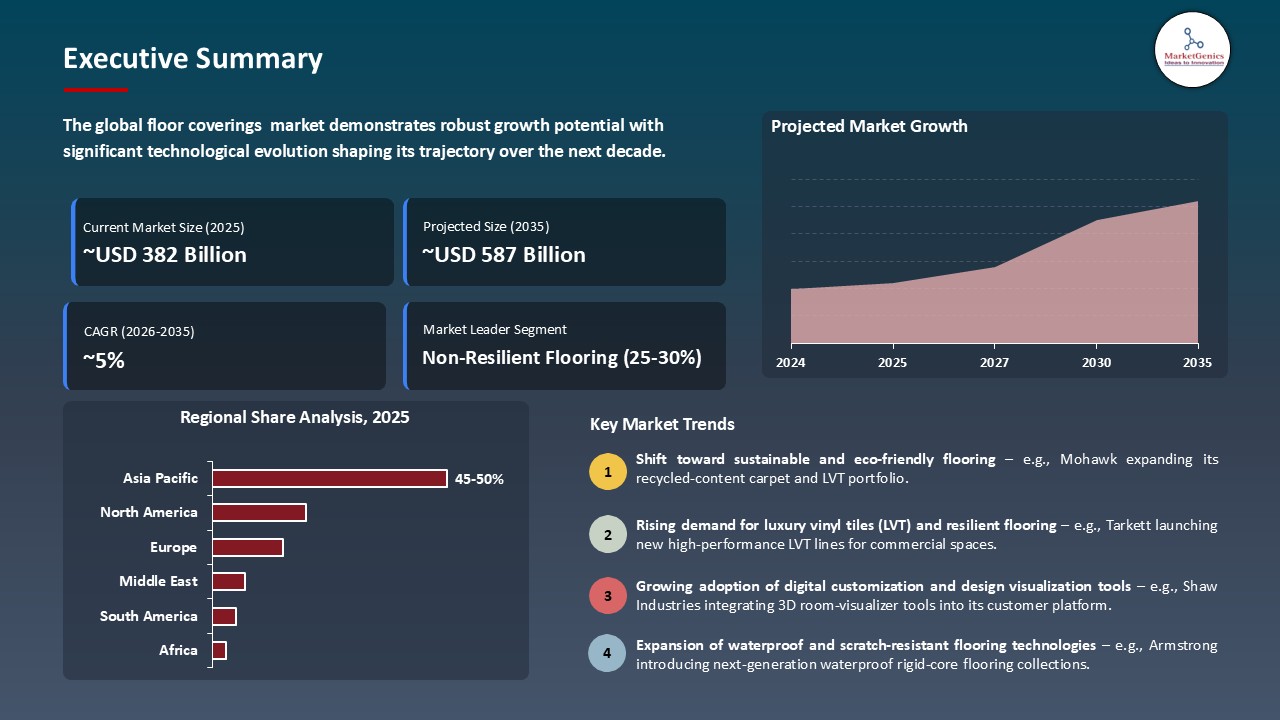

- The global floor coverings market is valued at USD 381.5 billion in 2025.

- The market is projected to grow at a CAGR of 4.4% during the forecast period of 2026 to 2035.

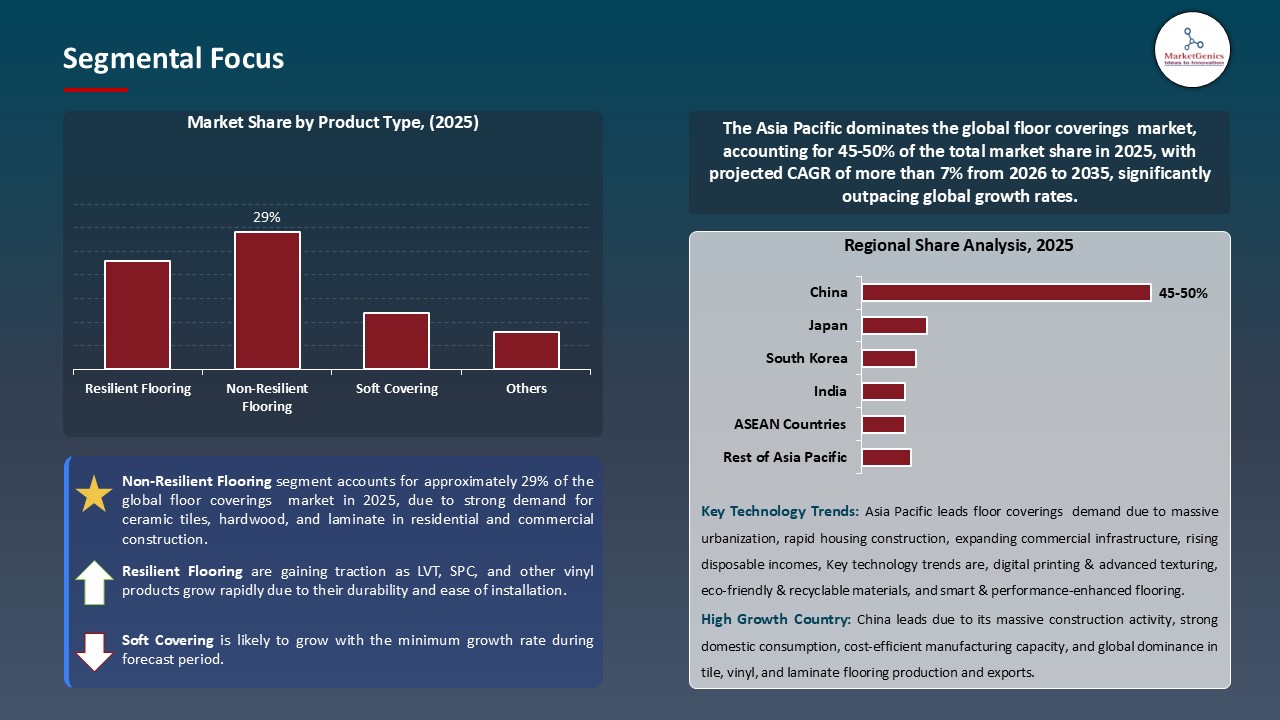

- The non-resilient flooring segment holds major share ~29% in the global floor coverings market, due to strong demand for ceramic tiles, hardwood, and laminate in residential and commercial construction.

- The floor coverings market growing due to Rising adoption of sustainable and PVC-free flooring solutions.

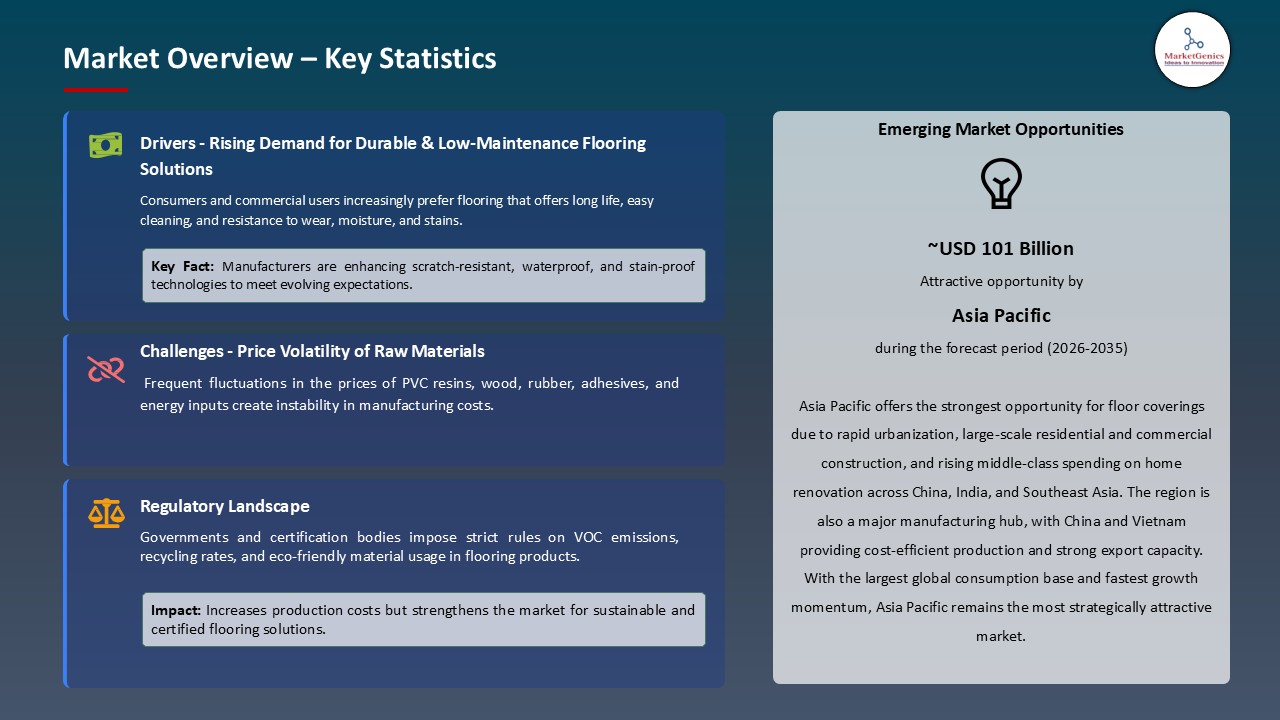

- The floor coverings market is driven by Increasing demand for durable, waterproof, and easy-to-maintain flooring in residential and commercial spaces.

- The top five players accounting for nearly 25% of the global floor coverings market share in 2025.

- In June 2025, Milliken & Company launched ‘Pattern Play,’ a sustainable carpet tile collection with over 70 design options, 61% recycled content, 90% recycled backing, and Cradle‑to‑Cradle Silver and Red List–free certifications.

- In March 2025, Tarkett acquired Parquets Marty in Southern France to enhance its expertise in engineered and solid wood flooring.

- Global Floor Coverings Market is likely to create the total forecasting opportunity of ~USD 205 Bn till 2035.

- Asia Pacific is most attractive region leads due to rapid urbanization, massive residential and commercial construction, rising middle-class home renovation spending, and large-scale infrastructure growth.

- The global floor coverings market growth is due to the growing consumer preference toward the use of PVC-free and bio-based flooring due to health- and environmentally conscious consumers favoring low-VOC, recyclable and eco-friendly flooring materials in their residential and commercial applications.

- For instance, in July 2024, AHF Products announced the Ingenious Plank, a 100 % PVC‑free hybrid flooring solution featuring a renewable wood‑fiber core and high-performance resin, delivering sustainable, waterproof, scratch-resistant, and easy-to-install flooring for residential and commercial applications. This introduction strengthens the market change to sustainable, high-performance, and environmental-friendly flooring solutions.

- Moreover, the growing regulatory focus on indoor air quality and the sustainability requirements is driving uptake of PVC-free and bio-based flooring options, which can allow manufacturers to distinguish products and at the same time are concerned about environmental compliance and long-term health.

- These factors combined are currently spurring the embrace of eco-friendly, compliant, health-conscious flooring, which is boosting market expansion and providing a competitive edge to sustainability-conscious manufacturers.

- The floor coverings market is experiencing high challenges because of fluctuating prices of the raw materials such as vinyl resins, polymers, adhesives and fillers, including key construction polymer inputs. Profit margins may be squeezed because of sudden cost rises, especially among small and middle-sized manufacturers that may not have the benefits of bulk-purchasing. This volatility tends to push firms into either absorbing the increased cost leading to decreased profitability or transferring them to consumers which can lead to decreased demand.

- Additionally, the volatility of raw-materials, import tariffs and trade restrictions also pose supply-chain uncertainties to flooring manufacturers. The introduction of tariffs on imported vinyl, SPC, or LVT parts increases the cost of production and lead times, which can influence the ability to complete a project on time and deliver the contract. Companies are investing in local manufacturing and alternative sourcing, which demand capital and operations changes.

- These issues limit profitability, adaptation of business operations, the speed of market development, and force smaller manufacturers to change or merge.

- The global floor coverings market growth can be influenced by the increasing need of acoustic and under-foot comfort flooring systems and materials because the creators of mixed-use residential, commercial, and hospitality spaces are required to improve the comfort of occupants, minimize the spread of noise, and provide better living conditions inside the entire building.

- For instance, in January 2025, LX Hausys introduced the technology of TrueQuiet using its durable flooring with up to five times the sound-reduction capacity than the regular LVT, to create a more comfortable experience in multi-occupancy tall buildings. This innovation enhances the use of acoustically-oriented flooring in sensitive noise residential and commercial buildings.

- Furthermore, the growing usage of resilient and hybrid flooring and built-in sound absorbing layers and underlays are driving the market growth and allowing manufactures to address noise-sensitive projects they also provide high-quality comfort and performance experience.

- For instance, in 2025, Arbiton added the Aculay Acoustic Layer to its portfolio of flooring to dampen sound propagation by up to 21 dB to improve comfort in multi-story and mixed-use buildings. The innovation increases the market attraction in the noise sensitive setting, which prompts the use of high-quality acoustic flooring solution.

- The global floor coverings market growth is being boosted by the rising demand of SPC and flexible LVT products, which are thinner in aspect, superior in terms of durability, dimensional stability and resistance to water, to be used in high traffic residential and commercial buildings. As an example, in 2025, International Flooring Co. introduced Canopy Flex LVT, glue-down flexible, and built-in acoustic padding line, which provided simple installation, underfoot comfort, and durability in an apartment and renovation project.

- Moreover, the switch to the use of thicker SPC flooring and flex-LVT flooring is driven by the fact that the consumers demand easy-to-install products that are versatile and can add aesthetic value and improve the performance during the diverse environmental conditions. This movement is promoting more widespread use of high-performance, multi-use flooring materials within the market, which increases the demand both in residential and commercial markets.

- The market is growing due to increased demand for durable, adaptable, and easy-to-install flooring solutions suitable for home and commercial applications.

- The non-resilient flooring segment dominates the global floor coverings market by the non-resilient segment with its exceptional strength, low maintenance, and high aesthetic value. Ceramic, porcelain, stone, and hardwood are some of the materials that are used in residential, commercial, and hospitality high-traffic places. With advanced finishes and digital printing, design versatility is also increased and there is no need to go to resilient floors when needs a long-lasting, stylish and practical floor choice in the world.

- For instance, in October 2025, VitrA Tiles released a 100% recycled porcelain tile at Cersaie, which provides environmentally sustainable flooring performance at full technical capacity, providing an example of matching non-resilient products to circular-economy and eco-friendly programs. This launch supports the move to sustainable, high-performance, non-resilient flooring in the global markets.

- Non-resilient flooring, which is durable, low-maintenance, and ecologically friendly, is gaining popularity in residential, commercial, and hospitality industries worldwide.

- Asia Pacific leads the global floor coverings market is because of the high rate of urbanization and increased disposable incomes which has driven the residential and commercial flooring systems needs in metropolitan and emerging cities. As an example, in 2025, VN Ecofloor presented new SPC and LVT flooring lines at the DOMOTEX Asia/CHINAFLOOR in Shanghai, providing durable and modern designs of residential and commercial development in the urban areas of Southeast Asia.

- The regions construction and infrastructure growth, including residential, shopping, and hotel buildings, is driving demand for more complex, long-lasting, and visually appealing floor coveringsas well as complementary industrial floor coating systems. For example, Mohawk Industries has increased production of durable flooring tailored to fit high-density growth markets in Asia-Pacific to meet rising infrastructure demands. High-quality floor coverings are becoming more popular due to increased market awareness and access to organized retail, e-commerce, and interior design services.

- The Asian Pacific region has a strong need for durable, high-performance, and visually appealing flooring solutions in residential, commercial, and infrastructure projects, contributing to its global domination.

- In June 2025, Milliken & Company has launched an innovative collection of carpet tiles named Pattern Play that has a vast range of design versatility, with more than 70 choices in color, shape and gradient. The collection is sustainable, including 61% recycled content weight, supporting composed of 90% recycled materials, and certifications such as the Cradle-to-Cradle Silver and Red List free.

- In March 2025, Tarkett has tactically purchased the Parquets Marty, which is a wood-flooring specialty firm located in Southern France, to boost its technical skills in engineered and solid wooden flooring to reinforce its market in Southern Europe and the Mediterranean region at large.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Amtico International

- Armstrong Flooring

- Balta Group

- Beaulieu International Group

- Congoleum Corporation

- Tajima Floor

- Gerflor

- Interface Inc.

- James Halstead PLC

- Forbo Holding AG

- Karndean Designflooring

- Kronospan Limited

- Mannington Mills

- Milliken & Company

- Mohawk Industries

- NOX Corporation

- Polyflor

- Shaw Industries Group

- Tarkett

- Victoria PLC

- Other Key Player

- Resilient Flooring

- Vinyl Flooring

- Luxury Vinyl Tiles (LVT)

- Vinyl Composition Tiles (VCT)

- Vinyl Sheets

- Others

- Linoleum Flooring

- Rubber Flooring

- Cork Flooring

- Others

- Vinyl Flooring

- Non-Resilient Flooring

- Ceramic Tiles

- Porcelain Tiles

- Stone Flooring

- Marble

- Granite

- Limestone

- Slate

- Others

- Glass Tiles

- Others

- Soft Covering

- Carpets

- Tufted Carpets

- Woven Carpets

- Needle Punch Carpets

- Others

- Rugs

- Carpet Tiles/Modular Carpets

- Others

- Carpets

- Wood Flooring

- Solid Hardwood

- Engineered Wood

- Bamboo Flooring

- Laminate Flooring

- Others

- Seamless Flooring

- Epoxy Flooring

- Polyurethane Flooring

- Concrete Flooring

- Resin Flooring

- Others

- Other Product Types

- Natural Materials

- Hardwood

- Bamboo

- Cork

- Natural Stone

- Wool

- Others

- Synthetic Materials

- Polyvinyl Chloride (PVC)

- Polyurethane

- Nylon

- Polyester

- Epoxy Resin

- Others

- Composite Materials

- Engineered Wood

- Luxury Vinyl

- Laminate

- Others

- Glue-Down

- Nail-Down

- Floating Installation

- Click-Lock System

- Interlocking Tiles

- Self-Adhesive

- Others

- Residential

- Living Rooms

- Bedrooms

- Kitchens

- Bathrooms

- Basements

- Entryways/Hallways

- Outdoor/Patio Areas

- Others

- Commercial

- Office Buildings

- Reception Areas

- Workstations

- Conference Rooms

- Corridors

- Others

- Retail Spaces

- Shopping Malls

- Showrooms

- Boutiques

- Supermarkets

- Others

- Hospitality

- Hotels/Resorts

- Restaurants

- Cafes

- Banquet Halls

- Others

- Healthcare Facilities

- Hospitals

- Clinics

- Nursing Homes

- Laboratories

- Others

- Educational Institutions

- Schools

- Colleges/Universities

- Libraries

- Laboratories

- Others

- Transportation Hubs

- Airports

- Railway Stations

- Bus Terminals

- Others

- Entertainment Venues

- Theaters

- Cinemas

- Museums

- Art Galleries

- Others

- Office Buildings

- Industrial

- Manufacturing Facilities

- Warehouses

- Distribution Centers

- Food Processing Plants

- Pharmaceutical Manufacturing

- Automotive Plants

- Cold Storage Facilities

- Others

- Other End-users

- Direct Sales

- Distributors/Wholesalers

- Retail Stores

- Online/E-commerce

- Contractors/Installers

- Abstract/Contemporary Patterns

- Traditional/Classic Patterns

- Geometric Patterns

- Solid Colors

- Textured Finishes

- Others

- Thin (< 2mm)

- Medium (2-4mm)

- Thick (4-6mm)

- Extra Thick (> 6mm)

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Floor Coverings Market Outlook

- 2.1.1. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Floor Coverings Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing urbanization and residential/commercial construction

- 4.1.1.2. Rising consumer preference for durable, aesthetically appealing, and easy-to-maintain flooring

- 4.1.1.3. Growth in hospitality, retail, and commercial infrastructure projects globally

- 4.1.2. Restraints

- 4.1.2.1. Volatility in raw material prices (wood, PVC, vinyl, etc.)

- 4.1.2.2. Environmental concerns and regulations related to non-biodegradable or chemically treated flooring products

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Floor Coverings Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-Users/Application

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Floor Coverings Market Demand

- 4.9.1. Historical Market Size – Volume (Million Square Feet) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Square Feet) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Floor Coverings Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Resilient Flooring

- 6.2.1.1. Vinyl Flooring

- 6.2.1.1.1. Luxury Vinyl Tiles (LVT)

- 6.2.1.1.2. Vinyl Composition Tiles (VCT)

- 6.2.1.1.3. Vinyl Sheets

- 6.2.1.1.4. Others

- 6.2.1.2. Linoleum Flooring

- 6.2.1.3. Rubber Flooring

- 6.2.1.4. Cork Flooring

- 6.2.1.5. Others

- 6.2.1.1. Vinyl Flooring

- 6.2.2. Non-Resilient Flooring

- 6.2.2.1. Ceramic Tiles

- 6.2.2.2. Porcelain Tiles

- 6.2.2.3. Stone Flooring

- 6.2.2.3.1. Marble

- 6.2.2.3.2. Granite

- 6.2.2.3.3. Limestone

- 6.2.2.3.4. Slate

- 6.2.2.3.5. Others

- 6.2.2.4. Glass Tiles

- 6.2.2.5. Others

- 6.2.3. Soft Covering

- 6.2.3.1. Carpets

- 6.2.3.1.1. Tufted Carpets

- 6.2.3.1.2. Woven Carpets

- 6.2.3.1.3. Needle Punch Carpets

- 6.2.3.1.4. Others

- 6.2.3.2. Rugs

- 6.2.3.3. Carpet Tiles/Modular Carpets

- 6.2.3.4. Others

- 6.2.3.1. Carpets

- 6.2.4. Wood Flooring

- 6.2.4.1. Solid Hardwood

- 6.2.4.2. Engineered Wood

- 6.2.4.3. Bamboo Flooring

- 6.2.4.4. Laminate Flooring

- 6.2.4.5. Others

- 6.2.5. Seamless Flooring

- 6.2.5.1. Epoxy Flooring

- 6.2.5.2. Polyurethane Flooring

- 6.2.5.3. Concrete Flooring

- 6.2.5.4. Resin Flooring

- 6.2.5.5. Others

- 6.2.6. Other Product Types

- 6.2.1. Resilient Flooring

- 7. Global Floor Coverings Market Analysis, by Material

- 7.1. Key Segment Analysis

- 7.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Material, 2021-2035

- 7.2.1. Natural Materials

- 7.2.1.1. Hardwood

- 7.2.1.2. Bamboo

- 7.2.1.3. Cork

- 7.2.1.4. Natural Stone

- 7.2.1.5. Wool

- 7.2.1.6. Others

- 7.2.2. Synthetic Materials

- 7.2.2.1. Polyvinyl Chloride (PVC)

- 7.2.2.2. Polyurethane

- 7.2.2.3. Nylon

- 7.2.2.4. Polyester

- 7.2.2.5. Epoxy Resin

- 7.2.2.6. Others

- 7.2.3. Composite Materials

- 7.2.3.1. Engineered Wood

- 7.2.3.2. Luxury Vinyl

- 7.2.3.3. Laminate

- 7.2.3.4. Others

- 7.2.1. Natural Materials

- 8. Global Floor Coverings Market Analysis, by Installation Type

- 8.1. Key Segment Analysis

- 8.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Installation Type, 2021-2035

- 8.2.1. Glue-Down

- 8.2.2. Nail-Down

- 8.2.3. Floating Installation

- 8.2.4. Click-Lock System

- 8.2.5. Interlocking Tiles

- 8.2.6. Self-Adhesive

- 8.2.7. Others

- 9. Global Floor Coverings Market Analysis, by End-users

- 9.1. Key Segment Analysis

- 9.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 9.2.1. Residential

- 9.2.1.1. Living Rooms

- 9.2.1.2. Bedrooms

- 9.2.1.3. Kitchens

- 9.2.1.4. Bathrooms

- 9.2.1.5. Basements

- 9.2.1.6. Entryways/Hallways

- 9.2.1.7. Outdoor/Patio Areas

- 9.2.1.8. Others

- 9.2.2. Commercial

- 9.2.2.1. Office Buildings

- 9.2.2.1.1. Reception Areas

- 9.2.2.1.2. Workstations

- 9.2.2.1.3. Conference Rooms

- 9.2.2.1.4. Corridors

- 9.2.2.1.5. Others

- 9.2.2.2. Retail Spaces

- 9.2.2.2.1. Shopping Malls

- 9.2.2.2.2. Showrooms

- 9.2.2.2.3. Boutiques

- 9.2.2.2.4. Supermarkets

- 9.2.2.2.5. Others

- 9.2.2.3. Hospitality

- 9.2.2.3.1. Hotels/Resorts

- 9.2.2.3.2. Restaurants

- 9.2.2.3.3. Cafes

- 9.2.2.3.4. Banquet Halls

- 9.2.2.3.5. Others

- 9.2.2.4. Healthcare Facilities

- 9.2.2.4.1. Hospitals

- 9.2.2.4.2. Clinics

- 9.2.2.4.3. Nursing Homes

- 9.2.2.4.4. Laboratories

- 9.2.2.4.5. Others

- 9.2.2.5. Educational Institutions

- 9.2.2.5.1. Schools

- 9.2.2.5.2. Colleges/Universities

- 9.2.2.5.3. Libraries

- 9.2.2.5.4. Laboratories

- 9.2.2.5.5. Others

- 9.2.2.6. Transportation Hubs

- 9.2.2.6.1. Airports

- 9.2.2.6.2. Railway Stations

- 9.2.2.6.3. Bus Terminals

- 9.2.2.6.4. Others

- 9.2.2.7. Entertainment Venues

- 9.2.2.7.1. Theaters

- 9.2.2.7.2. Cinemas

- 9.2.2.7.3. Museums

- 9.2.2.7.4. Art Galleries

- 9.2.2.7.5. Others

- 9.2.2.1. Office Buildings

- 9.2.3. Industrial

- 9.2.3.1. Manufacturing Facilities

- 9.2.3.2. Warehouses

- 9.2.3.3. Distribution Centers

- 9.2.3.4. Food Processing Plants

- 9.2.3.5. Pharmaceutical Manufacturing

- 9.2.3.6. Automotive Plants

- 9.2.3.7. Cold Storage Facilities

- 9.2.3.8. Others

- 9.2.4. Other End-users

- 9.2.1. Residential

- 10. Global Floor Coverings Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Direct Sales

- 10.2.2. Distributors/Wholesalers

- 10.2.3. Retail Stores

- 10.2.4. Online/E-commerce

- 10.2.5. Contractors/Installers

- 11. Global Floor Coverings Market Analysis, by Design/Aesthetic

- 11.1. Key Segment Analysis

- 11.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Design/Aesthetic, 2021-2035

- 11.2.1. Abstract/Contemporary Patterns

- 11.2.2. Traditional/Classic Patterns

- 11.2.3. Geometric Patterns

- 11.2.4. Solid Colors

- 11.2.5. Textured Finishes

- 11.2.6. Others

- 12. Global Floor Coverings Market Analysis, by Thickness

- 12.1. Key Segment Analysis

- 12.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Thickness, 2021-2035

- 12.2.1. Thin (< 2mm)

- 12.2.2. Medium (2-4mm)

- 12.2.3. Thick (4-6mm)

- 12.2.4. Extra Thick (> 6mm)

- 13. Global Floor Coverings Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Floor Coverings Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Material

- 14.3.3. Installation Type

- 14.3.4. End-users

- 14.3.5. Distribution Channel

- 14.3.6. Design/Aesthetic

- 14.3.7. Thickness

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Floor Coverings Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Material

- 14.4.4. Installation Type

- 14.4.5. End-users

- 14.4.6. Distribution Channel

- 14.4.7. Design/Aesthetic

- 14.4.8. Thickness

- 14.5. Canada Floor Coverings Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Material

- 14.5.4. Installation Type

- 14.5.5. End-users

- 14.5.6. Distribution Channel

- 14.5.7. Design/Aesthetic

- 14.5.8. Thickness

- 14.6. Mexico Floor Coverings Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Material

- 14.6.4. Installation Type

- 14.6.5. End-users

- 14.6.6. Distribution Channel

- 14.6.7. Design/Aesthetic

- 14.6.8. Thickness

- 15. Europe Floor Coverings Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material

- 15.3.3. Installation Type

- 15.3.4. End-users

- 15.3.5. Distribution Channel

- 15.3.6. Design/Aesthetic

- 15.3.7. Thickness

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Floor Coverings Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Material

- 15.4.4. Installation Type

- 15.4.5. End-users

- 15.4.6. Distribution Channel

- 15.4.7. Design/Aesthetic

- 15.4.8. Thickness

- 15.5. United Kingdom Floor Coverings Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Material

- 15.5.4. Installation Type

- 15.5.5. End-users

- 15.5.6. Distribution Channel

- 15.5.7. Design/Aesthetic

- 15.5.8. Thickness

- 15.6. France Floor Coverings Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Material

- 15.6.4. Installation Type

- 15.6.5. End-users

- 15.6.6. Distribution Channel

- 15.6.7. Design/Aesthetic

- 15.6.8. Thickness

- 15.7. Italy Floor Coverings Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Material

- 15.7.4. Installation Type

- 15.7.5. End-users

- 15.7.6. Distribution Channel

- 15.7.7. Design/Aesthetic

- 15.7.8. Thickness

- 15.8. Spain Floor Coverings Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Material

- 15.8.4. Installation Type

- 15.8.5. End-users

- 15.8.6. Distribution Channel

- 15.8.7. Design/Aesthetic

- 15.8.8. Thickness

- 15.9. Netherlands Floor Coverings Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Material

- 15.9.4. Installation Type

- 15.9.5. End-users

- 15.9.6. Distribution Channel

- 15.9.7. Design/Aesthetic

- 15.9.8. Thickness

- 15.10. Nordic Countries Floor Coverings Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Material

- 15.10.4. Installation Type

- 15.10.5. End-users

- 15.10.6. Distribution Channel

- 15.10.7. Design/Aesthetic

- 15.10.8. Thickness

- 15.11. Poland Floor Coverings Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Material

- 15.11.4. Installation Type

- 15.11.5. End-users

- 15.11.6. Distribution Channel

- 15.11.7. Design/Aesthetic

- 15.11.8. Thickness

- 15.12. Russia & CIS Floor Coverings Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Material

- 15.12.4. Installation Type

- 15.12.5. End-users

- 15.12.6. Distribution Channel

- 15.12.7. Design/Aesthetic

- 15.12.8. Thickness

- 15.13. Rest of Europe Floor Coverings Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Material

- 15.13.4. Installation Type

- 15.13.5. End-users

- 15.13.6. Distribution Channel

- 15.13.7. Design/Aesthetic

- 15.13.8. Thickness

- 16. Asia Pacific Floor Coverings Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Material

- 16.3.3. Installation Type

- 16.3.4. End-users

- 16.3.5. Distribution Channel

- 16.3.6. Design/Aesthetic

- 16.3.7. Thickness

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Floor Coverings Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Material

- 16.4.4. Installation Type

- 16.4.5. End-users

- 16.4.6. Distribution Channel

- 16.4.7. Design/Aesthetic

- 16.4.8. Thickness

- 16.5. India Floor Coverings Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Material

- 16.5.4. Installation Type

- 16.5.5. End-users

- 16.5.6. Distribution Channel

- 16.5.7. Design/Aesthetic

- 16.5.8. Thickness

- 16.6. Japan Floor Coverings Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Material

- 16.6.4. Installation Type

- 16.6.5. End-users

- 16.6.6. Distribution Channel

- 16.6.7. Design/Aesthetic

- 16.6.8. Thickness

- 16.7. South Korea Floor Coverings Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Material

- 16.7.4. Installation Type

- 16.7.5. End-users

- 16.7.6. Distribution Channel

- 16.7.7. Design/Aesthetic

- 16.7.8. Thickness

- 16.8. Australia and New Zealand Floor Coverings Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Material

- 16.8.4. Installation Type

- 16.8.5. End-users

- 16.8.6. Distribution Channel

- 16.8.7. Design/Aesthetic

- 16.8.8. Thickness

- 16.9. Indonesia Floor Coverings Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Material

- 16.9.4. Installation Type

- 16.9.5. End-users

- 16.9.6. Distribution Channel

- 16.9.7. Design/Aesthetic

- 16.9.8. Thickness

- 16.10. Malaysia Floor Coverings Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Material

- 16.10.4. Installation Type

- 16.10.5. End-users

- 16.10.6. Distribution Channel

- 16.10.7. Design/Aesthetic

- 16.10.8. Thickness

- 16.11. Thailand Floor Coverings Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Material

- 16.11.4. Installation Type

- 16.11.5. End-users

- 16.11.6. Distribution Channel

- 16.11.7. Design/Aesthetic

- 16.11.8. Thickness

- 16.12. Vietnam Floor Coverings Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Material

- 16.12.4. Installation Type

- 16.12.5. End-users

- 16.12.6. Distribution Channel

- 16.12.7. Design/Aesthetic

- 16.12.8. Thickness

- 16.13. Rest of Asia Pacific Floor Coverings Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Material

- 16.13.4. Installation Type

- 16.13.5. End-users

- 16.13.6. Distribution Channel

- 16.13.7. Design/Aesthetic

- 16.13.8. Thickness

- 17. Middle East Floor Coverings Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Material

- 17.3.3. Installation Type

- 17.3.4. End-users

- 17.3.5. Distribution Channel

- 17.3.6. Design/Aesthetic

- 17.3.7. Thickness

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Floor Coverings Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Material

- 17.4.4. Installation Type

- 17.4.5. End-users

- 17.4.6. Distribution Channel

- 17.4.7. Design/Aesthetic

- 17.4.8. Thickness

- 17.5. UAE Floor Coverings Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Material

- 17.5.4. Installation Type

- 17.5.5. End-users

- 17.5.6. Distribution Channel

- 17.5.7. Design/Aesthetic

- 17.5.8. Thickness

- 17.6. Saudi Arabia Floor Coverings Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Material

- 17.6.4. Installation Type

- 17.6.5. End-users

- 17.6.6. Distribution Channel

- 17.6.7. Design/Aesthetic

- 17.6.8. Thickness

- 17.7. Israel Floor Coverings Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Material

- 17.7.4. Installation Type

- 17.7.5. End-users

- 17.7.6. Distribution Channel

- 17.7.7. Design/Aesthetic

- 17.7.8. Thickness

- 17.8. Rest of Middle East Floor Coverings Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Material

- 17.8.4. Installation Type

- 17.8.5. End-users

- 17.8.6. Distribution Channel

- 17.8.7. Design/Aesthetic

- 17.8.8. Thickness

- 18. Africa Floor Coverings Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Material

- 18.3.3. Installation Type

- 18.3.4. End-users

- 18.3.5. Distribution Channel

- 18.3.6. Design/Aesthetic

- 18.3.7. Thickness

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Floor Coverings Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Material

- 18.4.4. Installation Type

- 18.4.5. End-users

- 18.4.6. Distribution Channel

- 18.4.7. Design/Aesthetic

- 18.4.8. Thickness

- 18.5. Egypt Floor Coverings Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Material

- 18.5.4. Installation Type

- 18.5.5. End-users

- 18.5.6. Distribution Channel

- 18.5.7. Design/Aesthetic

- 18.5.8. Thickness

- 18.6. Nigeria Floor Coverings Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Material

- 18.6.4. Installation Type

- 18.6.5. End-users

- 18.6.6. Distribution Channel

- 18.6.7. Design/Aesthetic

- 18.6.8. Thickness

- 18.7. Algeria Floor Coverings Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Material

- 18.7.4. Installation Type

- 18.7.5. End-users

- 18.7.6. Distribution Channel

- 18.7.7. Design/Aesthetic

- 18.7.8. Thickness

- 18.8. Rest of Africa Floor Coverings Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Material

- 18.8.4. Installation Type

- 18.8.5. End-users

- 18.8.6. Distribution Channel

- 18.8.7. Design/Aesthetic

- 18.8.8. Thickness

- 19. South America Floor Coverings Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Floor Coverings Market Size (Volume - Million Square Feet and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Material

- 19.3.3. Installation Type

- 19.3.4. End-users

- 19.3.5. Distribution Channel

- 19.3.6. Design/Aesthetic

- 19.3.7. Thickness

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Floor Coverings Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Material

- 19.4.4. Installation Type

- 19.4.5. End-users

- 19.4.6. Distribution Channel

- 19.4.7. Design/Aesthetic

- 19.4.8. Thickness

- 19.5. Argentina Floor Coverings Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Material

- 19.5.4. Installation Type

- 19.5.5. End-users

- 19.5.6. Distribution Channel

- 19.5.7. Design/Aesthetic

- 19.5.8. Thickness

- 19.6. Rest of South America Floor Coverings Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Material

- 19.6.4. Installation Type

- 19.6.5. End-users

- 19.6.6. Distribution Channel

- 19.6.7. Design/Aesthetic

- 19.6.8. Thickness

- 20. Key Players/ Company Profile

- 20.1. Amtico International

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Armstrong Flooring

- 20.3. Balta Group

- 20.4. Beaulieu International Group

- 20.5. Congoleum Corporation

- 20.6. Forbo Holding AG

- 20.7. Gerflor

- 20.8. Interface Inc.

- 20.9. James Halstead PLC

- 20.10. Karndean Designflooring

- 20.11. Kronospan Limited

- 20.12. Mannington Mills

- 20.13. Milliken & Company

- 20.14. Mohawk Industries

- 20.15. NOX Corporation

- 20.16. Polyflor

- 20.17. Shaw Industries Group

- 20.18. Tajima Floor

- 20.19. Tarkett

- 20.20. Victoria PLC

- 20.21. Other Key Players

- 20.1. Amtico International

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Floor Coverings Market Size, Share & Trends Analysis Report by Product Type (Resilient Flooring, Non-Resilient Flooring, Soft Covering, Wood Flooring, Seamless Flooring, Other Product Types), Material, Installation Type, End-users, Distribution Channel, Design/Aesthetic, Thickness, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Floor Coverings Market Size, Share, and Growth

The global floor coverings market is experiencing robust growth, with its estimated value of USD 381.5 billion in the year 2025 and USD 586.8 billion by 2035, registering a CAGR of 4.4%, during the forecast period. The global floor coverings market is driven by rapid urbanization, rising residential and commercial construction, increasing disposable incomes, renovation activities, infrastructure development, sustainability trends, and growing preference for durable, stylish, and low-maintenance flooring solutions.

Doug Jackson, CEO said,

“Santa Cruz represents a big leap forward for luxury laminate and really is everything Cali strives to deliver – beautiful, stress-free floors you’re proud to show off with a smarter design that makes home health a priority, our team has pushed the boundaries on this one and is confident this collection will set several new standards.”

The global floor coverings market growth is supported by the growing demand of moisture resistant flooring and pet-friendly flooring products that spurred the faster adaptation of new advanced products utilizing vinyl, laminate, and hybrid products that are aimed at enhanced durability and performance. As an example, in 2024, CALI released its collection of Santa Cruz laminate, which is 100% waterproof, extra-wide planks, with the underlay that reduces noise pollution, made to suit active families and pets. This trend increases the demand of durable, pet-friendly vinyl, laminate, and hybrid flooring.

Moreover, the global floor coverings market is propelled by use of digital printing and new texturing techniques that allow hyper-realistic look of wood and stone as well as scalable mass production to suit varied consumer tastes. For instance, in March 2025, the Crafted Connections LVT by LX Hausys, that has 18 wood and several stone/textile images and TrueMatte finishing which has a realistic touch and a soft touch. The innovation will increase consumer attraction and motivation toward superior design, customizable resilient flooring products.

Adjacent opportunities for the global floor coverings market include sustainable underlayment’s, acoustic and thermal insulation materials, smart flooring with IoT integration, modular and prefabricated construction solutions, and surface care and maintenance products. These segments are used to complement the flooring solutions and also tackle with performance, comfort and technological additions. The entry into such adjacent markets enhances revenue streams and spur innovation-based differentiation amid flooring manufacturers.

Floor Coverings Market Dynamics and Trends

Driver: Surge in PVC‑Free & Bio‑Based Flooring Demand for Health and Sustainability

Restraint: High Production Costs and Limited Mainstream Consumer Awareness

Opportunity: Emergence of Acoustic‑Optimized & Under‑Foot Comfort Flooring Solutions for Mixed‑Use Spaces

Key Trend: Rise of Thicker SPC and Flex‑LVT for Enhanced Performance and Versatility

Floor-Coverings-Market Analysis and Segmental Data

Non-Resilient Flooring Dominate Global Floor Coverings Market

Asia Pacific Leads Global Floor Coverings Market Demand

Floor-Coverings-Market Ecosystem

The global floor coverings market is moderately fragmented, with high concentration among key players such as Mohawk Industries, Shaw Industries Group, Tarkett, Forbo Holding AG, and Mannington Mills, who dominate through extensive product portfolios, strong distribution networks, strategic acquisitions, and continuous innovation in resilient and non-resilient flooring solutions.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 381.5 Bn |

|

Market Forecast Value in 2035 |

USD 586.8 Bn |

|

Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Square Feet for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Floor-Coverings-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Floor Coverings Market, By Product Type |

|

|

Floor Coverings Market, By Material |

|

|

Floor Coverings Market, By Installation Type |

|

|

Floor Coverings Market, By End-users |

|

|

Floor Coverings Market, By Distribution Channel

|

|

|

Floor Coverings Market, By Design/Aesthetic

|

|

|

Floor Coverings Market, By Thickness

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation