Distributed Control Systems (DCS) Market Size, Share & Trends Analysis Report Component (Hardware, Software, Services), System Type, Architecture, Control Loop, Communication Protocol, Organization Size, Integration Level, End-use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Distributed Control Systems (DCS) Market Size, Share, and Growth

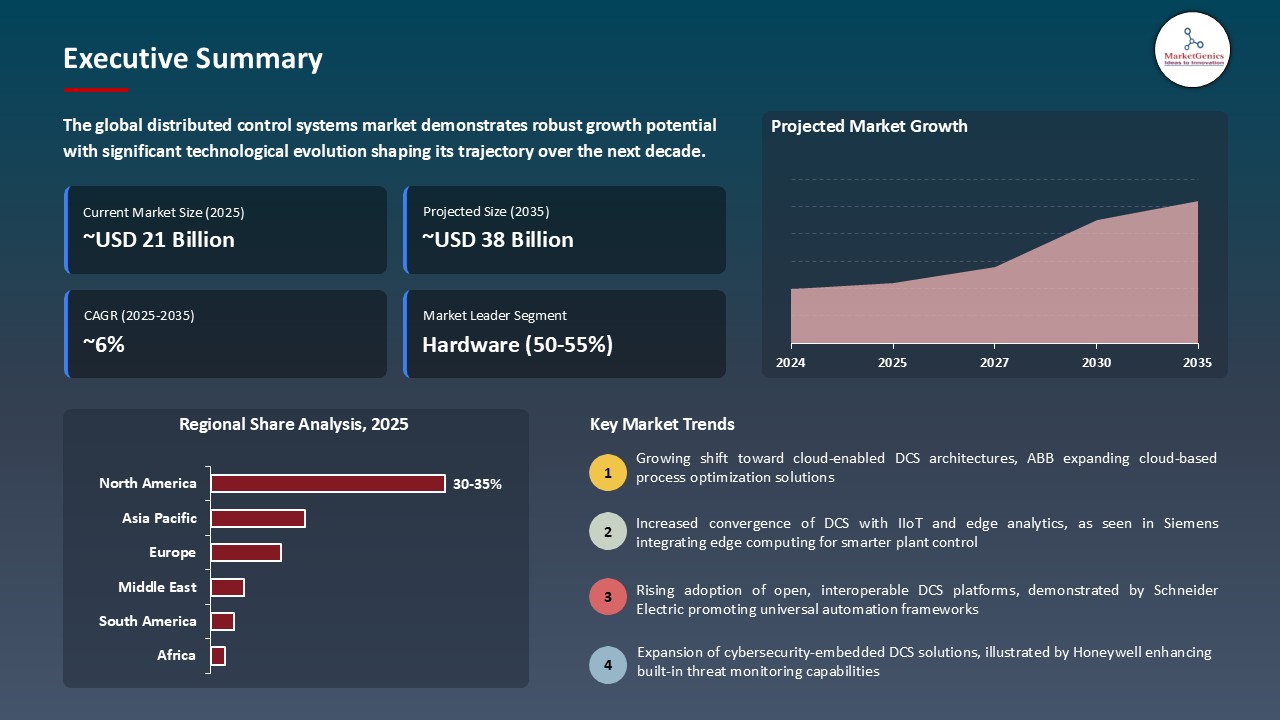

The global distributed control systems (DCS) market is witnessing strong growth, valued at USD 20.8 billion in 2025 and projected to reach ~USD 38 billion by 2035, expanding at a CAGR of 6.2% during the forecast period. The Asia Pacific region is the fastest-growing distributed control systems (DCS) market due to rapid industrialization, large-scale infrastructure expansion, and accelerated automation investments across manufacturing, energy, and process industries.

Jim Masso, President and CEO of Honeywell Process Solutions, said, “Honeywell's decades of domain expertise and industry knowledge are helping to solve our customers' toughest challenges with tangible solutions like Experion Operations Assistant, this pilot with TotalEnergies will mark a meaningful milestone for bridging the gap between autonomous technology and the operators that keep these facilities running safely and efficiently every day”.

The growing demand for high availability and redundant control architectures is a key driver for the distributed control systems (DCS) market. Industries such as power generation, refining, chemicals, and pharmaceuticals require continuous, uninterrupted operations where even minor downtime can result in major financial or safety risks. This pushes organizations to adopt fault-tolerant, fully redundant DCS platforms that ensure reliability, rapid failover, and seamless operational continuity.

Strategic collaborations between DCS vendors and technology partners drive market growth by accelerating system modernization, expanding digital capabilities, and enhancing operational reliability across industries. For instance, in 2025, Honeywell partnered with Nutanix to integrate Nutanix’s hybrid multi-cloud platform with Honeywell’s Experion Process Knowledge System (PKS) and other advanced control systems. This collaboration enables industrial enterprises in energy, chemicals, manufacturing, and pharmaceuticals to deploy secure, scalable, and cost-efficient DCS infrastructure.

The transition from traditional monolithic DCS platforms to modular, scalable, and standardized architectures, supported by initiatives such as Open Process Automation (OPA) is creating significant opportunities in the distributed control systems (DCS) market. This shift enables end users to integrate multi-vendor components, reduce lifecycle costs, and modernize systems without full replacement. As industries seek greater flexibility and interoperability, OPA-aligned DCS solutions gain strong potential for both upgrades and new deployments.

Distributed Control Systems (DCS) Market Dynamics and Trends

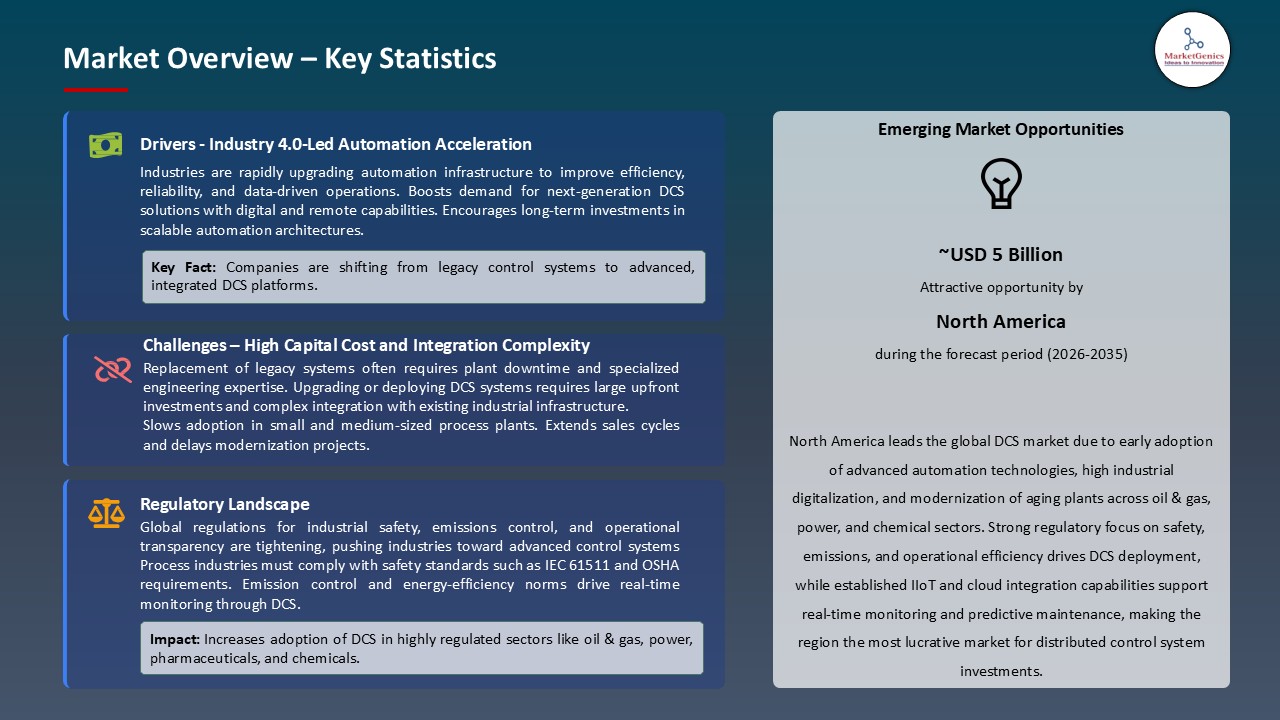

Driver: Infrastructure Modernization and Legacy System Replacement

- The move towards modernization of industrial infrastructure around the world is one of the leading incentives pushing the distributed control systems (DCS) market. The need to control aging structures, poor scalability, increasing maintenance expenses, and frequent downtime related to the use of the old systems are compelling industries to move towards the use of the advanced DCS platforms. However, modern DCS solutions are more flexible, provide a real-time view of the data, are more resistant to cybercrime, and can be easily integrated with Industry 4.0 technologies, i.e. IoT, advanced analytics and cloud connections.

- Industries like oil & gas, power generation, chemicals and manufacturing are getting more concerned with the need to replace old systems of control to enhance the efficiency of operations, maintain regulatory compliance and the life span of the assets. This is a continuous change that increases the urgency to adopt more reliable and future-sensitive DCS solutions that will enable the long-term digitalization.

- ProSoft Technology enhanced the process of industrial modernization through the introduction of migration gateways and in-chassis modules that allow gradual modernization of old PLCs and DCS systems to new Rockwell PlantPAx/ControlLogix installations. This will reduce downtimes and contributes to the effective replacement of the outdated architectures, including Modicon S908, GE Genius, Square D RIO, and TI 505, which directly leads to the demand to modernize DCS.

- The combination of these factors highlights a worldwide trend of urgency to update a foregone infrastructure of control by modern and future-ready DCS platforms that improve efficiency, reliability, and readiness to transform digitally.

Restraint: Limited Clinical Evidence Constrains Broader Reimbursement

-

The distributed control systems (DCS) market is faced by a huge constraint of modernization of aging control infrastructure since capital investment and operational risks are high. When legacy DCS/PLC architectures are to be replaced, it may be costly to upgrade hardware, re-engineer, re-configure software and perform long testing to assure system reliability and safety.

- In most of the asset-intensive sectors including oil and gas, power generation, chemicals and heavy manufacturing any downtime within the system can result in significant losses in production, contract fines or even hazardous situations. Sometimes companies can be reluctant to fully replace their systems and decide to keep working with old systems until the moment when maintenance is impossible.

- High implementation, integration and training costs coupled with the possible interference with the current operations pose significant financial and technical barriers which ignite slow uptake of new DCS platforms even though it will have long-term efficiency and security advantages.

- Moreover, the shortage of experienced specialists that can assist in the complex DCS migrations process only makes the problem bigger since companies are having difficulties locating professionals who would be willing to implement upgrades without causing the system to stop working, leading to long-term project durations and the need to rely on the services of expensive contractors.

Opportunity: Hybrid Cloud Architecture and Remote Operations

- The emerging trend of Hybrid cloud structure offers a significant market opportunity to the distributed control systems (DCS) market, as industries mix on-premise dependability of their control with the scalability and the ability to analyze the data on cloud frameworks.

- Hybrid cloud DCS models enable real-time data surveillance, sophisticated analytics, remote diagnostics and centralized decision making without the need to undermine system responsiveness and security. Remote operations are becoming necessary to provide companies with resilience, flexibility, and cost-efficiency in their operational frameworks as they continue to seek stronger, more adaptable, and economical operations.

- The shift is especially useful to the industries where the facilities are geographically spread like oil and gas, power distribution and mining that have high demand of DCS solutions that smoothly allows integration into the cloud and remote operation capabilities.

- Emerson improved remote operations and hybrid-cloud operations with the launch of DeltaV Edge Environment 2.0 in January 2025, which will allow one-way relocation of contextualized DCS information to edge or cloud environments. The solution enables industries to use batch-processing to combine DeltaV control data with analytics, AI/ML applications, and enterprise software and enhance visibility, batch predictability and remote decision-making without compromising on OT security.

- Collectively, these aspects denote a powerful development potential of contemporary DCS systems which combine secure cloud connectivity, allow trustworthy remote operation, and real-time, information-based decision-making on distributed industrial assets.

Key Trend: Artificial Intelligence Integration for Process Optimization

- The introduction of AI into the distributed control systems (DCS) market is becoming a disruptive force that allows plants to move towards self-optimizing, predictive operations instead of the reactive ones. Industries can use machine learning algorithms integrated into DCS platforms to review big volumes of real-time process data to discover inefficiencies, predict equipment failures, and automatically set control parameters to achieve maximum performance.

- Anomaly detection using AI can increase safety and reduce unexpected downtime, and the intelligent optimization can increase throughput, energy efficiency, and quality consistency. The rise in adoption of autonomous/semi-autonomous plant strategies by industries is leading to the need to deploy AI-enabled solutions to DCS in order to achieve increased decision cycles, lower variability in operations, and greater overall equipment effectiveness (OEE), which makes AI the key point of next-generation process automation.

- Honeywell also partnered with TotalEnergies to test its AI-based Experion Operations Assistant at its Port Arthur Refinery, Texas. Combined with DCS by Honeywell, the solution will offer real-time predictive analytics and operational analytics, which will allow operators to predict maintenance events, minimize downtime, raise safety, and streamline operations.

- Together, these developments highlight AI as a key driver transforming DCS platforms into predictive, self-optimizing, and safer systems that enhance operational efficiency and reliability.

Distributed-Control-Systems-Market Analysis and Segmental Data

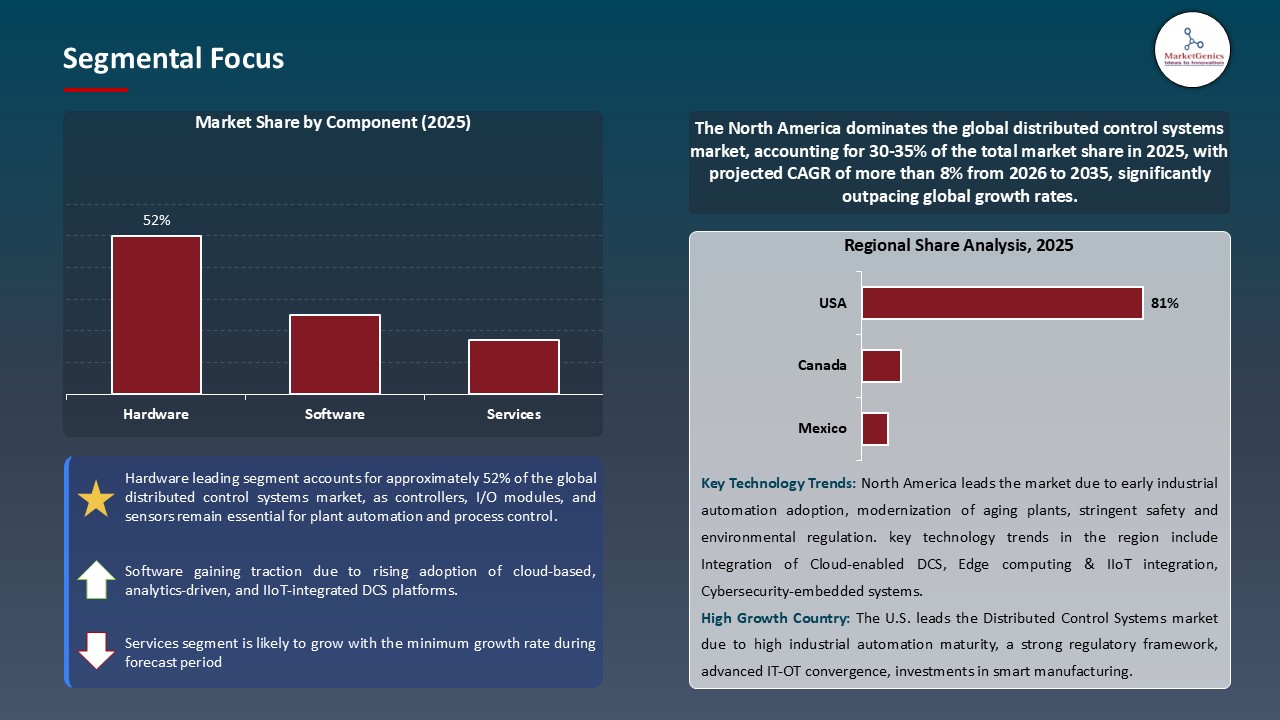

Hardware Dominate Global Distributed Control Systems (DCS) Market

- The hardware segment has been the dominant segment in the global distributed control systems (DCS) market with a good share of market since it plays a critical role in providing reliable and real-time control of industrial processes. The controllers, I/O modules, operator interfaces, field devices, and communication networks are considered to be key hardware components and they constitute the backbone of DCS architecture.

- Such industrial sectors like oil and gas, power generation, chemicals, and pharmaceuticals require high performing and durable hardware in order to ensure continuity in operations, safety, and accuracy of processes. The high demand is also fueled by the necessity to modernize outdated equipment, increase the redundancy of the system, and integrate with new software, analytics, and IoT-capable devices.

- A modular and rugged I/O platform, the Phoenix Contact Axioline I/O System is still the foundation of phase-out and upgrade projects on distributed control system (DCS) environments. It is a popular tool with companies that are upgrading old control systems to modern platform-independent control systems, including the necessary hardware interface between field devices and DCS controllers and permitting incremental migrations as well as edge-of-board deployments.

- The combination of these factors supports the predominance of hardware as the backbone of DCS in creating reliability, modernization, and smooth integration in industrial control systems.

North America Leads Global Distributed Control Systems (DCS) Market Demand

- North America leads the distributed control systems (DCS) market owing to its developed industrial base, extensive usage of new technologies of automation, and powerful investment into the modernization of the old control systems.

- Some of the main industries that are the drivers to high demand of reliable and high performance DCS solutions include oil and gas, chemicals, pharmaceuticals and power generation to maintain high efficiency of operation, safety, and regulatory measures. The discussed region is also oriented on the digital transformation that involves the integration of hybrid clouds, the optimization of processes powered by AI, and the ability to monitor everything remotely, which also leads to the faster adoption of DCS.

- Moreover, the availability of major DCS suppliers, as well as government programs promoting industrial automation and intelligent manufacturing, predisposes North America as the biggest and most technologically improved market of distributed control systems worldwide.

- Major US refinery upgraded to Nexus to upgrade its old architecture to newer control hardware, upgrading Honeywell DCS architecture (TDC3000/HPM + C300) to newer control hardware, enhancing the dependability of its system before the 2025 end-of-support risk.

- The domination of the market by DCS North America which is enabled by superior infrastructure, digital revolution and aggressiveness in modernizing old control systems.

Distributed-Control-Systems-Market Ecosystem

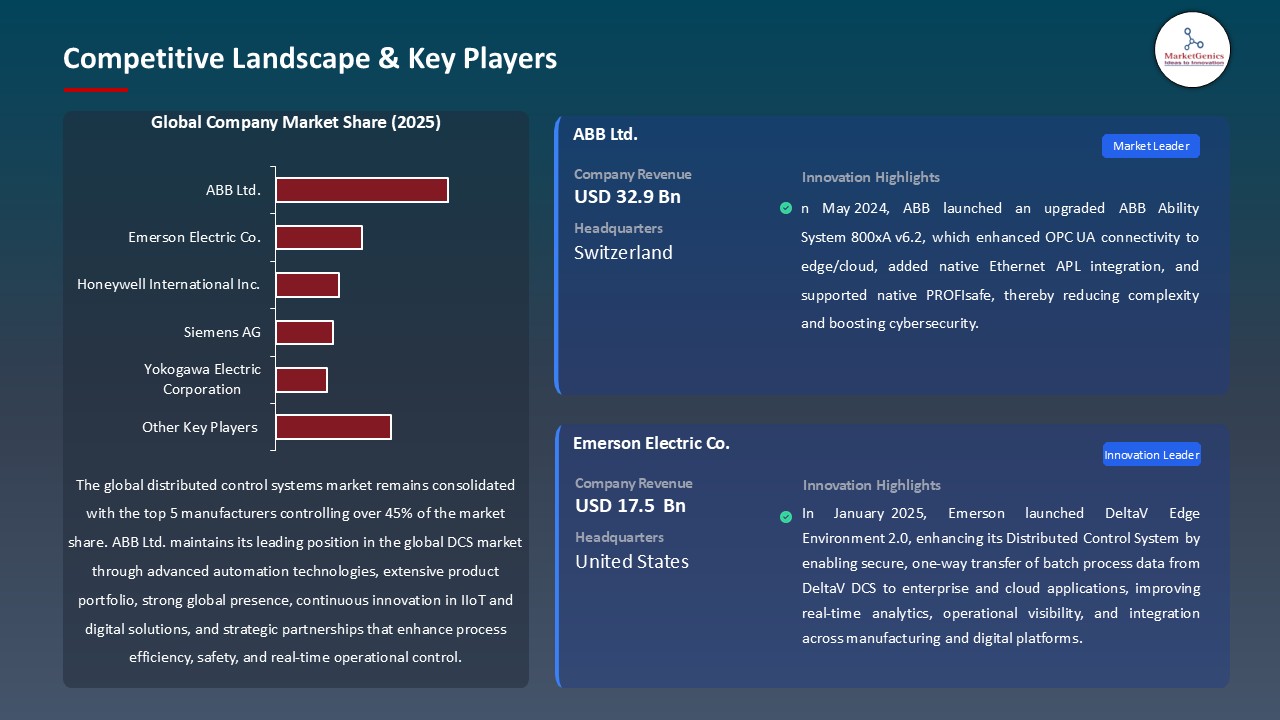

The global distributed control systems (DCS) market is consolidated, with the company holding approximately 46% of the market, that is, ABB Ltd., Emerson Electric Co., Honeywell International Inc., Siemens AG, and Yokogawa Electric Corporation. With their sophisticated automation systems, reliable control systems, and integrated digital solutions, these top companies play a major role in advancing industry dynamics by increasing the visibility of operations, improving process efficiency, and improving safety throughout the plant in oil and gas industry, power generation, chemicals, and manufacturing plants. This is because of their high-R&D capability, large product portfolio and international network of services which are barriers to entry in the market.

Moreover, these key players have long-term relationships with industrial establishments, engineering procurement and construction (EPC) companies, and system integrators to provide smooth technology implementation, compliance, and large-scale modernization initiatives. These partnerships hasten the implementation of the future DCS strategies such as predictive diagnostics, industrial cybersecurity, and digital twins, and increase the market presence of such companies.

The concentration of buyers is moderate because the energy, petrochemicals, water treatment and manufacture industries are important segments of demands. The degree of supplier concentration is high whereby the long-standing giants in the automation industry control hardware, software, and lifecycle services, though new competitors with modular and software-focused control offerings are on the rise. Deep switching costs due to relatively long operating cycles, interoperability across systems, and regulatory restrictions of the industry, promote long term relationships with vendors and the further establish the hegemony of the main DCS vendors.

Recent Development and Strategic Overview:

- In October 2025, Siemens advanced secure industrial connectivity with SINEC Secure Connect, a Zero-Trust OT security platform that enables encrypted, identity-verified machine-to-machine and machine-to-cloud communication without VPNs. By virtualizing network structures and integrating with SCALANCE devices, it simplifies OT security management and strengthens protection for increasingly cloud-connected DCS environments.

- In October 2025, COPA-DATA and RoviSys partnered to integrate RoviSys’ automation expertise with COPA-DATA’s zenon DCS platform, enabling industries to modernize operations, enhance uptime, ensure compliance, and accelerate digital transformation, demonstrating how collaborations drive DCS market growth.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 20.8 Bn |

|

Market Forecast Value in 2035 |

~USD 38 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Distributed-Control-Systems-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Distributed Control Systems (DCS) Market, By Component |

|

|

Distributed Control Systems (DCS) Market, By System Type |

|

|

Distributed Control Systems (DCS) Market, By Architecture |

|

|

Distributed Control Systems (DCS) Market, By Control Loop |

|

|

Distributed Control Systems (DCS) Market, By Communication Protocol |

|

|

Distributed Control Systems (DCS) Market, By Organization Size |

|

|

Distributed Control Systems (DCS) Market, By Integration Level |

|

|

Distributed Control Systems (DCS) Market, By End-use Industry |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Distributed Control Systems (DCS) Market Outlook

- 2.1.1. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Distributed Control Systems (DCS) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Integration with IIoT and Industry 4.0 enabling real-time monitoring and analytics

- 4.1.1.2. Demand for improved process efficiency, safety, and energy optimization

- 4.1.1.3. Replacement and modernization of aging plants across oil & gas, power, chemical and manufacturing sectors

- 4.1.2. Restraints

- 4.1.2.1. High upfront capital expenditure and long ROI cycles for DCS upgrades

- 4.1.2.2. Integration complexity, cybersecurity risks and shortage of skilled automation engineers

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Manufacturers and Technology Providers

- 4.4.3. Distributors

- 4.4.4. End Users

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Distributed Control Systems (DCS) Market Demand

- 4.7.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Distributed Control Systems (DCS) Market Analysis, By Component

- 6.1. Key Segment Analysis

- 6.1.1. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Component, 2021-2035

- 6.1.2. Hardware

- 6.1.2.1. Controllers

- 6.1.2.2. Input/Output Modules

- 6.1.2.3. Communication Interfaces

- 6.1.2.4. Human Machine Interface (HMI)

- 6.1.2.5. Field Devices

- 6.1.2.6. Others

- 6.1.3. Software

- 6.1.3.1. SCADA Software

- 6.1.3.2. Asset Management Software

- 6.1.3.3. Batch Management Software

- 6.1.3.4. Advanced Process Control Software

- 6.1.3.5. Others

- 6.1.4. Services

- 6.1.4.1. Installation & Commissioning

- 6.1.4.2. Maintenance & Support

- 6.1.4.3. Consulting Services

- 6.1.4.4. Training Services

- 6.1.4.5. Others

- 6.1. Key Segment Analysis

- 7. Global Distributed Control Systems (DCS) Market Analysis, By System Type

- 7.1. Key Segment Analysis

- 7.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By System Type, 2021-2035

- 7.2.1. Traditional DCS

- 7.2.2. Hybrid DCS

- 7.2.3. Networked DCS

- 7.2.4. Wireless DCS

- 8. Global Distributed Control Systems (DCS) Market Analysis,By Architecture

- 8.1. Key Segment Analysis

- 8.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Architecture, 2021-2035

- 8.2.1. Centralized Architecture

- 8.2.2. Distributed Architecture

- 8.2.3. Hybrid Architecture

- 9. Global Distributed Control Systems (DCS) Market Analysis, By Control Loop

- 9.1. Key Segment Analysis

- 9.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Control Loop, 2021-2035

- 9.2.1. Single Loop Controllers

- 9.2.2. Multi Loop Controllers

- 9.2.3. Programmable Logic Controllers (PLC)

- 10. Global Distributed Control Systems (DCS) Market Analysis, By Communication Protocol

- 10.1. Key Segment Analysis

- 10.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Communication Protocol, 2021-2035

- 10.2.1. Foundation Fieldbus

- 10.2.2. PROFIBUS

- 10.2.3. HART Protocol

- 10.2.4. Modbus

- 10.2.5. EtherNet/IP

- 10.2.6. OPC (OLE for Process Control)

- 10.2.7. Wireless Communication Protocols

- 11. Global Distributed Control Systems (DCS) Market Analysis, By Organization Size

- 11.1. Key Segment Analysis

- 11.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Organization Size, 2021-2035

- 11.2.1. Large Enterprises

- 11.2.2. Small and Medium Enterprises (SMEs)

- 12. Global Distributed Control Systems (DCS) Market Analysis, By Integration Level

- 12.1. Key Segment Analysis

- 12.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By Integration Level, 2021-2035

- 12.2.1. Standalone Systems

- 12.2.2. Integrated Systems

- 12.2.3. Fully Automated Systems

- 13. Global Distributed Control Systems (DCS) Market Analysis, By End-use Industry

- 13.1. Key Segment Analysis

- 13.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, By End-use Industry, 2021-2035

- 13.2.1. Oil & Gas

- 13.2.1.1. Upstream Operations (Exploration & Production)

- 13.2.1.2. Midstream Operations (Pipeline Monitoring)

- 13.2.1.3. Downstream Operations (Refining)

- 13.2.1.4. Storage & Distribution

- 13.2.1.5. Offshore Platform Control

- 13.2.1.6. Others

- 13.2.2. Power Generation

- 13.2.2.1. Fossil Fuel Power Plants

- 13.2.2.2. Nuclear Power Plants

- 13.2.2.3. Renewable Energy

- 13.2.2.4. Combined Cycle Power Plants

- 13.2.2.5. Grid Management

- 13.2.2.6. Others

- 13.2.3. Chemical & Petrochemical

- 13.2.3.1. Chemical Processing

- 13.2.3.2. Batch Processing

- 13.2.3.3. Continuous Processing

- 13.2.3.4. Others

- 13.2.4. Pharmaceutical & Biotechnology

- 13.2.4.1. Drug Manufacturing

- 13.2.4.2. Vaccine Production

- 13.2.4.3. Bioreactor Control

- 13.2.4.4. Cleanroom Monitoring

- 13.2.4.5. Batch Manufacturing

- 13.2.4.6. Others

- 13.2.5. Food & Beverage

- 13.2.5.1. Processing & Packaging

- 13.2.5.2. Brewing & Distilling

- 13.2.5.3. Beverage Production

- 13.2.5.4. Quality & Safety Monitoring

- 13.2.5.5. Others

- 13.2.6. Pulp & Paper

- 13.2.7. Water & Wastewater Treatment

- 13.2.8. Mining & Metals

- 13.2.9. Automotive

- 13.2.10. Cement

- 13.2.11. Textile

- 13.2.12. Marine & Shipbuilding

- 13.2.13. Other Industries

- 13.2.1. Oil & Gas

- 14. Global Distributed Control Systems (DCS) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Distributed Control Systems (DCS) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. System Type

- 15.3.3. Architecture

- 15.3.4. Control Loop

- 15.3.5. Communication Protocol

- 15.3.6. Organization Size

- 15.3.7. Integration Level

- 15.3.8. End-use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Distributed Control Systems (DCS) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. System Type

- 15.4.4. Architecture

- 15.4.5. Control Loop

- 15.4.6. Communication Protocol

- 15.4.7. Organization Size

- 15.4.8. Integration Level

- 15.4.9. End-use Industry

- 15.5. Canada Distributed Control Systems (DCS) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. System Type

- 15.5.4. Architecture

- 15.5.5. Control Loop

- 15.5.6. Communication Protocol

- 15.5.7. Organization Size

- 15.5.8. Integration Level

- 15.5.9. End-use Industry

- 15.6. Mexico Distributed Control Systems (DCS) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. System Type

- 15.6.4. Architecture

- 15.6.5. Control Loop

- 15.6.6. Communication Protocol

- 15.6.7. Organization Size

- 15.6.8. Integration Level

- 15.6.9. End-use Industry

- 16. Europe Distributed Control Systems (DCS) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. System Type

- 16.3.3. Architecture

- 16.3.4. Control Loop

- 16.3.5. Communication Protocol

- 16.3.6. Organization Size

- 16.3.7. Integration Level

- 16.3.8. End-use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Distributed Control Systems (DCS) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. System Type

- 16.4.4. Architecture

- 16.4.5. Control Loop

- 16.4.6. Communication Protocol

- 16.4.7. Organization Size

- 16.4.8. Integration Level

- 16.4.9. End-use Industry

- 16.5. United Kingdom Distributed Control Systems (DCS) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. System Type

- 16.5.4. Architecture

- 16.5.5. Control Loop

- 16.5.6. Communication Protocol

- 16.5.7. Organization Size

- 16.5.8. Integration Level

- 16.5.9. End-use Industry

- 16.6. France Distributed Control Systems (DCS) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. System Type

- 16.6.4. Architecture

- 16.6.5. Control Loop

- 16.6.6. Communication Protocol

- 16.6.7. Organization Size

- 16.6.8. Integration Level

- 16.6.9. End-use Industry

- 16.7. Italy Distributed Control Systems (DCS) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. System Type

- 16.7.4. Architecture

- 16.7.5. Control Loop

- 16.7.6. Communication Protocol

- 16.7.7. Organization Size

- 16.7.8. Integration Level

- 16.7.9. End-use Industry

- 16.8. Spain Distributed Control Systems (DCS) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. System Type

- 16.8.4. Architecture

- 16.8.5. Control Loop

- 16.8.6. Communication Protocol

- 16.8.7. Organization Size

- 16.8.8. Integration Level

- 16.8.9. End-use Industry

- 16.9. Netherlands Distributed Control Systems (DCS) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. System Type

- 16.9.4. Architecture

- 16.9.5. Control Loop

- 16.9.6. Communication Protocol

- 16.9.7. Organization Size

- 16.9.8. Integration Level

- 16.9.9. End-use Industry

- 16.10. Nordic Countries Distributed Control Systems (DCS) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. System Type

- 16.10.4. Architecture

- 16.10.5. Control Loop

- 16.10.6. Communication Protocol

- 16.10.7. Organization Size

- 16.10.8. Integration Level

- 16.10.9. End-use Industry

- 16.11. Poland Distributed Control Systems (DCS) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. System Type

- 16.11.4. Architecture

- 16.11.5. Control Loop

- 16.11.6. Communication Protocol

- 16.11.7. Organization Size

- 16.11.8. Integration Level

- 16.11.9. End-use Industry

- 16.12. Russia & CIS Distributed Control Systems (DCS) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. System Type

- 16.12.4. Architecture

- 16.12.5. Control Loop

- 16.12.6. Communication Protocol

- 16.12.7. Organization Size

- 16.12.8. Integration Level

- 16.12.9. End-use Industry

- 16.13. Rest of Europe Distributed Control Systems (DCS) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. System Type

- 16.13.4. Architecture

- 16.13.5. Control Loop

- 16.13.6. Communication Protocol

- 16.13.7. Organization Size

- 16.13.8. Integration Level

- 16.13.9. End-use Industry

- 17. Asia Pacific Distributed Control Systems (DCS) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. System Type

- 17.3.3. Architecture

- 17.3.4. Control Loop

- 17.3.5. Communication Protocol

- 17.3.6. Organization Size

- 17.3.7. Integration Level

- 17.3.8. End-use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Distributed Control Systems (DCS) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. System Type

- 17.4.4. Architecture

- 17.4.5. Control Loop

- 17.4.6. Communication Protocol

- 17.4.7. Organization Size

- 17.4.8. Integration Level

- 17.4.9. End-use Industry

- 17.5. India Distributed Control Systems (DCS) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. System Type

- 17.5.4. Architecture

- 17.5.5. Control Loop

- 17.5.6. Communication Protocol

- 17.5.7. Organization Size

- 17.5.8. Integration Level

- 17.5.9. End-use Industry

- 17.6. Japan Distributed Control Systems (DCS) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. System Type

- 17.6.4. Architecture

- 17.6.5. Control Loop

- 17.6.6. Communication Protocol

- 17.6.7. Organization Size

- 17.6.8. Integration Level

- 17.6.9. End-use Industry

- 17.7. South Korea Distributed Control Systems (DCS) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. System Type

- 17.7.4. Architecture

- 17.7.5. Control Loop

- 17.7.6. Communication Protocol

- 17.7.7. Organization Size

- 17.7.8. Integration Level

- 17.7.9. End-use Industry

- 17.8. Australia and New Zealand Distributed Control Systems (DCS) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. System Type

- 17.8.4. Architecture

- 17.8.5. Control Loop

- 17.8.6. Communication Protocol

- 17.8.7. Organization Size

- 17.8.8. Integration Level

- 17.8.9. End-use Industry

- 17.9. Indonesia Distributed Control Systems (DCS) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. System Type

- 17.9.4. Architecture

- 17.9.5. Control Loop

- 17.9.6. Communication Protocol

- 17.9.7. Organization Size

- 17.9.8. Integration Level

- 17.9.9. End-use Industry

- 17.10. Malaysia Distributed Control Systems (DCS) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. System Type

- 17.10.4. Architecture

- 17.10.5. Control Loop

- 17.10.6. Communication Protocol

- 17.10.7. Organization Size

- 17.10.8. Integration Level

- 17.10.9. End-use Industry

- 17.11. Thailand Distributed Control Systems (DCS) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. System Type

- 17.11.4. Architecture

- 17.11.5. Control Loop

- 17.11.6. Communication Protocol

- 17.11.7. Organization Size

- 17.11.8. Integration Level

- 17.11.9. End-use Industry

- 17.12. Vietnam Distributed Control Systems (DCS) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. System Type

- 17.12.4. Architecture

- 17.12.5. Control Loop

- 17.12.6. Communication Protocol

- 17.12.7. Organization Size

- 17.12.8. Integration Level

- 17.12.9. End-use Industry

- 17.13. Rest of Asia Pacific Distributed Control Systems (DCS) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. System Type

- 17.13.4. Architecture

- 17.13.5. Control Loop

- 17.13.6. Communication Protocol

- 17.13.7. Organization Size

- 17.13.8. Integration Level

- 17.13.9. End-use Industry

- 18. Middle East Distributed Control Systems (DCS) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. System Type

- 18.3.3. Architecture

- 18.3.4. Control Loop

- 18.3.5. Communication Protocol

- 18.3.6. Organization Size

- 18.3.7. Integration Level

- 18.3.8. End-use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Distributed Control Systems (DCS) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. System Type

- 18.4.4. Architecture

- 18.4.5. Control Loop

- 18.4.6. Communication Protocol

- 18.4.7. Organization Size

- 18.4.8. Integration Level

- 18.4.9. End-use Industry

- 18.5. UAE Distributed Control Systems (DCS) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. System Type

- 18.5.4. Architecture

- 18.5.5. Control Loop

- 18.5.6. Communication Protocol

- 18.5.7. Organization Size

- 18.5.8. Integration Level

- 18.5.9. End-use Industry

- 18.6. Saudi Arabia Distributed Control Systems (DCS) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. System Type

- 18.6.4. Architecture

- 18.6.5. Control Loop

- 18.6.6. Communication Protocol

- 18.6.7. Organization Size

- 18.6.8. Integration Level

- 18.6.9. End-use Industry

- 18.7. Israel Distributed Control Systems (DCS) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. System Type

- 18.7.4. Architecture

- 18.7.5. Control Loop

- 18.7.6. Communication Protocol

- 18.7.7. Organization Size

- 18.7.8. Integration Level

- 18.7.9. End-use Industry

- 18.8. Rest of Middle East Distributed Control Systems (DCS) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. System Type

- 18.8.4. Architecture

- 18.8.5. Control Loop

- 18.8.6. Communication Protocol

- 18.8.7. Organization Size

- 18.8.8. Integration Level

- 18.8.9. End-use Industry

- 19. Africa Distributed Control Systems (DCS) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. System Type

- 19.3.3. Architecture

- 19.3.4. Control Loop

- 19.3.5. Communication Protocol

- 19.3.6. Organization Size

- 19.3.7. Integration Level

- 19.3.8. End-use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Distributed Control Systems (DCS) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. System Type

- 19.4.4. Architecture

- 19.4.5. Control Loop

- 19.4.6. Communication Protocol

- 19.4.7. Organization Size

- 19.4.8. Integration Level

- 19.4.9. End-use Industry

- 19.5. Egypt Distributed Control Systems (DCS) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. System Type

- 19.5.4. Architecture

- 19.5.5. Control Loop

- 19.5.6. Communication Protocol

- 19.5.7. Organization Size

- 19.5.8. Integration Level

- 19.5.9. End-use Industry

- 19.6. Nigeria Distributed Control Systems (DCS) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. System Type

- 19.6.4. Architecture

- 19.6.5. Control Loop

- 19.6.6. Communication Protocol

- 19.6.7. Organization Size

- 19.6.8. Integration Level

- 19.6.9. End-use Industry

- 19.7. Algeria Distributed Control Systems (DCS) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. System Type

- 19.7.4. Architecture

- 19.7.5. Control Loop

- 19.7.6. Communication Protocol

- 19.7.7. Organization Size

- 19.7.8. Integration Level

- 19.7.9. End-use Industry

- 19.8. Rest of Africa Distributed Control Systems (DCS) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. System Type

- 19.8.4. Architecture

- 19.8.5. Control Loop

- 19.8.6. Communication Protocol

- 19.8.7. Organization Size

- 19.8.8. Integration Level

- 19.8.9. End-use Industry

- 20. South America Distributed Control Systems (DCS) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Distributed Control Systems (DCS) Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. System Type

- 20.3.3. Architecture

- 20.3.4. Control Loop

- 20.3.5. Communication Protocol

- 20.3.6. Organization Size

- 20.3.7. Integration Level

- 20.3.8. End-use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Distributed Control Systems (DCS) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. System Type

- 20.4.4. Architecture

- 20.4.5. Control Loop

- 20.4.6. Communication Protocol

- 20.4.7. Organization Size

- 20.4.8. Integration Level

- 20.4.9. End-use Industry

- 20.5. Argentina Distributed Control Systems (DCS) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. System Type

- 20.5.4. Architecture

- 20.5.5. Control Loop

- 20.5.6. Communication Protocol

- 20.5.7. Organization Size

- 20.5.8. Integration Level

- 20.5.9. End-use Industry

- 20.6. Rest of South America Distributed Control Systems (DCS) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. System Type

- 20.6.4. Architecture

- 20.6.5. Control Loop

- 20.6.6. Communication Protocol

- 20.6.7. Organization Size

- 20.6.8. Integration Level

- 20.6.9. End-use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Azbil Corporation

- 21.3. Beckhoff Automation

- 21.4. Emerson Electric Co.

- 21.5. Endress+Hauser Group

- 21.6. General Electric (GE)

- 21.7. Hitachi Ltd.

- 21.8. Hollysys Automation Technologies

- 21.9. Honeywell International Inc.

- 21.10. Kongsberg Gruppen

- 21.11. Metso Outotec

- 21.12. Mitsubishi Electric Corporation

- 21.13. Omron Corporation

- 21.14. Rockwell Automation Inc.

- 21.15. Schneider Electric SE

- 21.16. Siemens AG

- 21.17. SUPCON

- 21.18. Toshiba Corporation

- 21.19. Weihai Beiyang Electric Group Co., Ltd.

- 21.20. Yokogawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation