Active & Intelligent Packaging Market Size, Share & Trends Analysis Report by Technology Type (Active Packaging Technologies, Intelligent Packaging Technologies), Material Type, Release Mechanism, Packaging Format, Distribution Channel, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Active & Intelligent Packaging Market Size, Share, and Growth

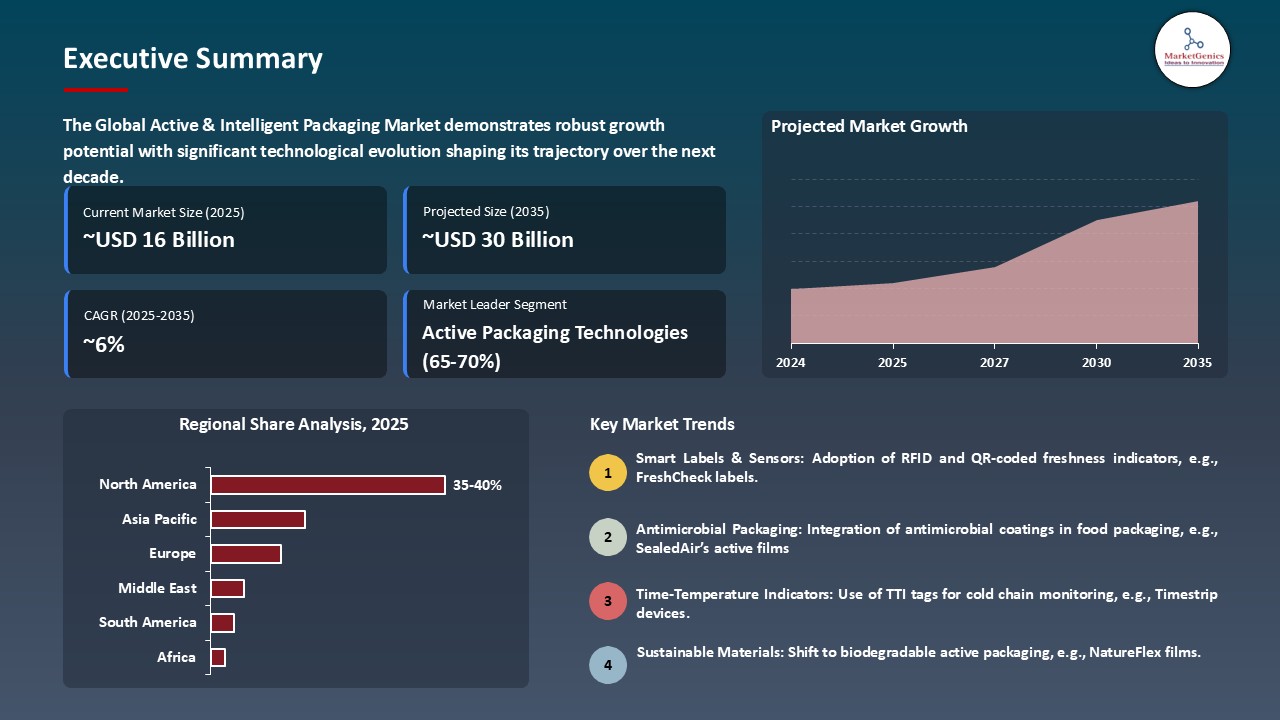

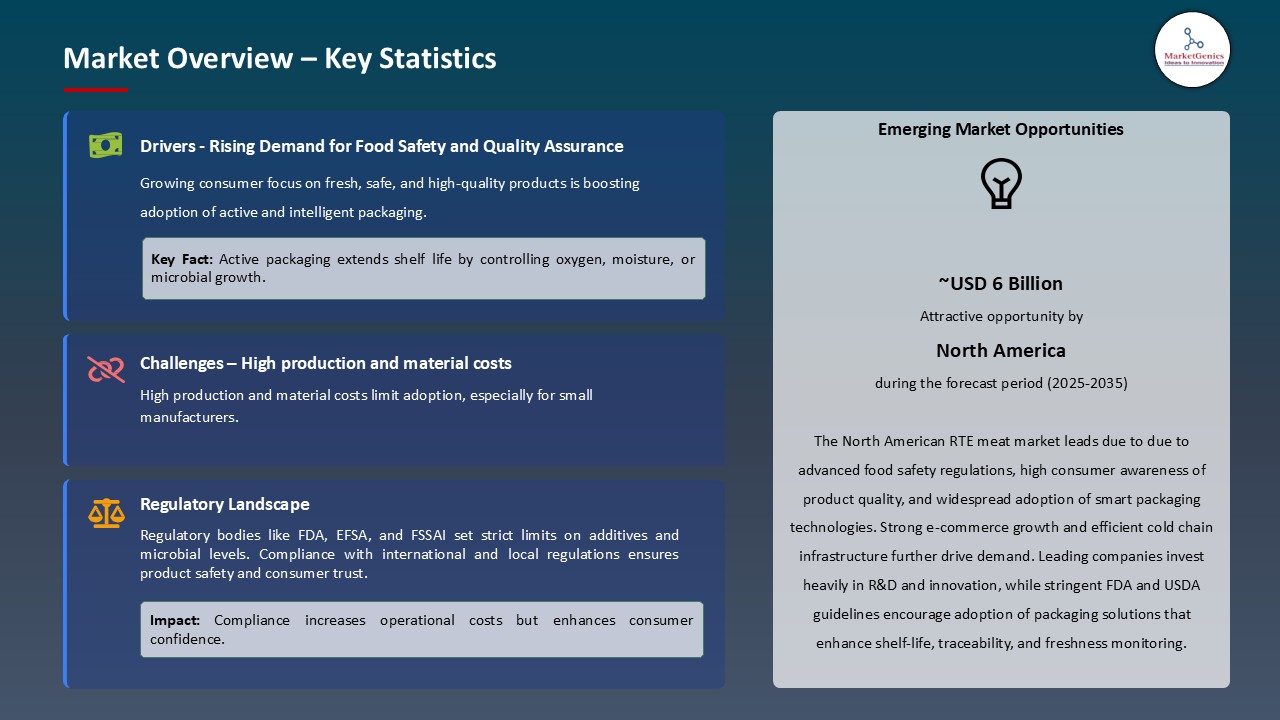

The global active & intelligent packaging market is experiencing robust growth, with its estimated value of USD 16.2 billion in the year 2025 and USD 29.8 billion by the period 2035, registering a CAGR of 6.3%, during the forecast period. The active & intelligent packaging market is growing due to the growing consumer demand for food safety, freshness, and longer shelf life, along with regulatory pressures and sustainability initiatives.

Jag Bains, Vice President for Commercial, EMEA, at Ball said,

“We’ve taken everything we’ve learned from the original series – and that our customers loved – and pushed the creative boundaries even further with Dynamark Advanced Pro.This technology gives brands and designers greater creative freedom, enabling more innovative, personalised and tailored design solutions. With enhanced capabilities and flexibility, Dynamark Advanced Pro, allows faster adaptation to market trends and customer preferences.”

Growing consumer demand for freshness and transparency is driving the active & intelligent packaging market, as manufacturers seek to extend shelf-life, display real-time status and reduce spoilage. For instance, in September 2025, Sealed Air Corporation launched the AUTOBAG 850HB Hybrid Bagging Machine, offering flexible paper or poly material options and fully recyclable packaging formats to enhance sustainability in fulfillment operations. The market is shifting from standard packaging toward higher-value, sensor-enabled, sustainable formats, thus expanding total addressable market and increasing packaging cost-base.

Moreover, the active & intelligent packaging market is growing due to the strategic partnership. For instance, in November 2024, Amcor plc’s collaborated with the Ellen MacArthur Foundation shows its push toward circular-economy packaging, with 94% of its flexible-portfolio having recycle-ready solutions. This initiative enhances Amcor’s leadership in recyclable flexible solutions and drives greater adoption of eco-efficient active and intelligent packaging, aligning innovation with global circular-economy objectives and regulatory compliance.

The regulatory framework across major economies is propelling the growth of the global active & intelligent packaging market by mandating sustainability, digital traceability, and circular design. For instance, in February 2025, the European Commission updated its Packaging and Packaging Waste Directive (PPWD), enforcing stricter recyclability and digital product passport requirements, accelerating the adoption of mono-material, smart sensor–enabled, and high-barrier active packaging solutions.

The key market opportunities of the global active & intelligent packaging market are smart labeling and RFID technologies, biodegradable and compostable material innovation, connected cold-chain logistics, AI-driven supply-chain monitoring, and nanotechnology-based antimicrobial coatings. These sectors align with intelligent packaging’s goals of traceability, freshness, and sustainability. The convergence of these markets accelerates technological innovation, enhances operational efficiency, and expands commercial adoption across diverse sectors such as food, pharmaceuticals, and e-commerce, driving a more interconnected and data-driven packaging ecosystem.

Active & Intelligent Packaging Market Dynamics and Trends

Driver: Expansion of Sustainable Bio-Active Materials Enhancing Circular Packaging Models

- The growing demand for eco-friendly solutions presents a strong opportunity for developing bio-based active materials that extend shelf life while supporting recyclability and compostability. Major companies are focusing on renewable feedstocks and biodegradable coatings for active barrier films. For instance, in September 2024, BASF SE introduced its bio-based polyamide (PA410) for oxygen-scavenging films, designed to enhance shelf life and reduce dependence on fossil-based polymers. The shift toward integrating biodegradable active elements such as antimicrobial natural additives reflects how environmental consciousness is driving technological evolution in packaging materials.

- Additionally, the active & intelligent packaging market is growing due to material advancements align with growing corporate commitments toward carbon neutrality and circular production systems. For instance, in 2023, Amcor plc expanded its AmFiber platform with cellulose-based active packaging designed for recyclability and freshness preservation in ready-meal segments.

- Thus, the use of bio-active materials is redefining sustainability benchmarks, driving large-scale adoption of circular and intelligent packaging solutions across global consumer goods markets.

Restraint: High Implementation Cost Limiting Technology Penetration in Emerging Markets

- The elevated cost of integrating electronic sensors, printed electronics, and communication systems within packaging materials continues to restrain the large-scale adoption of active and intelligent packaging, particularly in cost-sensitive economies. Manufacturers face challenges in balancing technological sophistication with affordability for high-volume consumer goods. In June Avery Dennison highlighted the issue by delaying the mass rollout of its NFC-based smart labels for mid-tier food brands due to high component and integration expenses. Limited infrastructure for recycling and lack of economies of scale in developing regions further hinder adoption.

- Additionally, although costs are expected to decline with advancing printed electronics and material innovations, the upfront investment remains a significant barrier for small and medium packaging converters.

Opportunity: Rising Demand for Sustainable and Compostable Smart Packaging Materials

- The active & intelligent packaging market is driven by sustainability-driven innovation is creating vast opportunities in active and intelligent packaging as companies focus on developing eco-friendly smart materials that combine functionality with environmental performance. Bio-based polymers and compostable coatings integrated with freshness indicators or moisture absorbers are gaining traction. For instance, in October 2024, Ball Corporation announced the re-launch of its proprietary printing technology, Dynamark for its beverage cans in Europe, Middle East and Africa (EMEA). This upgraded technology introduces an advanced tier of printing capabilities, unlocking leading-edge features to deliver greater flexibility and enhanced value for brands.

- Additionally, collaboration among chemical and packaging companies accelerates innovation and commercial scalability of these sustainable intelligent solutions. For instance, in July 2025, BASF SE entered a strategic collaboration with Amcor plc to develop bio-based barrier films and compostable active coatings using BASF’s ecovio and Epotal technologies. This partnership focuses on creating recyclable and compostable packaging solutions with moisture and oxygen control properties, supporting large-scale commercialization of sustainable intelligent packaging applications across food and personal care sectors.

Key Trend: Integration of Smart Sensors Enhancing Real-Time Food Quality Monitoring

- The increasing integration of advanced sensor technologies into packaging materials is significantly driving the growth of the global active and intelligent packaging market. Smart sensors enable real-time monitoring of temperature, humidity, and gas composition, ensuring product freshness and safety across supply chains. For instance, in July 2025, Avery Dennison Corporation announced the launch of its RFID-enabled In-Mold Label (IML) portfolio, which embeds RFID sensors directly into plastic items during the injection-moulding process to enable real-time tracking, reuse and enhanced traceability in circular systems. This innovation addresses the growing consumer demand for transparency and quality assurance while reducing food waste.

- Additionally, the adoption of intelligent sensors in beverage and pharmaceutical packaging enhances shelf-life management and compliance tracking. These digital innovations not only improve brand credibility but also align with sustainability goals by optimizing logistics and reducing product loss.

Active & Intelligent Packaging Market Analysis and Segmental Data

Active Packaging Technologies Dominate Global Active & Intelligent Packaging Market

- Active packaging technologies the global active & intelligent packaging market owing to their ability to enhance product safety, freshness, and shelf life through controlled interaction with the packaged contents. These systems utilize oxygen scavengers, moisture absorbers, antimicrobial agents, and ethylene regulators to actively maintain product integrity and reduce spoilage. For instance, in September 2025, Sealed Air Corporation launched its advanced CRYOVAC Freshness Preservation System, integrating multi-layer films with embedded active compounds that react to humidity and oxygen exposure, significantly extending protein shelf stability while reducing plastic content.

- Furthermore, the market’s growth trajectory reflects a shift toward smart, eco-efficient active packaging solutions that integrate sustainability, functionality, and shelf-life optimization as competitive differentiators.

North America Leads Global Active & Intelligent Packaging Market Demand

- North America leads the global active & intelligent packaging market, supported by advanced manufacturing, strong tech infrastructure, and strict FDA and USDA standards. The region’s food and retail sectors are rapidly adopting smart solutions for freshness, waste reduction, and traceability. For instance, in October 2024, Avery Dennison expanded its AD Engage RFID and NFC labels in the U.S., enabling real-time authentication and cold-chain tracking. This growing integration of digital identification with sustainability goals reinforces North America’s dominance in connected, compliant, and data-driven packaging systems.

- Additionally, rapid expansion of sustainable and recyclable active packaging materials supported by strong R&D investment and circular-economy policies. North American manufacturers are leading in developing bio-based, antimicrobial, and oxygen-absorbing packaging that extend shelf life while reducing environmental impact. For instance, in Tetra Pak introduced its NextGen Renewable Carton with Active Barrier Technology in the U.S. and Canada, featuring plant-based polymer coatings and embedded freshness-preserving layers that extend beverage shelf life while remaining fully recyclable.

Active & Intelligent Packaging Market Ecosystem

The global active & intelligent packaging market is moderately consolated, with high concentration among key players such as Amcor plc, Sealed Air Corporation, Avery Dennison Corporation, BASF SE, and Tetra Pak International S.A., who dominate through continuous technological innovation, strategic acquisitions, and expansion of smart, sustainable packaging portfolios. These companies leverage advanced R&D capabilities and global distribution networks to integrate features such as freshness sensors, RFID/NFC tagging, and bio-based active coatings into their packaging solutions. For instance, in February 2025, Amcor and Sealed Air expanded AI-enabled and barrier-formable packaging systems across North America. Through these initiatives, leading manufacturers are shaping market direction by combining digital intelligence, material innovation, and circular-economy practices.

Recent Development and Strategic Overview:

- In August 2025, Mondi announced €16 million investment in state-of-the-art technology at its plant in Solec (Poland) Mondi is ramping up production of this high-performance barrier paper which offers exceptional protection against oxygen, water vapour and grease, with an oxygen transmission rate (OTR) below 0.5 cm3/m2d and water vapor transmission rate (WVTR) below 0.5 g/m2d.

- In August 2024, Checkpoint Systems, a global leader in RFID technology and loss prevention solutions, has announced its participation in Labelexpo 2024. As part of CCL Label, a global leader in specialty label, security and packaging solutions, this action reinforces our commitment to innovation in the smart labeling market.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 16.2 Bn |

|

Market Forecast Value in 20255 |

USD 29.8 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Active & Intelligent Packaging Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Active & Intelligent Packaging Market By Technology Type |

|

|

Active & Intelligent Packaging Market By Material Type |

|

|

Active & Intelligent Packaging Market By Release Mechanism

|

|

|

Active & Intelligent Packaging Market By Packaging Format |

|

|

Active & Intelligent Packaging Market By Distribution Channel

|

|

|

Active & Intelligent Packaging Market By End-Use Industry

|

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Active & Intelligent Packaging Market Outlook

- 2.1.1. Active & Intelligent Packaging Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Active & Intelligent Packaging Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Active & Intelligent Packaging Industry Overview, 2025

- 3.1.1. PackagingIndustry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Packaging Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Active & Intelligent Packaging Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for food safety and extended shelf-life solutions

- 4.1.1.2. Growing e-commerce and cold chain logistics requirements

- 4.1.1.3. Increasing consumer awareness of product quality and authenticity

- 4.1.2. Restraints

- 4.1.2.1. High production and implementation costs of active & intelligent packaging

- 4.1.2.2. Regulatory and compliance challenges across different regions

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Active & Intelligent Packaging Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Active & Intelligent Packaging Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Active & Intelligent Packaging Market Analysis, by Technology Type

- 6.1. Key Segment Analysis

- 6.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology Type, 2021-2035

- 6.2.1. Active Packaging Technologies

- 6.2.1.1. Oxygen Scavengers

- 6.2.1.2. Moisture Absorbers

- 6.2.1.3. Ethylene Absorbers

- 6.2.1.4. Carbon Dioxide Emitters/Absorbers

- 6.2.1.5. Antimicrobial Agents

- 6.2.1.6. Antioxidant Releasers

- 6.2.1.7. Temperature Control Packaging

- 6.2.1.8. Others

- 6.2.2. Intelligent Packaging Technologies

- 6.2.2.1. Time-Temperature Indicators (TTI)

- 6.2.2.2. Freshness Indicators

- 6.2.2.3. Gas Indicators

- 6.2.2.4. RFID Tags

- 6.2.2.5. NFC Tags

- 6.2.2.6. QR Codes

- 6.2.2.7. Biosensors

- 6.2.2.8. pH Indicators

- 6.2.2.9. Others

- 6.2.1. Active Packaging Technologies

- 7. Global Active & Intelligent Packaging Market Analysis, by Material Type

- 7.1. Key Segment Analysis

- 7.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 7.2.1. Polymers

- 7.2.2. Polyethylene (PE)

- 7.2.2.1. Polypropylene (PP)

- 7.2.2.2. Polyethylene Terephthalate (PET)

- 7.2.2.3. Polyvinyl Chloride (PVC)

- 7.2.2.4. Polylactic Acid (PLA)

- 7.2.2.5. Others

- 7.2.3. Paper & Paperboard

- 7.2.4. Metal

- 7.2.4.1. Aluminum

- 7.2.4.2. Tin

- 7.2.4.3. Others

- 7.2.5. Glass

- 7.2.6. Bioplastics

- 7.2.7. Nanomaterials

- 7.2.8. Others

- 8. Global Active & Intelligent Packaging Market Analysis and Forecasts, by Release Mechanism

- 8.1. Key Findings

- 8.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Release Mechanism, 2021-2035

- 8.2.1. Absorber/Scavenger Systems

- 8.2.2. Emitter/Releaser Systems

- 8.2.3. Controlled Release Systems

- 8.2.4. Triggered Release Systems

- 8.2.5. Others

- 9. Global Active & Intelligent Packaging Market Analysis and Forecasts, by Packaging Format

- 9.1. Key Findings

- 9.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Packaging Format, 2021-2035

- 9.2.1. Flexible Packaging

- 9.2.1.1. Pouches

- 9.2.1.2. Bags

- 9.2.1.3. Films

- 9.2.1.4. Wraps

- 9.2.1.5. Others

- 9.2.2. Rigid Packaging

- 9.2.2.1. Bottles

- 9.2.2.2. Jars

- 9.2.2.3. Containers

- 9.2.2.4. Trays

- 9.2.2.5. Boxes

- 9.2.2.6. Others

- 9.2.3. Semi-Rigid Packaging

- 9.2.3.1. Cups

- 9.2.3.2. Tubs

- 9.2.3.3. Clamshells

- 9.2.3.4. Others

- 9.2.1. Flexible Packaging

- 10. Global Active & Intelligent Packaging Market Analysis and Forecasts, by Distribution Channel

- 10.1. Key Findings

- 10.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 10.2.1. Direct Sales

- 10.2.2. Distributors

- 10.2.3. Online Platforms

- 10.2.4. Retail Channels

- 11. Global Active & Intelligent Packaging Market Analysis and Forecasts, by End-Use Industry

- 11.1. Key Findings

- 11.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 11.2.1. Food & Beverages

- 11.2.1.1. Fresh Produce

- 11.2.1.2. Meat, Poultry & Seafood

- 11.2.1.3. Dairy Products

- 11.2.1.4. Bakery & Confectionery

- 11.2.1.5. Beverages

- 11.2.1.6. Ready-to-Eat Meals

- 11.2.1.7. Frozen Foods

- 11.2.1.8. Others

- 11.2.2. Pharmaceuticals

- 11.2.2.1. Prescription Drugs

- 11.2.2.2. Over-the-Counter (OTC) Medications

- 11.2.2.3. Vaccines

- 11.2.2.4. Biologics

- 11.2.2.5. Clinical Trial Materials

- 11.2.2.6. Others

- 11.2.3. Personal Care & Cosmetics

- 11.2.3.1. Skincare Products

- 11.2.3.2. Haircare Products

- 11.2.3.3. Fragrances

- 11.2.3.4. Color Cosmetics

- 11.2.3.5. Others

- 11.2.4. Healthcare & Medical Devices

- 11.2.4.1. Surgical Instruments

- 11.2.4.2. Medical Equipment

- 11.2.4.3. Diagnostic Kits

- 11.2.4.4. Hospital Supplies

- 11.2.4.5. Others

- 11.2.5. Industrial & Chemicals

- 11.2.5.1. Specialty Chemicals

- 11.2.5.2. Lubricants

- 11.2.5.3. Paints & Coatings

- 11.2.5.4. Others

- 11.2.6. Electronics & Consumer Goods

- 11.2.6.1. Electronic Components

- 11.2.6.2. Consumer Electronics

- 11.2.6.3. Batteries

- 11.2.6.4. Others

- 11.2.7. Agriculture

- 11.2.7.1. Seeds

- 11.2.7.2. Fertilizers

- 11.2.7.3. Pesticides

- 11.2.7.4. Others

- 11.2.8. Automotive

- 11.2.8.1. Spare Parts

- 11.2.8.2. Lubricants

- 11.2.8.3. Batteries

- 11.2.8.4. Others

- 11.2.9. Logistics & E-commerce

- 11.2.9.1. Shipping Packages

- 11.2.9.2. Temperature-Sensitive Shipments

- 11.2.9.3. Others

- 11.2.10. Other End-use Industries

- 11.2.1. Food & Beverages

- 12. Global Active & Intelligent Packaging Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Active & Intelligent Packaging Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Technology Type

- 13.3.2. Material Type

- 13.3.3. Release Mechanism

- 13.3.4. Packaging Format

- 13.3.5. Distribution Channel

- 13.3.6. End-Use Industry

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Active & Intelligent Packaging Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Technology Type

- 13.4.3. Material Type

- 13.4.4. Release Mechanism

- 13.4.5. Packaging Format

- 13.4.6. Distribution Channel

- 13.4.7. End-Use Industry

- 13.5. Canada Active & Intelligent Packaging Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Technology Type

- 13.5.3. Material Type

- 13.5.4. Release Mechanism

- 13.5.5. Packaging Format

- 13.5.6. Distribution Channel

- 13.5.7. End-Use Industry

- 13.6. Mexico Active & Intelligent Packaging Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Technology Type

- 13.6.3. Material Type

- 13.6.4. Release Mechanism

- 13.6.5. Packaging Format

- 13.6.6. Distribution Channel

- 13.6.7. End-Use Industry

- 14. Europe Active & Intelligent Packaging Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Technology Type

- 14.3.2. Material Type

- 14.3.3. Release Mechanism

- 14.3.4. Packaging Format

- 14.3.5. Distribution Channel

- 14.3.6. End-Use Industry

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Active & Intelligent Packaging Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Technology Type

- 14.4.3. Material Type

- 14.4.4. Release Mechanism

- 14.4.5. Packaging Format

- 14.4.6. Distribution Channel

- 14.4.7. End-Use Industry

- 14.5. United Kingdom Active & Intelligent Packaging Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Technology Type

- 14.5.3. Material Type

- 14.5.4. Release Mechanism

- 14.5.5. Packaging Format

- 14.5.6. Distribution Channel

- 14.5.7. End-Use Industry

- 14.6. France Active & Intelligent Packaging Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Technology Type

- 14.6.3. Material Type

- 14.6.4. Release Mechanism

- 14.6.5. Packaging Format

- 14.6.6. Distribution Channel

- 14.6.7. End-Use Industry

- 14.7. Italy Active & Intelligent Packaging Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Technology Type

- 14.7.3. Material Type

- 14.7.4. Release Mechanism

- 14.7.5. Packaging Format

- 14.7.6. Distribution Channel

- 14.7.7. End-Use Industry

- 14.8. Spain Active & Intelligent Packaging Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Technology Type

- 14.8.3. Material Type

- 14.8.4. Release Mechanism

- 14.8.5. Packaging Format

- 14.8.6. Distribution Channel

- 14.8.7. End-Use Industry

- 14.9. Netherlands Active & Intelligent Packaging Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Technology Type

- 14.9.3. Material Type

- 14.9.4. Release Mechanism

- 14.9.5. Packaging Format

- 14.9.6. Distribution Channel

- 14.9.7. End-Use Industry

- 14.10. Nordic Countries Active & Intelligent Packaging Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Technology Type

- 14.10.3. Material Type

- 14.10.4. Release Mechanism

- 14.10.5. Packaging Format

- 14.10.6. Distribution Channel

- 14.10.7. End-Use Industry

- 14.11. Poland Active & Intelligent Packaging Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Technology Type

- 14.11.3. Material Type

- 14.11.4. Release Mechanism

- 14.11.5. Packaging Format

- 14.11.6. Distribution Channel

- 14.11.7. End-Use Industry

- 14.12. Russia & CIS Active & Intelligent Packaging Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Technology Type

- 14.12.3. Material Type

- 14.12.4. Release Mechanism

- 14.12.5. Packaging Format

- 14.12.6. Distribution Channel

- 14.12.7. End-Use Industry

- 14.13. Rest of Europe Active & Intelligent Packaging Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Technology Type

- 14.13.3. Material Type

- 14.13.4. Release Mechanism

- 14.13.5. Packaging Format

- 14.13.6. Distribution Channel

- 14.13.7. End-Use Industry

- 15. Asia Pacific Active & Intelligent Packaging Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Technology Type

- 15.3.2. Material Type

- 15.3.3. Release Mechanism

- 15.3.4. Packaging Format

- 15.3.5. Distribution Channel

- 15.3.6. End-Use Industry

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Active & Intelligent Packaging Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Technology Type

- 15.4.3. Material Type

- 15.4.4. Release Mechanism

- 15.4.5. Packaging Format

- 15.4.6. Distribution Channel

- 15.4.7. End-Use Industry

- 15.5. India Active & Intelligent Packaging Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Technology Type

- 15.5.3. Material Type

- 15.5.4. Release Mechanism

- 15.5.5. Packaging Format

- 15.5.6. Distribution Channel

- 15.5.7. End-Use Industry

- 15.5.8. End-use Industry

- 15.6. Japan Active & Intelligent Packaging Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Technology Type

- 15.6.3. Material Type

- 15.6.4. Release Mechanism

- 15.6.5. Packaging Format

- 15.6.6. Distribution Channel

- 15.6.7. End-Use Industry

- 15.7. South Korea Active & Intelligent Packaging Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Technology Type

- 15.7.3. Material Type

- 15.7.4. Release Mechanism

- 15.7.5. Packaging Format

- 15.7.6. Distribution Channel

- 15.7.7. End-Use Industry

- 15.8. Australia and New Zealand Active & Intelligent Packaging Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Technology Type

- 15.8.3. Material Type

- 15.8.4. Release Mechanism

- 15.8.5. Packaging Format

- 15.8.6. Distribution Channel

- 15.8.7. End-Use Industry

- 15.9. Indonesia Active & Intelligent Packaging Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Technology Type

- 15.9.3. Material Type

- 15.9.4. Release Mechanism

- 15.9.5. Packaging Format

- 15.9.6. Distribution Channel

- 15.9.7. End-Use Industry

- 15.10. Malaysia Active & Intelligent Packaging Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Technology Type

- 15.10.3. Material Type

- 15.10.4. Release Mechanism

- 15.10.5. Packaging Format

- 15.10.6. Distribution Channel

- 15.10.7. End-Use Industry

- 15.11. Thailand Active & Intelligent Packaging Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Technology Type

- 15.11.3. Material Type

- 15.11.4. Release Mechanism

- 15.11.5. Packaging Format

- 15.11.6. Distribution Channel

- 15.11.7. End-Use Industry

- 15.12. Vietnam Active & Intelligent Packaging Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Technology Type

- 15.12.3. Material Type

- 15.12.4. Release Mechanism

- 15.12.5. Packaging Format

- 15.12.6. Distribution Channel

- 15.12.7. End-Use Industry

- 15.13. Rest of Asia Pacific Active & Intelligent Packaging Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Technology Type

- 15.13.3. Material Type

- 15.13.4. Release Mechanism

- 15.13.5. Packaging Format

- 15.13.6. Distribution Channel

- 15.13.7. End-Use Industry

- 16. Middle East Active & Intelligent Packaging Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Technology Type

- 16.3.2. Material Type

- 16.3.3. Release Mechanism

- 16.3.4. Packaging Format

- 16.3.5. Distribution Channel

- 16.3.6. End-Use Industry

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Active & Intelligent Packaging Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Technology Type

- 16.4.3. Material Type

- 16.4.4. Release Mechanism

- 16.4.5. Packaging Format

- 16.4.6. Distribution Channel

- 16.4.7. End-Use Industry

- 16.5. UAE Active & Intelligent Packaging Market

- 16.5.1. Technology Type

- 16.5.2. Material Type

- 16.5.3. Release Mechanism

- 16.5.4. Packaging Format

- 16.5.5. Distribution Channel

- 16.5.6. End-Use Industry

- 16.6. Saudi Arabia Active & Intelligent Packaging Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Technology Type

- 16.6.3. Material Type

- 16.6.4. Release Mechanism

- 16.6.5. Packaging Format

- 16.6.6. Distribution Channel

- 16.6.7. End-Use Industry

- 16.7. Israel Active & Intelligent Packaging Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Technology Type

- 16.7.3. Material Type

- 16.7.4. Release Mechanism

- 16.7.5. Packaging Format

- 16.7.6. Distribution Channel

- 16.7.7. End-Use Industry

- 16.8. Rest of Middle East Active & Intelligent Packaging Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Technology Type

- 16.8.3. Material Type

- 16.8.4. Release Mechanism

- 16.8.5. Packaging Format

- 16.8.6. Distribution Channel

- 16.8.7. End-Use Industry

- 17. Africa Active & Intelligent Packaging Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Technology Type

- 17.3.2. Material Type

- 17.3.3. Release Mechanism

- 17.3.4. Packaging Format

- 17.3.5. Distribution Channel

- 17.3.6. End-Use Industry

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Active & Intelligent Packaging Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Technology Type

- 17.4.3. Material Type

- 17.4.4. Release Mechanism

- 17.4.5. Packaging Format

- 17.4.6. Distribution Channel

- 17.4.7. End-Use Industry

- 17.5. Egypt Active & Intelligent Packaging Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Technology Type

- 17.5.3. Material Type

- 17.5.4. Release Mechanism

- 17.5.5. Packaging Format

- 17.5.6. Distribution Channel

- 17.5.7. End-Use Industry

- 17.6. Nigeria Active & Intelligent Packaging Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Technology Type

- 17.6.3. Material Type

- 17.6.4. Release Mechanism

- 17.6.5. Packaging Format

- 17.6.6. Distribution Channel

- 17.6.7. End-Use Industry

- 17.7. Algeria Active & Intelligent Packaging Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Technology Type

- 17.7.3. Material Type

- 17.7.4. Release Mechanism

- 17.7.5. Packaging Format

- 17.7.6. Distribution Channel

- 17.7.7. End-Use Industry

- 17.8. Rest of Africa Active & Intelligent Packaging Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Technology Type

- 17.8.3. Material Type

- 17.8.4. Release Mechanism

- 17.8.5. Packaging Format

- 17.8.6. Distribution Channel

- 17.8.7. End-Use Industry

- 18. South America Active & Intelligent Packaging Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Active & Intelligent Packaging Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Technology Type

- 18.3.2. Material Type

- 18.3.3. Release Mechanism

- 18.3.4. Packaging Format

- 18.3.5. Distribution Channel

- 18.3.6. End-Use Industry

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Active & Intelligent Packaging Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Technology Type

- 18.4.3. Material Type

- 18.4.4. Release Mechanism

- 18.4.5. Packaging Format

- 18.4.6. Distribution Channel

- 18.4.7. End-Use Industry

- 18.5. Argentina Active & Intelligent Packaging Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Technology Type

- 18.5.3. Material Type

- 18.5.4. Release Mechanism

- 18.5.5. Packaging Format

- 18.5.6. Distribution Channel

- 18.5.7. End-Use Industry

- 18.6. Rest of South America Active & Intelligent Packaging Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Technology Type

- 18.6.3. Material Type

- 18.6.4. Release Mechanism

- 18.6.5. Packaging Format

- 18.6.6. Distribution Channel

- 18.6.7. End-Use Industry

- 19. Key Players/ Company Profile

- 19.1. 3M Company

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Amcor plc

- 19.3. Avery Dennison Corporation

- 19.4. Ball Corporation

- 19.5. BASF SE

- 19.6. Bemis Company (Amcor)

- 19.7. Berry Global Inc.

- 19.8. CCL Industries Inc.

- 19.9. Constantia Flexibles Group

- 19.10. Coveris Holdings S.A.

- 19.11. Crown Holdings Inc.

- 19.12. DS Smith plc

- 19.13. Huhtamaki Oyj

- 19.14. Mitsubishi Gas Chemical Company

- 19.15. Mondi Group

- 19.16. Multisorb Technologies

- 19.17. Sealed Air Corporation

- 19.18. Smurfit Kappa Group

- 19.19. Stora Enso Oyj

- 19.20. Tetra Pak International S.A.

- 19.21. WestRock Company

- 19.22. Other Key Players

- 19.1. 3M Company

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation