Robotic Prosthetics Market Size, Share, Growth Opportunity Analysis Report by Product Type (Lower Limb Robotic Prosthetics, Upper Limb Robotic Prosthetics, Full Body Robotic Prosthetics, Hybrid Prosthetics (combined sensor and motor functions) and Others), Technology, Component, Mobility Level, Application, End User, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Robotic Prosthetics Market Size, Share, and Growth

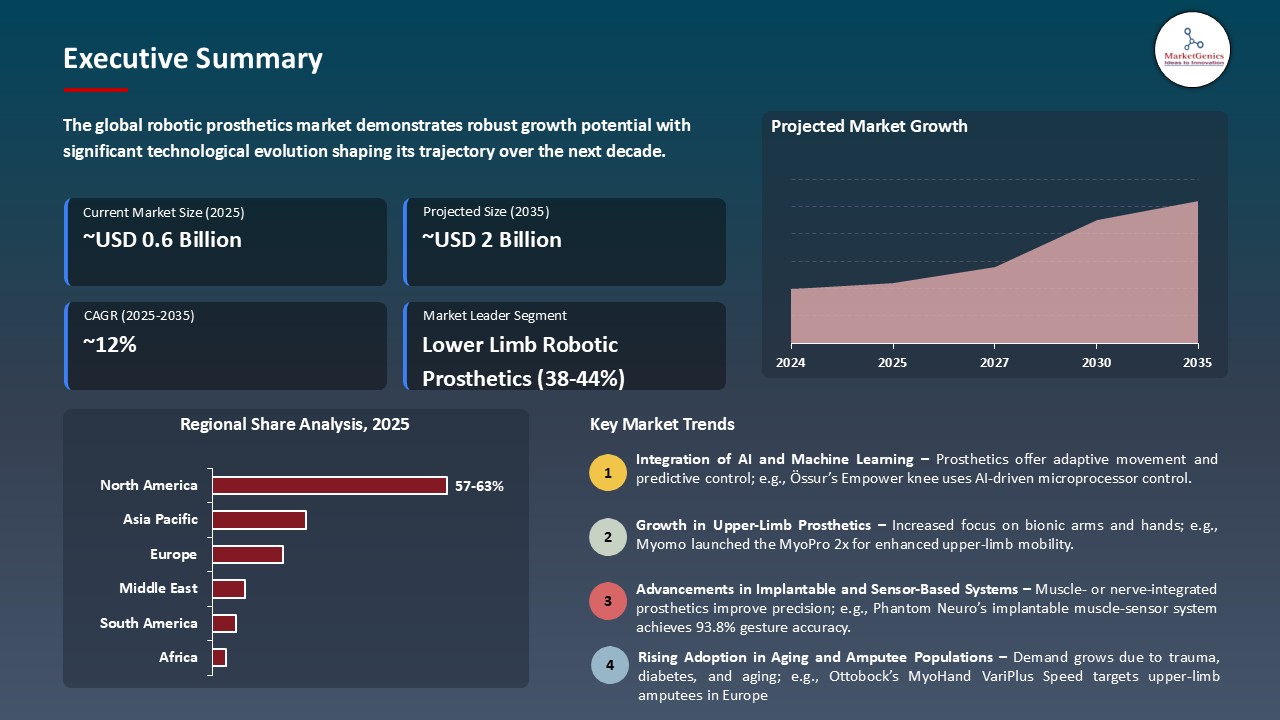

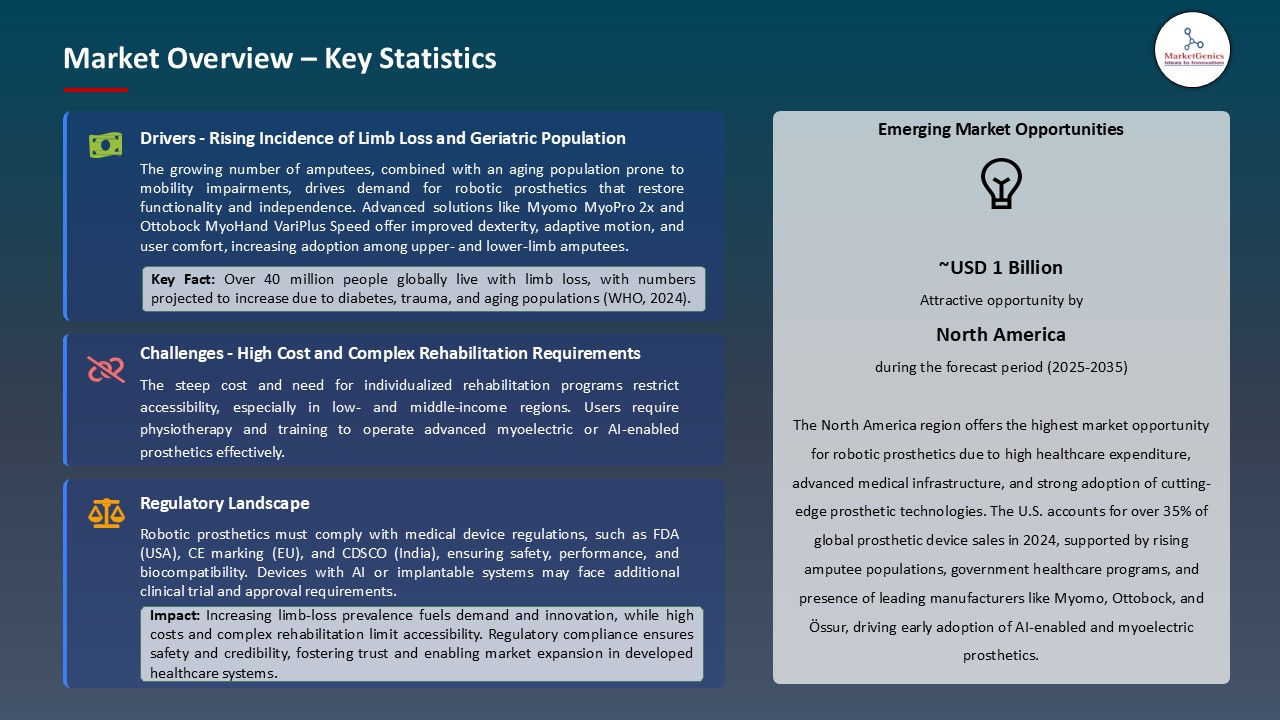

With a significant compounded annual growth rate of 12.3% from 2025-2035, global robotic prosthetics market is poised to be valued at USD 2.2 Billion in 2035. Rising cases of limb amputations because of diabetes and trauma, and the growth of AI and neuromuscular control systems are important contributors to the development of the global robotic prosthetics market.

"In March 2025, Under CEO Oliver Jakobi, Ottobock announced multi-million‑euro investments in two MIT spin‑outs MuscleMetrix and BionicSkins during its ISPO‑concurrent Otto day 2025 event. MuscleMetrix develops magnetic implant-based neuroprosthetic interfaces for intuitive limb control, while BionicSkins offers AI-guided 3D socket design and automated fitting using CT imaging and 3D printing."

In May 2025 Ossur introduced an AI-powered bionic leg that utilized adaptive real-time terrain identification to improve mobility and comfort to the user. On the same note, Open Bionics released a new Hero Arm specifically designed to work with children, which is more affordable and functional. Innovation in technology and increased medical demand are collectively raising the pace at which robotic prosthetic is adopted into both developed and the emerging markets.

Rehabilitation robotics, wearable exoskeletons, and brain-computer interface (BCI) systems represent a great opportunity to the global robotic prosthetics market. Along with prosthetics, these technologies can be used to complement mobility, neural control, and therapy results and establish an ecosystem of care around amputees and neuromuscular patients. The synergies with other neighboring technologies are widening horizons of innovation potential in the prosthetics environment as well as the patient-centric solutions.

Robotic Prosthetics Market Dynamics and Trends

Driver: Enhanced Patient Mobility via AI-Powered Prosthetics

- The faster development of artificial intelligence and sensor technology is driving the global robotic prosthetics market by providing high-level mobility and gait flexibility of use to the user. In April 2025, Ottobock unreleased its Genium X4 microprocessor-controlled leg, which would allow users to walk through rough surfaces, climb stairs, and self-adjust in real-time with a next-level balance and natural motion that could not be achieved by the previous models.

- Equally, in June 2025, Ossur reported an upgrade of its Proprio Foot, with the addition of machine-learning algorithms, which predict user intent and plot, and reduce cognitive burden during ambulation. Bilateral amputees and active veterans are particularly affected as these breakthroughs present additional autonomy and functionality. The market of intelligent prosthetics is the market of ever-growing need as the population grows older and wants to be mobile enough.

- The advancements through AI are transforming patient outcomes and increasing adoption rates and strengthening the momentum in the market.

Restraint: High Costs and Complex Reimbursement Landscape

- Although the technological advances made in this aspect have been very encouraging, high cost of robotic prosthetics and indeterminate reimbursement structure forms a major hindering factor to this business. Artificial legs with a custom AI addition may reach USD 80,000-120,00, which might be more than what insurance covers. In another example, shortly after the first months of 2025, patients in the U.K. complained of not being able to get Ottobock s” Genium X4 in a timely manner because of limits in NHS budgets and prior authorization requirements, whereas US veterans negotiated the labyrinths of approval.

- Also, some countries with lower and middle-income do not have distinct reimbursement policies from which even basic devices are hard to obtain. Such economic and systemic barriers have a disproportionately burdensome impact on pediatric and bilateral amputees, inhibits market penetration and hold up commercial growth in underserved territories.

- • Laws are some of the key factors that restrict access and the rate of adopting the use of medical marijuana across countries, particularly those with inaccessible premium healthcare provision.

Opportunity: Integration with Wearable Biomedical Sensors

- There is a large opportunity to integrate robotic prosthetics into wearable biomedical sensors and tele-rehabilitation platforms, providing dynamic, person-specific support. In March 2025, Coapt LLC released an exoskeleton-type controller on an arm-prosthesis with integrated EMG sensors that regulate grip force and movement according to the signs of muscle fatigue. Soon, Open Bionics started beta trials of their Hero Arm augmented with skin-mounted biomechanical trackers and connection to smartphone, which allows remote tuning and progress tracking.

- This combination enables calibration to condition, improves user comfort, and improves clinician collaboration through cloud-connected ecosystems. In addition, connection to wearable wellbeing gadgets makes it conceivable to approach complete recuperation, growing prosthetic market entrance to telemedical and domestic care.

- Prosthetics impregnated by sensors are cracking the door wide open on remote care patterns, data-driven optimization, the expansion of access and customer-experience generated innovation.

Key Trend: Modular, 3D-Printed Prosthetics for Global Accessibility

- An increasingly popular feature of robotic prosthetics is adoption of modular, 3D-printed parts, to lower cost, and aid customization. In May 2025, Mobius Bionics released a 3D-printed lower-limb socketing system that is matched with its motorized ankle unit providing customized fit in addition to less than a full third the cost of conventional sockets. Likewise, Open Bionics presented user-changeable modular MyArm kits consisting of 3D-printed fingers to cut maintenance costs and simplify repairs in distant locales.

- This transition will democratize the situation and enable local manufacturing of prosthetics, which are high functionality and low cost, by clinics and maker spaces in emerging economies. Once distributed manufacturing reaches maturity, it will enable the company to reduce its lead time in iterating any design, producing in its location, and reacting to anatomy needs.

- 3D-printed, modular prostheses are making substrates more available and establishing a more representative marketplace by being both high-tech and inexpensive.

Robotic Prosthetics Market Analysis and Segmental Data

Based on Component, the Lower Limb Robotic Prosthetics Segment Retains the Largest Share

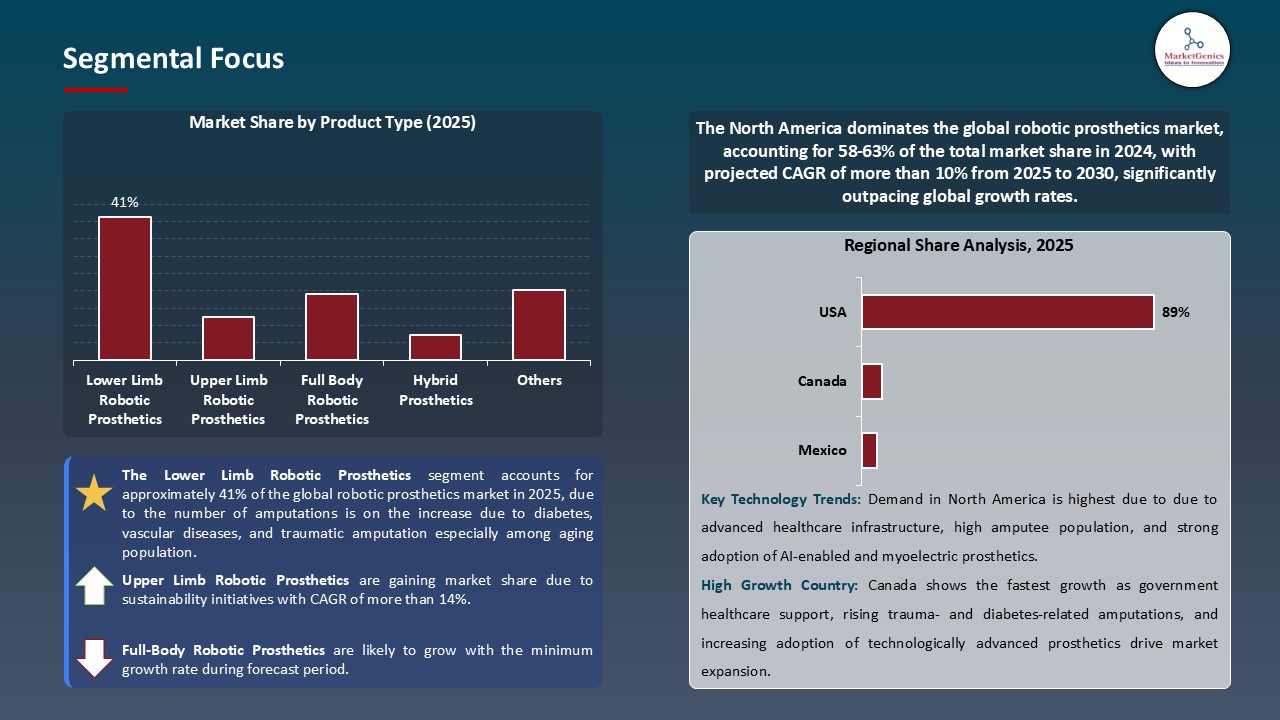

- The lower limb robotic prosthetics segment holds major share ~41% in the global robotic prosthetics market. The demand of lower limb robotic prosthetics is also largest in the world market since the number of amputations is on the increase due to diabetes, vascular diseases, and traumatic amputation especially among aging population. These prosthetics afford the much-needed mobility, stability, and gait correction, which are fundamental towards everyday activities. Ottobock rolled out its Genium x4 knee system with AI-powered terrain adaptation and water-proof construction in April 2025, to keep their users active and minimizing risks of falls.

- There are also improved microprocessor-controlled knees and powered ankles, which are influencing the use since veterans and elderly persons have adopted them. In March 2025, Össur released the Power Knee 2.0, which interprets the muscle signal in real-time to help in walking uphill, and climbing stairs, enhancing autonomy. These devices satisfy the clinical requirements and the demands of the users and enhance their natural movements.

- Among the major drivers of preference in the lower limb prosthetics segment is high levels of medical necessity paired up with performance-centricized innovation, which is entrenching the segment as the dominant one in the robotic prosthetics market.

North America Dominates Global Robotic Prosthetics Market in 2025 and Beyond

- North America: North America is the highest rank in the global robotic prosthetics market because it has a strong healthcare system, spending per capita in healthcare and its robust reimbursement system. The Department of Veterans Affairs has recently awarded a contract to develop advanced artificial intelligence (AI)-enabled actual legs, which means that this year veterans will be able to access Ottobock Genium X4 and Proprio Ossur artificial legs at any VA clinic in the country, which can be considered federal support and simplification of obtaining existing artificial legs. This institution support is a morale booster of the clinicians and results in wider adoption.

- Additionally, some of the most dominant mills in the production of prosthetics are located in North America, which means that more innovations are introduced more quickly in an area like the Open Bionics Hero Pro arm, which is currently available in more than 15 states across the U.S. since its expansion in the country occurred during the middle of the year 2025. Good clinician training programs and research alliances with the best universities also motivate acceptance by the end users.

- The developed healthcare processes and favorable ecosystem in North America are propelling innovation proliferation and growth by robotic prosthetics in the market

Robotic Prosthetics Market Ecosystem

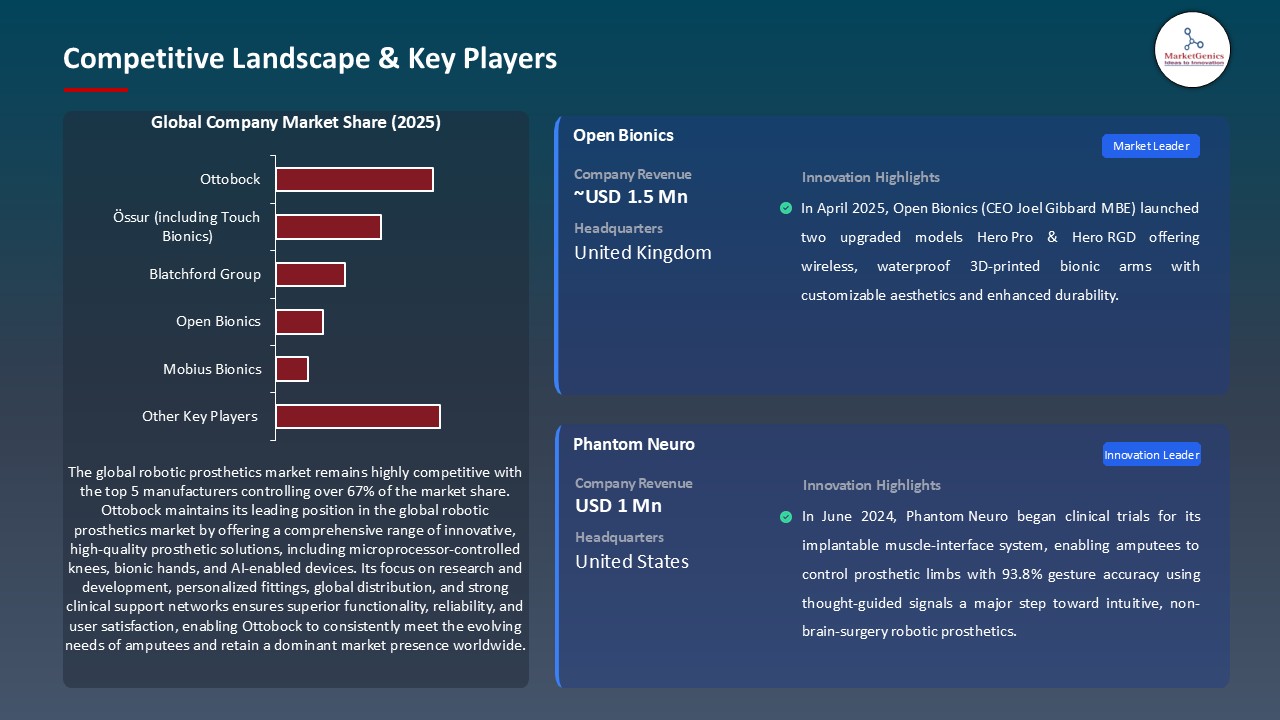

Key players in the global robotic prosthetics market include prominent companies such as Ottobock, Össur (including Touch Bionics), Blatchford Group, Open Bionics, Mobius Bionics and Other Key Players.

The robotic prosthetics market is moderately fragmented. Tier 1 players such as Össur, Ottobock, and Mobius Bionics lead and foster advanced bionics, AI integration, and worldwide rehabilitation networks. Whereas Tier 2 and Tier 3 players like Touch Bionics and Open Bionics look into cheap or niche products. The buyer concentration is low because of the nature of individualized clinical applications, while supplier concentration is high due to limited availability of precision actuators, neural interfaces, and components that have passed regulatory clearance and that are crucial for the working of prosthetics.

Recent Development and Strategic Overview:

- In April 2025, Myomo, Inc., led by CEO Paul Gudonis, unveiled the MyoPro 2x an enhanced powered upper‑limb orthosis designed for improved fit, donning ease, and user independence. Engineered from direct feedback across 3,000+ users, this iteration delivers more intuitive function and comfort, advancing accessibility for individuals with neuromuscular impairments.

- In December 2024, Phantom Neuro, a neurotechnology startup, initiated clinical trials of its implantable muscle‑sensor system, achieving 93.8% gesture accuracy in a study of 10 participants including amputee Alex Smith. This muscle-implant surpasses surface electrode controls, offering faster, more precise myoelectric prosthesis operation without invasive brain surgery.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.6 Bn |

|

Market Forecast Value in 2035 |

USD 2.2 Bn |

|

Growth Rate (CAGR) |

12.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Robotic Prosthetics Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Technology |

|

|

By Component |

|

|

By Mobility Level |

|

|

By Application |

|

|

By End Users |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Robotic Prosthetics Market Outlook

- 2.1.1. Robotic Prosthetics Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Robotic Prosthetics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.1. Global Automation & Process Control Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Integration of robotics, AI, sensors, and materials science enables prosthetics to mimic natural movement and offer personalized control.

- 4.1.1.2. Increasing amputations due to diabetes, vascular diseases, accidents, and aging populations are expanding the user base

- 4.1.1.3. Growing healthcare investments & awareness

- 4.1.2. Restraints

- 4.1.2.1. High costs and limited accessibility.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material/ Component Suppliers

- 4.4.2. Technology Providers/ System Integrators

- 4.4.3. Robotic Prosthetics Manufacturers

- 4.4.4. Dealers and Distributors

- 4.4.5. End User/ Customer

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Robotic Prosthetics Market Demand

- 4.9.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Robotic Prosthetics Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Lower Limb Robotic Prosthetics

- 6.2.2. Upper Limb Robotic Prosthetics

- 6.2.3. Full Body Robotic Prosthetics

- 6.2.4. Hybrid Prosthetics (combined sensor and motor functions)

- 6.2.5. Others

- 7. Global Robotic Prosthetics Market Analysis, by Technology

- 7.1. Key Segment Analysis

- 7.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Technology, 2021-2035

- 7.2.1. Microprocessor-Controlled Prosthetics

- 7.2.2. Myoelectric Prosthetics

- 7.2.3. Targeted Muscle Reinnervation (TMR)

- 7.2.4. Adaptive Learning and AI-Based Prosthetics

- 7.2.5. Body-Powered Prosthetics

- 7.2.6. Others

- 8. Global Robotic Prosthetics Market Analysis, by Component

- 8.1. Key Segment Analysis

- 8.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 8.2.1. Sensors

- 8.2.2. Actuators

- 8.2.3. Power Supply Units (Batteries, Charging Systems)

- 8.2.4. Controllers (Microcontrollers, Processors)

- 8.2.5. Software (Machine Learning, Control Algorithms)

- 8.2.6. Frame/Socket and Structural Components

- 8.2.7. Others

- 9. Global Robotic Prosthetics Market Analysis, by Mobility Level

- 9.1. Key Segment Analysis

- 9.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Mobility Level, 2021-2035

- 9.2.1. Active (Motor-Driven) Prosthetics

- 9.2.2. Passive Prosthetics

- 9.2.3. Semi-Active Prosthetics

- 10. Global Robotic Prosthetics Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Trauma Cases (e.g., road accidents, workplace injuries)

- 10.2.2. Congenital Conditions

- 10.2.3. Vascular Diseases (e.g., diabetes-related amputations)

- 10.2.4. Sports & Orthopedic Injuries

- 10.2.5. Combat & War Injuries

- 10.2.6. Others

- 11. Global Robotic Prosthetics Market Analysis, by End User

- 11.1. Key Segment Analysis

- 11.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 11.2.1. Hospitals

- 11.2.2. Prosthetic Clinics

- 11.2.3. Rehabilitation Centers

- 11.2.4. Military & Defense Organizations

- 11.2.5. Home Care Settings

- 11.2.6. Others

- 12. Global Robotic Prosthetics Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales (Manufacturers to Hospitals/Clinics)

- 12.2.2. Third-Party Distributors

- 12.2.3. Online Platforms

- 13. Global Robotic Prosthetics Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Robotic Prosthetics Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Robotic Prosthetics Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Technology

- 14.3.3. Component

- 14.3.4. Mobility Level

- 14.3.5. Application

- 14.3.6. End User

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Robotic Prosthetics Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Technology

- 14.4.4. Component

- 14.4.5. Mobility Level

- 14.4.6. Application

- 14.4.7. End User

- 14.4.8. Distribution Channel

- 14.5. Canada Robotic Prosthetics Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Technology

- 14.5.4. Component

- 14.5.5. Mobility Level

- 14.5.6. Application

- 14.5.7. End User

- 14.5.8. Distribution Channel

- 14.6. Mexico Robotic Prosthetics Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Technology

- 14.6.4. Component

- 14.6.5. Mobility Level

- 14.6.6. Application

- 14.6.7. End User

- 14.6.8. Distribution Channel

- 15. Europe Robotic Prosthetics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Technology

- 15.3.3. Component

- 15.3.4. Mobility Level

- 15.3.5. Application

- 15.3.6. End User

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Robotic Prosthetics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Technology

- 15.4.4. Component

- 15.4.5. Mobility Level

- 15.4.6. Application

- 15.4.7. End User

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Robotic Prosthetics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Technology

- 15.5.4. Component

- 15.5.5. Mobility Level

- 15.5.6. Application

- 15.5.7. End User

- 15.5.8. Distribution Channel

- 15.6. France Robotic Prosthetics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Technology

- 15.6.4. Component

- 15.6.5. Mobility Level

- 15.6.6. Application

- 15.6.7. End User

- 15.6.8. Distribution Channel

- 15.7. Italy Robotic Prosthetics Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Technology

- 15.7.4. Component

- 15.7.5. Mobility Level

- 15.7.6. Application

- 15.7.7. End User

- 15.7.8. Distribution Channel

- 15.8. Spain Robotic Prosthetics Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Technology

- 15.8.4. Component

- 15.8.5. Mobility Level

- 15.8.6. Application

- 15.8.7. End User

- 15.8.8. Distribution Channel

- 15.9. Netherlands Robotic Prosthetics Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Technology

- 15.9.4. Component

- 15.9.5. Mobility Level

- 15.9.6. Application

- 15.9.7. End User

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Robotic Prosthetics Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Technology

- 15.10.4. Component

- 15.10.5. Mobility Level

- 15.10.6. Application

- 15.10.7. End User

- 15.10.8. Distribution Channel

- 15.11. Poland Robotic Prosthetics Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Technology

- 15.11.4. Component

- 15.11.5. Mobility Level

- 15.11.6. Application

- 15.11.7. End User

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Robotic Prosthetics Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Technology

- 15.12.4. Component

- 15.12.5. Mobility Level

- 15.12.6. Application

- 15.12.7. End User

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Robotic Prosthetics Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Technology

- 15.13.4. Component

- 15.13.5. Mobility Level

- 15.13.6. Application

- 15.13.7. End User

- 15.13.8. Distribution Channel

- 16. Asia Pacific Robotic Prosthetics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Technology

- 16.3.3. Component

- 16.3.4. Mobility Level

- 16.3.5. Application

- 16.3.6. End User

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Robotic Prosthetics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Technology

- 16.4.4. Component

- 16.4.5. Mobility Level

- 16.4.6. Application

- 16.4.7. End User

- 16.4.8. Distribution Channel

- 16.5. India Robotic Prosthetics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Technology

- 16.5.4. Component

- 16.5.5. Mobility Level

- 16.5.6. Application

- 16.5.7. End User

- 16.5.8. Distribution Channel

- 16.6. Japan Robotic Prosthetics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Technology

- 16.6.4. Component

- 16.6.5. Mobility Level

- 16.6.6. Application

- 16.6.7. End User

- 16.6.8. Distribution Channel

- 16.7. South Korea Robotic Prosthetics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Technology

- 16.7.4. Component

- 16.7.5. Mobility Level

- 16.7.6. Application

- 16.7.7. End User

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Robotic Prosthetics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Technology

- 16.8.4. Component

- 16.8.5. Mobility Level

- 16.8.6. Application

- 16.8.7. End User

- 16.8.8. Distribution Channel

- 16.9. Indonesia Robotic Prosthetics Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Technology

- 16.9.4. Component

- 16.9.5. Mobility Level

- 16.9.6. Application

- 16.9.7. End User

- 16.9.8. Distribution Channel

- 16.10. Malaysia Robotic Prosthetics Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Technology

- 16.10.4. Component

- 16.10.5. Mobility Level

- 16.10.6. Application

- 16.10.7. End User

- 16.10.8. Distribution Channel

- 16.11. Thailand Robotic Prosthetics Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Technology

- 16.11.4. Component

- 16.11.5. Mobility Level

- 16.11.6. Application

- 16.11.7. End User

- 16.11.8. Distribution Channel

- 16.12. Vietnam Robotic Prosthetics Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Technology

- 16.12.4. Component

- 16.12.5. Mobility Level

- 16.12.6. Application

- 16.12.7. End User

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Robotic Prosthetics Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Technology

- 16.13.4. Component

- 16.13.5. Mobility Level

- 16.13.6. Application

- 16.13.7. End User

- 16.13.8. Distribution Channel

- 17. Middle East Robotic Prosthetics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Technology

- 17.3.3. Component

- 17.3.4. Mobility Level

- 17.3.5. Application

- 17.3.6. End User

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Robotic Prosthetics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Technology

- 17.4.4. Component

- 17.4.5. Mobility Level

- 17.4.6. Application

- 17.4.7. End User

- 17.4.8. Distribution Channel

- 17.5. UAE Robotic Prosthetics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Technology

- 17.5.4. Component

- 17.5.5. Mobility Level

- 17.5.6. Application

- 17.5.7. End User

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Robotic Prosthetics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Technology

- 17.6.4. Component

- 17.6.5. Mobility Level

- 17.6.6. Application

- 17.6.7. End User

- 17.6.8. Distribution Channel

- 17.7. Israel Robotic Prosthetics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Technology

- 17.7.4. Component

- 17.7.5. Mobility Level

- 17.7.6. Application

- 17.7.7. End User

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Robotic Prosthetics Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Technology

- 17.8.4. Component

- 17.8.5. Mobility Level

- 17.8.6. Application

- 17.8.7. End User

- 17.8.8. Distribution Channel

- 18. Africa Robotic Prosthetics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Technology

- 18.3.3. Component

- 18.3.4. Mobility Level

- 18.3.5. Application

- 18.3.6. End User

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Robotic Prosthetics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Technology

- 18.4.4. Component

- 18.4.5. Mobility Level

- 18.4.6. Application

- 18.4.7. End User

- 18.4.8. Distribution Channel

- 18.5. Egypt Robotic Prosthetics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Technology

- 18.5.4. Component

- 18.5.5. Mobility Level

- 18.5.6. Application

- 18.5.7. End User

- 18.5.8. Distribution Channel

- 18.6. Nigeria Robotic Prosthetics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Technology

- 18.6.4. Component

- 18.6.5. Mobility Level

- 18.6.6. Application

- 18.6.7. End User

- 18.6.8. Distribution Channel

- 18.7. Algeria Robotic Prosthetics Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Technology

- 18.7.4. Component

- 18.7.5. Mobility Level

- 18.7.6. Application

- 18.7.7. End User

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Robotic Prosthetics Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Technology

- 18.8.4. Component

- 18.8.5. Mobility Level

- 18.8.6. Application

- 18.8.7. End User

- 18.8.8. Distribution Channel

- 19. South America Robotic Prosthetics Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Robotic Prosthetics Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Technology

- 19.3.3. Component

- 19.3.4. Mobility Level

- 19.3.5. Application

- 19.3.6. End User

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Robotic Prosthetics Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Technology

- 19.4.4. Component

- 19.4.5. Mobility Level

- 19.4.6. Application

- 19.4.7. End User

- 19.4.8. Distribution Channel

- 19.5. Argentina Robotic Prosthetics Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Technology

- 19.5.4. Component

- 19.5.5. Mobility Level

- 19.5.6. Application

- 19.5.7. End User

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Robotic Prosthetics Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Technology

- 19.6.4. Component

- 19.6.5. Mobility Level

- 19.6.6. Application

- 19.6.7. End User

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. BiOM (iWalk)

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. BionX Medical Technologies

- 20.3. Blatchford

- 20.4. Coapt, LLC

- 20.5. Cyberdyne Inc.

- 20.6. DEKA Integrated Solutions (Luke Arm)

- 20.7. Ekso Bionics

- 20.8. Exceed Prosthetics

- 20.9. Fourier Intelligence

- 20.10. Hanger, Inc.

- 20.11. Levitate Technologies

- 20.12. Mobius Bionics

- 20.13. Myomo Inc.

- 20.14. Open Bionics

- 20.15. Ossur

- 20.16. Ottobock

- 20.17. ReWalk Robotics

- 20.18. RSLSteeper

- 20.19. Touch Bionics (part of Ossur)

- 20.20. Other Key Players

- 20.1. BiOM (iWalk)

Note* - This is just tentative list of players. While providing the report, we will cover a more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation