Variable Frequency Drives (VFD) Market Size, Share & Trends Analysis Report by Type/Technology (AC Drives, DC Drives, Servo Drives), Power Rating, Application, Control Type, Sales Channel, Configuration, Mounting Type, End-users and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Variable Frequency Drives (VFD) Market Size, Share, and Growth

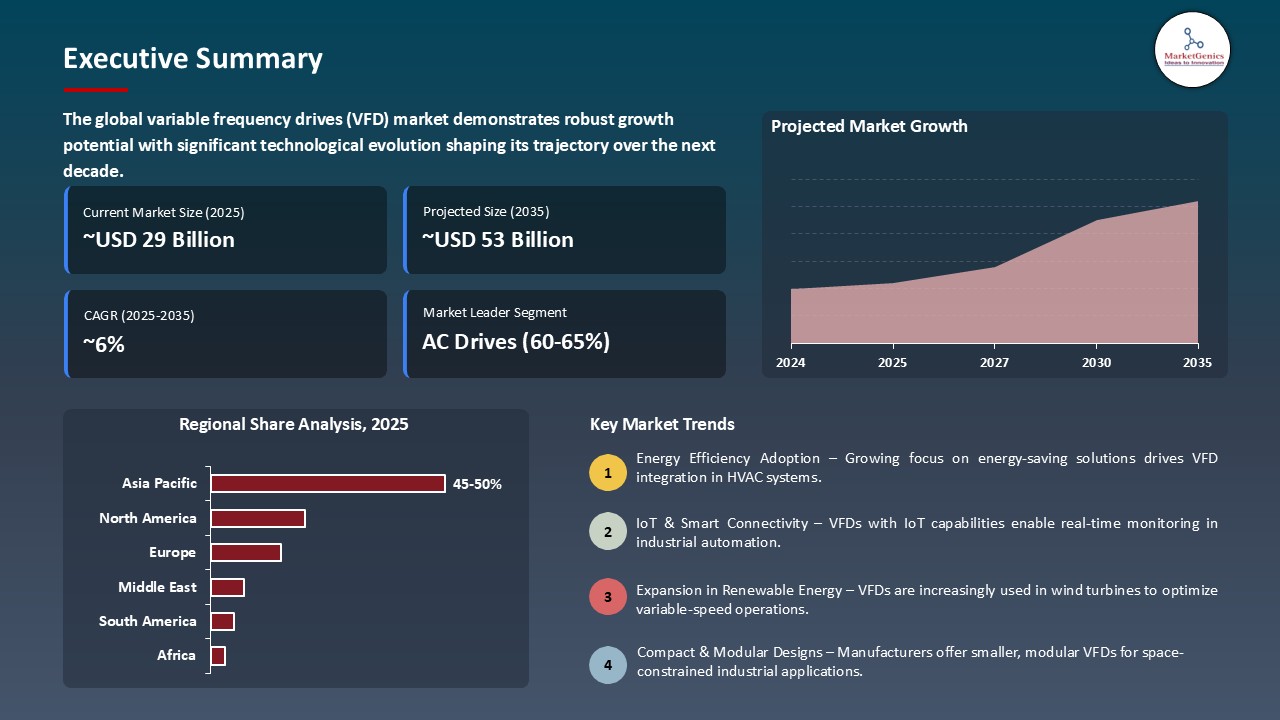

The global variable frequency drives (VFD) market is witnessing strong growth, valued at USD 28.7 billion in 2025 and projected to reach USD 52.4 billion by 2035, expanding at a CAGR of 6.2% during the forecast period. North America is the fastest-growing region in the variable frequency drives (VFD) market due to increasing industrial automation, infrastructure modernization, and stringent energy-efficiency regulations driving the adoption of advanced motor control solutions.

Mario Lemarroy, Product Market Manager, at ABB, said, “All customers in the HVACR industry need robust and reliable equipment, but there are situations where the drive needs outside installation, near the application, subject to extreme environments, our ACH580 4X drive also is equipped with HVACR specific software features, making it easy to commission and use”.

The global variable frequency drive is being propelled by the rapid change in technology whereby there has been the creation of the smart, compact and the modular drives. Current VFDs have sensorless operation, regenerative braking and harmonic reduction capabilities, which increase operational efficiency, the minimization of energy loss, and the stress on equipment. The innovations cover flexible use in industries, enhance reliability, and allow integration with automation, IoT, and smart factory systems, and the use of VFDs is becoming essential.

The emerging opportunities in the global variable frequency drives market are due to the rapid urbanization and development of smart cities. VFDs are finding applications in elevators, escalators, HVAC systems, and smart building management systems in order to maximize energy use, minimize the cost of operations and improve performance. They can be built into infrastructure and incorporated in smart building projects as they allow real-time monitoring, automation, and energy-saving operations, thus being fundamental modules of contemporary and sustainable infrastructure.

The main adjacent market prospects are industrial IoT data analytics platforms, monitoring solutions using clouds, edge computing infrastructure, and artificial intelligence applications. These complementary technologies have produced synergistic integrations opportunities that increase the overall addressable market and allow manufacturers to provide end-to-end solutions that both solve several pain points of customers at the same time.

Variable Frequency Drives (VFD) Market Dynamics and Trends

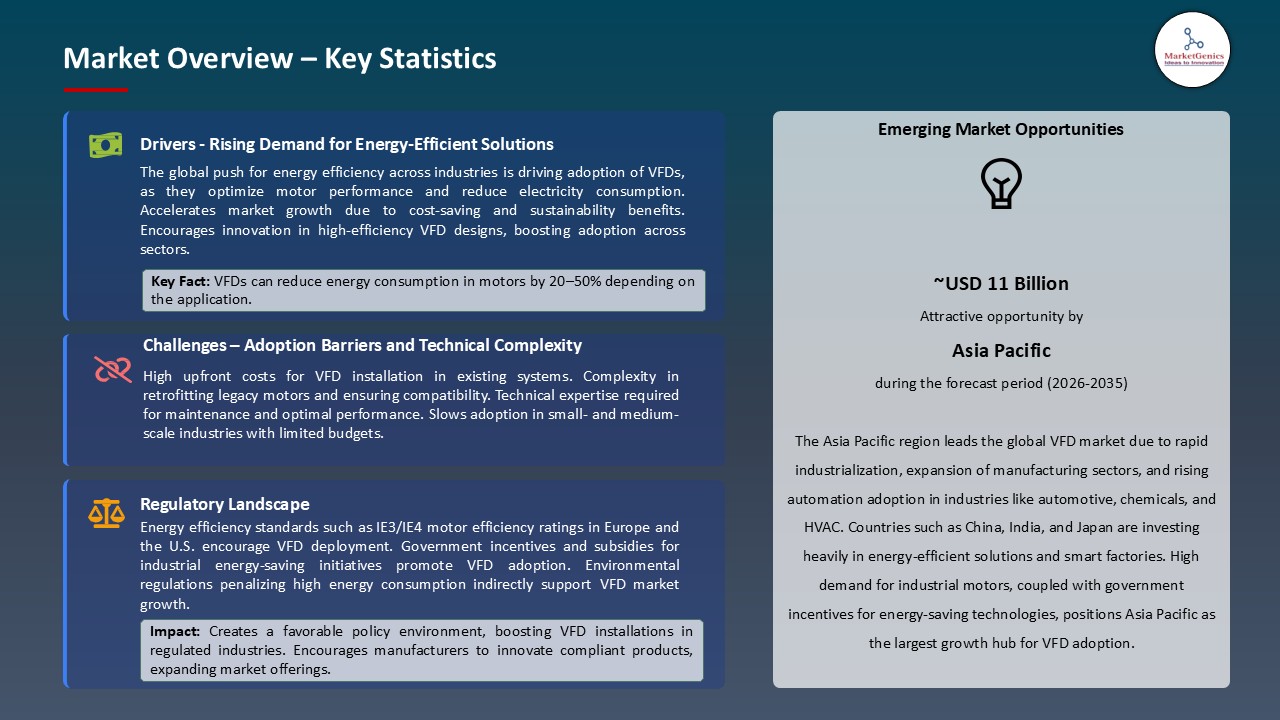

Driver: Growing Focus on Energy Efficiency and Sustainability

- The growing global interest in energy conservation, reduction of carbon footprint, and sustainable industrial operations is one of the major forces behind the Variable Frequency Drives (VFD) market. VFDs are useful in the optimization of motor speed, minimization of energy and wastage to industries, which comply with rigorous environmental standards and sustainability within corporations.

- With the increase in the cost of electricity and tightening of the emission regulations, VFDs are a good alternative to consider in ensuring that industries do not resort to operation reduction in pursuit of energy-saving. The implementation of smart manufacturing and Industry 4.0 programs further promote the use of VFDs, as they allow the accurate control of them, minimize energy waste, and save cost and labor in the long term, which contributes to stimulating their demand in a wide range of industries significantly.

- In June 2025, ABB pointed out that variable-speed drives (VFDs) had the potential to reduce industrial power consumption on motors by 25 percent but only 25 percent are operated with VFDs. ABB screened more than 10,500 systems, and average energy savings of 43 (approximately 941 000 MWh) were found, indicating that VFDs can make effective use of industrial energy to save energy and ensure sustainability.

- The broader use of VFDs is a significant possibility that can help industries improve their efficiency, reduce their energy bills, and improve their sustainability agenda.

Restraint: High Maintenance Requirements and Technical Expertise Needs

- Variable Frequency Drives (VFDs) need highly specialized maintenance and technical skills, which makes their use in certain industries restricted. These drives are complex electronic mechanisms which require frequent monitoring, preventive maintenance and expert troubleshooting in order to achieve optimal functionality and prevent system breakdowns.

- Many SMEs have the problem of providing trained staff to install, program, and diagnose the VFD systems. Poor management or technical incompetency may cause downtimes, inefficiencies in operations and increased expenses. The environmental factors like dust, moisture or voltage variability may further complicate the maintenance, require safeguard and regular inspection.

- The suitability of constant technical service and increased maintenance cost increases the overall ownership cost, especially in areas with low technical knowledge or poorly developed maintenance facilities. As a result, these are suppressants of the fast adoption and spread of the variable frequency drives (VFD) market.

Opportunity: Expansion in Water and Wastewater Treatment Infrastructure

- The increasing attention to water supply and wastewater management all over the world is fueling the need of variable frequency drives (VFDs). VFDs are popular in pumps, blowers, and treatment systems to control the flow, pressure, and energy consumption in the most efficient way, so they are the best solution in the present-day water and wastewater treatment plants.

- Governments and the private sectors are putting a lot of investment to modernize the old infrastructure and install new treatment plants to cope with the increasing urbanization, population and enhance environmental regulations. VDs improve the efficiency and sustainability of processes in water utilities since they allow these facilities to have close control of motor-driven equipment, minimize energy wastage, and reduce operational expenses.

- Flow Tech retrofitted four ABB ACQ580 VFDs with harmonic filters in the municipal water and wastewater plant at the City of Waterbury in May 2025. These enhancements streamlined the control of the pumps, minimized their energy usage, and improved their efficiency, which proved the value of VFDs in promoting economies of scale, sustainability, and consistent functionality in the growth of water and wastewater systems.

- The increase of water and wastewater infrastructure is an important growth market of the variable frequency drives in both the developed and emerging markets.

Key Trend: Integration of Predictive Maintenance and Condition Monitoring

- The shift toward predictive maintenance and condition monitoring technology is becoming one of the major trends in the market of the variable frequency drives (VFD). VFDs are also getting more sensors and digital interfaces that constantly monitor values like vibration, temperature, current and voltage. The resultant real-time data can be used to detect anomalies, possible failures and inefficiencies in performance early and thus do proactive maintenance as opposed to responding to failures.

- These technologies increase efficiency in operations and minimize the maintenance costs through minimizing unplanned downtime, elongating the life of equipment, and maximizing energy consumption. The combination of VFDs with Industry 4.0 and IoT platforms also provides the possibility of remote monitoring, data analytics and smart decision-making which stimulates their implementation in various industries that require increased reliability and productivity.

- In November 2025, ABB demonstrated legacy VSDs that had been installed with Electrical Signature Analysis (ESA) by Samotics at ADIPEC which would allow real-time monitoring of motors, pumps, fans and conveyors. The drives pick up the first signs of bearing wear, misalignment, and cavitation early, enabling predictive maintenance and minimizing downtime as well as increasing the reliability of operations in the hostile manufacturing conditions.

- The trend is also characterized by the increasing relevance of intelligent VFDs in facilitating predictive maintenance, enhancing asset reliability and creating efficiency in the current industrial practices.

Variable-Frequency-Drives-Market Analysis and Segmental Data

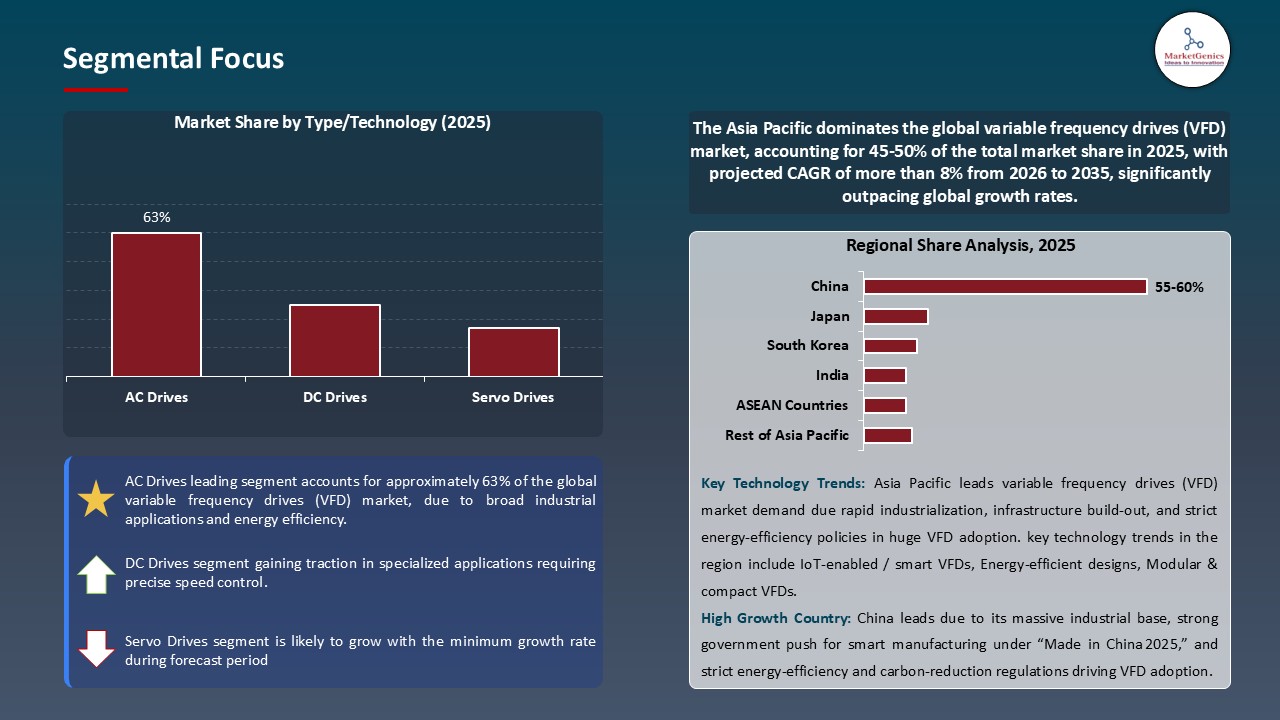

AC Drives Dominate Global Variable Frequency Drives (VFD) Market

- The AC drives market segment has dominated the world variable frequency drives (VFD) market because it is versatile, economical, and can be used in most industries around the world.

- The AC motors are used in industries like HVAC, water and wastewater treatment, mining, oil and gas, and manufacturing, whereby very accurate speed regulation of the motor is essential to maximize energy use and minimize operational expenses. Their capability to serve an extensive variety of types of motors, the support of variable loads as well as their integration with automation and control systems have strengthened their leadership in the market.

- In July 2025, ABB released the ABS380-E AC machinery drive, that has two Ethernet ports including Profinet, Ethernet/IP and Modbus protocols, built-in cybersecurity, and USB-C commissioning. Intended to be used in industrial machinery, it offers acute motor control, reduced integration, and regulatory compliance, which strengthens the role of AC drives as multipurpose, efficient and digitally connected solutions in the world VFD market.

- The sustained leadership of AC drives in the VFD market is due to their flexibility, energy saving nature and high level of digitalization.

Asia Pacific Leads Global Variable Frequency Drives (VFD) Market Demand

- The Asia Pacific region has the largest share of the variable frequency drives (VFD) market globally which is propelled by the fast industrialization, urbanization and the growth in the manufacturing industries of the countries like China, India, Japan and South Korea. Increasing investments in energy saving and efficient automation solutions, intelligent factories and Industry 4.0 programs have also increased the demand of VFDs.

- The increased attention on minimizing the operational cost, the optimisation of the use of energy and the conformity to the strict environmental standards has stimulated the use of VFDs in HVAC, water and wastewater treatment, mining, and process industries.

- The increased adoption of VFD is also aided by government incentives and infrastructure development projects in the area, thus Asia Pacific is the most successful market in the world in terms of volume and growth potential.

- In September 2025, INVT Electric released its own 30 MVA medium-voltage water-cooled VFD, a significant technology globally in industrial drives. The system is highly reliable, has long service life and is economical in energy use and is used in a variety of applications in the metallurgy, mining, oil, chemical, new energy, power and water conservancy.

- The main innovations are high-quality components, water-cooling design, cascaded unit rectification to reduce harmonics, proprietary motor control algorithms, and high overloading capability. This is the first of its kind in the industry and meets a critical market need in Asia Pacific.

Variable-Frequency-Drives-Market Ecosystem

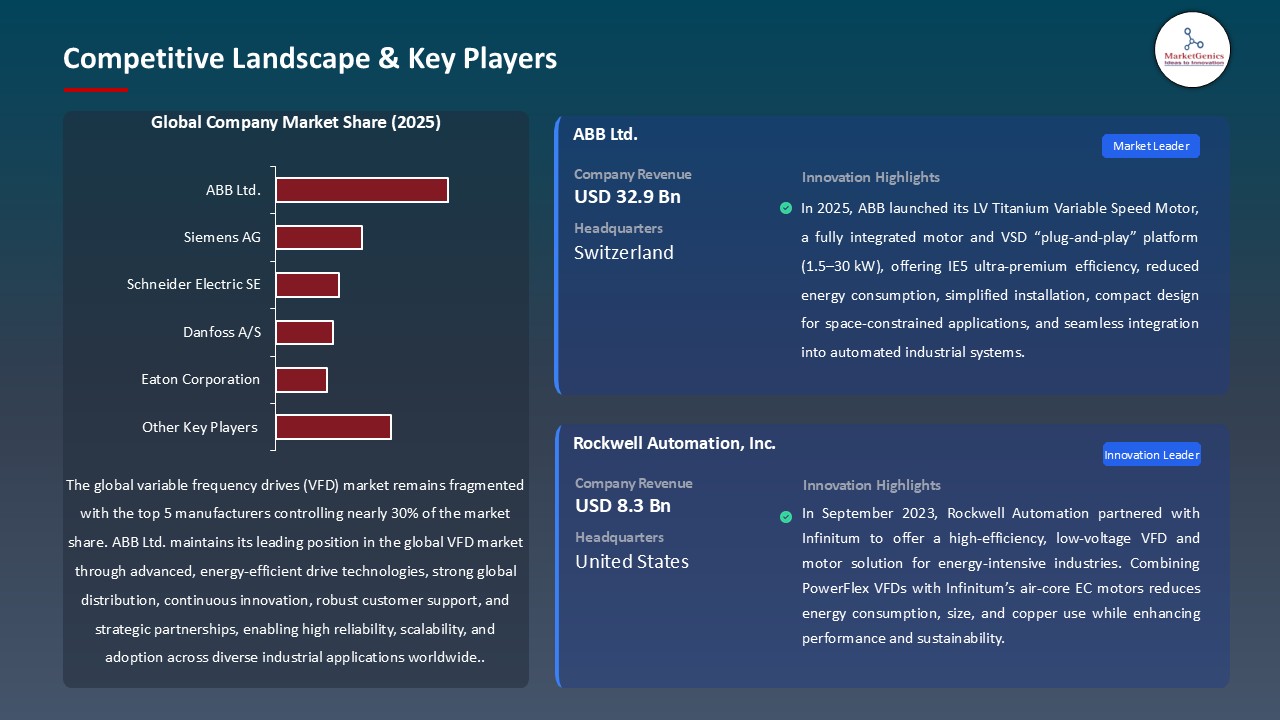

The global variable frequency drive (VFD) market is fragmented, with major giants such as ABB Ltd., Siemens AG, Schneider Electric SE, Danfoss A/S, and Eaton Corporation. These businesses stay in the leadership with good relations with customers, high-performance hardware which is reliable, and the compatibility of drives and motors in various industrial practices.

VFD market value chain includes the production of servo motors, drive, the design of controllers, the design of communication protocols, integration of systems, calibration, and post-installation services, such as predictive maintenance and compliance with cybersecurity.

There are high barriers to entry since there is a requirement to have proven and stable systems and customer trust and there are specialized vendors that keep on innovating to facilitate niche applications that are propelling the market towards continuous technological development.

Recent Development and Strategic Overview:

- In January 2024, ABB introduced the ACH580 4X, a fully sealed and weather resistant VFD designed to be used in HVACR in harsh conditions. It has a multi-pump control, freezestat response, resonance monitoring, Bluetooth commissioning, and fire-emergency override and is UL Type 4X/IP66 certified. Coming in 1300hp, it allows 1-phase 240 volts and 3-phase 208-600 volts, improving the outdoor usability and efficiency.

- In September 2023, Rockwell Automation collaborated with Infinitum to launch a high efficiency, low voltage VFD and motor offering to support energy intensive industrial processes. The integrated system integrates power flex VFDs with the air-core EC motors of Infinitum that consume less energy, less copper, and less space and has enhanced the working efficiency, sustainability, and integration capability with other automated industrial systems.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 28.7 Bn |

|

Market Forecast Value in 2035 |

USD 52.4 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Variable-Frequency-Drives-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Variable Frequency Drives (VFD) Market, By Type/Technology |

|

|

Variable Frequency Drives (VFD) Market, By Power Rating |

|

|

Variable Frequency Drives (VFD) Market, By Application |

|

|

Variable Frequency Drives (VFD) Market, By Control Type |

|

|

Variable Frequency Drives (VFD) Market, By Sales Channel |

|

|

Variable Frequency Drives (VFD) Market, By Configuration |

|

|

Variable Frequency Drives (VFD) Market, By Mounting Type |

|

|

Variable Frequency Drives (VFD) Market, By End-users |

|

Frequently Asked Questions

The global variable frequency drives (VFD) market was valued at USD 28.7 Bn in 2025.

The global variable frequency drives (VFD) market industry is expected to grow at a CAGR of 6.2% from 2026 to 2035.

Key factors driving demand include growing focus on energy efficiency and sustainability, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of type/technology, the AC drives segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for variable frequency drives (VFD) market.

Prominent players operating in the global variable frequency drives (VFD) market are ABB Ltd., Crompton Greaves Consumer Electricals Limited, Danfoss A/S, Delta Electronics Inc., Eaton Corporation, Emerson Electric Co., Fuji Electric Co., Ltd., General Electric (GE), Hitachi Ltd., Invertek Drives Ltd., Johnson Controls International, Mitsubishi Electric Corporation, Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Toshiba Corporation, WEG Industries, Yaskawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Variable Frequency Drives (VFD) Market Outlook

- 2.1.1. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Variable Frequency Drives (VFD) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for energy-efficient motor control systems

- 4.1.1.2. Growth in industrial automation and Industry 4.0 adoption

- 4.1.1.3. Government regulations and policies promoting energy conservation

- 4.1.2. Restraints

- 4.1.2.1. High initial installation and capital costs

- 4.1.2.2. Technical complexity requiring skilled labor and integration challenges

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- Component 4.4.1. Suppliers

- 4.4.2. VFD Manufacturers

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Variable Frequency Drives (VFD) Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Variable Frequency Drives (VFD) Market Analysis, by Type/Technology

- 6.1. Key Segment Analysis

- 6.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Type/Technology, 2021-2035

- 6.2.1. AC Drives

- 6.2.1.1. Low Voltage AC Drives (up to 690V)

- 6.2.1.2. Medium Voltage AC Drives (691V - 3.3kV)

- 6.2.1.3. High Voltage AC Drives (above 3.3kV)

- 6.2.2. DC Drives

- 6.2.3. Servo Drives

- 6.2.1. AC Drives

- 7. Global Variable Frequency Drives (VFD) Market Analysis, by Power Rating

- 7.1. Key Segment Analysis

- 7.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Power Rating, 2021-2035

- 7.2.1. Up to 1 kW

- 7.2.2. 1 kW - 40 kW

- 7.2.3. 41 kW - 200 kW

- 7.2.4. Above 200 kW

- 8. Global Variable Frequency Drives (VFD) Market Analysis, by Application

- 8.1. Key Segment Analysis

- 8.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 8.2.1. Pumps

- 8.2.2. Fans

- 8.2.3. Compressors

- 8.2.4. Conveyors

- 8.2.5. Extruders

- 8.2.6. HVAC Systems

- 8.2.7. Material Handling Equipment

- 8.2.8. Machine Tools

- 8.2.9. Others

- 9. Global Variable Frequency Drives (VFD) Market Analysis, by Control Type

- 9.1. Key Segment Analysis

- 9.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Control Type, 2021-2035

- 9.2.1. Scalar Control (V/f Control)

- 9.2.2. Vector Control

- 9.2.3. Direct Torque Control (DTC)

- 9.2.4. Field-Oriented Control (FOC)

- 9.2.5. Servo Control

- 10. Global Variable Frequency Drives (VFD) Market Analysis, by Sales Channel

- 10.1. Key Segment Analysis

- 10.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Sales Channel, 2021-2035

- 10.2.1. Direct Sales

- 10.2.2. Distributors

- 10.2.3. OEM

- 10.2.4. Online Channels

- 11. Global Variable Frequency Drives (VFD) Market Analysis, by Configuration

- 11.1. Key Segment Analysis

- 11.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Configuration, 2021-2035

- 11.2.1. Standalone VFDs

- 11.2.2. Integrated VFDs

- 11.2.3. Modular VFDs

- 12. Global Variable Frequency Drives (VFD) Market Analysis, by Mounting Type

- 12.1. Key Segment Analysis

- 12.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Mounting Type, 2021-2035

- 12.2.1. Wall-Mounted VFDs

- 12.2.2. Floor-Mounted VFDs

- 12.2.3. Panel-Mounted VFDs

- 12.2.4. DIN Rail-Mounted VFDs

- 12.2.5. Others

- 13. Global Variable Frequency Drives (VFD) Market Analysis, by End-users

- 13.1. Key Segment Analysis

- 13.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 13.2.1. Oil & Gas

- 13.2.2. Water & Wastewater Management

- 13.2.3. Power Generation

- 13.2.4. Mining & Metals

- 13.2.5. Pulp & Paper Industry

- 13.2.6. Cement Industry

- 13.2.7. HVAC

- 13.2.8. Automotive

- 13.2.9. Marine & Shipbuilding

- 13.2.10. Textile

- 13.2.11. Infrastructure & Construction

- 13.2.12. Other End-users

- 14. Global Variable Frequency Drives (VFD) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Variable Frequency Drives (VFD) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Variable Frequency Drives (VFD) Market Size Volume (Million units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type/Technology

- 15.3.2. Power Rating

- 15.3.3. Application

- 15.3.4. Control Type

- 15.3.5. Sales Channel

- 15.3.6. Configuration

- 15.3.7. Mounting Type

- 15.3.8. End-users

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Variable Frequency Drives (VFD) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type/Technology

- 15.4.3. Power Rating

- 15.4.4. Application

- 15.4.5. Control Type

- 15.4.6. Sales Channel

- 15.4.7. Configuration

- 15.4.8. Mounting Type

- 15.4.9. End-users

- 15.5. Canada Variable Frequency Drives (VFD) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type/Technology

- 15.5.3. Power Rating

- 15.5.4. Application

- 15.5.5. Control Type

- 15.5.6. Sales Channel

- 15.5.7. Configuration

- 15.5.8. Mounting Type

- 15.5.9. End-users

- 15.6. Mexico Variable Frequency Drives (VFD) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type/Technology

- 15.6.3. Power Rating

- 15.6.4. Application

- 15.6.5. Control Type

- 15.6.6. Sales Channel

- 15.6.7. Configuration

- 15.6.8. Mounting Type

- 15.6.9. End-users

- 16. Europe Variable Frequency Drives (VFD) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type/Technology

- 16.3.2. Power Rating

- 16.3.3. Application

- 16.3.4. Control Type

- 16.3.5. Sales Channel

- 16.3.6. Configuration

- 16.3.7. Mounting Type

- 16.3.8. End-users

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Variable Frequency Drives (VFD) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type/Technology

- 16.4.3. Power Rating

- 16.4.4. Application

- 16.4.5. Control Type

- 16.4.6. Sales Channel

- 16.4.7. Configuration

- 16.4.8. Mounting Type

- 16.4.9. End-users

- 16.5. United Kingdom Variable Frequency Drives (VFD) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type/Technology

- 16.5.3. Power Rating

- 16.5.4. Application

- 16.5.5. Control Type

- 16.5.6. Sales Channel

- 16.5.7. Configuration

- 16.5.8. Mounting Type

- 16.5.9. End-users

- 16.6. France Variable Frequency Drives (VFD) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type/Technology

- 16.6.3. Power Rating

- 16.6.4. Application

- 16.6.5. Control Type

- 16.6.6. Sales Channel

- 16.6.7. Configuration

- 16.6.8. Mounting Type

- 16.6.9. End-users

- 16.7. Italy Variable Frequency Drives (VFD) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type/Technology

- 16.7.3. Power Rating

- 16.7.4. Application

- 16.7.5. Control Type

- 16.7.6. Sales Channel

- 16.7.7. Configuration

- 16.7.8. Mounting Type

- 16.7.9. End-users

- 16.8. Spain Variable Frequency Drives (VFD) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type/Technology

- 16.8.3. Power Rating

- 16.8.4. Application

- 16.8.5. Control Type

- 16.8.6. Sales Channel

- 16.8.7. Configuration

- 16.8.8. Mounting Type

- 16.8.9. End-users

- 16.9. Netherlands Variable Frequency Drives (VFD) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Type/Technology

- 16.9.3. Power Rating

- 16.9.4. Application

- 16.9.5. Control Type

- 16.9.6. Sales Channel

- 16.9.7. Configuration

- 16.9.8. Mounting Type

- 16.9.9. End-users

- 16.10. Nordic Countries Variable Frequency Drives (VFD) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Type/Technology

- 16.10.3. Power Rating

- 16.10.4. Application

- 16.10.5. Control Type

- 16.10.6. Sales Channel

- 16.10.7. Configuration

- 16.10.8. Mounting Type

- 16.10.9. End-users

- 16.11. Poland Variable Frequency Drives (VFD) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Type/Technology

- 16.11.3. Power Rating

- 16.11.4. Application

- 16.11.5. Control Type

- 16.11.6. Sales Channel

- 16.11.7. Configuration

- 16.11.8. Mounting Type

- 16.11.9. End-users

- 16.12. Russia & CIS Variable Frequency Drives (VFD) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Type/Technology

- 16.12.3. Power Rating

- 16.12.4. Application

- 16.12.5. Control Type

- 16.12.6. Sales Channel

- 16.12.7. Configuration

- 16.12.8. Mounting Type

- 16.12.9. End-users

- 16.13. Rest of Europe Variable Frequency Drives (VFD) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Type/Technology

- 16.13.3. Power Rating

- 16.13.4. Application

- 16.13.5. Control Type

- 16.13.6. Sales Channel

- 16.13.7. Configuration

- 16.13.8. Mounting Type

- 16.13.9. End-users

- 17. Asia Pacific Variable Frequency Drives (VFD) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type/Technology

- 17.3.2. Power Rating

- 17.3.3. Application

- 17.3.4. Control Type

- 17.3.5. Sales Channel

- 17.3.6. Configuration

- 17.3.7. Mounting Type

- 17.3.8. End-users

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Variable Frequency Drives (VFD) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type/Technology

- 17.4.3. Power Rating

- 17.4.4. Application

- 17.4.5. Control Type

- 17.4.6. Sales Channel

- 17.4.7. Configuration

- 17.4.8. Mounting Type

- 17.4.9. End-users

- 17.5. India Variable Frequency Drives (VFD) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type/Technology

- 17.5.3. Power Rating

- 17.5.4. Application

- 17.5.5. Control Type

- 17.5.6. Sales Channel

- 17.5.7. Configuration

- 17.5.8. Mounting Type

- 17.5.9. End-users

- 17.6. Japan Variable Frequency Drives (VFD) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type/Technology

- 17.6.3. Power Rating

- 17.6.4. Application

- 17.6.5. Control Type

- 17.6.6. Sales Channel

- 17.6.7. Configuration

- 17.6.8. Mounting Type

- 17.6.9. End-users

- 17.7. South Korea Variable Frequency Drives (VFD) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type/Technology

- 17.7.3. Power Rating

- 17.7.4. Application

- 17.7.5. Control Type

- 17.7.6. Sales Channel

- 17.7.7. Configuration

- 17.7.8. Mounting Type

- 17.7.9. End-users

- 17.8. Australia and New Zealand Variable Frequency Drives (VFD) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type/Technology

- 17.8.3. Power Rating

- 17.8.4. Application

- 17.8.5. Control Type

- 17.8.6. Sales Channel

- 17.8.7. Configuration

- 17.8.8. Mounting Type

- 17.8.9. End-users

- 17.9. Indonesia Variable Frequency Drives (VFD) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type/Technology

- 17.9.3. Power Rating

- 17.9.4. Application

- 17.9.5. Control Type

- 17.9.6. Sales Channel

- 17.9.7. Configuration

- 17.9.8. Mounting Type

- 17.9.9. End-users

- 17.10. Malaysia Variable Frequency Drives (VFD) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type/Technology

- 17.10.3. Power Rating

- 17.10.4. Application

- 17.10.5. Control Type

- 17.10.6. Sales Channel

- 17.10.7. Configuration

- 17.10.8. Mounting Type

- 17.10.9. End-users

- 17.11. Thailand Variable Frequency Drives (VFD) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type/Technology

- 17.11.3. Power Rating

- 17.11.4. Application

- 17.11.5. Control Type

- 17.11.6. Sales Channel

- 17.11.7. Configuration

- 17.11.8. Mounting Type

- 17.11.9. End-users

- 17.12. Vietnam Variable Frequency Drives (VFD) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type/Technology

- 17.12.3. Power Rating

- 17.12.4. Application

- 17.12.5. Control Type

- 17.12.6. Sales Channel

- 17.12.7. Configuration

- 17.12.8. Mounting Type

- 17.12.9. End-users

- 17.13. Rest of Asia Pacific Variable Frequency Drives (VFD) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Type/Technology

- 17.13.3. Power Rating

- 17.13.4. Application

- 17.13.5. Control Type

- 17.13.6. Sales Channel

- 17.13.7. Configuration

- 17.13.8. Mounting Type

- 17.13.9. End-users

- 18. Middle East Variable Frequency Drives (VFD) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type/Technology

- 18.3.2. Power Rating

- 18.3.3. Application

- 18.3.4. Control Type

- 18.3.5. Sales Channel

- 18.3.6. Configuration

- 18.3.7. Mounting Type

- 18.3.8. End-users

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Variable Frequency Drives (VFD) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type/Technology

- 18.4.3. Power Rating

- 18.4.4. Application

- 18.4.5. Control Type

- 18.4.6. Sales Channel

- 18.4.7. Configuration

- 18.4.8. Mounting Type

- 18.4.9. End-users

- 18.5. UAE Variable Frequency Drives (VFD) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type/Technology

- 18.5.3. Power Rating

- 18.5.4. Application

- 18.5.5. Control Type

- 18.5.6. Sales Channel

- 18.5.7. Configuration

- 18.5.8. Mounting Type

- 18.5.9. End-users

- 18.6. Saudi Arabia Variable Frequency Drives (VFD) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type/Technology

- 18.6.3. Power Rating

- 18.6.4. Application

- 18.6.5. Control Type

- 18.6.6. Sales Channel

- 18.6.7. Configuration

- 18.6.8. Mounting Type

- 18.6.9. End-users

- 18.7. Israel Variable Frequency Drives (VFD) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type/Technology

- 18.7.3. Power Rating

- 18.7.4. Application

- 18.7.5. Control Type

- 18.7.6. Sales Channel

- 18.7.7. Configuration

- 18.7.8. Mounting Type

- 18.7.9. End-users

- 18.8. Rest of Middle East Variable Frequency Drives (VFD) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type/Technology

- 18.8.3. Power Rating

- 18.8.4. Application

- 18.8.5. Control Type

- 18.8.6. Sales Channel

- 18.8.7. Configuration

- 18.8.8. Mounting Type

- 18.8.9. End-users

- 19. Africa Variable Frequency Drives (VFD) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Type/Technology

- 19.3.3. Power Rating

- 19.3.4. Application

- 19.3.5. Control Type

- 19.3.6. Sales Channel

- 19.3.7. Configuration

- 19.3.8. Mounting Type

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. South Africa

- 19.3.10.2. Egypt

- 19.3.10.3. Nigeria

- 19.3.10.4. Algeria

- 19.3.10.5. Rest of Africa

- 19.4. South Africa Variable Frequency Drives (VFD) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type/Technology

- 19.4.3. Power Rating

- 19.4.4. Application

- 19.4.5. Control Type

- 19.4.6. Sales Channel

- 19.4.7. Configuration

- 19.4.8. Mounting Type

- 19.4.9. End-users

- 19.5. Egypt Variable Frequency Drives (VFD) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type/Technology

- 19.5.3. Power Rating

- 19.5.4. Application

- 19.5.5. Control Type

- 19.5.6. Sales Channel

- 19.5.7. Configuration

- 19.5.8. Mounting Type

- 19.5.9. End-users

- 19.6. Nigeria Variable Frequency Drives (VFD) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type/Technology

- 19.6.3. Power Rating

- 19.6.4. Application

- 19.6.5. Control Type

- 19.6.6. Sales Channel

- 19.6.7. Configuration

- 19.6.8. Mounting Type

- 19.6.9. End-users

- 19.7. Algeria Variable Frequency Drives (VFD) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type/Technology

- 19.7.3. Power Rating

- 19.7.4. Application

- 19.7.5. Control Type

- 19.7.6. Sales Channel

- 19.7.7. Configuration

- 19.7.8. Mounting Type

- 19.7.9. End-users

- 19.8. Rest of Africa Variable Frequency Drives (VFD) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type/Technology

- 19.8.3. Power Rating

- 19.8.4. Application

- 19.8.5. Control Type

- 19.8.6. Sales Channel

- 19.8.7. Configuration

- 19.8.8. Mounting Type

- 19.8.9. End-users

- 20. South America Variable Frequency Drives (VFD) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Variable Frequency Drives (VFD) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type/Technology

- 20.3.2. Power Rating

- 20.3.3. Application

- 20.3.4. Control Type

- 20.3.5. Sales Channel

- 20.3.6. Configuration

- 20.3.7. Mounting Type

- 20.3.8. End-users

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Variable Frequency Drives (VFD) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type/Technology

- 20.4.3. Power Rating

- 20.4.4. Application

- 20.4.5. Control Type

- 20.4.6. Sales Channel

- 20.4.7. Configuration

- 20.4.8. Mounting Type

- 20.4.9. End-users

- 20.5. Argentina Variable Frequency Drives (VFD) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type/Technology

- 20.5.3. Power Rating

- 20.5.4. Application

- 20.5.5. Control Type

- 20.5.6. Sales Channel

- 20.5.7. Configuration

- 20.5.8. Mounting Type

- 20.5.9. End-users

- 20.6. Rest of South America Variable Frequency Drives (VFD) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type/Technology

- 20.6.3. Power Rating

- 20.6.4. Application

- 20.6.5. Control Type

- 20.6.6. Sales Channel

- 20.6.7. Configuration

- 20.6.8. Mounting Type

- 20.6.9. End-users

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Crompton Greaves Consumer Electricals Limited

- 21.3. Danfoss A/S

- 21.4. Delta Electronics Inc.

- 21.5. Eaton Corporation

- 21.6. Emerson Electric Co.

- 21.7. Fuji Electric Co., Ltd.

- 21.8. General Electric (GE)

- 21.9. Hitachi Ltd.

- 21.10. Invertek Drives Ltd.

- 21.11. Johnson Controls International

- 21.12. Mitsubishi Electric Corporation

- 21.13. Nidec Corporation

- 21.14. Parker Hannifin Corporation

- 21.15. Rockwell Automation Inc.

- 21.16. Schneider Electric SE

- 21.17. Siemens AG

- 21.18. Toshiba Corporation

- 21.19. WEG Industries

- 21.20. Yaskawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data