Zip Skin Closure Market Size, Share & Trends Analysis Report by Product Type (Surgical Zip Skin Closures, Non-Invasive Zip Skin Closures, Adhesive-Based Zip Closures, Mechanical Zip Closures, Absorbable Zip Closures, Non-Absorbable Zip Closures), Size/Length, Application Method, Material Type, Wound Type, Age Group, Distribution Channel, End-Use, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Zip Skin Closure Market Size, Share, and Growth

The global zip skin closure market is experiencing robust growth, with its estimated value of USD 0.7 billion in the year 2025 and USD 1.2 billion by the period 2035, registering a CAGR of 5.8%, during the forecast period. Global zip skin closure market remains in high force due to increasing demand of less invasive wound closure systems, development of adhesive technology and increase in clinical usage in both surgical and emergency care.

Dr. Ronald Rigor said, “As the founder of one of the largest and fastest-growing stem cell centers in the Philippines, I am delighted to partner with and invest in Nova Cell. This is a fantastic opportunity to provide best-in-class stem cell therapy treatments, which could meet a huge unmet need in the Philippines. We look forward to bringing Nova Cell’s extensive experience in stem cell therapy production to provide innovative therapies to patients and to elevate the health and wellness industry in the Philippines.

Zip skin closure mechanisms utilize non-invasive zipper-like adhesive strips that utilize zipper-type systems that enable the surgeon to have precise approximation of the wound without needles or staples to penetrate the tissue. These systems provide uniform tension distribution on the wound edges and can be changed according to postoperative needs of swelling or drainage. This technology is beneficial to high tension closures, cosmetically sensitive, and patients at risk of infection due to the issue of foreign body implantation.

Clinical evidence of its effectiveness is increasing quickly with the adoption of the zip skin closure market and this has led to fewer scarring, reduction in infection and decreased postoperative pain as compared to the traditional sutures and staples. The zip surgical skin closure device invented and designed by ZipLine Medical has received the FDA clearance to be applied to a wide range of surgical activities including orthopaedic surgery and general surgery and has broadened the range of surgical populations to be addressed beyond the initial clean surgery indicators.

Surgeons prefer zip over meticulous suture techniques because it is faster, and the wound is sutured 30-40 percent faster. This productivity is especially high in the long processes, where operation time is reduced, and anesthetic reversion is possible earlier, which improves the measure of patient safety and facility use.

Zip Skin Closure Market Dynamics and Trends

Driver: Cosmetic Outcome Emphasis Particularly in Visible Anatomical Locations

- Patients are increasingly focusing on the aesthetic postoperative results, particularly around the face, neck and extremity procedures where the scarring can adversely affect the quality of life and social functioning. Zip closures can have superior cosmetic effects as they provide an even tension distribution and non-invasive tissue approximation, which eliminates track effects and the high profile post-surgery scarring commonly seen with the use of traditional sutures.

- Plastic surgery and elective surgical surgery zip closures can be applied to differentiate services in plastic surgery and elective surgery as a differentiator and the better scar result is the value-added proposition. It is particularly applicable in pediatric surgery whereby the operations performed on children during their tender age leave a scar that is observable over time as decades pass. This preference of parents and medical personnel towards the use of closure methods which result in fewer cosmetic consequences in the long term, serves to support the use of the technique of closure originally used in pediatric and aesthetic surgery.

- Clinical evidence that supports adoption results in reduced postoperative complications, rapid wound healing and increased patient satisfaction. Zip closures are effective, low cost and are gaining popularity in high volume surgical, pediatric and aesthetic surgery.

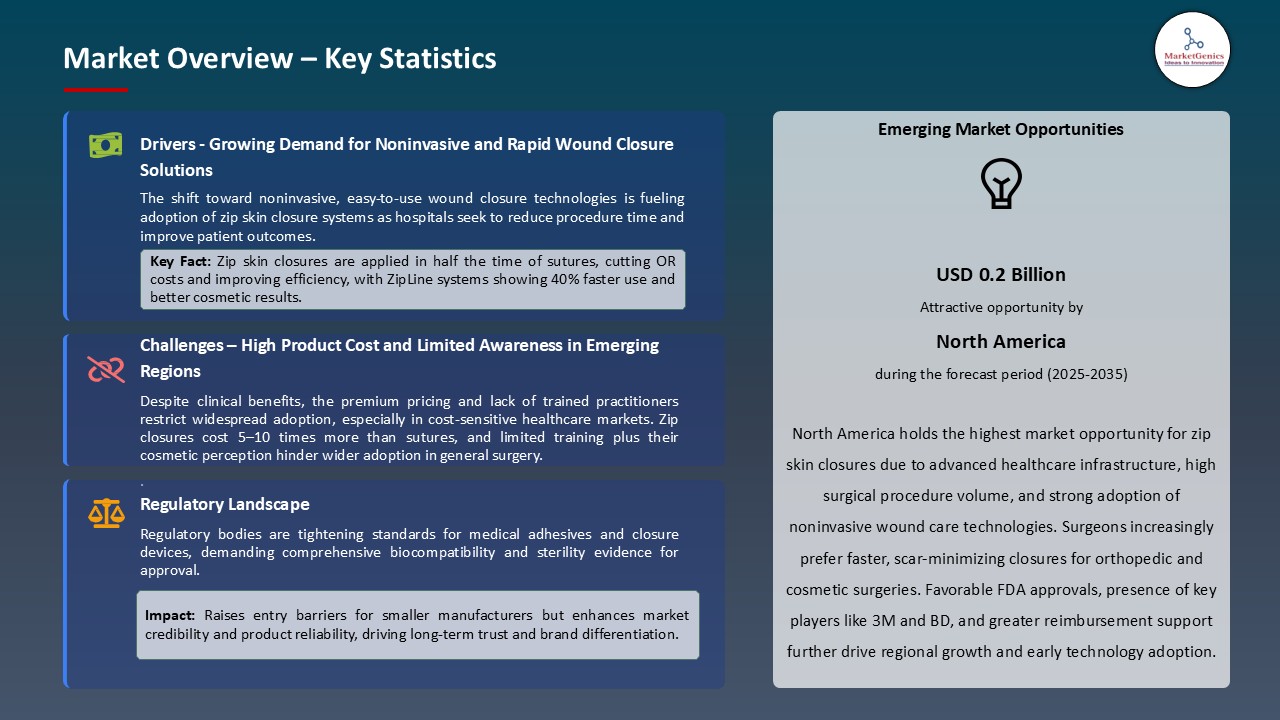

Restraint: Higher Device Costs Compared to Traditional Closure Methods Limit Adoption

- The zip skin closure market is facing high expenditure of the devices and operation, as compared to the traditional sutures or staples. The high quality adhesive materials, special production assembly and quality control are used in the production, significantly raising the cost of production.

- Moreover, the demand of a trained staff, high levels of sterility and careful attention to quality increase additional expenses. These financial costs hinder adoption, particularly with cost sensitive healthcare systems, small hospitals and rural/safety-net hospitals.

- Another bottleneck is the regulatory compliance. Zip closures are expected to have high standards of safety and efficacy prescribed by the FDA and other global standards which insist on a lot of test, documentation and post-market surveillance to ensure the wellbeing of patients. Zip skin closure devices are costly and regulatory issues limit their availability thereby reducing large scale commercialization and expansion of zip skin closure devices globally.

Opportunity: Outpatient Surgery Growth Expands Market for Patient-Friendly Closures

- The zip skin closure product is experiencing a massive growth due to the rise in outpatient and ambulatory surgical operations. The inclination towards less invasive surgery and the requirement to guarantee the fastest recovery and minimum stays of the patient is driving the adoption of non-invasive closure systems.

- Zip closures are alternatives to the conventional sutures and staples, which have faster wound closure, reduced post-surgery pain, and better cosmetics. They are convenient and efficient and facilitate the process of surgery and allow health professionals to serve more patients in same-day operations.

- The existing process on short-stay and rapid-recovery surgery is the encouragement of the broader usage of zip skin closure devices to outpatient treatment. The rise in the number of the outpatient procedures and spreading awareness of the advantages of the non-invasive closure makes the zip skin closure systems a significant solution to the evolving surgical and patient care requirements in the world.

Key Trend: Technology Enhancements Enable Adjustable Closure and Smart Monitoring

- More sophisticated closure technologies offer a customised wound approximation and real-time monitoring that could be utilized to optimise postoperative healing by surgeons. These inventions improve healing, reduce complications and provide a more cosmetic effect than the traditional sutures or staples.

- Installation of intelligent sensors and online monitoring platforms will enable the assessment of wound conditions, swelling, and drainage continuously, ensuring patient safety, and enabling the provision of clinical care in time. It allow clinicians to track recovery remotely, which results in higher efficiency in both following up and contacting the patient.

- The digital analytics and mechanical improvement, such as working with zipper-like systems of closures, make the surgical operations easier and reduce the time of work. These high-tech zip skin closure equipment are increasingly accepted in hospitals, outpatient and high-volume surgical units. Intelligent monitoring and the option of adjustable closure options are redefining the landscape of surgical care and transforming the world to be more receptive to more patient-friendly wound closure options.

Zip Skin Closure Market Analysis and Segmental Data

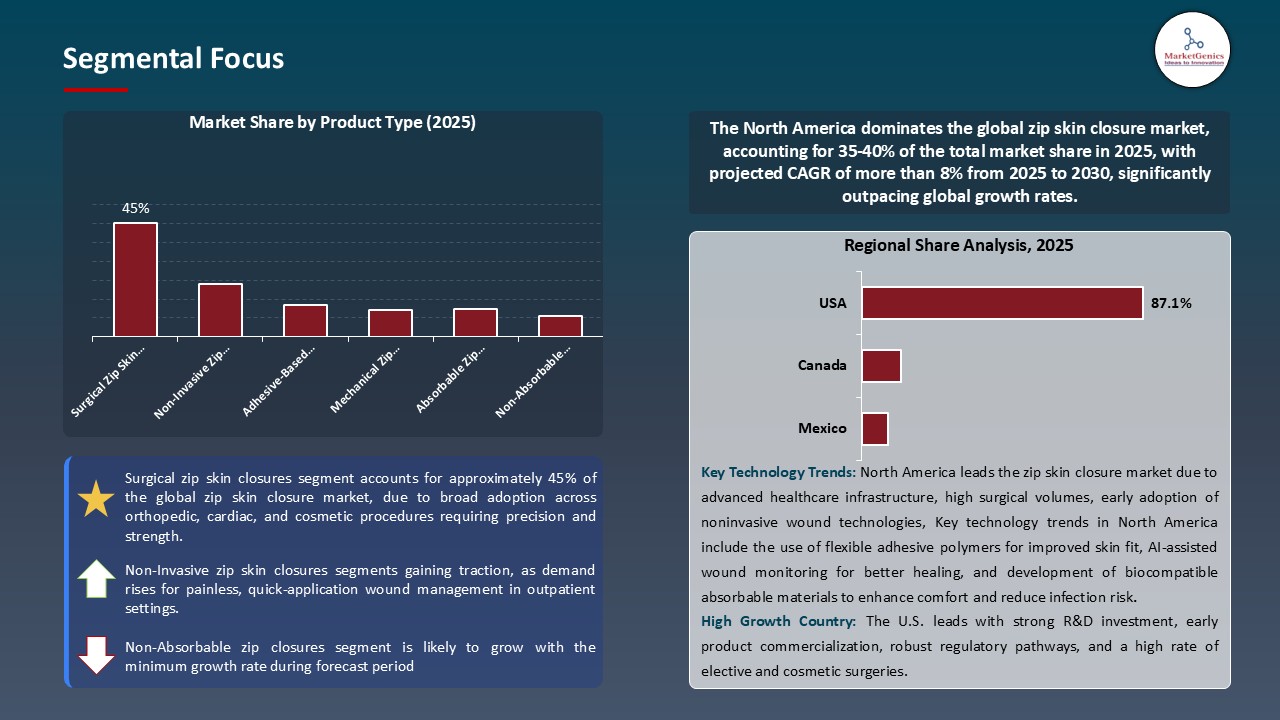

Surgical Zip Skin Closures Dominate Global Zip Skin Closure Market

- The surgical zip closure segment dominates the zip skin closure market is due to the reduced invasiveness of the segment, the absence of suture technique and the possibility of reducing the time taken in the process. These devices assist in minimizing risks of infection, minimizing the scarring and maximizing patient comfort, therefore, becoming the most sought after in hospitals, outpatient and surgery centers. The adoption is also encouraged by the growing number of surgical cases, outpatient cases, and the growing awareness of healthcare providers.

- Clinical evidence and surgeon familiarity with zip closure technology creates high switching costs in case of switching to staples or traditional suture that gives the market leadership position. Surgical zip tie closeures are regulatorially approved and safety tested as well as other new entrant barricades and this dominance consolidation has been attained.

- Technological advances, such as better adhesives and sterile application designs, are made to enhance the performance and usability to expand the use in orthopedic, cosmetic, and general surgical procedures. Along with other favorable hospital procurement policies and group purchasing organization contracts, the surgical zip closures are the most popular and most rapidly expanding market segment in the global zip skin closure market.

North America Leads Global Zip Skin Closure Market Demand

- North America is the leading in the zip skin closure market because of the rapid adoption of innovative technologies in surgical closure and the robust infrastructure that facilitates innovation in healthcare. A high number of hospitals, outpatient surgical facilities, and specialized clinics are present in the area, which are moving towards minimal invasive, non-suture closure systems to minimize the time of the given procedure, the risk of infection, and the scarring.

- An effective network of research facilities, medical equipment manufacturers and clinical education centers speeds up the adoption of zip skin closure systems by the clinical fraternity and surgeons. Joint efforts between hospitals, surgical societies and technology vendors assist in quicker product testing, training and commercialization processes allowing easier regulatory clearance and broader incursion.

- Supportive regulatory Environment, favourable reimbursement policies, and high levels of healthcare spending are other factors that enhance the market position of North America. The presence of well established distribution channels and hospital procurement networks, as well as awareness among the surgeons on the importance of efficiency and patient outcomes, strengthen the region as the largest and most technologically advanced market of zip skin closure devices in the world.

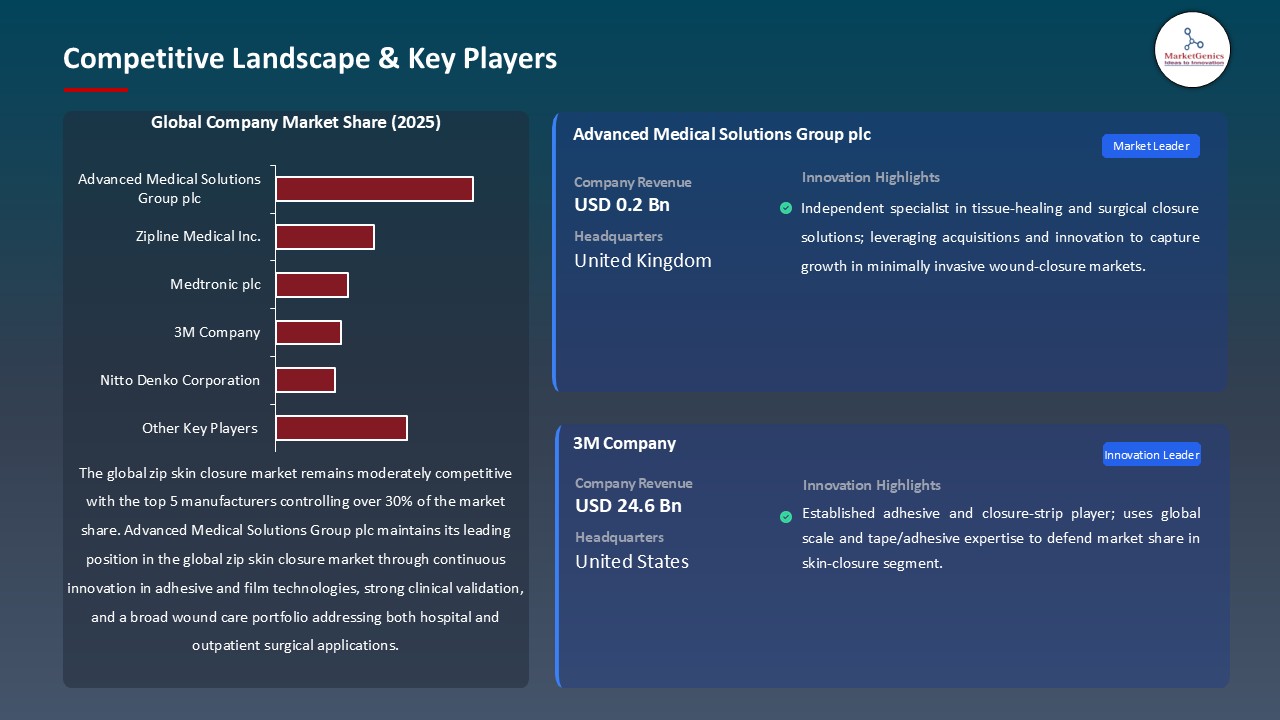

Zip-Skin-Closure-Market Ecosystem

The zip skin closure market in the world is highly concentrated, and the potential competitors have the required intellectual property as well as regulatory licenses. Zipline Medical Inc. leads in terms of innovative technology, numerous patents, first-mover benefits, setting clinical evidence and surgeon recognition. Tier 2 players include Advanced Medical Solutions Group plc, Medtronic plc, 3M Company and Nitto Denko Corporation which pursue adjacent wound closure innovation, advanced adhesive systems and minimally invasive technologies and smaller companies pursue niche applications or regional markets. Concentration of the market is maintained by significant levels of intellectual property protection and clinical evidence that is required to obtain regulatory approval and acceptance of the market.

The concentration of the buyers is low and individual hospitals and surgery centers purchase independently, although purchased based on the group purchasing organization contracts that are growing to greater adoption due to the volume pricing agreements. The supply is highly concentrated with supplier power, which is dominating manufacturers, but their pricing power may grow slowly due to capacity and distribution limitations. The requirement of clinical validation and surgeon training imposes switching costs to the established technologies that become advantageous after adoption.

Strategic Overview:

- Advanced Medical Solutions Group plc: UK-based tissue-healing and surgical closure technology independent specialist. Sells adhesives, sealants, sutures and wound-dressings in its two segments (Surgical and Woundcare). Centers around the provision of value to patients and payers through acquiring, polymer innovation and international expansion and deployment of minimally-invasive closure solutions.

- Zipline Medical Inc.: Inventor of non-invasive Zip surgical skin-closure, an adhesive-tape system, a network of strain distribution that eliminates the need to use staples / sutures to repair incisions and lacerations. Intends to enter the multi-billion-dollar wound-closure device market, with the goal of enhancing the cosmesis, speed, patient comfort and lessening complications through novel closure dynamics.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.7 Bn |

|

Market Forecast Value in 2035 |

USD 1.2 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Zip-Skin-Closure-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Zip Skin Closure Market, By Product Type |

|

|

Zip Skin Closure Market, By Size/Length |

|

|

Zip Skin Closure Market, By Application Method |

|

|

Zip Skin Closure Market, By Material Type |

|

|

Zip Skin Closure Market, By Wound Type |

|

|

Zip Skin Closure Market, By Age Group |

|

|

Zip Skin Closure Market, By Distribution Channel |

|

|

Zip Skin Closure Market, By End-Use |

|

Frequently Asked Questions

The global zip skin closure market was valued at USD 0.7 Bn in 2025.

The global zip skin closure market industry is expected to grow at a CAGR of 5.8% from 2025 to 2035.

The demand for zip skin closure is driven by the rising incidence of surgeries and traumatic wounds, coupled with advancements in adhesive and polymer technologies. Growing preference for non-invasive, infection-free, and scar-minimizing closure methods is further accelerating global market adoption.

In terms of product type, the surgical zip skin closures segment accounted for the major share in 2025.

Key players in the global zip skin closure market include prominent companies such as 3M Company, Advanced Medical Solutions Group plc, B. Braun Melsungen AG, Baxter International Inc., BSN medical (Essity), Cardinal Health Inc., Coloplast A/S, ConvaTec Group plc, Covidien (Medtronic), Derma Sciences Inc. (Integra LifeSciences), DeRoyal Industries Inc., Hollister Incorporated, Johnson & Johnson (Ethicon), Lohmann & Rauscher GmbH, McKesson Corporation, Medline Industries Inc., Medtronic plc, Molnlycke Health Care AB, Nitto Denko Corporation, Paul Hartmann AG, Smith & Nephew plc, Teleflex Incorporated, Zipline Medical Inc., ZipStitch, Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Zip Skin Closure Market Outlook

- 2.1.1. Zip Skin Closure Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Zip Skin Closure Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Healthcare Industry Overview, 2025

- 3.1.1. Healthcare Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare Industry

- 3.1.3. Regional Distribution for Healthcare Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Healthcare Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Faster wound closure and reduced operating-room time (improves OR throughput)

- 4.1.1.2. Better cosmetic outcomes and patient satisfaction versus traditional sutures/staples

- 4.1.1.3. Rising shift to outpatient/ambulatory procedures and demand for easy-to-use closure systems

- 4.1.2. Restraints

- 4.1.2.1. Higher per-unit device cost compared with sutures and staples

- 4.1.2.2. Limited reimbursement pathways and slow clinician adoption due to entrenched habits

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw materials & component supply

- 4.4.2. Manufacturing & Quality Control

- 4.4.3. Distribution & Logistics

- 4.4.4. End-users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Zip Skin Closure Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Zip Skin Closure Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Surgical Zip Skin Closures

- 6.2.2. Non-Invasive Zip Skin Closures

- 6.2.3. Adhesive-Based Zip Closures

- 6.2.4. Mechanical Zip Closures

- 6.2.5. Absorbable Zip Closures

- 6.2.6. Non-Absorbable Zip Closures

- 7. Global Zip Skin Closure Market Analysis, by Size/Length

- 7.1. Key Segment Analysis

- 7.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Size/Length, 2021-2035

- 7.2.1. Small (Less than 5 cm)

- 7.2.2. Medium (5-10 cm)

- 7.2.3. Large (10-15 cm)

- 7.2.4. Extra Large (Above 15 cm)

- 8. Global Zip Skin Closure Market Analysis, by Application Method

- 8.1. Key Segment Analysis

- 8.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application Method, 2021-2035

- 8.2.1. Manual Application

- 8.2.2. Device-Assisted Application

- 9. Global Zip Skin Closure Market Analysis, by Material Type

- 9.1. Key Segment Analysis

- 9.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 9.2.1. Polyethylene-Based

- 9.2.2. Polypropylene-Based

- 9.2.3. Silicone-Based

- 9.2.4. Hybrid Materials

- 9.2.5. Biocompatible Polymers

- 10. Global Zip Skin Closure Market Analysis, by Wound Type

- 10.1. Key Segment Analysis

- 10.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Wound Type, 2021-2035

- 10.2.1. Surgical Incisions

- 10.2.2. Traumatic Lacerations

- 10.2.3. Post-Operative Wounds

- 10.2.4. Emergency Wounds

- 10.2.5. Cosmetic Procedure Wounds

- 10.2.6. Chronic Wounds

- 11. Global Zip Skin Closure Market Analysis, by Age Group

- 11.1. Key Segment Analysis

- 11.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Age Group, 2021-2035

- 11.2.1. Pediatric

- 11.2.2. Adult

- 11.2.3. Geriatric

- 11.2.4. Neonatal

- 12. Global Zip Skin Closure Market Analysis, by Distribution Channel

- 12.1. Key Segment Analysis

- 12.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 12.2.1. Hospital Pharmacies

- 12.2.2. Retail Pharmacies

- 12.2.3. Online Pharmacies

- 12.2.4. Medical Device Distributors

- 12.2.5. Direct Hospital Supply

- 13. Global Zip Skin Closure Market Analysis, by End-Use

- 13.1. Key Segment Analysis

- 13.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use, 2021-2035

- 13.2.1. Healthcare Facilities

- 13.2.1.1. Hospitals

- 13.2.1.2. General Surgery

- 13.2.1.3. Orthopedic Surgery

- 13.2.1.4. Cardiovascular Surgery

- 13.2.1.5. Neurosurgery

- 13.2.1.6. Plastic & Reconstructive Surgery

- 13.2.1.7. Gynecological Surgery

- 13.2.1.8. Pediatric Surgery

- 13.2.1.9. Others

- 13.2.2. Ambulatory Surgical Centers

- 13.2.2.1. Minor Surgical Procedures

- 13.2.2.2. Outpatient Procedures

- 13.2.2.3. Day Surgery Cases

- 13.2.2.4. Others

- 13.2.3. Emergency & Trauma Centers

- 13.2.3.1. Acute Trauma Care

- 13.2.3.2. Emergency Laceration Repair

- 13.2.3.3. Accident & Emergency Departments

- 13.2.3.4. Others

- 13.2.4. Specialty Clinics

- 13.2.4.1. Dermatology Clinics

- 13.2.4.2. Cosmetic Surgery Clinics

- 13.2.4.3. Wound Care Clinics

- 13.2.4.4. Sports Medicine Clinics

- 13.2.4.5. Others

- 13.2.5. Military & Defense

- 13.2.5.1. Field Medical Units

- 13.2.5.2. Combat Casualty Care

- 13.2.5.3. Military Hospitals

- 13.2.5.4. Tactical Medical Applications

- 13.2.5.5. Others

- 13.2.6. Home Healthcare

- 13.2.6.1. Post-Discharge Wound Management

- 13.2.6.2. Home Nursing Care

- 13.2.6.3. Telemedicine-Guided Applications

- 13.2.6.4. Others

- 13.2.7. Veterinary Applications

- 13.2.7.1. Animal Hospitals

- 13.2.7.2. Veterinary Clinics

- 13.2.7.3. Wildlife Care Centers

- 13.2.7.4. Livestock Medical Care

- 13.2.7.5. Others

- 13.2.8. Research & Academic Institutions

- 13.2.1. Healthcare Facilities

- 14. Global Zip Skin Closure Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Zip Skin Closure Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Size/Length

- 15.3.3. Application Method

- 15.3.4. Material Type

- 15.3.5. Wound Type

- 15.3.6. Age Group

- 15.3.7. Distribution Channel

- 15.3.8. End-Use

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Zip Skin Closure Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Product Type

- 15.4.3. Size/Length

- 15.4.4. Application Method

- 15.4.5. Material Type

- 15.4.6. Wound Type

- 15.4.7. Age Group

- 15.4.8. Distribution Channel

- 15.4.9. End-Use

- 15.5. Canada Zip Skin Closure Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Product Type

- 15.5.3. Size/Length

- 15.5.4. Application Method

- 15.5.5. Material Type

- 15.5.6. Wound Type

- 15.5.7. Age Group

- 15.5.8. Distribution Channel

- 15.5.9. End-Use

- 15.6. Mexico Zip Skin Closure Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Product Type

- 15.6.3. Size/Length

- 15.6.4. Application Method

- 15.6.5. Material Type

- 15.6.6. Wound Type

- 15.6.7. Age Group

- 15.6.8. Distribution Channel

- 15.6.9. End-Use

- 16. Europe Zip Skin Closure Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Size/Length

- 16.3.3. Application Method

- 16.3.4. Material Type

- 16.3.5. Wound Type

- 16.3.6. Age Group

- 16.3.7. Distribution Channel

- 16.3.8. End-Use

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Zip Skin Closure Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Size/Length

- 16.4.4. Application Method

- 16.4.5. Material Type

- 16.4.6. Wound Type

- 16.4.7. Age Group

- 16.4.8. Distribution Channel

- 16.4.9. End-Use

- 16.5. United Kingdom Zip Skin Closure Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Size/Length

- 16.5.4. Application Method

- 16.5.5. Material Type

- 16.5.6. Wound Type

- 16.5.7. Age Group

- 16.5.8. Distribution Channel

- 16.5.9. End-Use

- 16.6. France Zip Skin Closure Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Size/Length

- 16.6.4. Application Method

- 16.6.5. Material Type

- 16.6.6. Wound Type

- 16.6.7. Age Group

- 16.6.8. Distribution Channel

- 16.6.9. End-Use

- 16.7. Italy Zip Skin Closure Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Product Type

- 16.7.3. Size/Length

- 16.7.4. Application Method

- 16.7.5. Material Type

- 16.7.6. Wound Type

- 16.7.7. Age Group

- 16.7.8. Distribution Channel

- 16.7.9. End-Use

- 16.8. Spain Zip Skin Closure Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Product Type

- 16.8.3. Size/Length

- 16.8.4. Application Method

- 16.8.5. Material Type

- 16.8.6. Wound Type

- 16.8.7. Age Group

- 16.8.8. Distribution Channel

- 16.8.9. End-Use

- 16.9. Netherlands Zip Skin Closure Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Product Type

- 16.9.3. Size/Length

- 16.9.4. Application Method

- 16.9.5. Material Type

- 16.9.6. Wound Type

- 16.9.7. Age Group

- 16.9.8. Distribution Channel

- 16.9.9. End-Use

- 16.10. Nordic Countries Zip Skin Closure Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Product Type

- 16.10.3. Size/Length

- 16.10.4. Application Method

- 16.10.5. Material Type

- 16.10.6. Wound Type

- 16.10.7. Age Group

- 16.10.8. Distribution Channel

- 16.10.9. End-Use

- 16.11. Poland Zip Skin Closure Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Product Type

- 16.11.3. Size/Length

- 16.11.4. Application Method

- 16.11.5. Material Type

- 16.11.6. Wound Type

- 16.11.7. Age Group

- 16.11.8. Distribution Channel

- 16.11.9. End-Use

- 16.12. Russia & CIS Zip Skin Closure Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Product Type

- 16.12.3. Size/Length

- 16.12.4. Application Method

- 16.12.5. Material Type

- 16.12.6. Wound Type

- 16.12.7. Age Group

- 16.12.8. Distribution Channel

- 16.12.9. End-Use

- 16.13. Rest of Europe Zip Skin Closure Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Product Type

- 16.13.3. Size/Length

- 16.13.4. Application Method

- 16.13.5. Material Type

- 16.13.6. Wound Type

- 16.13.7. Age Group

- 16.13.8. Distribution Channel

- 16.13.9. End-Use

- 17. Asia Pacific Zip Skin Closure Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. East Asia Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Size/Length

- 17.3.3. Application Method

- 17.3.4. Material Type

- 17.3.5. Wound Type

- 17.3.6. Age Group

- 17.3.7. Distribution Channel

- 17.3.8. End-Use

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Zip Skin Closure Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Size/Length

- 17.4.4. Application Method

- 17.4.5. Material Type

- 17.4.6. Wound Type

- 17.4.7. Age Group

- 17.4.8. Distribution Channel

- 17.4.9. End-Use

- 17.5. India Zip Skin Closure Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Size/Length

- 17.5.4. Application Method

- 17.5.5. Material Type

- 17.5.6. Wound Type

- 17.5.7. Age Group

- 17.5.8. Distribution Channel

- 17.5.9. End-Use

- 17.6. Japan Zip Skin Closure Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Size/Length

- 17.6.4. Application Method

- 17.6.5. Material Type

- 17.6.6. Wound Type

- 17.6.7. Age Group

- 17.6.8. Distribution Channel

- 17.6.9. End-Use

- 17.7. South Korea Zip Skin Closure Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Size/Length

- 17.7.4. Application Method

- 17.7.5. Material Type

- 17.7.6. Wound Type

- 17.7.7. Age Group

- 17.7.8. Distribution Channel

- 17.7.9. End-Use

- 17.8. Australia and New Zealand Zip Skin Closure Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Size/Length

- 17.8.4. Application Method

- 17.8.5. Material Type

- 17.8.6. Wound Type

- 17.8.7. Age Group

- 17.8.8. Distribution Channel

- 17.8.9. End-Use

- 17.9. Indonesia Zip Skin Closure Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Size/Length

- 17.9.4. Application Method

- 17.9.5. Material Type

- 17.9.6. Wound Type

- 17.9.7. Age Group

- 17.9.8. Distribution Channel

- 17.9.9. End-Use

- 17.10. Malaysia Zip Skin Closure Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Size/Length

- 17.10.4. Application Method

- 17.10.5. Material Type

- 17.10.6. Wound Type

- 17.10.7. Age Group

- 17.10.8. Distribution Channel

- 17.10.9. End-Use

- 17.11. Thailand Zip Skin Closure Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Size/Length

- 17.11.4. Application Method

- 17.11.5. Material Type

- 17.11.6. Wound Type

- 17.11.7. Age Group

- 17.11.8. Distribution Channel

- 17.11.9. End-Use

- 17.12. Vietnam Zip Skin Closure Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Size/Length

- 17.12.4. Application Method

- 17.12.5. Material Type

- 17.12.6. Wound Type

- 17.12.7. Age Group

- 17.12.8. Distribution Channel

- 17.12.9. End-Use

- 17.13. Rest of Asia Pacific Zip Skin Closure Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Size/Length

- 17.13.4. Application Method

- 17.13.5. Material Type

- 17.13.6. Wound Type

- 17.13.7. Age Group

- 17.13.8. Distribution Channel

- 17.13.9. End-Use

- 18. Middle East Zip Skin Closure Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Size/Length

- 18.3.3. Application Method

- 18.3.4. Material Type

- 18.3.5. Wound Type

- 18.3.6. Age Group

- 18.3.7. Distribution Channel

- 18.3.8. End-Use

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Zip Skin Closure Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Size/Length

- 18.4.4. Application Method

- 18.4.5. Material Type

- 18.4.6. Wound Type

- 18.4.7. Age Group

- 18.4.8. Distribution Channel

- 18.4.9. End-Use

- 18.5. UAE Zip Skin Closure Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Size/Length

- 18.5.4. Application Method

- 18.5.5. Material Type

- 18.5.6. Wound Type

- 18.5.7. Age Group

- 18.5.8. Distribution Channel

- 18.5.9. End-Use

- 18.6. Saudi Arabia Zip Skin Closure Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Size/Length

- 18.6.4. Application Method

- 18.6.5. Material Type

- 18.6.6. Wound Type

- 18.6.7. Age Group

- 18.6.8. Distribution Channel

- 18.6.9. End-Use

- 18.7. Israel Zip Skin Closure Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Size/Length

- 18.7.4. Application Method

- 18.7.5. Material Type

- 18.7.6. Wound Type

- 18.7.7. Age Group

- 18.7.8. Distribution Channel

- 18.7.9. End-Use

- 18.8. Rest of Middle East Zip Skin Closure Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Size/Length

- 18.8.4. Application Method

- 18.8.5. Material Type

- 18.8.6. Wound Type

- 18.8.7. Age Group

- 18.8.8. Distribution Channel

- 18.8.9. End-Use

- 19. Africa Zip Skin Closure Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Size/Length

- 19.3.3. Application Method

- 19.3.4. Material Type

- 19.3.5. Wound Type

- 19.3.6. Age Group

- 19.3.7. Distribution Channel

- 19.3.8. End-Use

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Zip Skin Closure Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Size/Length

- 19.4.4. Application Method

- 19.4.5. Material Type

- 19.4.6. Wound Type

- 19.4.7. Age Group

- 19.4.8. Distribution Channel

- 19.4.9. End-Use

- 19.5. Egypt Zip Skin Closure Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Size/Length

- 19.5.4. Application Method

- 19.5.5. Material Type

- 19.5.6. Wound Type

- 19.5.7. Age Group

- 19.5.8. Distribution Channel

- 19.5.9. End-Use

- 19.6. Nigeria Zip Skin Closure Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Size/Length

- 19.6.4. Application Method

- 19.6.5. Material Type

- 19.6.6. Wound Type

- 19.6.7. Age Group

- 19.6.8. Distribution Channel

- 19.6.9. End-Use

- 19.7. Algeria Zip Skin Closure Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Size/Length

- 19.7.4. Application Method

- 19.7.5. Material Type

- 19.7.6. Wound Type

- 19.7.7. Age Group

- 19.7.8. Distribution Channel

- 19.7.9. End-Use

- 19.8. Rest of Africa Zip Skin Closure Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Size/Length

- 19.8.4. Application Method

- 19.8.5. Material Type

- 19.8.6. Wound Type

- 19.8.7. Age Group

- 19.8.8. Distribution Channel

- 19.8.9. End-Use

- 20. South America Zip Skin Closure Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Central and South Africa Zip Skin Closure Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Size/Length

- 20.3.3. Application Method

- 20.3.4. Material Type

- 20.3.5. Wound Type

- 20.3.6. Age Group

- 20.3.7. Distribution Channel

- 20.3.8. End-Use

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Zip Skin Closure Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Size/Length

- 20.4.4. Application Method

- 20.4.5. Material Type

- 20.4.6. Wound Type

- 20.4.7. Age Group

- 20.4.8. Distribution Channel

- 20.4.9. End-Use

- 20.5. Argentina Zip Skin Closure Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Size/Length

- 20.5.4. Application Method

- 20.5.5. Material Type

- 20.5.6. Wound Type

- 20.5.7. Age Group

- 20.5.8. Distribution Channel

- 20.5.9. End-Use

- 20.6. Rest of South America Zip Skin Closure Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Size/Length

- 20.6.4. Application Method

- 20.6.5. Material Type

- 20.6.6. Wound Type

- 20.6.7. Age Group

- 20.6.8. Distribution Channel

- 20.6.9. End-Use

- 21. Key Players/ Company Profile

- 21.1. 3M Company.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Advanced Medical Solutions Group plc

- 21.3. B. Braun Melsungen AG

- 21.4. Baxter International Inc.

- 21.5. BSN medical (Essity)

- 21.6. Cardinal Health Inc.

- 21.7. Coloplast A/S

- 21.8. ConvaTec Group plc

- 21.9. Covidien (Medtronic)

- 21.10. Derma Sciences Inc. (Integra LifeSciences)

- 21.11. DeRoyal Industries Inc.

- 21.12. Hollister Incorporated

- 21.13. Johnson & Johnson (Ethicon)

- 21.14. Lohmann & Rauscher GmbH

- 21.15. McKesson Corporation

- 21.16. Medline Industries Inc.

- 21.17. Medtronic plc

- 21.18. Molnlycke Health Care AB

- 21.19. Nitto Denko Corporation

- 21.20. Paul Hartmann AG

- 21.21. Smith & Nephew plc

- 21.22. Teleflex Incorporated

- 21.23. Zipline Medical Inc.

- 21.24. ZipStitch

- 21.25. Other Key Players

- 21.1. 3M Company.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data