- The global live shopping platform technology market is valued at USD 1.2 billion in 2025.

- The market is projected to grow at a CAGR of 18.6% during the forecast period of 2026 to 2035.

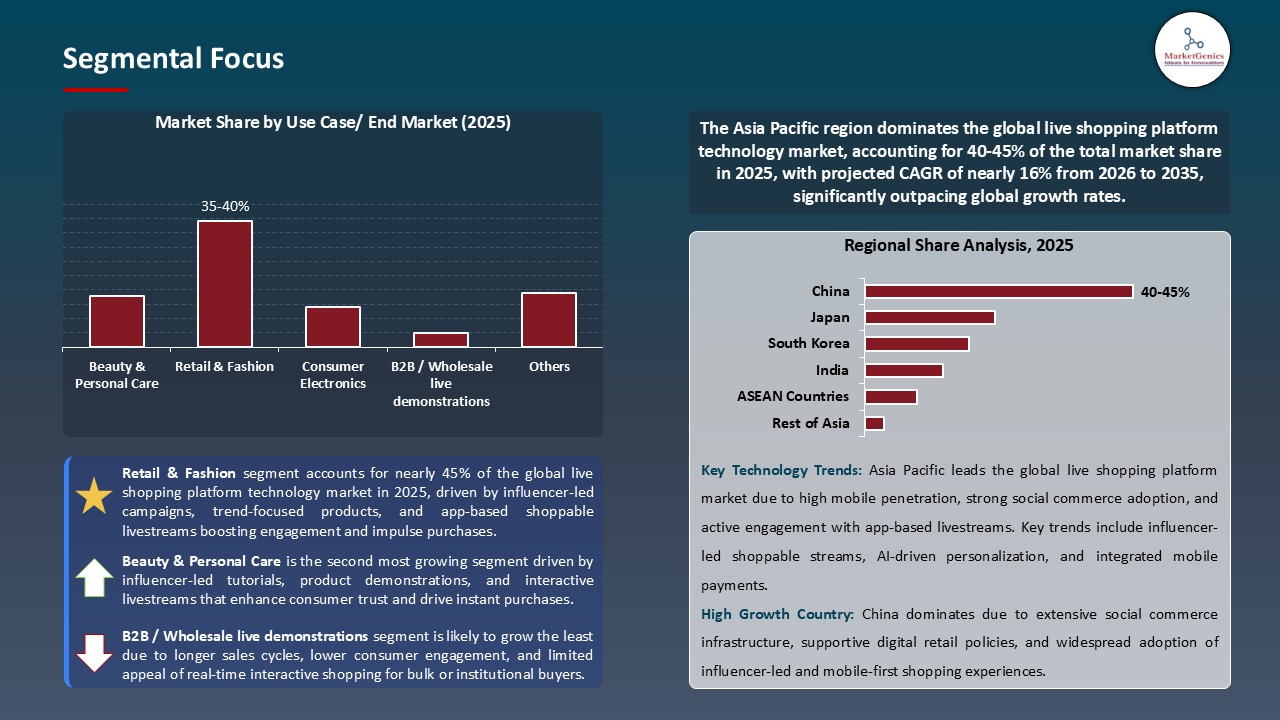

- The retail & fashion segment accounts for ~44% of the global live shopping platform technology market in 2025, driven by elevated consumer interest in real-time product exploration, influencer-driven shopping experiences, and swift conversion rates facilitated by engaging livestream commerce.

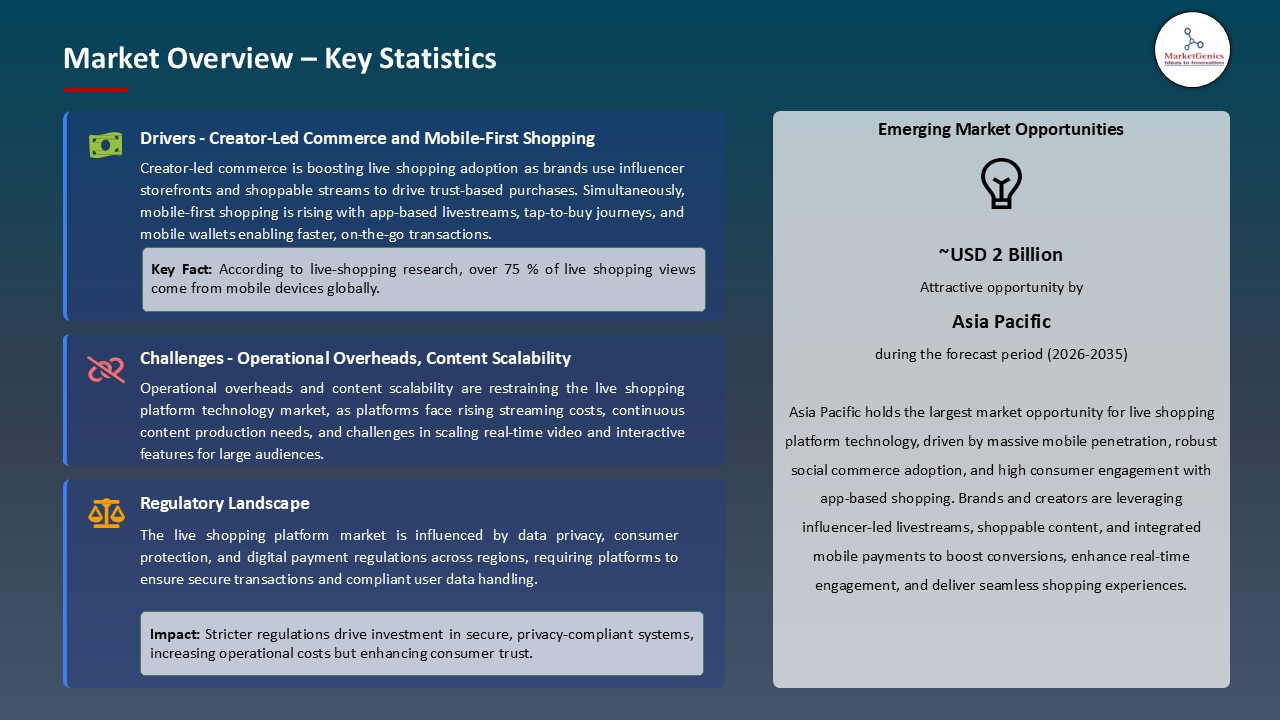

- The emergence of creator-driven storefronts and shoppable video formats is enhancing conversions and engagement in the worldwide live shopping technology market.

- The expansion of omnichannel retail, connecting social commerce, mobile livestreams, and in-app payments - is speeding up global market adoption

- The global live-shopping-platform-technology-market is highly consolidated, with the top five players accounting for over 50% of the market share in 2025.

- In September 2023, TikTok broadened the TikTok Shop and Live Shopping facilities throughout the U.S. by adding in-app checkout, shoppable livestreams, and creator affiliate tools that let users directly purchase products during a live session.

- In June 2024, Amazon made the Amazon Live Creator platform more attractive by the addition of the real-time analytics dashboard, AI-generated product tagging, and multi-stream distribution features that allow creators to broadcast their content.

- Global live shopping platform technology market is likely to create the total forecasting opportunity of USD 5.5 Bn till 2035

- Asia Pacific is most attractive region, due to its mobile-first consumer base, high social media penetration, and strong engagement with video-led commerce are the main factors behind that.

- The rise of creator-driven retail, a trend which has been strongly embraced by mobile users in Asia-Pacific, North America, and Europe, is pushing up the demand for live shopping technologies at a very fast rate. The platforms like TikTok, YouTube, Instagram, and Taobao have shown very high conversion rates from on-the-spot product demonstrations, which is why the brands are willing to invest in live-commerce infrastructure.

- The improved quality of the video streaming, integrated checkout, and AI-powered product tagging are some of the features that are making purchasing easy and without any interruption from a live-stream session. The drop-off rates are getting lower while the session-driven revenue is getting higher. The combination of content, community, and commerce is thus becoming the main global real-time retail engagement tool.

- Retailers in sectors such as beauty, apparel, electronics, and home décor are getting on board with the live shopping trend to lower their customer acquisition costs and, by means of interactive social experiences, increase the number of their customers who purchase again and thus, they are contributing to the strengthening of market momentum in both developed and emerging economies.

- In spite of their rapid expansion, a great number of brands are encountering difficulties regarding the operations of live-commerce initiatives that are scaled. These problems include, among others, the expenses that come with a professional production, the partnerships with creators, as well as the synchronization of the real-time inventory. Small retailers that have fragmented product data architectures are finding it hard to keep viewer-to-buyer conversions at a stable level.

- The integration of live shopping features with the already-existing e-commerce platforms and CRM systems is still a major challenge that requires lots of investments in API orchestration, product catalog management, and real-time logistics visibility. Due to these difficulties, adoption is limited to small and mid-sized merchants only.

- Platform fragmentation, i.e., the use of different tools, formats, analytics standards, and checkout systems in the major ecosystems, leads to the problem of interoperability and thus, restricts retailers from running unified, cross-platform campaigns. Owing to which, enterprises have an increased level of operational friction when they try to expand live-commerce globally.

- Across Southeast Asia, the Middle East, and Latin America, high-growth markets are the main drivers of new opportunities. Consumers are massively adopting mobile live-stream commerce in these regions for fashion, beauty, electronics, and lifestyle products. The rise of affordable smartphones and short-form video platforms is rapidly expanding market penetration.

- Digitization of SMEs through government-led initiatives in retail, such as those in Indonesia, India, and Brazil, is pushing small merchants to go live with the selling tools that are provided by marketplaces and fintech platforms, thus opening up new revenue streams for technology providers.

- There is a growing number of opportunities for solution providers to introduce creator-monetization tools, live-shopping analytics dashboards, AI-powered video features, and logistics integration layers for micro-sellers and regional marketplaces that enable them to reach more retail segments that have been traditionally underserved.

- With the help of AI/ML, live shopping is becoming more and more engaging through automated product recognition, smart overlays, personalized recommendations, and real-time sentiment analysis. These innovations attract more viewers, lessen the uncertainty of purchase, and give the retailers the opportunity to optimize their livestreams at scale.

- The integration of short-form shoppable videos with live streaming is a major trend that facilitates continuous discovery even when the live sessions are over. Retailers are now creating "video-first storefronts" which mix live, recorded, and interactive content into one commerce ecosystem.

- The customer experience is being transformed by the use of such technologies as AR try-ons, virtual hosts, 3D product visualizations, and interactive chatbots, which allow the customers to immerse themselves in product exploration and easily complete the checkout process during the live or on-demand viewing. The evolution of this ecosystem is a sign of the next stage of worldwide live-shopping platform adoption.

- Retail and fashion brands are swiftly embracing livestream commerce to facilitate spontaneous product discovery, influencer-led demonstrations, and interactive shopping experiences that attract more customer engagement and a higher conversion rate. TikTok Shop, Instagram, and Taobao Live are some of the platforms that show how visually oriented categories are the ones to gain the most from live, social purchasing.

- AI-driven recommendation systems, automated product tagging, and real-time analytics are being utilized to enhance personalization and to at times discourage purchase hesitancy. Amazon Live, Shopify, and Firework are getting closer to their visions of complete ecosystems with the necessary tools for enabling instant checkout within live sessions. The changes in platform payment policies at Meta, YouTube, and TikTok are securing transactions more and more, thus trust is built which supports frictionless in-stream purchases and the on-boarding of wider retailer communities is facilitated.

- The availability of live-shopping APIs and toolkits on a large scale from companies like CommentSold and Bambuser contributes to the easiness with which brands and marketplaces can implement video that is shoppable and features for creator monetization thereby positioning live shopping as one of the essential omnichannel retail components.

- Asia Pacific is the major contributor to live shopping platform technology worldwide market. Its mobile-first consumer base, high social media penetration, and strong engagement with video-led commerce are the main factors behind that. The couple of China, Japan, South Korea, and Southeast Asia are still the fastest-growing centers of the market with support from platforms like Taobao Live, Douyin, TikTok, Shopee, and Rakuten Live.

- The collaborations among Alibaba, JD.com, TikTok, and local retailer networks have facilitated real-time product catalog syncing, AI-powered recommendations, interactive storefronts, and creator-led broadcasts resulting in higher conversion and participation rates. The rules and digital infrastructure progressions are the other factors that head the region to be the leader in the market. The government-supported digital payment systems like UPI in India, Faster Payments in Singapore, and QR-code interoperability frameworks across ASEAN provide an environment for secure and instant digital transactions that are the main reasons for the reduction of live commerce checkout frictions.

- The creator economy of Asia Pacific and the consumers’ preference for video-driven engagement is the other side of the coin that allows the platforms to grow their monetization models, loyalty programs, and gamified shopping. The region is continually setting worldwide standards for ultra-low-latency streaming, AI-assisted moderation, and integrated commerce APIs which is a great advantage to keep them as a leader of live shopping platform technologies demand.

- In September 2023, TikTok broadened the TikTok Shop and Live Shopping facilities throughout the U.S. by adding in-app checkout, shoppable livestreams, and creator affiliate tools that let users directly purchase products during a live session. With this launch, mobile, cross-platform product catalogs powered by unified commerce APIs became feasible, thus lessening the friction and enabling peer-to-creator purchasing without the need to change the app.

- In June 2024, Amazon made the Amazon Live Creator platform more attractive by the addition of the real-time analytics dashboard, AI-generated product tagging, and multi-stream distribution features that allow creators to broadcast their content simultaneously across Amazon storefronts and external channels. The newly installed system performs streaming in a quick and direct way, without the need for a third-party tool, thus making the sellers more visible while the customers become more engaged.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Agora

- Alibaba (Taobao Live)

- Amazon (Amazon Live)

- Bambuser

- BigCommerce

- Brightcove

- Popshop Live

- NTWRK

- CommentSold

- Firework

- Livescale

- Shopify

- Vimeo (Livestream)

- Pinterest (Pinterest TV / shoppable features)

- Walmart (Walmart Live)

- ShopShops

- StreamElements

- StreamYard

- TalkShopLive

- TikTok (TikTok Shop / Live)

- Other Key Players

- Streaming Engine & CDN

- Interactive Overlay & Shoppable UI

- Real-time Engagement (chat, reactions, polls)

- Commerce & Checkout Module

- Inventory & Order Management Connector

- Analytics & Attribution Engine

- Payment & Payout Integrations

- Moderation & Trust & Safety Tools

- Others

- Cloud-Based

- On-Premises

- Hybrid

- Live one-to-many broadcasts

- Interactive live commerce (2-way video)

- Shoppable VOD / Clips & highlights

- Live auctions / timed drops

- Multi-host / studio productions

- Others

- Basic (chat + product links)

- Enhanced (real-time polls, Q&A, gamification)

- Social commerce (creator-driven, social graph integration)

- Collaborative (co-browsing, co-hosting, guest invites)

- Others

- Embedded in-stream checkout

- Link-out checkout (external cart)

- Affiliate / commission model

- Tips, gifts & virtual currency

- Subscription / membership commerce

- Others

- eCommerce platform connectors (Shopify, BigCommerce)

- OMS / ERP / WMS integrations

- Payment gateways & BNPL connectors

- CRM & marketing automation connectors

- Social network native integrations (TikTok, IG, Facebook)

- Others

- Brands & Retailers (enterprise)

- Marketplaces & Platforms

- Creators & Influencers

- Agencies & Merchandisers

- Small & Micro merchants

- Others

- Real-time engagement analytics

- Conversion & ROI attribution

- AI-driven product recommendations

- Automated highlights & clip generation

- Sentiment & fraud detection

- Others

- Retail & Fashion

- Beauty & Personal Care

- Consumer Electronics

- Grocery & FMCG

- Entertainment & Collectibles

- Automotive & High-ticket goods

- B2B / Wholesale live demonstrations

- Others

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Live Shopping Platform Technology Market Outlook

- 2.1.1. Live Shopping Platform Technology Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Live Shopping Platform Technology Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 3.1.1. Information Technology & Media Industry Analysis

- 3.1.2. Key Trends for Information Technology & Media Industry

- 3.1.3. Regional Distribution for Information Technology & Media Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.1. Global Information Technology & Media Ecosystem Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising demand for real-time, interactive shopping experiences.

- 4.1.1.2. Growing adoption of AI- and analytics-driven personalization and recommendation engines.

- 4.1.1.3. Increasing investments in omnichannel integration and secure payment solutions.

- 4.1.2. Restraints

- 4.1.2.1. High deployment and operational costs of streaming infrastructure and AI tools.

- 4.1.2.2. Challenges in integrating live shopping solutions with existing e-commerce and social media platforms.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. System Integrators/ Technology Providers

- 4.4.3. Live Shopping Platform Technology Providers

- 4.4.4. End Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Live Shopping Platform Technology Market Demand

- 4.9.1. Historical Market Size –Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size –Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Live Shopping Platform Technology Market Analysis, by Component

- 6.1. Key Segment Analysis

- 6.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Component, 2021-2035

- 6.2.1. Streaming Engine & CDN

- 6.2.2. Interactive Overlay & Shoppable UI

- 6.2.3. Real-time Engagement (chat, reactions, polls)

- 6.2.4. Commerce & Checkout Module

- 6.2.5. Inventory & Order Management Connector

- 6.2.6. Analytics & Attribution Engine

- 6.2.7. Payment & Payout Integrations

- 6.2.8. Moderation & Trust & Safety Tools

- 6.2.9. Others

- 7. Global Live Shopping Platform Technology Market Analysis, by Deployment Mode

- 7.1. Key Segment Analysis

- 7.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Deployment Mode, 2021-2035

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.2.3. Hybrid

- 8. Global Live Shopping Platform Technology Market Analysis, by Video Format/ Experience

- 8.1. Key Segment Analysis

- 8.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Video Format/ Experience, 2021-2035

- 8.2.1. Live one-to-many broadcasts

- 8.2.2. Interactive live commerce (2-way video)

- 8.2.3. Shoppable VOD / Clips & highlights

- 8.2.4. Live auctions / timed drops

- 8.2.5. Multi-host / studio productions

- 8.2.6. Others

- 9. Global Live Shopping Platform Technology Market Analysis, by Interactivity Level

- 9.1. Key Segment Analysis

- 9.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Interactivity Level, 2021-2035

- 9.2.1. Basic (chat + product links)

- 9.2.2. Enhanced (real-time polls, Q&A, gamification)

- 9.2.3. Social commerce (creator-driven, social graph integration)

- 9.2.4. Collaborative (co-browsing, co-hosting, guest invites)

- 9.2.5. Others

- 10. Global Live Shopping Platform Technology Market Analysis, by Monetization & Checkout Model

- 10.1. Key Segment Analysis

- 10.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Monetization & Checkout Model, 2021-2035

- 10.2.1. Embedded in-stream checkout

- 10.2.2. Link-out checkout (external cart)

- 10.2.3. Affiliate / commission model

- 10.2.4. Tips, gifts & virtual currency

- 10.2.5. Subscription / membership commerce

- 10.2.6. Others

- 11. Global Live Shopping Platform Technology Market Analysis, by Integration & Ecosystem

- 11.1. Key Segment Analysis

- 11.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Integration & Ecosystem, 2021-2035

- 11.2.1. eCommerce platform connectors (Shopify, BigCommerce)

- 11.2.2. OMS / ERP / WMS integrations

- 11.2.3. Payment gateways & BNPL connectors

- 11.2.4. CRM & marketing automation connectors

- 11.2.5. Social network native integrations (TikTok, IG, Facebook)

- 11.2.6. Others

- 12. Global Live Shopping Platform Technology Market Analysis, by Target User

- 12.1. Key Segment Analysis

- 12.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Target User, 2021-2035

- 12.2.1. Brands & Retailers (enterprise)

- 12.2.2. Marketplaces & Platforms

- 12.2.3. Creators & Influencers

- 12.2.4. Agencies & Merchandisers

- 12.2.5. Small & Micro merchants

- 12.2.6. Others

- 13. Global Live Shopping Platform Technology Market Analysis, by Analytics & AI Capabilities

- 13.1. Key Segment Analysis

- 13.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Analytics & AI Capabilities, 2021-2035

- 13.2.1. Real-time engagement analytics

- 13.2.2. Conversion & ROI attribution

- 13.2.3. AI-driven product recommendations

- 13.2.4. Automated highlights & clip generation

- 13.2.5. Sentiment & fraud detection

- 13.2.6. Others

- 14. Live Shopping Platform Technology Market Analysis and Forecasts, by Use Case/ End Market

- 14.1. Key Findings

- 14.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Use Case/ End Market, 2021-2035

- 14.2.1. Retail & Fashion

- 14.2.2. Beauty & Personal Care

- 14.2.3. Consumer Electronics

- 14.2.4. Grocery & FMCG

- 14.2.5. Entertainment & Collectibles

- 14.2.6. Automotive & High-ticket goods

- 14.2.7. B2B / Wholesale live demonstrations

- 14.2.8. Others

- 15. Global Live Shopping Platform Technology Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Live Shopping Platform Technology Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Live Shopping Platform Technology Market Size Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Component

- 16.3.2. Deployment Mode

- 16.3.3. Video Format/ Experience

- 16.3.4. Interactivity Level

- 16.3.5. Monetization & Checkout Model

- 16.3.6. Integration & Ecosystem

- 16.3.7. Target User

- 16.3.8. Analytics & AI Capabilities

- 16.3.9. Use Case/ End Market

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Live Shopping Platform Technology Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Component

- 16.4.3. Deployment Mode

- 16.4.4. Video Format/ Experience

- 16.4.5. Interactivity Level

- 16.4.6. Monetization & Checkout Model

- 16.4.7. Integration & Ecosystem

- 16.4.8. Target User

- 16.4.9. Analytics & AI Capabilities

- 16.4.10. Use Case/ End Market

- 16.5. Canada Live Shopping Platform Technology Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Component

- 16.5.3. Deployment Mode

- 16.5.4. Video Format/ Experience

- 16.5.5. Interactivity Level

- 16.5.6. Monetization & Checkout Model

- 16.5.7. Integration & Ecosystem

- 16.5.8. Target User

- 16.5.9. Analytics & AI Capabilities

- 16.5.10. Use Case/ End Market

- 16.6. Mexico Live Shopping Platform Technology Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Component

- 16.6.3. Deployment Mode

- 16.6.4. Video Format/ Experience

- 16.6.5. Interactivity Level

- 16.6.6. Monetization & Checkout Model

- 16.6.7. Integration & Ecosystem

- 16.6.8. Target User

- 16.6.9. Analytics & AI Capabilities

- 16.6.10. Use Case/ End Market

- 17. Europe Live Shopping Platform Technology Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component

- 17.3.2. Deployment Mode

- 17.3.3. Video Format/ Experience

- 17.3.4. Interactivity Level

- 17.3.5. Monetization & Checkout Model

- 17.3.6. Integration & Ecosystem

- 17.3.7. Target User

- 17.3.8. Analytics & AI Capabilities

- 17.3.9. Use Case/ End Market

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Live Shopping Platform Technology Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component

- 17.4.3. Deployment Mode

- 17.4.4. Video Format/ Experience

- 17.4.5. Interactivity Level

- 17.4.6. Monetization & Checkout Model

- 17.4.7. Integration & Ecosystem

- 17.4.8. Target User

- 17.4.9. Analytics & AI Capabilities

- 17.4.10. Use Case/ End Market

- 17.5. United Kingdom Live Shopping Platform Technology Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component

- 17.5.3. Deployment Mode

- 17.5.4. Video Format/ Experience

- 17.5.5. Interactivity Level

- 17.5.6. Monetization & Checkout Model

- 17.5.7. Integration & Ecosystem

- 17.5.8. Target User

- 17.5.9. Analytics & AI Capabilities

- 17.5.10. Use Case/ End Market

- 17.6. France Live Shopping Platform Technology Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component

- 17.6.3. Deployment Mode

- 17.6.4. Video Format/ Experience

- 17.6.5. Interactivity Level

- 17.6.6. Monetization & Checkout Model

- 17.6.7. Integration & Ecosystem

- 17.6.8. Target User

- 17.6.9. Analytics & AI Capabilities

- 17.6.10. Use Case/ End Market

- 17.7. Italy Live Shopping Platform Technology Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Component

- 17.7.3. Deployment Mode

- 17.7.4. Video Format/ Experience

- 17.7.5. Interactivity Level

- 17.7.6. Monetization & Checkout Model

- 17.7.7. Integration & Ecosystem

- 17.7.8. Target User

- 17.7.9. Analytics & AI Capabilities

- 17.7.10. Use Case/ End Market

- 17.8. Spain Live Shopping Platform Technology Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Component

- 17.8.3. Deployment Mode

- 17.8.4. Video Format/ Experience

- 17.8.5. Interactivity Level

- 17.8.6. Monetization & Checkout Model

- 17.8.7. Integration & Ecosystem

- 17.8.8. Target User

- 17.8.9. Analytics & AI Capabilities

- 17.8.10. Use Case/ End Market

- 17.9. Netherlands Live Shopping Platform Technology Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Component

- 17.9.3. Deployment Mode

- 17.9.4. Video Format/ Experience

- 17.9.5. Interactivity Level

- 17.9.6. Monetization & Checkout Model

- 17.9.7. Integration & Ecosystem

- 17.9.8. Target User

- 17.9.9. Analytics & AI Capabilities

- 17.9.10. Use Case/ End Market

- 17.10. Nordic Countries Live Shopping Platform Technology Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Component

- 17.10.3. Deployment Mode

- 17.10.4. Video Format/ Experience

- 17.10.5. Interactivity Level

- 17.10.6. Monetization & Checkout Model

- 17.10.7. Integration & Ecosystem

- 17.10.8. Target User

- 17.10.9. Analytics & AI Capabilities

- 17.10.10. Use Case/ End Market

- 17.11. Poland Live Shopping Platform Technology Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Component

- 17.11.3. Deployment Mode

- 17.11.4. Video Format/ Experience

- 17.11.5. Interactivity Level

- 17.11.6. Monetization & Checkout Model

- 17.11.7. Integration & Ecosystem

- 17.11.8. Target User

- 17.11.9. Analytics & AI Capabilities

- 17.11.10. Use Case/ End Market

- 17.12. Russia & CIS Live Shopping Platform Technology Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Component

- 17.12.3. Deployment Mode

- 17.12.4. Video Format/ Experience

- 17.12.5. Interactivity Level

- 17.12.6. Monetization & Checkout Model

- 17.12.7. Integration & Ecosystem

- 17.12.8. Target User

- 17.12.9. Analytics & AI Capabilities

- 17.12.10. Use Case/ End Market

- 17.13. Rest of Europe Live Shopping Platform Technology Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Component

- 17.13.3. Deployment Mode

- 17.13.4. Video Format/ Experience

- 17.13.5. Interactivity Level

- 17.13.6. Monetization & Checkout Model

- 17.13.7. Integration & Ecosystem

- 17.13.8. Target User

- 17.13.9. Analytics & AI Capabilities

- 17.13.10. Use Case/ End Market

- 18. Asia Pacific Live Shopping Platform Technology Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component

- 18.3.2. Deployment Mode

- 18.3.3. Video Format/ Experience

- 18.3.4. Interactivity Level

- 18.3.5. Monetization & Checkout Model

- 18.3.6. Integration & Ecosystem

- 18.3.7. Target User

- 18.3.8. Analytics & AI Capabilities

- 18.3.9. Use Case/ End Market

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Live Shopping Platform Technology Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component

- 18.4.3. Deployment Mode

- 18.4.4. Video Format/ Experience

- 18.4.5. Interactivity Level

- 18.4.6. Monetization & Checkout Model

- 18.4.7. Integration & Ecosystem

- 18.4.8. Target User

- 18.4.9. Analytics & AI Capabilities

- 18.4.10. Use Case/ End Market

- 18.5. India Live Shopping Platform Technology Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component

- 18.5.3. Deployment Mode

- 18.5.4. Video Format/ Experience

- 18.5.5. Interactivity Level

- 18.5.6. Monetization & Checkout Model

- 18.5.7. Integration & Ecosystem

- 18.5.8. Target User

- 18.5.9. Analytics & AI Capabilities

- 18.5.10. Use Case/ End Market

- 18.6. Japan Live Shopping Platform Technology Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component

- 18.6.3. Deployment Mode

- 18.6.4. Video Format/ Experience

- 18.6.5. Interactivity Level

- 18.6.6. Monetization & Checkout Model

- 18.6.7. Integration & Ecosystem

- 18.6.8. Target User

- 18.6.9. Analytics & AI Capabilities

- 18.6.10. Use Case/ End Market

- 18.7. South Korea Live Shopping Platform Technology Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component

- 18.7.3. Deployment Mode

- 18.7.4. Video Format/ Experience

- 18.7.5. Interactivity Level

- 18.7.6. Monetization & Checkout Model

- 18.7.7. Integration & Ecosystem

- 18.7.8. Target User

- 18.7.9. Analytics & AI Capabilities

- 18.7.10. Use Case/ End Market

- 18.8. Australia and New Zealand Live Shopping Platform Technology Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component

- 18.8.3. Deployment Mode

- 18.8.4. Video Format/ Experience

- 18.8.5. Interactivity Level

- 18.8.6. Monetization & Checkout Model

- 18.8.7. Integration & Ecosystem

- 18.8.8. Target User

- 18.8.9. Analytics & AI Capabilities

- 18.8.10. Use Case/ End Market

- 18.9. Indonesia Live Shopping Platform Technology Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Component

- 18.9.3. Deployment Mode

- 18.9.4. Video Format/ Experience

- 18.9.5. Interactivity Level

- 18.9.6. Monetization & Checkout Model

- 18.9.7. Integration & Ecosystem

- 18.9.8. Target User

- 18.9.9. Analytics & AI Capabilities

- 18.9.10. Use Case/ End Market

- 18.10. Malaysia Live Shopping Platform Technology Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Component

- 18.10.3. Deployment Mode

- 18.10.4. Video Format/ Experience

- 18.10.5. Interactivity Level

- 18.10.6. Monetization & Checkout Model

- 18.10.7. Integration & Ecosystem

- 18.10.8. Target User

- 18.10.9. Analytics & AI Capabilities

- 18.10.10. Use Case/ End Market

- 18.11. Thailand Live Shopping Platform Technology Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Component

- 18.11.3. Deployment Mode

- 18.11.4. Video Format/ Experience

- 18.11.5. Interactivity Level

- 18.11.6. Monetization & Checkout Model

- 18.11.7. Integration & Ecosystem

- 18.11.8. Target User

- 18.11.9. Analytics & AI Capabilities

- 18.11.10. Use Case/ End Market

- 18.12. Vietnam Live Shopping Platform Technology Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Component

- 18.12.3. Deployment Mode

- 18.12.4. Video Format/ Experience

- 18.12.5. Interactivity Level

- 18.12.6. Monetization & Checkout Model

- 18.12.7. Integration & Ecosystem

- 18.12.8. Target User

- 18.12.9. Analytics & AI Capabilities

- 18.12.10. Use Case/ End Market

- 18.13. Rest of Asia Pacific Live Shopping Platform Technology Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Component

- 18.13.3. Deployment Mode

- 18.13.4. Video Format/ Experience

- 18.13.5. Interactivity Level

- 18.13.6. Monetization & Checkout Model

- 18.13.7. Integration & Ecosystem

- 18.13.8. Target User

- 18.13.9. Analytics & AI Capabilities

- 18.13.10. Use Case/ End Market

- 19. Middle East Live Shopping Platform Technology Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component

- 19.3.2. Deployment Mode

- 19.3.3. Video Format/ Experience

- 19.3.4. Interactivity Level

- 19.3.5. Monetization & Checkout Model

- 19.3.6. Integration & Ecosystem

- 19.3.7. Target User

- 19.3.8. Analytics & AI Capabilities

- 19.3.9. Use Case/ End Market

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Live Shopping Platform Technology Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component

- 19.4.3. Deployment Mode

- 19.4.4. Video Format/ Experience

- 19.4.5. Interactivity Level

- 19.4.6. Monetization & Checkout Model

- 19.4.7. Integration & Ecosystem

- 19.4.8. Target User

- 19.4.9. Analytics & AI Capabilities

- 19.4.10. Use Case/ End Market

- 19.5. UAE Live Shopping Platform Technology Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component

- 19.5.3. Deployment Mode

- 19.5.4. Video Format/ Experience

- 19.5.5. Interactivity Level

- 19.5.6. Monetization & Checkout Model

- 19.5.7. Integration & Ecosystem

- 19.5.8. Target User

- 19.5.9. Analytics & AI Capabilities

- 19.5.10. Use Case/ End Market

- 19.6. Saudi Arabia Live Shopping Platform Technology Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component

- 19.6.3. Deployment Mode

- 19.6.4. Video Format/ Experience

- 19.6.5. Interactivity Level

- 19.6.6. Monetization & Checkout Model

- 19.6.7. Integration & Ecosystem

- 19.6.8. Target User

- 19.6.9. Analytics & AI Capabilities

- 19.6.10. Use Case/ End Market

- 19.7. Israel Live Shopping Platform Technology Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Component

- 19.7.3. Deployment Mode

- 19.7.4. Video Format/ Experience

- 19.7.5. Interactivity Level

- 19.7.6. Monetization & Checkout Model

- 19.7.7. Integration & Ecosystem

- 19.7.8. Target User

- 19.7.9. Analytics & AI Capabilities

- 19.7.10. Use Case/ End Market

- 19.8. Rest of Middle East Live Shopping Platform Technology Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component

- 19.8.3. Deployment Mode

- 19.8.4. Video Format/ Experience

- 19.8.5. Interactivity Level

- 19.8.6. Monetization & Checkout Model

- 19.8.7. Integration & Ecosystem

- 19.8.8. Target User

- 19.8.9. Analytics & AI Capabilities

- 19.8.10. Use Case/ End Market

- 20. Africa Live Shopping Platform Technology Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component

- 20.3.2. Deployment Mode

- 20.3.3. Video Format/ Experience

- 20.3.4. Interactivity Level

- 20.3.5. Monetization & Checkout Model

- 20.3.6. Integration & Ecosystem

- 20.3.7. Target User

- 20.3.8. Analytics & AI Capabilities

- 20.3.9. Use Case/ End Market

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Live Shopping Platform Technology Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component

- 20.4.3. Deployment Mode

- 20.4.4. Video Format/ Experience

- 20.4.5. Interactivity Level

- 20.4.6. Monetization & Checkout Model

- 20.4.7. Integration & Ecosystem

- 20.4.8. Target User

- 20.4.9. Analytics & AI Capabilities

- 20.4.10. Use Case/ End Market

- 20.5. Egypt Live Shopping Platform Technology Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component

- 20.5.3. Deployment Mode

- 20.5.4. Video Format/ Experience

- 20.5.5. Interactivity Level

- 20.5.6. Monetization & Checkout Model

- 20.5.7. Integration & Ecosystem

- 20.5.8. Target User

- 20.5.9. Analytics & AI Capabilities

- 20.5.10. Use Case/ End Market

- 20.6. Nigeria Live Shopping Platform Technology Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component

- 20.6.3. Deployment Mode

- 20.6.4. Video Format/ Experience

- 20.6.5. Interactivity Level

- 20.6.6. Monetization & Checkout Model

- 20.6.7. Integration & Ecosystem

- 20.6.8. Target User

- 20.6.9. Analytics & AI Capabilities

- 20.6.10. Use Case/ End Market

- 20.7. Algeria Live Shopping Platform Technology Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Component

- 20.7.3. Deployment Mode

- 20.7.4. Video Format/ Experience

- 20.7.5. Interactivity Level

- 20.7.6. Monetization & Checkout Model

- 20.7.7. Integration & Ecosystem

- 20.7.8. Target User

- 20.7.9. Analytics & AI Capabilities

- 20.7.10. Use Case/ End Market

- 20.8. Rest of Africa Live Shopping Platform Technology Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Component

- 20.8.3. Deployment Mode

- 20.8.4. Video Format/ Experience

- 20.8.5. Interactivity Level

- 20.8.6. Monetization & Checkout Model

- 20.8.7. Integration & Ecosystem

- 20.8.8. Target User

- 20.8.9. Analytics & AI Capabilities

- 20.8.10. Use Case/ End Market

- 21. South America Live Shopping Platform Technology Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Live Shopping Platform Technology Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Component

- 21.3.2. Deployment Mode

- 21.3.3. Video Format/ Experience

- 21.3.4. Interactivity Level

- 21.3.5. Monetization & Checkout Model

- 21.3.6. Integration & Ecosystem

- 21.3.7. Target User

- 21.3.8. Analytics & AI Capabilities

- 21.3.9. Use Case/ End Market

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Live Shopping Platform Technology Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Component

- 21.4.3. Deployment Mode

- 21.4.4. Video Format/ Experience

- 21.4.5. Interactivity Level

- 21.4.6. Monetization & Checkout Model

- 21.4.7. Integration & Ecosystem

- 21.4.8. Target User

- 21.4.9. Analytics & AI Capabilities

- 21.4.10. Use Case/ End Market

- 21.5. Argentina Live Shopping Platform Technology Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Component

- 21.5.3. Deployment Mode

- 21.5.4. Video Format/ Experience

- 21.5.5. Interactivity Level

- 21.5.6. Monetization & Checkout Model

- 21.5.7. Integration & Ecosystem

- 21.5.8. Target User

- 21.5.9. Analytics & AI Capabilities

- 21.5.10. Use Case/ End Market

- 21.6. Rest of South America Live Shopping Platform Technology Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Component

- 21.6.3. Deployment Mode

- 21.6.4. Video Format/ Experience

- 21.6.5. Interactivity Level

- 21.6.6. Monetization & Checkout Model

- 21.6.7. Integration & Ecosystem

- 21.6.8. Target User

- 21.6.9. Analytics & AI Capabilities

- 21.6.10. Use Case/ End Market

- 22. Key Players/ Company Profile

- 22.1. Agora

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Alibaba (Taobao Live)

- 22.3. Amazon (Amazon Live)

- 22.4. Bambuser

- 22.5. BigCommerce

- 22.6. Brightcove

- 22.7. CommentSold

- 22.8. Firework

- 22.9. Livescale

- 22.10. NTWRK

- 22.11. Pinterest (Pinterest TV / shoppable features)

- 22.12. Popshop Live

- 22.13. Shopify

- 22.14. ShopShops

- 22.15. StreamElements

- 22.16. StreamYard

- 22.17. TalkShopLive

- 22.18. TikTok (TikTok Shop / Live)

- 22.19. Vimeo (Livestream)

- 22.20. Walmart (Walmart Live)

- 22.21. Other Key Players

- 22.1. Agora

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Live Shopping Platform Technology Market by Component, Deployment Mode, Video Format/ Experience, Interactivity Level, Monetization & Checkout Model, Integration & Ecosystem, Target User, Analytics & AI Capabilities, Use Case/ End Market and Geography

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Live Shopping Platform Technology Market Size, Share & Trends Analysis Report by Component (Streaming Engine & CDN, Interactive Overlay & Shoppable UI, Real-time Engagement (chat, reactions, polls), Commerce & Checkout Module, Inventory & Order Management Connector, Analytics & Attribution Engine, Payment & Payout Integrations, Moderation & Trust & Safety Tools, Others), Deployment Mode, Video Format/ Experience, Interactivity Level, Monetization & Checkout Model, Integration & Ecosystem, Target User, Analytics & AI Capabilities, Use Case/ End Market and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

Market Structure & Evolution |

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Live Shopping Platform Technology Market Size, Share, and Growth

The global live shopping platform technology market is experiencing robust growth, with its estimated value of USD 1.2 billion in the year 2025 and USD 6.7 billion by the period 2035, registering a CAGR of 18.6% during the forecast period. The live-shopping-platform technology market is rapidly expanding globally, and Next Generation Interactive Commerce is the pivotal fuel for this growth evidenced by higher engagement and conversion rates across the board.

Imran Khan, co-founder and CEO of Verishop, mentioned that the use of livestream shopping "is going to be just one of the different ways that people do e-commerce" and that the conversion is elevated by the fact that these live streams are essentially turned into video libraries. He further pointed out that consumers are progressively depending on brief and real product videos in order to decide their purchases more quickly and with greater confidence."

Over the past several years, several leading retail and tech giants have rolled out increasingly efficient live-commerce technologies. Notably, TikTok Shop went nationwide in the U.S. and Southeast Asia in 2024 with native in-app checkout and shoppable livestreams, allowing creators and brands to directly convert the viewers during the broadcast - resulting in the beauty, apparel, and lifestyle sectors seeing measurable sales velocity increases.

For instance, Amazon has revitalized the segment with the continual upgrades it has made to Amazon Live, introducing a host of new features that enhance producer performance and consumer targeting such as new energizing creator dashboards, interactive product carousels, and up-to-the-minute analytics. The swell of social and mobile commerce worldwide, along with the global trend toward creator-driven purchasing, has injected a serious demand for more advanced live-shopping-tech platforms. Retailers across the globe are following the lead of such markets as China, where Alibaba’s Taobao Live has been the key driver for record-breaking Singles’ Day conversions in the last seasons, by implementing similar architectures to satisfy the ever-hungry consumers for instant discovery and frictionless checkout.

The digital retail market is becoming more and more competitive and the costs of acquiring customers are going up. As a result, brands are being forced to implement more potent live-commerce instruments which in turn facilitate product storytelling and diminish customer uncertainty. In addition, changing platform rules centered on safe payments and reliable transactions are, therefore, the main reasons for the worldwide spread of live shopping solutions at a rapid pace.

Live Shopping Platform Technology Market Dynamics and Trends

Driver: Rapid Shift Toward Creator-Led Commerce and Mobile-First Shopping

Restraint: Operational Overheads, Content Scalability, and Platform Fragmentation

Opportunity: Expansion in Emerging Markets and Retail Digitization Programs

Key Trend: AI-Powered Personalization, Shoppable Video Ecosystems & Interactive CX

Live Shopping Platform Technology Market Analysis and Segmental Data

“Retail & Fashion Leads Global Live Shopping Platform Technology Market amid Rising Demand for Real-Time, Interactive Commerce"

“Live Shopping Platform Technology Dominates Asia Pacific Market Demand"

Live-Shopping-Platform-Technology-Market Ecosystem

The live shopping platform technology market is witnessing a significant consolidation of power at the top of the market, with the leader primarily being TikTok, followed by other major players such as Amazon, Alibaba, Walmart Firework, and Bambuser who are all intensively using advanced AI, interactive video engines, and embedded checkout systems to upgrade their services and attract more customers. They are aggressively putting money into AI-controlled product tagging, real-time user engagement metrics, influencer monetization toolkits, and shoppable video CMS platforms as integral parts of the highly personalized and scalable livestream commerce experience they provide.

Moreover, government agencies, and research institutions are not standing on the sidelines but partnering in this technological race. Last year, in July 2024, the U.S. National Institute of Standards and Technology (NIST) took a significant step forward in real-time video compression in an effort to deliver faster streaming with less delay for commercial platforms, thus allowing the quality and stability of large-scale live shopping events to be improved. Besides, these corporations are still heavily into product diversification and integrated commerce ecosystems as their primary goals and are further widening their portfolios with omnichannel APIs, social checkout modules, and cross-platform content distribution systems to facilitate the operational side of the retailers.

Innovations on the arrival schedule are the October 2024 AI-driven video-enhancement models developed by Brightcove, which significantly expedited shoppable video interaction accuracy and loading by over 20%, thus showcasing how live shopping platform technology market metrics are being turned around at an accelerated speed by the deployment of AI and deep-learning technologies.

Recent Development and Strategic Overview:

Report Scope

|

Attribute |

Detail |

|

Market Size in 2025 |

USD 1.2 Bn |

|

Market Forecast Value in 2035 |

USD 6.7 Bn |

|

Growth Rate (CAGR) |

18.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

USD Bn for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

Regions and Countries Covered |

|||||

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Live-Shopping-Platform-Technology-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Live Shopping Platform Technology Market, By Component |

|

|

Live Shopping Platform Technology Market, By Deployment Mode |

|

|

Live Shopping Platform Technology Market, By Video Format/ Experience |

|

|

Live Shopping Platform Technology Market, By Interactivity Level |

|

|

Live Shopping Platform Technology Market, By Monetization & Checkout Model |

|

|

Live Shopping Platform Technology Market, By Integration & Ecosystem |

|

|

Live Shopping Platform Technology Market, By Target User |

|

|

Live Shopping Platform Technology Market, By Analytics & AI Capabilities |

|

|

Live Shopping Platform Technology Market, By Use Case/ End Market |

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation