String Inverter Market Size, Share & Trends Analysis Report by Inverter Type (Central String Inverters, Multi-MPPT String Inverters, Single-MPPT String Inverters, Hybrid (PV + Battery) String Inverters, Others), by Power Rating (<5 Kw, 5–50 kW, 50–150 kW, >150 kW), Phase, Mounting Type, Component/Feature, Application, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

String Inverter Market Size, Share, and Growth

The global string inverter market is experiencing robust growth, with its estimated value of USD 6.1 billion in the year 2025 and USD 10.5 billion by the period 2035, registering a CAGR of 5.6%. Asia Pacific leads the market with market share of 51% with USD 3.1 billion revenue.

David Chen, Chief Executive Officer, SolarEdge Systems, said,"Broadening our string inverter offering demonstrates our dedication to dependable solar solutions that are cost competitive, scalable, and maximize energy yield to encourage rapid global renewable penetration."

String inverters, which convert direct current (DC) to alternating current (AC) from solar panels, are becoming an essential part of a home, a commercial building, or utility-scale solar plants. String inverters are at the forefront of solar power electronics and reliability and modularity, and cost-effectiveness makes them much more appealing than central inverters. A leading example is Huawei's 2024 launch of a smart string inverter featuring AI-based monitoring that provides operators real-time diagnostics and increased power yields on all distributed solar projects.

Further, advanced capabilities like multi-MPPT (multiple maximum power point tracking) and new features like digital twin analytics are increasingly being utilized to maximize operational performance across an array of solar installations. Utilities are evolving from a one-size-fits-all method of building out power distribution with central inverters to the vastly superior string methodology, which produces a more reliable, more granular, longer lasting, and quicker turnaround on 'downtime' in larger solar farms.

Residential and commercial demand remains a key driver of rapid growth, with businesses like SolarEdge, SMA, and Huawei developing many new versions of inverters with customizable module-level monitoring, hybrid storage situations, and cutting-edge safety features. Such advancements are raising the bar on performance, user experience, and institutional resilience on the grid.

Furthermore, new applications in microgrids, EV charging and virtual power plants (VPPs) are additionally opening up new ways to enlarge the market. Enphase and Tesla are, for example, integrating string inverters into distributed energy systems that manage load, facilitate storage, and enable more intelligent interactions with the grid, a new chapter in decentralized and intelligent energy networks.

String Inverter Market Dynamics and Trends

Driver: Expanding Solar Installations and Demand for Modular, Efficient Power Conversion Boosting String Inverter Adoption

- String inverters are a familiar part of the technology landscape for solar energy today: multi-MPPT units are commonly associated with residential rooftops, hybrid inverters for smart homes, large three-phase systems for commercial facilities, and hybrid modular inverters for utility-scale plants. SolarEdge even announced in 2024 that it exceeded 50 million shipped power optimizers and string inverters, confirming that residential solar installations account for the largest share globally.

- Moreover, in June 2024 Huawei Digital Power launched their new FusionSolar Smart String Inverter series, which features AI-based fault detection, arc prevention, and digital twin analytics. These features are reflective of the ongoing transition to intelligent, modular, and grid-interactive solar inverters that will increase energy yields while making a safer provision across all types of projects.

- Moreover, increasingly more and more string inverters are appealing for residential and small commercial applications thanks to shrinking size and decreasing costs, while modernized cooling architectures and engineering have allowed even more capacity for utility-scale applications.

Restraint: Price Pressure and Grid Compliance Regulations Limit Wider Adoption of String Inverters

- The market for string inverters is limited by fierce cost competition, particularly in lower-cost price-sensitive markets. In India, the Ministry of New and Renewable Energy (MNRE) indicates that the average costs associated with installation for rooftop solar systems are still around INR 45,000 to INR 75,000 per kilowatt, signifying that high initial capital costs -including inverters- is a significant barrier to adoption.

- Increasing standards and performance specifications add to the complexity and challenges of installing string inverters. The Bureau of Energy Efficiency’s 2024-2025 Standards and Labeling Programme specifies minimum efficiency ratings for inverters - between 92% for up to 1 kW inverters to above 98% for larger than 20 kW inverters - to encourage energy savings and better grid stability but such standards also impose added design and compliance requirements for manufacturers and project developers alike.

Opportunity: Opportunities Rise with Policy Support and Smart Inverter Integration

- Favorable government policies have begun to drive new demand. For instance, the U.S. Department of Energy (DOE) has indicated that federal tax credits under the Investment Tax Credit (ITC) program reduce the cost of solar systems up to 30%, thus indirectly facilitating sustained inverter adoption under solar installations.

- In the report from the International Energy Agency (IEA), the authors note that distributed PV will likely constitute nearly half of total solar PV growth until 2023–2030; thereby directly increasing demand for string inverters designed for rooftop and decentralized applications.

- The regulatory environment promoted by organizations such as the California Energy Commission (CEC) defines functionality—via “smart inverter” features that would weave in value added grid-support services, including voltage ride-through, creating competitive opportunities for manufacturers willing to certify early and add value.

Key Trend: Expansion of Rooftop and Distributed Solar Systems Driving Advanced Inverter Technologies

- String inverters are being increasingly incorporated into residential, commercial, and distributed solar installations as a crucial component for efficient conversion of direct current (DC) to alternating current (AC) and modular energy management.

- The further adoption of rooftop solar and small-scale solar systems is driving demand for reliable, smart monitoring, and grid supporting inverters. Leading manufacturers including SolarEdge, SMA, and Enphase are now incorporating Internet of Things (IoT) enabled technologies, remote diagnostics, and autonomous power control into string inverters, creating greater compatibility and efficiency with emerging decentralized energy networks.

- Government incentives and renewable energy targets are accelerating the adoption of inverter technology. In North America, Europe, and across the Asia-Pacific region, supportive policies, incentive schemes, subsidies, and streamlined interconnection processes, are positively increasing the uptake of household and business rooftop solar, which directly drives demand for increased power stringing and inverter performance.

- In addition, the increasing focus on energy resilience and compatibility with smart grids is driving engineers to innovate advanced, software-enabled inverter alternatives that can handle dynamic load conditions, while providing real-time performance data. Emerging applications including community solar, microgrids, and hybrid solar-battery systems, have also contributed to design innovation.

String Inverter Market Analysis and Segmental Data

Utility-Scale Distributed Plants Maintain Dominance in Global Market amid Rising Rooftop and Decentralized Solar Adoption

- String inverters will continue, for the foreseeable future, to be the most preferred choice in the global solar inverter market, owing to some characteristics, like modularity, scalability, flexibility, and applicable in utility and distributed (or decentralized) systems. When it comes to add and configure most functionalities like rooftop systems, community solar, or when adding battery storage (hybrid systems), the flexibility to accommodate configurations of all types is invaluable.

- In 2025, SolarEdge Technologies expanded their smart inverter product lines by deploying IoT when they integrated further capabilities for monitoring, energy management, and bi-directional power flow, improving efficiency, grid support, and diagnostics (in near real-time) while consolidating deployment across private, commercial and utility-scale systems globally.

- Government & policy incentives such as net-metering guidelines, installation deployment guidance, and interconnection standards will continue to accelerate the upward adoption of string inverters (whether grid-connected, decentralized, or other) in solar energy projects. These conditions will likely ensure that string inverters will continue to captivate the market, representations of reliable, affordable, original, and smart systems, in these variable scale projects.

Asia Pacific Dominates the String Inverter Market, Driven by Rapid Solar Deployment and Supportive Government Policies

- Asia Pacific spearheads the global string inverter sector, thanks to explosive solar edge installations in China, India, Japan, and South Korea. Key market drivers include soaring electricity demand, industrialization, and rapidly falling module prices, driving growth in both utility-scale and rooftop solar, which means requirements for modular, reliable inverters. Major manufacturers such as SolarEdge, SMA, and Huawei are enhancing inverter technology with smart monitoring, bidirectional flow, and grid supporting features.

- The enabling environment remains present with government incentives and subsidies, as well as pre-approved interconnection standards to continue to drive rapid adoption — India has its MNRE rooftop program and China, feed-in tariffs. Many hybrid solar-plus-storage, microgrids, and community solar sites also drive demand, resulting in the Asia Pacific region emerge as the key region for development and deployment capacity in the string inverter sector.

String Inverter Market Ecosystem

The global string inverter market is fairly consolidated, with Tier 1 players - Huawei Technologies, SMA Solar Technology, SolarEdge, and Fronius International - building lock on the market share based on their technological hold and global reach. Tier 2 - 3 players are regional or niche players. The degree of buyer concentration is moderate to high, primarily due to large solar developers and utilities. The supplier concentration is low to moderate as there are different suppliers for each component in the string inverter so they can be flexible on prices and supply throughout the market.

Recent Development and Strategic Overview:

- In May 2025, Delta Electronics, Inc. launched its newest string inverter series, featuring new configurations that maximize efficiency in energy conversion and support smart grid connection. With enhanced thermal management, integrated AI performance optimizers, safety features, and a low carbon insecurity for residential, commercial, and utility operating styles, Delta's string inverters allow you to improve operational reliability, reduce downtime and maintenance costs, maximize returns on capital, and deploy reliable and economical solar energy to facilities around the world.

- In May 2025, FIMER S.p.A. has launched a new high-capacity string inverter platform, designed specifically for utility-scale and commercial solar projects. The solution utilizes innovative modular architecture to implement predictive diagnostics and high-efficiency conversion to produce higher energy yield and performance against changing weather conditions. Enhanced grid compliance monitoring, remote monitoring and reporting capabilities reduce operational complexity and lifecycle costs to better support future global large renewable energy adoption.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 6.1 Bn |

|

Market Forecast Value in 2035 |

USD 10.5 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2020 – 2024 |

|

Market Size Units |

USD Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

, S.A.

|

|

String inverter Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Inverter Type |

|

|

By Power Rating |

|

|

By Phase |

|

|

By Mounting Type |

|

|

By Component/Feature |

|

|

By Application |

|

|

By End User |

|

Frequently Asked Questions

The global string inverter market was valued at USD 6.1 Bn in 2025.

The global string inverter market industry is expected to grow at a CAGR of 5.6% from 2025 to 2035.

The demand for string inverters is driven by rising solar installations, supportive policies, technological advancements, cost competitiveness, and the need for reliable grid integration.

In terms of string inverter, the utility-scale distributed plants segment accounted for the major share in 2025.

Asia Pacific is the more attractive region for vendors.

Key players in the global string inverter market include prominent companies such as Canadian Solar Inc.

Chint Power Systems Co., Ltd., Delta Electronics, Inc., Eaton Corporation plc, FIMER S.p.A. (formerly ABB inverters), Fronius International GmbH, Ginlong Technologies (Solis), GoodWe (Jiangsu GoodWe Power Supply Technology Co., Ltd.), Growatt New Energy Technology Co., Ltd., Hitachi Energy, Huawei Technologies Co., Ltd., Ingeteam Power Technology, S.A., KACO New Energy GmbH, Power Electronics, Schneider Electric SE, SMA Solar Technology AG, SolarEdge Technologies, Inc., Sungrow Power Supply Co., Ltd., TMEIC Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global String Inverter Market Outlook

- 2.1.1. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global String Inverter Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global String Inverter Industry Overview, 2025

- 3.1.1. Energy & Power Ecosystem Analysis

- 3.1.2. Key Trends for Energy & Power Industry

- 3.1.3. Regional Distribution for Energy & Power Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Global String Inverter Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Expanding Solar Installations and Demand for Modular, Efficient Power Conversion Boosting String Inverter Adoption

- 4.1.2. Restraints

- 4.1.2.1. Price Pressure and Grid Compliance Regulations Limit Wider Adoption of String Inverters

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Resource Supply

- 4.4.2. Power Generation

- 4.4.3. Transmission & Distribution

- 4.4.4. Storage & Retail

- 4.4.5. End-Use & Sustainability

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global String Inverter Market Demand

- 4.9.1. Historical Market Size - (Volume - Million Units and Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size - (Volume - Million Units and Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global String Inverter Market Analysis, by Inverter Type

- 6.1. Key Segment Analysis

- 6.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Inverter Type, 2021-2035

- 6.2.1. Central String Inverters

- 6.2.2. Multi-MPPT String Inverters

- 6.2.3. Single-MPPT String Inverters

- 6.2.4. Hybrid (PV + Battery) String Inverters

- 6.2.5. Others

- 7. Global String Inverter Market Analysis, by Power Rating

- 7.1. Key Segment Analysis

- 7.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Power Rating, 2021-2035

- 7.2.1. <5 kW

- 7.2.2. 5–50 kW

- 7.2.3. 50–150 kW

- 7.2.4. >150 kW

- 8. Global String Inverter Market Analysis, by Phase

- 8.1. Key Segment Analysis

- 8.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, Phase, 2021-2035

- 8.2.1. Single-Phase

- 8.2.2. Three-Phase

- 9. Global String Inverter Market Analysis, by Mounting Type

- 9.1. Key Segment Analysis

- 9.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Mounting Type, 2021-2035

- 9.2.1. Rooftop String Inverters

- 9.2.2. Ground-Mounted / Plant String Inverters

- 10. Global String Inverter Market Analysis, by Component/Feature

- 10.1. Key Segment Analysis

- 10.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Component/Feature, 2021-2035

- 10.2.1. With Integrated Monitoring & IoT

- 10.2.2. With Power Optimizers (DC-level)

- 10.2.3. With Rapid Shutdown & Safety Features

- 10.2.4. With Advanced Grid-Support (V/VAR, Frequency Ride-Through)

- 10.2.5. Others

- 11. Global String Inverter Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Residential Rooftop Systems

- 11.2.2. Commercial & Industrial (C&I) Rooftops

- 11.2.3. Utility-Scale Distributed Plants

- 11.2.4. Off-grid / Microgrid Installations

- 11.2.5. Others

- 12. Global String Inverter Market Analysis, by End User

- 12.1. Key Segment Analysis

- 12.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by End User, 2021-2035

- 12.2.1. Homeowners / Residential Installers

- 12.2.2. Commercial Property Owners / EPCs

- 12.2.3. Independent Power Producers (IPPs) / Utilities

- 12.2.4. Government & Institutions

- 12.2.5. Others

- 13. Global String Inverter Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Global String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America String Inverter Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Inverter Type

- 14.3.2. Power Rating

- 14.3.3. Phase

- 14.3.4. Mounting Type

- 14.3.5. Component/Feature

- 14.3.6. Application

- 14.3.7. End User

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA String Inverter Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Inverter Type

- 14.4.3. Power Rating

- 14.4.4. Phase

- 14.4.5. Mounting Type

- 14.4.6. Component/Feature

- 14.4.7. Application

- 14.4.8. End User

- 14.5. Canada String Inverter Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Inverter Type

- 14.5.3. Power Rating

- 14.5.4. Phase

- 14.5.5. Mounting Type

- 14.5.6. Component/Feature

- 14.5.7. Application

- 14.5.8. End User

- 14.6. Mexico String Inverter Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Inverter Type

- 14.6.3. Power Rating

- 14.6.4. Phase

- 14.6.5. Mounting Type

- 14.6.6. Component/Feature

- 14.6.7. Application

- 14.6.8. End User

- 15. Europe String Inverter Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Inverter Type

- 15.3.2. Power Rating

- 15.3.3. Phase

- 15.3.4. Mounting Type

- 15.3.5. Component/Feature

- 15.3.6. Application

- 15.3.7. End User

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany String Inverter Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Inverter Type

- 15.4.3. Power Rating

- 15.4.4. Phase

- 15.4.5. Mounting Type

- 15.4.6. Component/Feature

- 15.4.7. Application

- 15.4.8. End User

- 15.5. United Kingdom String Inverter Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Inverter Type

- 15.5.3. Power Rating

- 15.5.4. Phase

- 15.5.5. Mounting Type

- 15.5.6. Component/Feature

- 15.5.7. Application

- 15.5.8. End User

- 15.6. France String Inverter Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Inverter Type

- 15.6.3. Power Rating

- 15.6.4. Phase

- 15.6.5. Mounting Type

- 15.6.6. Component/Feature

- 15.6.7. Application

- 15.6.8. End User

- 15.7. Italy String Inverter Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Inverter Type

- 15.7.3. Power Rating

- 15.7.4. Phase

- 15.7.5. Mounting Type

- 15.7.6. Component/Feature

- 15.7.7. Application

- 15.7.8. End User

- 15.8. Spain String Inverter Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Inverter Type

- 15.8.3. Power Rating

- 15.8.4. Phase

- 15.8.5. Mounting Type

- 15.8.6. Component/Feature

- 15.8.7. Application

- 15.8.8. End User

- 15.9. Netherlands String Inverter Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Inverter Type

- 15.9.3. Power Rating

- 15.9.4. Phase

- 15.9.5. Mounting Type

- 15.9.6. Component/Feature

- 15.9.7. Application

- 15.9.8. End User

- 15.10. Nordic Countries String Inverter Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Inverter Type

- 15.10.3. Power Rating

- 15.10.4. Phase

- 15.10.5. Mounting Type

- 15.10.6. Component/Feature

- 15.10.7. Application

- 15.10.8. End User

- 15.11. Poland String Inverter Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Inverter Type

- 15.11.3. Power Rating

- 15.11.4. Phase

- 15.11.5. Mounting Type

- 15.11.6. Component/Feature

- 15.11.7. Application

- 15.11.8. End User

- 15.12. Russia & CIS String Inverter Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Inverter Type

- 15.12.3. Power Rating

- 15.12.4. Phase

- 15.12.5. Mounting Type

- 15.12.6. Component/Feature

- 15.12.7. Application

- 15.12.8. End User

- 15.13. Rest of Europe String Inverter Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Inverter Type

- 15.13.3. Power Rating

- 15.13.4. Phase

- 15.13.5. Mounting Type

- 15.13.6. Component/Feature

- 15.13.7. Application

- 15.13.8. End User

- 16. Asia Pacific String Inverter Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Inverter Type

- 16.3.2. Power Rating

- 16.3.3. Phase

- 16.3.4. Mounting Type

- 16.3.5. Component/Feature

- 16.3.6. Application

- 16.3.7. End User

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia-Pacific

- 16.4. China String Inverter Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Inverter Type

- 16.4.3. Power Rating

- 16.4.4. Phase

- 16.4.5. Mounting Type

- 16.4.6. Component/Feature

- 16.4.7. Application

- 16.4.8. End User

- 16.5. India String Inverter Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Inverter Type

- 16.5.3. Power Rating

- 16.5.4. Phase

- 16.5.5. Mounting Type

- 16.5.6. Component/Feature

- 16.5.7. Application

- 16.5.8. End User

- 16.6. Japan String Inverter Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Inverter Type

- 16.6.3. Power Rating

- 16.6.4. Phase

- 16.6.5. Mounting Type

- 16.6.6. Component/Feature

- 16.6.7. Application

- 16.6.8. End User

- 16.7. South Korea String Inverter Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Inverter Type

- 16.7.3. Power Rating

- 16.7.4. Phase

- 16.7.5. Mounting Type

- 16.7.6. Component/Feature

- 16.7.7. Application

- 16.7.8. End User

- 16.8. Australia and New Zealand String Inverter Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Inverter Type

- 16.8.3. Power Rating

- 16.8.4. Phase

- 16.8.5. Mounting Type

- 16.8.6. Component/Feature

- 16.8.7. Application

- 16.8.8. End User

- 16.9. Indonesia String Inverter Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Inverter Type

- 16.9.3. Power Rating

- 16.9.4. Phase

- 16.9.5. Mounting Type

- 16.9.6. Component/Feature

- 16.9.7. Application

- 16.9.8. End User

- 16.10. Malaysia String Inverter Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Inverter Type

- 16.10.3. Power Rating

- 16.10.4. Phase

- 16.10.5. Mounting Type

- 16.10.6. Component/Feature

- 16.10.7. Application

- 16.10.8. End User

- 16.11. Thailand String Inverter Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Inverter Type

- 16.11.3. Power Rating

- 16.11.4. Phase

- 16.11.5. Mounting Type

- 16.11.6. Component/Feature

- 16.11.7. Application

- 16.11.8. End User

- 16.12. Vietnam String Inverter Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Inverter Type

- 16.12.3. Power Rating

- 16.12.4. Phase

- 16.12.5. Mounting Type

- 16.12.6. Component/Feature

- 16.12.7. Application

- 16.12.8. End User

- 16.13. Rest of Asia Pacific String Inverter Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Inverter Type

- 16.13.3. Power Rating

- 16.13.4. Phase

- 16.13.5. Mounting Type

- 16.13.6. Component/Feature

- 16.13.7. Application

- 16.13.8. End User

- 17. Middle East String Inverter Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Inverter Type

- 17.3.2. Power Rating

- 17.3.3. Phase

- 17.3.4. Mounting Type

- 17.3.5. Component/Feature

- 17.3.6. Application

- 17.3.7. End User

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey String Inverter Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Inverter Type

- 17.4.3. Power Rating

- 17.4.4. Phase

- 17.4.5. Mounting Type

- 17.4.6. Component/Feature

- 17.4.7. Application

- 17.4.8. End User

- 17.5. UAE String Inverter Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Inverter Type

- 17.5.3. Power Rating

- 17.5.4. Phase

- 17.5.5. Mounting Type

- 17.5.6. Component/Feature

- 17.5.7. Application

- 17.5.8. End User

- 17.6. Saudi Arabia String Inverter Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Inverter Type

- 17.6.3. Power Rating

- 17.6.4. Phase

- 17.6.5. Mounting Type

- 17.6.6. Component/Feature

- 17.6.7. Application

- 17.6.8. End User

- 17.7. Israel String Inverter Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Inverter Type

- 17.7.3. Power Rating

- 17.7.4. Phase

- 17.7.5. Mounting Type

- 17.7.6. Component/Feature

- 17.7.7. Application

- 17.7.8. End User

- 17.8. Rest of Middle East String Inverter Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Inverter Type

- 17.8.3. Power Rating

- 17.8.4. Phase

- 17.8.5. Mounting Type

- 17.8.6. Component/Feature

- 17.8.7. Application

- 17.8.8. End User

- 18. Africa String Inverter Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Inverter Type

- 18.3.2. Power Rating

- 18.3.3. Phase

- 18.3.4. Mounting Type

- 18.3.5. Component/Feature

- 18.3.6. Application

- 18.3.7. End User

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa String Inverter Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Inverter Type

- 18.4.3. Power Rating

- 18.4.4. Phase

- 18.4.5. Mounting Type

- 18.4.6. Component/Feature

- 18.4.7. Application

- 18.4.8. End User

- 18.5. Egypt String Inverter Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Inverter Type

- 18.5.3. Power Rating

- 18.5.4. Phase

- 18.5.5. Mounting Type

- 18.5.6. Component/Feature

- 18.5.7. Application

- 18.5.8. End User

- 18.6. Nigeria String Inverter Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Inverter Type

- 18.6.3. Power Rating

- 18.6.4. Phase

- 18.6.5. Mounting Type

- 18.6.6. Component/Feature

- 18.6.7. Application

- 18.6.8. End User

- 18.7. Algeria String Inverter Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Inverter Type

- 18.7.3. Power Rating

- 18.7.4. Phase

- 18.7.5. Mounting Type

- 18.7.6. Component/Feature

- 18.7.7. Application

- 18.7.8. End User

- 18.8. Rest of Africa String Inverter Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Inverter Type

- 18.8.3. Power Rating

- 18.8.4. Phase

- 18.8.5. Mounting Type

- 18.8.6. Component/Feature

- 18.8.7. Application

- 18.8.8. End User

- 19. South America String Inverter Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa String Inverter Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Inverter Type

- 19.3.2. Power Rating

- 19.3.3. Phase

- 19.3.4. Mounting Type

- 19.3.5. Component/Feature

- 19.3.6. Application

- 19.3.7. End User

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil String Inverter Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Inverter Type

- 19.4.3. Power Rating

- 19.4.4. Phase

- 19.4.5. Mounting Type

- 19.4.6. Component/Feature

- 19.4.7. Application

- 19.4.8. End User

- 19.5. Argentina String Inverter Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Inverter Type

- 19.5.3. Power Rating

- 19.5.4. Phase

- 19.5.5. Mounting Type

- 19.5.6. Component/Feature

- 19.5.7. Application

- 19.5.8. End User

- 19.6. Rest of South America String Inverter Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Inverter Type

- 19.6.3. Power Rating

- 19.6.4. Phase

- 19.6.5. Mounting Type

- 19.6.6. Component/Feature

- 19.6.7. Application

- 19.6.8. End User

- 20. Key Players/ Company Profile

- 20.1. Canadian Solar Inc.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Chint Power Systems Co., Ltd.

- 20.3. Delta Electronics, Inc.

- 20.4. Eaton Corporation plc

- 20.5. FIMER S.p.A. (formerly ABB inverters)

- 20.6. Fronius International GmbH

- 20.7. Ginlong Technologies (Solis)

- 20.8. GoodWe (Jiangsu GoodWe Power Supply Technology Co., Ltd.)

- 20.9. Growatt New Energy Technology Co., Ltd.

- 20.10. Hitachi Energy

- 20.11. Huawei Technologies Co., Ltd.

- 20.12. Ingeteam Power Technology, S.A.

- 20.13. KACO New Energy GmbH

- 20.14. Power Electronics

- 20.15. Schneider Electric SE

- 20.16. SMA Solar Technology AG

- 20.17. SolarEdge Technologies, Inc.

- 20.18. Sungrow Power Supply Co., Ltd.

- 20.19. TMEIC Corporation

- 20.20. Others Key Players

- 20.1. Canadian Solar Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

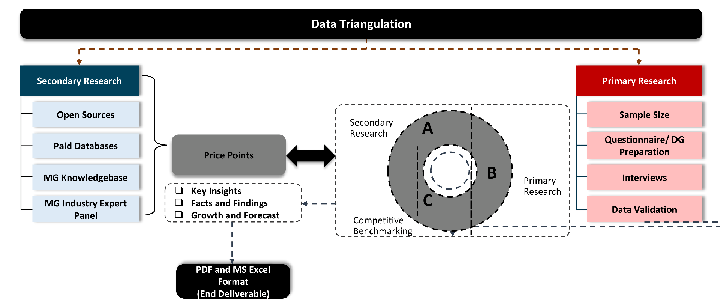

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data