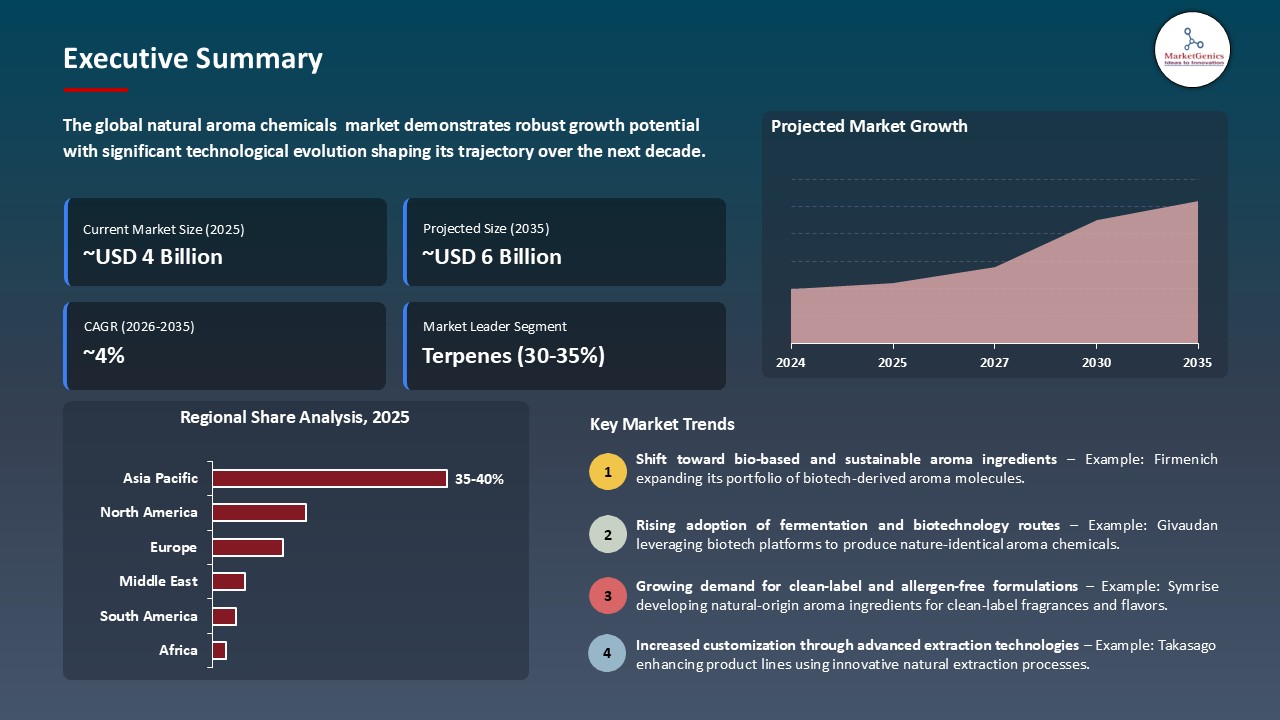

- The global natural aroma chemicals market is valued at USD 4.1 billion in 2025.

- The market is projected to grow at a CAGR of 3.6% during the forecast period of 2026 to 2035.

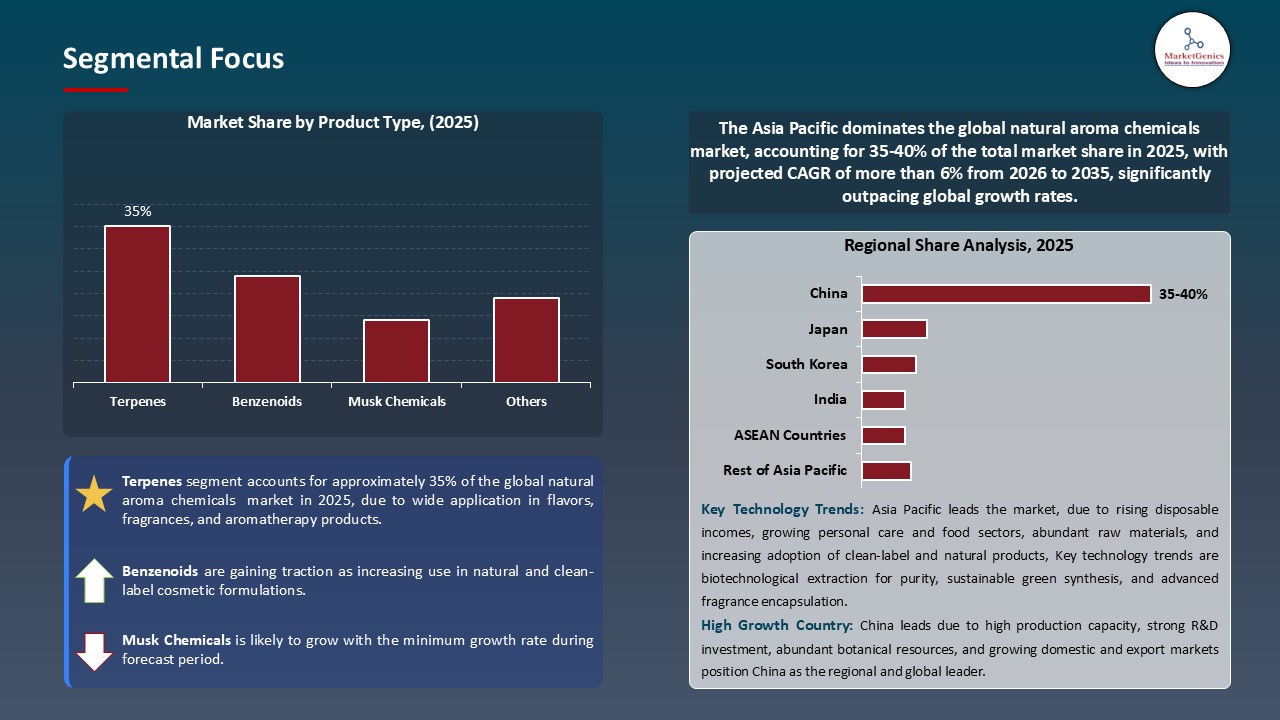

- The terpenes segment holds major share ~35% in the global natural aroma chemicals market, due to wide application in flavors, fragrances, and aromatherapy products.

- The natural aroma chemicals market growing due to natural aroma chemicals are widely used in skincare, perfumes, haircare, and wellness products due to the clean-label movement.

- The natural aroma chemicals market is driven by demand for fair-trade, traceable, and non-toxic botanical extracts is rising, especially in premium fragrance and food brands.

- The top five players accounting for nearly 40% of the global natural aroma chemicals market share in 2025.

- In October 2025, Symrise expanded its biotechnology strategy through targeted investments and collaborations to advance fermentation-based production of flavor and aroma molecules, accelerating clean-label growth and reducing dependence on seasonal botanicals.

- In March 2025, MANE launched a 100% natural Vanilla Bourbon Infusion, reinforcing its focus on premium botanical extracts with differentiated sensory performance and full traceability.

- Global Natural Aroma Chemicals Market is likely to create the total forecasting opportunity of ~USD 2 Bn till 2035.

- Asia Pacific is most attractive region due to strong demand from cosmetics, food & beverage industries, growing disposable income, and expanding manufacturing capabilities.

- The global natural aroma chemicals market is projected to grow with increase in the level of high-end consumerism in the demand of natural and sustainable sensory experiences in products in the personal care, beauty, food, and home-care sectors. In order to enhance ethical positioning and more stringent formulation criteria, brands are emphasizing on clean-label, traceable fragrance and flavor ingredients that have lower environmental footprints.

- Major ingredient companies are reducing their time-to-market by providing certified, high-purity, natural aroma chemicals, as well as, formulation support services. For instance, in January 2025, IFF introduced the NEO natural flavor range to grow citrus options and simplify product developers to meet regulatory compliance. The change leads to the investment in high-purity and bio-based aroma chemicals that contribute to sustainability and performance, which helps with premium pricing and better customer loyalty.

- Natural aroma chemical suppliers can differentiate themselves by offering value-added, sustainability-based products, leading to long-term market growth.

- The global natural aroma chemicals market is increasingly constrained due to the growing safety measures, ingredient restrictions and fluctuations in botanical raw-material supply chains, which increase the compliance burden and sourcing costs to the manufacturers. The constant regulatory changes require reformulation, improved quality-testing, and effective traceability systems, whereas changing agricultural output and logistical risks keep on affecting the availability of feedstock and market prices.

- For instance, the IFRA Standards (including the recent introduction of new amendments) still dictate limitations and new specifications which manufacturers have to embrace, shrinking product development cycles and raising reformulation cost.

- Also, the volatility of agricultural supply and essential-oil supply witnessed as far as 2024-2025 have increased the level of cost and supply uncertainty, making firms hedge through certified supply programs or investing in alternative production technologies.

- Regulatory and supply-side pressures are increasing operational costs, emphasizing the importance of vertical integration, certified sourcing, and risk reduction throughout the value chain.

- The global natural aroma chemicals market is on a rising trend with the opportunities in clean-label flavor systems and wellness-related aromatherapy uses, alongside increasing incorporation of plant-derived bioactive ingredients in functional cosmetics and nutraceutical-grade sensory applications. The growing focus on products with visible ingredient sources and functionality is driving a diversification into natural flavorings and essential oils-based wellness formats by manufacturers to facilitate a wider end-use penetration and value addition across the food, beverage, personal care and home-care markets.

- By providing custom natural aroma solutions to clean-label flavors, aromatherapy, functional cosmetics and high-quality home-care formulations, manufacturers will be able to influence surrounding growth by focusing on provenance, performance, and sustainability. For instance, in September 2025, Natara declared a strategic collaboration in distribution with Ashapura, an Azelis firm, to be more robust in market access and customer coverage.

- These possible opportunities foster revenue diversification, customer liaison, and competitive differentiation through innovation that aligns with sustainability concerns in emerging adjacent sectors.

- The global natural aroma chemicals market is experiencing a significant transformation to fermentation and bioprocessing scale-up, which can produce nature-identical components reliably, traceably, and at scale, without being affected by the seasonal nature of crops. The breakthrough of accuracy fermentation and purification methods is increasing cost effectiveness, sustainability, and availability of supplies leading to the accelerated change towards biotech-facilitated natural aroma ingredient production.

- For instance, in April 2025 the ChainCraft B.V. and Eternis Fine Chemicals formed a strategic partnership to build on the industrial-scale fermentation expertise of ChainCraft and the commercial access of Eternis to establish and grow the market of low-carbon, bio-based aroma ingredients. This collaboration improves the large-scale production of aroma ingredients using biotechnology and market penetration of biotech-produced aroma ingredients.

- Furthermore, the introduction of bioprocessing is also improving supply security and also providing scalable production of high quality, certified natural ingredients, thus, transferring the competitive edge to technologically advanced producers.

- Biotechnology-enabled manufacturers are gaining a competitive advantage in the market by adopting high-efficiency and low-carbon production methods.

- The terpenes segment dominates the global natural aroma chemicals market due to its broad-based functionality in flavor, fragrance and wellness formulations, with good use in foods, beverages, cosmetics and home-care products with consumer demand in natural sensory ingredients.

- For instance, in April 2025, BASF SE’s Aroma Ingredients division introduced its first reduced-product-carbon-footprint (PCF) items including L-Menthol FCC rPCF, tapping into the terpenes/terpenoids space with more sustainable sourcing and certification. This further supports the strategic position of terpenes as sustainable high value natural aroma ingredients, as it enhances their market leadership among natural aroma chemicals.

- Additionally, the growing interest in botanically sourced and clean label formulations is driving the growth of terpene use since they provide true aroma profiles, traceability and conformity to the demands of sustainability and regulatory compliance in high-end product lines.

- Terpenes are the largest growth contributor in the global natural aroma chemicals market, mainly due to rising demand for sustainable, clean-label, and high-performance ingredients in premium applications.

- Asia Pacific leads the global natural aroma chemicals market is due to increasing consumer expenditure on personal care, beauty and wellness products in emerging economies like China, India, Japan and South Korea is increasing the use of natural aroma ingredients in skincare, hair care and fine fragrances.

- For instance, in April 2025, BASF SE declared the introduction of three new natural-based skin and hair-care ingredient solutions in the Asia Pacific region, with the specific aim to capitalize on the booming demand of skin- and hair-care formulations with clean-label botanical-based aroma systems. This trend highlights the first-mover advantage ingredient companies in Asian Pacific are gaining because of regional personal-care growth.

- Additionally, the increased usage of natural aroma chemicals in the region is also greatly propelling due to the rapid growth of the processed food and beverage industry as well as increased demands on natural flavoring solutions in convenience foods, nutraceuticals and functional beverages.

- The Asia Pacific region is a key growth driver for natural aroma chemicals market, providing opportunities for ingredient providers to achieve scale, develop locally, and lead in high-end applications.

- In October 2025, Symrise implemented its biotechnology-focused strategy by pursuing targeted equity investments and collaborative partnerships to secure access to proprietary fermentation technologies. It will enable the large-scale synthesis of fermentation-based aroma compounds and contribute to the clean-label sustainability and decrease the reliance on seasonal raw materials.

- In March 2025, MANE launched its 100% natural Vanilla Bourbon Infusion, targeting premium flavour and fragrance segments, the introduction highlights a strategy of proprietary botanical extracts that bring differentiated sensory profiles and traceable provenance to high-end food and personal-care formulations.

- United States

- Canada

- Mexico

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic Countries

- Poland

- Russia & CIS

- China

- India

- Japan

- South Korea

- Australia and New Zealand

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Turkey

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Nigeria

- Algeria

- Brazil

- Argentina

- Aromata Group

- Augustus Oils Ltd.

- Bell Flavors & Fragrances

- Ernesto Ventós SA

- Eternis Fine Chemicals Ltd.

- Firmenich SA

- Fleurchem Inc.

- Givaudan SA

- Keva Flavours Pvt. Ltd.

- Huabao International Holdings Limited

- International Flavors & Fragrances Inc. (IFF)

- Moellhausen S.p.A.

- Privi Organics Limited

- Robertet Group

- Sensient Technologies Corporation

- Mane SA

- Symrise AG

- Synergy Flavors

- Takasago International Corporation

- Treatt PLC

- Ungerer & Company

- Vigon International Inc.

- T. Hasegawa Co., Ltd.

- Other Key Players

- Terpenes

- Limonene

- Pinene

- Myrcene

- Linalool

- Geraniol

- Others

- Benzenoids

- Vanillin

- Eugenol

- Cinnamaldehyde

- Anisaldehyde

- Others

- Musk Chemicals

- Plant-based Musk

- Animal-derived Musk alternatives

- Lactones

- Gamma-Decalactone

- Delta-Decalactone

- Massoia Lactone

- Others

- Esters

- Linalyl Acetate

- Geranyl Acetate

- Benzyl Acetate

- Others

- Alcohols

- Citronellol

- Menthol

- Phenylethyl Alcohol

- Others

- Ketones

- Ionones

- Damascones

- Methyl Ketones

- Others

- Plant-based

- Essential Oils

- Oleoresins

- Absolutes

- Concretes

- Others

- Flower-based

- Fruit-based

- Leaf-based

- Wood-based

- Animal-derived

- Others

- Steam Distillation

- Cold Pressing

- Solvent Extraction

- CO2 Extraction (Supercritical)

- Enfleurage

- Biotechnological Methods

- Others

- Liquid

- Powder

- Paste

- Crystalline

- Resinoid

- Food Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Industrial Grade

- Therapeutic Grade

- Floral Notes

- Citrus Notes

- Woody Notes

- Fruity Notes

- Spicy Notes

- Herbal Notes

- Others

- >90%

- 50-90%

- <50%

- Direct Sales

- Distributors

- Online Retail

- Specialty Stores

- Wholesalers

- B2B Platforms

- Food & Beverages

- Bakery Products

- Confectionery

- Dairy Products

- Beverages

- Savory Snacks

- Sauces & Condiments

- Ice Cream & Frozen Desserts

- Others

- Fragrance & Perfume

- Fine Fragrances

- Luxury Perfumes

- Body Mists

- Room Fresheners

- Car Fresheners

- Personal Care Fragrances

- Others

- Cosmetics & Personal Care

- Skincare Products

- Hair Care Products

- Bath & Shower Products

- Deodorants & Antiperspirants

- Oral Care Products

- Men's Grooming Products

- Others

- Household & Cleaning Products

- Laundry Detergents

- Fabric Softeners

- Dishwashing Products

- Surface Cleaners

- Air Care Products

- Toilet Cleaners

- Others

- Pharmaceutical

- Over-the-counter (OTC) Medications

- Topical Ointments

- Aromatherapy Medicine

- Ayurvedic Formulations

- Herbal Medicines

- Flavor Masking Agents

- Others

- Aromatherapy & Wellness

- Essential Oil Blends

- Massage Oils

- Diffuser Products

- Spa & Wellness Products

- Stress Relief Products

- Sleep Aid Products

- Others

- Tobacco Products

- Animal Feed & Pet Care

- Industrial Applications

- Other End-users

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Natural Aroma Chemicals Market Outlook

- 2.1.1. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2026-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Natural Aroma Chemicals Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 3.1.1. Chemicals & Materials Ecosystem Analysis

- 3.1.2. Key Trends for Chemicals & Materials Industry

- 3.1.3. Regional Distribution for Chemicals & Materials Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Chemicals & Materials Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Growing consumer preference for natural and organic products

- 4.1.1.2. Increasing demand from food & beverage, cosmetics, and personal care industries

- 4.1.1.3. Advances in extraction technologies for high-purity natural aroma compounds

- 4.1.2. Restraints

- 4.1.2.1. High production cost of natural aroma chemicals compared to synthetics

- 4.1.2.2. Raw material supply volatility due to agricultural and climatic factors

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Value Chain Analysis

- 4.4.1. Raw Material Suppliers

- 4.4.2. Natural Aroma Chemicals Manufacturers

- 4.4.3. Distribution & Logistics

- 4.4.4. End-Users/ Customers

- 4.5. Cost Structure Analysis

- 4.5.1. Parameter’s Share for Cost Associated

- 4.5.2. COGP vs COGS

- 4.5.3. Profit Margin Analysis

- 4.6. Pricing Analysis

- 4.6.1. Regional Pricing Analysis

- 4.6.2. Segmental Pricing Trends

- 4.6.3. Factors Influencing Pricing

- 4.7. Porter’s Five Forces Analysis

- 4.8. PESTEL Analysis

- 4.9. Global Natural Aroma Chemicals Market Demand

- 4.9.1. Historical Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2020-2024

- 4.9.2. Current and Future Market Size – Volume (Kilo Tons) and Value (US$ Bn), 2026–2035

- 4.9.2.1. Y-o-Y Growth Trends

- 4.9.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Natural Aroma Chemicals Market Analysis, by Product Type

- 6.1. Key Segment Analysis

- 6.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Product Type, 2021-2035

- 6.2.1. Terpenes

- 6.2.1.1. Limonene

- 6.2.1.2. Pinene

- 6.2.1.3. Myrcene

- 6.2.1.4. Linalool

- 6.2.1.5. Geraniol

- 6.2.1.6. Others

- 6.2.2. Benzenoids

- 6.2.2.1. Vanillin

- 6.2.2.2. Eugenol

- 6.2.2.3. Cinnamaldehyde

- 6.2.2.4. Anisaldehyde

- 6.2.2.5. Others

- 6.2.3. Musk Chemicals

- 6.2.3.1. Plant-based Musk

- 6.2.3.2. Animal- derived Musk alternatives

- 6.2.4. Lactones

- 6.2.4.1. Gamma-Decalactone

- 6.2.4.2. Delta-Decalactone

- 6.2.4.3. Massoia Lactone

- 6.2.4.4. Others

- 6.2.5. Esters

- 6.2.5.1. Linalyl Acetate

- 6.2.5.2. Geranyl Acetate

- 6.2.5.3. Benzyl Acetate

- 6.2.5.4. Others

- 6.2.6. Alcohols

- 6.2.6.1. Citronellol

- 6.2.6.2. Menthol

- 6.2.6.3. Phenylethyl Alcohol

- 6.2.6.4. Others

- 6.2.7. Ketones

- 6.2.7.1. Ionones

- 6.2.7.2. Damascones

- 6.2.7.3. Methyl Ketones

- 6.2.7.4. Others

- 6.2.1. Terpenes

- 7. Global Natural Aroma Chemicals Market Analysis, by Source

- 7.1. Key Segment Analysis

- 7.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Source, 2021-2035

- 7.2.1. Plant-based

- 7.2.1.1. Essential Oils

- 7.2.1.2. Oleoresins

- 7.2.1.3. Absolutes

- 7.2.1.4. Concretes

- 7.2.1.5. Others

- 7.2.2. Flower-based

- 7.2.3. Fruit-based

- 7.2.4. Leaf-based

- 7.2.5. Wood-based

- 7.2.6. Animal-derived

- 7.2.7. Others

- 7.2.1. Plant-based

- 8. Global Natural Aroma Chemicals Market Analysis, by Extraction Method

- 8.1. Key Segment Analysis

- 8.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Extraction Method, 2021-2035

- 8.2.1. Steam Distillation

- 8.2.2. Cold Pressing

- 8.2.3. Solvent Extraction

- 8.2.4. CO2 Extraction (Supercritical)

- 8.2.5. Enfleurage

- 8.2.6. Biotechnological Methods

- 8.2.7. Others

- 9. Global Natural Aroma Chemicals Market Analysis, by Form

- 9.1. Key Segment Analysis

- 9.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Form, 2021-2035

- 9.2.1. Liquid

- 9.2.2. Powder

- 9.2.3. Paste

- 9.2.4. Crystalline

- 9.2.5. Resinoid

- 10. Global Natural Aroma Chemicals Market Analysis, by Grade

- 10.1. Key Segment Analysis

- 10.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Grade, 2021-2035

- 10.2.1. Food Grade

- 10.2.2. Cosmetic Grade

- 10.2.3. Pharmaceutical Grade

- 10.2.4. Industrial Grade

- 10.2.5. Therapeutic Grade

- 11. Global Natural Aroma Chemicals Market Analysis, by Aroma Profile

- 11.1. Key Segment Analysis

- 11.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Aroma Profile, 2021-2035

- 11.2.1. Floral Notes

- 11.2.2. Citrus Notes

- 11.2.3. Woody Notes

- 11.2.4. Fruity Notes

- 11.2.5. Spicy Notes

- 11.2.6. Herbal Notes

- 11.2.7. Others

- 12. Global Natural Aroma Chemicals Market Analysis, by Concentration Level

- 12.1. Key Segment Analysis

- 12.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Concentration Level, 2021-2035

- 12.2.1. >90%

- 12.2.2. 50-90%

- 12.2.3. <50%

- 13. Global Natural Aroma Chemicals Market Analysis, by Distribution Channel

- 13.1. Key Segment Analysis

- 13.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Distribution Channel, 2021-2035

- 13.2.1. Direct Sales

- 13.2.2. Distributors

- 13.2.3. Online Retail

- 13.2.4. Specialty Stores

- 13.2.5. Wholesalers

- 13.2.6. B2B Platforms

- 14. Global Natural Aroma Chemicals Market Analysis, by End-users

- 14.1. Key Segment Analysis

- 14.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by End-users, 2021-2035

- 14.2.1. Food & Beverages

- 14.2.1.1. Bakery Products

- 14.2.1.2. Confectionery

- 14.2.1.3. Dairy Products

- 14.2.1.4. Beverages

- 14.2.1.5. Savory Snacks

- 14.2.1.6. Sauces & Condiments

- 14.2.1.7. Ice Cream & Frozen Desserts

- 14.2.1.8. Others

- 14.2.2. Fragrance & Perfume

- 14.2.2.1. Fine Fragrances

- 14.2.2.2. Luxury Perfumes

- 14.2.2.3. Body Mists

- 14.2.2.4. Room Fresheners

- 14.2.2.5. Car Fresheners

- 14.2.2.6. Personal Care Fragrances

- 14.2.2.7. Others

- 14.2.3. Cosmetics & Personal Care

- 14.2.3.1. Skincare Products

- 14.2.3.2. Hair Care Products

- 14.2.3.3. Bath & Shower Products

- 14.2.3.4. Deodorants & Antiperspirants

- 14.2.3.5. Oral Care Products

- 14.2.3.6. Men's Grooming Products

- 14.2.3.7. Others

- 14.2.4. Household & Cleaning Products

- 14.2.4.1. Laundry Detergents

- 14.2.4.2. Fabric Softeners

- 14.2.4.3. Dishwashing Products

- 14.2.4.4. Surface Cleaners

- 14.2.4.5. Air Care Products

- 14.2.4.6. Toilet Cleaners

- 14.2.4.7. Others

- 14.2.5. Pharmaceutical

- 14.2.5.1. Over-the-counter (OTC) Medications

- 14.2.5.2. Topical Ointments

- 14.2.5.3. Aromatherapy Medicine

- 14.2.5.4. Ayurvedic Formulations

- 14.2.5.5. Herbal Medicines

- 14.2.5.6. Flavor Masking Agents

- 14.2.5.7. Others

- 14.2.6. Aromatherapy & Wellness

- 14.2.6.1. Essential Oil Blends

- 14.2.6.2. Massage Oils

- 14.2.6.3. Diffuser Products

- 14.2.6.4. Spa & Wellness Products

- 14.2.6.5. Stress Relief Products

- 14.2.6.6. Sleep Aid Products

- 14.2.6.7. Others

- 14.2.7. Tobacco Products

- 14.2.8. Animal Feed & Pet Care

- 14.2.9. Industrial Applications

- 14.2.10. Other End-users

- 14.2.1. Food & Beverages

- 15. Global Natural Aroma Chemicals Market Analysis and Forecasts, by Region

- 15.1. Key Findings

- 15.2. Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, by Region, 2021-2035

- 15.2.1. North America

- 15.2.2. Europe

- 15.2.3. Asia Pacific

- 15.2.4. Middle East

- 15.2.5. Africa

- 15.2.6. South America

- 16. North America Natural Aroma Chemicals Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. North America Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Product Type

- 16.3.2. Source

- 16.3.3. Extraction Method

- 16.3.4. Form

- 16.3.5. Grade

- 16.3.6. Aroma Profile

- 16.3.7. Concentration Level

- 16.3.8. Distribution Channel

- 16.3.9. End-users

- 16.3.10. Country

- 16.3.10.1. USA

- 16.3.10.2. Canada

- 16.3.10.3. Mexico

- 16.4. USA Natural Aroma Chemicals Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Product Type

- 16.4.3. Source

- 16.4.4. Extraction Method

- 16.4.5. Form

- 16.4.6. Grade

- 16.4.7. Aroma Profile

- 16.4.8. Concentration Level

- 16.4.9. Distribution Channel

- 16.4.10. End-users

- 16.5. Canada Natural Aroma Chemicals Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Product Type

- 16.5.3. Source

- 16.5.4. Extraction Method

- 16.5.5. Form

- 16.5.6. Grade

- 16.5.7. Aroma Profile

- 16.5.8. Concentration Level

- 16.5.9. Distribution Channel

- 16.5.10. End-users

- 16.6. Mexico Natural Aroma Chemicals Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Product Type

- 16.6.3. Source

- 16.6.4. Extraction Method

- 16.6.5. Form

- 16.6.6. Grade

- 16.6.7. Aroma Profile

- 16.6.8. Concentration Level

- 16.6.9. Distribution Channel

- 16.6.10. End-users

- 17. Europe Natural Aroma Chemicals Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Europe Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Product Type

- 17.3.2. Source

- 17.3.3. Extraction Method

- 17.3.4. Form

- 17.3.5. Grade

- 17.3.6. Aroma Profile

- 17.3.7. Concentration Level

- 17.3.8. Distribution Channel

- 17.3.9. End-users

- 17.3.10. Country

- 17.3.10.1. Germany

- 17.3.10.2. United Kingdom

- 17.3.10.3. France

- 17.3.10.4. Italy

- 17.3.10.5. Spain

- 17.3.10.6. Netherlands

- 17.3.10.7. Nordic Countries

- 17.3.10.8. Poland

- 17.3.10.9. Russia & CIS

- 17.3.10.10. Rest of Europe

- 17.4. Germany Natural Aroma Chemicals Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Product Type

- 17.4.3. Source

- 17.4.4. Extraction Method

- 17.4.5. Form

- 17.4.6. Grade

- 17.4.7. Aroma Profile

- 17.4.8. Concentration Level

- 17.4.9. Distribution Channel

- 17.4.10. End-users

- 17.5. United Kingdom Natural Aroma Chemicals Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Product Type

- 17.5.3. Source

- 17.5.4. Extraction Method

- 17.5.5. Form

- 17.5.6. Grade

- 17.5.7. Aroma Profile

- 17.5.8. Concentration Level

- 17.5.9. Distribution Channel

- 17.5.10. End-users

- 17.6. France Natural Aroma Chemicals Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Product Type

- 17.6.3. Source

- 17.6.4. Extraction Method

- 17.6.5. Form

- 17.6.6. Grade

- 17.6.7. Aroma Profile

- 17.6.8. Concentration Level

- 17.6.9. Distribution Channel

- 17.6.10. End-users

- 17.7. Italy Natural Aroma Chemicals Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Product Type

- 17.7.3. Source

- 17.7.4. Extraction Method

- 17.7.5. Form

- 17.7.6. Grade

- 17.7.7. Aroma Profile

- 17.7.8. Concentration Level

- 17.7.9. Distribution Channel

- 17.7.10. End-users

- 17.8. Spain Natural Aroma Chemicals Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Product Type

- 17.8.3. Source

- 17.8.4. Extraction Method

- 17.8.5. Form

- 17.8.6. Grade

- 17.8.7. Aroma Profile

- 17.8.8. Concentration Level

- 17.8.9. Distribution Channel

- 17.8.10. End-users

- 17.9. Netherlands Natural Aroma Chemicals Market

- 17.9.1. Country Segmental Analysis

- 17.9.2. Product Type

- 17.9.3. Source

- 17.9.4. Extraction Method

- 17.9.5. Form

- 17.9.6. Grade

- 17.9.7. Aroma Profile

- 17.9.8. Concentration Level

- 17.9.9. Distribution Channel

- 17.9.10. End-users

- 17.10. Nordic Countries Natural Aroma Chemicals Market

- 17.10.1. Country Segmental Analysis

- 17.10.2. Product Type

- 17.10.3. Source

- 17.10.4. Extraction Method

- 17.10.5. Form

- 17.10.6. Grade

- 17.10.7. Aroma Profile

- 17.10.8. Concentration Level

- 17.10.9. Distribution Channel

- 17.10.10. End-users

- 17.11. Poland Natural Aroma Chemicals Market

- 17.11.1. Country Segmental Analysis

- 17.11.2. Product Type

- 17.11.3. Source

- 17.11.4. Extraction Method

- 17.11.5. Form

- 17.11.6. Grade

- 17.11.7. Aroma Profile

- 17.11.8. Concentration Level

- 17.11.9. Distribution Channel

- 17.11.10. End-users

- 17.12. Russia & CIS Natural Aroma Chemicals Market

- 17.12.1. Country Segmental Analysis

- 17.12.2. Product Type

- 17.12.3. Source

- 17.12.4. Extraction Method

- 17.12.5. Form

- 17.12.6. Grade

- 17.12.7. Aroma Profile

- 17.12.8. Concentration Level

- 17.12.9. Distribution Channel

- 17.12.10. End-users

- 17.13. Rest of Europe Natural Aroma Chemicals Market

- 17.13.1. Country Segmental Analysis

- 17.13.2. Product Type

- 17.13.3. Source

- 17.13.4. Extraction Method

- 17.13.5. Form

- 17.13.6. Grade

- 17.13.7. Aroma Profile

- 17.13.8. Concentration Level

- 17.13.9. Distribution Channel

- 17.13.10. End-users

- 18. Asia Pacific Natural Aroma Chemicals Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Asia Pacific Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Product Type

- 18.3.2. Source

- 18.3.3. Extraction Method

- 18.3.4. Form

- 18.3.5. Grade

- 18.3.6. Aroma Profile

- 18.3.7. Concentration Level

- 18.3.8. Distribution Channel

- 18.3.9. End-users

- 18.3.10. Country

- 18.3.10.1. China

- 18.3.10.2. India

- 18.3.10.3. Japan

- 18.3.10.4. South Korea

- 18.3.10.5. Australia and New Zealand

- 18.3.10.6. Indonesia

- 18.3.10.7. Malaysia

- 18.3.10.8. Thailand

- 18.3.10.9. Vietnam

- 18.3.10.10. Rest of Asia Pacific

- 18.4. China Natural Aroma Chemicals Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Product Type

- 18.4.3. Source

- 18.4.4. Extraction Method

- 18.4.5. Form

- 18.4.6. Grade

- 18.4.7. Aroma Profile

- 18.4.8. Concentration Level

- 18.4.9. Distribution Channel

- 18.4.10. End-users

- 18.5. India Natural Aroma Chemicals Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Product Type

- 18.5.3. Source

- 18.5.4. Extraction Method

- 18.5.5. Form

- 18.5.6. Grade

- 18.5.7. Aroma Profile

- 18.5.8. Concentration Level

- 18.5.9. Distribution Channel

- 18.5.10. End-users

- 18.6. Japan Natural Aroma Chemicals Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Product Type

- 18.6.3. Source

- 18.6.4. Extraction Method

- 18.6.5. Form

- 18.6.6. Grade

- 18.6.7. Aroma Profile

- 18.6.8. Concentration Level

- 18.6.9. Distribution Channel

- 18.6.10. End-users

- 18.7. South Korea Natural Aroma Chemicals Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Product Type

- 18.7.3. Source

- 18.7.4. Extraction Method

- 18.7.5. Form

- 18.7.6. Grade

- 18.7.7. Aroma Profile

- 18.7.8. Concentration Level

- 18.7.9. Distribution Channel

- 18.7.10. End-users

- 18.8. Australia and New Zealand Natural Aroma Chemicals Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Product Type

- 18.8.3. Source

- 18.8.4. Extraction Method

- 18.8.5. Form

- 18.8.6. Grade

- 18.8.7. Aroma Profile

- 18.8.8. Concentration Level

- 18.8.9. Distribution Channel

- 18.8.10. End-users

- 18.9. Indonesia Natural Aroma Chemicals Market

- 18.9.1. Country Segmental Analysis

- 18.9.2. Product Type

- 18.9.3. Source

- 18.9.4. Extraction Method

- 18.9.5. Form

- 18.9.6. Grade

- 18.9.7. Aroma Profile

- 18.9.8. Concentration Level

- 18.9.9. Distribution Channel

- 18.9.10. End-users

- 18.10. Malaysia Natural Aroma Chemicals Market

- 18.10.1. Country Segmental Analysis

- 18.10.2. Product Type

- 18.10.3. Source

- 18.10.4. Extraction Method

- 18.10.5. Form

- 18.10.6. Grade

- 18.10.7. Aroma Profile

- 18.10.8. Concentration Level

- 18.10.9. Distribution Channel

- 18.10.10. End-users

- 18.11. Thailand Natural Aroma Chemicals Market

- 18.11.1. Country Segmental Analysis

- 18.11.2. Product Type

- 18.11.3. Source

- 18.11.4. Extraction Method

- 18.11.5. Form

- 18.11.6. Grade

- 18.11.7. Aroma Profile

- 18.11.8. Concentration Level

- 18.11.9. Distribution Channel

- 18.11.10. End-users

- 18.12. Vietnam Natural Aroma Chemicals Market

- 18.12.1. Country Segmental Analysis

- 18.12.2. Product Type

- 18.12.3. Source

- 18.12.4. Extraction Method

- 18.12.5. Form

- 18.12.6. Grade

- 18.12.7. Aroma Profile

- 18.12.8. Concentration Level

- 18.12.9. Distribution Channel

- 18.12.10. End-users

- 18.13. Rest of Asia Pacific Natural Aroma Chemicals Market

- 18.13.1. Country Segmental Analysis

- 18.13.2. Product Type

- 18.13.3. Source

- 18.13.4. Extraction Method

- 18.13.5. Form

- 18.13.6. Grade

- 18.13.7. Aroma Profile

- 18.13.8. Concentration Level

- 18.13.9. Distribution Channel

- 18.13.10. End-users

- 19. Middle East Natural Aroma Chemicals Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. Middle East Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Product Type

- 19.3.2. Source

- 19.3.3. Extraction Method

- 19.3.4. Form

- 19.3.5. Grade

- 19.3.6. Aroma Profile

- 19.3.7. Concentration Level

- 19.3.8. Distribution Channel

- 19.3.9. End-users

- 19.3.10. Country

- 19.3.10.1. Turkey

- 19.3.10.2. UAE

- 19.3.10.3. Saudi Arabia

- 19.3.10.4. Israel

- 19.3.10.5. Rest of Middle East

- 19.4. Turkey Natural Aroma Chemicals Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Product Type

- 19.4.3. Source

- 19.4.4. Extraction Method

- 19.4.5. Form

- 19.4.6. Grade

- 19.4.7. Aroma Profile

- 19.4.8. Concentration Level

- 19.4.9. Distribution Channel

- 19.4.10. End-users

- 19.5. UAE Natural Aroma Chemicals Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Product Type

- 19.5.3. Source

- 19.5.4. Extraction Method

- 19.5.5. Form

- 19.5.6. Grade

- 19.5.7. Aroma Profile

- 19.5.8. Concentration Level

- 19.5.9. Distribution Channel

- 19.5.10. End-users

- 19.6. Saudi Arabia Natural Aroma Chemicals Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Product Type

- 19.6.3. Source

- 19.6.4. Extraction Method

- 19.6.5. Form

- 19.6.6. Grade

- 19.6.7. Aroma Profile

- 19.6.8. Concentration Level

- 19.6.9. Distribution Channel

- 19.6.10. End-users

- 19.7. Israel Natural Aroma Chemicals Market

- 19.7.1. Country Segmental Analysis

- 19.7.2. Product Type

- 19.7.3. Source

- 19.7.4. Extraction Method

- 19.7.5. Form

- 19.7.6. Grade

- 19.7.7. Aroma Profile

- 19.7.8. Concentration Level

- 19.7.9. Distribution Channel

- 19.7.10. End-users

- 19.8. Rest of Middle East Natural Aroma Chemicals Market

- 19.8.1. Country Segmental Analysis

- 19.8.2. Product Type

- 19.8.3. Source

- 19.8.4. Extraction Method

- 19.8.5. Form

- 19.8.6. Grade

- 19.8.7. Aroma Profile

- 19.8.8. Concentration Level

- 19.8.9. Distribution Channel

- 19.8.10. End-users

- 20. Africa Natural Aroma Chemicals Market Analysis

- 20.1. Key Segment Analysis

- 20.2. Regional Snapshot

- 20.3. Africa Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 20.3.1. Product Type

- 20.3.2. Source

- 20.3.3. Extraction Method

- 20.3.4. Form

- 20.3.5. Grade

- 20.3.6. Aroma Profile

- 20.3.7. Concentration Level

- 20.3.8. Distribution Channel

- 20.3.9. End-users

- 20.3.10. Country

- 20.3.10.1. South Africa

- 20.3.10.2. Egypt

- 20.3.10.3. Nigeria

- 20.3.10.4. Algeria

- 20.3.10.5. Rest of Africa

- 20.4. South Africa Natural Aroma Chemicals Market

- 20.4.1. Country Segmental Analysis

- 20.4.2. Product Type

- 20.4.3. Source

- 20.4.4. Extraction Method

- 20.4.5. Form

- 20.4.6. Grade

- 20.4.7. Aroma Profile

- 20.4.8. Concentration Level

- 20.4.9. Distribution Channel

- 20.4.10. End-users

- 20.5. Egypt Natural Aroma Chemicals Market

- 20.5.1. Country Segmental Analysis

- 20.5.2. Product Type

- 20.5.3. Source

- 20.5.4. Extraction Method

- 20.5.5. Form

- 20.5.6. Grade

- 20.5.7. Aroma Profile

- 20.5.8. Concentration Level

- 20.5.9. Distribution Channel

- 20.5.10. End-users

- 20.6. Nigeria Natural Aroma Chemicals Market

- 20.6.1. Country Segmental Analysis

- 20.6.2. Product Type

- 20.6.3. Source

- 20.6.4. Extraction Method

- 20.6.5. Form

- 20.6.6. Grade

- 20.6.7. Aroma Profile

- 20.6.8. Concentration Level

- 20.6.9. Distribution Channel

- 20.6.10. End-users

- 20.7. Algeria Natural Aroma Chemicals Market

- 20.7.1. Country Segmental Analysis

- 20.7.2. Product Type

- 20.7.3. Source

- 20.7.4. Extraction Method

- 20.7.5. Form

- 20.7.6. Grade

- 20.7.7. Aroma Profile

- 20.7.8. Concentration Level

- 20.7.9. Distribution Channel

- 20.7.10. End-users

- 20.8. Rest of Africa Natural Aroma Chemicals Market

- 20.8.1. Country Segmental Analysis

- 20.8.2. Product Type

- 20.8.3. Source

- 20.8.4. Extraction Method

- 20.8.5. Form

- 20.8.6. Grade

- 20.8.7. Aroma Profile

- 20.8.8. Concentration Level

- 20.8.9. Distribution Channel

- 20.8.10. End-users

- 21. South America Natural Aroma Chemicals Market Analysis

- 21.1. Key Segment Analysis

- 21.2. Regional Snapshot

- 21.3. South America Natural Aroma Chemicals Market Size (Volume - Kilo Tons and Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 21.3.1. Product Type

- 21.3.2. Source

- 21.3.3. Extraction Method

- 21.3.4. Form

- 21.3.5. Grade

- 21.3.6. Aroma Profile

- 21.3.7. Concentration Level

- 21.3.8. Distribution Channel

- 21.3.9. End-users

- 21.3.10. Country

- 21.3.10.1. Brazil

- 21.3.10.2. Argentina

- 21.3.10.3. Rest of South America

- 21.4. Brazil Natural Aroma Chemicals Market

- 21.4.1. Country Segmental Analysis

- 21.4.2. Product Type

- 21.4.3. Source

- 21.4.4. Extraction Method

- 21.4.5. Form

- 21.4.6. Grade

- 21.4.7. Aroma Profile

- 21.4.8. Concentration Level

- 21.4.9. Distribution Channel

- 21.4.10. End-users

- 21.5. Argentina Natural Aroma Chemicals Market

- 21.5.1. Country Segmental Analysis

- 21.5.2. Product Type

- 21.5.3. Source

- 21.5.4. Extraction Method

- 21.5.5. Form

- 21.5.6. Grade

- 21.5.7. Aroma Profile

- 21.5.8. Concentration Level

- 21.5.9. Distribution Channel

- 21.5.10. End-users

- 21.6. Rest of South America Natural Aroma Chemicals Market

- 21.6.1. Country Segmental Analysis

- 21.6.2. Product Type

- 21.6.3. Source

- 21.6.4. Extraction Method

- 21.6.5. Form

- 21.6.6. Grade

- 21.6.7. Aroma Profile

- 21.6.8. Concentration Level

- 21.6.9. Distribution Channel

- 21.6.10. End-users

- 22. Key Players/ Company Profile

- 22.1. Aromata Group

- 22.1.1. Company Details/ Overview

- 22.1.2. Company Financials

- 22.1.3. Key Customers and Competitors

- 22.1.4. Business/ Industry Portfolio

- 22.1.5. Product Portfolio/ Specification Details

- 22.1.6. Pricing Data

- 22.1.7. Strategic Overview

- 22.1.8. Recent Developments

- 22.2. Augustus Oils Ltd.

- 22.3. Bell Flavors & Fragrances

- 22.4. Ernesto Ventós SA

- 22.5. Eternis Fine Chemicals Ltd.

- 22.6. Firmenich SA

- 22.7. Fleurchem Inc.

- 22.8. Givaudan SA

- 22.9. Huabao International Holdings Limited

- 22.10. International Flavors & Fragrances Inc. (IFF)

- 22.11. Keva Flavours Pvt. Ltd.

- 22.12. Mane SA

- 22.13. Moellhausen S.p.A.

- 22.14. Privi Organics Limited

- 22.15. Robertet Group

- 22.16. Sensient Technologies Corporation

- 22.17. Symrise AG

- 22.18. Synergy Flavors

- 22.19. T. Hasegawa Co., Ltd.

- 22.20. Takasago International Corporation

- 22.21. Treatt PLC

- 22.22. Ungerer & Company

- 22.23. Vigon International Inc.

- 22.24. Other Key Players

- 22.1. Aromata Group

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data

Insightified

Mid-to-large firms spend $20K–$40K quarterly on systematic research and typically recover multiples through improved growth and profitability

Research is no longer optional. Leading firms use it to uncover $10M+ in hidden revenue opportunities annually

Our research-consulting programs yields measurable ROI: 20–30% revenue increases from new markets, 11% profit upticks from pricing, and 20–30% cost savings from operations

Natural Aroma Chemicals Market Size, Share & Trends Analysis Report by Product Type (Terpenes, Benzenoids, Musk Chemicals, Lactones, Esters, Alcohols, Ketones), Source, Extraction Method, Form, Grade, Aroma Profile, Concentration Level, Distribution Channel, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Natural Aroma Chemicals Market Size, Share, and Growth

The global natural aroma chemicals market is experiencing robust growth, with its estimated value of USD 4.1 billion in the year 2025 and USD 5.8 billion by 2035, registering a CAGR of 3.6%, during the forecast period. The global natural aroma chemicals market demand is driven by increasing consumer preference for clean-label, plant-based fragrances and flavors, expanding use across personal care, cosmetics and food industries, rising aromatherapy and wellness trends, regulatory support for natural formulations, and premiumization in luxury perfumes.

Billy Gittins, Vice President Strategy, Marketing & Product Management at Eternis said,

“Eternis is constantly looking for new partners with innovative technologies that can facilitate the transformation of our industry towards sustainability and next-generation fragrance ingredients.”

The global natural aroma chemicals market demand is being propelled by a sharp market move towards clean-label, responsibly sourced fragrance and flavor ingredients, increasing the integration of high-purity natural extracts in premium formulations that meet sustainability and regulatory requirements, which has driven large-scale producers to increase high-purity bio-based production. As an example, in October 2025, the Aroma Ingredients division of BASF has introduced Isobionics Natural alpha-Farnesene 95, a fermentation-derived ingredient that is made using renewable feedstock to increase the sustainability profile of citrus-based flavor formulations. This innovative product will hasten the diversification of the market and value capture via superior, sustainably certified aroma products.

In addition, the global natural aroma chemicals market has been facilitated by the robust growth of cosmetics, personal care, and home-care product segments, in which growing disposable incomes and changing lifestyles are boosting interest in high-end, fragrance-enhanced formulations. For instance, in June 2025, Natara entered into a distribution contract with BLH (Azelis Group) to distribute botanical extracts and specialty aroma chemicals to France and Italy, widening the reach of cosmetics and fragrance consumers. These trends demonstrate the fact that manufacturers are improving high-end sensory services and are improving sustainability by upgrading the natural aroma chemicals value chain.

Adjacent opportunities to the global natural aroma chemicals market include growth in natural flavor systems, bio-based solvents, plant-derived active ingredients for cosmetics, aromatherapy and wellness oils, and sustainable home-care fragrance solutions. The further promotion of cross-sector adoption is made by the increasing focus of regulatory control on clean formulations and high-quality sensory experiences. The adjacent segments will be able to speed up the market expansion and diversification.

Natural Aroma Chemicals Market Dynamics and Trends

Driver: Premium Consumer Demand for Natural, Sustainable Sensory Experiences

Restraint: Regulatory and Supply-Chain Complexity Increasing Compliance and Sourcing Costs Significantly

Opportunity: Expansion into Clean-Label Flavors and Wellness Aromatherapy Segments

Key Trend: Fermentation and Bioprocessing Scale-Up Transforming Production Efficiency Profiles

Natural-Aroma-Chemicals-Market Analysis and Segmental Data

Terpenes Dominate Global Natural Aroma Chemicals Market

Asia Pacific Leads Global Natural Aroma Chemicals Market Demand

Natural-Aroma-Chemicals-Market Ecosystem

The global natural aroma chemicals market is moderately consolidated, with high concentration among key players such as International Flavors & Fragrances Inc. (IFF), Symrise AG, Takasago, Givaudan SA, and Firmenich SA, who dominate through product portfolios, high level of bioprocessing, robust global distribution and most importantly long-term strategic alliances with major food and beverage, personal care, and fragrance producers. For instance, in September 2025, International Flavors & Fragrances Inc. (IFF) enlarged its LMR Naturals location in Grasse and promised to introduce four to six new products based on natural ingredients every year, with sustainability being the main focus of the business.

Their competitive advantage is also enhanced by their unrelenting investment in sustainable sourcing, regulatory compliance excellence and differentiated aroma innovation based on regional consumer preferences.

Recent Development and Strategic Overview:

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 4.1 Bn |

|

Market Forecast Value in 2035 |

USD 5.8 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value Kilo Tons for Volume |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

|

Natural-Aroma-Chemicals-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Natural Aroma Chemicals Market, By Product Type |

|

|

Natural Aroma Chemicals Market, By Source |

|

|

Natural Aroma Chemicals Market, By Extraction Method |

|

|

Natural Aroma Chemicals Market, By Form |

|

|

Natural Aroma Chemicals Market, By Grade

|

|

|

Natural Aroma Chemicals Market, By Aroma Profile

|

|

|

Natural Aroma Chemicals Market, By Concentration Level

|

|

|

Natural Aroma Chemicals Market, By Distribution Channel

|

|

|

Natural Aroma Chemicals Market, By End-users

|

|

Frequently Asked Questions

Table of Contents

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Research Design

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

Research Approach

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

Research Methods

Desk / Secondary Research

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is a combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase, and others.

We also employ the model mapping approach to estimate the product level market data through the players' product portfolio

Primary Research

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources include primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

Forecasting Factors and Models

Forecasting Factors

Forecasting Models / Techniques

Multiple Regression Analysis

Time Series Analysis – Seasonal Patterns

Time Series Analysis – Trend Analysis

Expert Opinion – Expert Interviews

Multi-Scenario Development

Time Series Analysis – Moving Averages

Econometric Models

Expert Opinion – Delphi Method

Monte Carlo Simulation

Research Analysis

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Validation & Evaluation

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

Custom Market Research Services

We will customise the research for you, in case the report listed above does not meet your requirements.

Get 10% Free Customisation