Motion Control Systems Market Size, Share & Trends Analysis Report by Component Type (Motion Controllers, Motors, Actuators & Mechanical Systems, Drives & Amplifiers, Sensors & Feedback Devices, Software), System Type, Axis Type, Rated Capacity (Torque), Rated Power, Communication Protocol, Control Type, Precision Level, Mounting Configuration, End-Use Industry and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Motion Control Systems Market Size, Share, and Growth

The global motion control systems market is witnessing strong growth, valued at USD 12.8 billion in 2025 and projected to reach USD 19.3 billion by 2035, expanding at a CAGR of 4.2% during the forecast period. North America is the fastest-growing region in the motion control systems market due to increasing automation adoption and demand for advanced manufacturing technologies.

Sanjay Soni, Managing Director of izmo Ltd, said, “This motor controller is an important milestone for izmomicro, bringing together our expertise in power electronics, systems design, and advanced manufacturing, It is technologies like these that will power India’s rapidly expanding industrial and EV ecosystem. By delivering this product entirely in-house, we are not only demonstrating advanced design capability but also India’s growing strength in developing globally competitive solutions”.

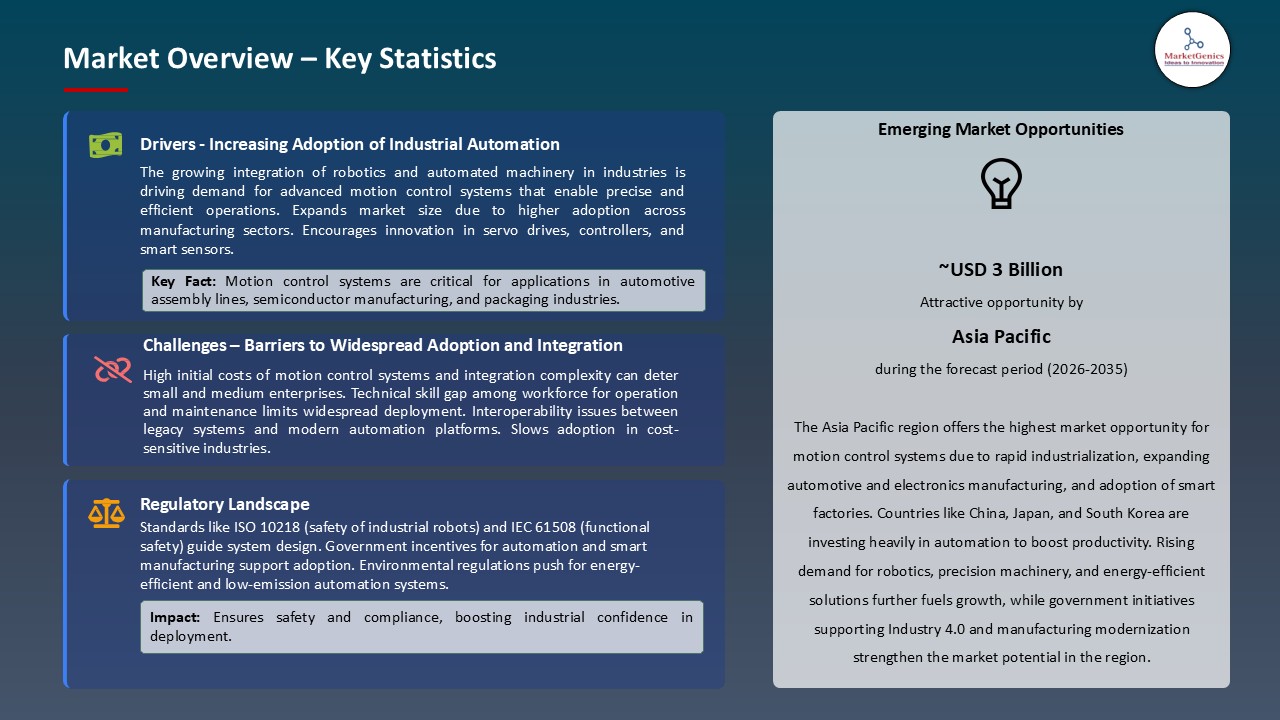

The growing use of automated production and robotization of the industries is fueling the need of sophisticated motion control systems. These systems permit a means of precise control of motors, actuators and robotic arms and enhance operation efficiency, decrease human error and maximize production throughput. With the adoption of Industry 4.0 and smart manufacturing in factories, motion control controllers need to be reliable and capable of high performance in order to facilitate smooth automation and provide high productivity.

The increasing need of the high-efficiency, space-saving, and safer motor control solutions is a big opportunity to the market. Compact motion controllers require less energy, less operational cost and increase system reliability are becoming essential to industries. Power electronics, thermal management, and miniaturized designs allow manufacturers to create smarter, greener, and more sustainable automation designs in the fields of industrial, automotive and robotics design.

The key adjacent market opportunities are industrial IoT platforms to data analytics, cloud-based monitoring solutions, edge computing infrastructure, and artificial intelligence applications. These complementary technologies open up synergistic integration opportunities that increase the overall addressable market and allows manufactures to offer comprehensive solutions to many customer pain points at the same time.

Motion Control Systems Market Dynamics and Trends

Driver: Growing Demand for Precision Manufacturing and Assembly

- The increasing need in precision manufacture and automation of assembly is a major force in the motion control systems market. High-precision machinery is used in industries like automotive, electronics, aerospace, and medical products to enhance the quality of their products, minimize defect, and increase the efficiency of production.

- Motion control systems allow machines to be positioned precisely, have a speed regulator and synchronization that are important in areas such as component assembly, robots, and automated inspection. The use of advanced motion control solutions is gaining rapid momentum as producers aim to achieve tighter tolerances, increased throughput, and more flexible production abilities.

- Mark Roberts Motion Control (MRMC) introduced the Cinebot Nano, a small, mobile 9-axis camera robot that is used to shoot on-location with precision. It has a 4.2m/s speed, 7kg load, and 1m reach, so it is easy to set up, has PushMoco control, and the Flair Lite software, which shows that the market is increasingly demanding high-precision, portable motion control solutions in the film and content creation process.

- The trend indicates that the rise of more specificity, efficiency, and portability is leading to the extensive spread of sophisticated motion control systems in the industries.

Restraint: High Initial Capital Investment Requirements

- The motion control systems market faces a major constraint in the form of large initial capital outlay to buy and install these advanced solutions. Motion control systems are composed of precision motors, drives, controllers, sensors, and software with high initial investment and therefore are less available to small and medium-sized enterprises (SMEs) or price sensitive manufacturers. Besides the cost of hardware, there are system integration, customization, training and maintenance costs that further escalate the amount invested.

- Industries interested in implementing motion control technologies should not only focus on the purchase price, but also on the amount of money they would need to invest in order to upgrade the existing equipment, design the production lines, and implement the complex automation software. In industries with constrained budgets or small volumes of production, these kinds of investments might be viewed as costly economically, slowing down or restricting its implementation.

- Motion control systems can improve efficiency, quality, and precision, but their high initial cost can be a barrier for small enterprises and developing nations. This financial constraint shortens the time to enter the market, and cost minimization is a primary concern for motion control system vendors.

Opportunity: Expansion in Electric Vehicle and Battery Manufacturing

- Motion control systems market has a major opportunity in the fast-growing electric vehicle (EV) and battery manufacturing industry. The production of EVs implies some complicated assembly operations, such as battery module management, motor assembly, and the correct positioning of the components, which need high-precision motion control systems.

- State-of-the-art motion control systems allow manufacturers to attain precise positioning, coordinated processes and consistency in production which improves the efficiency of production and the quality of a product. Also, the growing use of automated assembly lines and robotics in EV and battery productions promotes the need to develop scalable and flexible motion control technologies.

- Parker Hannifin opened the first certified Mobile Electrification Technology Center (METC) in North America in March 2025, to assist OEMs and fleet operators in electrifying mobile equipment. The center offers complete hydraulic, electrical and control solutions that enhance energy efficiency, range of operations and performance implying the increasing demand of motion control systems in electric vehicle and battery production.

- As the EV industry expands, there will be a greater demand for high-quality motion control systems, opening up new opportunities for solution providers.

Key Trend: Integration of Artificial Intelligence for Adaptive Motion Control

- The application of Artificial Intelligence (AI) to adaptive motion control is a current trend in the motion control systems market. Motion control systems enabled by AI may examine real time operative data, forecast the system behavior and dynamically modify the motor speeds, positions and paths to optimize the performance. This improves accuracy, saves on time and allows a predictive maintenance that is less costly to operate.

- The automotive, electronics, aerospace, and robotics industries are also shifting to AI-based motion control to do complex tasks, enhance efficiency, and sustain high quality of work. With machines learning and adjusting to environmental changes, the implementation of AI is changing conventional motion control into self-optimizing systems and pushing to greater heights productivity and opening new possibilities of automation and advanced manufacturing.

- Infineon Technologies collaborated with NVIDIA to bring humanoid robotics into a new era In August 2025, Infineon Technologies partnered with NVIDIA to use Infineon microcontrollers, sensors, smart actuators, and NVIDIA Jetson Thor to provide real-time, AI-enabled precision motion control. This cooperation allows humanoid robots in the manufacturing, logistics, and healthcare to be highly efficient, versatile, and safe, thus putting a new standard of intelligent robotic systems.

- Intelligent, adaptive and highly efficient systems are being developed as a result of the integration of AI in motion control, improving precision, productivity, and automation in industries.

Motion-Control-Systems-Market Analysis and Segmental Data

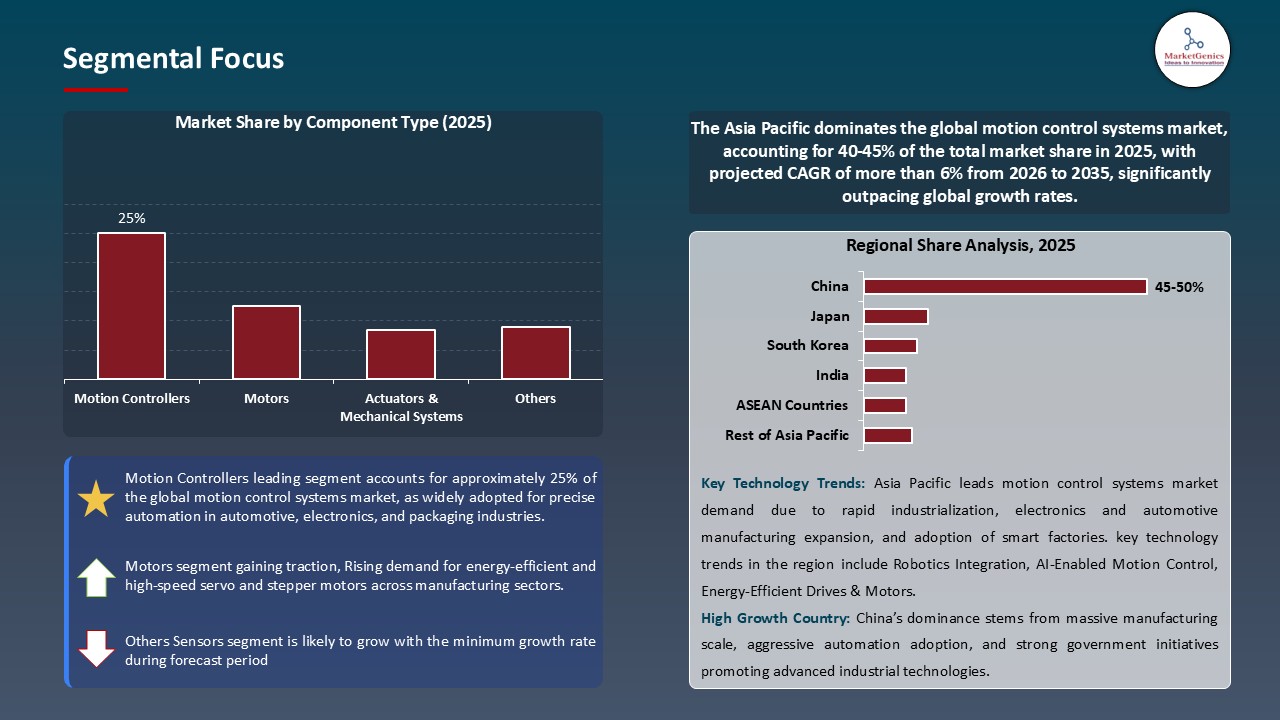

Motion Controllers Dominate Global Motion Control Systems Market

- The motion controllers segment is the leading global motion control systems market because of their importance in controlling and coordinating movement of machines with high precision and reliability. The motion controllers act as a central processing unit of motion control systems allowing the precise synchronization of motors, drives and actuators in a diverse range of industrial applications including automotive, electronics, aerospace, robotics and packaging.

- The execution of complex motion profiles, multi-axis support, and sensor and feedback integration make them necessary in achieving high productivity, minimized error, and optimally functioning efficiency. The demand of sophisticated motion controllers is also the key factor that propels the market leadership of the segment as the automation and smart manufacturing trend is gaining momentum in the industries.

- Mitsubishi Electric released MELSEC MX Controller, a high-speed, multi-axis motion controller with 128 axes using CC-Link IE TSN, OPC UA, cybersecurity and without code-based programming, which can drive smart manufacturing and digital transformation of industries such as batteries with lithium-ione, semiconductors, and LCD manufacturing.

- The prevalence of motion controllers underscores the significance of motion controllers in the facilitation of high-precision, multi-axis, and efficient automation in various industries.

Asia Pacific Leads Global Motion Control Systems Market Demand

- The Asia Pacific region dominates the global motion control systems market because of the high pace in industrialization, the increasing use of automation and the increased manufacturing industries. The nations like China, Japan, South Korea, and India are putting money in smart factory, robotics and other high-tech production methods to improve the efficiency, accuracy and productivity of operations.

- The high automotive, electronics, semiconductor, and consumer goods manufacturing in the region further contributes to the demand of a motion control solution that will support multi-axis control, high-speed capabilities, and easy integration with the sensor and feedback devices.

- Besides, the governmental programs to stimulate Industry 4.0, digital transformation, and energy-efficient manufacturing approaches are increasing the pace of the implementation of the sophisticated motion controllers, drives, and actuators, which precondition that Asia Pacific is the most significant and active market in the world.

- An example of a 2025 relevancy is Inovance Technology India propelling smart manufacturing through its EtherCAT-based servo drives, motion controllers, PLCs, HMIs and robotic solutions. The solutions used in packaging, textiles, food and beverage production, and electronics allow high-speed and precise and synchronized work, enhance throughput and accuracy, and minimize waste, and digital transformation via IIoT connectivity, predictive maintenance, and production optimization implemented in Indian shopfloors.

- The Asia Pacific is becoming the most vibrant and dominant motion control systems market due to the strong industrialization, wider use of automation, and sophisticated motion control systems.

Motion-Control-Systems-Market Ecosystem

The market of the global motion control systems is fragmented with major players such as Siemens AG, ABB Ltd., Yaskawa Electric Corporation, Fanuc Corporation, and Rockwell Automation Inc. controlling about 25% percent of the market. The companies exploit the established customer relationships, performance of the platform over time, and ability to integrate with various industrial settings to have a competitive advantage.

The value chain of the market includes the development of SCADA software and motion control development, HMI and visualization software development, controller and drive development, system development, commissioning, and maintenance, and cybersecurity management. Major vendors in the market normally build fundamental platforms and work in partnership with the hardware vendors and integration partners to offer total solutions.

High barriers to entry of this ecosystem are due to the maturity of the technologies, customer relationships and need to have reliable, tested operational systems, such that major players can continue playing in the market, and niche vendors can innovate in all the special applications or industry-specific segments.

Recent Development and Strategic Overview:

- In September 2025, izmomicro declared a new technology breakthrough in motor control methods of high performance, its Galvanic Isolated Hex Bridge Inverter. The controller is aimed at industrial automation, robotics, EVs, aerospace and defense and delivers 100A continuous at 48VDC galvanically isolated to support three-phase Servo/BLDC motors.

- In May 2025, igus GmbH augmented its D1 motor control with Siemens approved PROFINET/ PROFIdrive integration to make seamless and fast connection to upper-level control systems such as Siemens, Beckhoff, Wago, and others. The update can run stepper, DC, EC/BLDC motors in electric linear drives, handling systems, as well as robot axes, with cycle speeds of 816ms.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 12.8 Bn |

|

Market Forecast Value in 2035 |

USD 19.3 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Motion-Control-Systems-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Motion Control Systems Market, By Component Type |

|

|

Motion Control Systems Market, By System Type |

|

|

Motion Control Systems Market, By Axis Type |

|

|

Motion Control Systems Market, By Rated Capacity (Torque) |

|

|

Motion Control Systems Market, By Rated Power |

|

|

Motion Control Systems Market, By Communication Protocol |

|

|

Motion Control Systems Market, By Control Type |

|

|

Motion Control Systems Market, By Precision Level |

|

|

Motion Control Systems Market, By Mounting Configuration |

|

|

Motion Control Systems Market, By End-Use Industry |

|

Frequently Asked Questions

The global motion control systems market was valued at USD 12.8 Bn in 2025.

The global motion control systems market industry is expected to grow at a CAGR of 4.2% from 2026 to 2035.

Key factors driving demand include growing demand for precision manufacturing and assembly automation, increasing industrial automation adoption, technological innovation, and growing requirements for operational efficiency and safety compliance across multiple industry verticals.

In terms of component type, the motion controllers segment accounted for the major share in 2025.

Asia Pacific is the most attractive region for motion control systems market.

Prominent players operating in the global motion control systems market are ABB Ltd., Beckhoff Automation GmbH, Bosch Rexroth AG, Delta Electronics Inc., Emerson Electric Co., Fanuc Corporation, Fuji Electric Co. Ltd., Lenze SE, Mitsubishi Electric Corporation, Moog Inc., Nidec Corporation, OMRON Corporation, Panasonic Corporation, Parker Hannifin Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Toshiba Corporation, Trio Motion Technology Ltd., Yaskawa Electric Corporation, and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Motion Control Systems Market Outlook

- 2.1.1. Motion Control Systems Market Size Value (US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Motion Control Systems Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 3.1.1. Automation & Process Control Industry Ecosystem Analysis

- 3.1.2. Key Trends for Automation & Process Control Industry

- 3.1.3. Regional Distribution for Automation & Process Control Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Automation & Process Control Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Rising industrial automation and adoption of Industry 4.0.

- 4.1.1.2. Growth of robotics and semiconductor/electronics manufacturing.

- 4.1.1.3. Technological innovation, including AI/IoT integration and advanced sensors.

- 4.1.2. Restraints

- 4.1.2.1. High initial investment and setup/maintenance costs.

- 4.1.2.2. Complexity in integrating motion control systems with existing or legacy equipment.

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Component Suppliers

- 4.4.2. Technology Providers

- 4.4.3. System Integrators

- 4.4.4. Distributors & Dealers

- 4.4.5. End-Users

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Motion Control Systems Market Demand

- 4.9.1. Historical Market Size – Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Motion Control Systems Market Analysis, by Component Type

- 6.1. Key Segment Analysis

- 6.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Component Type, 2021-2035

- 6.2.1. Motion Controllers

- 6.2.1.1. Standalone Motion Controllers

- 6.2.1.2. PC-based Motion Controllers

- 6.2.1.3. PLCs with Motion Control

- 6.2.1.4. Others

- 6.2.2. Motors

- 6.2.2.1. Servo Motors

- 6.2.2.1.1. AC Servo Motors

- 6.2.2.1.2. DC Servo Motors

- 6.2.2.2. Stepper Motors

- 6.2.2.3. Linear Motors

- 6.2.2.4. Others

- 6.2.2.1. Servo Motors

- 6.2.3. Actuators & Mechanical Systems

- 6.2.3.1. Electric Actuators

- 6.2.3.2. Hydraulic Actuators

- 6.2.3.3. Pneumatic Actuators

- 6.2.3.4. Others

- 6.2.4. Drives & Amplifiers

- 6.2.4.1. Servo Drives

- 6.2.4.2. Stepper Drives

- 6.2.4.3. Variable Frequency Drives (VFD)

- 6.2.4.4. Others

- 6.2.5. Sensors & Feedback Devices

- 6.2.5.1. Encoders

- 6.2.5.2. Resolvers

- 6.2.5.3. Linear Position Sensors

- 6.2.5.4. Others

- 6.2.6. Software

- 6.2.6.1. Motion Control Software

- 6.2.6.2. HMI/SCADA Software

- 6.2.6.3. Others

- 6.2.1. Motion Controllers

- 7. Global Motion Control Systems Market Analysis, by System Type

- 7.1. Key Segment Analysis

- 7.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by System Type, 2021-2035

- 7.2.1. Open Loop Systems

- 7.2.2. Closed Loop Systems

- 7.2.3. Hybrid Systems

- 8. Global Motion Control Systems Market Analysis, by Axis Type

- 8.1. Key Segment Analysis

- 8.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Axis Type, 2021-2035

- 8.2.1. Single-Axis Motion Control

- 8.2.2. Multi-Axis Motion Control

- 8.2.2.1. 2-Axis Systems

- 8.2.2.2. 3-Axis Systems

- 8.2.2.3. 4-Axis and Above

- 9. Global Motion Control Systems Market Analysis, by Rated Capacity (Torque)

- 9.1. Key Segment Analysis

- 9.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Rated Capacity (Torque), 2021-2035

- 9.2.1. Up to 10 Nm

- 9.2.2. 10 Nm to 100 Nm

- 9.2.3. 100 Nm to 500 Nm

- 9.2.4. Above 500 Nm

- 10. Global Motion Control Systems Market Analysis, by Rated Power

- 10.1. Key Segment Analysis

- 10.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Rated Power, 2021-2035

- 10.2.1. Up to 1 kW

- 10.2.2. 1 kW to 10 kW

- 10.2.3. 10 kW to 50 kW

- 10.2.4. Above 50 kW

- 11. Global Motion Control Systems Market Analysis, by Communication Protocol

- 11.1. Key Segment Analysis

- 11.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Communication Protocol, 2021-2035

- 11.2.1. EtherCAT

- 11.2.2. PROFINET

- 11.2.3. Ethernet/IP

- 11.2.4. CANopen

- 11.2.5. SERCOS

- 11.2.6. Modbus

- 11.2.7. Proprietary Protocols

- 12. Global Motion Control Systems Market Analysis, by Control Type

- 12.1. Key Segment Analysis

- 12.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Control Type, 2021-2035

- 12.2.1. Point-to-Point Control

- 12.2.2. Path Control

- 12.2.3. Coordinated Motion Control

- 12.2.4. Electronic Gearing

- 12.2.5. Electronic Camming

- 12.2.6. Others

- 13. Global Motion Control Systems Market Analysis, by Precision Level

- 13.1. Key Segment Analysis

- 13.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Precision Level, 2021-2035

- 13.2.1. Standard Precision

- 13.2.2. High Precision

- 13.2.3. Ultra-High Precision

- 14. Global Motion Control Systems Market Analysis, by Mounting Configuration

- 14.1. Key Segment Analysis

- 14.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Mounting Configuration, 2021-2035

- 14.2.1. Horizontal Mount

- 14.2.2. Vertical Mount

- 14.2.3. Flange Mount

- 14.2.4. Foot Mount

- 15. Global Motion Control Systems Market Analysis, by End-Use Industry

- 15.1. Key Segment Analysis

- 15.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by End-Use Industry, 2021-2035

- 15.2.1. Automotive

- 15.2.1.1. Assembly Lines

- 15.2.1.2. Welding & Robotics

- 15.2.1.3. Material Handling

- 15.2.1.4. Paint & Coating Systems

- 15.2.1.5. Testing & Quality Control

- 15.2.1.6. Others

- 15.2.2. Electronics & Semiconductor

- 15.2.2.1. PCB Assembly

- 15.2.2.2. Pick & Place Operations

- 15.2.2.3. Wafer Handling

- 15.2.2.4. Die Bonding

- 15.2.2.5. Testing Equipment

- 15.2.2.6. Others

- 15.2.3. Food & Beverage

- 15.2.3.1. Packaging Systems

- 15.2.3.2. Filling & Bottling

- 15.2.3.3. Sorting & Inspection

- 15.2.3.4. Conveying Systems

- 15.2.3.5. Cutting & Slicing

- 15.2.3.6. Others

- 15.2.4. Pharmaceutical & Medical Devices

- 15.2.4.1. Laboratory Automation

- 15.2.4.2. Drug Manufacturing

- 15.2.4.3. Medical Device Assembly

- 15.2.4.4. Packaging & Labeling

- 15.2.4.5. Diagnostic Equipment

- 15.2.4.6. Others

- 15.2.5. Aerospace & Defense

- 15.2.5.1. Aircraft Manufacturing

- 15.2.5.2. Flight Simulators

- 15.2.5.3. Satellite Positioning Systems

- 15.2.5.4. UAV/Drone Control

- 15.2.5.5. Testing Equipment

- 15.2.5.6. Others

- 15.2.6. Metal & Mining

- 15.2.6.1. CNC Machining

- 15.2.6.2. Metal Forming & Stamping

- 15.2.6.3. Welding Automation

- 15.2.6.4. Material Handling

- 15.2.6.5. Surface Treatment

- 15.2.6.6. Others

- 15.2.7. Printing & Paper

- 15.2.7.1. Printing Presses

- 15.2.7.2. Web Handling

- 15.2.7.3. Cutting & Trimming

- 15.2.7.4. Laminating

- 15.2.7.5. Packaging

- 15.2.7.6. Others

- 15.2.8. Textile

- 15.2.8.1. Weaving Machines

- 15.2.8.2. Knitting Machines

- 15.2.8.3. Dyeing & Finishing

- 15.2.8.4. Cutting & Sewing

- 15.2.8.5. Embroidery

- 15.2.8.6. Others

- 15.2.9. Packaging

- 15.2.9.1. Cartoning Machines

- 15.2.9.2. Wrapping Systems

- 15.2.9.3. Labeling Equipment

- 15.2.9.4. Palletizing

- 15.2.9.5. Form-Fill-Seal Machines

- 15.2.9.6. Others

- 15.2.10. Material Handling & Logistics

- 15.2.10.1. Automated Guided Vehicles (AGVs)

- 15.2.10.2. Conveyors

- 15.2.10.3. Sortation Systems

- 15.2.10.4. Cranes & Hoists

- 15.2.10.5. Warehouse Automation

- 15.2.10.6. Others

- 15.2.11. Robotics & Automation

- 15.2.11.1. Industrial Robots

- 15.2.11.2. Collaborative Robots (Cobots)

- 15.2.11.3. Gantry Systems

- 15.2.11.4. SCARA Robots

- 15.2.11.5. Delta Robots

- 15.2.11.6. Others

- 15.2.12. Renewable Energy

- 15.2.12.1. Solar Panel Manufacturing

- 15.2.12.2. Wind Turbine Systems

- 15.2.12.3. Solar Tracking Systems

- 15.2.12.4. Battery Manufacturing

- 15.2.12.5. Energy Storage Systems

- 15.2.12.6. Others

- 15.2.13. Other Industries

- 15.2.1. Automotive

- 16. Global Motion Control Systems Market Analysis and Forecasts, by Region

- 16.1. Key Findings

- 16.2. Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 16.2.1. North America

- 16.2.2. Europe

- 16.2.3. Asia Pacific

- 16.2.4. Middle East

- 16.2.5. Africa

- 16.2.6. South America

- 17. North America Motion Control Systems Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. North America Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Component Type

- 17.3.2. System Type

- 17.3.3. Axis Type

- 17.3.4. Rated Capacity (Torque)

- 17.3.5. Rated Power

- 17.3.6. Communication Protocol

- 17.3.7. Control Type

- 17.3.8. Precision Level

- 17.3.9. Mounting Configuration

- 17.3.10. End-Use Industry

- 17.3.11. Country

- 17.3.11.1. USA

- 17.3.11.2. Canada

- 17.3.11.3. Mexico

- 17.4. USA Motion Control Systems Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Component Type

- 17.4.3. System Type

- 17.4.4. Axis Type

- 17.4.5. Rated Capacity (Torque)

- 17.4.6. Rated Power

- 17.4.7. Communication Protocol

- 17.4.8. Control Type

- 17.4.9. Precision Level

- 17.4.10. Mounting Configuration

- 17.4.11. End-Use Industry

- 17.5. Canada Motion Control Systems Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Component Type

- 17.5.3. System Type

- 17.5.4. Axis Type

- 17.5.5. Rated Capacity (Torque)

- 17.5.6. Rated Power

- 17.5.7. Communication Protocol

- 17.5.8. Control Type

- 17.5.9. Precision Level

- 17.5.10. Mounting Configuration

- 17.5.11. End-Use Industry

- 17.6. Mexico Motion Control Systems Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Component Type

- 17.6.3. System Type

- 17.6.4. Axis Type

- 17.6.5. Rated Capacity (Torque)

- 17.6.6. Rated Power

- 17.6.7. Communication Protocol

- 17.6.8. Control Type

- 17.6.9. Precision Level

- 17.6.10. Mounting Configuration

- 18. End-Use Industry Europe Motion Control Systems Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Europe Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Component Type

- 18.3.2. System Type

- 18.3.3. Axis Type

- 18.3.4. Rated Capacity (Torque)

- 18.3.5. Rated Power

- 18.3.6. Communication Protocol

- 18.3.7. Control Type

- 18.3.8. Precision Level

- 18.3.9. Mounting Configuration

- 18.3.10. End-Use Industry

- 18.3.10.1. Germany

- 18.3.10.2. United Kingdom

- 18.3.10.3. France

- 18.3.10.4. Italy

- 18.3.10.5. Spain

- 18.3.10.6. Netherlands

- 18.3.10.7. Nordic Countries

- 18.3.10.8. Poland

- 18.3.10.9. Russia & CIS

- 18.3.10.10. Rest of Europe

- 18.4. Germany Motion Control Systems Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Component Type

- 18.4.3. System Type

- 18.4.4. Axis Type

- 18.4.5. Rated Capacity (Torque)

- 18.4.6. Rated Power

- 18.4.7. Communication Protocol

- 18.4.8. Control Type

- 18.4.9. Precision Level

- 18.4.10. Mounting Configuration

- 18.4.11. End-Use Industry

- 18.5. United Kingdom Motion Control Systems Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Component Type

- 18.5.3. System Type

- 18.5.4. Axis Type

- 18.5.5. Rated Capacity (Torque)

- 18.5.6. Rated Power

- 18.5.7. Communication Protocol

- 18.5.8. Control Type

- 18.5.9. Precision Level

- 18.5.10. Mounting Configuration

- 18.5.11. End-Use Industry

- 18.6. France Motion Control Systems Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Component Type

- 18.6.3. System Type

- 18.6.4. Axis Type

- 18.6.5. Rated Capacity (Torque)

- 18.6.6. Rated Power

- 18.6.7. Communication Protocol

- 18.6.8. Control Type

- 18.6.9. Precision Level

- 18.6.10. Mounting Configuration

- 18.6.11. End-Use Industry

- 18.7. Italy Motion Control Systems Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Component Type

- 18.7.3. System Type

- 18.7.4. Axis Type

- 18.7.5. Rated Capacity (Torque)

- 18.7.6. Rated Power

- 18.7.7. Communication Protocol

- 18.7.8. Control Type

- 18.7.9. Precision Level

- 18.7.10. Mounting Configuration

- 18.7.11. End-Use Industry

- 18.8. Spain Motion Control Systems Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Component Type

- 18.8.3. System Type

- 18.8.4. Axis Type

- 18.8.5. Rated Capacity (Torque)

- 18.8.6. Rated Power

- 18.8.7. Communication Protocol

- 18.8.8. Control Type

- 18.8.9. Precision Level

- 18.8.10. Mounting Configuration

- 18.8.11. End-Use Industry

- 18.9. Netherlands Motion Control Systems Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Component Type

- 18.9.3. System Type

- 18.9.4. Axis Type

- 18.9.5. Rated Capacity (Torque)

- 18.9.6. Rated Power

- 18.9.7. Communication Protocol

- 18.9.8. Control Type

- 18.9.9. Precision Level

- 18.9.10. Mounting Configuration

- 18.9.11. End-Use Industry

- 18.10. Nordic Countries Motion Control Systems Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Component Type

- 18.10.3. System Type

- 18.10.4. Axis Type

- 18.10.5. Rated Capacity (Torque)

- 18.10.6. Rated Power

- 18.10.7. Communication Protocol

- 18.10.8. Control Type

- 18.10.9. Precision Level

- 18.10.10. Mounting Configuration

- 18.10.11. End-Use Industry

- 18.11. Poland Motion Control Systems Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Component Type

- 18.11.3. System Type

- 18.11.4. Axis Type

- 18.11.5. Rated Capacity (Torque)

- 18.11.6. Rated Power

- 18.11.7. Communication Protocol

- 18.11.8. Control Type

- 18.11.9. Precision Level

- 18.11.10. Mounting Configuration

- 18.11.11. End-Use Industry

- 18.12. Russia & CIS Motion Control Systems Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Component Type

- 18.12.3. System Type

- 18.12.4. Axis Type

- 18.12.5. Rated Capacity (Torque)

- 18.12.6. Rated Power

- 18.12.7. Communication Protocol

- 18.12.8. Control Type

- 18.12.9. Precision Level

- 18.12.10. Mounting Configuration

- 18.12.11. End-Use Industry

- 18.13. Rest of Europe Motion Control Systems Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Component Type

- 18.13.3. System Type

- 18.13.4. Axis Type

- 18.13.5. Rated Capacity (Torque)

- 18.13.6. Rated Power

- 18.13.7. Communication Protocol

- 18.13.8. Control Type

- 18.13.9. Precision Level

- 18.13.10. Mounting Configuration

- 18.13.11. End-Use Industry

- 18.13.12. End-use Industry

- 19. Asia Pacific Motion Control Systems Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Asia Pacific Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Component Type

- 19.3.2. System Type

- 19.3.3. Axis Type

- 19.3.4. Rated Capacity (Torque)

- 19.3.5. Rated Power

- 19.3.6. Communication Protocol

- 19.3.7. Control Type

- 19.3.8. Precision Level

- 19.3.9. Mounting Configuration

- 19.3.10. End-Use Industry

- 19.3.11. Country

- 19.3.11.1. China

- 19.3.11.2. India

- 19.3.11.3. Japan

- 19.3.11.4. South Korea

- 19.3.11.5. Australia and New Zealand

- 19.3.11.6. Indonesia

- 19.3.11.7. Malaysia

- 19.3.11.8. Thailand

- 19.3.11.9. Vietnam

- 19.3.11.10. Rest of Asia Pacific

- 19.4. China Motion Control Systems Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Component Type

- 19.4.3. System Type

- 19.4.4. Axis Type

- 19.4.5. Rated Capacity (Torque)

- 19.4.6. Rated Power

- 19.4.7. Communication Protocol

- 19.4.8. Control Type

- 19.4.9. Precision Level

- 19.4.10. Mounting Configuration

- 19.4.11. End-Use Industry

- 19.5. India Motion Control Systems Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Component Type

- 19.5.3. System Type

- 19.5.4. Axis Type

- 19.5.5. Rated Capacity (Torque)

- 19.5.6. Rated Power

- 19.5.7. Communication Protocol

- 19.5.8. Control Type

- 19.5.9. Precision Level

- 19.5.10. Mounting Configuration

- 19.5.11. End-Use Industry

- 19.6. Japan Motion Control Systems Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Component Type

- 19.6.3. System Type

- 19.6.4. Axis Type

- 19.6.5. Rated Capacity (Torque)

- 19.6.6. Rated Power

- 19.6.7. Communication Protocol

- 19.6.8. Control Type

- 19.6.9. Precision Level

- 19.6.10. Mounting Configuration

- 19.6.11. End-Use Industry

- 19.7. South Korea Motion Control Systems Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Sensor Type

- 19.7.3. Component Type

- 19.7.4. System Type

- 19.7.5. Axis Type

- 19.7.6. Rated Capacity (Torque)

- 19.7.7. Rated Power

- 19.7.8. Communication Protocol

- 19.7.9. Control Type

- 19.7.10. Precision Level

- 19.7.11. Mounting Configuration

- 19.7.12. End-Use Industry

- 19.8. Australia and New Zealand Motion Control Systems Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Component Type

- 19.8.3. System Type

- 19.8.4. Axis Type

- 19.8.5. Rated Capacity (Torque)

- 19.8.6. Rated Power

- 19.8.7. Communication Protocol

- 19.8.8. Control Type

- 19.8.9. Precision Level

- 19.8.10. Mounting Configuration

- 19.8.11. End-Use Industry

- 19.9. Indonesia Motion Control Systems Market

- 19.9.1. Country Segmental Analysis

- 19.9.2. Component Type

- 19.9.3. System Type

- 19.9.4. Axis Type

- 19.9.5. Rated Capacity (Torque)

- 19.9.6. Rated Power

- 19.9.7. Communication Protocol

- 19.9.8. Control Type

- 19.9.9. Precision Level

- 19.9.10. Mounting Configuration

- 19.9.11. End-Use Industry

- 19.10. Malaysia Motion Control Systems Market

- 19.10.1. Country Segmental Analysis

- 19.10.2. Component Type

- 19.10.3. System Type

- 19.10.4. Axis Type

- 19.10.5. Rated Capacity (Torque)

- 19.10.6. Rated Power

- 19.10.7. Communication Protocol

- 19.10.8. Control Type

- 19.10.9. Precision Level

- 19.10.10. Mounting Configuration

- 19.10.11. End-Use Industry

- 19.11. Thailand Motion Control Systems Market

- 19.11.1. Country Segmental Analysis

- 19.11.2. Component Type

- 19.11.3. System Type

- 19.11.4. Axis Type

- 19.11.5. Rated Capacity (Torque)

- 19.11.6. Rated Power

- 19.11.7. Communication Protocol

- 19.11.8. Control Type

- 19.11.9. Precision Level

- 19.11.10. Mounting Configuration

- 19.11.11. End-Use Industry

- 19.12. Vietnam Motion Control Systems Market

- 19.12.1. Country Segmental Analysis

- 19.12.2. Component Type

- 19.12.3. System Type

- 19.12.4. Axis Type

- 19.12.5. Rated Capacity (Torque)

- 19.12.6. Rated Power

- 19.12.7. Communication Protocol

- 19.12.8. Control Type

- 19.12.9. Precision Level

- 19.12.10. Mounting Configuration

- 19.12.11. End-Use Industry

- 19.13. Rest of Asia Pacific Motion Control Systems Market

- 19.13.1. Country Segmental Analysis

- 19.13.2. Component Type

- 19.13.3. System Type

- 19.13.4. Axis Type

- 19.13.5. Rated Capacity (Torque)

- 19.13.6. Rated Power

- 19.13.7. Communication Protocol

- 19.13.8. Control Type

- 19.13.9. Precision Level

- 19.13.10. Mounting Configuration

- 19.13.11. End-Use Industry

- 20. Middle East Motion Control Systems Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Middle East Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Component Type

- 20.3.2. System Type

- 20.3.3. Axis Type

- 20.3.4. Rated Capacity (Torque)

- 20.3.5. Rated Power

- 20.3.6. Communication Protocol

- 20.3.7. Control Type

- 20.3.8. Precision Level

- 20.3.9. Mounting Configuration

- 20.3.10. End-Use Industry

- 20.3.11. Country

- 20.3.11.1. Turkey

- 20.3.11.2. UAE

- 20.3.11.3. Saudi Arabia

- 20.3.11.4. Israel

- 20.3.11.5. Rest of Middle East

- 20.4. Turkey Motion Control Systems Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Component Type

- 20.4.3. System Type

- 20.4.4. Axis Type

- 20.4.5. Rated Capacity (Torque)

- 20.4.6. Rated Power

- 20.4.7. Communication Protocol

- 20.4.8. Control Type

- 20.4.9. Precision Level

- 20.4.10. Mounting Configuration

- 20.4.11. End-Use Industry

- 20.5. UAE Motion Control Systems Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Component Type

- 20.5.3. System Type

- 20.5.4. Axis Type

- 20.5.5. Rated Capacity (Torque)

- 20.5.6. Rated Power

- 20.5.7. Communication Protocol

- 20.5.8. Control Type

- 20.5.9. Precision Level

- 20.5.10. Mounting Configuration

- 20.5.11. End-Use Industry

- 20.6. Saudi Arabia Motion Control Systems Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Component Type

- 20.6.3. System Type

- 20.6.4. Axis Type

- 20.6.5. Rated Capacity (Torque)

- 20.6.6. Rated Power

- 20.6.7. Communication Protocol

- 20.6.8. Control Type

- 20.6.9. Precision Level

- 20.6.10. Mounting Configuration

- 20.6.11. End-Use Industry y

- 20.7. Israel Motion Control Systems Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Component Type

- 20.7.3. System Type

- 20.7.4. Axis Type

- 20.7.5. Rated Capacity (Torque)

- 20.7.6. Rated Power

- 20.7.7. Communication Protocol

- 20.7.8. Control Type

- 20.7.9. Precision Level

- 20.7.10. Mounting Configuration

- 20.7.11. End-Use Industry

- 20.8. Rest of Middle East Motion Control Systems Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Component Type

- 20.8.3. System Type

- 20.8.4. Axis Type

- 20.8.5. Rated Capacity (Torque)

- 20.8.6. Rated Power

- 20.8.7. Communication Protocol

- 20.8.8. Control Type

- 20.8.9. Precision Level

- 20.8.10. Mounting Configuration

- 20.8.11. End-Use Industry

- 21. Africa Motion Control Systems Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. Africa Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Component Type

- 21.3.2. System Type

- 21.3.3. Axis Type

- 21.3.4. Rated Capacity (Torque)

- 21.3.5. Rated Power

- 21.3.6. Communication Protocol

- 21.3.7. Control Type

- 21.3.8. Precision Level

- 21.3.9. Mounting Configuration

- 21.3.10. End-Use Industry

- 21.3.11. Country

- 21.3.11.1. South Africa

- 21.3.11.2. Egypt

- 21.3.11.3. Nigeria

- 21.3.11.4. Algeria

- 21.3.11.5. Rest of Africa

- 21.4. South Africa Motion Control Systems Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Component Type

- 21.4.3. System Type

- 21.4.4. Axis Type

- 21.4.5. Rated Capacity (Torque)

- 21.4.6. Rated Power

- 21.4.7. Communication Protocol

- 21.4.8. Control Type

- 21.4.9. Precision Level

- 21.4.10. Mounting Configuration

- 21.4.11. End-Use Industry

- 21.5. Egypt Motion Control Systems Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Component Type

- 21.5.3. System Type

- 21.5.4. Axis Type

- 21.5.5. Rated Capacity (Torque)

- 21.5.6. Rated Power

- 21.5.7. Communication Protocol

- 21.5.8. Control Type

- 21.5.9. Precision Level

- 21.5.10. Mounting Configuration

- 21.5.11. End-Use Industry

- 21.6. Nigeria Motion Control Systems Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Component Type

- 21.6.3. System Type

- 21.6.4. Axis Type

- 21.6.5. Rated Capacity (Torque)

- 21.6.6. Rated Power

- 21.6.7. Communication Protocol

- 21.6.8. Control Type

- 21.6.9. Precision Level

- 21.6.10. Mounting Configuration

- 21.6.11. End-Use Industry

- 21.7. Algeria Motion Control Systems Market

- 21.7.1. Country Segmental Analysis

- 21.7.2. Component Type

- 21.7.3. System Type

- 21.7.4. Axis Type

- 21.7.5. Rated Capacity (Torque)

- 21.7.6. Rated Power

- 21.7.7. Communication Protocol

- 21.7.8. Control Type

- 21.7.9. Precision Level

- 21.7.10. Mounting Configuration

- 21.7.11. End-Use Industry

- 21.8. Rest of Africa Motion Control Systems Market

- 21.8.1. Country Segmental Analysis

- 21.8.2. Component Type

- 21.8.3. System Type

- 21.8.4. Axis Type

- 21.8.5. Rated Capacity (Torque)

- 21.8.6. Rated Power

- 21.8.7. Communication Protocol

- 21.8.8. Control Type

- 21.8.9. Precision Level

- 21.8.10. Mounting Configuration

- 21.8.11. End-Use Industry

- 22. South America Motion Control Systems Market Analysis

- 22.1. Key Segment Analysis

- 22.2. Regional Snapshot

- 22.3. South America Motion Control Systems Market Size Value (US$ Bn), Analysis, and Forecasts, 2021-2035

- 22.3.1. Sensor Type

- 22.3.2. Technology

- 22.3.3. Output Type

- 22.3.4. Accuracy Class

- 22.3.5. Connectivity

- 22.3.6. Mounting Type

- 22.3.7. End-use Industry

- 22.3.8. Country

- 22.3.8.1. Brazil

- 22.3.8.2. Argentina

- 22.3.8.3. Rest of South America

- 22.4. Brazil Motion Control Systems Market

- 22.4.1. Country Segmental Analysis

- 22.4.2. Component Type

- 22.4.3. System Type

- 22.4.4. Axis Type

- 22.4.5. Rated Capacity (Torque)

- 22.4.6. Rated Power

- 22.4.7. Communication Protocol

- 22.4.8. Control Type

- 22.4.9. Precision Level

- 22.4.10. Mounting Configuration

- 22.4.11. End-Use Industry

- 22.5. Argentina Motion Control Systems Market

- 22.5.1. Country Segmental Analysis

- 22.5.2. Component Type

- 22.5.3. System Type

- 22.5.4. Axis Type

- 22.5.5. Rated Capacity (Torque)

- 22.5.6. Rated Power

- 22.5.7. Communication Protocol

- 22.5.8. Control Type

- 22.5.9. Precision Level

- 22.5.10. Mounting Configuration

- 22.5.11. End-Use Industry

- 22.6. Rest of South America Motion Control Systems Market

- 22.6.1. Country Segmental Analysis

- 22.6.2. Component Type

- 22.6.3. System Type

- 22.6.4. Axis Type

- 22.6.5. Rated Capacity (Torque)

- 22.6.6. Rated Power

- 22.6.7. Communication Protocol

- 22.6.8. Control Type

- 22.6.9. Precision Level

- 22.6.10. Mounting Configuration

- 22.6.11. End-Use Industry

- 23. Key Players/ Company Profile

- 23.1. ABB Ltd.

- 23.1.1. Company Details/ Overview

- 23.1.2. Company Financials

- 23.1.3. Key Customers and Competitors

- 23.1.4. Business/ Industry Portfolio

- 23.1.5. Product Portfolio/ Specification Details

- 23.1.6. Pricing Data

- 23.1.7. Strategic Overview

- 23.1.8. Recent Developments

- 23.2. Beckhoff Automation GmbH

- 23.3. Bosch Rexroth AG

- 23.4. Delta Electronics Inc.

- 23.5. Emerson Electric Co.

- 23.6. Fanuc Corporation

- 23.7. Fuji Electric Co. Ltd.

- 23.8. Lenze SE

- 23.9. Mitsubishi Electric Corporation

- 23.10. Moog Inc.

- 23.11. Nidec Corporation

- 23.12. OMRON Corporation

- 23.13. Panasonic Corporation

- 23.14. Parker Hannifin Corporation

- 23.15. Rockwell Automation Inc.

- 23.16. Schneider Electric SE

- 23.17. Siemens AG

- 23.18. Toshiba Corporation

- 23.19. Trio Motion Technology Ltd.

- 23.20. Yaskawa Electric Corporation

- 23.21. Other Key Players

- 23.1. ABB Ltd.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data