Synthetic Fiber Market Size, Share & Trends Analysis Report by Adhesive Type (Urea-Formaldehyde (UF), Melamine-Urea-Formaldehyde (MUF), Phenol-Formaldehyde (PF), Polyvinyl Acetate (PVA), Epoxy Adhesives, Polyurethane (PU) Adhesives, Soy-based Adhesives, Acrylic-based Adhesives, Others), Substrate Type, Technology, Resin Origin, Product Form, End-use Industry, Distribution Channel, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Synthetic Fiber Market Size, Share, and Growth

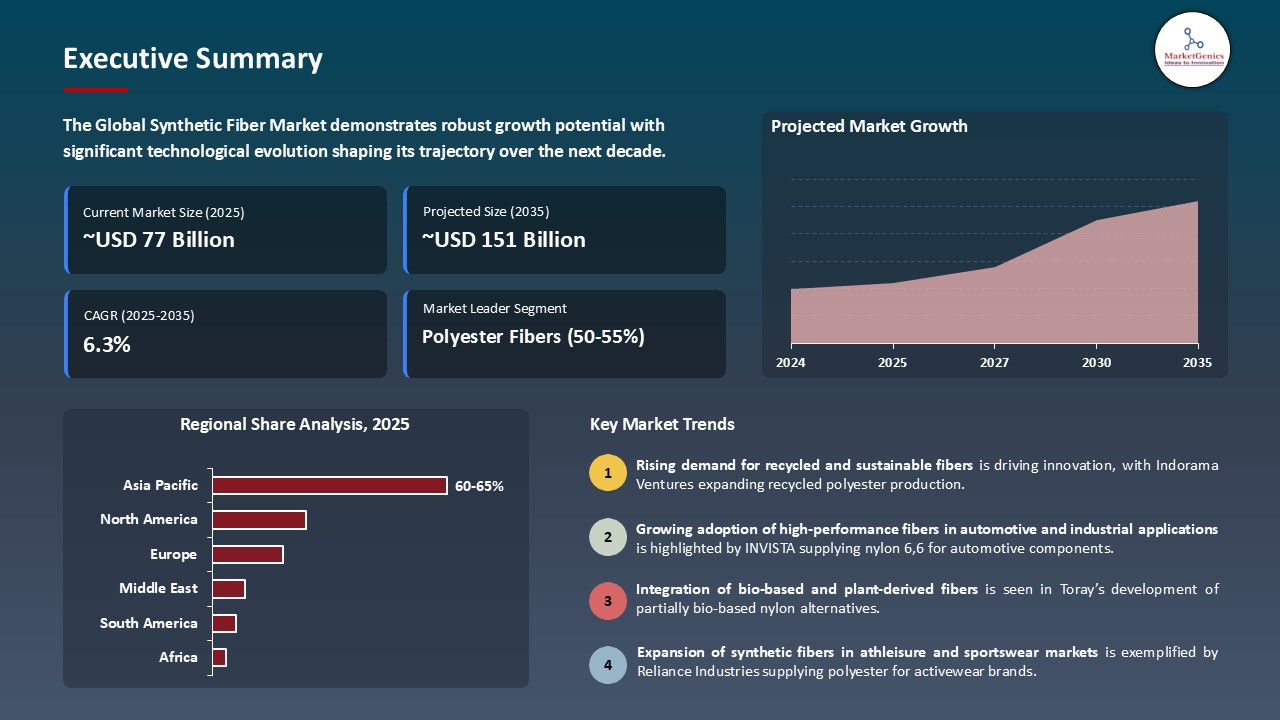

The global synthetic fiber market is experiencing robust growth, with its estimated value of USD 76.9 billion in the year 2025 and USD 150.6 billion by the period 2035, registering a CAGR of 6.3%. Asia Pacific leads the market with market share of 62.5% with USD 48.1 billion revenue.

On April 27, 2025, Chairman Mukesh D. Ambani announced RIL’s continued push into sustainability: the company plans to invest ₹75,000 crore (~USD 9 billion) in its polyester value chain alongside new energy ventures. This includes chemical recycling technologies to enhance circularity and more than doubling PET bottle recycling capacity to 5 billion bottles annually.

The world is increasingly demanding synthetic fibers due to the advantages of their versatility as well as low prices and ever- growing performance values that address new consumer and industrial functions. In areas where cotton supplies are erratic or agricultural prices are on the rise, polyester, nylon, and polypropylene fiber are being used more and more in the manufacture of apparel, home textiles, automobile parts, and technical fabrics.

As an example, Reliance Industries has recently commissioned a state-of-the-art polyester staple fiber (PSF) manufacturing unit at Jamnagar, India, thereby improving its capacity to produce eco-blended fibers to both domestic and export promotion markets as well as taking advantage of integrated refining-to-fiber on a cost-efficient basis.

Meanwhile, the trend toward durable, stain block, and wrinkle-resistant fabrics in fast-moving fashion/sportswear is motivating key brands to purchase high-tenacity nylon fibers with companies such as INVISTA recently launching a reinforced nylon 6,6 fiber specifically intended to be used on rough-drive active/outdoor wear. Such trends emphasize the way robust manufacturing and performance-based innovation is still paying dividends to synthetic fiber adoption to an increasing array of industries.

Adjacent to the global synthetic fiber market, the potential opportunities are in technical textiles, geotextiles, nonwoven fabrics, recycled fiber innovations, and performance-based composites. These fibers are using synthetic fibers in order to make it durable, sustainable and serve as an advanced application in various industries like in construction and even in areas like in the medical industry to extend its growth opportunities.

Synthetic Fiber Market Dynamics and Trends

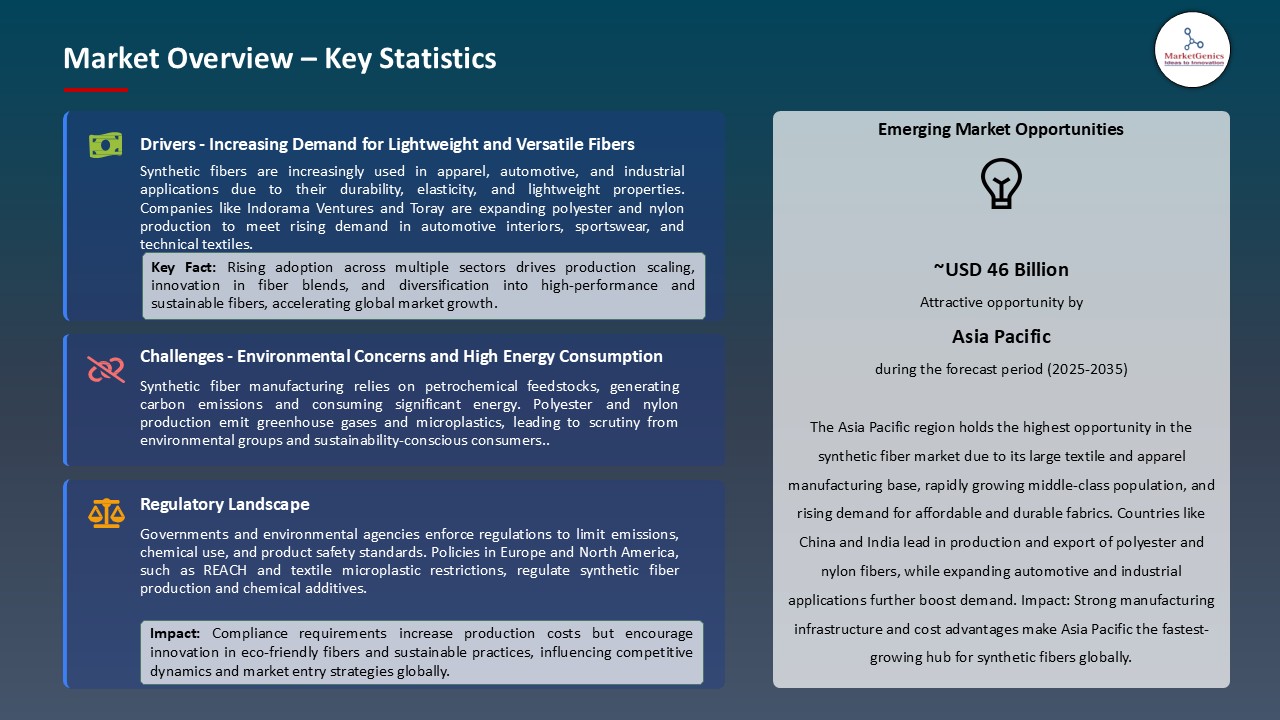

Driver: Integrated production-to-fiber investments lower costs and enable rapid scale-up of synthetic fiber supply globally efficiently

- Comprehensive upstream-to-fiber investment strategies are transforming the competitive picture: those companies that monopolize feedstock, polymerization and spinning cut open-ended pressure on margins and increase the speed of product development, moving swiftly to respond to fashion, automotive and technical textile possibilities. The IVL 2.0 program and brand-new refinancing deal at Indorama Ventures show how that strategy has paid off--focusing on liquidity, regional blending and strategic polymer alliances to translate petrochemical integration into reliable fiber production and customized grades to satisfy customers.

- Using vertical integration to capture scale also reduces the qualification cycle and drives landed costs down among large buyers, encouraging longer-term offtake agreements and increasing capacity commitments among brands and converters; a structural change that drives longer-term offtake arrangements and increases high-capacity commitments by brands and converters; these trends help stabilize supply, even in the face of raw material fluctuations.

- The presence of vertical integration by large producers contributes to better supply resilience, which acts to suppress spot price volatility and further solidifies incumbent power.

Restraint: Volatile raw material feedstock prices and overcapacity pressure compress margins across global synthetic fiber producers

- The sustained volatility in PTA, MEG and aromatics prices and their flurry of new capacity installations in various jurisdictions has diminished margins across many fiber manufacturers that have had to scale back runs or certain types of lower-margin commodity-based fibers. Recent analyses of the developed Chinese PET and polyester capacity have shown how rapid incremental capacity and feedstock deflation has been placing pressure on regional utilizations and marginances.

- This environment increases capital discipline as a defensive modus operandi: producers postpone brownfield investments, specialization grades or integrated value-adds, and institute cost-out programs. Those companies without downstream differentiation will have their margins eroded and have to develop capabilities or merge.

- Feedstock volatility and capacity expansions are putting pressure on commodity profitability, fast-tracking mergers and acquisitions and premium-products diversification.

Opportunity: Demand for recycled and bio-based fibers opens premium markets for sustainable performance-driven synthetic fiber products

- Increasing buyer requirements and brand commitments to reduce lifecycle emissions are driving premium demand into rPET, chemically recycled nylons and bio-based derived monomer fibers; suppliers that certify traceable circular portfolio command higher ASP and preferred supplier status. Corporates such as Indorama supporting cross-industry sustainable polyester supply chains and partnerships to offer high-performance specialty polymers to meet brand specifications demonstrate how scale players are commercializing circular products.

- This opportunity confers a benefit to investing in collection, depolymerization and verified supply chains and to recover margin through value added certified, as opposed to price competing in commodity segments.

- The presence of circular and bio-based fiber products can price a profitable premium level and increase speedy capital investment in recycling and traceability systems.

Key Trend: Advanced chemical recycling and AI-enabled process optimization accelerate circularity in synthetic fiber manufacturing worldwide rapidly

- Increasingly sophisticated depolymerization technologies and process analytical controls are enabling previously recycling-resistant polymers such as nylon-66 and other complex mixes, to be reprocessed as commercially viable endeavors, and AI and process control systems continue to optimize reprocessing yields and energy input. Toray announcing its nylon-66 virgin-grade chemical-recycling development is just one example of how advanced technology can accelerate circular product lifetimes via re-entry of monomers into the product supply chain.

- The use of these technologies can help producers to achieve stringent recycled content target, cut carbon intensity and exposure to petrochemical price volatility, but piloting to commercial-scale implementation requires capital and logistics robust feedstock collection logistic.

- Technical recycling and AI enhanced circularity and cost curves effectively so that the recycled fibers can compete commercially with the virgin ones.

Synthetic Fiber Market Analysis and Segmental Data

Polyester Fibers: The Cornerstone of Global Synthetic Fiber Consumption

- Polyester fibers dominate the synthetic fiber market due to their versatility, cost-effectiveness, and adaptability across apparel, home textiles, industrial fabrics, and technical applications. Their flexibility, wrinkle resistant ability, and ability to be dyed makes them the favorite choice of consumer mass textiles. Besides, increased popularity of blended material in fashion and athleisure adds to polyester market power, especially as apparel companies around the world expand their manufacturing so extensively with trusted synthetic resources.

- Recently, Reliance Industries increased its PET and polyester fiber capacities in India, to contribute to the growing local and export demand, consolidating itself as a global leader in polyester-based supply chains. This business direction is representative of the critical role of the fiber in both older cloth production and in newer and technologically advanced fibers, ensuring the supremacy of polyester among the synthetic fibers.

- Polyester fibers continue to be the mainstay of synthetic fiber demand, because of versatility, cost-effectiveness and large-scale manufacturing investments.

Asia Pacific Drives Global Synthetic Fiber Demand Through Manufacturing Scale and Consumption Growth

- Asia Pacific region dominates the global synthetic fiber market owing to its strong textile industry base, massive population and substantial apparel consumption, and fast-growing industrial use. The availability of raw material is high and the presence of production facilities and relatively cheap labour are factors that make large scale fiber production feasible in countries like China and India.

- As an example, Indorama Ventures is increasing its polyester staple fiber capacities in Southeast Asia to consume the increasing demand of polyester fiber within the region in fast fashion and technical products, fueling domestic demand and exports. The larger package production combined with end-use demand is one of the main reasons that Asia Pacific continues to lead in consuming synthetic fibers.

- The size and strength of regional markets, combined with manufacturing scale, makes Asia Pacific the fastest-growing center of synthetic fiber in the world.

Synthetic Fiber Market Ecosystem

The global synthetic fiber market demonstrates a moderately consolidated structure, with Tier 1 players such as Reliance Industries, Indorama Corporation, and BASF SE dominating through extensive capacities and global reach, while Tier 2 and Tier 3 players like Bombay Dyeing and Kolon Industries serve niche or regional markets. Buyer concentration remains moderate, as textile and automotive industries drive consistent demand, while supplier concentration is relatively high due to dependency on petrochemical feedstocks, giving suppliers significant influence over raw material pricing and availability.

Recent Development and Strategic Overview:

- In April 2025, BASF unveiled Haptex synthetic leather reducing greenhouse gases by 52% and launched the ‘Loop’ series featuring post-consumer recycled content for footwear and automotive segments.

- In June 2025, Fibroline entered a strategic partnership Big Frog Innovation LLC on bringing innovation to the filtration and nonwovens industries. With this new collaboration, Fibroline aims to extend the use of its solutions in the filtration industry and especially in the American market.

- In April 2024, Hyosung TNC launched an advanced high-stretch spandex fiber designed for premium sportswear and athleisure. By focusing on durability, elasticity, and comfort, Hyosung is enhancing its brand position in the performance fiber market while responding to surging global demand for functional textiles.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 76.9 Bn |

|

Market Forecast Value in 2035 |

USD 150.6 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Synthetic Fiber Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Type |

|

|

By End-Use Industry |

|

|

By Fiber Length |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Synthetic Fiber Market Outlook

- 2.1.1. Synthetic Fiber Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Synthetic Fiber Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemical & Material Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemical & Material Industry

- 3.1.3. Regional Distribution for Chemical & Material Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemical & Material Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand from the textile and apparel industry due to durability, cost-effectiveness, and versatility of synthetic fibers

- 4.1.1.2. Expanding applications in home furnishing, automotive, and industrial textiles, supported by innovations in fiber technology

- 4.1.2. Restraints

- 4.1.2.1. Environmental concerns and stringent regulations regarding non-biodegradability and microplastic pollution

- 4.1.2.2. Volatility in crude oil prices impacting raw material costs for synthetic fiber production

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Synthetic Fiber Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Synthetic Fiber Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Synthetic Fiber Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Polyester Fibers

- 6.2.2. Nylon Fibers

- 6.2.3. Acrylic Fibers

- 6.2.4. Polypropylene Fibers

- 6.2.5. Polyolefin Fibers

- 6.2.6. UHMWPE Fibers

- 6.2.7. Others (Carbon Fibers, Aramid Fibers, Viscose Fibers, Acetate Fibers, etc.)

- 7. Global Synthetic Fiber Market Analysis, by End-Use Industry

- 7.1. Key Segment Analysis

- 7.2. Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 7.2.1. Industrial Applications

- 7.2.1.1. Filtration Media

- 7.2.1.2. Geotextiles

- 7.2.1.3. Conveyor Belts

- 7.2.1.4. Ropes & Cordage

- 7.2.1.5. Industrial Fabrics

- 7.2.1.6. Protective Textiles

- 7.2.1.7. Others

- 7.2.2. Automotive

- 7.2.2.1. Seat Covers & Upholstery

- 7.2.2.2. Carpeting

- 7.2.2.3. Tire Cord

- 7.2.2.4. Airbag Fabrics

- 7.2.2.5. Interior Trim

- 7.2.2.6. Insulation Materials

- 7.2.2.7. Others

- 7.2.3. Construction

- 7.2.3.1. Concrete Reinforcement

- 7.2.3.2. Roofing Materials

- 7.2.3.3. Insulation Products

- 7.2.3.4. Geosynthetics

- 7.2.3.5. Building Wraps

- 7.2.3.6. Others

- 7.2.4. Electronics

- 7.2.4.1. Circuit Board Substrates

- 7.2.4.2. Insulation Materials

- 7.2.4.3. Others

- 7.2.5. Medical & Healthcare

- 7.2.6. Aerospace & Defense

- 7.2.7. Apparel & Textiles

- 7.2.8. Home Furnishing

- 7.2.9. Packaging

- 7.2.10. Others (Agriculture, Sports & Leisure, etc.)

- 7.2.1. Industrial Applications

- 8. Global Synthetic Fiber Market Analysis, by Fiber Length

- 8.1. Key Segment Analysis

- 8.2. Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, by Fiber Length, 2021-2035

- 8.2.1. Staple Fibers (Short Fibers)

- 8.2.2. Filament Fibers (Continuous)

- 8.2.3. Microfibers

- 8.2.4. Nanofibers

- 9. Global Synthetic Fiber Market Analysis, by Distribution Channel

- 9.1. Key Segment Analysis

- 9.2. Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 9.2.1. Direct Sales (B2B)

- 9.2.2. Distributors & Wholesalers

- 9.2.3. Retail

- 9.2.4. Online Platforms

- 10. Global Synthetic Fiber Market Analysis and Forecasts, by Region

- 10.1. Key Findings

- 10.2. Synthetic Fiber Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 10.2.1. North America

- 10.2.2. Europe

- 10.2.3. Asia Pacific

- 10.2.4. Middle East

- 10.2.5. Africa

- 10.2.6. South America

- 11. North America Synthetic Fiber Market Analysis

- 11.1. Key Segment Analysis

- 11.2. Regional Snapshot

- 11.3. North America Synthetic Fiber Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 11.3.1. Type

- 11.3.2. End-Use Industry

- 11.3.3. Fiber Length

- 11.3.4. Distribution Channel

- 11.3.5. Country

- 11.3.5.1. USA

- 11.3.5.2. Canada

- 11.3.5.3. Mexico

- 11.4. USA Synthetic Fiber Market

- 11.4.1. Country Segmental Analysis

- 11.4.2. Type

- 11.4.3. End-Use Industry

- 11.4.4. Fiber Length

- 11.4.5. Distribution Channel

- 11.5. Canada Synthetic Fiber Market

- 11.5.1. Country Segmental Analysis

- 11.5.2. Type

- 11.5.3. End-Use Industry

- 11.5.4. Fiber Length

- 11.5.5. Distribution Channel

- 11.6. Mexico Synthetic Fiber Market

- 11.6.1. Country Segmental Analysis

- 11.6.2. Type

- 11.6.3. End-Use Industry

- 11.6.4. Fiber Length

- 11.6.5. Distribution Channel

- 12. Europe Synthetic Fiber Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. Europe Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Type

- 12.3.2. End-Use Industry

- 12.3.3. Fiber Length

- 12.3.4. Distribution Channel

- 12.3.5. Country

- 12.3.5.1. Germany

- 12.3.5.2. United Kingdom

- 12.3.5.3. France

- 12.3.5.4. Italy

- 12.3.5.5. Spain

- 12.3.5.6. Netherlands

- 12.3.5.7. Nordic Countries

- 12.3.5.8. Poland

- 12.3.5.9. Russia & CIS

- 12.3.5.10. Rest of Europe

- 12.4. Germany Synthetic Fiber Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Type

- 12.4.3. End-Use Industry

- 12.4.4. Fiber Length

- 12.4.5. Distribution Channel

- 12.5. United Kingdom Synthetic Fiber Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Type

- 12.5.3. End-Use Industry

- 12.5.4. Fiber Length

- 12.5.5. Distribution Channel

- 12.6. France Synthetic Fiber Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Type

- 12.6.3. End-Use Industry

- 12.6.4. Fiber Length

- 12.6.5. Distribution Channel

- 12.7. Italy Synthetic Fiber Market

- 12.7.1. Country Segmental Analysis

- 12.7.2. Type

- 12.7.3. End-Use Industry

- 12.7.4. Fiber Length

- 12.7.5. Distribution Channel

- 12.8. Spain Synthetic Fiber Market

- 12.8.1. Country Segmental Analysis

- 12.8.2. Type

- 12.8.3. End-Use Industry

- 12.8.4. Fiber Length

- 12.8.5. Distribution Channel

- 12.9. Netherlands Synthetic Fiber Market

- 12.9.1. Country Segmental Analysis

- 12.9.2. Type

- 12.9.3. End-Use Industry

- 12.9.4. Fiber Length

- 12.9.5. Distribution Channel

- 12.10. Nordic Countries Synthetic Fiber Market

- 12.10.1. Country Segmental Analysis

- 12.10.2. Type

- 12.10.3. End-Use Industry

- 12.10.4. Fiber Length

- 12.10.5. Distribution Channel

- 12.11. Poland Synthetic Fiber Market

- 12.11.1. Country Segmental Analysis

- 12.11.2. Type

- 12.11.3. End-Use Industry

- 12.11.4. Fiber Length

- 12.11.5. Distribution Channel

- 12.12. Russia & CIS Synthetic Fiber Market

- 12.12.1. Country Segmental Analysis

- 12.12.2. Type

- 12.12.3. End-Use Industry

- 12.12.4. Fiber Length

- 12.12.5. Distribution Channel

- 12.13. Rest of Europe Synthetic Fiber Market

- 12.13.1. Country Segmental Analysis

- 12.13.2. Type

- 12.13.3. End-Use Industry

- 12.13.4. Fiber Length

- 12.13.5. Distribution Channel

- 13. Asia Pacific Synthetic Fiber Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. East Asia Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Type

- 13.3.2. End-Use Industry

- 13.3.3. Fiber Length

- 13.3.4. Distribution Channel

- 13.3.5. Country

- 13.3.5.1. China

- 13.3.5.2. India

- 13.3.5.3. Japan

- 13.3.5.4. South Korea

- 13.3.5.5. Australia and New Zealand

- 13.3.5.6. Indonesia

- 13.3.5.7. Malaysia

- 13.3.5.8. Thailand

- 13.3.5.9. Vietnam

- 13.3.5.10. Rest of Asia Pacific

- 13.4. China Synthetic Fiber Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Type

- 13.4.3. End-Use Industry

- 13.4.4. Fiber Length

- 13.4.5. Distribution Channel

- 13.5. India Synthetic Fiber Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Type

- 13.5.3. End-Use Industry

- 13.5.4. Fiber Length

- 13.5.5. Distribution Channel

- 13.6. Japan Synthetic Fiber Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Type

- 13.6.3. End-Use Industry

- 13.6.4. Fiber Length

- 13.6.5. Distribution Channel

- 13.7. South Korea Synthetic Fiber Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Type

- 13.7.3. End-Use Industry

- 13.7.4. Fiber Length

- 13.7.5. Distribution Channel

- 13.8. Australia and New Zealand Synthetic Fiber Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Type

- 13.8.3. End-Use Industry

- 13.8.4. Fiber Length

- 13.8.5. Distribution Channel

- 13.9. Indonesia Synthetic Fiber Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Type

- 13.9.3. End-Use Industry

- 13.9.4. Fiber Length

- 13.9.5. Distribution Channel

- 13.10. Malaysia Synthetic Fiber Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Type

- 13.10.3. End-Use Industry

- 13.10.4. Fiber Length

- 13.10.5. Distribution Channel

- 13.11. Thailand Synthetic Fiber Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Type

- 13.11.3. End-Use Industry

- 13.11.4. Fiber Length

- 13.11.5. Distribution Channel

- 13.12. Vietnam Synthetic Fiber Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Type

- 13.12.3. End-Use Industry

- 13.12.4. Fiber Length

- 13.12.5. Distribution Channel

- 13.13. Rest of Asia Pacific Synthetic Fiber Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Type

- 13.13.3. End-Use Industry

- 13.13.4. Fiber Length

- 13.13.5. Distribution Channel

- 14. Middle East Synthetic Fiber Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Middle East Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Type

- 14.3.2. End-Use Industry

- 14.3.3. Fiber Length

- 14.3.4. Distribution Channel

- 14.3.5. Country

- 14.3.5.1. Turkey

- 14.3.5.2. UAE

- 14.3.5.3. Saudi Arabia

- 14.3.5.4. Israel

- 14.3.5.5. Rest of Middle East

- 14.4. Turkey Synthetic Fiber Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Type

- 14.4.3. End-Use Industry

- 14.4.4. Fiber Length

- 14.4.5. Distribution Channel

- 14.5. UAE Synthetic Fiber Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Type

- 14.5.3. End-Use Industry

- 14.5.4. Fiber Length

- 14.5.5. Distribution Channel

- 14.6. Saudi Arabia Synthetic Fiber Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Type

- 14.6.3. End-Use Industry

- 14.6.4. Fiber Length

- 14.6.5. Distribution Channel

- 14.7. Israel Synthetic Fiber Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Type

- 14.7.3. End-Use Industry

- 14.7.4. Fiber Length

- 14.7.5. Distribution Channel

- 14.8. Rest of Middle East Synthetic Fiber Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Type

- 14.8.3. End-Use Industry

- 14.8.4. Fiber Length

- 14.8.5. Distribution Channel

- 15. Africa Synthetic Fiber Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Africa Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type

- 15.3.2. End-Use Industry

- 15.3.3. Fiber Length

- 15.3.4. Distribution Channel

- 15.3.5. Country

- 15.3.5.1. South Africa

- 15.3.5.2. Egypt

- 15.3.5.3. Nigeria

- 15.3.5.4. Algeria

- 15.3.5.5. Rest of Africa

- 15.4. South Africa Synthetic Fiber Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type

- 15.4.3. End-Use Industry

- 15.4.4. Fiber Length

- 15.4.5. Distribution Channel

- 15.5. Egypt Synthetic Fiber Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type

- 15.5.3. End-Use Industry

- 15.5.4. Fiber Length

- 15.5.5. Distribution Channel

- 15.6. Nigeria Synthetic Fiber Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type

- 15.6.3. End-Use Industry

- 15.6.4. Fiber Length

- 15.6.5. Distribution Channel

- 15.7. Algeria Synthetic Fiber Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Type

- 15.7.3. End-Use Industry

- 15.7.4. Fiber Length

- 15.7.5. Distribution Channel

- 15.8. Rest of Africa Synthetic Fiber Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Type

- 15.8.3. End-Use Industry

- 15.8.4. Fiber Length

- 15.8.5. Distribution Channel

- 16. South America Synthetic Fiber Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Central and South Africa Synthetic Fiber Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. End-Use Industry

- 16.3.3. Fiber Length

- 16.3.4. Distribution Channel

- 16.3.5. Country

- 16.3.5.1. Brazil

- 16.3.5.2. Argentina

- 16.3.5.3. Rest of South America

- 16.4. Brazil Synthetic Fiber Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. End-Use Industry

- 16.4.4. Fiber Length

- 16.4.5. Distribution Channel

- 16.5. Argentina Synthetic Fiber Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. End-Use Industry

- 16.5.4. Fiber Length

- 16.5.5. Distribution Channel

- 16.6. Rest of South America Synthetic Fiber Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. End-Use Industry

- 16.6.4. Fiber Length

- 16.6.5. Distribution Channel

- 17. Key Players/ Company Profile

- 17.1. Asahi Kasei Corporation

- 17.1.1. Company Details/ Overview

- 17.1.2. Company Financials

- 17.1.3. Key Customers and Competitors

- 17.1.4. Business/ Industry Portfolio

- 17.1.5. Product Portfolio/ Specification Details

- 17.1.6. Pricing Data

- 17.1.7. Strategic Overview

- 17.1.8. Recent Developments

- 17.2. BASF SE

- 17.3. Bombay Dyeing

- 17.4. China Petroleum Corporation

- 17.5. DuPont de Nemours, Inc.

- 17.6. Eastman Chemical Company

- 17.7. Formosa Plastics Corporation

- 17.8. Hyosung TNC Corporation

- 17.9. Indorama Corporation

- 17.10. Kolon Industries, Inc.

- 17.11. Lenzing AG

- 17.12. Mitsubishi Chemical Holdings Corporation

- 17.13. Reliance Industries Limited

- 17.14. Teijin Limited

- 17.15. Tongkun Group Co., Ltd.

- 17.16. Toray Chemical Korea, Inc.

- 17.17. Toyobo Co., Ltd.

- 17.18. Other Key Players

- 17.1. Asahi Kasei Corporation

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation