Weight‑Loss Pill Market Size, Share & Trends Analysis Report by Product Type (Prescription Weight-Loss Pills, Over-the-Counter (OTC) Weight-Loss Pills, Natural/Herbal Weight-Loss Pills), Mechanism of Action, Distribution Channel, Dosage Form, Patient Demographics, BMI Category, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Weight‑Loss Pill Market Size, Share, and Growth

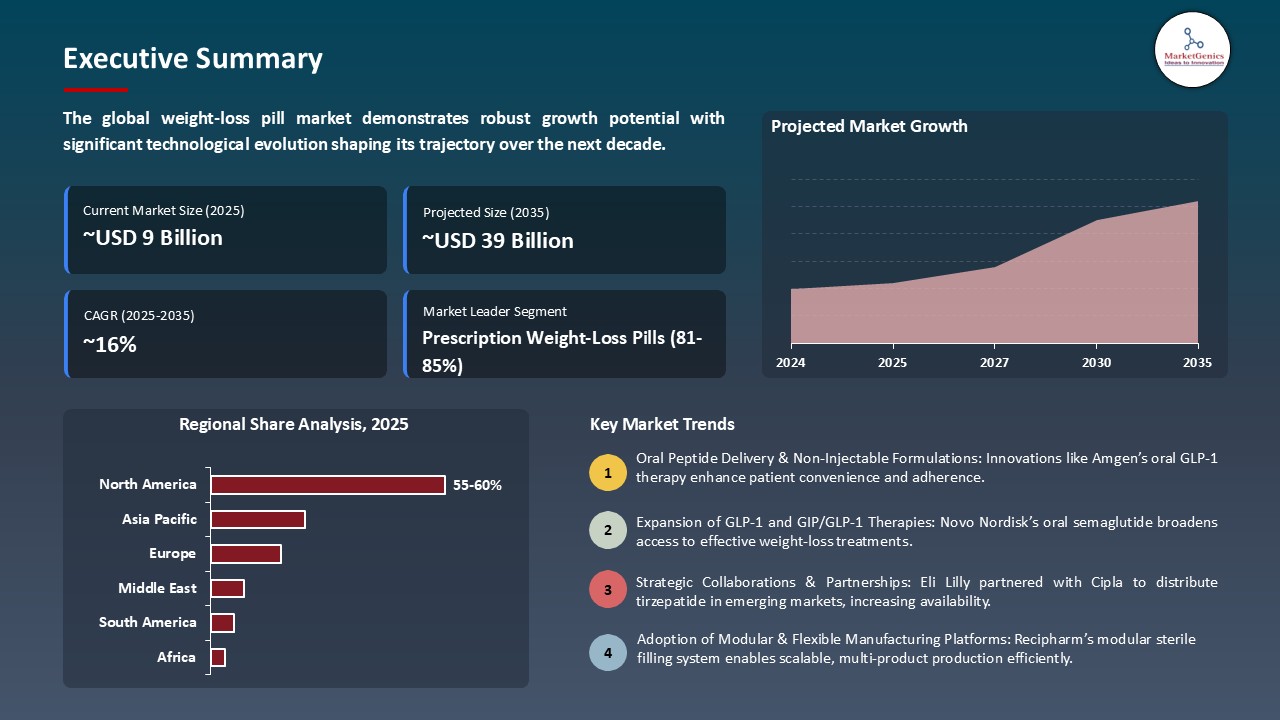

The global weight‑loss pill market is experiencing robust growth, with its estimated value of USD 9.4 billion in the year 2025 and USD 39.4 billion by the period 2035, registering a CAGR of 15.7%, during the forecast period. The global weight-loss pill market is expanding at an accelerating rate with the increasing obesity rates and the use of GLP-1 and GIP/GLP-1 therapies. Oral and injectable formulations, automated and modular production, are new technologies that improve patient compliance and efficiency of production. Market growth and expansion are also being encouraged by strategic alliances, regulatory clearances, and expansion of facilities.

Ron Renaud, President and Chief Executive Officer of Kailera, said, “We are excited to welcome our new investors and sincerely thank our current investors for their continued confidence in our vision. With obesity affecting a growing global population and limited treatment options for higher BMIs, the need for effective therapies has never been greater. This funding will accelerate our pipeline, including KAI-9531, which has the potential to deliver substantial weight loss. We look forward to starting global Phase 3 trials by year-end, a pivotal step in empowering people with obesity to live healthier lives.

The global epidemic of obesity and metabolic conditions is driving the weight-loss pill industry to explode, with GLP-1 and GIP/GLP-1 being the leading innovations in this sector. Pharmaceutical companies are showing a growing tendency to outsource the manufacturing process to contract development and manufacturing organizations (CDMOs) to coordinate their elaborate manufacturing processes, maintain regulatory standards, and expedite time-to-market of high-demand therapies. Advanced weight-loss therapies, such as oral and injectable GLP-1 compounds, necessitate high-precision, sterile, and high-containment production settings, necessitating the outsourcing, of which specific expertise is necessary to ensure efficiency and scalability.

Current technological advancements in aseptic and oral drug production, including automated fill-finish systems (tablets/capsules), single-use bioreactors and isolator-based containment, are improving production efficiency and minimizing the risk of contamination. For instance, in October 2025, Symbiosis Pharmaceutical Services qualified a new automated sterile fill/ finish line at a commercial production plant in Stirling, Scotland. As part of a project to expand by 26 million, this plant will produce 15,000 vials per lot and should be able to enter into commercial production in Q4 2025.

Current technological advancements in aseptic and oral drug production, including automated fill-finish systems (tablets/capsules), single-use bioreactors and isolator-based containment, are improving production efficiency and minimizing the risk of contamination. For instance, in October 2025, Symbiosis Pharmaceutical Services qualified a new automated sterile fill/ finish line at a commercial production plant in Stirling, Scotland. As part of a project to expand by 26 million, this plant will produce 15,000 vials per lot and should be able to enter into commercial production in Q4 2025.

Weight Loss Pill Market Dynamics and Trends

Driver: Rising Adoption of GLP-1 and GIP/GLP-1 Combination Therapies

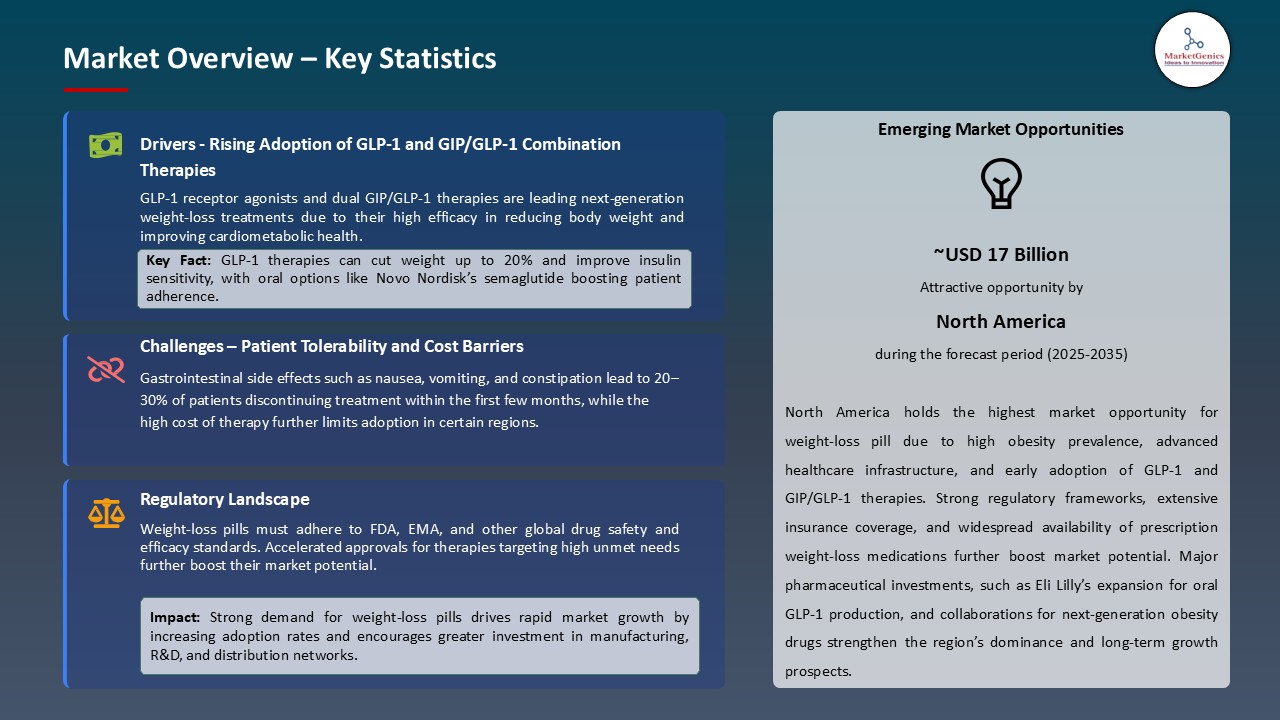

- The growing worldwide prevalence of obesity and related metabolic diseases has increased the demand in the development of superior pharmacological interventions that goes beyond conventional appetite suppressants. The next-generation additives to effective and sustained weight management are getting to consist of GLP-1 receptor agonists and dual-acting GIP/GLP-1 agents. With up to 20 per cent average weight reduction, these drugs are clinically effective, and have other cardiometabolic effects, such as enhanced insulin sensitivity and decreased cardiovascular risk.

- Companies are targeting oral formulation development and extending indications of long-term obesity management to increase patient adherence and market penetration. For instance, in May 2025, Novo Nordisk approved oral semaglutide 50 mg (Wegovy) the first once-daily GLP-1 weight-loss pill which is easier to administer and increases access among non-injectable patient groups.

- This development marks a turning point in designing drugs that are patient-centric and allow more patients to have access and adhere to the treatment. It reinforces the therapeutic pathway of obesity management and makes oral GLP-1 formulations a major growth driver in the weight-loss pill market of the world.

Restraint: Gastrointestinal Adverse Effects and Patient Discontinuation

- The presence of gastrointestinal side effects (nausea, vomiting, and constipation) is one of the most significant constraints of GLP-1 and GIP/GLP-1 combination therapy. These adverse effects usually lower the patient tolerance and lead to the withdrawal of treatment in the long-term.

- The research indicates that approximately 20-30 percent of patients abandon treatment in the first 3-6 months of development as a result of adverse reactions, subtracting clinical effectiveness and clinical outcomes on actual performance.

- These problems necessitate optimization of dose escalation, patient education and sophisticated formulation plans, which make treatment more complex and expensive. For instance, in September 2025 Pfizer claimed, it would stop developing its oral GLP-1 candidate, danuglipron, following Phase 2 trials where high discontinuation rates were reported as a result of gastrointestinal side effects, the need to design formulations with a patient-centred approach to achieve sustained therapy adherence and expand its acceptance in the market was further supported.

Opportunity: Expansion into Cardiometabolic and Non-Obesity Indications

- The weight-loss pills market is experiencing an increase in the exploration of the broader cardiometabolic focus of therapies, including type 2 diabetes, non-alcoholic steatohepatitis (NASH), and cardiovascular disease. Since obesity is a major comorbidity in such disorders, the potential clinical indications of GLP-1-based and multi-agonist medications have significant commercial and research potential.

- Pharmaceutical companies have initiated late-stage studies to establish non-weight loss effects to make these agents comprehensive metabolic health agents. To support this growth, major companies are producing clinical data to prove cardioprotective effectiveness. For instance, in July 2025, Eli Lilly announced the statistically significant decrease in major adverse cardiovascular events (MACE-3) in adults with type 2 diabetes and cardiovascular disease with tirzepatide (a dual GIP/GLP-1 agonist), which demonstrated its potential beyond weight control.

- The cross-indication approach is broadening the therapeutic scope of weight-loss drugs, to obesity. It is also expected to foster clinical adoption, enhance patient outcome and enhance long-term sustainable market growth.

Key Trend: Emergence of Oral Peptide Delivery and Non-Injectable Formulations

- The weight-loss pills market is turning to oral peptide delivery and non-injectable preparations that help to improve patient comfort and convenience and comply with the treatment in the long term. The technologies do not require injections and thus long-term therapy will be more affordable and acceptable by a broader range of patients.

- Nanoparticle encapsulation, absorption enhancers and permeation technologies are improving the bioavailability and pharmacokinetics of peptide-based drugs. They enable delivery of large molecules, which were previously restricted to injectable delivery, by mouth, which increases the consumer base and promotes the maintenance of adherence to therapy.

- Companies are developing oral preparations at late phase trials to meet new product demands and prove clinical effectiveness to support more widespread adoption and therapy compliance. For instance, in June 2025 Amgen reported positive Phase 2 results of AMG-133, a new oral small-molecule GLP-1 receptor modulator that produced greater than 14 percent mean weight reduction in 36 weeks, showing the influence of next-generation non-injectable technologies on market innovation, competitiveness and adoption by patients.

Weight‑Loss Pill Market Analysis and Segmental Data

Prescription Weight-Loss Pills Dominate Global Weight‑Loss Pill Market

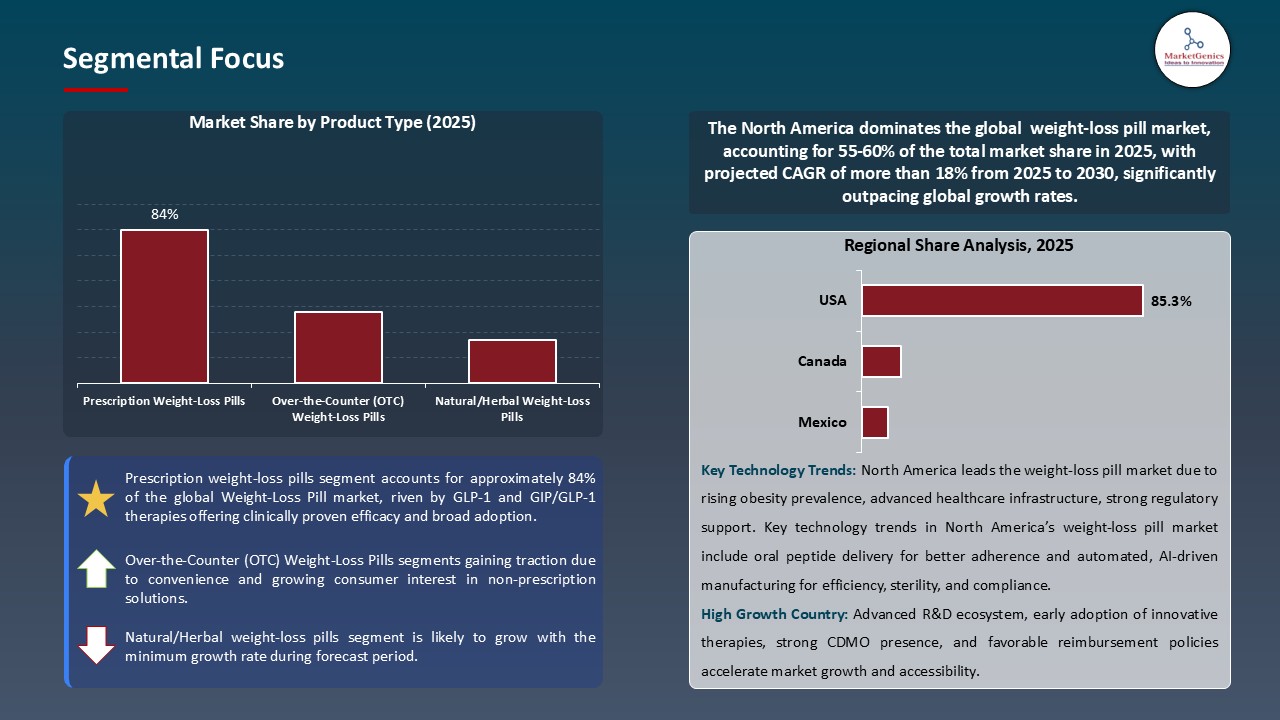

- Prescription weight loss pills, especially GLP-1 receptor agonists and dual GIP/GLP-1 agonists, dominate the market in the weight-loss pill industry globally because of their any proven ability to cause substantial weight loss and cardiometabolic health improvement. Their high level of sophistication and exactness of drug development and the manufacturing processes make them desirable to the medical givers and patients.

- Technological advances such as oral peptide delivery, nanoparticle encapsulation and absorption enhancers enhance patient compliance, ease of use and provide certainty in pharmacokinetics and predictable effect. Capacity expansion and advanced manufacturing are being used to enhance market access. An example is when Eli Lilly in October 2025 expanded production of its orforglipron which is an oral GLP-1 therapy citing that late-stage trials showed significant weight loss and metabolic improvements, making it more widely available across the globe.

- These advancements improve scalability, accessibility of medicines to patients, and reliability of treatment, which makes prescription weight-loss pills the most popular and rapidly expanding category in the world market.

North America Leads Global Weight‑Loss Pill Market Demand

- North America has a huge market share of the global market of the weight-loss pills, due to the high prevalence of obesity, good healthcare infrastructure and good consumer demand of effective weight management products.

- The presence of powerful reimbursement systems, insurances, and a large number of healthcare providers and pharmacies also enhance the dominance of the region, which will provide wide access to prescription weight-loss drugs.

- Technology, such as creation of oral peptide delivery systems and new formulations of drugs, has promoted better patient compliance and increased treatment possibilities, leading to growth of the market. As an example, in September 2025, Eli Lilly announced an intention to construct a $6.5 billion manufacturing plant in Houston, Texas, where it intends to manufacture active pharmaceutical ingredients such as orforglipron, its first oral GLP-1 receptor agonist in the treatment of obesity.

- The growth also underscores the strategic location and weight-loss pill market of North America, increased production capacities, more accessibility to patients, and strengthening the market-moving innovation and market growth.

Weight‑Loss-Pill-Market Ecosystem

The global weight-loss pill market is supported by a dynamic ecosystem of large CDMOs such as Novo Nordisk, Eli Lilly and Company, AstraZeneca, GlaxoSmithKline plc, Takeda Pharmaceutical Company, and CordenPharma, and is being fuelled by the development of high-throughput oral and injectable manufacturing, automated fill-finishing lines, and scalable production of capsules, tablets, pre-filled pens, and vials. Such abilities enable pharmaceutical and bio-tech firms to outsource the drug development, manufacturing, regulatory compliance, and fast scale-up in a more competitive environment.

Institutional and international investment and strategic capacity development are contributing to the growth of special manufacturing plants. As an example, in March 2025, Viking Therapeutics had entered a manufacturing deal with CordenPharma to assist in commercializing its oral and injectable weight-loss drug, VK2735. CordenPharma shall offer fill-finishing of both formulations, such as annual contracts of autoinjectors, vials, pre-filled syringes and more than one billion oral pills, which will guarantee a scalable production and distribution all over the world.

All these complementary ecosystems built around the backbone of major CDMOs, strong investment, and strategic alliances enhance outsourcing relationship, enhance the quality of products, and provide a scalable global supply chain of weight-loss therapies.

Recent Development and Strategic Overview:

- In August 2025, Teva Pharmaceuticals was permitted by the FDA and subsequently introduced a generic analog of Saxenda (liraglutide injection), the initial generic GLP-1 receptor agonist weight reduction medication in the U.S. The treatment offers a cheaper alternative to adult and adolescent obese patients, responding to the increasing need of availability of weight management interventions and contributing to the increased use of GLP-1-based medications.

- In October 2025, Eli Lilly and Cipla declared a strategic collaboration to distribute and commercialize tirzepatide as Yurpeak in India. The development of accessibility to the GLP-1 receptor agonist, spread outside metropolitan regions, is the goal of this collaboration. Lilly will remain in the manufacture and supply of the medication whereas Cipla would market and distribute the medication with pricing in line with the Lilly Mounjaro brand.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 9.4 Bn |

|

Market Forecast Value in 2035 |

USD 39.4 Bn |

|

Growth Rate (CAGR) |

15.7% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Weight‑Loss-Pill-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Weight‑Loss Pill Market, By Product Type |

|

|

Weight‑Loss Pill Market, By Mechanism of Action |

|

|

Weight‑Loss Pill Market, By Distribution Channel |

|

|

Weight‑Loss Pill Market, By Dosage Form |

|

|

Weight‑Loss Pill Market, By Patient Demographics |

|

|

Weight‑Loss Pill Market, By BMI Category |

|

|

Weight‑Loss Pill Market, By End-users |

|

Frequently Asked Questions

The global weight‑loss pill market was valued at USD 9.4 Bn in 2025.

The global weight‑loss pill market industry is expected to grow at a CAGR of 15.7% from 2025 to 2035.

The demand for the weight‑loss pill market is driven by the rising prevalence of obesity and metabolic disorders, growing adoption of GLP-1 and dual GIP/GLP-1 therapies, and expansion of oral and injectable formulations. Strategic partnerships and increased manufacturing capacity support faster commercialization. Technological advancements and favorable reimbursement policies further boost market growth.

In terms of product type, prescription weight-loss pills segment accounted for the major share in 2025

Key players in the global weight‑loss pill market include prominent companies such as Abbott Laboratories, Amgen Inc., Amneal Pharmaceuticals, Amway Corporation, AstraZeneca, Atkins Nutritionals, Bausch Health Companies, Boehringer Ingelheim, Creative Bioscience, Currax Pharmaceuticals, Eli Lilly and Company, Glanbia plc, GlaxoSmithKline (GSK), Herbalife Nutrition Ltd., Iovate Health Sciences International, Nalpropion Pharmaceuticals, Nature's Bounty Co., Nestlé Health Science, Novo Nordisk, NOW Foods, NutriSystem Inc., Pfizer Inc., Roche Holding AG, Takeda Pharmaceutical Company, Teva Pharmaceutical Industries, USANA Health Sciences, VIVUS Inc., and Other Key Players

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Weight‑Loss Pill Market Outlook

- 2.1.1. Weight‑Loss Pill Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Weight‑Loss Pill Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising prevalence of obesity and metabolic disorders globally.

- 4.1.1.2. Increasing adoption of GLP-1 and GIP/GLP-1 combination therapies.

- 4.1.1.3. Technological advancements in oral peptide delivery and injectable formulations.

- 4.1.2. Restraints

- 4.1.2.1. Gastrointestinal side effects leading to patient discontinuation.

- 4.1.2.2. High cost of advanced therapies limiting accessibility in some regions.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Research & Development

- 4.4.2. Clinical Trials

- 4.4.3. Marketing & Distribution

- 4.4.4. End-User & Patient Access

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Weight‑Loss Pill Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Weight‑Loss Pill Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Prescription Weight-Loss Pills

- 6.2.1.1. Orlistat (Xenical)

- 6.2.1.2. Phentermine-Topiramate (Qsymia)

- 6.2.1.3. Naltrexone-Bupropion (Contrave)

- 6.2.1.4. Liraglutide (Saxenda)

- 6.2.1.5. Semaglutide (Wegovy)

- 6.2.1.6. Setmelanotide

- 6.2.1.7. Others

- 6.2.2. Over-the-Counter (OTC) Weight-Loss Pills

- 6.2.2.1. Orlistat 60mg (Alli)

- 6.2.2.2. Herbal supplements

- 6.2.2.3. Dietary supplements

- 6.2.2.4. Others

- 6.2.3. Natural/Herbal Weight-Loss Pills

- 6.2.3.1. Green tea extract

- 6.2.3.2. Garcinia cambogia

- 6.2.3.3. Conjugated linoleic acid (CLA)

- 6.2.3.4. Raspberry ketones

- 6.2.3.5. Glucomannan

- 6.2.3.6. Others

- 6.2.1. Prescription Weight-Loss Pills

- 7. Global Weight‑Loss Pill Market Analysis, by Mechanism of Action

- 7.1. Key Segment Analysis

- 7.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Mechanism of Action, 2021-2035

- 7.2.1. Fat Absorption Inhibitors

- 7.2.2. Appetite Suppressants

- 7.2.3. Metabolism Boosters/Thermogenics

- 7.2.4. Fat Burners

- 7.2.5. Carbohydrate Blockers

- 7.2.6. Combination Mechanisms

- 8. Global Weight‑Loss Pill Market Analysis, by Distribution Channel

- 8.1. Key Segment Analysis

- 8.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 8.2.1. Hospital Pharmacies

- 8.2.2. Retail Pharmacies

- 8.2.3. Online Pharmacies/E-commerce

- 8.2.4. Supermarkets/Hypermarkets

- 9. Global Weight‑Loss Pill Market Analysis, by Dosage Form

- 9.1. Key Segment Analysis

- 9.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Dosage Form, 2021-2035

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.2.3. Soft Gels

- 9.2.4. Extended-Release Formulations

- 9.2.5. Chewable Tablets

- 9.2.6. Others

- 10. Global Weight‑Loss Pill Market Analysis, by Patient Demographics

- 10.1. Key Segment Analysis

- 10.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Patient Demographics, 2021-2035

- 10.2.1. Adults (18-40 years)

- 10.2.2. Middle-aged (41-60 years)

- 10.2.3. Senior Citizens (Above 60 years)

- 10.2.4. Gender-specific

- 10.2.4.1. Male

- 10.2.4.2. Female

- 11. Global Weight‑Loss Pill Market Analysis, by BMI Category

- 11.1. Key Segment Analysis

- 11.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by BMI Category, 2021-2035

- 11.2.1. Overweight (BMI 25-29.9)

- 11.2.2. Obese Class I (BMI 30-34.9)

- 11.2.3. Obese Class II (BMI 35-39.9)

- 11.2.4. Obese Class III (BMI ≥40)

- 12. Global Weight‑Loss Pill Market Analysis, by End-users

- 12.1. Key Segment Analysis

- 12.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 12.2.1. Healthcare Facilities

- 12.2.1.1. Hospitals

- 12.2.1.2. Obesity Treatment Programs

- 12.2.1.3. Diabetes Management

- 12.2.1.4. Post-surgical Weight Management

- 12.2.1.5. Others

- 12.2.2. Weight Loss Clinics

- 12.2.2.1. Structured Weight Loss Programs

- 12.2.2.2. Maintenance Therapy

- 12.2.2.3. Others

- 12.2.3. Medical Practices

- 12.2.3.1. Primary Care Weight Management

- 12.2.3.2. Endocrine Disorder Treatment

- 12.2.3.3. Others

- 12.2.4. Retail & Consumer

- 12.2.4.1. Home-based Weight Management

- 12.2.4.2. Self-directed Weight Loss

- 12.2.4.3. Preventive Health Management

- 12.2.4.4. Fitness Enhancement

- 12.2.4.5. Athletic Performance Support

- 12.2.4.6. Others

- 12.2.5. Dietary & Nutrition Services

- 12.2.5.1. Meal Plan Integration

- 12.2.5.2. Behavioral Weight Loss Support

- 12.2.5.3. Disease-specific Weight Management

- 12.2.5.4. Others

- 12.2.6. Corporate Wellness Programs

- 12.2.7. Other End-users

- 12.2.1. Healthcare Facilities

- 13. Global Weight‑Loss Pill Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Weight‑Loss Pill Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Product Type

- 14.3.2. Mechanism of Action

- 14.3.3. Distribution Channel

- 14.3.4. Dosage Form

- 14.3.5. Patient Demographics

- 14.3.6. BMI Category

- 14.3.7. End-users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Weight‑Loss Pill Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Product Type

- 14.4.3. Mechanism of Action

- 14.4.4. Distribution Channel

- 14.4.5. Dosage Form

- 14.4.6. Patient Demographics

- 14.4.7. BMI Category

- 14.4.8. End-users

- 14.5. Canada Weight‑Loss Pill Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Product Type

- 14.5.3. Mechanism of Action

- 14.5.4. Distribution Channel

- 14.5.5. Dosage Form

- 14.5.6. Patient Demographics

- 14.5.7. BMI Category

- 14.5.8. End-users

- 14.6. Mexico Weight‑Loss Pill Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Product Type

- 14.6.3. Mechanism of Action

- 14.6.4. Distribution Channel

- 14.6.5. Dosage Form

- 14.6.6. Patient Demographics

- 14.6.7. BMI Category

- 14.6.8. End-users

- 15. Europe Weight‑Loss Pill Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Mechanism of Action

- 15.3.3. Distribution Channel

- 15.3.4. Dosage Form

- 15.3.5. Patient Demographics

- 15.3.6. BMI Category

- 15.3.7. End-users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Weight‑Loss Pill Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Mechanism of Action

- 15.4.4. Distribution Channel

- 15.4.5. Dosage Form

- 15.4.6. Patient Demographics

- 15.4.7. BMI Category

- 15.4.8. End-users

- 15.5. United Kingdom Weight‑Loss Pill Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Mechanism of Action

- 15.5.4. Distribution Channel

- 15.5.5. Dosage Form

- 15.5.6. Patient Demographics

- 15.5.7. BMI Category

- 15.5.8. End-users

- 15.6. France Weight‑Loss Pill Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Mechanism of Action

- 15.6.4. Distribution Channel

- 15.6.5. Dosage Form

- 15.6.6. Patient Demographics

- 15.6.7. BMI Category

- 15.6.8. End-users

- 15.7. Italy Weight‑Loss Pill Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Product Type

- 15.7.3. Mechanism of Action

- 15.7.4. Distribution Channel

- 15.7.5. Dosage Form

- 15.7.6. Patient Demographics

- 15.7.7. BMI Category

- 15.7.8. End-users

- 15.8. Spain Weight‑Loss Pill Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Product Type

- 15.8.3. Mechanism of Action

- 15.8.4. Distribution Channel

- 15.8.5. Dosage Form

- 15.8.6. Patient Demographics

- 15.8.7. BMI Category

- 15.8.8. End-users

- 15.9. Netherlands Weight‑Loss Pill Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Product Type

- 15.9.3. Mechanism of Action

- 15.9.4. Distribution Channel

- 15.9.5. Dosage Form

- 15.9.6. Patient Demographics

- 15.9.7. BMI Category

- 15.9.8. End-users

- 15.10. Nordic Countries Weight‑Loss Pill Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Product Type

- 15.10.3. Mechanism of Action

- 15.10.4. Distribution Channel

- 15.10.5. Dosage Form

- 15.10.6. Patient Demographics

- 15.10.7. BMI Category

- 15.10.8. End-users

- 15.11. Poland Weight‑Loss Pill Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Product Type

- 15.11.3. Mechanism of Action

- 15.11.4. Distribution Channel

- 15.11.5. Dosage Form

- 15.11.6. Patient Demographics

- 15.11.7. BMI Category

- 15.11.8. End-users

- 15.12. Russia & CIS Weight‑Loss Pill Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Product Type

- 15.12.3. Mechanism of Action

- 15.12.4. Distribution Channel

- 15.12.5. Dosage Form

- 15.12.6. Patient Demographics

- 15.12.7. BMI Category

- 15.12.8. End-users

- 15.13. Rest of Europe Weight‑Loss Pill Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Product Type

- 15.13.3. Mechanism of Action

- 15.13.4. Distribution Channel

- 15.13.5. Dosage Form

- 15.13.6. Patient Demographics

- 15.13.7. BMI Category

- 15.13.8. End-users

- 16. Asia Pacific Weight‑Loss Pill Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Mechanism of Action

- 16.3.3. Distribution Channel

- 16.3.4. Dosage Form

- 16.3.5. Patient Demographics

- 16.3.6. BMI Category

- 16.3.7. End-users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Weight‑Loss Pill Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Mechanism of Action

- 16.4.4. Distribution Channel

- 16.4.5. Dosage Form

- 16.4.6. Patient Demographics

- 16.4.7. BMI Category

- 16.4.8. End-users

- 16.5. India Weight‑Loss Pill Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Mechanism of Action

- 16.5.4. Distribution Channel

- 16.5.5. Dosage Form

- 16.5.6. Patient Demographics

- 16.5.7. BMI Category

- 16.5.8. End-users

- 16.6. Japan Weight‑Loss Pill Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Mechanism of Action

- 16.6.4. Distribution Channel

- 16.6.5. Dosage Form

- 16.6.6. Patient Demographics

- 16.6.7. BMI Category

- 16.6.8. End-users

- 16.7. South Korea Weight‑Loss Pill Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Mechanism of Action

- 16.7.4. Distribution Channel

- 16.7.5. Dosage Form

- 16.7.6. Patient Demographics

- 16.7.7. BMI Category

- 16.7.8. End-users

- 16.8. Australia and New Zealand Weight‑Loss Pill Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Mechanism of Action

- 16.8.4. Distribution Channel

- 16.8.5. Dosage Form

- 16.8.6. Patient Demographics

- 16.8.7. BMI Category

- 16.8.8. End-users

- 16.9. Indonesia Weight‑Loss Pill Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Mechanism of Action

- 16.9.4. Distribution Channel

- 16.9.5. Dosage Form

- 16.9.6. Patient Demographics

- 16.9.7. BMI Category

- 16.9.8. End-users

- 16.10. Malaysia Weight‑Loss Pill Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Mechanism of Action

- 16.10.4. Distribution Channel

- 16.10.5. Dosage Form

- 16.10.6. Patient Demographics

- 16.10.7. BMI Category

- 16.10.8. End-users

- 16.11. Thailand Weight‑Loss Pill Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Mechanism of Action

- 16.11.4. Distribution Channel

- 16.11.5. Dosage Form

- 16.11.6. Patient Demographics

- 16.11.7. BMI Category

- 16.11.8. End-users

- 16.12. Vietnam Weight‑Loss Pill Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Mechanism of Action

- 16.12.4. Distribution Channel

- 16.12.5. Dosage Form

- 16.12.6. Patient Demographics

- 16.12.7. BMI Category

- 16.12.8. End-users

- 16.13. Rest of Asia Pacific Weight‑Loss Pill Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Mechanism of Action

- 16.13.4. Distribution Channel

- 16.13.5. Dosage Form

- 16.13.6. Patient Demographics

- 16.13.7. BMI Category

- 16.13.8. End-users

- 17. Middle East Weight‑Loss Pill Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Mechanism of Action

- 17.3.3. Distribution Channel

- 17.3.4. Dosage Form

- 17.3.5. Patient Demographics

- 17.3.6. BMI Category

- 17.3.7. End-users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Weight‑Loss Pill Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Mechanism of Action

- 17.4.4. Distribution Channel

- 17.4.5. Dosage Form

- 17.4.6. Patient Demographics

- 17.4.7. BMI Category

- 17.4.8. End-users

- 17.5. UAE Weight‑Loss Pill Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Mechanism of Action

- 17.5.4. Distribution Channel

- 17.5.5. Dosage Form

- 17.5.6. Patient Demographics

- 17.5.7. BMI Category

- 17.5.8. End-users

- 17.6. Saudi Arabia Weight‑Loss Pill Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Mechanism of Action

- 17.6.4. Distribution Channel

- 17.6.5. Dosage Form

- 17.6.6. Patient Demographics

- 17.6.7. BMI Category

- 17.6.8. End-users

- 17.7. Israel Weight‑Loss Pill Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Mechanism of Action

- 17.7.4. Distribution Channel

- 17.7.5. Dosage Form

- 17.7.6. Patient Demographics

- 17.7.7. BMI Category

- 17.7.8. End-users

- 17.8. Rest of Middle East Weight‑Loss Pill Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Mechanism of Action

- 17.8.4. Distribution Channel

- 17.8.5. Dosage Form

- 17.8.6. Patient Demographics

- 17.8.7. BMI Category

- 17.8.8. End-users

- 18. Africa Weight‑Loss Pill Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Mechanism of Action

- 18.3.3. Distribution Channel

- 18.3.4. Dosage Form

- 18.3.5. Patient Demographics

- 18.3.6. BMI Category

- 18.3.7. End-users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Weight‑Loss Pill Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Mechanism of Action

- 18.4.4. Distribution Channel

- 18.4.5. Dosage Form

- 18.4.6. Patient Demographics

- 18.4.7. BMI Category

- 18.4.8. End-users

- 18.5. Egypt Weight‑Loss Pill Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Mechanism of Action

- 18.5.4. Distribution Channel

- 18.5.5. Dosage Form

- 18.5.6. Patient Demographics

- 18.5.7. BMI Category

- 18.5.8. End-users

- 18.6. Nigeria Weight‑Loss Pill Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Mechanism of Action

- 18.6.4. Distribution Channel

- 18.6.5. Dosage Form

- 18.6.6. Patient Demographics

- 18.6.7. BMI Category

- 18.6.8. End-users

- 18.7. Algeria Weight‑Loss Pill Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Mechanism of Action

- 18.7.4. Distribution Channel

- 18.7.5. Dosage Form

- 18.7.6. Patient Demographics

- 18.7.7. BMI Category

- 18.7.8. End-users

- 18.8. Rest of Africa Weight‑Loss Pill Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Mechanism of Action

- 18.8.4. Distribution Channel

- 18.8.5. Dosage Form

- 18.8.6. Patient Demographics

- 18.8.7. BMI Category

- 18.8.8. End-users

- 19. South America Weight‑Loss Pill Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Weight‑Loss Pill Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Mechanism of Action

- 19.3.3. Distribution Channel

- 19.3.4. Dosage Form

- 19.3.5. Patient Demographics

- 19.3.6. BMI Category

- 19.3.7. End-users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Weight‑Loss Pill Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Mechanism of Action

- 19.4.4. Distribution Channel

- 19.4.5. Dosage Form

- 19.4.6. Patient Demographics

- 19.4.7. BMI Category

- 19.4.8. End-users

- 19.5. Argentina Weight‑Loss Pill Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Mechanism of Action

- 19.5.4. Distribution Channel

- 19.5.5. Dosage Form

- 19.5.6. Patient Demographics

- 19.5.7. BMI Category

- 19.5.8. End-users

- 19.6. Rest of South America Weight‑Loss Pill Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Mechanism of Action

- 19.6.4. Distribution Channel

- 19.6.5. Dosage Form

- 19.6.6. Patient Demographics

- 19.6.7. BMI Category

- 19.6.8. End-users

- 20. Key Players/ Company Profile

- 20.1. Abbott Laboratories.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Amgen Inc.

- 20.3. Amneal Pharmaceuticals

- 20.4. Amway Corporation

- 20.5. AstraZeneca

- 20.6. Atkins Nutritionals

- 20.7. Bausch Health Companies

- 20.8. Boehringer Ingelheim

- 20.9. Creative Bioscience

- 20.10. Currax Pharmaceuticals

- 20.11. Eli Lilly and Company

- 20.12. Glanbia plc

- 20.13. GlaxoSmithKline (GSK)

- 20.14. Herbalife Nutrition Ltd.

- 20.15. Iovate Health Sciences International

- 20.16. Nalpropion Pharmaceuticals

- 20.17. Nature's Bounty Co.

- 20.18. Nestlé Health Science

- 20.19. Novo Nordisk

- 20.20. NOW Foods

- 20.21. NutriSystem Inc.

- 20.22. Pfizer Inc.

- 20.23. Roche Holding AG

- 20.24. Takeda Pharmaceutical Company

- 20.25. Teva Pharmaceutical Industries

- 20.26. USANA Health Sciences

- 20.27. VIVUS Inc.

- 20.28. Other Key Players

- 20.1. Abbott Laboratories.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data