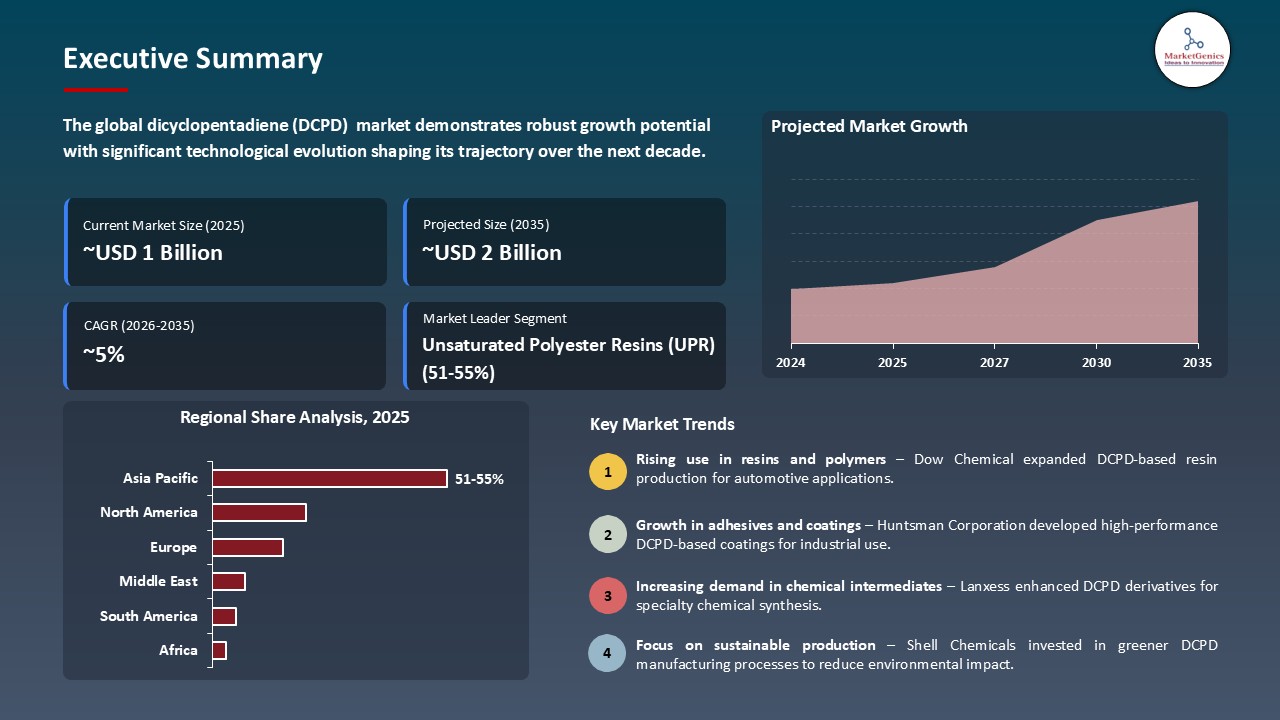

- The global dicyclopentadiene (DCPD) market is valued at USD 1.2 billion in 2025.

- The market is projected to grow at a CAGR of 4.5% during the forecast period of 2026 to 2035.

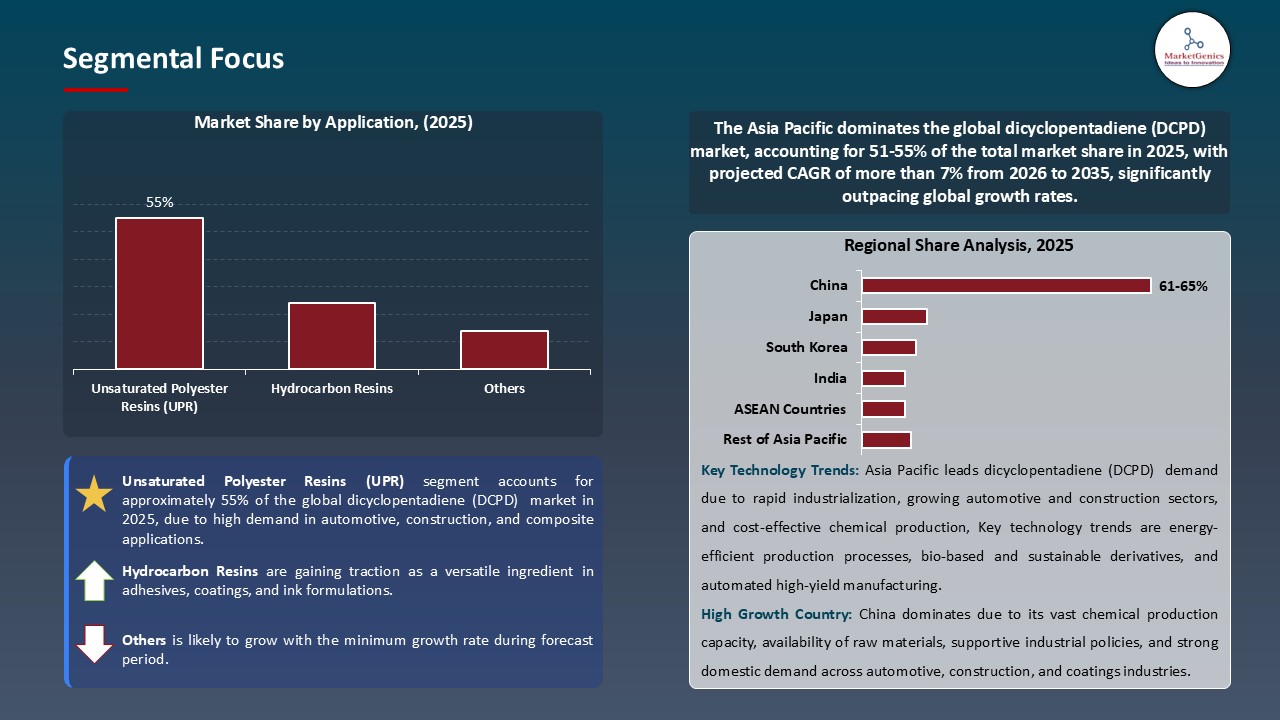

- The unsaturated polyester resins (UPR) segment holds major share ~55% in the global dicyclopentadiene (DCPD) market, due to high demand in automotive, construction, and composite applications.

- The dicyclopentadiene (DCPD) market growing due to increasing utilization in poly-DCPD composites for high-durability, corrosion-resistant parts in infrastructure and renewable energy applications.

- The dicyclopentadiene (DCPD) market is driven by shift toward sustainable DCPD production and bio-based grades, driven by green chemistry initiatives and regulatory pressure.

- The top five players accounting for over 40% of the global dicyclopentadiene (DCPD) market share in 2025.

- In April 2025, Maruzen announced in-house ethylene unit by FY2026/27, consolidating production with Keiyo Ethylene JV, potentially tightening Japan’s C5/DCPD feedstock supply and impacting regional economics.

- In November 2024, Braskem launched nine PCR resin grades for flexible applications, highlighting a shift to circular feedstocks and pushing DCPD suppliers to focus on certified, low-carbon, traceable supply chains.

- Global Dicyclopentadiene (DCPD) Market is likely to create the total forecasting opportunity of ~USD 1 Bn till 2035.

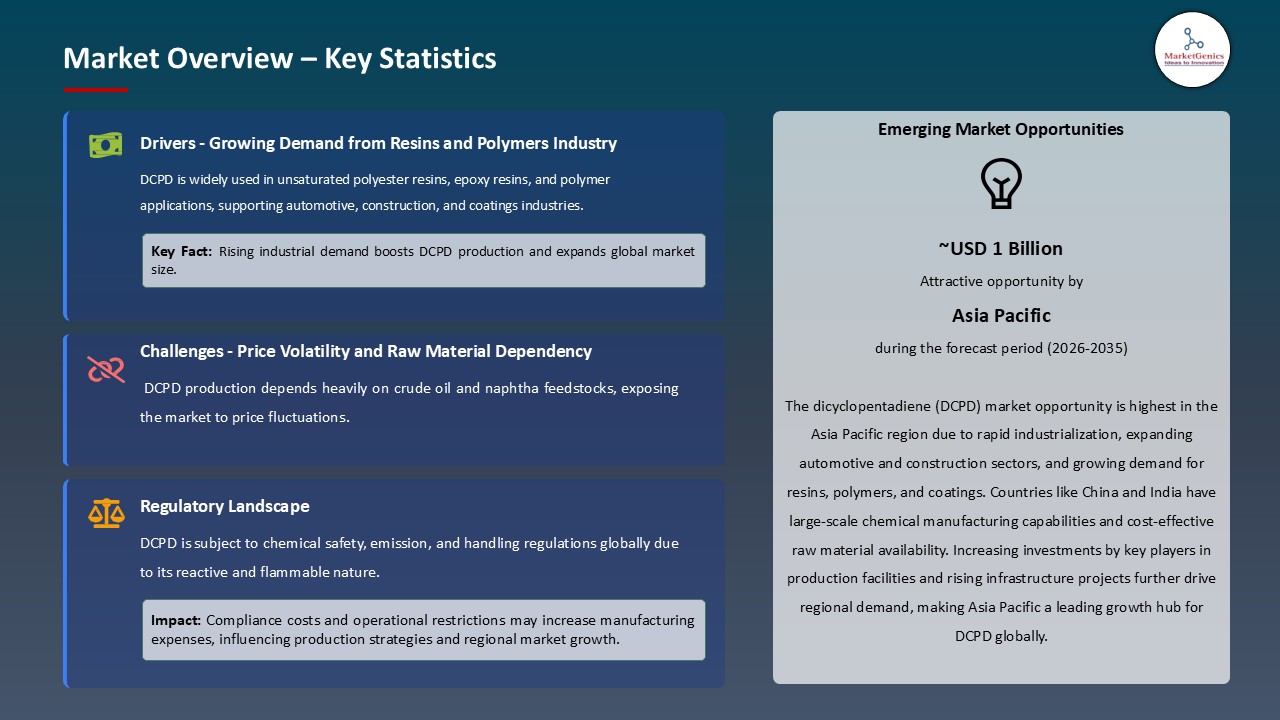

- Asia Pacific is most attractive region due to rapid industrialization, expanding automotive and construction sectors, and cost-effective chemical manufacturing.

- The global dicyclopentadiene (DCPD) market is also getting propelled by the growing demand in EPDM elastomers and hydrocarbon resin which are required in automotive electrification, sophisticated wiring and development of modern infrastructure. The use as a primary diene feedstock increases the material durability and heat resistance and insulation performance, which increases the need among manufacturers who seek lightweight, high-performance components in mobility and construction value chains.

- For instance, in November 2024, ExxonMobil Corporation announced an investment above the US 200 million in expanding its advanced recycling of plastic materials at its sites in Baytown and Beaumont (Texas) with a goal of converting plastic waste into chemical production feedstocks by 2027. Increased integration of sustainable feedstocks strengthens the long-term growth and strategic positioning of DCPD in the high-technology sectors of materials applications.

- DCPD-based unsaturated polyester and poly-DCPD resin are in high demand due to their superior mechanical strength, corrosion resistance, and weight reduction in challenging structural applications, including marine, wind power, and industry.

- The global dicyclopentadiene (DCPD) market is limited by the dependence on the activity of crackers on naphtha and availability of C5 feedstock which increases vulnerability to the instability of oil prices and fluctuating production rates. Subsequent supply volatility and pricing risks make it more difficult to enter into long-term contracts, less profitable, and discourage the investment, in time, into capacity increases and high-tech purification systems.

- Additionally, regulatory controls of the hazardous emissions, flammability, and VOCs are increasing the compliance costs of the DCPD producers necessitating upgrades on storage, handling and monitoring facilities, and the permitting, transportation regulations and the carbon-intensity minimizing are creating delays and inefficiencies in the supply chain. These regulatory pressures make manufacturers less flexible, diminish the availability of products in some areas and slow the growth of markets where environmental investigation is intense.

- The global dicyclopentadiene market faces operational risks and cost pressure because to feedstock volatility and regulatory restrictions, limiting capacity growth and hampering response to downstream demand.

- The global dicyclopentadiene (DCPD) market has a huge potential due to the growth in the use of lightweight composites in electric vehicles where poly-DCPD and DCPD-based resins are poised to be used to enhance the strength to weight ratio, battery protection, and thermal isolation. The growing number of EVs and OEM emphasis on building light reduces the overall structural weight, and thus, the use of advanced materials and DCPD is a potential strategic feedstock in future mobility scenarios.

- In January 2025, Exothermic Molding, Inc. introduced a new poly-DCPD resin system for electric vehicles. This system reduces weight by 7-10% compared to traditional epoxies and offers improved durability, chemical resistance, and thermal resistance. Poly-DCPD composites are becoming increasingly popular in electric vehicles due to their lightweight design, battery safety, and thermal performance. This makes DCPD a key material for future transportation.

- The development of novel resins targeted at reducing component weight while increasing strength is expected to accelerate the growth of demand in EV structural applications.

- The global dicyclopentadiene (DCPD) Market is increasingly characterized by a strategic shift toward bio-based feedstocks and circular chemistry, as producers work to reduce carbon intensity and enhance supply resilience. The innovation targets renewable monomer precursors, better C5 stream exploitation, low-energy catalytic process, and contributes to sustainability commitments in the automotive, construction, and electronics value chain and allows the long-term differentiation at a competitive level.

- For instance, in June 2025, Zeon Corporation invested in its Yonezawa research facility to create plant-based production processes of synthetic rubber precursors, which represents the shift by C4/C5 chemistry suppliers to bio-based inputs and material circularity. Since downstream customers are increasing demands on sustainability, results of the R&D that reduce carbon intensity or allow the use of recycled feedstocks will be quickly valorized.

- Innovations in bio-based and circular DCPD processes will improve market competitiveness and customer acceptance, particularly in low-carbon, high-performance materials.

- The unsaturated polyester resins (UPR) segment dominates the global dicyclopentadiene (DCPD) market with the rapid infrastructure growth and increasing demand of lightweight composite material in construction, marine, and transportation structures that require UPR to provide high strength, corrosiveness, and affordability.

- In 2024, AOC Nanjing installed a new unsaturated polyester resin production line with 10,000 tons of high-performance capacity to suit composite production needs. These innovations confirm the core of UPR in motivating DCPD intake and estrange the major manufacturers to seize the growth in composites and performance applications. The expanding usage of fiber-reinforced plastics and carbon fiber composites in wind energy, automotive body parts, and industrial machinery leads to increased UPR production, making DCPD a better feedstock for advanced composite formulations.

- The rising use of composites in the energy and mobility industries is driving up demand for DCPD due to increased UPR production and material selection based on performance.

- Asia Pacific leads the global dicyclopentadiene (DCPD) market is due to the high rate of industrialization and high-volume construction, marine, transportation, and electrical production in Asia, China, India, and Southeast Asia stimulate high demand of the DCPD-based resin. An example, in 2024, Changzhou Huake Polymers Co., Ltd. increased the scale of a new unsaturated polyester resin manufacturing line, which is intended to be used in the fiber-reinforced products in the rail and marine markets.

- Additionally, the trends towards the adoption of renewable energy, electric transportation, and urban development launched by the government stimulates the increased use of fiber-reinforced composites and other infrastructure materials that resist degradation, further increasing the demand in the use of DCPD-based UPR and specialty polymer applications. For instance, in March 2024, India endorsed the Scheme to Promote manufacture of Electric Passenger Cars, a scheme that promotes the manufacture of EVs and electric vehicle part components domestically.

- Furthermore, oil and gas region and petro-chemical manufacturers are highly represented in the region, combined with strong integrated cracking facilities, which guarantee the availability of competitive feedstock, which means that in the Asian Pacific, downstream DCPD production can remain cost-effective in the resin and elastomer market.

- Asia Pacific's rising industrial base, legislative support for advanced composites, and strong petrochemical infrastructure are driving demand for DCPD, making the area a vital marketplace for expansion and investment.

- In April 2025, Maruzen announced consolidation ethylene production and shut an in-house ethylene unit by FY2026/27 to streamline operations in Keiyo Ethylene JV, which is a strategic shift that has the potential to tighten regional C5/DCPD feedstock markets and change supply economics in Japan.

- In November 2024, Braskem introduced a nine grade range of post-consumer-recycled (PCR) resins in flexible applications, indicating a shift to circular feedstocks by downstream resin producers and motivating DCPD suppliers to focus on certified, lower-carbon streams and traceability of their supply chains in order to maintain formulation relevance.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Braskem

- Chevron Phillips Chemical Company

- Cymetech Corporation

- Kolon Industries

- Dow Chemical Company

- Eastman Chemical Company

- ExxonMobil Corporation

- Jiangsu Zhongdan Group

- JX Nippon Oil & Energy Corporation

- LyondellBasell Industries

- Maruzen Petrochemical

- Ningbo Jinhai Chenguang Chemical

- NOVA Chemicals Corporation

- SABIC

- Shandong Yuhuang Chemical

- Shanghai Petrochemical

- Shell Chemicals

- Sigma-Aldrich

- Texmark Chemicals

- TotalEnergies

- ZEON Corporation

- Other Key Players

- High Purity DCPD (>95%)

- Standard Grade DCPD (90-95%)

- Low Grade DCPD (<90%)

- Cyclopentadiene (CPD)

- Tricyclodecane Dimethanol

- Dicyclopentadiene Dioxide

- Hydrogenated DCPD

- Methyl Cyclopentadiene Dimer

- Others

- Steam Cracking

- Catalytic Cracking

- Thermal Cracking

- Dimerization Process

- Others

- Liquid

- Solid/Flakes

- Resin Form

- Direct Sales/OEM

- Distributors

- Online Channels

- Third-party Suppliers

- Ring-Opening Metathesis Polymerization (ROMP)

- Hydroformylation

- Diels-Alder Reaction Based

- Conventional Polymerization

- Others

- Unsaturated Polyester Resins (UPR)

- Hydrocarbon Resins

- EPDM Elastomers (Ethylene Propylene Diene Monomer)

- Poly-DCPD

- COC/COP (Cyclic Olefin Copolymer/Polymer)

- Inks and Coatings

- Adhesives

- Flame Retardants

- Others

- Automotive

- Construction & Building

- Electrical & Electronics

- Packaging Industry

- Paints & Coatings

- Rubber & Tire

- Marine

- Aerospace & Defense

- Healthcare & Pharmaceuticals

- Consumer Goods

- Sports & Recreation

- Oil & Gas

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Dicyclopentadiene (DCPD) Market Outlook

- 2.1.1. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Dicyclopentadiene (DCPD) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for lightweight, high-performance materials in automotive and construction

- 4.1.1.2. Growing use in unsaturated polyester resins (UPR), hydrocarbon resins, and EPDM elastomers

- 4.1.1.3. Increasing adoption in renewable energy applications, such as wind turbine blades

- 4.1.2. Restraints

- 4.1.2.1. Volatility of raw material (crude oil/naphtha) prices

- 4.1.2.2. Environmental and regulatory concerns related to emissions and disposal

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Dicyclopentadiene (DCPD) Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Dicyclopentadiene (DCPD) Market Demand

- 4.9.1. Historical Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Dicyclopentadiene (DCPD) Market Analysis, by Product Type/Grade

- 6.1. Key Segment Analysis

- 6.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Product Type/Grade, 2021-2035

- 6.2.1. High Purity DCPD (>95%)

- 6.2.2. Standard Grade DCPD (90-95%)

- 6.2.3. Low Grade DCPD (<90%)

- 7. Global Dicyclopentadiene (DCPD) Market Analysis, by Derivative Type

- 7.1. Key Segment Analysis

- 7.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Derivative Type, 2021-2035

- 7.2.1. Cyclopentadiene (CPD)

- 7.2.2. Tricyclodecane Dimethanol

- 7.2.3. Dicyclopentadiene Dioxide

- 7.2.4. Hydrogenated DCPD

- 7.2.5. Methyl Cyclopentadiene Dimer

- 7.2.6. Others

- 8. Global Dicyclopentadiene (DCPD) Market Analysis, by Manufacturing Process

- 8.1. Key Segment Analysis

- 8.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Manufacturing Process, 2021-2035

- 8.2.1. Steam Cracking

- 8.2.2. Catalytic Cracking

- 8.2.3. Thermal Cracking

- 8.2.4. Dimerization Process

- 8.2.5. Others

- 9. Global Dicyclopentadiene (DCPD) Market Analysis, by Form

- 9.1. Key Segment Analysis

- 9.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 9.2.1. Liquid

- 9.2.2. Solid/Flakes

- 9.2.3. Resin Form

- 10. Global Dicyclopentadiene (DCPD) Market Analysis, by Distribution Channel

- 10.1. Key Segment Analysis

- 10.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Direct Sales/OEM

- 10.2.2. Distributors

- 10.2.3. Online Channels

- 10.2.4. Third-party Suppliers

- 11. Global Dicyclopentadiene (DCPD) Market Analysis, by Technology

- 11.1. Key Segment Analysis

- 11.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 11.2.1. Ring-Opening Metathesis Polymerization (ROMP)

- 11.2.2. Hydroformylation

- 11.2.3. Diels-Alder Reaction Based

- 11.2.4. Conventional Polymerization

- 11.2.5. Others

- 12. Global Dicyclopentadiene (DCPD) Market Analysis, by Application

- 12.1. Key Segment Analysis

- 12.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 12.2.1. Unsaturated Polyester Resins (UPR)

- 12.2.2. Hydrocarbon Resins

- 12.2.3. EPDM Elastomers (Ethylene Propylene Diene Monomer)

- 12.2.4. Poly-DCPD

- 12.2.5. COC/COP (Cyclic Olefin Copolymer/Polymer)

- 12.2.6. Inks and Coatings

- 12.2.7. Adhesives

- 12.2.8. Flame Retardants

- 12.2.9. Others

- 13. Global Dicyclopentadiene (DCPD) Market Analysis, by End-users

- 13.1. Key Segment Analysis

- 13.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 13.2.1. Automotive

- 13.2.2. Construction & Building

- 13.2.3. Electrical & Electronics

- 13.2.4. Packaging Industry

- 13.2.5. Paints & Coatings

- 13.2.6. Rubber & Tire

- 13.2.7. Marine

- 13.2.8. Aerospace & Defense

- 13.2.9. Healthcare & Pharmaceuticals

- 13.2.10. Consumer Goods

- 13.2.11. Sports & Recreation

- 13.2.12. Oil & Gas

- 13.2.13. Other End-users

- 14. Global Dicyclopentadiene (DCPD) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Dicyclopentadiene (DCPD) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type/Grade

- 15.3.2. Derivative Type

- 15.3.3. Manufacturing Process

- 15.3.4. Form

- 15.3.5. Distribution Channel

- 15.3.6. Technology

- 15.3.7. Application

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Dicyclopentadiene (DCPD) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type/Grade

- 15.4.3. Derivative Type

- 15.4.4. Manufacturing Process

- 15.4.5. Form

- 15.4.6. Distribution Channel

- 15.4.7. Technology

- 15.4.8. Application

- 15.4.9. End-users

- 15.5. Canada Dicyclopentadiene (DCPD) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type/Grade

- 15.5.3. Derivative Type

- 15.5.4. Manufacturing Process

- 15.5.5. Form

- 15.5.6. Distribution Channel

- 15.5.7. Technology

- 15.5.8. Application

- 15.5.9. End-users

- 15.6. Mexico Dicyclopentadiene (DCPD) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type/Grade

- 15.6.3. Derivative Type

- 15.6.4. Manufacturing Process

- 15.6.5. Form

- 15.6.6. Distribution Channel

- 15.6.7. Technology

- 15.6.8. Application

- 15.6.9. End-users

- 16. Europe Dicyclopentadiene (DCPD) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type/Grade

- 16.3.2. Derivative Type

- 16.3.3. Manufacturing Process

- 16.3.4. Form

- 16.3.5. Distribution Channel

- 16.3.6. Technology

- 16.3.7. Application

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Dicyclopentadiene (DCPD) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type/Grade

- 16.4.3. Derivative Type

- 16.4.4. Manufacturing Process

- 16.4.5. Form

- 16.4.6. Distribution Channel

- 16.4.7. Technology

- 16.4.8. Application

- 16.4.9. End-users

- 16.5. United Kingdom Dicyclopentadiene (DCPD) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type/Grade

- 16.5.3. Derivative Type

- 16.5.4. Manufacturing Process

- 16.5.5. Form

- 16.5.6. Distribution Channel

- 16.5.7. Technology

- 16.5.8. Application

- 16.5.9. End-users

- 16.6. France Dicyclopentadiene (DCPD) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type/Grade

- 16.6.3. Derivative Type

- 16.6.4. Manufacturing Process

- 16.6.5. Form

- 16.6.6. Distribution Channel

- 16.6.7. Technology

- 16.6.8. Application

- 16.6.9. End-users

- 16.7. Italy Dicyclopentadiene (DCPD) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type/Grade

- 16.7.3. Derivative Type

- 16.7.4. Manufacturing Process

- 16.7.5. Form

- 16.7.6. Distribution Channel

- 16.7.7. Technology

- 16.7.8. Application

- 16.7.9. End-users

- 16.8. Spain Dicyclopentadiene (DCPD) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type/Grade

- 16.8.3. Derivative Type

- 16.8.4. Manufacturing Process

- 16.8.5. Form

- 16.8.6. Distribution Channel

- 16.8.7. Technology

- 16.8.8. Application

- 16.8.9. End-users

- 16.9. Netherlands Dicyclopentadiene (DCPD) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type/Grade

- 16.9.3. Derivative Type

- 16.9.4. Manufacturing Process

- 16.9.5. Form

- 16.9.6. Distribution Channel

- 16.9.7. Technology

- 16.9.8. Application

- 16.9.9. End-users

- 16.10. Nordic Countries Dicyclopentadiene (DCPD) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type/Grade

- 16.10.3. Derivative Type

- 16.10.4. Manufacturing Process

- 16.10.5. Form

- 16.10.6. Distribution Channel

- 16.10.7. Technology

- 16.10.8. Application

- 16.10.9. End-users

- 16.11. Poland Dicyclopentadiene (DCPD) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type/Grade

- 16.11.3. Derivative Type

- 16.11.4. Manufacturing Process

- 16.11.5. Form

- 16.11.6. Distribution Channel

- 16.11.7. Technology

- 16.11.8. Application

- 16.11.9. End-users

- 16.12. Russia & CIS Dicyclopentadiene (DCPD) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type/Grade

- 16.12.3. Derivative Type

- 16.12.4. Manufacturing Process

- 16.12.5. Form

- 16.12.6. Distribution Channel

- 16.12.7. Technology

- 16.12.8. Application

- 16.12.9. End-users

- 16.13. Rest of Europe Dicyclopentadiene (DCPD) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type/Grade

- 16.13.3. Derivative Type

- 16.13.4. Manufacturing Process

- 16.13.5. Form

- 16.13.6. Distribution Channel

- 16.13.7. Technology

- 16.13.8. Application

- 16.13.9. End-users

- 17. Asia Pacific Dicyclopentadiene (DCPD) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type/Grade

- 17.3.2. Derivative Type

- 17.3.3. Manufacturing Process

- 17.3.4. Form

- 17.3.5. Distribution Channel

- 17.3.6. Technology

- 17.3.7. Application

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Dicyclopentadiene (DCPD) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type/Grade

- 17.4.3. Derivative Type

- 17.4.4. Manufacturing Process

- 17.4.5. Form

- 17.4.6. Distribution Channel

- 17.4.7. Technology

- 17.4.8. Application

- 17.4.9. End-users

- 17.5. India Dicyclopentadiene (DCPD) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type/Grade

- 17.5.3. Derivative Type

- 17.5.4. Manufacturing Process

- 17.5.5. Form

- 17.5.6. Distribution Channel

- 17.5.7. Technology

- 17.5.8. Application

- 17.5.9. End-users

- 17.6. Japan Dicyclopentadiene (DCPD) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type/Grade

- 17.6.3. Derivative Type

- 17.6.4. Manufacturing Process

- 17.6.5. Form

- 17.6.6. Distribution Channel

- 17.6.7. Technology

- 17.6.8. Application

- 17.6.9. End-users

- 17.7. South Korea Dicyclopentadiene (DCPD) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type/Grade

- 17.7.3. Derivative Type

- 17.7.4. Manufacturing Process

- 17.7.5. Form

- 17.7.6. Distribution Channel

- 17.7.7. Technology

- 17.7.8. Application

- 17.7.9. End-users

- 17.8. Australia and New Zealand Dicyclopentadiene (DCPD) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type/Grade

- 17.8.3. Derivative Type

- 17.8.4. Manufacturing Process

- 17.8.5. Form

- 17.8.6. Distribution Channel

- 17.8.7. Technology

- 17.8.8. Application

- 17.8.9. End-users

- 17.9. Indonesia Dicyclopentadiene (DCPD) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type/Grade

- 17.9.3. Derivative Type

- 17.9.4. Manufacturing Process

- 17.9.5. Form

- 17.9.6. Distribution Channel

- 17.9.7. Technology

- 17.9.8. Application

- 17.9.9. End-users

- 17.10. Malaysia Dicyclopentadiene (DCPD) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type/Grade

- 17.10.3. Derivative Type

- 17.10.4. Manufacturing Process

- 17.10.5. Form

- 17.10.6. Distribution Channel

- 17.10.7. Technology

- 17.10.8. Application

- 17.10.9. End-users

- 17.11. Thailand Dicyclopentadiene (DCPD) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type/Grade

- 17.11.3. Derivative Type

- 17.11.4. Manufacturing Process

- 17.11.5. Form

- 17.11.6. Distribution Channel

- 17.11.7. Technology

- 17.11.8. Application

- 17.11.9. End-users

- 17.12. Vietnam Dicyclopentadiene (DCPD) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type/Grade

- 17.12.3. Derivative Type

- 17.12.4. Manufacturing Process

- 17.12.5. Form

- 17.12.6. Distribution Channel

- 17.12.7. Technology

- 17.12.8. Application

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Dicyclopentadiene (DCPD) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type/Grade

- 17.13.3. Derivative Type

- 17.13.4. Manufacturing Process

- 17.13.5. Form

- 17.13.6. Distribution Channel

- 17.13.7. Technology

- 17.13.8. Application

- 17.13.9. End-users

- 18. Middle East Dicyclopentadiene (DCPD) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type/Grade

- 18.3.2. Derivative Type

- 18.3.3. Manufacturing Process

- 18.3.4. Form

- 18.3.5. Distribution Channel

- 18.3.6. Technology

- 18.3.7. Application

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Dicyclopentadiene (DCPD) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type/Grade

- 18.4.3. Derivative Type

- 18.4.4. Manufacturing Process

- 18.4.5. Form

- 18.4.6. Distribution Channel

- 18.4.7. Technology

- 18.4.8. Application

- 18.4.9. End-users

- 18.5. UAE Dicyclopentadiene (DCPD) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type/Grade

- 18.5.3. Derivative Type

- 18.5.4. Manufacturing Process

- 18.5.5. Form

- 18.5.6. Distribution Channel

- 18.5.7. Technology

- 18.5.8. Application

- 18.5.9. End-users

- 18.6. Saudi Arabia Dicyclopentadiene (DCPD) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type/Grade

- 18.6.3. Derivative Type

- 18.6.4. Manufacturing Process

- 18.6.5. Form

- 18.6.6. Distribution Channel

- 18.6.7. Technology

- 18.6.8. Application

- 18.6.9. End-users

- 18.7. Israel Dicyclopentadiene (DCPD) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type/Grade

- 18.7.3. Derivative Type

- 18.7.4. Manufacturing Process

- 18.7.5. Form

- 18.7.6. Distribution Channel

- 18.7.7. Technology

- 18.7.8. Application

- 18.7.9. End-users

- 18.8. Rest of Middle East Dicyclopentadiene (DCPD) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type/Grade

- 18.8.3. Derivative Type

- 18.8.4. Manufacturing Process

- 18.8.5. Form

- 18.8.6. Distribution Channel

- 18.8.7. Technology

- 18.8.8. Application

- 18.8.9. End-users

- 19. Africa Dicyclopentadiene (DCPD) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type/Grade

- 19.3.2. Derivative Type

- 19.3.3. Manufacturing Process

- 19.3.4. Form

- 19.3.5. Distribution Channel

- 19.3.6. Technology

- 19.3.7. Application

- 19.3.8. End-users

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Dicyclopentadiene (DCPD) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type/Grade

- 19.4.3. Derivative Type

- 19.4.4. Manufacturing Process

- 19.4.5. Form

- 19.4.6. Distribution Channel

- 19.4.7. Technology

- 19.4.8. Application

- 19.4.9. End-users

- 19.5. Egypt Dicyclopentadiene (DCPD) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type/Grade

- 19.5.3. Derivative Type

- 19.5.4. Manufacturing Process

- 19.5.5. Form

- 19.5.6. Distribution Channel

- 19.5.7. Technology

- 19.5.8. Application

- 19.5.9. End-users

- 19.6. Nigeria Dicyclopentadiene (DCPD) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type/Grade

- 19.6.3. Derivative Type

- 19.6.4. Manufacturing Process

- 19.6.5. Form

- 19.6.6. Distribution Channel

- 19.6.7. Technology

- 19.6.8. Application

- 19.6.9. End-users

- 19.7. Algeria Dicyclopentadiene (DCPD) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type/Grade

- 19.7.3. Derivative Type

- 19.7.4. Manufacturing Process

- 19.7.5. Form

- 19.7.6. Distribution Channel

- 19.7.7. Technology

- 19.7.8. Application

- 19.7.9. End-users

- 19.8. Rest of Africa Dicyclopentadiene (DCPD) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type/Grade

- 19.8.3. Derivative Type

- 19.8.4. Manufacturing Process

- 19.8.5. Form

- 19.8.6. Distribution Channel

- 19.8.7. Technology

- 19.8.8. Application

- 19.8.9. End-users

- 20. South America Dicyclopentadiene (DCPD) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Dicyclopentadiene (DCPD) Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type/Grade

- 20.3.2. Derivative Type

- 20.3.3. Manufacturing Process

- 20.3.4. Form

- 20.3.5. Distribution Channel

- 20.3.6. Technology

- 20.3.7. Application

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Dicyclopentadiene (DCPD) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type/Grade

- 20.4.3. Derivative Type

- 20.4.4. Manufacturing Process

- 20.4.5. Form

- 20.4.6. Distribution Channel

- 20.4.7. Technology

- 20.4.8. Application

- 20.4.9. End-users

- 20.5. Argentina Dicyclopentadiene (DCPD) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type/Grade

- 20.5.3. Derivative Type

- 20.5.4. Manufacturing Process

- 20.5.5. Form

- 20.5.6. Distribution Channel

- 20.5.7. Technology

- 20.5.8. Application

- 20.5.9. End-users

- 20.6. Rest of South America Dicyclopentadiene (DCPD) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type/Grade

- 20.6.3. Derivative Type

- 20.6.4. Manufacturing Process

- 20.6.5. Form

- 20.6.6. Distribution Channel

- 20.6.7. Technology

- 20.6.8. Application

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. Braskem

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Chevron Phillips Chemical Company

- 21.3. Cymetech Corporation

- 21.4. Dow Chemical Company

- 21.5. Eastman Chemical Company

- 21.6. ExxonMobil Corporation

- 21.7. Jiangsu Zhongdan Group

- 21.8. JX Nippon Oil & Energy Corporation

- 21.9. Kolon Industries

- 21.10. LyondellBasell Industries

- 21.11. Maruzen Petrochemical

- 21.12. Ningbo Jinhai Chenguang Chemical

- 21.13. NOVA Chemicals Corporation

- 21.14. SABIC

- 21.15. Shandong Yuhuang Chemical

- 21.16. Shanghai Petrochemical

- 21.17. Shell Chemicals

- 21.18. Sigma-Aldrich

- 21.19. Texmark Chemicals

- 21.20. TotalEnergies

- 21.21. ZEON Corporation

- 21.22. Other Key Players

- 21.1. Braskem

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Dicyclopentadiene (DCPD) Market Size, Share & Trends Analysis Report by Product Type/Grade (High Purity DCPD (>95%), Standard Grade DCPD (90-95%), Low Grade DCPD (<90%)), Derivative Type, Manufacturing Process, Form, Distribution Channel, Technology, Application, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Dicyclopentadiene (DCPD) Market Size, Share, and Growth

The global dicyclopentadiene (DCPD) market is experiencing robust growth, with its estimated value of USD 1.2 billion in the year 2025 and USD 1.9 billion by 2035, registering a CAGR of 4.5%, during the forecast period. The global dicyclopentadiene (DCPD) market demand is driven by its rising use in high-performance resins and polymers across automotive, construction, and electronics sectors, where it enhances strength, heat resistance, and light weighting.

Zshelyz Lee, Global Automotive Plastics Circularity Team Leader said,

“At Dow, we recognize the necessity to support our customers in their decarbonization journeys, as we drive towards our own carbon neutrality, with our commitment to deliver 3 million metric tons per year of circular and renewable solutions by 2030, we are proud to bring NORDEL REN EPDM as the newest offering to help our customers achieve their ambitious sustainability goals and create a better tomorrow.”

The global dicyclopentadiene (DCPD) is being propelled by trend of lightweight composites in the automotive and construction industry, aligning with broader demand for sustainable materials with DCPD-derived unsaturated polyester resins and hydrocarbon resins contributing to performance in terms of high strength, heat-resistance and reduced weight. For instance, in September 2023, OQ Chemicals announced an ISCC PLUS-certified product based on bio-circular DCPD provided by Shell Chemicals Europe, which shows that the industry is strategically shifting to sustainable feedstocks and can be used in more applications. This development improves the transition of the market to sustainable, high-performance DCPD solutions.

Moreover, the growing dicyclopentadiene demand is supported by production of more EPDM elastomers and hydrocarbon resin used in wire cable, tires, adhesives and roofing due to the infrastructure expansions and the need to electrify automotive products to be more durable and flexible. As an example, in July 2024, Dow announced NORDEL REN EPDM as a car and building product and cable, and a move to more sustainable EPDM, made possible by the DCPD-based diene chemistry. The need to innovate EPDM and resin continues to boost long-term and high-value consumption of DCPD in industrial sectors.

Adjacent opportunities to the global dicyclopentadiene market include growth in advanced composites for EVs, high-performance marine resins, sustainable EPDM elastomers, specialty hydrocarbon tackifier resins for adhesives, and insulation materials in expanding construction. These related industries contribute to value-chain integration and bring new sources of diversifying the DCPD demand and increasing the margins.

Dicyclopentadiene (DCPD) Market Dynamics and Trends

Driver: Growing EPDM and Resin Demand from Automotive Electrification and Infrastructure

Restraint: Feedstock Price Volatility and Regulatory Constraints Raising Operational Complexity

Opportunity: Expansion in Electric Vehicle Lightweight Composites

Key Trend: Research Pivot to Bio Based Feedstocks and Circular Chemistry Innovation

Dicyclopentadiene-Market Analysis and Segmental Data

Unsaturated Polyester Resins (UPR) Dominate Global Dicyclopentadiene (DCPD) Market

Asia Pacific Leads Global Dicyclopentadiene (DCPD) Market Demand

Dicyclopentadiene-Market Ecosystem

The global dicyclopentadiene (DCPD) market is slightly consolidated, with high concentration among key players such as Dow Chemical Company, Braskem, Chevron Phillips Chemical Company, ExxonMobil Corporation, and LyondellBasell Industries, dominates through vertically integrated operations, high control of C5 feedstock streams, advanced purification technologies, and long-term supply agreements with large manufacturers of resins and elastomers.

For instance, Chevron Phillips Chemical, which has Crude DCPD as a by-product at its Sweeny ethylene facility, which shows that the large players are using integrated C5 feedstreams to produce DCPD. The concentration allows major firms to have pricing power, reliability in adequate supply of materials, and speed in innovation in high purity grades in composites, automobile, and specialty polymer uses.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 1.2 Bn |

|

Market Forecast Value in 2035 |

USD 1.9 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Kilo Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Dicyclopentadiene-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Dicyclopentadiene (DCPD) Market, By Product Type/Grade |

|

|

Dicyclopentadiene (DCPD) Market, By Derivative Type |

|

|

Dicyclopentadiene (DCPD) Market, By Manufacturing Process |

|

|

Dicyclopentadiene (DCPD) Market, By Form |

|

|

Dicyclopentadiene (DCPD) Market, By Distribution Channel

|

|

|

Dicyclopentadiene (DCPD) Market, By Technology

|

|

|

Dicyclopentadiene (DCPD) Market, By Application

|

|

|

Dicyclopentadiene (DCPD) Market, By End-users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation