Metalized Flexible Packaging Market Size, Share, Growth Opportunity Analysis Report by Material (Aluminum Foil, Metalized Films, BOPP (Biaxially Oriented Polypropylene), PET (Polyethylene Terephthalate), PE (Polyethylene), Nylon and Others), Structure, Packaging, Technology, Functionality, Distribution, End-use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2025–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Metalized Flexible Packaging Market Size, Share, and Growth

The global metalized flexible packaging market is projected to grow from USD 14.3 Billion in 2025 to USD 22.6 Billion by 2035, registering a strong CAGR of 4.2% during the forecast period. The market is growing due for barrier protection, sustainability, and premium shelf appeal across food, pharmaceuticals, and personal care sectors.

Metalized flexible packaging is redefining performance and sustainability in today’s packaging landscape. As brands seek lightweight, high-barrier, and visually striking solutions, metalized films deliver on both function and shelf appeal. The industry’s move toward recyclable, mono-material structures is no longer a trend it is a strategic necessity driving innovation, compliance, and consumer trust across global markets.

Light weight material applications, recyclability and better aesthetics are supporting market penetration. For instance, in 2023, Amcor partnered with Licella and Mura Technology to develop recyclable metalized packaging through the utilization of advanced chemical recycling technology, to support its circular economy goals within its food and snack segments. This allowed brands to reduce their carbon footprints, while maintaining product quality and shelf presence.

Digital-first packaging overhauls are tapping-up premium brands to connect with consumers. For Instance, in 2022, Tata Tea Premium with the metalized pouch pack offering re-engineering its packaging to introduce regional design on its packs, including at the bottom, the QR codes, delivering superior market differentiation and Tier 2, 3 market sales uplifts.

Metalized-Flexible-Packaging-Market Dynamics and Trends

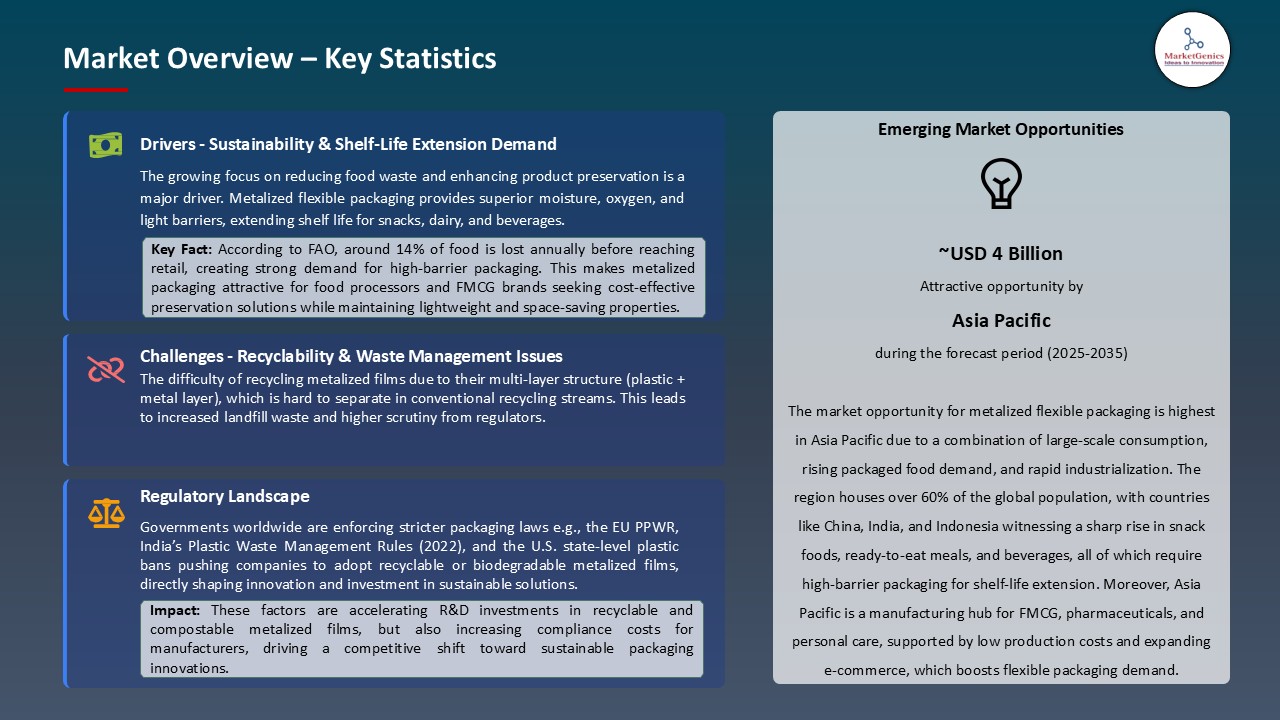

Driver: Demand for Extended Shelf Life & Product Protection

- The main drivers are to shelf-life extend and protect the quality of foods, beverages and pharma products. Metallized flexible films offer superb barriers to moisture, oxygen, and light to maintain the freshness of perishable products. For Instance, in 2023, Nestle introduced high-barrier metalized flexible pouches for its dairy-based on-the-go ready-to-drink products, such as its cold coffee and milk-based beverages.

- Food spoilage due to oxygen and light with the high barrier of metalized PET, the oxygen and light transmission was greatly minimized, which helped maintain flavour and nutritional value and extended shelf life without refrigeration. This change enabled Nestlé to enter new channels such as rural and non-refrigerated retail, cut down on product returns from spoilage and meet the company’s packaging sustainability commitments.

Restraint: High Production Costs & Raw Material Volatility

- Metallized films are expensive to produce which requires special vacuum metalizing machines and materials of highest quality. For Instance, the price of aluminium surges or the cost of plastic resin increases, packagers encounter tighter margins more challenging to offset without the guidance and flexibility of working capital and may be forced to increase prices or absorb costs. These are some of the continued challenges for the industry due to this capital intensity and volatility.

- One of the biggest challenges for metalized flexible packaging is the sustainability. Most metalized Packages are multi-layer such as aluminum, making them challenging to recycle by the current method.

Opportunity: Innovation in Sustainable Packaging

- Increasing environmental consciousness is opening the way for eco-friendly metalized packaging solutions. For instance, in 2022, Constantia Flexibles launched EcoLamPlus as an alternative to conventional foil laminates. These innovations not only appeal to environmentally conscious consumers and regulators, but they can also reduce material costs in the long run.

- Smart packaging can be integrated into metalized flexible packs, such as QR codes, NFC/RFID tags, or holographic security features, to enable seamless connectivity without sacrificing package integrity. This opens up value-added possibilities. A brand can use QR code on a package for not just consumer engagement, but also for product authenticity verification, or for tracking products through the supply chain. For Instance, Bulgarian luxury brand Bulgari selected Temera to incorporate NFC into its packaging, which involves inserting NFC tags onto its packaging, like metalized flexible film wrappers for cosmetics and fragrances.

- Mapping the tactile package experience with the personalized digital experience has enhanced the integrity of Bulgari’s brand and strengthened customer loyalty.

Key Trend: Shift to Sustainable & Mono-Material Packaging

- Sustainability is the defining trend in packaging. Manufacturers are redesigning packaging to use single-base-material so that the end product can be recycled more easily. For instance, in March 2024, Jindal Films introduced a PP mono-material barrier film to replace conventional metalized structures. This innovation offers the same level of high oxygen and moisture barrier for food packaging, while now being able to pass through standard recycling streams, making it much more circular.

- Visual appeal is a strong trend, particularly in packaging for food, beverage and personal care. manufacturers are developing advances in metallization and printing on foil, giving more flexibility with graphic definition and super designs on flexible packs. This drives high demand for metallized labels and pouches that catch the eyes of consumers.

Metalized Flexible Packaging Market Analysis and Segmental Data

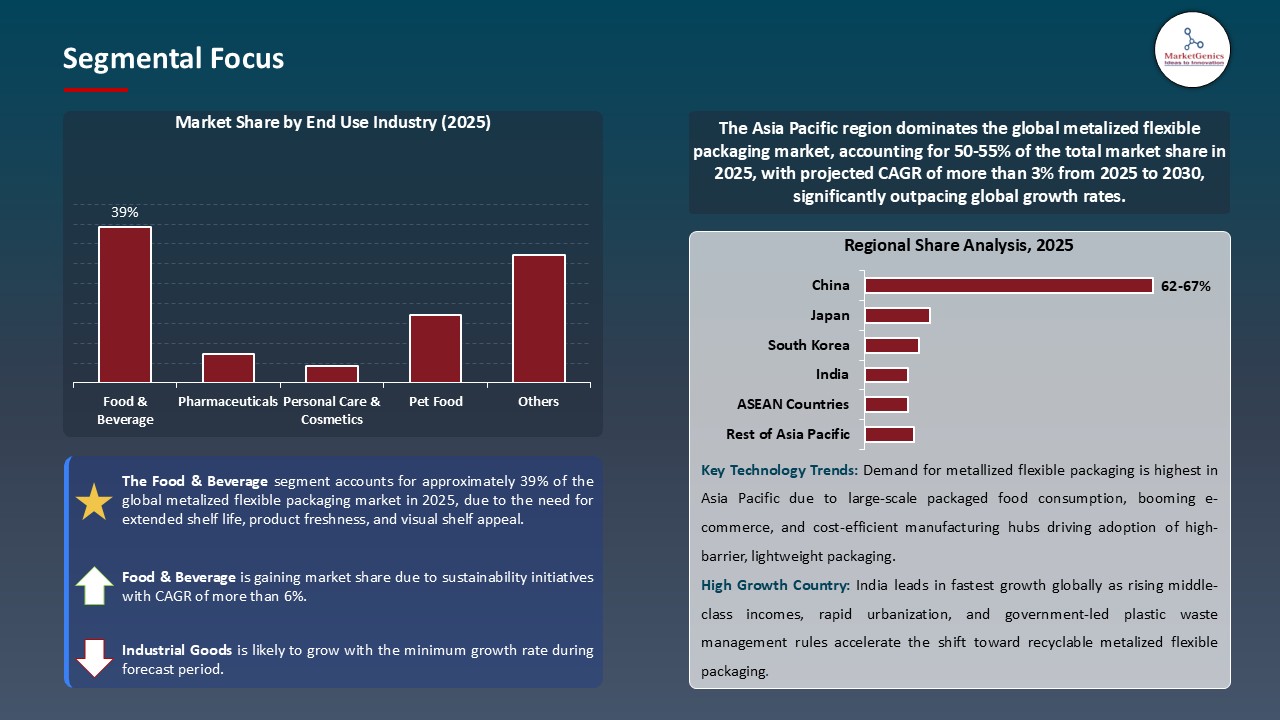

Food & Beverage holds majority share in Metalized Flexible Packaging Market

- Food & Beverage dominates the metalized-flexible-packaging-market with ~39% share at global level because the need for extended shelf life, product freshness, and visual shelf appeal. Metalized films offer superior moisture and oxygen barriers, making ideal for packaging snacks, ready-to-eat meals, coffee, and confectionery products. For instance, PepsiCo and Nestlé have introduced metalized film laminates for snack and powdered beverage items that also improve shelf life and reduce spoilage over varied climates. This package format has facilitated an efficient supply chain, maintained product integrity, and catered to the increasing convenience retail space, especially among emerging markets.

- Global trends indicate an increasing consumption of packaged, processed and ready-to-eat food such as instant meals and snack bars. This is driven by rapid urbanisation and increasing middle class. Hence, stand-up pouches and sachets, have become popular in this space because they are lightweight, easy to open, and extend product shelf life.

Asia Pacific Dominates Metalized Flexible Packaging Market in 2025 and Beyond

- Asia Pacific is the largest regional market holding the share of ~53% in the metalized-flexible-packaging-market, due to rapid urbanization, thriving FMCG, pharmaceutical, and personal care industries. With its massive population and economic growth, the Asia-Pacific region has created a huge appetite for packaged consumer goods. In fact, China, India, and Japan combined consumed a significant demand for the metalized packaging market.

- Asia Pacific is positioned to remain the global innovation hub in metalized flexible packaging, will likely continue through 2035, driven by evolving consumer behaviours, regulatory encouragement for recyclable packaging, and ongoing investments in production technology.

Metalized Flexible Packaging Market Ecosystem

Key players in the global metalized flexible packaging market include prominent companies such as Amcor, Constantia Flexibles, Mondi Group, Berry Global, Sealed Air and Other Key Players.

The global metalized flexible packaging market is moderately competitive with major players Amcor plc, Mondi Group, and Sealed Air Corporation commanding the market due to their better production capabilities, substantial brand portfolios, and distribution presence. They are able to provide packaging solutions with high quality, barrier protective characteristics widely to the food, beverage, and pharmaceutical markets. The mid-sized players like Constantia Flexibles and Cosmo Films have a strong presence based on specialty application for high barrier applications including snacks, coffee, and dairy, serving branded and private labels. Smaller regional players cater to niche markets with lower-cost packaging solutions that are customized for local food processors, and small consumer goods brands with specific needs. There is moderate buyer concentration propelled by growing demand from FMCG manufacturers, processed food brands, and e-commerce packaging needs which all have package requirements to extend shelf life and provide premium characteristics.

Recent Developments and Strategic Overview

- In 2025, Amcor introduced “Liquiflex AmPrima” pouches designed for bulk foodservice use. These mono-material PE films are recyclable within European waste streams, reduce transport/storage space compared to cans, and help brands comply with EU PPWR regulations and plastic taxes.

- In 2025, TIPA launched an advanced home-compostable metalized high-barrier film “312MET Premium” aimed at snack packaging. This ultra-thin film offers high protection against salt, oil, and moisture without foil layers.

- In 2024, UFlex Limited (India) introduced a new high-barrier metalized BOPP film, branded ‘B-UUB-M’, targeting applications like dry fruits, snacks, and confectionery. This product offers improved moisture and oxygen barrier properties for extending shelf life of food items.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 14.3 Bn |

|

Market Forecast Value in 2035 |

USD 22.6 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2025 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Metalized Flexible Packaging Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

By Packaging |

|

|

By Material

|

|

|

By Technology

|

|

|

By Functionality |

|

|

By End Use Industry

|

|

Frequently Asked Questions

Metalized flexible packaging refers to lightweight, high-barrier packaging materials that incorporate a thin metal layer (typically aluminium) laminated onto plastic films. These are widely used in food, personal care, and pharmaceutical products due to their superior moisture, oxygen, and light protection.

The metalized flexible packaging market is valued at USD 14.3 Billion in 2025.

The market is expected to grow at a CAGR of 4.2 % from 2025 to 2035.

Food & Beverage lead the market due to high demand for longer shelf life, barrier protection, and attractive visual appeal in packaging.

Asia Pacific dominates the market with share of ~53%.

Amcor, Sonoco, Huhtamaki, Cosmo Films, UFlex, Huhtamaki Oyj, Jindal Poly Films Ltd., Mondi Group, Polyplex Corporation Ltd., Sealed Air Corporation, Sonoco Products Company, Toppan Printing Co., Ltd., Toray Plastics (America), Inc., Transcontinental Inc., Celplast Metallized Products Limited and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Metalized Flexible Packaging Market Outlook

- 2.1.1. Metalized Flexible Packaging Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Metalized Flexible Packaging Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Industry Overview, 2025

- 3.1.1. Industry Ecosystem Analysis

- 3.1.2. Key Trends for Packaging Industry

- 3.1.3. Regional Distribution for Industry

- 3.2. Supplier Customer Data

- 3.3. Source Roadmap and Developments

- 3.4. Trump Tariff Impact Analysis

- 3.4.1. Manufacturer

- 3.4.2. Supply Chain/Distributor

- 3.4.3. End Consumer

- 3.1. Global Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Environmental regulations and consumer awareness

- 4.1.1.2. Rapid expansion of e-commerce and food delivery services

- 4.1.2. Restraints

- 4.1.2.1. Advanced metallization and coating processes

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material

- 4.4.2. Manufacturers

- 4.4.3. Technology

- 4.4.4. Wholesalers/ Distributor

- 4.4.5. End-users/ Customers

- 4.5. Raw Material Analysis

- 4.6. Cost Structure Analysis

- 4.6.1. Parameter’s Share for Cost Associated

- 4.6.2. COGP vs COGS

- 4.6.3. Profit Margin Analysis

- 4.7. Pricing Analysis

- 4.7.1. Regional Pricing Analysis

- 4.7.2. Segmental Pricing Trends

- 4.7.3. Factors Influencing Pricing

- 4.8. Porter’s Five Forces Analysis

- 4.9. PESTEL Analysis

- 4.10. Metalized Flexible Packaging Market Demand

- 4.10.1. Historical Market Size - in Value (US$ Billion), 2021-2024

- 4.10.2. Current and Future Market Size - in Value (US$ Billion), 2025–2035

- 4.10.2.1. Y-o-Y Growth Trends

- 4.10.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Metalized Flexible Packaging Market Analysis, by Material

- 6.1. Key Segment Analysis

- 6.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Material Type, 2021-2035

- 6.2.1. Aluminum Foil

- 6.2.2. Metalized Films

- 6.2.2.1. BOPP (Biaxially Oriented Polypropylene)

- 6.2.2.2. PET (Polyethylene Terephthalate)

- 6.2.2.3. PE (Polyethylene)

- 6.2.2.4. Nylon

- 6.2.2.5. Others (PVC, PP, etc.)

- 7. Metalized Flexible Packaging Market Analysis, by Structure Type

- 7.1. Key Segment Analysis

- 7.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Structure Type, 2021-2035

- 7.2.1. Single Layer

- 7.2.2. Multi-layer Laminates

- 7.2.2.1. Two-layer

- 7.2.2.2. Three-layer or more (e.g., PET/Alu/PE)

- 8. Metalized Flexible Packaging Market Analysis, by Packaging Type

- 8.1. Key Segment Analysis

- 8.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Packaging Type, 2021-2035

- 8.2.1. Pouches (Stand-up, Zipper, Retort)

- 8.2.2. Wraps

- 8.2.3. Sachets

- 8.2.4. Bags (Gusseted, Vacuum)

- 8.2.5. Lids and Labels

- 8.2.6. Rollstock

- 8.2.7. Blisters & Strips

- 8.2.8. Others

- 9. Metalized Flexible Packaging Market Analysis, by Technology

- 9.1. Key Segment Analysis

- 9.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Technology, 2021-2035

- 9.2.1. Vacuum Metalizing

- 9.2.2. Electron Beam Evaporation

- 9.2.3. Sputter Coating

- 9.2.4. Thermal Evaporation

- 9.2.5. Others

- 10. Metalized Flexible Packaging Market Analysis, by Functionality

- 10.1. Key Segment Analysis

- 10.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Functionality, 2021-2035

- 10.2.1. Barrier Protection (Moisture, Light, Oxygen)

- 10.2.2. Heat Sealability

- 10.2.3. Printability & Aesthetics

- 10.2.4. Tear Resistance & Durability

- 10.2.5. Recyclability/Compostability

- 10.2.6. Others

- 11. Metalized Flexible Packaging Market Analysis, by Distribution Channel

- 11.1. Key Segment Analysis

- 11.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 11.2.1. Direct Sales (OEMs, Manufacturers)

- 11.2.2. Distributors & Wholesalers

- 11.2.3. Retailers & Online Platforms

- 12. Metalized Flexible Packaging Market Analysis, by End-Use Industry

- 12.1. Key Segment Analysis

- 12.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 12.2.1. Food & Beverage

- 12.2.2. Pharmaceuticals

- 12.2.3. Personal Care & Cosmetics

- 12.2.4. Pet Food

- 12.2.5. Home Care Products

- 12.2.6. Agricultural Products

- 12.2.7. Industrial Goods

- 12.2.8. Others (e.g., Tobacco, Electronics)

- 13. Metalized Flexible Packaging Market Analysis and Forecasts, by region

- 13.1. Key Findings

- 13.2. Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Metalized Flexible Packaging Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 14.3.1. Material

- 14.3.2. Structure Type

- 14.3.3. Packaging Type

- 14.3.4. Technology

- 14.3.5. Functionality

- 14.3.6. Distribution

- 14.3.7. End-Use Industry

- 14.3.8. Country

-

- 14.3.8.1.1. USA

- 14.3.8.1.2. Canada

- 14.3.8.1.3. Mexico

-

- 14.4. USA Metalized Flexible Packaging Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Material

- 14.4.3. Structure Type

- 14.4.4. Packaging Type

- 14.4.5. Technology

- 14.4.6. Functionality

- 14.4.7. Distribution

- 14.4.8. End-Use Industry

- 14.5. Canada Metalized Flexible Packaging Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Material

- 14.5.3. Structure Type

- 14.5.4. Packaging Type

- 14.5.5. Technology

- 14.5.6. Functionality

- 14.5.7. Distribution

- 14.5.8. End-Use Industry

- 14.6. Mexico Metalized Flexible Packaging Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Material

- 14.6.3. Structure Type

- 14.6.4. Packaging Type

- 14.6.5. Technology

- 14.6.6. Functionality

- 14.6.7. Distribution

- 14.6.8. End-Use Industry

- 15. Europe Metalized Flexible Packaging Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 15.3.1. Country Segmental Analysis

- 15.3.2. Material

- 15.3.3. Structure Type

- 15.3.4. Packaging Type

- 15.3.5. Technology

- 15.3.6. Functionality

- 15.3.7. Distribution

- 15.3.8. End-Use Industry

- 15.3.9. Country

- 15.3.9.1. Germany

- 15.3.9.2. United Kingdom

- 15.3.9.3. France

- 15.3.9.4. Italy

- 15.3.9.5. Spain

- 15.3.9.6. Netherlands

- 15.3.9.7. Nordic Countries

- 15.3.9.8. Poland

- 15.3.9.9. Russia & CIS

- 15.3.9.10. Rest of Europe

- 15.4. Germany Metalized Flexible Packaging Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Material

- 15.4.3. Structure Type

- 15.4.4. Packaging Type

- 15.4.5. Technology

- 15.4.6. Functionality

- 15.4.7. Distribution

- 15.4.8. End-Use Industry

- 15.5. United Kingdom Metalized Flexible Packaging Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Material

- 15.5.3. Structure Type

- 15.5.4. Packaging Type

- 15.5.5. Technology

- 15.5.6. Functionality

- 15.5.7. Distribution

- 15.5.8. End-Use Industry

- 15.6. France Metalized Flexible Packaging Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Material

- 15.6.3. Structure Type

- 15.6.4. Packaging Type

- 15.6.5. Technology

- 15.6.6. Functionality

- 15.6.7. Distribution

- 15.6.8. End-Use Industry

- 15.7. Italy Metalized Flexible Packaging Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Material

- 15.7.3. Structure Type

- 15.7.4. Packaging Type

- 15.7.5. Technology

- 15.7.6. Functionality

- 15.7.7. Distribution

- 15.7.8. End-Use Industry

- 15.8. Spain Metalized Flexible Packaging Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Material

- 15.8.3. Structure Type

- 15.8.4. Packaging Type

- 15.8.5. Technology

- 15.8.6. Functionality

- 15.8.7. Distribution

- 15.8.8. End-Use Industry

- 15.9. Netherlands Metalized Flexible Packaging Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Material

- 15.9.3. Structure Type

- 15.9.4. Packaging Type

- 15.9.5. Technology

- 15.9.6. Functionality

- 15.9.7. Distribution

- 15.9.8. End-Use Industry

- 15.10. Nordic Countries Metalized Flexible Packaging Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Material

- 15.10.3. Structure Type

- 15.10.4. Packaging Type

- 15.10.5. Technology

- 15.10.6. Functionality

- 15.10.7. Distribution

- 15.10.8. End-Use Industry

- 15.11. Poland Metalized Flexible Packaging Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Material

- 15.11.3. Structure Type

- 15.11.4. Packaging Type

- 15.11.5. Technology

- 15.11.6. Functionality

- 15.11.7. Distribution

- 15.11.8. End-Use Industry

- 15.12. Russia & CIS Metalized Flexible Packaging Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Material

- 15.12.3. Structure Type

- 15.12.4. Packaging Type

- 15.12.5. Technology

- 15.12.6. Functionality

- 15.12.7. Distribution

- 15.12.8. End-Use Industry

- 15.13. Rest of Europe Metalized Flexible Packaging Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Material

- 15.13.3. Structure Type

- 15.13.4. Packaging Type

- 15.13.5. Technology

- 15.13.6. Functionality

- 15.13.7. Distribution

- 15.13.8. End-Use Industry

- 16. Asia Pacific Metalized Flexible Packaging Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. East Asia Metalized Flexible Packaging Market Size in Value (US$ Billion), and Forecasts, 2021-2035

- 16.3.1. Material

- 16.3.2. Structure Type

- 16.3.3. Packaging Type

- 16.3.4. Technology

- 16.3.5. Functionality

- 16.3.6. Distribution

- 16.3.7. End-Use Industry

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Metalized Flexible Packaging Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Material

- 16.4.3. Structure Type

- 16.4.4. Packaging Type

- 16.4.5. Technology

- 16.4.6. Functionality

- 16.4.7. Distribution

- 16.4.8. End-Use Industry

- 16.5. India Metalized Flexible Packaging Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Material

- 16.5.3. Structure Type

- 16.5.4. Packaging Type

- 16.5.5. Technology

- 16.5.6. Functionality

- 16.5.7. Distribution

- 16.5.8. End-Use Industry

- 16.6. Japan Metalized Flexible Packaging Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Material

- 16.6.3. Structure Type

- 16.6.4. Packaging Type

- 16.6.5. Technology

- 16.6.6. Functionality

- 16.6.7. Distribution

- 16.6.8. End-Use Industry

- 16.7. South Korea Metalized Flexible Packaging Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Material

- 16.7.3. Structure Type

- 16.7.4. Packaging Type

- 16.7.5. Technology

- 16.7.6. Functionality

- 16.7.7. Distribution

- 16.7.8. End-Use Industry

- 16.8. Australia and New Zealand Metalized Flexible Packaging Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Material

- 16.8.3. Structure Type

- 16.8.4. Packaging Type

- 16.8.5. Technology

- 16.8.6. Functionality

- 16.8.7. Distribution

- 16.8.8. End-Use Industry

- 16.9. Indonesia Metalized Flexible Packaging Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Material

- 16.9.3. Structure Type

- 16.9.4. Packaging Type

- 16.9.5. Technology

- 16.9.6. Functionality

- 16.9.7. Distribution

- 16.9.8. End-Use Industry

- 16.10. Malaysia Metalized Flexible Packaging Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Material

- 16.10.3. Structure Type

- 16.10.4. Packaging Type

- 16.10.5. Technology

- 16.10.6. Functionality

- 16.10.7. Distribution

- 16.10.8. End-Use Industry

- 16.11. Thailand Metalized Flexible Packaging Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Material

- 16.11.3. Structure Type

- 16.11.4. Packaging Type

- 16.11.5. Technology

- 16.11.6. Functionality

- 16.11.7. Distribution

- 16.11.8. End-Use Industry

- 16.12. Vietnam Metalized Flexible Packaging Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Material

- 16.12.3. Structure Type

- 16.12.4. Packaging Type

- 16.12.5. Technology

- 16.12.6. Functionality

- 16.12.7. Distribution

- 16.12.8. End-Use Industry

- 16.13. Rest of Asia Pacific Metalized Flexible Packaging Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Material

- 16.13.3. Structure Type

- 16.13.4. Packaging Type

- 16.13.5. Technology

- 16.13.6. Functionality

- 16.13.7. Distribution

- 16.13.8. End-Use Industry

- 17. Middle East Metalized Flexible Packaging Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 17.3.1. Material

- 17.3.2. Structure Type

- 17.3.3. Packaging Type

- 17.3.4. Technology

- 17.3.5. Functionality

- 17.3.6. Distribution

- 17.3.7. End-Use Industry

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Metalized Flexible Packaging Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Material

- 17.4.3. Structure Type

- 17.4.4. Packaging Type

- 17.4.5. Technology

- 17.4.6. Functionality

- 17.4.7. Distribution

- 17.4.8. End-Use Industry

- 17.5. UAE Metalized Flexible Packaging Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Material

- 17.5.3. Structure Type

- 17.5.4. Packaging Type

- 17.5.5. Technology

- 17.5.6. Functionality

- 17.5.7. Distribution

- 17.5.8. End-Use Industry

- 17.6. Saudi Arabia Metalized Flexible Packaging Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Material

- 17.6.3. Structure Type

- 17.6.4. Packaging Type

- 17.6.5. Technology

- 17.6.6. Functionality

- 17.6.7. Distribution

- 17.6.8. End-Use Industry

- 17.7. Israel Metalized Flexible Packaging Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Material

- 17.7.3. Structure Type

- 17.7.4. Packaging Type

- 17.7.5. Technology

- 17.7.6. Functionality

- 17.7.7. Distribution

- 17.7.8. End-Use Industry

- 17.8. Rest of Middle East Metalized Flexible Packaging Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Material

- 17.8.3. Structure Type

- 17.8.4. Packaging Type

- 17.8.5. Technology

- 17.8.6. Functionality

- 17.8.7. Distribution

- 17.8.8. End-Use Industry

- 18. Africa Metalized Flexible Packaging Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 18.3.1. Material

- 18.3.2. Structure Type

- 18.3.3. Packaging Type

- 18.3.4. Technology

- 18.3.5. Functionality

- 18.3.6. Distribution

- 18.3.7. End-Use Industry

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Metalized Flexible Packaging Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Material

- 18.4.3. Structure Type

- 18.4.4. Packaging Type

- 18.4.5. Technology

- 18.4.6. Functionality

- 18.4.7. Distribution

- 18.4.8. End-Use Industry

- 18.5. Egypt Metalized Flexible Packaging Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Material

- 18.5.3. Structure Type

- 18.5.4. Packaging Type

- 18.5.5. Technology

- 18.5.6. Functionality

- 18.5.7. Distribution

- 18.5.8. End-Use Industry

- 18.6. Nigeria Metalized Flexible Packaging Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Material

- 18.6.3. Structure Type

- 18.6.4. Packaging Type

- 18.6.5. Technology

- 18.6.6. Functionality

- 18.6.7. Distribution

- 18.6.8. End-Use Industry

- 18.7. Algeria Metalized Flexible Packaging Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Material

- 18.7.3. Structure Type

- 18.7.4. Packaging Type

- 18.7.5. Technology

- 18.7.6. Functionality

- 18.7.7. Distribution

- 18.7.8. End-Use Industry

- 18.8. Rest of Africa Metalized Flexible Packaging Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Material

- 18.8.3. Structure Type

- 18.8.4. Packaging Type

- 18.8.5. Technology

- 18.8.6. Functionality

- 18.8.7. Distribution

- 18.8.8. End-Use Industry

- 19. South America Metalized Flexible Packaging Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Central and South Africa Metalized Flexible Packaging Market Size in Value (US$ Billion), Analysis, and Forecasts, 2021-2035

- 19.3.1. Material

- 19.3.2. Structure Type

- 19.3.3. Packaging Type

- 19.3.4. Technology

- 19.3.5. Functionality

- 19.3.6. Distribution

- 19.3.7. End-Use Industry

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Metalized Flexible Packaging Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Material

- 19.4.3. Structure Type

- 19.4.4. Packaging Type

- 19.4.5. Technology

- 19.4.6. Functionality

- 19.4.7. Distribution

- 19.4.8. End-Use Industry

- 19.5. Argentina Metalized Flexible Packaging Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Material

- 19.5.3. Structure Type

- 19.5.4. Packaging Type

- 19.5.5. Technology

- 19.5.6. Functionality

- 19.5.7. Distribution

- 19.5.8. End-Use Industry

- 19.6. Rest of South America Metalized Flexible Packaging Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Material

- 19.6.3. Structure Type

- 19.6.4. Packaging Type

- 19.6.5. Technology

- 19.6.6. Functionality

- 19.6.7. Distribution

- 19.6.8. End-Use Industry

- 20. Key Players/ Company Profile

- 20.1. Amcor plc

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. AR Metallizing (Nissha Co., Ltd.)

- 20.3. Berry Global Inc.

- 20.4. Bischof + Klein SE & Co. KG

- 20.5. Celplast Metallized Products Limited

- 20.6. Clondalkin Group

- 20.7. Constantia Flexibles

- 20.8. Cosmo Films Ltd.

- 20.9. Glenroy, Inc.

- 20.10. Huhtamaki Oyj

- 20.11. Jindal Poly Films Ltd.

- 20.12. Mondi Group

- 20.13. Polyplex Corporation Ltd.

- 20.14. Sealed Air Corporation

- 20.15. Sonoco Products Company

- 20.16. Toppan Printing Co., Ltd.

- 20.17. Toray Plastics (America), Inc.

- 20.18. Transcontinental Inc.

- 20.19. Uflex Ltd.

- 20.20. Winpak Ltd.

- 20.21. Other Key Players

- 20.1. Amcor plc

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography.

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data