Biodegradable Plastic Market Size, Share & Trends Analysis Report by Material Type (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch-Based Plastics, Polybutylene Succinate (PBS), Polybutylene Adipate Terephthalate (PBAT), Cellulose-Based Plastics, Polyglycolic Acid (PGA), Bio-Polyethylene (Bio-PE), Bio-Polypropylene (Bio-PP), Polycaprolactone (PCL), others), Source, Production Technology, Product Form, Biodegradability Type, Distribution Channel, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Biodegradable Plastic Market Size, Share, and Growth

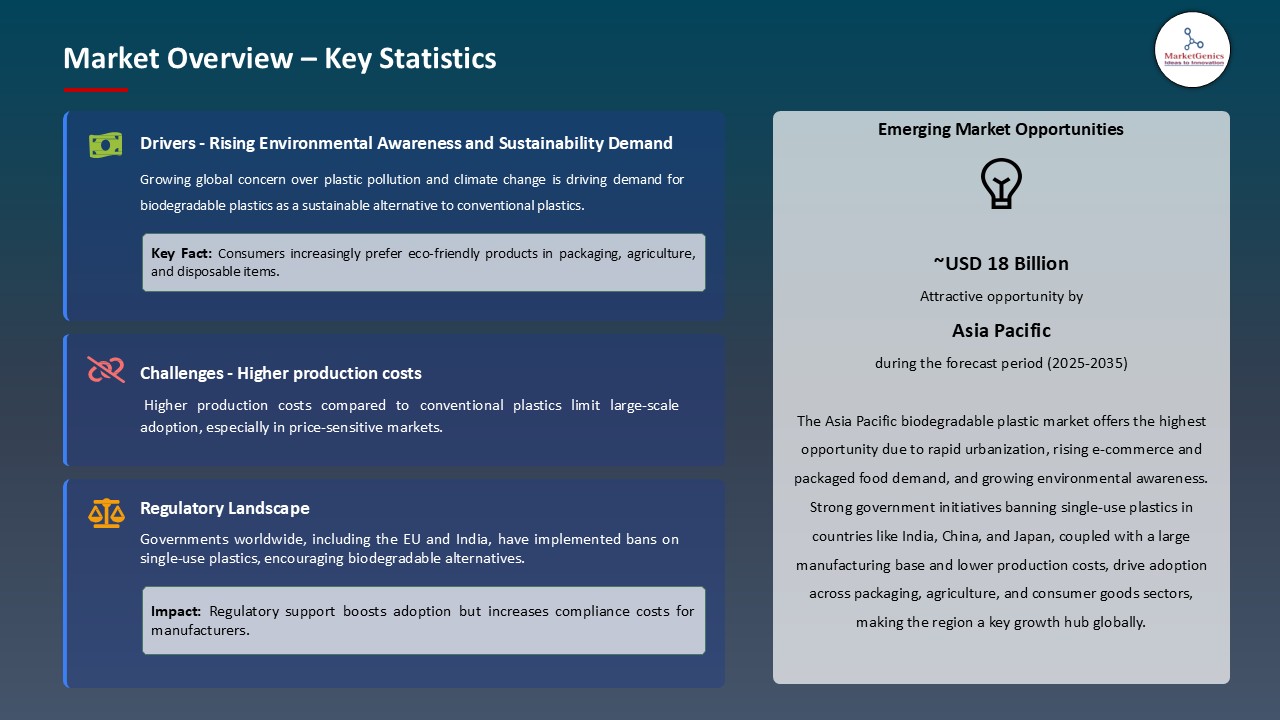

The global biodegradable plastic market is experiencing robust growth, with its estimated value of USD 12.1 billion in the year 2025 and USD 57.2 billion by the period 2035, registering a CAGR of 16.8%, during the forecast period. The biodegradable plastic market is driving due to rising environmental awareness and government regulations like single-use plastic bans, which increase consumer preference for sustainable products.

Suratun Kongton, Chief Wholesale Banking Officer of Krungthai Bank said,

“Thailand is a regional and global leader in driving the development of a global bioeconomy, and commercial banks play a crucial role in driving this transition.”

The global biodegradable plastics market is being propelled by regulatory enforcement of single-use plastic bans, corporate sustainability mandates, and innovations in compostable polymer technology. Major producers are scaling bio-based resin capacity to meet circular economy goals. For instance, in May 2024, NatureWorks, announced the historic financial support from Krungthai Bank PCL to optimize the capital structure for the new fully-integrated Ingeo PLA manufacturing facility in Thailand.

Moreover, the biogradable plastic market is driven by growing brand-owner collaboration and government incentives for compostable materials continue to accelerate commercialization and cost competitiveness. For instance, in 2023, BASF expanded its ecovio portfolio with a new industrially compostable grade tailored for agricultural twines and food packaging, strengthening its presence in high-value sectors. Rising regulatory alignment and capacity expansions are driving sustained market penetration of biodegradable polymers globally.

The regulatory framework across major economies is accelerating the growth of the global biodegradable plastic market by enforcing circular economy principles, compostability certification, and bio-based content mandates. For instance, in September 2024, the U.S. Environmental Protection Agency (EPA) introduced updated guidelines for biodegradable materials in food-contact and agricultural films, promoting lifecycle transparency and end-of-life traceability through digital product labeling. These measures are driving innovation in next-generation biodegradable polymers, such as PLA, PHA, and PBS, while encouraging investments in large-scale composting infrastructure.

The key market opportunities of the global biodegradable plastic market are bio-based polymers (PLA blends, PHA copolymers), compostable coatings for paper packaging, sustainable agricultural films, biodegradable medical devices, and biopolymer additives for textiles and automotive interiors. These interconnected segments enhance circular material integration and cross-industry adoption.

Biodegradable Plastic Market Dynamics and Trends

Driver: Expanding Corporate Commitments Toward Certified Compostable Packaging Solutions

- The global biodegradable plastic market is driven by increasing commitments from multinational corporations to replace fossil-based polymers with certified compostable materials. Consumer goods, retail, and food-service companies are prioritizing bioplastics to achieve measurable sustainability targets. For instance, in May 2025, BASF SE announced an expanded partnership with a major European food-packaging group to scale its ecovio compostable materials for single-use cups and flexible wraps under EN 13432 compliance.

- Additionally, this collaboration reflects a strong corporate shift toward closed-loop packaging ecosystems, particularly in regions with robust composting infrastructure. Accelerating demand for renewable, traceable, and compostable solutions aligns with evolving consumer preferences and government-backed eco-label standards.

- Thus, the growing institutional adoption of certified compostable packaging significantly strengthens long-term revenue stability and material innovation across the biodegradable plastics industry.

Restraint: High Cost Structures and Complex Biopolymer Processing Limit Adoption

- Despite rising awareness, cost competitiveness remains a major restraint in the global biodegradable plastic market. Production expenses, tied to feedstock availability and advanced polymerization technologies, restrict scalability. For instance, in May 2024, NatureWorks LLC reported delays in the commissioning of its Ingeo PLA plant in Thailand due to escalating feedstock and construction costs, increasing total project expenditure beyond the planned $350 million. Such challenges highlight the sensitivity of bio-based supply chains to raw material volatility and the difficulty of maintaining pricing parity with petrochemical plastics.

- Additionally, Complex biopolymer processing equipment requirements deter smaller converters from adopting biodegradable plastics, as these materials often demand precise temperature control, specialized extrusion systems, and dedicated compostable resin handling. The need for retrofitting existing lines or investing in new machinery raises operational costs, making transitions financially unfeasible for small and mid-scale manufacturers.

Opportunity: Rapid Expansion of Biodegradable Polymers in Agricultural Applications

- Growing agricultural sustainability initiatives are unlocking new opportunities for biodegradable plastics. Biodegradable mulch films, plant pots, and slow-release fertilizer coatings are replacing traditional polyethylene-based products. For instance, in 2024, BASF SE launched new grades of ecovio for agricultural applications, designed to biodegrade under soil conditions and meet updated EU agricultural plastic regulation standards. These innovations address regulatory restrictions on non-degradable agricultural plastics and promote cost-effective soil recovery solutions.

- Furthermore, biodegradable plastic market is growing due to expanding agricultural use cases position biodegradable plastics as a key enabler of sustainable farming systems and soil health improvement. For instance, in 2025, FKuR Kunststoff GmbH, a leading bioplastic compounder, partnered with BASF SE to commercialize next-generation biodegradable mulch films formulated from Bio-Flex blends tailored for controlled soil degradation and enhanced oxygen permeability. These films eliminate post-harvest removal costs and naturally decompose into biomass and CO₂, improving soil structure and moisture retention.

Key Trend: Integration of AI and Digital Traceability in Biopolymer Supply Chains

- The integration of artificial intelligence and blockchain-based traceability is transforming the biodegradable plastics value chain. Companies are implementing digital product passports and smart labeling to verify material authenticity and environmental performance. For instance, in June 2025, Total Corbion PLA introduced an AI-enabled lifecycle assessment platform to track the carbon footprint and compositional data of its Luminy PLA grades across production and distribution. This digital integration enhances transparency, enables regulatory compliance, and improves customer trust in certified bio-based materials.

- Furthermore, the trend reflects broader digitalization in sustainability reporting and aligns with the EU’s circular economy monitoring framework. For instance, EU’s Circular Economy Monitoring Framework, ensuring transparent sustainability reporting and compliance with upcoming Digital Product Passport (DPP) requirements for packaging and materials.

Biodegradable Plastic Market Analysis and Segmental Data

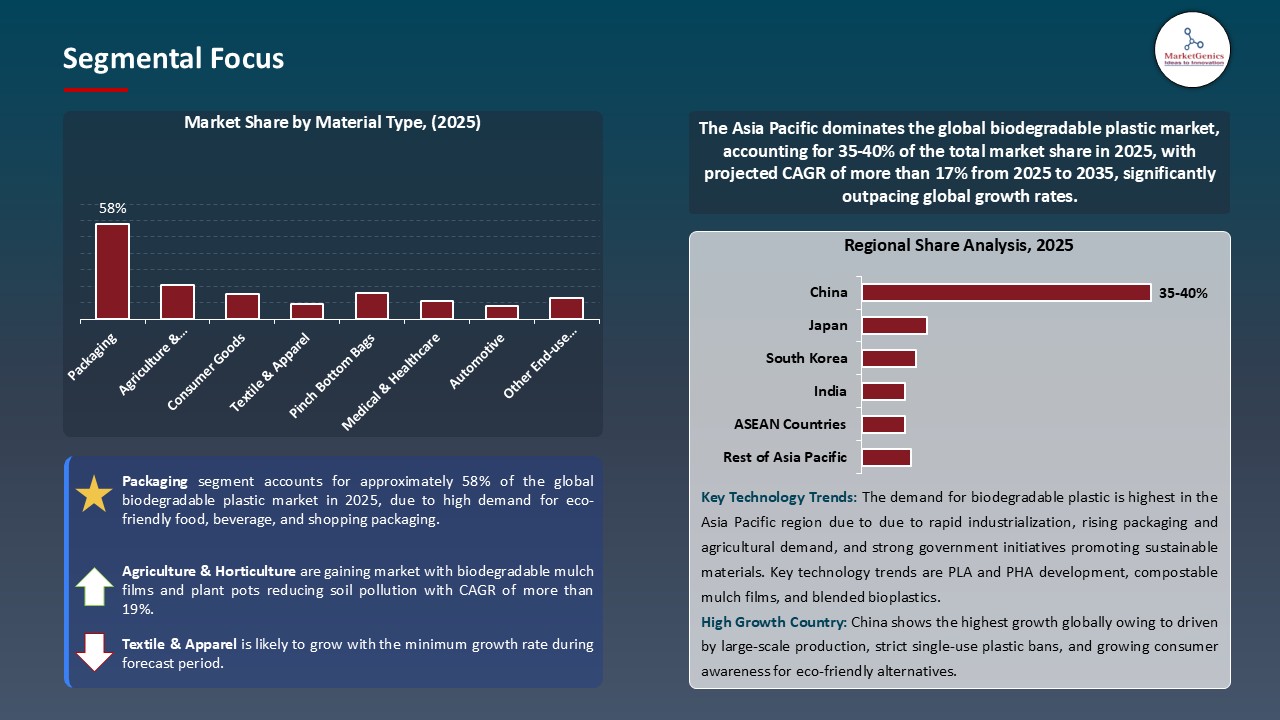

Packaging Industry Dominate Global Biodegradable Plastic Market

- Packaging industry the global biodegradable plastic market owing to its central role in meeting sustainability mandates, consumer demand for eco-friendly materials, and brand-driven decarbonization goals. Biodegradable plastics such as PLA, PHA, and PBS are increasingly replacing conventional polyethylene and polypropylene in food service ware, films, and flexible pouches. For instance, in September 2025, Mitsubishi Chemical Corporation has unveiled a groundbreaking new line of biodegradable plastic solutions designed specifically for the packaging industry. This innovative product line is set to significantly reduce the environmental impact of plastic waste, responding to growing consumer demand for sustainable packaging options.

- Additionally, the adoption of circular packaging models and closed-loop recycling infrastructure, which is reinforcing biodegradable plastic demand across FMCG and e-commerce supply chains. For instance, in February 2025, Total Corbion PLA announced partnerships with global brand owners to pilot Expanded PLA (EPLA) foam packaging for protective and thermal applications, offering lightweight, compostable alternatives to EPS.

Asia Pacific Leads Global Biodegradable Plastic Market Demand

- Asia Pacific leads the global biodegradable plastic market, due to rapid industrialization, stringent regulatory reforms on single-use plastics, and increasing investment in bio-based manufacturing infrastructure. Governments across China, Japan, South Korea, and India are promoting compostable alternatives through green procurement and waste management policies. For instance, in 2023, Mitsubishi Chemical Group expanded production of its BioPBS resin in Japan and Southeast Asia to meet growing regional demand for biodegradable food service ware and agricultural films. These developments underscore Asia Pacific’s position as a strategic hub for sustainable polymer production driven by strong domestic consumption and export potential.

- Furthermore, the Asia Pacific biodegradable plastic market driver is the region’s evolving consumer behavior and corporate sustainability alignment. Increasing environmental awareness and demand for eco-friendly packaging among fast-moving consumer goods (FMCG) and e-commerce sectors are accelerating the shift toward biodegradable plastics. For instance, in February 2024, LG Chem partnered with CJ CheilJedang in South Korea to scale up PHA-based biodegradable resin production, focusing on flexible films and rigid packaging markets in the Asia-Pacific region.

Biodegradable Plastic Market Ecosystem

The global biodegradable plastic market is moderately fragmented, with high concentration among key players such as NatureWorks LLC, BASF SE, Mitsubishi Chemical Corporation, Total Corbion PLA, and Danimer Scientific Inc., who dominate through strategic capacity expansions, technology partnerships, and product diversification. These companies are investing heavily in next-generation bio-based polymers and compostable applications to capture the rising demand for sustainable materials. For instance, in 2025, NatureWorks continued the construction of its fully integrated PLA facility in Thailand to strengthen supply in Asia. Concentrated innovation and regional capacity expansion among leading producers are shaping competitive dynamics and accelerating commercialization across biodegradable plastic end-use sectors.

Recent Development and Strategic Overview:

- In April 2025, TotalEnergies Corbion and Useon have announced a strategic partnership to advance the development and global commercialization of EPLA molded products a new generation of sustainable, high-performance foam materials made from Luminy PLA bioplastics.

- In January 2024, SEE has developed the first biobased, industrial compostable tray for protein packaging that has been successfully tested to meet the demands of existing food processing equipment.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 12.1 Bn |

|

Market Forecast Value in 20255 |

USD 57.2 Bn |

|

Growth Rate (CAGR) |

16.8% |

|

Forecast Period |

2025 – 20255 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value MMT for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Biodegradable Plastic Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Biodegradable Plastic Market By Material Type |

|

|

Biodegradable Plastic Market By Source |

|

|

Biodegradable Plastic Market By Production Technology

|

|

|

Biodegradable Plastic Market By Product Form |

|

|

Biodegradable Plastic Market By Biodegradability Type

|

|

|

Biodegradable Plastic Market By Distribution Channel

|

|

|

Biodegradable Plastic Market By End-Use Industry

|

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Biodegradable Plastic Market Outlook

- 2.1.1. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Biodegradable Plastic Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Biodegradable Plastic Industry Overview, 2025

- 3.1.1. PackagingIndustry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Packaging Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Biodegradable Plastic Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing environmental concerns and regulations against single-use plastics

- 4.1.1.2. Increasing demand from packaging, agriculture, and consumer goods industries

- 4.1.1.3. Rising consumer awareness and preference for sustainable products

- 4.1.2. Restraints

- 4.1.2.1. Higher production costs compared to conventional plastics

- 4.1.2.2. Limited mechanical and thermal properties for certain applications

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Biodegradable Plastic Manufacturers

- 4.4.3. Distributors/ Suppliers

- 4.4.4. End-users/ Customers

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Biodegradable Plastic Market Demand

- 4.7.1. Historical Market Size - in (Volume - MMT and Value - US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in (Volume - MMT and Value - US$ Bn), 2025–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Biodegradable Plastic Market Analysis, by Material Type

- 6.1. Key Segment Analysis

- 6.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Material Type, 2021-2035

- 6.2.1. Polylactic Acid (PLA)

- 6.2.2. Polyhydroxyalkanoates (PHA)

- 6.2.3. Starch-Based Plastics

- 6.2.4. Polybutylene Succinate (PBS)

- 6.2.5. Polybutylene Adipate Terephthalate (PBAT)

- 6.2.6. Cellulose-Based Plastics

- 6.2.7. Polyglycolic Acid (PGA)

- 6.2.8. Bio-Polyethylene (Bio-PE)

- 6.2.9. Bio-Polypropylene (Bio-PP)

- 6.2.10. Polycaprolactone (PCL)

- 6.2.11. Others

- 7. Global Biodegradable Plastic Market Analysis, by Source

- 7.1. Key Segment Analysis

- 7.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 7.2.1. Plant-Based

- 7.2.1.1. Corn

- 7.2.1.2. Sugarcane

- 7.2.1.3. Cassava

- 7.2.1.4. Potato

- 7.2.1.5. Wheat

- 7.2.1.6. Others

- 7.2.2. Animal-Based

- 7.2.3. Microbial Fermentation

- 7.2.4. Algae-Based

- 7.2.5. Others

- 7.2.1. Plant-Based

- 8. Global Biodegradable Plastic Market Analysis and Forecasts, by Production Technology

- 8.1. Key Findings

- 8.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Production Technology, 2021-2035

- 8.2.1. Injection Molding

- 8.2.2. Extrusion

- 8.2.3. Blow Molding

- 8.2.4. Thermoforming

- 8.2.5. Foaming

- 8.2.6. Film Extrusion

- 8.2.7. Compression Molding

- 8.2.8. Others

- 9. Global Biodegradable Plastic Market Analysis and Forecasts, by Product Form

- 9.1. Key Findings

- 9.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Product Form, 2021-2035

- 9.2.1. Films & Sheets

- 9.2.2. Rigid Packaging

- 9.2.3. Flexible Packaging

- 9.2.4. Bottles & Containers

- 9.2.5. Bags & Pouches

- 9.2.6. Foams

- 9.2.7. Fibers

- 9.2.8. Coatings

- 9.2.9. Others

- 10. Global Biodegradable Plastic Market Analysis and Forecasts, by Biodegradability Type

- 10.1. Key Findings

- 10.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Biodegradability Type, 2021-2035

- 10.2.1. Fully Biodegradable

- 10.2.2. Compostable (Industrial)

- 10.2.3. Compostable (Home)

- 10.2.4. Marine Degradable

- 10.2.5. Soil Degradable

- 11. Global Biodegradable Plastic Market Analysis and Forecasts, by Distribution Channel

- 11.1. Key Findings

- 11.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales (B2B)

- 11.2.2. Distributors

- 11.2.3. Online Platforms

- 11.2.4. Retail Chains

- 12. Global Biodegradable Plastic Market Analysis and Forecasts, by End-Use Industry

- 12.1. Key Findings

- 12.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Thickness, 2021-2035

- 12.2.1. Packaging

- 12.2.1.1. Food Packaging

- 12.2.1.2. Beverage Packaging

- 12.2.1.3. Personal Care & Cosmetics Packaging

- 12.2.1.4. Pharmaceutical Packaging

- 12.2.1.5. E-commerce Packaging

- 12.2.1.6. Others

- 12.2.2. Agriculture & Horticulture

- 12.2.2.1. Mulch Films

- 12.2.2.2. Seed Coating

- 12.2.2.3. Plant Pots & Containers

- 12.2.2.4. Greenhouse Films

- 12.2.2.5. Crop Protection Nets

- 12.2.2.6. Others

- 12.2.3. Consumer Goods

- 12.2.3.1. Disposable Cutlery & Tableware

- 12.2.3.2. Shopping Bags

- 12.2.3.3. Garbage Bags

- 12.2.3.4. Food Service Items (cups, plates, straws)

- 12.2.3.5. Personal Hygiene Products

- 12.2.3.6. Others

- 12.2.4. Textile & Apparel

- 12.2.4.1. Clothing & Garments

- 12.2.4.2. Non-Woven Fabrics

- 12.2.4.3. Technical Textiles

- 12.2.4.4. Home Furnishings

- 12.2.4.5. Others

- 12.2.5. Medical & Healthcare

- 12.2.5.1. Surgical Sutures

- 12.2.5.2. Drug Delivery Systems

- 12.2.5.3. Medical Implants

- 12.2.5.4. Surgical Instruments

- 12.2.5.5. Medical Packaging

- 12.2.5.6. Others

- 12.2.6. Automotive

- 12.2.6.1. Interior Components

- 12.2.6.2. Dashboard Parts

- 12.2.6.3. Door Panels

- 12.2.6.4. Seat Cushions

- 12.2.6.5. Insulation Materials

- 12.2.6.6. Others

- 12.2.7. Electronics & Electrical

- 12.2.7.1. Phone Cases

- 12.2.7.2. Cable Insulation

- 12.2.7.3. Electronic Component Housing

- 12.2.7.4. Protective Packaging

- 12.2.7.5. Others

- 12.2.8. Construction & Building

- 12.2.9. Toys & Recreational Products

- 12.2.10. 3D Printing

- 12.2.11. Other End-use Industries

- 12.2.1. Packaging

- 13. Global Biodegradable Plastic Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Biodegradable Plastic Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Material Type

- 14.3.2. Source

- 14.3.3. Production Technology

- 14.3.4. Product Form

- 14.3.5. Biodegradability Type

- 14.3.6. Distribution Channel

- 14.3.7. End-Use Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Biodegradable Plastic Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Material Type

- 14.4.3. Source

- 14.4.4. Production Technology

- 14.4.5. Product Form

- 14.4.6. Biodegradability Type

- 14.4.7. Distribution Channel

- 14.4.8. End-Use Industry

- 14.5. Canada Biodegradable Plastic Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Material Type

- 14.5.3. Source

- 14.5.4. Production Technology

- 14.5.5. Product Form

- 14.5.6. Biodegradability Type

- 14.5.7. Distribution Channel

- 14.5.8. End-Use Industry

- 14.6. Mexico Biodegradable Plastic Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Material Type

- 14.6.3. Source

- 14.6.4. Production Technology

- 14.6.5. Product Form

- 14.6.6. Biodegradability Type

- 14.6.7. Distribution Channel

- 14.6.8. End-Use Industry

- 15. Europe Biodegradable Plastic Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Product Type

- 15.3.2. Material Type

- 15.3.3. Source

- 15.3.4. Production Technology

- 15.3.5. Product Form

- 15.3.6. Biodegradability Type

- 15.3.7. Distribution Channel

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. Germany

- 15.3.9.2. United Kingdom

- 15.3.9.3. France

- 15.3.9.4. Italy

- 15.3.9.5. Spain

- 15.3.9.6. Netherlands

- 15.3.9.7. Nordic Countries

- 15.3.9.8. Poland

- 15.3.9.9. Russia & CIS

- 15.3.9.10. Rest of Europe

- 15.4. Germany Biodegradable Plastic Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Material Type

- 15.4.3. Source

- 15.4.4. Production Technology

- 15.4.5. Product Form

- 15.4.6. Biodegradability Type

- 15.4.7. Distribution Channel

- 15.4.8. End-Use Industry

- 15.5. United Kingdom Biodegradable Plastic Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Material Type

- 15.5.3. Source

- 15.5.4. Production Technology

- 15.5.5. Product Form

- 15.5.6. Biodegradability Type

- 15.5.7. Distribution Channel

- 15.5.8. End-Use Industry

- 15.6. France Biodegradable Plastic Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Material Type

- 15.6.3. Source

- 15.6.4. Production Technology

- 15.6.5. Product Form

- 15.6.6. Biodegradability Type

- 15.6.7. Distribution Channel

- 15.6.8. End-Use Industry

- 15.7. Italy Biodegradable Plastic Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Material Type

- 15.7.3. Source

- 15.7.4. Production Technology

- 15.7.5. Product Form

- 15.7.6. Biodegradability Type

- 15.7.7. Distribution Channel

- 15.7.8. End-Use Industry

- 15.8. Spain Biodegradable Plastic Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Material Type

- 15.8.3. Source

- 15.8.4. Production Technology

- 15.8.5. Product Form

- 15.8.6. Biodegradability Type

- 15.8.7. Distribution Channel

- 15.8.8. End-Use Industry

- 15.9. Netherlands Biodegradable Plastic Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Material Type

- 15.9.3. Source

- 15.9.4. Production Technology

- 15.9.5. Product Form

- 15.9.6. Biodegradability Type

- 15.9.7. Distribution Channel

- 15.9.8. End-Use Industry

- 15.10. Nordic Countries Biodegradable Plastic Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Material Type

- 15.10.3. Source

- 15.10.4. Production Technology

- 15.10.5. Product Form

- 15.10.6. Biodegradability Type

- 15.10.7. Distribution Channel

- 15.10.8. End-Use Industry

- 15.11. Poland Biodegradable Plastic Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Material Type

- 15.11.3. Source

- 15.11.4. Production Technology

- 15.11.5. Product Form

- 15.11.6. Biodegradability Type

- 15.11.7. Distribution Channel

- 15.11.8. End-Use Industry

- 15.12. Russia & CIS Biodegradable Plastic Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Material Type

- 15.12.3. Source

- 15.12.4. Production Technology

- 15.12.5. Product Form

- 15.12.6. Biodegradability Type

- 15.12.7. Distribution Channel

- 15.12.8. End-Use Industry

- 15.13. Rest of Europe Biodegradable Plastic Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Material Type

- 15.13.3. Source

- 15.13.4. Production Technology

- 15.13.5. Product Form

- 15.13.6. Biodegradability Type

- 15.13.7. Distribution Channel

- 15.13.8. End-Use Industry

- 16. Asia Pacific Biodegradable Plastic Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Material Type

- 16.3.2. Source

- 16.3.3. Production Technology

- 16.3.4. Product Form

- 16.3.5. Biodegradability Type

- 16.3.6. Distribution Channel

- 16.3.7. End-Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Biodegradable Plastic Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material Type

- 16.4.3. Source

- 16.4.4. Production Technology

- 16.4.5. Product Form

- 16.4.6. Biodegradability Type

- 16.4.7. Distribution Channel

- 16.4.8. End-Use Industry

- 16.5. India Biodegradable Plastic Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material Type

- 16.5.3. Source

- 16.5.4. Production Technology

- 16.5.5. Product Form

- 16.5.6. Biodegradability Type

- 16.5.7. Distribution Channel

- 16.5.8. End-Use Industry

- 16.6. Japan Biodegradable Plastic Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material Type

- 16.6.3. Source

- 16.6.4. Production Technology

- 16.6.5. Product Form

- 16.6.6. Biodegradability Type

- 16.6.7. Distribution Channel

- 16.6.8. End-Use Industry

- 16.7. South Korea Biodegradable Plastic Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Material Type

- 16.7.3. Source

- 16.7.4. Production Technology

- 16.7.5. Product Form

- 16.7.6. Biodegradability Type

- 16.7.7. Distribution Channel

- 16.7.8. End-Use Industry

- 16.8. Australia and New Zealand Biodegradable Plastic Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Material Type

- 16.8.3. Source

- 16.8.4. Production Technology

- 16.8.5. Product Form

- 16.8.6. Biodegradability Type

- 16.8.7. Distribution Channel

- 16.8.8. End-Use Industry

- 16.9. Indonesia Biodegradable Plastic Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Material Type

- 16.9.3. Source

- 16.9.4. Production Technology

- 16.9.5. Product Form

- 16.9.6. Biodegradability Type

- 16.9.7. Distribution Channel

- 16.9.8. End-Use Industry

- 16.10. Malaysia Biodegradable Plastic Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Material Type

- 16.10.3. Source

- 16.10.4. Production Technology

- 16.10.5. Product Form

- 16.10.6. Biodegradability Type

- 16.10.7. Distribution Channel

- 16.10.8. End-Use Industry

- 16.11. Thailand Biodegradable Plastic Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Material Type

- 16.11.3. Source

- 16.11.4. Production Technology

- 16.11.5. Product Form

- 16.11.6. Biodegradability Type

- 16.11.7. Distribution Channel

- 16.11.8. End-Use Industry

- 16.12. Vietnam Biodegradable Plastic Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Material Type

- 16.12.3. Source

- 16.12.4. Production Technology

- 16.12.5. Product Form

- 16.12.6. Biodegradability Type

- 16.12.7. Distribution Channel

- 16.12.8. End-Use Industry

- 16.13. Rest of Asia Pacific Biodegradable Plastic Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Material Type

- 16.13.3. Source

- 16.13.4. Production Technology

- 16.13.5. Product Form

- 16.13.6. Biodegradability Type

- 16.13.7. Distribution Channel

- 16.13.8. End-Use Industry

- 17. Middle East Biodegradable Plastic Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Material Type

- 17.3.2. Source

- 17.3.3. Production Technology

- 17.3.4. Product Form

- 17.3.5. Biodegradability Type

- 17.3.6. Distribution Channel

- 17.3.7. End-Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Biodegradable Plastic Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Material Type

- 17.4.3. Source

- 17.4.4. Production Technology

- 17.4.5. Product Form

- 17.4.6. Biodegradability Type

- 17.4.7. Distribution Channel

- 17.4.8. End-Use Industry

- 17.5. UAE Biodegradable Plastic Market

- 17.5.1. Product Type

- 17.5.2. Material Type

- 17.5.3. Source

- 17.5.4. Production Technology

- 17.5.5. Product Form

- 17.5.6. Biodegradability Type

- 17.5.7. Distribution Channel

- 17.5.8. End-Use Industry

- 17.6. Saudi Arabia Biodegradable Plastic Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Material Type

- 17.6.3. Source

- 17.6.4. Production Technology

- 17.6.5. Product Form

- 17.6.6. Biodegradability Type

- 17.6.7. Distribution Channel

- 17.6.8. End-Use Industry

- 17.7. Israel Biodegradable Plastic Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Material Type

- 17.7.3. Source

- 17.7.4. Production Technology

- 17.7.5. Product Form

- 17.7.6. Biodegradability Type

- 17.7.7. Distribution Channel

- 17.7.8. End-Use Industry

- 17.8. Rest of Middle East Biodegradable Plastic Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Material Type

- 17.8.3. Source

- 17.8.4. Production Technology

- 17.8.5. Product Form

- 17.8.6. Biodegradability Type

- 17.8.7. Distribution Channel

- 17.8.8. End-Use Industry

- 18. Africa Biodegradable Plastic Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Material Type

- 18.3.2. Source

- 18.3.3. Production Technology

- 18.3.4. Product Form

- 18.3.5. Biodegradability Type

- 18.3.6. Distribution Channel

- 18.3.7. End-Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Biodegradable Plastic Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Material Type

- 18.4.3. Source

- 18.4.4. Production Technology

- 18.4.5. Product Form

- 18.4.6. Biodegradability Type

- 18.4.7. Distribution Channel

- 18.4.8. End-Use Industry

- 18.5. Egypt Biodegradable Plastic Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Material Type

- 18.5.3. Source

- 18.5.4. Production Technology

- 18.5.5. Product Form

- 18.5.6. Biodegradability Type

- 18.5.7. Distribution Channel

- 18.5.8. End-Use Industry

- 18.6. Nigeria Biodegradable Plastic Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Material Type

- 18.6.3. Source

- 18.6.4. Production Technology

- 18.6.5. Product Form

- 18.6.6. Biodegradability Type

- 18.6.7. Distribution Channel

- 18.6.8. End-Use Industry

- 18.7. Algeria Biodegradable Plastic Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Material Type

- 18.7.3. Source

- 18.7.4. Production Technology

- 18.7.5. Product Form

- 18.7.6. Biodegradability Type

- 18.7.7. Distribution Channel

- 18.7.8. End-Use Industry

- 18.8. Rest of Africa Biodegradable Plastic Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Material Type

- 18.8.3. Source

- 18.8.4. Production Technology

- 18.8.5. Product Form

- 18.8.6. Biodegradability Type

- 18.8.7. Distribution Channel

- 18.8.8. End-Use Industry

- 19. South America Biodegradable Plastic Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Biodegradable Plastic Market Size (Volume - MMT and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Material Type

- 19.3.2. Source

- 19.3.3. Production Technology

- 19.3.4. Product Form

- 19.3.5. Biodegradability Type

- 19.3.6. Distribution Channel

- 19.3.7. End-Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Biodegradable Plastic Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Material Type

- 19.4.3. Source

- 19.4.4. Production Technology

- 19.4.5. Product Form

- 19.4.6. Biodegradability Type

- 19.4.7. Distribution Channel

- 19.4.8. End-Use Industry

- 19.5. Argentina Biodegradable Plastic Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Material Type

- 19.5.3. Source

- 19.5.4. Production Technology

- 19.5.5. Product Form

- 19.5.6. Biodegradability Type

- 19.5.7. Distribution Channel

- 19.5.8. End-Use Industry

- 19.6. Rest of South America Biodegradable Plastic Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Material Type

- 19.6.3. Source

- 19.6.4. Production Technology

- 19.6.5. Product Form

- 19.6.6. Biodegradability Type

- 19.6.7. Distribution Channel

- 19.6.8. End-Use Industry

- 20. Key Players/ Company Profile

- 20.1. Arkema S.A.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. BASF SE

- 20.3. Biobag International AS

- 20.4. Biome Bioplastics

- 20.5. Bio-on S.p.A.

- 20.6. Biotec GmbH & Co. KG

- 20.7. Cardia Bioplastics

- 20.8. Corbion N.V.

- 20.9. Danimer Scientific

- 20.10. Evonik Industries AG

- 20.11. FKuR Kunststoff GmbH

- 20.12. Futamura Chemical Co., Ltd.

- 20.13. Green Dot Bioplastics

- 20.14. Kingfa Sci. & Tech. Co., Ltd.

- 20.15. Mitsubishi Chemical Holdings Corporation

- 20.16. NatureWorks LLC

- 20.17. Novamont S.p.A.

- 20.18. Plantic Technologies Limited

- 20.19. PTT MCC Biochem

- 20.20. SECOS Group Ltd.

- 20.21. Tianan Biologic Materials Co., Ltd.

- 20.22. Toray Industries, Inc.

- 20.23. Total Corbion PLA

- 20.24. Yield10 Bioscience, Inc.

- 20.25. Zhejiang Hisun Biomaterials Co., Ltd.

- 20.26. Other Key Players

- 20.1. Arkema S.A.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation