Bakery Ingredients Market Size, Share, Growth Opportunity Analysis Report by Ingredient Type (Flour, Yeast, Baking Powder & Baking Soda, Emulsifiers, Enzymes, Fats & Shortenings, Sweeteners, Colors & Flavors, Preservatives, Starch, Proteins and Others (Hydrocolloids, Improvers, etc.)), Product Type, Source, Form, End Use and Distribution Channel Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Bakery Ingredients Market Size, Share, and Growth

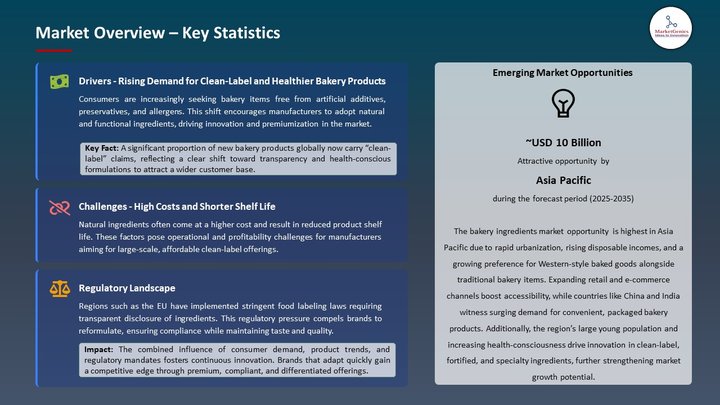

The worldwide bakery ingredients market is expanding from USD 19.6 billion in 2025 to USD 36.8 billion by the year 2035, showing a CAGR of 5.9% over the forecast period. With ozone clean and healthful image bestowed upon baked goods, the other would-be natural products bakery ingredients are now witnessing an upshot in demand.

GoodMills Innovation, under the leadership of CEO Dr. Elisabeth Böhm, introduced GoWell Tasty Protein in February 2025 a high-protein flour blend combining fava beans, yellow peas, sunflower seeds, and wheat, offering ~60% protein content without off-notes. Specifically tailored for bakery applications such as burger buns, sandwich rolls, and pretzels, the blend integrates seamlessly into existing production processes.

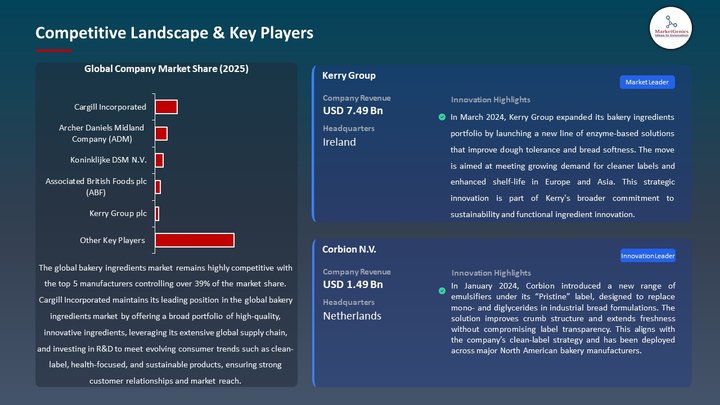

In May 2024, Kerry Group introduced a new range of plant-based emulsifiers and enzyme systems, a very good thing mainly to allow bakeries to avoid the use of synthetic additives as far as they can, to retain shelf life and texture in their products. This also endorses a rapidly growing global trend emphasizing ingredient transparency, which plays in favor of the clean-label concept for both premium and mass-market bakery products.

The growing demand for frozen and convenience bakery products in urban settings goes hand-in-hand with the increasing demands for ingredients, especially dough conditioners and stabilizers. In early 2024, Corbion extended its offerings under the Pristine line of dough improvers in North America and Europe while catering to industrial bakeries that wish to improve texture and freeze-thaw stability without compromising on clean label aspect. It is an illustration of the shift of the market towards convenience-driven innovation of bakery formats.

Bakery Ingredients Market Dynamics and Trends

Driver: Surge in Plant-Based & Alternative Flours

- The bakery ingredients market is growing at a rapid pace mainly due to the rising market for alternative flours such as chickpea, sorghum, and cassava. These gluten-free, plant-based candidates are provided for consumers targeting more healthful and allergen-friendly products.

- A gluten-free Nutrisource Pulse Flour Blend, made from chickpea and lentil proteins for enhanced formula stability and higher protein content in breads and snacks, was launched by Ingredion in April 2025. Clean-labeling trends and consumer demands for nutrient-dense bakery mixes or baking products of this type are building up. Pulse flours support sustainable agricultural practices by nitrogen-fixing the soils and being source plants that are climate-resilient. Their presence in bakery uses provides an avenue for manufacturers to produce protein-enriched breads, cookies, and snacks. This factor is propelled on the dual fronts of consumer demand-base for health and sustainability: retail sales indicate that clean-label products with alternative flours sell as much as 25% higher. As shelf life and textural formulation evolve, pulse flours, alongside other new flours, will find their way into mainstream consumer-building bakery innovations.

Driver: Demand for Natural Enzymes & Clean-Label Emulsifiers

- With consumers demanding baked goods created with minimal processing and recognizable ingredients, the demand for natural enzymes and emulsifiers is on the rise. The Kerry Group presented a line of plant-based emulsifiers and enzymes branded under the “NaturBake” label in February 2025, aimed at replacing synthetic ingredients and assisting in texture enhancement and shelf-life improvement in cakes and frozen par-baked products. These clean-label solutions bring with them limitations in acceptance in terms of softening of crumbs and retention of moisture, placing the consumer's preference at the forefront of regulations favoring natural additives. Thus, these ingredients allow for cleaning of labels that might otherwise compromise quality.

- An enzyme such as alpha-amylase and lipase is made from a non-GMO microbial source, thus appealing to a large segment of consumers that shun artificial additives. Manufacturers that use these types of innovations can claim clean label and marginal functional superiority while delivering on shelf life. Consequently, according to sales data from Kerry, NaturBake is spreading fast across Europe and North America, bearing testimony to the appeal that clean yet performance-based bakery solutions have in the marketplace.

Restraint: Price Sensitivity and Volatility in Commodity Ingredients

- Prices of commodity inputs such as wheat, sugar, and edible oils become volatile and reactive and thus restrain the bakery ingredients market. Because of supply chain disturbances across the globe causative climate events (such as the mid-2024 drought in the Canadian Prairie) or political instability in Ukraine, wheat prices went up by more than 40% annually. Such cost pressures negatively affected the ingredient manufacturers and bakeries from adding nut flours or natural enzymes to their premium additives. While clean and functional products are in demand, many consumers are still not willing to bear the cost.

- In mid-2024, Corbion put a temporary halt to the expansion of the plant-based emulsifier line in Latin America because of the perception of non-willingness to pay premium prices by the consumer. These limitations between ingredient costs and retail price elasticity are thus hampering the growth potential for advanced bakery solutions, particularly in developing countries where low-cost plain breads dominate.

Opportunity: Customized Functional Blends for Health Applications

- There is a new opportunity to develop tailormade functional ingredient blends for certain targeted health benefits, such as gut health and immune support. At the beginning of 2025, Puratos introduced the proprietary "Healthia GutDefense Blend" of prebiotic fibers, natural beta-glucans, and plant proteins for probiotic breads in the North American and European markets. It is an answer to the consumer appeal for baked goods that are functional and promote wellness beyond basic nutrition. Such blends tie in with the functional foods trend, so bakers can claim differentiation for health purposes.

- Upon gaining some regulatory clarity on functional claims, such tuples are an avenue for manufacturers to pursue cases of innovation: brands can offer "immune boosting bread" or "gut-friendly muffins" at premium prices. The upside is in the scalable rollout involving industrial bakers, foodservice operators, and supermarkets seeking functional differentiation without essentially changing supply chains.

Key Trend: Rise of Keto- & Low-Carb Bakery Solutions

- A strong trend is the emergence of low-carb and keto bakery products backed by ingredients such as inulin, erythritol, and almond flour. In March 2024, Mondelez launched the Ideal Protein line of low-sugar, high-fiber keto breads in fitness center cafes and DTC channels. These products use chicory-based inulin as the fiber binder with almond and coconut flours and natural sweeteners to maintain the texture and taste but reduce carb content. Bakeries are refashioning recipes as low-carb diets are increasingly coming into acceptance among weight-conscious consumers. Ingredient suppliers are also offering custom blends and processing aids to reduce glycemic impact and keep moist textures otherwise associated with carb-heavy products.

- Prebiotic fiber like inulin gives an additional edge to the win-win profile of these products, which are friendly to the gut. With transparent labeling climbing up the ladder of importance and clinical backing following, this trend is certainly set to stay. Packaging the low-carb bakery items as mainstream thus drilling a new and broad retail segment into mass and specialty retail.

Bakery Ingredients Market Analysis and Segmental Data

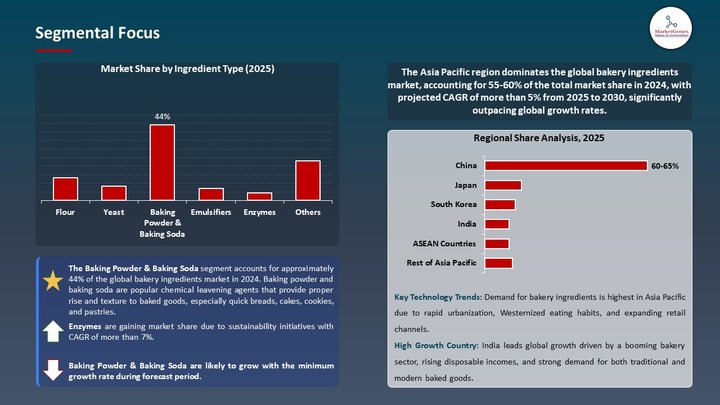

Based on Ingredient Type, the baking powder & baking soda segment retains the largest share

- The baking powder & baking soda segment holds major share ~44% in the global bakery ingredients market. Baking powder and baking soda are popular chemical leavening agents that provide proper rise and texture to baked goods, especially quick breads, cakes, cookies, and pastries. The widespread applicability of these products from home baking to large-scale commercial production leads to ever high demand.

- Due to the restrictions imposed by COVID-19, the trend for home baking had boomed worldwide, and the trend has stayed. Underground powders and soda-based leaveners tempt every baker with simplicity and predictability, whether a novice or an expert baker. As dry products having long shelf life and contained in popular baking mixes, these leavening agents have become pantry essentials, especially in countries where quick baking and homemade baking are well accepted.

- The widespread functional utility and all-around acceptance by industries and consumers alike keep baking powder and baking soda at the center of attention in the bakery ingredient market.

Bread Expected to Be Top by Product Type Through Forecast Period

- Bread will continue to dominate due to the primary diet category of the world; basically, loaves to specialty variants. Its essential interaction with meals-from breakfast toast to sandwich slices-has kept a solid demand both from the industrial bakery and retail side with high volumes. Gluten free, whole grain, low carb, multigrain, or probiotic-enriched functional breads have momentarily received consumer interest, thereby posing a requirement for specialty ingredients like ancient grain flours, fiber blends, and dough conditioners.

- One example cited says that the launching of a low-carb keto white bread in April 2023 by Flowers Foods shows the strength in growth of low-carb and specialty bread segments. These health-oriented innovations reinforce the premium positioning and sustain the continuous volume growth from ingredients within bread.

North America Dominates Global Bakery Ingredients Market in 2024 and Beyond

- Bakery ingredients are in high demand in the Asia-Pacific because of shifting consumer preferences towards western bakery products such as bread, cakes, and pastries, owing to rapid urbanization and lifestyle changes. Consumption preferences are changing in India, China, and Indonesia-all being influenced by global food trends-which promote packaged foods and bakery products.

- For example, to capitalize on the rising demand for bread and cake products in tier-2 and tier-3 cities in India, Britannia Industries started greenfield expansions for its bakery operations in April 2024. The growth of the F&B industry, including cafés, QSR, and convenience bakeries, has contributed to the growth in demand for ingredients in the region. Also, ingredient manufacturers have started customizing ingredient solutions for local tastes, e.g., sweetened buns or eggless cakes.

- In March 2024, the Puratos innovation center was launched in China to work on region-related bakery ingredient formulations, including plant-based and clean label solutions, to foster the sustainable development of the Market.

Bakery Ingredients Market Ecosystem

Key players in the global bakery ingredients market include prominent companies such as Cargill Incorporated, Archer Daniels Midland Company (ADM), Associated British Foods plc (ABF), Kerry Group plc, Koninklijke DSM N.V. and Other Key Players.

The international market of bakery ingredients shows moderate fragmentation and competes between multinationals and regional players. Holding the market positions with large-scale resources and innovative capacities, the level 1 companies concentrate in building large markets. The level 2 companies target niche offerings while the level 3 companies operate at local demand. The buyer concentration remains moderate as bakeries vary in their scale and buying power; however, the supplier concentration remains low due to the wide base of raw material providers, so manufacturers have multiple options for sourcing their requirements.

Recent Development and Strategic Overview:

- In February 2025, Eurostar Commodities introduced Rise Re:Gen, a 100% British regenerative wheat-flour that is cultivated by methods of enhancing soil biodiversity, minimizing pesticide use, and carbon sequestration. The flour in Strong White and All-Purpose variants, BRCGS AAA certified, promises bakers a sustainable way to bake high-quality loaves while ensuring taste is never compromised. Not only does this satisfy an increasing demand for eco-conscious ingredients, but Eurostar also drives the forefront of combining environmental valorization with performance.

- In April 2025, in 2025, at IBA in Düsseldorf, DeutscheBack released TopBake Fresh and TopBake Taste, enzyme blends for yeast-risen doughs and pastries to maximize natural flavor extenders, ensure freshness for longer, and reduce emulsifier and sugar content. At 0.1% application, these enzyme solutions increase moisture retention and softness of crumbs for at least a few days, enabling clean-label status. In this, we observe a transition toward enzymatic shelf life and sensory enhancement of baked goods.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 19.6 Bn |

|

Market Forecast Value in 2035 |

USD 36.8 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2020 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Bakery Ingredients Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Ingredient Type |

|

|

By Product Type |

|

|

By Source |

|

|

By Form |

|

|

By End Use |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Bakery Ingredients Market Outlook

- 2.1.1. Bakery Ingredients Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Bakery Ingredients Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Bakery Ingredients Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Bakery Ingredients Industry

- 3.1.3. Regional Distribution for Bakery Ingredients

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Bakery Ingredients Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for convenient and ready-to-eat bakery products.

- 4.1.1.2. Increasing health consciousness fueling demand for organic and clean-label ingredients.

- 4.1.1.3. Growth of retail chains and expansion of e-commerce distribution channels.

- 4.1.2. Restraints

- 4.1.2.1. Volatility in raw material prices, especially wheat, sugar, and dairy inputs.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Sourcing

- 4.4.2. Manufacturing and Processing

- 4.4.3. Wholesalers/ E-commerce Platform

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Bakery Ingredients Market Demand

- 4.9.1. Historical Market Size - in Value (US$ Bn), 2021-2024

- 4.9.2. Current and Future Market Size - in Value (US$ Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Bakery Ingredients Market Analysis, by Ingredient Type

- 6.1. Key Segment Analysis

- 6.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Ingredient Type, 2021-2035

- 6.2.1. Flour

- 6.2.2. Yeast

- 6.2.3. Baking Powder & Baking Soda

- 6.2.4. Emulsifiers

- 6.2.5. Enzymes

- 6.2.6. Fats & Shortenings

- 6.2.7. Sweeteners

- 6.2.8. Colors & Flavors

- 6.2.9. Preservatives

- 6.2.10. Starch

- 6.2.11. Proteins

- 6.2.12. Others (Hydrocolloids, Improvers, etc.)

- 7. Global Bakery Ingredients Market Analysis, by Product Type

- 7.1. Key Segment Analysis

- 7.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 7.2.1. Bread

- 7.2.2. Cookies & Biscuits

- 7.2.3. Cakes & Pastries

- 7.2.4. Pizza Crusts

- 7.2.5. Pies & Tarts

- 7.2.6. Donuts

- 7.2.7. Rolls & Buns

- 7.2.8. Others (Muffins, Brownies, etc.)

- 8. Global Bakery Ingredients Market Analysis, by Source

- 8.1. Key Segment Analysis

- 8.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 8.2.1. Plant-Based

- 8.2.2. Animal-Based

- 8.2.3. Synthetic

- 9. Global Bakery Ingredients Market Analysis, by Form

- 9.1. Key Segment Analysis

- 9.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 9.2.1. Dry

- 9.2.2. Liquid

- 9.2.3. Powder

- 9.2.4. Granules

- 9.2.5. Paste/Gel

- 9.2.6. Others

- 10. Global Bakery Ingredients Market Analysis, by End Use

- 10.1. Key Segment Analysis

- 10.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by End Use, 2021-2035

- 10.2.1. Commercial/Bakery Industry

- 10.2.2. Retail/Artisanal Bakeries

- 10.2.3. Foodservice/HoReCa

- 10.2.4. Household/Consumer Use

- 11. Global Bakery Ingredients Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales (B2B)

- 11.2.2. Retail Stores

- 11.2.3. Supermarkets/Hypermarkets

- 11.2.4. Online Stores

- 11.2.5. Specialty Stores

- 11.2.6. Wholesale Distributors

- 12. Global Bakery Ingredients Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Bakery Ingredients Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Bakery Ingredients Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Ingredient Type

- 13.3.2. Product Type

- 13.3.3. Source

- 13.3.4. Form

- 13.3.5. End Use

- 13.3.6. Distribution Channel

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Bakery Ingredients Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Ingredient Type

- 13.4.3. Product Type

- 13.4.4. Source

- 13.4.5. Form

- 13.4.6. End Use

- 13.4.7. Distribution Channel

- 13.5. Canada Bakery Ingredients Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Ingredient Type

- 13.5.3. Product Type

- 13.5.4. Source

- 13.5.5. Form

- 13.5.6. End Use

- 13.5.7. Distribution Channel

- 13.6. Mexico Bakery Ingredients Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Ingredient Type

- 13.6.3. Product Type

- 13.6.4. Source

- 13.6.5. Form

- 13.6.6. End Use

- 13.6.7. Distribution Channel

- 14. Europe Bakery Ingredients Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Ingredient Type

- 14.3.2. Product Type

- 14.3.3. Source

- 14.3.4. Form

- 14.3.5. End Use

- 14.3.6. Distribution Channel

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Bakery Ingredients Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Ingredient Type

- 14.4.3. Product Type

- 14.4.4. Source

- 14.4.5. Form

- 14.4.6. End Use

- 14.4.7. Distribution Channel

- 14.5. United Kingdom Bakery Ingredients Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Ingredient Type

- 14.5.3. Product Type

- 14.5.4. Source

- 14.5.5. Form

- 14.5.6. End Use

- 14.5.7. Distribution Channel

- 14.6. France Bakery Ingredients Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Ingredient Type

- 14.6.3. Product Type

- 14.6.4. Source

- 14.6.5. Form

- 14.6.6. End Use

- 14.6.7. Distribution Channel

- 14.7. Italy Bakery Ingredients Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Ingredient Type

- 14.7.3. Product Type

- 14.7.4. Source

- 14.7.5. Form

- 14.7.6. End Use

- 14.7.7. Distribution Channel

- 14.8. Spain Bakery Ingredients Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Ingredient Type

- 14.8.3. Product Type

- 14.8.4. Source

- 14.8.5. Form

- 14.8.6. End Use

- 14.8.7. Distribution Channel

- 14.9. Netherlands Bakery Ingredients Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Ingredient Type

- 14.9.3. Product Type

- 14.9.4. Source

- 14.9.5. Form

- 14.9.6. End Use

- 14.9.7. Distribution Channel

- 14.10. Nordic Countries Bakery Ingredients Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Ingredient Type

- 14.10.3. Product Type

- 14.10.4. Source

- 14.10.5. Form

- 14.10.6. End Use

- 14.10.7. Distribution Channel

- 14.11. Poland Bakery Ingredients Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Ingredient Type

- 14.11.3. Product Type

- 14.11.4. Source

- 14.11.5. Form

- 14.11.6. End Use

- 14.11.7. Distribution Channel

- 14.12. Russia & CIS Bakery Ingredients Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Ingredient Type

- 14.12.3. Product Type

- 14.12.4. Source

- 14.12.5. Form

- 14.12.6. End Use

- 14.12.7. Distribution Channel

- 14.13. Rest of Europe Bakery Ingredients Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Ingredient Type

- 14.13.3. Product Type

- 14.13.4. Source

- 14.13.5. Form

- 14.13.6. End Use

- 14.13.7. Distribution Channel

- 15. Asia Pacific Bakery Ingredients Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Ingredient Type

- 15.3.2. Product Type

- 15.3.3. Source

- 15.3.4. Form

- 15.3.5. End Use

- 15.3.6. Distribution Channel

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Bakery Ingredients Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Ingredient Type

- 15.4.3. Product Type

- 15.4.4. Source

- 15.4.5. Form

- 15.4.6. End Use

- 15.4.7. Distribution Channel

- 15.5. India Bakery Ingredients Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Ingredient Type

- 15.5.3. Product Type

- 15.5.4. Source

- 15.5.5. Form

- 15.5.6. End Use

- 15.5.7. Distribution Channel

- 15.6. Japan Bakery Ingredients Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Ingredient Type

- 15.6.3. Product Type

- 15.6.4. Source

- 15.6.5. Form

- 15.6.6. End Use

- 15.6.7. Distribution Channel

- 15.7. South Korea Bakery Ingredients Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Ingredient Type

- 15.7.3. Product Type

- 15.7.4. Source

- 15.7.5. Form

- 15.7.6. End Use

- 15.7.7. Distribution Channel

- 15.8. Australia and New Zealand Bakery Ingredients Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Ingredient Type

- 15.8.3. Product Type

- 15.8.4. Source

- 15.8.5. Form

- 15.8.6. End Use

- 15.8.7. Distribution Channel

- 15.9. Indonesia Bakery Ingredients Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Ingredient Type

- 15.9.3. Product Type

- 15.9.4. Source

- 15.9.5. Form

- 15.9.6. End Use

- 15.9.7. Distribution Channel

- 15.10. Malaysia Bakery Ingredients Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Ingredient Type

- 15.10.3. Product Type

- 15.10.4. Source

- 15.10.5. Form

- 15.10.6. End Use

- 15.10.7. Distribution Channel

- 15.11. Thailand Bakery Ingredients Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Ingredient Type

- 15.11.3. Product Type

- 15.11.4. Source

- 15.11.5. Form

- 15.11.6. End Use

- 15.11.7. Distribution Channel

- 15.12. Vietnam Bakery Ingredients Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Ingredient Type

- 15.12.3. Product Type

- 15.12.4. Source

- 15.12.5. Form

- 15.12.6. End Use

- 15.12.7. Distribution Channel

- 15.13. Rest of Asia Pacific Bakery Ingredients Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Ingredient Type

- 15.13.3. Product Type

- 15.13.4. Source

- 15.13.5. Form

- 15.13.6. End Use

- 15.13.7. Distribution Channel

- 16. Middle East Bakery Ingredients Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Ingredient Type

- 16.3.2. Product Type

- 16.3.3. Source

- 16.3.4. Form

- 16.3.5. End Use

- 16.3.6. Distribution Channel

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Bakery Ingredients Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Ingredient Type

- 16.4.3. Product Type

- 16.4.4. Source

- 16.4.5. Form

- 16.4.6. End Use

- 16.4.7. Distribution Channel

- 16.5. UAE Bakery Ingredients Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Ingredient Type

- 16.5.3. Product Type

- 16.5.4. Source

- 16.5.5. Form

- 16.5.6. End Use

- 16.5.7. Distribution Channel

- 16.6. Saudi Arabia Bakery Ingredients Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Ingredient Type

- 16.6.3. Product Type

- 16.6.4. Source

- 16.6.5. Form

- 16.6.6. End Use

- 16.6.7. Distribution Channel

- 16.7. Israel Bakery Ingredients Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Ingredient Type

- 16.7.3. Product Type

- 16.7.4. Source

- 16.7.5. Form

- 16.7.6. End Use

- 16.7.7. Distribution Channel

- 16.8. Rest of Middle East Bakery Ingredients Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Ingredient Type

- 16.8.3. Product Type

- 16.8.4. Source

- 16.8.5. Form

- 16.8.6. End Use

- 16.8.7. Distribution Channel

- 17. Africa Bakery Ingredients Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Ingredient Type

- 17.3.2. Product Type

- 17.3.3. Source

- 17.3.4. Form

- 17.3.5. End Use

- 17.3.6. Distribution Channel

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Bakery Ingredients Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Ingredient Type

- 17.4.3. Product Type

- 17.4.4. Source

- 17.4.5. Form

- 17.4.6. End Use

- 17.4.7. Distribution Channel

- 17.5. Egypt Bakery Ingredients Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Ingredient Type

- 17.5.3. Product Type

- 17.5.4. Source

- 17.5.5. Form

- 17.5.6. End Use

- 17.5.7. Distribution Channel

- 17.6. Nigeria Bakery Ingredients Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Ingredient Type

- 17.6.3. Product Type

- 17.6.4. Source

- 17.6.5. Form

- 17.6.6. End Use

- 17.6.7. Distribution Channel

- 17.7. Algeria Bakery Ingredients Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Ingredient Type

- 17.7.3. Product Type

- 17.7.4. Source

- 17.7.5. Form

- 17.7.6. End Use

- 17.7.7. Distribution Channel

- 17.8. Rest of Africa Bakery Ingredients Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Ingredient Type

- 17.8.3. Product Type

- 17.8.4. Source

- 17.8.5. Form

- 17.8.6. End Use

- 17.8.7. Distribution Channel

- 18. South America Bakery Ingredients Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Bakery Ingredients Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Ingredient Type

- 18.3.2. Product Type

- 18.3.3. Source

- 18.3.4. Form

- 18.3.5. End Use

- 18.3.6. Distribution Channel

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Bakery Ingredients Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Ingredient Type

- 18.4.3. Product Type

- 18.4.4. Source

- 18.4.5. Form

- 18.4.6. End Use

- 18.4.7. Distribution Channel

- 18.5. Argentina Bakery Ingredients Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Ingredient Type

- 18.5.3. Product Type

- 18.5.4. Source

- 18.5.5. Form

- 18.5.6. End Use

- 18.5.7. Distribution Channel

- 18.6. Rest of South America Bakery Ingredients Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Ingredient Type

- 18.6.3. Product Type

- 18.6.4. Source

- 18.6.5. Form

- 18.6.6. End Use

- 18.6.7. Distribution Channel

- 19. Key Players/ Company Profile

- 19.1. AAK AB

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. Archer Daniels Midland Company (ADM)

- 19.3. Associated British Foods plc

- 19.4. Bakels Group

- 19.5. Camlin Fine Sciences Ltd.

- 19.6. Cargill Incorporated

- 19.7. Corbion N.V.

- 19.8. Dawn Food Products Inc.

- 19.9. Döhler GmbH

- 19.10. DuPont de Nemours, Inc.

- 19.11. Ingredion Incorporated

- 19.12. International Flavors & Fragrances Inc. (IFF)

- 19.13. Kerry Group plc

- 19.14. Koninklijke DSM N.V. (DSM)

- 19.15. Lallemand Inc.

- 19.16. Puratos Group N.V.

- 19.17. Roquette Frères

- 19.18. Tate & Lyle plc

- 19.19. Taura Natural Ingredients Ltd.

- 19.20. Tereos S.A.

- 19.21. Other Key Players

- 19.1. AAK AB

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation