Water Treatment Systems Market Size, Share, Growth Opportunity Analysis Report by Product Type (Point-of-Use (PoU) Systems, Point-of-Entry (PoE) Systems, Packaged Water Treatment Systems, Modular/ Skid-Mounted Systems and Others), Technology Type, Contaminant Type, Mobility, Application, End Use Industry, Distribution Channel and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035.

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Water Treatment Systems Market Size, Share, and Growth

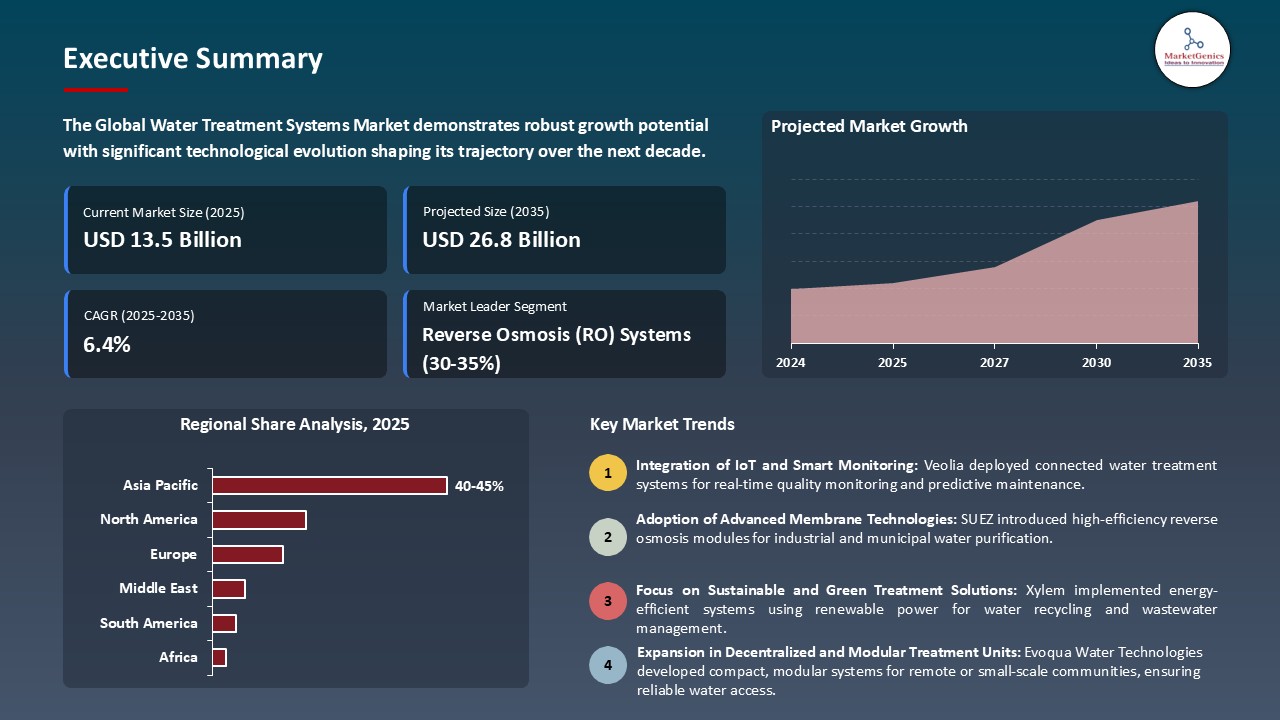

With a significant compounded annual growth rate of 6.4% from 2025-2035, global water treatment systems market is poised to be valued at USD 26.8 Billion in 2035. The construction arrangements in the global water treatment systems market have their roots in various driving force factors such as high industrial wastewater discharge regulations and huge demands for potable water supply in urban areas. For example, Veolia Water Technologies in the year 2024 partnered with ArcelorMittal for the implementation of advanced zero liquid discharge (ZLD) systems for steel plants in Europe, thus, addressing stricter EU wastewater compliance.

In June 2025, Pentair plc launched its new Everpure H2Optimo Series, a smart commercial water filtration system designed for foodservice and hospitality sectors. The system integrates IoT-enabled monitoring for real-time water quality and predictive maintenance. John L. Stauch, President and CEO of Pentair, emphasized the move as part of their strategy to deliver “smarter, more sustainable water solutions” to meet evolving customer needs globally. This innovation enhances operational efficiency and expands Pentair’s footprint in the commercial water treatment segment.

Moreover, Pentair launched a new series of smart residential water filtration solutions in March 2025 in view of the rise in demand for clean drinking water from urban households across North America. These are some of the triggering forces that have accelerated global adoption of industrial and residential water treatment systems.

The enormous opportunities in global water treatment systems include smart water metering solutions, industrial sludge management technologies, and advanced membrane manufacturing. These further aid water utilities and industries with efficiency, regulatory compliance, and system integration. These neighboring markets promote synergistic growth as a whole that adds significant value to the water treatment solutions around the world.

Water Treatment Systems Market Dynamics and Trends

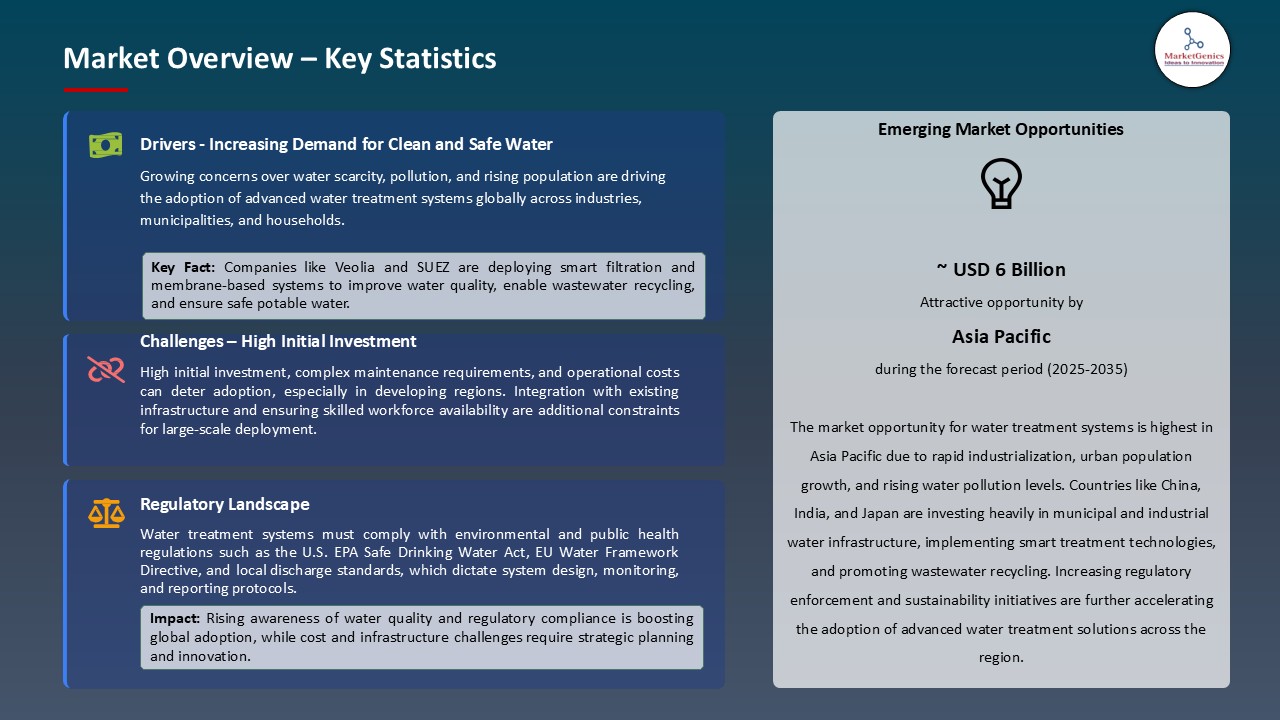

Driver: Increasing Water Scarcity and Reuse Mandates

- Being water-scarce is emerging as a critical issue on a global level. As a result, advanced water treatment systems are being implemented across municipal, industrial, and agricultural spaces. There are, as per the United Nations, over 2.3 billion persons living in water-stressed countries; the governments are, therefore, imposing stringent norms on water reuse and recycling.

- May 2025 saw an agreement between Xylem Inc. and the city of Los Angeles for the deployment of decentralized water reuse systems to treat and reuse up to 100 million gallons per day of wastewater by 2030. They reduce the extraction of freshwater by way of membrane bioreactors (MBR) and ultraviolet advanced oxidation process (UV-AOPs). The newer agenda of water security and circular water economy is driving investments, both public and private, into water treatment technologies.

- With rising water stress and reuse policies, the demand for decentralized and advanced water treatment systems is increasing world over.

Restraint: High Initial Capital and Maintenance Costs

- Despite rising demand in water treatment, the systems often hit a roadblock with the initial big costs and, more importantly, ones of long-term maintenance, and this hits especially in low- and middle-income regions. Technologies like reverse osmosis, UV disinfection applications, ion-exchange-based water softening, and so forth require a lot of initial investment for infrastructure and skilled labor in their operation and maintainance. So, it is a classic case of a trade-off: on one hand, DuPont Water Solutions came to light in January 2025 with a state-of-the-art industrial RO system with a higher energy efficiency; on the other, because of an initial big price tag, it may not really be able to penetrate small-scale businesses and developing economies.

- Moreover, membrane change, chemicals purchase, and energy utilization build up operating expenses; hence markets considered cost-sensitive find it very difficult to penetrate their hand in it, be it by environmental or regulatory requirements.

- Capital expenditure and operating expenditure stand in the way of the adoption of water treatment systems in areas that are budget-constrained and in distressed areas.

Opportunity: Growth in Decentralized and Modular Systems

- As the concept of centralized water treatment infrastructure does not offer enough capacity for rural and rapidly urbanizing areas, decentralized and modular systems are increasingly found in demand. Small, smaller-scale units provide purification and reuse of water for small communities, remote industries, and off-grid locations.

- In 2025 March, Aquatech International announced the launch of its new modular water treatment platform, WaterTrex, especially for commercial and rural customers across Asia and Africa. Filter, UV disinfect, and remote monitor-the plug-and-play system-so installation time reduced and enhanced the latter's adaptability. To decentralize and act at a local level, solutions entrain application of place-specific remedies to an environment perturbed by climate change and population dynamics, bringing in an additional source of revenue to newly developed areas.

- Modular and decentralized water treatment systems represent a scalable opportunity to deepen market penetration in emerging and remote areas.

Key Trend: Integration of AI and IoT in Smart Water Management

- With the joining of AI and IoT, the water treatment sector is undergoing a major transformation wherein predictive maintenance, real-time quality inspections, and process optimization are enabled. In February 2025, the SUEZ Group deployed an AI-powered solution across its water treatment plants in the Middle East using machine learning algorithms to optimize chemical dosing and energy consumption.

- IoT sensors are also embedded in filtration and membrane systems to monitor activities and detect anomalies instantly. Such digitalization ensures operational efficiency, uptime, and compliance to regulation. As smart cities come out into the open and industrial digitization gains traction, AI-IoT water management is becoming a selling point for manufacturers and utilities alike.

- With the rise in AI and IoT adoption in water treatment, there is an increasing shift toward global, smarter, data-driven water infrastructure.

Water Treatment Systems Market Analysis and Segmental Data

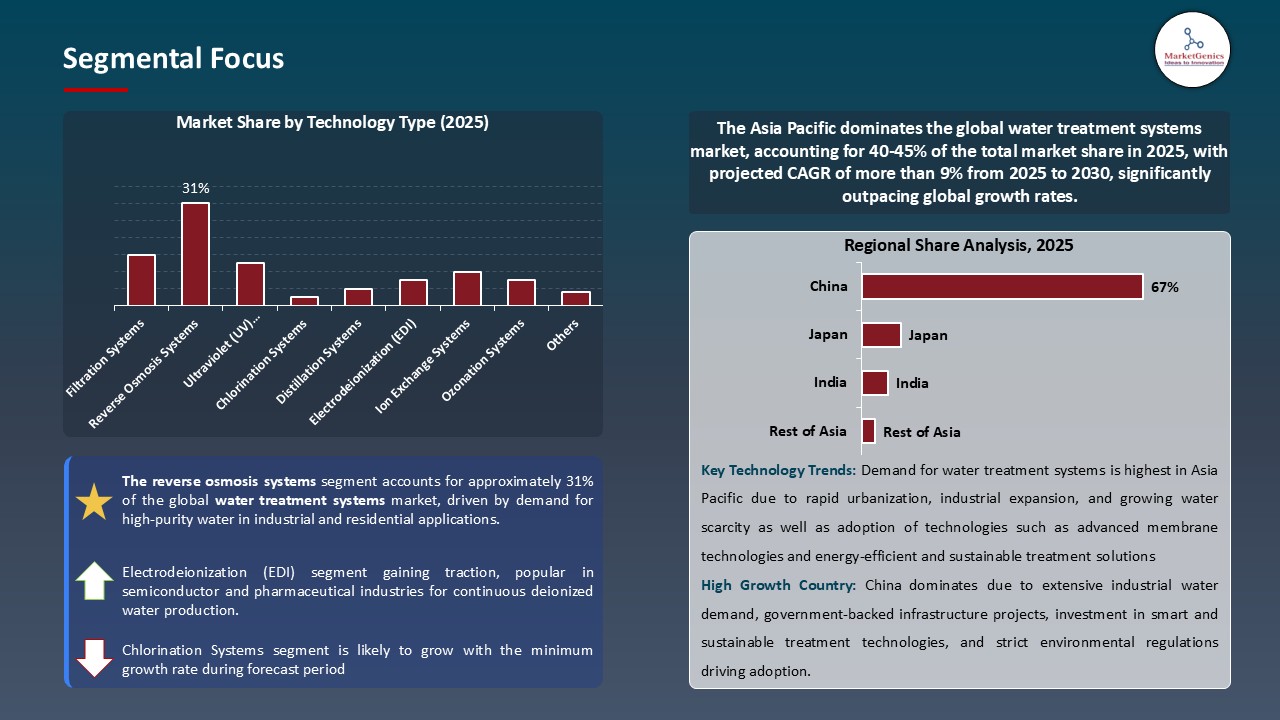

Based on Technology Type, the Reverse Osmosis (RO) Systems Segment Retains the Largest Share

- Due to their high efficiency in removing contaminants such as salts, heavy metals, and microorganisms, RO water treatment systems retain the maximum market share at almost 31%. This makes them sought after for both industrial and domestic use. Due to the lack of freshwater, RO is adopted more for seawater desalination and brackish water treatment. LG Chem has introduced, in May 2025, a next-generation RO membrane featuring 10% better salt rejection and 20% superior energy efficiency, addressing municipal and industrial clients in water-stressed areas of the Middle East and South Asia.

- Further, the rise in consumer awareness concerning waterborne diseases and clean water demand for drinking is contributing to the installation of home RO systems worldwide. Also, the segment gains from technological developments in energy recovery and membrane robustness, thereby reducing operational costs and increasing system life. Heavy investments from governments and private players are going into RO-based infrastructure to fulfill drinking and standards for process water.

- Advanced performance and adaptability of RO systems are driving their dominance across both municipal and industrial water treatment markets globally.

Asia Pacific Dominates Global Water Treatment Systems Market in 2025 and Beyond

- Due to rapid urbanization and industrialization along with the increased pollution of surface and groundwater resources, water treatment systems fetch the highest demand in the Asia Pacific market. Countries such as India and China are heavily investing in infrastructure to tackle the hazards of water contamination and scarcity. For instance, in April 2025, Evoqua Water Technologies secured a major order of supplying industrial water treatment systems for the semiconductor manufacturing plants in Taiwan to support the growing electronics sector in the region. The industries require ultrapure water, thereby driving the implementation of advanced treatment processes such as reverse osmosis and ion exchange.

- With increasing public health consciousness and clean water initiatives by the government, there is also a growing demand for residential and municipal water treatment. In March 2025, India's Jal Jeevan Mission announced an enhancement of $5 billion for rural drinking water purification systems, supported in collaboration with a few major private sector entities. The mix of policy push and industrial pull makes Asia Pacific the fastest water treatment solution market.

- Strong policy backing and industrial expansion are propelling Asia Pacific to lead global demand for water treatment systems.

Key Players Operating in the Water Treatment Systems Market

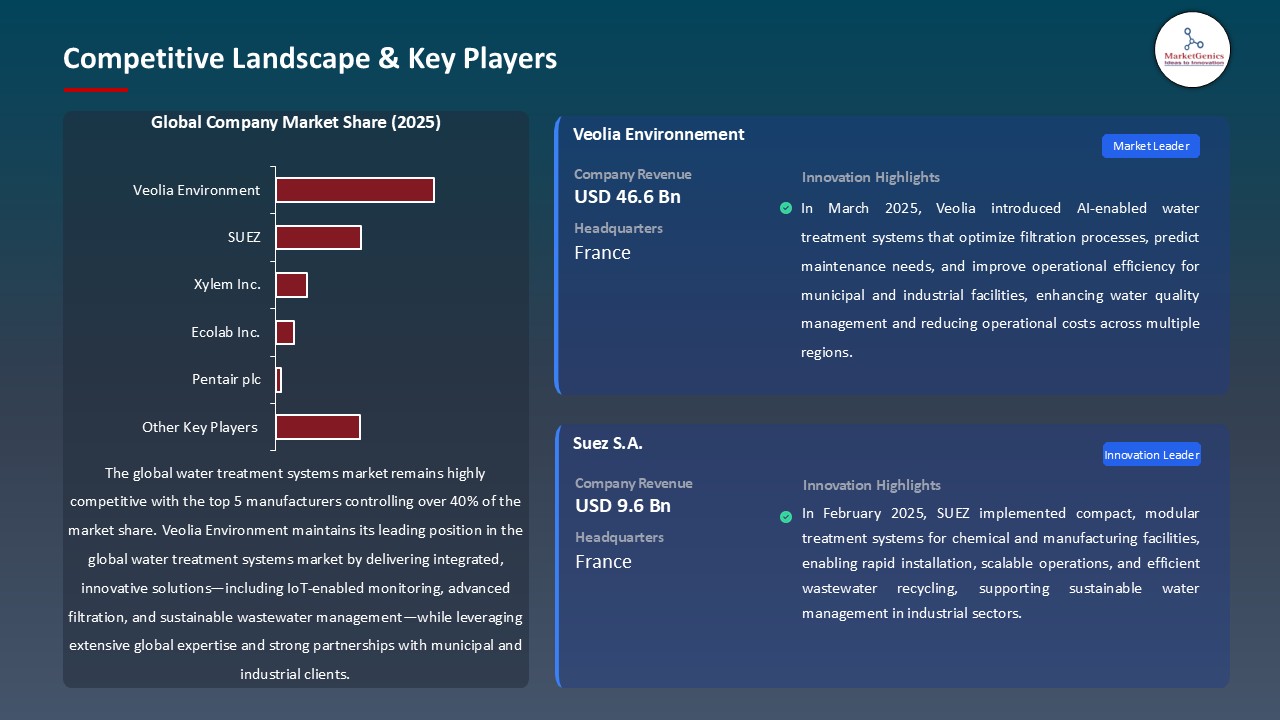

Key players in the global water treatment systems market include prominent companies such Veolia Environment, SUEZ, Xylem Inc., Ecolab Inc., Pentair plc, and Other Key Players.

The water treatment systems market is moderately consolidated, with a handful of Tier 1 players that include Veolia, SUEZ, and Danaher Corporation, who lead through comprehensive portfolios and infrastructure projects of global scale. Tier 2 and 3 players, including Lenntech and Pure Aqua, meet local or specialized needs. Buyer concentration is moderate, spanning the industrial, municipal, and residential sectors. Supplier concentration is high because of reliance on advanced filtration technology, membrane components, and chemical formulations compliant with regulatory standards from a limited number of specialized manufacturers.

Recent Development and Strategic Overview:

- In July 2025, Technopark in Thiruvananthapuram launched a state-of-the-art sewage treatment plant featuring automated membrane bioreactor (MBR) systems capable of processing 750,000 L/day. The compact design ensures consistent, high-quality effluent reuse for landscaping and cooling systems a prime example of smart, space-efficient wastewater solutions.

- In June 2025, San Antonio Water System began a $163 million upgrade for its Steven M. Clouse Water Recycling Center, including new high-efficiency blowers and aeration basins. Expected to reduce energy costs by over $1 million annually and secure future operations, the project is slated for completion in 2027.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 13.5 Billion |

|

Market Forecast Value in 2035 |

USD 26.8 Billion |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value

|

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Water Treatment Systems Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Technology Type |

|

|

By Product Type |

|

|

By Contaminant Type |

|

|

By Mobility |

|

|

By Application |

|

|

By End Use Industry |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Water Treatment Systems Market Outlook

- 2.1.1. Water Treatment Systems Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Water Treatment Systems Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automation & Process Control Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing Water Scarcity & Pollution

- 4.1.1.2. Stringent Environmental Regulations

- 4.1.1.3. Rising Awareness of Health Risks

- 4.1.2. Restraints

- 4.1.2.1. High Initial Capital & Maintenance Costs.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Raw Material/ Component Suppliers

- 4.4.2. Equipment Manufacturers

- 4.4.3. System Integrators & OEM

- 4.4.4. Distributors & Service Providers

- 4.4.5. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Water Treatment Systems Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Water Treatment Systems Market Analysis, by Technology Type

- 6.1. Key Segment Analysis

- 6.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Technology Type, 2021-2035

- 6.2.1. Filtration Systems

- 6.2.1.1. Sand

- 6.2.1.2. Cartridge

- 6.2.1.3. Activated Carbon

- 6.2.1.4. Others

- 6.2.2. Reverse Osmosis (RO) Systems

- 6.2.3. Ultraviolet (UV) Disinfection

- 6.2.4. Chlorination Systems

- 6.2.5. Distillation Systems

- 6.2.6. Electrodeionization (EDI)

- 6.2.7. Ion Exchange Systems

- 6.2.8. Ozonation Systems

- 6.2.9. Others

- 6.2.1. Filtration Systems

- 7. Global Water Treatment Systems Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Point-of-Use (PoU) Systems

- 7.2.2. Point-of-Entry (PoE) Systems

- 7.2.3. Packaged Water Treatment Systems

- 7.2.4. Modular/ Skid-Mounted Systems

- 7.2.5. Others

- 8. Global Water Treatment Systems Market Analysis, by Contaminant Type

- 8.1. Key Segment Analysis

- 8.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Contaminant Type, 2021-2035

- 8.2.1. Biological (Bacteria, Viruses)

- 8.2.2. Chemical (Pesticides, Heavy Metals)

- 8.2.3. Physical (Sediments, Particles)

- 8.2.4. Radiological Contaminants

- 8.2.5. Others

- 9. Global Water Treatment Systems Market Analysis, by Mobility

- 9.1. Key Segment Analysis

- 9.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Mobility, 2021-2035

- 9.2.1. Stationary Water Treatment Systems

- 9.2.2. Mobile/ Containerized Water Treatment Systems

- 10. Global Water Treatment Systems Market Analysis, by Application

- 10.1. Key Segment Analysis

- 10.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application, 2021-2035

- 10.2.1. Process Water Treatment

- 10.2.2. Wastewater Treatment

- 10.2.3. Desalination

- 10.2.4. Cooling Water Treatment

- 10.2.5. Boiler Feed Water Treatment

- 10.2.6. Others

- 11. Global Water Treatment Systems Market Analysis, by End Use Industry

- 11.1. Key Segment Analysis

- 11.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by End Use Industry, 2021-2035

- 11.2.1. Municipal

- 11.2.2. Industrial

- 11.2.2.1. Power Generation

- 11.2.2.2. Oil & Gas

- 11.2.2.3. Chemicals

- 11.2.2.4. Food & Beverage

- 11.2.2.5. Pharmaceuticals

- 11.2.2.6. Others

- 11.2.3. Residential

- 11.2.4. Commercial Buildings

- 12. Global Water Treatment Systems Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Direct Sales

- 12.2.2. Retail Sales

- 12.2.3. Online Platforms

- 12.2.4. Third-Party Distributors

- 12.2.5. Others

- 13. Global Water Treatment Systems Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Water Treatment Systems Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Water Treatment Systems Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Technology Type

- 14.3.2. Product Type

- 14.3.3. Contaminant Type

- 14.3.4. Mobility

- 14.3.5. Application

- 14.3.6. End Use Industry

- 14.3.7. Distribution Channel

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Water Treatment Systems Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Technology Type

- 14.4.3. Product Type

- 14.4.4. Contaminant Type

- 14.4.5. Mobility

- 14.4.6. Application

- 14.4.7. End Use Industry

- 14.4.8. Distribution Channel

- 14.5. Canada Water Treatment Systems Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Technology Type

- 14.5.3. Product Type

- 14.5.4. Contaminant Type

- 14.5.5. Mobility

- 14.5.6. Application

- 14.5.7. End Use Industry

- 14.5.8. Distribution Channel

- 14.6. Mexico Water Treatment Systems Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Technology Type

- 14.6.3. Product Type

- 14.6.4. Contaminant Type

- 14.6.5. Mobility

- 14.6.6. Application

- 14.6.7. End Use Industry

- 14.6.8. Distribution Channel

- 15. Europe Water Treatment Systems Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology Type

- 15.3.2. Product Type

- 15.3.3. Contaminant Type

- 15.3.4. Mobility

- 15.3.5. Application

- 15.3.6. End Use Industry

- 15.3.7. Distribution Channel

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Water Treatment Systems Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Product Type

- 15.4.4. Contaminant Type

- 15.4.5. Mobility

- 15.4.6. Application

- 15.4.7. End Use Industry

- 15.4.8. Distribution Channel

- 15.5. United Kingdom Water Treatment Systems Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Product Type

- 15.5.4. Contaminant Type

- 15.5.5. Mobility

- 15.5.6. Application

- 15.5.7. End Use Industry

- 15.5.8. Distribution Channel

- 15.6. France Water Treatment Systems Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Product Type

- 15.6.4. Contaminant Type

- 15.6.5. Mobility

- 15.6.6. Application

- 15.6.7. End Use Industry

- 15.6.8. Distribution Channel

- 15.7. Italy Water Treatment Systems Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Technology Type

- 15.7.3. Product Type

- 15.7.4. Contaminant Type

- 15.7.5. Mobility

- 15.7.6. Application

- 15.7.7. End Use Industry

- 15.7.8. Distribution Channel

- 15.8. Spain Water Treatment Systems Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Technology Type

- 15.8.3. Product Type

- 15.8.4. Contaminant Type

- 15.8.5. Mobility

- 15.8.6. Application

- 15.8.7. End Use Industry

- 15.8.8. Distribution Channel

- 15.9. Netherlands Water Treatment Systems Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Technology Type

- 15.9.3. Product Type

- 15.9.4. Contaminant Type

- 15.9.5. Mobility

- 15.9.6. Application

- 15.9.7. End Use Industry

- 15.9.8. Distribution Channel

- 15.10. Nordic Countries Water Treatment Systems Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Technology Type

- 15.10.3. Product Type

- 15.10.4. Contaminant Type

- 15.10.5. Mobility

- 15.10.6. Application

- 15.10.7. End Use Industry

- 15.10.8. Distribution Channel

- 15.11. Poland Water Treatment Systems Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Technology Type

- 15.11.3. Product Type

- 15.11.4. Contaminant Type

- 15.11.5. Mobility

- 15.11.6. Application

- 15.11.7. End Use Industry

- 15.11.8. Distribution Channel

- 15.12. Russia & CIS Water Treatment Systems Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Technology Type

- 15.12.3. Product Type

- 15.12.4. Contaminant Type

- 15.12.5. Mobility

- 15.12.6. Application

- 15.12.7. End Use Industry

- 15.12.8. Distribution Channel

- 15.13. Rest of Europe Water Treatment Systems Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Technology Type

- 15.13.3. Product Type

- 15.13.4. Contaminant Type

- 15.13.5. Mobility

- 15.13.6. Application

- 15.13.7. End Use Industry

- 15.13.8. Distribution Channel

- 16. Asia Pacific Water Treatment Systems Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology Type

- 16.3.2. Product Type

- 16.3.3. Contaminant Type

- 16.3.4. Mobility

- 16.3.5. Application

- 16.3.6. End Use Industry

- 16.3.7. Distribution Channel

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Water Treatment Systems Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Product Type

- 16.4.4. Contaminant Type

- 16.4.5. Mobility

- 16.4.6. Application

- 16.4.7. End Use Industry

- 16.4.8. Distribution Channel

- 16.5. India Water Treatment Systems Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Technology Type

- 16.5.3. Product Type

- 16.5.4. Contaminant Type

- 16.5.5. Mobility

- 16.5.6. Application

- 16.5.7. End Use Industry

- 16.5.8. Distribution Channel

- 16.6. Japan Water Treatment Systems Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Product Type

- 16.6.4. Contaminant Type

- 16.6.5. Mobility

- 16.6.6. Application

- 16.6.7. End Use Industry

- 16.6.8. Distribution Channel

- 16.7. South Korea Water Treatment Systems Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Product Type

- 16.7.4. Contaminant Type

- 16.7.5. Mobility

- 16.7.6. Application

- 16.7.7. End Use Industry

- 16.7.8. Distribution Channel

- 16.8. Australia and New Zealand Water Treatment Systems Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology Type

- 16.8.3. Product Type

- 16.8.4. Contaminant Type

- 16.8.5. Mobility

- 16.8.6. Application

- 16.8.7. End Use Industry

- 16.8.8. Distribution Channel

- 16.9. Indonesia Water Treatment Systems Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Technology Type

- 16.9.3. Product Type

- 16.9.4. Contaminant Type

- 16.9.5. Mobility

- 16.9.6. Application

- 16.9.7. End Use Industry

- 16.9.8. Distribution Channel

- 16.10. Malaysia Water Treatment Systems Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Technology Type

- 16.10.3. Product Type

- 16.10.4. Contaminant Type

- 16.10.5. Mobility

- 16.10.6. Application

- 16.10.7. End Use Industry

- 16.10.8. Distribution Channel

- 16.11. Thailand Water Treatment Systems Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Technology Type

- 16.11.3. Product Type

- 16.11.4. Contaminant Type

- 16.11.5. Mobility

- 16.11.6. Application

- 16.11.7. End Use Industry

- 16.11.8. Distribution Channel

- 16.12. Vietnam Water Treatment Systems Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Technology Type

- 16.12.3. Product Type

- 16.12.4. Contaminant Type

- 16.12.5. Mobility

- 16.12.6. Application

- 16.12.7. End Use Industry

- 16.12.8. Distribution Channel

- 16.13. Rest of Asia Pacific Water Treatment Systems Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Technology Type

- 16.13.3. Product Type

- 16.13.4. Contaminant Type

- 16.13.5. Mobility

- 16.13.6. Application

- 16.13.7. End Use Industry

- 16.13.8. Distribution Channel

- 17. Middle East Water Treatment Systems Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology Type

- 17.3.2. Product Type

- 17.3.3. Contaminant Type

- 17.3.4. Mobility

- 17.3.5. Application

- 17.3.6. End Use Industry

- 17.3.7. Distribution Channel

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Water Treatment Systems Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Product Type

- 17.4.4. Contaminant Type

- 17.4.5. Mobility

- 17.4.6. Application

- 17.4.7. End Use Industry

- 17.4.8. Distribution Channel

- 17.5. UAE Water Treatment Systems Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Product Type

- 17.5.4. Contaminant Type

- 17.5.5. Mobility

- 17.5.6. Application

- 17.5.7. End Use Industry

- 17.5.8. Distribution Channel

- 17.6. Saudi Arabia Water Treatment Systems Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Product Type

- 17.6.4. Contaminant Type

- 17.6.5. Mobility

- 17.6.6. Application

- 17.6.7. End Use Industry

- 17.6.8. Distribution Channel

- 17.7. Israel Water Treatment Systems Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Product Type

- 17.7.4. Contaminant Type

- 17.7.5. Mobility

- 17.7.6. Application

- 17.7.7. End Use Industry

- 17.7.8. Distribution Channel

- 17.8. Rest of Middle East Water Treatment Systems Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Product Type

- 17.8.4. Contaminant Type

- 17.8.5. Mobility

- 17.8.6. Application

- 17.8.7. End Use Industry

- 17.8.8. Distribution Channel

- 18. Africa Water Treatment Systems Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology Type

- 18.3.2. Product Type

- 18.3.3. Contaminant Type

- 18.3.4. Mobility

- 18.3.5. Application

- 18.3.6. End Use Industry

- 18.3.7. Distribution Channel

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Water Treatment Systems Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Product Type

- 18.4.4. Contaminant Type

- 18.4.5. Mobility

- 18.4.6. Application

- 18.4.7. End Use Industry

- 18.4.8. Distribution Channel

- 18.5. Egypt Water Treatment Systems Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Product Type

- 18.5.4. Contaminant Type

- 18.5.5. Mobility

- 18.5.6. Application

- 18.5.7. End Use Industry

- 18.5.8. Distribution Channel

- 18.6. Nigeria Water Treatment Systems Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Product Type

- 18.6.4. Contaminant Type

- 18.6.5. Mobility

- 18.6.6. Application

- 18.6.7. End Use Industry

- 18.6.8. Distribution Channel

- 18.7. Algeria Water Treatment Systems Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Technology Type

- 18.7.3. Product Type

- 18.7.4. Contaminant Type

- 18.7.5. Mobility

- 18.7.6. Application

- 18.7.7. End Use Industry

- 18.7.8. Distribution Channel

- 18.8. Rest of Africa Water Treatment Systems Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Technology Type

- 18.8.3. Product Type

- 18.8.4. Contaminant Type

- 18.8.5. Mobility

- 18.8.6. Application

- 18.8.7. End Use Industry

- 18.8.8. Distribution Channel

- 19. South America Water Treatment Systems Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Water Treatment Systems Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Technology Type

- 19.3.2. Product Type

- 19.3.3. Contaminant Type

- 19.3.4. Mobility

- 19.3.5. Application

- 19.3.6. End Use Industry

- 19.3.7. Distribution Channel

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Water Treatment Systems Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Technology Type

- 19.4.3. Product Type

- 19.4.4. Contaminant Type

- 19.4.5. Mobility

- 19.4.6. Application

- 19.4.7. End Use Industry

- 19.4.8. Distribution Channel

- 19.5. Argentina Water Treatment Systems Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Technology Type

- 19.5.3. Product Type

- 19.5.4. Contaminant Type

- 19.5.5. Mobility

- 19.5.6. Application

- 19.5.7. End Use Industry

- 19.5.8. Distribution Channel

- 19.6. Rest of South America Water Treatment Systems Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Technology Type

- 19.6.3. Product Type

- 19.6.4. Contaminant Type

- 19.6.5. Mobility

- 19.6.6. Application

- 19.6.7. End Use Industry

- 19.6.8. Distribution Channel

- 20. Key Players/ Company Profile

- 20.1. 3M Company

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. A.O. Smith Corporation

- 20.3. Aquatech International LLC

- 20.4. Calgon Carbon Corporation

- 20.5. Culligan International Company

- 20.6. Danaher Corporation

- 20.7. DuPont Water Solutions

- 20.8. Ecolab Inc.

- 20.9. Evoqua Water Technologies

- 20.10. GE Water and Process Technologies

- 20.11. Hitachi Ltd.

- 20.12. Kurita Water Industries Ltd.

- 20.13. Lenntech B.V.

- 20.14. Pentair plc

- 20.15. Pure Aqua, Inc.

- 20.16. SUEZ SA

- 20.17. Thermax Limited

- 20.18. Toshiba Water Solutions

- 20.19. Veolia Environnement S.A.

- 20.20. Xylem Inc.

- 20.21. Other Key Players

- 20.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation