather accurate information without the need to conduct their experiments in the laboratory. The first self-illuminating quantum biosensor was created by the EPFL researchers and it can detect the biomolecules with a sensitivity of a trillionth-of-a-gram without using any external sources of light. It can be described as the forerunner of miniaturized and portable quantum sensors, with its ultra-compact chip-sized form factoring in the momentum of miniaturized point-of-care diagnostics and the development of the quantum biomedical imaging market.

- Smaller, portable quantum sensors are becoming a trend, which is increasing their wider application, offering highly sensitive, accessible and real-time diagnostics in clinical and research environments.

- Quantum-Enhanced MRI segment controls the entire quantum biomedical imaging market in the world since it has the highest sensitivity and spatial resolution among other MRI systems. These systems can detect minute changes in the molecular and cellular systems to make diagnosis of diseases earlier and monitor treatment progress more accurately using quantum technologies like superconducting qubits and quantum sensors.

- The increasing use in oncology, neurology, and cardiology combined with the rise in investments in advanced imaging infrastructure makes quantum-enhanced MRI the most widely used and commercially important of the segments, which is driving market growth and establishing new standards of high-precision medical imaging across the globe.

- gSpin-gSpin quantum-enhanced MRI sensors improve molecular signals 10-100X to enable imaging at higher rates and with higher resolution, and point-of-care uses. The company is also constructing a quantum sensing based, non-invasive, real-time blood test device, which is going to revolutionize high-precision medical diagnostics.

- Quantum-enhanced MRI will transform high-quality, early, and available diagnostics of care in healthcare.

- North America is at the forefront of the quantum biomedical imaging market, because of regions well-developed health care system, research ecosystem, and it is among the first to embrace and utilize the latest medical technology. The region also pools-in major investments from government agencies, commercial and research institutions in quantum technologies, such as quantum-enhanced MRI, quantum sensors, and AI-based imaging with integrated AI.

- The availability of top healthcare providers, big imaging equipment suppliers, and a continuous cooperation between hospitals and technology developers quickens the implementation of the market. Also, there is an established regulatory environment that promotes clinical trials and early commercialization of innovative diagnostic equipment in North America.

- High awareness of precision medicine and increasing demand of early disease detection are also additional drivers of the adoption of quantum biomedical imaging solutions. With effective financial support and alliances, technological improvements make North America an important source of development of the global market, setting trends and requirements of quantum imaging implementation across the globe.

- Quantum BioPharma announced that it has scanned the first patient with Multiple Sclerosis using a new PET/MR imaging procedure in a joint study with Massachusetts General Hospital, which indicates the implementation of the latest quantum-enhanced imaging technologies in the US and reflects the leadership of the region in the development of the latest biomedical imaging applications.

- North America has a well-developed infrastructure, a well-developed research community, and has early adopters of quantum imaging technologies which solidly position it in the quantum biomedical imaging market as a global leader.

- In March 2025, Canon received regulatory clearance for its Aquilion ONE / INSIGHT Edition CT scanner, featuring AI-driven image reconstruction and enhanced matrix/filter technology, enabling faster, higher-resolution imaging and expanding clinical applications, highlighting the company’s leadership in advanced medical imaging innovations.

- In May 2025, Researchers at Quanta Image Sensors developed a high-sensitivity imaging system that enhances bioluminescent signal detection in living cells. By improving photon capture and image acquisition, the technology enables sharper, more precise visualization of cellular processes, supporting advanced biomedical imaging applications and demonstrating progress in quantum sensor–based imaging tools.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Canon Medical Systems

- Carl Zeiss AG

- gSpin Technologies

- EuQlid

- Q-CTRL

- Leica Microsystems

- Miltenyi Biotec

- IonQ

- NVision Imaging Technologies

- Oxford Instruments

- QCI (Quantum Computing Inc.)

- Quantum Motion

- QuTech

- ARQ Controls

- Olympus Corporation

- Rigetti Computing

- Siemens Healthineers

- Photon Mission BV

- Thermo Fisher Scientific

- Other Key Players

- Quantum Sensors

- Nitrogen-Vacancy (NV) Center Sensors

- Superconducting Quantum Interference Devices (SQUIDs)

- Quantum Dots

- Single-Photon Detectors

- Others

- Quantum Entanglement Imaging

- Quantum Coherence Imaging

- Quantum-Enhanced MRI

- Quantum Optical Coherence Tomography (Q-OCT)

- Quantum Photonic Imaging

- Others

- Quantum Magnetic Resonance Imaging (Q-MRI)

- Ultra-Low Field MRI

- Hyperpolarized MRI

- Quantum Optical Imaging

- Quantum Fluorescence Microscopy

- Quantum Plasmonic Imaging

- Quantum Ultrasound Imaging

- Quantum X-ray Imaging

- Quantum Photoacoustic Imaging

- Quantum Electron Microscopy

- Hybrid Quantum Imaging Systems

- Disease Diagnosis

- Cancer Detection

- Neurological Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Others

- Drug Discovery & Development

- Cellular & Molecular Imaging

- Anatomical Imaging

- Functional Imaging

- Real-time Surgical Guidance

- Preclinical Research

- Theranostics

- Other Applications

- Nanoscale Imaging (< 100 nm)

- Microscale Imaging (100 nm - 100 μm)

- Mesoscale Imaging (100 μm - 1 mm)

- Macroscale Imaging (> 1 mm)

- Quantum Imaging Systems

- Standalone Systems

- Integrated Systems

- Quantum Contrast Agents

- Quantum Dots-based Agents

- Nanoparticle-based Agents

- Quantum Imaging Software

- Image Acquisition Software

- Image Processing & Analysis Software

- Quantum Sensors & Detectors

- Accessories & Consumables

- Hospitals & Clinics

- Multi-specialty Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

- Diagnostic Imaging Centers

- Academic & Research Institutions

- Universities

- Research Laboratories

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Veterinary Clinics

- Other End-users

- Benchtop Systems

- Portable/Handheld Devices

- Mobile Imaging Units

- Fixed Installation Systems

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Quantum Biomedical Imaging Market Outlook

- 2.1.1. Quantum Biomedical Imaging Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Quantum Biomedical Imaging Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare & Pharmaceutical Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for high-precision diagnostics

- 4.1.1.2. Increased R&D and government funding in quantum imaging

- 4.1.1.3. Adoption of advanced healthcare technologies

- 4.1.2. Restraints

- 4.1.2.1. High cost of quantum imaging equipment

- 4.1.2.2. Limited availability of skilled professionals

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturers

- 4.4.3. System Integrators

- 4.4.4. Distributors

- 4.4.5. End Users

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Quantum Biomedical Imaging Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Quantum Biomedical Imaging Market Analysis, By Technology Type

- 6.1. Key Segment Analysis

- 6.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Technology Type, 2021-2035

- 6.2.1. Quantum Sensors

- 6.2.1.1. Nitrogen-Vacancy (NV) Center Sensors

- 6.2.1.2. Superconducting Quantum Interference Devices (SQUIDs)

- 6.2.1.3. Quantum Dots

- 6.2.1.4. Single-Photon Detectors

- 6.2.1.5. Others

- 6.2.2. Quantum Entanglement Imaging

- 6.2.3. Quantum Coherence Imaging

- 6.2.4. Quantum-Enhanced MRI

- 6.2.5. Quantum Optical Coherence Tomography (Q-OCT)

- 6.2.6. Quantum Photonic Imaging

- 6.2.7. Others

- 6.2.1. Quantum Sensors

- 7. Global Quantum Biomedical Imaging Market Analysis, By Imaging Modality

- 7.1. Key Segment Analysis

- 7.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Imaging Modality, 2021-2035

- 7.2.1. Quantum Magnetic Resonance Imaging (Q-MRI)

- 7.2.1.1. Ultra-Low Field MRI

- 7.2.1.2. Hyperpolarized MRI

- 7.2.2. Quantum Optical Imaging

- 7.2.2.1. Quantum Fluorescence Microscopy

- 7.2.2.2. Quantum Plasmonic Imaging

- 7.2.3. Quantum Ultrasound Imaging

- 7.2.4. Quantum X-ray Imaging

- 7.2.5. Quantum Photoacoustic Imaging

- 7.2.6. Quantum Electron Microscopy

- 7.2.7. Hybrid Quantum Imaging Systems

- 7.2.1. Quantum Magnetic Resonance Imaging (Q-MRI)

- 8. Global Quantum Biomedical Imaging Market Analysis,By Application

- 8.1. Key Segment Analysis

- 8.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Application, 2021-2035

- 8.2.1. Disease Diagnosis

- 8.2.1.1. Cancer Detection

- 8.2.1.2. Neurological Disorders

- 8.2.1.3. Cardiovascular Diseases

- 8.2.1.4. Infectious Diseases

- 8.2.1.5. Others

- 8.2.2. Drug Discovery & Development

- 8.2.3. Cellular & Molecular Imaging

- 8.2.4. Anatomical Imaging

- 8.2.5. Functional Imaging

- 8.2.6. Real-time Surgical Guidance

- 8.2.7. Preclinical Research

- 8.2.8. Theranostics

- 8.2.9. Other Applications

- 8.2.1. Disease Diagnosis

- 9. Global Quantum Biomedical Imaging Market Analysis, By Resolution Type

- 9.1. Key Segment Analysis

- 9.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Resolution Type, 2021-2035

- 9.2.1. Nanoscale Imaging (< 100 nm)

- 9.2.2. Microscale Imaging (100 nm - 100 μm)

- 9.2.3. Mesoscale Imaging (100 μm - 1 mm)

- 9.2.4. Macroscale Imaging (> 1 mm)

- 10. Global Quantum Biomedical Imaging Market Analysis, By Product Type

- 10.1. Key Segment Analysis

- 10.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Product Type, 2021-2035

- 10.2.1. Quantum Imaging Systems

- 10.2.1.1. Standalone Systems

- 10.2.1.2. Integrated Systems

- 10.2.2. Quantum Contrast Agents

- 10.2.2.1. Quantum Dots-based Agents

- 10.2.2.2. Nanoparticle-based Agents

- 10.2.3. Quantum Imaging Software

- 10.2.3.1. Image Acquisition Software

- 10.2.3.2. Image Processing & Analysis Software

- 10.2.4. Quantum Sensors & Detectors

- 10.2.5. Accessories & Consumables

- 10.2.1. Quantum Imaging Systems

- 11. Global Quantum Biomedical Imaging Market Analysis, By End-User Type

- 11.1. Key Segment Analysis

- 11.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-User Type, 2021-2035

- 11.2.1. Hospitals & Clinics

- 11.2.1.1. Multi-specialty Hospitals

- 11.2.1.2. Specialty Clinics

- 11.2.1.3. Ambulatory Surgical Centers

- 11.2.1.4. Others

- 11.2.2. Diagnostic Imaging Centers

- 11.2.3. Academic & Research Institutions

- 11.2.4. Universities

- 11.2.5. Research Laboratories

- 11.2.6. Pharmaceutical & Biotechnology Companies

- 11.2.7. Contract Research Organizations (CROs)

- 11.2.8. Veterinary Clinics

- 11.2.9. Other End-users

- 11.2.1. Hospitals & Clinics

- 12. Global Quantum Biomedical Imaging Market Analysis, By Portability

- 12.1. Key Segment Analysis

- 12.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, By Portability, 2021-2035

- 12.2.1. Benchtop Systems

- 12.2.2. Portable/Handheld Devices

- 12.2.3. Mobile Imaging Units

- 12.2.4. Fixed Installation Systems

- 13. Global Quantum Biomedical Imaging Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Quantum Biomedical Imaging Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Technology Type

- 14.3.2. Imaging Modality

- 14.3.3. Application

- 14.3.4. Resolution Type

- 14.3.5. Product Type

- 14.3.6. End-User Type

- 14.3.7. Portability

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Quantum Biomedical Imaging Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Technology Type

- 14.4.3. Imaging Modality

- 14.4.4. Application

- 14.4.5. Resolution Type

- 14.4.6. Product Type

- 14.4.7. End-User Type

- 14.4.8. Portability

- 14.5. Canada Quantum Biomedical Imaging Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Technology Type

- 14.5.3. Imaging Modality

- 14.5.4. Application

- 14.5.5. Resolution Type

- 14.5.6. Product Type

- 14.5.7. End-User Type

- 14.5.8. Portability

- 14.6. Mexico Quantum Biomedical Imaging Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Technology Type

- 14.6.3. Imaging Modality

- 14.6.4. Application

- 14.6.5. Resolution Type

- 14.6.6. Product Type

- 14.6.7. End-User Type

- 14.6.8. Portability

- 15. Europe Quantum Biomedical Imaging Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology/Platform Type

- 15.3.2. Technology Type

- 15.3.3. Imaging Modality

- 15.3.4. Application

- 15.3.5. Resolution Type

- 15.3.6. Product Type

- 15.3.7. End-User Type

- 15.3.8. Portability

- 15.3.9. Country

- 15.3.9.1. Germany

- 15.3.9.2. United Kingdom

- 15.3.9.3. France

- 15.3.9.4. Italy

- 15.3.9.5. Spain

- 15.3.9.6. Netherlands

- 15.3.9.7. Nordic Countries

- 15.3.9.8. Poland

- 15.3.9.9. Russia & CIS

- 15.3.9.10. Rest of Europe

- 15.4. Germany Quantum Biomedical Imaging Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Imaging Modality

- 15.4.4. Application

- 15.4.5. Resolution Type

- 15.4.6. Product Type

- 15.4.7. End-User Type

- 15.4.8. Portability

- 15.5. United Kingdom Quantum Biomedical Imaging Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Imaging Modality

- 15.5.4. Application

- 15.5.5. Resolution Type

- 15.5.6. Product Type

- 15.5.7. End-User Type

- 15.5.8. Portability

- 15.6. France Quantum Biomedical Imaging Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Imaging Modality

- 15.6.4. Application

- 15.6.5. Resolution Type

- 15.6.6. Product Type

- 15.6.7. End-User Type

- 15.6.8. Portability

- 15.7. Italy Quantum Biomedical Imaging Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Technology Type

- 15.7.3. Imaging Modality

- 15.7.4. Application

- 15.7.5. Resolution Type

- 15.7.6. Product Type

- 15.7.7. End-User Type

- 15.7.8. Portability

- 15.8. Spain Quantum Biomedical Imaging Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Technology Type

- 15.8.3. Imaging Modality

- 15.8.4. Application

- 15.8.5. Resolution Type

- 15.8.6. Product Type

- 15.8.7. End-User Type

- 15.8.8. Portability

- 15.9. Netherlands Quantum Biomedical Imaging Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Technology Type

- 15.9.3. Imaging Modality

- 15.9.4. Application

- 15.9.5. Resolution Type

- 15.9.6. Product Type

- 15.9.7. End-User Type

- 15.9.8. Portability

- 15.10. Nordic Countries Quantum Biomedical Imaging Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Technology Type

- 15.10.3. Imaging Modality

- 15.10.4. Application

- 15.10.5. Resolution Type

- 15.10.6. Product Type

- 15.10.7. End-User Type

- 15.10.8. Portability

- 15.11. Poland Quantum Biomedical Imaging Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Technology Type

- 15.11.3. Imaging Modality

- 15.11.4. Application

- 15.11.5. Resolution Type

- 15.11.6. Product Type

- 15.11.7. End-User Type

- 15.11.8. Portability

- 15.12. Russia & CIS Quantum Biomedical Imaging Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Technology Type

- 15.12.3. Imaging Modality

- 15.12.4. Application

- 15.12.5. Resolution Type

- 15.12.6. Product Type

- 15.12.7. End-User Type

- 15.12.8. Portability

- 15.13. Rest of Europe Quantum Biomedical Imaging Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Technology Type

- 15.13.3. Imaging Modality

- 15.13.4. Application

- 15.13.5. Resolution Type

- 15.13.6. Product Type

- 15.13.7. End-User Type

- 15.13.8. Portability

- 16. Asia Pacific Quantum Biomedical Imaging Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology Type

- 16.3.2. Imaging Modality

- 16.3.3. Application

- 16.3.4. Resolution Type

- 16.3.5. Product Type

- 16.3.6. End-User Type

- 16.3.7. Portability

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Quantum Biomedical Imaging Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Imaging Modality

- 16.4.4. Application

- 16.4.5. Resolution Type

- 16.4.6. Product Type

- 16.4.7. End-User Type

- 16.4.8. Portability

- 16.5. India Quantum Biomedical Imaging Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology Type

- 16.5.3. Imaging Modality

- 16.5.4. Application

- 16.5.5. Resolution Type

- 16.5.6. Product Type

- 16.5.7. End-User Type

- 16.5.8. Portability

- 16.6. Japan Quantum Biomedical Imaging Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Imaging Modality

- 16.6.4. Application

- 16.6.5. Resolution Type

- 16.6.6. Product Type

- 16.6.7. End-User Type

- 16.6.8. Portability

- 16.7. South Korea Quantum Biomedical Imaging Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Imaging Modality

- 16.7.4. Application

- 16.7.5. Resolution Type

- 16.7.6. Product Type

- 16.7.7. End-User Type

- 16.7.8. Portability

- 16.8. Australia and New Zealand Quantum Biomedical Imaging Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology Type

- 16.8.3. Imaging Modality

- 16.8.4. Application

- 16.8.5. Resolution Type

- 16.8.6. Product Type

- 16.8.7. End-User Type

- 16.8.8. Portability

- 16.9. Indonesia Quantum Biomedical Imaging Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology Type

- 16.9.3. Imaging Modality

- 16.9.4. Application

- 16.9.5. Resolution Type

- 16.9.6. Product Type

- 16.9.7. End-User Type

- 16.9.8. Portability

- 16.10. Malaysia Quantum Biomedical Imaging Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology Type

- 16.10.3. Imaging Modality

- 16.10.4. Application

- 16.10.5. Resolution Type

- 16.10.6. Product Type

- 16.10.7. End-User Type

- 16.10.8. Portability

- 16.11. Thailand Quantum Biomedical Imaging Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology Type

- 16.11.3. Imaging Modality

- 16.11.4. Application

- 16.11.5. Resolution Type

- 16.11.6. Product Type

- 16.11.7. End-User Type

- 16.11.8. Portability

- 16.12. Vietnam Quantum Biomedical Imaging Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology Type

- 16.12.3. Imaging Modality

- 16.12.4. Application

- 16.12.5. Resolution Type

- 16.12.6. Product Type

- 16.12.7. End-User Type

- 16.12.8. Portability

- 16.13. Rest of Asia Pacific Quantum Biomedical Imaging Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology Type

- 16.13.3. Imaging Modality

- 16.13.4. Application

- 16.13.5. Resolution Type

- 16.13.6. Product Type

- 16.13.7. End-User Type

- 16.13.8. Portability

- 17. Middle East Quantum Biomedical Imaging Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology Type

- 17.3.2. Imaging Modality

- 17.3.3. Application

- 17.3.4. Resolution Type

- 17.3.5. Product Type

- 17.3.6. End-User Type

- 17.3.7. Portability

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Quantum Biomedical Imaging Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Imaging Modality

- 17.4.4. Application

- 17.4.5. Resolution Type

- 17.4.6. Product Type

- 17.4.7. End-User Type

- 17.4.8. Portability

- 17.5. UAE Quantum Biomedical Imaging Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Imaging Modality

- 17.5.4. Application

- 17.5.5. Resolution Type

- 17.5.6. Product Type

- 17.5.7. End-User Type

- 17.5.8. Portability

- 17.6. Saudi Arabia Quantum Biomedical Imaging Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Imaging Modality

- 17.6.4. Application

- 17.6.5. Resolution Type

- 17.6.6. Product Type

- 17.6.7. End-User Type

- 17.6.8. Portability

- 17.7. Israel Quantum Biomedical Imaging Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Imaging Modality

- 17.7.4. Application

- 17.7.5. Resolution Type

- 17.7.6. Product Type

- 17.7.7. End-User Type

- 17.7.8. Portability

- 17.8. Rest of Middle East Quantum Biomedical Imaging Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Imaging Modality

- 17.8.4. Application

- 17.8.5. Resolution Type

- 17.8.6. Product Type

- 17.8.7. End-User Type

- 17.8.8. Portability

- 18. Africa Quantum Biomedical Imaging Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology Type

- 18.3.2. Imaging Modality

- 18.3.3. Application

- 18.3.4. Resolution Type

- 18.3.5. Product Type

- 18.3.6. End-User Type

- 18.3.7. Portability

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Quantum Biomedical Imaging Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Imaging Modality

- 18.4.4. Application

- 18.4.5. Resolution Type

- 18.4.6. Product Type

- 18.4.7. End-User Type

- 18.4.8. Portability

- 18.5. Egypt Quantum Biomedical Imaging Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Imaging Modality

- 18.5.4. Application

- 18.5.5. Resolution Type

- 18.5.6. Product Type

- 18.5.7. End-User Type

- 18.5.8. Portability

- 18.6. Nigeria Quantum Biomedical Imaging Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Imaging Modality

- 18.6.4. Application

- 18.6.5. Resolution Type

- 18.6.6. Product Type

- 18.6.7. End-User Type

- 18.6.8. Portability

- 18.7. Algeria Quantum Biomedical Imaging Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology Type

- 18.7.3. Imaging Modality

- 18.7.4. Application

- 18.7.5. Resolution Type

- 18.7.6. Product Type

- 18.7.7. End-User Type

- 18.7.8. Portability

- 18.8. Rest of Africa Quantum Biomedical Imaging Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology Type

- 18.8.3. Imaging Modality

- 18.8.4. Application

- 18.8.5. Resolution Type

- 18.8.6. Product Type

- 18.8.7. End-User Type

- 18.8.8. Portability

- 19. South America Quantum Biomedical Imaging Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Quantum Biomedical Imaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology Type

- 19.3.2. Imaging Modality

- 19.3.3. Application

- 19.3.4. Resolution Type

- 19.3.5. Product Type

- 19.3.6. End-User Type

- 19.3.7. Portability

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Quantum Biomedical Imaging Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology Type

- 19.4.3. Imaging Modality

- 19.4.4. Application

- 19.4.5. Resolution Type

- 19.4.6. Product Type

- 19.4.7. End-User Type

- 19.4.8. Portability

- 19.5. Argentina Quantum Biomedical Imaging Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology Type

- 19.5.3. Imaging Modality

- 19.5.4. Application

- 19.5.5. Resolution Type

- 19.5.6. Product Type

- 19.5.7. End-User Type

- 19.5.8. Portability

- 19.6. Rest of South America Quantum Biomedical Imaging Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology Type

- 19.6.3. Imaging Modality

- 19.6.4. Application

- 19.6.5. Resolution Type

- 19.6.6. Product Type

- 19.6.7. End-User Type

- 19.6.8. Portability

- 20. Key Players/ Company Profile

- 20.1. ARQ Controls

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Canon Medical Systems

- 20.3. Carl Zeiss AG

- 20.4. EuQlid

- 20.5. gSpin Technologies

- 20.6. IonQ

- 20.7. Leica Microsystems

- 20.8. Miltenyi Biotec

- 20.9. NVision Imaging Technologies

- 20.10. Olympus Corporation

- 20.11. Oxford Instruments

- 20.12. Photon Mission BV

- 20.13. QCI (Quantum Computing Inc.)

- 20.14. Q-CTRL

- 20.15. QDI Systems

- 20.16. Quantum Motion

- 20.17. QuTech

- 20.18. Rigetti Computing

- 20.19. Siemens Healthineers

- 20.20. Thermo Fisher Scientific

- 20.21. Other Key Players

- 20.1. ARQ Controls

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Quantum Biomedical Imaging Market Size, Share & Trends Analysis Report by Technology Type (Quantum Sensors, Quantum Entanglement Imaging, Quantum Coherence Imaging, Quantum-Enhanced MRI, Quantum Optical Coherence Tomography (Q-OCT), Quantum Photonic Imaging, Others), Imaging Modality, Application, Resolution Type, Product Type, End-User Type, Portability and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Quantum Biomedical Imaging Market Size, Share, and Growth

The global quantum biomedical imaging market is witnessing strong growth, valued at USD 1.3 billion in 2025 and projected to reach USD 6.4 billion by 2035, expanding at a CAGR of 17.3% during the forecast period. The Asia Pacific region is the fastest-growing quantum biomedical imaging market due to rapid technological adoption, expanding healthcare infrastructure, and increasing investments in advanced diagnostic imaging solutions.

Allan Sheffield, myDNA Co-founder, said,

“myDNA is excited to partner with the University of Glasgow's Living Laboratory for Quantum Biomedical Imaging to accelerate pharmacogenomics adoption. Our expertise in providing pharmacogenomic clinical decision support, coupled with the Living Lab’s research capabilities, positions us to generate compelling real-world evidence showcasing PGx's clinical and economic value.”

The quantum biomedical imaging market is increasing due to the growing utilization of non-invasive and real-time imaging technologies that allow much faster, safer and more accurate diagnostics without involving invasive procedures. An example is SeeDevice, which was named the Best Image Sensor Technology Company due to its QMOS quantum-effect CMOS sensors, which allow non-invasive imaging with high sensitivity. These sensors not only increase diagnostic accuracy, but also promote real-time monitoring, and the applications in both the healthcare and multi-spectrum imaging, positioning SeeDevice as an important pioneer in the next generation biomedical imaging technology.

The quantum biomedical imaging market is driven by collaborations, which enhance innovation, share expertise, and commercially develop advanced, high-precision imaging solutions. An example of such an announcement is QDI Systems (Netherlands) raised €7.5 million, including a 2.5million-euro grant by the European Innovation Council to scale its quantum-dot technology to X-ray and SWIR medical imaging in 2025. This investment will enhance the development of high-resolution, non-invasive imaging solutions, which will enhance the role of QDI in the established quantum biomedical imaging market.

The prospect of expansion into molecular imaging and oncology is also a big opportunity since quantum biomedical imaging has potential to offer highly accurate, non-invasive images of cellular and molecular processes. This allows the initial diagnosis of cancer, better monitoring of the treatment, and individual planning of therapies, which pushes the demand towards the development of modern imaging systems in research and clinical oncology practice.

Quantum Biomedical Imaging Market Dynamics and Trends

Driver: Rising Demand for Early Disease Detection and Precision Medicine

Restraint: High Capital Investment and Technical Complexity

Opportunity: Integration with Artificial Intelligence for Enhanced Diagnostics

Key Trend: Miniaturization and Development of Portable Quantum Sensors

Quantum-Biomedical-Imaging-Market Analysis and Segmental Data

Quantum-Enhanced MRI Dominate Global Quantum Biomedical Imaging Market

North America Leads Global Quantum Biomedical Imaging Market Demand

Quantum-Biomedical-Imaging-Market Ecosystem

The quantum biomedical imaging market is moderately fragmented with Siemens Healthineers, GE HealthCare, Philips health care, Canon Medical Systems and Bruker Corporation dominating the market share of about 27%. These industry leaders have made a considerable contribution in the industry by creating highly sophisticated quantum imaging technologies, high-resolution diagnostic systems, and AI-based imaging platforms that allow to precisely detect the disease and plan the treatment individually in the fields of oncology, neuroscience, cardiology, and other treatment domains. New entrants are faced with high barriers to entry due to their huge R&D capabilities, extensive intellectual property portfolio, and vast global distribution networks.

The strategic partnerships with the hospitals, diagnostic laboratories and research institutions also contribute to the implementation of new imaging technologies, clinical validation, and regulatory compliance. Such collaborations enable faster adoption of quantum imaging into the clinical processes, enhance personalization of patient treatment, and increase the availability of the personalized diagnostics, thus leading to the market growth and solidification of the leadership positions of these key participants.

The buying power of the consumers is medium because hospitals, oncology practices and pharmaceutical manufacturers are large sources of revenue. The concentration among the suppliers of sequencing instruments and reagents is high with Illumina leading the market but with an increase in the competition in the market with BGI Genomics, Pacific Biosciences, and Oxford Nanopore Technologies. The switching costs created due to the long development cycles and regulatory requirements promote the establishment of the long-term relationships.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.3 Bn |

|

Market Forecast Value in 2035 |

USD 6.4 Bn |

|

Growth Rate (CAGR) |

17.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Quantum-Biomedical-Imaging-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Quantum Biomedical Imaging Market, By Technology Type |

|

|

Quantum Biomedical Imaging Market, By Imaging Modality |

|

|

Quantum Biomedical Imaging Market, By Application |

|

|

Quantum Biomedical Imaging Market, By Resolution Type |

|

|

Quantum Biomedical Imaging Market, By Product Type |

|

|

Quantum Biomedical Imaging Market, By End-User Type |

|

|

Quantum Biomedical Imaging Market, By Portability |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation