Neurodegenerative Disorders Market Size, Share & Trends Analysis Report by Disease Type (Alzheimer's Disease, Parkinson's Disease, Huntington's Disease, Amyotrophic Lateral Sclerosis (ALS), Multiple Sclerosis (MS), Others), Drug Class, Route of Administration, Mechanism of Action, Stage of Disease, Patient Demographics, End-users, and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) – Global Industry Data, Trends, and Forecasts, 2026–2035

|

|

|

Segmental Data Insights |

|

|

Demand Trends |

|

|

Competitive Landscape |

|

|

Strategic Development |

|

|

Future Outlook & Opportunities |

|

Neurodegenerative Disorders Market Size, Share, and Growth

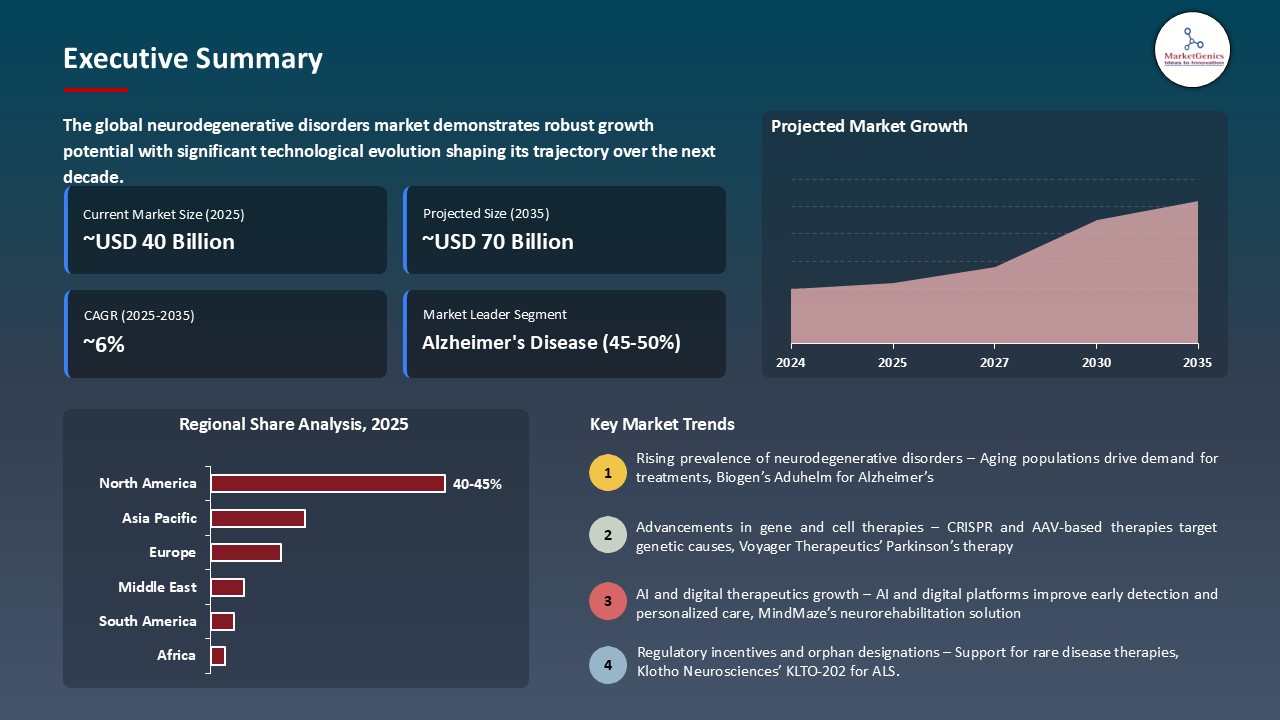

The global neurodegenerative disorders market is witnessing strong growth, valued at USD 39.8 billion in 2025 and projected to reach USD 69.9 billion by 2035, expanding at a CAGR of 5.8% during the forecast period. Asia is the fastest-growing region for the neurodegenerative disorders market because of its rapidly aging population, increasing healthcare investments, and expanding access to advanced therapies.

Zvonimir Vrselja, CEO and Co-founder at Bexorg said that, “Our ability to collect longitudinal data from our whole-brain discovery platform allows us to validate new targets and biomarkers and understand the pharmacokinetic and pharmacodynamic profiles and potential safety and effectiveness of drugs before going into the clinic. We are thrilled to team up with Biohaven to help advance two preclinical programs and potentially unlock a faster, more precise path to new CNS therapies”.

Enhancing the healthcare profession, patients, and caregiver’s awareness about neurodegenerative diseases is one of the key factors in the growth of neurodegenerative disorders in the market. When the symptoms are identified early and medical consultation provided in time, the chances of successful diagnosis and treatment of a patient are high. As one example, IXICO plc assisted Fujirebio Diagnostics to gain FDA approval of a blood-based test of Alzheimer disease biomarkers in 2025, which is now able to identify the disease earlier and more broadly accessible to more patients.

Collaborations help the neurodegenerative disorders market to grow by bringing together expertise, risk sharing, innovation speed, and global market reach and expansion. As an example, Nissan Chemical had earlier signed an exclusive global license with RaQualia Pharma to design and market new neurological therapeutics using Nissan-developed research.

Orphan drug development is an important opportunity in the neurodegenerative disorders market because it focuses on rare or ultra-rare neurodegenerative diseases where there are no effective therapies. As an example, in 2025 BioArctic AB was awarded FDA Orphan Drug Designation exidavnemab treating Multiple System Atrophy (MSA) and was given regulatory incentives, such as market exclusivity, tax credits and waiver of fees, to speed up the development of this rare neurodegenerative therapy.

Neurodegenerative Disorders Market Dynamics and Trends

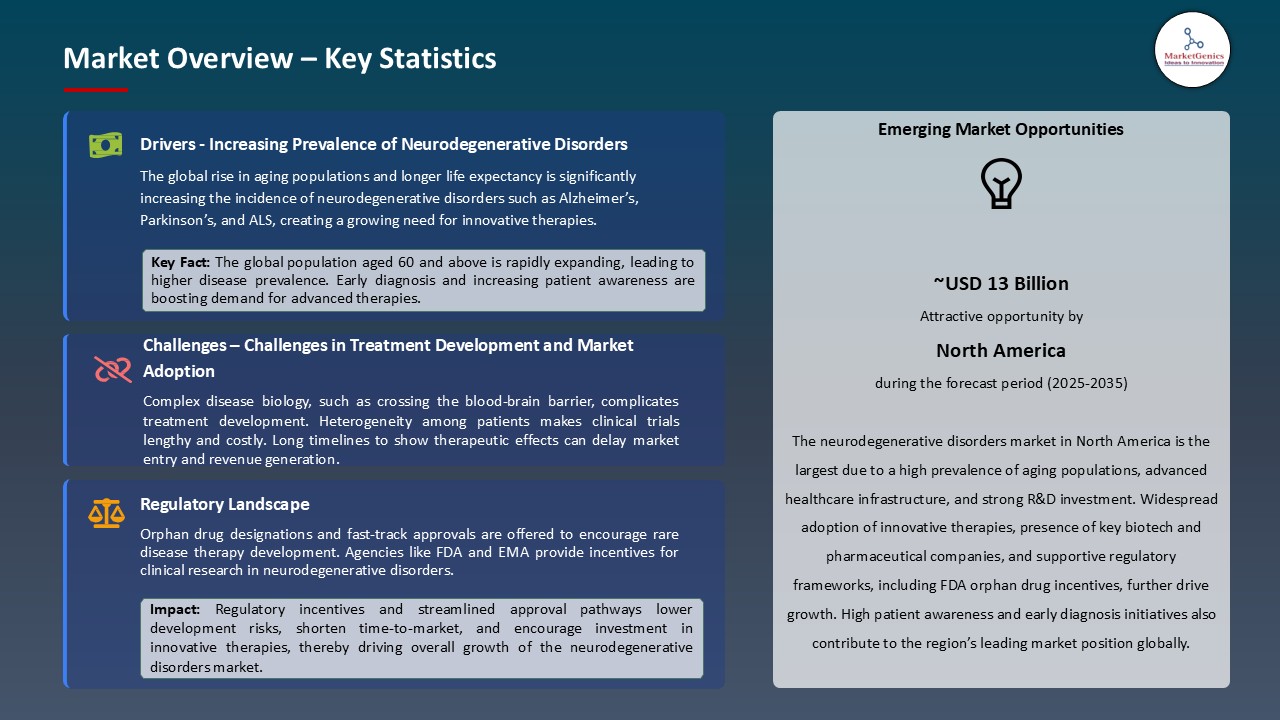

Driver: Rising Global Prevalence and Aging Demographics

- The growing life expectancy across the globe and fast-growing ageing population are the main demographic conditions that hasten the occurrence of neurodegenerative diseases including Alzheimer disease, Parkinson disease among others that will further cause an increase in neurodegenerative disorders market. World Health Organization (WHO) articulates that, by 2050, the number of people aged 60 years and above across the world is expected to increase twofold, which poses a huge epidemiological and economic burden on the healthcare systems.

- Pharmaceutical and biotechnology companies are meeting this demographic-based need by investing more in the study of neurodegenerative diseases, especially disease-modifying and neuroprotective drug development to help prevent neurodegeneration at an earlier stage, as well as to manage the disease.

- Johnson and Johnson presented new Alzheimer research at the AAIC 2025, including tau-targeted research and biomarker development in its Global Neurodegeneration Proteomics Consortium with Gates Ventures. As the cases of the Alzheimer increase with the world aging, J&J emphasis on the early diagnosis and disease-modifying treatment.

- The trends in aging population and increased prevalence of diseases are fueling increased investment in R&D, increased innovation speed, and market expansion opportunities in neurodegenerative disorders market.

Restraint: Complex Biology and Clinical Challenges in Neurodegenerative Disease Development

- The complex biology of neurodegenerative diseases is one of the significant obstacles to therapeutic innovation and development of neurodegenerative disorders market. The blood-brain barrier (BBB) restricts the delivery of drugs to be taken up by neural tissues making the establishment of effective central nervous system (CNS) treatment very complex.

- Additionally, the heterogeneity of the patient groups, genetic factors, disease course, and expression of the biomarkers, complicates the development of universal therapeutic options and the attainment of uniform clinical effects.

- Moreover, neurodegenerative diseases develop gradually, and it takes a long and expensive clinical trial to establish their significant therapeutic benefit, delaying time-to-market and raising the development risk. Failure of trials and unpredictability of translational effectiveness of animal models to humans are also higher in discouraging investment and delaying innovation.

- Taken together, these biological and clinical complexities limit the rate of new drug approval, increase the costs of R&D, and serve as a major inhibitor of the growth of the neurodegenerative disorders market as a whole.

Opportunity: Transformative Potential of Gene and Cell Therapies in Neurodegenerative Disorders

- The neurodegenerative disorders market has potential to provide a tremendous opportunity with the introduction of gene and cell therapy since the fast developments of gene-editing systems like CRISPR and adeno-associated viral (AAV) vectors are transforming the treatment paradigm of neurodegenerative disorders. These novel technologies allow targeted and precise correction of genetic defects that cause disorders like Amyotrophic Lateral Sclerosis (ALS) and Huntington disease that could offer long-term or curative results.

- UniQure in 2025 AMT-130 gene therapy AMT-130 gene therapy targets a reduction of disease progression in Huntington disease trials in both Phase I/II (75% progression reduction). The publication of AAV5-miRNA technology to silence the mutant huntingtin gene, AMT-130, under Breakthrough, RMAT, Fast Track, and Orphan designation by the FDA is an important milestone to gene-silencing treatment of the neurodegenerative diseases.

- The breakthroughs highlight a crucial move to curative, gene-based interventions, and place gene and cell therapies as the growth drivers in the neurodegenerative disorders market.

Key Trend: AI-Driven Digital Convergence Transforming Neurodegenerative Drug Discovery and Patient Care

- The convergence of artificial intelligence and sophisticated digital health technologies is changing the neurodegenerative disorders market, establishing a smooth flow between initial research efforts and actual patient care.

- Even in complex neurological disorders, AI-based modeling will accelerate target discovery, biomarker validation, and optimization of trials and shorten timelines, increasing their success. At the same time, online platforms based on remote tests, wearables, and neuroimaging allow monitoring and identifying the onset of the disease in the initial stages.

- Altoida Inc. in 2025, made global AI, pharma, and Alzheimer’s specialists its advisory board members to speed up the development of its AI-powered brain health platform. The platform applies smartphone-based cognitive tests to identify the neurological disorders at an early stage, implying that AI and digital health keep converging in terms of developing more precise neurotherapeutics.

- The innovations are shifting neurodegenerative care to a more data-driven, patient-centric approach that is staging therapeutic innovation more rapidly and enhancing the results of early disease diagnosis and management.

Neurodegenerative-Disorders-Market Analysis and Segmental Data

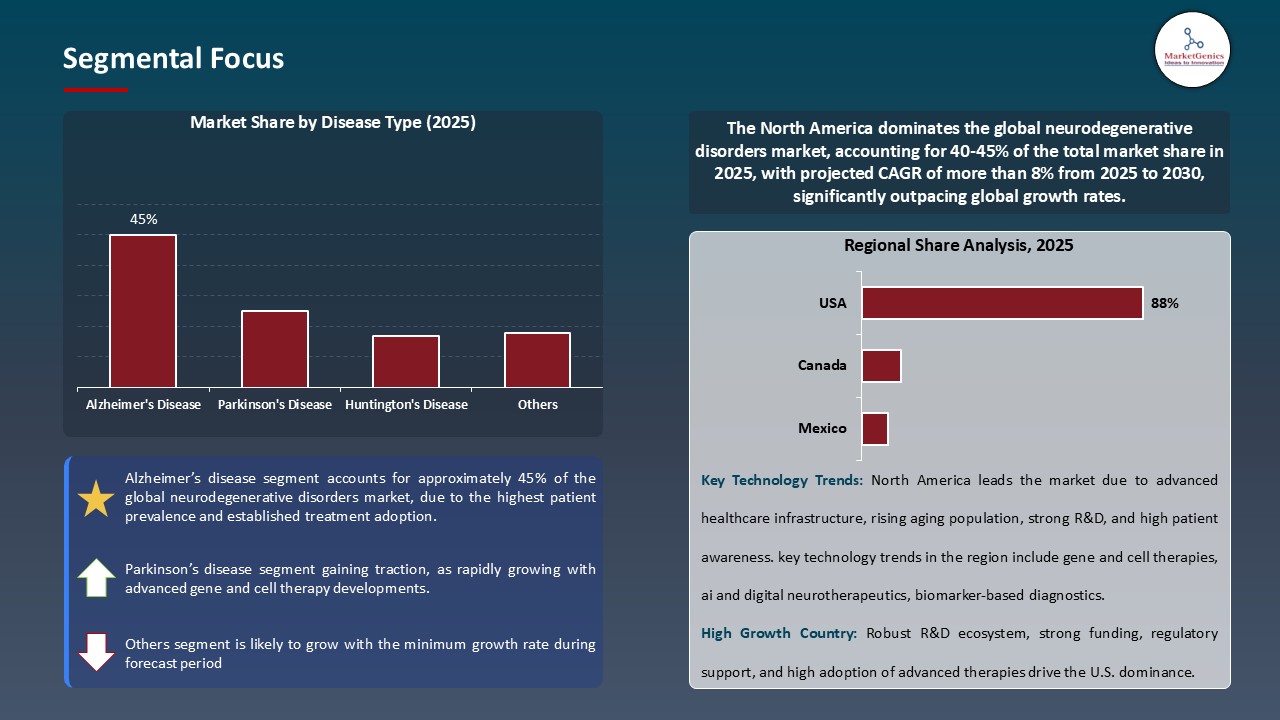

Alzheimer's Disease Dominate Global Neurodegenerative Disorders Market

- Alzheimer disease segment leads with the largest market share in the neurodegenerative disorders globally, owing to its high rate of disease burden, increased geriatric population, and the long-term research and development work. Its market leadership is still strengthened by a presence of strong product pipelines, regulatory approvals to disease-modifying therapies and a growing utilization of sophisticated diagnostics.

- Roche displayed significant achievements in the treatment and diagnostics of the Alzheimer disease at the AD/PD 2025 conference, with positive Phase Ib/IIa data on its bispecific antibody Trontinemab (Brainshuttle), reporting a high amyloid plaque reduction with a desirable side effect profile.

- The Roche corporation also introduced the Elecsys pTau181 plasma test, a type of blood-based test that allows the detection of the Alzheimer pathology at a younger age and with less invasive procedures. These two innovations cement the position of Roche in the market of neurodegenerative disorders and facilitate the transformation to the focus on precision and the early intervention.

- The increased awareness campaigns and increased expenditure on healthcare further increases the demand making the Alzheimer disease the most important revenue-generating segment in the neurodegenerative disorders market.

North America Leads Global Neurodegenerative Disorders Market Demand

- The neurodegenerative disorders markets are most prevalent in North America, which has the largest proportion of the world market given that the US is the most vulnerable to Alzheimer, Parkinson, and ALS, an aging population and, above all, healthcare expenditure are high. It has a developed diagnostic, a well-developed clinical research centre, and essential market participants such as Biogen, Eli Lilly, and Roche that invest in new treatment strategies.

- In addition, CQDM and Brain Canada Foundation declared that they would make a joint investment of a sum more than $5.4 million in order to speed up the research and innovation of neuroscience in Canada. The funding underlines numerous joint initiatives by academic researchers and biotech companies, which revolve around finding new therapeutics of neurodegenerative diseases. This project enhances the ecosystem of life sciences in Canada, promotes the establishment of partnerships between the government and the business in the field of R&D and emphasizes the interest of Canada in developing the next-generation therapies to address neurological disorders.

- Favorable FDA regulatory policies, having invested heavily in neuroscience research and increasing access to disease-modifying and gene-based therapies also add to the strength of North America dominating the global market demand and innovation.

Neurodegenerative-Disorders-Market Ecosystem

The neurodegenerative disorders market is fragmented worldwide and the top competitors that include, Biogen Inc., Eli Lilly and Company, Roche Holding AG, Novartis AG, and AstraZeneca plc, have a combined market share amounting to about 28% of the market. These businesses are on the leading edge of creating disease-modifying and symptomatic medicines to illnesses such as Alzheimer, Parkinson, and ALS supported by large clinical pipelines, robust intellectual estate and robust R&D strengths. Their biologics, gene and cell therapy, and precision medicine strategies make them leaders in the space in terms of strategic focus.

Cultivating regulatory interactions, strategic alliances that are worthwhile, and substantial investment into neuroscience research and development, companies have established industry benchmarks that increase the levels of therapeutic effectiveness and safety. Moreover, partnerships with contract research and manufacturing (CROs and CDMOs) are facilitating scalable production, regulatory adherence in harsh regulatory and regulatory settings, and examining clinical translation of new therapeutics faster. Indicatively, Biogen has been using the strong research network in the world and partnerships with academic and biotech collaborators to strengthen its pipeline of neurodegenerative drugs, which further strengthens its leadership in the market and competitive barriers to new entrants.

Recent Development and Strategic Overview:

- In October 2025, Klotho Neurosciences, Inc. is expected to get FDA Orphan Drug Designation of KLTO-202 to cure Amyotrophic Lateral Sclerosis (ALS). The designation facilitates the potential of the drug to treat this rare form of neurodegenerative disease and gives the drug advantages like market exclusivity and tax benefits, which reinforce the company dedication to developing and promoting innovative ALS therapies.

- In June 2025, Bexorg announced that it was collaborating with Biohaven to apply its AI-driven whole-brain discovery platform to speed up the development of CNS drugs. The platform leverages the latest neural model, multi-omics data to increase target identification and biomarker discovery, a form of neurodegenerative drug research that shows increasing importance of AI-enabled neurobiology to increase precision and efficiency.

Report Scope

|

Detail |

|

|

Market Size in 2025 |

USD 39.8 Bn |

|

Market Forecast Value in 2035 |

USD 69.9 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2026 – 2035 |

|

Historical Data Available for |

2021 – 2024 |

|

Market Size Units |

US$ Billion for Value |

|

Report Format |

Electronic (PDF) + Excel |

|

North America |

Europe |

Asia Pacific |

Middle East |

Africa |

South America |

|

|

|

|

|

|

|

Companies Covered |

|||||

|

|

|

|

|

|

Neurodegenerative-Disorders-Market Segmentation and Highlights

|

Segment |

Sub-segment |

|

Neurodegenerative Disorders Market, By Disease Type |

|

|

Neurodegenerative Disorders Market, By Drug Class |

|

|

Neurodegenerative Disorders Market, By Route of Administration |

|

|

Neurodegenerative Disorders Market, By Mechanism of Action |

|

|

Neurodegenerative Disorders Market, By Stage of Disease |

|

|

Neurodegenerative Disorders Market, By Patient Demographics |

|

|

Neurodegenerative Disorders Market, By End-users |

|

Frequently Asked Questions

The global neurodegenerative disorders market was valued at USD 39.8 Bn in 2025.

The global neurodegenerative disorders market industry is expected to grow at a CAGR of 5.8% from 2026 to 2035.

Rising disease prevalence, aging population, and increasing adoption of advanced gene and cell therapies are key factors driving demand in the neurodegenerative disorders market.

In terms of disease type, the alzheimer's disease segment accounted for the major share in 2025.

North America is the most attractive region for neurodegenerative disorders market.

Prominent players operating in the global neurodegenerative disorders market are AbbVie Inc., Acorda Therapeutics, Inc., Amneal Pharmaceuticals LLC, AstraZeneca plc, Biogen Inc., Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Eisai Co., Ltd., Eli Lilly and Company, GlaxoSmithKline plc, Johnson & Johnson, Lundbeck A/S, Merck & Co., Inc., Novartis AG, Orion Corporation, Pfizer Inc., Roche Holding AG, Sanofi S.A., Teva Pharmaceutical Industries Ltd., UCB S.A., and Other Key Players.

Table of Contents

- 1. Research Methodology and Assumptions

- 1.1. Definitions

- 1.2. Research Design and Approach

- 1.3. Data Collection Methods

- 1.4. Base Estimates and Calculations

- 1.5. Forecasting Models

- 1.5.1. Key Forecast Factors & Impact Analysis

- 1.6. Secondary Research

- 1.6.1. Open Sources

- 1.6.2. Paid Databases

- 1.6.3. Associations

- 1.7. Primary Research

- 1.7.1. Primary Sources

- 1.7.2. Primary Interviews with Stakeholders across Ecosystem

- 2. Executive Summary

- 2.1. Global Neurogenerative Disorders Market Outlook

- 2.1.1. Neurogenerative Disorders Market Size (Value - US$ Bn), and Forecasts, 2021-2035

- 2.1.2. Compounded Annual Growth Rate Analysis

- 2.1.3. Growth Opportunity Analysis

- 2.1.4. Segmental Share Analysis

- 2.1.5. Geographical Share Analysis

- 2.2. Market Analysis and Facts

- 2.3. Supply-Demand Analysis

- 2.4. Competitive Benchmarking

- 2.5. Go-to- Market Strategy

- 2.5.1. Customer/ End-use Industry Assessment

- 2.5.2. Growth Opportunity Data, 2025-2035

- 2.5.2.1. Regional Data

- 2.5.2.2. Country Data

- 2.5.2.3. Segmental Data

- 2.5.3. Identification of Potential Market Spaces

- 2.5.4. GAP Analysis

- 2.5.5. Potential Attractive Price Points

- 2.5.6. Prevailing Market Risks & Challenges

- 2.5.7. Preferred Sales & Marketing Strategies

- 2.5.8. Key Recommendations and Analysis

- 2.5.9. A Way Forward

- 2.1. Global Neurogenerative Disorders Market Outlook

- 3. Industry Data and Premium Insights

- 3.1. Global Neurogenerative Disorders Industry Overview, 2025

- 3.1.1. Healthcare & Pharmaceutical Industry Ecosystem Analysis

- 3.1.2. Key Trends for Healthcare & Pharmaceutical Industry

- 3.1.3. Regional Distribution for Healthcare & Pharmaceutical Industry

- 3.2. Supplier Customer Data

- 3.3. Technology Roadmap and Developments

- 3.4. Trade Analysis

- 3.4.1. Import & Export Analysis, 2025

- 3.4.2. Top Importing Countries

- 3.4.3. Top Exporting Countries

- 3.5. Trump Tariff Impact Analysis

- 3.5.1. Manufacturer

- 3.5.1.1. Based on the component & Raw material

- 3.5.2. Supply Chain

- 3.5.3. End Consumer

- 3.5.1. Manufacturer

- 3.6. Raw Material Analysis

- 3.1. Global Neurogenerative Disorders Industry Overview, 2025

- 4. Market Overview

- 4.1. Market Dynamics

- 4.1.1. Drivers

- 4.1.1.1. Aging population & rising disease prevalence

- 4.1.1.2. Advances in gene/cell therapies and biomarkers

- 4.1.1.3. Rising R&D investment and regulatory incentives

- 4.1.2. Restraints

- 4.1.2.1. Complex biology (blood–brain barrier) and long clinical timelines

- 4.1.2.2. High development costs and uncertain reimbursement

- 4.1.1. Drivers

- 4.2. Key Trend Analysis

- 4.3. Regulatory Framework

- 4.3.1. Key Regulations, Norms, and Subsidies, by Key Countries

- 4.3.2. Tariffs and Standards

- 4.3.3. Impact Analysis of Regulations on the Market

- 4.4. Ecosystem Analysis

- 4.5. Porter’s Five Forces Analysis

- 4.6. PESTEL Analysis

- 4.7. Global Neurogenerative Disorders Market Demand

- 4.7.1. Historical Market Size - in Value (US$ Bn), 2020-2024

- 4.7.2. Current and Future Market Size - in Value (US$ Bn), 2026–2035

- 4.7.2.1. Y-o-Y Growth Trends

- 4.7.2.2. Absolute $ Opportunity Assessment

- 4.1. Market Dynamics

- 5. Competition Landscape

- 5.1. Competition structure

- 5.1.1. Fragmented v/s consolidated

- 5.2. Company Share Analysis, 2025

- 5.2.1. Global Company Market Share

- 5.2.2. By Region

- 5.2.2.1. North America

- 5.2.2.2. Europe

- 5.2.2.3. Asia Pacific

- 5.2.2.4. Middle East

- 5.2.2.5. Africa

- 5.2.2.6. South America

- 5.3. Product Comparison Matrix

- 5.3.1. Specifications

- 5.3.2. Market Positioning

- 5.3.3. Pricing

- 5.1. Competition structure

- 6. Global Neurogenerative Disorders Market Analysis, By Disease Type

- 6.1. Key Segment Analysis

- 6.2. Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, By Disease Type, 2021-2035

- 6.2.1. Alzheimer's Disease

- 6.2.2. Parkinson's Disease

- 6.2.3. Huntington's Disease

- 6.2.4. Amyotrophic Lateral Sclerosis (ALS)

- 6.2.5. Multiple Sclerosis (MS)

- 6.2.6. Others

- 7. Global Neurogenerative Disorders Market Analysis, By Drug Class

- 7.1. Key Segment Analysis

- 7.2. Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, By Drug Class, 2021-2035

- 7.2.1. Cholinesterase Inhibitors

- 7.2.2. NMDA Receptor Antagonists

- 7.2.3. Dopamine Agonists

- 7.2.4. MAO-B Inhibitors

- 7.2.5. COMT Inhibitors

- 7.2.6. Immunomodulators

- 7.2.7. Immunosuppressants

- 7.2.8. Others

- 8. Global Neurogenerative Disorders Market Analysis and Forecasts,By Route of Administration

- 8.1. Key Findings

- 8.2. Neurogenerative Disorders Market Size (Value - US$ Mn), Analysis, and Forecasts, By Route of Administration, 2021-2035

- 8.2.1. Oral

- 8.2.2. Injectable

- 8.2.2.1. Subcutaneous

- 8.2.2.2. Intramuscular

- 8.2.2.3. Intravenous

- 8.2.2.4. Others

- 8.2.3. Transdermal Patches

- 8.2.4. Inhalation

- 9. Global Neurogenerative Disorders Market Analysis and Forecasts, By Mechanism of Action

- 9.1. Key Findings

- 9.2. Neurogenerative Disorders Market Size (Vo Value - US$ Mn), Analysis, and Forecasts, By Mechanism of Action, 2021-2035

- 9.2.1. Symptomatic Treatment

- 9.2.2. Disease-Modifying Treatment

- 9.2.3. Neuroprotective Agents

- 9.2.4. Anti-inflammatory Agents

- 9.2.5. Gene Therapy

- 9.2.6. Cell Therapy

- 9.2.7. Others

- 10. Global Neurogenerative Disorders Market Analysis and Forecasts, By Stage of Disease

- 10.1. Key Findings

- 10.2. Neurogenerative Disorders Market Size (Value - US$ Mn), Analysis, and Forecasts, By Stage of Disease, 2021-2035

- 10.2.1. Early Stage/Mild

- 10.2.2. Moderate Stage

- 10.2.3. Advanced/Severe Stage

- 10.2.4. Preclinical/Prodromal

- 11. Global Neurogenerative Disorders Market Analysis and Forecasts, By Patient Demographics

- 11.1. Key Findings

- 11.2. Neurogenerative Disorders Market Size (Value - US$ Mn), Analysis, and Forecasts, By Patient Demographics, 2021-2035

- 11.2.1. Pediatric

- 11.2.2. Adult

- 11.2.3. Geriatric

- 12. Global Neurogenerative Disorders Market Analysis and Forecasts, By End-users

- 12.1. Key Findings

- 12.2. Neurogenerative Disorders Market Size (Value - US$ Mn), Analysis, and Forecasts, By End-users, 2021-2035

- 12.2.1. Hospitals & Clinics

- 12.2.1.1. Diagnosis & Screening

- 12.2.1.2. Disease Management

- 12.2.1.3. Symptomatic Treatment

- 12.2.1.4. Rehabilitation Services

- 12.2.1.5. Emergency Care

- 12.2.1.6. Inpatient Treatment

- 12.2.1.7. Others

- 12.2.2. Research & Academic Institutions

- 12.2.2.1. Clinical Trials

- 12.2.2.2. Drug Discovery & Development

- 12.2.2.3. Biomarker Research

- 12.2.2.4. Genetic Studies

- 12.2.2.5. Epidemiological Studies

- 12.2.2.6. Others

- 12.2.3. Pharmaceutical & Biotechnology Companies

- 12.2.3.1. Drug Manufacturing

- 12.2.3.2. Biologics Production

- 12.2.3.3. Gene Therapy Development

- 12.2.3.4. Vaccine Development

- 12.2.3.5. Clinical Development

- 12.2.3.6. Others

- 12.2.4. Diagnostic Laboratories

- 12.2.4.1. Biomarker Testing

- 12.2.4.2. Genetic Screening

- 12.2.4.3. CSF Analysis

- 12.2.4.4. Neuroimaging Services

- 12.2.4.5. Pathology Services

- 12.2.4.6. Others

- 12.2.5. Home Healthcare Providers

- 12.2.5.1. Long-term Care Management

- 12.2.5.2. Medication Administration

- 12.2.5.3. Patient Monitoring

- 12.2.5.4. Rehabilitation Support

- 12.2.5.5. Palliative Care

- 12.2.5.6. Others

- 12.2.6. Specialty Clinics

- 12.2.6.1. Movement Disorder Clinics

- 12.2.6.2. Memory Clinics

- 12.2.6.3. ALS Clinics

- 12.2.6.4. MS Centers

- 12.2.6.5. Cognitive Assessment Centers

- 12.2.6.6. Others

- 12.2.7. Other End-users

- 12.2.1. Hospitals & Clinics

- 13. Global Neurogenerative Disorders Market Analysis and Forecasts, by Region

- 13.1. Key Findings

- 13.2. Neurogenerative Disorders Market Size (Value - US$ Mn), Analysis, and Forecasts, by Region, 2021-2035

- 13.2.1. North America

- 13.2.2. Europe

- 13.2.3. Asia Pacific

- 13.2.4. Middle East

- 13.2.5. Africa

- 13.2.6. South America

- 14. North America Neurogenerative Disorders Market Analysis

- 14.1. Key Segment Analysis

- 14.2. Regional Snapshot

- 14.3. North America Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 14.3.1. Disease Type

- 14.3.2. Drug Class

- 14.3.3. Route of Administration

- 14.3.4. Mechanism of Action

- 14.3.5. Stage of Disease

- 14.3.6. Patient Demographics

- 14.3.7. End-Users

- 14.3.8. Country

- 14.3.8.1. USA

- 14.3.8.2. Canada

- 14.3.8.3. Mexico

- 14.4. USA Neurogenerative Disorders Market

- 14.4.1. Country Segmental Analysis

- 14.4.2. Disease Type

- 14.4.3. Drug Class

- 14.4.4. Route of Administration

- 14.4.5. Mechanism of Action

- 14.4.6. Stage of Disease

- 14.4.7. Patient Demographics

- 14.4.8. End-Users

- 14.5. Canada Neurogenerative Disorders Market

- 14.5.1. Country Segmental Analysis

- 14.5.2. Disease Type

- 14.5.3. Drug Class

- 14.5.4. Route of Administration

- 14.5.5. Mechanism of Action

- 14.5.6. Stage of Disease

- 14.5.7. Patient Demographics

- 14.5.8. End-Users

- 14.6. Mexico Neurogenerative Disorders Market

- 14.6.1. Country Segmental Analysis

- 14.6.2. Disease Type

- 14.6.3. Drug Class

- 14.6.4. Route of Administration

- 14.6.5. Mechanism of Action

- 14.6.6. Stage of Disease

- 14.6.7. Patient Demographics

- 14.6.8. End-Users

- 15. Europe Neurogenerative Disorders Market Analysis

- 15.1. Key Segment Analysis

- 15.2. Regional Snapshot

- 15.3. Europe Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 15.3.1. Disease Type

- 15.3.2. Drug Class

- 15.3.3. Route of Administration

- 15.3.4. Mechanism of Action

- 15.3.5. Stage of Disease

- 15.3.6. Patient Demographics

- 15.3.7. End-Users

- 15.3.8. Country

- 15.3.8.1. Germany

- 15.3.8.2. United Kingdom

- 15.3.8.3. France

- 15.3.8.4. Italy

- 15.3.8.5. Spain

- 15.3.8.6. Netherlands

- 15.3.8.7. Nordic Countries

- 15.3.8.8. Poland

- 15.3.8.9. Russia & CIS

- 15.3.8.10. Rest of Europe

- 15.4. Germany Neurogenerative Disorders Market

- 15.4.1. Country Segmental Analysis

- 15.4.2. Disease Type

- 15.4.3. Drug Class

- 15.4.4. Route of Administration

- 15.4.5. Mechanism of Action

- 15.4.6. Stage of Disease

- 15.4.7. Patient Demographics

- 15.4.8. End-Users

- 15.5. United Kingdom Neurogenerative Disorders Market

- 15.5.1. Country Segmental Analysis

- 15.5.2. Disease Type

- 15.5.3. Drug Class

- 15.5.4. Route of Administration

- 15.5.5. Mechanism of Action

- 15.5.6. Stage of Disease

- 15.5.7. Patient Demographics

- 15.5.8. End-Users

- 15.6. France Neurogenerative Disorders Market

- 15.6.1. Country Segmental Analysis

- 15.6.2. Disease Type

- 15.6.3. Drug Class

- 15.6.4. Route of Administration

- 15.6.5. Mechanism of Action

- 15.6.6. Stage of Disease

- 15.6.7. Patient Demographics

- 15.6.8. End-Users

- 15.7. Italy Neurogenerative Disorders Market

- 15.7.1. Country Segmental Analysis

- 15.7.2. Disease Type

- 15.7.3. Drug Class

- 15.7.4. Route of Administration

- 15.7.5. Mechanism of Action

- 15.7.6. Stage of Disease

- 15.7.7. Patient Demographics

- 15.7.8. End-Users

- 15.8. Spain Neurogenerative Disorders Market

- 15.8.1. Country Segmental Analysis

- 15.8.2. Disease Type

- 15.8.3. Drug Class

- 15.8.4. Route of Administration

- 15.8.5. Mechanism of Action

- 15.8.6. Stage of Disease

- 15.8.7. Patient Demographics

- 15.8.8. End-Users

- 15.9. Netherlands Neurogenerative Disorders Market

- 15.9.1. Country Segmental Analysis

- 15.9.2. Disease Type

- 15.9.3. Drug Class

- 15.9.4. Route of Administration

- 15.9.5. Mechanism of Action

- 15.9.6. Stage of Disease

- 15.9.7. Patient Demographics

- 15.9.8. End-Users

- 15.10. Nordic Countries Neurogenerative Disorders Market

- 15.10.1. Country Segmental Analysis

- 15.10.2. Disease Type

- 15.10.3. Drug Class

- 15.10.4. Route of Administration

- 15.10.5. Mechanism of Action

- 15.10.6. Stage of Disease

- 15.10.7. Patient Demographics

- 15.10.8. End-Users

- 15.11. Poland Neurogenerative Disorders Market

- 15.11.1. Country Segmental Analysis

- 15.11.2. Disease Type

- 15.11.3. Drug Class

- 15.11.4. Route of Administration

- 15.11.5. Mechanism of Action

- 15.11.6. Stage of Disease

- 15.11.7. Patient Demographics

- 15.11.8. End-Users

- 15.12. Russia & CIS Neurogenerative Disorders Market

- 15.12.1. Country Segmental Analysis

- 15.12.2. Disease Type

- 15.12.3. Drug Class

- 15.12.4. Route of Administration

- 15.12.5. Mechanism of Action

- 15.12.6. Stage of Disease

- 15.12.7. Patient Demographics

- 15.12.8. End-Users

- 15.13. Rest of Europe Neurogenerative Disorders Market

- 15.13.1. Country Segmental Analysis

- 15.13.2. Disease Type

- 15.13.3. Drug Class

- 15.13.4. Route of Administration

- 15.13.5. Mechanism of Action

- 15.13.6. Stage of Disease

- 15.13.7. Patient Demographics

- 15.13.8. End-Users

- 16. Asia Pacific Neurogenerative Disorders Market Analysis

- 16.1. Key Segment Analysis

- 16.2. Regional Snapshot

- 16.3. Asia Pacific Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 16.3.1. Disease Type

- 16.3.2. Drug Class

- 16.3.3. Route of Administration

- 16.3.4. Mechanism of Action

- 16.3.5. Stage of Disease

- 16.3.6. Patient Demographics

- 16.3.7. End-Users

- 16.3.8. Country

- 16.3.8.1. China

- 16.3.8.2. India

- 16.3.8.3. Japan

- 16.3.8.4. South Korea

- 16.3.8.5. Australia and New Zealand

- 16.3.8.6. Indonesia

- 16.3.8.7. Malaysia

- 16.3.8.8. Thailand

- 16.3.8.9. Vietnam

- 16.3.8.10. Rest of Asia Pacific

- 16.4. China Neurogenerative Disorders Market

- 16.4.1. Country Segmental Analysis

- 16.4.2. Disease Type

- 16.4.3. Drug Class

- 16.4.4. Route of Administration

- 16.4.5. Mechanism of Action

- 16.4.6. Stage of Disease

- 16.4.7. Patient Demographics

- 16.4.8. End-Users

- 16.5. India Neurogenerative Disorders Market

- 16.5.1. Country Segmental Analysis

- 16.5.2. Disease Type

- 16.5.3. Drug Class

- 16.5.4. Route of Administration

- 16.5.5. Mechanism of Action

- 16.5.6. Stage of Disease

- 16.5.7. Patient Demographics

- 16.5.8. End-Users

- 16.6. Japan Neurogenerative Disorders Market

- 16.6.1. Country Segmental Analysis

- 16.6.2. Disease Type

- 16.6.3. Drug Class

- 16.6.4. Route of Administration

- 16.6.5. Mechanism of Action

- 16.6.6. Stage of Disease

- 16.6.7. Patient Demographics

- 16.6.8. End-Users

- 16.7. South Korea Neurogenerative Disorders Market

- 16.7.1. Country Segmental Analysis

- 16.7.2. Disease Type

- 16.7.3. Drug Class

- 16.7.4. Route of Administration

- 16.7.5. Mechanism of Action

- 16.7.6. Stage of Disease

- 16.7.7. Patient Demographics

- 16.7.8. End-Users

- 16.8. Australia and New Zealand Neurogenerative Disorders Market

- 16.8.1. Country Segmental Analysis

- 16.8.2. Disease Type

- 16.8.3. Drug Class

- 16.8.4. Route of Administration

- 16.8.5. Mechanism of Action

- 16.8.6. Stage of Disease

- 16.8.7. Patient Demographics

- 16.8.8. End-Users

- 16.9. Indonesia Neurogenerative Disorders Market

- 16.9.1. Country Segmental Analysis

- 16.9.2. Disease Type

- 16.9.3. Drug Class

- 16.9.4. Route of Administration

- 16.9.5. Mechanism of Action

- 16.9.6. Stage of Disease

- 16.9.7. Patient Demographics

- 16.9.8. End-Users

- 16.10. Malaysia Neurogenerative Disorders Market

- 16.10.1. Country Segmental Analysis

- 16.10.2. Disease Type

- 16.10.3. Drug Class

- 16.10.4. Route of Administration

- 16.10.5. Mechanism of Action

- 16.10.6. Stage of Disease

- 16.10.7. Patient Demographics

- 16.10.8. End-Users

- 16.11. Thailand Neurogenerative Disorders Market

- 16.11.1. Country Segmental Analysis

- 16.11.2. Disease Type

- 16.11.3. Drug Class

- 16.11.4. Route of Administration

- 16.11.5. Mechanism of Action

- 16.11.6. Stage of Disease

- 16.11.7. Patient Demographics

- 16.11.8. End-Users

- 16.12. Vietnam Neurogenerative Disorders Market

- 16.12.1. Country Segmental Analysis

- 16.12.2. Disease Type

- 16.12.3. Drug Class

- 16.12.4. Route of Administration

- 16.12.5. Mechanism of Action

- 16.12.6. Stage of Disease

- 16.12.7. Patient Demographics

- 16.12.8. End-Users

- 16.13. Rest of Asia Pacific Neurogenerative Disorders Market

- 16.13.1. Country Segmental Analysis

- 16.13.2. Disease Type

- 16.13.3. Drug Class

- 16.13.4. Route of Administration

- 16.13.5. Mechanism of Action

- 16.13.6. Stage of Disease

- 16.13.7. Patient Demographics

- 16.13.8. End-Users

- 17. Middle East Neurogenerative Disorders Market Analysis

- 17.1. Key Segment Analysis

- 17.2. Regional Snapshot

- 17.3. Middle East Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 17.3.1. Disease Type

- 17.3.2. Drug Class

- 17.3.3. Route of Administration

- 17.3.4. Mechanism of Action

- 17.3.5. Stage of Disease

- 17.3.6. Patient Demographics

- 17.3.7. End-Users

- 17.3.8. Country

- 17.3.8.1. Turkey

- 17.3.8.2. UAE

- 17.3.8.3. Saudi Arabia

- 17.3.8.4. Israel

- 17.3.8.5. Rest of Middle East

- 17.4. Turkey Neurogenerative Disorders Market

- 17.4.1. Country Segmental Analysis

- 17.4.2. Disease Type

- 17.4.3. Drug Class

- 17.4.4. Route of Administration

- 17.4.5. Mechanism of Action

- 17.4.6. Stage of Disease

- 17.4.7. Patient Demographics

- 17.4.8. End-Users

- 17.5. UAE Neurogenerative Disorders Market

- 17.5.1. Country Segmental Analysis

- 17.5.2. Disease Type

- 17.5.3. Drug Class

- 17.5.4. Route of Administration

- 17.5.5. Mechanism of Action

- 17.5.6. Stage of Disease

- 17.5.7. Patient Demographics

- 17.5.8. End-Users

- 17.6. Saudi Arabia Neurogenerative Disorders Market

- 17.6.1. Country Segmental Analysis

- 17.6.2. Disease Type

- 17.6.3. Drug Class

- 17.6.4. Route of Administration

- 17.6.5. Mechanism of Action

- 17.6.6. Stage of Disease

- 17.6.7. Patient Demographics

- 17.6.8. End-Users

- 17.7. Israel Neurogenerative Disorders Market

- 17.7.1. Country Segmental Analysis

- 17.7.2. Disease Type

- 17.7.3. Drug Class

- 17.7.4. Route of Administration

- 17.7.5. Mechanism of Action

- 17.7.6. Stage of Disease

- 17.7.7. Patient Demographics

- 17.7.8. End-Users

- 17.8. Rest of Middle East Neurogenerative Disorders Market

- 17.8.1. Country Segmental Analysis

- 17.8.2. Disease Type

- 17.8.3. Drug Class

- 17.8.4. Route of Administration

- 17.8.5. Mechanism of Action

- 17.8.6. Stage of Disease

- 17.8.7. Patient Demographics

- 17.8.8. End-Users

- 18. Africa Neurogenerative Disorders Market Analysis

- 18.1. Key Segment Analysis

- 18.2. Regional Snapshot

- 18.3. Africa Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 18.3.1. Disease Type

- 18.3.2. Drug Class

- 18.3.3. Route of Administration

- 18.3.4. Mechanism of Action

- 18.3.5. Stage of Disease

- 18.3.6. Patient Demographics

- 18.3.7. End-Users

- 18.3.8. Country

- 18.3.8.1. South Africa

- 18.3.8.2. Egypt

- 18.3.8.3. Nigeria

- 18.3.8.4. Algeria

- 18.3.8.5. Rest of Africa

- 18.4. South Africa Neurogenerative Disorders Market

- 18.4.1. Country Segmental Analysis

- 18.4.2. Disease Type

- 18.4.3. Drug Class

- 18.4.4. Route of Administration

- 18.4.5. Mechanism of Action

- 18.4.6. Stage of Disease

- 18.4.7. Patient Demographics

- 18.4.8. End-Users

- 18.5. Egypt Neurogenerative Disorders Market

- 18.5.1. Country Segmental Analysis

- 18.5.2. Disease Type

- 18.5.3. Drug Class

- 18.5.4. Route of Administration

- 18.5.5. Mechanism of Action

- 18.5.6. Stage of Disease

- 18.5.7. Patient Demographics

- 18.5.8. End-Users

- 18.6. Nigeria Neurogenerative Disorders Market

- 18.6.1. Country Segmental Analysis

- 18.6.2. Disease Type

- 18.6.3. Drug Class

- 18.6.4. Route of Administration

- 18.6.5. Mechanism of Action

- 18.6.6. Stage of Disease

- 18.6.7. Patient Demographics

- 18.6.8. End-Users

- 18.7. Algeria Neurogenerative Disorders Market

- 18.7.1. Country Segmental Analysis

- 18.7.2. Disease Type

- 18.7.3. Drug Class

- 18.7.4. Route of Administration

- 18.7.5. Mechanism of Action

- 18.7.6. Stage of Disease

- 18.7.7. Patient Demographics

- 18.7.8. End-Users

- 18.8. Rest of Africa Neurogenerative Disorders Market

- 18.8.1. Country Segmental Analysis

- 18.8.2. Disease Type

- 18.8.3. Drug Class

- 18.8.4. Route of Administration

- 18.8.5. Mechanism of Action

- 18.8.6. Stage of Disease

- 18.8.7. Patient Demographics

- 18.8.8. End-Users

- 19. South America Neurogenerative Disorders Market Analysis

- 19.1. Key Segment Analysis

- 19.2. Regional Snapshot

- 19.3. South America Neurogenerative Disorders Market Size (Value - US$ Bn), Analysis, and Forecasts, 2021-2035

- 19.3.1. Disease Type

- 19.3.2. Drug Class

- 19.3.3. Route of Administration

- 19.3.4. Mechanism of Action

- 19.3.5. Stage of Disease

- 19.3.6. Patient Demographics

- 19.3.7. End-Users

- 19.3.8. Country

- 19.3.8.1. Brazil

- 19.3.8.2. Argentina

- 19.3.8.3. Rest of South America

- 19.4. Brazil Neurogenerative Disorders Market

- 19.4.1. Country Segmental Analysis

- 19.4.2. Disease Type

- 19.4.3. Drug Class

- 19.4.4. Route of Administration

- 19.4.5. Mechanism of Action

- 19.4.6. Stage of Disease

- 19.4.7. Patient Demographics

- 19.4.8. End-Users

- 19.5. Argentina Neurogenerative Disorders Market

- 19.5.1. Country Segmental Analysis

- 19.5.2. Disease Type

- 19.5.3. Drug Class

- 19.5.4. Route of Administration

- 19.5.5. Mechanism of Action

- 19.5.6. Stage of Disease

- 19.5.7. Patient Demographics

- 19.5.8. End-Users

- 19.6. Rest of South America Neurogenerative Disorders Market

- 19.6.1. Country Segmental Analysis

- 19.6.2. Disease Type

- 19.6.3. Drug Class

- 19.6.4. Route of Administration

- 19.6.5. Mechanism of Action

- 19.6.6. Stage of Disease

- 19.6.7. Patient Demographics

- 19.6.8. End-Users

- 20. Key Players/ Company Profile

- 20.1. AbbVie Inc.

- 20.1.1. Company Details/ Overview

- 20.1.2. Company Financials

- 20.1.3. Key Customers and Competitors

- 20.1.4. Business/ Industry Portfolio

- 20.1.5. Product Portfolio/ Specification Details

- 20.1.6. Pricing Data

- 20.1.7. Strategic Overview

- 20.1.8. Recent Developments

- 20.2. Acorda Therapeutics, Inc.

- 20.3. Amneal Pharmaceuticals LLC

- 20.4. AstraZeneca plc

- 20.5. Biogen Inc.

- 20.6. Boehringer Ingelheim International GmbH

- 20.7. Bristol-Myers Squibb Company

- 20.8. Eisai Co., Ltd.

- 20.9. Eli Lilly and Company

- 20.10. GlaxoSmithKline plc

- 20.11. Johnson & Johnson

- 20.12. Lundbeck A/S

- 20.13. Merck & Co., Inc.

- 20.14. Novartis AG

- 20.15. Orion Corporation

- 20.16. Pfizer Inc.

- 20.17. Roche Holding AG

- 20.18. Sanofi S.A.

- 20.19. Teva Pharmaceutical Industries Ltd.

- 20.20. UCB S.A.

- 20.21. Other Key Players

- 20.1. AbbVie Inc.

Note* - This is just tentative list of players. While providing the report, we will cover more number of players based on their revenue and share for each geography

Our research design integrates both demand-side and supply-side analysis through a balanced combination of primary and secondary research methodologies. By utilizing both bottom-up and top-down approaches alongside rigorous data triangulation methods, we deliver robust market intelligence that supports strategic decision-making.

MarketGenics' comprehensive research design framework ensures the delivery of accurate, reliable, and actionable market intelligence. Through the integration of multiple research approaches, rigorous validation processes, and expert analysis, we provide our clients with the insights needed to make informed strategic decisions and capitalize on market opportunities.

MarketGenics leverages a dedicated industry panel of experts and a comprehensive suite of paid databases to effectively collect, consolidate, and analyze market intelligence.

Our approach has consistently proven to be reliable and effective in generating accurate market insights, identifying key industry trends, and uncovering emerging business opportunities.

Through both primary and secondary research, we capture and analyze critical company-level data such as manufacturing footprints, including technical centers, R&D facilities, sales offices, and headquarters.

Our expert panel further enhances our ability to estimate market size for specific brands based on validated field-level intelligence.

Our data mining techniques incorporate both parametric and non-parametric methods, allowing for structured data collection, sorting, processing, and cleaning.

Demand projections are derived from large-scale data sets analyzed through proprietary algorithms, culminating in robust and reliable market sizing.

The bottom-up approach builds market estimates by starting with the smallest addressable market units and systematically aggregating them to create comprehensive market size projections.

This method begins with specific, granular data points and builds upward to create the complete market landscape.

Customer Analysis → Segmental Analysis → Geographical Analysis

The top-down approach starts with the broadest possible market data and systematically narrows it down through a series of filters and assumptions to arrive at specific market segments or opportunities.

This method begins with the big picture and works downward to increasingly specific market slices.

TAM → SAM → SOM

While analysing the market, we extensively study secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial report. Secondary sources that we utilize are not only the public sources, but it is combination of Open Source, Associations, Paid Databases, MG Repository & Knowledgebase and Others.

- Company websites, annual reports, financial reports, broker reports, and investor presentations

- National government documents, statistical databases and reports

- News articles, press releases and web-casts specific to the companies operating in the market, Magazines, reports, and others

- We gather information from commercial data sources for deriving company specific data such as segmental revenue, share for geography, product revenue, and others

- Internal and external proprietary databases (industry-specific), relevant patent, and regulatory databases

- Governing Bodies, Government Organizations

- Relevant Authorities, Country-specific Associations for Industries

We also employ the model mapping approach to estimate the product level market data through the players product portfolio

Primary research/ interviews is vital in analyzing the market. Most of the cases involves paid primary interviews. Primary sources includes primary interviews through e-mail interactions, telephonic interviews, surveys as well as face-to-face interviews with the different stakeholders across the value chain including several industry experts.

| Type of Respondents | Number of Primaries |

|---|---|

| Tier 2/3 Suppliers | ~20 |

| Tier 1 Suppliers | ~25 |

| End-users | ~25 |

| Industry Expert/ Panel/ Consultant | ~30 |

| Total | ~100 |

MG Knowledgebase

• Repository of industry blog, newsletter and case studies

• Online platform covering detailed market reports, and company profiles

- Historical Trends – Past market patterns, cycles, and major events that shaped how markets behave over time. Understanding past trends helps predict future behavior.

- Industry Factors – Specific characteristics of the industry like structure, regulations, and innovation cycles that affect market dynamics.

- Macroeconomic Factors – Economic conditions like GDP growth, inflation, and employment rates that affect how much money people have to spend.

- Demographic Factors – Population characteristics like age, income, and location that determine who can buy your product.

- Technology Factors – How quickly people adopt new technology and how much technology infrastructure exists.

- Regulatory Factors – Government rules, laws, and policies that can help or restrict market growth.

- Competitive Factors – Analyzing competition structure such as degree of competition and bargaining power of buyers and suppliers.

Multiple Regression Analysis

- Identify and quantify factors that drive market changes

- Statistical modeling to establish relationships between market drivers and outcomes

Time Series Analysis – Seasonal Patterns

- Understand regular cyclical patterns in market demand

- Advanced statistical techniques to separate trend, seasonal, and irregular components

Time Series Analysis – Trend Analysis

- Identify underlying market growth patterns and momentum

- Statistical analysis of historical data to project future trends

Expert Opinion – Expert Interviews

- Gather deep industry insights and contextual understanding

- In-depth interviews with key industry stakeholders

Multi-Scenario Development

- Prepare for uncertainty by modeling different possible futures

- Creating optimistic, pessimistic, and most likely scenarios

Time Series Analysis – Moving Averages

- Sophisticated forecasting for complex time series data

- Auto-regressive integrated moving average models with seasonal components

Econometric Models

- Apply economic theory to market forecasting

- Sophisticated economic models that account for market interactions

Expert Opinion – Delphi Method

- Harness collective wisdom of industry experts

- Structured, multi-round expert consultation process

Monte Carlo Simulation

- Quantify uncertainty and probability distributions

- Thousands of simulations with varying input parameters

Our research framework is built upon the fundamental principle of validating market intelligence from both demand and supply perspectives. This dual-sided approach ensures comprehensive market understanding and reduces the risk of single-source bias.

Demand-Side Analysis: We understand end-user/application behavior, preferences, and market needs along with the penetration of the product for specific application.

Supply-Side Analysis: We estimate overall market revenue, analyze the segmental share along with industry capacity, competitive landscape, and market structure.

Data triangulation is a validation technique that uses multiple methods, sources, or perspectives to examine the same research question, thereby increasing the credibility and reliability of research findings. In market research, triangulation serves as a quality assurance mechanism that helps identify and minimize bias, validate assumptions, and ensure accuracy in market estimates.

- Data Source Triangulation – Using multiple data sources to examine the same phenomenon

- Methodological Triangulation – Using multiple research methods to study the same research question

- Investigator Triangulation – Using multiple researchers or analysts to examine the same data

- Theoretical Triangulation – Using multiple theoretical perspectives to interpret the same data