Specialty Oilfield Chemicals Market Size, Share & Trends Analysis Report by Product Type (Corrosion Inhibitors, Demulsifiers, Scale Inhibitors, Biocides, Surfactants, Polymers, Friction Reducers, Paraffin Inhibitors, Asphaltene Inhibitors, Gelling Agents, Clay Stabilizers, Others), Application, Well Type, Reservoir Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Specialty Oilfield Chemicals Market Size, Share, and Growth

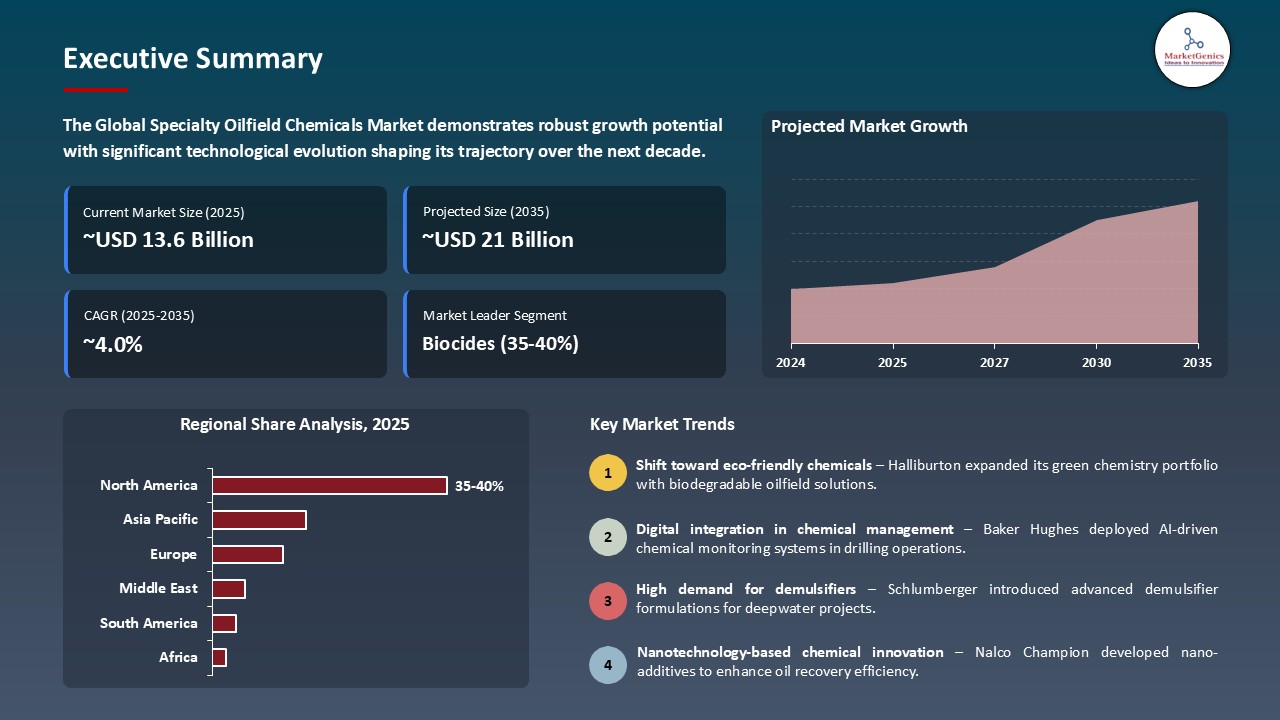

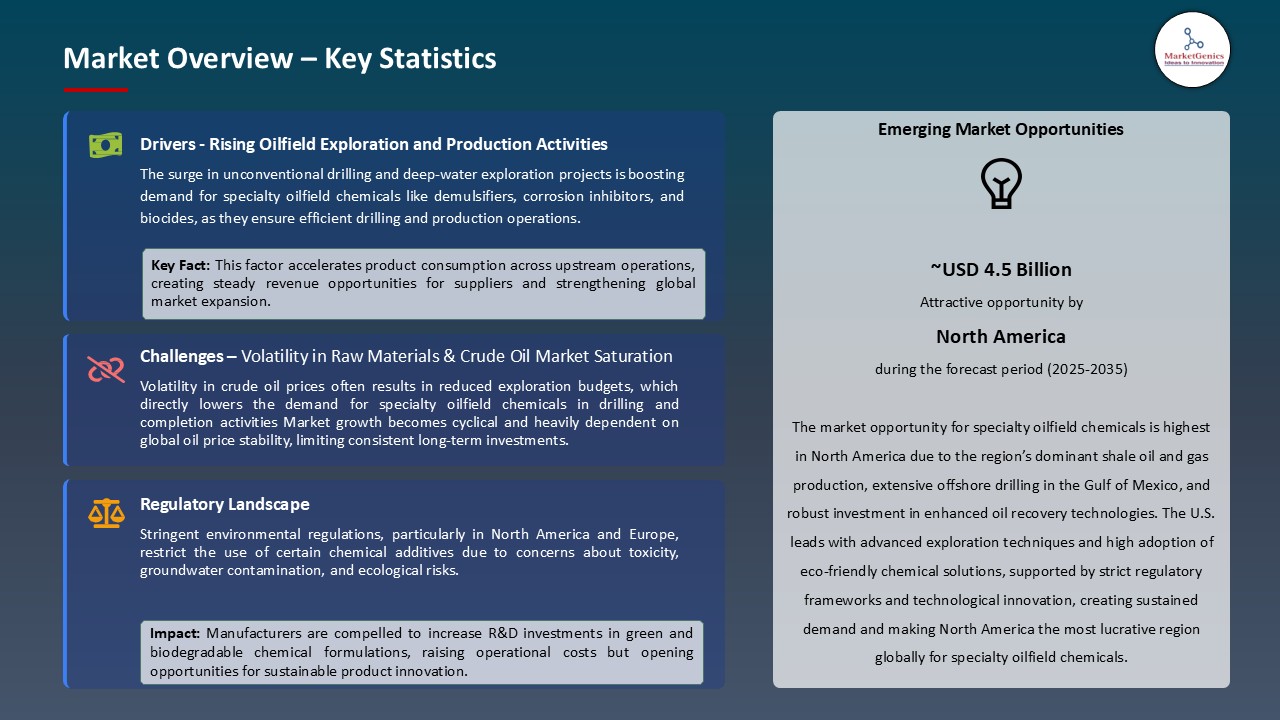

The global specialty oilfield chemicals market is experiencing robust growth, with its estimated value of USD 13.6 billion in the year 2025 and USD 21 billion by the period 2035, registering a CAGR of 4.0%. North America leads the market with market share of 39.2% with USD 5.2 billion revenue.

"Baker Hughes’ CEO Lorenzo Simonelli announced the immediate appointment of Ahmed Moghal as CFO, chosen for his deep insider knowledge of the Industrial & Energy Technology (IET) segment; the move aims to strengthen the company’s pivot to high-growth sectors like LNG, natural gas, digital, and new energy businesses."

In recent years, the global specialty oilfield chemicals sector has gained pivotal momentum thanks to evolving drilling and production complexities that demand precision-formulated chemical solutions tailored to challenging environments. As an example, in February 2025, Baker Hughes won a substantial contract to provide specialty chemicals in the Uaru and Whiptail offshore developments, which are essential offshore developments that highlight the potential of advanced chemical interventions needed to guarantee flow assurance and equipment protection.

The increase in deepwater and ultra-deepwater drilling, along with additional focus on enhanced oil recovery (EOR) methods, only serves to increase the demand of custom-made chemical additives, which boost extraction efficiency and integrity of operations. Such innovations do not only address complex reservoir issues but also fall in line with the overall industry trends of producing smarter with an emphasis on keeping the equipment intact longer so that it does not pollute the environment. The growing complexity of oilfield operational and unique chemical needs is driving strategic investments in specialty oilfield chemicals further strengthening the resilience and growth in the market.

Specialty Oilfield Chemicals Market Dynamics and Trends

Driver: Expanding deepwater projects intensify flow assurance needs, accelerating specialty oilfield chemical adoption globally

- Increased offshore investment is driving operators into hotter, harsher and deeper environments, where flow assurance is becoming mission-critical. The essential defence against uptime, especially in the context of long subsea tiebacks feeding high-throughput FPSOs, is specialty chemicals, scale inhibitors, paraffin/asphaltene dispersant, hydrate inhibitors, and emulsion breakers, alongside integrity solutions associated with the pipe insulation.

- In February 2025, Baker Hughes was awarded a multi-year contract to provide production chemicals and services to the Uaru/ Whiptail developments to be built by ExxonMobil in the Stabroek Block offshore Guyana, including topside, subsea, water injection and utilities on the Errea Wittu and Jaguar FPSO projects, both engineered to extremely large volumes and complex fluids. The scope is an indicator of how operators are packaging chemistry with monitoring, logistics, and on-site technical service to entrench reliability at first oil and beyond.

- These projects impose specifications that trickle down through upstream vendor portfolios in favour of those suppliers that have large formulation libraries, regional blending capabilities, and the depth of field engineering skills to adjust programs as the reservoirs grow older.

Restraint: Intensifying regulatory scrutiny on hazardous substances and transparency escalates compliance costs and reformulation burden

- The regulatory lens on oilfield chemistry is becoming sharper and this includes the PFAS ban, the wider TSCA examinations, and more states mandating disclosures levels that increase risk and costing of suppliers and operators, particularly for solvent systems linked to the hexane. In 2025, the U.S. EPA sought to ensure extensive historical PFAS reporting to satisfy the TSCA reporting requirements, whereas other states, like Minnesota, began prohibiting PFAS products.

- At the same time, there has been more scrutiny of disclosure compliance over hydraulic fracturing chemicals, presenting reputational and enforcement risk. Production-wise, the effects are portfolio audits, rushed reformulation, and data systems, all of which eat up R&D capacity and margin.

- Simultaneously, competition authorities are also investigating mergers in the production chemicals market: in May 2025, the CMA imposed conditions on the acquisition of ChampionX by SLB, highlighting antitrust concern surrounding the combination of chemicals with automation. These approvals are frequently subject to divestitures and licensing arrangements that redefine product market access and pricing leverage.

Opportunity: Localized innovation and customer proximity create white-space for low-carbon, fit-for-purpose chemical solutions

- Operators are increasingly expecting their suppliers to co-develop close field chemistry, reduce qualification time and provide lower lifecycle emissions documentation. This gives an upper hand to the producers who are increasing the formulation and application test centers within major basins. In June 2025, Nouryon launched an Innovation Center to oilfield solutions in Texas further anchoring its presence in the U.S. and adding pilot-scale capacity to enhance lab-to-field timelines in demulsifiers, corrosion inhibitors, pour-point depressants, and clarifiers.

- This allows an accelerated rapid troubleshooting, basin specific blending and validation within parameters that reflect reality of the field in terms of temperature, pressure and crude chemistries- a significant challenge as the nature of crude slate changes and increases water cut. They also enable the introduction of more sustainable chemistries and packaging/logistics-optimization reductions in scope-3.

- Increased nationalized content expectations in the Middle East and Latin America, respectively, necessitate similar investment in R&D, blending and technical services that provide defensible share in key strategic markets.

Key Trend: Convergence of digital monitoring with chemical programs becomes standard, reshaping service models and contracting

- The specialty oilfield chemicals portfolio is fast incorporating sensors and diagnostics together with artificial intelligence-aided optimization into treatment programs, moving purchase values off commod organics to actual performance-based contracts. Traditionally, this convergence is making pace with consolidation: in July 2025, SLB purchased ChampionX, specifically eschewing in the interest of explicitly attracting synergies deriving production systems, automation, and production chemicals.

- The integrated portfolios allow closed-loop programs with corrosion/scale risk forecast, a dynamically adjusted dose, and automated inventory re-ordering based on field telemetry-limiting non-productive time and chemical over-treatment. This architecture is able to support more stringent emissions accounting and water stewardship on the operator side and integrate chemistry further into production workflows with longer-term supply contracts on the supplier side.

- Digitally powered chemistry will increase recurring revenue and distinguish leaders through outcomes-linked performance.

Specialty Oilfield Chemicals Market Analysis and Segmental Data

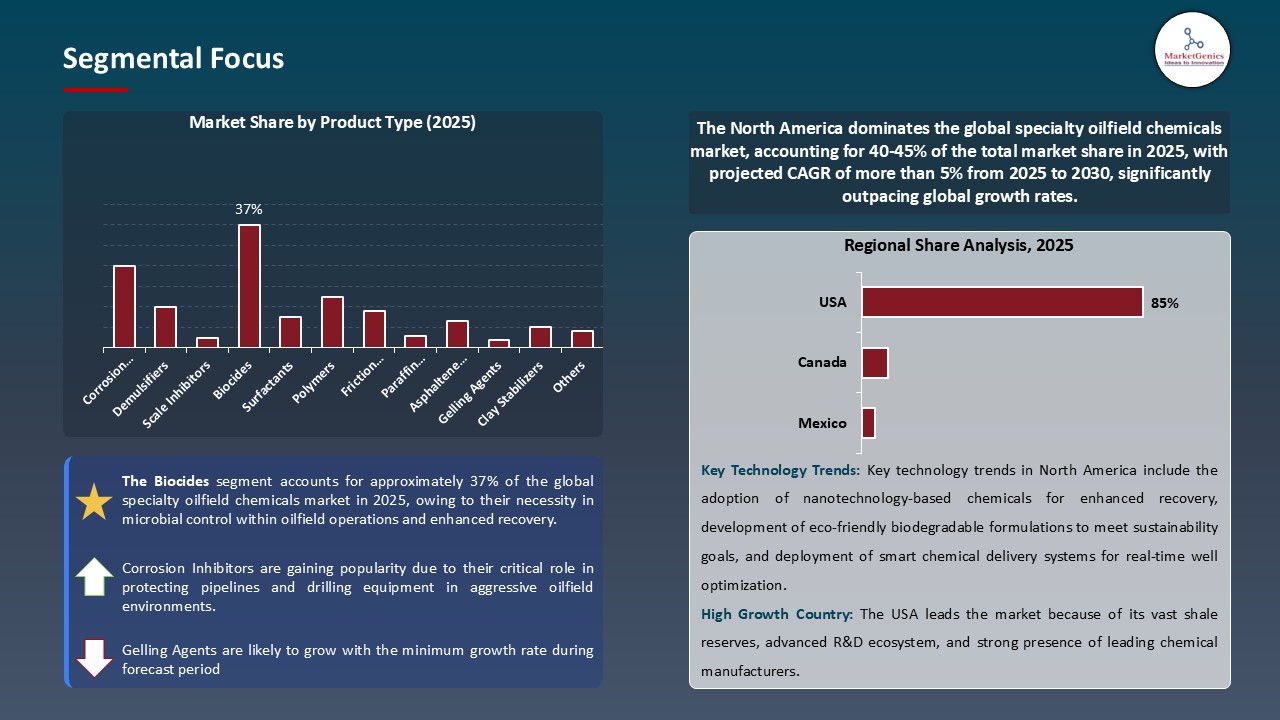

Rising Microbial Control Challenges Strengthen Biocides Dominance in Specialty Oilfield Chemicals Market

- The biocides segment commands the highest demand in the specialty oilfield chemicals market because of its importance in reducing the occurrence of microbial contamination which may lead to destroyed pipelines, recuperation of oil, and souring inwells. The enhanced oil recovery projects involving a higher dose of water injection have escalated probability of microbial proliferation which should be countered with powerful biocidal programs. In March 2025 BASF launched an ultramodern oilfield biocide that works to provide longer protection against sulfate-reducing bacteria in offshore operation to bring reliability, repeatability, and also prolongation of asset life.

- In addition, the higher environment and safety restrictions are forcing the operators towards using more effective and environmentally acceptable biocides. Work in shale operations in the United States characterizes recent applications of targeted microbial control in fracking processes, where the cost of productivity loss due to induced contaminations on the water supply is high. With system integrity and its optimized recovery, biocides continue to be irreplaceable to present-day oilfield operations which only further solidifies their niche of dominance over specialty oilfield chemicals.

Shale Expansion and Unconventional Production Cement North America’s Leadership in Specialty Oilfield Chemicals

-

North America leads the global specialty oilfield chemicals market because of the dominance of shale production and unconventional oil and gas activities which seek sophisticated chemical solutions in drilling, stimulation, and production. The US continues to be the centre of hydraulic fracturing where specific chemicals like scale inhibitors, biocides, and reduce friction are very crucial. In January 2025, Halliburton increased its specialty chemicals plant in Texas to supply shale operators with high-performance formulations indicating that the region continues to face a demand to develop custom-made solutions that boost well efficiency and productivity.

- Moreover, activity in Canada oil sands also adds to the high demand in the region because demulsifiers and corrosion inhibitors are extensively used in extracting oil sands. Recent investments in the improved oil recovery projects across Alberta testify to the fact that the operations in the region remain chemical intense.

- The volume and variety of unconventional production firmly establish North America as the biggest user of specialty oilfield chemicals worldwide.

Specialty Oilfield Chemicals Market Ecosystem

The global specialty oilfield chemicals market is moderately consolidated, with Tier 1 players such as Baker Hughes, Halliburton, Schlumberger, BASF, and Dow Inc. dominating through extensive portfolios, service integration, and global reach. Tier 2 participants, including Clariant, Ecolab (Nalco Champion), Huntsman, and Kemira, compete in specific niches, while Tier 3 firms like Roemex, Dorf Ketal, and Thermax target regional and specialized applications. Buyer concentration is moderate-to-high due to large oilfield operators, while supplier concentration remains high, giving leading chemical manufacturers stronger bargaining power.

Recent Development and Strategic Overview:

- In July 2025, Cathedral Holdings inaugurated a 5,000 sq ft technical laboratory and office in The Woodlands to support Centrium Energy Solutions. This facility enables rapid chemical problem-solving for Permian Basin operations, offering results within 48 hours using real crude and brine, facilitating faster solutions for corrosion, wax inhibition, and produced water disposal challenges that can lead to seismic risks.

- In March 2025, Jacam Catalyst launched new production chemicals tailored for offshore environments, leveraging its 2022 acquisition of ProFlow. Manufactured at the Gardendale facility, these formulations aim to meet the distinct challenges of offshore operations, while also enhancing onshore chemical offerings.

- In March 2025, Baker Hughes entered a joint technology development collaboration with Petrobras to address stress corrosion cracking in CO₂-exposed flexible pipe systems. The initiative seeks durable, long-life solutions to bolster asset integrity under corrosive conditions in offshore applications.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 13.6 Bn |

|

Market Forecast Value in 2035 |

USD 21.0 Bn |

|

Growth Rate (CAGR) |

4.0% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Specialty Oilfield Chemicals Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Product Type |

|

|

By Application |

|

|

By Well Type |

|

|

By Reservoir Type |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Specialty Oilfield Chemicals Market Outlook

- 2.1.1. Specialty Oilfield Chemicals Market Size (Value – US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Specialty Oilfield Chemicals Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals and Materials Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals and Materials Industry

- 3.1.3. Regional Distribution for Chemicals and Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals and Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing demand for enhanced oil recovery (EOR) techniques

- 4.1.1.2. Rising shale gas exploration and production activities

- 4.1.1.3. Growing need for drilling fluid additives to improve well efficiency

- 4.1.2. Restraints

- 4.1.2.1. Stringent environmental regulations on chemical usage

- 4.1.2.2. Volatility in crude oil prices affecting exploration investments

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Specialty Oilfield Chemicals Manufacturers

- 4.4.3. Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Specialty Oilfield Chemicals Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Specialty Oilfield Chemicals Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Corrosion Inhibitors

- 6.2.2. Demulsifiers

- 6.2.3. Scale Inhibitors

- 6.2.4. Biocides

- 6.2.5. Surfactants

- 6.2.6. Polymers

- 6.2.7. Friction Reducers

- 6.2.8. Paraffin Inhibitors

- 6.2.9. Asphaltene Inhibitors

- 6.2.10. Gelling Agents

- 6.2.11. Clay Stabilizers

- 6.2.12. Others

- 7. Global Specialty Oilfield Chemicals Market Analysis, by Application

- 7.1. Key Segment Analysis

- 7.2. Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 7.2.1. Drilling Fluids

- 7.2.2. Cementing

- 7.2.3. Production Chemicals

- 7.2.4. Enhanced Oil Recovery (EOR)

- 7.2.5. Well Stimulation

- 7.2.6. Workover & Completion

- 7.2.7. Others

- 8. Global Specialty Oilfield Chemicals Market Analysis, by Well Type

- 8.1. Key Segment Analysis

- 8.2. Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, by Well Type, 2021-2035

- 8.2.1. Onshore

- 8.2.2. Offshore

- 9. Global Specialty Oilfield Chemicals Market Analysis, by Reservoir Type

- 9.1. Key Segment Analysis

- 9.2. Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, by Reservoir Type, 2021-2035

- 9.2.1. Conventional

- 9.2.2. Unconventional

- 10. Global Specialty Oilfield Chemicals Market Analysis and Forecasts, by Region

- 10.1. Key Findings

- 10.2. Specialty Oilfield Chemicals Market Size (Volume - Mn Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 10.2.1. North America

- 10.2.2. Europe

- 10.2.3. Asia Pacific

- 10.2.4. Middle East

- 10.2.5. Africa

- 10.2.6. South America

- 11. North America Specialty Oilfield Chemicals Market Analysis

- 11.1. Key Segment Analysis

- 11.2. Regional Snapshot

- 11.3. North America Specialty Oilfield Chemicals Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 11.3.1. Product Type

- 11.3.2. Application

- 11.3.3. Well Type

- 11.3.4. Reservoir Type

- 11.3.5. Country

- 11.3.5.1. USA

- 11.3.5.2. Canada

- 11.3.5.3. Mexico

- 11.4. USA Specialty Oilfield Chemicals Market

- 11.4.1. Country Segmental Analysis

- 11.4.2. Product Type

- 11.4.3. Application

- 11.4.4. Well Type

- 11.4.5. Reservoir Type

- 11.5. Canada Specialty Oilfield Chemicals Market

- 11.5.1. Country Segmental Analysis

- 11.5.2. Product Type

- 11.5.3. Application

- 11.5.4. Well Type

- 11.5.5. Reservoir Type

- 11.6. Mexico Specialty Oilfield Chemicals Market

- 11.6.1. Country Segmental Analysis

- 11.6.2. Product Type

- 11.6.3. Application

- 11.6.4. Well Type

- 11.6.5. Reservoir Type

- 12. Europe Specialty Oilfield Chemicals Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. Europe Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Product Type

- 12.3.2. Application

- 12.3.3. Well Type

- 12.3.4. Reservoir Type

- 12.3.5. Country

- 12.3.5.1. Germany

- 12.3.5.2. United Kingdom

- 12.3.5.3. France

- 12.3.5.4. Italy

- 12.3.5.5. Spain

- 12.3.5.6. Netherlands

- 12.3.5.7. Nordic Countries

- 12.3.5.8. Poland

- 12.3.5.9. Russia & CIS

- 12.3.5.10. Rest of Europe

- 12.4. Germany Specialty Oilfield Chemicals Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Product Type

- 12.4.3. Application

- 12.4.4. Well Type

- 12.4.5. Reservoir Type

- 12.5. United Kingdom Specialty Oilfield Chemicals Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Product Type

- 12.5.3. Application

- 12.5.4. Well Type

- 12.5.5. Reservoir Type

- 12.6. France Specialty Oilfield Chemicals Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Product Type

- 12.6.3. Application

- 12.6.4. Well Type

- 12.6.5. Reservoir Type

- 12.7. Italy Specialty Oilfield Chemicals Market

- 12.7.1. Country Segmental Analysis

- 12.7.2. Product Type

- 12.7.3. Application

- 12.7.4. Well Type

- 12.7.5. Reservoir Type

- 12.8. Spain Specialty Oilfield Chemicals Market

- 12.8.1. Country Segmental Analysis

- 12.8.2. Product Type

- 12.8.3. Application

- 12.8.4. Well Type

- 12.8.5. Reservoir Type

- 12.9. Netherlands Specialty Oilfield Chemicals Market

- 12.9.1. Country Segmental Analysis

- 12.9.2. Product Type

- 12.9.3. Application

- 12.9.4. Well Type

- 12.9.5. Reservoir Type

- 12.10. Nordic Countries Specialty Oilfield Chemicals Market

- 12.10.1. Country Segmental Analysis

- 12.10.2. Product Type

- 12.10.3. Application

- 12.10.4. Well Type

- 12.10.5. Reservoir Type

- 12.11. Poland Specialty Oilfield Chemicals Market

- 12.11.1. Country Segmental Analysis

- 12.11.2. Product Type

- 12.11.3. Application

- 12.11.4. Well Type

- 12.11.5. Reservoir Type

- 12.12. Russia & CIS Specialty Oilfield Chemicals Market

- 12.12.1. Country Segmental Analysis

- 12.12.2. Product Type

- 12.12.3. Application

- 12.12.4. Well Type

- 12.12.5. Reservoir Type

- 12.13. Rest of Europe Specialty Oilfield Chemicals Market

- 12.13.1. Country Segmental Analysis

- 12.13.2. Product Type

- 12.13.3. Application

- 12.13.4. Well Type

- 12.13.5. Reservoir Type

- 13. Asia Pacific Specialty Oilfield Chemicals Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. East Asia Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Product Type

- 13.3.2. Application

- 13.3.3. Well Type

- 13.3.4. Reservoir Type

- 13.3.5. Country

- 13.3.5.1. China

- 13.3.5.2. India

- 13.3.5.3. Japan

- 13.3.5.4. South Korea

- 13.3.5.5. Australia and New Zealand

- 13.3.5.6. Indonesia

- 13.3.5.7. Malaysia

- 13.3.5.8. Thailand

- 13.3.5.9. Vietnam

- 13.3.5.10. Rest of Asia Pacific

- 13.4. China Specialty Oilfield Chemicals Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Product Type

- 13.4.3. Application

- 13.4.4. Well Type

- 13.4.5. Reservoir Type

- 13.5. India Specialty Oilfield Chemicals Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Product Type

- 13.5.3. Application

- 13.5.4. Well Type

- 13.5.5. Reservoir Type

- 13.6. Japan Specialty Oilfield Chemicals Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Product Type

- 13.6.3. Application

- 13.6.4. Well Type

- 13.6.5. Reservoir Type

- 13.7. South Korea Specialty Oilfield Chemicals Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Product Type

- 13.7.3. Application

- 13.7.4. Well Type

- 13.7.5. Reservoir Type

- 13.8. Australia and New Zealand Specialty Oilfield Chemicals Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Product Type

- 13.8.3. Application

- 13.8.4. Well Type

- 13.8.5. Reservoir Type

- 13.9. Indonesia Specialty Oilfield Chemicals Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Product Type

- 13.9.3. Application

- 13.9.4. Well Type

- 13.9.5. Reservoir Type

- 13.10. Malaysia Specialty Oilfield Chemicals Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Product Type

- 13.10.3. Application

- 13.10.4. Well Type

- 13.10.5. Reservoir Type

- 13.11. Thailand Specialty Oilfield Chemicals Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Product Type

- 13.11.3. Application

- 13.11.4. Well Type

- 13.11.5. Reservoir Type

- 13.12. Vietnam Specialty Oilfield Chemicals Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Product Type

- 13.12.3. Application

- 13.12.4. Well Type

- 13.12.5. Reservoir Type

- 13.13. Rest of Asia Pacific Specialty Oilfield Chemicals Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Product Type

- 13.13.3. Application

- 13.13.4. Well Type

- 13.13.5. Reservoir Type

- 14. Middle East Specialty Oilfield Chemicals Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Middle East Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Application

- 14.3.3. Well Type

- 14.3.4. Reservoir Type

- 14.3.5. Country

- 14.3.5.1. Turkey

- 14.3.5.2. UAE

- 14.3.5.3. Saudi Arabia

- 14.3.5.4. Israel

- 14.3.5.5. Rest of Middle East

- 14.4. Turkey Specialty Oilfield Chemicals Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Application

- 14.4.4. Well Type

- 14.4.5. Reservoir Type

- 14.5. UAE Specialty Oilfield Chemicals Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Application

- 14.5.4. Well Type

- 14.5.5. Reservoir Type

- 14.6. Saudi Arabia Specialty Oilfield Chemicals Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Application

- 14.6.4. Well Type

- 14.6.5. Reservoir Type

- 14.7. Israel Specialty Oilfield Chemicals Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Product Type

- 14.7.3. Application

- 14.7.4. Well Type

- 14.7.5. Reservoir Type

- 14.8. Rest of Middle East Specialty Oilfield Chemicals Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Product Type

- 14.8.3. Application

- 14.8.4. Well Type

- 14.8.5. Reservoir Type

- 15. Africa Specialty Oilfield Chemicals Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Africa Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Application

- 15.3.3. Well Type

- 15.3.4. Reservoir Type

- 15.3.5. Country

- 15.3.5.1. South Africa

- 15.3.5.2. Egypt

- 15.3.5.3. Nigeria

- 15.3.5.4. Algeria

- 15.3.5.5. Rest of Africa

- 15.4. South Africa Specialty Oilfield Chemicals Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Application

- 15.4.4. Well Type

- 15.4.5. Reservoir Type

- 15.5. Egypt Specialty Oilfield Chemicals Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Application

- 15.5.4. Well Type

- 15.5.5. Reservoir Type

- 15.6. Nigeria Specialty Oilfield Chemicals Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Application

- 15.6.4. Well Type

- 15.6.5. Reservoir Type

- 15.7. Algeria Specialty Oilfield Chemicals Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Application

- 15.7.4. Well Type

- 15.7.5. Reservoir Type

- 15.8. Rest of Africa Specialty Oilfield Chemicals Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Application

- 15.8.4. Well Type

- 15.8.5. Reservoir Type

- 16. South America Specialty Oilfield Chemicals Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Central and South Africa Specialty Oilfield Chemicals Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Application

- 16.3.3. Well Type

- 16.3.4. Reservoir Type

- 16.3.5. Country

- 16.3.5.1. Brazil

- 16.3.5.2. Argentina

- 16.3.5.3. Rest of South America

- 16.4. Brazil Specialty Oilfield Chemicals Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Application

- 16.4.4. Well Type

- 16.4.5. Reservoir Type

- 16.5. Argentina Specialty Oilfield Chemicals Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Application

- 16.5.4. Well Type

- 16.5.5. Reservoir Type

- 16.6. Rest of South America Specialty Oilfield Chemicals Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Application

- 16.6.4. Well Type

- 16.6.5. Reservoir Type

- 17. Key Players/ Company Profile

- 17.1. Ashland Global Holdings Inc.

- 17.1.1. Company Details/ Overview

- 17.1.2. Company Financials

- 17.1.3. Key Customers and Competitors

- 17.1.4. Business/ Industry Portfolio

- 17.1.5. Product Portfolio/ Specification Details

- 17.1.6. Pricing Data

- 17.1.7. Strategic Overview

- 17.1.8. Recent Developments

- 17.2. Baker Hughes Company

- 17.3. BASF SE

- 17.4. Chevron Phillips Chemical Company

- 17.5. Clariant AG

- 17.6. Croda International Plc

- 17.7. Dorf Ketal Chemicals

- 17.8. Dow Inc.

- 17.9. Ecolab Inc. (Nalco Champion)

- 17.10. Halliburton Company

- 17.11. Huntsman Corporation

- 17.12. Innospec Inc.

- 17.13. Kemira Oyj

- 17.14. Lubrizol Corporation

- 17.15. Roemex Limited

- 17.16. Schlumberger Limited

- 17.17. SNF Floerger

- 17.18. Solvay S.A.

- 17.19. Stepan Company

- 17.20. Thermax Limited

- 17.21. Other Key Players

- 17.1. Ashland Global Holdings Inc.

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation