Surgical Robots Market Size, Share, Growth Opportunity Analysis Report by Robot Type (Multi-Arm Robotic Systems, Single-Arm Robotic Systems, Robotic Surgical Accessories and Others), Surgical Specialty, Component, Mode of Operation, Purchase Model, Application Scenario, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

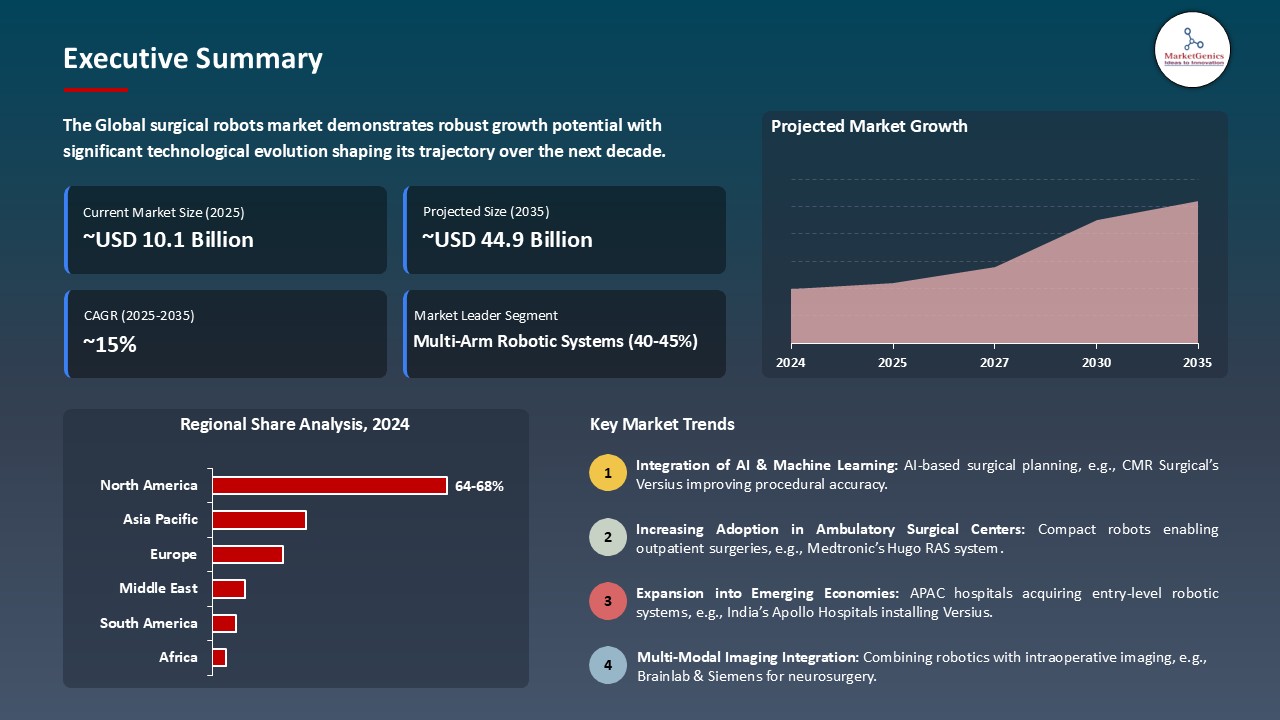

Surgical Robots Market Size, Share, and Growth

The growth of global surgical robots market is likely to create a significant opportunity of USD 34.8 Billion during the forecasting period, 2025-2035. With MIS operations being on the rise, so is the demand for robotic systems to deliver precision and ergonomics and to undertake 3D visualization. CMR Surgical acknowledged that more than 100,000 procedures had been undertaken using its Versius multi-arm robotic system in March 2025, underlining the expenses hospitals bear for the rapid acceptance in gynecology and general surgery.

In May 2025, Asensus Surgical announced a strategic partnership with a major U.S. hospital chain to deploy its Senhance Surgical System across multiple locations, focusing on general and gynecologic procedures. The system integrates augmented intelligence to support surgeon decision-making and improve procedural consistency. Anthony Fernando, President and CEO of Asensus Surgical, emphasized that this move reflects growing demand for intelligent, cost-effective alternatives to traditional robotic platforms. Asensus’s AI-powered system expansion marks a key step toward making surgical robotics more accessible and outcome-driven in mid-tier healthcare networks.

Orthopedic specialists are now inclining toward robot-assisted joint replacements and spine surgeries for accuracy in alignment and reduction of postoperative complications. In May 2025, with its 70,000th knee replacement surgical procedure, the MAKO robotic system from Stryker asserted itself as the market leader in image-guided robotics. With more refinements in robot accuracy and surgical applications along with increased adoption rate and huge market growth, the global surgical robotics landscape is now ascending.

Strong market dynamics exist across the global surgical robotics sector in robotic rehabilitation systems, linked to the robotic prosthetics continuum, AI-based preoperative planning platforms, and surgical navigation systems. They additionally co-act with robotic surgery towards faster patient recovery, better surgical precision, and more optimized clinical workflow; hence they promote the adoption of an integrated robotic ecosystem. The surgical robots market is multiplying in growth and innovation owing to integration with adjacent digital and robotic healthcare technologies.

Surgical Robots Market Dynamics and Trends

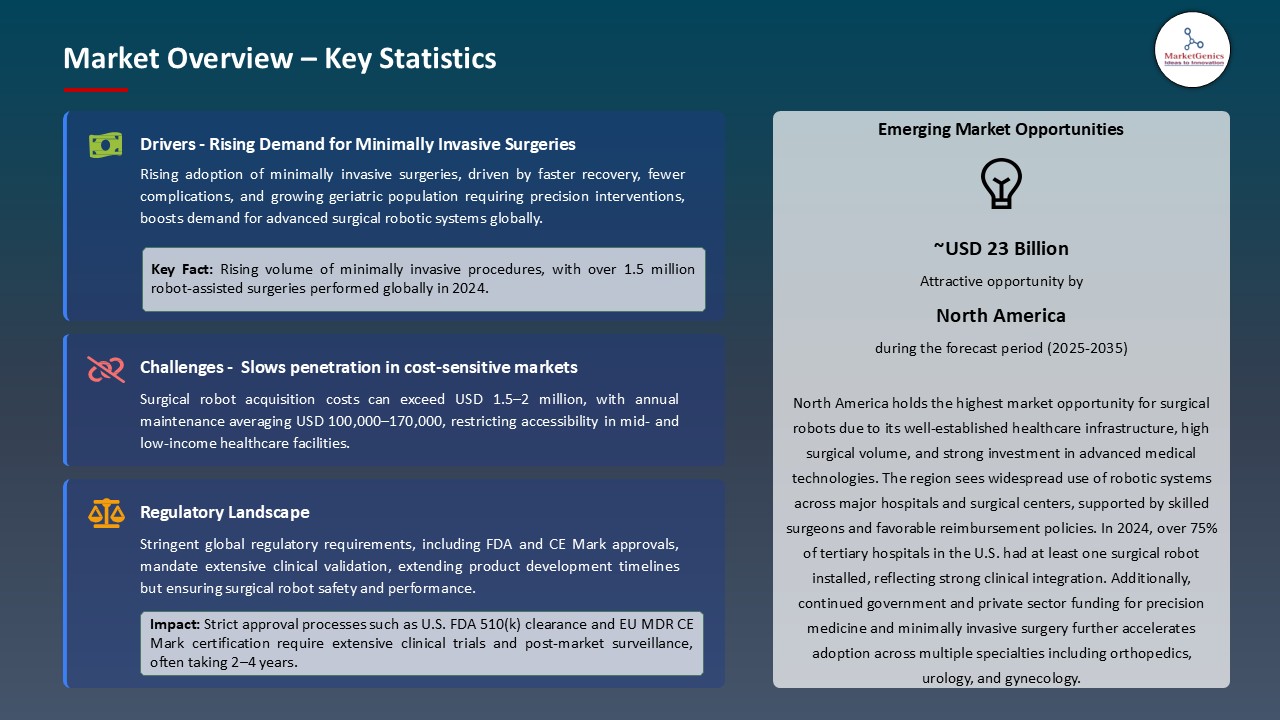

Driver: Rising Demand for Precision Surgery and Minimally Invasive Techniques

- The surgical robot market is fueled by the world shift toward minimally invasive procedures, characterized by less trauma, shorter hospital stays, and quicker recovery. Increasingly, surgeons prefer the robotic approach, having greater dexterity at their disposal, high-definition 3D visualization, and tremor-free motion. Also, with the growing awareness of patients and support of insurers for MIS, hospitals can invest in robotic systems to better surgical outcomes and ultimately prove cost-effective.

- The FDA approved and widely launched in May 2025, by Medtronic for colorectal and general surgeries, the Hugo RAS System. The multi-port robotic system, designed as a modular and an open platform, brings emphasis to precision targeting and interaction with an ergonomic console. The commercial rollout of Hugo perfectly expresses the growing preference by the surgeons for mastery robotic assistance in a variety of specialties.

- In acceptance of precision MIS techniques, the surgical robot adoption has been fast-tracked across global health systems.

Restraint: High Acquisition Costs and Reimbursement Limitations

- In terms of clinical advantage, surgical robots remain grossly overpriced for many hospitals, especially those that are mid-sized and those in rural locations. Costs include acquisition, training, maintenance, and per-procedure instrument charge. These far outstrip the equivalent charges for conventional laparoscopic instruments. Sporadic insurance reimbursements and limited procedure-specific funding act as deterrents for wider deployment of the system.

- The European hospital consortium had reportedly deferred its planned investment in surgical robotics because of unacceptable reimbursement frameworks for robotic procedures existing in several regions. It has affected the willingness to go ahead among other competing hospitals, and many robotic systems now operate below capacity, reducing ROI and delaying wide adoption outside premier centers.

- High upfront cost and denial of reimbursement parity continue to constrain the spread of surgical robots in resource-sensitive healthcare markets.

Opportunity: Expanding into Hybrid Operating Theaters and AI Integration

- The surgical machines by then further penetrated the hybrid OR under the tutelage of intraoperative imaging, navigation, and robotics. Robotics, combined with AI-powered analytics (such as performance metrics and anatomy recognition), provides even higher precision, gives predictive insights, and tailors clinical workflows that are especially beneficial for big-city hospitals.

- Stryker came out with the Mako Core platform-a combination of joint-replacement robotics intraoperative CT, and AI-guided bone planning-in April 2025. This invention arguably spearheads integrated surgical suites that empower robotics and imaging with intelligent decision support.

- AI-enabled hybrid ORs lay the track of future robotic-assisted surgeries with slimming precision and outcomes

Key Trend: Shift Toward Multi-Quadrant and Modular Robot Systems

- The robotic systems are advancing from single-procedure platforms to modular, multi-quadrant designs capable of working with multiple specialties and anatomies, reflecting the evolution toward polyfunctional robotics (abdominal, gynecologic, thoracic, etc.) on a single console, enhancing OR utilization and cost efficiency.

- In March 2025, Asensus Surgical announced the modularized version of its Senhance Surgical System with wristed instrumentation and integration for thoracic and urologic procedures from the abdominal staging. This development decreases complexity of the program, maximizes usage rates, and lowers costs per care for hospital investment.

- Modular, multi-specialty robotic platforms are enhancing the flexibility and utilization of an operating room, which could put robotics within consideration across a larger scope of care settings.

Surgical Robots Market Analysis and Segmental Data

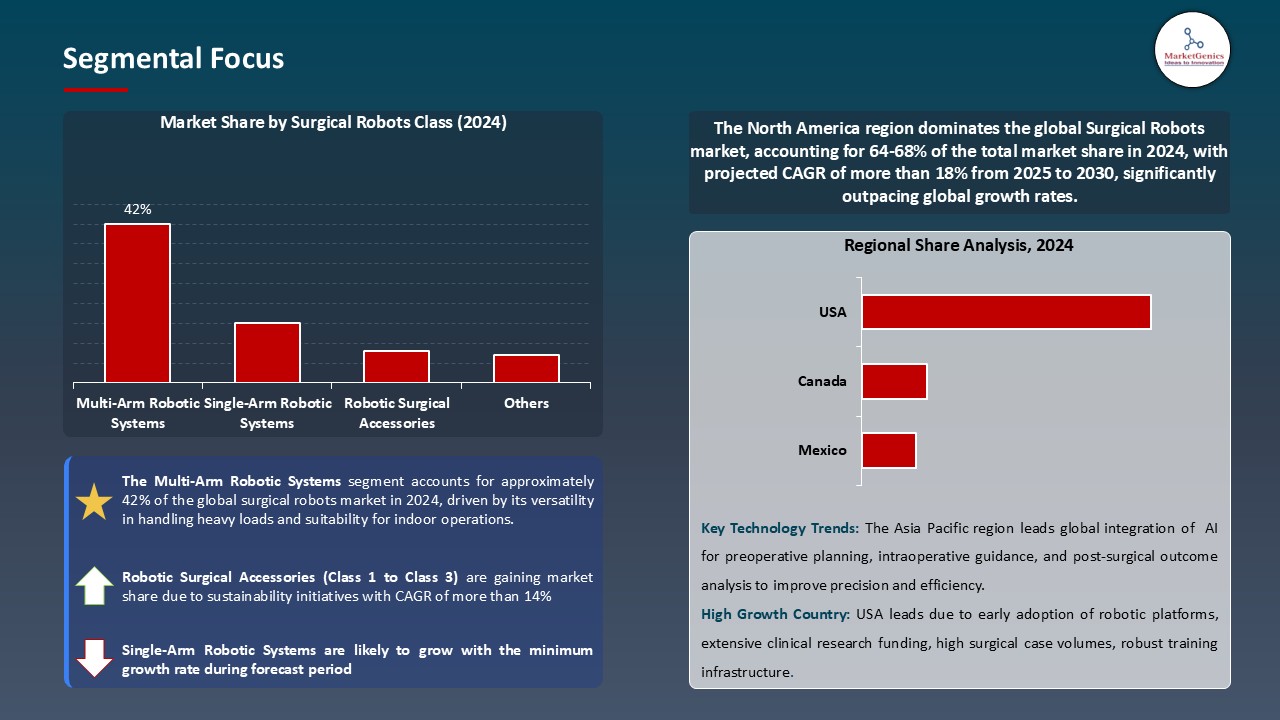

Based on Robot Type, the Multi-Arm Robotic Systems Segment Retains the Largest Share

- Multi-arm robotic systems segment holds a bigger portion of the surgical robots market, ~42%, mainly because they carry out complex multi-quadrant procedures with advanced accuracy and control. In such operations, the surgeon uses the robot to manipulate multiple instruments at the same time, cutting down on reliance on surgical staff and performing efficient minimally invasive procedures. The multi-arm configuration will be mostly appreciated in general surgery, urology, and gynecology, where one needs to access different anatomical regions for a single procedure.

- In February 2025, CMR Surgical extended the scope of its Versius multi-arm robotic platform to thoracic surgery in key European hospitals. Its modular arms work independently of each other, and its open console design allows for a highest degree of adaptability. These factors contribute to a great improvement in ergonomics and surgical outcomes. This extension itself is one clear indication of the growing clinical preference for such flexible multi-arm systems in highly complex specialties.

- Demand is being fueled by these multi-arm robotic platforms as they have become synonymous with surgical versatility, enhanced precision, and procedural efficiency in many specializations.

North America Dominates Global Surgical Robots Market in 2024 and Beyond

- North America witnesses the maximum demand for surgical robots, in wide contrast with advanced healthcare infrastructure, strong reimbursement frameworks, and the presence of robotic surgeons in major concentration. Hospitals in the U.S. are heavily focused on innovations that reduce surgical complications and hospital stay; this ensures that there is continuous investment for existence in the robotic systems realm for application areas in cardiology, urology, and general surgery. FDA approvals also give the region huge leverage together with active clinical research to back the robotic-assisted outcomes.

- Intuitive Surgical announced in March 2025 that more than 1.5 million procedures have been performed in the U.S. alone using the da Vinci surgical system, signaling increased penetration of hospitals and diversification of procedures. The company has also announced expansion in their training centers across North America to cater to increased adoption by mid-tier hospitals.

- With technological maturity of the region plus the supportive healthcare ecosystem, North America ranks as the most dominant, innovation-led market in the world for surgical robots.

Surgical Robots Market Ecosystem

Key players in the global surgical robots market include prominent companies such as Intuitive Surgical

Stryker (MAKO platform), Medtronic, Smith & Nephew, Zimmer Biomet and Other Key Players.

Surgical robots market is a moderately consolidated sector where Tier 1 players like Intuitive Surgical, Medtronic, and Johnson & Johnson dominate the landscape, rolling out advanced robotic platforms with a global presence and massive R&D spends. On the other hand, Tier 2 and 3 manufacturers try to span across emerging technologies or regional markets. Buyer concentration is moderate since hospitals and surgical centers remain critical consumers. Supplier concentration is increased owing to the special robotic components, precision in manufacturing, and adherence to regulations of the healthcare industry.

Recent Development and Strategic Overview:

- In April 2025, Intuitive Surgical unfolds AR package for its da Vinci Xi system to enhance operative visualization through functioning, real-time overlay of anatomical structures on the procedure. This characterization carries the potential to optimize accuracy and decrement the hours of intricate surgeries pertaining to the thoracic and urologic region.

- In June 2025, transformations occurred with Hugo robot-assisted surgical unit being capable of integration with Medtronic Cios spin 3D imaging and surgical navigation suite. This hybrid system enables anatomical visualization through colorectal and spine interventions in the real-time manner, artists in precision and workflow efficiency in the ORs.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 10.1 Bn |

|

Market Forecast Value in 2035 |

USD 44.9 Bn |

|

Growth Rate (CAGR) |

14.5% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Surgical Robots Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Robot Type |

|

|

By Surgical Specialty |

|

|

By Component |

|

|

By Mode of Operation |

|

|

By Purchase Model |

|

|

By Application Scenario |

|

|

By End User |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Surgical Robots Market Outlook

- 2.1.1. Surgical Robots Market Size (Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Surgical Robots Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Surgical Specialty Control Overview, 2024

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automation & Surgical Specialty Control Overview, 2024

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for minimally invasive and precision-guided surgeries.

- 4.1.1.2. Expansion of applications in orthopedics, urology, gynecology, and general surgery

- 4.1.1.3. Technological advancements such as AI integration, haptic feedback, and enhanced imaging capabilities.

- 4.1.2. Restraints

- 4.1.2.1. High acquisition and maintenance costs with limited reimbursement structures

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Technology Providers/ System Integrators

- 4.4.3. Surgical Robots Manufacturers

- 4.4.4. Distributors & Healthcare Facilities

- 4.4.5. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Surgical Robots Market Demand

- 4.8.1. Historical Market Size - in Value (Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2024

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Surgical Robots Market Analysis, by Robot Type

- 6.1. Key Segment Analysis

- 6.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Robot Type, 2021-2035

- 6.2.1. Multi-Arm Robotic Systems

- 6.2.2. Single-Arm Robotic Systems

- 6.2.3. Robotic Surgical Accessories

- 6.2.4. Others

- 7. Global Surgical Robots Market Analysis, by Surgical Specialty

- 7.1. Key Segment Analysis

- 7.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Surgical Specialty, 2021-2035

- 7.2.1. General Surgery

- 7.2.2. Urology

- 7.2.3. Gynecology

- 7.2.4. Orthopedics

- 7.2.5. Neurosurgery & Spinal Surgery

- 7.2.6. Cardiothoracic Surgery

- 7.2.7. ENT Surgery

- 7.2.8. Others (e.g., bariatric, colorectal, pediatric)

- 8. Global Surgical Robots Market Analysis, by Component

- 8.1. Key Segment Analysis

- 8.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Component, 2021-2035

- 8.2.1. Robot Hardware

- 8.2.1.1. Arms

- 8.2.1.2. End Effectors

- 8.2.1.3. Others

- 8.2.2. Software & AI Platforms

- 8.2.2.1. Vision

- 8.2.2.2. Simulation

- 8.2.2.3. Analytics

- 8.2.2.4. Others

- 8.2.3. Instruments & Accessories

- 8.2.4. Services & Maintenance

- 8.2.5. Others

- 8.2.1. Robot Hardware

- 9. Global Surgical Robots Market Analysis, by Mode of Operation

- 9.1. Key Segment Analysis

- 9.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Mode of Operation, 2021-2035

- 9.2.1. Master–Slave (Teleoperated)

- 9.2.2. Image-Guided Navigation Systems

- 9.2.3. Supervisory-Controlled Robotic Systems

- 9.2.4. Others

- 10. Global Surgical Robots Market Analysis, by Purchase Model

- 10.1. Key Segment Analysis

- 10.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Purchase Model, 2021-2035

- 10.2.1. Capital Purchase (outright buy)

- 10.2.2. Leasing/Pay-per-Use

- 10.2.3. Robot-as-a-Service (RaaS)

- 10.2.4. Others

- 11. Global Surgical Robots Market Analysis, by Application Scenario

- 11.1. Key Segment Analysis

- 11.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Application Scenario, 2021-2035

- 11.2.1. Minimally Invasive Procedures

- 11.2.1.1. Laparoscopic

- 11.2.1.2. Arthroscopic

- 11.2.1.3. Others

- 11.2.2. Open Surgery

- 11.2.3. Rehabilitation & Therapy

- 11.2.3.1. Robotic Exoskeletons

- 11.2.3.2. Therapy Bots

- 11.2.3.3. Others

- 11.2.4. Others

- 11.2.1. Minimally Invasive Procedures

- 12. Global Surgical Robots Market Analysis, by End User

- 12.1. Key Segment Analysis

- 12.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by End User, 2021-2035

- 12.2.1. Hospitals (large multispecialty hospitals)

- 12.2.2. Ambulatory Surgical Centers

- 12.2.3. Specialty Clinics & Orthopedic Centers

- 12.2.4. Academic & Research Institutes

- 12.2.5. Others

- 13. Global Surgical Robots Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Surgical Robots Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Surgical Robots Market Size Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Robot Type

- 14.3.2. Surgical Specialty

- 14.3.3. Component

- 14.3.4. Mode of Operation

- 14.3.5. Purchase Model

- 14.3.6. Application Scenario

- 14.3.7. End User

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Surgical Robots Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Robot Type

- 14.4.3. Surgical Specialty

- 14.4.4. Component

- 14.4.5. Mode of Operation

- 14.4.6. Purchase Model

- 14.4.7. Application Scenario

- 14.4.8. End User

- 14.5. Canada Surgical Robots Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Robot Type

- 14.5.3. Surgical Specialty

- 14.5.4. Component

- 14.5.5. Mode of Operation

- 14.5.6. Purchase Model

- 14.5.7. Application Scenario

- 14.5.8. End User

- 14.6. Mexico Surgical Robots Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Robot Type

- 14.6.3. Surgical Specialty

- 14.6.4. Component

- 14.6.5. Mode of Operation

- 14.6.6. Purchase Model

- 14.6.7. Application Scenario

- 14.6.8. End User

- 15. Europe Surgical Robots Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Robot Type

- 15.3.2. Surgical Specialty

- 15.3.3. Component

- 15.3.4. Mode of Operation

- 15.3.5. Purchase Model

- 15.3.6. Application Scenario

- 15.3.7. End User

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Surgical Robots Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Robot Type

- 15.4.3. Surgical Specialty

- 15.4.4. Component

- 15.4.5. Mode of Operation

- 15.4.6. Purchase Model

- 15.4.7. Application Scenario

- 15.4.8. End User

- 15.5. United Kingdom Surgical Robots Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Robot Type

- 15.5.3. Surgical Specialty

- 15.5.4. Component

- 15.5.5. Mode of Operation

- 15.5.6. Purchase Model

- 15.5.7. Application Scenario

- 15.5.8. End User

- 15.6. France Surgical Robots Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Robot Type

- 15.6.3. Surgical Specialty

- 15.6.4. Component

- 15.6.5. Mode of Operation

- 15.6.6. Purchase Model

- 15.6.7. Application Scenario

- 15.6.8. End User

- 15.7. Italy Surgical Robots Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Robot Type

- 15.7.3. Surgical Specialty

- 15.7.4. Component

- 15.7.5. Mode of Operation

- 15.7.6. Purchase Model

- 15.7.7. Application Scenario

- 15.7.8. End User

- 15.8. Spain Surgical Robots Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Robot Type

- 15.8.3. Surgical Specialty

- 15.8.4. Component

- 15.8.5. Mode of Operation

- 15.8.6. Purchase Model

- 15.8.7. Application Scenario

- 15.8.8. End User

- 15.9. Netherlands Surgical Robots Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Robot Type

- 15.9.3. Surgical Specialty

- 15.9.4. Component

- 15.9.5. Mode of Operation

- 15.9.6. Purchase Model

- 15.9.7. Application Scenario

- 15.9.8. End User

- 15.10. Nordic Countries Surgical Robots Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Robot Type

- 15.10.3. Surgical Specialty

- 15.10.4. Component

- 15.10.5. Mode of Operation

- 15.10.6. Purchase Model

- 15.10.7. Application Scenario

- 15.10.8. End User

- 15.11. Poland Surgical Robots Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Robot Type

- 15.11.3. Surgical Specialty

- 15.11.4. Component

- 15.11.5. Mode of Operation

- 15.11.6. Purchase Model

- 15.11.7. Application Scenario

- 15.11.8. End User

- 15.12. Russia & CIS Surgical Robots Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Robot Type

- 15.12.3. Surgical Specialty

- 15.12.4. Component

- 15.12.5. Mode of Operation

- 15.12.6. Purchase Model

- 15.12.7. Application Scenario

- 15.12.8. End User

- 15.13. Rest of Europe Surgical Robots Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Robot Type

- 15.13.3. Surgical Specialty

- 15.13.4. Component

- 15.13.5. Mode of Operation

- 15.13.6. Purchase Model

- 15.13.7. Application Scenario

- 15.13.8. End User

- 16. Asia Pacific Surgical Robots Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Robot Type

- 16.3.2. Surgical Specialty

- 16.3.3. Component

- 16.3.4. Mode of Operation

- 16.3.5. Purchase Model

- 16.3.6. Application Scenario

- 16.3.7. End User

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Surgical Robots Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Robot Type

- 16.4.3. Surgical Specialty

- 16.4.4. Component

- 16.4.5. Mode of Operation

- 16.4.6. Purchase Model

- 16.4.7. Application Scenario

- 16.4.8. End User

- 16.5. India Surgical Robots Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Robot Type

- 16.5.3. Surgical Specialty

- 16.5.4. Component

- 16.5.5. Mode of Operation

- 16.5.6. Purchase Model

- 16.5.7. Application Scenario

- 16.5.8. End User

- 16.6. Japan Surgical Robots Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Robot Type

- 16.6.3. Surgical Specialty

- 16.6.4. Component

- 16.6.5. Mode of Operation

- 16.6.6. Purchase Model

- 16.6.7. Application Scenario

- 16.6.8. End User

- 16.7. South Korea Surgical Robots Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Robot Type

- 16.7.3. Surgical Specialty

- 16.7.4. Component

- 16.7.5. Mode of Operation

- 16.7.6. Purchase Model

- 16.7.7. Application Scenario

- 16.7.8. End User

- 16.8. Australia and New Zealand Surgical Robots Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Robot Type

- 16.8.3. Surgical Specialty

- 16.8.4. Component

- 16.8.5. Mode of Operation

- 16.8.6. Purchase Model

- 16.8.7. Application Scenario

- 16.8.8. End User

- 16.9. Indonesia Surgical Robots Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Robot Type

- 16.9.3. Surgical Specialty

- 16.9.4. Component

- 16.9.5. Mode of Operation

- 16.9.6. Purchase Model

- 16.9.7. Application Scenario

- 16.9.8. End User

- 16.10. Malaysia Surgical Robots Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Robot Type

- 16.10.3. Surgical Specialty

- 16.10.4. Component

- 16.10.5. Mode of Operation

- 16.10.6. Purchase Model

- 16.10.7. Application Scenario

- 16.10.8. End User

- 16.11. Thailand Surgical Robots Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Robot Type

- 16.11.3. Surgical Specialty

- 16.11.4. Component

- 16.11.5. Mode of Operation

- 16.11.6. Purchase Model

- 16.11.7. Application Scenario

- 16.11.8. End User

- 16.12. Vietnam Surgical Robots Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Robot Type

- 16.12.3. Surgical Specialty

- 16.12.4. Component

- 16.12.5. Mode of Operation

- 16.12.6. Purchase Model

- 16.12.7. Application Scenario

- 16.12.8. End User

- 16.13. Rest of Asia Pacific Surgical Robots Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Robot Type

- 16.13.3. Surgical Specialty

- 16.13.4. Component

- 16.13.5. Mode of Operation

- 16.13.6. Purchase Model

- 16.13.7. Application Scenario

- 16.13.8. End User

- 17. Middle East Surgical Robots Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Robot Type

- 17.3.2. Surgical Specialty

- 17.3.3. Component

- 17.3.4. Mode of Operation

- 17.3.5. Purchase Model

- 17.3.6. Application Scenario

- 17.3.7. End User

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Surgical Robots Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Robot Type

- 17.4.3. Surgical Specialty

- 17.4.4. Component

- 17.4.5. Mode of Operation

- 17.4.6. Purchase Model

- 17.4.7. Application Scenario

- 17.4.8. End User

- 17.5. UAE Surgical Robots Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Robot Type

- 17.5.3. Surgical Specialty

- 17.5.4. Component

- 17.5.5. Mode of Operation

- 17.5.6. Purchase Model

- 17.5.7. Application Scenario

- 17.5.8. End User

- 17.6. Saudi Arabia Surgical Robots Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Robot Type

- 17.6.3. Surgical Specialty

- 17.6.4. Component

- 17.6.5. Mode of Operation

- 17.6.6. Purchase Model

- 17.6.7. Application Scenario

- 17.6.8. End User

- 17.7. Israel Surgical Robots Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Robot Type

- 17.7.3. Surgical Specialty

- 17.7.4. Component

- 17.7.5. Mode of Operation

- 17.7.6. Purchase Model

- 17.7.7. Application Scenario

- 17.7.8. End User

- 17.8. Rest of Middle East Surgical Robots Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Robot Type

- 17.8.3. Surgical Specialty

- 17.8.4. Component

- 17.8.5. Mode of Operation

- 17.8.6. Purchase Model

- 17.8.7. Application Scenario

- 17.8.8. End User

- 18. Africa Surgical Robots Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Robot Type

- 18.3.2. Surgical Specialty

- 18.3.3. Component

- 18.3.4. Mode of Operation

- 18.3.5. Purchase Model

- 18.3.6. Application Scenario

- 18.3.7. End User

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Surgical Robots Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Robot Type

- 18.4.3. Surgical Specialty

- 18.4.4. Component

- 18.4.5. Mode of Operation

- 18.4.6. Purchase Model

- 18.4.7. Application Scenario

- 18.4.8. End User

- 18.5. Egypt Surgical Robots Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Robot Type

- 18.5.3. Surgical Specialty

- 18.5.4. Component

- 18.5.5. Mode of Operation

- 18.5.6. Purchase Model

- 18.5.7. Application Scenario

- 18.5.8. End User

- 18.6. Nigeria Surgical Robots Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Robot Type

- 18.6.3. Surgical Specialty

- 18.6.4. Component

- 18.6.5. Mode of Operation

- 18.6.6. Purchase Model

- 18.6.7. Application Scenario

- 18.6.8. End User

- 18.7. Algeria Surgical Robots Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Robot Type

- 18.7.3. Surgical Specialty

- 18.7.4. Component

- 18.7.5. Mode of Operation

- 18.7.6. Purchase Model

- 18.7.7. Application Scenario

- 18.7.8. End User

- 18.8. Rest of Africa Surgical Robots Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Robot Type

- 18.8.3. Surgical Specialty

- 18.8.4. Component

- 18.8.5. Mode of Operation

- 18.8.6. Purchase Model

- 18.8.7. Application Scenario

- 18.8.8. End User

- 19. South America Surgical Robots Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Surgical Robots Market Size (Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Robot Type

- 19.3.2. Surgical Specialty

- 19.3.3. Component

- 19.3.4. Mode of Operation

- 19.3.5. Purchase Model

- 19.3.6. Application Scenario

- 19.3.7. End User

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Surgical Robots Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Robot Type

- 19.4.3. Surgical Specialty

- 19.4.4. Component

- 19.4.5. Mode of Operation

- 19.4.6. Purchase Model

- 19.4.7. Application Scenario

- 19.4.8. End User

- 19.5. Argentina Surgical Robots Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Robot Type

- 19.5.3. Surgical Specialty

- 19.5.4. Component

- 19.5.5. Mode of Operation

- 19.5.6. Purchase Model

- 19.5.7. Application Scenario

- 19.5.8. End User

- 19.6. Rest of South America Surgical Robots Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Robot Type

- 19.6.3. Surgical Specialty

- 19.6.4. Component

- 19.6.5. Mode of Operation

- 19.6.6. Purchase Model

- 19.6.7. Application Scenario

- 19.6.8. End User

- 20. Key Players/ Company Profile

- 20.1. Auris Health (acquired by Johnson & Johnson)

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Avatera Medical

- 20.3. Blue Belt Technologies (acquired by Smith+Nephew)

- 20.4. CMR Surgical

- 20.5. Corindus Vascular Robotics (acquired by Siemens Healthineers)

- 20.6. Globus Medical

- 20.7. Hansen Medical

- 20.8. Intuitive Surgical

- 20.9. Johnson & Johnson (Verb Surgical)

- 20.10. Mazor Robotics (now part of Medtronic)

- 20.11. Medtronic

- 20.12. Renishaw plc

- 20.13. Smith+Nephew

- 20.14. Stryker Corporation

- 20.15. THINK Surgical

- 20.16. Titan Medical

- 20.17. TransEnterix (Asensus Surgical)

- 20.18. Verb Surgical (JV of J&J and Verily)

- 20.19. Virtual Incision Corporation

- 20.20. Zimmer Biomet

- 20.21. Other Key Players

- 20.1. Auris Health (acquired by Johnson & Johnson)

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation