Supervisory Control and Data Acquisition (SCADA) Systems Market Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), Architecture Type, Deployment Mode, Communication Protocol, Security Level, Enterprise Size, Technology Integration, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Supervisory Control and Data Acquisition (SCADA) Systems Market Size, Share, and Growth

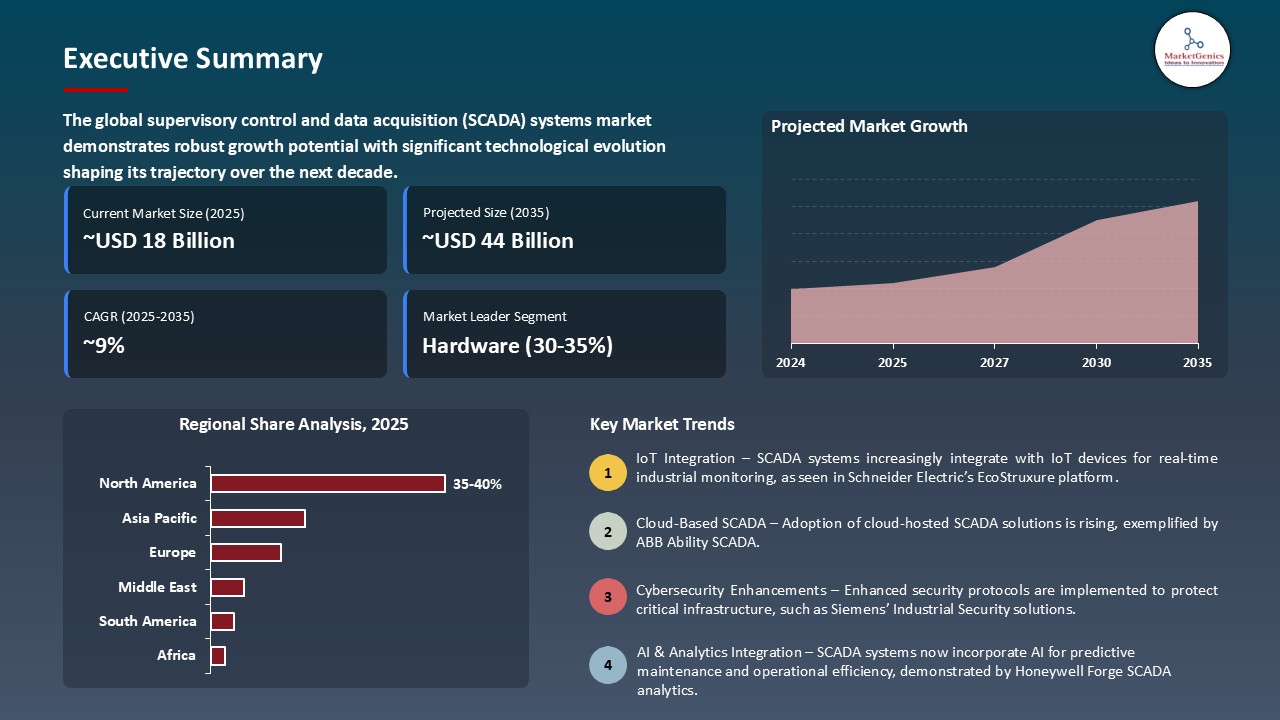

The global supervisory control and data acquisition (SCADA) systems market is witnessing strong growth, valued at USD 17.7 billion in 2025 and projected to reach USD 43.5 billion by 2035, expanding at a CAGR of 9.4% during the forecast period. The Asia Pacific is the fastest-growing region in the SCADA systems market due to rapid industrial expansion and significant investments in smart infrastructure and utility modernization.

Lars Skoglund, electrical safety manager for Sandvik, said, “We can get statistics, analyze what has gone wrong with interruption reports and find weak points in the network where we can focus on preventive maintenance and also get alarms for emergency maintenance, One of the biggest strengths of MicroSCADA X is how it handles time resolution, as it is very important that we get times when different events have occurred in order to be able to deduce any errors”.

Deploying SCADA systems at the edge enables real-time data processing with minimal latency, improves operational efficiency, and enhances responsiveness, driving broader adoption across distributed industrial sites and contributing to the overall growth of global supervisory control and data acquisition (SCADA) systems market. As an example, Tyrion Integration Services installed its Nucleus SCADA platform in the Permian Basin that allowed oil and gas operators to remotely monitor and control distributed field assets in real-time and to enhance operational efficiency, reduce downtime, and limit the necessity of on-site interventions.

Partnerships between SCADA vendors and technology partners lead to innovation, integration of technologies, and wider adoption, further stimulating the development of the global supervisory control and data acquisition (SCADA) systems market. As an example, Barbara and Inductive Automation facilitated the deployment of Ignition SCADA instantly in 2025 through Barbara Edge Orchestration Platform allowing industry sectors such as Energy, Utilities, Oil and Gas and Manufacturing to have centralized, secure, and scalable edge management that saves time on installation, manual effort and reduces the costs of maintenance.

Using SCADA-generated data, mastered by AI and machine learning, allows industries to conduct predictive maintenance, optimize real-time processes, minimize unplanned downtime, enhance asset usage, and make operational decisions data-driven and relying on reliable and effective tools, which opens enormous efficiency and cost-saving potential in manufacturing, energy, and utility industries.

Supervisory Control and Data Acquisition (SCADA) Systems Market Dynamics and Trends

Driver: Critical Infrastructure Modernization and Grid Resilience Requirements

- The growing demand to bring aging critical infrastructure into the modernization era and to improve grid resilience is a significant cause of the supervisory control and data acquisition (SCADA) systems market. Captivated by the need to overcome the old control equipment, assure continuity of operations, and the growing expectations of reliability, utilities, energy operators and industrial facilities are moving towards new SCADA platforms.

- Real-time visibility, automated fault detection, and secure communication networks would make the SCADA infrastructure more resilient to cyber threats, extreme weather, and equipment failures, which are all made possible by modern SCADA systems. The governments and regulators are also driving infrastructure upgrades and resilience requirements, and increased investment in digital monitoring and control technologies is expedited.

- Siemens AG, modernized its grid with greater integration of its SIMATIC WinCC Unified SCADA into the Siemens Xcelerator digital and IoT ecosystem to allow utilities to gain real-time grid visibility, quicker fault response, and enhanced resilience, directly accelerating the use of SCADA to upgrade a critical infrastructure.

- A combination of these modernization pressures, resilience pressures, and technology innovation leads to an imminent transition to next-generation SCADA systems to make them a key point of infrastructure in achieving reliable, secure, and future-proof industrial and utility operations.

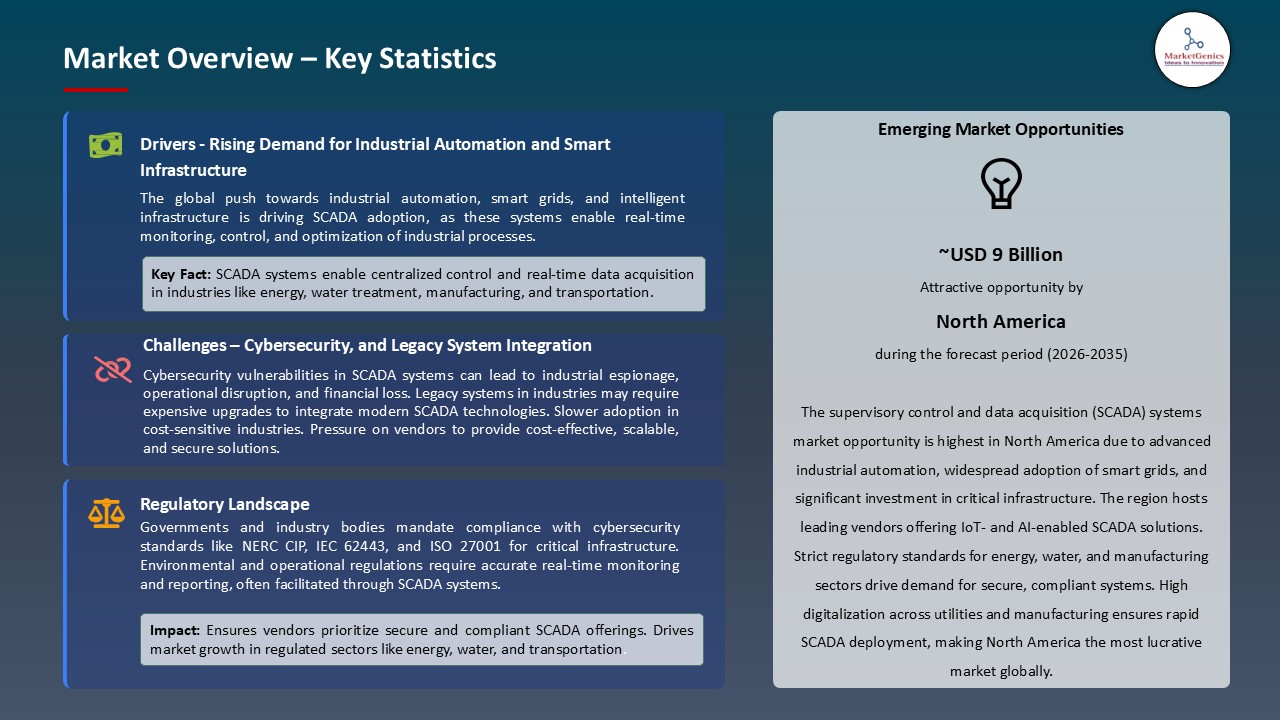

Restraint: Cybersecurity Threats and Regulatory Compliance Complexity

- The growing cybersecurity risks are a significant challenge to the supervisory control and data acquisition (SCADA) systems market because the critical infrastructure operators are increasingly vulnerable to ransomware or state-sponsored attacks as well as the vulnerabilities of the old equipment. Recent SCADA settings necessitate sound security structures, oblivious repairing, intrusion recognition, division of networks and encrypted transmissions necessities that certainly raise implementation and running expenses.

- Concurrently, companies have to operate within an increasingly intricate and expanding environment of regulatory needs in power, oil and gas, water and transportation among others. The compliance regulations such as NERC CIP, ISA/IEC 62443, and national cybersecurity guidelines require stringent controls, auditing, and risk management procedures, which most of the operators find hard to comply with. These needs increase the project timelines, create integration burdens and demand frequent updates of systems.

- The merging of IT and OT space also makes security and compliance work more complex as the integration of cloud services, remote access, and connected field devices also creates new attack surfaces and interoperability issues. It involves high-level coordination, specialized skills, and sustained surveillance elements which make sure that end-to-end protection is ensured on hybrid infrastructures, and this would compound the pace in modernizing SCADA deployments.

Opportunity: Cloud-Native Architecture and Software-as-a-Service Models

- The transition to cloud-native architecture and Software-as-a-Service (SaaS) paradigms is a significant opportunity to the supervisory control and data acquisition (SCADA) systems market. With cloud-native SCADA, most industries can cost-effectively deploy their operational infrastructure, and scale relies on their operational requirements and operational capacity at the time of deployment without the need to invest heavily in hardware. SCADA systems built on SaaS allow operators to control assets that are located at distant locations in real time and be centralized, support updates quickly, and integrate well with IoT devices and edge analytics.

- The models will also lessen maintenance overheads, enhance disaster recovery, and deliver greater cybersecurity due to continuous patches that are managed by vendors. With the shift of organizations toward digital transformation and remote operation, the need of cloud-native and subscription-based SCADA is likely to gain great pace in the utility, manufacturing, and oil and gas industries.

- In April 2025, Emerson introduced DeltaV SaaS SCADA, an edge-enabled preconfigured SCADA based on cloud architecture designed to enable user connecting field devices with a cloud-hosted SCADA system in a few minutes.

- Built on PACEdge software, includes native device protocols, secure ISA-62443 compatible architecture, dynamic polling, data buffering, and low code customization simplifying data mobility across OT-IT borders and facilitating faster and safer and more flexible remote operations.

- In summary, cloud-native and SaaS SCADA designs will play a pivotal role in industrial digitalization, providing a greater number of scalable, safe, and cost-efficient operational controls of widely distributed assets.

Key Trend: Mobile Access and Augmented Reality Field Service Integration

- Mobile-enabled SCADA platforms and field services tools based on augmented reality (AR) are becoming key trends that are transforming the supervisory control and data acquisition (SCADA) systems. The industries are also moving towards using mobile SCADA applications that offer real time visibility, remote alarm and on-the-fly device control so that technicians and operators can respond to problems more quickly without having to be physical control rooms.

- Digitization of AR increases this capacity by superimposing digital instructions, equipment status and directed workflows on physical properties using smartphones, tablets or AR headsets. This saves time in troubleshooting, human error is minimized and workforce efficiency is enhanced, particularly in remote or multiple industrial settings.

- Emerson Movicon.NExT is an example of a universal, Industry 4.0-ready SCADA platform with a small Linux-based HMI at one end and a large supervisory system at the other. Its modular design, OPC UA connectivity, and Python scripting make it easy to integrate with IoT and analytics applications, and AR applications so that technicians can use mobile devices or AR headsets to get real-time SCADA data.

- Collectively, the innovations are leading to higher speed, safety, and efficiency of industrial processes and this heralds a great transition to entirely linked, intelligent factories.

Supervisory-Control-and-Data-Acquisition-Systems-Market Analysis and Segmental Data

Hardware Dominate Global Supervisory Control and Data Acquisition (SCADA) Systems Market

- Hardware holds substantial market share in the global supervisory control and data acquisition (SCADA) systems market since physical components are still relevant in real time data acquisition, control and connectivity of industrial settings. The fundamentals of SCADA infrastructure include remote terminal units (RTUs), programmable logic controllers (PLCs) and sensors, communication modules, and human-machine interface (HMI) panels that allow reliable interactions of the field level.

- An increase in automation and modernization of the old industrial equipment, as well as increase in smart manufacturing, keeps increasing hardware demand. Moreover, oil and gas, power generation, water utilities, and transportation industries also depend on hardware of this longevity and performance to sustain operational continuity, safety and compliance, which underlines hardware leading market share in the SCADA market.

- On November, 2025, the Haryana Shahari Vikas Pradhikaran (HSVP) initiated a smart water-metering project to update the water management in its staff quarters in Panchkula. This will entail installation of 915 ultrasonic AMR (Automatic Meter Reading) water meters. The meters will be connected through LoRaWAN to a central SCADA system where real-time monitoring, leak detection and automated billing will be performed.

- Conclusively, hardware still prevails in the supervisory control and data acquisition systems market because it is essential in guaranteeing reliable, real-time monitoring, control, and continuity of industrial operations in various sectors.

North America Leads Global Supervisory Control and Data Acquisition (SCADA) Systems Market Demand

- North America is the world leader in supervisory control and data acquisition (SCADA) systems as the region has the most developed industrial infrastructure, a high level of automation, and continuous investments in digital transformation of the most critical areas. Oil and gas industry, power generation, water and wastewater management, and manufacturing are among the industries that are highly dependent on SCADA in order to be efficient, safe, and meet regulatory requirements.

- The introduction of IIoT, edge computing, and cloud-based SCADA infrastructure can be integrated in the region early, which adds further momentum to the modernization efforts. Also, a large number of SCADA solution suppliers, large amounts of pipeline and utility systems, and high levels of environmental monitoring standards all lead to continuous market growth.

- One example of this would be the City of Westerville, Ohio in 2025, which launched a large-scale SCADA modernization project by RFP to develop an integrated, secure platform that would consist of SCADA, outage management, and distribution automation. The upgrading will focus on improving the visibility of the grid, increasing the reliability, and strengthening real-time operational control of the electric distribution network of the city.

- Combined, the factors firmly establish North America as the most prominent market of SCADA systems in the world.

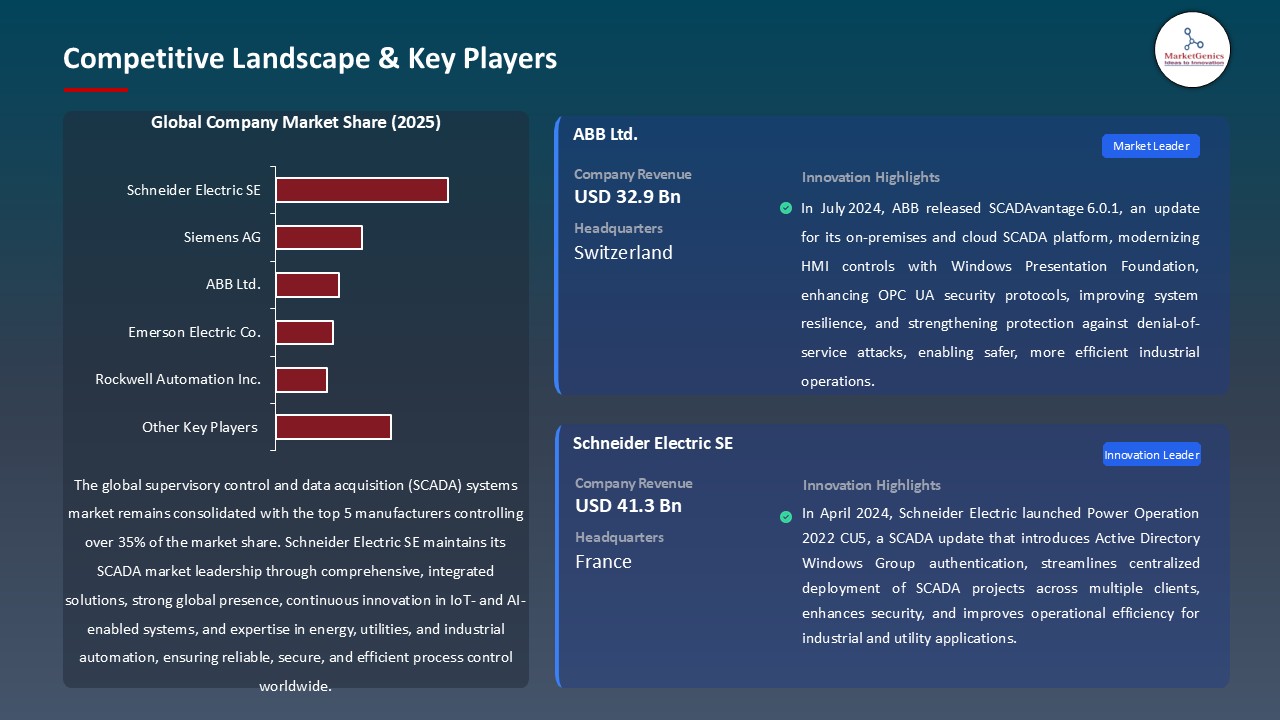

Supervisory-Control-and-Data-Acquisition-Systems-Market Ecosystem

The global supervisory control and data acquisition (SCADA) systems market is moderately concentrated, with several major players dominating the market (Schneider Electric SE, Siemens AG, ABB Ltd., Emerson Electric Co., and Rockwell Automation Inc.) supplying 36 percent of the market. Their superiority lies in the years of customer relationships, stability in platform performance, and even excellent integration skills in industrial settings. Some other players are software developers specialized and regional automation vendors as well as system integrators serving niche applications or industry-oriented needs.

The value chain of the market includes SCADA software development, HMI and visualization tools, communication protocol engineering, RTU and controller manufacturing, system integration, commissioning and maintenance, including risk cybersecurity management. The large vendors usually have development of core platforms but they work together with hardware vendors and integration partners to provide complete solutions.

This arrangement generates significant barriers to entry based on the maturity of the ecosystem, the established customer dependencies, and the necessity to have a tested and reliable operational system, allowing the hard-established vendors to maintain competitive advantages and positions, but allowing niche providers to continue to innovate in segments.

Recent Development and Strategic Overview:

- In May 2025, Sandvik Materials Technology is upgrading to MicroSCADA X to improve supervision of its large Sandviken power network to be able to see 100,000+ signals in real-time, provide stronger cybersecurity, mobile access, and fault detection, and ensure scalability and efficient control of its grid of city scale.

- In May 2024, Honeywell collaborated with Weatherford to combine Honeywell emissions management suite with Weatherford Cygnet SCADA platform, which allows upstream oil and gas operators to monitor, report and nearly reduce emissions in real time. The integrated solution will enhance the regulatory compliance, the environmental performance and help the operators achieve their net-zero objectives with the help of advanced analytical tools and data-driven decisions.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 17.7 Bn |

|

Market Forecast Value in 2035 |

USD 43.5 Bn |

|

Growth Rate (CAGR) |

9.4% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Supervisory-Control-and-Data-Acquisition-Systems-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Component |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Architecture Type |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Deployment Mode |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Communication Protocol |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Security Level |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Enterprise Size |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By Technology Integration |

|

|

Supervisory Control and Data Acquisition (SCADA) Systems Market, By End-Use Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Outlook

- 2.1.1. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing adoption of industrial automation and smart manufacturing

- 4.1.1.2. Rising need for real-time monitoring and control in critical infrastructure

- 4.1.1.3. Integration with IoT and advanced analytics for operational efficiency

- 4.1.2. Restraints

- 4.1.2.1. High implementation and maintenance costs

- 4.1.2.2. Cybersecurity and data privacy concerns

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturers and Technology Providers

- 4.4.3. Distributors

- 4.4.4. System Integrators

- 4.4.5. End Users

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Component

- 6.1. Key Segment Analysis

- 6.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Programmable Logic Controllers (PLCs)

- 6.2.1.2. Remote Terminal Units (RTUs)

- 6.2.1.3. Human Machine Interface (HMI)

- 6.2.1.4. Communication Systems

- 6.2.1.5. Sensors and Actuators

- 6.2.1.6. Input/Output Modules

- 6.2.1.7. Others

- 6.2.2. Software

- 6.2.2.1. Supervisory Software

- 6.2.2.2. Database Software

- 6.2.2.3. Communication Software

- 6.2.2.4. SCADA Security Software

- 6.2.2.5. Data Acquisition Software

- 6.2.2.6. Others

- 6.2.3. Services

- 6.2.3.1. Installation and Integration

- 6.2.3.2. Consulting Services

- 6.2.3.3. Training and Education

- 6.2.3.4. Maintenance and Support

- 6.2.3.5. Managed Services

- 6.2.3.6. Others

- 6.2.1. Hardware

- 7. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Architecture Type

- 7.1. Key Segment Analysis

- 7.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Architecture Type, 2021-2035

- 7.2.1. Monolithic SCADA Systems

- 7.2.2. Distributed SCADA Systems

- 7.2.3. Networked SCADA Systems

- 7.2.4. Hybrid SCADA Systems

- 8. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis,By Deployment Mode

- 8.1. Key Segment Analysis

- 8.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Deployment Mode, 2021-2035

- 8.2.1. On-Premise

- 8.2.2. Cloud-Based

- 9. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Communication Protocol

- 9.1. Key Segment Analysis

- 9.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Communication Protocol, 2021-2035

- 9.2.1. Modbus

- 9.2.2. DNP3 (Distributed Network Protocol)

- 9.2.3. IEC 60870-5

- 9.2.4. IEC 61850

- 9.2.5. OPC (OLE for Process Control)

- 9.2.6. Profibus

- 9.2.7. Ethernet/IP

- 9.2.8. BACnet

- 9.2.9. Others

- 10. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Security Level

- 10.1. Key Segment Analysis

- 10.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Security Level, 2021-2035

- 10.2.1. Basic Security Systems

- 10.2.2. Enhanced Security Systems

- 10.2.3. Critical Infrastructure Protection Systems

- 11. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Enterprise Size

- 11.1. Key Segment Analysis

- 11.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Enterprise Size, 2021-2035

- 11.2.1. Large Enterprises

- 11.2.2. Small and Medium Enterprises (SMEs)

- 12. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By Technology Integration

- 12.1. Key Segment Analysis

- 12.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By Integration Level, 2021-2035

- 12.2.1. IoT-Enabled SCADA Systems

- 12.2.2. AI/ML-Integrated SCADA Systems

- 12.2.3. Big Data Analytics Integration

- 12.2.4. Edge Computing Integration

- 12.2.5. Blockchain-Enabled Systems

- 12.2.6. Others

- 13. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis, By End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-Use Industry, 2021-2035

- 13.2.1. Oil & Gas Industry

- 13.2.1.1. Pipeline Monitoring and Control

- 13.2.1.2. Offshore Platform Management

- 13.2.1.3. Refinery Operations

- 13.2.1.4. Storage Tank Monitoring

- 13.2.1.5. Leak Detection Systems

- 13.2.1.6. Drilling Operations Management

- 13.2.1.7. Others

- 13.2.2. Power & Energy

- 13.2.2.1. Power Generation Monitoring

- 13.2.2.2. Transmission and Distribution Control

- 13.2.2.3. Substation Automation

- 13.2.2.4. Renewable Energy Management (Solar, Wind)

- 13.2.2.5. Grid Management

- 13.2.2.6. Energy Storage Systems

- 13.2.2.7. Others

- 13.2.3. Water & Wastewater Management

- 13.2.3.1. Water Treatment Plant Control

- 13.2.3.2. Wastewater Treatment Monitoring

- 13.2.3.3. Pumping Station Control

- 13.2.3.4. Distribution Network Management

- 13.2.3.5. Reservoir Level Monitoring

- 13.2.3.6. Water Quality Monitoring

- 13.2.3.7. Others

- 13.2.4. Manufacturing

- 13.2.4.1. Process Control and Automation

- 13.2.4.2. Production Line Monitoring

- 13.2.4.3. Quality Control Systems

- 13.2.4.4. Material Handling

- 13.2.4.5. Equipment Performance Monitoring

- 13.2.4.6. Batch Processing Control

- 13.2.4.7. Others

- 13.2.5. Chemical & Petrochemical

- 13.2.5.1. Chemical Processing Control

- 13.2.5.2. Reactor Monitoring

- 13.2.5.3. Safety Systems Management

- 13.2.5.4. Inventory Management

- 13.2.5.5. Blending Operations

- 13.2.5.6. Environmental Compliance Monitoring

- 13.2.5.7. Others

- 13.2.6. Food & Beverage

- 13.2.6.1. Production Process Control

- 13.2.6.2. Packaging Line Monitoring

- 13.2.6.3. Cold Chain Management

- 13.2.6.4. Quality Assurance Systems

- 13.2.6.5. Batch Recipe Management

- 13.2.6.6. Clean-in-Place (CIP) Systems

- 13.2.6.7. Others

- 13.2.7. Pharmaceutical

- 13.2.7.1. Manufacturing Process Control

- 13.2.7.2. Clean Room Monitoring

- 13.2.7.3. Batch Production Management

- 13.2.7.4. Compliance and Validation Systems

- 13.2.7.5. Environmental Monitoring

- 13.2.7.6. Equipment Sterilization Control

- 13.2.7.7. Others

- 13.2.8. Transportation

- 13.2.9. Building Automation

- 13.2.10. Mining & Metals

- 13.2.11. Pulp & Paper

- 13.2.12. Telecommunications

- 13.2.13. Agriculture

- 13.2.14. Other Industries

- 13.2.1. Oil & Gas Industry

- 14. Global Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Architecture Type

- 15.3.3. Deployment Mode

- 15.3.4. Communication Protocol

- 15.3.5. Security Level

- 15.3.6. Enterprise Size

- 15.3.7. Technology Integration

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Supervisory Control and Data Acquisition (SCADA) Systems Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Architecture Type

- 15.4.4. Deployment Mode

- 15.4.5. Communication Protocol

- 15.4.6. Security Level

- 15.4.7. Enterprise Size

- 15.4.8. Technology Integration

- 15.4.9. End-Use Industry

- 15.5. Canada Supervisory Control and Data Acquisition (SCADA) Systems Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Architecture Type

- 15.5.4. Deployment Mode

- 15.5.5. Communication Protocol

- 15.5.6. Security Level

- 15.5.7. Enterprise Size

- 15.5.8. Technology Integration

- 15.5.9. End-Use Industry

- 15.6. Mexico Supervisory Control and Data Acquisition (SCADA) Systems Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Architecture Type

- 15.6.4. Deployment Mode

- 15.6.5. Communication Protocol

- 15.6.6. Security Level

- 15.6.7. Enterprise Size

- 15.6.8. Technology Integration

- 15.6.9. End-Use Industry

- 16. Europe Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Architecture Type

- 16.3.3. Deployment Mode

- 16.3.4. Communication Protocol

- 16.3.5. Security Level

- 16.3.6. Enterprise Size

- 16.3.7. Technology Integration

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Architecture Type

- 16.4.4. Deployment Mode

- 16.4.5. Communication Protocol

- 16.4.6. Security Level

- 16.4.7. Enterprise Size

- 16.4.8. Technology Integration

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Architecture Type

- 16.5.4. Deployment Mode

- 16.5.5. Communication Protocol

- 16.5.6. Security Level

- 16.5.7. Enterprise Size

- 16.5.8. Technology Integration

- 16.5.9. End-Use Industry

- 16.6. France Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Architecture Type

- 16.6.4. Deployment Mode

- 16.6.5. Communication Protocol

- 16.6.6. Security Level

- 16.6.7. Enterprise Size

- 16.6.8. Technology Integration

- 16.6.9. End-Use Industry

- 16.7. Italy Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Architecture Type

- 16.7.4. Deployment Mode

- 16.7.5. Communication Protocol

- 16.7.6. Security Level

- 16.7.7. Enterprise Size

- 16.7.8. Technology Integration

- 16.7.9. End-Use Industry

- 16.8. Spain Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Architecture Type

- 16.8.4. Deployment Mode

- 16.8.5. Communication Protocol

- 16.8.6. Security Level

- 16.8.7. Enterprise Size

- 16.8.8. Technology Integration

- 16.8.9. End-Use Industry

- 16.9. Netherlands Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Architecture Type

- 16.9.4. Deployment Mode

- 16.9.5. Communication Protocol

- 16.9.6. Security Level

- 16.9.7. Enterprise Size

- 16.9.8. Technology Integration

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Architecture Type

- 16.10.4. Deployment Mode

- 16.10.5. Communication Protocol

- 16.10.6. Security Level

- 16.10.7. Enterprise Size

- 16.10.8. Technology Integration

- 16.10.9. End-Use Industry

- 16.11. Poland Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Architecture Type

- 16.11.4. Deployment Mode

- 16.11.5. Communication Protocol

- 16.11.6. Security Level

- 16.11.7. Enterprise Size

- 16.11.8. Technology Integration

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Architecture Type

- 16.12.4. Deployment Mode

- 16.12.5. Communication Protocol

- 16.12.6. Security Level

- 16.12.7. Enterprise Size

- 16.12.8. Technology Integration

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Supervisory Control and Data Acquisition (SCADA) Systems Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Architecture Type

- 16.13.4. Deployment Mode

- 16.13.5. Communication Protocol

- 16.13.6. Security Level

- 16.13.7. Enterprise Size

- 16.13.8. Technology Integration

- 16.13.9. End-Use Industry

- 17. Asia Pacific Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Architecture Type

- 17.3.3. Deployment Mode

- 17.3.4. Communication Protocol

- 17.3.5. Security Level

- 17.3.6. Enterprise Size

- 17.3.7. Technology Integration

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Architecture Type

- 17.4.4. Deployment Mode

- 17.4.5. Communication Protocol

- 17.4.6. Security Level

- 17.4.7. Enterprise Size

- 17.4.8. Technology Integration

- 17.4.9. End-Use Industry

- 17.5. India Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Architecture Type

- 17.5.4. Deployment Mode

- 17.5.5. Communication Protocol

- 17.5.6. Security Level

- 17.5.7. Enterprise Size

- 17.5.8. Technology Integration

- 17.5.9. End-Use Industry

- 17.6. Japan Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Architecture Type

- 17.6.4. Deployment Mode

- 17.6.5. Communication Protocol

- 17.6.6. Security Level

- 17.6.7. Enterprise Size

- 17.6.8. Technology Integration

- 17.6.9. End-Use Industry

- 17.7. South Korea Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Architecture Type

- 17.7.4. Deployment Mode

- 17.7.5. Communication Protocol

- 17.7.6. Security Level

- 17.7.7. Enterprise Size

- 17.7.8. Technology Integration

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Architecture Type

- 17.8.4. Deployment Mode

- 17.8.5. Communication Protocol

- 17.8.6. Security Level

- 17.8.7. Enterprise Size

- 17.8.8. Technology Integration

- 17.8.9. End-Use Industry

- 17.9. Indonesia Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Architecture Type

- 17.9.4. Deployment Mode

- 17.9.5. Communication Protocol

- 17.9.6. Security Level

- 17.9.7. Enterprise Size

- 17.9.8. Technology Integration

- 17.9.9. End-Use Industry

- 17.10. Malaysia Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Architecture Type

- 17.10.4. Deployment Mode

- 17.10.5. Communication Protocol

- 17.10.6. Security Level

- 17.10.7. Enterprise Size

- 17.10.8. Technology Integration

- 17.10.9. End-Use Industry

- 17.11. Thailand Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Architecture Type

- 17.11.4. Deployment Mode

- 17.11.5. Communication Protocol

- 17.11.6. Security Level

- 17.11.7. Enterprise Size

- 17.11.8. Technology Integration

- 17.11.9. End-Use Industry

- 17.12. Vietnam Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Architecture Type

- 17.12.4. Deployment Mode

- 17.12.5. Communication Protocol

- 17.12.6. Security Level

- 17.12.7. Enterprise Size

- 17.12.8. Technology Integration

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Supervisory Control and Data Acquisition (SCADA) Systems Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Architecture Type

- 17.13.4. Deployment Mode

- 17.13.5. Communication Protocol

- 17.13.6. Security Level

- 17.13.7. Enterprise Size

- 17.13.8. Technology Integration

- 17.13.9. End-Use Industry

- 18. Middle East Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Architecture Type

- 18.3.3. Deployment Mode

- 18.3.4. Communication Protocol

- 18.3.5. Security Level

- 18.3.6. Enterprise Size

- 18.3.7. Technology Integration

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Supervisory Control and Data Acquisition (SCADA) Systems Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Architecture Type

- 18.4.4. Deployment Mode

- 18.4.5. Communication Protocol

- 18.4.6. Security Level

- 18.4.7. Enterprise Size

- 18.4.8. Technology Integration

- 18.4.9. End-Use Industry

- 18.5. UAE Supervisory Control and Data Acquisition (SCADA) Systems Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Architecture Type

- 18.5.4. Deployment Mode

- 18.5.5. Communication Protocol

- 18.5.6. Security Level

- 18.5.7. Enterprise Size

- 18.5.8. Technology Integration

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Supervisory Control and Data Acquisition (SCADA) Systems Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Architecture Type

- 18.6.4. Deployment Mode

- 18.6.5. Communication Protocol

- 18.6.6. Security Level

- 18.6.7. Enterprise Size

- 18.6.8. Technology Integration

- 18.6.9. End-Use Industry

- 18.7. Israel Supervisory Control and Data Acquisition (SCADA) Systems Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Architecture Type

- 18.7.4. Deployment Mode

- 18.7.5. Communication Protocol

- 18.7.6. Security Level

- 18.7.7. Enterprise Size

- 18.7.8. Technology Integration

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Supervisory Control and Data Acquisition (SCADA) Systems Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Architecture Type

- 18.8.4. Deployment Mode

- 18.8.5. Communication Protocol

- 18.8.6. Security Level

- 18.8.7. Enterprise Size

- 18.8.8. Technology Integration

- 18.8.9. End-Use Industry

- 19. Africa Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Architecture Type

- 19.3.3. Deployment Mode

- 19.3.4. Communication Protocol

- 19.3.5. Security Level

- 19.3.6. Enterprise Size

- 19.3.7. Technology Integration

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Supervisory Control and Data Acquisition (SCADA) Systems Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Architecture Type

- 19.4.4. Deployment Mode

- 19.4.5. Communication Protocol

- 19.4.6. Security Level

- 19.4.7. Enterprise Size

- 19.4.8. Technology Integration

- 19.4.9. End-Use Industry

- 19.5. Egypt Supervisory Control and Data Acquisition (SCADA) Systems Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Architecture Type

- 19.5.4. Deployment Mode

- 19.5.5. Communication Protocol

- 19.5.6. Security Level

- 19.5.7. Enterprise Size

- 19.5.8. Technology Integration

- 19.5.9. End-Use Industry

- 19.6. Nigeria Supervisory Control and Data Acquisition (SCADA) Systems Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Architecture Type

- 19.6.4. Deployment Mode

- 19.6.5. Communication Protocol

- 19.6.6. Security Level

- 19.6.7. Enterprise Size

- 19.6.8. Technology Integration

- 19.6.9. End-Use Industry

- 19.7. Algeria Supervisory Control and Data Acquisition (SCADA) Systems Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Architecture Type

- 19.7.4. Deployment Mode

- 19.7.5. Communication Protocol

- 19.7.6. Security Level

- 19.7.7. Enterprise Size

- 19.7.8. Technology Integration

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Supervisory Control and Data Acquisition (SCADA) Systems Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Architecture Type

- 19.8.4. Deployment Mode

- 19.8.5. Communication Protocol

- 19.8.6. Security Level

- 19.8.7. Enterprise Size

- 19.8.8. Technology Integration

- 19.8.9. End-Use Industry

- 20. South America Supervisory Control and Data Acquisition (SCADA) Systems Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Supervisory Control and Data Acquisition (SCADA) Systems Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Architecture Type

- 20.3.3. Deployment Mode

- 20.3.4. Communication Protocol

- 20.3.5. Security Level

- 20.3.6. Enterprise Size

- 20.3.7. Technology Integration

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Supervisory Control and Data Acquisition (SCADA) Systems Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Architecture Type

- 20.4.4. Deployment Mode

- 20.4.5. Communication Protocol

- 20.4.6. Security Level

- 20.4.7. Enterprise Size

- 20.4.8. Technology Integration

- 20.4.9. End-Use Industry

- 20.5. Argentina Supervisory Control and Data Acquisition (SCADA) Systems Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Architecture Type

- 20.5.4. Deployment Mode

- 20.5.5. Communication Protocol

- 20.5.6. Security Level

- 20.5.7. Enterprise Size

- 20.5.8. Technology Integration

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Supervisory Control and Data Acquisition (SCADA) Systems Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Architecture Type

- 20.6.4. Deployment Mode

- 20.6.5. Communication Protocol

- 20.6.6. Security Level

- 20.6.7. Enterprise Size

- 20.6.8. Technology Integration

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Adroit Technologies

- 21.3. Aveva Group plc

- 21.4. Emerson Electric Co.

- 21.5. Fortive Corporation

- 21.6. General Electric Company

- 21.7. Hitachi Ltd.

- 21.8. Honeywell International Inc.

- 21.9. Iconics Inc.

- 21.10. Inductive Automation (Ignition)

- 21.11. Kepware (PTC Inc.)

- 21.12. Mitsubishi Electric Corporation

- 21.13. Omron Corporation

- 21.14. Progea International

- 21.15. Rockwell Automation Inc.

- 21.16. Schneider Electric SE

- 21.17. Schweitzer Engineering Laboratories

- 21.18. Siemens AG

- 21.19. Toshiba Corporation

- 21.20. Wonderware (AVEVA)

- 21.21. Yokogawa Electric Corporation

- 21.22. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation