Sterile Injectable Outsourcing Market Size, Share & Trends Analysis Report by Product Type (Small Molecules, Large Molecules (Biologics), Biosimilars), Container Type, Filling Type, Service Type, Therapeutic Application, Molecule Type, Technology Platform, Production Scale, Sterilization Method, Contract Type, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Sterile Injectable Outsourcing Market Size, Share, and Growth

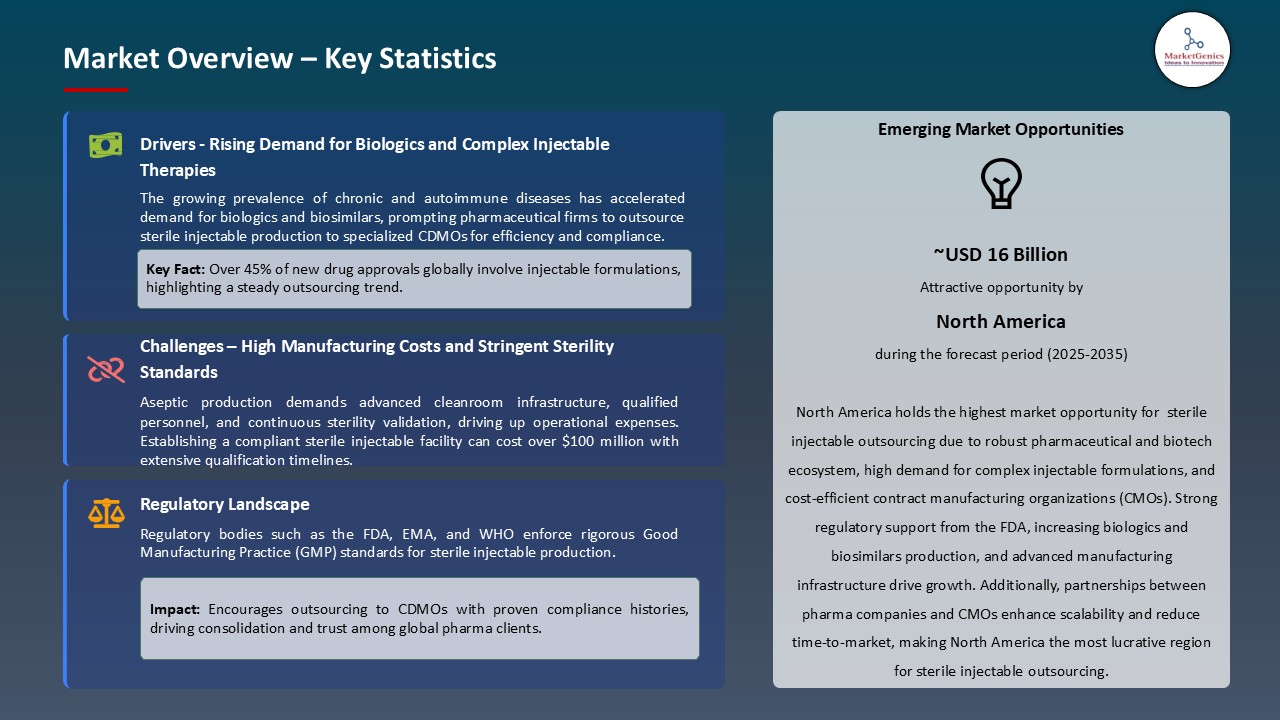

The global sterile injectable outsourcing market is experiencing robust growth, with its estimated value of SD 15.5 billion in the year 2025 and USD 31.4 billion by the period 2035, registering a CAGR of 7.3%, during the forecast period. The global sterile injectable outsourcing market is growing rapidly, driven by rising demand for biologics, high-potency injectables, and complex sterile formulations. Adoption of modular, flexible aseptic manufacturing, automation, and digital quality systems is enhancing efficiency and scalability. Strategic collaborations and supportive government policies are further expanding market reach and patient access worldwide.

Dr. Minzhang Chen, Co-CEO of WuXi AppTec and CEO of WuXi STA, said, “I’m thrilled that our HP injectable R&D and manufacturing platform has achieved yet another significant milestone. In addressing the growing needs of high-potency drugs, WuXi STA, as an innovation enabler, will continue to strengthen our CRDMO platform capabilities. With our proven track record of consistent quality and EHS systems across all sites globally, we are committed to accelerating pharmaceutical development and bringing new therapeutics for patients worldwide.”

The growing market demand of biologics, monoclonal antibodies, and high-potency injectables has been driving the Sterile Injectable Outsourcing Market. Pharmaceutical firms are progressively addressing production to Contract Development and Manufacturing Organization (CDMOs) to handle complicated manufacturing operations, adhere to rigid regulatory standards, and speed up time to market on life-saving treatments. More complex treatments, such as gene and cell therapies, need high-containment production facilities that are sterile, and therefore, specialized outsourcing is necessary due to scalability and efficiency.

The recent technological innovations of aseptic fill-finishing operations, such as single-use systems, automated vial filling and isolator-based containment are enhancing efficiency of production and minimizing the risk of contamination. Indicatively, in May 2025, Symbiosis Pharma was granted MHRA approval of its new 20,000 sq ft GMP manufacturing plant in Scotland. This plant assists in the fill/finish of sterile injectables, such as biologics and high-potency compound, aseptically, as well as part of a £26 million expansion that improves the company's ability to manufacture aseptic drugs.

Also, the use of modular and flexible manufacturing platforms allows CDMOs to change products rapidly, scale production and target various therapeutic fields. Enhanced automation, robotics, and single use technologies enhance efficiency, lower the risk of contamination and compliance with regulations. Capacity and responsiveness are further enhanced by strategic collaborations and government support which enhances access of patients to important sterile injectable therapies worldwide.

Sterile Injectable Outsourcing Market Dynamics and Trends

Driver: Expansion of High-Capacity and Specialized Manufacturing

- Pharmaceutical companies are outsourcing to Contract Development and Manufacturing Organizations (CDMOs) because of the increased demand of biologics, cell therapies, and high-potency injectables. Outsourcing allows production to be scaled, meet high standards of regulation and management of complicated manufacturing processes.

- Complex treatments, such as cell and gene therapies, demand specific aseptic manufacturing facilities. Dedicated facilities of CDMOs enable flexible manufacturing, scale-up in a short time, and timely production of life-saving treatment.

- To address this increased demand, the companies are spending on the state of the art facilities to support the complex therapies in a safe and efficient approach. One such trend is represented by a recent industry development: in 2025, Vertex Pharmaceuticals and Lonza declared the development of a dedicated 130,000-square-foot facility in Portsmouth, New Hampshire in Type 1 diabetes (T1D) cell therapies, such as VX-880 and VX-264. The facility will facilitate commercial scale manufacturing of investigative stem cell-based insulin-producing islet therapies, which underscores the industry and increasing dependence on specific manufacturing solutions.

- The development will increase supply chain resiliency, advanced therapy capacity, and spur the increase in sterile injectable outsourcing market.

Restraint: High Capital and Compliance Costs in Sterile Injectable Manufacturing

- The setting up and operation of sterile injectable manufacturing involves large financial and operational costs and this is a challenge to many businesses in the market. The upfront technology required to create cleanrooms, isolator, automated filling lines and sophisticated lyophilization facilities are costly, restricting their availability to smaller CDMOs and first-time biotech companies.

- Further, the high regulatory adherence to standards, including FDA, EMA, and PIC/S, requires constant validation, high-quality monitoring, and regular inspections in relation to product sterility, potency, and patient safety.

- It is even more complicated with high-potency, cytotoxic, or biologic therapies that are subject to special containment, high-level staffing, and advanced safety measures.

- The combination of these factors makes the barriers to entry obstructive, it adds more complexity to operations, and slows down market growth, hindering the growth of a smaller player and making it difficult to scale sterile injectable outsourcing operations even with established companies.

Opportunity: Expansion of High-Potency and Specialty Injectable Outsourcing

- The growing market of high-potency and specialty sterile injectables, including oncology treatment, vaccines, and antibody-drug conjugates, introduces a huge growth market to the sterile injectable outsourcing Market. These drugs demand high-grade containment, aseptic filling and the skills of handling cytotoxic substances, and outsourcing to CDMOs is becoming more alluring.

- Companies are setting up state of the art plants with isolator technology, barrier systems and robotics to safely produce and fill these complex injectables and meet high regulatory standards. This will allow pharmaceutical companies to obtain quality production without the expense of internal infrastructure.

- In response to this increased demand, CDMOs are increasing their high-potency production capacity across the world. For instance, in October 2025, Lonza had installed a new aseptic drug product filling line at its Stein, Switzerland plant, and this improved its liquid and lyophilized vial filling. The line also uses state of the art containment technology to produce highly potent biologics in a safe manner, which is keeping with the increasing demand of specialty injectables and also makes Lonza a stronger player in the market. This trend creates new business prospects, joint ventures, and geographical growth, and provides profitable opportunities in the outsourced sterile injectable business.

Key Trend: Adoption of Modular and Flexible Manufacturing Platforms

- One of the major trends in the sterile injectable outsourcing market deals with the embrace of modular, flexible, and single-use production platforms. The systems allow Contract Development and Manufacturing Organizations (CDMOs) to rapidly change product line, effectively produce multi-sterile injectable approaches in large quantities and reduce downtime, meeting the growing need to produce numerous sterile injectable therapies at once.

- Modular plants lower capital investments, shorten time-to-market and support quicker adaptation to new therapeutic requirements, such as vaccines, biologics, and high-potency medications. They also facilitate regional supply lines and decentralized production policies which increase world accessibility.

- To address this increasing demand, firms are investing in facilities with state-of-the-art facilities with isolator technology, barrier systems as well as robotics. For instance, in February 2025, Recipharm has introduced a new modular sterile filling system at its plant in Sweden, specifically to use in process development, pilot scale, and clinical supply. This system is flexible and scalable as it is in line with the industry trend in the direction of finding more modular and flexible manufacturing solutions.

- This direction is the cause of efficiency, responsiveness, and sustainability in the production of sterile injectables, and modular platforms become the key factor of market development and customer acquisition.

Sterile Injectable Outsourcing Market Analysis and Segmental Data

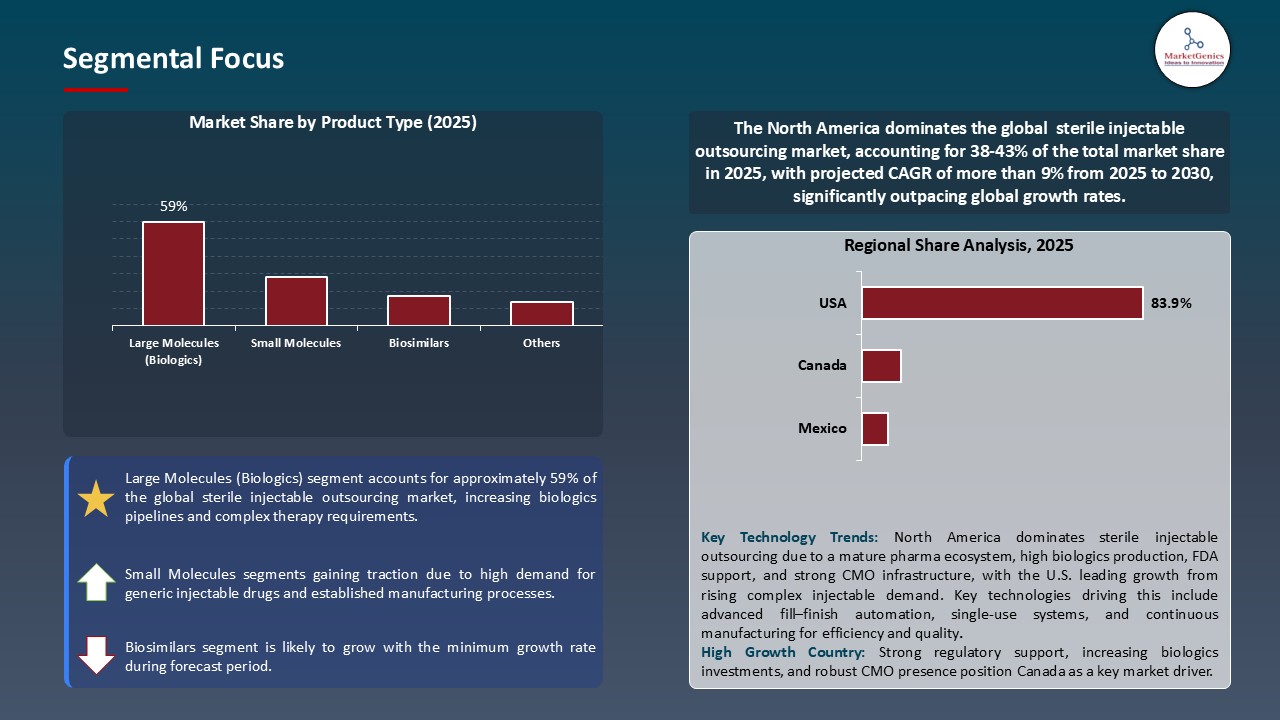

Large Molecules (Biologics) Dominate Global Sterile Injectable Outsourcing Market

- The global sterile injectable outsourcing industry is dominated by large molecule biologics as the number of monoclonal antibodies, therapeutic proteins and vaccines continues to increase. The manufacturing of these products is complex and needs aseptic production and sterile fill-finish processes that are of high quality and specific handling, and thus the outsourcing of these products to CDMOs is critical to the biopharma companies.

- Technological innovations, including single-use bioreactors, aseptic filling by isolators, automated quality control systems, and others enhance the reliability of batches, mitigate the chances of contamination, and maximize regulatory conformity.

- Market access is being augmented by facilities expansions and new services. For instance, in April 2025, Samsung Biologics hastened the opening of its fifth manufacturing facility in Songdo, South Korea, which increased 180,000 liters of biomanufacturing. The facility adds overall capacity of 784,000 liters, advanced automation, digital systems and sustainable operation, and meets the needs of biologics around the world.

- These advancements reinforce scalability, reliability, as well as accessibility, establishing large molecules as the key segment and booming growth in the global sterile injectable outsourcing market.

North America Leads Global Sterile Injectable Outsourcing Market Demand

- North America is the most successful market in the Sterile Injectable Outsourcing industry because it is an early adopter of the advanced aseptic manufacturing, biologics production, and high capacity fill-finish solution. Its dominance is also fuelled by robust regulatory frameworks, the formation of CDMOs and escalating outsourcing of complex injectables, including monoclonal antibodies, vaccines, and high-potency drugs.

- The region will have an established network of CDMOs, biotech companies and pharmaceutical research centers where new manufacturing technology can be quickly implemented. For instance, in October 2025, Sharp Services added 157,500 square feet to its facility in Macungie, Pennsylvania, to add capacity to secondary packaging of sterile injectables, such as autoinjector/pen assembly, vial labeling, pre-filled syringe assembly, and injectables kitting and cartoning, enhancing the U.S. and global presence of Sharp in the sterile injectable outsourcing market.

- Favourable government policies, the incentive to invest in manufacturing biologics in the country, and digital quality control solutions also enhance the leadership of North America. Combined with good R&D cultures and strategic alliances between the CDMOs and biotech companies, the region remains the biggest market share and seeks international investors in sterile injectable outsourcing.

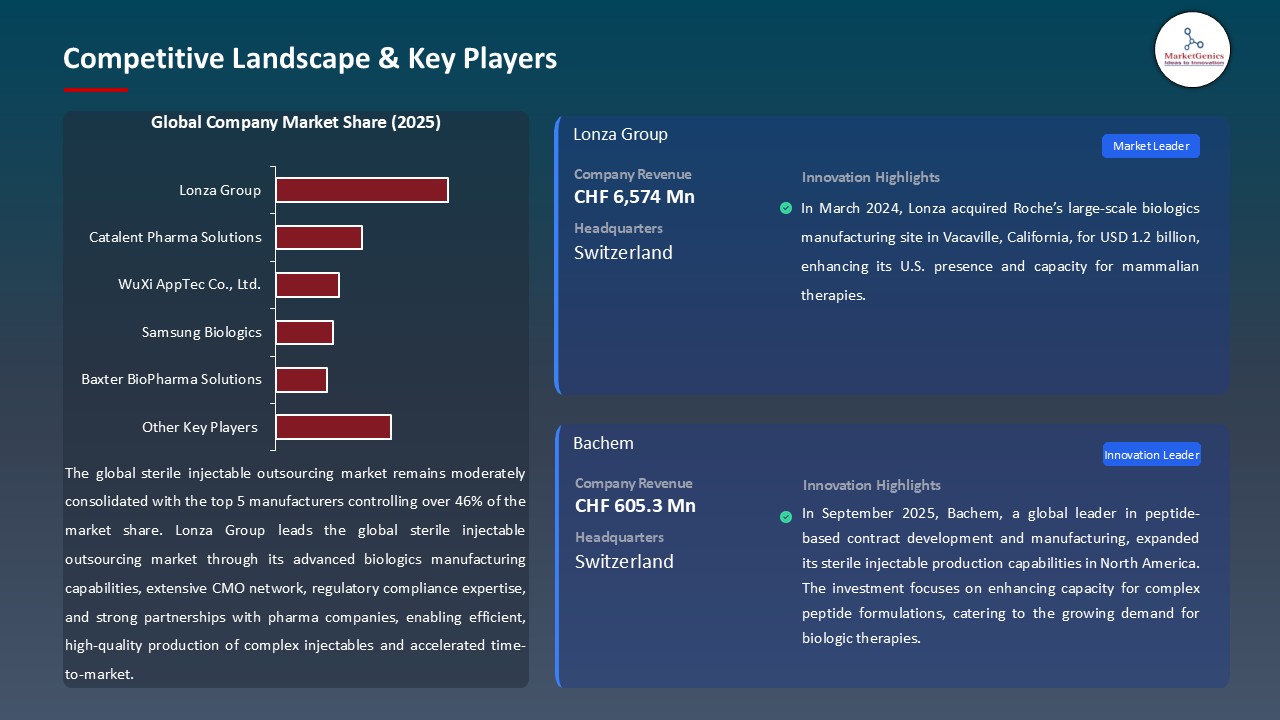

Sterile Injectable Outsourcing Market Ecosystem

A dynamic ecosystem of large CDMOs, including Lonza Group, Catalent Pharma Solutions, WuXi AppTec Co., Ltd., Samsung Biologics and Baxter BioPharma Solutions, supports the global Sterile Injectable Outsourcing Market, which is being driven by the advancements of high-throughput aseptic processing, single-use systems, isolator-based fill-finish lines, and increased capacity in vials, pre-filled syringes and cartridges. These strengths allow pharmaceutical and biotech companies to outsource sterile injectable manufacturing, capital investment, speed to market, and regulatory compliance in a more and more challenging environment.

The expansion of sophisticated sterile injectable manufacturing facilities is being driven by institutional investment, international investment and expansion of strategic capacities. For instance, in October 2024, Kindeva Drug Delivery, as part of a milestone in outsourced sterile injectable capacity addition, registered a batch of products at its newly commissioned state-of-the-art aseptic injectable fill-finish plant in Bridgeton, Missouri. In the meantime, CordenPharma stated in October 2025 that it was advancing a massive capacity expansion at its Caponago (Italy) facility to add isolator filling lines to vials, pre-filled syringes and cartridges and substantially expand aseptic fill-finish capacity, a trend that continues to exist where outsourcing infrastructure is concerned.

The combination of these interdependent ecosystems that are anchored by major CDMOs, financing by robust investment, as well as dedicated to advanced manufacturing of sterile injectables, helps to construct stronger outsourcing relationships, enhanced quality of the products and scalable global supply chains of sterile injectables.

Recent Development and Strategic Overview:

- In May 2025, PCI Pharma Services announced the acquisition of Ajinomoto Althea, Inc., a U.S.-based aseptic fill-finish CDMO specializing in sterile injectables. This strategic move strengthens PCI’s position in the sterile injectable outsourcing market by expanding its capabilities in vial, prefilled syringe, and cartridge manufacturing, along with lyophilization and high-potency filling. The acquisition also enhances PCI’s presence in advanced drug delivery and supports its goal of offering end-to-end solutions for complex biologics and injectable therapeutics.

- In October 2024, Recipharm AB and Exela Pharma Sciences announced an exclusive strategic alliance to enhance sterile-injectable manufacturing capacity, including vial and pre-filled syringe formats and expansion into advanced drug-delivery solutions.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 15.5 Bn |

|

Market Forecast Value in 2035 |

USD 31.4 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Sterile Injectable Outsourcing Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Sterile Injectable Outsourcing Market, By Product Type |

|

|

Sterile Injectable Outsourcing Market, By Container Type |

|

|

Sterile Injectable Outsourcing Market, By Application Area |

|

|

Sterile Injectable Outsourcing Market, By Service Type |

|

|

Sterile Injectable Outsourcing Market, By Therapeutic Application |

|

|

Sterile Injectable Outsourcing Market, By Molecule Type |

|

|

Sterile Injectable Outsourcing Market, By Technology Platform |

|

|

Sterile Injectable Outsourcing Market, By Production Scale |

|

|

Sterile Injectable Outsourcing Market, By Sterilization Method |

|

|

Sterile Injectable Outsourcing Market, By Contract Type |

|

|

Sterile Injectable Outsourcing Market, By End-users |

|

Frequently Asked Questions

The global sterile injectable outsourcing market was valued at USD 15.5 Bn in 2025.

The global sterile injectable outsourcing market industry is expected to grow at a CAGR of 7.3% from 2025 to 2035.

The demand for sterile injectable outsourcing market is driven by the demand for the Sterile Injectable Outsourcing Market is driven by the rising prevalence of chronic diseases such as cancer and diabetes, increasing biologics and biosimilars production, and the growing need for cost-efficient, compliant manufacturing solutions. Pharmaceutical companies are outsourcing to focus on core R&D and accelerate product launches. Additionally, advancements in fill-finish technologies and the expansion of CDMO capabilities in emerging economies are further fueling market growth.

In terms of product type, large molecules (biologics) segment accounted for the major share in 2025.

Key players in the global sterile injectable outsourcing market include prominent companies such as AbbVie Contract Manufacturing, Aenova Group, Ajinomoto Bio-Pharma Services, Baxter BioPharma Solutions, Boehringer Ingelheim BioXcellence, Catalent Pharma Solutions, Corden Pharma, Evonik Health Care, Famar Health Care Services, Fresenius Kabi, Hikma Pharmaceuticals, Jubilant HollisterStier, Kindeva Drug Delivery, Lonza Group, Lyophilization Technology, Patheon (Thermo Fisher Scientific), Pfizer CentreOne, Recipharm, Samsung Biologics, Sandoz (Novartis division), Siegfried AG, Sopharma, Vetter Pharma, WuXi AppTec Co., Ltd., West Pharmaceutical Services, and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Sterile Injectable Outsourcing Market Outlook

- 2.1.1. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Sterile Injectable Outsourcing Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for biologics, biosimilars, and complex injectable formulations.

- 4.1.1.2. Increasing pharmaceutical outsourcing to reduce manufacturing costs and time-to-market.

- 4.1.1.3. Growing adoption of prefilled syringes and ready-to-use injectable products.

- 4.1.2. Restraints

- 4.1.2.1. High capital investment and stringent sterility compliance requirements.

- 4.1.2.2. Supply chain disruptions and limited availability of skilled workforce in aseptic manufacturing.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Manufacturers

- 4.4.3. Distribution & Cold Chain Logistics

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Sterile Injectable Outsourcing Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Sterile Injectable Outsourcing Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Small Molecules

- 6.2.1.1. Cytotoxic compounds

- 6.2.1.2. Non-cytotoxic compounds

- 6.2.1.3. Others

- 6.2.2. Large Molecules (Biologics)

- 6.2.2.1. Monoclonal antibodies

- 6.2.2.2. Vaccines

- 6.2.2.3. Recombinant proteins

- 6.2.2.4. Peptides

- 6.2.2.5. Hormones

- 6.2.2.6. Others

- 6.2.3. Biosimilars

- 6.2.1. Small Molecules

- 7. Global Sterile Injectable Outsourcing Market Analysis, by Container Type

- 7.1. Key Segment Analysis

- 7.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Container Type, 2021-2035

- 7.2.1. Vials

- 7.2.1.1. Single-dose vials

- 7.2.1.2. Multi-dose vials

- 7.2.2. Prefilled Syringes

- 7.2.2.1. Glass prefilled syringes

- 7.2.2.2. Polymer prefilled syringes

- 7.2.3. Ampoules

- 7.2.4. Cartridges

- 7.2.5. IV Bags

- 7.2.6. Bottles

- 7.2.1. Vials

- 8. Global Sterile Injectable Outsourcing Market Analysis, by Filling Type

- 8.1. Key Segment Analysis

- 8.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Filling Type, 2021-2035

- 8.2.1. Powder Filling

- 8.2.2. Liquid Filling

- 8.2.3. Lyophilized (Freeze-dried) Filling

- 9. Global Sterile Injectable Outsourcing Market Analysis, by Service Type

- 9.1. Key Segment Analysis

- 9.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Service Type, 2021-2035

- 9.2.1. Manufacturing Services

- 9.2.1.1. Formulation development

- 9.2.1.2. Process development

- 9.2.1.3. Fill-finish services

- 9.2.1.4. Aseptic filling

- 9.2.1.5. Terminal sterilization

- 9.2.1.6. Others

- 9.2.2. Packaging Services

- 9.2.2.1. Primary packaging

- 9.2.2.2. Secondary packaging

- 9.2.2.3. Labeling and serialization

- 9.2.2.4. Others

- 9.2.3. Testing & Quality Services

- 9.2.3.1. Analytical testing

- 9.2.3.2. Stability testing

- 9.2.3.3. Microbial testing

- 9.2.3.4. Method development & validation

- 9.2.3.5. Others

- 9.2.1. Manufacturing Services

- 10. Global Sterile Injectable Outsourcing Market Analysis, by Therapeutic Application

- 10.1. Key Segment Analysis

- 10.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Therapeutic Application, 2021-2035

- 10.2.1. Oncology

- 10.2.2. Autoimmune Diseases

- 10.2.3. Infectious Diseases

- 10.2.4. Cardiovascular Diseases

- 10.2.5. Metabolic Disorders

- 10.2.6. Central Nervous System Disorders

- 10.2.7. Pain Management

- 10.2.8. Hormonal Disorders

- 10.2.9. Respiratory Diseases

- 10.2.10. Ophthalmology

- 10.2.11. Others

- 11. Global Sterile Injectable Outsourcing Market Analysis, by Molecule Type

- 11.1. Key Segment Analysis

- 11.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Molecule Type, 2021-2035

- 11.2.1. Conventional Drugs

- 11.2.2. Innovative Drugs

- 11.2.3. Generic Drugs

- 11.2.4. Orphan Drugs

- 12. Global Sterile Injectable Outsourcing Market Analysis, by Technology Platform

- 12.1. Key Segment Analysis

- 12.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology Platform, 2021-2035

- 12.2.1. Blow-Fill-Seal (BFS)

- 12.2.2. Form-Fill-Seal (FFS)

- 12.2.3. Ready-to-Fill (RTF) Systems

- 12.2.4. Isolator Technology

- 12.2.5. Restricted Access Barrier Systems (RABS)

- 12.2.6. Others

- 13. Global Sterile Injectable Outsourcing Market Analysis, by Production Scale

- 13.1. Key Segment Analysis

- 13.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Production Scale, 2021-2035

- 13.2.1. Clinical Scale

- 13.2.1.1. Phase I

- 13.2.1.2. Phase II

- 13.2.1.3. Phase III

- 13.2.2. Commercial Scale

- 13.2.2.1. Small batch

- 13.2.2.2. Large batch

- 13.2.1. Clinical Scale

- 14. Global Sterile Injectable Outsourcing Market Analysis, by Sterilization Method

- 14.1. Key Segment Analysis

- 14.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Sterilization Method, 2021-2035

- 14.2.1. Aseptic Processing

- 14.2.2. Terminal Sterilization

- 14.2.2.1. Steam sterilization (autoclave)

- 14.2.2.2. Radiation sterilization

- 14.2.2.3. Ethylene oxide sterilization

- 14.2.2.4. Others

- 15. Global Sterile Injectable Outsourcing Market Analysis, by Contract Type

- 15.1. Key Segment Analysis

- 15.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Contract Type, 2021-2035

- 15.2.1. Contract Manufacturing Organization (CMO)

- 15.2.2. Contract Development and Manufacturing Organization (CDMO)

- 16. Global Sterile Injectable Outsourcing Market Analysis, by End-users

- 16.1. Key Segment Analysis

- 16.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 16.2.1. Pharmaceutical Companies

- 16.2.2. Biotechnology Companies

- 16.2.3. Research Institutions

- 16.2.4. Hospitals & Healthcare Providers

- 16.2.5. Contract Research Organizations (CROs)

- 16.2.6. Veterinary Medicine

- 16.2.7. Others

- 17. Global Sterile Injectable Outsourcing Market Analysis and Forecasts, by Region

- 17.1. Key Findings

- 17.2. Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 17.2.1. North America

- 17.2.2. Europe

- 17.2.3. Asia Pacific

- 17.2.4. Middle East

- 17.2.5. Africa

- 17.2.6. South America

- 18. North America Sterile Injectable Outsourcing Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. North America Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Container Type

- 18.3.3. Filling Type

- 18.3.4. Service Type

- 18.3.5. Therapeutic Application

- 18.3.6. Molecule Type

- 18.3.7. Technology Platform

- 18.3.8. Production Scale

- 18.3.9. Sterilization Method

- 18.3.10. Contract Type

- 18.3.11. End-users

- 18.3.12. Country

- 18.3.12.1. USA

- 18.3.12.2. Canada

- 18.3.12.3. Mexico

- 18.4. USA Sterile Injectable Outsourcing Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Container Type

- 18.4.4. Filling Type

- 18.4.5. Service Type

- 18.4.6. Therapeutic Application

- 18.4.7. Molecule Type

- 18.4.8. Technology Platform

- 18.4.9. Production Scale

- 18.4.10. Sterilization Method

- 18.4.11. Contract Type

- 18.4.12. End-users

- 18.5. Canada Sterile Injectable Outsourcing Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Container Type

- 18.5.4. Filling Type

- 18.5.5. Service Type

- 18.5.6. Therapeutic Application

- 18.5.7. Molecule Type

- 18.5.8. Technology Platform

- 18.5.9. Production Scale

- 18.5.10. Sterilization Method

- 18.5.11. Contract Type

- 18.5.12. End-users

- 18.6. Mexico Sterile Injectable Outsourcing Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Container Type

- 18.6.4. Filling Type

- 18.6.5. Service Type

- 18.6.6. Therapeutic Application

- 18.6.7. Molecule Type

- 18.6.8. Technology Platform

- 18.6.9. Production Scale

- 18.6.10. Sterilization Method

- 18.6.11. Contract Type

- 18.6.12. End-users

- 19. Europe Sterile Injectable Outsourcing Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Europe Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Container Type

- 19.3.3. Filling Type

- 19.3.4. Service Type

- 19.3.5. Therapeutic Application

- 19.3.6. Molecule Type

- 19.3.7. Technology Platform

- 19.3.8. Production Scale

- 19.3.9. Sterilization Method

- 19.3.10. Contract Type

- 19.3.11. End-users

- 19.3.12. Country

- 19.3.12.1. Germany

- 19.3.12.2. United Kingdom

- 19.3.12.3. France

- 19.3.12.4. Italy

- 19.3.12.5. Spain

- 19.3.12.6. Netherlands

- 19.3.12.7. Nordic Countries

- 19.3.12.8. Poland

- 19.3.12.9. Russia & CIS

- 19.3.12.10. Rest of Europe

- 19.4. Germany Sterile Injectable Outsourcing Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Container Type

- 19.4.4. Filling Type

- 19.4.5. Service Type

- 19.4.6. Therapeutic Application

- 19.4.7. Molecule Type

- 19.4.8. Technology Platform

- 19.4.9. Production Scale

- 19.4.10. Sterilization Method

- 19.4.11. Contract Type

- 19.4.12. End-users

- 19.5. United Kingdom Sterile Injectable Outsourcing Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Container Type

- 19.5.4. Filling Type

- 19.5.5. Service Type

- 19.5.6. Therapeutic Application

- 19.5.7. Molecule Type

- 19.5.8. Technology Platform

- 19.5.9. Production Scale

- 19.5.10. Sterilization Method

- 19.5.11. Contract Type

- 19.5.12. End-users

- 19.6. France Sterile Injectable Outsourcing Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Container Type

- 19.6.4. Filling Type

- 19.6.5. Service Type

- 19.6.6. Therapeutic Application

- 19.6.7. Molecule Type

- 19.6.8. Technology Platform

- 19.6.9. Production Scale

- 19.6.10. Sterilization Method

- 19.6.11. Contract Type

- 19.6.12. End-users

- 19.7. Italy Sterile Injectable Outsourcing Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Container Type

- 19.7.4. Filling Type

- 19.7.5. Service Type

- 19.7.6. Therapeutic Application

- 19.7.7. Molecule Type

- 19.7.8. Technology Platform

- 19.7.9. Production Scale

- 19.7.10. Sterilization Method

- 19.7.11. Contract Type

- 19.7.12. End-users

- 19.8. Spain Sterile Injectable Outsourcing Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Container Type

- 19.8.4. Filling Type

- 19.8.5. Service Type

- 19.8.6. Therapeutic Application

- 19.8.7. Molecule Type

- 19.8.8. Technology Platform

- 19.8.9. Production Scale

- 19.8.10. Sterilization Method

- 19.8.11. Contract Type

- 19.8.12. End-users

- 19.9. Netherlands Sterile Injectable Outsourcing Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Product Type

- 19.9.3. Container Type

- 19.9.4. Filling Type

- 19.9.5. Service Type

- 19.9.6. Therapeutic Application

- 19.9.7. Molecule Type

- 19.9.8. Technology Platform

- 19.9.9. Production Scale

- 19.9.10. Sterilization Method

- 19.9.11. Contract Type

- 19.9.12. End-users

- 19.10. Nordic Countries Sterile Injectable Outsourcing Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Product Type

- 19.10.3. Container Type

- 19.10.4. Filling Type

- 19.10.5. Service Type

- 19.10.6. Therapeutic Application

- 19.10.7. Molecule Type

- 19.10.8. Technology Platform

- 19.10.9. Production Scale

- 19.10.10. Sterilization Method

- 19.10.11. Contract Type

- 19.10.12. End-users

- 19.11. Poland Sterile Injectable Outsourcing Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Product Type

- 19.11.3. Container Type

- 19.11.4. Filling Type

- 19.11.5. Service Type

- 19.11.6. Therapeutic Application

- 19.11.7. Molecule Type

- 19.11.8. Technology Platform

- 19.11.9. Production Scale

- 19.11.10. Sterilization Method

- 19.11.11. Contract Type

- 19.11.12. End-users

- 19.12. Russia & CIS Sterile Injectable Outsourcing Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Product Type

- 19.12.3. Container Type

- 19.12.4. Filling Type

- 19.12.5. Service Type

- 19.12.6. Therapeutic Application

- 19.12.7. Molecule Type

- 19.12.8. Technology Platform

- 19.12.9. Production Scale

- 19.12.10. Sterilization Method

- 19.12.11. Contract Type

- 19.12.12. End-users

- 19.13. Rest of Europe Sterile Injectable Outsourcing Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Product Type

- 19.13.3. Container Type

- 19.13.4. Filling Type

- 19.13.5. Service Type

- 19.13.6. Therapeutic Application

- 19.13.7. Molecule Type

- 19.13.8. Technology Platform

- 19.13.9. Production Scale

- 19.13.10. Sterilization Method

- 19.13.11. Contract Type

- 19.13.12. End-users

- 20. Asia Pacific Sterile Injectable Outsourcing Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. East Asia Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Container Type

- 20.3.3. Filling Type

- 20.3.4. Service Type

- 20.3.5. Therapeutic Application

- 20.3.6. Molecule Type

- 20.3.7. Technology Platform

- 20.3.8. Production Scale

- 20.3.9. Sterilization Method

- 20.3.10. Contract Type

- 20.3.11. End-users

- 20.3.12. Country

- 20.3.12.1. China

- 20.3.12.2. India

- 20.3.12.3. Japan

- 20.3.12.4. South Korea

- 20.3.12.5. Australia and New Zealand

- 20.3.12.6. Indonesia

- 20.3.12.7. Malaysia

- 20.3.12.8. Thailand

- 20.3.12.9. Vietnam

- 20.3.12.10. Rest of Asia Pacific

- 20.4. China Sterile Injectable Outsourcing Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Container Type

- 20.4.4. Filling Type

- 20.4.5. Service Type

- 20.4.6. Therapeutic Application

- 20.4.7. Molecule Type

- 20.4.8. Technology Platform

- 20.4.9. Production Scale

- 20.4.10. Sterilization Method

- 20.4.11. Contract Type

- 20.4.12. End-users

- 20.5. India Sterile Injectable Outsourcing Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Container Type

- 20.5.4. Filling Type

- 20.5.5. Service Type

- 20.5.6. Therapeutic Application

- 20.5.7. Molecule Type

- 20.5.8. Technology Platform

- 20.5.9. Production Scale

- 20.5.10. Sterilization Method

- 20.5.11. Contract Type

- 20.5.12. End-users

- 20.6. Japan Sterile Injectable Outsourcing Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Container Type

- 20.6.4. Filling Type

- 20.6.5. Service Type

- 20.6.6. Therapeutic Application

- 20.6.7. Molecule Type

- 20.6.8. Technology Platform

- 20.6.9. Production Scale

- 20.6.10. Sterilization Method

- 20.6.11. Contract Type

- 20.6.12. End-users

- 20.7. South Korea Sterile Injectable Outsourcing Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Container Type

- 20.7.4. Filling Type

- 20.7.5. Service Type

- 20.7.6. Therapeutic Application

- 20.7.7. Molecule Type

- 20.7.8. Technology Platform

- 20.7.9. Production Scale

- 20.7.10. Sterilization Method

- 20.7.11. Contract Type

- 20.7.12. End-users

- 20.8. Australia and New Zealand Sterile Injectable Outsourcing Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Container Type

- 20.8.4. Filling Type

- 20.8.5. Service Type

- 20.8.6. Therapeutic Application

- 20.8.7. Molecule Type

- 20.8.8. Technology Platform

- 20.8.9. Production Scale

- 20.8.10. Sterilization Method

- 20.8.11. Contract Type

- 20.8.12. End-users

- 20.9. Indonesia Sterile Injectable Outsourcing Market

- 20.9.1. Country Segmental Analysis

- 20.9.2. Product Type

- 20.9.3. Container Type

- 20.9.4. Filling Type

- 20.9.5. Service Type

- 20.9.6. Therapeutic Application

- 20.9.7. Molecule Type

- 20.9.8. Technology Platform

- 20.9.9. Production Scale

- 20.9.10. Sterilization Method

- 20.9.11. Contract Type

- 20.9.12. End-users

- 20.10. Malaysia Sterile Injectable Outsourcing Market

- 20.10.1. Country Segmental Analysis

- 20.10.2. Product Type

- 20.10.3. Container Type

- 20.10.4. Filling Type

- 20.10.5. Service Type

- 20.10.6. Therapeutic Application

- 20.10.7. Molecule Type

- 20.10.8. Technology Platform

- 20.10.9. Production Scale

- 20.10.10. Sterilization Method

- 20.10.11. Contract Type

- 20.10.12. End-users

- 20.11. Thailand Sterile Injectable Outsourcing Market

- 20.11.1. Country Segmental Analysis

- 20.11.2. Product Type

- 20.11.3. Container Type

- 20.11.4. Filling Type

- 20.11.5. Service Type

- 20.11.6. Therapeutic Application

- 20.11.7. Molecule Type

- 20.11.8. Technology Platform

- 20.11.9. Production Scale

- 20.11.10. Sterilization Method

- 20.11.11. Contract Type

- 20.11.12. End-users

- 20.12. Vietnam Sterile Injectable Outsourcing Market

- 20.12.1. Country Segmental Analysis

- 20.12.2. Product Type

- 20.12.3. Container Type

- 20.12.4. Filling Type

- 20.12.5. Service Type

- 20.12.6. Therapeutic Application

- 20.12.7. Molecule Type

- 20.12.8. Technology Platform

- 20.12.9. Production Scale

- 20.12.10. Sterilization Method

- 20.12.11. Contract Type

- 20.12.12. End-users

- 20.13. Rest of Asia Pacific Sterile Injectable Outsourcing Market

- 20.13.1. Country Segmental Analysis

- 20.13.2. Product Type

- 20.13.3. Container Type

- 20.13.4. Filling Type

- 20.13.5. Service Type

- 20.13.6. Therapeutic Application

- 20.13.7. Molecule Type

- 20.13.8. Technology Platform

- 20.13.9. Production Scale

- 20.13.10. Sterilization Method

- 20.13.11. Contract Type

- 20.13.12. End-users

- 21. Middle East Sterile Injectable Outsourcing Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Middle East Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Container Type

- 21.3.3. Filling Type

- 21.3.4. Service Type

- 21.3.5. Therapeutic Application

- 21.3.6. Molecule Type

- 21.3.7. Technology Platform

- 21.3.8. Production Scale

- 21.3.9. Sterilization Method

- 21.3.10. Contract Type

- 21.3.11. End-users

- 21.3.12. Country

- 21.3.12.1. Turkey

- 21.3.12.2. UAE

- 21.3.12.3. Saudi Arabia

- 21.3.12.4. Israel

- 21.3.12.5. Rest of Middle East

- 21.4. Turkey Sterile Injectable Outsourcing Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Container Type

- 21.4.4. Filling Type

- 21.4.5. Service Type

- 21.4.6. Therapeutic Application

- 21.4.7. Molecule Type

- 21.4.8. Technology Platform

- 21.4.9. Production Scale

- 21.4.10. Sterilization Method

- 21.4.11. Contract Type

- 21.4.12. End-users

- 21.5. UAE Sterile Injectable Outsourcing Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Container Type

- 21.5.4. Filling Type

- 21.5.5. Service Type

- 21.5.6. Therapeutic Application

- 21.5.7. Molecule Type

- 21.5.8. Technology Platform

- 21.5.9. Production Scale

- 21.5.10. Sterilization Method

- 21.5.11. Contract Type

- 21.5.12. End-users

- 21.6. Saudi Arabia Sterile Injectable Outsourcing Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Container Type

- 21.6.4. Filling Type

- 21.6.5. Service Type

- 21.6.6. Therapeutic Application

- 21.6.7. Molecule Type

- 21.6.8. Technology Platform

- 21.6.9. Production Scale

- 21.6.10. Sterilization Method

- 21.6.11. Contract Type

- 21.6.12. End-users

- 21.7. Israel Sterile Injectable Outsourcing Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Product Type

- 21.7.3. Container Type

- 21.7.4. Filling Type

- 21.7.5. Service Type

- 21.7.6. Therapeutic Application

- 21.7.7. Molecule Type

- 21.7.8. Technology Platform

- 21.7.9. Production Scale

- 21.7.10. Sterilization Method

- 21.7.11. Contract Type

- 21.7.12. End-users

- 21.8. Rest of Middle East Sterile Injectable Outsourcing Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Product Type

- 21.8.3. Container Type

- 21.8.4. Filling Type

- 21.8.5. Service Type

- 21.8.6. Therapeutic Application

- 21.8.7. Molecule Type

- 21.8.8. Technology Platform

- 21.8.9. Production Scale

- 21.8.10. Sterilization Method

- 21.8.11. Contract Type

- 21.8.12. End-users

- 22. Africa Sterile Injectable Outsourcing Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. Africa Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Product Type

- 22.3.2. Container Type

- 22.3.3. Filling Type

- 22.3.4. Service Type

- 22.3.5. Therapeutic Application

- 22.3.6. Molecule Type

- 22.3.7. Technology Platform

- 22.3.8. Production Scale

- 22.3.9. Sterilization Method

- 22.3.10. Contract Type

- 22.3.11. End-users

- 22.3.12. Country

- 22.3.12.1. South Africa

- 22.3.12.2. Egypt

- 22.3.12.3. Nigeria

- 22.3.12.4. Algeria

- 22.3.12.5. Rest of Africa

- 22.4. South Africa Sterile Injectable Outsourcing Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Product Type

- 22.4.3. Container Type

- 22.4.4. Filling Type

- 22.4.5. Service Type

- 22.4.6. Therapeutic Application

- 22.4.7. Molecule Type

- 22.4.8. Technology Platform

- 22.4.9. Production Scale

- 22.4.10. Sterilization Method

- 22.4.11. Contract Type

- 22.4.12. End-users

- 22.5. Egypt Sterile Injectable Outsourcing Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Product Type

- 22.5.3. Container Type

- 22.5.4. Filling Type

- 22.5.5. Service Type

- 22.5.6. Therapeutic Application

- 22.5.7. Molecule Type

- 22.5.8. Technology Platform

- 22.5.9. Production Scale

- 22.5.10. Sterilization Method

- 22.5.11. Contract Type

- 22.5.12. End-users

- 22.6. Nigeria Sterile Injectable Outsourcing Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Product Type

- 22.6.3. Container Type

- 22.6.4. Filling Type

- 22.6.5. Service Type

- 22.6.6. Therapeutic Application

- 22.6.7. Molecule Type

- 22.6.8. Technology Platform

- 22.6.9. Production Scale

- 22.6.10. Sterilization Method

- 22.6.11. Contract Type

- 22.6.12. End-users

- 22.7. Algeria Sterile Injectable Outsourcing Market

- 22.7.1. Country Segmental Analysis

- 22.7.2. Product Type

- 22.7.3. Container Type

- 22.7.4. Filling Type

- 22.7.5. Service Type

- 22.7.6. Therapeutic Application

- 22.7.7. Molecule Type

- 22.7.8. Technology Platform

- 22.7.9. Production Scale

- 22.7.10. Sterilization Method

- 22.7.11. Contract Type

- 22.7.12. End-users

- 22.8. Rest of Africa Sterile Injectable Outsourcing Market

- 22.8.1. Country Segmental Analysis

- 22.8.2. Product Type

- 22.8.3. Container Type

- 22.8.4. Filling Type

- 22.8.5. Service Type

- 22.8.6. Therapeutic Application

- 22.8.7. Molecule Type

- 22.8.8. Technology Platform

- 22.8.9. Production Scale

- 22.8.10. Sterilization Method

- 22.8.11. Contract Type

- 22.8.12. End-users

- 23. South America Sterile Injectable Outsourcing Market Analysis

- 23.1. Key Segment Analysis

- 23.2. Regional Snapshot

- 23.3. Central and South Africa Sterile Injectable Outsourcing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 23.3.1. Product Type

- 23.3.2. Container Type

- 23.3.3. Filling Type

- 23.3.4. Service Type

- 23.3.5. Therapeutic Application

- 23.3.6. Molecule Type

- 23.3.7. Technology Platform

- 23.3.8. Production Scale

- 23.3.9. Sterilization Method

- 23.3.10. Contract Type

- 23.3.11. End-users

- 23.3.12. Country

- 23.3.12.1. Brazil

- 23.3.12.2. Argentina

- 23.3.12.3. Rest of South America

- 23.4. Brazil Sterile Injectable Outsourcing Market

- 23.4.1. Country Segmental Analysis

- 23.4.2. Product Type

- 23.4.3. Container Type

- 23.4.4. Filling Type

- 23.4.5. Service Type

- 23.4.6. Therapeutic Application

- 23.4.7. Molecule Type

- 23.4.8. Technology Platform

- 23.4.9. Production Scale

- 23.4.10. Sterilization Method

- 23.4.11. Contract Type

- 23.4.12. End-users

- 23.5. Argentina Sterile Injectable Outsourcing Market

- 23.5.1. Country Segmental Analysis

- 23.5.2. Product Type

- 23.5.3. Container Type

- 23.5.4. Filling Type

- 23.5.5. Service Type

- 23.5.6. Therapeutic Application

- 23.5.7. Molecule Type

- 23.5.8. Technology Platform

- 23.5.9. Production Scale

- 23.5.10. Sterilization Method

- 23.5.11. Contract Type

- 23.5.12. End-users

- 23.6. Rest of South America Sterile Injectable Outsourcing Market

- 23.6.1. Country Segmental Analysis

- 23.6.2. Product Type

- 23.6.3. Container Type

- 23.6.4. Filling Type

- 23.6.5. Service Type

- 23.6.6. Therapeutic Application

- 23.6.7. Molecule Type

- 23.6.8. Technology Platform

- 23.6.9. Production Scale

- 23.6.10. Sterilization Method

- 23.6.11. Contract Type

- 23.6.12. End-users

- 24. Key Players/ Company Profile

- 24.1. AbbVie Contract Manufacturing

- 24.1.1. Company Details/ Overview

- 24.1.2. Company Financials

- 24.1.3. Key Customers and Competitors

- 24.1.4. Business/ Industry Portfolio

- 24.1.5. Product Portfolio/ Specification Details

- 24.1.6. Pricing Data

- 24.1.7. Strategic Overview

- 24.1.8. Recent Developments

- 24.2. Aenova Group

- 24.3. Ajinomoto Bio-Pharma Services

- 24.4. Baxter BioPharma Solutions

- 24.5. Boehringer Ingelheim BioXcellence

- 24.6. Catalent Pharma Solutions

- 24.7. Corden Pharma

- 24.8. Evonik Health Care

- 24.9. Famar Health Care Services

- 24.10. Fresenius Kabi

- 24.11. Hikma Pharmaceuticals

- 24.12. Jubilant HollisterStier

- 24.13. Kindeva Drug Delivery

- 24.14. Lonza Group

- 24.15. Lyophilization Technology

- 24.16. Patheon (Thermo Fisher Scientific)

- 24.17. Pfizer CentreOne

- 24.18. Recipharm

- 24.19. Samsung Biologics

- 24.20. Sandoz (Novartis division)

- 24.21. Siegfried AG

- 24.22. Sopharma

- 24.23. Vetter Pharma

- 24.24. WuXi AppTec Co., Ltd.

- 24.25. West Pharmaceutical Services

- 24.26. Other Key Players

- 24.1. AbbVie Contract Manufacturing

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data