Workforce Analytics Market Size, Share & Trends Analysis Report by Type (Software and Services), Deployment Mode, Organization Size, Analytics Type, Function, Data Type, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025 – 2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Workflow Analytics Market Size, Share, And Growth

The global workflow analytics market is experiencing robust growth, with its estimated value of USD 1.9 billion in the year 2025 and USD 4.5 billion by the period 2035, registering a CAGR of 8.8% during the forecast period.

Azi Handley, Vice President of Global Strategic Alliances at Kyndryl, said “Our new AI-powered solution will enable airlines to deliver personalized experiences to travelers and enhance flight operations. The combination of Kyndryl's Agentic AI expertise, as well as Google Cloud data and analytics.”

The integration of artificial intelligence (AI) with workforce analytics is growing alongside the desire for data-driven decision-making and improved employee engagement with AI-based workforce management solutions to improve talent acquisition, workforce planning, and employee retention.

Microsoft Viva Insights is one such example, demonstrating the use of AI algorithms to discern employee work patterns, wellbeing data, and collaboration behaviors. By providing personalized recommendations for productivity and wellness, organizations will be able to manage burnout, improve team productivity, and enhance work-life balance. Workday is another example that leverages AI-based analytics to enhance talent management, predicting people trends in the future workforce and improving workforce alignment to business objectives.

Workforce analytics solutions are also increasingly supported by regulatory frameworks and data privacy mitigation strategies, prompting businesses to implement bolder, smarter interventional systems related to human capital. The interface of AI and workforce performance operations results in a disruptive transformation of organizational structures as they will provide real-time insights and analyses to displace turnover and improve enjoyment of work.

Advanced employee engagement platforms, predictive talent management systems, AI-driven performance analytics, and automated workforce scheduling are some of the significant prospects in the global market for workforce analytics. Emerging technologies are helping organizations enhance operational and organizational efficiency and employee experience, and improve overall business performance across various organizations, labor-intensive industries, and geographies/globalization in an era of digital transformation.

Workflow Analytics Market Dynamics and Trends

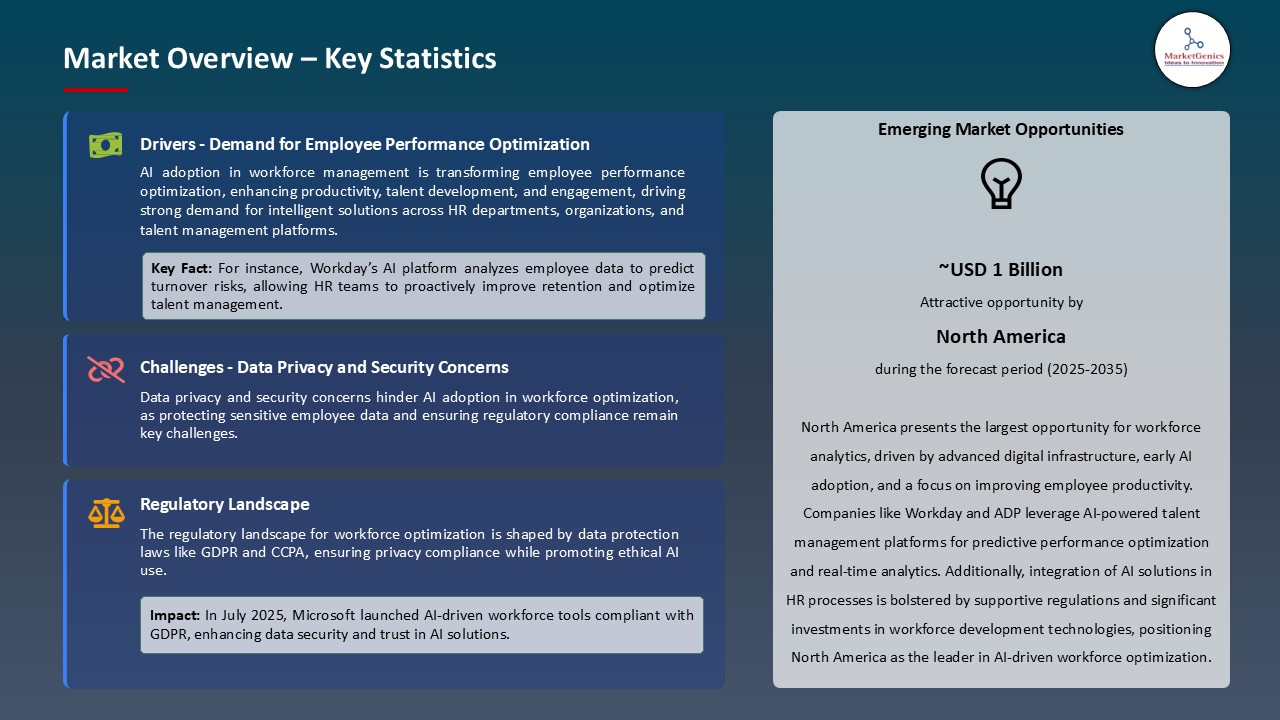

Driver: Escalating Demand for Employee Performance Optimization

- The workforce analytics market is experiencing heightened demand as businesses explore ways to enhance employee engagement and performance, minimize turnover, and improve productivity, particularly with rising labor costs and the growth of remote work. Organizations are beginning to embrace AI-based tools that will analyze employee and workforce data while also supporting the enhancement of employee engagement and productivity.

- AI algorithms will analyze employee behavior, performance indicators, and organizational patterns to better inform data-based recommendations for maximizing productivity, improving burnout, and enhancing employee happiness. The solutions will continually adapt to workforce changes and become data informed to improve workforce performance.

- For example, in 2024 IBM launched its Watson Talent Insights platform, leveraging AI to evaluate the expansive employee data sets to forecast talent risks and opportunities for maximizing employee performance. This resulted in a 15% productivity workplace increase at Fortune 500 companies. AI-powered workforce analytics solutions will change the economics of business. Business will gain demonstrable ROI for companies by being able to allocate more resources toward human capital, talent, and retention.

Restraint: Data Privacy and Security Concerns Hindering Full Adoption

- The workforce analytics market continues to rise, data privacy and security concerns remain significant impediments to scale adoption. There is wariness by many organizations with the use of sensitive employee data and AI-powered analytics - particularly given the increased regulatory environment surrounding data privacy and security, with regulations like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA).

- Notably, in 2024 a leading technology company has held off AI-supported deployment of workforce analytics solutions to ensure employee data privacy, while considering new guardrails, and also express mounting concern about complying with an ever-changing landscape of global data privacy regulations and compliance, complicating the development of AI-based systems.

- Companies need to develop greater guardrails to protect employee data privacy, while still providing both a commitment to security and the potential for actionable insight, which will drive the next wave of large-scale deployment.

Opportunity: Adoption of Predictive Analytics for Talent Management

- The need to predict and plan for the future workforce continues to increase, the workforce analytics market is at an inflection point that will lead to tremendous opportunity for AI-enabled predictive analytics. Utilizing an AI modeling, organizations can forecast talent shortages, employee turnover needs, and performance gaps. This will give organizations a preemptive approach to workforce planning and talent development efforts.

- For instance, LinkedIn’s Talent Insights, a new AI-enhanced addition to LinkedIn's recruitment products being released in 2024, can predict hiring trends, skill gaps, and employee movement to help businesses identify talent shortages and concerns before they create issues for the organization. This emerging technology will give organizations the ability to align people strategy with business strategy in real time, enabling more strategic decision-making and reducing reliance on contingency recruiting services.

- While more organizations begin adopting AI-driven predictive analytics in their talent management programs, the workforce analytics market is likely to increase in value as organizations look to optimize their human capital expenditures and remain viable competitors in a volatile work environment.

Key Trend: Integration of Generative AI for Employee Training and Development

- Generative AI is changing the future of employee training through adaptive, personalized learning paths that were originally developed to address individual performance deficits. Organizations are starting to leverage AI-generated simulations, as well as smart learning systems that utilize generative AI to enhance employee skills while reducing cost and time associated with delivering employee training through traditional methods.

- For example, in 2024 Accenture launched a generative AI-based training platform that creates personalized learning paths for employees using real-time performance analytics. The solution demonstrated a 25% uplift in employee completion rates of training courses and demonstrated proficiency in skill areas of focus.

- Generative AI further supports workforce readiness by generating authentic training scenarios that provide employees with both real-time feedback and a pathway to personalized learning content that evolves based on the learner's progress. This trend is expected to further reduce training costs while accelerating the development of talent and improving employee performance in the marketplace for workforce analytics.

Workflow-Analytics-Market Analysis and Segmental Data

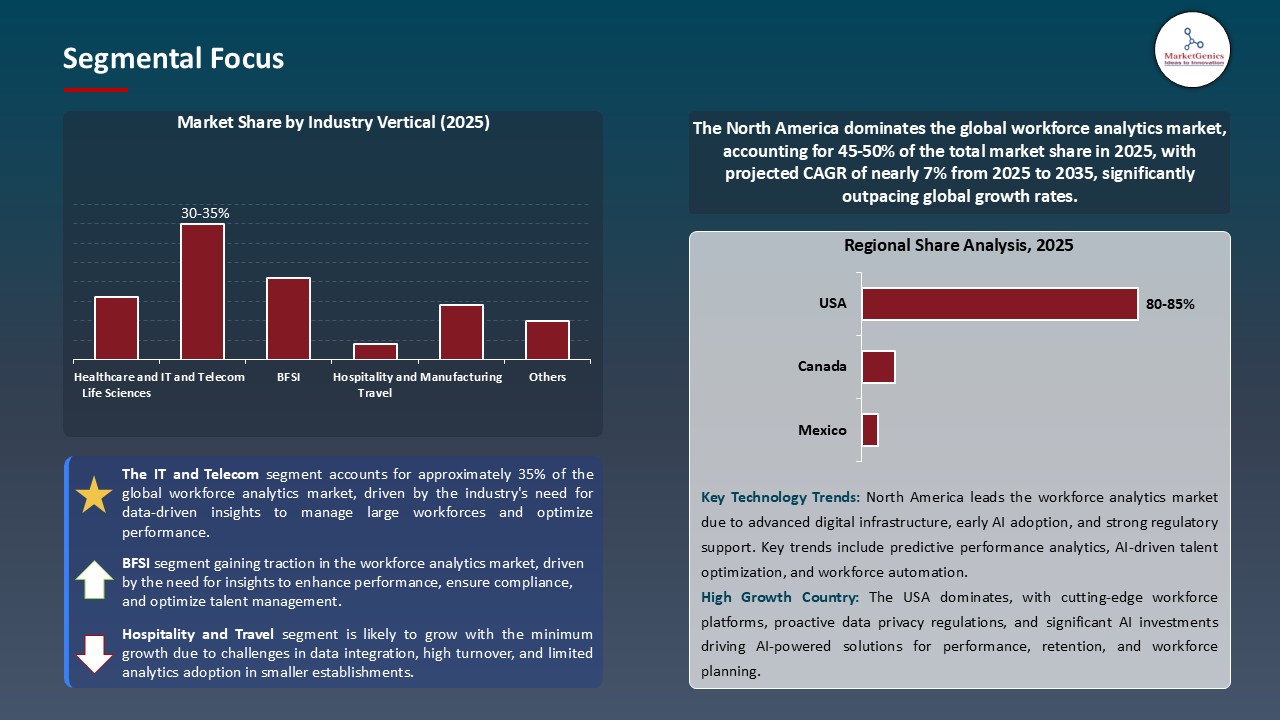

IT and Telecom Industry’s Supremacy in Workflow Analytics Industry

- Driven by the considerable reliance on data processing and analytics, network optimization, and customer experience enhancement in this sector. Telecom operators such as Verizon and AT&T are increasingly utilizing workflow analytics with features powered by artificial intelligence (AI) and machine learning (ML) to drive network operations and provide improved service delivery. As an example, Verizon's Network Intelligence platform, developed in 2024 and utilizing smart ML algorithms, is designed to predict network failures and automate service recovery to maximize uptime and enhance customer satisfaction.

- Moreover, the facilitation of AI into workflow analytics is not only a way of optimizing network operations. It is used to enhance customer support operations, improve resource allocation, and predict customer demand. This capability in telecom operations is critical to remain competitive, and has implications for improving the ability to personalize usage to the customer, and to deliver efficient cost savings in an increasingly more competitive environment.

- Therefore, telecom companies are investing in advanced analytic capabilities to facilitate real-time decision making, improve operational efficiency, and deliver reliable service. This emphasis on AI-analytics provides a way for telecom providers to improve operational efficiency, meet growing service demands, and continue to lead in an increasingly data driven competitive marketplace.

North American Dominance in Workflow Analytics Implementation

- The North America region leads the workflow analytics market, specifically through major technology companies such as IBM, Microsoft, and Oracle, and an emphasis on digital transformation in industry. North America has highly developed infrastructure and regulatory support to adopt AI and automation technology in workflow management. In 2024, the U.S. Department of Labor released new guidelines promoting AI as a tool to improve workforce efficiency, which bodes well for future growth prospects for the market.

- For example, IBM initiated AI-driven workflow analytics in Global Services, which automates repetitive tasks for its people in the delivery model and improves decision making. They reported a 25% reduction to their operational costs since implementing the technology in addition to a 40% improvement in the service delivery efficiencies in its global operations.

- With ongoing investments represented as financial capital, North America has evolved into a global leader in the development of workflow analytics, establishing standards across industries, and enabling organizational improvements to strengthen productivity, efficiency, and innovation.

Workflow-Analytics-Market Ecosystem

The workforce analytics market is a highly consolidated, with key players, such as ADP, Inc., Ceridian HCM Holding Inc., Workday, Inc., IBM Corporation, and SAP SE, all using innovative technologies, including AI, machine learning, and data analytics, to gain a competitive edge. Total solution represents the purpose of these market leaders, who utilize cutting-edge technology to support data-driven solutions that address employee performance, operational efficiency, and workforce analytics.

The workforce analytics market industry leaders are applying their expertise to focus on specialized solutions to increase innovation with the management of the workforce. An example is Cornerstone OnDemand, who provides AI-based learning management systems to deliver customized development to employees. Humanyze Inc. has developed social sensing technology to measure and enhance employee engagement with organizational behaviors.

Support from government agencies and R&D institutes is another method of advancing these technologies. For example, in March 2024, the U.S. Department of Labor proposed a partnership with IBM to develop an AI-based workforce analytical solution to identify skills gap and recommend workforce training. With this technology, real-time analysis of skill shortage can be utilized, as well as recommendations with personalized training to eliminate workforce employment gaps.

For instance, in April 2024, QlikTech International AB launched an AI-enabled workforce dashboard which improves decision-making with actionable insights on employee performance, and provides a 20% increase in productivity to companies utilizing the system.

Recent Development and Strategic Overview:

- In December 2025, Ceridian HCM Holding Inc. developed its AI-enabled employee performance analytics software to give real-time insight into employee productivity and employee engagement levels. The system takes advantage of machine learning algorithms to analyze patterns and suggest tailored development programs, enabling HR teams to optimize their performance management processes and proactively drive continuous improvement within organizations.

- In January 2025, SAP SE released its AI-based workforce planning tool, which can integrate with a company's existing HR platform. This system uses predictive analytics to help foresee staffing and resource allocation needs, positioning companies to adjust quickly to shifts in business demand. As a result, workforce agility is improved and operational costs are reduced.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.9 Bn |

|

Market Forecast Value in 2035 |

USD 4.5 Bn |

|

Growth Rate (CAGR) |

8.8% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Workflow-Analytics-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Workflow Analytics Market, By Type |

|

|

Workflow Analytics Market, By Deployment Type |

|

|

Workflow Analytics Market, By Organization Size |

|

|

Workflow Analytics Market, By Analytics Type |

|

|

Workflow Analytics Market, By Function |

|

|

Workflow Analytics Market, By Data Type |

|

|

Workflow Analytics Market, By Application |

|

|

Workflow Analytics Market, By Industry Vertical |

|

Frequently Asked Questions

The global workflow analytics market was valued at USD 1.9 Bn in 2025

The global workflow analytics market industry is expected to grow at a CAGR of 8.8% from 2025 to 2035

The demand for the workflow analytics market is driven by the need for improved operational efficiency, data-driven decision-making, automation of business processes, and enhanced productivity across industries.

In terms of industry vertical, the IT and telecom segment accounted for the major share in 2025

North America is a more attractive region for vendors

Key players in the global workflow analytics market include prominent companies such as ADP, Inc., Ceridian HCM Holding Inc., Cornerstone OnDemand, Inc., Humanyze Inc., IBM Corporation, Infor Inc., Kronos Incorporated (now UKG), Microsoft Corporation, Oracle Corporation, PeopleFluent (Learning Technologies Group), QlikTech International AB, Qualtrics International Inc., SAP SE, SAS Institute Inc., Tableau Software, Talentsoft SAS, Ultimate Software Group, Inc., Visier Inc., Workday, Inc., Zoho Corporation, and several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Workforce Analytics Market Outlook

- 2.1.1. Workforce Analytics Market Size (Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Workforce Analytics Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing adoption of automation and digital transformation across enterprises.

- 4.1.1.2. Rising need for real-time business process optimization and efficiency improvement.

- 4.1.1.3. Increasing integration of AI and machine learning in workflow management systems.

- 4.1.2. Restraints

- 4.1.2.1. High implementation costs and complexity in integrating workflow analytics with legacy systems.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Technology Providers/ System Integrators

- 4.4.2. Workforce Analytics Software Providers

- 4.4.3. Service Providers

- 4.4.4. End Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Workforce Analytics Market Demand

- 4.9.1. Historical Market Size – (Value - USD Bn), 2020-2024

- 4.9.2. Current and Future Market Size – (Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Workforce Analytics Market Analysis, by Type

- 6.1. Key Segment Analysis

- 6.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Type, 2021-2035

- 6.2.1. Software

- 6.2.1.1. Workforce Planning Software

- 6.2.1.2. Performance Management Software

- 6.2.1.3. Learning Management Software

- 6.2.1.4. Talent Management Software

- 6.2.1.5. Recruiting & Onboarding Software

- 6.2.1.6. Payroll & Compensation Management Software

- 6.2.1.7. Time & Attendance Tracking Software

- 6.2.1.8. Workforce Forecasting & Optimization Software

- 6.2.1.9. HR Analytics & Reporting Software

- 6.2.1.10. Employee Engagement & Sentiment Analysis Software

- 6.2.1.11. Others

- 6.2.2. Services

- 6.2.2.1. Consulting Services

- 6.2.2.2. Implementation & Integration Services

- 6.2.2.3. Support & Maintenance Services

- 6.2.2.4. Training & Education Services

- 6.2.2.5. Managed Services

- 6.2.2.6. Data Management & Migration Services

- 6.2.2.7. Customization Services

- 6.2.2.8. Cloud Deployment Services

- 6.2.2.9. Analytics-as-a-Service (AaaS)

- 6.2.2.10. Post-Deployment Optimization Services

- 6.2.2.11. Others

- 6.2.1. Software

- 7. Global Workforce Analytics Market Analysis, by Deployment Mode

- 7.1. Key Segment Analysis

- 7.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 7.2.1. On-Premises

- 7.2.2. Cloud-Based

- 8. Global Workforce Analytics Market Analysis, by Organization Size

- 8.1. Key Segment Analysis

- 8.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Organization Size, 2021-2035

- 8.2.1. Small and Medium Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 9. Global Workforce Analytics Market Analysis, by Analytics Type

- 9.1. Key Segment Analysis

- 9.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Analytics Type, 2021-2035

- 9.2.1. Descriptive Analytics

- 9.2.2. Predictive Analytics

- 9.2.3. Prescriptive Analytics

- 10. Global Workforce Analytics Market Analysis, by Function

- 10.1. Key Segment Analysis

- 10.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Function, 2021-2035

- 10.2.1. Human Resources

- 10.2.2. Finance and Payroll

- 10.2.3. Operations

- 10.2.4. Sales and Marketing

- 10.2.5. Others

- 11. Global Workforce Analytics Market Analysis, by Data Type

- 11.1. Key Segment Analysis

- 11.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Data Type, 2021-2035

- 11.2.1. Structured Data

- 11.2.2. Unstructured Data

- 12. Global Workforce Analytics Market Analysis, by Application

- 12.1. Key Segment Analysis

- 12.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Application, 2021-2035

- 12.2.1. Recruitment and Talent Acquisition

- 12.2.2. Performance Management

- 12.2.3. Workforce Planning and Optimization

- 12.2.4. Learning and Development

- 12.2.5. Compensation and Benefits Management

- 12.2.6. Employee Engagement and Retention

- 12.2.7. Attendance and Time Tracking

- 12.2.8. HR Compliance and Risk Management

- 12.2.9. Others

- 13. Global Workforce Analytics Market Analysis, by Industry Vertical

- 13.1. Key Segment Analysis

- 13.2. Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 13.2.1. BFSI

- 13.2.2. IT and Telecom

- 13.2.3. Healthcare and Life Sciences

- 13.2.4. Manufacturing

- 13.2.5. Retail and E-commerce

- 13.2.6. Education

- 13.2.7. Government

- 13.2.8. Energy and Utilities

- 13.2.9. Hospitality and Travel

- 13.2.10. Others

- 14. Global Workforce Analytics Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Workforce Analytics Market Size (Volume - Million Units and Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Workforce Analytics Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Workforce Analytics Market Size Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Type

- 15.3.2. Deployment Mode

- 15.3.3. Organization Size

- 15.3.4. Analytics Type

- 15.3.5. Function

- 15.3.6. Data Type

- 15.3.7. Application

- 15.3.8. Industry Vertical

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Workforce Analytics Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Type

- 15.4.3. Deployment Mode

- 15.4.4. Organization Size

- 15.4.5. Analytics Type

- 15.4.6. Function

- 15.4.7. Data Type

- 15.4.8. Application

- 15.4.9. Industry Vertical

- 15.5. Canada Workforce Analytics Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Type

- 15.5.3. Deployment Mode

- 15.5.4. Organization Size

- 15.5.5. Analytics Type

- 15.5.6. Function

- 15.5.7. Data Type

- 15.5.8. Application

- 15.5.9. Industry Vertical

- 15.6. Mexico Workforce Analytics Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Type

- 15.6.3. Deployment Mode

- 15.6.4. Organization Size

- 15.6.5. Analytics Type

- 15.6.6. Function

- 15.6.7. Data Type

- 15.6.8. Application

- 15.6.9. Industry Vertical

- 16. Europe Workforce Analytics Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Type

- 16.3.2. Deployment Mode

- 16.3.3. Organization Size

- 16.3.4. Analytics Type

- 16.3.5. Function

- 16.3.6. Data Type

- 16.3.7. Application

- 16.3.8. Industry Vertical

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Workforce Analytics Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Type

- 16.4.3. Deployment Mode

- 16.4.4. Organization Size

- 16.4.5. Analytics Type

- 16.4.6. Function

- 16.4.7. Data Type

- 16.4.8. Application

- 16.4.9. Industry Vertical

- 16.5. United Kingdom Workforce Analytics Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Type

- 16.5.3. Deployment Mode

- 16.5.4. Organization Size

- 16.5.5. Analytics Type

- 16.5.6. Function

- 16.5.7. Data Type

- 16.5.8. Application

- 16.5.9. Industry Vertical

- 16.6. France Workforce Analytics Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Type

- 16.6.3. Deployment Mode

- 16.6.4. Organization Size

- 16.6.5. Analytics Type

- 16.6.6. Function

- 16.6.7. Data Type

- 16.6.8. Application

- 16.6.9. Industry Vertical

- 16.7. Italy Workforce Analytics Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Type

- 16.7.3. Deployment Mode

- 16.7.4. Organization Size

- 16.7.5. Analytics Type

- 16.7.6. Function

- 16.7.7. Data Type

- 16.7.8. Application

- 16.7.9. Industry Vertical

- 16.8. Spain Workforce Analytics Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Type

- 16.8.3. Deployment Mode

- 16.8.4. Organization Size

- 16.8.5. Analytics Type

- 16.8.6. Function

- 16.8.7. Data Type

- 16.8.8. Application

- 16.8.9. Industry Vertical

- 16.9. Netherlands Workforce Analytics Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Type

- 16.9.3. Deployment Mode

- 16.9.4. Organization Size

- 16.9.5. Analytics Type

- 16.9.6. Function

- 16.9.7. Data Type

- 16.9.8. Application

- 16.9.9. Industry Vertical

- 16.10. Nordic Countries Workforce Analytics Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Type

- 16.10.3. Deployment Mode

- 16.10.4. Organization Size

- 16.10.5. Analytics Type

- 16.10.6. Function

- 16.10.7. Data Type

- 16.10.8. Application

- 16.10.9. Industry Vertical

- 16.11. Poland Workforce Analytics Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Type

- 16.11.3. Deployment Mode

- 16.11.4. Organization Size

- 16.11.5. Analytics Type

- 16.11.6. Function

- 16.11.7. Data Type

- 16.11.8. Application

- 16.11.9. Industry Vertical

- 16.12. Russia & CIS Workforce Analytics Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Type

- 16.12.3. Deployment Mode

- 16.12.4. Organization Size

- 16.12.5. Analytics Type

- 16.12.6. Function

- 16.12.7. Data Type

- 16.12.8. Application

- 16.12.9. Industry Vertical

- 16.13. Rest of Europe Workforce Analytics Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Type

- 16.13.3. Deployment Mode

- 16.13.4. Organization Size

- 16.13.5. Analytics Type

- 16.13.6. Function

- 16.13.7. Data Type

- 16.13.8. Application

- 16.13.9. Industry Vertical

- 17. Asia Pacific Workforce Analytics Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Type

- 17.3.2. Deployment Mode

- 17.3.3. Organization Size

- 17.3.4. Analytics Type

- 17.3.5. Function

- 17.3.6. Data Type

- 17.3.7. Application

- 17.3.8. Industry Vertical

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Workforce Analytics Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Type

- 17.4.3. Deployment Mode

- 17.4.4. Organization Size

- 17.4.5. Analytics Type

- 17.4.6. Function

- 17.4.7. Data Type

- 17.4.8. Application

- 17.4.9. Industry Vertical

- 17.5. India Workforce Analytics Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Type

- 17.5.3. Deployment Mode

- 17.5.4. Organization Size

- 17.5.5. Analytics Type

- 17.5.6. Function

- 17.5.7. Data Type

- 17.5.8. Application

- 17.5.9. Industry Vertical

- 17.6. Japan Workforce Analytics Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Type

- 17.6.3. Deployment Mode

- 17.6.4. Organization Size

- 17.6.5. Analytics Type

- 17.6.6. Function

- 17.6.7. Data Type

- 17.6.8. Application

- 17.6.9. Industry Vertical

- 17.7. South Korea Workforce Analytics Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Type

- 17.7.3. Deployment Mode

- 17.7.4. Organization Size

- 17.7.5. Analytics Type

- 17.7.6. Function

- 17.7.7. Data Type

- 17.7.8. Application

- 17.7.9. Industry Vertical

- 17.8. Australia and New Zealand Workforce Analytics Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Type

- 17.8.3. Deployment Mode

- 17.8.4. Organization Size

- 17.8.5. Analytics Type

- 17.8.6. Function

- 17.8.7. Data Type

- 17.8.8. Application

- 17.8.9. Industry Vertical

- 17.9. Indonesia Workforce Analytics Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Type

- 17.9.3. Deployment Mode

- 17.9.4. Organization Size

- 17.9.5. Analytics Type

- 17.9.6. Function

- 17.9.7. Data Type

- 17.9.8. Application

- 17.9.9. Industry Vertical

- 17.10. Malaysia Workforce Analytics Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Type

- 17.10.3. Deployment Mode

- 17.10.4. Organization Size

- 17.10.5. Analytics Type

- 17.10.6. Function

- 17.10.7. Data Type

- 17.10.8. Application

- 17.10.9. Industry Vertical

- 17.11. Thailand Workforce Analytics Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Type

- 17.11.3. Deployment Mode

- 17.11.4. Organization Size

- 17.11.5. Analytics Type

- 17.11.6. Function

- 17.11.7. Data Type

- 17.11.8. Application

- 17.11.9. Industry Vertical

- 17.12. Vietnam Workforce Analytics Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Type

- 17.12.3. Deployment Mode

- 17.12.4. Organization Size

- 17.12.5. Analytics Type

- 17.12.6. Function

- 17.12.7. Data Type

- 17.12.8. Application

- 17.12.9. Industry Vertical

- 17.13. Rest of Asia Pacific Workforce Analytics Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Type

- 17.13.3. Deployment Mode

- 17.13.4. Organization Size

- 17.13.5. Analytics Type

- 17.13.6. Function

- 17.13.7. Data Type

- 17.13.8. Application

- 17.13.9. Industry Vertical

- 18. Middle East Workforce Analytics Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Type

- 18.3.2. Deployment Mode

- 18.3.3. Organization Size

- 18.3.4. Analytics Type

- 18.3.5. Function

- 18.3.6. Data Type

- 18.3.7. Application

- 18.3.8. Industry Vertical

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Workforce Analytics Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Type

- 18.4.3. Deployment Mode

- 18.4.4. Organization Size

- 18.4.5. Analytics Type

- 18.4.6. Function

- 18.4.7. Data Type

- 18.4.8. Application

- 18.4.9. Industry Vertical

- 18.5. UAE Workforce Analytics Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Type

- 18.5.3. Deployment Mode

- 18.5.4. Organization Size

- 18.5.5. Analytics Type

- 18.5.6. Function

- 18.5.7. Data Type

- 18.5.8. Application

- 18.5.9. Industry Vertical

- 18.6. Saudi Arabia Workforce Analytics Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Type

- 18.6.3. Deployment Mode

- 18.6.4. Organization Size

- 18.6.5. Analytics Type

- 18.6.6. Function

- 18.6.7. Data Type

- 18.6.8. Application

- 18.6.9. Industry Vertical

- 18.7. Israel Workforce Analytics Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Type

- 18.7.3. Deployment Mode

- 18.7.4. Organization Size

- 18.7.5. Analytics Type

- 18.7.6. Function

- 18.7.7. Data Type

- 18.7.8. Application

- 18.7.9. Industry Vertical

- 18.8. Rest of Middle East Workforce Analytics Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Type

- 18.8.3. Deployment Mode

- 18.8.4. Organization Size

- 18.8.5. Analytics Type

- 18.8.6. Function

- 18.8.7. Data Type

- 18.8.8. Application

- 18.8.9. Industry Vertical

- 19. Africa Workforce Analytics Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Type

- 19.3.2. Deployment Mode

- 19.3.3. Organization Size

- 19.3.4. Analytics Type

- 19.3.5. Function

- 19.3.6. Data Type

- 19.3.7. Application

- 19.3.8. Industry Vertical

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Workforce Analytics Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Type

- 19.4.3. Deployment Mode

- 19.4.4. Organization Size

- 19.4.5. Analytics Type

- 19.4.6. Function

- 19.4.7. Data Type

- 19.4.8. Application

- 19.4.9. Industry Vertical

- 19.5. Egypt Workforce Analytics Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Type

- 19.5.3. Deployment Mode

- 19.5.4. Organization Size

- 19.5.5. Analytics Type

- 19.5.6. Function

- 19.5.7. Data Type

- 19.5.8. Application

- 19.5.9. Industry Vertical

- 19.6. Nigeria Workforce Analytics Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Type

- 19.6.3. Deployment Mode

- 19.6.4. Organization Size

- 19.6.5. Analytics Type

- 19.6.6. Function

- 19.6.7. Data Type

- 19.6.8. Application

- 19.6.9. Industry Vertical

- 19.7. Algeria Workforce Analytics Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Type

- 19.7.3. Deployment Mode

- 19.7.4. Organization Size

- 19.7.5. Analytics Type

- 19.7.6. Function

- 19.7.7. Data Type

- 19.7.8. Application

- 19.7.9. Industry Vertical

- 19.8. Rest of Africa Workforce Analytics Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Type

- 19.8.3. Deployment Mode

- 19.8.4. Organization Size

- 19.8.5. Analytics Type

- 19.8.6. Function

- 19.8.7. Data Type

- 19.8.8. Application

- 19.8.9. Industry Vertical

- 20. South America Workforce Analytics Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Workforce Analytics Market Size (Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Type

- 20.3.2. Deployment Mode

- 20.3.3. Organization Size

- 20.3.4. Analytics Type

- 20.3.5. Function

- 20.3.6. Data Type

- 20.3.7. Application

- 20.3.8. Industry Vertical

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Workforce Analytics Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Type

- 20.4.3. Deployment Mode

- 20.4.4. Organization Size

- 20.4.5. Analytics Type

- 20.4.6. Function

- 20.4.7. Data Type

- 20.4.8. Application

- 20.4.9. Industry Vertical

- 20.5. Argentina Workforce Analytics Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Type

- 20.5.3. Deployment Mode

- 20.5.4. Organization Size

- 20.5.5. Analytics Type

- 20.5.6. Function

- 20.5.7. Data Type

- 20.5.8. Application

- 20.5.9. Industry Vertical

- 20.6. Rest of South America Workforce Analytics Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Type

- 20.6.3. Deployment Mode

- 20.6.4. Organization Size

- 20.6.5. Analytics Type

- 20.6.6. Function

- 20.6.7. Data Type

- 20.6.8. Application

- 20.6.9. Industry Vertical

- 21. Key Players/ Company Profile

- 21.1. ADP, Inc.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Ceridian HCM Holding Inc.

- 21.3. Cornerstone OnDemand, Inc.

- 21.4. Humanyze Inc.

- 21.5. IBM Corporation

- 21.6. Infor Inc.

- 21.7. Kronos Incorporated (now UKG)

- 21.8. Microsoft Corporation

- 21.9. Oracle Corporation

- 21.10. PeopleFluent (Learning Technologies Group)

- 21.11. QlikTech International AB

- 21.12. Qualtrics International Inc.

- 21.13. SAP SE

- 21.14. SAS Institute Inc.

- 21.15. Tableau Software

- 21.16. Talentsoft SAS

- 21.17. Ultimate Software Group, Inc.

- 21.18. Visier Inc.

- 21.19. Workday, Inc.

- 21.20. Zoho Corporation

- 21.21. Others Key Players

- 21.1. ADP, Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data