Radiopharmaceuticals Therapy Market Size, Share & Trends Analysis Report by Radioisotope Type (Alpha Emitters, Beta Emitters, Auger Emitters), Therapeutic Application, Product Type, Molecule Type, Source of Radioisotope, Route of Administration, Distribution Channel, Production Method, Technology Platform, Half-Life Duration, End-Users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Radiopharmaceuticals Therapy Market Size, Share, and Growth

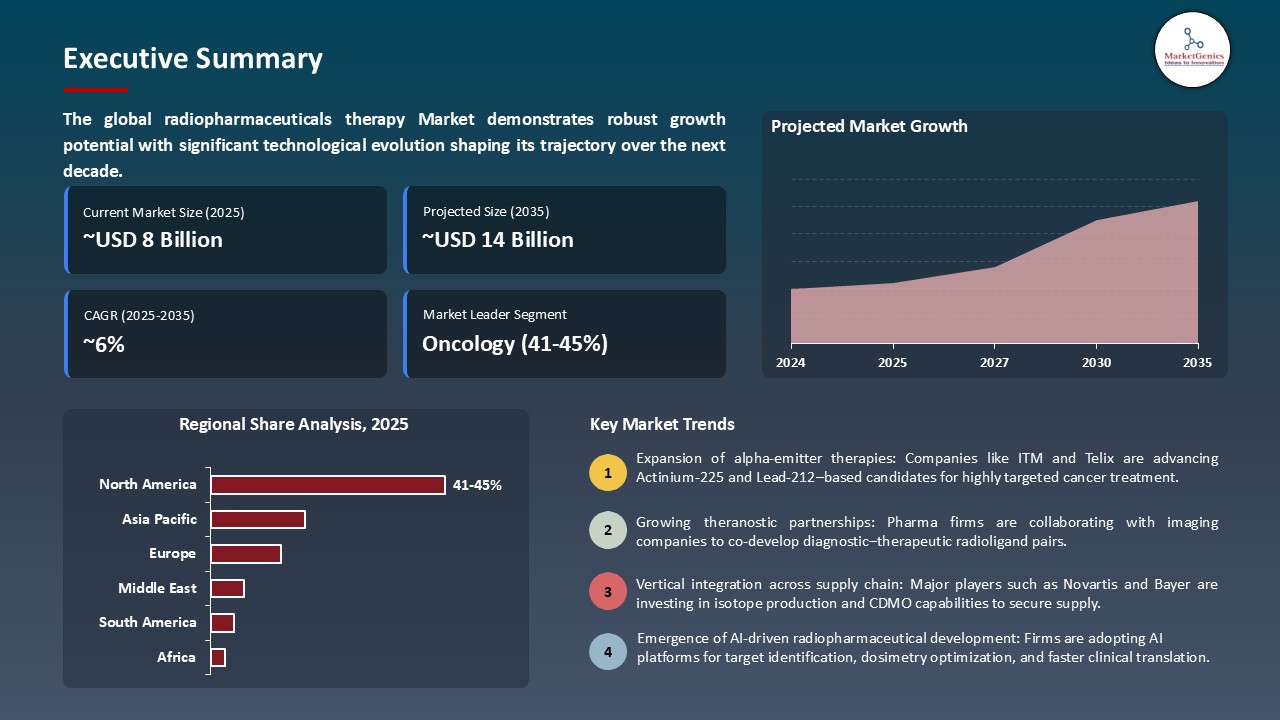

The global radiopharmaceuticals therapy market is experiencing robust growth, with its estimated value of USD 7.6 billion in the year 2025 and USD 13.9 billion by the period 2035, registering a CAGR of 6.2%, during the forecast period. The radiopharmaceuticals therapy market in the world is witnessing a healthy growth owing to the growing need in targeted therapies in oncology and other diseases. The increase in investment and growth in biotech research, good partnerships between pharmaceutical firms and universities, and innovation of drug discovery platforms are also contributing to this growth.

Susan Galbraith, Executive Vice President, Oncology R&D, AstraZeneca, said: Between thirty and fifty per cent of patients with cancer today receive radiotherapy at some point during treatment, and the acquisition of Fusion furthers our ambition to transform this aspect of care with next-generation radioconjugates. Together with Fusion, we have an opportunity to accelerate the development of FPI-2265 as a potential new treatment for prostate cancer, and to harness their innovative actinium-based platform to develop radioconjugates as foundational regimens.

The growing interest in high-throughput screening of isotopes, theranostic design, and radiochemistry has become one of the largest drivers of the global radiopharmaceuticals therapy market. An example is an announcement by Curium Pharma in June 2024 of the use of AI-informed radioligand design to optimize the binding affinity and isotope stability in their neuroendocrine tumor therapies, simplifying the preclinical screening and candidate selection.

The market is also growing due to the development of radionuclides through innovative platforms and targeted delivery presented by new biotech companies. In February of 2025 Magnet Biomedicine entered into a partnership with Eli Lilly to develop new radiolabeled therapeutics using its TrueGlue-inspired technology to enhance precision targeting and reduce times to discovery.

Technological development in PET/CT imaging, conjugation of alpha and beta emitters as well as the use of nanoparticles or liposomes as delivery systems have been made in the improvement of radiopharmaceuticals in terms of treatment potency, tissue specificity and systemic stability. Computerization of modeling and simulations based on AI is helping make optimization of ligand-receptor interactions more rapid, predictive dosimetry, and making therapeutic clinical translation easier, which facilitates more personalized therapy.

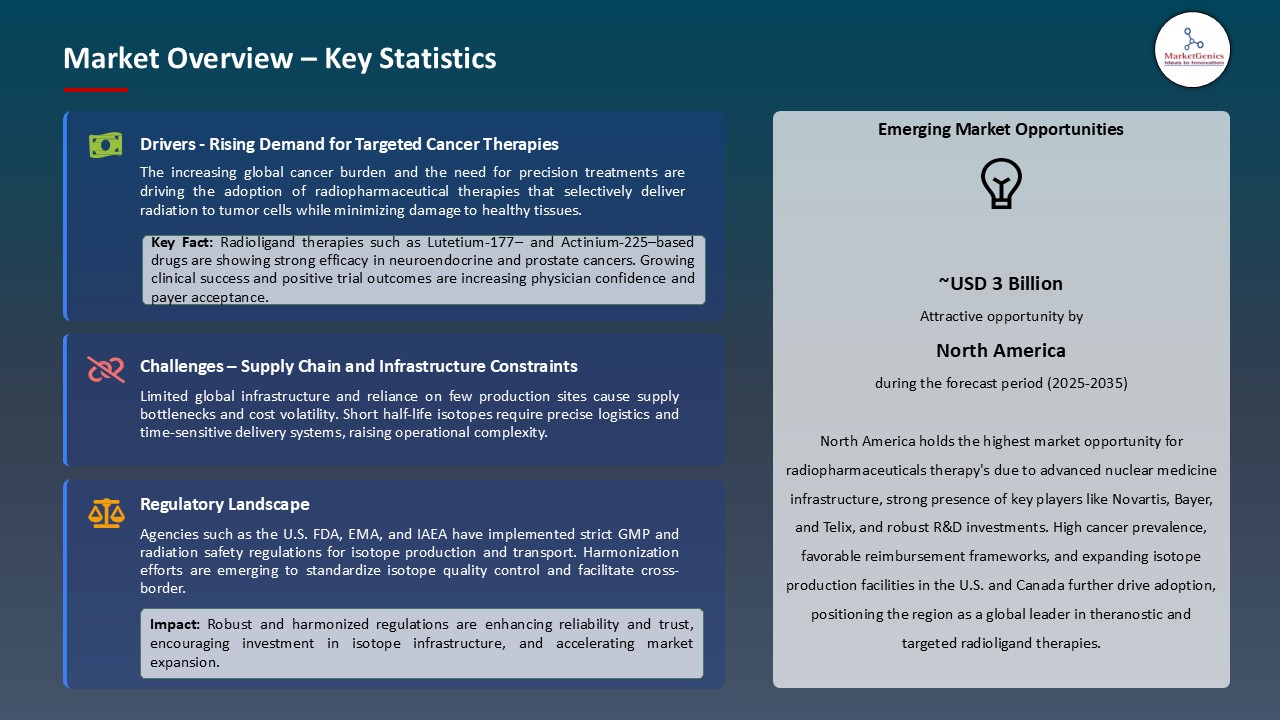

On the regulatory front, radiopharmaceuticals are experiencing fast-tracked approvals and favourable frameworks. In 2025, the FDA of the U.S. approved several treatments of Lu-177 and Ac-225 treatments under priority consideration to prostate and neuroendocrine cancer. The European medicines agency (EMA) also boosted its accelerated assessment program on innovative radiopharmaceuticals, that will permit the patient to access it sooner. IND approvals of new theranostic agents have also been facilitated by National Medical Products Administration (NMPA) of China to permit local clinical trials and facilitate the development of isotope-based oncology therapies.

Radiopharmaceuticals Therapy Market Dynamics and Trends

Driver: Rising Incidence of Cancer and Chronic Disorders

- The accelerated growth of cancer, neuroendocrine neoplasms, cardiovascular and chronic diseases across the globe have turned out to be one of the key drivers of the radiopharmaceuticals therapy market. The conventional chemotherapies and external beam radiations are generally not very selective and are toxic to the host system making it acutely necessary to develop radioligand treatments, which can be used to selectively deliver tumor cell isotopes such as the Lutetium-177 and the Actinium- 225 in a fashion where it is localized on the tumor cell and not on the healthy tissues.

- Radiopharmaceuticals invent a new paradigm of cancer treatment because they combine diagnostic imaging with targeted treatment (theranostics) in order to achieve real-time tumor imaging and response imaging. Novartis (Advanced Accelerator Applications) in March 2025, follow-up manufacturing network for its Pluvicto (Lu-177 vipivotide tetraxetan), after excellent clinical results in patients whose prostate cancer had advanced, and is still researching earlier-line therapy. These developments bring about the shift in the market to precision and disease-modifying radioligand therapies.

- Overall, these developments are accelerating the adoption of radiopharmaceutical therapy in oncology and the treatment of chronic diseases in the pathway.

Restraint: Limited Isotope Supply and High Production Complexity

- The radiopharmaceutical treatments rely on Lutetium-177, Actinium-225 and Yttrium-90 (critical isotopes) with short half-lives and which require extremely specialized isotope production sites such as nuclear reactors and cyclotrons. The dependency is associated with deep challenges in maintaining the constant and reliable supply chain in clinical and commercial use.

- These areotopes, particularly, the Actinium-225, are limited worldwide hence leading to delays in treatment, increase in price and competition of medical trials and commercial programs. GMP requirements and radiation rules are other causes of high production costs and limit the scale-ability of the new biotech and midsize pharmaceutical firms.

- The production of radiopharmaceuticals is a complex and expensive process that requires long development cycles in addition to high quality standards which complicate market penetration and entry barriers.

Opportunity: Expansion into Alpha-Emitter Therapies and New Indications

- On AI-based and computational platforms, radiopharmaceuticals based on alpha-emission (e.g., Ac-225, Pb-212) are developed. Radionuclide binding may be predicted using machine learning models and in silico simulations and targeting ligands may be optimized and tumor selectivity increased with reduced off-target toxicity.

- AI-based predictive tools have the capability of emulating the pharmacokinetics, biodistribution, and radiobiological activities of alpha-emitters before undergoing preclinical studies. This improves quicker choice of the candidates, lessening the expenses related to development and shortening the schedules in reaching clinical development leading to efficiency in R&D.

- The companies are constructing high-throughput alpha-emitter conjugates and testing the stability of the structure with platforms of AI. As an example, in June 2025, Clarity Pharmaceuticals started a Phase II clinical trial to test SAR-Bombesin (Ac-225) to treat breast and prostate cancers, which demonstrates that AI can accelerate its pipeline.

- The uses of AI in generation of alpha-emitters could expand the signs to micrometastatic and resistant malignancies, increase treatment-specificity, use combination treatment methods, and potentially high-value, curative therapeutics, altering the Radiopharmaceutical Therapy market.

Key Trend: Theranostics Integration and Decentralized Delivery Models

- The radiopharmaceuticals therapy market has been shifting towards more frequent theranostic therapies that entail the same molecular target both as a diagnostic imaging agent and a targeted therapy drug. It enables real-time selection of the patients, personalized treatment regimens and continuous observation of treatment reaction, which could lead to improved clinical outcomes and increased performance.

- Healthcare providers are transitioning to decentralized forms of healthcare delivery and establish regional radiopharmacies and PET/CT-therapy centers within the community. It will reduce travel of patients, lessen treatment schedules and increase accessibility beyond big academic hospitals. As an example, in 2025, GE HealthCare partnered with Cardinal Health to expand theranostic services in over 150 community hospitals in North America, and expand local access to both diagnostic tracers and therapeutic radiopharmaceuticals.

- Also, safe, efficient, and scalable outpatient and semi-urban healthcare delivery of radiopharmaceuticals is also being facilitated by integration of digital logistics, supply chain management and automated dose preparation. The trend democratizes the delivery of precision oncology, promotes the intervention at earlier stages, supports workflow efficiency, and strengthens the market adoption in new markets.

Radiopharmaceuticals Therapy Market Analysis and Segmental Data

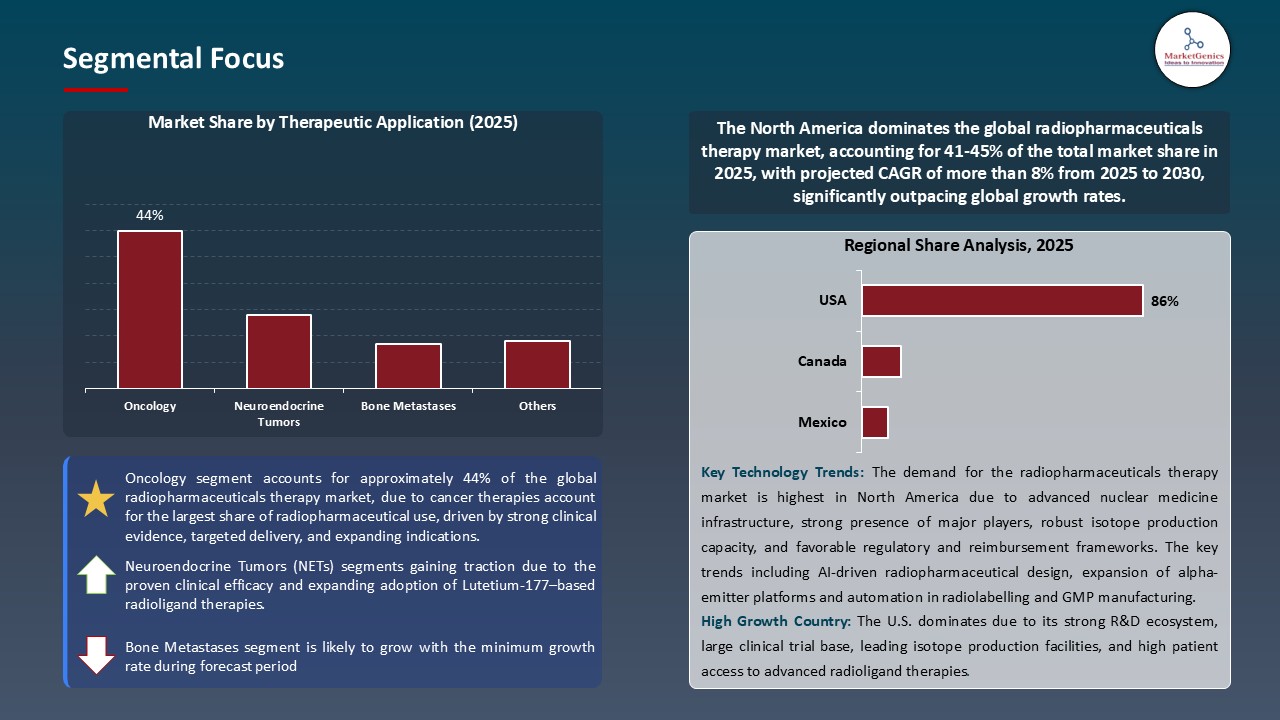

Oncology Dominate Global Radiopharmaceuticals Therapy Market

- In the global market, oncology segment is leading the radiopharmaceutical therapy market due to high rates of cancers such as prostate, neuroendocrine and hematologic malignancies. Targeted radionuclide therapies are clinically useful, provide high degree of specificity to the tumor cells with low degree of systemic toxicity and of much interest to hospitals, biotech and pharmaceutical companies. Actinium-225, Yttrium-90, and Lutetium-177 are the leaders of these precision oncology treatment tests.

- New technology, including AI-assisted radioligand design, high throughput isotope screens, high resolution PET/CT and SPECT imaging and better dosimetry simulations, now allows the development and optimization of radiopharmaceuticals. With better chemistry of chelators, fabrication technology and advances of nanoparticle- and liposome-based delivery systems that enhance tumor selectivity, pharmacokinetics and safety, better treatments regimens can be provided and personalized to the patient.

- Innovation in regulation makes the oncology market more and more central. As an example, Telix Pharmaceuticals cleared Gozellix, a prostate cancer screening agent that allows PET scanning of PSMA-positive lesions in March 2025. This approval has a greater shelf life than the current gallium-based imaging product, and provides a greater clinical utility, greater access to patients, which further promotes the rate of adoption and solidifies the role of radiopharmaceuticals as a vital component of diagnostic and patient care in cancer therapy.

North America Leads Global Radiopharmaceuticals Therapy Market Demand

- North America continues to lead the radiopharmaceuticals therapy market worldwide as a result of early adoptions of advanced technologies encompassing AI-assisted radioligand design, high-throughput isotope screening, precision PET/CT and SPECT imaging, high-throughput isotope screening and advanced dosimetry simulations.

- In June 2025, the U.S. Department of Energy claimed a clinical trial of accelerator-produced Actinium-225 (Ac-225) to treat a cancer patient as the initial clinical use of accelerator-produced Ac-225 and an end to the drastic limitations in supply of isotopes. This highlights the concern on the part of the region in the discovery of radiopharmaceuticals and the availability of innovative therapies to more patients.

- The region is able to proudly publicize a well-established clinical trial system, successful collaborating amid bio-technology corporations, pharmaceutical corporations and crucial academic bodies, and enormous input on accuracy oncology. They provide faster preclinical and clinical testing of radiopharmaceuticals, easier regulatory approvals, and effective administration of treatment to strengthen the North American market dominance.

- All these together with a well-developed manufacturing, distribution systems and reimbursement policies all this makes North America have the highest market share and one of the most appealing areas where radiopharmaceutical development and investment stands a chance to be realised.

Radiopharmaceuticals Therapy Market Ecosystem

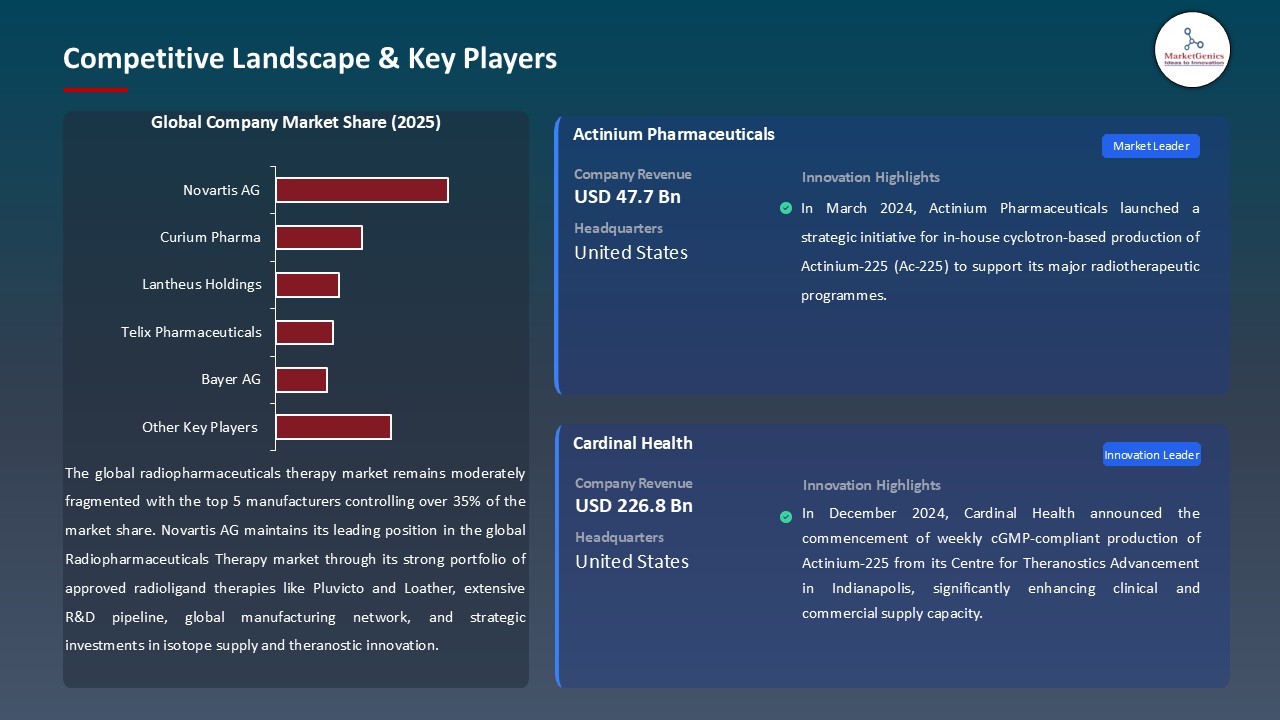

The worldwide radiopharmaceuticals therapy market is defined by an innovative and dynamical ecosystem with the largest pharmaceutical and biotech companies like Novartis, Bayer AG, Eli Lilly, Molecular Partners AG, ITM Isotope Technologies Munich SE and Orano Med spearheading the development of targeted radiopharmaceutical therapies. They are specialized in the field of therapeutic radiopharmaceuticals in oncology, alpha-emitter therapies in rare cancers and therapies in precision medicine.

Government grants, research institutions, and private investors contribute greatly to research and development in this market and finance the production of isotopes, optimization of radioconuglates, and targeted delivery platforms. Such programs modify their clinical development and help in the development of patient-specific treatment regimens. For instance, in September 2024, RadioMedix and Orano Med partnered with Sanofi to develop AlphaMedix (²¹²Pb-DOTAMTATE), an alpha-targeted neuroendocrine tumor therapy, in an exclusive licensing deal, which indicates cooperation between pharma and specialized radiopharmaceutical developers.

Other complementary technologies are being brought in by new startups and academic laboratories to increase the efficacy, selectivity, and scalability of radiopharmaceuticals. The integration of AI-based drug discovery tools, predictive pharmacokinetic modeling, and structural analytics are becoming more and more beneficial to streamline the optimization of leads and enhance clinical performance.

Comprehensively, the sustainable growth, high adoption and accelerated clinical translation of radiopharmaceuticals therapy market around the world is being informed by a dynamic ecosystem of strategic collaborations, technology, and long-term investment.

Recent Development and Strategic Overview:

- In January 2025, Molecular Partners AG and Orano Med expanded their strategic collaboration to develop up to ten targeted-alpha radiopharmaceutical therapies leveraging the isotope lead-212 (²¹²Pb). The partnership aims to accelerate the development of innovative cancer treatments under Molecular Partners’ Radio-DARPin platform, combining precision targeting with potent alpha-emitting isotopes to address unmet needs in oncology.

- In October 2025, ITM Isotope Technologies Munich SE reported positive Phase 3 clinical trial results for its radiopharmaceutical ¹⁷⁷Lu-edotreotide (ITM-11). The therapy demonstrated a significantly higher objective response rate compared to Everolimus in patients with gastroenteropancreatic neuroendocrine tumors (GEP-NETs), highlighting its potential as a more effective targeted treatment option and reinforcing ITM’s position in the radiopharmaceutical oncology market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 7.6 Bn |

|

Market Forecast Value in 2035 |

USD 13.9 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

Siemens Healthineers

|

Radiopharmaceuticals Therapy Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Radiopharmaceuticals Therapy Market, By Radioisotope Type |

|

|

Radiopharmaceuticals Therapy Market, By Therapeutic Application |

|

|

Radiopharmaceuticals Therapy Market, By Product Type |

|

|

Radiopharmaceuticals Therapy Market, By Molecule Type |

|

|

Radiopharmaceuticals Therapy Market, By Source of Radioisotope |

|

|

Radiopharmaceuticals Therapy Market, By Route of Administration |

|

|

Radiopharmaceuticals Therapy Market, By Distribution Channel |

|

|

Radiopharmaceuticals Therapy Market, By Production Method |

|

|

Radiopharmaceuticals Therapy Market, By Technology Platform |

|

|

Radiopharmaceuticals Therapy Market, By Half-Life Duration |

|

|

Radiopharmaceuticals Therapy Market, By End-Users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Radiopharmaceuticals Therapy Market Outlook

- 2.1.1. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Radiopharmaceuticals Therapy Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of cancer and cardiovascular diseases driving demand for targeted radionuclide therapies.

- 4.1.1.2. Advancements in radioisotope production and theranostic technologies enabling precise, personalized treatment approaches.

- 4.1.1.3. Growing investments and strategic collaborations among pharma companies and CDMOs to expand isotope supply and GMP manufacturing capacity.

- 4.1.2. Restraints

- 4.1.2.1. Limited availability of medical radioisotopes (e.g., Lu-177, Ac-225) and complex production logistics.

- 4.1.2.2. High production and infrastructure costs associated with regulatory compliance, radiation safety, and specialized facilities.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Radiopharmaceuticals Therapy Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Radiopharmaceuticals Therapy Market Analysis, by Radioisotope Type

- 6.1. Key Segment Analysis

- 6.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Radioisotope Type, 2021-2035

- 6.2.1. Alpha Emitters

- 6.2.1.1. Radium-223

- 6.2.1.2. Actinium-225

- 6.2.1.3. Lead-212

- 6.2.1.4. Bismuth-213

- 6.2.1.5. Astatine-211

- 6.2.2. Beta Emitters

- 6.2.2.1. Lutetium-177

- 6.2.2.2. Iodine-131

- 6.2.2.3. Yttrium-90

- 6.2.2.4. Samarium-153

- 6.2.2.5. Strontium-89

- 6.2.2.6. Rhenium-186

- 6.2.2.7. Rhenium-188

- 6.2.3. Auger Emitters

- 6.2.3.1. Iodine-125

- 6.2.3.2. Indium-111

- 6.2.1. Alpha Emitters

- 7. Global Radiopharmaceuticals Therapy Market Analysis, by Therapeutic Application

- 7.1. Key Segment Analysis

- 7.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Therapeutic Application, 2021-2035

- 7.2.1. Oncology

- 7.2.1.1. Prostate Cancer

- 7.2.1.2. Neuroendocrine Tumors (NETs)

- 7.2.1.3. Thyroid Cancer

- 7.2.1.4. Liver Cancer

- 7.2.1.5. Bone Metastases

- 7.2.1.6. Lymphoma

- 7.2.1.7. Brain Tumors

- 7.2.1.8. Others

- 7.2.2. Non-Oncology

- 7.2.2.1. Bone Pain Palliation

- 7.2.2.2. Rheumatoid Arthritis

- 7.2.2.3. Polycythemia Vera

- 7.2.2.4. Others

- 7.2.1. Oncology

- 8. Global Radiopharmaceuticals Therapy Market Analysis, by Product Type

- 8.1. Key Segment Analysis

- 8.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 8.2.1. Targeted Radiopharmaceuticals

- 8.2.1.1. Peptide Receptor Radionuclide Therapy (PRRT)

- 8.2.1.2. Radioligand Therapy

- 8.2.1.3. Radioimmunotherapy

- 8.2.1.4. Others

- 8.2.2. Non-Targeted Radiopharmaceuticals

- 8.2.2.1. Selective Internal Radiation Therapy (SIRT)

- 8.2.2.2. Systemic Radiotherapy

- 8.2.2.3. Others

- 8.2.1. Targeted Radiopharmaceuticals

- 9. Global Radiopharmaceuticals Therapy Market Analysis, by Molecule Type

- 9.1. Key Segment Analysis

- 9.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Molecule Type, 2021-2035

- 9.2.1. Small Molecules

- 9.2.1.1. Radioiodine

- 9.2.1.2. Radium Chloride

- 9.2.2. Biologics

- 9.2.2.1. Monoclonal Antibodies

- 9.2.2.2. Peptides

- 9.2.2.3. Aptamers

- 9.2.1. Small Molecules

- 10. Global Radiopharmaceuticals Therapy Market Analysis, by Source of Radioisotope

- 10.1. Key Segment Analysis

- 10.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source of Radioisotope, 2021-2035

- 10.2.1. Nuclear Reactors

- 10.2.2. Cyclotrons

- 10.2.3. Generators

- 10.2.4. Accelerators

- 11. Global Radiopharmaceuticals Therapy Market Analysis, by Route of Administration

- 11.1. Key Segment Analysis

- 11.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Route of Administration, 2021-2035

- 11.2.1. Intravenous

- 11.2.2. Oral

- 11.2.3. Intra-arterial

- 11.2.4. Intracavitary

- 11.2.5. Intraperitoneal

- 12. Global Radiopharmaceuticals Therapy Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Hospital Pharmacies

- 12.2.2. Specialty Pharmacies

- 12.2.3. Retail Pharmacies

- 12.2.4. Online Pharmacies

- 13. Global Radiopharmaceuticals Therapy Market Analysis, by Production Method

- 13.1. Key Segment Analysis

- 13.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Production Method, 2021-2035

- 13.2.1. Carrier-Added

- 13.2.2. No-Carrier-Added

- 13.2.3. Carrier-Free

- 14. Global Radiopharmaceuticals Therapy Market Analysis, by Technology Platform

- 14.1. Key Segment Analysis

- 14.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology Platform, 2021-2035

- 14.2.1. Theranostics (Combination Diagnostic & Therapeutic)

- 14.2.2. Standalone Therapeutics

- 14.2.3. Companion Diagnostics-Guided Therapy

- 15. Global Radiopharmaceuticals Therapy Market Analysis, by Half-Life Duration

- 15.1. Key Segment Analysis

- 15.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Half-Life Duration, 2021-2035

- 15.2.1. Short Half-Life (< 24 hours)

- 15.2.2. Medium Half-Life (1-10 days)

- 15.2.3. Long Half-Life (> 10 days)

- 16. Global Radiopharmaceuticals Therapy Market Analysis, by End-Users

- 16.1. Key Segment Analysis

- 16.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 16.2.1. Hospitals

- 16.2.2. Specialty Cancer Centers

- 16.2.3. Ambulatory Surgical Centers

- 16.2.4. Research & Academic Institutions

- 16.2.5. Nuclear Medicine Centers

- 16.2.6. Others

- 17. Global Radiopharmaceuticals Therapy Market Analysis and Forecasts, by Region

- 17.1. Key Findings

- 17.2. Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 17.2.1. North America

- 17.2.2. Europe

- 17.2.3. Asia Pacific

- 17.2.4. Middle East

- 17.2.5. Africa

- 17.2.6. South America

- 18. North America Radiopharmaceuticals Therapy Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. North America Radiopharmaceuticals Therapy Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Radioisotope Type

- 18.3.2. Therapeutic Application

- 18.3.3. Product Type

- 18.3.4. Molecule Type

- 18.3.5. Source of Radioisotope

- 18.3.6. Route of Administration

- 18.3.7. Distribution Channel

- 18.3.8. Production Method

- 18.3.9. Technology Platform

- 18.3.10. Half-Life Duration

- 18.3.11. End-Users

- 18.3.12. Country

- 18.3.12.1. USA

- 18.3.12.2. Canada

- 18.3.12.3. Mexico

- 18.4. USA Radiopharmaceuticals Therapy Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Radioisotope Type

- 18.4.3. Therapeutic Application

- 18.4.4. Product Type

- 18.4.5. Molecule Type

- 18.4.6. Source of Radioisotope

- 18.4.7. Route of Administration

- 18.4.8. Distribution Channel

- 18.4.9. Production Method

- 18.4.10. Technology Platform

- 18.4.11. Half-Life Duration

- 18.4.12. End-Users

- 18.5. Canada Radiopharmaceuticals Therapy Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Radioisotope Type

- 18.5.3. Therapeutic Application

- 18.5.4. Product Type

- 18.5.5. Molecule Type

- 18.5.6. Source of Radioisotope

- 18.5.7. Route of Administration

- 18.5.8. Distribution Channel

- 18.5.9. Production Method

- 18.5.10. Technology Platform

- 18.5.11. Half-Life Duration

- 18.5.12. End-Users

- 18.6. Mexico Radiopharmaceuticals Therapy Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Radioisotope Type

- 18.6.3. Therapeutic Application

- 18.6.4. Product Type

- 18.6.5. Molecule Type

- 18.6.6. Source of Radioisotope

- 18.6.7. Route of Administration

- 18.6.8. Distribution Channel

- 18.6.9. Production Method

- 18.6.10. Technology Platform

- 18.6.11. Half-Life Duration

- 18.6.12. End-Users

- 19. Europe Radiopharmaceuticals Therapy Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Europe Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Radioisotope Type

- 19.3.2. Therapeutic Application

- 19.3.3. Product Type

- 19.3.4. Molecule Type

- 19.3.5. Source of Radioisotope

- 19.3.6. Route of Administration

- 19.3.7. Distribution Channel

- 19.3.8. Production Method

- 19.3.9. Technology Platform

- 19.3.10. Half-Life Duration

- 19.3.11. End-Users

- 19.3.12. Country

- 19.3.12.1. Germany

- 19.3.12.2. United Kingdom

- 19.3.12.3. France

- 19.3.12.4. Italy

- 19.3.12.5. Spain

- 19.3.12.6. Netherlands

- 19.3.12.7. Nordic Countries

- 19.3.12.8. Poland

- 19.3.12.9. Russia & CIS

- 19.3.12.10. Rest of Europe

- 19.4. Germany Radiopharmaceuticals Therapy Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Radioisotope Type

- 19.4.3. Therapeutic Application

- 19.4.4. Product Type

- 19.4.5. Molecule Type

- 19.4.6. Source of Radioisotope

- 19.4.7. Route of Administration

- 19.4.8. Distribution Channel

- 19.4.9. Production Method

- 19.4.10. Technology Platform

- 19.4.11. Half-Life Duration

- 19.4.12. End-Users

- 19.5. United Kingdom Radiopharmaceuticals Therapy Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Radioisotope Type

- 19.5.3. Therapeutic Application

- 19.5.4. Product Type

- 19.5.5. Molecule Type

- 19.5.6. Source of Radioisotope

- 19.5.7. Route of Administration

- 19.5.8. Distribution Channel

- 19.5.9. Production Method

- 19.5.10. Technology Platform

- 19.5.11. Half-Life Duration

- 19.5.12. End-Users

- 19.6. France Radiopharmaceuticals Therapy Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Radioisotope Type

- 19.6.3. Therapeutic Application

- 19.6.4. Product Type

- 19.6.5. Molecule Type

- 19.6.6. Source of Radioisotope

- 19.6.7. Route of Administration

- 19.6.8. Distribution Channel

- 19.6.9. Production Method

- 19.6.10. Technology Platform

- 19.6.11. Half-Life Duration

- 19.6.12. End-Users

- 19.7. Italy Radiopharmaceuticals Therapy Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Radioisotope Type

- 19.7.3. Therapeutic Application

- 19.7.4. Product Type

- 19.7.5. Molecule Type

- 19.7.6. Source of Radioisotope

- 19.7.7. Route of Administration

- 19.7.8. Distribution Channel

- 19.7.9. Production Method

- 19.7.10. Technology Platform

- 19.7.11. Half-Life Duration

- 19.7.12. End-Users

- 19.8. Spain Radiopharmaceuticals Therapy Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Radioisotope Type

- 19.8.3. Therapeutic Application

- 19.8.4. Product Type

- 19.8.5. Molecule Type

- 19.8.6. Source of Radioisotope

- 19.8.7. Route of Administration

- 19.8.8. Distribution Channel

- 19.8.9. Production Method

- 19.8.10. Technology Platform

- 19.8.11. Half-Life Duration

- 19.8.12. End-Users

- 19.9. Netherlands Radiopharmaceuticals Therapy Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Radioisotope Type

- 19.9.3. Therapeutic Application

- 19.9.4. Product Type

- 19.9.5. Molecule Type

- 19.9.6. Source of Radioisotope

- 19.9.7. Route of Administration

- 19.9.8. Distribution Channel

- 19.9.9. Production Method

- 19.9.10. Technology Platform

- 19.9.11. Half-Life Duration

- 19.9.12. End-Users

- 19.10. Nordic Countries Radiopharmaceuticals Therapy Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Radioisotope Type

- 19.10.3. Therapeutic Application

- 19.10.4. Product Type

- 19.10.5. Molecule Type

- 19.10.6. Source of Radioisotope

- 19.10.7. Route of Administration

- 19.10.8. Distribution Channel

- 19.10.9. Production Method

- 19.10.10. Technology Platform

- 19.10.11. Half-Life Duration

- 19.10.12. End-Users

- 19.11. Poland Radiopharmaceuticals Therapy Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Radioisotope Type

- 19.11.3. Therapeutic Application

- 19.11.4. Product Type

- 19.11.5. Molecule Type

- 19.11.6. Source of Radioisotope

- 19.11.7. Route of Administration

- 19.11.8. Distribution Channel

- 19.11.9. Production Method

- 19.11.10. Technology Platform

- 19.11.11. Half-Life Duration

- 19.11.12. End-Users

- 19.12. Russia & CIS Radiopharmaceuticals Therapy Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Radioisotope Type

- 19.12.3. Therapeutic Application

- 19.12.4. Product Type

- 19.12.5. Molecule Type

- 19.12.6. Source of Radioisotope

- 19.12.7. Route of Administration

- 19.12.8. Distribution Channel

- 19.12.9. Production Method

- 19.12.10. Technology Platform

- 19.12.11. Half-Life Duration

- 19.12.12. End-Users

- 19.13. Rest of Europe Radiopharmaceuticals Therapy Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Radioisotope Type

- 19.13.3. Therapeutic Application

- 19.13.4. Product Type

- 19.13.5. Molecule Type

- 19.13.6. Source of Radioisotope

- 19.13.7. Route of Administration

- 19.13.8. Distribution Channel

- 19.13.9. Production Method

- 19.13.10. Technology Platform

- 19.13.11. Half-Life Duration

- 19.13.12. End-Users

- 20. Asia Pacific Radiopharmaceuticals Therapy Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. East Asia Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Radioisotope Type

- 20.3.2. Therapeutic Application

- 20.3.3. Product Type

- 20.3.4. Molecule Type

- 20.3.5. Source of Radioisotope

- 20.3.6. Route of Administration

- 20.3.7. Distribution Channel

- 20.3.8. Production Method

- 20.3.9. Technology Platform

- 20.3.10. Half-Life Duration

- 20.3.11. End-Users

- 20.3.12. Country

- 20.3.12.1. China

- 20.3.12.2. India

- 20.3.12.3. Japan

- 20.3.12.4. South Korea

- 20.3.12.5. Australia and New Zealand

- 20.3.12.6. Indonesia

- 20.3.12.7. Malaysia

- 20.3.12.8. Thailand

- 20.3.12.9. Vietnam

- 20.3.12.10. Rest of Asia Pacific

- 20.4. China Radiopharmaceuticals Therapy Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Radioisotope Type

- 20.4.3. Therapeutic Application

- 20.4.4. Product Type

- 20.4.5. Molecule Type

- 20.4.6. Source of Radioisotope

- 20.4.7. Route of Administration

- 20.4.8. Distribution Channel

- 20.4.9. Production Method

- 20.4.10. Technology Platform

- 20.4.11. Half-Life Duration

- 20.4.12. End-Users

- 20.5. India Radiopharmaceuticals Therapy Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Radioisotope Type

- 20.5.3. Therapeutic Application

- 20.5.4. Product Type

- 20.5.5. Molecule Type

- 20.5.6. Source of Radioisotope

- 20.5.7. Route of Administration

- 20.5.8. Distribution Channel

- 20.5.9. Production Method

- 20.5.10. Technology Platform

- 20.5.11. Half-Life Duration

- 20.5.12. End-Users

- 20.6. Japan Radiopharmaceuticals Therapy Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Radioisotope Type

- 20.6.3. Therapeutic Application

- 20.6.4. Product Type

- 20.6.5. Molecule Type

- 20.6.6. Source of Radioisotope

- 20.6.7. Route of Administration

- 20.6.8. Distribution Channel

- 20.6.9. Production Method

- 20.6.10. Technology Platform

- 20.6.11. Half-Life Duration

- 20.6.12. End-Users

- 20.7. South Korea Radiopharmaceuticals Therapy Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Radioisotope Type

- 20.7.3. Therapeutic Application

- 20.7.4. Product Type

- 20.7.5. Molecule Type

- 20.7.6. Source of Radioisotope

- 20.7.7. Route of Administration

- 20.7.8. Distribution Channel

- 20.7.9. Production Method

- 20.7.10. Technology Platform

- 20.7.11. Half-Life Duration

- 20.7.12. End-Users

- 20.8. Australia and New Zealand Radiopharmaceuticals Therapy Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Radioisotope Type

- 20.8.3. Therapeutic Application

- 20.8.4. Product Type

- 20.8.5. Molecule Type

- 20.8.6. Source of Radioisotope

- 20.8.7. Route of Administration

- 20.8.8. Distribution Channel

- 20.8.9. Production Method

- 20.8.10. Technology Platform

- 20.8.11. Half-Life Duration

- 20.8.12. End-Users

- 20.9. Indonesia Radiopharmaceuticals Therapy Market

- 20.9.1. Country Segmental Analysis

- 20.9.2. Radioisotope Type

- 20.9.3. Therapeutic Application

- 20.9.4. Product Type

- 20.9.5. Molecule Type

- 20.9.6. Source of Radioisotope

- 20.9.7. Route of Administration

- 20.9.8. Distribution Channel

- 20.9.9. Production Method

- 20.9.10. Technology Platform

- 20.9.11. Half-Life Duration

- 20.9.12. End-Users

- 20.10. Malaysia Radiopharmaceuticals Therapy Market

- 20.10.1. Country Segmental Analysis

- 20.10.2. Radioisotope Type

- 20.10.3. Therapeutic Application

- 20.10.4. Product Type

- 20.10.5. Molecule Type

- 20.10.6. Source of Radioisotope

- 20.10.7. Route of Administration

- 20.10.8. Distribution Channel

- 20.10.9. Production Method

- 20.10.10. Technology Platform

- 20.10.11. Half-Life Duration

- 20.10.12. End-Users

- 20.11. Thailand Radiopharmaceuticals Therapy Market

- 20.11.1. Country Segmental Analysis

- 20.11.2. Radioisotope Type

- 20.11.3. Therapeutic Application

- 20.11.4. Product Type

- 20.11.5. Molecule Type

- 20.11.6. Source of Radioisotope

- 20.11.7. Route of Administration

- 20.11.8. Distribution Channel

- 20.11.9. Production Method

- 20.11.10. Technology Platform

- 20.11.11. Half-Life Duration

- 20.11.12. End-Users

- 20.12. Vietnam Radiopharmaceuticals Therapy Market

- 20.12.1. Country Segmental Analysis

- 20.12.2. Radioisotope Type

- 20.12.3. Therapeutic Application

- 20.12.4. Product Type

- 20.12.5. Molecule Type

- 20.12.6. Source of Radioisotope

- 20.12.7. Route of Administration

- 20.12.8. Distribution Channel

- 20.12.9. Production Method

- 20.12.10. Technology Platform

- 20.12.11. Half-Life Duration

- 20.12.12. End-Users

- 20.13. Rest of Asia Pacific Radiopharmaceuticals Therapy Market

- 20.13.1. Country Segmental Analysis

- 20.13.2. Radioisotope Type

- 20.13.3. Therapeutic Application

- 20.13.4. Product Type

- 20.13.5. Molecule Type

- 20.13.6. Source of Radioisotope

- 20.13.7. Route of Administration

- 20.13.8. Distribution Channel

- 20.13.9. Production Method

- 20.13.10. Technology Platform

- 20.13.11. Half-Life Duration

- 20.13.12. End-Users

- 21. Middle East Radiopharmaceuticals Therapy Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Middle East Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Radioisotope Type

- 21.3.2. Therapeutic Application

- 21.3.3. Product Type

- 21.3.4. Molecule Type

- 21.3.5. Source of Radioisotope

- 21.3.6. Route of Administration

- 21.3.7. Distribution Channel

- 21.3.8. Production Method

- 21.3.9. Technology Platform

- 21.3.10. Half-Life Duration

- 21.3.11. End-Users

- 21.3.12. Country

- 21.3.12.1. Turkey

- 21.3.12.2. UAE

- 21.3.12.3. Saudi Arabia

- 21.3.12.4. Israel

- 21.3.12.5. Rest of Middle East

- 21.4. Turkey Radiopharmaceuticals Therapy Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Radioisotope Type

- 21.4.3. Therapeutic Application

- 21.4.4. Product Type

- 21.4.5. Molecule Type

- 21.4.6. Source of Radioisotope

- 21.4.7. Route of Administration

- 21.4.8. Distribution Channel

- 21.4.9. Production Method

- 21.4.10. Technology Platform

- 21.4.11. Half-Life Duration

- 21.4.12. End-Users

- 21.5. UAE Radiopharmaceuticals Therapy Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Radioisotope Type

- 21.5.3. Therapeutic Application

- 21.5.4. Product Type

- 21.5.5. Molecule Type

- 21.5.6. Source of Radioisotope

- 21.5.7. Route of Administration

- 21.5.8. Distribution Channel

- 21.5.9. Production Method

- 21.5.10. Technology Platform

- 21.5.11. Half-Life Duration

- 21.5.12. End-Users

- 21.6. Saudi Arabia Radiopharmaceuticals Therapy Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Radioisotope Type

- 21.6.3. Therapeutic Application

- 21.6.4. Product Type

- 21.6.5. Molecule Type

- 21.6.6. Source of Radioisotope

- 21.6.7. Route of Administration

- 21.6.8. Distribution Channel

- 21.6.9. Production Method

- 21.6.10. Technology Platform

- 21.6.11. Half-Life Duration

- 21.6.12. End-Users

- 21.7. Israel Radiopharmaceuticals Therapy Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Radioisotope Type

- 21.7.3. Therapeutic Application

- 21.7.4. Product Type

- 21.7.5. Molecule Type

- 21.7.6. Source of Radioisotope

- 21.7.7. Route of Administration

- 21.7.8. Distribution Channel

- 21.7.9. Production Method

- 21.7.10. Technology Platform

- 21.7.11. Half-Life Duration

- 21.7.12. End-Users

- 21.8. Rest of Middle East Radiopharmaceuticals Therapy Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Radioisotope Type

- 21.8.3. Therapeutic Application

- 21.8.4. Product Type

- 21.8.5. Molecule Type

- 21.8.6. Source of Radioisotope

- 21.8.7. Route of Administration

- 21.8.8. Distribution Channel

- 21.8.9. Production Method

- 21.8.10. Technology Platform

- 21.8.11. Half-Life Duration

- 21.8.12. End-Users

- 22. Africa Radiopharmaceuticals Therapy Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. Africa Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Radioisotope Type

- 22.3.2. Therapeutic Application

- 22.3.3. Product Type

- 22.3.4. Molecule Type

- 22.3.5. Source of Radioisotope

- 22.3.6. Route of Administration

- 22.3.7. Distribution Channel

- 22.3.8. Production Method

- 22.3.9. Technology Platform

- 22.3.10. Half-Life Duration

- 22.3.11. End-Users

- 22.3.12. Country

- 22.3.12.1. South Africa

- 22.3.12.2. Egypt

- 22.3.12.3. Nigeria

- 22.3.12.4. Algeria

- 22.3.12.5. Rest of Africa

- 22.4. South Africa Radiopharmaceuticals Therapy Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Radioisotope Type

- 22.4.3. Therapeutic Application

- 22.4.4. Product Type

- 22.4.5. Molecule Type

- 22.4.6. Source of Radioisotope

- 22.4.7. Route of Administration

- 22.4.8. Distribution Channel

- 22.4.9. Production Method

- 22.4.10. Technology Platform

- 22.4.11. Half-Life Duration

- 22.4.12. End-Users

- 22.5. Egypt Radiopharmaceuticals Therapy Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Radioisotope Type

- 22.5.3. Therapeutic Application

- 22.5.4. Product Type

- 22.5.5. Molecule Type

- 22.5.6. Source of Radioisotope

- 22.5.7. Route of Administration

- 22.5.8. Distribution Channel

- 22.5.9. Production Method

- 22.5.10. Technology Platform

- 22.5.11. Half-Life Duration

- 22.5.12. End-Users

- 22.6. Nigeria Radiopharmaceuticals Therapy Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Radioisotope Type

- 22.6.3. Therapeutic Application

- 22.6.4. Product Type

- 22.6.5. Molecule Type

- 22.6.6. Source of Radioisotope

- 22.6.7. Route of Administration

- 22.6.8. Distribution Channel

- 22.6.9. Production Method

- 22.6.10. Technology Platform

- 22.6.11. Half-Life Duration

- 22.6.12. End-Users

- 22.7. Algeria Radiopharmaceuticals Therapy Market

- 22.7.1. Country Segmental Analysis

- 22.7.2. Radioisotope Type

- 22.7.3. Therapeutic Application

- 22.7.4. Product Type

- 22.7.5. Molecule Type

- 22.7.6. Source of Radioisotope

- 22.7.7. Route of Administration

- 22.7.8. Distribution Channel

- 22.7.9. Production Method

- 22.7.10. Technology Platform

- 22.7.11. Half-Life Duration

- 22.7.12. End-Users

- 22.8. Rest of Africa Radiopharmaceuticals Therapy Market

- 22.8.1. Country Segmental Analysis

- 22.8.2. Radioisotope Type

- 22.8.3. Therapeutic Application

- 22.8.4. Product Type

- 22.8.5. Molecule Type

- 22.8.6. Source of Radioisotope

- 22.8.7. Route of Administration

- 22.8.8. Distribution Channel

- 22.8.9. Production Method

- 22.8.10. Technology Platform

- 22.8.11. Half-Life Duration

- 22.8.12. End-Users

- 23. South America Radiopharmaceuticals Therapy Market Analysis

- 23.1. Key Segment Analysis

- 23.2. Regional Snapshot

- 23.3. Central and South Africa Radiopharmaceuticals Therapy Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 23.3.1. Radioisotope Type

- 23.3.2. Therapeutic Application

- 23.3.3. Product Type

- 23.3.4. Molecule Type

- 23.3.5. Source of Radioisotope

- 23.3.6. Route of Administration

- 23.3.7. Distribution Channel

- 23.3.8. Production Method

- 23.3.9. Technology Platform

- 23.3.10. Half-Life Duration

- 23.3.11. End-Users

- 23.3.12. Country

- 23.3.12.1. Brazil

- 23.3.12.2. Argentina

- 23.3.12.3. Rest of South America

- 23.4. Brazil Radiopharmaceuticals Therapy Market

- 23.4.1. Country Segmental Analysis

- 23.4.2. Radioisotope Type

- 23.4.3. Therapeutic Application

- 23.4.4. Product Type

- 23.4.5. Molecule Type

- 23.4.6. Source of Radioisotope

- 23.4.7. Route of Administration

- 23.4.8. Distribution Channel

- 23.4.9. Production Method

- 23.4.10. Technology Platform

- 23.4.11. Half-Life Duration

- 23.4.12. End-Users

- 23.5. Argentina Radiopharmaceuticals Therapy Market

- 23.5.1. Country Segmental Analysis

- 23.5.2. Radioisotope Type

- 23.5.3. Therapeutic Application

- 23.5.4. Product Type

- 23.5.5. Molecule Type

- 23.5.6. Source of Radioisotope

- 23.5.7. Route of Administration

- 23.5.8. Distribution Channel

- 23.5.9. Production Method

- 23.5.10. Technology Platform

- 23.5.11. Half-Life Duration

- 23.5.12. End-Users

- 23.6. Rest of South America Radiopharmaceuticals Therapy Market

- 23.6.1. Country Segmental Analysis

- 23.6.2. Radioisotope Type

- 23.6.3. Therapeutic Application

- 23.6.4. Product Type

- 23.6.5. Molecule Type

- 23.6.6. Source of Radioisotope

- 23.6.7. Route of Administration

- 23.6.8. Distribution Channel

- 23.6.9. Production Method

- 23.6.10. Technology Platform

- 23.6.11. Half-Life Duration

- 23.6.12. End-Users

- 24. Key Players/ Company Profile

- 24.1. Actinium Pharmaceuticals

- 24.1.1. Company Details/ Overview

- 24.1.2. Company Financials

- 24.1.3. Key Customers and Competitors

- 24.1.4. Business/ Industry Portfolio

- 24.1.5. Product Portfolio/ Specification Details

- 24.1.6. Pricing Data

- 24.1.7. Strategic Overview

- 24.1.8. Recent Developments

- 24.2. Advanced Accelerator Applications (AAA) - Novartis

- 24.3. AstraZeneca

- 24.4. Bayer AG

- 24.5. Bristol Myers Squibb

- 24.6. Cardinal Health

- 24.7. Clarity Pharmaceuticals

- 24.8. Curium Pharma

- 24.9. Eckert & Ziegler

- 24.10. Fusion Pharmaceuticals

- 24.11. GE HealthCare

- 24.12. Isotope Technologies Garching (ITG)

- 24.13. Jubilant Pharma

- 24.14. Lantheus Holdings

- 24.15. Novartis AG

- 24.16. Perspective Therapeutics

- 24.17. POINT Biopharma

- 24.18. RadioMedix

- 24.19. RayzeBio (acquired by Bristol Myers Squibb)

- 24.20. Revvity, Inc.

- 24.21. Siemens Healthineers

- 24.22. Telix Pharmaceuticals

- 24.23. Other Key Players

- 24.1. Actinium Pharmaceuticals

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation