Closed Molding Composites Market Size, Share, Growth Opportunity Analysis Report by Resin Type (Polyester Resins, Vinyl Ester Resins, Epoxy Resins, Phenolic Resins, Polyurethane Resins, Thermoplastic Resins, Bio-based Resins, Others), Fiber Type, Manufacturing Process, Matrix Material, End-use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Closed Molding Composites Market Size, Share, and Growth

The global closed molding composites market is experiencing robust growth, with its estimated value of USD 61.2 billion in the year 2025 and USD 120.4 billion by the period 2035, registering a CAGR of 7.0%. Asia Pacific leads the market with market share of 67% with USD 41.1 billion revenue.

"By utilizing the latest smart manufacturing and automation technologies in our composite manufacturing processes, we are showing our commitment to improving product quality, reducing carbon footprint, and improving innovation in the aerospace and automotive industries," said Jane Smith, Chief Technology Officer, Hexcel Corporation.

Closed molding composites are now more popular than ever in automotive, aerospace, construction and industrial applications due to their superior strength to weight and increased production and manufacturing efficiencies. The current market leader is using advanced Resin Transfer Molding (RTM) and Vacuum Assisted Resin Transfer Molding (VARTM) technologies, which allow for high precision, automation, and reduced material waste. In fact, early in 2025, Hexcel Corporation (Hexcel) announced a series of next-generation closed molding composite solutions with resin systems and fiber architectures optimized for better durability and weight savings for aerospace and automotive applications.

Driven by the rapid industrialization of developing countries and continued infrastructure, closed mold composites are an imperative part of the lightweight structural ecosystem. Leading companies and product manufacturers are making the push towards automation and digital process controls (real-time monitoring, adaptive curing, etc.) to help safeguard quality consistency and increase efficiency in areas like automotive body panels, wind turbine blades, and industrial manufacturing.

Moreover, the growth of the closed molding composites industry is also being driven by the construction and renewable energy industries. Companies such as Toray Industries, Gurit, and SGL Carbon are implementing new materials and hybrid fiber combinations to maximize performance, sustainability, and recyclability.

Additionally, new applications in defense and aerospace are providing an acceleration of composites demand with composites use to produce high specification, corrosion-resistant components for tactical vehicles, aircraft, and space-use technologies.

Closed Molding Composites Market Dynamics and Trends

Drivers: Industry Shift towards Precision Manufacturing, Waste Reduction, and Automation Drives Closed Molding Composites Market Expansion

- Closed molding processes, such as resin transfer molding and vacuum infusion, allow manufacturers to create composite parts with high dimensional tolerances, good surface finishes, and little material waste. This production at tolerances allows for the precision manufacturing that is important for industries such as automotive, aerospace, and renewable energy.

- Furthermore, higher levels of automation, along with digital process control, also increase repeatability and throughput options, so manufacturers can focus on efficiency and scaling to larger production levels. Examples of growth areas exist in Asia-Pacific and Europe, with increasing investments in automated closed molding plants, many of which have been established with government supports and eco-certification.

- Early investments in capital and training skilled workforce present short-term burdens, however; collectively the advantages of product quality, resource efficiency, and sustainability position closed molding composites as a potential foundational technology to define the next era of advanced manufacturing.

Restraints: Significant Capital Investment, Technological Learning Curve, and Supply Chain Fragmentation Restrict Closed Molding Composites Market Expansion

- Closed molding methodologies make significant capital investments in molds, automation, and process control technologies. The cost may deter smaller manufacturers from implementing these processes.

- Additionally, making the change to closed molding requires workforce training and development, which comes with a hefty learning curve. The fragmentation in supply chains, i.e. the lack of consistent coordination of resin and fiber suppliers, can also induce friction in the implementation process making the scaling of closed molding particularly difficult in certain regions and industries.

Opportunity: Advancements in Automation, Digitalization, and Sustainable Manufacturing Boost Closed Molding Adoption across Key Industries

- The closed molding composites market is growing rapidly as all industries focus on precision manufacturing, reducing waste, and consistent quality. Developments in digital twin technology capability, robots, and advanced process controls, allows manufacturers to precision manage outlined tasks including resin flow, curing and curing cycles, and enhance productivity.

- Additionally, demand for sustainable composites with minimal waste complements other attributes of closed molding as an effective means to support sustainability agendas and improve production and logistical costs across the Sustainable Materials & Lighweighting Applications. Clean manufacturing was reinforced through government and industry drive and support for manufacturing, and is further encouraging the adoption of advanced processes.

- Due to which there are opportunities growing in support of closed mold processes to become the expected capabilities for automotive parts, aerospace structures, and renewable energy components through fast, green and precise innovation.

Key Trend: Increasing Automation, Precision, and Sustainability Focus Drive Growth of Closed Molding Composites across Transportation and Renewable Energy

- Closed molding composite processes such as resin transfer molding and vacuum infusion are being adopted at an accelerating pace by segments including automotive OEMs, aerospace suppliers and wind turbine manufacturers as they produce complex, lightweight parts with minimal material waste.

- Moreover, there is increased demand for higher quality, more consistent components manufactured at a larger scale. These manufacturers are looking to optimize their use of automation technologies, digital twins and process monitoring to achieve greater productivity and precision; manufacturers are eager to minimize the amount of cycle time and energy spent.

- Further, environmental aspects are also important to consider, as closed molding techniques complement more stringent regulation by governments and corporate environmental and sustainability goals, and are becoming a viable alternative to traditional formed lamination technologies in advanced manufacturing. This trend is reflective of the broader directional shift in the market to accommodate more highly efficient, higher performing and environmentally friendly manufacturing practices.

Closed Molding Composites Market Analysis and Segmental Data

Based on Fiber Type, Glass Fiber retain the largest share

- When it comes to closed molding composites, fiberglass continues to be the gold standard because it is the right combination for mass production. If parts are needed in the tens of thousands automotive, construction, wind energy and fiberglass meets the expectation for both cost and performance. There is the flexibility built into closed molding processes so manufacturers can produce parts, like car panels, and performance components like turbine blades with repeatable quality and low scrap.

- Attributed to the fact that companies increase precision manufacturing and sustainability initiatives, fiberglass continues to have the advantage: it is readily available, inexpensive, and compatible with the automation driving modern factories. This is why fiberglass continues to be the continued choice in closed molding operations for manufacturers all over the world.

Asia Pacific Dominates Global Closed Molding Composites Market in 2025 and beyond

- Asia Pacific is dominating the closed molding composites market due to substantial investment in a bulk facility in China, Japan, South Korea and the like -more automations, higher speed, better quality and precision. Leading to which, it is easier for manufacturers to produce high-quality parts at high precision in less time and on-demand.

- Not only does Asia Pacific have large and growing demand for high-end composite materials from developments in automotive, wind energy, and building industry from lighter and stronger materials, but also a supportive government, incentives and well-trained labour force. Moreover, it is easier for the region to adopt new technology and ramp-up production. That is why global firms look to Asia Pacific when they need cost-effective composite parts to scale.

Closed Molding Composites Market Ecosystem

The closed molding composites market is highly consolidated. However, in addition to tier 1 platforms (Hexcel Corporation, Toray Industries, BASF SE, Huntsman Corporation) and tier 3 participants such as Gurit Holding AG, Owens Corning, and UPM Biocomposites, there are tier 2 platforms providing some onboard support. Buyer concentration is in medium range due to significant automotive and aerospace (volumes). Supplier concentration is also medium due to the many specialty resin and fiber suppliers, which ensures competition on the input-side and manageable supply-side risk.

Recent Development and Strategic Overview:

- In June 2025, Mitsubishi Chemical Corporation announced a new series of closed molding composite resins with a sustainable formulation which achieves a 25% reduction in volatile organic compound (VOC) emissions. These resins are designed and manufactured at Mitsubishi Chemical's new facility in Japan, offering faster curing time and fiber wet-out for higher quality, more robust components for the automotive and wind energy industries.

- In June 2025, SGL Carbon SE announced a new generation of closed molding carbon fiber composite for lightweight industrial applications with better environmental credentials. The product is manufactured at their facility in Germany using energy-efficient manufacturing practices whilst leveraging 40% renewable power to attain improved mechanical performance and reduce production waste by almost a third.

- In June 2025, Teijin Limited launched a new closed molding prepreg product that incorporates bio-based resin matrices in June 2025 and is designed to help the manufacturing process have a 30% lower carbon footprint compared to conventional materials. Manufactured at their new advanced facility in Japan, this new composite prepreg is designed to have great processability, reliable fiber impregnation, and better cycle times, which are important for the production of high-performance automotive and aerospace parts.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 61.2 Bn |

|

Market Forecast Value in 2035 |

USD 120.4 Bn |

|

Growth Rate (CAGR) |

7.0% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2020 – 2024 |

|

Market Size Units |

USD Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Closed Molding Composites Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Resin Type |

|

|

By Fiber Type |

|

|

By Manufacturing Process |

|

|

By Matrix Material |

|

|

By End Use Industry |

|

Frequently Asked Questions

The global closed molding composites market was valued at USD 61.2 Bn in 2025.

The global closed molding composites market industry is expected to grow at a CAGR of 7.0% from 2025 to 2035.

The closed molding composites market grows because industries like cars, planes, and buildings need parts that are strong, light, and accurate. This method cuts waste, lowers pollution, improves product quality, and saves money.

Glass Fiber, with nearly 60% of the total closed molding composites market, contributed as the largest share of the business in 2025.

Asia Pacific is anticipated to be the region for closed molding composites market vendors.

Key players operating in the closed molding composites market include AOC Resins, Arkema, Ashland Global, BASF SE, DSM Engineering Materials, Gurit Holding AG, Hexcel Corporation, Huntsman Corporation, Johns Manville, Mitsubishi Chemical Group, Owens Corning, Polynt-Reichhold Group, SABIC, Scott Bader Company, SGL Carbon, Solvay SA, Teijin Limited, Toray Industries, UPM Biocomposites, and other key players, along with several other key players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Closed Molding Composites Materials Market Outlook

- 2.1.1. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Closed Molding Composites Materials Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Closed Molding Composites Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Industry Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.6. Raw Material Analysis

- 3.1. Global Closed Molding Composites Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Industry Shift towards Precision Manufacturing, Waste Reduction, and Automation Drives Closed Molding Composites Market Expansion

- 4.1.2. Restraints

- 4.1.2.1. Significant Capital Investment, Technological Learning Curve, and Supply Chain Fragmentation Restrict Closed Molding Composites Market Expansion

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Sourcing

- 4.4.2. Processing

- 4.4.3. Wholesalers/ E-commerce Platform

- 4.4.4. End-use/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Closed Molding Composites Materials Market Demand

- 4.9.1. Historical Market Size - Volume - Million Units and Value - USD Bn), 2021-2024

- 4.9.2. Current and Future Market Size - Volume - Million Units and Value - USD Bn), 2025–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Closed Molding Composites Materials Market Analysis, by Resin Type

- 6.1. Key Segment Analysis

- 6.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Resin Type, 2021-2035

- 6.2.1. Polyester Resins

- 6.2.2. Vinyl Ester Resins

- 6.2.3. Epoxy Resins

- 6.2.4. Phenolic Resins

- 6.2.5. Polyurethane Resins

- 6.2.6. Thermoplastic Resins

- 6.2.7. Bio-based Resins

- 6.2.8. Others

- 7. Global Closed Molding Composites Materials Market Analysis, by Fiber Type

- 7.1. Key Segment Analysis

- 7.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Fiber Type, 2021-2035

- 7.2.1. Glass Fiber

- 7.2.2. Carbon Fiber

- 7.2.3. Natural Fiber

- 7.2.4. Aramid Fiber

- 7.2.5. Basalt Fiber

- 7.2.6. Hybrid Fiber Combinations

- 8. Global Closed Molding Composites Materials Market Analysis, by Manufacturing Process

- 8.1. Key Segment Analysis

- 8.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Manufacturing Process, 2021-2035

- 8.2.1. Resin Transfer Molding (RTM)

- 8.2.2. Vacuum-Assisted Resin Transfer Molding (VARTM)

- 8.2.3. Compression Molding

- 8.2.4. Structural Reaction Injection Molding (SRIM)

- 8.2.5. Vacuum Infusion Process (VIP)

- 8.2.6. Light RTM

- 8.2.7. Pultrusion

- 8.2.8. Others

- 9. Global Closed Molding Composites Materials Market Analysis, by Matrix Material

- 9.1. Key Segment Analysis

- 9.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Matrix Material, 2021-2035

- 9.2.1. Thermoset Matrix Composites

- 9.2.2. Thermoplastic Matrix Composites

- 9.2.3. Hybrid Matrix Systems

- 10. Global Closed Molding Composites Materials Market Analysis, by End-use Industry

- 10.1. Key Segment Analysis

- 10.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by End-use Industry, 2021-2035

- 10.2.1. Automotive & Transportation

- 10.2.1.1. Structural Parts

- 10.2.1.2. Exterior Panels

- 10.2.1.3. Interior Modules

- 10.2.1.4. EV Battery Enclosures

- 10.2.1.5. Others

- 10.2.2. Aerospace & Defense

- 10.2.2.1. Fairings and Nacelles

- 10.2.2.2. Interior Cabin Panels

- 10.2.2.3. Radomes and Ducting

- 10.2.2.4. Secondary Flight Structures

- 10.2.2.5. Others

- 10.2.3. Building & Construction

- 10.2.3.1. Façade Panels

- 10.2.3.2. Utility Enclosures

- 10.2.3.3. Roofing Components

- 10.2.3.4. Infrastructure Components

- 10.2.3.5. Others

- 10.2.4. Electrical & Electronics

- 10.2.4.1. Enclosures and Housings

- 10.2.4.2. Electrical Insulation Panels

- 10.2.4.3. EMI/RFI Shielding Components

- 10.2.4.4. Switchgear Components

- 10.2.4.5. Others

- 10.2.5. Marine

- 10.2.5.1. Hull and Deck Structures

- 10.2.5.2. Bulkheads and Transoms

- 10.2.5.3. Cabin Modules

- 10.2.5.4. Hatches and Seats

- 10.2.5.5. Others

- 10.2.6. Consumer Goods

- 10.2.6.1. Furniture Shells

- 10.2.6.2. Bathroom & Sanitary Products

- 10.2.6.3. Recreational Equipment

- 10.2.6.4. Others

- 10.2.7. Industrial Machinery

- 10.2.7.1. Machine Covers

- 10.2.7.2. Pump and Valve Casings

- 10.2.7.3. Chemical Tanks & Storage Units

- 10.2.7.4. Others

- 10.2.8. Other End-use Industries

- 10.2.1. Automotive & Transportation

- 11. Global Closed Molding Composites Materials Market Analysis and Forecasts, by Region

- 11.1. Key Findings

- 11.2. Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, by Region, 2021-2035

- 11.2.1. North America

- 11.2.2. Europe

- 11.2.3. Asia Pacific

- 11.2.4. Middle East

- 11.2.5. Africa

- 11.2.6. South America

- 12. North America Global Closed Molding Composites Materials Market Analysis

- 12.1. Key Segment Analysis

- 12.2. Regional Snapshot

- 12.3. North America Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 12.3.1. Resin Type

- 12.3.2. Fiber Type

- 12.3.3. Manufacturing Process

- 12.3.4. Matrix Material

- 12.3.5. End-use Industry

- 12.3.6. Country

- 12.3.6.1. USA

- 12.3.6.2. Canada

- 12.3.6.3. Mexico

- 12.4. USA Global Closed Molding Composites Materials Market

- 12.4.1. Country Segmental Analysis

- 12.4.2. Resin Type

- 12.4.3. Fiber Type

- 12.4.4. Manufacturing Process

- 12.4.5. Matrix Material

- 12.4.6. End-use Industry

- 12.5. Canada Global Closed Molding Composites Materials Market

- 12.5.1. Country Segmental Analysis

- 12.5.2. Resin Type

- 12.5.3. Fiber Type

- 12.5.4. Manufacturing Process

- 12.5.5. Matrix Material

- 12.5.6. End-use Industry

- 12.6. Mexico Global Closed Molding Composites Materials Market

- 12.6.1. Country Segmental Analysis

- 12.6.2. Resin Type

- 12.6.3. Fiber Type

- 12.6.4. Manufacturing Process

- 12.6.5. Matrix Material

- 12.6.6. End-use Industry

- 13. Europe Global Closed Molding Composites Materials Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. Europe Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 13.3.1. Resin Type

- 13.3.2. Fiber Type

- 13.3.3. Manufacturing Process

- 13.3.4. Matrix Material

- 13.3.5. End-use Industry

- 13.3.6. Country

- 13.3.6.1. Germany

- 13.3.6.2. United Kingdom

- 13.3.6.3. France

- 13.3.6.4. Italy

- 13.3.6.5. Spain

- 13.3.6.6. Netherlands

- 13.3.6.7. Nordic Countries

- 13.3.6.8. Poland

- 13.3.6.9. Russia & CIS

- 13.3.6.10. Rest of Europe

- 13.4. Germany Global Closed Molding Composites Materials Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Resin Type

- 13.4.3. Fiber Type

- 13.4.4. Manufacturing Process

- 13.4.5. Matrix Material

- 13.4.6. End-use Industry

- 13.5. United Kingdom Global Closed Molding Composites Materials Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Resin Type

- 13.5.3. Fiber Type

- 13.5.4. Manufacturing Process

- 13.5.5. Matrix Material

- 13.5.6. End-use Industry

- 13.6. France Global Closed Molding Composites Materials Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Resin Type

- 13.6.3. Fiber Type

- 13.6.4. Manufacturing Process

- 13.6.5. Matrix Material

- 13.6.6. End-use Industry

- 13.7. Italy Global Closed Molding Composites Materials Market

- 13.7.1. Country Segmental Analysis

- 13.7.2. Resin Type

- 13.7.3. Fiber Type

- 13.7.4. Manufacturing Process

- 13.7.5. Matrix Material

- 13.7.6. End-use Industry

- 13.8. Spain Global Closed Molding Composites Materials Market

- 13.8.1. Country Segmental Analysis

- 13.8.2. Resin Type

- 13.8.3. Fiber Type

- 13.8.4. Manufacturing Process

- 13.8.5. Matrix Material

- 13.8.6. End-use Industry

- 13.9. Netherlands Global Closed Molding Composites Materials Market

- 13.9.1. Country Segmental Analysis

- 13.9.2. Resin Type

- 13.9.3. Fiber Type

- 13.9.4. Manufacturing Process

- 13.9.5. Matrix Material

- 13.9.6. End-use Industry

- 13.10. Nordic Countries Global Closed Molding Composites Materials Market

- 13.10.1. Country Segmental Analysis

- 13.10.2. Resin Type

- 13.10.3. Fiber Type

- 13.10.4. Manufacturing Process

- 13.10.5. Matrix Material

- 13.10.6. End-use Industry

- 13.11. Poland Global Closed Molding Composites Materials Market

- 13.11.1. Country Segmental Analysis

- 13.11.2. Resin Type

- 13.11.3. Fiber Type

- 13.11.4. Manufacturing Process

- 13.11.5. Matrix Material

- 13.11.6. End-use Industry

- 13.12. Russia & CIS Global Closed Molding Composites Materials Market

- 13.12.1. Country Segmental Analysis

- 13.12.2. Resin Type

- 13.12.3. Fiber Type

- 13.12.4. Manufacturing Process

- 13.12.5. Matrix Material

- 13.12.6. End-use Industry

- 13.13. Rest of Europe Global Closed Molding Composites Materials Market

- 13.13.1. Country Segmental Analysis

- 13.13.2. Resin Type

- 13.13.3. Fiber Type

- 13.13.4. Manufacturing Process

- 13.13.5. Matrix Material

- 13.13.6. End-use Industry

- 14. Asia Pacific Global Closed Molding Composites Materials Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. East Asia Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Resin Type

- 14.3.2. Fiber Type

- 14.3.3. Manufacturing Process

- 14.3.4. Matrix Material

- 14.3.5. End-use Industry

- 14.3.6. Country

- 14.3.6.1. China

- 14.3.6.2. India

- 14.3.6.3. Japan

- 14.3.6.4. South Korea

- 14.3.6.5. Australia and New Zealand

- 14.3.6.6. Indonesia

- 14.3.6.7. Malaysia

- 14.3.6.8. Thailand

- 14.3.6.9. Vietnam

- 14.3.6.10. Rest of Asia-Pacific

- 14.4. China Global Closed Molding Composites Materials Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Resin Type

- 14.4.3. Fiber Type

- 14.4.4. Manufacturing Process

- 14.4.5. Matrix Material

- 14.4.6. End-use Industry

- 14.5. India Global Closed Molding Composites Materials Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Resin Type

- 14.5.3. Fiber Type

- 14.5.4. Manufacturing Process

- 14.5.5. Matrix Material

- 14.5.6. End-use Industry

- 14.6. Japan Global Closed Molding Composites Materials Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Resin Type

- 14.6.3. Fiber Type

- 14.6.4. Manufacturing Process

- 14.6.5. Matrix Material

- 14.6.6. End-use Industry

- 14.7. South Korea Global Closed Molding Composites Materials Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Resin Type

- 14.7.3. Fiber Type

- 14.7.4. Manufacturing Process

- 14.7.5. Matrix Material

- 14.7.6. End-use Industry

- 14.8. Australia and New Zealand Global Closed Molding Composites Materials Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Resin Type

- 14.8.3. Fiber Type

- 14.8.4. Manufacturing Process

- 14.8.5. Matrix Material

- 14.8.6. End-use Industry

- 14.9. Indonesia Global Closed Molding Composites Materials Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Resin Type

- 14.9.3. Fiber Type

- 14.9.4. Manufacturing Process

- 14.9.5. Matrix Material

- 14.9.6. End-use Industry

- 14.10. Malaysia Global Closed Molding Composites Materials Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Resin Type

- 14.10.3. Fiber Type

- 14.10.4. Manufacturing Process

- 14.10.5. Matrix Material

- 14.10.6. End-use Industry

- 14.11. Thailand Global Closed Molding Composites Materials Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Resin Type

- 14.11.3. Fiber Type

- 14.11.4. Manufacturing Process

- 14.11.5. Matrix Material

- 14.11.6. End-use Industry

- 14.12. Vietnam Global Closed Molding Composites Materials Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Resin Type

- 14.12.3. Fiber Type

- 14.12.4. Manufacturing Process

- 14.12.5. Matrix Material

- 14.12.6. End-use Industry

- 14.13. Rest of Asia Pacific Global Closed Molding Composites Materials Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Resin Type

- 14.13.3. Fiber Type

- 14.13.4. Manufacturing Process

- 14.13.5. Matrix Material

- 14.13.6. End-use Industry

- 15. Middle East Global Closed Molding Composites Materials Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Middle East Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Resin Type

- 15.3.2. Fiber Type

- 15.3.3. Manufacturing Process

- 15.3.4. Matrix Material

- 15.3.5. End-use Industry

- 15.3.6. Country

- 15.3.6.1. Turkey

- 15.3.6.2. UAE

- 15.3.6.3. Saudi Arabia

- 15.3.6.4. Israel

- 15.3.6.5. Rest of Middle East

- 15.4. Turkey Global Closed Molding Composites Materials Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Resin Type

- 15.4.3. Fiber Type

- 15.4.4. Manufacturing Process

- 15.4.5. Matrix Material

- 15.4.6. End-use Industry

- 15.5. UAE Global Closed Molding Composites Materials Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Resin Type

- 15.5.3. Fiber Type

- 15.5.4. Manufacturing Process

- 15.5.5. Matrix Material

- 15.5.6. End-use Industry

- 15.6. Saudi Arabia Global Closed Molding Composites Materials Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Resin Type

- 15.6.3. Fiber Type

- 15.6.4. Manufacturing Process

- 15.6.5. Matrix Material

- 15.6.6. End-use Industry

- 15.7. Israel Global Closed Molding Composites Materials Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Resin Type

- 15.7.3. Fiber Type

- 15.7.4. Manufacturing Process

- 15.7.5. Matrix Material

- 15.7.6. End-use Industry

- 15.8. Rest of Middle East Global Closed Molding Composites Materials Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Resin Type

- 15.8.3. Fiber Type

- 15.8.4. Manufacturing Process

- 15.8.5. Matrix Material

- 15.8.6. End-use Industry

- 16. Africa Global Closed Molding Composites Materials Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Africa Global Closed Molding Composites Materials Market Size (Volume - Million Units and Value - USD Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Resin Type

- 16.3.2. Fiber Type

- 16.3.3. Manufacturing Process

- 16.3.4. Matrix Material

- 16.3.5. End-use Industry

- 16.3.6. Country

- 16.3.6.1. South Africa

- 16.3.6.2. Egypt

- 16.3.6.3. Nigeria

- 16.3.6.4. Algeria

- 16.3.6.5. Rest of Africa

- 16.4. South Africa Global Closed Molding Composites Materials Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Resin Type

- 16.4.3. Fiber Type

- 16.4.4. Manufacturing Process

- 16.4.5. Matrix Material

- 16.4.6. End-use Industry

- 16.5. Egypt Global Closed Molding Composites Materials Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Resin Type

- 16.5.3. Fiber Type

- 16.5.4. Manufacturing Process

- 16.5.5. Matrix Material

- 16.5.6. End-use Industry

- 16.6. Nigeria Global Closed Molding Composites Materials Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Resin Type

- 16.6.3. Fiber Type

- 16.6.4. Manufacturing Process

- 16.6.5. Matrix Material

- 16.6.6. End-use Industry

- 16.7. Algeria Global Closed Molding Composites Materials Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Resin Type

- 16.7.3. Fiber Type

- 16.7.4. Manufacturing Process

- 16.7.5. Matrix Material

- 16.7.6. End-use Industry

- 16.8. Rest of Africa Global Closed Molding Composites Materials Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Resin Type

- 16.8.3. Fiber Type

- 16.8.4. Manufacturing Process

- 16.8.5. Matrix Material

- 16.8.6. End-use Industry

- 17. South America Global Closed Molding Composites Materials Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Central and South Africa Global Closed Molding Composites Materials Market Size (Value - US$ Billion) ; (Volume - Million Units), Analysis, and Forecasts, 2021-2035

- 17.3.1. Resin Type

- 17.3.2. Fiber Type

- 17.3.3. Manufacturing Process

- 17.3.4. Matrix Material

- 17.3.5. End-use Industry

- 17.3.6. Country

- 17.3.6.1. Brazil

- 17.3.6.2. Argentina

- 17.3.6.3. Rest of South America

- 17.4. Brazil Global Closed Molding Composites Materials Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Resin Type

- 17.4.3. Fiber Type

- 17.4.4. Manufacturing Process

- 17.4.5. Matrix Material

- 17.4.6. End-use Industry

- 17.5. Argentina Global Closed Molding Composites Materials Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Resin Type

- 17.5.3. Fiber Type

- 17.5.4. Manufacturing Process

- 17.5.5. Matrix Material

- 17.5.6. End-use Industry

- 17.6. Rest of South America Global Closed Molding Composites Materials Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Resin Type

- 17.6.3. Fiber Type

- 17.6.4. Manufacturing Process

- 17.6.5. Matrix Material

- 17.6.6. End-use Industry

- 18. Key Players/ Company Profile

- 18.1. AOC Resins

- 18.1.1. Company Details/ Overview

- 18.1.2. Company Financials

- 18.1.3. Key Customers and Competitors

- 18.1.4. Business/ Industry Portfolio

- 18.1.5. Product Portfolio/ Specification Details

- 18.1.6. Pricing Data

- 18.1.7. Strategic Overview

- 18.1.8. Recent Developments

- 18.2. Arkema

- 18.3. Ashland Global

- 18.4. BASF SE

- 18.5. DSM Engineering Materials

- 18.6. Gurit Holding AG

- 18.7. Hexcel Corporation

- 18.8. Huntsman Corporation

- 18.9. Johns Manville

- 18.10. Mitsubishi Chemical Group

- 18.11. Owens Corning

- 18.12. Polynt-Reichhold Group

- 18.13. SABIC

- 18.14. Scott Bader Company

- 18.15. SGL Carbon

- 18.16. Solvay SA

- 18.17. Teijin Limited

- 18.18. Toray Industries

- 18.19. UPM Biocomposites

- 18.20. Other Key Players

- 18.1. AOC Resins

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

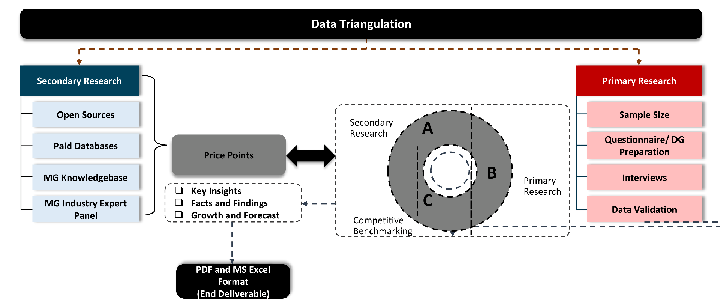

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data