Electric Vehicle Battery Recycling Market Size, Share, Growth Opportunity Analysis Report by Battery Type (Lithium-Ion Battery, Lead-Acid Battery, Nickel-Metal Hydride Battery, Solid-State Battery and Others), Recycling Process, Material Recovered, Type of Recycled Product, Technology Provider, End Use Application and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Electric Vehicle Battery Recycling Market Size, Share, and Growth

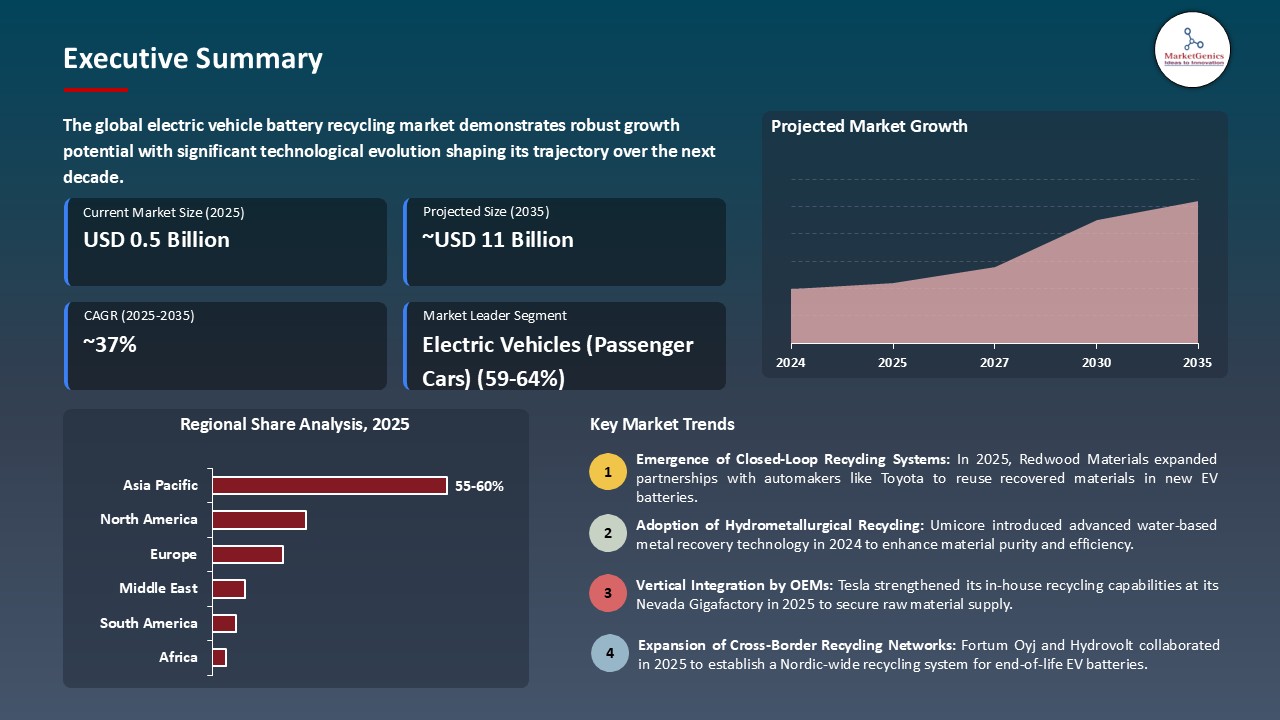

The global electric vehicle battery recycling market is projected to grow from USD 0.5 Billion in 2025 to USD 11.4 Billion in 2035, with a strong CAGR of 37.2% during the forecasted period. Asia Pacific leads the electric vehicle battery recycling market with market share of 58.1% with USD 0.3 billion revenue.

In August 2025, Glencore Plc acquired Li-Cycle Corp., a leading North American lithium-ion battery recycler, integrating Li-Cycle's patented Spoke & Hub technology into Glencore's operations. This strategic acquisition aims to bolster Glencore's position in the battery recycling sector by enhancing its capacity to process end-of-life batteries and manufacturing scrap, thereby securing a sustainable supply of critical materials for the electric vehicle industry. The integration of Li-Cycle's technology is expected to improve efficiency and reduce environmental impact in the recycling process.

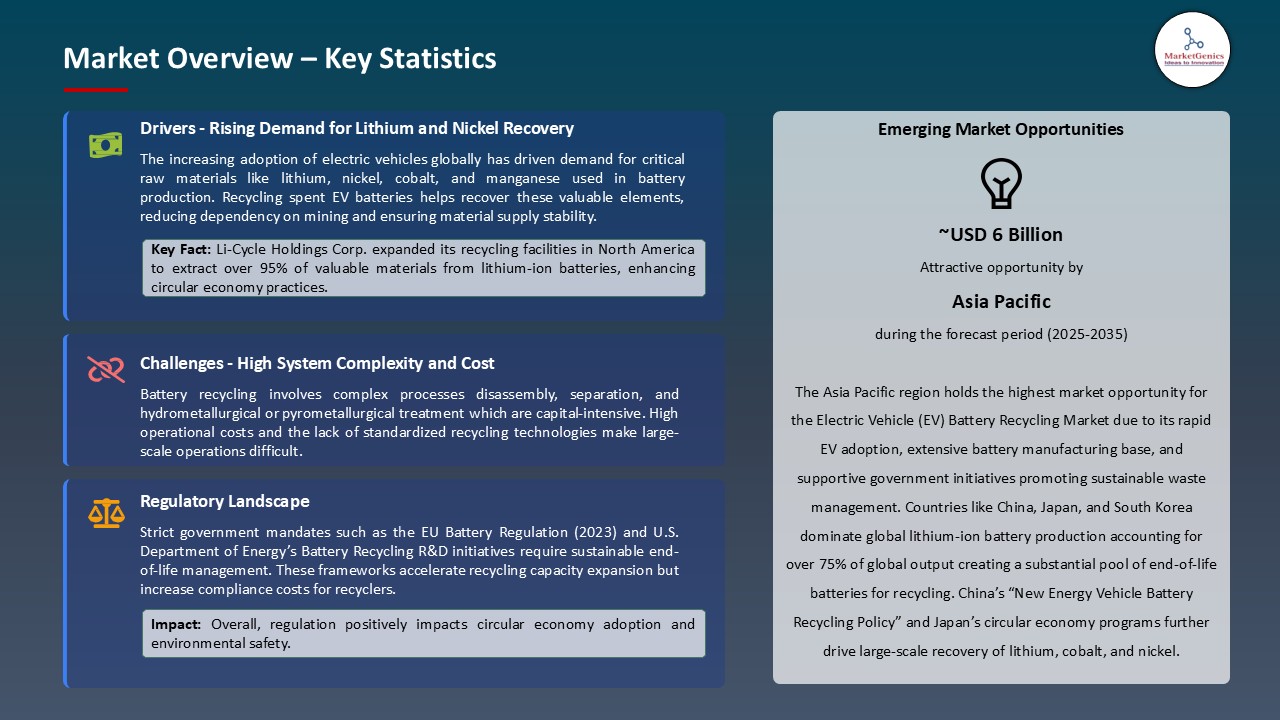

The electric vehicle battery recycling market development in the world, one can distinguish the growing interest in the essential battery material, and the tight environmental protection restrictions. Immediate EV implementation has boomed the demand of lithium, cobalt, and nickel and manufacturers, such as Li-Cycle Corp. have created cutting-edge methods of recycling as a means of ensuring material sustainability.

The governments of various countries are tightening regulations to minimize e-waste and promote recycling, which is why companies like Glencore Plc are willing to invest in the development of larger recycling facilities. All these aspects will help advance to a faster stage of the implementation of the efficient battery recycling solutions, improve the material recovery, and help to increase the overall sustainability and resilience of the EV supply chain. The said drivers are not only increasing the electric vehicle battery recycling market on recycled battery materials but also enhancing technologies in the recycling activities.

The electric vehicle battery recycling market is in the globe offers key opportunities in the second-life battery, battery material trading and supply, and battery technology licensing supporting the vehicle-to-grid technology. The used EV batteries can be used to store energy systems or to trade recovered lithium and cobalt or license out advanced technology to recycle, which opens other sources of revenue and markets. They include these opportunities that can improve profitability, ensure sustainability, and improve the circular economy of the EV battery ecosystem.

Electric Vehicle Battery Recycling Market Dynamics and Trends

Driver: Expansion of Recycling Infrastructure

- Recycling infrastructure is a key contributor to the electric vehicle battery recycling market in the global market. With the growing pace of the electric automobile adoption, the number of used batteries that need to be recycled grows as well. To curb this, businesses are investing in setting up and modernization of recycling plants.

- For instance, in March 2025, a Vancouver-based mining company Teck Resources stated that it will build a lithium-ion battery recycling plant in British Columbia. It is estimated that this plant will be the largest west coast, battery recycling plant in the North American region, and will have the capacity to recycle 35 tonnes of battery material per annum, which is equivalent to 140,000 electric automobiles in a year. This is a calculated step that is in line with the general industry trend to improve on recycling capacity to satisfy the increased demand of sustainable disposition of the battery and the recovery of the materials. The fact that such facilities are developed not only contributes to the environmental objectives but also to the circular economy, since it provides a consistent number of recycled materials to create new batteries.

- Improves recycling of materials, contributes to the cyclical economy, and maintains a stable supply of battery materials to produce EV.

Restraint: Financial Challenges and Operational Costs

- Electric vehicle battery recycling market is characterized by a high cost of performing activities and has high financial difficulties which may hinder development. Recycling facilities are very elaborate and thus need heavy capital investment in their set up and upkeep. Secondly, recycling of lithium-ion batteries is laborious and energy-consuming, which makes its operation costly.

- One such company is Li-Cycle Corp., an example of a battery recycling company located in Canada where the company filed a bankruptcy protection in May 2025. Li-Cycle faced an upswing of cost overruns and technical issues that negatively affected its financial capabilities, despite being provided with a loan of 475 million in November 2024, by the U.S Department of Energy. This lack of profitability of the firm caused its acquisition by Glencore Plc in August 2025. The financial risks of the industry and the importance of effective processes and financial approaches to achieve sustainability and profitability of the EV battery recycling business operations are eminent in this situation.

- The low recycling rates of the electric vehicle battery and the slow pace of new facilities development can be caused by high costs of capital and operation.

Opportunity: Strategic Partnerships and Acquisitions

- The electric vehicle battery recycling market has great opportunities of growth through strategic partnerships and acquiring. Through the cooperation of the established players, the companies are able to capitalize on already available infrastructure, technology, and market reach to improve their business.

- An example in point is the acquisition of Li-Cycle Corp. by Glencore Plc in August 2025. This was accompanied by the acquisition of the battery recycling plants of Li-Cycle in the United States, Germany, and Canada and its intellectual property. The relocation will enable Glencore to have a bigger representation in the battery materials supply chain and increase its recycling capacity. These strategic acquisitions help the companies to diversify their portfolios, enter into new markets, and also integrate cutting-edge technologies, which position them perfectly competitively in the fast-changing EV battery recycling industry.

- Enhances the competitive edge in the market, speeds up the pace in adopting technology and creates new geographic and business opportunities.

Key Trend: Technological Advancements in Recycling Processes

- The technological development can be seen as one of the trends that influence the EV battery recycling market. New innovations to enhance the efficiency and effectiveness of the recycling processes are on the increase. To cite an example, in August 2025, Li-Cycle Corp. has started battery recycling in its new plant in Germany. The plant operates a Li-Cycle proprietary technology (Spoke and Hub) and requires first shredding batteries into smaller sizes (Spoke) and then working on them in centralized locations (Hub) to extract valuable materials. The two-step process will promote material recovery rates and lessen the environmental impact.

- The use of these sophisticated technologies is increasingly becoming common as businesses strive to streamline recycling, cut down operations as well as comply with high environmental standards. The strong growth of EV battery recycling market and its sustainability can be further promoted by continuous advancement and realization of new recycling technologies.

- Enhances efficiency, minimizes environmental effects and maximizes recoveries, leading to sustainable industry development.

Electric Vehicle Battery Recycling Market Analysis and Segmental Data

Based on End Use Application, the Electric Vehicles (Passenger Cars) Segment Retains the Largest Share

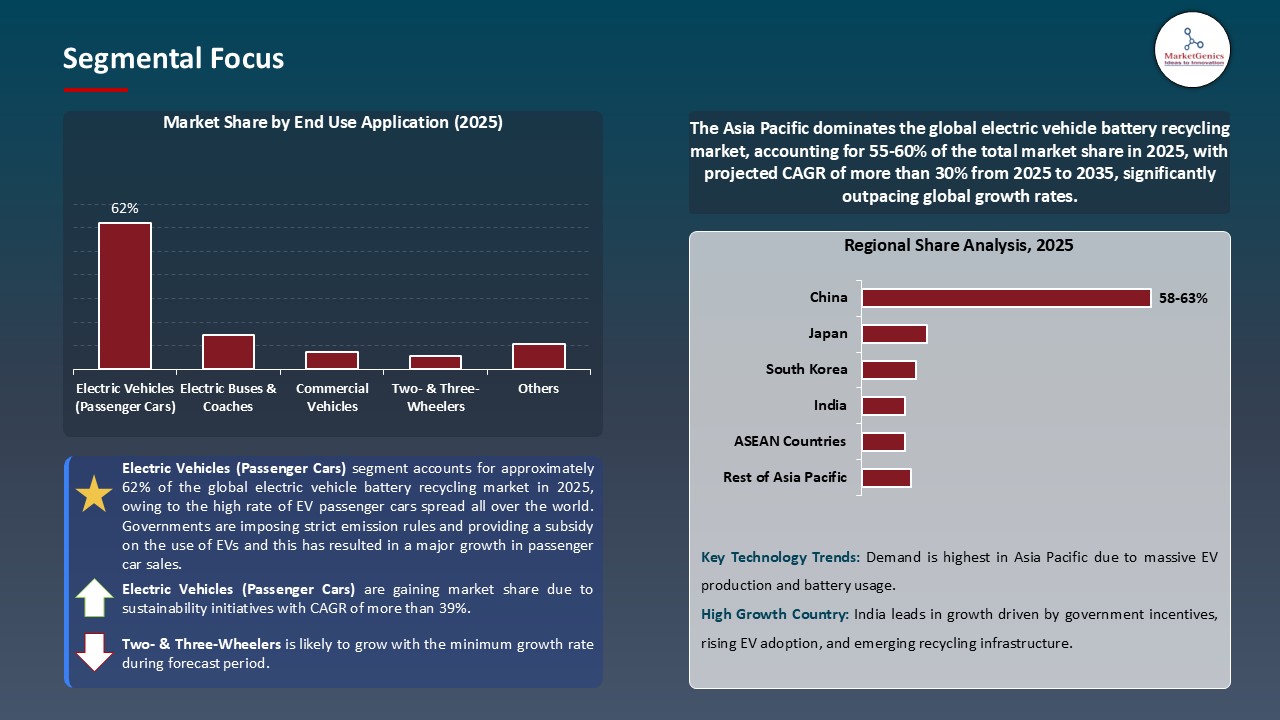

- The electric vehicles (passenger cars) segment holds major share ~62% in the global electric vehicle battery recycling market, owing to the high rate of EV passenger cars spread all over the world within the broader electric vehicle ecosystem. Governments are imposing strict emission rules and providing a subsidy on the use of EVs and this has resulted in a major growth in passenger car sales. Indicatively, BYD Company Ltd. recorded an annual sales growth of 45% on passenger EV in 2025, with Europe and Asia Pacific leading this growth. This wave produces an increasing number of expired batteries that have to be recycled and increases the demand in the electric vehicle battery recycling market.

- In addition, passenger car batteries are generally smaller and more homogeneous than batteries of commercial vehicles, which are easier and cheaper to collect, transport, and recycle. Such companies as Li-Cycle Corp. have scaled their Spoke and Hub recycling technology to ensure that these batteries can be efficiently processed to improve material recovery and the sustainability of supply chains. The concentration on passenger EV will guarantee steady feedstock supply, also accelerating the electric vehicle battery recycling market.

- The EVs adoption among the passengers are also high, which contributes to the steady growth of battery recycling, which guarantees constant availability of essential materials.

Asia Pacific Dominates Global Electric Vehicle Battery Recycling Market in 2025 and Beyond

- The electric vehicle battery recycling market demand is the most needed in the Asia pacific region because of the drastic growth in the use of electric vehicles especially in China, Japan and South Korea. China is the largest electric vehicle market in the world with 7.5 million electric passenger cars in 2025, generating a significant amount of end-of-life battery. Firms such as Ganfeng Lithium Co., Ltd. have put large scale lithium, cobalt and nickel recycling plants in Jiangxi province in order to recycle the materials to provide sustainable materials to domestic battery manufacturing, and to give assistance to government-led cyclic economy programs.

- Moreover, Asia Pacific region has good government policies and subsidies that encourage battery recycling and EV production. As an example, in 2025, the Chinese Ministry of Industry and Information Technology (MIIT) required better recycling standards regarding lithium-ion batteries, which will lead manufacturers to consider incorporating recycling solutions. The high EV penetration and regulatory support coupled with the presence of battery producers’ giants makes the Asia Pacific market dominant in the recycling of EV batteries.

- Battery recycling is highly adopted and regulated in Asia Pacific, which is the largest and the fastest-growing battery recycling hub that provides a stable supply of the critical materials.

Electric Vehicle Battery Recycling Market Ecosystem

The electric vehicle battery recycling market world is moderately fragmented with many players in the market, each involved in the collection, transportation, processing, and recovery of materials used in making the batteries, although, strategic acquisitions are consolidating the market gradually. Li-Cycle Corp., Glencore Plc and Redwood Materials are Tier 1 players that offer end-to-end recycling solutions hence they guarantee operational efficiency and a large market share. Tier 2 companies like Umicore, Fortum Oyj and Ganfeng Lithium Co., Ltd. deal with refining and material recovery with specific expertise, whereas Tier 3 innovators like Poen do it to refurbish used battery packs into second-life use reducing waste and serving to store renewable energy.

The main nodes of the key value chain are collection and transportation, which are done by companies such as Retriev Technologies and TES-Amm, the safety and compliance of the battery handling, as well as the recovery and refining of the material, which is done by companies such as Redwood Materials who recover up to 95% of the lithium, cobalt, and nickel to be reused to create new batteries. The changing ecosystem provided by the market, which has been enabled by the consolidation and improved technology, is more efficient, sustainable and resilient to the EV supply chain.

Recent Development and Strategic Overview:

- In August 2025, Glencore Plc has also acquired Li-Cycle Holdings Corp., one of the recycling companies of lithium-ion batteries in the North Americas. This is a strategic action after Li-Cycle filed a bankruptcy and it takes some of the most important assets owned by that company including the Rochester Hub and a number of spoke facilities located in North America and Europe. The acquisition will also improve the standing of Glencore in the battery recycling business to combine the Li-Cycle proprietary Spoke and Hub technology and hence making it more effective in the recovery of materials and the provision of a sustainable source of the critical minerals to the electric car industry.

- In September 2024, BMW of North America and Redwood Materials declared that they have formed a joint venture to recycle lithium-ion batteries of all electric, plug-in hybrid-electric, and mild hybrid BMW, MINI, Rolls-Royce, and BMW Motorrad vehicles in the U.S. This partnership is to rely on the use of Redwood Materials plant in Nevada and South Carolina to extract valuable materials like nickel, cobalt, and copper contained in end-of-life batteries. The project contributes to the sustainability of BMW and the creation of a closed-loop, circular value chain of the lithium-ion batteries, which is connected to the increasing trend of recycling and resource efficiency in the automotive industry.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 0.5 Bn |

|

Market Forecast Value in 2035 |

USD 11.4 Bn |

|

Growth Rate (CAGR) |

37.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value MMT for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Electric Vehicle Battery Recycling Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Battery Type |

|

|

By Recycling Process |

|

|

By Material Recovered |

|

|

By Type of Recycled Product |

|

|

By Technology Provider |

|

|

By End Use Application |

|

Frequently Asked Questions

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Electric Vehicle Battery Recycling Market Outlook

- 2.1.1. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to-Market Strategy

- 2.5.1. Customer/ End Use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Electric Vehicle Battery Recycling Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automotive & Transportation Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automotive & Transportation Industry

- 3.1.3. Regional Distribution for Automotive & Transportation

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Automotive & Transportation Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising adoption of electric vehicles leading to increased end-of-life battery volumes.

- 4.1.1.2. Government regulations promoting circular economy and recycling mandates.

- 4.1.1.3. Growing demand for recovered critical materials such as lithium, cobalt, and nickel.

- 4.1.2. Restraints

- 4.1.2.1. High recycling costs and technological complexity in extracting pure materials from spent batteries.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis/ Ecosystem Analysis

- 4.4.1. EV Battery Suppliers

- 4.4.2. Technology/ System Integrators

- 4.4.3. Electric Vehicle Battery Recycling Providers

- 4.4.4. End-users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Porter’s Five Forces Analysis

- 4.7. PESTEL Analysis

- 4.8. Global Electric Vehicle Battery Recycling Market Demand

- 4.8.1. Historical Market Size - in Value (Volume - MMT & Value - US$ Billion), 2021-2024

- 4.8.2. Current and Future Market Size - in Value (Volume - MMT & Value - US$ Billion), 2025–2035

- 4.8.2.1. Y-o-Y Growth Trends

- 4.8.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Electric Vehicle Battery Recycling Market Analysis, by Battery Type

- 6.1. Key Segment Analysis

- 6.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Battery Type, 2021-2035

- 6.2.1. Lithium-Ion Battery

- 6.2.2. Lead-Acid Battery

- 6.2.3. Nickel-Metal Hydride Battery

- 6.2.4. Solid-State Battery

- 6.2.5. Others

- 7. Global Electric Vehicle Battery Recycling Market Analysis, by Recycling Process

- 7.1. Key Segment Analysis

- 7.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Recycling Process, 2021-2035

- 7.2.1. Pyrometallurgical Process

- 7.2.2. Hydrometallurgical Process

- 7.2.3. Direct Recycling Process

- 7.2.4. Mechanical Process

- 7.2.5. Others

- 8. Global Electric Vehicle Battery Recycling Market Analysis, by Material Recovered

- 8.1. Key Segment Analysis

- 8.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Material Recovered, 2021-2035

- 8.2.1. Lithium

- 8.2.2. Cobalt

- 8.2.3. Nickel

- 8.2.4. Copper

- 8.2.5. Graphite

- 8.2.6. Others

- 9. Global Electric Vehicle Battery Recycling Market Analysis, by Type of Recycled Product

- 9.1. Key Segment Analysis

- 9.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Type of Recycled Product, 2021-2035

- 9.2.1. Battery Materials (Active Cathode/Anode Materials)

- 9.2.2. Metals (Aluminum, Copper, Steel)

- 9.2.3. Electrolytes & Other Chemicals

- 10. Global Electric Vehicle Battery Recycling Market Analysis, by Technology Provider

- 10.1. Key Segment Analysis

- 10.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Technology Provider, 2021-2035

- 10.2.1. Battery Recycling Companies

- 10.2.2. Automotive OEMs

- 10.2.3. Third-Party Recycling Service Providers

- 11. Global Electric Vehicle Battery Recycling Market Analysis, by End Use Application

- 11.1. Key Segment Analysis

- 11.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by End Use Application, 2021-2035

- 11.2.1. Electric Vehicles (Passenger Cars)

- 11.2.2. Electric Buses & Coaches

- 11.2.3. Commercial Vehicles

- 11.2.4. Two- & Three-Wheelers

- 11.2.5. Others

- 12. Global Electric Vehicle Battery Recycling Market Analysis and Forecasts, by Region

- 12.1. Key Findings

- 12.2. Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 12.2.1. North America

- 12.2.2. Europe

- 12.2.3. Asia Pacific

- 12.2.4. Middle East

- 12.2.5. Africa

- 12.2.6. South America

- 13. North America Electric Vehicle Battery Recycling Market Analysis

- 13.1. Key Segment Analysis

- 13.2. Regional Snapshot

- 13.3. North America Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 13.3.1. Battery Type

- 13.3.2. Recycling Process

- 13.3.3. Material Recovered

- 13.3.4. Type of Recycled Product

- 13.3.5. Technology Provider

- 13.3.6. End Use Application

- 13.3.7. Country

- 13.3.7.1. USA

- 13.3.7.2. Canada

- 13.3.7.3. Mexico

- 13.4. USA Electric Vehicle Battery Recycling Market

- 13.4.1. Country Segmental Analysis

- 13.4.2. Battery Type

- 13.4.3. Recycling Process

- 13.4.4. Material Recovered

- 13.4.5. Type of Recycled Product

- 13.4.6. Technology Provider

- 13.4.7. End Use Application

- 13.5. Canada Electric Vehicle Battery Recycling Market

- 13.5.1. Country Segmental Analysis

- 13.5.2. Battery Type

- 13.5.3. Recycling Process

- 13.5.4. Material Recovered

- 13.5.5. Type of Recycled Product

- 13.5.6. Technology Provider

- 13.5.7. End Use Application

- 13.6. Mexico Electric Vehicle Battery Recycling Market

- 13.6.1. Country Segmental Analysis

- 13.6.2. Battery Type

- 13.6.3. Recycling Process

- 13.6.4. Material Recovered

- 13.6.5. Type of Recycled Product

- 13.6.6. Technology Provider

- 13.6.7. End Use Application

- 14. Europe Electric Vehicle Battery Recycling Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. Europe Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Battery Type

- 14.3.2. Recycling Process

- 14.3.3. Material Recovered

- 14.3.4. Type of Recycled Product

- 14.3.5. Technology Provider

- 14.3.6. End Use Application

- 14.3.7. Country

- 14.3.7.1. Germany

- 14.3.7.2. United Kingdom

- 14.3.7.3. France

- 14.3.7.4. Italy

- 14.3.7.5. Spain

- 14.3.7.6. Netherlands

- 14.3.7.7. Nordic Countries

- 14.3.7.8. Poland

- 14.3.7.9. Russia & CIS

- 14.3.7.10. Rest of Europe

- 14.4. Germany Electric Vehicle Battery Recycling Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Battery Type

- 14.4.3. Recycling Process

- 14.4.4. Material Recovered

- 14.4.5. Type of Recycled Product

- 14.4.6. Technology Provider

- 14.4.7. End Use Application

- 14.5. United Kingdom Electric Vehicle Battery Recycling Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Battery Type

- 14.5.3. Recycling Process

- 14.5.4. Material Recovered

- 14.5.5. Type of Recycled Product

- 14.5.6. Technology Provider

- 14.5.7. End Use Application

- 14.6. France Electric Vehicle Battery Recycling Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Battery Type

- 14.6.3. Recycling Process

- 14.6.4. Material Recovered

- 14.6.5. Type of Recycled Product

- 14.6.6. Technology Provider

- 14.6.7. End Use Application

- 14.7. Italy Electric Vehicle Battery Recycling Market

- 14.7.1. Country Segmental Analysis

- 14.7.2. Battery Type

- 14.7.3. Recycling Process

- 14.7.4. Material Recovered

- 14.7.5. Type of Recycled Product

- 14.7.6. Technology Provider

- 14.7.7. End Use Application

- 14.8. Spain Electric Vehicle Battery Recycling Market

- 14.8.1. Country Segmental Analysis

- 14.8.2. Battery Type

- 14.8.3. Recycling Process

- 14.8.4. Material Recovered

- 14.8.5. Type of Recycled Product

- 14.8.6. Technology Provider

- 14.8.7. End Use Application

- 14.9. Netherlands Electric Vehicle Battery Recycling Market

- 14.9.1. Country Segmental Analysis

- 14.9.2. Battery Type

- 14.9.3. Recycling Process

- 14.9.4. Material Recovered

- 14.9.5. Type of Recycled Product

- 14.9.6. Technology Provider

- 14.9.7. End Use Application

- 14.10. Nordic Countries Electric Vehicle Battery Recycling Market

- 14.10.1. Country Segmental Analysis

- 14.10.2. Battery Type

- 14.10.3. Recycling Process

- 14.10.4. Material Recovered

- 14.10.5. Type of Recycled Product

- 14.10.6. Technology Provider

- 14.10.7. End Use Application

- 14.11. Poland Electric Vehicle Battery Recycling Market

- 14.11.1. Country Segmental Analysis

- 14.11.2. Battery Type

- 14.11.3. Recycling Process

- 14.11.4. Material Recovered

- 14.11.5. Type of Recycled Product

- 14.11.6. Technology Provider

- 14.11.7. End Use Application

- 14.12. Russia & CIS Electric Vehicle Battery Recycling Market

- 14.12.1. Country Segmental Analysis

- 14.12.2. Battery Type

- 14.12.3. Recycling Process

- 14.12.4. Material Recovered

- 14.12.5. Type of Recycled Product

- 14.12.6. Technology Provider

- 14.12.7. End Use Application

- 14.13. Rest of Europe Electric Vehicle Battery Recycling Market

- 14.13.1. Country Segmental Analysis

- 14.13.2. Battery Type

- 14.13.3. Recycling Process

- 14.13.4. Material Recovered

- 14.13.5. Type of Recycled Product

- 14.13.6. Technology Provider

- 14.13.7. End Use Application

- 15. Asia Pacific Electric Vehicle Battery Recycling Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. East Asia Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Battery Type

- 15.3.2. Recycling Process

- 15.3.3. Material Recovered

- 15.3.4. Type of Recycled Product

- 15.3.5. Technology Provider

- 15.3.6. End Use Application

- 15.3.7. Country

- 15.3.7.1. China

- 15.3.7.2. India

- 15.3.7.3. Japan

- 15.3.7.4. South Korea

- 15.3.7.5. Australia and New Zealand

- 15.3.7.6. Indonesia

- 15.3.7.7. Malaysia

- 15.3.7.8. Thailand

- 15.3.7.9. Vietnam

- 15.3.7.10. Rest of Asia Pacific

- 15.4. China Electric Vehicle Battery Recycling Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Battery Type

- 15.4.3. Recycling Process

- 15.4.4. Material Recovered

- 15.4.5. Type of Recycled Product

- 15.4.6. Technology Provider

- 15.4.7. End Use Application

- 15.5. India Electric Vehicle Battery Recycling Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Battery Type

- 15.5.3. Recycling Process

- 15.5.4. Material Recovered

- 15.5.5. Type of Recycled Product

- 15.5.6. Technology Provider

- 15.5.7. End Use Application

- 15.6. Japan Electric Vehicle Battery Recycling Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Battery Type

- 15.6.3. Recycling Process

- 15.6.4. Material Recovered

- 15.6.5. Type of Recycled Product

- 15.6.6. Technology Provider

- 15.6.7. End Use Application

- 15.7. South Korea Electric Vehicle Battery Recycling Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Battery Type

- 15.7.3. Recycling Process

- 15.7.4. Material Recovered

- 15.7.5. Type of Recycled Product

- 15.7.6. Technology Provider

- 15.7.7. End Use Application

- 15.8. Australia and New Zealand Electric Vehicle Battery Recycling Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Battery Type

- 15.8.3. Recycling Process

- 15.8.4. Material Recovered

- 15.8.5. Type of Recycled Product

- 15.8.6. Technology Provider

- 15.8.7. End Use Application

- 15.9. Indonesia Electric Vehicle Battery Recycling Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Battery Type

- 15.9.3. Recycling Process

- 15.9.4. Material Recovered

- 15.9.5. Type of Recycled Product

- 15.9.6. Technology Provider

- 15.9.7. End Use Application

- 15.10. Malaysia Electric Vehicle Battery Recycling Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Battery Type

- 15.10.3. Recycling Process

- 15.10.4. Material Recovered

- 15.10.5. Type of Recycled Product

- 15.10.6. Technology Provider

- 15.10.7. End Use Application

- 15.11. Thailand Electric Vehicle Battery Recycling Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Battery Type

- 15.11.3. Recycling Process

- 15.11.4. Material Recovered

- 15.11.5. Type of Recycled Product

- 15.11.6. Technology Provider

- 15.11.7. End Use Application

- 15.12. Vietnam Electric Vehicle Battery Recycling Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Battery Type

- 15.12.3. Recycling Process

- 15.12.4. Material Recovered

- 15.12.5. Type of Recycled Product

- 15.12.6. Technology Provider

- 15.12.7. End Use Application

- 15.13. Rest of Asia Pacific Electric Vehicle Battery Recycling Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Battery Type

- 15.13.3. Recycling Process

- 15.13.4. Material Recovered

- 15.13.5. Type of Recycled Product

- 15.13.6. Technology Provider

- 15.13.7. End Use Application

- 16. Middle East Electric Vehicle Battery Recycling Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Middle East Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 16.3.1. Battery Type

- 16.3.2. Recycling Process

- 16.3.3. Material Recovered

- 16.3.4. Type of Recycled Product

- 16.3.5. Technology Provider

- 16.3.6. End Use Application

- 16.3.7. Country

- 16.3.7.1. Turkey

- 16.3.7.2. UAE

- 16.3.7.3. Saudi Arabia

- 16.3.7.4. Israel

- 16.3.7.5. Rest of Middle East

- 16.4. Turkey Electric Vehicle Battery Recycling Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Battery Type

- 16.4.3. Recycling Process

- 16.4.4. Material Recovered

- 16.4.5. Type of Recycled Product

- 16.4.6. Technology Provider

- 16.4.7. End Use Application

- 16.5. UAE Electric Vehicle Battery Recycling Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Battery Type

- 16.5.3. Recycling Process

- 16.5.4. Material Recovered

- 16.5.5. Type of Recycled Product

- 16.5.6. Technology Provider

- 16.5.7. End Use Application

- 16.6. Saudi Arabia Electric Vehicle Battery Recycling Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Battery Type

- 16.6.3. Recycling Process

- 16.6.4. Material Recovered

- 16.6.5. Type of Recycled Product

- 16.6.6. Technology Provider

- 16.6.7. End Use Application

- 16.7. Israel Electric Vehicle Battery Recycling Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Battery Type

- 16.7.3. Recycling Process

- 16.7.4. Material Recovered

- 16.7.5. Type of Recycled Product

- 16.7.6. Technology Provider

- 16.7.7. End Use Application

- 16.8. Rest of Middle East Electric Vehicle Battery Recycling Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Battery Type

- 16.8.3. Recycling Process

- 16.8.4. Material Recovered

- 16.8.5. Type of Recycled Product

- 16.8.6. Technology Provider

- 16.8.7. End Use Application

- 17. Africa Electric Vehicle Battery Recycling Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Africa Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Battery Type

- 17.3.2. Recycling Process

- 17.3.3. Material Recovered

- 17.3.4. Type of Recycled Product

- 17.3.5. Technology Provider

- 17.3.6. End Use Application

- 17.3.7. Country

- 17.3.7.1. South Africa

- 17.3.7.2. Egypt

- 17.3.7.3. Nigeria

- 17.3.7.4. Algeria

- 17.3.7.5. Rest of Africa

- 17.4. South Africa Electric Vehicle Battery Recycling Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Battery Type

- 17.4.3. Recycling Process

- 17.4.4. Material Recovered

- 17.4.5. Type of Recycled Product

- 17.4.6. Technology Provider

- 17.4.7. End Use Application

- 17.5. Egypt Electric Vehicle Battery Recycling Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Battery Type

- 17.5.3. Recycling Process

- 17.5.4. Material Recovered

- 17.5.5. Type of Recycled Product

- 17.5.6. Technology Provider

- 17.5.7. End Use Application

- 17.6. Nigeria Electric Vehicle Battery Recycling Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Battery Type

- 17.6.3. Recycling Process

- 17.6.4. Material Recovered

- 17.6.5. Type of Recycled Product

- 17.6.6. Technology Provider

- 17.6.7. End Use Application

- 17.7. Algeria Electric Vehicle Battery Recycling Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Battery Type

- 17.7.3. Recycling Process

- 17.7.4. Material Recovered

- 17.7.5. Type of Recycled Product

- 17.7.6. Technology Provider

- 17.7.7. End Use Application

- 17.8. Rest of Africa Electric Vehicle Battery Recycling Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Battery Type

- 17.8.3. Recycling Process

- 17.8.4. Material Recovered

- 17.8.5. Type of Recycled Product

- 17.8.6. Technology Provider

- 17.8.7. End Use Application

- 18. South America Electric Vehicle Battery Recycling Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Central and South Africa Electric Vehicle Battery Recycling Market Size (Volume - MMT & Value - US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Battery Type

- 18.3.2. Recycling Process

- 18.3.3. Material Recovered

- 18.3.4. Type of Recycled Product

- 18.3.5. Technology Provider

- 18.3.6. End Use Application

- 18.3.7. Country

- 18.3.7.1. Brazil

- 18.3.7.2. Argentina

- 18.3.7.3. Rest of South America

- 18.4. Brazil Electric Vehicle Battery Recycling Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Battery Type

- 18.4.3. Recycling Process

- 18.4.4. Material Recovered

- 18.4.5. Type of Recycled Product

- 18.4.6. Technology Provider

- 18.4.7. End Use Application

- 18.5. Argentina Electric Vehicle Battery Recycling Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Battery Type

- 18.5.3. Recycling Process

- 18.5.4. Material Recovered

- 18.5.5. Type of Recycled Product

- 18.5.6. Technology Provider

- 18.5.7. End Use Application

- 18.6. Rest of South America Electric Vehicle Battery Recycling Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Battery Type

- 18.6.3. Recycling Process

- 18.6.4. Material Recovered

- 18.6.5. Type of Recycled Product

- 18.6.6. Technology Provider

- 18.6.7. End Use Application

- 19. Key Players/ Company Profile

- 19.1. Accurec Recycling GmbH

- 19.1.1. Company Details/ Overview

- 19.1.2. Company Financials

- 19.1.3. Key Customers and Competitors

- 19.1.4. Business/ Industry Portfolio

- 19.1.5. Product Portfolio/ Specification Details

- 19.1.6. Pricing Data

- 19.1.7. Strategic Overview

- 19.1.8. Recent Developments

- 19.2. American Manganese Inc.

- 19.3. BASF SE

- 19.4. Canadian Lithium Battery Recycling Inc.

- 19.5. Duesenfeld GmbH

- 19.6. Ecobat Technologies Ltd.

- 19.7. Fortum Oyj

- 19.8. Ganfeng Lithium Co., Ltd.

- 19.9. Glencore Technology

- 19.10. Jiangxi Ganfeng Lithium Recycling Co., Ltd.

- 19.11. Li-Cycle Corp.

- 19.12. Neometals Ltd.

- 19.13. Recupyl SAS

- 19.14. Redwood Materials, Inc.

- 19.15. Retriev Technologies

- 19.16. SK Innovation Co., Ltd.

- 19.17. SungEel HiTech Co., Ltd.

- 19.18. TES-Amm

- 19.19. Umicore

- 19.20. Veolia Group

- 19.21. Other Key Players

- 19.1. Accurec Recycling GmbH

Note* - This is just tentative list of players. While providing the report, we will cover a greater number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Forecasting Models / Techniques

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation