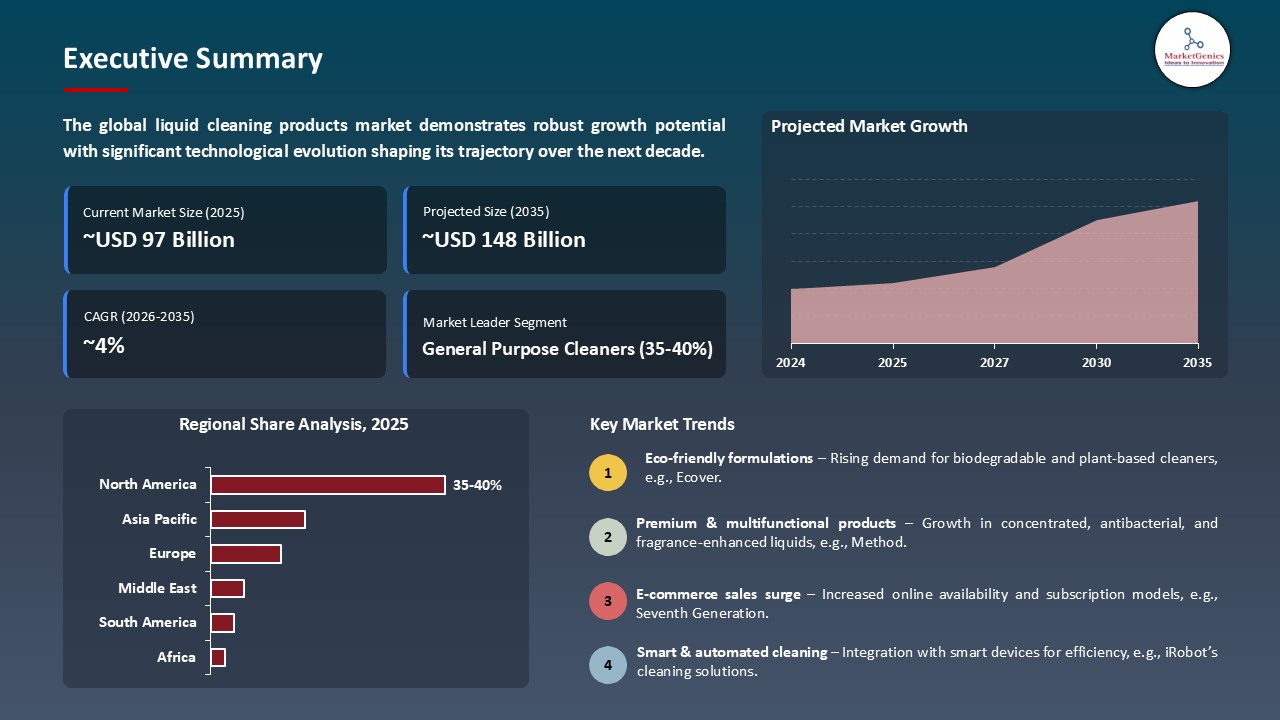

- The global liquid cleaning products market is valued at USD 97.4 billion in 2025.

- The market is projected to grow at a CAGR of 4.3% during the forecast period of 2026 to 2035.

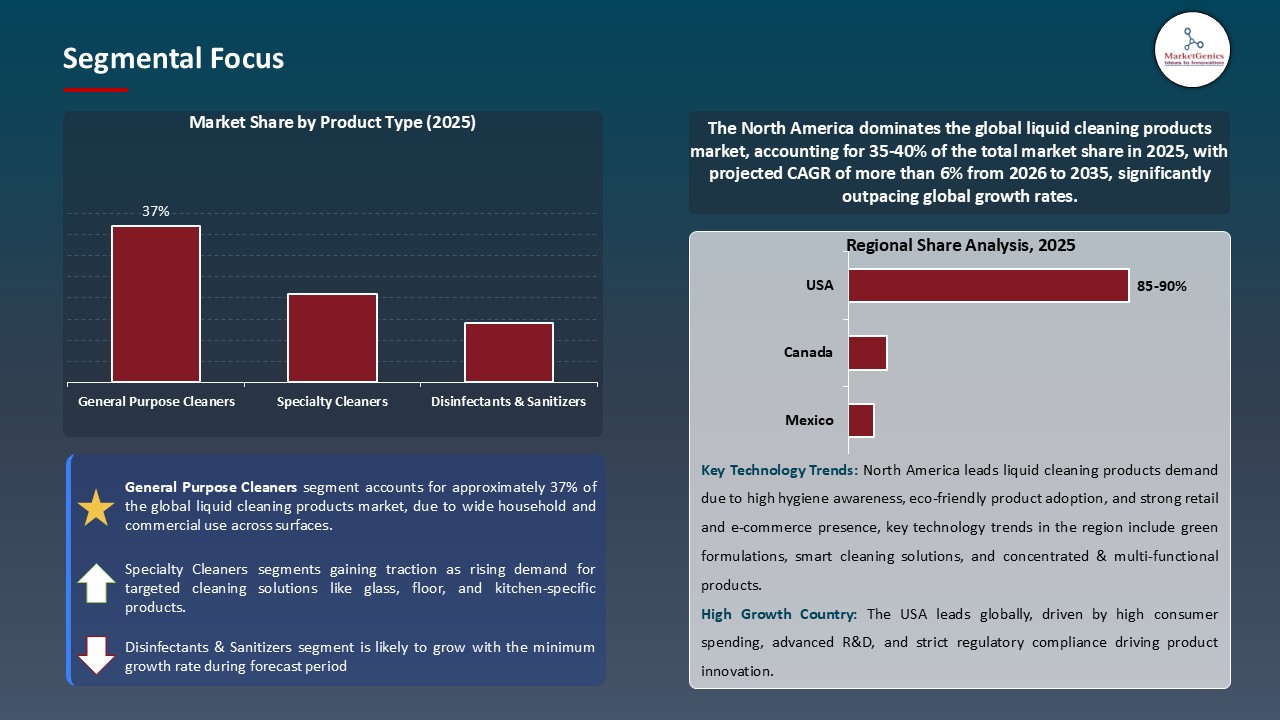

- The general-purpose cleaners segment holds major share ~37% in the global liquid cleaning products market, due to wide household and commercial use across surfaces.

- The liquid cleaning products market growing due to rising demand for concentrated liquids and refill packs to reduce plastic use.

- The liquid cleaning products market is driven by increased adoption of premium antibacterial/disinfectant solutions post-pandemic.

- The top five players accounting for over 30% of the global liquid cleaning products market share in 2025.

- In October 2025, LANXESS launched “Scopeblue” solutions like Kalaguard SB for household and laundry cleaners, using over 50% sustainable materials or delivering 50% lower CO₂ footprint to support eco-friendly formulation goals.

- In July 2025, BASF SE expanded its liquid enzyme portfolio for laundry and cleaning applications, adding lipase, cellulase, and amylase to enhance performance across liquid cleaning formulations.

- Global Liquid Cleaning Products Market is likely to create the total forecasting opportunity of ~USD 51 Bn till 2035.

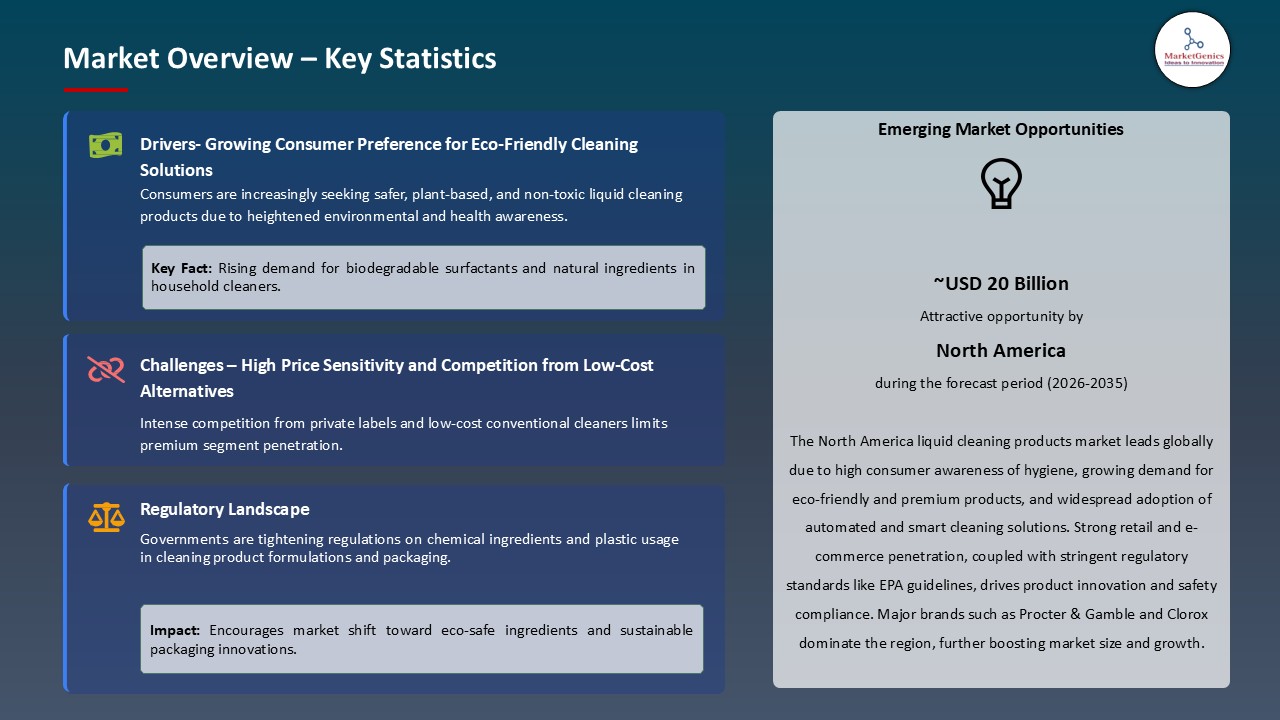

- North America is most attractive region leads due to high hygiene awareness, eco-friendly product adoption, and strong retail and e-commerce presence.

- The global demand for liquid cleaning products is being influenced by the increased sustainability, tougher regulations on reducing plastic, and the increasing consumer desire to have a high-performance and environmentally-benefiting product. It is also this evolution that is driving the brands to use more advanced formulation technologies that eliminate chemical intensity whilst ensuring better cleaning efficacy.

- Manufacturers are also focusing on low-waste format, biodegradable ingredients and reduction of packaging to stay competitive in both the mature and emerging markets. For instance, in February 2025, Unilever increased its reuse-and-refill pilot initiatives in Sri Lanka, Bangladesh, and Indonesia and introduced high-tech refill stations to minimize the utilization of virgin-plastic.

- This transformation is driving the industry to the next stage of circular and low-impact product ecosystems, reinforcing competitive positioning and favorable development of the market in the long term.

- The global liquid cleaning products market performance is being hampered by the increasing prices of surfactants, solvents, and packaging materials which is reinforced by the volatility of the global energy prices and the disruptions in the global supply chain. Continuous logistics delays, material shortages, and changing resin prices also increase the burden on operations especially on high-volume portfolios whose structure in terms of margins is of narrow margins.

- This dynamic is forcing manufacturers to streamline their procurement plans, diversify sourcing locations, and repackage formulations to decrease reliance on variable petrochemical-based components. As an example, Colgate-Palmolive decreased the amount of recycled content to stabilize the resin demand and minimize the fluctuations of the price on virgin plastics.

- Manufacturers are adopting more efficient sourcing and formulation strategies to maintain profitability in the face of supply and cost concerns.

- The global liquid cleaning products market growth is driven by the increasing consumer preference to time-saving and short-cycle detergent formats that minimize the time spent in the wash line but do not lower cleaning performance. This trend correlates with the rapid urban living styles and promotes the use of high-endurance performance-based liquid formulations, which favor convenience, energy efficiency and utilize rate.

- For instance, in 2024, Unilever launched its Persil Wonder Wash detergent, which promised high-quality cleaning in 15-minute wash time using its own Pro-S Technology that improved efficiency and responded to the need of quick, high-quality laundering. The development attracts the busy urban consumers who are time restricted, consumes less energy per wash and contributes to increased frequency of usage and adoption of high-end products which enhances the growth in the liquid cleaning formulations.

- This is an accelerating demand of high-performance liquid formulations, which is increasing market value due to performance-based differentiation and increased consumer interaction.

- The global liquid cleaning products market is becoming more affected by introduction of smart cleaning laundry technologies: AI-controlled optimization of the laundry cycle, automatic dose of detergent, IoT-based integration of appliances, fabric-care sensing, and performance monitoring, which is driven by cross-industry collaboration.

- Partnerships between cleaning manufacturers and appliance innovators are making gains in AI-enabled dispensing, cycle optimization, and connected usage monitoring and making consumers more convenient, efficient, and attached to their products. As an example, in September 2024, Unilever has entered into a cross-sector alliance with Samsung to use artificial intelligence and interconnected appliances to improve and streamline end-to-end laundry operations.

- The confluence of digital and cleaning technologies improves premiumization, user interaction, and product differentiation in the liquid cleaning products industry.

- The general-purpose cleaners segment dominates the global liquid cleaning products market characterized by the dominance of the general-purpose cleaner’s segment due to the increasing household hygiene awareness and the fact that the multi-surface cleaning solutions require the products with the ability to meet a wide range of daily household cleaners which are reinforcing the robust demand in the general-purpose cleaner’s segment.

- For instance, in August 2024, Ecolab has launched its MAXX Synbiotic line, consisting of a biodegradable all-purpose cleaner, developed as a synergistic combination of pro- and pre-biotics to keep cleaning the soil and odor compounds continuously, improving the cleaning performance and environmental performance over an extended time. This development strengthens the market development through the boosting of the long-term, environmentally-resilient cleaning performance.

- Additionally, the growing urbanization, and the rapid uptake of convenient and ready-to-use liquid formulations are escalating the intake of cleaners of general use which are adaptable, quick and have wide usage both in domestic and commercial setups. For instance, in 2024, in India, HUL launched its Vim UltraPro Floor Cleaner that combined a high-performing formula with an exotic long-lasting fragrance.

- Convenience-science-based and sustainable cleaning solutions are driving market share growth.

- North America leads the global liquid cleaning products market due to high income levels and demand for premium and specialty cleaning products (e.g., fragrance-infused or hypoallergenic liquids). The market is also growing in terms of value-added and performance-based formulations. In 2024, CloroxPro introduced Clorox EcoClean disinfection Wipes, a high-performing, eco-friendly disinfection solution with a plant-based substrate and citric-acid active component.

- The widespread use of e-commerce in North America makes it easier to get novel liquid cleaning products, leading to faster consumption and the adoption of environmentally friendly formulations. Manufacturers are developing low-VOC, biodegradable liquid cleaners in response to tightening regulations and green programs in North America. These cleaners are already widely used in homes and institutions.

- The foregoing features promote leadership in the North American liquid cleaning products industry, encouraging premium, sustainable, and high-performing solutions, accelerating innovation, and increasing market value.

- In October 2025, LANXESS launched its own-labeled green products (e.g., Kalaguard SB) of household and laundry cleaning agents, demonstrating at least 50 % reduction in the CO₂ footprint or 50% sustainable raw materials, which surpass the upstream chemical suppliers in the formulation sustainability.

- In July 2025, BASF SE has declared expansion of its liquid enzyme portfolio to laundry and cleaning formulations, which features lipase, cellulase and amylase enzymes, to establish a comprehensive range of offering of all liquid types of enzymes to satisfy the increasing performance requirements in liquid cleaning products.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Amway Corporation

- Blueland

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Diversey Holdings, Ltd.

- Ecolab Inc.

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- McBride plc

- Method Products, PBC

- Mrs. Meyer's Clean Day (Caldrea Company)

- Nice-Pak Products, Inc.

- Procter & Gamble (P&G)

- Reckitt Benckiser Group

- S.C. Johnson & Son, Inc.

- Seventh Generation Inc.

- Sunshine Makers, Inc. (Simple Green)

- The Clorox Company

- Unilever

- Other Key Players

- General Purpose Cleaners

- All-purpose liquid cleaners

- Multi-surface cleaners

- Specialty Cleaners

- Glass cleaners

- Floor cleaners

- Bathroom cleaners

- Kitchen cleaners

- Furniture polish

- Others

- Disinfectants & Sanitizers

- Antibacterial liquids

- Hospital-grade disinfectants

- Others

- Degreasers

- Fabric Care Liquids

- Liquid detergents

- Fabric softeners

- Stain removers

- Others

- Dishwashing Liquids

- Hand dishwashing liquids

- Automatic dishwasher liquids

- Concentrated Liquids

- Ready-to-Use (RTU) Liquids

- Dilutable Concentrates

- Gel-based Liquids

- Foam-based Liquids

- Bottles

- Spray bottles

- Squeeze bottles

- Trigger spray bottles

- Pouches & Sachets

- Bulk Containers

- Jerry cans

- Drums

- Refill Packs

- Single-dose Packaging

- Others

- Online Channels

- E-commerce platforms

- Company websites

- Online marketplaces

- Others

- Offline Channels

- Supermarkets & Hypermarkets

- Convenience stores

- Specialty stores

- Wholesalers & Distributors

- Direct sales (B2B)

- Others

- Synthetic/Chemical-based

- Natural & Organic

- Bio-based

- Eco-friendly/Green Products

- Hybrid Formulations

- Scented

- Floral

- Citrus

- Lavender

- Ocean/Fresh

- Others

- Unscented/Fragrance-free

- Hypoallergenic

- Acidic Cleaners (pH < 7)

- Neutral Cleaners (pH 7)

- Alkaline Cleaners (pH > 7)

- Residential/Household

- Commercial

- Hospitality & Food Service

- Healthcare & Medical Facilities

- Educational Institutions

- Office & Commercial Buildings

- Industrial & Manufacturing

- Automotive

- Retail & Supermarkets

- Transportation & Logistics

- Others

- Industrial

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Liquid Cleaning Products Market Outlook

- 2.1.1. Liquid Cleaning Products Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Liquid Cleaning Products Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing consumer awareness of hygiene and cleanliness

- 4.1.1.2. Rising demand for eco-friendly and biodegradable liquid cleaning formulas

- 4.1.1.3. Innovations in formulation and packaging, such as concentrated detergents and refill packs

- 4.1.2. Restraints

- 4.1.2.1. High production and raw material costs, especially surfactants

- 4.1.2.2. Environmental concerns over plastic packaging and chemical ingredients

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Liquid Cleaning Products Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-Users/Application

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Liquid Cleaning Products Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Liquid Cleaning Products Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. General Purpose Cleaners

- 6.2.1.1. All-purpose liquid cleaners

- 6.2.1.2. Multi-surface cleaners

- 6.2.2. Specialty Cleaners

- 6.2.2.1. Glass cleaners

- 6.2.2.2. Floor cleaners

- 6.2.2.3. Bathroom cleaners

- 6.2.2.4. Kitchen cleaners

- 6.2.2.5. Furniture polish

- 6.2.2.6. Others

- 6.2.3. Disinfectants & Sanitizers

- 6.2.3.1. Antibacterial liquids

- 6.2.3.2. Hospital-grade disinfectants

- 6.2.3.3. Others

- 6.2.4. Degreasers

- 6.2.5. Fabric Care Liquids

- 6.2.5.1. Liquid detergents

- 6.2.5.2. Fabric softeners

- 6.2.5.3. Stain removers

- 6.2.5.4. Others

- 6.2.6. Dishwashing Liquids

- 6.2.6.1. Hand dishwashing liquids

- 6.2.6.2. Automatic dishwasher liquids

- 6.2.1. General Purpose Cleaners

- 7. Global Liquid Cleaning Products Market Analysis, by Formulation Type

- 7.1. Key Segment Analysis

- 7.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Formulation Type, 2021-2035

- 7.2.1. Concentrated Liquids

- 7.2.2. Ready-to-Use (RTU) Liquids

- 7.2.3. Dilutable Concentrates

- 7.2.4. Gel-based Liquids

- 7.2.5. Foam-based Liquids

- 8. Global Liquid Cleaning Products Market Analysis, by Packaging Type

- 8.1. Key Segment Analysis

- 8.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 8.2.1. Bottles

- 8.2.1.1. Spray bottles

- 8.2.1.2. Squeeze bottles

- 8.2.1.3. Trigger spray bottles

- 8.2.2. Pouches & Sachets

- 8.2.3. Bulk Containers

- 8.2.3.1. Jerry cans

- 8.2.3.2. Drums

- 8.2.4. Refill Packs

- 8.2.5. Single-dose Packaging

- 8.2.6. Others

- 8.2.1. Bottles

- 9. Global Liquid Cleaning Products Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Online Channels

- 9.2.1.1. E-commerce platforms

- 9.2.1.2. Company websites

- 9.2.1.3. Online marketplaces

- 9.2.1.4. Others

- 9.2.2. Offline Channels

- 9.2.2.1. Supermarkets & Hypermarkets

- 9.2.2.2. Convenience stores

- 9.2.2.3. Specialty stores

- 9.2.2.4. Wholesalers & Distributors

- 9.2.2.5. Direct sales (B2B)

- 9.2.2.6. Others

- 9.2.1. Online Channels

- 10. Global Liquid Cleaning Products Market Analysis, by Nature/Composition

- 10.1. Key Segment Analysis

- 10.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Nature/Composition, 2021-2035

- 10.2.1. Synthetic/Chemical-based

- 10.2.2. Natural & Organic

- 10.2.3. Bio-based

- 10.2.4. Eco-friendly/Green Products

- 10.2.5. Hybrid Formulations

- 11. Global Liquid Cleaning Products Market Analysis, by Fragrance Type

- 11.1. Key Segment Analysis

- 11.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Fragrance Type, 2021-2035

- 11.2.1. Scented

- 11.2.1.1. Floral

- 11.2.1.2. Citrus

- 11.2.1.3. Lavender

- 11.2.1.4. Ocean/Fresh

- 11.2.1.5. Others

- 11.2.2. Unscented/Fragrance-free

- 11.2.3. Hypoallergenic

- 11.2.1. Scented

- 12. Global Liquid Cleaning Products Market Analysis, by pH Level

- 12.1. Key Segment Analysis

- 12.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by pH Level, 2021-2035

- 12.2.1. Acidic Cleaners (pH < 7)

- 12.2.2. Neutral Cleaners (pH 7)

- 12.2.3. Alkaline Cleaners (pH > 7)

- 13. Global Liquid Cleaning Products Market Analysis, by Consumer Type

- 13.1. Key Segment Analysis

- 13.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Consumer Type, 2021-2035

- 13.2.1. Residential/Household

- 13.2.2. Commercial

- 13.2.2.1. Hospitality & Food Service

- 13.2.2.2. Healthcare & Medical Facilities

- 13.2.2.3. Educational Institutions

- 13.2.2.4. Office & Commercial Buildings

- 13.2.2.5. Industrial & Manufacturing

- 13.2.2.6. Automotive

- 13.2.2.7. Retail & Supermarkets

- 13.2.2.8. Transportation & Logistics

- 13.2.2.9. Others

- 13.2.3. Industrial

- 14. Global Liquid Cleaning Products Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Liquid Cleaning Products Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Formulation Type

- 15.3.3. Packaging Type

- 15.3.4. Distribution Channel

- 15.3.5. Nature/Composition

- 15.3.6. Fragrance Type

- 15.3.7. pH Level

- 15.3.8. Consumer Type

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Liquid Cleaning Products Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Formulation Type

- 15.4.4. Packaging Type

- 15.4.5. Distribution Channel

- 15.4.6. Nature/Composition

- 15.4.7. Fragrance Type

- 15.4.8. pH Level

- 15.4.9. Consumer Type

- 15.5. Canada Liquid Cleaning Products Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Formulation Type

- 15.5.4. Packaging Type

- 15.5.5. Distribution Channel

- 15.5.6. Nature/Composition

- 15.5.7. Fragrance Type

- 15.5.8. pH Level

- 15.5.9. Consumer Type

- 15.6. Mexico Liquid Cleaning Products Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Formulation Type

- 15.6.4. Packaging Type

- 15.6.5. Distribution Channel

- 15.6.6. Nature/Composition

- 15.6.7. Fragrance Type

- 15.6.8. pH Level

- 15.6.9. Consumer Type

- 16. Europe Liquid Cleaning Products Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Formulation Type

- 16.3.3. Packaging Type

- 16.3.4. Distribution Channel

- 16.3.5. Nature/Composition

- 16.3.6. Fragrance Type

- 16.3.7. pH Level

- 16.3.8. Consumer Type

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Liquid Cleaning Products Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Formulation Type

- 16.4.4. Packaging Type

- 16.4.5. Distribution Channel

- 16.4.6. Nature/Composition

- 16.4.7. Fragrance Type

- 16.4.8. pH Level

- 16.4.9. Consumer Type

- 16.5. United Kingdom Liquid Cleaning Products Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Formulation Type

- 16.5.4. Packaging Type

- 16.5.5. Distribution Channel

- 16.5.6. Nature/Composition

- 16.5.7. Fragrance Type

- 16.5.8. pH Level

- 16.5.9. Consumer Type

- 16.6. France Liquid Cleaning Products Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Formulation Type

- 16.6.4. Packaging Type

- 16.6.5. Distribution Channel

- 16.6.6. Nature/Composition

- 16.6.7. Fragrance Type

- 16.6.8. pH Level

- 16.6.9. Consumer Type

- 16.7. Italy Liquid Cleaning Products Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Formulation Type

- 16.7.4. Packaging Type

- 16.7.5. Distribution Channel

- 16.7.6. Nature/Composition

- 16.7.7. Fragrance Type

- 16.7.8. pH Level

- 16.7.9. Consumer Type

- 16.8. Spain Liquid Cleaning Products Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Formulation Type

- 16.8.4. Packaging Type

- 16.8.5. Distribution Channel

- 16.8.6. Nature/Composition

- 16.8.7. Fragrance Type

- 16.8.8. pH Level

- 16.8.9. Consumer Type

- 16.9. Netherlands Liquid Cleaning Products Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Formulation Type

- 16.9.4. Packaging Type

- 16.9.5. Distribution Channel

- 16.9.6. Nature/Composition

- 16.9.7. Fragrance Type

- 16.9.8. pH Level

- 16.9.9. Consumer Type

- 16.10. Nordic Countries Liquid Cleaning Products Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Formulation Type

- 16.10.4. Packaging Type

- 16.10.5. Distribution Channel

- 16.10.6. Nature/Composition

- 16.10.7. Fragrance Type

- 16.10.8. pH Level

- 16.10.9. Consumer Type

- 16.11. Poland Liquid Cleaning Products Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Formulation Type

- 16.11.4. Packaging Type

- 16.11.5. Distribution Channel

- 16.11.6. Nature/Composition

- 16.11.7. Fragrance Type

- 16.11.8. pH Level

- 16.11.9. Consumer Type

- 16.12. Russia & CIS Liquid Cleaning Products Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Formulation Type

- 16.12.4. Packaging Type

- 16.12.5. Distribution Channel

- 16.12.6. Nature/Composition

- 16.12.7. Fragrance Type

- 16.12.8. pH Level

- 16.12.9. Consumer Type

- 16.13. Rest of Europe Liquid Cleaning Products Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Formulation Type

- 16.13.4. Packaging Type

- 16.13.5. Distribution Channel

- 16.13.6. Nature/Composition

- 16.13.7. Fragrance Type

- 16.13.8. pH Level

- 16.13.9. Consumer Type

- 17. Asia Pacific Liquid Cleaning Products Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Formulation Type

- 17.3.3. Packaging Type

- 17.3.4. Distribution Channel

- 17.3.5. Nature/Composition

- 17.3.6. Fragrance Type

- 17.3.7. pH Level

- 17.3.8. Consumer Type

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Liquid Cleaning Products Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Formulation Type

- 17.4.4. Packaging Type

- 17.4.5. Distribution Channel

- 17.4.6. Nature/Composition

- 17.4.7. Fragrance Type

- 17.4.8. pH Level

- 17.4.9. Consumer Type

- 17.5. India Liquid Cleaning Products Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Formulation Type

- 17.5.4. Packaging Type

- 17.5.5. Distribution Channel

- 17.5.6. Nature/Composition

- 17.5.7. Fragrance Type

- 17.5.8. pH Level

- 17.5.9. Consumer Type

- 17.6. Japan Liquid Cleaning Products Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Formulation Type

- 17.6.4. Packaging Type

- 17.6.5. Distribution Channel

- 17.6.6. Nature/Composition

- 17.6.7. Fragrance Type

- 17.6.8. pH Level

- 17.6.9. Consumer Type

- 17.7. South Korea Liquid Cleaning Products Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Formulation Type

- 17.7.4. Packaging Type

- 17.7.5. Distribution Channel

- 17.7.6. Nature/Composition

- 17.7.7. Fragrance Type

- 17.7.8. pH Level

- 17.7.9. Consumer Type

- 17.8. Australia and New Zealand Liquid Cleaning Products Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Formulation Type

- 17.8.4. Packaging Type

- 17.8.5. Distribution Channel

- 17.8.6. Nature/Composition

- 17.8.7. Fragrance Type

- 17.8.8. pH Level

- 17.8.9. Consumer Type

- 17.9. Indonesia Liquid Cleaning Products Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Formulation Type

- 17.9.4. Packaging Type

- 17.9.5. Distribution Channel

- 17.9.6. Nature/Composition

- 17.9.7. Fragrance Type

- 17.9.8. pH Level

- 17.9.9. Consumer Type

- 17.10. Malaysia Liquid Cleaning Products Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Formulation Type

- 17.10.4. Packaging Type

- 17.10.5. Distribution Channel

- 17.10.6. Nature/Composition

- 17.10.7. Fragrance Type

- 17.10.8. pH Level

- 17.10.9. Consumer Type

- 17.11. Thailand Liquid Cleaning Products Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Formulation Type

- 17.11.4. Packaging Type

- 17.11.5. Distribution Channel

- 17.11.6. Nature/Composition

- 17.11.7. Fragrance Type

- 17.11.8. pH Level

- 17.11.9. Consumer Type

- 17.12. Vietnam Liquid Cleaning Products Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Formulation Type

- 17.12.4. Packaging Type

- 17.12.5. Distribution Channel

- 17.12.6. Nature/Composition

- 17.12.7. Fragrance Type

- 17.12.8. pH Level

- 17.12.9. Consumer Type

- 17.13. Rest of Asia Pacific Liquid Cleaning Products Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Formulation Type

- 17.13.4. Packaging Type

- 17.13.5. Distribution Channel

- 17.13.6. Nature/Composition

- 17.13.7. Fragrance Type

- 17.13.8. pH Level

- 17.13.9. Consumer Type

- 18. Middle East Liquid Cleaning Products Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Formulation Type

- 18.3.3. Packaging Type

- 18.3.4. Distribution Channel

- 18.3.5. Nature/Composition

- 18.3.6. Fragrance Type

- 18.3.7. pH Level

- 18.3.8. Consumer Type

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Liquid Cleaning Products Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Formulation Type

- 18.4.4. Packaging Type

- 18.4.5. Distribution Channel

- 18.4.6. Nature/Composition

- 18.4.7. Fragrance Type

- 18.4.8. pH Level

- 18.4.9. Consumer Type

- 18.5. UAE Liquid Cleaning Products Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Formulation Type

- 18.5.4. Packaging Type

- 18.5.5. Distribution Channel

- 18.5.6. Nature/Composition

- 18.5.7. Fragrance Type

- 18.5.8. pH Level

- 18.5.9. Consumer Type

- 18.6. Saudi Arabia Liquid Cleaning Products Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Formulation Type

- 18.6.4. Packaging Type

- 18.6.5. Distribution Channel

- 18.6.6. Nature/Composition

- 18.6.7. Fragrance Type

- 18.6.8. pH Level

- 18.6.9. Consumer Type

- 18.7. Israel Liquid Cleaning Products Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Formulation Type

- 18.7.4. Packaging Type

- 18.7.5. Distribution Channel

- 18.7.6. Nature/Composition

- 18.7.7. Fragrance Type

- 18.7.8. pH Level

- 18.7.9. Consumer Type

- 18.8. Rest of Middle East Liquid Cleaning Products Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Formulation Type

- 18.8.4. Packaging Type

- 18.8.5. Distribution Channel

- 18.8.6. Nature/Composition

- 18.8.7. Fragrance Type

- 18.8.8. pH Level

- 18.8.9. Consumer Type

- 19. Africa Liquid Cleaning Products Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Formulation Type

- 19.3.3. Packaging Type

- 19.3.4. Distribution Channel

- 19.3.5. Nature/Composition

- 19.3.6. Fragrance Type

- 19.3.7. pH Level

- 19.3.8. Consumer Type

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Liquid Cleaning Products Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Formulation Type

- 19.4.4. Packaging Type

- 19.4.5. Distribution Channel

- 19.4.6. Nature/Composition

- 19.4.7. Fragrance Type

- 19.4.8. pH Level

- 19.4.9. Consumer Type

- 19.5. Egypt Liquid Cleaning Products Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Formulation Type

- 19.5.4. Packaging Type

- 19.5.5. Distribution Channel

- 19.5.6. Nature/Composition

- 19.5.7. Fragrance Type

- 19.5.8. pH Level

- 19.5.9. Consumer Type

- 19.6. Nigeria Liquid Cleaning Products Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Formulation Type

- 19.6.4. Packaging Type

- 19.6.5. Distribution Channel

- 19.6.6. Nature/Composition

- 19.6.7. Fragrance Type

- 19.6.8. pH Level

- 19.6.9. Consumer Type

- 19.7. Algeria Liquid Cleaning Products Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Formulation Type

- 19.7.4. Packaging Type

- 19.7.5. Distribution Channel

- 19.7.6. Nature/Composition

- 19.7.7. Fragrance Type

- 19.7.8. pH Level

- 19.7.9. Consumer Type

- 19.8. Rest of Africa Liquid Cleaning Products Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Formulation Type

- 19.8.4. Packaging Type

- 19.8.5. Distribution Channel

- 19.8.6. Nature/Composition

- 19.8.7. Fragrance Type

- 19.8.8. pH Level

- 19.8.9. Consumer Type

- 20. South America Liquid Cleaning Products Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Liquid Cleaning Products Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Formulation Type

- 20.3.3. Packaging Type

- 20.3.4. Distribution Channel

- 20.3.5. Nature/Composition

- 20.3.6. Fragrance Type

- 20.3.7. pH Level

- 20.3.8. Consumer Type

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Liquid Cleaning Products Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Formulation Type

- 20.4.4. Packaging Type

- 20.4.5. Distribution Channel

- 20.4.6. Nature/Composition

- 20.4.7. Fragrance Type

- 20.4.8. pH Level

- 20.4.9. Consumer Type

- 20.5. Argentina Liquid Cleaning Products Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Formulation Type

- 20.5.4. Packaging Type

- 20.5.5. Distribution Channel

- 20.5.6. Nature/Composition

- 20.5.7. Fragrance Type

- 20.5.8. pH Level

- 20.5.9. Consumer Type

- 20.6. Rest of South America Liquid Cleaning Products Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Formulation Type

- 20.6.4. Packaging Type

- 20.6.5. Distribution Channel

- 20.6.6. Nature/Composition

- 20.6.7. Fragrance Type

- 20.6.8. pH Level

- 20.6.9. Consumer Type

- 21. Key Players/ Company Profile

- 21.1. Amway Corporation

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Blueland

- 21.3. Church & Dwight Co., Inc.

- 21.4. Colgate-Palmolive Company

- 21.5. Diversey Holdings, Ltd.

- 21.6. Ecolab Inc.

- 21.7. Godrej Consumer Products Limited

- 21.8. Henkel AG & Co. KGaA

- 21.9. Kao Corporation

- 21.10. Lion Corporation

- 21.11. McBride plc

- 21.12. Method Products, PBC

- 21.13. Mrs. Meyer's Clean Day (Caldrea Company)

- 21.14. Nice-Pak Products, Inc.

- 21.15. Procter & Gamble (P&G)

- 21.16. Reckitt Benckiser Group

- 21.17. S.C. Johnson & Son, Inc.

- 21.18. Seventh Generation Inc.

- 21.19. Sunshine Makers, Inc. (Simple Green)

- 21.20. The Clorox Company

- 21.21. Unilever

- 21.22. Other Key Players

- 21.1. Amway Corporation

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Liquid Cleaning Products Market Size, Share & Trends Analysis Report by Product Type (General Purpose Cleaners, Specialty Cleaners, Disinfectants & Sanitizers, Degreasers, Fabric Care Liquids, Dishwashing Liquids), Formulation Type, Packaging Type, Distribution Channel, Nature/Composition, Fragrance Type, pH Level, Consumer Type, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Liquid Cleaning Products Market Size, Share, and Growth

The global liquid cleaning products market is experiencing robust growth, with its estimated value of USD 97.4 billion in the year 2025 and USD 148.4 billion by 2035, registering a CAGR of 4.3%, during the forecast period. The global liquid cleaning products market demand is driven by rising hygiene awareness, rapid urbanization, and increasing household cleaning frequency, especially post-pandemic. Growth of e-commerce and premium cleaning solutions, along with innovations in multi-surface, eco-friendly, and concentrate-based formulations, further boosts adoption across residential, commercial, and institutional sectors.

Gisela Pinheiro, Senior Vice President Home Care and I&I Cleaning at BASF said,

"The expansion and integration of these enzyme types into our first-class product portfolio allows us to collaboratively develop sustainable and high-performing solutions for laundry formulations with our customers."

The global liquid cleaning products market growth is significantly driven by growing environmental awareness and the growing popularity of resource-efficient formulations, and major players in the market are hastening the creation of concentrated, low-waste, and sustainably packaged liquid cleaning solutions. For instance, in April 2025, Henkel released concentrated all, Persil, and Snuggle detergents with a reduction in the dosage of approximately 16% and a new packaging made of approximately 50% recycled plastic to enhance sustainability. This trend is speeding up the process of moving the market towards high efficiency low impact cleaning solutions.

Additionally, the market innovations in liquid cleaning products across the world depict a sustainable innovation, strategic partnership, and localized product releases that complement sustainability goals without compromising high standards of performance. As an example, in 2024 SC Johnson launched its Ships in Product Packaging program on Windex, enhancing distribution through the elimination of external packaging and the reduction of plastic waste by around four metric tons. The trend will further reinforce the pivot of markets towards lean, low-impact supply chains that amplify the environmental operations and efficiency.

Adjacent opportunities in the global liquid cleaning products market include growth in eco-friendly packaging, concentrated refill systems, bio-based surfactants derived from bioethanol, smart dispensing devices, and antimicrobial surface-care solutions. These markets have the advantage of increasing hygiene standards, growing sustainability concerns and incorporation of technology, which presents high spillover opportunities to manufacturers. These adjacencies increase the value pools and enhance market diversification based on innovation.

Liquid Cleaning Products Market Dynamics and Trends

Driver: Rising Demand for Sustainable, High-Efficiency Cleaning Formulations Across Global Markets

Restraint: Persistent Cost Pressures from Raw Materials and Global Supply Chain Volatility

Opportunity: Rapid Adoption of Short-Cycle, Time-Saving Detergent Formats by Consumers

Key Trend: Integration of Smart Laundry Technologies Through Cross-Industry Collaboration

Liquid-Cleaning-Products-Market Analysis and Segmental Data

General Purpose Cleaners Dominate Global Liquid Cleaning Products Market

North America Leads Global Liquid Cleaning Products Market Demand

Liquid-Cleaning-Products-Market Ecosystem

The global liquid cleaning products market is slightly consolited, with high concentration among key players such as Procter & Gamble (P&G), Unilever, Reckitt Benckiser Group, Henkel AG & Co. KGaA, and S.C. Johnson & Son, Inc., who dominate through high concentration in terms of brand portfolios, expansive distribution network, constant product innovation and strategic marketing programs. As an example, in February 2025, Dawn introduced new Dawn PowerSuds, its top liquid dish soap - ideal on many dishes. These strategic product introductions and brand extensions enhance dominance in the market, consumer loyalty and long-term growth in the highly competitive liquid cleaning products global market.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 97.4 Bn |

|

Market Forecast Value in 2035 |

USD 148.4 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Liquid-Cleaning-Products-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Liquid Cleaning Products Market, By Product Type |

|

|

Liquid Cleaning Products Market, By Formulation Type |

|

|

Liquid Cleaning Products Market, By Packaging Type |

|

|

Liquid Cleaning Products Market, By Distribution Channel |

|

|

Liquid Cleaning Products Market, By Nature/Composition

|

|

|

Liquid Cleaning Products Market, By Fragrance Type

|

|

|

Liquid Cleaning Products Market, By pH Level

|

|

|

Liquid Cleaning Products Market, By Consumer Type

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation