Autonomous Ships Market Size, Share, Growth Opportunity Analysis Report by Level of Autonomy (Partially Autonomous, Remotely Operated and Fully Autonomous); Solution, Ship Type, Installation, Propulsion and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Autonomous Ships Market Size, Share, and Growth

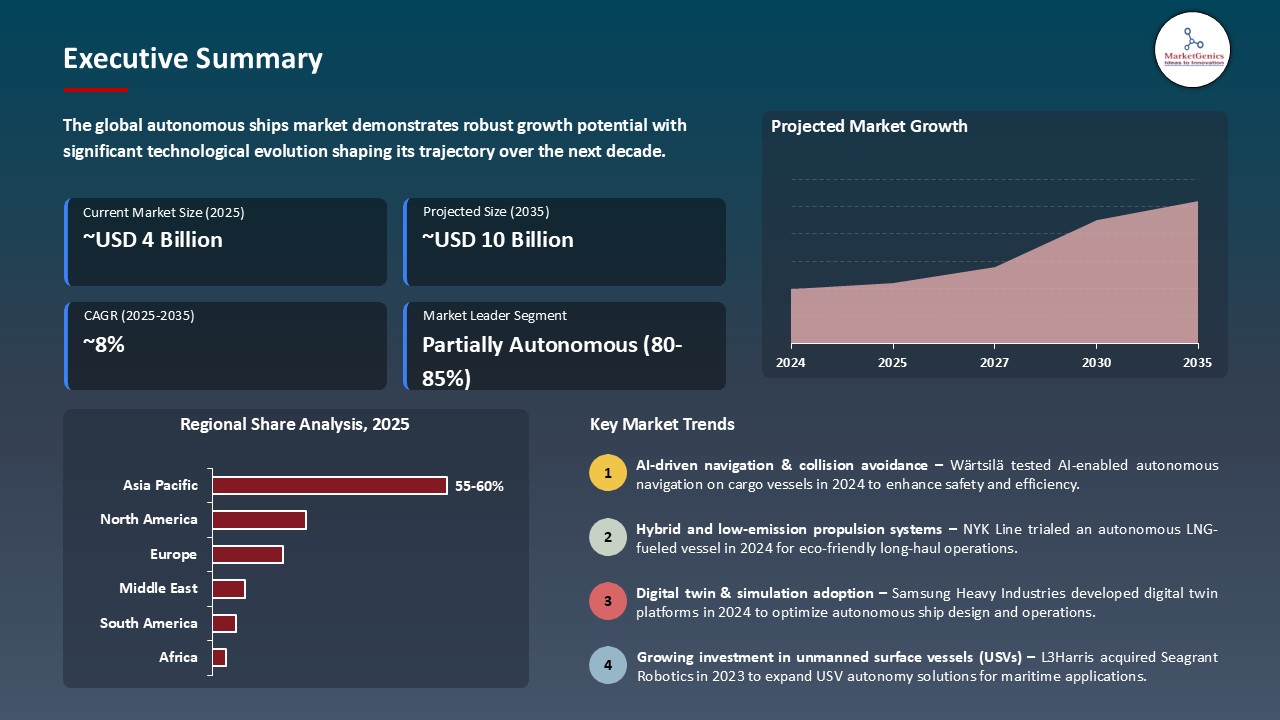

The worldwide autonomous ships market is expanding from USD 4.5 billion in 2024 to USD 10.8 billion by the year 2035, showing a CAGR of 8.2% over the forecast period. In the pursuit of showcasing supremacy in maritime measures, the defense domain greatly contributes to the autonomous ships market. To accomplish tasks considered too dangerous or dull for human crews, top defense contractors have taken upon themselves to create unmanned surface vessels.

"The U.S.-based maritime autonomy company Saronic Technologies closed Series C funding at $600 million, which raised its valuation to $4 billion. Having this great funding in hand has allowed the company to build Port Alpha, a next-generation shipyard that will enable it to produce autonomous surface vessels at an unprecedented scale. According to Saronic, their ASV name-dropped Corsair is a 24-foot vessel with a modular design, the highest application of advanced AI for full mission-level autonomy, and has a distance of 1,000 nautical miles. This makes Saronic a big name in meeting the U.S. Navy's hybrid fleet needs that consist of crewed and uncrewed vessels."

For instance, BAE Systems' P-38, equipped with the Autonomous Systems N-automate, is conducting sea trials to autonomously carry out border patrol and anti-piracy operations. At the same time, the mine-hunting USVs developed by Thales aim to neutralize naval mines faster, safer, and more efficiently than conventional means. This showcases one more example of how the defense sector has until now been speeding up the development of autonomous maritime technology.

Sensor systems for marine diagnostics of the best situational awareness; satellite communication systems providing real-time remote control of vessels; and maritime cybersecurity solutions tackling increasing digital vulnerabilities form the neighboring markets affording growth potentials to the global autonomous ship market, with technology overlap extending into the Automotive Sensors. They share a common need for technology and infrastructure. These allied markets contribute to the acceptance of autonomous ships by rendering maritime operations safer, smarter, and more connected.

Autonomous Ships Market Dynamics and Trends

Driver: Defense Sector's Pursuit of Autonomous Vessels

- As the emphasis on upscaling maritime capabilities in the defense industry grows, the autonomous ship market sees increasing demand. USVs are designed in the U.S. by major defense contractors to perform missions deemed too hazardous or mundane for human crews. For example, BAE Systems' P-38, fitted with the "Nautomate" system, is undergoing trials at sea to carry out autonomous border patrol and antipiracy operations.

- Similarly, mine-hunting USVs are being developed by Thales for safer and more efficient naval mine detection and neutralization than traditional means. These developments hence support the defense industry in the forefront of autonomous maritime technologies.

Driver: Environmental Regulations and Sustainability Goals

- Due to strict environmental regulations and the global drive toward sustainable shipping activities, autonomous vessels are being set into transacting and service. Autonomous ships, especially electric or hybrids, are less pollutant, also more fuel efficient. In an amended strategy by the International Maritime Organization, the net-zero ship emission scenario is targeted by 2050, thereby urging the manufacturers to initiate innovations.

- Seadronix, for example, launched AI-based platform in April 2024 to convert conventional vessels into smart ships, hence improving operational efficiency and environmental compliance.

Restraint: Regulatory Uncertainty and Legal Frameworks

- The development of autonomous ships would suffer a significant hindrance in the absence of adequate international regulation and legislation pertaining to these vessels. The issues of liability in the event of accidents, the compliance of the autonomous vessel with maritime laws, or its interface in the present traffic system remain very nice areas of argument.

- On the other hand, while the International Maritime Organization continues to work on formulating recommendations around autonomous shipping, the lack of a standardized regulation across countries thwarts manufacturers and operators. This lack of regulatory clarity may become an investment hurdle and thus slow down the deployment of autonomous vessels worldwide.

Opportunity: Integration of AI and Advanced Technologies

- In essence, the autonomous ship market offers a realm of opportunities that emerge from the integration of AI, machine learning, and advanced sensors. These very technologies bring in, along with navigation, also better obstacle detection and decision-making, making an autonomous vessel much more reliable and efficient.

- An instance is the acquisition of the Swiss start-up Sevensense, which has AI-enabled 3D vision navigation technologies, by ABB in January 2024 for strengthening its portfolio of autonomous systems. Such evolution would make it possible to advance the development of autonomous ships that can safely operate through inshore environments, thus opening greater streams of revenue for commercial and defense use.

Key Trend: Rise of Collaborative Ventures and Pilot Projects

- Increasing connectivity between the two industries allows for the co-operation trend to be set up, where maritime companies work together with technology providers and governments to develop and test vessels using autonomous technology. Therefore, these partnerships will further accelerate innovation and standardize industrial criteria.

- For example, these partnerships allow implementation of necessary technical challenges while scaling the adoption of autonomous ships into multiple different maritime industries; in March 2023, Samsung Heavy Industries and Kongsberg Maritime entered into a joint development contract concerning a next-generation concept of an autonomous LNG carrier with remote-control and low-emission technologies.

Autonomous Ships Market Analysis and Segmental Data

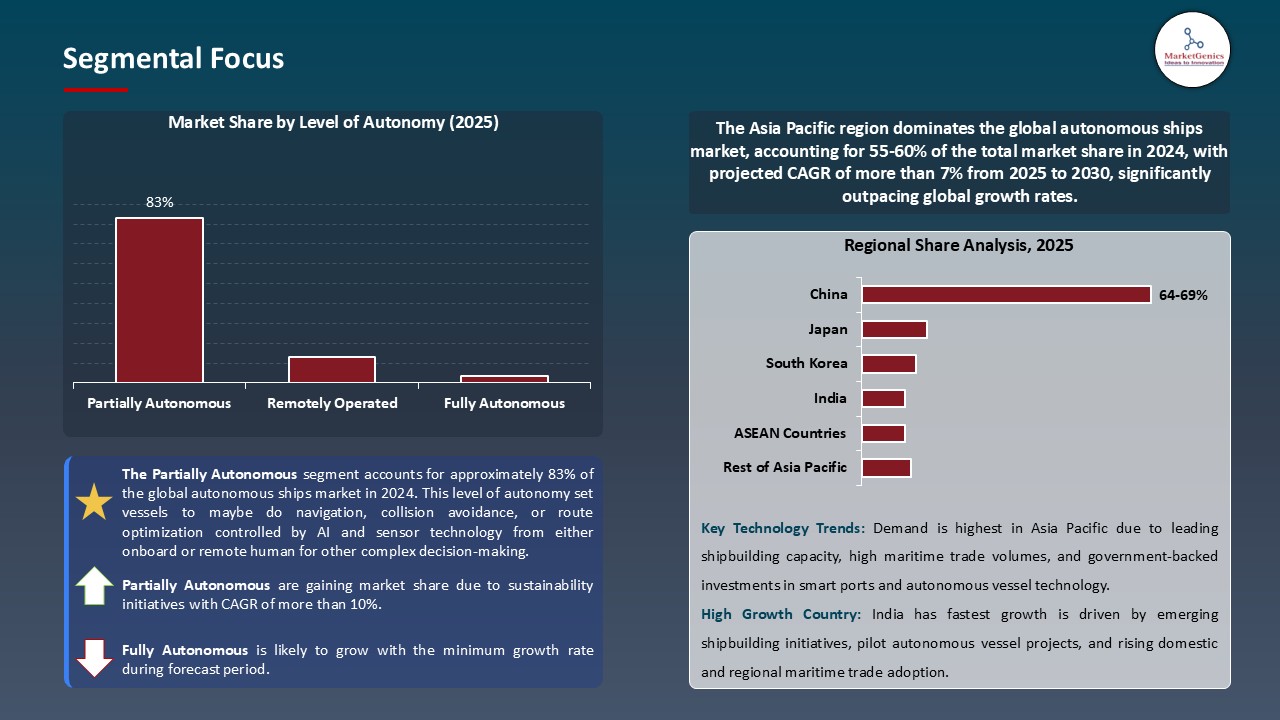

Based on level of autonomy, the partially autonomous segment retains the largest share

- Partially autonomous segment dominates the global autonomous ships market with nearly 83% share, mainly because of balanced integration of automation and human input. This level of autonomy set vessels to maybe do navigation, collision avoidance, or route optimization controlled by AI and sensor technology from either onboard or remote human for other complex decision-making. It is a step that shipowners can confidently take on their way toward full autonomy without completely relinquishing control. Besides, they can reduce operational cost, human error, or risk that may arise from operational decisions while retaining a margin of safety and regulatory compliance. For example, Rolls-Royce and SEA-KIT International collaborated on building semi-autonomous cargo-carrying vessels equipped with very advanced situational awareness systems, illustrating strong industry uptake.

- The partnership of Kongsberg Maritime and Massterly executed in October 2023 the launch of a semi-autonomous container feeder vessel operating between Norwegian ports-the reduced crew costs and emissions being two main impetuses. This hybrid concept, meanwhile, serves as a testbed that facilitates further scale-up towards greater autonomy levels as well as present commercial value.

Systems Expected to Be Top by Solution Through Forecast Period

- The global autonomous ship market is greatly expanding in the systems segment due to the concurrent demand for integrated hardware components to foster vessel automation. Key systems would include sensors, GPS tracker modules for automated navigation, and propulsion control modules for any autonomous operation of a vessel. Therefore, these systems are used to allow the continual receipt of input data for the purposes of situational awareness and in the context of autonomous navigation, the situational awareness of hazards and the subsequent navigation of the ship in a manner such that the function can be performed safely and efficiently by the autonomous ship.

- For example, Mitsubishi Shipbuilding Co., Ltd., a subsidiary of Mitsubishi Heavy Industries, has been developing and testing autonomous navigation systems together with The Nippon Foundation, which intends to validate the technologies through trials in Japanese coastal waters.

Asia Pacific Dominates Global Autonomous Ships Market in 2024 and Beyond

- In demand for autonomy in the shipping industry, the Asia Pacific region continues to be the primary one as far as its key contribution to the world maritime trade and technology. In this region of advanced shipbuilding capabilities, China, Japan, and South Korea are thus developing autonomous marine technologies with a significant amount of emphasis. That is to say, State Shipbuilding Corporation of China further took the steps toward gaining autonomous navy capability with the Thunderer A2000, a combat unmanned surface vessel, in 2024. On the other hand, concurrent with Japan's advances in autonomous navigation systems, in July 2023, the IPAs had authorized Nippon Yusen Kabushiki Kaisha's (NYK) APExS-auto system for fully autonomous ships.

- Furthermore, increased shipping activities require efficient and reliable means of transport, a demand dynamic closely aligned with scale effects seen in the E-commerce Logistics. This growth is well highlighted with the port of Singapore breaking records in 2024, handling 41.12 million TEUs, as an increase in cargo traffic is a signal. Autonomous vessels hence need to utilize and mitigate human errors. Moreover, pro-active government policies and cooperation amongst industry actors and research institutions boost innovations.

Autonomous Ships Market Ecosystem

Key players in the global autonomous ships market include prominent companies such as ABB Ltd., Wärtsilä Corporation, Rolls-Royce plc, Kongsberg Gruppen ASA, L3 ASV and Other Key Players.

The global autonomous ship market is moderately consolidated, the medium-high concentration of Tier 1 players-KONGSBERG, Wartsila, ABB Ltd., and Siemens AG-is wielding the utmost power, offering fully integrated solutions in automation, propulsion, and navigation. Tier 2 and Tier 3 players, including Praxis Automation Technology and Marine Technologies, offer specialized systems and components, thus creating several layers in the ecosystem of maritime OEMs, defense contractors, and system integrators. The market is thus typified by ever-increasing collaboration between technology companies and shipbuilders for enabling next-generation autonomous capabilities. From the concentration of buyers is medium because of the limited number of giant shipbuilders or naval customers, while the concentration of suppliers is significantly high owing to the technological complexity and proprietary nature of autonomous ship systems.

Recent Development and Strategic Overview:

- In March 2024, Samsung Heavy Industries (SHI) and Kongsberg Maritime entered a joint development agreement to design a next-generation approximately 174K autonomous LNG carrier. This partnership aims at integrating autonomous remote control and low-emission technology for marine transport systems working with elevated operational efficiency and sustainability.

-

In April 2023, in an acquisition augmented L3Harris Technologies further into the autonomy domain by acquiring Seagrant Robotics, an autonomic system for vessel control. With their acquisition, L3Harris expands its portfolio in autonomic maritime systems, so as to provide the most modern technology and solutions for unmanned surface vessels (USV) and maritime autonomy systems.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.5 Bn |

|

Market Forecast Value in 2035 |

USD 10.8 Bn |

|

Growth Rate (CAGR) |

8.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Autonomous Ships Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Level of Autonomy |

|

|

By Solution |

|

|

By Ship Type |

|

|

By Installation |

|

|

By Propulsion |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Autonomous Ships Market Outlook

- 2.1.1. Autonomous Ships Market Size (Volume – Mn Units and Value - US$ Bn), and Forecasts, 2020-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Autonomous Ships Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Autonomous Ships Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Autonomous Ships Industry

- 3.1.3. Regional Distribution for Autonomous Ships Industry

- 3.2. Supplier Customer Data

- 3.3. Solution Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Component

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Autonomous Ships Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Expansion of global maritime trade

- 4.1.1.2. Advancements in Artificial intelligence and sensor technologies

- 4.1.1.3. Reduction in human error and enhanced safety

- 4.1.2. Restraints

- 4.1.2.1. Cybersecurity risks and system vulnerabilities

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Autonomous Ships Manufacturers

- 4.4.3. Dealers/ Distributors

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Autonomous Ships Market Demand

- 4.9.1. Historical Market Size - in Volume (Mn Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size - in Volume (Mn Units) and Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Autonomous Ships Market Analysis, by Level of Autonomy

- 6.1. Key Segment Analysis

- 6.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Level of Autonomy, 2020-2035

- 6.2.1. Partially Autonomous

- 6.2.2. Remotely Operated

- 6.2.3. Fully Autonomous

- 7. Global Autonomous Ships Market Analysis, by Solution

- 7.1. Key Segment Analysis

- 7.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Solution, 2020-2035

- 7.2.1. Systems

- 7.2.1.1. Communication & Connectivity

- 7.2.1.1.1. Satellite Systems

- 7.2.1.1.2. Very Small Aperture Terminals

- 7.2.1.1.3. Terrestrial Communication Systems

- 7.2.1.1.4. 5G Mobile Communication Networks

- 7.2.1.2. Intelligent Awareness System

- 7.2.1.2.1. Alarm Management Systems

- 7.2.1.2.2. Surveillance and Safety Systems

- 7.2.1.2.2.1. Radar

- 7.2.1.2.2.2. Automatic Identification system

- 7.2.1.2.2.3. Optical and Infra-red Cameras

- 7.2.1.2.2.4. High-resolution Sonar

- 7.2.1.2.3. Navigation Systems

- 7.2.1.2.3.1. LiDAR

- 7.2.1.2.3.2. GPS

- 7.2.1.2.3.3. Inertial Navigation Systems

- 7.2.1.2.4. Machinery Management Systems

- 7.2.1.2.5. Power Management Systems

- 7.2.1.2.6. Propulsion Control Systems

- 7.2.1.2.7. Others (Thruster Control Systems, etc.)

- 7.2.1.1. Communication & Connectivity

- 7.2.2. Software

- 7.2.2.1. Fleet Management Software

- 7.2.2.2. Data Analysis Software

- 7.2.2.3. Artificial Intelligence

- 7.2.2.4. Machine Learning

- 7.2.2.5. Computer Vision

- 7.2.3. Structures

- 7.2.1. Systems

- 8. Global Autonomous Ships Market Analysis, by Ship Type

- 8.1. Key Segment Analysis

- 8.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Ship Type, 2020-2035

- 8.2.1. Commercial

- 8.2.1.1. Passenger Vessels

- 8.2.1.1.1. Cruise Ships

- 8.2.1.1.2. Passenger Ferries

- 8.2.1.1.3. Yachts & Motorboats

- 8.2.1.2. Cargo Vessel

- 8.2.1.2.1. Bulk Carriers

- 8.2.1.2.2. Gas Tankers

- 8.2.1.2.3. Tankers

- 8.2.1.2.4. Dry Cargo Vessels

- 8.2.1.2.5. Container Vessels

- 8.2.1.2.6. Barges and Tugboats

- 8.2.1.3. Others (Research Vessels, etc.)

- 8.2.1.1. Passenger Vessels

- 8.2.2. Defense

- 8.2.2.1. Aircraft Carriers

- 8.2.2.2. Amphibious Ships

- 8.2.2.3. Destroyers

- 8.2.2.4. Frigates

- 8.2.2.5. Submarines

- 8.2.2.6. Nuclear Sunmarines

- 8.2.2.7. Others

- 8.2.1. Commercial

- 9. Global Autonomous Ships Market Analysis, by Installation

- 9.1. Key Segment Analysis

- 9.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Installation, 2020-2035

- 9.2.1. Line Fit (Newbuild)

- 9.2.2. Retrofit

- 10. Global Autonomous Ships Market Analysis, by Propulsion

- 10.1. Key Segment Analysis

- 10.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Propulsion, 2020-2035

- 10.2.1. Fully Electric

- 10.2.2. Hybrid

- 10.2.3. Conventional

- 11. Global Autonomous Ships Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, by Region, 2020-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Autonomous Ships Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Autonomous Ships Market Size Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 12.3.1. Level of Autonomy

- 12.3.2. Solution

- 12.3.3. Ship Type

- 12.3.4. Installation

- 12.3.5. Propulsion

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Autonomous Ships Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Level of Autonomy

- 12.4.3. Solution

- 12.4.4. Ship Type

- 12.4.5. Installation

- 12.4.6. Propulsion

- 12.5. Canada Autonomous Ships Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Level of Autonomy

- 12.5.3. Solution

- 12.5.4. Ship Type

- 12.5.5. Installation

- 12.5.6. Propulsion

- 12.6. Mexico Autonomous Ships Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Level of Autonomy

- 12.6.3. Solution

- 12.6.4. Ship Type

- 12.6.5. Installation

- 12.6.6. Propulsion

- 13. Europe Autonomous Ships Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 13.3.1. Level of Autonomy

- 13.3.2. Solution

- 13.3.3. Ship Type

- 13.3.4. Installation

- 13.3.5. Propulsion

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Autonomous Ships Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Level of Autonomy

- 13.4.3. Solution

- 13.4.4. Ship Type

- 13.4.5. Installation

- 13.4.6. Propulsion

- 13.5. United Kingdom Autonomous Ships Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Level of Autonomy

- 13.5.3. Solution

- 13.5.4. Ship Type

- 13.5.5. Installation

- 13.5.6. Propulsion

- 13.6. France Autonomous Ships Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Level of Autonomy

- 13.6.3. Solution

- 13.6.4. Ship Type

- 13.6.5. Installation

- 13.6.6. Propulsion

- 13.7. Italy Autonomous Ships Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Level of Autonomy

- 13.7.3. Solution

- 13.7.4. Ship Type

- 13.7.5. Installation

- 13.7.6. Propulsion

- 13.8. Spain Autonomous Ships Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Level of Autonomy

- 13.8.3. Solution

- 13.8.4. Ship Type

- 13.8.5. Installation

- 13.8.6. Propulsion

- 13.9. Netherlands Autonomous Ships Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Level of Autonomy

- 13.9.3. Solution

- 13.9.4. Ship Type

- 13.9.5. Installation

- 13.9.6. Propulsion

- 13.10. Nordic Countries Autonomous Ships Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Level of Autonomy

- 13.10.3. Solution

- 13.10.4. Ship Type

- 13.10.5. Installation

- 13.10.6. Propulsion

- 13.11. Poland Autonomous Ships Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Level of Autonomy

- 13.11.3. Solution

- 13.11.4. Ship Type

- 13.11.5. Installation

- 13.11.6. Propulsion

- 13.12. Russia & CIS Autonomous Ships Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Level of Autonomy

- 13.12.3. Solution

- 13.12.4. Ship Type

- 13.12.5. Installation

- 13.12.6. Propulsion

- 13.13. Rest of Europe Autonomous Ships Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Level of Autonomy

- 13.13.3. Solution

- 13.13.4. Ship Type

- 13.13.5. Installation

- 13.13.6. Propulsion

- 14. Asia Pacific Autonomous Ships Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 14.3.1. Level of Autonomy

- 14.3.2. Solution

- 14.3.3. Ship Type

- 14.3.4. Installation

- 14.3.5. Propulsion

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia Pacific

- 14.4. China Autonomous Ships Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Level of Autonomy

- 14.4.3. Solution

- 14.4.4. Ship Type

- 14.4.5. Installation

- 14.4.6. Propulsion

- 14.5. India Autonomous Ships Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Level of Autonomy

- 14.5.3. Solution

- 14.5.4. Ship Type

- 14.5.5. Installation

- 14.5.6. Propulsion

- 14.6. Japan Autonomous Ships Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Level of Autonomy

- 14.6.3. Solution

- 14.6.4. Ship Type

- 14.6.5. Installation

- 14.6.6. Propulsion

- 14.7. South Korea Autonomous Ships Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Level of Autonomy

- 14.7.3. Solution

- 14.7.4. Ship Type

- 14.7.5. Installation

- 14.7.6. Propulsion

- 14.8. Australia and New Zealand Autonomous Ships Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Level of Autonomy

- 14.8.3. Solution

- 14.8.4. Ship Type

- 14.8.5. Installation

- 14.8.6. Propulsion

- 14.9. Indonesia Autonomous Ships Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Level of Autonomy

- 14.9.3. Solution

- 14.9.4. Ship Type

- 14.9.5. Installation

- 14.9.6. Propulsion

- 14.10. Malaysia Autonomous Ships Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Level of Autonomy

- 14.10.3. Solution

- 14.10.4. Ship Type

- 14.10.5. Installation

- 14.10.6. Propulsion

- 14.11. Thailand Autonomous Ships Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Level of Autonomy

- 14.11.3. Solution

- 14.11.4. Ship Type

- 14.11.5. Installation

- 14.11.6. Propulsion

- 14.12. Vietnam Autonomous Ships Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Level of Autonomy

- 14.12.3. Solution

- 14.12.4. Ship Type

- 14.12.5. Installation

- 14.12.6. Propulsion

- 14.13. Rest of Asia Pacific Autonomous Ships Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Level of Autonomy

- 14.13.3. Solution

- 14.13.4. Ship Type

- 14.13.5. Installation

- 14.13.6. Propulsion

- 15. Middle East Autonomous Ships Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 15.3.1. Level of Autonomy

- 15.3.2. Solution

- 15.3.3. Ship Type

- 15.3.4. Installation

- 15.3.5. Propulsion

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Autonomous Ships Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Level of Autonomy

- 15.4.3. Solution

- 15.4.4. Ship Type

- 15.4.5. Installation

- 15.4.6. Propulsion

- 15.5. UAE Autonomous Ships Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Level of Autonomy

- 15.5.3. Solution

- 15.5.4. Ship Type

- 15.5.5. Installation

- 15.5.6. Propulsion

- 15.6. Saudi Arabia Autonomous Ships Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Level of Autonomy

- 15.6.3. Solution

- 15.6.4. Ship Type

- 15.6.5. Installation

- 15.6.6. Propulsion

- 15.7. Israel Autonomous Ships Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Level of Autonomy

- 15.7.3. Solution

- 15.7.4. Ship Type

- 15.7.5. Installation

- 15.7.6. Propulsion

- 15.8. Rest of Middle East Autonomous Ships Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Level of Autonomy

- 15.8.3. Solution

- 15.8.4. Ship Type

- 15.8.5. Installation

- 15.8.6. Propulsion

- 16. Africa Autonomous Ships Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 16.3.1. Level of Autonomy

- 16.3.2. Solution

- 16.3.3. Ship Type

- 16.3.4. Installation

- 16.3.5. Propulsion

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Autonomous Ships Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Level of Autonomy

- 16.4.3. Solution

- 16.4.4. Ship Type

- 16.4.5. Installation

- 16.4.6. Propulsion

- 16.5. Egypt Autonomous Ships Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Level of Autonomy

- 16.5.3. Solution

- 16.5.4. Ship Type

- 16.5.5. Installation

- 16.5.6. Propulsion

- 16.6. Nigeria Autonomous Ships Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Level of Autonomy

- 16.6.3. Solution

- 16.6.4. Ship Type

- 16.6.5. Installation

- 16.6.6. Propulsion

- 16.7. Algeria Autonomous Ships Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Level of Autonomy

- 16.7.3. Solution

- 16.7.4. Ship Type

- 16.7.5. Installation

- 16.7.6. Propulsion

- 16.8. Rest of Africa Autonomous Ships Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Level of Autonomy

- 16.8.3. Solution

- 16.8.4. Ship Type

- 16.8.5. Installation

- 16.8.6. Propulsion

- 17. South America Autonomous Ships Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Autonomous Ships Market Size (Volume - Mn Units and Value - US$ Bn), Analysis, and Forecasts, 2020-2035

- 17.3.1. Level of Autonomy

- 17.3.2. Solution

- 17.3.3. Ship Type

- 17.3.4. Installation

- 17.3.5. Propulsion

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Autonomous Ships Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Level of Autonomy

- 17.4.3. Solution

- 17.4.4. Ship Type

- 17.4.5. Installation

- 17.4.6. Propulsion

- 17.5. Argentina Autonomous Ships Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Level of Autonomy

- 17.5.3. Solution

- 17.5.4. Ship Type

- 17.5.5. Installation

- 17.5.6. Propulsion

- 17.6. Rest of South America Autonomous Ships Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Level of Autonomy

- 17.6.3. Solution

- 17.6.4. Ship Type

- 17.6.5. Installation

- 17.6.6. Propulsion

- 18. Key Players/ Company Profile

- 18.1. ABB Ltd.

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. DNV GL

- 18.3. Fugro

- 18.4. General Electric

- 18.5. Honeywell International Inc.

- 18.6. Hyundai Heavy Industries Co., Ltd.

- 18.7. KONGSBERG

- 18.8. Marine Technologies, LLC

- 18.9. Northrop Grumman.

- 18.10. Praxis Automation Technology B.V.

- 18.11. Samsung Heavy Industries Co., Ltd

- 18.12. Siemens

- 18.13. Vigor Industrial LLC.

- 18.14. Wartsila

- 18.15. Other Key Players

- 18.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation