Safety Instrumented Systems (SIS) Market Size, Share & Trends Analysis Report by Component Type (Hardware, Software, Services), Safety Level, System Type, Technology, Communication Protocol, Application, Automation Level, End-Use Industry, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Safety Instrumented Systems (SIS) Market Size, Share, and Growth

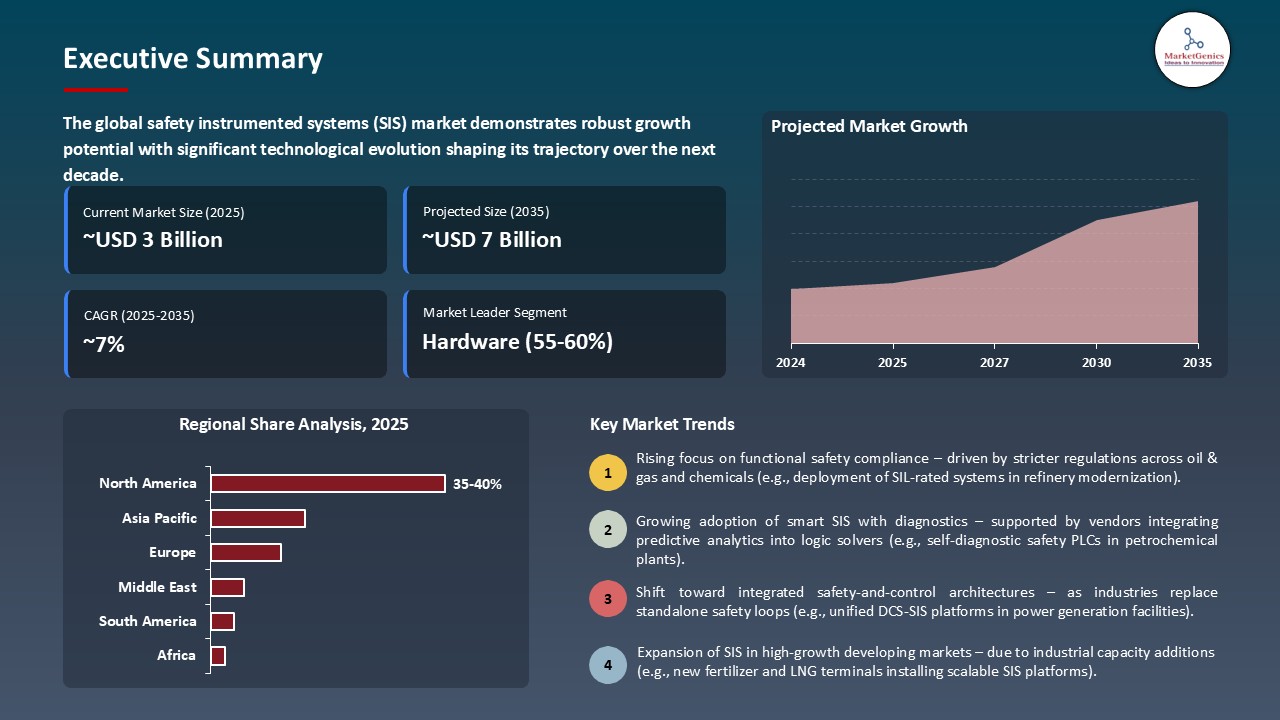

The global safety instrumented systems (SIS) market is witnessing strong growth, valued at USD 3.4 billion in 2025 and projected to reach USD 6.9 billion by 2035, expanding at a CAGR of 7.3% during the forecast period. Asia Pacific is the fastest-growing region in the safety instrumented systems (SIS) market due to rapid industrial expansion and increasing investments in automation-driven safety compliance across sectors.

Rinol Pereira, Head of Product & Technology at ABB’s Energy Industries division, said, “Safety is fundamental to the operational excellence of industrial operations, at a time of growing energy demand, At ABB, our role is to help customers operate with confidence by combining automation, electrification and digitalization to reduce risk, enhance reliability and protect people and assets. This ML5 certification, achieved following rigorous assessment by TÜV Rheinland, demonstrates our leadership in functional safety today and our commitment to advancing the standards of the future”.

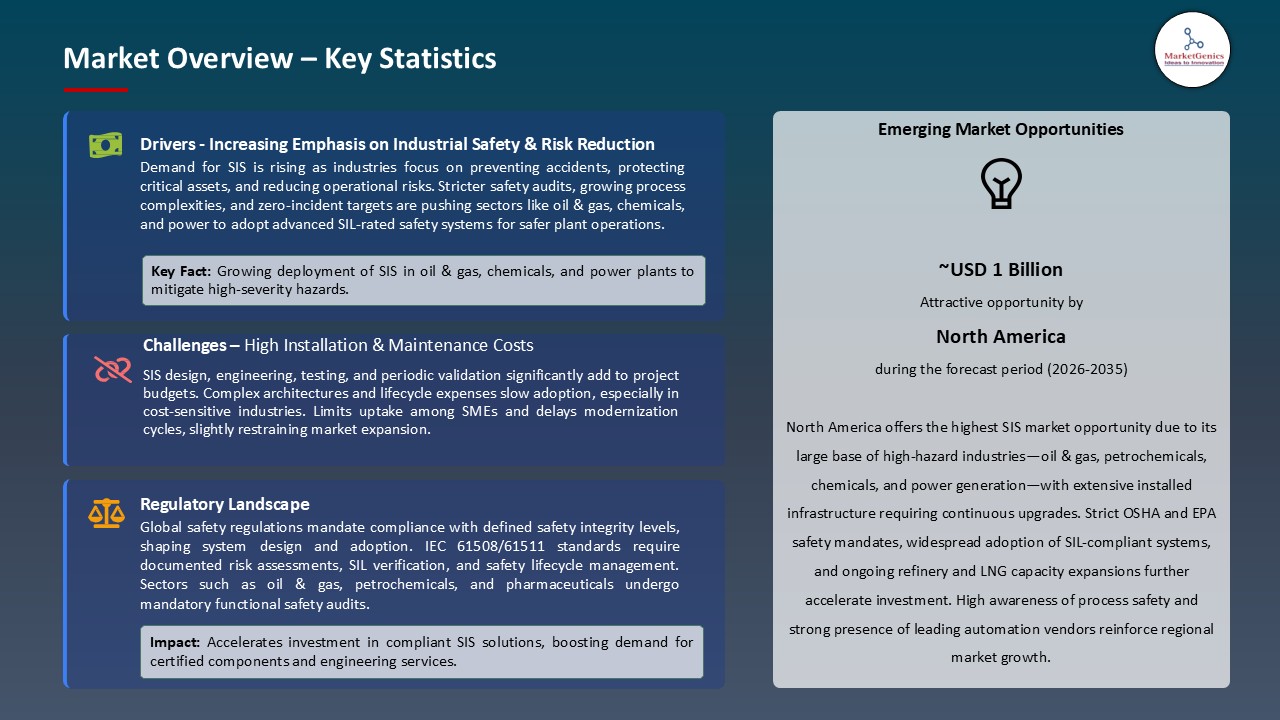

The popularity of the safety instrumented systems (SIS) market has been driven to a large extent by increasing emphasis on the industrial safety and reduction of risks in hazardous process industries where facilities that work with chemicals, hydrocarbons, and high-pressure operations strive to avoid accidents, protect workers and reduce the downtime. Increasing awareness of disastrous failures and more rigorous internal safety requirements promotes the use of automated SIS protective layers even further.

The safety instrumented systems (SIS) market is on the rise due to the collaborations between the major industrial safety vendors and technology suppliers, which makes possible the development of sophisticated, integrated, and digitally connected safety systems. As a part of its 2025 strategy, SABIC engaged ABB and Wison Engineering to implement ABB Ability System 800xa which incorporates DCS, control, and Safety Instrumented Systems (SIS) at a greenfield pilot facility in Jubail, Saudi Arabia. This cooperation makes it possible to achieve real-time analytics, predictive safety management, and the IEC 61508/61511 compliance to increase the efficiency of the operations, reliability, and safety of the high-risk industrial processes.

A significant opportunity to the Safety Instrumented Systems (SIS) Market is the integration of AI, analytics, and digital twins, which will allow making the safety lifecycle management smarter and more efficient. These technologies allow to improve hazard prediction, automatize the work of SIL verification, and increase the accuracy of proof-testing. Digital twins enable proactive risk reduction, less engineering effort and quicker decisions by simulating process variation and equipment behavior. Due to the growth of industries on advanced digital platforms, AI-enabled SIS solutions are in high demand.

Safety Instrumented Systems (SIS) Market Dynamics and Trends

Driver: Mandatory Compliance with IEC 61508 and IEC 61511 Standards

- Mandatory adherence to IEC 61508, IEC 61511 standards are also a strong motivation to the safety instrumented systems (SIS) market, since such standards outline the functional safety standard that industries must be able to comply with to guarantee the acceptable level of risks in hazardous processes.

- The standards require a systematic lifecycle safety management, the SIL classification, strict documentation, periodic verification of proofs testing, and the verification of safety functions, all of which must be certified with certified SIS hardware, software and engineering practices. Oil and gas, chemical, power, and refinery industries have to show compliance during audits and this is compelling them to modernize old systems, use SIL-rated components, and invest in a new safety platform.

- ABB achieved TUV Rheinland Maturity Level 5 (ML5) certification of its Functional Safety Management System in Safety Execution Centers in Germany, Italy, Norway, and Singapore in October 2025, forming a whole new leadership in advanced SIS lifecycle management.

- Comprehensively, This regulatory pressure spurs SIS deployment and modernization at an exceptionally high rate in global industrial facilities.

Restraint: Complex Engineering and Validation Requirements

- The safety instrumented systems (SIS) market is still limited by complex engineering and validation requirements, since the design and implementation of a fully compliant SIS require strict technical skills, multi-level verification, and accuracy in all documentation throughout the entire safety lifecycle.

- Every safety functionality should go through a careful hazard analysis, SIL calculation, system architecture design, redundancy plan, failure mode analysis, and cybersecurity analysis- all of which need dedicated engineering teams and a great deal of coordination. The validation steps, which include, factory acceptance test (FAT), site acceptance test (SAT), loop tests and proof-testing processes, also bring in extra time, cost and complexity.

- An additional workload on engineering is required by certification to compliance standards such as IEC 61508 and IEC 61511 with a required traceability, periodical audit and lifecycle documentation. These engineering and validation challenges are slowing SIS deployment and lengthening project timelines and raising overall project cost to many operators, particularly those with small technical staffs or legacy systems.

- Consequently, a significant portion of the facilities postpone upgrades or use a low-compliance solution, thus limiting the general rate of SIS modernization and adoption.

Opportunity: Adoption in Emerging Markets with Developing Safety Regulations

- The safety instrumented systems (SIS) market has a great opportunity to see an upsurge in adoption both in the emerging economies where the industrial industries including chemicals, oil and gas, power generation and pharmaceuticals have been booming in such a way that they are expected to drive growth in the safety instrumented systems (SIS) market. With the increase in efforts by governments in areas such as Southeast Asia, Africa, and Latin America, to enhance occupational safety requirements and be in harmony with the world requirements like IEC 61508/61511, industrial operators have turned to modern safety architectures.

- The appearance of the growing foreign direct investments, new greenfield plants, and increasing awareness of risk mitigation stimulate the use of SIS to achieve integrity of the processes and prevent accidents. Furthermore, the conversion of local industries with basic safety measures to high-level automated safety layers presents suppliers of SIS, integrators and engineering companies with high potential in the market in the long term.

- In June 2025, Yokogawa released its next-generation CENTUM VP Release 7.01 integrated production control system, which advanced the safety, predictive monitoring, and safe autonomous operations throughout the plants. The platform is enabling the emerging-market industries to enhance their safety architectures to modern standards with extended OPC UA connectivity, enhanced cybersecurity, and enhanced AI-based control, which increases the uptake of safety instrumented systems (SIS) as governments increase safety and environmental standards.

- Emerging markets are expected to experience substantial growth in the safety instrumented systems (SIS) market in the coming years.

Key Trend: Convergence of Functional Safety and Cybersecurity Requirements

- Convergence of functional safety and cybersecurity requirements is a major trend in the industry of safety instrumented systems (SIS). With the growing level of digitization and connectivity of industrial processes, SIS systems should not only secure people, assets, and the environment against operational risks but also prevent cyber-attacks that may destroy the integrity of the systems.

- The current generation of SIS solutions is thus being developed with inbuilt cybersecurity capabilities such as secure communications, access controls, intrusion detection and data encryption as well as the conventional SIL-rated safety features. This two-fold focus guarantees the adherence to changing standards and regulations, high-level reliability of operations, and the confidence in automated systems of safety, which spur its implementation in the most dangerous industries, including oil and gas, chemicals, power generation, and pharmaceutical sectors.

- Honeywell introduced its Cyber Proactive Defense and OT Security Operations Center in June 2025, which are AI-enabled services that combine the industrial control system and safety systems with cybersecurity. The technologies actively identify and prevent cyber threat, increase resilience of operations, and facilitate continuous and safe operation, which has strengthened the integration of functional safety and cybersecurity in the safety instrumented systems (SIS) market.

- The trend underscores the increasing significance of coordinated safety and cybersecurity applications in the quest to create reliable and resilient SIS integration in the high-risk sectors.

Safety-Instrumented-Systems-Market Analysis and Segmental Data

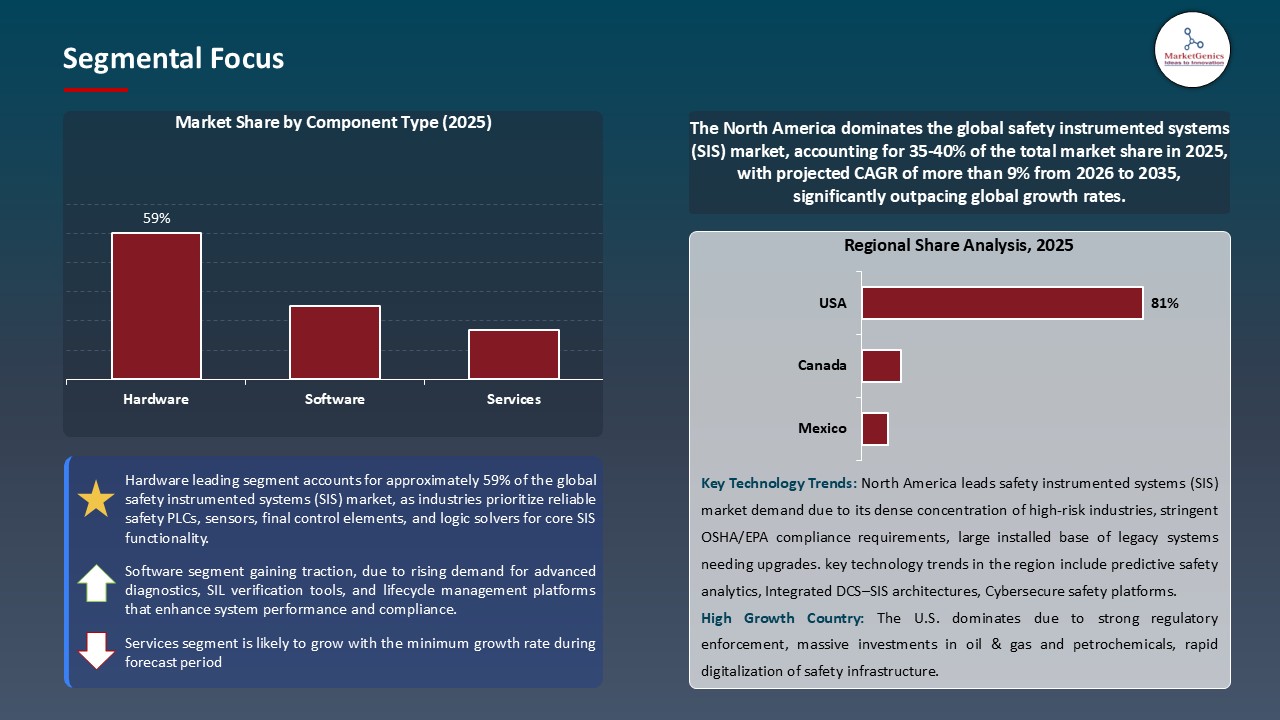

Hardware Dominate Global Safety Instrumented Systems (SIS) Market

- The global safety instrumented systems (SIS) market is mainly dominated by the hardware segment which is necessitated by the critical role played by the physical components in the provision of the functional safety and reliability of the process. Some of the important hardware components include safety PLCs, logic solvers, sensors, actuators, shutdown valves and relay modules, which are essential in hazard detection and implementation of automated safety measures.

- High-quality, SIL-rated equipment is essential to address stringent international safety standards, including IEC 61508 and IEC 61511. The ever-growing industrialization and modernization of high-risk infrastructure are also contributing to the need to have high quality SIS hardware. It is the most commonly adopted and long-lived high-value and tangible, due to its high-value nature and long-life cycle, which is the basis of SIS implementation in oil and gas, chemical, power and pharmaceutical companies worldwide.

- Mitsubishi Electric introduced MELSEC iQ -R safety local I/O modules (RX40NC6S -TS and RY48PT20S -TS) in January 2025 to make industrial automation more efficient and cost-effective. These SIL-rated hardware units enable the stable safety monitoring and control which further confirms the supremacy of the hardware sector in safety instrumented systems (SIS) market.

- The SIS market is still anchored on hardware segment, which has contributed to reliability, safety and wide market coverage in the high-risk industrial segments.

North America Leads Global Safety Instrumented Systems (SIS) Market Demand

- North America dominates the safety instrumented systems (SIS) market attributable to stringent regulations, industrial infrastructure, and automation adoption. The region is densely populated with risky businesses such as oil and gas, chemicals, power generation, and pharmaceuticals, all of which require careful process safety.

- Strongly adhering to international standards like IEC 61508 and IEC 61511 enables widespread usage of SIL-based SIS solutions. Furthermore, significant expenditures in the upgrading of aged industrial plants, the implementation of digital technologies, AI-controlled systems, predictive diagnostics, and so on all contribute to the need for more advanced safety designs.

- Leading suppliers and service providers enable rapid technology adoption, lifecycle support, and integration of functional safety and cybersecurity. All of these factors contribute to the North American market being the leading provider of SIS solutions, as well as the primary driver of consistent growth and innovation.

Safety-Instrumented-Systems-Market Ecosystem

The global safety instrumented systems (SIS) market is fragmented, with prominent businesses including Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Siemens AG, and ABB Ltd. These companies persist on top by maintaining outstanding client relationships, implementing high-reliability SIS systems, and integrating safety systems with other high-risk industries.

Market value chain includes SIS and controller production, sensor and actuator design, communication protocol design, system design, calibration, and after sales services, including predictive maintenance design, compliance audits, and cybersecurity services.

The barriers to entry are very high because of the requirement of certified and dependable systems and customer credibility. Meanwhile, the specialized vendors keep innovating to provide niche uses, with more sophisticated safety designs, AI-powered diagnostics and onboard cybersecurity; all of which contributes to technical development and the general evolution of the SIS market.

Recent Development and Strategic Overview:

- In June 2025, Yokogawa collaborated with Shell to include advanced machine vision and AI-driven robotics - through Shell Operator Round by Exception (ORE) - into its OpreX Robot Management Core, which allows autonomous inspection of the plant, safer plant maintenance, and further integration of its control and safety systems. This partnership assists in increasing the uptake of SIS to enable the developing industries to consolidate their risk management, automate hazard detection, and adapt to changing safety compliance demands.

- In September 2024, Rockwell Automation introduced its Logix SIS, which is a high-availability safety instrumented system with SIL 2 and SIL 3 certifications. The integrated hardware and software make use of the system to improve the safety of the process, minimize the engineering time, and facilitate the continuous operation, further confirming the leadership of North America in the use of SIS.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 3.4 Bn |

|

Market Forecast Value in 2035 |

USD 6.9 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Thousand Units for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Safety-Instrumented-Systems-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Safety Instrumented Systems (SIS) Market, By Component Type |

|

|

Safety Instrumented Systems (SIS) Market, By Safety Level |

|

|

Safety Instrumented Systems (SIS) Market, By System Type |

|

|

Safety Instrumented Systems (SIS) Market, By Technology |

|

|

Safety Instrumented Systems (SIS) Market, By Functionality |

|

|

Safety Instrumented Systems (SIS) Market, By Communication Protocol |

|

|

Safety Instrumented Systems (SIS) Market, By Application |

|

|

Safety Instrumented Systems (SIS) Market, By Automation Level |

|

|

Safety Instrumented Systems (SIS) Market, By End-Use Industry |

|

Frequently Asked Questions

The global safety instrumented systems (SIS) market was valued at USD 3.4 Bn in 2025.

The global safety instrumented systems (SIS) market industry is expected to grow at a CAGR of 7.3% from 2026 to 2035.

Key factors driving demand include mandatory compliance with IEC 61508 and IEC 61511 standards, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of component type, the hardware segment accounted for the major share in 2025.

North America is the most attractive region for safety instrumented systems (SIS) market.

Prominent players operating in the global safety instrumented systems (SIS) market are ABB Ltd., Danfoss A/S, Eaton Corporation, Emerson Electric Co., Endress+Hauser Group, Fortive Corporation, General Electric Company, HIMA Paul Hildebrandt GmbH, Honeywell International Inc., Johnson Controls International, Mitsubishi Electric Corporation, Omron Corporation, Pepperl+Fuchs SE, Phoenix Contact GmbH & Co. KG, Rockwell Automation Inc., Schneider Electric SE, SICK AG, Siemens AG, Triconex (Baker Hughes), Yokogawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Safety Instrumented Systems (SIS) Market Outlook

- 2.1.1. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Safety Instrumented Systems (SIS) Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Increasing focus on industrial safety and accident prevention in high-risk industries.

- 4.1.1.2. Growing complexity of industrial processes requiring automated safety layers.

- 4.1.1.3. Mandatory compliance with international safety standards (IEC 61508/61511).

- 4.1.2. Restraints

- 4.1.2.1. High installation, engineering, and maintenance costs.

- 4.1.2.2. Complex engineering and validation requirements for SIL-rated systems.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material & Component Suppliers

- 4.4.2. Manufacturing & Assembly

- 4.4.3. Distributors & Supply Chain

- 4.4.4. End-User Industries

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Safety Instrumented Systems (SIS) Market Demand

- 4.9.1. Historical Market Size – Volume (Million Units) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Million Units) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Safety Instrumented Systems (SIS) Market Analysis, by Component Type

- 6.1. Key Segment Analysis

- 6.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Component Type, 2021-2035

- 6.2.1. Hardware

- 6.2.1.1. Safety Controllers/Logic Solvers

- 6.2.1.2. Safety Sensors

- 6.2.1.3. Safety Actuators

- 6.2.1.4. Safety Valves

- 6.2.1.5. Emergency Shutdown Systems (ESD)

- 6.2.1.6. Fire and Gas Detection Systems

- 6.2.1.7. Safety Relays

- 6.2.1.8. Human Machine Interface (HMI)

- 6.2.1.9. Others

- 6.2.2. Software

- 6.2.2.1. Safety Application Software

- 6.2.2.2. Configuration Software

- 6.2.2.3. Monitoring and Diagnostic Software

- 6.2.2.4. Asset Management Software

- 6.2.2.5. Others

- 6.2.3. Services

- 6.2.3.1. Engineering and Design Services

- 6.2.3.2. Installation and Commissioning

- 6.2.3.3. Maintenance and Support

- 6.2.3.4. Training and Consulting

- 6.2.3.5. System Integration Services

- 6.2.3.6. Safety Lifecycle Services

- 6.2.3.7. Others

- 6.2.1. Hardware

- 7. Global Safety Instrumented Systems (SIS) Market Analysis, by Safety Level

- 7.1. Key Segment Analysis

- 7.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Safety Level, 2021-2035

- 7.2.1. SIL 1

- 7.2.2. SIL 2

- 7.2.3. SIL 3

- 7.2.4. SIL 4

- 8. Global Safety Instrumented Systems (SIS) Market Analysis, by System Type

- 8.1. Key Segment Analysis

- 8.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by System Type, 2021-2035

- 8.2.1. Emergency Shutdown Systems (ESD)

- 8.2.2. Fire and Gas Monitoring Systems (F&G)

- 8.2.3. High Integrity Pressure Protection Systems (HIPPS)

- 8.2.4. Burner Management Systems (BMS)

- 8.2.5. Turbomachinery Control (TMC)

- 8.2.6. Safety Interlock Systems

- 8.2.7. Others

- 9. Global Safety Instrumented Systems (SIS) Market Analysis, by Technology

- 9.1. Key Segment Analysis

- 9.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Technology, 2021-2035

- 9.2.1. Programmable Electronic Systems (PES)

- 9.2.2. Relay-Based Systems

- 9.2.3. Distributed Control Systems (DCS) Integrated

- 9.2.4. Standalone Safety Systems

- 9.2.5. Hybrid Systems

- 10. Global Safety Instrumented Systems (SIS) Market Analysis, by Communication Protocol

- 10.1. Key Segment Analysis

- 10.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Communication Protocol, 2021-2035

- 10.2.1. HART Protocol

- 10.2.2. PROFIBUS

- 10.2.3. Foundation Fieldbus

- 10.2.4. Modbus

- 10.2.5. Ethernet/IP

- 10.2.6. Wireless Communication

- 11. Global Safety Instrumented Systems (SIS) Market Analysis, by Application

- 11.1. Key Segment Analysis

- 11.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Application, 2021-2035

- 11.2.1. Process Shutdown

- 11.2.2. Equipment Protection

- 11.2.3. Personnel Protection

- 11.2.4. Environmental Protection

- 11.2.5. Asset Protection

- 11.2.6. Others

- 12. Global Safety Instrumented Systems (SIS) Market Analysis, by Automation Level

- 12.1. Key Segment Analysis

- 12.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Automation Level, 2021-2035

- 12.2.1. Fully Automated

- 12.2.2. Semi-Automated

- 12.2.3. Manual Override Systems

- 13. Global Safety Instrumented Systems (SIS) Market Analysis, by End-Use Industry

- 13.1. Key Segment Analysis

- 13.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 13.2.1. Oil & Gas

- 13.2.2. Chemical & Petrochemical

- 13.2.3. Power Generation

- 13.2.4. Pharmaceutical & Biotechnology

- 13.2.5. Energy Storage & Battery Manufacturing

- 13.2.6. Automotive Manufacturing

- 13.2.7. Metal & Mining

- 13.2.8. Water & Wastewater Treatment

- 13.2.9. Manufacturing (General)

- 13.2.10. Marine & Shipping

- 13.2.11. Energy & Utilities

- 13.2.12. Others

- 14. Global Safety Instrumented Systems (SIS) Market Analysis and Forecasts, by Region

- 14.1. Key Findings

- 14.2. Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 14.2.1. North America

- 14.2.2. Europe

- 14.2.3. Asia Pacific

- 14.2.4. Middle East

- 14.2.5. Africa

- 14.2.6. South America

- 15. North America Safety Instrumented Systems (SIS) Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. North America Safety Instrumented Systems (SIS) Market Size Volume (Million units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Component Type

- 15.3.2. Safety Level

- 15.3.3. System Type

- 15.3.4. Technology

- 15.3.5. Communication Protocol

- 15.3.6. Application

- 15.3.7. Automation Level

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. USA

- 15.3.9.2. Canada

- 15.3.9.3. Mexico

- 15.4. USA Safety Instrumented Systems (SIS) Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Component Type

- 15.4.3. Safety Level

- 15.4.4. System Type

- 15.4.5. Technology

- 15.4.6. Communication Protocol

- 15.4.7. Application

- 15.4.8. Automation Level

- 15.4.9. End-Use Industry

- 15.5. Canada Safety Instrumented Systems (SIS) Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Component Type

- 15.5.3. Safety Level

- 15.5.4. System Type

- 15.5.5. Technology

- 15.5.6. Communication Protocol

- 15.5.7. Application

- 15.5.8. Automation Level

- 15.5.9. End-Use Industry

- 15.6. Mexico Safety Instrumented Systems (SIS) Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Component Type

- 15.6.3. Safety Level

- 15.6.4. System Type

- 15.6.5. Technology

- 15.6.6. Communication Protocol

- 15.6.7. Application

- 15.6.8. Automation Level

- 15.6.9. End-Use Industry

- 16. Europe Safety Instrumented Systems (SIS) Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Europe Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component Type

- 16.3.2. Safety Level

- 16.3.3. System Type

- 16.3.4. Technology

- 16.3.5. Communication Protocol

- 16.3.6. Application

- 16.3.7. Automation Level

- 16.3.8. End-Use Industry

- 16.3.9. Country

- 16.3.9.1. Germany

- 16.3.9.2. United Kingdom

- 16.3.9.3. France

- 16.3.9.4. Italy

- 16.3.9.5. Spain

- 16.3.9.6. Netherlands

- 16.3.9.7. Nordic Countries

- 16.3.9.8. Poland

- 16.3.9.9. Russia & CIS

- 16.3.9.10. Rest of Europe

- 16.4. Germany Safety Instrumented Systems (SIS) Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component Type

- 16.4.3. Safety Level

- 16.4.4. System Type

- 16.4.5. Technology

- 16.4.6. Communication Protocol

- 16.4.7. Application

- 16.4.8. Automation Level

- 16.4.9. End-Use Industry

- 16.5. United Kingdom Safety Instrumented Systems (SIS) Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component Type

- 16.5.3. Safety Level

- 16.5.4. System Type

- 16.5.5. Technology

- 16.5.6. Communication Protocol

- 16.5.7. Application

- 16.5.8. Automation Level

- 16.5.9. End-Use Industry

- 16.6. France Safety Instrumented Systems (SIS) Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component Type

- 16.6.3. Safety Level

- 16.6.4. System Type

- 16.6.5. Technology

- 16.6.6. Communication Protocol

- 16.6.7. Application

- 16.6.8. Automation Level

- 16.6.9. End-Use Industry

- 16.7. Italy Safety Instrumented Systems (SIS) Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Component Type

- 16.7.3. Safety Level

- 16.7.4. System Type

- 16.7.5. Technology

- 16.7.6. Communication Protocol

- 16.7.7. Application

- 16.7.8. Automation Level

- 16.7.9. End-Use Industry

- 16.8. Spain Safety Instrumented Systems (SIS) Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Component Type

- 16.8.3. Safety Level

- 16.8.4. System Type

- 16.8.5. Technology

- 16.8.6. Communication Protocol

- 16.8.7. Application

- 16.8.8. Automation Level

- 16.8.9. End-Use Industry

- 16.9. Netherlands Safety Instrumented Systems (SIS) Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Component Type

- 16.9.3. Safety Level

- 16.9.4. System Type

- 16.9.5. Technology

- 16.9.6. Communication Protocol

- 16.9.7. Application

- 16.9.8. Automation Level

- 16.9.9. End-Use Industry

- 16.10. Nordic Countries Safety Instrumented Systems (SIS) Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Component Type

- 16.10.3. Safety Level

- 16.10.4. System Type

- 16.10.5. Technology

- 16.10.6. Communication Protocol

- 16.10.7. Application

- 16.10.8. Automation Level

- 16.10.9. End-Use Industry

- 16.11. Poland Safety Instrumented Systems (SIS) Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Component Type

- 16.11.3. Safety Level

- 16.11.4. System Type

- 16.11.5. Technology

- 16.11.6. Communication Protocol

- 16.11.7. Application

- 16.11.8. Automation Level

- 16.11.9. End-Use Industry

- 16.12. Russia & CIS Safety Instrumented Systems (SIS) Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Component Type

- 16.12.3. Safety Level

- 16.12.4. System Type

- 16.12.5. Technology

- 16.12.6. Communication Protocol

- 16.12.7. Application

- 16.12.8. Automation Level

- 16.12.9. End-Use Industry

- 16.13. Rest of Europe Safety Instrumented Systems (SIS) Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Component Type

- 16.13.3. Safety Level

- 16.13.4. System Type

- 16.13.5. Technology

- 16.13.6. Communication Protocol

- 16.13.7. Application

- 16.13.8. Automation Level

- 16.13.9. End-Use Industry

- 17. Asia Pacific Safety Instrumented Systems (SIS) Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Asia Pacific Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component Type

- 17.3.2. Safety Level

- 17.3.3. System Type

- 17.3.4. Technology

- 17.3.5. Communication Protocol

- 17.3.6. Application

- 17.3.7. Automation Level

- 17.3.8. End-Use Industry

- 17.3.9. Country

- 17.3.9.1. China

- 17.3.9.2. India

- 17.3.9.3. Japan

- 17.3.9.4. South Korea

- 17.3.9.5. Australia and New Zealand

- 17.3.9.6. Indonesia

- 17.3.9.7. Malaysia

- 17.3.9.8. Thailand

- 17.3.9.9. Vietnam

- 17.3.9.10. Rest of Asia Pacific

- 17.4. China Safety Instrumented Systems (SIS) Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component Type

- 17.4.3. Safety Level

- 17.4.4. System Type

- 17.4.5. Technology

- 17.4.6. Communication Protocol

- 17.4.7. Application

- 17.4.8. Automation Level

- 17.4.9. End-Use Industry

- 17.5. India Safety Instrumented Systems (SIS) Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component Type

- 17.5.3. Safety Level

- 17.5.4. System Type

- 17.5.5. Technology

- 17.5.6. Communication Protocol

- 17.5.7. Application

- 17.5.8. Automation Level

- 17.5.9. End-Use Industry

- 17.6. Japan Safety Instrumented Systems (SIS) Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component Type

- 17.6.3. Safety Level

- 17.6.4. System Type

- 17.6.5. Technology

- 17.6.6. Communication Protocol

- 17.6.7. Application

- 17.6.8. Automation Level

- 17.6.9. End-Use Industry

- 17.7. South Korea Safety Instrumented Systems (SIS) Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component Type

- 17.7.3. Safety Level

- 17.7.4. System Type

- 17.7.5. Technology

- 17.7.6. Communication Protocol

- 17.7.7. Application

- 17.7.8. Automation Level

- 17.7.9. End-Use Industry

- 17.8. Australia and New Zealand Safety Instrumented Systems (SIS) Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component Type

- 17.8.3. Safety Level

- 17.8.4. System Type

- 17.8.5. Technology

- 17.8.6. Communication Protocol

- 17.8.7. Application

- 17.8.8. Automation Level

- 17.8.9. End-Use Industry

- 17.9. Indonesia Safety Instrumented Systems (SIS) Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component Type

- 17.9.3. Safety Level

- 17.9.4. System Type

- 17.9.5. Technology

- 17.9.6. Communication Protocol

- 17.9.7. Application

- 17.9.8. Automation Level

- 17.9.9. End-Use Industry

- 17.10. Malaysia Safety Instrumented Systems (SIS) Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component Type

- 17.10.3. Safety Level

- 17.10.4. System Type

- 17.10.5. Technology

- 17.10.6. Communication Protocol

- 17.10.7. Application

- 17.10.8. Automation Level

- 17.10.9. End-Use Industry

- 17.11. Thailand Safety Instrumented Systems (SIS) Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component Type

- 17.11.3. Safety Level

- 17.11.4. System Type

- 17.11.5. Technology

- 17.11.6. Communication Protocol

- 17.11.7. Application

- 17.11.8. Automation Level

- 17.11.9. End-Use Industry

- 17.12. Vietnam Safety Instrumented Systems (SIS) Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component Type

- 17.12.3. Safety Level

- 17.12.4. System Type

- 17.12.5. Technology

- 17.12.6. Communication Protocol

- 17.12.7. Application

- 17.12.8. Automation Level

- 17.12.9. End-Use Industry

- 17.13. Rest of Asia Pacific Safety Instrumented Systems (SIS) Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component Type

- 17.13.3. Safety Level

- 17.13.4. System Type

- 17.13.5. Technology

- 17.13.6. Communication Protocol

- 17.13.7. Application

- 17.13.8. Automation Level

- 17.13.9. End-Use Industry

- 18. Middle East Safety Instrumented Systems (SIS) Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Middle East Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component Type

- 18.3.2. Safety Level

- 18.3.3. System Type

- 18.3.4. Technology

- 18.3.5. Communication Protocol

- 18.3.6. Application

- 18.3.7. Automation Level

- 18.3.8. End-Use Industry

- 18.3.9. Country

- 18.3.9.1. Turkey

- 18.3.9.2. UAE

- 18.3.9.3. Saudi Arabia

- 18.3.9.4. Israel

- 18.3.9.5. Rest of Middle East

- 18.4. Turkey Safety Instrumented Systems (SIS) Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component Type

- 18.4.3. Safety Level

- 18.4.4. System Type

- 18.4.5. Technology

- 18.4.6. Communication Protocol

- 18.4.7. Application

- 18.4.8. Automation Level

- 18.4.9. End-Use Industry

- 18.5. UAE Safety Instrumented Systems (SIS) Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component Type

- 18.5.3. Safety Level

- 18.5.4. System Type

- 18.5.5. Technology

- 18.5.6. Communication Protocol

- 18.5.7. Application

- 18.5.8. Automation Level

- 18.5.9. End-Use Industry

- 18.6. Saudi Arabia Safety Instrumented Systems (SIS) Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component Type

- 18.6.3. Safety Level

- 18.6.4. System Type

- 18.6.5. Technology

- 18.6.6. Communication Protocol

- 18.6.7. Application

- 18.6.8. Automation Level

- 18.6.9. End-Use Industry

- 18.7. Israel Safety Instrumented Systems (SIS) Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component Type

- 18.7.3. Safety Level

- 18.7.4. System Type

- 18.7.5. Technology

- 18.7.6. Communication Protocol

- 18.7.7. Application

- 18.7.8. Automation Level

- 18.7.9. End-Use Industry

- 18.8. Rest of Middle East Safety Instrumented Systems (SIS) Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component Type

- 18.8.3. Safety Level

- 18.8.4. System Type

- 18.8.5. Technology

- 18.8.6. Communication Protocol

- 18.8.7. Application

- 18.8.8. Automation Level

- 18.8.9. End-Use Industry

- 19. Africa Safety Instrumented Systems (SIS) Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Africa Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component Type

- 19.3.2. Safety Level

- 19.3.3. System Type

- 19.3.4. Technology

- 19.3.5. Communication Protocol

- 19.3.6. Application

- 19.3.7. Automation Level

- 19.3.8. End-Use Industry

- 19.3.9. Country

- 19.3.9.1. South Africa

- 19.3.9.2. Egypt

- 19.3.9.3. Nigeria

- 19.3.9.4. Algeria

- 19.3.9.5. Rest of Africa

- 19.4. South Africa Safety Instrumented Systems (SIS) Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component Type

- 19.4.3. Safety Level

- 19.4.4. System Type

- 19.4.5. Technology

- 19.4.6. Communication Protocol

- 19.4.7. Application

- 19.4.8. Automation Level

- 19.4.9. End-Use Industry

- 19.5. Egypt Safety Instrumented Systems (SIS) Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component Type

- 19.5.3. Safety Level

- 19.5.4. System Type

- 19.5.5. Technology

- 19.5.6. Communication Protocol

- 19.5.7. Application

- 19.5.8. Automation Level

- 19.5.9. End-Use Industry

- 19.6. Nigeria Safety Instrumented Systems (SIS) Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component Type

- 19.6.3. Safety Level

- 19.6.4. System Type

- 19.6.5. Technology

- 19.6.6. Communication Protocol

- 19.6.7. Application

- 19.6.8. Automation Level

- 19.6.9. End-Use Industry

- 19.7. Algeria Safety Instrumented Systems (SIS) Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component Type

- 19.7.3. Safety Level

- 19.7.4. System Type

- 19.7.5. Technology

- 19.7.6. Communication Protocol

- 19.7.7. Application

- 19.7.8. Automation Level

- 19.7.9. End-Use Industry

- 19.8. Rest of Africa Safety Instrumented Systems (SIS) Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component Type

- 19.8.3. Safety Level

- 19.8.4. System Type

- 19.8.5. Technology

- 19.8.6. Communication Protocol

- 19.8.7. Application

- 19.8.8. Automation Level

- 19.8.9. End-Use Industry

- 20. South America Safety Instrumented Systems (SIS) Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. South America Safety Instrumented Systems (SIS) Market Size Volume (Million Units) and Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component Type

- 20.3.2. Safety Level

- 20.3.3. System Type

- 20.3.4. Technology

- 20.3.5. Communication Protocol

- 20.3.6. Application

- 20.3.7. Automation Level

- 20.3.8. End-Use Industry

- 20.3.9. Country

- 20.3.9.1. Brazil

- 20.3.9.2. Argentina

- 20.3.9.3. Rest of South America

- 20.4. Brazil Safety Instrumented Systems (SIS) Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component Type

- 20.4.3. Safety Level

- 20.4.4. System Type

- 20.4.5. Technology

- 20.4.6. Communication Protocol

- 20.4.7. Application

- 20.4.8. Automation Level

- 20.4.9. End-Use Industry

- 20.5. Argentina Safety Instrumented Systems (SIS) Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component Type

- 20.5.3. Safety Level

- 20.5.4. System Type

- 20.5.5. Technology

- 20.5.6. Communication Protocol

- 20.5.7. Application

- 20.5.8. Automation Level

- 20.5.9. End-Use Industry

- 20.6. Rest of South America Safety Instrumented Systems (SIS) Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component Type

- 20.6.3. Safety Level

- 20.6.4. System Type

- 20.6.5. Technology

- 20.6.6. Communication Protocol

- 20.6.7. Application

- 20.6.8. Automation Level

- 20.6.9. End-Use Industry

- 21. Key Players/ Company Profile

- 21.1. ABB Ltd.

- 21.1.1. Company Details/ Overview

- 21.1.2. Company Financials

- 21.1.3. Key Customers and Competitors

- 21.1.4. Business/ Industry Portfolio

- 21.1.5. Product Portfolio/ Specification Details

- 21.1.6. Pricing Data

- 21.1.7. Strategic Overview

- 21.1.8. Recent Developments

- 21.2. Danfoss A/S

- 21.3. Eaton Corporation

- 21.4. Emerson Electric Co.

- 21.5. Endress+Hauser Group

- 21.6. Fortive Corporation

- 21.7. General Electric Company

- 21.8. HIMA Paul Hildebrandt GmbH

- 21.9. Honeywell International Inc.

- 21.10. Johnson Controls International

- 21.11. Mitsubishi Electric Corporation

- 21.12. Omron Corporation

- 21.13. Pepperl+Fuchs SE

- 21.14. Phoenix Contact GmbH & Co. KG

- 21.15. Rockwell Automation Inc.

- 21.16. Schneider Electric SE

- 21.17. SICK AG

- 21.18. Siemens AG

- 21.19. Triconex (Baker Hughes)

- 21.20. Yokogawa Electric Corporation

- 21.21. Other Key Players

- 21.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data