- The global AI ethics and governance platforms market is valued at USD 1.9 billion in 2025.

- The market is projected to grow at a CAGR of 37.1% during the forecast period of 2026 to 2035.

- The platforms/ suites segment accounts for ~55% of the global AI ethics and governance platforms market in 2025, driven by the growing business need for integrated, comprehensive governance frameworks that consolidate compliance, risk assessment, model supervision, and policy automation within a single scalable setting.

- The AI ethics and governance platforms market is growing as companies implement conformable mechanisms for auditability and compliance that are focused on managing AI risks in large-scale deployments.

- The improvements in automated policy enforcement, bias detection workflows, and lifecycle governance tools are not only making responsible AI operations more robust but also facilitating regulatory alignment.

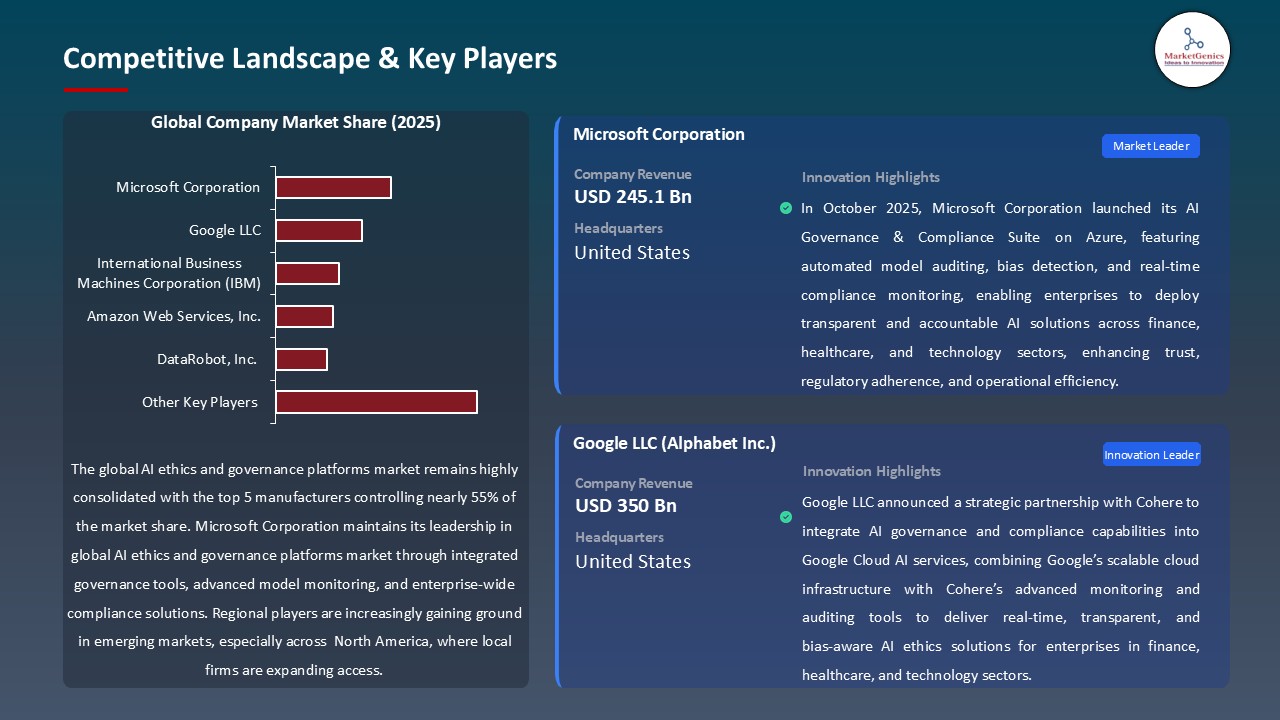

- The global AI-ethics-and-governance-platforms-market is highly consolidated, with the top five players accounting for nearly 55% of the market share in 2025.

- In March 2024, Anthropic unveiled its Claude 3 model family-Haiku, Sonnet, and Opus-artfully created with progressive constitutional AI methods that allow safer reasoning, less hallucination, and better transparency in enterprise applications.

- In May 2024, Google DeepMind launched Gemini 1.5 Pro, boasting a revolutionary long-context window of up to 1 million tokens enabled by a Mixture-of-Experts (MoE) architecture.

- Global AI ethics and governance platforms market is likely to create the total forecasting opportunity of USD 43.4 Bn till 2035

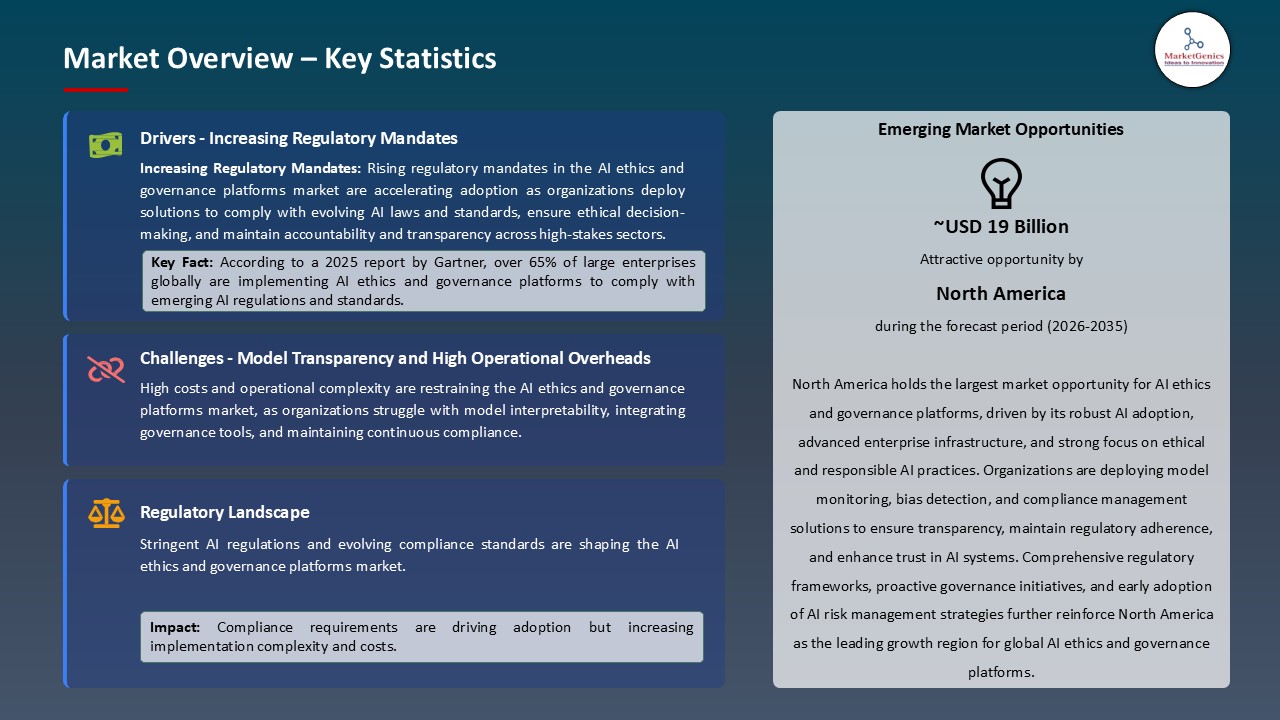

- North America is most attractive region, upheld by solid regulatory activities, enterprise investments in responsible AI, and the fast-paced adoption of governance frameworks across various sectors.

- One of the main reasons why the adoption of AI ethics and governance platforms has been changing globally is because of the global regulatory frameworks such as the EU AI Act (officially adopted in 2024). This act demands transparency, human oversight, and risk control for AI systems; thus, enterprises will be forced to integrate governance tooling into AI lifecycles.

- In the United States, the adoption of the same is further boosted by the White House Executive Order on Safe, Secure, and Trustworthy AI (October 2023) and the NIST AI Risk Management Framework (2023) that request federal agencies and regulated units to proceed with documenting, auditing, and continuously monitoring their AI systems.

- Owing to which, those industries using AI in banking, insurance, public services, healthcare, etc., are progressively committing themselves to the implementation of AI governance instruments to meet the requirements of openness, impartiality, and responsibility, stated in industry frameworks such as ISO/IEC 42001:2023, the first global standard for AI Management System.

- The lack of sufficient model documentation, the inherently opaque nature of deep learning models, and a fragmented MLOps ecosystem resulting in complicated and expensive end-to-end governance challenges exacerbate the efforts to integrate AI governance platforms at organizations.

- Continuous monitoring, red-team testing efforts, fairness evaluations, and dataset governance can only be done through dedicated technical teams and infrastructure investments, which many mid-size enterprises are not in a good position to undertake yet.

- Compliance requirements stemming from different jurisdictional requirements - EU, U.S., Canada, Singapore, and the UK - complicate things because organizations are having to work to align with different regulatory expectations and sector-specific audit requirements.

- The implementation of ISO/IEC 42001, OECD AI Principles, and sectoral certifications (e.g., financial-services model risk standards) is attracting platform vendors that provide audit automation, policy-mapping, and lifecycle documentation solutions to exploit this new space. Authorities are speeding up the responsible AI transformation.

- Attributed to which, Canada's Directive on Automated Decision-Making, Singapore's Model AI Governance Framework, and the UK's AI Regulation White Paper have encouraged public agencies to implement structured AI oversight, thus creating a fresh demand for governance platform providers.

- Further, the demand for cross-border assurance, ethical-AI reporting, and stringent dataset governance is a source of new-business potential for those platforms that feature dataset lineage tracking, bias reduction tooling, and structured transparency reporting.

- AI ethics and governance toolkits are increasingly integrating several features of explainable AI (XAI) engines, automated model-risk scoring, and policy-driven guardrails based on frameworks like the NIST AI RMF and EU AI Act compliance assessment requirements. Organizations are developing real-time compliance, largely by leveraging automated drift detection, adversarial testing tools, and human-in-the-loop verification systems to ensure the on-going trustworthiness of AI models throughout their lifecycle.

- Cloud providers, such as Microsoft, Google, AWS, and IBM, continue to incorporate responsible-AI toolkits in their ML platforms that support fairness assessments, transparency dashboards, dataset governance, and regulatory reporting, while steering a wider organization shift toward governance-by-design frameworks.

- Various criteria enterprises in the sectors of finance, healthcare, and public administration are progressively implementing full AI governance suites to handle model transparency, fairness assessment, and automated documentation. In pursuit of this, Microsoft, for instance, in the year 2024, broadened its Responsible AI Toolkit within Azure AI to facilitate the organizations in operationalizing transparency, model interpretability, and risk mitigation in production AI workflows.

- The integration of AI governance SDKs, model-monitoring APIs, and bias-detection libraries has opened up new possibilities in explainability, drift detection, and data-provenance tracking at a much faster pace. To meet the requirements of large-scale AI deployments and at the same time improve audit readiness, big enterprises such as IBM and Google are progressing the on-platform governance controls–model cards, lineage tracing, and automated testing–by offering them as a service.

- The introduction of responsible AI features by means of regulatory frameworks like the EU AI Act (2024) and the NIST AI Risk Management Framework (2023) is a big push towards the establishment of platforms that unify documentation, risk scoring, and lifecycle governance. Due to these regulations, organizations have started using governance suites extensively for compliance management, impact assessment, and cross-border AI assurance.

- With the help of scalable AI governance platforms, developers, risk teams, and compliance officers are now in a position to quickly execute accountability measures in different AI models. The existence of contemporary suites as primary layers which make it possible to have transparent, compliant, and ethically aligned AI ecosystems worldwide is exemplified by the offerings from Fiddler AI, Arthur AI, and DataRobot.

- North America is a front-runner in the AI ethics and governance platforms market, upheld by solid regulatory activities, enterprise investments in responsible AI, and the fast-paced adoption of governance frameworks across various sectors. The U.S. National Institute of Standards and Technology (NIST) energized this trend by its AI Risk Management Framework (AI RMF 1.0) release in January 2023. The document defined nationwide standards for transparency, accountability, and risk mitigation and, therefore, led to the tooling used in governance widely being embraced by the organizations.

- The cross-sector collaboration has been a great factor in North America’s leadership position. Among others, the U.S. AI Safety Institute (founded 2024), Microsoft, IBM, Google, and big research labs cooperate on model evaluation, monitoring standards, and safety benchmarks to secure and facilitate the responsible deployment of AI in those industries that are most critical.

- The Canadian government is still in the process of enacting Bill C-27 (AIDA), which will govern high-impact AI systems. The Standards Council of Canada (SCC) and the Digital Governance Council (DGC) are also in the process of developing national standards for AI governance, safety validation, and algorithmic accountability. By staying the course with funding for model monitoring, fairness assessment, and compliance platforms, the U.S. and Canada reinforce their leadership position for responsible AI, and North America becomes a destination for transparent and trustworthy AI governing of ecosystems.

- In March 2024, Anthropic unveiled its Claude 3 model family-Haiku, Sonnet, and Opus-artfully created with progressive constitutional AI methods that allow safer reasoning, less hallucination, and better transparency in enterprise applications. The models achieve cutting-edge results in multilingual understanding, long-context processing, and real-time decision support, thus facilitating trust, safety, and auditability in LLM deployments in the regulated sectors.

- In May 2024, Google DeepMind launched Gemini 1.5 Pro, boasting a revolutionary long-context window of up to 1 million tokens enabled by a Mixture-of-Experts (MoE) architecture. This progression makes it possible to smoothly input large documents, codebases, and multi-modal inputs in a single prompt which in turn elevates cross-domain reasoning, lessens the need for retrieval systems, and opens the way for high-accuracy workflows in research, enterprise automation, and scientific computing.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Accenture plc

- Alation, Inc.

- Amazon Web Services, Inc

- Arthur AI, Inc.

- BigID, Inc.

- Collibra, Inc.

- Immuta, Inc.

- Privacera, Inc.

- DataRobot, Inc.

- Deloitte LLP

- Ernst & Young Global Limited (EY)

- Fiddler AI, Inc.

- Google LLC

- H2O.ai, Inc.

- IBM Corporation

- Microsoft Corporation

- OneTrust, LLC

- PricewaterhouseCoopers (PwC)

- Securiti.ai, Inc.

- Truera, Inc.

- Others Key Players

- Platforms/ Suites

- Comprehensive AI Governance Suites

- Responsible AI Management Platforms

- End-to-End Model Governance Frameworks

- Policy Enforcement and Compliance Platforms

- Others

- Tools & Modules

- Bias Detection and Mitigation Tools

- Explainability and Transparency Modules

- Model Monitoring and Drift Detection Tools

- Audit Trail and Accountability Tools

- Fairness Assessment and Evaluation Modules

- Risk Scoring and Impact Analysis Tools

- Others

- Services

- Professional Services

- Implementation and Integration Services

- Consulting and Advisory Services

- AI Ethics Framework Development Services

- Customization and System Configuration Services

- Others

- Managed Services

- Continuous Model Governance Management

- Policy Compliance and Audit Support

- Managed Data Privacy and Security Services

- Ongoing Ethical Risk Monitoring and Maintenance

- Others

- Training & Certification Services

- AI Ethics and Governance Training Programs

- Responsible AI Certification Courses

- Employee Awareness and Compliance Workshops

- Custom Corporate Training Programs

- Others

- Cloud-Based

- On-Premises

- Hybrid

- MLOps / CI-CD Pipeline Integration

- Data Lake / Data Warehouse Integration

- Model Registry & Metadata Integration

- API & SDK Integrations

- Others

- Text / LLM Governance

- Computer Vision Model Governance

- Tabular / Structured Model Governance

- Multimodal Model Governance

- Streaming / Real-time Data Models

- Others

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Public Sector / Government Agencies

- Responsible AI for Customer-facing Models

- Internal Decisioning & Credit Scoring Governance

- Clinical & Healthcare Model Governance

- Automated Hiring & HR Decision Governance

- Regulatory Reporting & Compliance

- Others

- Banking, Financial Services & Insurance (BFSI)

- Healthcare & Life Sciences

- Government & Public Sector

- Retail & Consumer Goods

- Technology & Telecommunications

- Manufacturing

- Energy & Utilities

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global AI Ethics and Governance Platforms Market Outlook

- 2.1.1. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global AI Ethics and Governance Platforms Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for transparent, accountable, and ethically compliant AI systems

- 4.1.1.2. Growing adoption of AI ethics and governance platforms across finance, healthcare, and technology sectors

- 4.1.1.3. Increasing regulatory requirements for AI risk management, compliance, and bias mitigation

- 4.1.2. Restraints

- 4.1.2.1. High implementation and integration costs of AI ethics and governance platforms

- 4.1.2.2. Challenges in integrating governance tools with legacy AI models and existing IT infrastructures

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Data Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Secure Enterprise Communication Networks Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global AI Ethics and Governance Platforms Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global AI Ethics and Governance Platforms Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Platforms/ Suites

- 6.2.1.1. Comprehensive AI Governance Suites

- 6.2.1.2. Responsible AI Management Platforms

- 6.2.1.3. End-to-End Model Governance Frameworks

- 6.2.1.4. Policy Enforcement and Compliance Platforms

- 6.2.1.5. Others

- 6.2.2. Tools & Modules

- 6.2.2.1. Bias Detection and Mitigation Tools

- 6.2.2.2. Explainability and Transparency Modules

- 6.2.2.3. Model Monitoring and Drift Detection Tools

- 6.2.2.4. Audit Trail and Accountability Tools

- 6.2.2.5. Fairness Assessment and Evaluation Modules

- 6.2.2.6. Risk Scoring and Impact Analysis Tools

- 6.2.2.7. Others

- 6.2.3. Services

- 6.2.3.1. Professional Services

- 6.2.3.1.1. Implementation and Integration Services

- 6.2.3.1.2. Consulting and Advisory Services

- 6.2.3.1.3. AI Ethics Framework Development Services

- 6.2.3.1.4. Customization and System Configuration Services

- 6.2.3.1.5. Others

- 6.2.3.2. Managed Services

- 6.2.3.2.1. Continuous Model Governance Management

- 6.2.3.2.2. Policy Compliance and Audit Support

- 6.2.3.2.3. Managed Data Privacy and Security Services

- 6.2.3.2.4. Ongoing Ethical Risk Monitoring and Maintenance

- 6.2.3.2.5. Others

- 6.2.3.3. Training & Certification Services

- 6.2.3.3.1. AI Ethics and Governance Training Programs

- 6.2.3.3.2. Responsible AI Certification Courses

- 6.2.3.3.3. Employee Awareness and Compliance Workshops

- 6.2.3.3.4. Custom Corporate Training Programs

- 6.2.3.3.5. Others

- 6.2.3.1. Professional Services

- 6.2.1. Platforms/ Suites

- 7. Global AI Ethics and Governance Platforms Market Analysis, by Deployment Mode

- 7.1. Key Segment Analysis

- 7.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.2.3. Hybrid

- 8. Global AI Ethics and Governance Platforms Market Analysis, by Integration & Interoperability

- 8.1. Key Segment Analysis

- 8.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Integration & Interoperability, 2021-2035

- 8.2.1. MLOps / CI-CD Pipeline Integration

- 8.2.2. Data Lake / Data Warehouse Integration

- 8.2.3. Model Registry & Metadata Integration

- 8.2.4. API & SDK Integrations

- 8.2.5. Others

- 9. Global AI Ethics and Governance Platforms Market Analysis, by Model Type / Data Type Supported

- 9.1. Key Segment Analysis

- 9.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Model Type / Data Type Supported, 2021-2035

- 9.2.1. Text / LLM Governance

- 9.2.2. Computer Vision Model Governance

- 9.2.3. Tabular / Structured Model Governance

- 9.2.4. Multimodal Model Governance

- 9.2.5. Streaming / Real-time Data Models

- 9.2.6. Others

- 10. Global AI Ethics and Governance Platforms Market Analysis, by Enterprise Size

- 10.1. Key Segment Analysis

- 10.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium Enterprises (SMEs)

- 10.2.3. Public Sector / Government Agencies

- 11. Global AI Ethics and Governance Platforms Market Analysis, by Use Case / Application

- 11.1. Key Segment Analysis

- 11.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Use Case / Application, 2021-2035

- 11.2.1. Responsible AI for Customer-facing Models

- 11.2.2. Internal Decisioning & Credit Scoring Governance

- 11.2.3. Clinical & Healthcare Model Governance

- 11.2.4. Automated Hiring & HR Decision Governance

- 11.2.5. Regulatory Reporting & Compliance

- 11.2.6. Others

- 12. Global AI Ethics and Governance Platforms Market Analysis, by Industry Vertical

- 12.1. Key Segment Analysis

- 12.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 12.2.1. Banking, Financial Services & Insurance (BFSI)

- 12.2.2. Healthcare & Life Sciences

- 12.2.3. Government & Public Sector

- 12.2.4. Retail & Consumer Goods

- 12.2.5. Technology & Telecommunications

- 12.2.6. Manufacturing

- 12.2.7. Energy & Utilities

- 12.2.8. Others

- 13. Global AI Ethics and Governance Platforms Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America AI Ethics and Governance Platforms Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America AI Ethics and Governance Platforms Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Deployment Mode

- 14.3.3. Integration & Interoperability

- 14.3.4. Model/ Data Type Supported

- 14.3.5. Enterprise Size

- 14.3.6. Use Case / Application

- 14.3.7. Industry Vertical

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA AI Ethics and Governance Platforms Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Deployment Mode

- 14.4.4. Integration & Interoperability

- 14.4.5. Model / Data Type Supported

- 14.4.6. Enterprise Size

- 14.4.7. Use Case / Application

- 14.4.8. Industry Vertical

- 14.5. Canada AI Ethics and Governance Platforms Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Deployment Mode

- 14.5.4. Integration & Interoperability

- 14.5.5. Model / Data Type Supported

- 14.5.6. Enterprise Size

- 14.5.7. Use Case / Application

- 14.5.8. Industry Vertical

- 14.6. Mexico AI Ethics and Governance Platforms Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Deployment Mode

- 14.6.4. Integration & Interoperability

- 14.6.5. Model / Data Type Supported

- 14.6.6. Enterprise Size

- 14.6.7. Use Case / Application

- 14.6.8. Industry Vertical

- 15. Europe AI Ethics and Governance Platforms Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Deployment Mode

- 15.3.3. Integration & Interoperability

- 15.3.4. Model / Data Type Supported

- 15.3.5. Enterprise Size

- 15.3.6. Use Case / Application

- 15.3.7. Industry Vertical

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany AI Ethics and Governance Platforms Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Deployment Mode

- 15.4.4. Integration & Interoperability

- 15.4.5. Model / Data Type Supported

- 15.4.6. Enterprise Size

- 15.4.7. Use Case / Application

- 15.4.8. Industry Vertical

- 15.5. United Kingdom AI Ethics and Governance Platforms Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Deployment Mode

- 15.5.4. Integration & Interoperability

- 15.5.5. Model / Data Type Supported

- 15.5.6. Enterprise Size

- 15.5.7. Use Case / Application

- 15.5.8. Industry Vertical

- 15.6. France AI Ethics and Governance Platforms Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Deployment Mode

- 15.6.4. Integration & Interoperability

- 15.6.5. Model / Data Type Supported

- 15.6.6. Enterprise Size

- 15.6.7. Use Case / Application

- 15.6.8. Industry Vertical

- 15.7. Italy AI Ethics and Governance Platforms Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Deployment Mode

- 15.7.4. Integration & Interoperability

- 15.7.5. Model / Data Type Supported

- 15.7.6. Enterprise Size

- 15.7.7. Use Case / Application

- 15.7.8. Industry Vertical

- 15.8. Spain AI Ethics and Governance Platforms Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Deployment Mode

- 15.8.4. Integration & Interoperability

- 15.8.5. Model / Data Type Supported

- 15.8.6. Enterprise Size

- 15.8.7. Use Case / Application

- 15.8.8. Industry Vertical

- 15.9. Netherlands AI Ethics and Governance Platforms Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Deployment Mode

- 15.9.4. Integration & Interoperability

- 15.9.5. Model / Data Type Supported

- 15.9.6. Enterprise Size

- 15.9.7. Use Case / Application

- 15.9.8. Industry Vertical

- 15.10. Nordic Countries AI Ethics and Governance Platforms Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Deployment Mode

- 15.10.4. Integration & Interoperability

- 15.10.5. Model / Data Type Supported

- 15.10.6. Enterprise Size

- 15.10.7. Use Case / Application

- 15.10.8. Industry Vertical

- 15.11. Poland AI Ethics and Governance Platforms Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Deployment Mode

- 15.11.4. Integration & Interoperability

- 15.11.5. Model / Data Type Supported

- 15.11.6. Enterprise Size

- 15.11.7. Use Case / Application

- 15.11.8. Industry Vertical

- 15.12. Russia & CIS AI Ethics and Governance Platforms Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Deployment Mode

- 15.12.4. Integration & Interoperability

- 15.12.5. Model / Data Type Supported

- 15.12.6. Enterprise Size

- 15.12.7. Use Case / Application

- 15.12.8. Industry Vertical

- 15.13. Rest of Europe AI Ethics and Governance Platforms Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Deployment Mode

- 15.13.4. Integration & Interoperability

- 15.13.5. Model / Data Type Supported

- 15.13.6. Enterprise Size

- 15.13.7. Use Case / Application

- 15.13.8. Industry Vertical

- 16. Asia Pacific AI Ethics and Governance Platforms Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Deployment Mode

- 16.3.3. Integration & Interoperability

- 16.3.4. Model / Data Type Supported

- 16.3.5. Enterprise Size

- 16.3.6. Use Case / Application

- 16.3.7. Industry Vertical

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China AI Ethics and Governance Platforms Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Deployment Mode

- 16.4.4. Integration & Interoperability

- 16.4.5. Model / Data Type Supported

- 16.4.6. Enterprise Size

- 16.4.7. Use Case / Application

- 16.4.8. Industry Vertical

- 16.5. India AI Ethics and Governance Platforms Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Deployment Mode

- 16.5.4. Integration & Interoperability

- 16.5.5. Model / Data Type Supported

- 16.5.6. Enterprise Size

- 16.5.7. Use Case / Application

- 16.5.8. Industry Vertical

- 16.6. Japan AI Ethics and Governance Platforms Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Deployment Mode

- 16.6.4. Integration & Interoperability

- 16.6.5. Model / Data Type Supported

- 16.6.6. Enterprise Size

- 16.6.7. Use Case / Application

- 16.6.8. Industry Vertical

- 16.7. South Korea AI Ethics and Governance Platforms Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Deployment Mode

- 16.7.4. Integration & Interoperability

- 16.7.5. Model / Data Type Supported

- 16.7.6. Enterprise Size

- 16.7.7. Use Case / Application

- 16.7.8. Industry Vertical

- 16.8. Australia and New Zealand AI Ethics and Governance Platforms Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Deployment Mode

- 16.8.4. Integration & Interoperability

- 16.8.5. Model / Data Type Supported

- 16.8.6. Enterprise Size

- 16.8.7. Use Case / Application

- 16.8.8. Industry Vertical

- 16.9. Indonesia AI Ethics and Governance Platforms Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Deployment Mode

- 16.9.4. Integration & Interoperability

- 16.9.5. Model / Data Type Supported

- 16.9.6. Enterprise Size

- 16.9.7. Use Case / Application

- 16.9.8. Industry Vertical

- 16.10. Malaysia AI Ethics and Governance Platforms Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Deployment Mode

- 16.10.4. Integration & Interoperability

- 16.10.5. Model / Data Type Supported

- 16.10.6. Enterprise Size

- 16.10.7. Use Case / Application

- 16.10.8. Industry Vertical

- 16.11. Thailand AI Ethics and Governance Platforms Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Deployment Mode

- 16.11.4. Integration & Interoperability

- 16.11.5. Model / Data Type Supported

- 16.11.6. Enterprise Size

- 16.11.7. Use Case / Application

- 16.11.8. Industry Vertical

- 16.12. Vietnam AI Ethics and Governance Platforms Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Deployment Mode

- 16.12.4. Integration & Interoperability

- 16.12.5. Model / Data Type Supported

- 16.12.6. Enterprise Size

- 16.12.7. Use Case / Application

- 16.12.8. Industry Vertical

- 16.13. Rest of Asia Pacific AI Ethics and Governance Platforms Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Deployment Mode

- 16.13.4. Integration & Interoperability

- 16.13.5. Model / Data Type Supported

- 16.13.6. Enterprise Size

- 16.13.7. Use Case / Application

- 16.13.8. Industry Vertical

- 17. Middle East AI Ethics and Governance Platforms Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Deployment Mode

- 17.3.3. Integration & Interoperability

- 17.3.4. Model / Data Type Supported

- 17.3.5. Enterprise Size

- 17.3.6. Use Case / Application

- 17.3.7. Industry Vertical

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey AI Ethics and Governance Platforms Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Deployment Mode

- 17.4.4. Integration & Interoperability

- 17.4.5. Model / Data Type Supported

- 17.4.6. Enterprise Size

- 17.4.7. Use Case / Application

- 17.4.8. Industry Vertical

- 17.5. UAE AI Ethics and Governance Platforms Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Deployment Mode

- 17.5.4. Integration & Interoperability

- 17.5.5. Model / Data Type Supported

- 17.5.6. Enterprise Size

- 17.5.7. Use Case / Application

- 17.6. Industry Vertical Saudi Arabia AI Ethics and Governance Platforms Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Deployment Mode

- 17.6.4. Integration & Interoperability

- 17.6.5. Model / Data Type Supported

- 17.6.6. Enterprise Size

- 17.6.7. Use Case / Application

- 17.6.8. Industry Vertical

- 17.7. Israel AI Ethics and Governance Platforms Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Deployment Mode

- 17.7.4. Integration & Interoperability

- 17.7.5. Model / Data Type Supported

- 17.7.6. Enterprise Size

- 17.7.7. Use Case / Application

- 17.7.8. Industry Vertical

- 17.8. Rest of Middle East AI Ethics and Governance Platforms Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Deployment Mode

- 17.8.4. Integration & Interoperability

- 17.8.5. Model / Data Type Supported

- 17.8.6. Enterprise Size

- 17.8.7. Use Case / Application

- 17.8.8. Industry Vertical

- 18. Africa AI Ethics and Governance Platforms Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Deployment Mode

- 18.3.3. Integration & Interoperability

- 18.3.4. Model / Data Type Supported

- 18.3.5. Enterprise Size

- 18.3.6. Use Case / Application

- 18.3.7. Industry Vertical

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa AI Ethics and Governance Platforms Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Deployment Mode

- 18.4.4. Integration & Interoperability

- 18.4.5. Model / Data Type Supported

- 18.4.6. Enterprise Size

- 18.4.7. Use Case / Application

- 18.4.8. Industry Vertical

- 18.5. Egypt AI Ethics and Governance Platforms Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Deployment Mode

- 18.5.4. Integration & Interoperability

- 18.5.5. Model / Data Type Supported

- 18.5.6. Enterprise Size

- 18.5.7. Use Case / Application

- 18.5.8. Industry Vertical

- 18.6. Nigeria AI Ethics and Governance Platforms Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Deployment Mode

- 18.6.4. Integration & Interoperability

- 18.6.5. Model / Data Type Supported

- 18.6.6. Enterprise Size

- 18.6.7. Use Case / Application

- 18.6.8. Industry Vertical

- 18.7. Algeria AI Ethics and Governance Platforms Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Deployment Mode

- 18.7.4. Integration & Interoperability

- 18.7.5. Model / Data Type Supported

- 18.7.6. Enterprise Size

- 18.7.7. Use Case / Application

- 18.7.8. Industry Vertical

- 18.8. Rest of Africa AI Ethics and Governance Platforms Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Deployment Mode

- 18.8.4. Integration & Interoperability

- 18.8.5. Model / Data Type Supported

- 18.8.6. Enterprise Size

- 18.8.7. Use Case / Application

- 18.8.8. Industry Vertical

- 19. South America AI Ethics and Governance Platforms Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America AI Ethics and Governance Platforms Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Deployment Mode

- 19.3.3. Integration & Interoperability

- 19.3.4. Model / Data Type Supported

- 19.3.5. Enterprise Size

- 19.3.6. Use Case / Application

- 19.3.7. Industry Vertical

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil AI Ethics and Governance Platforms Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Deployment Mode

- 19.4.4. Integration & Interoperability

- 19.4.5. Model / Data Type Supported

- 19.4.6. Enterprise Size

- 19.4.7. Use Case / Application

- 19.4.8. Industry Vertical

- 19.5. Argentina AI Ethics and Governance Platforms Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Deployment Mode

- 19.5.4. Integration & Interoperability

- 19.5.5. Model / Data Type Supported

- 19.5.6. Enterprise Size

- 19.5.7. Use Case / Application

- 19.5.8. Industry Vertical

- 19.6. Rest of South America AI Ethics and Governance Platforms Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Deployment Mode

- 19.6.4. Integration & Interoperability

- 19.6.5. Model / Data Type Supported

- 19.6.6. Enterprise Size

- 19.6.7. Use Case / Application

- 19.6.8. Industry Vertical

- 20. Key Players/ Company Profile

- 20.1. Accenture plc

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Alation, Inc.

- 20.3. Amazon Web Services, Inc

- 20.4. Arthur AI, Inc.

- 20.5. BigID, Inc.

- 20.6. Collibra, Inc.

- 20.7. DataRobot, Inc.

- 20.8. Deloitte LLP

- 20.9. Ernst & Young Global Limited (EY)

- 20.10. Fiddler AI, Inc.

- 20.11. Google LLC

- 20.12. H2O.ai, Inc.

- 20.13. IBM Corporation

- 20.14. Immuta, Inc.

- 20.15. Microsoft Corporation

- 20.16. OneTrust, LLC

- 20.17. PricewaterhouseCoopers (PwC)

- 20.18. Privacera, Inc.

- 20.19. Securiti.ai, Inc.

- 20.20. Truera, Inc.

- 20.21. Others Key Players

- 20.1. Accenture plc

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

AI Ethics and Governance Platforms Market by Component, Deployment Mode, Integration & Interoperability, Model / Data Type Supported, Enterprise Size, Use Case / Application, Application, Industry Vertical and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

AI Ethics and Governance Platforms Market Size, Share & Trends Analysis Report by Component (Platforms/ Suites, Tools & Modules and Services), Deployment Mode, Integration & Interoperability, Model / Data Type Supported, Enterprise Size, Use Case / Application, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

AI Ethics And Governance Platforms Market Size, Share, and Growth

The global AI ethics and governance platforms market is experiencing robust growth, with its estimated value of USD 1.9 billion in the year 2025 and USD 45.3 billion by the period 2035, registering a CAGR of 37.1% during the forecast period. The AI ethics and governance platforms market is undergoing a significant growth worldwide. This is largely due to the imposition of stringent regulatory mandates, increased organizational accountability, and the rising preference for trustworthy AI practices by organizations.

"Ethics and an empathetic framework for AI design are the most vital elements without which the whole next step of the AI journey would be meaningless," said Satya Nadella, CEO of Microsoft. His point goes to show that the demand for AI ethics and governance frameworks is rapidly increasing to be able to provide these features to different industries that have to be handled carefully, to ensure transparency in the way the model behaves, to have an appropriate supervision and trustworthy deployment.

One of the major accelerators has been the enactment of the EU AI Act which was formally approved in 2024 and, thus, established the world's first comprehensive legal framework for managing AI risks. This has been a major driver for companies to deploy platforms that ensure transparency, model documentation, bias mitigation, and regulatory reporting.

Government and institutional initiatives are creating the momentum for the adoption of standardized governance processes. The U.S. National Institute of Standards and Technology (NIST) unveiled the AI Risk Management Framework (AI RMF 1.0) in January 2023, which is a globally recognized guidance for implementing measurable controls regarding fairness, accountability, and explainability. This framework has been instrumental in increasing the demand for governance platforms that feature risk assessments and monitoring capabilities as part of their functionalities.

Additionally, the release of ISO/IEC 42001 in December 2023-the first global standard for AI management systems-has been the major factor behind enterprise purchases of audit-ready governance suites. These suites currently provide adjacent opportunities such as model monitoring tools, policy automation software, explainable AI systems, compliance documentation solutions, algorithmic auditing services, and ethics training modules.

AI Ethics and Governance Platforms Market Dynamics and Trends

Driver: Increasing Regulatory Mandates Driving Adoption of AI Ethics & Governance Platforms

Restraint: Model Transparency Challenges and High Operational Overheads Limiting Widespread Awareness

Opportunity: Standardization, Responsible AI Certification, and Public-Sector Modernization Supporting the Future of AI Ethics and Governance Platforms Market

Key Trend: Convergence of Explainability, Policy Automation & Continuous Assurance

AI Ethics and Governance Platforms Market Analysis and Segmental Data

“Platforms/ Suites Dominates Global AI Ethics and Governance Platforms Market amid Rising Demand for Integrated, End-to-End Responsible AI Compliance Frameworks"

“North American Dominancy in Leads AI Ethics and Governance Platforms Market "

AI-Ethics-and-Governance-Platforms-Market Ecosystem

The AI ethics & governance platforms market is witnessing a highly consolidation, where the top-tier companies like IBM, Microsoft, Amazon Web Services (AWS), DataRobot, Fiddler AI, and Truera are mainly setting the pace. They outshine in the competition by employing advanced model-risk assessment, explainability tools, and real-time compliance workflows. The key to their success is an integrated, scalable set of governance tools that combine auditability, monitoring, and policy enforcement.

Major vendors concentrate on small segments of the market: for example, Fiddler AI offers concept-drift detection and root cause analysis, Truera is engaged in bias and fairness scoring, DataRobot embeds model documentation and transparency in its AutoML pipelines, and AWS provides model explainability and bias detection through its SageMaker Clarify. These specialized instruments serve as the main drivers of innovation in responsible AI. NIST published its AI Risk Management Framework (AI RMF 1.0) in January 2023. This is a non-binding structure that helps organizations govern AI systems through functions like "govern, map, measure, manage".

The enterprises have already been using this framework for their deployments of governance platforms. Top players are extending their product lines to keep their market positions. For instance, Microsoft, IBM, and AWS provide governance modules integrated with their cloud-native AI stacks, whereas DataRobot and Fiddler are implementing drift-detection, compliance reporting, and explainability into a single risk-monitoring solution that enhances operational efficiency and reduces the manual audit burden.

Recent Development and Strategic Overview:

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.9 Bn |

|

Market Forecast Value in 2035 |

USD 45.3 Bn |

|

Growth Rate (CAGR) |

37.1% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

AI-Ethics-and-Governance-Platforms-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

AI Ethics and Governance Platforms Market, By Component |

|

|

AI Ethics and Governance Platforms Market, By Deployment Mode |

|

|

AI Ethics and Governance Platforms Market, By Integration & Interoperability |

|

|

AI Ethics and Governance Platforms Market, By Model / Data Type Supported |

|

|

AI Ethics and Governance Platforms Market, By Enterprise Size |

|

|

AI Ethics and Governance Platforms Market, By Use Case / Application |

|

|

AI Ethics and Governance Platforms Market, By Industry Vertical |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation