Industrial Safety Systems Market Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), System Type, Safety Level, Application, Functionality, Communication Protocol, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Industrial Safety Systems Market Size, Share, and Growth

The global industrial safety systems market is witnessing strong growth, valued at USD 7.8 billion in 2025 and projected to reach USD 13.6 billion by 2035, expanding at a CAGR of 5.7% during the forecast period. North America is the fastest-growing region in the industrial safety systems market due to high adoption of advanced safety technologies, stringent regulatory standards, and continuous investments in industrial modernization and risk mitigation.

Daniel Smith, senior product manager with Emerson’s discrete automation business, said, “Adding the PACSystems RX3i CPS400 Safety Controller to our extensive portfolio of safety products, we continue to deliver tools users need to create compliant safety systems that are easily developed and integrated into sophisticated automation solutions”.

The industrial safety systems market adoption is being led by continuous innovations in industrial safety systems like the increased torque density, smaller and lightweight shapes, better heat dissipation, and inbuilt safety systems like Safe Torque Off (STO) and vibration suppression. Such improvements enable manufacturers to operate more accurately driven, faster and dependable in harsh industrial settings, such as robotics, packaging, electronics, and even automobile uses.

The industrial safety systems market is evolving towards higher levels through collaborations with technology partners and the market leaders in industrial safety industry, which will allow developing more advanced, more integrated, and digitally connected safety solutions. As an example, A recent 2025 partnership in the industrial safety systems market is an agreement between Honeywell and Nutanix to transform the Honeywell Integrated Control and Safety System (ICSS). It is a combined effort of Nutanix hybrid cloud infrastructure and Honeywell safety and control solutions that can help to provide scale-to-need, safe, and resilient safety systems, advanced cybersecurity, and better operation efficiency to industrial plants.

The newer opportunity in the industrial safety systems market is modular and scalable safety solutions tailored to small and medium enterprises (SMEs). The SMEs are frequently limited in their budgets and space unlike in large industrial setups and the mix tailored and flexible safety systems are of significant appeal. Those solutions enable those that operate small businesses to adopt vigorous safety protocols, regulatory compliance and increase efficiency in their operations without incurring high costs as incurred in large-scale systems.

Industrial Safety Systems Market Dynamics and Trends

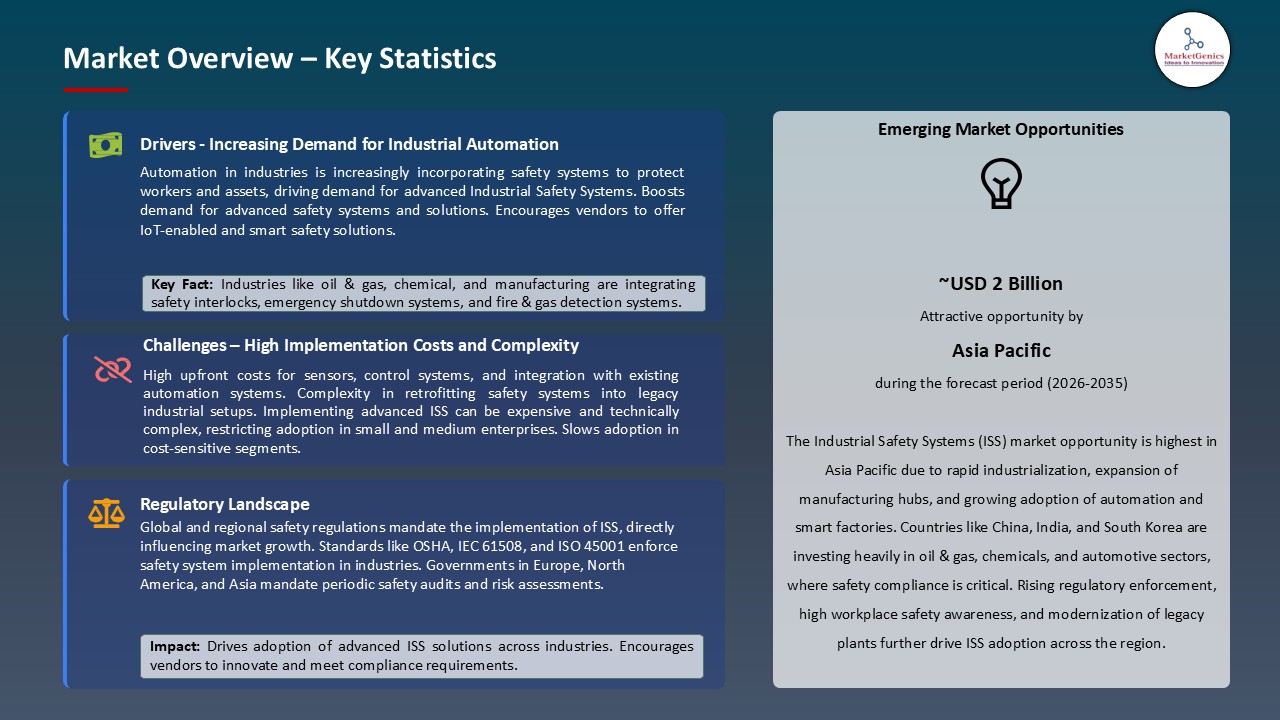

Driver: Stringent Safety Regulations in Oil and Gas and Chemical Industries

- The industrial safety systems market is highly propelled by stringent safety rules in oil and gas and chemical industries whereby any form of failure can cause serious accidents, environmental degradation, and expensive downfalls. Regulatory authorities are growing more complex requiring the use of certified safety instrumented systems, emergency shutdown systems, fire and gas monitoring, and process safety controls to guarantee reliability in operations.

- Organizations are forced to replace old systems by sophisticated and safe technologies that are compliant so as to align with the changing standards and reduce liability. Such an impetus towards obligatory compliance not only increases the standard of safety infrastructural support, but it also accelerates demand of solid, automated and digitally merged industrial safety solutions in essential operations.

- In 2025, the introduction of the revised Offshore Petroleum and Greenhouse Gas Storage (Safety) Regulations 2024 in Australia and new NOPSEMA guidelines and new, tougher requirements on safety-cases forced the offshore operators to upgrade their compliance, monitoring, and process-safety equipment, which prompted more users to seek out advanced industrial safety solutions.

- On the whole, all these considerations support the importance of the role of regulatory-based modernization in the continued expansion of the industrial safety systems market.

Restraint: High Implementation and Certification Costs

- High implementation and certification costs are still a serious limitation to the market of the Industrial Safety Systems because implementation of the systems demands lots of capital investment in the hardware, engineering, integration and compliance efforts. Efforts to meet high standards of safety in the world like IEC 61508, IEC 61511 and SIL levels are additional to a large scale of monetary expenditure in the form of testing, third party validation, documentation, and repeat auditing.

- Special technical knowledge and lengthy installation periods add more on to the cost of the project. These premium initial and ongoing expenses tend to postpone the today adoption process or restrict upgrades of already in place safety structures to many small and medium sized enterprises and industries, which operate in cost sensitive settings. In developing countries, the scarcity of funds and access to qualified safety experts make the task more difficult, limiting the market.

- Overall, the implementation and certification cost intensity tend to be a major deterrent, further decelerating the process of complete introduction of comprehensive industrial safety systems to most end-use industries.

Opportunity: Modernization of Aging Safety Infrastructure

- Modernization of aging safety infrastructure offers a significant market opportunity to the industrial safety systems market since most facilities in the oil and gas, chemicals, power generation, and manufacturing industries are still utilizing non-compliant, outdated or partially automated safety systems. These old installations do not have the sophisticated monitoring, diagnostic and fail-safe functionality to achieve the most recent safety standards and needs of operation.

- Since industries are trying to minimize unexpected downtime, improve the reliability, and keep in line with the ever-tightening regulations, the necessity to replace or upgrade the outdated systems gains a top priority. This poses a significant demand on sophisticated safety instrumented systems, real time hazard detection, digital monitoring systems and closed loop shutdown which places modernization efforts as a significant growth environment in capitalizing on market expansion.

- In 2025, the Krško Nuclear Power Plant (NEK) started a major outage to modernize its ageing safety infrastructure such as by replacing its central alarm system, upgrading its process computer system, and providing more resilience to critical safety equipment - showing an increasing trend in worldwide investment in the modernization of its outdated industrial safety infrastructure.

- Overall, these advances underscore the strengthening market potential of the emerging industrial safety systems on the global market by large-scale modernization efforts.

Key Trend: Integration of Wireless Safety Sensors and Edge Analytics

- The use of wireless safety sensors and edge analytics is becoming a trend in the Industrial Safety Systems market because it is required to monitor its safety at a faster and more flexible and responsive manner. The wireless sensors allow real-time monitoring of important parameters such as gas leaks, temperature variations, pressure, and equipment performance without the drawbacks of the wired installation that is why it is great in remote, hazardous, and inaccessible industrial settings.

- In combination with edge analytics, data processing is done locally on the edge, which can lower latency and allow immediate remedying measures including notifications of safety concerns, shutdowns, or automated corrective actions. This tendency leads to better predictive maintenance, situational awareness, and less down time of operations which makes wireless and edge-enabled safety solutions one of the leading innovations of next-generation industrial safety systems.

- SYSGO presented its Industrial Edge Demo in 2025 at Embedded World, using real-time AI-aided quality control, edge-based decision making, and a certifiable safety-critical edge platform-demonstrating an advanced edge computing and secure embedded architecture, and accelerated the implementation of wireless safety sensors and edge analytics in an industrial setting.

- Collectively, these innovations are quickly turning industrial safety installed systems into quicker, smarter, and more autonomous safety systems.

Industrial-Safety-Systems-Market Analysis and Segmental Data

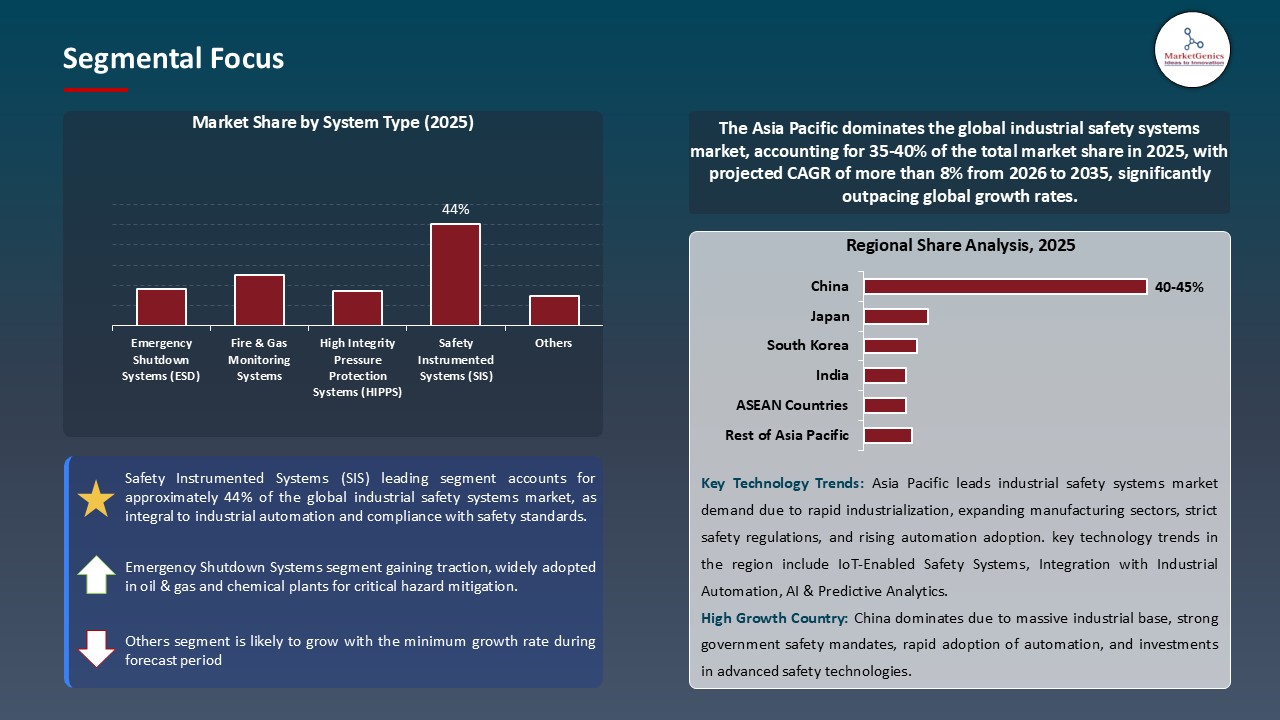

Safety Instrumented Systems (SIS) Dominate Global Industrial Safety Systems Market

- Safety Instrumented Systems (SIS) are the prevailing industrial safety systems in the world market since they are the main protective interface in high-risk environments like oil and gas, chemicals, power generation, and refining. SIS are also imperative in the prevention of the dangerous events by overseeing the vital processes and identifying the deviation and triggering automatic shutdowns to ensure safe working conditions.

- They have become more important due to the increase in safety standards in industries, the need to achieve greater reliability, and the growing use of automation in complicated activities. The certification of SIS solutions is further supported by the compliance requirements like IEC 61508 and IEC 61511.

- Because of modernizing aging infrastructure and the adoption of new and sophisticated digital safety technologies, SIS remain the most essential and ubiquitous segment of the industrial safety community. In 2025, Yokogawa reinforced the international acceptance of their ProSafe-RS Safety Instrumented System, a TUV certified SIL1-SIL3 platform with flexible modular redundancy, online editing, integrated control-safety design, and automated compliance notification.

- ProSafe-RS, with its scalable design, live risk displays, and publically approved Functional Safety Management structure, is one of the best choices for petrochemical, offshore, and diverse process firms that require a reliable and continuously accessible SIS.

- Combined, the factors make SIS the most urgent and always prioritized safety technology that determines the future of industrial risk management.

Asia Pacific Leads Global Industrial Safety Systems Market Demand

- Asia Pacific leads the industrial safety systems market, due to rapid industrial growth, increased manufacturing, and regulatory compliance in industries such as oil & gas, chemicals, power generation, mining, and electronics. The region's rapid adoption of automation, smart factories, and other process control technologies is leading to increased integration of safety instrumented systems, fire & gas detection systems, emergency shutdown systems, and real-time monitoring systems.

- Growth in investment of refining capacity, LNG terminals, renewable energy development as well as development of high-risk industrial operations further increases the demand to have certified and modern safety systems. Moreover, in China, India, Japan and South Korea, the governments are expanding the workplace safety standards, forcing industries to modernize old systems and implement the highly digitalized safety systems, which makes the Asia Pacific region consolidate demand by global markets.

- HollySys enhanced its market presence in Asia Pacific industrial safety systems with the introduction of its HiaGuard SIL3 Safety Instrumented System that is TUV certified, 2oo3D high-availability architecture, SC3/SIL3 conforming, advanced diagnostics, built in DCS-SIS connectivity, and secure safety communication-supporting thousands of applications in refining, petrochemicals, oil and gas, power and other critical markets.

- Asia Pacific is the booming market for industrial safety systems, driven by strong industrial expansion, tighter management requirements, and modernization of safety infrastructure.

Industrial-Safety-Systems-Market Ecosystem

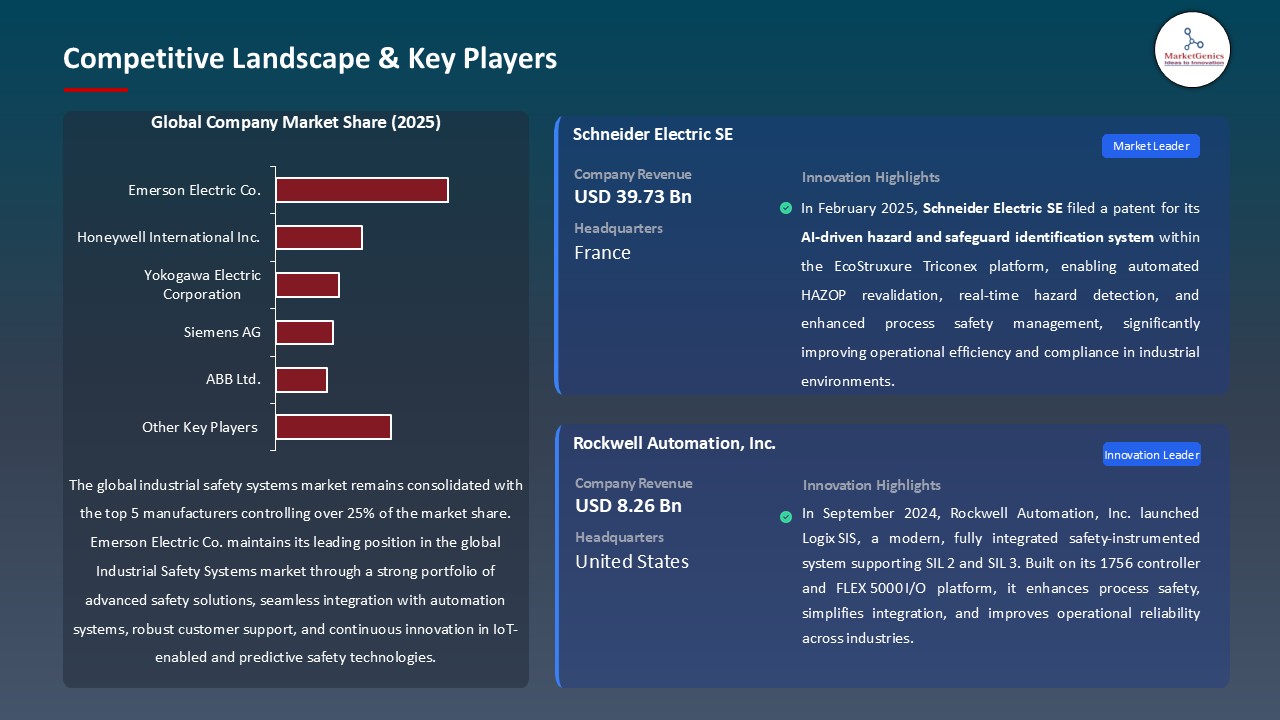

The global industrial safety systems market is slightly fragmented, with significant companies including Honeywell International Inc., Emerson Electric Co., ABB Ltd., Siemens AG, and Schneider Electric SE. The strong customer relationships, safety solutions that are highly reliable and easily integrated safety systems across various industrial applications help these leading companies to maintain this status.

The market value chain incorporates safety instrumented system (SIS) and controller production, sensor and actuator innovations, communication protocol, system integration, calibration and after sales including predictive maintenance, compliance audit, and cybersecurity.

Entry barriers are high because certified, reliable systems are needed and there is an existing customer trust where special vendors are yet to innovate in niche safety applications furthering the technological development in the industrial safety systems market.

Recent Development and Strategic Overview:

- In June 2025, Yokogawa released the next-generation CENTUM VP Release 7.01, which is a part of the OpreX Control and Safety System, and it improves the capabilities of the system to provide safety, cybersecurity, and autonomous control on a plant-wide level. The upgrade led to more adoption of advanced SIS in oil and gas, chemicals and power sectors due to increased OPC UA connectivity, predictive monitoring and enhanced safety-critical architecture.

- In August 2025, Emerson introduced its PACSystems RX3i CPS400 Safety Controller, a SIL2-certified solution based on fire and gas management, burner management, and emergency shutdown applications. It has pre-developed templates that are safety certified, 2,000 scalable I/O points, secure-by-design architecture with Secure Boot and TPM, and seamless integration with OPC UA, EGD, and Modbus TCP, allowing more efficient integration and dependable deployment of advanced Safety Instrumented Systems (SIS).

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 7.8 Bn |

|

Market Forecast Value in 2035 |

USD 13.6 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Million Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Industrial-Safety-Systems-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Industrial Safety Systems Market, By Component |

|

|

Industrial Safety Systems Market, By System Type |

|

|

Industrial Safety Systems Market, By Safety Level |

|

|

Industrial Safety Systems Market, By Application |

|

|

Industrial Safety Systems Market, By Functionality |

|

|

Industrial Safety Systems Market, By Communication Protocol |

|

|

Industrial Safety Systems Market, By End-Use Industry |

|

Frequently Asked Questions

The global industrial safety systems market was valued at USD 7.8 Bn in 2025.

The global industrial safety systems market industry is expected to grow at a CAGR of 5.7% from 2026 to 2035.

Key factors driving demand include stringent safety regulations in oil and gas and chemical industries, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of system type, the safety instrumented systems (SIS) segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for industrial safety systems market.

Prominent players operating in the global industrial safety systems market are ABB Ltd., Balluff GmbH, Banner Engineering Corp., Eaton Corporation, Emerson Electric Co., Endress+Hauser Group, Fortress Interlocks Ltd., General Electric (GE), HIMA Paul Hildebrandt GmbH, Honeywell International Inc., IDEC Corporation, Keyence Corporation, Mitsubishi Electric Corporation, Omron Corporation, Pepperl+Fuchs SE, Pilz GmbH & Co. KG, Rockwell Automation Inc., Schneider Electric SE, SICK AG, Siemens AG, Yokogawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Industrial Safety Systems Market Outlook

- 2.1.1. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Industrial Safety Systems Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Strict government and industry safety regulations.

- 4.1.1.2. Increasing adoption of IIoT, AI, and automation in industrial processes.

- 4.1.1.3. Rise in workplace hazards and accident risk driving demand for advanced safety systems.

- 4.1.2. Restraints

- 4.1.2.1. High upfront capital expenditure for implementing certified safety systems.

- 4.1.2.2. Complexity of integrating new safety systems with legacy control infrastructure.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material & Component Suppliers

- 4.4.2. Manufacturing & Assembly

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End-User Industries

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Industrial Safety Systems Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Industrial Safety Systems Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Safety Controllers

- 6.2.1.2. Safety Sensors

- 6.2.1.3. Emergency Stop Devices

- 6.2.1.4. Safety Relays

- 6.2.1.5. Safety Switches

- 6.2.1.6. Safety Light Curtains

- 6.2.1.7. Safety PLCs (Programmable Logic Controllers)

- 6.2.1.8. Others

- 6.2.2. Software

- 6.2.2.1. Safety Management Software

- 6.2.2.2. Monitoring & Control Software

- 6.2.2.3. Data Analytics & Reporting Software

- 6.2.2.4. Others

- 6.2.3. Services

- 6.2.3.1. Installation & Commissioning

- 6.2.3.2. Maintenance & Support

- 6.2.3.3. Consulting Services

- 6.2.3.4. Training & Education

- 6.2.3.5. Others

- 6.2.1. Hardware

- 7. Global Industrial Safety Systems Market Analysis, by System Type

- 7.1. Key Segment Analysis

- 7.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by System Type, 2021-2035

- 7.2.1. Emergency Shutdown Systems (ESD)

- 7.2.2. Fire & Gas Monitoring Systems

- 7.2.3. High Integrity Pressure Protection Systems (HIPPS)

- 7.2.4. Burner Management Systems (BMS)

- 7.2.5. Turbo-Machinery Control (TMC)

- 7.2.6. Safety Instrumented Systems (SIS)

- 7.2.7. Supervisory Control and Data Acquisition (SCADA)

- 7.2.8. Others

- 8. Global Industrial Safety Systems Market Analysis, by Safety Level

- 8.1. Key Segment Analysis

- 8.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Safety Level, 2021-2035

- 8.2.1. SIL 1

- 8.2.2. SIL 2

- 8.2.3. SIL 3

- 8.2.4. SIL 4

- 9. Global Industrial Safety Systems Market Analysis, by Application

- 9.1. Key Segment Analysis

- 9.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 9.2.1. Machine Safety

- 9.2.2. Process Safety

- 9.2.3. Worker Safety

- 9.2.4. Perimeter Safety

- 9.2.5. Area Safety

- 9.2.6. Material Handling Safety

- 9.2.7. Equipment Monitoring

- 9.2.8. Hazardous Area Protection

- 9.2.9. Others

- 10. Global Industrial Safety Systems Market Analysis, by Functionality

- 10.1. Key Segment Analysis

- 10.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Functionality, 2021-2035

- 10.2.1. Detection & Sensing

- 10.2.2. Alarm & Notification

- 10.2.3. Control & Shutdown

- 10.2.4. Monitoring & Surveillance

- 10.2.5. Access Control

- 10.2.6. Incident Management

- 10.2.7. Others

- 11. Global Industrial Safety Systems Market Analysis, by Communication Protocol

- 11.1. Key Segment Analysis

- 11.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Communication Protocol, 2021-2035

- 11.2.1. Profibus

- 11.2.2. Profinet

- 11.2.3. Modbus

- 11.2.4. EtherNet/IP

- 11.2.5. DeviceNet

- 11.2.6. Others

- 12. Global Industrial Safety Systems Market Analysis, by End-Use Industry

- 12.1. Key Segment Analysis

- 12.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 12.2.1. Oil & Gas

- 12.2.1.1. Process Safety

- 12.2.1.2. Fire & Gas Monitoring

- 12.2.1.3. Emergency Shutdown

- 12.2.1.4. Hazardous Area Protection

- 12.2.1.5. Pipeline Safety

- 12.2.1.6. Offshore Platform Safety

- 12.2.1.7. Others

- 12.2.2. Chemical & Petrochemical

- 12.2.2.1. Process Safety

- 12.2.2.2. Chemical Hazard Management

- 12.2.2.3. Emergency Shutdown

- 12.2.2.4. Reactor Safety

- 12.2.2.5. Storage Tank Safety

- 12.2.2.6. Others

- 12.2.3. Power Generation

- 12.2.3.1. Turbine Safety

- 12.2.3.2. Boiler Safety

- 12.2.3.3. Process Safety

- 12.2.3.4. Equipment Monitoring

- 12.2.3.5. Worker Safety

- 12.2.3.6. Others

- 12.2.4. Pharmaceutical & Biotechnology

- 12.2.5. Food & Beverage

- 12.2.6. Automotive

- 12.2.7. Mining & Metals

- 12.2.8. Pulp & Paper

- 12.2.9. Water & Wastewater Treatment

- 12.2.10. Manufacturing (General)

- 12.2.11. Marine & Shipping

- 12.2.12. Energy & Utilities

- 12.2.13. Others

- 12.2.1. Oil & Gas

- 13. Global Industrial Safety Systems Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Industrial Safety Systems Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Component

- 14.3.2. System Type

- 14.3.3. Safety Level

- 14.3.4. Application

- 14.3.5. Functionality

- 14.3.6. Communication Protocol

- 14.3.7. End-Use Industry

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Industrial Safety Systems Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Component

- 14.4.3. System Type

- 14.4.4. Safety Level

- 14.4.5. Application

- 14.4.6. Functionality

- 14.4.7. Communication Protocol

- 14.4.8. End-Use Industry

- 14.5. Canada Industrial Safety Systems Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Component

- 14.5.3. System Type

- 14.5.4. Safety Level

- 14.5.5. Application

- 14.5.6. Functionality

- 14.5.7. Communication Protocol

- 14.5.8. End-Use Industry

- 14.6. Mexico Industrial Safety Systems Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Component

- 14.6.3. System Type

- 14.6.4. Safety Level

- 14.6.5. Application

- 14.6.6. Functionality

- 14.6.7. Communication Protocol

- 14.6.8. End-Use Industry

- 15. Europe Industrial Safety Systems Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component

- 15.3.2. System Type

- 15.3.3. Safety Level

- 15.3.4. Application

- 15.3.5. Functionality

- 15.3.6. Communication Protocol

- 15.3.7. End-Use Industry

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Industrial Safety Systems Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component

- 15.4.3. System Type

- 15.4.4. Safety Level

- 15.4.5. Application

- 15.4.6. Functionality

- 15.4.7. Communication Protocol

- 15.4.8. End-Use Industry

- 15.5. United Kingdom Industrial Safety Systems Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component

- 15.5.3. System Type

- 15.5.4. Safety Level

- 15.5.5. Application

- 15.5.6. Functionality

- 15.5.7. Communication Protocol

- 15.5.8. End-Use Industry

- 15.6. France Industrial Safety Systems Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component

- 15.6.3. System Type

- 15.6.4. Safety Level

- 15.6.5. Application

- 15.6.6. Functionality

- 15.6.7. Communication Protocol

- 15.6.8. End-Use Industry

- 15.7. Italy Industrial Safety Systems Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Component

- 15.7.3. System Type

- 15.7.4. Safety Level

- 15.7.5. Application

- 15.7.6. Functionality

- 15.7.7. Communication Protocol

- 15.7.8. End-Use Industry

- 15.8. Spain Industrial Safety Systems Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Component

- 15.8.3. System Type

- 15.8.4. Safety Level

- 15.8.5. Application

- 15.8.6. Functionality

- 15.8.7. Communication Protocol

- 15.8.8. End-Use Industry

- 15.9. Netherlands Industrial Safety Systems Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Component

- 15.9.3. System Type

- 15.9.4. Safety Level

- 15.9.5. Application

- 15.9.6. Functionality

- 15.9.7. Communication Protocol

- 15.9.8. End-Use Industry

- 15.10. Nordic Countries Industrial Safety Systems Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Component

- 15.10.3. System Type

- 15.10.4. Safety Level

- 15.10.5. Application

- 15.10.6. Functionality

- 15.10.7. Communication Protocol

- 15.10.8. End-Use Industry

- 15.11. Poland Industrial Safety Systems Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Component

- 15.11.3. System Type

- 15.11.4. Safety Level

- 15.11.5. Application

- 15.11.6. Functionality

- 15.11.7. Communication Protocol

- 15.11.8. End-Use Industry

- 15.12. Russia & CIS Industrial Safety Systems Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Component

- 15.12.3. System Type

- 15.12.4. Safety Level

- 15.12.5. Application

- 15.12.6. Functionality

- 15.12.7. Communication Protocol

- 15.12.8. End-Use Industry

- 15.13. Rest of Europe Industrial Safety Systems Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Component

- 15.13.3. System Type

- 15.13.4. Safety Level

- 15.13.5. Application

- 15.13.6. Functionality

- 15.13.7. Communication Protocol

- 15.13.8. End-Use Industry

- 16. Asia Pacific Industrial Safety Systems Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. System Type

- 16.3.3. Safety Level

- 16.3.4. Application

- 16.3.5. Functionality

- 16.3.6. Communication Protocol

- 16.3.7. End-Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Industrial Safety Systems Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. System Type

- 16.4.4. Safety Level

- 16.4.5. Application

- 16.4.6. Functionality

- 16.4.7. Communication Protocol

- 16.4.8. End-Use Industry

- 16.5. India Industrial Safety Systems Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. System Type

- 16.5.4. Safety Level

- 16.5.5. Application

- 16.5.6. Functionality

- 16.5.7. Communication Protocol

- 16.5.8. End-Use Industry

- 16.6. Japan Industrial Safety Systems Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. System Type

- 16.6.4. Safety Level

- 16.6.5. Application

- 16.6.6. Functionality

- 16.6.7. Communication Protocol

- 16.6.8. End-Use Industry

- 16.7. South Korea Industrial Safety Systems Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component

- 16.7.3. System Type

- 16.7.4. Safety Level

- 16.7.5. Application

- 16.7.6. Functionality

- 16.7.7. Communication Protocol

- 16.7.8. End-Use Industry

- 16.8. Australia and New Zealand Industrial Safety Systems Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component

- 16.8.3. System Type

- 16.8.4. Safety Level

- 16.8.5. Application

- 16.8.6. Functionality

- 16.8.7. Communication Protocol

- 16.8.8. End-Use Industry

- 16.9. Indonesia Industrial Safety Systems Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component

- 16.9.3. System Type

- 16.9.4. Safety Level

- 16.9.5. Application

- 16.9.6. Functionality

- 16.9.7. Communication Protocol

- 16.9.8. End-Use Industry

- 16.10. Malaysia Industrial Safety Systems Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component

- 16.10.3. System Type

- 16.10.4. Safety Level

- 16.10.5. Application

- 16.10.6. Functionality

- 16.10.7. Communication Protocol

- 16.10.8. End-Use Industry

- 16.11. Thailand Industrial Safety Systems Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component

- 16.11.3. System Type

- 16.11.4. Safety Level

- 16.11.5. Application

- 16.11.6. Functionality

- 16.11.7. Communication Protocol

- 16.11.8. End-Use Industry

- 16.12. Vietnam Industrial Safety Systems Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component

- 16.12.3. System Type

- 16.12.4. Safety Level

- 16.12.5. Application

- 16.12.6. Functionality

- 16.12.7. Communication Protocol

- 16.12.8. End-Use Industry

- 16.13. Rest of Asia Pacific Industrial Safety Systems Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component

- 16.13.3. System Type

- 16.13.4. Safety Level

- 16.13.5. Application

- 16.13.6. Functionality

- 16.13.7. Communication Protocol

- 16.13.8. End-Use Industry

- 17. Middle East Industrial Safety Systems Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. System Type

- 17.3.3. Safety Level

- 17.3.4. Application

- 17.3.5. Functionality

- 17.3.6. Communication Protocol

- 17.3.7. End-Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Industrial Safety Systems Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. System Type

- 17.4.4. Safety Level

- 17.4.5. Application

- 17.4.6. Functionality

- 17.4.7. Communication Protocol

- 17.4.8. End-Use Industry

- 17.5. UAE Industrial Safety Systems Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. System Type

- 17.5.4. Safety Level

- 17.5.5. Application

- 17.5.6. Functionality

- 17.5.7. Communication Protocol

- 17.5.8. End-Use Industry

- 17.6. Saudi Arabia Industrial Safety Systems Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. System Type

- 17.6.4. Safety Level

- 17.6.5. Application

- 17.6.6. Functionality

- 17.6.7. Communication Protocol

- 17.6.8. End-Use Industry

- 17.7. Israel Industrial Safety Systems Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. System Type

- 17.7.4. Safety Level

- 17.7.5. Application

- 17.7.6. Functionality

- 17.7.7. Communication Protocol

- 17.7.8. End-Use Industry

- 17.8. Rest of Middle East Industrial Safety Systems Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. System Type

- 17.8.4. Safety Level

- 17.8.5. Application

- 17.8.6. Functionality

- 17.8.7. Communication Protocol

- 17.8.8. End-Use Industry

- 18. Africa Industrial Safety Systems Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. System Type

- 18.3.3. Safety Level

- 18.3.4. Application

- 18.3.5. Functionality

- 18.3.6. Communication Protocol

- 18.3.7. End-Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Industrial Safety Systems Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. System Type

- 18.4.4. Safety Level

- 18.4.5. Application

- 18.4.6. Functionality

- 18.4.7. Communication Protocol

- 18.4.8. End-Use Industry

- 18.5. Egypt Industrial Safety Systems Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. System Type

- 18.5.4. Safety Level

- 18.5.5. Application

- 18.5.6. Functionality

- 18.5.7. Communication Protocol

- 18.5.8. End-Use Industry

- 18.6. Nigeria Industrial Safety Systems Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. System Type

- 18.6.4. Safety Level

- 18.6.5. Application

- 18.6.6. Functionality

- 18.6.7. Communication Protocol

- 18.6.8. End-Use Industry

- 18.7. Algeria Industrial Safety Systems Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. System Type

- 18.7.4. Safety Level

- 18.7.5. Application

- 18.7.6. Functionality

- 18.7.7. Communication Protocol

- 18.7.8. End-Use Industry

- 18.8. Rest of Africa Industrial Safety Systems Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. System Type

- 18.8.4. Safety Level

- 18.8.5. Application

- 18.8.6. Functionality

- 18.8.7. Communication Protocol

- 18.8.8. End-Use Industry

- 19. South America Industrial Safety Systems Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Industrial Safety Systems Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. System Type

- 19.3.3. Safety Level

- 19.3.4. Application

- 19.3.5. Functionality

- 19.3.6. Communication Protocol

- 19.3.7. End-Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Industrial Safety Systems Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. System Type

- 19.4.4. Safety Level

- 19.4.5. Application

- 19.4.6. Functionality

- 19.4.7. Communication Protocol

- 19.4.8. End-Use Industry

- 19.5. Argentina Industrial Safety Systems Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. System Type

- 19.5.4. Safety Level

- 19.5.5. Application

- 19.5.6. Functionality

- 19.5.7. Communication Protocol

- 19.5.8. End-Use Industry

- 19.6. Rest of South America Industrial Safety Systems Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. System Type

- 19.6.4. Safety Level

- 19.6.5. Application

- 19.6.6. Functionality

- 19.6.7. Communication Protocol

- 19.6.8. End-Use Industry

- 20. Key Players/ Company Profile

- 20.1. ABB Ltd.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Balluff GmbH

- 20.3. Banner Engineering Corp.

- 20.4. Eaton Corporation

- 20.5. Emerson Electric Co.

- 20.6. Endress+Hauser Group

- 20.7. Fortress Interlocks Ltd.

- 20.8. General Electric (GE)

- 20.9. HIMA Paul Hildebrandt GmbH

- 20.10. Honeywell International Inc.

- 20.11. IDEC Corporation

- 20.12. Keyence Corporation

- 20.13. Mitsubishi Electric Corporation

- 20.14. Omron Corporation

- 20.15. Pepperl+Fuchs SE

- 20.16. Pilz GmbH & Co. KG

- 20.17. Rockwell Automation Inc.

- 20.18. Schneider Electric SE

- 20.19. SICK AG

- 20.20. Siemens AG

- 20.21. Yokogawa Electric Corporation

- 20.22. Other Key Players

- 20.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data