Regenerative Medicine Market Size, Share & Trends Analysis Report by Product Type (Cell Therapy, Gene Therapy, Tissue Engineering, Small Molecules & Biologics, Biomaterial-based Products), Cell Type, Material, Therapeutic Area, Technology, Mode of Administration, Distribution Channel, Source, Processing Method, Processing Method, Price Range, End-users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Regenerative Medicine Market Size, Share, and Growth

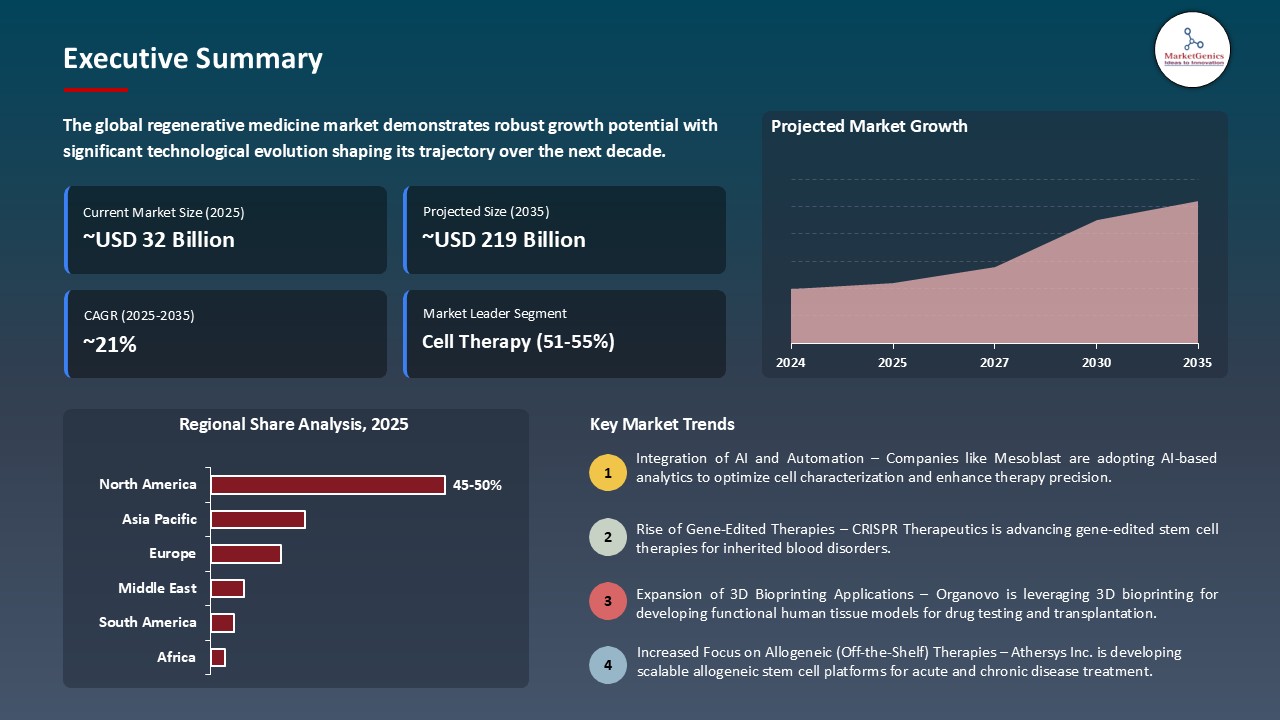

The global regenerative medicine market is experiencing robust growth, with its estimated value of USD 31.7 billion in the year 2025 and USD 218.6 billion by the period 2035, registering a CAGR of 21.3%, during the forecast period. The global regenerative medicine market is experiencing robust growth, driven by the increasing demand for targeted therapies in oncology and other diseases. This expansion is further fueled by rising investments in biotech research, strong collaborations between pharmaceutical companies and academic institutions, and advancements in drug discovery platforms.

Dr. Ronald Rigor said, “As the founder of one of the largest and fastest-growing stem cell centers in the Philippines, I am delighted to partner with and invest in Nova Cell. This is a fantastic opportunity to provide best-in-class stem cell therapy treatments, which could meet a huge unmet need in the Philippines. We look forward to bringing Nova Cell’s extensive experience in stem cell therapy production to provide innovative therapies to patients and to elevate the health and wellness industry in the Philippines.

The global regenerative medicine market has been registering a pronounced growth due to developments in cell-based therapy, tissue engineering and gene editing technology. For instance, in 2025, Longeveron Inc., was granted both Regenerative Medicine Advanced Therapy (RMAT) and Fast Track designation by the U.S. FDA on its stem cell therapy, laromestrocel, targeting mild Alzheimer, demonstrating a growing interest in regenerative therapy as a treatment of complex neurological disorders and in shortening the clinical development time-scale. The potential of regenerative medicine to change the paradigm of treatment and provide new hope to patients with neurodegenerative diseases can be seen in this development.

New biotech startups are also driving the growth of the regenerative medicine Market with novel engineered tissues and exosomes-based therapies platforms. For instance, in July 2025, Pluristyx collaborated with Lonza to develop scalable production of pluripotent stem cell-derived therapeutics to provide more precise and reproducible therapeutics and accelerate clinical translation and shorten production times. This association demonstrates the role of strategic alliances in creating growth and efficiency in the operation of the global Regenerative Medicine Market.

The viability, integration and functionality of regenerative therapies being improved with the help of technological advances, including 3D bio printing, automated cell culture, and computational tissue modeling. Computer simulations with artificial intelligence make cell-matrix interactions faster to optimize, tissue vascularization, and personalized designing treatment options possible, which opens the way to safer and more effective therapy in cardiovascular, musculoskeletal, and dermatological indications. These innovations are driving growth and innovation within the Regenerative Medicine Market.

Regulatory frameworks are undergoing changes to facilitate the faster development and approval of regenerative therapies. In 2025, the amimestrocel injection (hUC-MSC PLEB-001) by Platinum Life Excellence Biotech Co. Ltd. is conditionally approved by China National Medical Products Administration (NMPA) as the first human umbilical cord-derived mesenchymal stem cell treatment of steroid refractory severe acute graft-versus-host disease (GVHD). This acceptance indicates that China is intent on the development of the regenerative medicine Market and offering innovative methods of treating patients with intricate hematologic disorders.

Regenerative Medicine Market Dynamics and Trends

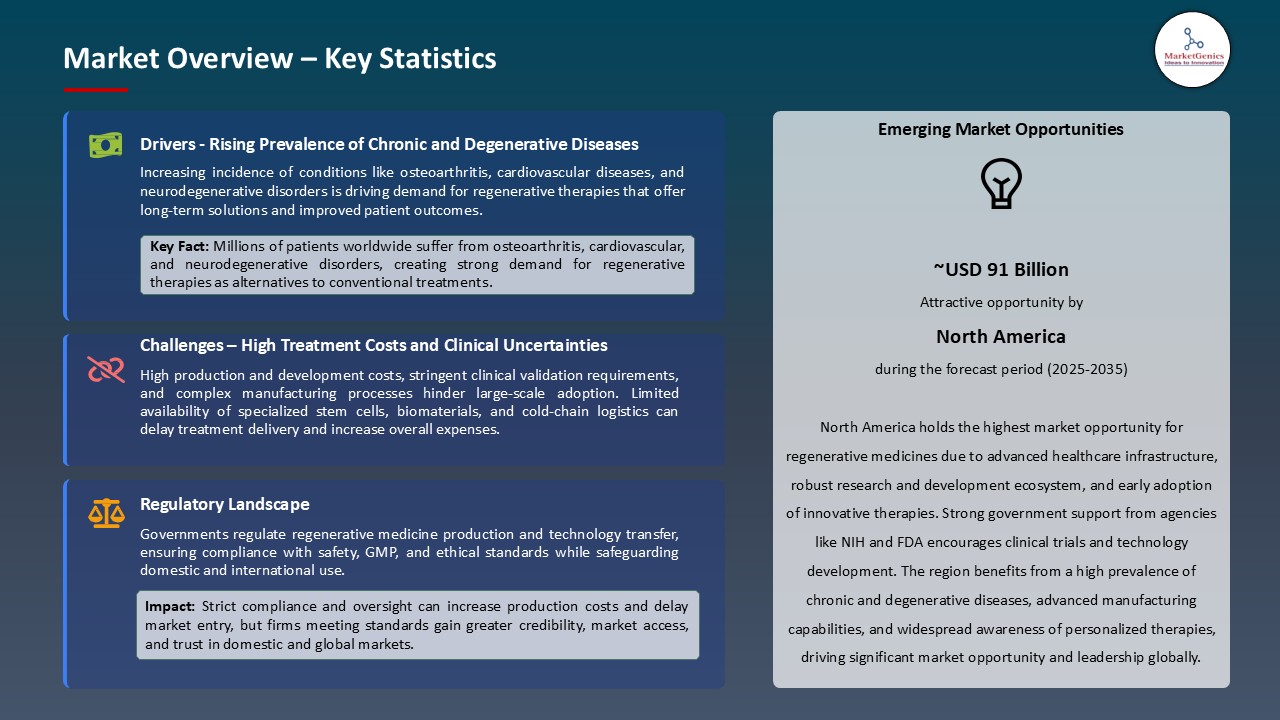

Driver: Rising Prevalence of Chronic and Degenerative Diseases

- The increased cases of musculoskeletal infections, diabetes, cardiovascular and neurodegenerative diseases that are being experienced globally have become among the driving forces of the market for regenerative medicine. Traditional medicine usually heals symptoms and not the damage to tissue, which is an important requirement in regenerative therapy when disease is treated at a biological level.

- Regenerative medicine uses living cells, biomaterials, and tissue-engineering technology to maintain or repair injured structures and functions. Descriptively, in 2025, Mesoblast Limited made regulatory advancement on its allogeneic stem cell treatment Rexlemestrocel-L focused on repairing intervertebral disc tissue and treating chronic low back pain.

- The emerging technologies in healthcare across the world are progressively integrating regenerative therapies in clinical protocols because of its proven capacity to heal tissue damage, lowering of relapse rates, and delivering a lasting functional recovery. This kind of integration aids transition to curative as opposed to palliative healthcare models.

- This is because continuous scientific validation and success rates in patients are an encouraging factor to investment, policy backing, and commercialization. All these forces are driving the integration of regenerative therapies around the globe and strengthening their position as a paradigm shift in contemporary medicine.

Restraint: High Manufacturing Cost and Complex Regulatory Oversight

- Despite impressive technological progress, the regenerative medicine market is highly limited by the high production costs because of cell- and tissue-based products. The manufacturing of these therapies needs special bioprocessing plants, controlled conditions, and complicated logistics storage, handling and transportation, which significantly raise the operating costs.

- The high cost level is further enhanced by the fact that it requires highly skilled staff, high standard of sterility and long production cycles. They pose financial barriers to many companies and slow down massive commercialization, especially in price-sensitive markets.

- Regulatory oversight is also a sensitive bottleneck. Regenerative products approval requires stringent consideration of safety, efficacy, and reproducibility, which may require lengthy clinical trials and post-marketing surveillance to determine patient safety.

- The compounded effects of cost and complexity of regulation slow down the approval of the products, reduce their accessibility, and shorten their scalability to globalization. Consequently, such issues remain a limiting factor in the pervasiveness and commercial expansion capacity of regenerative medicine across the globe.

Opportunity: Advancements in 3D Bioprinting and Tissue Engineering

- The regenerative medicine market has experienced a great opportunity due to sustained innovation in the 3D bioprinting and tissue engineering technologies. Such developments are changing the paradigm of functional human tissues and organ development and provide new opportunities in the treatment of unmet clinical conditions in transplantation and tissue repair.

- Bioinks, stem cells and biomimetic scaffolds allow the re-creation of native tissue architecture, which facilitates superior integration and functionality after implantation. The improved cell viability, structural fidelity and vascularization at a larger scale is becoming feasible and providing pathway to a practical clinical application.

- With the increasing number of studies moving out of the laboratory scale models into organ-scale constructs, the major biotechnology companies and research institutions are speeding up the advancements in bioprinting precision and tissue sustainability. In April 2025, FluidForm Bio announced a major advance in its FRESH-3D-bioprinting platform, which is now capable of printing vascularized tissue scaffolds by loading the bioprinted scaffold with sacrificial gelatin micro-particles in order to enhance cell survival in thicker tissues-bringing large scale, implantable engineered tissues a step closer to the real world.

- The possibilities of such developments include revolutionizing the regenerative therapies, reducing the dependence of the world on donor organs, and commercializing the next generation of tissue-engineered products. The convergence of the current trends in technological maturity, regulatory maturity, and investment issue renders bioprinting a powerful field of expansion in the market of regenerative medicine.

Key Trend: Integration of Artificial Intelligence and Automation in Regenerative Development

- The use of artificial intelligence (AI) and automation in therapeutic design, cell line optimization, and manufacturing processes is a significant new trend that is influencing the regenerative medicine market. AI models are used to improve the process of identifying the most optimal cell differentiation routes most quickly and forecasts the outcome of tissue regeneration with the highest level of accuracy.

- Reproducibility, scalability and adherence to GMP criteria that are imperative to commercial preparedness are being enhanced by automation technologies, including robotic cell culture systems and closed-loop bioprocessing units. This has made it easy to reduce variability and development cycles are shortened through this integration.

- The introduction of AI and automation is becoming a common practice in the leading pharmaceutical and research organizations to streamline regenerative therapy pipelines and speed up clinical translation. As an example, in 2025, AstraZeneca joined a strategic partnership with Stanford Medicine to capitalize on AI-based methods in regenerative medicine, and new treatment of cardiovascular diseases. This partnership is an example of the integration of digital biology and regenerative therapeutics to hasten the discovery.

- The increasing integration of AI, automation and superior analytics will transform the development, testing, and production of regenerative products and improve the clinical efficacy and economic viability of the next-generation regenerative treatments across the globe.

Regenerative Medicine Market Analysis and Segmental Data

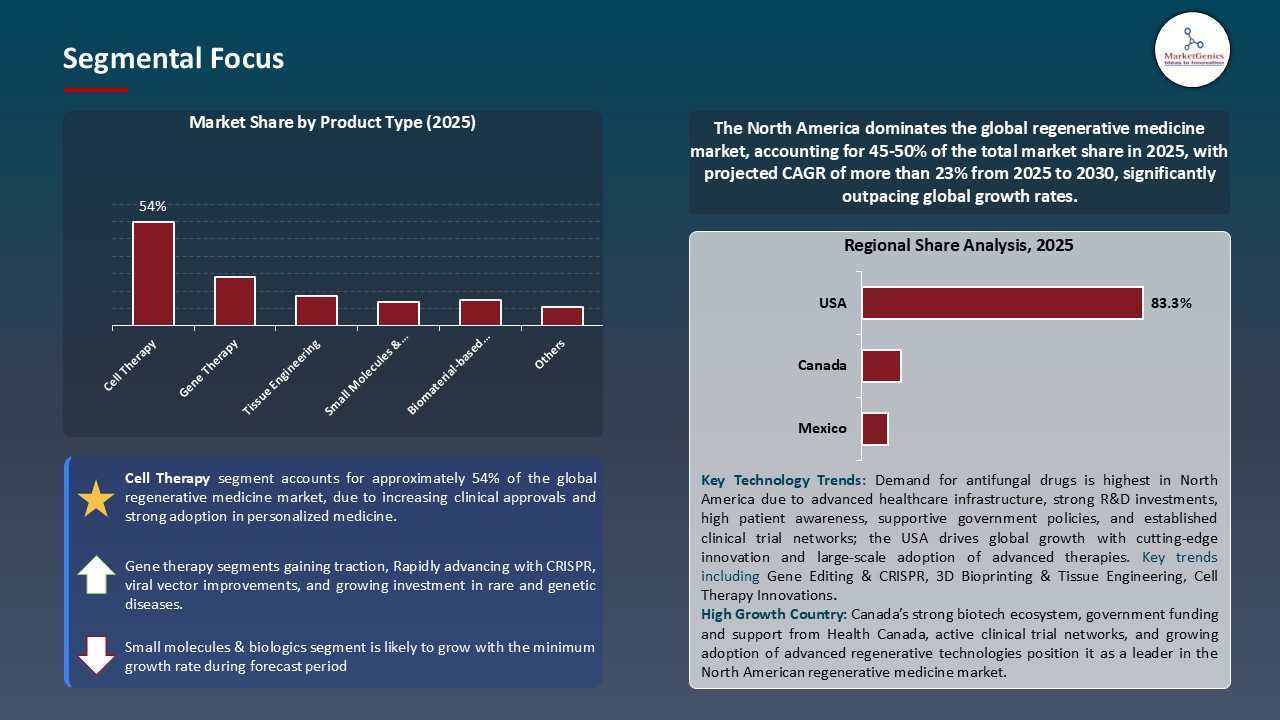

Cell Therapy Dominate Global Regenerative Medicine Market

- The cell therapy segment leads the regenerative medicine global market due to its extensive application in the cure of chronic ailments, genetic diseases as well as degenerative illnesses. Therapy is especially being revolutionized by stem cell-derived remedies, which support tissue regeneration, reduce inflammation, and restore organ function. Increased clinical application and government as well as commercial investment are also accelerating innovation and commercialization.

- Cell differentiation with AI, 3D bioprinting, and automated cell culture systems are making cell-based therapies more scalable, reproducible, and safe. These technologies provide the opportunity to develop highly targeted and individualized treatment, which enhances patient outcomes and increases the scope of therapically treated musculoskeletal, cardiovascular and neurological diseases.

- There is also the rise of regulatory and industry partnerships which are advancing the development of cell therapy for example, bemdaneprocel (BRT-DA01), a self-autologous stem cell-derived dopaminergic neuron therapy of Parkinson disease, initiated a Phase II clinical trial in May 2025 by BlueRock Therapeutics, a Bayer AG subsidiary. The breakthrough is supported by Fast Track designation by the U.S. FDA, as evidence that the greater confidence in the potential of cell therapy and the global interest in the development of regenerative therapies to chronic and complex diseases.

North America Leads Global Regenerative Medicine Market Demand

- North America is the world leader in regenerative medicine with the adoption of high-tech solutions at the earliest stage, including artificial intelligence-based cell differentiation, 3D bioprinting, and CRISPR-based gene editing, as well as automated stem cell production systems. In April 2025, Vertex Pharmaceuticals announced a 250-million-dollar expansion of its Boston facility to expand production of its stem cell-based Type 1 diabetes medicine (VX-880), bolstering the region's role in the regenerative manufacturing, restoring North America's position as a leader in next-generation regenerative therapies.

- Apart from this, the area also possesses a strong network of research centers, biotechnology companies, and health care providers supporting high activity levels of clinical trials and translational research. The collaborations between firms such as Harvard Stem Cell Institute, Mayo Clinic, and BlueRock Therapeutics have resulted in quicker clinical validation, easier regulatory, and more commercialization of sophisticated regenerative products.

- These factors, together with the proven manufacturing and distribution channels, make North America the center of regenerative medicine innovation and commercialization in the world.

Regenerative Medicine Market Ecosystem

The regenerative medicine market is dynamic and innovative, with the major pharmaceutical and biotechnology institutions like Novartis, Bayer AG, Eli Lilly, Molecular Partners AG, Mesoblast and Organovo at the frontline in the development of newer and highly cellular, gene and tissue-engineered therapies. These firms focus on musculoskeletal disorders, cardiovascular disease, neurodegenerative disease regenerative therapeutics, and individualized cell therapy.

Funding Research and development Government programs, research centers and commercial investors have a central role to play in financing research and development allowing large-scale production of cell therapies, development of engineered tissue platforms, and optimization of gene- and stem-cell-based regenerative approaches. Such programs improve the speed of clinical development and assist in the development of patient-specific treatment programs. As an example, in June 2025, the Stem Cell Network (SCN) of Canada reported that it had allocated 13.5 million dollars towards 36 new regenerative medicine research projects and clinical trials. The project has 63 partner organizations that have contributed more than 19.5 million in matching cash and in- kind contributions to this project that is a collective 33 million dollar addition to the regenerative medicine ecosystem in Canada.

Complementary technologies intended to improve the efficacy, accuracy, and scalability are also being introduced by academic laboratories and startups. The use of AI-based predictive modeling combined with high throughput screening and automated cell culture platforms is becoming more commonly used to accelerate the screening of therapeutic leads, enhance reproducibility, and shorten timelines in clinical translation.

Together, the globe is experiencing the sustainable expansion, speed up in adoption, and speed up in clinical translation of regenerative therapeutics due to an operative ecosystem of strategic partnerships, innovative technologies, and long-term investments that have developed a solid foundation of the subsequent generation of curative treatments.

Recent Development and Strategic Overview:

- In September 2025, luristyx, Inc. and Solesis, LLC declared a strategic partnership to streamline technology in standardized, reliable, and reproducible tools in the use of pluripotent stem cells against research, diagnostics and treatment.

- In October 2025, BioNexus Gene Lab Corp entered a strategic partnership with BirchBioMed Inc. to advance the FS2 topical platform in Southeast Asia. This collaboration involves a $10 million financing round to enhance the commercialization of Birch's FS2 topical cream, targeting dermal fibrosis and scarring.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 31.7 Bn |

|

Market Forecast Value in 2035 |

USD 218.6 Bn |

|

Growth Rate (CAGR) |

21.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Regenerative Medicine Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Regenerative Medicine Market, By Product Type |

|

|

Regenerative Medicine Market, By Cell Type |

|

|

Regenerative Medicine Market, By Material |

|

|

Regenerative Medicine Market, By Therapeutic Area |

|

|

Regenerative Medicine Market, By Technology |

|

|

Regenerative Medicine Market, By Mode of Administration |

|

|

Regenerative Medicine Market, By Distribution Channel |

|

|

Regenerative Medicine Market, By Source |

|

|

Regenerative Medicine Market, By Processing Method |

|

|

Regenerative Medicine Market, By Price Range |

|

|

Regenerative Medicine Market, By End-Users |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Regenerative Medicine Market Outlook

- 2.1.1. Regenerative Medicine Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Regenerative Medicine Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of chronic and degenerative diseases

- 4.1.1.2. Advances in cell-/gene-based technologies and biomaterials

- 4.1.1.3. Growing investment, strategic partnerships, and supportive public/private funding

- 4.1.2. Restraints

- 4.1.2.1. High treatment and development costs with limited reimbursement pathways

- 4.1.2.2. Complex regulatory, safety and ethical challenges slowing commercialization

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material and Component Suppliers

- 4.4.2. Producers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Regenerative Medicine Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Regenerative Medicine Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Cell Therapy

- 6.2.1.1. Autologous Cell Therapy

- 6.2.1.2. Allogeneic Cell Therapy

- 6.2.2. Gene Therapy

- 6.2.2.1. In Vivo Gene Therapy

- 6.2.2.2. Ex Vivo Gene Therapy

- 6.2.3. Tissue Engineering

- 6.2.3.1. Scaffolds

- 6.2.3.2. Biomaterials

- 6.2.4. Cell-based Tissue Engineering

- 6.2.5. Small Molecules & Biologics

- 6.2.6. Biomaterial-based Products

- 6.2.1. Cell Therapy

- 7. Global Regenerative Medicine Market Analysis, by Cell Type

- 7.1. Key Segment Analysis

- 7.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Cell Type, 2021-2035

- 7.2.1. Stem Cells

- 7.2.1.1. Embryonic Stem Cells

- 7.2.1.2. Adult Stem Cells

- 7.2.1.3. Induced Pluripotent Stem Cells (iPSCs)

- 7.2.1.4. Mesenchymal Stem Cells (MSCs)

- 7.2.1.5. Hematopoietic Stem Cells

- 7.2.1.6. Others

- 7.2.2. Primary Cells

- 7.2.3. Differentiated Cells

- 7.2.1. Stem Cells

- 8. Global Regenerative Medicine Market Analysis, by Material

- 8.1. Key Segment Analysis

- 8.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Material, 2021-2035

- 8.2.1. Synthetic Materials

- 8.2.1.1. Polymers

- 8.2.1.2. Ceramics

- 8.2.1.3. Metals

- 8.2.1.4. Others

- 8.2.2. Biologically Derived Materials

- 8.2.2.1. Collagen

- 8.2.2.2. Hyaluronic Acid

- 8.2.2.3. Fibrin

- 8.2.2.4. Chitosan

- 8.2.2.5. Others

- 8.2.3. Genetically Engineered Materials

- 8.2.1. Synthetic Materials

- 9. Global Regenerative Medicine Market Analysis, by Therapeutic Area

- 9.1. Key Segment Analysis

- 9.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Therapeutic Area, 2021-2035

- 9.2.1. Orthopedics & Musculoskeletal

- 9.2.2. Cardiovascular

- 9.2.3. Dermatology & Wound Care

- 9.2.4. Oncology

- 9.2.5. Neurology

- 9.2.6. Ophthalmology

- 9.2.7. Dental

- 9.2.8. Diabetes

- 9.2.9. Other Therapeutic Areas

- 10. Global Regenerative Medicine Market Analysis, by Technology

- 10.1. Key Segment Analysis

- 10.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 10.2.1. 3D Bioprinting

- 10.2.2. CRISPR/Gene Editing

- 10.2.3. Cell Culture & Expansion

- 10.2.4. Organoid Technology

- 10.2.5. Biomaterial Fabrication

- 10.2.6. Nanotechnology

- 10.2.7. Immunotherapy

- 10.2.8. Scaffold Technology

- 10.2.9. Others

- 11. Global Regenerative Medicine Market Analysis, by Mode of Administration

- 11.1. Key Segment Analysis

- 11.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Mode of Administration, 2021-2035

- 11.2.1. Injectable

- 11.2.2. Topical

- 11.2.3. Implantable

- 11.2.4. Systemic

- 12. Global Regenerative Medicine Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Hospitals & Clinics

- 12.2.2. Specialty Centers

- 12.2.3. Research Laboratories

- 12.2.4. Online Pharmacies

- 12.2.5. Retail Pharmacies

- 13. Global Regenerative Medicine Market Analysis, by Source

- 13.1. Key Segment Analysis

- 13.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 13.2.1. Autologous (Self-derived)

- 13.2.2. Allogeneic (Donor-derived)

- 13.2.3. Xenogeneic (Animal-derived)

- 13.2.4. Synthetic/Artificial

- 14. Global Regenerative Medicine Market Analysis, by Processing Method

- 14.1. Key Segment Analysis

- 14.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Processing Method, 2021-2035

- 14.2.1. Minimally Manipulated

- 14.2.2. Extensively Manipulated

- 14.2.3. Point-of-Care Processing

- 14.2.4. Centralized Processing

- 15. Global Regenerative Medicine Market Analysis, by Price Range

- 15.1. Key Segment Analysis

- 15.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Price Range, 2021-2035

- 15.2.1. Premium

- 15.2.2. Mid-range

- 15.2.3. Economy

- 16. Global Regenerative Medicine Market Analysis, by End-Users

- 16.1. Key Segment Analysis

- 16.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Users, 2021-2035

- 16.2.1. Healthcare Facilities

- 16.2.1.1. Orthopedic Applications

- 16.2.1.1.1. Bone Regeneration

- 16.2.1.1.2. Cartilage Repair

- 16.2.1.1.3. Tendon & Ligament Repair

- 16.2.1.1.4. Others

- 16.2.1.2. Cardiovascular Applications

- 16.2.1.2.1. Heart Valve Repair

- 16.2.1.2.2. Myocardial Regeneration

- 16.2.1.2.3. Vascular Grafts

- 16.2.1.2.4. Others

- 16.2.1.3. Wound Healing Applications

- 16.2.1.3.1. Chronic Wound Treatment

- 16.2.1.3.2. Burn Treatment

- 16.2.1.3.3. Diabetic Ulcer Treatment

- 16.2.1.3.4. Others

- 16.2.1.4. Dental Applications

- 16.2.1.4.1. Periodontal Regeneration

- 16.2.1.4.2. Dental Pulp Regeneration

- 16.2.1.4.3. Bone Grafting

- 16.2.1.4.4. Others

- 16.2.1.1. Orthopedic Applications

- 16.2.2. Research & Academic Institutions

- 16.2.2.1. Drug Discovery Applications

- 16.2.2.1.1. Toxicity Testing

- 16.2.2.1.2. Disease Modeling

- 16.2.2.1.3. Pharmacological Studies

- 16.2.2.1.4. Others

- 16.2.2.2. Basic Research Applications

- 16.2.2.2.1. Stem Cell Research

- 16.2.2.2.2. Tissue Development Studies

- 16.2.2.2.3. Regenerative Biology Research

- 16.2.2.2.4. Others

- 16.2.2.3. Translational Research Applications

- 16.2.2.3.1. Clinical Trial Support

- 16.2.2.3.2. Proof-of-Concept Studies

- 16.2.2.3.3. Others

- 16.2.2.1. Drug Discovery Applications

- 16.2.3. Biotechnology & Pharmaceutical Companies

- 16.2.3.1. Product Development Applications

- 16.2.3.1.1. Cell Therapy Product Development

- 16.2.3.1.2. Gene Therapy Product Development

- 16.2.3.1.3. Tissue Engineered Product Development

- 16.2.3.1.4. Others

- 16.2.3.2. Manufacturing Applications

- 16.2.3.2.1. Cell Banking

- 16.2.3.2.2. Bioproduction

- 16.2.3.2.3. Quality Control Testing

- 16.2.3.2.4. Others

- 16.2.3.1. Product Development Applications

- 16.2.4. Cosmetic & Aesthetic Clinics

- 16.2.4.1. Anti-Aging Applications

- 16.2.4.1.1. Skin Rejuvenation

- 16.2.4.1.2. Hair Regeneration

- 16.2.4.1.3. Facial Reconstruction

- 16.2.4.1.4. Others

- 16.2.4.2. Reconstructive Applications

- 16.2.4.2.1. Scar Treatment

- 16.2.4.2.2. Tissue Volume Restoration

- 16.2.4.2.3. Others

- 16.2.4.1. Anti-Aging Applications

- 16.2.5. Veterinary Clinics

- 16.2.5.1. Animal Orthopedic Applications

- 16.2.5.1.1. Joint Repair in Animals

- 16.2.5.1.2. Bone Healing

- 16.2.5.1.3. Others

- 16.2.5.2. Companion Animal Care Applications

- 16.2.5.2.1. Soft Tissue Repair

- 16.2.5.2.2. Wound Healing

- 16.2.5.2.3. Others

- 16.2.5.1. Animal Orthopedic Applications

- 16.2.6. Other End-users

- 16.2.1. Healthcare Facilities

- 17. Global Regenerative Medicine Market Analysis and Forecasts, by Region

- 17.1. Key Findings

- 17.2. Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 17.2.1. North America

- 17.2.2. Europe

- 17.2.3. Asia Pacific

- 17.2.4. Middle East

- 17.2.5. Africa

- 17.2.6. South America

- 18. North America Regenerative Medicine Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. North America Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Cell Type

- 18.3.3. Material

- 18.3.4. Therapeutic Area

- 18.3.5. Technology

- 18.3.6. Mode of Administration

- 18.3.7. Distribution Channel

- 18.3.8. Source

- 18.3.9. Processing Method

- 18.3.10. Price Range

- 18.3.11. End-users

- 18.3.12. Country

- 18.3.12.1. USA

- 18.3.12.2. Canada

- 18.3.12.3. Mexico

- 18.4. USA Regenerative Medicine Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Cell Type

- 18.4.4. Material

- 18.4.5. Therapeutic Area

- 18.4.6. Technology

- 18.4.7. Mode of Administration

- 18.4.8. Distribution Channel

- 18.4.9. Source

- 18.4.10. Processing Method

- 18.4.11. Price Range

- 18.4.12. End-users

- 18.5. Canada Regenerative Medicine Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Cell Type

- 18.5.4. Material

- 18.5.5. Therapeutic Area

- 18.5.6. Technology

- 18.5.7. Mode of Administration

- 18.5.8. Distribution Channel

- 18.5.9. Source

- 18.5.10. Processing Method

- 18.5.11. Price Range

- 18.5.12. End-users

- 18.6. Mexico Regenerative Medicine Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Cell Type

- 18.6.4. Material

- 18.6.5. Therapeutic Area

- 18.6.6. Technology

- 18.6.7. Mode of Administration

- 18.6.8. Distribution Channel

- 18.6.9. Source

- 18.6.10. Processing Method

- 18.6.11. Price Range

- 18.6.12. End-users

- 19. Europe Regenerative Medicine Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Europe Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Cell Type

- 19.3.3. Material

- 19.3.4. Therapeutic Area

- 19.3.5. Technology

- 19.3.6. Mode of Administration

- 19.3.7. Distribution Channel

- 19.3.8. Source

- 19.3.9. Processing Method

- 19.3.10. Price Range

- 19.3.11. End-users

- 19.3.12. Country

- 19.3.12.1. Germany

- 19.3.12.2. United Kingdom

- 19.3.12.3. France

- 19.3.12.4. Italy

- 19.3.12.5. Spain

- 19.3.12.6. Netherlands

- 19.3.12.7. Nordic Countries

- 19.3.12.8. Poland

- 19.3.12.9. Russia & CIS

- 19.3.12.10. Rest of Europe

- 19.4. Germany Regenerative Medicine Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Cell Type

- 19.4.4. Material

- 19.4.5. Therapeutic Area

- 19.4.6. Technology

- 19.4.7. Mode of Administration

- 19.4.8. Distribution Channel

- 19.4.9. Source

- 19.4.10. Processing Method

- 19.4.11. Price Range

- 19.4.12. End-users

- 19.5. United Kingdom Regenerative Medicine Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Cell Type

- 19.5.4. Material

- 19.5.5. Therapeutic Area

- 19.5.6. Technology

- 19.5.7. Mode of Administration

- 19.5.8. Distribution Channel

- 19.5.9. Source

- 19.5.10. Processing Method

- 19.5.11. Price Range

- 19.5.12. End-users

- 19.6. France Regenerative Medicine Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Cell Type

- 19.6.4. Material

- 19.6.5. Therapeutic Area

- 19.6.6. Technology

- 19.6.7. Mode of Administration

- 19.6.8. Distribution Channel

- 19.6.9. Source

- 19.6.10. Processing Method

- 19.6.11. Price Range

- 19.6.12. End-users

- 19.7. Italy Regenerative Medicine Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Cell Type

- 19.7.4. Material

- 19.7.5. Therapeutic Area

- 19.7.6. Technology

- 19.7.7. Mode of Administration

- 19.7.8. Distribution Channel

- 19.7.9. Source

- 19.7.10. Processing Method

- 19.7.11. Price Range

- 19.7.12. End-users

- 19.8. Spain Regenerative Medicine Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Cell Type

- 19.8.4. Material

- 19.8.5. Therapeutic Area

- 19.8.6. Technology

- 19.8.7. Mode of Administration

- 19.8.8. Distribution Channel

- 19.8.9. Source

- 19.8.10. Processing Method

- 19.8.11. Price Range

- 19.8.12. End-users

- 19.9. Netherlands Regenerative Medicine Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Cell Type

- 19.9.4. Material

- 19.9.5. Therapeutic Area

- 19.9.6. Technology

- 19.9.7. Mode of Administration

- 19.9.8. Distribution Channel

- 19.9.9. Source

- 19.9.10. Processing Method

- 19.9.11. Price Range

- 19.9.12. End-users

- 19.10. Nordic Countries Regenerative Medicine Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Cell Type

- 19.10.4. Material

- 19.10.5. Therapeutic Area

- 19.10.6. Technology

- 19.10.7. Mode of Administration

- 19.10.8. Distribution Channel

- 19.10.9. Source

- 19.10.10. Processing Method

- 19.10.11. Price Range

- 19.10.12. End-users

- 19.11. Poland Regenerative Medicine Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Cell Type

- 19.11.4. Material

- 19.11.5. Therapeutic Area

- 19.11.6. Technology

- 19.11.7. Mode of Administration

- 19.11.8. Distribution Channel

- 19.11.9. Source

- 19.11.10. Processing Method

- 19.11.11. Price Range

- 19.11.12. End-users

- 19.12. Russia & CIS Regenerative Medicine Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Cell Type

- 19.12.4. Material

- 19.12.5. Therapeutic Area

- 19.12.6. Technology

- 19.12.7. Mode of Administration

- 19.12.8. Distribution Channel

- 19.12.9. Source

- 19.12.10. Processing Method

- 19.12.11. Price Range

- 19.12.12. End-users

- 19.13. Rest of Europe Regenerative Medicine Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Cell Type

- 19.13.4. Material

- 19.13.5. Therapeutic Area

- 19.13.6. Technology

- 19.13.7. Mode of Administration

- 19.13.8. Distribution Channel

- 19.13.9. Source

- 19.13.10. Processing Method

- 19.13.11. Price Range

- 19.13.12. End-users

- 20. Asia Pacific Regenerative Medicine Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. East Asia Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Cell Type

- 20.3.3. Material

- 20.3.4. Therapeutic Area

- 20.3.5. Technology

- 20.3.6. Mode of Administration

- 20.3.7. Distribution Channel

- 20.3.8. Source

- 20.3.9. Processing Method

- 20.3.10. Price Range

- 20.3.11. End-users

- 20.3.12. Country

- 20.3.12.1. China

- 20.3.12.2. India

- 20.3.12.3. Japan

- 20.3.12.4. South Korea

- 20.3.12.5. Australia and New Zealand

- 20.3.12.6. Indonesia

- 20.3.12.7. Malaysia

- 20.3.12.8. Thailand

- 20.3.12.9. Vietnam

- 20.3.12.10. Rest of Asia Pacific

- 20.4. China Regenerative Medicine Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Cell Type

- 20.4.4. Material

- 20.4.5. Therapeutic Area

- 20.4.6. Technology

- 20.4.7. Mode of Administration

- 20.4.8. Distribution Channel

- 20.4.9. Source

- 20.4.10. Processing Method

- 20.4.11. Price Range

- 20.4.12. End-users

- 20.5. India Regenerative Medicine Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Cell Type

- 20.5.4. Material

- 20.5.5. Therapeutic Area

- 20.5.6. Technology

- 20.5.7. Mode of Administration

- 20.5.8. Distribution Channel

- 20.5.9. Source

- 20.5.10. Processing Method

- 20.5.11. Price Range

- 20.5.12. End-users

- 20.6. Japan Regenerative Medicine Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Cell Type

- 20.6.4. Material

- 20.6.5. Therapeutic Area

- 20.6.6. Technology

- 20.6.7. Mode of Administration

- 20.6.8. Distribution Channel

- 20.6.9. Source

- 20.6.10. Processing Method

- 20.6.11. Price Range

- 20.6.12. End-users

- 20.7. South Korea Regenerative Medicine Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Cell Type

- 20.7.4. Material

- 20.7.5. Therapeutic Area

- 20.7.6. Technology

- 20.7.7. Mode of Administration

- 20.7.8. Distribution Channel

- 20.7.9. Source

- 20.7.10. Processing Method

- 20.7.11. Price Range

- 20.7.12. End-users

- 20.8. Australia and New Zealand Regenerative Medicine Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Cell Type

- 20.8.4. Material

- 20.8.5. Therapeutic Area

- 20.8.6. Technology

- 20.8.7. Mode of Administration

- 20.8.8. Distribution Channel

- 20.8.9. Source

- 20.8.10. Processing Method

- 20.8.11. Price Range

- 20.8.12. End-users

- 20.9. Indonesia Regenerative Medicine Market

- 20.9.1. Country Segmental Analysis

- 20.9.2. Product Type

- 20.9.3. Cell Type

- 20.9.4. Material

- 20.9.5. Therapeutic Area

- 20.9.6. Technology

- 20.9.7. Mode of Administration

- 20.9.8. Distribution Channel

- 20.9.9. Source

- 20.9.10. Processing Method

- 20.9.11. Price Range

- 20.9.12. End-users

- 20.10. Malaysia Regenerative Medicine Market

- 20.10.1. Country Segmental Analysis

- 20.10.2. Product Type

- 20.10.3. Cell Type

- 20.10.4. Material

- 20.10.5. Therapeutic Area

- 20.10.6. Technology

- 20.10.7. Mode of Administration

- 20.10.8. Distribution Channel

- 20.10.9. Source

- 20.10.10. Processing Method

- 20.10.11. Price Range

- 20.10.12. End-users

- 20.11. Thailand Regenerative Medicine Market

- 20.11.1. Country Segmental Analysis

- 20.11.2. Product Type

- 20.11.3. Cell Type

- 20.11.4. Material

- 20.11.5. Therapeutic Area

- 20.11.6. Technology

- 20.11.7. Mode of Administration

- 20.11.8. Distribution Channel

- 20.11.9. Source

- 20.11.10. Processing Method

- 20.11.11. Price Range

- 20.11.12. End-users

- 20.12. Vietnam Regenerative Medicine Market

- 20.12.1. Country Segmental Analysis

- 20.12.2. Product Type

- 20.12.3. Cell Type

- 20.12.4. Material

- 20.12.5. Therapeutic Area

- 20.12.6. Technology

- 20.12.7. Mode of Administration

- 20.12.8. Distribution Channel

- 20.12.9. Source

- 20.12.10. Processing Method

- 20.12.11. Price Range

- 20.12.12. End-users

- 20.13. Rest of Asia Pacific Regenerative Medicine Market

- 20.13.1. Country Segmental Analysis

- 20.13.2. Product Type

- 20.13.3. Cell Type

- 20.13.4. Material

- 20.13.5. Therapeutic Area

- 20.13.6. Technology

- 20.13.7. Mode of Administration

- 20.13.8. Distribution Channel

- 20.13.9. Source

- 20.13.10. Processing Method

- 20.13.11. Price Range

- 20.13.12. End-users

- 21. Middle East Regenerative Medicine Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Middle East Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Cell Type

- 21.3.3. Material

- 21.3.4. Therapeutic Area

- 21.3.5. Technology

- 21.3.6. Mode of Administration

- 21.3.7. Distribution Channel

- 21.3.8. Source

- 21.3.9. Processing Method

- 21.3.10. Price Range

- 21.3.11. End-users

- 21.3.12. Country

- 21.3.12.1. Turkey

- 21.3.12.2. UAE

- 21.3.12.3. Saudi Arabia

- 21.3.12.4. Israel

- 21.3.12.5. Rest of Middle East

- 21.4. Turkey Regenerative Medicine Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Cell Type

- 21.4.4. Material

- 21.4.5. Therapeutic Area

- 21.4.6. Technology

- 21.4.7. Mode of Administration

- 21.4.8. Distribution Channel

- 21.4.9. Source

- 21.4.10. Processing Method

- 21.4.11. Price Range

- 21.4.12. End-users

- 21.5. UAE Regenerative Medicine Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Cell Type

- 21.5.4. Material

- 21.5.5. Therapeutic Area

- 21.5.6. Technology

- 21.5.7. Mode of Administration

- 21.5.8. Distribution Channel

- 21.5.9. Source

- 21.5.10. Processing Method

- 21.5.11. Price Range

- 21.5.12. End-users

- 21.6. Saudi Arabia Regenerative Medicine Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Cell Type

- 21.6.4. Material

- 21.6.5. Therapeutic Area

- 21.6.6. Technology

- 21.6.7. Mode of Administration

- 21.6.8. Distribution Channel

- 21.6.9. Source

- 21.6.10. Processing Method

- 21.6.11. Price Range

- 21.6.12. End-users

- 21.7. Israel Regenerative Medicine Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Cell Type

- 21.7.4. Material

- 21.7.5. Therapeutic Area

- 21.7.6. Technology

- 21.7.7. Mode of Administration

- 21.7.8. Distribution Channel

- 21.7.9. Source

- 21.7.10. Processing Method

- 21.7.11. Price Range

- 21.7.12. End-users

- 21.8. Rest of Middle East Regenerative Medicine Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Cell Type

- 21.8.4. Material

- 21.8.5. Therapeutic Area

- 21.8.6. Technology

- 21.8.7. Mode of Administration

- 21.8.8. Distribution Channel

- 21.8.9. Source

- 21.8.10. Processing Method

- 21.8.11. Price Range

- 21.8.12. End-users

- 22. Africa Regenerative Medicine Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. Africa Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Cell Type

- 22.3.3. Material

- 22.3.4. Therapeutic Area

- 22.3.5. Technology

- 22.3.6. Mode of Administration

- 22.3.7. Distribution Channel

- 22.3.8. Source

- 22.3.9. Processing Method

- 22.3.10. Price Range

- 22.3.11. End-users

- 22.3.12. Country

- 22.3.12.1. South Africa

- 22.3.12.2. Egypt

- 22.3.12.3. Nigeria

- 22.3.12.4. Algeria

- 22.3.12.5. Rest of Africa

- 22.4. South Africa Regenerative Medicine Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Cell Type

- 22.4.4. Material

- 22.4.5. Therapeutic Area

- 22.4.6. Technology

- 22.4.7. Mode of Administration

- 22.4.8. Distribution Channel

- 22.4.9. Source

- 22.4.10. Processing Method

- 22.4.11. Price Range

- 22.4.12. End-users

- 22.5. Egypt Regenerative Medicine Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Cell Type

- 22.5.4. Material

- 22.5.5. Therapeutic Area

- 22.5.6. Technology

- 22.5.7. Mode of Administration

- 22.5.8. Distribution Channel

- 22.5.9. Source

- 22.5.10. Processing Method

- 22.5.11. Price Range

- 22.5.12. End-users

- 22.6. Nigeria Regenerative Medicine Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Cell Type

- 22.6.4. Material

- 22.6.5. Therapeutic Area

- 22.6.6. Technology

- 22.6.7. Mode of Administration

- 22.6.8. Distribution Channel

- 22.6.9. Source

- 22.6.10. Processing Method

- 22.6.11. Price Range

- 22.6.12. End-users

- 22.7. Algeria Regenerative Medicine Market

- 22.7.1. Country Segmental Analysis

- 22.7.2. Product Type

- 22.7.3. Cell Type

- 22.7.4. Material

- 22.7.5. Therapeutic Area

- 22.7.6. Technology

- 22.7.7. Mode of Administration

- 22.7.8. Distribution Channel

- 22.7.9. Source

- 22.7.10. Processing Method

- 22.7.11. Price Range

- 22.7.12. End-users

- 22.8. Rest of Africa Regenerative Medicine Market

- 22.8.1. Country Segmental Analysis

- 22.8.2. Product Type

- 22.8.3. Cell Type

- 22.8.4. Material

- 22.8.5. Therapeutic Area

- 22.8.6. Technology

- 22.8.7. Mode of Administration

- 22.8.8. Distribution Channel

- 22.8.9. Source

- 22.8.10. Processing Method

- 22.8.11. Price Range

- 22.8.12. End-users

- 23. South America Regenerative Medicine Market Analysis

- 23.1. Key Segment Analysis

- 23.2. Regional Snapshot

- 23.3. Central and South Africa Regenerative Medicine Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 23.3.1. Product Type

- 23.3.2. Cell Type

- 23.3.3. Material

- 23.3.4. Therapeutic Area

- 23.3.5. Technology

- 23.3.6. Mode of Administration

- 23.3.7. Distribution Channel

- 23.3.8. Source

- 23.3.9. Processing Method

- 23.3.10. Price Range

- 23.3.11. End-users

- 23.3.12. Country

- 23.3.12.1. Brazil

- 23.3.12.2. Argentina

- 23.3.12.3. Rest of South America

- 23.4. Brazil Regenerative Medicine Market

- 23.4.1. Country Segmental Analysis

- 23.4.2. Product Type

- 23.4.3. Cell Type

- 23.4.4. Material

- 23.4.5. Therapeutic Area

- 23.4.6. Technology

- 23.4.7. Mode of Administration

- 23.4.8. Distribution Channel

- 23.4.9. Source

- 23.4.10. Processing Method

- 23.4.11. Price Range

- 23.4.12. End-users

- 23.5. Argentina Regenerative Medicine Market

- 23.5.1. Country Segmental Analysis

- 23.5.2. Product Type

- 23.5.3. Cell Type

- 23.5.4. Material

- 23.5.5. Therapeutic Area

- 23.5.6. Technology

- 23.5.7. Mode of Administration

- 23.5.8. Distribution Channel

- 23.5.9. Source

- 23.5.10. Processing Method

- 23.5.11. Price Range

- 23.5.12. End-users

- 23.6. Rest of South America Regenerative Medicine Market

- 23.6.1. Country Segmental Analysis

- 23.6.2. Product Type

- 23.6.3. Cell Type

- 23.6.4. Material

- 23.6.5. Therapeutic Area

- 23.6.6. Technology

- 23.6.7. Mode of Administration

- 23.6.8. Distribution Channel

- 23.6.9. Source

- 23.6.10. Processing Method

- 23.6.11. Price Range

- 23.6.12. End-users

- 24. Key Players/ Company Profile

- 24.1. Anterogen Co., Ltd.

- 24.1.1. Company Details/ Overview

- 24.1.2. Company Financials

- 24.1.3. Key Customers and Competitors

- 24.1.4. Business/ Industry Portfolio

- 24.1.5. Product Portfolio/ Specification Details

- 24.1.6. Pricing Data

- 24.1.7. Strategic Overview

- 24.1.8. Recent Developments

- 24.2. Astellas Pharma Inc.

- 24.3. Athersys, Inc.

- 24.4. AxoGen, Inc.

- 24.5. BioTime, Inc.

- 24.6. Bristol-Myers Squibb Company (Celgene)

- 24.7. CORESTEM Inc.

- 24.8. Gilead Sciences, Inc. (Kite Pharma)

- 24.9. Integra LifeSciences Holdings Corporation

- 24.10. Johnson & Johnson (DePuy Synthes)

- 24.11. MEDIPOST Co., Ltd.

- 24.12. Medtronic plc

- 24.13. Mesoblast Limited

- 24.14. Novartis AG (AveXis)

- 24.15. NuVasive, Inc.

- 24.16. Organogenesis Holdings Inc.

- 24.17. Osiris Therapeutics, Inc.

- 24.18. Smith & Nephew plc

- 24.19. Stryker Corporation

- 24.20. Takeda Pharmaceutical Company Limited

- 24.21. Vericel Corporation

- 24.22. Zimmer Biomet Holdings, Inc.

- 24.23. Other Key Players

- 24.1. Anterogen Co., Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation