Edge Computing Market Size, Share & Trends Analysis Report by Component (Hardware, Software and Services), Authentication Method, Technology, Deployment Type, Enterprise Size, Application, Industry Vertical and Geography (North America, Europe, Asia Pacific, Middle East, Africa and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Edge Computing Market Size, Share, and Growth

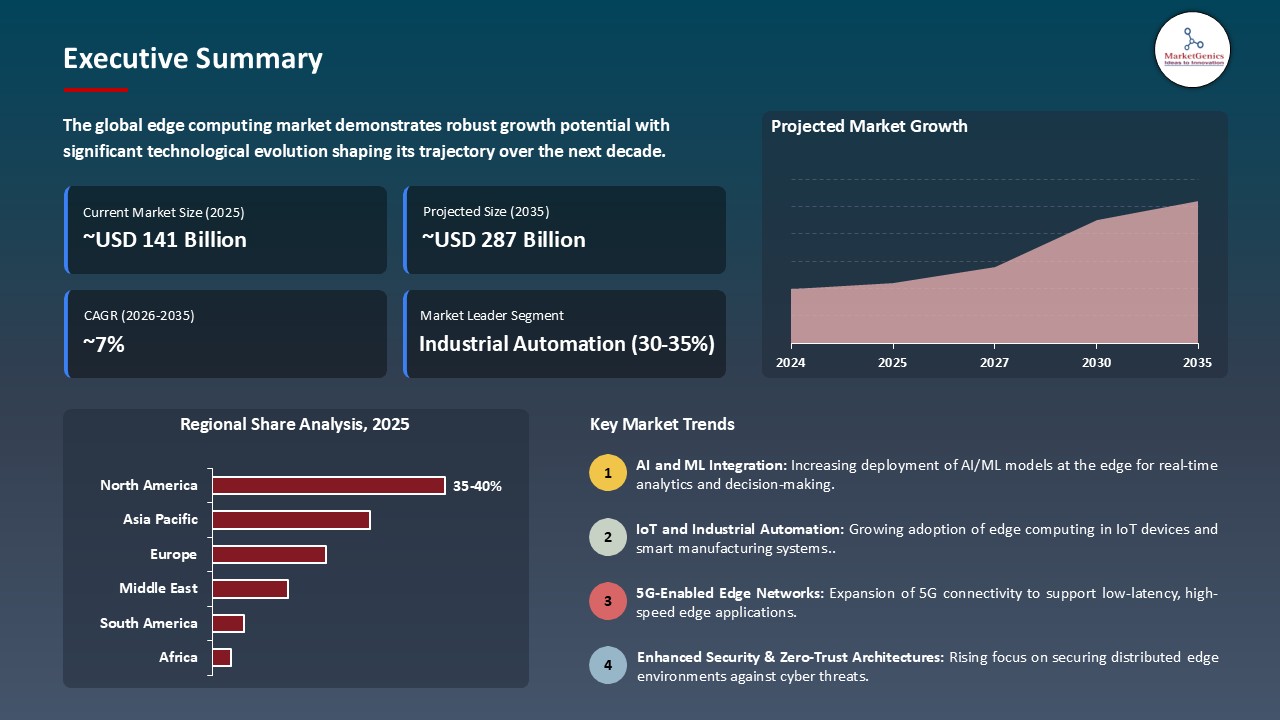

The global edge computing market is experiencing robust growth, with its estimated value of USD 141.1 billion in the year 2025 and USD 286.6 billion by the period 2035, registering a CAGR of 7.3% during the forecast period.

“Our clients are seeking to broaden the use of AI within their existing infrastructure and workflows at the edge … we are essentially taking our edge AI products and support to the next level with Intel AI Edge Systems, Edge AI Suites and Open Edge Platform is ultimately to streamline the deployment of AI-ready solutions across the ecosystem.” — Pat Gelsinger, CEO of Intel Corporation.

The global edge computing sector is rapidly developing with many concurrent factors for its adoption, specifically the use of distributed computing resources and AI‑powered analytics, which allow for in-the-moment decision‑making. For instance, in May 2023, Singtel and Microsoft Azure announced a commercial trial for Azure Public MEC (“multi‑access edge computing”) with 5G providing a way to do good quality medical imaging for use in health‑care and in real time.

The growing use of autonomous systems, IoT devices, and smart city infrastructure have increased the demand for advanced edge solutions - which requires ultra‑low latency, higher throughput, and localized processing. The evolving frameworks around data‑sovereignty and edge-native architectures are also compelling clients to adopt edge solutions that are compliant and efficient.

The combination of technology developments, regulatory stimuli, and increasing connected devices are driving the edge computing ecosystem, which results in improved responsiveness, lower bandwidth costs, and increased operational efficiency.

For adjacent opportunities, edge‑AI module manufacturing, micro ‑datacentre deployment, decentralized orchestrating systems, real‑time video analytics gateways, and industrial Internet of Things (IoT) edge platforms are good examples. Providers can capitalize on adjacent segments to expand their solution portfolios and increase share in the growing edge ecosystem.

Edge Computing Market Dynamics and Trends

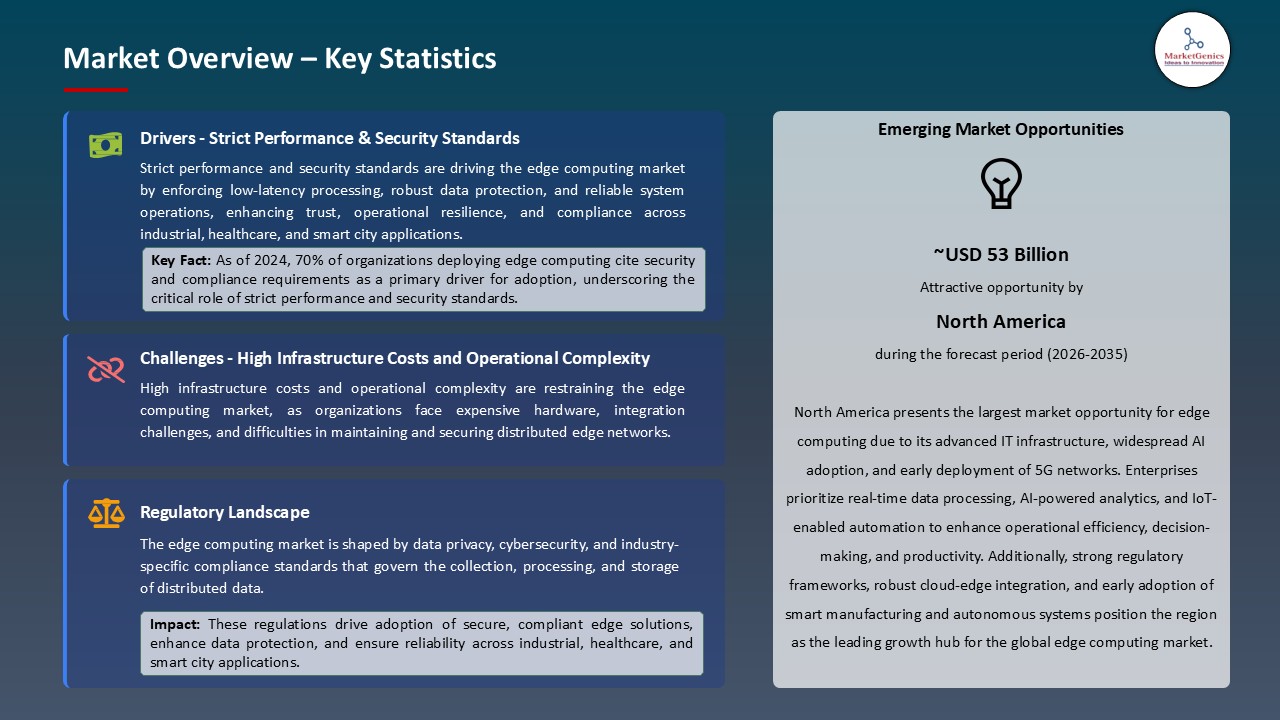

Driver: Strict Performance & Security Standards Fuel Adoption of Edge Computing Market Platforms

- The global edge computing market is experiencing rapid growth due to low-latency requirement demands across industries such as manufacturing, healthcare, automotive, and telecommunications. Being able to process data locally is essential for mission-critical systems where decision-making can take place instantaneously. The regulatory pressure surrounding data privacy and data localization, particularly with laws such as GDPR in Europe and similar data-sovereignty laws in Asia, are also driving organizations to deploy edge nodes closer to the users.

- In 2025, a number of leading providers including Amazon Web Services (AWS) and Microsoft Azure expanded their edge infrastructure to operate with real-time analytics and support 5G-enabled industrial use cases.

- With the maturation of 5G networks, enterprises are now shifting workloads to the edge to improve responsiveness and reduce network congestion, which is creating an ecosystem of edge hardware, software, and artificial intelligence-integration providers.

Restraint: High Infrastructure Costs and Operational Complexity Limiting Uptake and Widespread Adoption

- The edge deployment is still not cost-effective. Distributed micro-data centers and ruggedized servers can be expensive and also incur high-op costs to operate in the field, by being co-located with users. Another challenge is providing security consistency across thousands of edge nodes, due to the necessary encryption, authentication, and threat monitoring for each edge site to comply with enterprise security standards.

- Limited access to available skilled labor and the complexity of DevOps and orchestration tools necessary for edge deployments represent significant barriers for small enterprises and remote facilities for deploying edge solutions.

- These barriers limit large-scale rollouts of edge computing market solutions, especially in less developed areas/developing world countries, and in small to medium business contexts.

Opportunity: Growth in Emerging Regions & Industry-Specific Edge Deployments

- Emerging countries are becoming significant areas of growth for edge computing as governments and telecom operators invest in 5G connectivity and smart infrastructure. Countries in Southeast Asia, Latin America, and India, in particular, are prioritizing the enablement of localized compute capacity for industrial, retail, and public sector use-cases.

- In smart cities, autonomous transport, healthcare diagnostics, energy grid management, and retail analytics, edge computing is being utilized strategically to process data with minimal latency which enables automation, predictive maintenance, and operational efficiencies.

- For example, Intel and Telefónica in 2025 announced the expansion of edge networks throughout Latin America to support smart manufacturing and the IOT innovation ecosystem, enabling enhanced latency, and reliability, as well as local processing capacities.

- These opportunities lead to partnerships between hardware manufacturers, telecoms, and cloud-edge software vendors, as well as foster ecosystems that develop edge AI platforms, micro-data-center project deployment, and industrial IOT gateways that enable lower cost, and heightened resilience in emerging markets.

Key Trend: AI/ML Integration, Zero-Trust Security & Containerized Orchestration aiding Edge computing Industry

- A major trend that is driving the edge computing market is integrating AI/ML inference models as close to the edge as possible. This trend allows predictive analytics, automated actions and near real-time decisions to be made at various endpoints while being independent of centralized clouds. The deployment of orchestration technologies (Kubernetes, Docker, micro-VM) has increased the number of containerized, scalable edge environments that become more manageable and secure as organizations adopt edge computing.

- Companies are moving towards zero-trust edge architectures to retain and secure distributed networks from data breach issues, only allowing verifiable devices and workloads to function at the data edge.

- The evolution of AI-enabled edge devices, leveraging connectivity beyond cellular, seamless functionality, and inference-customized autonomous adapter intelligence is changing the game for companies in many vertical applications from smart factories to tele-health and digital healthcare, to formalize edge computing as a key pillar of digital transformation.

- In addition, predictive maintenance, energy optimization, and real-time analytics are becoming commonplace, as standardized edge applications drive measurable efficiency improvements for enterprises, and lower operational costs across all economic sectors.

Edge Computing Market Analysis and Segmental Data

“Industrial Automation Maintain Dominance in Global Edge Computing Market amid Growing Demand for Real-Time Data Processing"

- The industrial automation sector of the edge computing market continues to be vital across manufacturing and production environments. The importance of industrial automation transcends just manufacturing and production environments and is an overarching theme across most industrial and commercial environments. The demand in this sector arises mainly because of real-time monitoring, predictive maintenance, and AI-enabled process optimization.

- In addition to the above observations, additionally, a collaborative study by Intel and Siemens published in March 2025 on smart factory use of edge deployments established that AI-enabled edge platforms could reduce machine downtime by as much as 25%, by establishing indicators for delivering real-time anomaly detection to increase production efficiencies. The study suggested that edge computing provided the ability to process data locally for immediate decision-making in real-world scenarios within and across complicated industrial procedures.

- Conclusively, the use of edge computing is expanding from manufacturing lines into logistics, robotics, and supply chain automation, where localized processing, increased bandwidth across connected devices, low latency, and predictive analytics are common drivers for the expansion. It is able to markedly improve operational efficiency, provide developer upgrades with compliance, and a solid path forward for scalability within and outside of industrial systems.

“North American Supremacy in Edge Computing Market amid Rapid 5G and AI Adoption "

- North America remains in front of the global edge computing market largely due to the rapid rollout of 5G, underlying advanced infrastructure for AI and strong enterprise adoption across a range of industries. In 2024, the U.S. Federal Communications Commission (FCC) identified programs aimed at expanding 5G wireless networks to every corner of the country and enabling ultra-low latency connectivity and supporting real-time edge computing applications in smart factories, autonomous vehicles, and healthcare diagnostics.

- Concurrently, the National Institute of Standards and Technology (NIST) identified edge computing as a significant aspect of its research agenda for AI and IoT, developing funding for projects that will improve security, low-latency processing, security, industrial automation, and transportation and energy management applications.

- The joint government and institutional support, along with private sector innovation that still hails from companies like Intel, Microsoft, NVIDIA, and IBM, further supports North America’s dominance in edge computing. The region enjoys an ecosystem that interconnects 5G, AI, and distributed computing while enabling more widespread deployment of edge solutions across industrial, commercial, and public-sector use cases, setting measures for efficiency, security, and operational performance.

Edge-Computing-Market Ecosystem

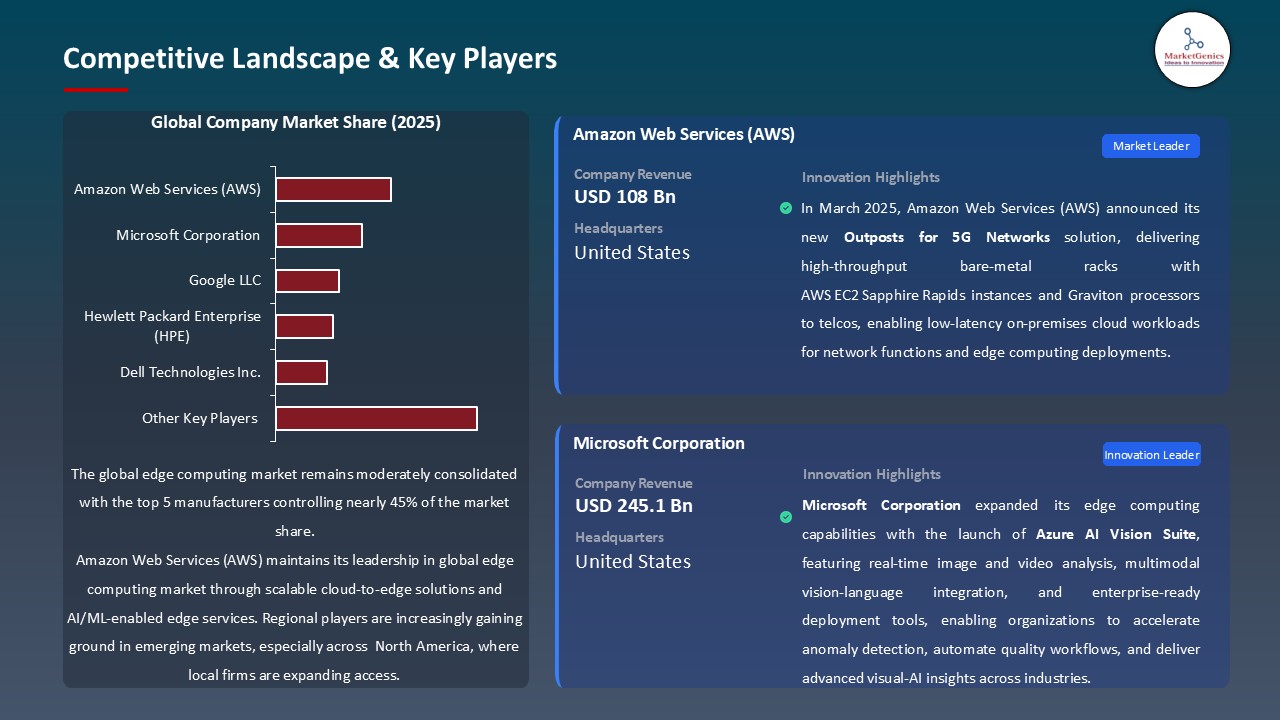

The global edge computing market is becoming more consolidated with prominent players such as Intel Corporation, Microsoft Corporation, IBM Corporation, Cisco Systems, NVIDIA Corporation, and Dell Technologies, which inflect significant market share with advanced solutions leveraging technologies such as AI-enabled edge analytics, 5G, and distributed cloud. These key entities utilize their technical sophistication to provide high-performance, low-latency decentralized solutions for industrial use cases, commercial use cases, and public-sector uses.

Key players are committed to niche solutions to spur innovation. For example, Intel offers AI-Edge Systems that perform local inference processing, enabling smart manufacturing. Microsoft Azure Edge Zones enable cloud computing services with low-latency use cases in autonomous systems and smart city infrastructure. Cisco's IOx tracks IoT devices and manages real-time analytics through a mobile embedded edge device, simply providing examples of specialized solutions and high-value deployments.

Government and research and development (R&D) organizations are also investing in and providing funding in order to incentivize existing organizations to enhance edge technologies. In May 2023, Singtel and Microsoft Azure conducted test cases of multiple-access edge computing (MEC) platforms for healthcare technology use cases that provided real-time medical imaging and analytics at the edge, this resulted in shortening latency times and improving operational efficiencies.

Organizations are emphasizing a high level of product diversification and integrated solutions, offering complementary platforms that converge AI, IoT, and analytics to provide business efficiencies and sustainability. These concepts were highlighted in March 2025, when Intel and Siemens rolled out AI-based edge platforms to smart factories and plants, providing better than 25% reductions in machine non-operating times and improved predictive maintenance capabilities.

Recent Development and Strategic Overview:

- In March 2025, Cisco Systems unveiled its Edge Intelligence Platform, which franchises both edge computing and AI together to deliver a transformative solution to industrial IoT. Cisco’s Edge Intelligence Platform keeps sensor data on the manufacturing floor, where its machine learning algorithms find anomalies as they arise, predict equipment failures, and automate corrective action to improve operational efficiency to minimize downtime.

- In March 2025, Intel Corporation presented its Intel AI Edge Systems, Edge AI Suites and Open Edge Platform initiative, which combines hardware with edge computing and AI together to give organizations the ability to deploy AI-enabled applications in retail, manufacturing and smart cities, for example.

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 141.1 Bn |

|

Market Forecast Value in 2035 |

USD 286.6 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Edge-Computing-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Edge Computing Market, By Component |

|

|

Edge Computing Market, By Authentication Method |

|

|

Edge Computing Market, By Technology |

|

|

Edge Computing Market, By Deployment Type |

|

|

Edge Computing Market, By Enterprise Size |

|

|

Edge Computing Market, By Application |

|

|

Edge Computing Market, By Industry Vertical |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Edge Computing Market Outlook

- 2.1.1. Edge Computing Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Edge Computing Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Ecosystem Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for real-time data processing and low-latency computing

- 4.1.1.2. Growing adoption of AI/ML-enabled edge analytics and IoT devices

- 4.1.1.3. Increasing regulatory focus on data security, privacy, and compliance for distributed systems

- 4.1.2. Restraints

- 4.1.2.1. High infrastructure and deployment costs of edge computing solutions

- 4.1.2.2. Integration challenges with legacy systems and complex IT architectures

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Edge Computing Solution Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Edge Computing Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Edge Computing Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Edge Servers

- 6.2.1.2. Edge Gateways and Nodes

- 6.2.1.3. Sensors and IoT Devices

- 6.2.1.4. Edge Routers and Switches

- 6.2.1.5. Embedded Computing Boards

- 6.2.1.6. Network Storage Devices

- 6.2.1.7. Power and Cooling Systems

- 6.2.1.8. Connectivity Modules (5G, Wi-Fi, LPWAN)

- 6.2.1.9. Others

- 6.2.2. Software

- 6.2.2.1. Edge Computing Platforms

- 6.2.2.2. Edge Data Management Software

- 6.2.2.3. Edge AI and Machine Learning Software

- 6.2.2.4. Edge Analytics and Visualization Tools

- 6.2.2.5. Virtualization and Containerization Software

- 6.2.2.6. Network Orchestration and Management Software

- 6.2.2.7. Edge Security and Encryption Software

- 6.2.2.8. Application Programming Interfaces (APIs) and Middleware

- 6.2.2.9. Others

- 6.2.3. Services

- 6.2.3.1. Professional Services

- 6.2.3.1.1. Consulting and Strategy Services

- 6.2.3.1.2. System Integration and Implementation

- 6.2.3.1.3. Training and Certification

- 6.2.3.2. Managed Services

- 6.2.3.2.1. Network Management and Optimization

- 6.2.3.2.2. Cloud and Edge Infrastructure Management

- 6.2.3.2.3. Edge Device Maintenance and Support

- 6.2.3.2.4. Security and Compliance Management

- 6.2.3.1. Professional Services

- 6.2.1. Hardware

- 7. Global Edge Computing Market Analysis, by Authentication Method

- 7.1. Key Segment Analysis

- 7.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Authentication Method, 2021-2035

- 7.2.1. Password-Based Authentication

- 7.2.2. OTP / SMS / Email Verification

- 7.2.3. Biometric Authentication (fingerprint, face, iris, voice)

- 7.2.4. Token-Based Authentication (hardware/software tokens)

- 7.2.5. Behavioral & Risk-Based Authentication

- 7.2.6. Passwordless Authentication

- 7.2.7. Others

- 8. Global Edge Computing Market Analysis, by Technology

- 8.1. Key Segment Analysis

- 8.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 8.2.1. Fog Computing

- 8.2.2. Mobile Edge Computing (MEC)

- 8.2.3. Cloudlets

- 8.2.4. Multi-access Edge Computing

- 8.2.5. IoT Edge

- 8.2.6. Others

- 9. Global Edge Computing Market Analysis, by Deployment Type

- 9.1. Key Segment Analysis

- 9.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Type, 2021-2035

- 9.2.1. On-premises

- 9.2.2. Cloud-based

- 9.2.3. Hybrid

- 10. Global Edge Computing Market Analysis, by Enterprise Size

- 10.1. Key Segment Analysis

- 10.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Enterprise Size, 2021-2035

- 10.2.1. Small and Medium Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 11. Global Edge Computing Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Smart Cities and Infrastructure

- 11.2.2. Industrial Automation

- 11.2.3. Remote Monitoring

- 11.2.4. Video Surveillance and Analytics

- 11.2.5. AR/VR and Immersive Experiences

- 11.2.6. Content Delivery and Optimization

- 11.2.7. Connected Vehicles

- 11.2.8. Smart Homes and Buildings

- 11.2.9. Others

- 12. Global Edge Computing Market Analysis, by Industry Vertical

- 12.1. Key Segment Analysis

- 12.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Industry Vertical, 2021-2035

- 12.2.1. Manufacturing

- 12.2.2. Energy and Utilities

- 12.2.3. Transportation and Logistics

- 12.2.4. Healthcare and Life Sciences

- 12.2.5. Retail and E-commerce

- 12.2.6. Telecommunications

- 12.2.7. BFSI

- 12.2.8. Government and Defense

- 12.2.9. Others

- 13. Global Edge Computing Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Edge Computing Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Edge Computing Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. Authentication Method

- 14.3.3. Technology

- 14.3.4. Deployment Type

- 14.3.5. Enterprise Size

- 14.3.6. Application

- 14.3.7. Industry Vertical

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Edge Computing Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. Authentication Method

- 14.4.4. Technology

- 14.4.5. Deployment Type

- 14.4.6. Enterprise Size

- 14.4.7. Application

- 14.4.8. Industry Vertical

- 14.5. Canada Edge Computing Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. Authentication Method

- 14.5.4. Technology

- 14.5.5. Deployment Type

- 14.5.6. Enterprise Size

- 14.5.7. Application

- 14.5.8. Industry Vertical

- 14.6. Mexico Edge Computing Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. Authentication Method

- 14.6.4. Technology

- 14.6.5. Deployment Type

- 14.6.6. Enterprise Size

- 14.6.7. Application

- 14.6.8. Industry Vertical

- 15. Europe Edge Computing Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. Authentication Method

- 15.3.3. Technology

- 15.3.4. Deployment Type

- 15.3.5. Enterprise Size

- 15.3.6. Application

- 15.3.7. Industry Vertical

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Edge Computing Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. Authentication Method

- 15.4.4. Technology

- 15.4.5. Deployment Type

- 15.4.6. Enterprise Size

- 15.4.7. Application

- 15.4.8. Industry Vertical

- 15.5. United Kingdom Edge Computing Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. Authentication Method

- 15.5.4. Technology

- 15.5.5. Deployment Type

- 15.5.6. Enterprise Size

- 15.5.7. Application

- 15.5.8. Industry Vertical

- 15.6. France Edge Computing Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. Authentication Method

- 15.6.4. Technology

- 15.6.5. Deployment Type

- 15.6.6. Enterprise Size

- 15.6.7. Application

- 15.6.8. Industry Vertical

- 15.7. Italy Edge Computing Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. Authentication Method

- 15.7.4. Technology

- 15.7.5. Deployment Type

- 15.7.6. Enterprise Size

- 15.7.7. Application

- 15.7.8. Industry Vertical

- 15.8. Spain Edge Computing Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. Authentication Method

- 15.8.4. Technology

- 15.8.5. Deployment Type

- 15.8.6. Enterprise Size

- 15.8.7. Application

- 15.8.8. Industry Vertical

- 15.9. Netherlands Edge Computing Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. Authentication Method

- 15.9.4. Technology

- 15.9.5. Deployment Type

- 15.9.6. Enterprise Size

- 15.9.7. Application

- 15.9.8. Industry Vertical

- 15.10. Nordic Countries Edge Computing Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. Authentication Method

- 15.10.4. Technology

- 15.10.5. Deployment Type

- 15.10.6. Enterprise Size

- 15.10.7. Application

- 15.10.8. Industry Vertical

- 15.11. Poland Edge Computing Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. Authentication Method

- 15.11.4. Technology

- 15.11.5. Deployment Type

- 15.11.6. Enterprise Size

- 15.11.7. Application

- 15.11.8. Industry Vertical

- 15.12. Russia & CIS Edge Computing Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. Authentication Method

- 15.12.4. Technology

- 15.12.5. Deployment Type

- 15.12.6. Enterprise Size

- 15.12.7. Application

- 15.12.8. Industry Vertical

- 15.13. Rest of Europe Edge Computing Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. Authentication Method

- 15.13.4. Technology

- 15.13.5. Deployment Type

- 15.13.6. Enterprise Size

- 15.13.7. Application

- 15.13.8. Industry Vertical

- 16. Asia Pacific Edge Computing Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Authentication Method

- 16.3.3. Technology

- 16.3.4. Deployment Type

- 16.3.5. Enterprise Size

- 16.3.6. Application

- 16.3.7. Industry Vertical

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Edge Computing Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Authentication Method

- 16.4.4. Technology

- 16.4.5. Deployment Type

- 16.4.6. Enterprise Size

- 16.4.7. Application

- 16.4.8. Industry Vertical

- 16.5. India Edge Computing Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Authentication Method

- 16.5.4. Technology

- 16.5.5. Deployment Type

- 16.5.6. Enterprise Size

- 16.5.7. Application

- 16.5.8. Industry Vertical

- 16.6. Japan Edge Computing Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Authentication Method

- 16.6.4. Technology

- 16.6.5. Deployment Type

- 16.6.6. Enterprise Size

- 16.6.7. Application

- 16.6.8. Industry Vertical

- 16.7. South Korea Edge Computing Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. Authentication Method

- 16.7.4. Technology

- 16.7.5. Deployment Type

- 16.7.6. Enterprise Size

- 16.7.7. Application

- 16.7.8. Industry Vertical

- 16.8. Australia and New Zealand Edge Computing Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. Authentication Method

- 16.8.4. Technology

- 16.8.5. Deployment Type

- 16.8.6. Enterprise Size

- 16.8.7. Application

- 16.8.8. Industry Vertical

- 16.9. Indonesia Edge Computing Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. Authentication Method

- 16.9.4. Technology

- 16.9.5. Deployment Type

- 16.9.6. Enterprise Size

- 16.9.7. Application

- 16.9.8. Industry Vertical

- 16.10. Malaysia Edge Computing Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. Authentication Method

- 16.10.4. Technology

- 16.10.5. Deployment Type

- 16.10.6. Enterprise Size

- 16.10.7. Application

- 16.10.8. Industry Vertical

- 16.11. Thailand Edge Computing Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. Authentication Method

- 16.11.4. Technology

- 16.11.5. Deployment Type

- 16.11.6. Enterprise Size

- 16.11.7. Application

- 16.11.8. Industry Vertical

- 16.12. Vietnam Edge Computing Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. Authentication Method

- 16.12.4. Technology

- 16.12.5. Deployment Type

- 16.12.6. Enterprise Size

- 16.12.7. Application

- 16.12.8. Industry Vertical

- 16.13. Rest of Asia Pacific Edge Computing Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. Authentication Method

- 16.13.4. Technology

- 16.13.5. Deployment Type

- 16.13.6. Enterprise Size

- 16.13.7. Application

- 16.13.8. Industry Vertical

- 17. Middle East Edge Computing Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Authentication Method

- 17.3.3. Technology

- 17.3.4. Deployment Type

- 17.3.5. Enterprise Size

- 17.3.6. Application

- 17.3.7. Industry Vertical

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Edge Computing Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Authentication Method

- 17.4.4. Technology

- 17.4.5. Deployment Type

- 17.4.6. Enterprise Size

- 17.4.7. Application

- 17.4.8. Industry Vertical

- 17.5. UAE Edge Computing Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Authentication Method

- 17.5.4. Technology

- 17.5.5. Deployment Type

- 17.5.6. Enterprise Size

- 17.5.7. Application

- 17.5.8. Industry Vertical

- 17.6. Saudi Arabia Edge Computing Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Authentication Method

- 17.6.4. Technology

- 17.6.5. Deployment Type

- 17.6.6. Enterprise Size

- 17.6.7. Application

- 17.6.8. Industry Vertical

- 17.7. Israel Edge Computing Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Authentication Method

- 17.7.4. Technology

- 17.7.5. Deployment Type

- 17.7.6. Enterprise Size

- 17.7.7. Application

- 17.7.8. Industry Vertical

- 17.8. Rest of Middle East Edge Computing Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Authentication Method

- 17.8.4. Technology

- 17.8.5. Deployment Type

- 17.8.6. Enterprise Size

- 17.8.7. Application

- 17.8.8. Industry Vertical

- 18. Africa Edge Computing Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Authentication Method

- 18.3.3. Technology

- 18.3.4. Deployment Type

- 18.3.5. Enterprise Size

- 18.3.6. Application

- 18.3.7. Industry Vertical

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Edge Computing Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Authentication Method

- 18.4.4. Technology

- 18.4.5. Deployment Type

- 18.4.6. Enterprise Size

- 18.4.7. Application

- 18.4.8. Industry Vertical

- 18.5. Egypt Edge Computing Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Authentication Method

- 18.5.4. Technology

- 18.5.5. Deployment Type

- 18.5.6. Enterprise Size

- 18.5.7. Application

- 18.5.8. Industry Vertical

- 18.6. Nigeria Edge Computing Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Authentication Method

- 18.6.4. Technology

- 18.6.5. Deployment Type

- 18.6.6. Enterprise Size

- 18.6.7. Application

- 18.6.8. Industry Vertical

- 18.7. Algeria Edge Computing Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Authentication Method

- 18.7.4. Technology

- 18.7.5. Deployment Type

- 18.7.6. Enterprise Size

- 18.7.7. Application

- 18.7.8. Industry Vertical

- 18.8. Rest of Africa Edge Computing Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Authentication Method

- 18.8.4. Technology

- 18.8.5. Deployment Type

- 18.8.6. Enterprise Size

- 18.8.7. Application

- 18.8.8. Industry Vertical

- 19. South America Edge Computing Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Edge Computing Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Authentication Method

- 19.3.3. Technology

- 19.3.4. Deployment Type

- 19.3.5. Enterprise Size

- 19.3.6. Application

- 19.3.7. Industry Vertical

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Edge Computing Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Authentication Method

- 19.4.4. Technology

- 19.4.5. Deployment Type

- 19.4.6. Enterprise Size

- 19.4.7. Application

- 19.4.8. Industry Vertical

- 19.5. Argentina Edge Computing Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Authentication Method

- 19.5.4. Technology

- 19.5.5. Deployment Type

- 19.5.6. Enterprise Size

- 19.5.7. Application

- 19.5.8. Industry Vertical

- 19.6. Rest of South America Edge Computing Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Authentication Method

- 19.6.4. Technology

- 19.6.5. Deployment Type

- 19.6.6. Enterprise Size

- 19.6.7. Application

- 19.6.8. Industry Vertical

- 20. Key Players/ Company Profile

- 20.1. ADLINK Technology Inc.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Amazon Web Services (AWS)

- 20.3. Cisco Systems, Inc.

- 20.4. ClearBlade, Inc.

- 20.5. Dell Technologies Inc.

- 20.6. EdgeConneX, Inc.

- 20.7. Equinix, Inc.

- 20.8. Fujitsu Limited

- 20.9. Google LLC

- 20.10. Hewlett Packard Enterprise (HPE)

- 20.11. Huawei Technologies Co., Ltd.

- 20.12. IBM Corporation

- 20.13. Intel Corporation

- 20.14. Lenovo Group Limited

- 20.15. Litmus Automation Inc.

- 20.16. Microsoft Corporation

- 20.17. NVIDIA Corporation

- 20.18. Schneider Electric SE

- 20.19. Siemens AG

- 20.20. Vapor IO

- 20.21. Others Key Players

- 20.1. ADLINK Technology Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation