Shaving Care Market Size, Share, Growth Opportunity Analysis Report by Product (Razors and Blades, Shaving Creams, Shaving Foams, Shaving Gels, Aftershave Products (Lotions, Balms, Sprays), Pre-shave Products (Oils, Cleansers) Wax and Depilatories, Electric Shavers and Trimmers and Others), Category, Gender, Skin Type, Price Range, End-user, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Shaving Care Market Size, Share, and Growth

The global shaving care market is projected to grow from USD 14.5 Billion in 2025 to USD 21.6 Billion by 2035, with a strong CAGR of 3.7% during the forecast period. This growth is mainly driven by rising awareness of personal grooming, demand for premium shaving products, and innovations catering to sensitive skin and sustainable lifestyles.

“The world's first plastic‑free shaving system will cost you only $10.”- Nimbi, discussing its newly launched eco-friendly shaving system made from waste wood pulp, pine oil, and clay, priced accessibly and fully vegan.

Innovation is also helping the market growth. For instance, in 2024, Gillette introduced the ‘Planet KIND’ razor range made of recycled plastic and packaging for the environmentally aware users without sacrificing performance. These kinds of product lines exemplify the ways in which brands are combining performance with sustainability in order to appeal to contemporary consumers.

Massive growth of the shaving care market is also attributed to digital outreach, influencer marketing, and demand from developing economies. For instance, Beardo and Bombay Shaving Company both have quickly grown with hyper-digital first approach to take grooming products to Tier 2 and Tier 3 cities. These campaigns serve not only to boost market penetration but also contribute to change of grooming behaviour in previously untapped regions that make a contribution to spread the footprint of global shaving care brands.

Shaving Care Market Dynamics and Trends

Driver: Rising Focus on Personal Grooming and Hygiene Awareness

- There has been increasing focus on personal grooming, skin care, and hygiene, particularly after the pandemic, which has fuelled demand for premium quality shaving care products in both men and women. For instance, Procter & Gamble extended its Gillette SkinGuard range targeted at men with a propensity to razor burns and bumps, receiving impressive interest from the dermatologist community and with consumers as well.

- With growing consumer interest towards skin health and grooming rituals, this shift towards health and skin care products is anticipated to foster new product development leading the shaving care market in both the urban and semi urban regions where disposable income and lifestyle changes are driving the penetration of the shaving care market.

Restraint: Rising Competition from Alternative Grooming Solutions

- The market for shaving care is under pressure from competitors like laser hair-removal, electric trimmers and waxing products that make hair removal more permanent. These are becoming popular, especially with busy or younger customers that want something more convenient and low-maintenance. For instance, Philips and Braun have diversified their grooming appliance options to include body-safe, precision-targeted electric shavers and IPL (Intense Pulsed Light) devices, which provide lasting results with minimal skin-irritation.

- This shift in consumer preferences is gradually reducing the frequency of traditional shaving product usage. multi-functional grooming gadgets are reaching the masses at affordable price points. Hence, brands within the shaving care category need to differentiate themselves with new personalized offerings, across skin care integration and even premium experiences to retain relevance in a diversifying grooming market.

Opportunity: Growing Demand for Gender-Neutral and Inclusive Grooming Products

- The increasing awareness and inclusivity of different genders and skin types has led to a growing market of shaving care products which serve everyone. Consumers are also shunning heavily gendered branding in favor of 'products that emphasize performance, sensitivity, skin compatibility. For Instances, in 2023, Billie, expanded its product range offering with gender-neutral razors and shaving creams suitable for all skin types, impressing many of the Gen-Z and millennials who appreciate brands that are inclusive and transparent. This movement is opening up entirely new market segments by making it possible for brands to distinguish themselves in a crowded space. Companies that embrace diverse product development and marketing can build brand loyalty, and reach out to unfocused or overlooked consumer groups.

- Digital-first, subscription-based shaving brands are gaining momentum by offering personalized, convenient grooming solutions delivered directly to consumers. For instance, Dollar Shave Club have built strong customer bases through customizable plans, affordable pricing, and digital engagement, reshaping how consumers purchase grooming products.

Key Trend: Elevated Demand for Natural, Clean-Label, and Dermatologist-Tested Shaving Products

- There is a growing trend of consumers moving towards shaving care products that make use of the natural and non-skin toxic ingredients. The clean beauty movement is affecting shaving creams, gels, and aftershaves, and a high priority is placed on sulphate-free, paraben-free, and alcohol-free solutions. For Instance, Bulldog Skincare expanded its sensitive skin shaving range using aloe vera, green tea and camelina oil, free from artificial colors or synthetic fragrances. These products became popular with men who suffered from sensitive skin, and with eco-friendly consumers.

- This trend reflects increasing consumer interest in transparency and wellness-oriented grooming. Clean-label formulations and dermatologist-backed claims align with a direction the industry is taking toward safer, more ethical product offerings and better appeal to establish trust and drive trial among health aware users.

Shaving Care Market Analysis and Segmental Data

Razors and Blades holds majority share in Shaving Care Market

- Razors and Blades are leading the market with 66% share at global level driven by high-frequency usage, product variety, and continued consumer reliance on manual grooming tools. These items are essential in daily-use necessities, particularly for men, and are frequently bought in multi-packs or via subscription services that result in repeat sales. Brand leaders such as Gillette, Bic, and Schick continue to stand at the forefront of razor innovation with blade precision, ergonomic design and skin protection technology.

- Electric shavers and grooming devices are gaining popularity, but they cater to a more niche, premium audience. Razors and blades continue to be the most effective and affordable solution for the mass market. Wide distribution at supermarkets, pharmacies, and e-commerce enable the ongoing dominance, especially in price-sensitive and emerging markets where traditional grooming habits still prevail.

North America Dominates Shaving Care Market in 2025 and Beyond

- North America leads the global shaving care market with a dominant share of 44% in 2025, as consumers continue to spend on personal grooming, high preference of consumers towards premium offerings and strong retail presence. The U.S. is a key player such as Gillette (P&G), Harry’s, Dollar Shave Club and their diversified portfolio offerings in both an offline and online capacity. Growing trends in subscription grooming kits and clean-label products have also helped to fuelled category expansion.

- Consumers in the region are highly engaged with self-care routines with easy access to technological advancements in shaving products and dermatologist tested solutions. Moreover, e-commerce advanced in North America and innovation is a focus, so new formats like green razors, skin-contact gels are more easily taken up by the market. These attributes will allow the region to continue to lead in the shaving care category until 2035.

Shaving Care Market Ecosystem

The global shaving care market is moderately consolidated, with Tier 1 players like Procter & Gamble, Unilever, and Philips N.V. dominating through premium innovations, while Tier 2–3 brands such as Harry’s and Dollar Shave Club gain traction via affordability and direct-to-consumer models. Buyer concentration remains high, with strong brand loyalty influencing purchase decisions, whereas supplier concentration is low-to-moderate given multiple raw material sources, enabling manufacturers to diversify inputs and maintain competitive margins within a dynamic but brand-driven ecosystem.

Recent Developments and Strategic Overview

- In 2025, Gillette launched its new Planet KIND shaving range in Europe, featuring razors and shaving gels made with recycled plastics and naturally derived ingredients. The line is part of Procter & Gamble’s broader push toward sustainability and offers refillable razor handles and recyclable packaging aimed at eco-conscious consumers.

- In 2025, Beiersdorf expanded its NIVEA Men grooming line with a sensitive skin shaving foam infused with oat extract and vitamin E, tailored for markets in Southeast Asia. The launch responds to rising demand for skin-friendly shaving solutions among younger male consumers in humid climates.

- In 2024, Edgewell Personal Care announced a partnership with TerraCycle to introduce a take-back program for used razors and blades across North America. This initiative supports waste reduction and circular product development, enhancing the brand’s sustainability image in the grooming category.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 14.5 Billion |

|

Market Forecast Value in 2035 |

USD 21.6 Billion |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Shaving Care Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Category

|

|

|

By Gender

|

|

|

By Skin Type |

|

|

By Price Range |

|

|

By End User |

|

|

By Distribution Channel |

|

Frequently Asked Questions

The Shaving Care Market includes grooming products such as razors, shaving creams, gels, foams, aftershaves, and skincare treatments formulated for pre- and post-shaving routines. These products are designed to enhance shaving comfort, reduce irritation, and support personal grooming needs for both men and women.

The market is valued at USD 14.5 Billion

The market is expected to grow at a CAGR of 3.7 % from 2025 to 2035.

Razors and blades lead the market, supported by high product turnover, strong brand loyalty, and continuous innovation in shaving systems.

North America dominates the market with share of ~44%.

Growth is fueled by rising personal grooming awareness, increasing demand for sustainable and skin-friendly products, e-commerce expansion, and product innovation targeting diverse skin types and consumer preferences.

Beiersdorf AG, Bic Group, Braun GmbH, Colgate-Palmolive Company, Dollar Shave Club, Dorco Co. Ltd., Edgewell Personal Care, Feather Safety Razor Co., Ltd., Flamingo (a Harry’s brand), Gillette (a brand of P&G), Harry’s Inc., L’Oréal S.A., Panasonic Corporation, Philips N.V., Procter & Gamble Co., Reckitt Benckiser Group plc, Schick (a brand of Edgewell), The Estée Lauder Companies Inc., Unilever PLC, Wahl Clipper Corporation, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Shaving Care Market Outlook

- 2.1.1. Shaving Care Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-User Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Shaving Care Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Consumer Goods & Services Industry

- 3.1.3. Regional Distribution for Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain/Distributor

- 3.5.3. End Consumer

- 3.1. Global Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing societal acceptance and encouragement of male grooming, coupled with increasing awareness of self-care routines, is significantly boosting demand for shaving products globally.

- 4.1.1.2. Consumers are increasingly seeking shaving products made with natural, sustainable, and skin-friendly ingredients, prompting innovation in shaving creams, gels, and post-shave care formulations.

- 4.1.1.3. The growth of online platforms and direct-to-consumer subscription services is enhancing accessibility and convenience, especially for niche and premium shaving brands.

- 4.1.2. Restraints

- 4.1.2.1. Trends such as bearded looks and hybrid work culture are reducing the daily need for shaving among men, especially in North America and Europe, thereby impacting product consumption.

- 4.1.2.2. The presence of numerous local and international brands offering similar product lines has intensified competition, often leading to price wars and margin pressures.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Category

- 4.4.2. Product

- 4.4.3. Wholesalers/ Distributor

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Shaving Care Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Billion), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Billion), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Shaving Care Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Razors and Blades

- 6.2.2. Shaving Creams

- 6.2.3. Shaving Foams

- 6.2.4. Shaving Gels

- 6.2.5. Aftershave Products (Lotions, Balms, Sprays)

- 6.2.6. Pre-shave Products (Oils, Cleansers)

- 6.2.7. Wax and Depilatories

- 6.2.8. Electric Shavers and Trimmers

- 6.2.9. Others

- 7. Shaving Care Market Analysis, by Category

- 7.1. Key Segment Analysis

- 7.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Category, 2021-2035

- 7.2.1. Manual Shaving Products

- 7.2.2. Electric Shaving Products

- 7.2.3. Disposable Shaving Products

- 7.2.4. Reusable Shaving Products

- 8. Shaving Care Market Analysis, by Gender

- 8.1. Key Segment Analysis

- 8.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Gender, 2021-2035

- 8.2.1. Male

- 8.2.2. Female

- 8.2.3. Unisex

- 9. Shaving Care Market Analysis, by Skin Type

- 9.1. Key Segment Analysis

- 9.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Skin Type, 2021-2035

- 9.2.1. Normal Skin

- 9.2.2. Sensitive Skin

- 9.2.3. Dry Skin

- 9.2.4. Oily Skin

- 9.2.5. Others

- 10. Shaving Care Market Analysis, by Price Range

- 10.1. Key Segment Analysis

- 10.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Price Range, 2021-2035

- 10.2.1. Premium

- 10.2.2. Mid-range

- 10.2.3. Economy

- 11. Shaving Care Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Specialty Stores

- 11.2.3. Pharmacies & Drugstores

- 11.2.4. Online Retail

- 11.2.5. Convenience Stores

- 11.2.6. Departmental Stores

- 12. Shaving Care Market Analysis, by End-User

- 12.1. Key Segment Analysis

- 12.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by End-User, 2021-2035

- 12.2.1. Individual/Personal Use

- 12.2.2. Salons and Barbershops

- 12.2.3. Spas and Aesthetic Clinics

- 12.2.4. Others

- 13. Shaving Care Market Analysis and Forecasts, By Region

- 13.1. Key Findings

- 13.2. Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Shaving Care Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Category

- 14.3.3. Gender

- 14.3.4. Skin Type

- 14.3.5. Price

- 14.3.6. End-User

- 14.3.7. Distribution

- 14.3.8. Country

-

- 14.3.8.1.1. USA

- 14.3.8.1.2. Canada

- 14.3.8.1.3. Mexico

-

- 14.4. USA Shaving Care Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Category

- 14.4.4. Gender

- 14.4.5. Skin Type

- 14.4.6. Price

- 14.4.7. End-User

- 14.4.8. Distribution

- 14.5. Canada Shaving Care Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Category

- 14.5.4. Gender

- 14.5.5. Skin Type

- 14.5.6. Price

- 14.5.7. End-User

- 14.5.8. Distribution

- 14.6. Mexico Shaving Care Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Category

- 14.6.4. Gender

- 14.6.5. Skin Type

- 14.6.6. Price

- 14.6.7. End-User

- 14.6.8. Distribution

- 15. Europe Shaving Care Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Country Segmental Analysis

- 15.3.2. Product Type

- 15.3.3. Category

- 15.3.4. Gender

- 15.3.5. Skin Type

- 15.3.6. Price

- 15.3.7. End-User

- 15.3.8. Distribution

- 15.3.9. Country

- 15.3.9.1. Germany

- 15.3.9.2. United Kingdom

- 15.3.9.3. France

- 15.3.9.4. Italy

- 15.3.9.5. Spain

- 15.3.9.6. Netherlands

- 15.3.9.7. Nordic Countries

- 15.3.9.8. Poland

- 15.3.9.9. Russia & CIS

- 15.3.9.10. Rest of Europe

- 15.4. Germany Shaving Care Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Category

- 15.4.4. Gender

- 15.4.5. Skin Type

- 15.4.6. Price

- 15.4.7. End-User

- 15.4.8. Distribution

- 15.5. United Kingdom Shaving Care Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Category

- 15.5.4. Gender

- 15.5.5. Skin Type

- 15.5.6. Price

- 15.5.7.

- 15.5.8. End-User

- 15.5.9. Distribution

- 15.6. France Shaving Care Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Category

- 15.6.4. Gender

- 15.6.5. Skin Type

- 15.6.6. Price

- 15.6.7. End-User

- 15.6.8. Distribution

- 15.7. Italy Shaving Care Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Category

- 15.7.4. Gender

- 15.7.5. Skin Type

- 15.7.6. Price

- 15.7.7. End-User

- 15.7.8. Distribution

- 15.8. Spain Shaving Care Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Category

- 15.8.4. Gender

- 15.8.5. Skin Type

- 15.8.6. Price

- 15.8.7. End-User

- 15.8.8. Distribution

- 15.9. Netherlands Shaving Care Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Category

- 15.9.4. Gender

- 15.9.5. Skin Type

- 15.9.6. Price

- 15.9.7. End-User

- 15.9.8. Distribution

- 15.10. Nordic Countries Shaving Care Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Category

- 15.10.4. Gender

- 15.10.5. Skin Type

- 15.10.6. Price

- 15.10.7. End-User

- 15.10.8. Distribution

- 15.11. Poland Shaving Care Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Category

- 15.11.4. Gender

- 15.11.5. Skin Type

- 15.11.6. Price

- 15.11.7. End-User

- 15.11.8. Distribution

- 15.12. Russia & CIS Shaving Care Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Category

- 15.12.4. Gender

- 15.12.5. Skin Type

- 15.12.6. Price

- 15.12.7. End-User

- 15.12.8. Distribution

- 15.13. Rest of Europe Shaving Care Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Category

- 15.13.4. Gender

- 15.13.5. Skin Type

- 15.13.6. Price

- 15.13.7. End-User

- 15.13.8. Distribution

- 16. Asia Pacific Shaving Care Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Shaving Care Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Category

- 16.3.3. Gender

- 16.3.4. Skin Type

- 16.3.5. Price

- 16.3.6. End-User

- 16.3.7. Distribution

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Shaving Care Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Category

- 16.4.4. Gender

- 16.4.5. Skin Type

- 16.4.6. Price

- 16.4.7. End-User

- 16.4.8. Distribution

- 16.5. India Shaving Care Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Category

- 16.5.4. Gender

- 16.5.5. Skin Type

- 16.5.6. Price

- 16.5.7. End-User

- 16.5.8. Distribution

- 16.6. Japan Shaving Care Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Category

- 16.6.4. Gender

- 16.6.5. Skin Type

- 16.6.6. Price

- 16.6.7. End-User

- 16.6.8. Distribution

- 16.7. South Korea Shaving Care Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Category

- 16.7.4. Gender

- 16.7.5. Skin Type

- 16.7.6. Price

- 16.7.7. End-User

- 16.7.8. Distribution

- 16.8. Australia and New Zealand Shaving Care Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Category

- 16.8.4. Gender

- 16.8.5. Skin Type

- 16.8.6. Price

- 16.8.7. End-User

- 16.8.8. Distribution

- 16.9. Indonesia Shaving Care Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Category

- 16.9.4. Gender

- 16.9.5. Skin Type

- 16.9.6. Price

- 16.9.7. End-User

- 16.9.8. Distribution

- 16.10. Malaysia Shaving Care Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Category

- 16.10.4. Gender

- 16.10.5. Skin Type

- 16.10.6. Price

- 16.10.7. End-User

- 16.10.8. Distribution

- 16.11. Thailand Shaving Care Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Category

- 16.11.4. Gender

- 16.11.5. Skin Type

- 16.11.6. Price

- 16.11.7. End-User

- 16.11.8. Distribution

- 16.12. Vietnam Shaving Care Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Category

- 16.12.4. Gender

- 16.12.5. Skin Type

- 16.12.6. Price

- 16.12.7. End-User

- 16.12.8. Distribution

- 16.13. Rest of Asia Pacific Shaving Care Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Category

- 16.13.4. Gender

- 16.13.5. Skin Type

- 16.13.6. Price

- 16.13.7. End-User

- 16.13.8. Distribution

- 17. Middle East Shaving Care Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Category

- 17.3.3. Gender

- 17.3.4. Skin Type

- 17.3.5. Price

- 17.3.6. End-User

- 17.3.7. Distribution

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Shaving Care Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Category

- 17.4.4. Gender

- 17.4.5. Skin Type

- 17.4.6. Price

- 17.4.7. End-User

- 17.4.8. Distribution

- 17.5. UAE Shaving Care Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Category

- 17.5.4. Gender

- 17.5.5. Skin Type

- 17.5.6. Price

- 17.5.7. End-User

- 17.5.8. Distribution

- 17.6. Saudi Arabia Shaving Care Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Category

- 17.6.4. Gender

- 17.6.5. Skin Type

- 17.6.6. Price

- 17.6.7. End-User

- 17.6.8. Distribution

- 17.7. Israel Shaving Care Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Category

- 17.7.4. Gender

- 17.7.5. Skin Type

- 17.7.6. Price

- 17.7.7. End-User

- 17.7.8. Distribution

- 17.8. Rest of Middle East Shaving Care Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Category

- 17.8.4. Gender

- 17.8.5. Skin Type

- 17.8.6. Price

- 17.8.7. End-User

- 17.8.8. Distribution

- 18. Africa Shaving Care Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Category

- 18.3.3. Gender

- 18.3.4. Skin Type

- 18.3.5. Price

- 18.3.6. End-User

- 18.3.7. Distribution

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Shaving Care Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Category

- 18.4.4. Gender

- 18.4.5. Skin Type

- 18.4.6. Price

- 18.4.7. End-User

- 18.4.8. Distribution

- 18.5. Egypt Shaving Care Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Category

- 18.5.4. Gender

- 18.5.5. Skin Type

- 18.5.6. Price

- 18.5.7. End-User

- 18.5.8. Distribution

- 18.6. Nigeria Shaving Care Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Category

- 18.6.4. Gender

- 18.6.5. Skin Type

- 18.6.6. Price

- 18.6.7. End-User

- 18.6.8. Distribution

- 18.7. Algeria Shaving Care Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Category

- 18.7.4. Gender

- 18.7.5. Skin Type

- 18.7.6. Price

- 18.7.7. End-User

- 18.7.8. Distribution

- 18.8. Rest of Africa Shaving Care Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Category

- 18.8.4. Gender

- 18.8.5. Skin Type

- 18.8.6. Price

- 18.8.7. End-User

- 18.8.8. Distribution

- 19. South America Shaving Care Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Shaving Care Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Category

- 19.3.3. Gender

- 19.3.4. Skin Type

- 19.3.5. Price

- 19.3.6. End-User

- 19.3.7. Distribution

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Shaving Care Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Category

- 19.4.4. Gender

- 19.4.5. Skin Type

- 19.4.6. Price

- 19.4.7. End-User

- 19.4.8. Distribution

- 19.5. Argentina Shaving Care Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Category

- 19.5.4. Gender

- 19.5.5. Skin Type

- 19.5.6. Price

- 19.5.7. End-User

- 19.5.8. Distribution

- 19.6. Rest of South America Shaving Care Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Category

- 19.6.4. Gender

- 19.6.5. Skin Type

- 19.6.6. Price

- 19.6.7. End-User

- 19.6.8. Distribution

- 20. Key Players/ Company Profile

- 20.1. Beiersdorf AG

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Bic Group

- 20.3. Braun GmbH

- 20.4. Colgate-Palmolive Company

- 20.5. Dollar Shave Club

- 20.6. Dorco Co. Ltd.

- 20.7. Edgewell Personal Care

- 20.8. Feather Safety Razor Co., Ltd.

- 20.9. Flamingo (a Harry’s brand)

- 20.10. Gillette (a brand of P&G)

- 20.11. Harry’s Inc.

- 20.12. L’Oréal S.A.

- 20.13. Panasonic Corporation

- 20.14. Philips N.V.

- 20.15. Procter & Gamble Co.

- 20.16. Reckitt Benckiser Group plc

- 20.17. Schick (a brand of Edgewell)

- 20.18. The Estée Lauder Companies Inc.

- 20.19. Unilever PLC

- 20.20. Wahl Clipper Corporation

- 20.21. Other key Players

- 20.1. Beiersdorf AG

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography.

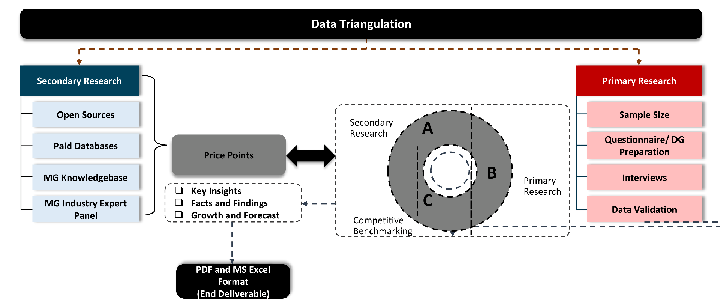

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data